- MCFE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

McAfee (MCFE) S-1IPO registration

Filed: 7 Sep 21, 4:06pm

Delaware | 7372 | 84-2467341 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Thomas Holden Benjamin Kozik Ropes & Gray LLP 3 Embarcadero Center San Francisco, CA 94111-4006 (415) 315-6300 | Sayed Darwish Chief Legal Officer McAfee Corp. 6220 America Center Drive San Jose, CA 95002 (866) 622-3911 | Katharine Martin Andrew Hill Andrew Gillman Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, CA 94304-1050 (650) 493-9300 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ | |||||

Title of Each Class of Securities to be Registered | Shares to Be Registered(1) | Proposed Maximum Aggregate Offering Price per Share(2) | Proposed Maximum Aggregate Offering Price (1)(2) | Amount of Registration Fee | ||||

Class A common stock, $0.001 par value per share | 23,000,000 | $26.54 | $610,420,000 | $66,596.83 | ||||

| (1) | Includes 3,000,000 shares of Class A common stock that may be sold if the underwriters’ option to purchase additional shares is exercised. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) under the Securities Act of 1933, as amended. In accordance with Rule 457(c) under the Securities Act of 1933, as amended, the price shown is the average of the high and low prices on August 31, 2021 as reported on the Nasdaq Stock Market LLC. |

Per share | Total | |||||||

Public offering price | $ | $ | ||||||

Underwriting discounts and commissions (1) | $ | $ | ||||||

Proceeds to the selling stockholders, before expenses | $ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses in connection with this offering. See “Underwriters (Conflicts of Interest)” for additional information regarding underwriting compensation. |

Morgan Stanley | Goldman Sachs & Co. LLC | TPG Capital BD, LLC |

BofA Securities | Citigroup |

Page | ||||

| 2 | ||||

| 24 | ||||

| 66 | ||||

| 68 | ||||

| 68 | ||||

| 69 | ||||

| 70 | ||||

| 71 | ||||

| 72 | ||||

| 117 | ||||

| 129 | ||||

| 133 | ||||

| 169 | ||||

| 173 | ||||

| 178 | ||||

| 182 | ||||

| 187 | ||||

| 189 | ||||

| 193 | ||||

| 207 | ||||

| 207 | ||||

| 208 | ||||

| F-1 | ||||

| • | “Enterprise Business” refers to certain of our Enterprise assets together with certain of our Enterprise liabilities, which were sold to STG pursuant to a definitive agreement dated March 6, 2021; |

| • | “fiscal 2018” refers to the fiscal year of Foundation Technology Worldwide LLC and its subsidiaries ended December 29, 2018; |

| • | “fiscal 2019” refers to our fiscal year ended December 28, 2019; |

| • | “fiscal 2020” refers to our fiscal year ended December 26, 2020; |

| • | “fiscal 2021” refers to our fiscal year ending December 25, 2021; |

| • | “Intel” refers to Intel Corporation; |

| • | “IPO” refers to the initial public offering of shares of Class A common stock of McAfee Corp.; |

| • | “Reorganization Transactions” refers to the reorganization transactions that are described under “Prospectus Summary—Summary of the Reorganization Transactions and Our Structure”; |

| • | “Sponsor Acquisition” refers to: (i) the conversion of McAfee, Inc., which was then a part of a business unit of Intel, into a limited liability company, McAfee, LLC, (ii) the contribution of McAfee, LLC to Foundation Technology Worldwide LLC, a wholly-owned subsidiary of Intel, (iii) the transfer beginning on April 3, 2017, by Intel and its subsidiaries of assets and liabilities of the Predecessor Business not already held through Foundation Technology Worldwide LLC to Foundation Technology Worldwide LLC, and (iv) the acquisition immediately thereafter on April 3, 2017, by our Sponsors and certain co-investors of a majority stake in Foundation Technology Worldwide LLC, following which our Sponsors and certain of theirco-investors owned 51.0% of the common equity interests in Foundation Technology Worldwide LLC, with certain affiliates of Intel retaining the remaining 49.0% of the common equity interests; |

