- MCFE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DRS Filing

McAfee (MCFE) DRSDraft registration statement

Filed: 3 Aug 21, 12:00am

As confidentially submitted to the U.S. Securities and Exchange Commission on August 3, 2021. This draft registration statement has not been filed, publicly or otherwise, with the U.S. Securities and Exchange Commission and all information contained herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

McAfee Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 7372 | 84-2467341 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

6220 America Center Drive

San Jose, CA 95002

(866) 622-3911

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Peter Leav

Chief Executive Officer

McAfee Corp.

6220 America Center Drive

San Jose, CA 95002

(866) 622-3911

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas Holden Benjamin Kozik Ropes & Gray LLP 3 Embarcadero Center San Francisco, CA 94111-4006 (415) 315-6300 | Sayed Darwish Chief Legal Officer McAfee Corp. 6220 America Center Drive San Jose, CA 95002 (866) 622-3911 | Katharine Martin Andrew Hill Andrew Gillman Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, CA 94304-1050 (650) 493-9300 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| ||||||||

Title of Each Class of Securities to be Registered | Shares to Be Registered(1) | Proposed Maximum Aggregate Offering Price per Share(2) | Proposed Maximum Aggregate | Amount of Registration Fee | ||||

Class A common stock, $0.001 par value per share | $ | $ | $ | |||||

| ||||||||

| ||||||||

| (1) | Includes shares of Class A common stock that may be sold if the underwriters’ option to purchase additional shares is exercised. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion)

Issued , 2021

SHARES

McAfee Corp.

CLASS A COMMON STOCK

$ per share

The selling stockholders identified in this prospectus are offering shares of our Class A common stock. We are not selling any shares of Class A common stock under this prospectus, and we will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders.

Our Class A common stock is listed on the Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “MCFE.” On , 2021, the last sale price of our Class A common stock as reported on the Nasdaq was $ per share.

Investing in shares of our Class A common stock involves risk. See “Risk Factors” beginning on page 24.

| Per share | Total | |||||||

Public offering price | $ | $ | ||||||

Underwriting discounts and commissions(1) | $ | $ | ||||||

Proceeds to the selling stockholders, before expenses | $ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriters (Conflicts of Interest)” for additional information regarding underwriting compensation. |

To the extent that the underwriters sell more than shares of our Class A common stock, the selling stockholders have granted the underwriters the option to purchase up to additional shares of our Class A common stock at the initial public offering price less the underwriting discount within 30 days from the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our Class A common stock to our investors on or about , 2021.

| Goldman Sachs & Co. LLC | TPG Capital BD, LLC |

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

| Page | ||||

| 2 | ||||

| 24 | ||||

| 66 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 73 | |||

| 119 | ||||

| 131 | ||||

| 135 | ||||

| 171 | ||||

| 175 | ||||

| 179 | ||||

| 183 | ||||

| 188 | ||||

Material U.S. Federal Income Tax Considerations for Non-U.S. Holders | 190 | |||

| 194 | ||||

| 208 | ||||

| �� | 208 | |||

| 209 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. Neither we nor the selling stockholders nor the underwriters have authorized anyone to provide you with different information, and neither we nor the selling stockholders nor the underwriters take responsibility for any other information others may give you. Neither we nor the selling stockholders nor the underwriters are making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

For investors outside of the United States: neither we nor the selling stockholders nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and observe any restrictions relating to, this offering of the shares of our Class A common stock and the distribution of this prospectus and any such free writing prospectus outside of the United States.

i

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

BASIS OF PRESENTATION

Unless the context requires otherwise, references in this prospectus to the “Company,” “we,” “us,” “our,” and “McAfee” refer to McAfee Corp. and its consolidated subsidiaries after giving effect to the reorganization transactions described in this prospectus that were completed in connection with our initial public offering and excluding the Enterprise Business (as defined herein), which was sold to STG (as defined herein) on July 27, 2021.

As used in this prospectus:

| • | “Enterprise Business” refers to certain of our Enterprise assets together with certain of our Enterprise liabilities, which were sold to STG pursuant to a definitive agreement dated March 6, 2021; |

| • | “fiscal 2018” refers to the fiscal year of Foundation Technology Worldwide LLC and its subsidiaries ended December 29, 2018; |

| • | “fiscal 2019” refers to our fiscal year ended December 28, 2019; |

| • | “fiscal 2020” refers to our fiscal year ended December 26, 2020; |

| • | “fiscal 2021” refers to our fiscal year ending December 25, 2021; |

| • | “Intel” refers to Intel Corporation; |

| • | “IPO” refers to the initial public offering of shares of Class A common stock of McAfee Corp; |

| • | “Reorganization Transactions” refers to the reorganization transactions that are described under “Prospectus Summary—Summary of the Reorganization Transactions and Our Structure”; |

| • | “Sponsor Acquisition” refers to: (i) the conversion of McAfee, Inc., which was then a part of a business unit of Intel, into a limited liability company, McAfee, LLC, (ii) the contribution of McAfee, LLC to Foundation Technology Worldwide LLC, a wholly-owned subsidiary of Intel, (iii) the transfer beginning on April 3, 2017, by Intel and its subsidiaries of assets and liabilities of the Predecessor Business not already held through Foundation Technology Worldwide LLC to Foundation Technology Worldwide LLC, and (iv) the acquisition immediately thereafter on April 3, 2017, by our Sponsors and certain co-investors of a majority stake in Foundation Technology Worldwide LLC, following which our Sponsors and certain of their co-investors owned 51.0% of the common equity interests in Foundation Technology Worldwide LLC, with certain affiliates of Intel retaining the remaining 49.0% of the common equity interests; |

| • | “Sponsors” refers to investment funds affiliated with or advised by TPG Global, LLC (“TPG”) and Thoma Bravo, L.P. (“Thoma Bravo”), respectively; and |

| • | “STG” refers to Symphony Technology Group. |

1

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our Class A common stock, and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” and our financial statements and the related notes, before deciding to purchase shares of our Class A common stock.

OVERVIEW

Our Company

McAfee has been a pioneer and leader in protecting consumers from cyberattacks for more than 30 years with integrated security, privacy, and trust solutions. We built our platform through a deep, rich history of innovation and have established a leading global brand. When securing the digital experience of a consumer who is increasingly living life online, McAfee is singularly committed to one mission: to protect all things that matter through leading-edge cybersecurity.

We live in a digital world. Consumers are increasingly mobile, interacting through multiple devices, networks and platforms, while leveraging technology as they work, socialize, consume and transact. Remote work and increasing work from home arrangements are driving a pronounced convergence of work and personal life. This lifestyle shift has been accompanied by a more challenging threat landscape and an increase in points of vulnerability, risking individuals’ privacy, identity, data and other vital resources. This challenge, coupled with an increase in cyberthreats, has heightened the importance of the consumer in making security decisions for their converged digital lives.

