PROXY STATEMENT OF CHIASMA, INC. | | | PROSPECTUS OF AMRYT PHARMA PLC |

| | |  |

Sincerely, | | | Sincerely, |

| | |  |

Raj Kannan Chief Executive Officer and President Chiasma, Inc. | | | Dr. Joseph Wiley Chief Executive Officer Amryt Pharma plc |

PROXY STATEMENT OF CHIASMA, INC. | | | PROSPECTUS OF AMRYT PHARMA PLC |

| | |  |

Sincerely, | | | Sincerely, |

| | |  |

Raj Kannan Chief Executive Officer and President Chiasma, Inc. | | | Dr. Joseph Wiley Chief Executive Officer Amryt Pharma plc |

Chiasma, Inc. 140 Kendrick Street, Building C East Needham, MA 02494 Attention: Investor Relations Telephone: (617) 928-5300 | | | Amryt Pharma plc 45 Mespil Road Dublin 4 Ireland Attention: Investor Relations Telephone: +353 (0)1 518 0200 |

| • | the unaudited consolidated financial statements of Amryt Pharma plc as of March 31, 2021 and the audited consolidated financial statements of Amryt as of December 31, 2020 and 2019 and for the three years in the period ended December 31, 2020, (i) prepared in accordance with International Accounting Standards in conformity with the requirements of the Companies Act 2006, (ii) as prepared in accordance with the accounting provisions required by International Financial Reporting Standards |

| • | the unaudited consolidated financial statements of Chiasma, Inc. as of March 31, 2021 and the audited consolidated financial statements of Chiasma as of December 31, 2020 and 2019 and for the three years in the period ended December 31, 2020, prepared on the basis of U.S. GAAP (which we refer to as the “Chiasma consolidated financial statements”). |

| • | to consider and vote on a proposal (which we refer to as the “merger proposal”) to adopt the Agreement and Plan of Merger, dated as of May 4, 2021 (which, as it may be amended from time to time, we refer to as the “merger agreement”) by and among Chiasma, Amryt Pharma plc (which we refer to as “Amryt”) and Acorn Merger Sub, Inc., an indirect wholly owned subsidiary of Amryt (which we refer to as “Merger Sub”), pursuant to which Merger Sub will merge with and into Chiasma (which we refer to as the “merger”), with Chiasma surviving the merger as an indirect wholly owned subsidiary of Amryt; |

| • | to consider and vote on a non-binding, advisory proposal to approve the compensation that may be paid or may become payable to Chiasma’s named executive officers in connection with the merger (which we refer to as the “advisory, non-binding compensation proposal”); and |

| • | to consider and vote on a proposal (which we refer to as the “adjournment proposal”) to approve the adjournment or postponement of the Chiasma special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Chiasma special meeting to approve the merger proposal or to ensure that any supplement or amendment to this proxy statement/prospectus is timely provided to Chiasma stockholders. |

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

| Q: | Why am I receiving this proxy statement/prospectus? |

| A: | You are receiving this proxy statement/prospectus because Chiasma has agreed to be acquired by Amryt through a merger of Merger Sub with and into Chiasma (which we refer to as the “merger”) with Chiasma surviving the merger as an indirect wholly owned subsidiary of Amryt. The merger agreement, which governs the terms and conditions of the merger, is attached to this proxy statement/prospectus as Annex A. |

| Q: | What matters am I being asked to vote on? |

| A: | In order to complete the merger, among other things, Chiasma stockholders must adopt the merger agreement in accordance with the Delaware General Corporation Law (which we refer to as the “DGCL”), which proposal is referred to as the “merger proposal.” |

| • | a non-binding, advisory proposal to approve the compensation that may be paid or may become payable to Chiasma’s named executive officers in connection with the merger (which proposal we refer to as the “advisory, non-binding compensation proposal”); and |

| • | a proposal to approve the adjournment or postponement of the Chiasma special meeting, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Chiasma special meeting to approve the merger proposal or to ensure that any supplement or amendment to this proxy statement/prospectus is timely provided to Chiasma stockholders (which proposal we refer to as the “adjournment proposal”). |

| Q: | Does my vote matter? |

| A: | Yes, your vote is very important, regardless of the number of shares that you own. The merger cannot be completed unless, among other things, the merger proposal is approved by Chiasma stockholders. |

| Q: | How does the Chiasma Board recommend that I vote at the Chiasma special meeting? |

| A: | The Chiasma Board recommends that you vote “FOR” the merger proposal, “FOR” the advisory, non-binding compensation proposal and “FOR” the adjournment proposal. |

| Q: | Why am I being asked to consider and vote on a proposal to approve, by non-binding, advisory vote, the merger-related compensation for Chiasma’s named executive officers (i.e., the advisory, non-binding compensation proposal)? |

| A: | Under SEC rules, Chiasma is required to seek a non-binding, advisory vote of its stockholders with respect to the compensation that may be paid or become payable to Chiasma’s named executive officers that is based on or otherwise relates to the merger. |

| Q: | What happens if Chiasma stockholders do not approve, by non-binding, advisory vote, the merger-related compensation for Chiasma’s named executive officers (i.e., the advisory, non-binding compensation proposal)? |

| A: | Because the vote to approve the advisory, non-binding compensation proposal is advisory in nature, the outcome of the vote will not be binding upon Chiasma or the combined company, and the completion of the merger is not conditioned or dependent upon the approval of the advisory, non-binding compensation proposal. Accordingly, the merger-related compensation, which is described in the section entitled “Interests of Chiasma’s Directors and Executive Officers in the Merger” beginning on page 87 of this proxy statement/prospectus, may be paid to Chiasma’s named executive officers even if Chiasma’s stockholders do not approve the advisory, non-binding compensation proposal. |

| Q: | Are there any risks that I should consider in deciding whether to vote for the approval of the merger proposal? |

| A: | Yes. You should read and carefully consider the risk factors set forth in the section entitled “Risk Factors” beginning on page 13. You also should read and carefully consider the risk factors with respect to Chiasma that are contained in the documents that are incorporated by reference into this proxy statement/prospectus. |

| Q: | When and where will the Chiasma special meeting take place? |

| A: | The Chiasma special meeting will be held virtually via the Internet on August 3, 2021, beginning at 9:00 a.m., Eastern Time. The Chiasma special meeting will be held solely via live webcast and there will not be a physical meeting location. Chiasma stockholders will be able to attend the Chiasma special meeting online and vote their shares electronically during the meeting by visiting https://web.lumiagm.com/226280530 using the password “chiasma2021” (case sensitive) (which we refer to as the “special meeting website”). If you choose to attend the Chiasma special meeting and vote your shares during the Chiasma special meeting, you will need the 11-digit control number located on your proxy card as described in the section entitled “The Chiasma Special Meeting—Attending the Chiasma Special Meeting” beginning on page 43. |

| Q: | Who is entitled to vote at the Chiasma special meeting? |

| A: | All holders of record of shares of Chiasma common stock who held shares at the close of business on June 15, 2021, the record date, are entitled to receive notice of, and to vote at, the Chiasma special meeting. Each such holder of Chiasma common stock is entitled to cast one vote on each matter properly brought before the Chiasma special meeting for each share of Chiasma common stock that such holder owned of record as of the record date. Attendance at the Chiasma special meeting is not required to vote. See below and the section entitled “The Chiasma Special Meeting—Methods of Voting” beginning on page 41 for instructions on how to vote your shares without attending the Chiasma special meeting. |

| Q: | What constitutes a quorum for the Chiasma special meeting? |

| A: | A quorum is the minimum number of shares required to be represented, either by the appearance of the stockholder in person (including virtually) or through representation by proxy, to hold a valid meeting. |

| Q: | How many votes do I have for the Chiasma special meeting? |

| A: | Each Chiasma stockholder is entitled to one vote for each share of Chiasma common stock held of record as of the close of business on the record date. As of the close of business on the record date, there were 63,191,027 outstanding shares of Chiasma common stock. |

| Q: | How can I vote my shares at the Chiasma special meeting? |

| A: | Shares held directly in your name as the stockholder of record of Chiasma may be voted during the Chiasma special meeting via the special meeting website. If you choose to vote your shares during the virtual meeting, you will need the 11-digit control number included on your proxy card in order to access the special meeting website and to vote as described in the section entitled “The Chiasma Special Meeting—Attending the Chiasma Special Meeting” beginning on page 43. |

| Q: | If my Chiasma common stock is represented by physical stock certificates, should I send my stock certificates now? |

| A: | No. After the merger is completed, you will receive a transmittal form with instructions for the surrender of your Chiasma common stock certificates. Please do not send your stock certificates with your proxy card. |

| Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner of shares held in “street name?” |

| A: | If your shares of common stock in Chiasma are registered directly in your name with American Stock Transfer & Trust Company, LLC, the transfer agent for Chiasma, you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to vote your shares directly at the Chiasma special meeting. You may also grant a proxy for your vote directly to Chiasma or to a third party to vote your shares at the Chiasma special meeting. |

| Q: | If my shares of Chiasma common stock are held in “street name” by my bank, broker or other nominee, will my bank, broker or other nominee automatically vote those shares for me? |

| A: | No. Your bank, broker or other nominee will only be permitted to vote your shares of Chiasma common stock if you instruct your bank, broker or other nominee how to vote. You should follow the procedures provided by your bank, broker or other nominee regarding the voting of your shares. Under Nasdaq rules, banks, brokers and other nominees who hold shares of Chiasma common stock in “street name” for their customers have authority to vote on “routine” proposals when they have not received instructions from beneficial owners. However, banks, brokers and other nominees are prohibited from exercising their voting discretion with respect to non-routine matters, which include all the proposals currently scheduled to be considered and voted on at the Chiasma special meeting. As a result, absent specific instructions from the beneficial owner of such shares, banks, brokers and other nominees are not empowered to vote such shares. |

| Q: | If I hold my shares in “street name,” can I change my voting instructions after I have submitted voting instructions to my bank, broker or other nominee? |

| A: | If your shares are held in the name of a bank, broker or other nominee and you previously provided voting instructions to your bank, broker or other nominee, you should follow the instructions provided by your bank, broker or other nominee to revoke or change your voting instructions. |

| Q: | What should I do if I receive more than one set of voting materials for the Chiasma special meeting? |

| A: | If you hold shares of Chiasma common stock in “street name” and also directly in your name as a stockholder of record or otherwise, or if you hold shares of Chiasma common stock in more than one brokerage account, you may receive more than one set of voting materials relating to the Chiasma special meeting. |

| Q: | How can I vote my shares without attending the Chiasma special meeting? |

| A: | Whether you hold your shares directly as the stockholder of record of Chiasma or beneficially in “street name,” you may direct your vote by proxy without attending the Chiasma special meeting via the special meeting website. If you are a stockholder of record, you can vote by proxy over the Internet, or by telephone or by mail by following the instructions provided in the enclosed proxy card. Please note that if you hold shares beneficially in “street name,” you should follow the voting instructions provided by your bank, broker or other nominee. |

| Q: | What is a proxy? |

| A: | A proxy is a stockholder’s legal designation of another person to vote shares owned by such stockholder on their behalf. The document used to designate a proxy to vote your shares of Chiasma common stock is referred to as a “proxy card.” |

| Q: | If a stockholder gives a proxy, how are the shares of Chiasma common stock voted? |

| A: | Regardless of the method you choose to vote, the individuals named on the enclosed proxy card will vote your shares of Chiasma common stock in the way that you indicate. For each item before the Chiasma special meeting, you may specify whether your shares of Chiasma common stock should be voted for or against, or abstain from voting. |

| Q: | How will my shares of Chiasma common stock be voted if I return a blank proxy? |

| A: | If you sign, date and return your proxy and do not indicate how you want your shares of Chiasma common stock to be voted, then your shares of Chiasma common stock will be voted in accordance with the recommendation of the Chiasma Board: “FOR” the merger proposal, “FOR” the advisory, non-binding compensation proposal and “FOR” the adjournment proposal. |

| Q: | Can I change my vote after I have submitted my proxy? |

| A: | Any Chiasma stockholder giving a proxy has the right to revoke the proxy and change their vote before the proxy is voted at the Chiasma special meeting by doing any of the following: |

| • | subsequently submitting a new proxy (including by submitting a proxy via the Internet or telephone) for the Chiasma special meeting that is received by the deadline specified on the accompanying proxy card; |

| • | giving written notice of your revocation to Chiasma’s Corporate Secretary; or |

| • | revoking your proxy and voting at the Chiasma special meeting. |

| Q: | What stockholder vote is required for the approval of each proposal at the Chiasma special meeting? What will happen if I fail to vote or abstain from voting on each proposal at the Chiasma special meeting? |

| A: | Proposal 1: Merger Proposal. Assuming a quorum is present at the Chiasma special meeting, approval of the merger proposal requires the affirmative vote of the holders of at least a majority of the outstanding shares of Chiasma common stock. Accordingly, a Chiasma stockholder’s abstention from voting or the failure of any Chiasma stockholder to vote (including the failure of a Chiasma stockholder who holds its shares in “street name” through a bank, broker or other nominee to give voting instructions to such bank, broker or other nominee with respect to the merger proposal), will have the same effect as a vote “AGAINST” the merger proposal. |

| Q: | What is a “broker non-vote”? |

| A: | Under the Nasdaq rules, banks, brokers and other nominees may use their discretion to vote “uninstructed” shares (i.e., shares of record held by banks, brokers or other nominees, but with respect to which the beneficial owner of such shares has not provided instructions on how to vote on a particular proposal) with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. All of the proposals currently expected to be brought before the Chiasma special meeting are “non-routine” matters under Nasdaq rules. |

| Q: | Where can I find the voting results of the Chiasma special meeting? |

| A: | Within four business days following certification of the final voting results Chiasma will file the final voting results of the Chiasma special meeting (or, if the final voting results have not yet been certified, the preliminary results) with the SEC on a Current Report on Form 8-K. |

| Q: | What will Chiasma stockholders receive for their shares if the merger is completed? |

| A: | If the merger is completed, each share of common stock, par value $0.01 per share, of Chiasma issued and outstanding (other than certain excluded shares as described in the merger agreement) will be converted into the right to receive 0.396 (which number we refer to as the “exchange ratio”) Amryt ADSs (which we collectively refer to as the “merger consideration”). |

| Q: | Is the exchange ratio subject to adjustment based on changes in the prices of Chiasma common stock or Amryt ADSs? Can it be adjusted for any other reason? |

| A: | For the merger consideration, you will receive a fixed number of Amryt ADSs, not a number of shares that will be determined based on a fixed market value. The market value of Amryt ADSs and the market value of Chiasma common stock at the effective time may vary significantly from their respective values on the date that the merger agreement was executed or at other dates, such as the date of this proxy statement/prospectus or the date of the Chiasma special meeting. Stock price changes may result from a variety of factors, including changes in Amryt’s or Chiasma’s respective businesses, operations or prospects, regulatory considerations, and general business, market, industry or economic conditions. The exchange ratio will not be adjusted to reflect any changes in the market value of Amryt ADSs or market value of Chiasma common stock. Therefore, the aggregate market value of the Amryt ADSs that you are entitled to receive at the time that the merger is completed could vary significantly from the value of such shares on the date of this proxy statement/prospectus or the date of the Chiasma special meeting. |

| Q: | Will the Amryt ADSs that I receive in the merger be publicly traded on an exchange? |

| A: | Yes. It is a condition to the completion of the merger that the Amryt ADSs (and the Amryt ordinary shares represented thereby) to be issued in connection with the merger be approved for listing on the Nasdaq, subject to official notice of issuance. In addition, it is a condition to the completion of the merger that the London Stock Exchange (which we refer to as the “LSE”) will not have informed Amryt or its agent that the Amryt ordinary shares underlying the Amryt ADSs to be issued pursuant to the merger will not be admitted to trading on AIM. Therefore, at the effective time, all Amryt ADSs received by Chiasma stockholders in connection with the merger will be listed on the Nasdaq under the ticker symbol “AMYT” and may be traded on the exchange by stockholders. |

| Q: | What equity stake will Chiasma stockholders hold in Amryt immediately following the merger? |

| A: | Based on the number of Amryt and Chiasma securities outstanding on June 9, 2021, using the treasury stock method, upon completion of the merger, former Chiasma securityholders are expected to receive approximately 40 percent of the equity of the combined company (excluding the impact of dilution from Amryt's convertible debentures). The relative ownership interests of Amryt shareholders and former Chiasma stockholders in Amryt immediately following the merger will depend on the number of Amryt ordinary shares and shares of Chiasma common stock issued and outstanding immediately prior to the merger. |

| Q: | If I am a Chiasma stockholder, how will I receive the merger consideration to which I am entitled? |

| A: | If you hold your shares of Chiasma common stock in book-entry form, whether through The Depository Trust Company or otherwise, you will not be required to take any specific actions to exchange your shares for Amryt ADSs. Your Chiasma shares will, following the effective time of the merger, be automatically exchanged for the Amryt ADSs (in book-entry form) to which you are entitled. If you instead hold your shares of Chiasma common stock in certificated form, then, after receiving the proper and completed documentation from you following the effective time of the merger, the exchange agent will deliver to you the Amryt ADSs (in book-entry form) to which you are entitled. More information may be found in the sections entitled “The Merger Agreement—Merger Consideration” and “The Merger Agreement—No Fractional ADSs” each beginning on page 108. |