| • | “Sponsors” refers to investment funds affiliated with or advised by TPG Global, LLC (“TPG”) and Thoma Bravo, L.P. (“Thoma Bravo”), respectively; and |

| • | “STG” refers to Symphony Technology Group. |

| • | Comprehensive and convenient security solutions to protect consumers across their digital footprint. |

| • | Consumer protection powered by seamless digital experience across device platforms. |

| • | Consumer products to address privacy needs. |

| • | Comprehensive threat intelligence leveraging a unique global sensor network. |

| • | Our solutions provide a seamless and user friendly experience. time-to-value |

| • | Our solutions have comprehensive features that provide consumers peace of mind that their online experience is protected. |

| • | Our solutions are supported by our global threat intelligence network, which is bolstered by artificial intelligence, machine learning, and deep learning to increase efficacy and efficiency. |

| • | Brand recognition |

| • | Holistic cybersecurity solutions seamlessly integrated across the consumers’ entire digital ecosystem. |

| • | Unique footprint across devices. |

| • | Scale and diversity of threat intelligence network |

| • | Differentiated omnichannel go-to-market |

| • | Experienced management team with deep cybersecurity expertise. go-to-market |

| • | Continue to leverage our strength as a trusted cybersecurity brand to increase sales from new and existing subscribers. |

| • | Invest in new and existing routes to market for subscribers. direct-to-consumer |

| • | Enhance and tailor the subscriber conversion and renewal process. |

| • | Continue to innovate and enhance our consumer security platform and user experience. |

| • | Continue to pursue targeted acquisitions. |

and believe we are well positioned to successfully execute on our acquisition strategy by leveraging our scale, global reach and routes to market, and data assets. |

| • | Device Security. Anti-Malware Software Total Protection / LiveSafe Secure Home Platform (“SHP”) . |

| • | Online Privacy and Comprehensive Internet Security. Safe Connect VPN TunnelBear any Wi-Fi connection safe and private. With bank-gradeAES 256-bit encryption, our solution keeps personal data, such as banking account credentials and credit card information protected while keeping IP addresses and physical locations private. This capability helps consumers prevent password and data theftand IP-based tracking and allows customers to access global content, by bypassing local censorship. Consumers can add an additional layer of protection with FileLock Shredder WebAdvisor Safe Family blocks age-inappropriate websites, provides device usage monitoring and device restriction services and gives parents the ability to track children’s devices. |

| • | Identity Protection. IdentityProtection |

credit monitoring and SSN trace, helping consumers take action to prevent from fraud. Our solution also helps consumers recover from fraud through our 24/7/365 support and range of additional services, such as our full-service ID restoration, stolen funds reimbursement, lost wallet recovery, and identify theft insurance, covering expenses up to $1 million. Our Password Manager or re-used passwords. |

| • | Platform Innovation. |

| • | Ability to Integrate with Our Partners. |

| • | Direct to consumer marketing. |

| • | PC OEMs. we pre-install a 30-day free a one-year or longer subscription and the OEM pays McAfee a royalty. During the subscription lifecycle, McAfee engages the consumer with our digital marketing engine to convert the consumer to a McAfee customer at the end of the subscription period. |

| • | Retail and eCommerce. |

| • | Communications Service Providers, ISPs and Mobile Providers. Verizon, T-Mobile, Lumen, Telefonica, NTT Docomo, Softbank, British Telecom, and Sky, to offer our mobile security and secure home platform products through the service providers. In some cases, we also partner with the service providers to integrate and bundle one or more of our security products into their mobile product value added service offerings. In addition to our partnerships with service providers, we partner with Samsungto pre-install one or more of our security products on their smartphones. |

| • | Search Providers |

| • | The COVID-19 pandemic has affected how we are operating our business, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain. |

| • | If we are unsuccessful at executing our business plan and necessary transition activities as a standalone consumer cybersecurity company following the recent sale of our Enterprise Business, our business and results of operations may be adversely affected and our ability to invest in and grow our business could be limited. |