We have a differentiated ability to secure the digital experience against cyberthreats, using threat intelligence capabilities developed through the scale and diversity of our sensor network. Our sensor network includes our customers’ endpoints, personal networks, and cloud-based environments that generate massive amounts of data that we translate into actionable, real-time insights. The platform is continuously enriched by artificial intelligence, machine learning and the telemetry gathered from over sensors across our customer base. Our vast and dynamic data set and advanced analytics capabilities enable us to provide defense for advanced zero-day threats by training machine learning models on the over threat queries we receive each day. McAfee simplifies the complexity of threat detection and response by correlating events, detecting new threats, reducing false positives, and guiding consumers through remediation. Protecting our customers has been the foundation of our success, enabling us to maintain an industry-leading reputation among our customers and partners.

For over 30 years, consumers have turned to McAfee as a leader in cybersecurity services. Our Personal Protection Service provides holistic digital protection for an individual or family at home, on the go, and on the web. Our platform includes device security, privacy and safe Wi-Fi, online protection, and identity protection, creating a seamless and integrated digital moat. With a single interface, simple set up and ease of use, consumers obtain immediate time-to-value whether on a computer, smartphone or tablet, and across multiple operating systems.

Our digitally-led omni channel go-to-market strategy has reached the consumer at crucial moments in their purchase lifecycle resulting in the protection of over devices as of June 26, 2021. We have longstanding exclusive partnerships with many of the leading PC original equipment manufacturers (“OEMs”) and

2

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

increasingly with mobile and internet service providers (“ISPs”) as the demand for mobile security protection increases. Through many of these relationships, our consumer security software is pre-installed on devices on a trial basis until conversion to a paid subscription. Our go-to-market channel also includes some of the largest electronics retailers globally. We operate a global business, with 37% of our fiscal 2020 net revenue earned outside of the United States and Canada.

In 2017, investment funds affiliated with or advised by TPG Global, LLC (“TPG”) and Thoma Bravo, L.P. (“Thoma Bravo”) (collectively “Sponsors”) acquired a controlling interest in McAfee, accelerating our transformational journey to optimize and reinforce our cybersecurity platform. Over the years, we have invested in new routes to market and partnerships for the business. We have also made multiple operational changes designed to increase efficiency in our product delivery and go-to-market strategies. These efforts included the transformation of our performance marketing through a digital first approach focused on new customer acquisition, channel led conversion and overall customer retention, through our PC led product experience and consumer application development programs. Our investments in our platform and strategy have reinforced our market leadership, and we intend to continue innovating to protect our customers.

Sale of our Enterprise Business

On July 27, 2021, we completed the sale of our Enterprise Business to STG, pursuant to a Contribution and Equity Purchase Agreement (the “Purchase Agreement”) entered in on March 6, 2021 between McAfee, LLC (“US Seller”) and McAfee Security UK LTD (“UK Seller” and together with US Seller, the “Seller Entities”) and Magenta Buyer LLC, organized by a consortium led by STG, entered into a Contribution and Equity Purchase Agreement (the “Purchase Agreement”), in exchange for (i) $4,000,000,000 in cash consideration and (ii) the assumption of certain liabilities of the Enterprise Business as specified in the Purchase Agreement. We believe this transaction will allow McAfee to singularly focus on our Consumer business and to accelerate our strategy to be a leader in personal security for consumers.

In connection with the closing of the sale, the Seller Entities and Buyer to enter into a Transition Services Agreement, Transitional Trademark License Agreement, Intellectual Property Matters Agreement and Commercial Services Agreement, under which each party granted certain licenses to the other party with respect to certain intellectual property rights and technology transferred by us in the Enterprise Sale and retained by us after the consummation of the sale of our Enterprise Business. We also agreed not to compete with the Enterprise Business for four years following the closing of the transaction. In addition, we and Buyer agreed to indemnify each other for losses arising from certain covenant breaches under the Purchase Agreement and certain liabilities expressly assumed or retained by the relevant indemnifying party.

On , 2021, we used $ of the proceeds received in the transaction to repay a portion of our existing indebtedness under our . We expect to use a portion of such proceeds to pay approximately $175 million in customary transaction expenses and other one-time charges. The remaining proceeds were be distributed by Foundation Technology Worldwide LLC, our controlled subsidiary, on a pro rata basis to all holders, including McAfee Corp. McAfee Corp. expects its pro rata portion of such proceeds to pay approximately $300 million in required corporate taxes and related payments in connection with the transaction. McAfee Corp. paid a one-time special dividend of $4.50 per share to holders of record of our Class A Common Stock as of August 13, 2021. Purchases of shares in this offering will not receive this special dividend. We also expect to pay approximately $300 million in total additional one-time separation costs and stranded cost optimization, a portion of which will be expenses paid using proceeds from the sale of our Enterprise Business.

3

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

Industry Background

We live in an increasingly digitally interconnected and mobile world that is driving profound changes for consumers, causing them to react to the following trends:

Online adoption use is global and continues to grow. According to IDC, there were over 4 billion Internet users in 2020, of which the number of mobile-only Internet users is expected to grow at an approximate 8% compound annual growth rate (“CAGR”) from 2020 to 2024. Furthermore, Frost & Sullivan estimates there were over 6 billion Internet-connected devices worldwide in 2020. This significant growth in the mobile install base is driving the ubiquity of the Internet and online browsing.

The global consumer is completing more of their everyday routine online, expanding their digital footprint. Consumers are more comfortable engaging in critical transactions on mobile devices and their PCs. At the same time, they are rapidly expanding their social interactions and media consumption online, while shifting data storage to cloud-based solutions to store personal photos and large amounts of data that is accessible across any endpoint device. Per eMarketer, the average U.S. adult spent over 7.5 hours per day consuming digital media in 2020, representing 55% of total media consumption and an increase of 12% over the prior year. While unlocking consumers’ digital lives allows for convenience, using a greater number of digital platforms increases the surface area that cybercriminals can use to access personal data.

Increased attack surface results in high risk of being hacked and critical data used for profit. Cyberattacks have evolved from rudimentary malware into highly sophisticated, organized and large-scale attacks. According to RiskBased Security, during 2020, nearly 4,000 data breaches were reported, resulting in over 37 billion records being exposed. We have seen the number of threats from external actors targeting cloud services increase approximately 630% from January 2020 to April 2020. Increasing ransomware attacks have generated billions of dollars in payments to cybercriminals and inflicted significant damage and expenses for consumers.

There is a need for integrated device-to-cloud cybersecurity solutions that secure consumers in a connected world by offering the following:

| • | Comprehensive and convenient security solutions to protect consumers across their digital footprint. |

| • | Consumer protection powered by seamless digital experience across device platforms. |

| • | Consumer products to address privacy needs. |

| • | Comprehensive threat intelligence leveraging a unique global sensor network. |

KEY BENEFITS OF OUR SOLUTIONS

We protect consumers with our differentiated ability to detect, analyze, and manage responses to adversarial threats. Our customers trust us to protect and defend their families, data, network and online experience whether it is on a device or in the cloud, at home or on the go.