| Q: | What happens if I sell my shares of Chiasma common stock after the record date but before the Chiasma special meeting? |

| A: | The record date is earlier than the date of the Chiasma special meeting. If you sell or otherwise transfer your shares of Chiasma common stock after the record date but before the Chiasma special meeting, you will, unless special arrangements are made, retain your right to vote at the Chiasma special meeting. |

| Q: | When is the merger expected to be completed? |

| A: | Subject to the satisfaction or waiver of the closing conditions described under the section entitled “The Merger Agreement—Conditions to the Completion of the Merger” beginning on page 110, including approval of the merger proposal by Chiasma stockholders, the merger is expected to be completed in the third quarter of 2021. However, neither Chiasma nor Amryt can predict the actual date on which the merger will be completed, or if the merger will be completed at all, because completion of the merger is subject to conditions and factors outside the control of both companies, including the receipt of certain required regulatory approvals. Chiasma and Amryt hope to complete the merger as soon as reasonably practicable. The merger agreement contains an end date of December 1, 2021 for the completion of the merger, which may be extended by mutual agreement of Chiasma and Amryt, which we refer to as the “end date.” See also the section entitled “The Merger Proposal—Regulatory Approvals Required for the Merger” beginning on page 91. |

| Q: | What happens if the merger is not completed? |

| A: | If the merger proposal is not approved by Chiasma stockholders, or if the merger is not completed for any other reason, Chiasma stockholders will not receive the merger consideration, and their shares of Chiasma common stock will remain outstanding. |

| Q: | Do Chiasma stockholders have dissenters’ or appraisal rights? |

| A: | No, under applicable Delaware law, dissenters and appraisal rights will not be available with respect to the merger and the other transactions contemplated by the merger agreement. |

| Q: | Who will solicit and pay the cost of soliciting proxies? |

| A: | Chiasma has engaged MacKenzie Partners, Inc. to assist in the solicitation of proxies for the Chiasma special meeting. Chiasma estimates that it will pay MacKenzie Partners, Inc. a fee of approximately $10,000 plus reasonable expenses. Chiasma has agreed to indemnify MacKenzie Partners, against certain losses, damages and expenses. |

| Q: | What are the material U.S. federal income tax considerations of the merger for U.S. holders of shares of Chiasma common stock? |

| A: | It is intended that, for U.S. federal income tax purposes, the merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (which we refer to as the “Code”) and that Section 367(a)(1) of the Code will not apply to cause the transaction to result in gain recognition by Chiasma stockholders that exchange their shares of Chiasma common stock for the merger consideration (other than any such Chiasma stockholder that is treated as a “five-percent transferee shareholder” (within the meaning of Treasury Regulations Section 1.367(a)-3(c)(5)(ii)) of Amryt following the transaction that does not enter into a five-year gain recognition agreement in the form provided in Treasury Regulations Section 1.367(a)-8). |

| Q: | What should I do now? |

| A: | You should read this proxy statement/prospectus carefully and in its entirety, including the annexes, and return your completed, signed and dated proxy card(s) by mail in the enclosed postage-paid envelope or submit your voting instructions by telephone or over the Internet as soon as possible so that your shares will be voted in accordance with your instructions. |

| Q: | How can I find more information about Chiasma or Amryt? |

| A: | You can find more information about Chiasma or Amryt from various sources described in the section entitled “Where You Can Find Additional Information” beginning on page 181 of the accompanying proxy statement/prospectus. |

| Q: | Whom do I call if I have questions about the Chiasma special meeting or the merger? |

| A: | If you have questions about the Chiasma special meeting or the merger, or desire additional copies of this proxy statement/prospectus or additional proxies, you may contact: |

| • | There is no assurance when or if the merger will be completed. |

| • | Failure to complete the merger could negatively affect Amryt’s or Chiasma’s stock prices, future business and financial results. |

| • | The exchange ratio is fixed and will not be adjusted in the event of any changes in either party’s stock price. |

| • | Upon completion of the merger, Chiasma stockholders will become Amryt ADS holders, and the market price for Amryt ADSs may be affected by factors different from those that historically have affected Chiasma. |

| • | In order to complete the merger, Amryt and Chiasma must obtain certain governmental approvals, and if such approvals are not granted or are granted with conditions that become applicable to the parties, completion of the merger may be delayed, jeopardized or prevented and the anticipated benefits of the merger could be reduced. |

| • | The combined company may not realize all of the anticipated benefits of the merger. |

| • | Amryt’s future performance following the completion of the merger depends, in part, on its ability to successfully implement its strategy. |

| • | The announcement and pendency of the merger could adversely affect each of Chiasma’s and Amryt’s business, results of operations and financial condition. |

| • | Chiasma and Amryt will incur substantial transaction fees and costs in connection with the merger. |

| • | The unaudited pro forma condensed combined financial information of Chiasma and Amryt is presented for illustrative purposes only and may not be indicative of the results of operations or financial condition of the combined company following the merger. |

| • | While the merger agreement is in effect, Chiasma, Amryt and their respective subsidiaries’ businesses are subject to restrictions on their business activities. |

| • | The termination of the merger agreement could negatively impact Chiasma and Amryt. |

| • | Directors and executive officers of Chiasma have interests in the merger that may differ from the interests of Chiasma stockholders generally, including, if the merger is completed, the receipt of financial and other benefits. |

| • | Except in specified circumstances, if the merger is not completed by December 1, 2021, subject to extension by mutual written agreement of Amryt and Chiasma, either Amryt or Chiasma may choose not to proceed with the merger. |

| • | There may be less publicly available information concerning Amryt than there is for issuers that are not foreign private issuers because, as a foreign private issuer, Amryt is exempt from a number of rules under the U.S. Exchange Act and is permitted to file less information with the SEC than issuers that are not foreign private issuers and Amryt, as a foreign private issuer, is permitted to follow home country practice in lieu of the listing requirements of Nasdaq, subject to certain exceptions. |

| • | Amryt is organized under the laws of England and Wales and certain of its directors and officers reside outside of the United States and most of the assets of its non-U.S. subsidiaries are located outside of the United States. As a result, it may not be possible for shareholders to enforce civil liability provisions of the securities laws of the United States against Amryt or Amryt’s directors and members of the Amryt Board. |

| • | Resales of Amryt ADSs following the merger may cause the market value of Amryt ADSs to decline. |

| • | The market value of Amryt ADSs may decline as a result of the merger. |

| • | The rights of Chiasma stockholders who become holders of Amryt ADSs in the merger will not be the same as the rights of holders of Amryt ordinary shares or Chiasma common stock. |

| • | Current Amryt shareholders and Chiasma stockholders will have a reduced ownership and voting interest after the merger and will exercise less influence over the management of the combined company. |

| • | Chiasma is a target of a lawsuit that could result in substantial costs and may delay or prevent the merger from being completed. |

| • | The combined company may be exposed to increased litigation, which could have an adverse effect on the combined company’s business and operations. |

| • | The merger may be a taxable event for Chiasma stockholders if it does not qualify as a “reorganization” for U.S. federal income tax purposes or if the merger does not satisfy the requirements of Section 367(a)(1) of the Code. |

| • | For U.S. federal income tax purposes, Amryt is treated as a surrogate foreign corporation, and there is a risk that Amryt may be treated as a U.S. corporation under certain circumstances, including as a result of proposed U.S. federal tax legislation. |

| • | Amryt and Chiasma may have difficulty attracting, motivating and retaining executives and other key employees in light of the merger. |

| • | The merger agreement contains provisions that make it more difficult for Amryt and Chiasma to pursue alternatives to the merger and may discourage other companies from trying to acquire Chiasma for greater consideration than what Amryt has agreed to pay. |

| • | The financial forecasts are based on various assumptions that may not be realized. |

| • | Exchange rate fluctuations may adversely affect the foreign currency value of Amryt ADSs. |

| • | Because the market value of Amryt ADSs that Chiasma stockholders will receive in the merger may fluctuate, Chiasma stockholders cannot be sure of the market value of the merger consideration that they will receive in the merger. |

| • | U.S. holders of Amryt ADSs may suffer adverse tax consequences if Amryt is characterized as a passive foreign investment company. |