| • | The cybersecurity market is rapidly evolving and becoming increasingly competitive in response to continually evolving cybersecurity threats from a variety of increasingly sophisticated cyberattackers. If we fail to anticipate changing customer requirements or industry and market developments, or we fail to adapt our business model to keep pace with evolving market trends, our financial performance will suffer. |

| • | We operate in a highly competitive environment, and we expect competitive pressures to increase in the future, which could cause us to lose market share. |

| • | Our results of operations can be difficult to predict and may fluctuate significantly, which could result in a failure to meet investor expectations. |

| • | Forecasting our estimated annual effective tax rate is complex and subject to uncertainty, and there may be material differences between our forecasted and actual tax rates. |

| • | We face risks associated with past and future investments, acquisitions, and other strategic transactions. |

| • | Over the last several years, we have pursued a variety of strategic initiatives designed to optimize and reinforce our cybersecurity platform. If the benefits of these initiatives are less than we anticipate, or if the realization of such benefits is delayed, our business and results of operations may be harmed. |

| • | If our solutions have or are perceived to have defects, errors, or vulnerabilities, or if our solutions fail or are perceived to fail to detect, prevent, or block cyberattacks, including in circumstances where customers may fail to take action on attacks identified by our solutions, our reputation and our brand could suffer, which would adversely impact our business, financial condition, results of operations, and cash flows. |

| • | Failure to adapt our product and service offerings to changing customer demands, or lack of customer acceptance of new or enhanced solutions, could harm our business and financial results. |

| • | If the protection of our proprietary technology is inadequate, we may not be able to adequately protect our innovations and brand. |

| • | If we fail to maintain relationships with our channel partners, or if we must agree to significant adverse changes in the terms of our agreements with these partners, it may have an adverse effect on our ability to successfully and profitably market and sell our products and solutions. |

| • | If our security measures are breached or unauthorized access to our data is otherwise obtained, our brand, reputation, and business could be harmed, and we may incur significant liabilities. |

| • | We operate globally and are subject to significant business, economic, regulatory, social, political, and other risks in many jurisdictions. |

| • | We may become involved in litigation, investigations, and regulatory inquiries and proceedings that could negatively affect us and our reputation. |

| • | Our substantial leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our market, expose us to interest rate risk, and prevent us from timely satisfying our obligations. |

| • | Restrictions imposed by our outstanding indebtedness and any future indebtedness may limit our ability to operate our business and to finance our future operations or capital needs or to engage in acquisitions or other business activities necessary to achieve growth. |

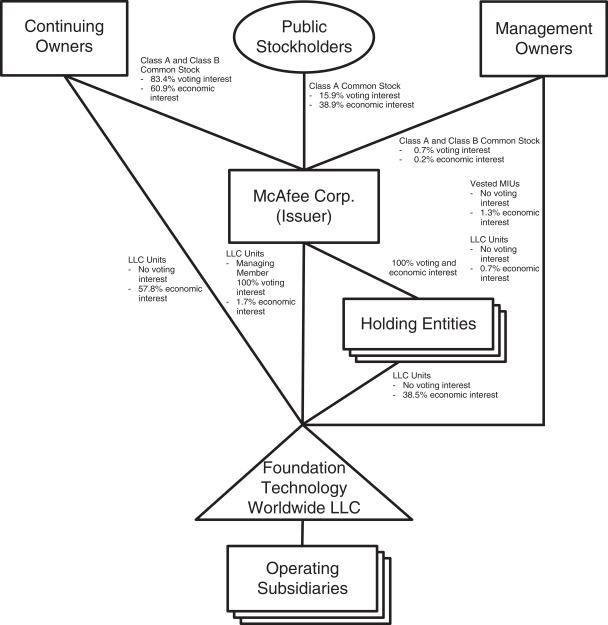

| • | Our principal asset is our interest in Foundation Technology Worldwide LLC, and we are dependent upon Foundation Technology Worldwide LLC and its consolidated subsidiaries for our results of operations, cash flows, and distributions. |