Our products are multi-faceted privacy protection solutions that provide consumers security in their everyday lives. Our Personal Protection Service is designed to provide a comprehensive suite of features that protect consumers and their families across their digital lives. Our products provide cross-device identity protection, online privacy, and Internet and device security against the latest virus, malware, spyware and ransomware attacks that are pervasive across all digital devices. Personal Protection Service allows consumers to have mobile and PC virus protection across all of their devices, spam filtering capabilities, the ability to securely

4

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

encrypt sensitive files on public networks, and erases digital footprints that could be used to compromise their data, identity and privacy.

| • | Our solutions provide a seamless and user friendly experience. From working on laptops, to accessing social media on phones, or accessing home entertainment, our Personal Protection Service provides multi device protection for the modern connected family. With a single McAfee Total Protection subscription, our customers can protect multiples devices without impeding the consumer experience via cloud-based online and offline protection across devices to enjoy security at home and on the go. McAfee Total Protection comes with performance-enhancing features that allow for more productivity and entertainment by automatically assigning more dedicated processor power to the apps you are actively using. With a single interface, simple set up and ease of use, consumers obtain immediate time-to-value from our solutions once installed. Our security, privacy and trust solutions provide a seamless and convenient experience, and an integrated digital moat. We are one of the few scaled cybersecurity companies with integrated data protection and threat defense capabilities built into technologies and solutions that span the digital ecosystem. |

| • | Our solutions have comprehensive features that provide consumers peace of mind that their online experience is protected. Our Personal Protection Service is designed to be a holistic digital protection of consumers and their families. Personal Protection Service encompasses data and device security and identity protection through our suite of products while delivering an experience that is equally easy to use whether on a computer, a mobile smartphone or a tablet and across multiple operating system platforms. |

| • | Our solutions are supported by our global threat intelligence network, which is bolstered by artificial intelligence, machine learning, and deep learning to increase efficacy and efficiency. Our portfolio leverages over telemetry sensors across multiple domains that feed our threat intelligence and insights engines. McAfee’s Global Threat Intelligence (“GTI”) receives over threat queries each year. By leveraging artificial intelligence, machine learning, and deep learning, we use complex threat detection and response algorithms that collect data from our vast customer base to correlate events, detect new threats, reduce false positives, and customers through remediation. |

Market Opportunity

According to Frost & Sullivan, the global consumer endpoint security market (comprised of endpoint protection and prevention and consumer privacy and identity protection) addressed by our solutions is expected to reach nearly $13.1 billion in 2020, growing to $18.7 billion in 2024. The consumer endpoint security market has remained strong throughout the COVID-19 pandemic and has not shown signs of waning during the first half of 2021. While the COVID-19 pandemic may have accelerated the market for consumer endpoint security solutions, we believe there continues to be a robust market for consumer personal protection, including mobile solution and broader Consumer protection offerings.

Competitive Strengths

Our competitive strengths include:

| • | Brand recognition. We have been a trusted provider of cybersecurity products for over 30 years. This trust was built on protecting hundreds of millions of consumers. Our brand recognition continues to drive customer loyalty and bolsters mutually-beneficial long-standing partner relationships. |

| • | Holistic cybersecurity solutions seamlessly integrated across the consumers’ entire digital ecosystem. Our holistic personal protection service is designed to secure the digital experience and protect privacy of our consumers and their loved ones, across multitude of devices, online, and virtually anywhere. With a single interface, simple set up and ease of use, we provide a seamless and integrated digital moat. |

5

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

| • | Unique footprint across devices. Our consumer solutions protected over million devices as of June 26, 2021. Our massive security footprint spans traditional devices including PCs, mobile devices including smartphones and tablets, home gateways and smart / Internet of Things (“IoT”) devices. The vast data from these endpoints helps inform our intelligence and insights engine. |

| • | Scale and diversity of threat intelligence network. The McAfee portfolio is continuously enriched by the intelligence gathered from over sensors across diverse domains and multiple segments to inform our machine learning, deep learning, and artificial intelligence capabilities. |

| • | Differentiated omnichannel go-to-market strategy. We have longstanding exclusive partnerships with many of the leading PC and mobile OEMs, communications and ISPs, retailers and ecommerce sites, and search providers. The varied routes to market let us reach the consumer at several crucial moments in their subscription lifecycle. |

| • | Experienced management team with deep cybersecurity expertise. Our world-class management team has extensive cybersecurity expertise and a proven track record of building innovative products and cultivating effective go-to-market strategies at scaled public and private software businesses. |

Our Growth Strategy

Our strategy is to maintain and extend our technology leadership in cybersecurity solutions by driving frictionless and secure digital experiences. We believe that consummation of the Enterprise Sale will enable us to focus on and devote all of our resources to delivering leading solutions to protect consumers across their digital lives. The following are key elements of our growth strategy:

| • | Continue to leverage our strength as a trusted cybersecurity brand to increase sales from new and existing customers. We have one of the most trusted brands and comprehensive cybersecurity platforms in the market. We will continue to invest in and leverage our brand to take advantage of the significant growth opportunity within our core business, as our portfolio of solutions expands. We will continue to target and educate customers through our various sales & marketing motions. |

| • | Invest in new and existing routes to market for customers. We will continue to drive sales through our direct-to-consumer channels by investing in digital and performance marketing motions. We intend to strengthen our value proposition to our PC OEMs, and replicate that success with retail and ecommerce partners. We also intend to drive new customer growth by expanding our relationships with communications service providers and ISPs utilizing the cross-platform functionality of our solutions. |

| • | Enhance and tailor the subscriber conversion and renewal process. As we expand our routes to market and partnerships, we strive to evolve our conversion and renewal process through our performance marketing and other digital marketing approaches, as well as, partner education that best supports mutually beneficial consumer-centric initiatives. |

| • | Continue to innovate and enhance our consumer security platform and user experience. To protect our customer’s digital experience across devices, networks and online interactions we plan to continue to invest in new product and platform innovation to help protect data wherever it resides or travels and defend against threats across multiple domains. At the product level, we have created a platform of integrated solutions that aligns with consumer needs for a holistic, easy to use cybersecurity solution. We will continue to utilize our “test and learn” design methodology to improve the customer experience while ensuring our products deliver value and an engaging experience on PC, mobile, tablet, and online. As the digital world gets more complex, our approach is to continue to offer unified solutions that meet customer needs. |

| • | Continue to pursue targeted acquisitions. We have successfully acquired and integrated businesses, including TunnelBear (a consumer VPN provider). We will continue to pursue targeted acquisitions |

6

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

and believe we are well positioned to successfully execute on our acquisition strategy by leveraging our scale, global reach and routes to market, and data assets. |

Our Products

We have one of the industry’s most comprehensive cybersecurity portfolios protecting consumers’ digital life.