Date | | | Amryt ADSs Nasdaq | | | Chiasma Common Stock Nasdaq | | | Equivalent value of merger consideration per share of Chiasma stock based on price of Amryt ADSs on Nasdaq |

| | | (US$) | | | (US$) | | | (US$) | |

May 4, 2021 | | | 12.95 | | | 2.84 | | | 5.13 |

June 28, 2021 | | | $12.45 | | | $4.71 | | | $4.93 |

| • | Proposal 1: Adoption of the Merger Agreement. To consider and vote on the merger proposal; |

| • | Proposal 2: Approval, on an Advisory, Non-Binding Basis, of Certain Merger-Related Compensatory Arrangements with Chiasma’s Named Executive Officers. To consider and vote on the advisory, non-binding compensation proposal; and |

| • | Proposal 3: Adjournment or Postponement of the Chiasma Special Meeting. To consider and vote on the adjournment proposal. |

| • | Chiasma has entered into employment agreements with certain employees, including its executive officers, entitling them to certain payments and benefits in connection with a termination of employment following a change of control of Chiasma; |

| • | certain outstanding equity awards held by the Chiasma executive officers may accelerate upon a qualifying termination of their employment in connection with the merger; and |

| • | directors and officers of Chiasma have continuing rights to indemnification and directors’ and officers’ liability insurance. |

| • | adoption of the merger agreement by Chiasma stockholders; |

| • | approval of the transactions contemplated by the merger agreement by Amryt shareholders; |

| • | the absence of any order issued by any court or other governmental authority of competent jurisdiction that remains in effect and enjoins, prevents or prohibits completion of the merger, and the absence of any applicable law enacted, entered or promulgated by any governmental authority that remains in effect and prohibits or makes illegal completion of the merger; |

| • | effectiveness of the registration statement for the Amryt ADSs and Amryt ordinary shares represented thereby to be issued in the merger (of which this proxy statement/prospectus forms a part) and, if applicable, of the registration statement on Form F-6 relating to the Amryt ADSs and the absence of any stop order suspending that effectiveness or any proceedings for that purpose pending before the SEC; |

| • | the distribution of the shareholder circular to Amryt shareholders in accordance with Amryt’s organizational documents; |

| • | (i) approval for listing on Nasdaq of the Amryt ADSs (and the Amryt ordinary shares represented thereby) to be issued in connection with the merger, subject to official notice of issuance, and (ii) the LSE not having informed Amryt that the Amryt ordinary shares represented by the Amryt ADSs will not be admitted to trading on AIM; and |

| • | any applicable waiting period under the HSR Act shall have expired or been terminated. |

| • | performance in all material respects by Chiasma of all of its obligations under the merger agreement required to be performed by it at or prior to the effective time; |

| • | subject to certain exceptions and materiality standards provided in the merger agreement, the representations and warranties of Chiasma being true and correct at and as of the date of the merger agreement and at and as of the closing date as though made at and as of the closing date; |

| • | absence of a material adverse effect on Chiasma since the date of the merger agreement; and |

| • | receipt of a certificate from an executive officer of Chiasma certifying that the conditions set forth in the three bullets directly above have been satisfied. |

| • | performance in all material respects by each of Amryt and Merger Sub of all of its obligations under the merger agreement required to be performed by it at or prior to the effective time; |

| • | subject to certain exceptions and materiality standards provided in the merger agreement, the representations and warranties of Amryt being true and correct at and as of the date of the merger agreement and at and as of the closing date as though made at and as of the closing date; |

| • | absence of a material adverse effect on Amryt since the date of the merger agreement; |

| • | receipt of a certificate from an executive officer of Amryt certifying that the conditions set forth in the three bullets directly above have been satisfied; and |

| • | the receipt by Chiasma of a tax opinion as to certain tax matters. |

| • | by mutual written agreement of Amryt and Chiasma; |

| • | by either Amryt or Chiasma, if the merger has not been completed by the end date of December 1, 2021, subject to extension by mutual written agreement of Amryt and Chiasma; |

| • | by either Amryt or Chiasma, if a governmental authority has issued a final and non-appealable injunction or other order that permanently enjoins, prevents or prohibits the completion of the merger; |

| • | by either Amryt or Chiasma, if (i) Chiasma stockholders fail to adopt the merger agreement upon a vote taken on a proposal to adopt the merger agreement at the Chiasma special meeting or (ii) Amryt shareholders fail to approve the transactions contemplated by the merger agreement upon a vote taken on a proposal to approve the transactions contemplated by the merger agreement; |

| • | by Amryt if, prior to the adoption of the merger agreement by Chiasma stockholders: (i) the Chiasma Board makes an adverse recommendation change, (ii) Chiasma fails to publicly confirm to Chiasma stockholders, within 10 business days after the commencement of a tender or exchange offer subject to Regulation 14D under the U.S. Exchange Act that constitutes an acquisition proposal, that Chiasma recommends rejection of such tender or exchange offer (or shall have withdrawn any such rejection thereafter), (iii) other than in the context of a tender or exchange offer, Chiasma fails to publicly reaffirm the Chiasma Board’s recommendation to adopt the merger agreement after the date any acquisition proposal with respect to Chiasma or any material modification thereto (which request may only be made once per acquisition proposal or material modification) is first publicly announced, within five business days after a request from Amryt, (iv) other than in the context of an acquisition proposal, Chiasma fails to publicly reaffirm the Chiasma Board’s recommendation to adopt the merger agreement within 5 business days following a written request from Amryt (which request may only be made once other than in the context of an acquisition proposal), or (v) Chiasma has breached or failed to perform any of its obligations described under “—No Solicitation” in any material respect; |

| • | by Amryt if there has been a breach of any representation or warranty or failure to perform any covenant or agreement on the part of Chiasma (other than with respect to its obligations described under “—No Solicitation”) that, individually or in the aggregate, would give rise to the failure of a closing condition by the other party and is incapable of being cured prior to the end date or is not cured within 30 days after the giving of notice thereof by Amryt or the end date; |

| • | by Amryt if, prior to the approval of the transactions contemplated by the merger agreement by Amryt shareholders, Amryt terminates the merger agreement in order to enter into a definitive agreement for a superior proposal; |

| • | by Chiasma if, prior to the approval of the transactions contemplated by the merger agreement by Amryt shareholders: (i) the Amryt Board makes an adverse recommendation change, (ii) Amryt fails to publicly confirm to Amryt shareholders, within ten business days after the announcement or commencement of a tender or exchange offer subject to Regulation 14D under the U.S. Exchange Act that constitutes an acquisition proposal, that Amryt recommends rejection of such tender or exchange offer (or shall have withdrawn any such rejection thereafter), (iii) other than in the context of a tender or exchange offer, Amryt fails to publicly reaffirm the Amryt Board’s recommendation to approve the transactions contemplated by the merger agreement after the date any acquisition proposal with respect to Amryt or any material modification thereto (which request may only be made once per acquisition proposal or material modification) is first publicly announced, within five business days after a request from Chiasma, (iv) other than in the context of an acquisition proposal, Amryt fails to publicly reaffirm the Amryt Board’s recommendation to approve the transactions contemplated by the merger agreement within five business days following a written request from Chiasma (which request may only be made once other than in the context of an acquisition proposal), or (v) Amryt or Merger Sub has breached or failed to perform any of its obligations described under “—No Solicitation” in any material respect. |

| • | by Chiasma if there has been a breach of any representation or warranty or failure to perform any covenant or agreement on the part of Amryt or Merger Sub (other than with respect to its obligations described under “—No Solicitation”) that, individually or in the aggregate, would give rise to the failure of a closing condition by the other party and is incapable of being cured prior to the end date or is not cured within 30 days after the giving of notice thereof by Chiasma or the end date; or |

| • | by Chiasma if, prior to the adoption of the merger agreement by Chiasma stockholders, Chiasma terminates the merger agreement in order to enter into a definitive agreement for a superior proposal. |

| • | Chiasma and Amryt may experience negative reactions from the financial markets, including a decline of their share prices (which may reflect a market assumption that the merger will be completed); |

| • | Chiasma and Amryt may experience negative reactions from the investment community, their customers, suppliers, distributors, regulators and employees and other partners in the business community; |

| • | Chiasma and Amryt may be required to pay certain costs relating to the merger, whether or not the merger is completed; and |

| • | matters relating to the merger will have required substantial commitments of time and resources by Chiasma and Amryt management, which would otherwise have been devoted to day-to-day operations and other opportunities that may have been beneficial to Chiasma and Amryt, respectively, had the merger not been contemplated. |

| • | at least 75 percent of its gross income is “passive income,” or |

| • | at least 50 percent of the value, determined on the basis of a quarterly average, of its gross assets is attributable to assets that produce or are held for the production of “passive income.” |