Our Personal Protection Service provides holistic digital protection of the individual and family wherever they go, whatever they do and whatever they own. It encompasses device security, privacy, and safe Wi-Fi, online protection, and identity protection through a trusted brand with an experience that is equally easy to use whether on a computer, a mobile smartphone or a tablet and across multiple operating system platforms. Our Personal Protection Service delivers a multi-experience user interface with no performance trade-offs, and with a focus on simple and seamless protection during a consumers’ digital experience. Our platform frees consumers to work on sensitive files, videoconference their friends, and have their kids go on social media platforms while having peace of mind that our Personal Protection Service is keeping their data and files encrypted, alerting them when they are at risk, and helping them to resolve security threats. We achieve this by integrating the following solutions and capabilities within our Personal Protection Service:

| • | Device Security. Our award-winning Anti-Malware Software and real-time threat defense has won over 50 awards since 2015 and helps protect over million consumer devices across Android, iOS, and Windows protected from viruses, ransomware, malware, spyware and phishing as of June 27, 2020. Our net promoter score grew from 36 in 2019 to as of June 26, 2021. These million devices help power our threat intelligence engine. As consumers expand their digital footprint with an increasing number of devices and share personal data among them by hopping from one device to another, our threat intelligence engine becomes more robust. We built our Total Protection / LiveSafe solution with the purpose of protecting all of our consumers’ data, regardless of the device they are using or the network they are on. Through our interface, consumers can easily protect additional devices and have peace of mind by being able to observe each device’s security status. Beyond PCs and mobile, we have developed our Secure Home Platform (“SHP”) that protects consumer household IoT systems. Provided through major service providers and router OEMs around the world, our SHP simplifies network security in the home and protects household IoT devices, such as Alexa, smart TVs, and gaming systems. |

| • | Online Privacy and Comprehensive Internet Security. Our Safe Connect VPN and TunnelBear help consumers make any Wi-Fi connection safe and private. With bank-grade AES 256-bit encryption, our solution keeps personal data, such as banking account credentials and credit card information protected while keeping IP addresses and physical locations private. This capability helps consumers prevent password and data theft and IP-based tracking and allows customers to access global content, by bypassing local censorship. Consumers can add an additional layer of protection with FileLock by creating password-protected encrypted drives to store their sensitive files, such as tax returns and financial documents. Once these documents are not needed anymore they can be securely deleted with Shredder. Our WebAdvisor acts as a trusted companion protecting consumers from accessing malware and phishing sites while surfing and from downloading unsafe files. As we protect the consumer’s digital life, we also offer our Safe Family solution to keep children safe while they learn to navigate the digital life. Our parental control software blocks age-inappropriate websites, provides device usage monitoring and device restriction services and gives parents the ability to track children’s devices. |

| • | Identity Protection. Our IdentityProtection includes cyber monitoring, which searches over 600,000 online black markets—including the Dark Web—for compromised personally identifiable information, |

7

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

credit monitoring and SSN trace, helping consumers take action to prevent from fraud. Our solution also helps consumers recover from fraud through our 24/7/365 support and range of additional services, such as our full-service ID restoration, stolen funds reimbursement, lost wallet recovery, and identify theft insurance, covering expenses up to $1 million. Our Password Manager adds another level of security by securely managing and storing various complex passwords eliminating potential weaknesses caused by simple or re-used passwords. |

We also provide these services to consumers who want to complement their existing protection in the form of individual products, such as Mobile Security, Safe Connect, Safe Family, WebAdvisor, and Identity Theft Protection, as well as to consumers who want to protect their complete digital life through our Total Protection and LiveSafe portfolio brands.

In addition, we extended our protection services to small business owners and the gamer community. Our Small Business Security package helps small businesses keep their businesses and customer data safe by leveraging our award-winning multi-device protection and privacy capabilities, enhanced with our 24/7 technical support and virus removal service. Our Gamer Security package delivers anti-malware functionality while enhancing gaming performance. By offloading threat detection to the cloud, keeping necessary virus definitions locally, and optimizing system resources like CPU, GPU, and RAM by pausing background services, we deliver a smoother and safer gaming experience.

Our Technology

We deploy the latest technologies to maintain our competitive advantage in our product offerings as well as to design a digital experience for consumers that drive customer engagement, satisfaction, and retention.

Quality of Our Protection and AI

Our solutions defend against a wide range of threats by using technology that leverages a combination of threat intelligence and artificial intelligence. Unlike other alternatives that rely only on artificial intelligence, our approach minimizes false positives while detecting a wide range of threats, including new zero-day threats that have never been seen before.

Our solutions are enhanced by our Global Threat Intelligence Telemetry from detected events across the product portfolio in addition to structural and behavioral feature vectors from telemetry collected through our artificial intelligence sensors. This telemetry enables McAfee to understand the blueprint of threats for which we do not necessarily possess the sample but can identify based on behavioral and structural vectors which improves our efficacy in detecting zero-day threats.

Our Machine Learning Scanner provides two options for performing automated analysis—on the device or in the cloud. The former uses machine learning on customer systems to determine whether existing and incoming files match known malware. Our cloud-based machine learning scanner collects and sends file attributes and behavioral information to the machine-learning system in the cloud for malware analysis, without transmitting personally identifiable information.

Anti-Malware Engine

Our anti-malware engine is the core component of our award-winning products. Using patented technology, the engine analyzes potentially malicious code to detect and block Trojans, viruses, worms, adware, spyware, and other threats. The engine scans files at particular points, processes, and pattern-matches malware definitions with data it finds within scanned files, decrypts, and runs malware code in an emulated environment, applies heuristic techniques to recognize new malware, and removes infectious code from legitimate files.

8

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

Consumer Experience Innovation

We continuously improve the digital experience for consumers through the following technologies:

| • | Platform Innovation. Our continuous innovations across our online presence, ecommerce, analytics, and product platform aim towards creating the best-possible experience for consumers. Our analytics platform draws from millions of consumer engagement interactions, accumulated over years and years, provides us with the insights to craft the ideal consumer experience. We use these insights to design a comprehensive, unified seamless security experience for consumers that can be managed from any mobile device. This rich set of engagement patterns also allows us to fine-tune the purchasing process by displaying the right landing page and choosing the ideal payment provider to ensure a successful transaction. Combined with our next generation messaging system and tailored marketing campaigns, we improve customer engagement, satisfaction, as well as acquisition efficiency and retention. |

| • | Ability to Integrate with Our Partners. Through our ongoing collaboration with our OEM partners, we developed an integrated consumer experience that increases the conversation of potential indirect customers to our platform. Working closely with each OEM, we are continuously testing and improving each element of the consumer journey, from our tailored OEM landing pages and messaging, to our product trials, trial experience, offerings options, pricing, and shopping chart and payments experience. Additionally, we also integrated our product platform with leading telecommunication providers, retailers, as well as networking equipment manufacturers to be the underlying platform for their mobile and IoT related security offerings. |

Sales and Marketing

Our go-to-market engine consists of a digitally-led omnichannel approach to reach the consumer at crucial moments in their purchase lifecycle including direct to consumer online sales, acquisition through trial pre-loads on PC OEM devices, and other indirect modes via additional partners such as mobile providers, ISPs, electronics retailers, ecommerce sites, and search providers.