| • | future market conditions, including the risk of disruptions to the financial or capital markets and currency fluctuations |

| • | the behavior of other market participants |

| • | changes in the political, social and regulatory framework in which Amryt operates or in economic, technological or consumer trends or conditions |

| • | the impact of uncertainty and volatility in relation to the UK’s exit from the EU |

| • | the course of the COVID-19 pandemic and the impact it may have or continue to have on these risks, on Amryt’s or Chiasma’s ability to continue to mitigate these risks, and on Amryt’s or Chiasma’s operations, financial results or financial condition |

| • | the risk of unexpected deterioration in Amryt’s or Chiasma’s financial position |

| • | actual or contingent liabilities |

| • | the outcome of clinical trials |

| • | the occurrence of cyber incidents or breaches in cybersecurity |

| • | changes in U.S. federal income tax rules |

| • | the actions of regulators and other factors such as Amryt’s ability to obtain financing |

| • | uncertainties as to the timing of the contemplated merger |

| • | uncertainties as to the approvals by Amryt’s shareholders or Chiasma’s stockholders required in connection with the contemplated merger |

| • | the possibility that a competing proposal will be made |

| • | the possibility that the closing conditions to the merger may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant a necessary regulatory approval |

| • | the effects of disruption caused by the announcement of the contemplated merger making it more difficult to maintain relationships with employees, customers, vendors and other business partners |

| • | the risk of failure to attract, develop, engage and retain a diverse, talented and capable workforce, including following the consummation of the merger |

| • | the risk that stockholder litigation in connection with the contemplated merger may affect the timing or occurrence of the contemplated merger or result in significant costs of defense, indemnification and liability |

| • | other business effects, including the effects of industry, economic or political conditions outside of the control of the parties to the contemplated merger |

| • | transaction costs, including the risk that management’s time and attention are diverted on transaction-related issues or that disruption from the merger makes it more difficult to maintain business, contractual and operational relationships |

| • | and the risk that Amryt is unable to achieve the synergies and value creation contemplated by the merger, or that Amryt is unable to promptly and effectively integrate Chiasma’s businesses |

| | | For the Three Months Ended March 31, | | | For the Years Ended December 31, | |||||||||||||

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | (in thousands except share and per share data) | ||||||||||||||||

Consolidated Statement of Operations Data | | | | | | | | | | | | | ||||||

Product revenue, net | | | $1,924 | | | $1,106 | | | $— | | | $— | | | $— | | | $— |

Cost of goods sold | | | 67 | | | 61 | | | — | | | — | | | — | | | — |

Gross profit | | | 1,857 | | | 1,045 | | | — | | | — | | | — | | | — |

Operating expenses: | | | | | | | | | | | | | ||||||

Selling, general and administrative | | | 15,698 | | | 44,892 | | | 15,122 | | | 9,974 | | | 9,146 | | | 21,815 |

Research and development | | | 4,199 | | | 26,802 | | | 22,457 | | | 22,362 | | | 17,948 | | | 31,317 |

Restructuring charges | | | — | | | — | | | — | | | — | | | 1,038 | | | 8,179 |

Total operating expenses | | | 19,897 | | | 71,694 | | | 37,579 | | | 32,336 | | | 28,132 | | | 61,311 |

Loss from operations | | | (18,040) | | | (70,649) | | | (37,579) | | | (32,336) | | | (28,132) | | | (61,311) |

Interest and other income (loss), net | | | (9,583) | | | 1,826 | | | 1,543 | | | 1,044 | | | 716 | | | 547 |

Interest expense | | | (2,873) | | | (5,872) | | | — | | | — | | | — | | | — |

Loss before income taxes | | | (30,496) | | | (74,695) | | | (36,036) | | | (31,292) | | | (27,416) | | | (60,764) |

Provision (benefit) for income taxes | | | 52 | | | 84 | | | 284 | | | (31) | | | (590) | | | 347 |

Net loss | | | $(30,548) | | | $(74,779) | | | $(36,320) | | | $(31,261) | | | $(26,826) | | | $(61,111) |

| | | | | | | | | | | | | |||||||

Earnings per share attributable to common stockholders | | | | | | | | | | | | | ||||||

Basic | | | $(0.49) | | | $(1.43) | | | $(1.06) | | | $(1.28) | | | $(1.10) | | | $(2.51) |

Diluted | | | $(0.49) | | | $(1.43) | | | $(1.06) | | | $(1.28) | | | $(1.10) | | | $(2.51) |

| | | | | | | | | | | | | |||||||

Weighted-average shares outstanding: | | | | | | | | | | | | | ||||||

Basic | | | 62,831,141 | | | 52,234,945 | | | 34,204,284 | | | 24,399,706 | | | 24,366,681 | | | 24,319,443 |

Diluted | | | 62,831,141 | | | 52,234,945 | | | 34,204,284 | | | 24,399,706 | | | 24,366,681 | | | 24,319,443 |

| | | March 31, | | | December 31, | |||||||||||||

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| | | (in thousands) | ||||||||||||||||

Consolidated Balance Sheet Data | | | | | | | | | | | | | ||||||

Cash and cash equivalents | | | $24,576 | | | $15,462 | | | $27,855 | | | $13,060 | | | $14,603 | | | $37,013 |

Marketable securities | | | 90,457 | | | 119,959 | | | 64,520 | | | 28,602 | | | 52,336 | | | 55,971 |

Accounts receivable | | | 1,015 | | | 538 | | | — | | | — | | | — | | | — |

Inventory | | | 14,381 | | | 10,955 | | | — | | | — | | | — | | | — |

Current assets | | | 137,032 | | | 153,358 | | | 96,256 | | | 62,187 | | | 68,707 | | | 95,094 |

Total assets | | | 159,535 | | | 176,338 | | | 98,826 | | | 63,256 | | | 69,883 | | | 96,756 |

Current liabilities | | | 17,319 | | | 16,731 | | | 11,375 | | | 28,627 | | | 6,745 | | | 8,400 |

Deferred royalty obligation | | | 73,368 | | | 63,548 | | | — | | | — | | | — | | | — |

Long-term liabilities | | | 6,160 | | | 4,274 | | | 1,682 | | | 505 | | | 664 | | | 2,631 |

Total liabilities | | | 96,847 | | | 84,553 | | | 13,057 | | | 29,132 | | | 7,409 | | | 11,031 |

Total stockholders’ equity | | | 62,688 | | | 91,785 | | | 85,769 | | | 34,124 | | | 62,474 | | | 85,725 |

| | | Three Months Ended March 31, | ||||

| | | 2021 | | | 2020 | |

| | | US$’000 | | | US$’000 | |

Revenue | | | 48,432 | | | 44,574 |

Cost of sales | | | (23,489) | | | (32,620) |

Gross profit | | | 24,943 | | | 11,954 |

Research and development expenses | | | (8,916) | | | (8,934) |

Selling, general and administrative expenses | | | (18,156) | | | (18,406) |

Restructuring and acquisition costs | | | — | | | (853) |

Share based payment expenses | | | (1,263) | | | (745) |

Operating loss before finance expense | | | (3,392) | | | (16,984) |

Non-cash change in fair value of contingent consideration | | | (2,874) | | | (2,906) |

Non-cash contingent value rights finance expense | | | (1,763) | | | (1,448) |

Net finance expense - other | | | (7,898) | | | (9,416) |

Loss on ordinary activities before taxation | | | (15,927) | | | (30,754) |

Tax (charge)/credit on loss on ordinary activities | | | (610) | | | 1,857 |

Loss for the period attributable to the equity holders of Amryt | | | (16,537) | | | (28,897) |

Exchange translation differences which may be reclassified through profit or loss | | | 2,547 | | | (13) |

Total other comprehensive income/(loss) | | | 2,547 | | | (13) |

Total comprehensive loss for the period attributable to the equity holders of Amryt | | | (13,990) | | | (28,910) |

| | | | | |||

Loss per share | | | | | ||

Loss per share - basic and diluted, attributable to ordinary equity holders of the parent (US$) | | | (0.09) | | | (0.19) |

| | | Year ended December 31, | |||||||

| | | 2020 | | | 2019 (restated) | | | 2018 | |

| | | US$’000 | | | US$’000 | | | US$’000 | |

Revenue | | | 182,607 | | | 58,124 | | | 17,095 |

Cost of sales | | | (119,029) | | | (38,733) | | | (6,266) |

Gross profit | | | 63,578 | | | 19,391 | | | 10,829 |

Research and development expenses | | | (27,618) | | | (15,827) | | | (10,703) |

Selling, general and administrative expenses | | | (76,673) | | | (35,498) | | | (17,342) |