| • | Direct to consumer marketing. We market directly to consumers through our website, McAfee.com, with digital sales motions and analytics-based cart conversion capabilities. |

| • | PC OEMs. We have a strong PC OEM partner ecosystem with major OEMs including Dell, HP, Lenovo, Asus, and Samsung, in which we pre-install a 30-day free trial of our security platform. Our digital and performance marketing engine engages with the purchasing customer to highlight the value of the security platform and convert the consumer to a direct McAfee customer. In some cases, PC OEMs preinstall a one-year or longer subscription and the OEM pays McAfee a royalty. During the subscription lifecycle, McAfee engages the consumer with our digital marketing engine to convert the consumer to a McAfee customer at the end of the subscription period. |

| • | Retail and eCommerce. We partner with major retailers worldwide including Office Depot, Staples, Walmart, Sam’s Club, MediaMarkt, Best Buy, and Amazon, to offer consumers a McAfee subscription for purchase through the retailer stores and ecommerce websites. During the subscription lifecycle McAfee engages the consumer with our digital marketing engine to convert the consumer to a McAfee customer at the end of the subscription period. |

| • | Communications Service Providers, ISPs and Mobile Providers. We partner with major service providers worldwide including Verizon, T-Mobile, CenturyLink, Telefonica, NTT Docomo, Softbank, British Telecom, and Sky, to offer our mobile security and secure home platform products through the service providers. In some cases, we also partner with the service providers to integrate and bundle one or more of our security products into their mobile product value added service offerings. In addition to our partnerships with service providers, we partner with Samsung to pre-install one or more of our security products on their smartphones. |

9

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

| • | Search Providers. McAfee also partners with search engine providers to integrate our secure web search products. |

Our omnichannel approach and strong partnerships work together to increase our presence at key moments of purchase and security engagement for consumers, allowing us to drive customer engagement and acquisition of new customers.

SUMMARY RISK FACTORS

An investment in our Class A common stock involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this prospectus, and, in particular, you should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our Class A common stock. Among these important risks are the following:

| • | The COVID-19 pandemic has affected how we are operating our business, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain. |

| • | If we are unsuccessful at executing our business plan and necessary transition activities as a standalone consumer cybersecurity company following the recent sale of our Enterprise Business, our business and results of operations may be adversely affected and our ability to invest in and grow our business could be limited. |

| • | The cybersecurity market is rapidly evolving and becoming increasingly competitive in response to continually evolving cybersecurity threats from a variety of increasingly sophisticated cyberattackers. If we fail to anticipate changing customer requirements or industry and market developments, or we fail to adapt our business model to keep pace with evolving market trends, our financial performance will suffer. |

| • | We operate in a highly competitive environment, and we expect competitive pressures to increase in the future, which could cause us to lose market share. |

| • | Our results of operations can be difficult to predict and may fluctuate significantly, which could result in a failure to meet investor expectations. |

| • | Forecasting our estimated annual effective tax rate is complex and subject to uncertainty, and there may be material differences between our forecasted and actual tax rates. |

| • | We face risks associated with past and future investments, acquisitions, and other strategic transactions. |

| • | Over the last several years, we have pursued a variety of strategic initiatives designed to optimize and reinforce our cybersecurity platform. If the benefits of these initiatives are less than we anticipate, or if the realization of such benefits is delayed, our business and results of operations may be harmed. |

| • | If our solutions have or are perceived to have defects, errors, or vulnerabilities, or if our solutions fail or are perceived to fail to detect, prevent, or block cyberattacks, including in circumstances where customers may fail to take action on attacks identified by our solutions, our reputation and our brand could suffer, which would adversely impact our business, financial condition, results of operations, and cash flows. |

| • | Failure to adapt our product and service offerings to changing customer demands, or lack of customer acceptance of new or enhanced solutions, could harm our business and financial results. |

10

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

| • | If the protection of our proprietary technology is inadequate, we may not be able to adequately protect our innovations and brand. |

| • | If we fail to maintain relationships with our channel partners, or if we must agree to significant adverse changes in the terms of our agreements with these partners, it may have an adverse effect on our ability to successfully and profitably market and sell our products and solutions. |

| • | If our security measures are breached or unauthorized access to our data is otherwise obtained, our brand, reputation, and business could be harmed, and we may incur significant liabilities. |

| • | We operate globally and are subject to significant business, economic, regulatory, social, political, and other risks in many jurisdictions. |

| • | We may become involved in litigation, investigations, and regulatory inquiries and proceedings that could negatively affect us and our reputation. |

| • | Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our market, expose us to interest rate risk, and prevent us from timely satisfying our obligations. |

| • | Restrictions imposed by our outstanding indebtedness and any future indebtedness may limit our ability to operate our business and to finance our future operations or capital needs or to engage in acquisitions or other business activities necessary to achieve growth. |

| • | Our principal asset is our interest in Foundation Technology Worldwide LLC, and we are dependent upon Foundation Technology Worldwide LLC and its consolidated subsidiaries for our results of operations, cash flows, and distributions. |

| • | We will be required to pay certain Continuing Owners and certain Management Owners for certain tax benefits we may realize or are deemed to realize in accordance with the tax receivable agreement between us and such Continuing Owners and Management Owners, and we expect that the payments we will be required to make will be substantial. |

| • | In certain circumstances, under its limited liability company agreement, Foundation Technology Worldwide LLC will be required to make tax distributions to us, the Continuing Owners and certain Management Owners and the distributions that Foundation Technology Worldwide LLC will be required to make may be substantial. |

SPONSOR ACQUISITION

Through April 3, 2017, the Predecessor Business was operated as a part of a business unit of Intel. Also prior to April 3, 2017, McAfee, Inc., a Delaware corporation, then a wholly-owned subsidiary of Intel, was converted into a Delaware limited liability company, McAfee, LLC. Following such conversion, Intel contributed McAfee, LLC to Foundation Technology Worldwide LLC, a wholly-owned subsidiary of Intel. On April 3, 2017, Intel and its subsidiaries transferred assets and liabilities of the Predecessor Business not already held through Foundation Technology Worldwide LLC to Foundation Technology Worldwide LLC. Immediately thereafter on April 3, 2017, our Sponsors and certain of their co-investors acquired a majority stake in Foundation Technology Worldwide LLC, which we refer to, collectively, as the Sponsor Acquisition. Following the Sponsor Acquisition, our Sponsors and certain of their co-investors owned 51.0% of the common equity interests in Foundation Technology Worldwide LLC, with certain affiliates of Intel retaining the remaining 49.0% of the common equity interests. We have operated as a standalone company at all times following the Sponsor Acquisition.