Restructuring and acquisition costs | | | (1,017) | | | (13,038) | | | — |

Share based payment expenses | | | (4,729) | | | (841) | | | (821) |

Impairment charge | | | — | | | (4,670) | | | — |

Operating loss before finance expense | | | (46,459) | | | (50,483) | | | (18,037) |

Non-cash change in fair value of contingent consideration | | | (27,827) | | | (6,740) | | | (10,566) |

Non-cash contingent value rights finance expense | | | (12,004) | | | (1,511) | | | — |

Net finance expense - other | | | (19,569) | | | (4,759) | | | (1,841) |

Loss on ordinary activities before taxation | | | (105,859) | | | (63,493) | | | (30,444) |

Tax credit/(charge) on loss on ordinary activities | | | 1,332 | | | 495 | | | (43) |

Loss for the year attributable to the equity holders of Amryt | | | (104,527) | | | (62,998) | | | (30,487) |

Exchange translation differences which may be reclassified through profit or loss | | | (2,164) | | | 755 | | | (77) |

Total other comprehensive (loss)/income | | | (2,164) | | | 755 | | | (77) |

Total comprehensive loss for the year attributable to the equity holders of Amryt | | | (106,691) | | | (62,243) | | | (30,564) |

| | | | | | | ||||

Loss per share | | | | | | | |||

Loss per share - basic and diluted, attributable to ordinary equity holders of the parent (US$) | | | (0.66) | | | (0.83) | | | (0.67) |

| | | As at | ||||

| | | March 31, 2021 | | | December 31, 2020 | |

| | | US$’000 | | | US$’000 | |

Statement of financial position data: | | | | | ||

Cash and cash equivalents, including restricted cash | | | 118,551 | | | 118,798 |

Trade and other receivables | | | 43,963 | | | 43,185 |

Inventories | | | 39,371 | | | 40,992 |

Working capital(1) | | | 107,729 | | | 101,800 |

Total assets | | | 521,971 | | | 536,591 |

Long term loan | | | 88,769 | | | 87,302 |

Convertible notes | | | 102,216 | | | 101,086 |

Total liabilities | | | 467,607 | | | 470,449 |

Accumulated deficit | | | (252,142) | | | (235,605) |

Total equity | | | 54,364 | | | 66,142 |

| (1) | We define working capital as current assets less current liabilities. |

| | | As at December 31, | ||||

| | | 2020 | | | 2019 (restated) | |

| | | US$’000 | | | US$’000 | |

Statement of financial position data: | | | | | ||

Cash and cash equivalents, including restricted cash | | | 118,798 | | | 67,229 |

Trade and other receivables | | | 43,185 | | | 35,500 |

Inventories | | | 40,992 | | | 58,000 |

Working capital(1) | | | 101,800 | | | 58,503 |

Total assets | | | 536,591 | | | 527,096 |

Long term loan | | | 87,302 | | | 81,610 |

Convertible Notes, net of equity component | | | 101,086 | | | 96,856 |

Total liabilities | | | 470,449 | | | 395,263 |

Accumulated deficit | | | (235,605) | | | (131,137) |

Total equity | | | 66,142 | | | 131,833 |

| (1) | We define working capital as current assets less current liabilities. |

| | | Quarter Ended March 31, 2021 | | | Year Ended December 31, 2020 | |

| | | US$’000 | | | US$’000 | |

Revenue | | | 50,356 | | | 183,713 |

Cost of sales | | | (28,758) | | | (126,026) |

Gross profit | | | 21,598 | | | 57,687 |

Research and development expenses | | | (12,936) | | | (53,482) |

Selling, general and administrative expenses | | | (32,661) | | | (146,375) |

Restructuring and acquisition costs | | | — | | | (1,017) |

Share based payment expenses | | | (3,485) | | | (12,489) |

Operating loss before finance expense | | | (27,484) | | | (155,676) |

Non-cash change in fair value of contingent consideration | | | (2,874) | | | (27,827) |

Non-cash contingent value rights finance expense | | | (1,763) | | | (12,004) |

Net finance expense – other | | | (7,821) | | | (19,061) |

Loss on ordinary activities before taxation | | | (39,942) | | | (214,568) |

Tax credit/(charge) on loss on ordinary activities | | | 589 | | | 2,916 |

Loss for the year attributable to the equity holders of Amryt | | | (39,353) | | | (211,652) |

| | | | | |||

Loss per share | | | | | ||

Loss per share - basic and diluted, attributable to ordinary equity holders of the parent (US$) | | | (0.13) | | | (0.73) |

| | | As at March 31, 2021 | |

| | | US$’000 | |

Cash and cash equivalents, including restricted cash | | | 107,981 |

Trade and other receivables | | | 51,581 |

Inventories | | | 53,752 |

Working capital(1) | | | 104,748 |

Total assets | | | 936,472 |

Long term loan | | | 88,769 |

Convertible Notes, net of equity component | | | 102,216 |

Total liabilities | | | 560,087 |

Accumulated deficit | | | (271,163) |

Total equity | | | 376,385 |

| (1) | We define working capital as current assets less current liabilities. |

Date | | | Amryt ADSs Nasdaq | | | Chiasma Common Stock Nasdaq | | | Equivalent value of merger consideration per share of Chiasma stock based on price of Amryt ADSs on Nasdaq |

| | | (US$) | | | (US$) | | | (US$) | |

May 4, 2021 | | | 12.95 | | | 2.84 | | | 5.13 |

June 28, 2021 | | | $12.45 | | | $4.71 | | | $4.93 |

| | | Year Ended December 31, 2020 | |

| | | (US$) | |

Amryt Historical per Ordinary Share Data: | | | |

Net Earnings/(Loss)—basic | | | ($0.66) |

Net Earnings/(Loss)—diluted | | | ($0.66) |

Cash dividends paid | | | $0 |

Book Value | | | $0.42 |

Chiasma Historical per Common Share Data: | | | |

Net Earnings/(Loss)—basic | | | ($1.43) |

Net Earnings/(Loss)—diluted | | | ($1.43) |

Cash dividends declared | | | $0 |

Book Value | | | $1.76 |

| | | Quarter Ended March 31, 2021 | |

Unaudited Pro Forma Combined per Amryt Ordinary Share Data: | | | |

Net (Loss)—basic | | | ($0.13) |

Net Earnings/(Loss)—diluted | | | ($0.13) |

Cash dividends paid | | | $0 |

Book Value | | | $1.21 |

| | | Quarter Ended March 31, 2021 | |

Unaudited Pro Forma Combined per Chiasma Equivalent Share Data: | | | |

Net (Loss)—basic | | | ($0.05) |

Net (Loss)—diluted | | | ($0.05) |

Cash dividends paid | | | $0 |

Book Value | | | $0.48 |

| • | Proposal 1: Adoption of the Merger Agreement. To consider and vote on the merger proposal; |

| • | Proposal 2: Approval, on an Advisory, Non-Binding Basis, of Certain Merger-Related Compensatory Arrangements with Chiasma’s Named Executive Officers. To consider and vote on the advisory, non-binding compensation proposal; and |

| • | Proposal 3: Adjournment or Postponement of the Chiasma Special Meeting. To consider and vote on the adjournment proposal. |

| • | Proposal 1: “FOR” the merger proposal; |

| • | Proposal 2: “FOR” the advisory, non-binding compensation proposal; and |

| • | Proposal 3: “FOR” the adjournment proposal. |

Proposal | | | Required Vote | | | Effect of Certain Actions |

Proposal 1: Merger Proposal | | | Approval requires the affirmative vote of at least a majority of the outstanding shares of Chiasma common stock entitled to vote on the merger proposal. | | | Shares of Chiasma common stock not present at the Chiasma special meeting, shares that are present and not voted on the merger proposal, including due to the failure of any Chiasma stockholder who holds their shares in “street name” through a bank, broker or other nominee to give voting instructions to such bank, broker or other nominee with respect to the merger proposal, and abstentions will have the same effect as a vote “AGAINST” the merger proposal |

| | | | | |||

Proposal 2: Advisory, Non-Binding Compensation Proposal | | | Approval requires the affirmative vote of at least a majority of votes cast on the advisory, non-binding compensation proposal (meaning the number of votes cast “FOR” this proposal must exceed the votes cast “AGAINST”). | | | A failure to vote, a broker non-vote or an abstention will have no effect on the outcome of the advisory, non-binding compensation proposal, assuming a quorum is present. |

| | | | | |||

Proposal 3: Adjournment Proposal | | | Approval requires the affirmative vote of at least a majority of votes cast on the adjournment proposal (meaning the number of votes cast “FOR” this proposal must exceed the votes cast “AGAINST”). | | | A failure to vote, a broker non-vote or an abstention will have no effect on the outcome of the adjournment proposal. |

| • | By Internet: By visiting the Internet address provided on the proxy card and following the instructions provided on your proxy card. |

| • | By Telephone: By calling the number located on the proxy card and following the recorded instructions. |

| • | By Mail: If you have received a paper copy of the proxy materials by mail, you may complete, sign, date and return by mail the enclosed proxy card in the envelope provided to you with your proxy materials. |

| • | Via the Special Meeting Website: All stockholders of record may vote at the Chiasma special meeting by attending the meeting via the special meeting website. Stockholders who plan to attend the Chiasma special meeting will need the 11-digit control number included on their proxy card in order to access the special meeting website and to attend and vote thereat. |

| • | by voting again by Internet or telephone as instructed on your proxy card before the closing of the voting facilities at 11:59 p.m., Eastern Time, on August 2, 2021; |

| • | by sending a signed written notice of revocation to Chiasma’s Corporate Secretary, provided such statement is received before the Chiasma special meeting; |

| • | by submitting a properly signed and dated proxy card as instructed above in advance of the Chiasma special meeting; or |

| • | by attending the Chiasma special meeting via the special meeting website and requesting that your proxy be revoked or voting via the website as described above. |

| • | Synergies. The merger is expected to accelerate and diversify Amryt’s growing revenues and deliver cost synergies. Both Amryt and Chiasma currently enjoy a significant degree of customer call-point overlap and combining operations would provide significant salesforce scale opportunities. The merger is also expected to result in a diversified and broad shareholder base with leading biotech investors supportive of the company’s long-term growth plans. |

| • | Diversified Portfolio of Established and Growing Products and Financial Strength. Consistent with Amryt’s shareholder-endorsed strategy to acquire, develop and commercialize novel treatments for rare diseases, the portfolio of products of the combined company would offer a pathway to a potential $1.0 billion of peak revenues. The merger would solidify Amryt’s position as a global leader in treating rare and orphan conditions and the combined company would have three approved commercial products as well as a robust clinical pipeline of development assets. The addition of MYCAPSSA, which was recently launched in the U.S., to Amryt’s commercial product portfolio would represent a strong strategic, operational and commercial fit given the overlap existing across Chiasma’s and Amryt’s portfolios. |

| • | Improved Competitive Positioning. The merger would deliver improved competitive positioning with increased scale for the combined company in the U.S., the EU and beyond. The merger is expected to enhance the combined company’s commercial and medical infrastructure globally, which would enable Amryt’s future growth plans in highly attractive markets and help Amryt continue to execute its future growth plans. |

| • | Increased Share Liquidity. The merger is expected to result in increased share liquidity for holders of the combined company following the completion of the merger due to the benefits associated with a larger market capitalization and more diverse shareholder base. |

| • | Business Climate. The current and prospective business climate in the biopharmaceutical industry, including the regulatory and litigation environment, and the position of current and likely competitors, including as a result of other business combinations. |

| • | Due Diligence. The results of the due diligence review of Chiasma conducted by Amryt and its financial advisor. |

| • | Merger Agreement. The view that the terms and conditions of the merger agreement and the merger, including the covenants, closing conditions and terminations, are favorable to completing the merger. |

| • | Alternatives Available. Potential strategic alternatives that might be available to Amryt relative to the merger, including remaining a standalone entity or other acquisition opportunities and the belief of the Amryt Board that the merger is in the best interests of Amryt, its stakeholders and its shareholders as a whole given the potential risks, rewards and uncertainties associated with each alternative, including execution and regulatory risks and achievement of anticipated synergies. |

| • | the fact that the exchange ratio is fixed and will not fluctuate based upon changes in the stock price of Chiasma or Amryt prior to completion of the merger; and |

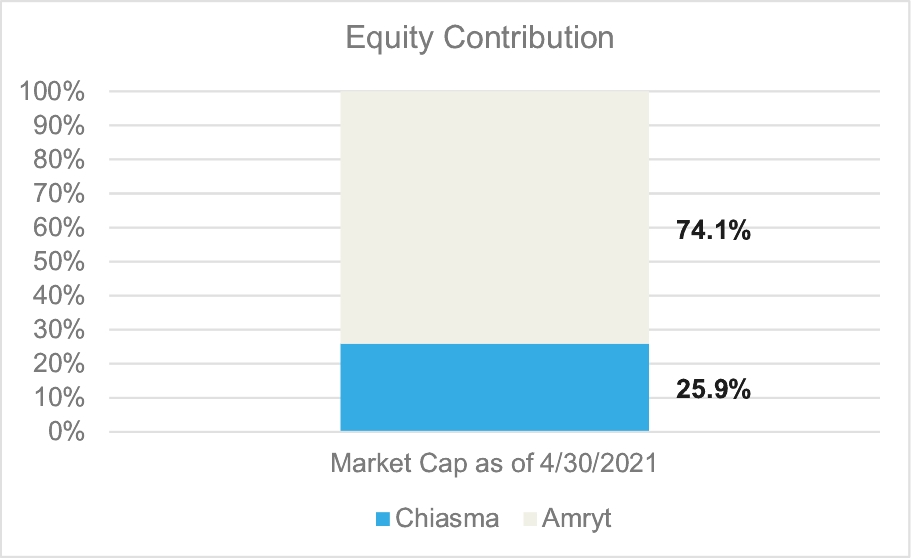

| • | that the merger consideration had an implied value per share of Chiasma common stock of $5.52, based on the closing price of Amryt ordinary shares and Chiasma common stock as of April 30, 2021, and the implied offer price based on the preliminary exchange ratio of 1.975 Amryt ordinary shares for each share of Chiasma common stock, or 0.395 Amryt ADSs (each Amryt ADS representing the right to receive five Amryt ordinary shares), which represented a premium of approximately 85.2 percent to Chiasma stockholders. |

| • | following the receipt of an alternative acquisition proposal that the Chiasma Board determines in good faith (after consultation with its outside counsel and its financial advisor) is or is reasonably likely to lead to a superior proposal (as defined in the section entitled “The Merger Agreement —No Solicitation”), subject to certain restrictions imposed by the merger agreement, including that the Chiasma Board shall have determined in good faith (after consultation with its financial advisor and outside legal counsel) that the failure to take such action would be inconsistent with its fiduciary duties under applicable law and that Amryt shall have been given an opportunity to match the superior proposal; or |

| • | in response to an intervening event (as defined in the section entitled “The Merger Agreement—No Solicitation”), subject to certain restrictions imposed by the merger agreement, including that the Chiasma Board shall have determined in good faith (after consultation with its financial advisor and outside legal counsel) that the failure to take such action would be inconsistent with its fiduciary duties under applicable law and provided Amryt with prior notice of its intention to take such action. |

| • | the fact that Chiasma stockholders will be sharing participation of Chiasma’s upside with Amryt shareholders as part of the combined company; |

| • | the fact that forecasts of future results of operations and synergies are estimates based on assumptions that may not be realized within the expected time frame or at all; |

| • | the effect of the public announcement of the merger agreement, including effects on Chiasma’s relationship with its partners and other business relationships and Chiasma’s ability to attract and retain key management and personnel; |

| • | the risk of the coronavirus pandemic making it more difficult for Amryt and Chiasma to consummate the merger, including increased difficulty in obtaining sufficient votes for the recommended proposals and other logistical challenges; |

| • | the fact that the merger agreement precludes Chiasma from actively soliciting alternative transaction proposals and requires payment by Chiasma of a $8.0 million termination fee under certain circumstances; |

| • | the fact that Chiasma will be required to pay a $3.5 million termination fee to Amryt if the merger agreement is terminated because Chiasma’s stockholders fail to adopt the merger agreement; |

| • | the fact that, because the exchange ratio is fixed, if the price of the Amryt ADSs declines and does not recover prior to the effective time of the merger, the value of consideration received by Chiasma stockholders in connection with the merger would also decline; |

| • | the risks associated with integrating businesses upon completion of the merger, including risks of employee disruption, risks relating to melding of company cultures and retention risks relating to key management and employees; |

| • | the possibility that the merger will not be consummated and the potential negative effects on Chiasma’s business, operations, financial results and stock price; |

| • | the restrictions imposed by the merger agreement on the conduct of Chiasma’s business prior to completion of the merger, which could delay or prevent Chiasma from undertaking some business opportunities that may arise during that time, including Chiasma’s ability to capitalize the company to continue operations; |

| • | the potential for litigation relating to the proposed merger and the associated costs, burden and inconvenience involved in defending those proceedings; |