11

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

SUMMARY OF THE REORGANIZATION TRANSACTIONS AND OUR STRUCTURE

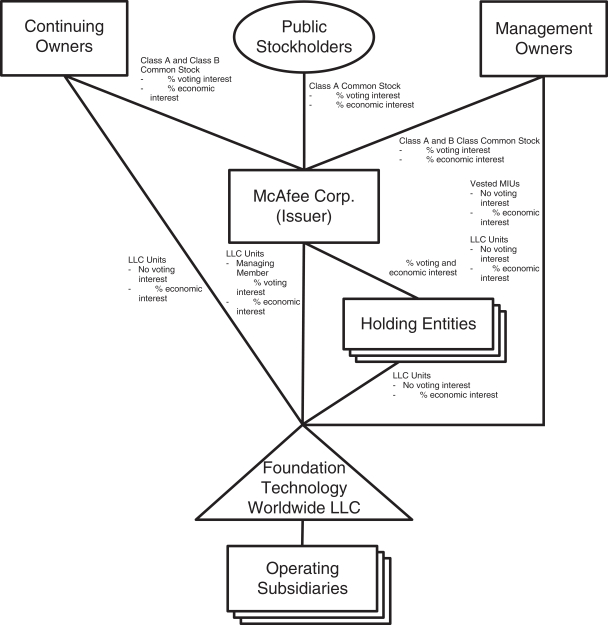

McAfee Corp. (the “Corporation”) was incorporated in Delaware on July 19, 2019. The Corporation was formed for the purpose of completing an initial public offering (the “IPO”) and related transactions in order to carry on the business of Foundation Technology Worldwide LLC (“FTW”) and its subsidiaries (the Corporation, FTW and its subsidiaries are collectively the “Company”). On October 21, 2020, the Corporation became the sole managing member and holder of 100% of the voting power of FTW due to the reorganization transactions described below. With respect to the Corporation and FTW, each entity owns only the respective entities below it in the corporate structure and each entity has no other material operations, assets, or liabilities.

In October, 2020, the Corporation completed the IPO pursuant to which the Corporation and selling stockholders sold an aggregate of 37 million shares of Class A common stock par value $0.001 per share (“Class A common stock”) at a public offering price of $20.00 per share. The Corporation issued 31 million shares and received $586 million in proceeds, net of underwriting discounts and commissions, of which $553 million was used to purchase newly-issued limited liability company units (“LLC Units”) and $33 million was used to purchase LLC Units from existing holders (“Continuing LLC Owners”) of interests in FTW, at a purchase price per unit equal to the public offering price per share of Class A common stock, less underwriting discounts and commissions.

We refer to the holders of management incentive units of FTW (“MIUs”) as well as members of management who hold LLC Units following the closing of the offering or are to receive Class A common stock in satisfaction of existing incentive awards as “Management Owners.” We refer to those of our pre-IPO investors and certain of their affiliates who received shares of Class A common stock in connection with the Reorganization Transactions (as defined below) and who do not hold LLC Units as “Continuing Corporate Owners,” and together with the Continuing LLC Owners, as “Continuing Owners.”

In connection with the closing of the IPO, the following Reorganization Transactions were consummated:

| • | a new limited liability company operating agreement (“New LLC Agreement”) was adopted for FTW making the Corporation the sole managing member of FTW; |

| • | the Corporation’s certificate of incorporation was amended and restated to, among other things, (i) provide for Class A common stock and Class B common stock and (ii) issue shares of Class B common stock to the Continuing Owners and Management Owners, on a one-to-one basis with the number of LLC Units they own (except that Management Owners will not receive shares of Class B common stock in connection with their exchange of Management Incentive Units (“MIUs”)), the exchange of which will be settled in cash or shares of Class A common stock, at the option of the Company, for nominal consideration; and |

| • | the Corporation (i) issued 126.3 million shares of its Class A common stock to certain of the Continuing Owners in exchange for their contribution of LLC units or the equity of certain other entities, which pursuant to the Reorganization Transactions, became its direct or indirect subsidiaries and (ii) settled 5.7 million restricted stock units (“RSUs”) with shares of its Class A common stock, net of tax withholding, held by certain employees, which were satisfied in connection with the Reorganization Transactions. |

12

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

The diagram below depicts our organizational structure immediately following this offering, assuming no exercise by the underwriters of their option to purchase additional shares of Class A common stock.

DIVESTITURE OF THE ENTERPRISE BUSINESS

On July 27, 2021, McAfee, LLC and McAfee Security UK LTD (“UK Seller” and together with US Seller, the “Seller Entities”) and Magenta Buyer LLC, organized by a consortium led by STG, entered into the Second Amendment to Contribution and Equity Purchase Agreement (the “Purchase Agreement Amendment”) governing the sale by the Company of certain assets of its Enterprise Business to STG in exchange for (i)

13

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

$4,000,000,000 in cash consideration and (ii) the assumption of certain liabilities of the Enterprise business as specified in the Contribution and Equity Purchase Agreement (as amended, the “Purchase Agreement”) (such transaction, the “Enterprise Business Sale”). The Purchase Agreement Amendment clarifies the treatment of certain transferred employees of the Enterprise Business and the treatment of certain residual cash balances and certain transferred assets and liabilities upon the consummation of the Enterprise Business Sale, among other matters.

OUR SPONSORS

TPG. TPG is a leading global alternative asset firm founded in 1992 with more than $91 billion of assets under management as of December 31, 2020 and offices in Austin, Beijing, Fort Worth, Hong Kong, London, Luxembourg, Melbourne, Moscow, Mumbai, New York, San Francisco, Seoul, Singapore and Washington, DC. TPG’s investment platforms are across a wide range of asset classes, including private equity, growth equity, real estate, and public equity. TPG aims to build dynamic products and options for its investors while also instituting discipline and operational excellence across the investment strategy and performance of its portfolio.

Thoma Bravo. Thoma Bravo is a leading private equity firm with a 40+ year history, including more than $50 billion in capital commitments, and a focus on investing in software and technology companies. Thoma Bravo pioneered the buy-and-build investment strategy, and first applied this strategy to the software and technology industries 20+ years ago. Since then, the firm has acquired more than 260 software and technology companies representing over $78 billion of value. Thoma Bravo’s investment philosophy is centered around working collaboratively with existing management teams to help drive operating results and innovation. It executes through a partnership-driven approach supported by a set of management principles, operating metrics, and business processes. Thoma Bravo supports its companies by investing in growth initiatives and strategic acquisitions designed to drive long-term value.

CORPORATE INFORMATION

McAfee Corp. was formed in Delaware on July 19, 2019. Our principal executive offices are located at 6220 America Center Drive, San Jose, California 95002, and our telephone number is (866) 622-3911. Our Internet website is www.mcafee.com. The information on, or that can be accessed through, our website and the other websites that we present in this prospectus is not part of this prospectus, and you should not rely on any such information in making the decision whether to purchase shares of our Class A common stock.