| • | the fact that the strategic direction of the continuing company following the completion of the merger will be determined by a board of directors initially comprised of a majority of designees of Amryt; |

| • | the fact that, under Delaware law, Chiasma stockholders are not entitled to appraisal rights, dissenters’ rights or similar rights of an objecting shareholder in connection with the merger; |

| • | the interests that certain directors and executive officers of Chiasma may have with respect to the merger that may be different from, or in addition to, their interests as stockholders of Chiasma or the interests of Chiasma’s other stockholders generally, as described under “—Interests of Chiasma’s Directors and Executive Officers in the Merger”; and |

| • | the various other applicable risks associated with Chiasma, Amryt and the merger, including the risks described in “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors.” |

| 1. | Reviewed documents, including but not limited to the following, regarding Chiasma: |

| a. | Chiasma’s annual reports and audited financial statements on Form 10-K filed with the SEC for the fiscal year ended December 31, 2020; |

| b. | Certain internal financial analyses and forecasts of Chiasma prepared by and provided to Duff & Phelps by Chiasma management relating to Chiasma’s business and utilized per instruction of Chiasma (which we refer to as the “Adjusted Chiasma Projections”), as set forth and described more fully in the section entitled “—Certain Prospective Financial Information Reviewed by the Chiasma Board and Its Financial Advisor”; and |

| c. | Revenue Interest Financing Agreement (which we refer to as the “RIFA”) between HCR and Chiasma, dated as of April 7, 2020; |

| 2. | Reviewed the documents including, but not limited to the following, regarding Amryt: |

| a. | Amryt’s annual report for the year ended December 31, 2019; |

| b. | Amryt’s audited financial statements for the year ended December 31, 2020 as filed with the SEC; |

| c. | Amryt’s prospectus filings with the SEC, including the Amendment No. 1 to Form F-1 filed on January 11, 2021, the 424(b)(4) Prospectus filed on January 14, 2021, and the 424(b)(3) Prospectus Supplement No.1 filed on March 4, 2021; |

| d. | Certain internal financial analyses and forecasts for Amryt prepared based on information provided by the management of Amryt and adjusted and provided by the management of Chiasma relating to Amryt’s business and utilized per instruction of Chiasma (which we refer to as the “Chiasma Management Adjusted Amryt Projections”), as set forth and described more fully in the section entitled “—Certain Prospective Financial Information Reviewed by the Chiasma Board and Its Financial Advisor”; and |

| e. | Certain cost synergies expected to be realized in the proposed transaction, as well as the costs to achieve these synergies, provided by Amryt management and reviewed by Chiasma management, as set forth and described more fully in the section entitled “—Certain Prospective Financial Information Reviewed by the Chiasma Board and Its Financial Advisor”; |

| 3. | Documents related to the Proposed Transaction, including: |

| a. | The letter of intent from Amryt to Chiasma dated April 21, 2021; |

| b. | The draft of the merger agreement dated May 4, 2021 (which we refer to as the “draft merger agreement”); |

| 4. | Discussed the information referred to above and the background and other elements of the proposed transaction with Chiasma management and their representatives, including Torreya in Torreya’s capacity as investment banker for Chiasma; |

| 5. | Discussed the Adjusted Chiasma Projections (as set forth and described more fully in the section entitled “—Certain Prospective Financial Information Reviewed by the Chiasma Board and Its Financial Advisor”) and their underlying assumptions with Chiasma management and representatives from Torreya; |

| 6. | Discussed the Chiasma Management Adjusted Amryt Projections (as set forth and described more fully in the section entitled “—Certain Prospective Financial Information Reviewed by the Chiasma Board and Its Financial Advisor”) and their underlying assumptions and the analysis of transaction synergies with Amryt management, as well as with Chiasma management; |

| 7. | Reviewed various analyst reports for each of Chiasma, Amryt and the selected public companies; |

| 8. | Reviewed the historical trading price and trading volume of the Chiasma common stock and Amryt ADSs and the publicly traded securities of certain other companies that Duff & Phelps deemed relevant; |

| 9. | Performed certain valuation and comparative analyses using generally accepted valuation and analytical techniques consisting of discounted cash flow, selected public companies and precedent M&A transactions analyses; and |

| 10. | Conducted such other analyses and considered such other factors as Duff & Phelps deemed appropriate. |

| 1. | Relied upon the accuracy, completeness and fair presentation of all information, data, advice, opinions and representations obtained from public sources or provided to it from private sources, including Chiasma management and did not independently verify such information; |

| 2. | Relied upon the fact that the Chiasma Board and Chiasma have been advised by counsel as to all legal matters with respect to the proposed transaction, including whether all procedures required by law to be taken in connection with the proposed transaction have been duly, validly and timely taken; |

| 3. | Assumed that any estimates, evaluations, forecasts and projections furnished to Duff & Phelps were reasonably prepared and based upon the best currently available information and good faith judgment of the person furnishing the same, and Duff & Phelps expresses no opinion with respect to such projections or the underlying assumptions; |

| 4. | Assumed that the merger will qualify for federal income tax purposes as a reorganization under the provisions of Section 368(a) of the Code; |

| 5. | Assumed that information supplied and representations made by Chiasma management are substantially accurate regarding Chiasma and the proposed transaction; |

| 6. | Assumed that the representations and warranties made in the merger agreement are substantially accurate; |

| 7. | Assumed that the final executed merger agreement will not differ in any material respect from the draft merger agreement reviewed by Duff & Phelps; |

| 8. | Assumed that there has been no material change in the assets, liabilities, financial condition, results of operations, business, or prospects of Chiasma or Amryt since the date of the most recent financial statements and other information made available to or discussed with Duff & Phelps, and that there was no information or facts that would make the information reviewed by or discussed with Duff & Phelps incomplete or misleading; |

| 9. | Assumed that all of the conditions required to implement the proposed transaction will be satisfied and that the proposed transaction will be completed in accordance with the merger agreement without any amendments thereto or any waivers of any terms or conditions thereof; and |

| 10. | Assumed that all governmental, regulatory or other consents and approvals necessary for the consummation of the proposed transaction will be obtained without any adverse effect on Chiasma or the contemplated benefits expected to be derived in the proposed transaction. |

Chiasma Discounted Cash Flow Analysis | | | | | | | | | | | | | | | | | | | ||||||||||||

($ in millions) | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | | Chiasma Projections | ||||||||||||||||||||||||||||

| | | 2021P | | | 2022P | | | 2023P | | | 2024P | | | 2025P | | | 2026P | | | 2027P | | | 2028P | | | 2029P | | | 2030P | |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

Earnings Before Interest and Taxes | | | ($66.0) | | | ($27.6) | | | $44.7 | | | $105.0 | | | $149.7 | | | $194.8 | | | $240.7 | | | $307.8 | | | $309.2 | | | $308.5 |

Taxes(1) | | | 0.0 | | | 0.0 | | | (2.5) | | | (5.8) | | | (30.0) | | | (53.3) | | | (65.9) | | | (84.6) | | | (85.0) | | | (84.9) |

Net Operating Profit After Tax | | | (66.0) | | | (27.6) | | | 42.2 | | | 99.3 | | | 119.7 | | | 141.5 | | | 174.8 | | | 223.1 | | | 224.2 | | | 223.7 |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

Tax Depreciation | | | 0.5 | | | 0.2 | | | 0.1 | | | 4.0 | | | 0.9 | | | 0.7 | | | 0.6 | | | 0.5 | | | 0.6 | | | 0.6 |

Capital Expenditures | | | (0.4) | | | (0.1) | | | 0.0 | | | (6.0) | | | (0.5) | | | (0.5) | | | (0.5) | | | (0.5) | | | (0.5) | | | (0.5) |

(Increase) Decrease in Working Capital | | | (23.5) | | | (15.4) | | | (8.1) | | | (5.7) | | | (19.0) | | | (13.3) | | | (8.9) | | | (7.3) | | | (6.6) | | | (0.9) |

Unlevered Free Cash Flow | | | ($89.4) | | | ($42.9) | | | $34.1 | | | $91.5 | | | $101.1 | | | $128.4 | | | $166.0 | | | $215.8 | | | $217.6 | | | $223.0 |

Enterprise Value | | | | | Low | | | Mid | | | High | |

Perpetuity Rate of Decline(1) | | | | | (20.0%) | | | (20.0%) | | | (20.0%) | |

Weighted Average Cost of Capital | | | | | 14.0% | | | 13.0% | | | 12.0% | |

Indicated Enterprise Value Range * | | | | | $540.0 | | | $590.0 | | | $640.0 | |

| | | | | | | | | |||||