14

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

THE OFFERING

Issuer in this offering | McAfee Corp. |

Class A common stock offered by the selling stockholders | shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

Underwriters’ option to purchase additional shares of Class A common stock from the selling stockholders | shares |

Class A common stock to be outstanding after this offering | shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

Class B common stock to be outstanding after this offering | shares (or shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

Voting power held by holders of Class A common stock after giving effect to this offering by the selling stockholders | % |

Voting power held by holders of Class B common stock after giving effect to this offering by the selling stockholders | % |

Voting rights | Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to stockholders for their vote or approval, except as otherwise required by law or as otherwise provided by our certificate of incorporation. Each share of Class A common stock and Class B common stock entitles its holder to one vote per share on all such matters. See “Description of Capital Stock.” |

Use of proceeds | The selling stockholders will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of shares of Class A common stock offered by the selling stockholders. We will, however, bear the costs associated with the sale of shares by the selling stockholders, other than underwriting discounts and commissions. See “Use of Proceeds.” |

Conflicts of Interest | Affiliates of TPG beneficially own in excess of 10% of our issued and outstanding common stock. Because TPG Capital BD, LLC, an affiliate of TPG, is an underwriter in this offering and its affiliates own in excess of 10% of our issued and outstanding common stock, TPG Capital BD, LLC is deemed to have a “conflict of interest” |

15

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

under Rule 5121 (“Rule 5121”) of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering is being made in compliance with the requirements of Rule 5121. Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as the member primarily responsible for managing the public offering does not have a conflict of interest, is not an affiliate of any member that has a conflict of interest and meets the requirements of paragraph (f)(12)(E) of Rule 5121. See “Underwriters (Conflicts of Interest).” |

Dividend Policy | Foundation Technology Worldwide LLC expects to pay a cash distribution to its members on a quarterly basis at an aggregate annual rate of approximately $200 million. McAfee Corp. is expected to receive a portion of any such distribution through the LLC Units it holds directly or indirectly through its wholly-owned subsidiaries on the record date for any such distribution declared by Foundation Technology Worldwide LLC, which is expected to equal the number of shares of Class A common stock outstanding on such date. McAfee Corp. expects to use the proceeds it receives from such quarterly distribution to declare a cash dividend on its shares of Class A common stock. We intend to fund any future dividends from distributions made by Foundation Technology Worldwide LLC from its available cash generated from operations. |

| In addition, in connection with the consummation of the sale of our Enterprise Business to STG, we declared and paid a one-time special dividend of $4.50 to holders of record of our Class A common stock as of August 13, 2021. Purchasers of shares in this offering will not be entitled to receive such special dividend with the respect to the shares of Class A common stock that they purchase in this offering. |

| The timing, declaration, amount of, and payment of any such dividends will be made at the discretion of McAfee Corp.’s board of directors, subject to applicable laws, and will depend upon many factors, including the amount of the distribution received by McAfee Corp. from Foundation Technology Worldwide LLC, our financial condition, results of operations, capital requirements, contractual restrictions, general business conditions, and other factors that McAfee Corp.’s board of directors may deem relevant. Moreover, if, as expected, McAfee Corp. determines to initially pay a dividend following any quarterly distributions from Foundation Technology Worldwide LLC, there can be no assurance that McAfee Corp. will continue to pay dividends in the same amounts or at all thereafter. See “Dividend Policy.” |

Controlled Company | Following this offering, our Sponsors and Intel and certain of its affiliates will control approximately % of the combined voting power of our outstanding common stock. As a result, we will continue to be a “controlled company” under the Exchange’s corporate governance standards. Under these standards, a company of which more than 50% of the voting power is held by an individual, group, or |

16

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

another company is a “controlled company” and may elect not to comply with certain corporate governance standards. |

Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Class A common stock. |

Exchange symbol | “MCFE” |

Unless otherwise indicated, the number of shares of Class A common stock to be outstanding after this offering is based on shares of Class A common stock outstanding as of June 26, 2021 and excludes:

| • | shares of Class A common stock issuable upon exchange or redemption of LLC Units, together with corresponding shares of Class B common stock; |

| • | shares of Class A common stock that would be outstanding if all vested MIUs were exchanged for shares of Class A common stock, and shares of Class A common stock that would be outstanding if all unvested MIUs were exchanged for shares of Class A common stock; |

| • | shares of Class A common stock issuable upon vesting of outstanding RSUs; |

| • | shares of Class A common stock issuable upon exercise of vested option awards having a weighted average exercise price of $and shares of Class A common stock issuable upon exercise of unvested option awards having a weighted average exercise price of $; |

| • | shares of Class A common stock reserved for future issuance under our 2020 equity incentive plan, without taking into account the “evergreen” provision of our 2020 equity incentive plan; and |

| • | shares of Class A common stock authorized for sale under the Employee Stock Purchase Plan (“ESPP”) without taking into account the “evergreen” provision of our ESPP; |

Unless otherwise indicated, this prospectus reflects and assumes no exercise by the underwriters of their option to purchase up to additional shares of our Class A common stock in this offering.

17

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

SUMMARY OF CONSOLIDATED FINANCIAL AND OTHER DATA

The following table sets forth the summary consolidated financial and other data of McAfee Corp. for the periods presented and at the dates indicated below.

The summary of consolidated statements of operations and cash flows data presented below for fiscal 2018, fiscal 2019, and fiscal 2020 are derived from the audited consolidated financial statements that are included elsewhere in this prospectus. The consolidated balance sheet data as of March 27, 2021 is derived from unaudited condensed consolidated financial statements that are included elsewhere in this prospectus. The summary of unaudited condensed consolidated statements of operations and cash flows data for the three months ended March 28, 2020 and March 27, 2021 are derived from unaudited condensed consolidated financial statements that are included elsewhere in this prospectus.

On March 6, 2021, we entered into a definitive agreement (the “Purchase Agreement”) with a consortium led by Symphony Technology Group (“STG”) under which STG agreed to purchase certain of our Enterprise assets together with certain of our Enterprise liabilities (“Enterprise Business”), representing substantially all of our Enterprise segment, for an all cash purchase price of $4.0 billion. The divestiture transaction closed on July 27, 2021. The divestiture of our Enterprise Business represents a strategic shift in our operations that will allow us to focus on our Consumer Business. As a result of the divestiture, the results of our Enterprise Business were reclassified as discontinued operations in our consolidated statements of operations and excluded from both continuing operations and segment results for all periods presented. Starting in the first quarter of fiscal 2021, we began to operate in one reportable segment as the Enterprise Business comprised substantially all of our Enterprise segment. Results of discontinued operations includes all revenues and expenses directly derived from our Enterprise Business, with the exception of general corporate overhead costs that were previously allocated to our Enterprise segment but have not been allocated to discontinued operations. The Enterprise Business, as specified in the Purchase Agreement, was reclassified as discontinued operations in our consolidated balance sheets, subject to changes set forth in the Purchase Agreement, which included amendments to the agreement in July 2021. See Note 3 for additional information about the divestiture of our Enterprise Business.

We maintain a 52- or 53-week fiscal year that ends on the last Saturday in December. The year ended December 29, 2018 is a 52-week year starting on December 31, 2017 and ending on December 29, 2018. The year ended December 28, 2019 is a 52-week year starting on December 30, 2018 and ending on December 28, 2019. The year ended December 26, 2020 is a 52-week year starting on December 29, 2019 and ending on December 26, 2020. Three months ended March 28, 2020 is a three month period starting on December 29, 2019 and ending on March 28, 2020. Three months ended March 27, 2021 is a three month period starting on December 27, 2020 and ending on March 27, 2021.

The unaudited condensed consolidated financial statements were prepared on a basis consistent with our audited consolidated financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair statement of the financial condition and results of operations as of and for such periods. Operating results for the periods presented are not necessarily indicative of the results that may be expected in future periods, and operating results for the three months ended March 27, 2021 are not necessarily indicative of results for the full year. The following information should be read in conjunction with “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited consolidated financial statements and the related notes included elsewhere in this prospectus.

18

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

Results of Operations Data

| Fiscal Year Ended | Three Months Ended | |||||||||||||||||||

| (in millions) except per unit and per share data | December 29, 2018 | December 28, 2019 | December 26, 2020 | March 28, 2020 | March 27, 2021 | |||||||||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 1,558 | $ | 354 | $ | 442 | ||||||||||

Cost of sales(2) | 386 | 391 | 444 | 99 | 116 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Gross profit | 775 | 912 | 1,114 | 255 | 326 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Sales and marketing(2) | 348 | 299 | 348 | 60 | 85 | |||||||||||||||

Research and development(2) | 186 | 161 | 188 | 38 | 44 | |||||||||||||||

General and administrative(2) | 170 | 182 | 235 | 58 | 48 | |||||||||||||||

Amortization of intangibles | 153 | 146 | 143 | 36 | 36 | |||||||||||||||

Restructuring charges (Note 9) | 19 | 6 | 2 | 1 | 8 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total operating expenses | 876 | 794 | 916 | 193 | 221 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Operating income (loss) | (101 | ) | 118 | 198 | 62 | 105 | ||||||||||||||

Interest (expense) and other, net | (308 | ) | (296 | ) | (307 | ) | (75 | ) | (60 | ) | ||||||||||

Foreign exchange gain (loss), net | 30 | 21 | (104 | ) | 11 | 35 | ||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) from continuing operations before income taxes | (379 | ) | (157 | ) | (213 | ) | (2 | ) | 80 | |||||||||||

Provision for income tax expense (benefit) | 29 | 38 | 5 | (10 | ) | (3 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Income (loss) from continuing operations | (408 | ) | (195 | ) | (218 | ) | 8 | 83 | ||||||||||||

Income (loss) from discontinued operations, net of taxes | (104 | ) | (41 | ) | (71 | ) | 1 | 11 | ||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income (loss) | $ | (512 | ) | $ | (236 | ) | $ | (289 | ) | $ | 9 | $ | 94 | |||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Less: Net income (loss) attributable to redeemable noncontrolling interests | N/A | N/A | (171 | ) | N/A | 64 | ||||||||||||||

|

|

|

| |||||||||||||||||

Net income (loss) attributable to McAfee Corp. | N/A | N/A | $ | (118 | ) | N/A | $ | 30 | ||||||||||||

|

|

|

| |||||||||||||||||

Net income (loss) attributable to McAfee Corp.: | ||||||||||||||||||||

Income (loss) from continuing operations attributable to McAfee Corp. | N/A | N/A | $ | (55 | ) | N/A | $ | 27 | ||||||||||||

Income (loss) from discontinued operations attributable to McAfee Corp. | N/A | N/A | $ | (63 | ) | N/A | $ | 3 | ||||||||||||

|

|

|

| |||||||||||||||||

Net income (loss) attributable to McAfee Corp. | N/A | N/A | $ | (118 | ) | N/A | $ | 30 | ||||||||||||

|

|

|

| |||||||||||||||||

Earnings (loss) per share attributable to McAfee Corp., basic: | ||||||||||||||||||||

Continuing operations | N/A | N/A | $ | (0.34 | ) | N/A | $ | 0.17 | ||||||||||||

Discontinued operations | N/A | N/A | $ | (0.39 | ) | N/A | $ | 0.02 | ||||||||||||

Earnings (loss) per share, basic(1) | N/A | N/A | $ | (0.73 | ) | N/A | $ | 0.18 | ||||||||||||

|

|

|

| |||||||||||||||||

Earnings (loss) per share attributable to McAfee Corp., diluted: | ||||||||||||||||||||

Continuing operations | N/A | N/A | $ | (0.34 | ) | N/A | $ | 0.16 | ||||||||||||

Discontinued operations | N/A | N/A | $ | (0.39 | ) | N/A | $ | 0.02 | ||||||||||||

|

|

|

| |||||||||||||||||

Earnings (loss) per share, diluted(1) | N/A | N/A | $ | (0.73 | ) | N/A | $ | 0.18 | ||||||||||||

|

|

|

| |||||||||||||||||

Weighted-average shares outstanding, basic | N/A | N/A | 162.3 | N/A | 162.4 | |||||||||||||||

Weighted-average shares outstanding, diluted | N/A | N/A | 162.3 | N/A | 176.3 | |||||||||||||||

Statements of Cash Flows Data | ||||||||||||||||||||

Net cash provided by (used in): | ||||||||||||||||||||

Operating activities | $ | 319 | $ | 496 | $ | 760 | $ | 171 | $ | 259 | ||||||||||

Investing activities | (677 | ) | (63 | ) | (51 | ) | (21 | ) | (11 | ) | ||||||||||

Financing activities | 459 | (734 | ) | (651 | ) | 239 | (130 | ) | ||||||||||||

| (1) | Basic and diluted earnings (loss) per share of Class A common stock are applicable only for periods after October 22, 2020, which is the period following our IPO and related Reorganization Transactions. Refer to Note 17 in our audited consolidated financial statements included elsewhere in this prospectus for information about the Net Loss Per Share during fiscal 2020. Refer to Note 15 Earnings Per Share |

19

Confidential Treatment Requested by McAfee Corp.

Pursuant to 17 C.F.R. Section 200.83

in the notes to the unaudited condensed consolidated financial statements included elsewhere in this prospectus for information about the Earnings Per Share during the three months ended March 27, 2021. |

| (2) | Includes equity-based compensation expense as follows: |

| Fiscal Year Ended | Three Months Ended | |||||||||||||||||||

| (in millions) | December 29, 2018 | December 28, 2019 | December 26, 2020 | March 28, 2020 | March 27, 2021 | |||||||||||||||

Cost of sales | $ | 1 | $ | — | $ | 5 | $ | — | $ | 1 | ||||||||||

Sales and marketing | 1 | 1 | 23 | 1 | 3 | |||||||||||||||

Research and development | 1 | 1 | 40 | — | 3 | |||||||||||||||

General and administrative | 3 | 3 | 45 | 13 | 7 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total equity-based compensation expense from continuing operations | 6 | 5 | 113 | 14 | 14 | |||||||||||||||

Discontinued operations | 22 | 20 | 200 | 1 | 12 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Total equity-based compensation expense | $ | 28 | $ | 25 | $ | 313 | $ | 15 | $ | 26 | ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Consolidated Balance Sheet Data

| As of March 27, 2021 | ||||

| (in millions) | Actual | |||

Cash and cash equivalents | $ | 346 | ||

Working capital(1) | (1,457 | ) | ||

Total assets | 5,362 | |||

Current and long-term deferred revenue | 1,007 | |||

Current and long-term debt, net of borrowing costs | 3,937 | |||

Redeemable noncontrolling interests | 6,177 | |||

Accumulated deficit | (88 | ) | ||

| (1) | Working capital is comprised of current assets less current liabilities. |

Non-GAAP Financial Measures