| • | We will be required to pay certain Continuing Owners and certain Management Owners for certain tax benefits we may realize or are deemed to realize in accordance with the tax receivable agreement between us and such Continuing Owners and Management Owners, and we expect that the payments we will be required to make will be substantial. |

| • | In certain circumstances, under its limited liability company agreement, Foundation Technology Worldwide LLC will be required to make tax distributions to us, the Continuing Owners and certain Management Owners and the distributions that Foundation Technology Worldwide LLC will be required to make may be substantial. |

| • | a new limited liability company operating agreement (“New LLC Agreement”) was adopted for FTW making the Corporation the sole managing member of FTW; |

| • | the Corporation’s certificate of incorporation was amended and restated to, among other things, (i) provide for Class A common stock and Class B common stock and (ii) issue shares of Class B common stock to the Continuing Owners and Management Owners, on a one-to-one |

| • | the Corporation (i) issued 126.3 million shares of its Class A common stock to certain of the Continuing Owners in exchange for their contribution of LLC units or the equity of certain other entities, which pursuant to the Reorganization Transactions, became its direct or indirect subsidiaries and (ii) settled 5.7 million restricted stock units (“RSUs”) with shares of its Class A common stock, net of tax withholding, held by certain employees, which were satisfied in connection with the Reorganization Transactions. |

Issuer in this offering | McAfee Corp. |

Class A common stock offered by the selling stockholders | 20,000,000 shares (or 23,000,000 shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

Underwriters’ option to purchase additional shares of Class A common stock from the selling stockholders | 3,000,000 shares. |

Class A common stock to be outstanding after this offering | 175,849,441 shares (or 178,003,855 shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

Class B common stock to be outstanding after this offering | 255,532,090 shares (or 253,377,676 shares if the underwriters exercise in full their option to purchase additional shares of Class A common stock). |

Voting power held by holders of Class A common stock after giving effect to this offering by the selling stockholders | 40.8% |

Voting power held by holders of Class B common stock after giving effect to this offering by the selling stockholders | 59.2% |

Voting rights | Holders of our Class A common stock and Class B common stock vote together as a single class on all matters presented to stockholders for their vote or approval, except as otherwise required by law or as otherwise provided by our certificate of incorporation. Each share of Class A common stock and Class B common stock entitles its holder to one vote per share on all such matters. See “Description of Capital Stock.” |

Use of proceeds | The selling stockholders will receive all of the net proceeds from this offering. We will not receive any of the proceeds from the sale of shares of Class A common stock offered by the selling stockholders. We will, however, bear the costs associated with the sale of shares by the selling stockholders, other than underwriting discounts and commissions. See “Use of Proceeds.” |

Conflicts of Interest | Affiliates of TPG beneficially own in excess of 10% of our issued and outstanding common stock. Because TPG Capital BD, LLC, an |

affiliate of TPG, is an underwriter in this offering and its affiliates own in excess of 10% of our issued and outstanding common stock, TPG Capital BD, LLC is deemed to have a “conflict of interest” under Rule 5121 (“Rule 5121”) of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Accordingly, this offering is being made in compliance with the requirements of Rule 5121. Pursuant to that rule, the appointment of a “qualified independent underwriter” is not required in connection with this offering as the member primarily responsible for managing the public offering does not have a conflict of interest, is not an affiliate of any member that has a conflict of interest and meets the requirements of paragraph (f)(12)(E) of Rule 5121. See “Underwriters (Conflicts of Interest).” |

Dividend Policy | Foundation Technology Worldwide LLC expects to pay a cash distribution to its members on a quarterly basis at an aggregate annual rate of approximately $200 million. McAfee Corp. is expected to receive a portion of any such distribution through the LLC Units it holds directly or indirectly through its wholly-owned subsidiaries on the record date for any such distribution declared by Foundation Technology Worldwide LLC, which is expected to equal the number of shares of Class A common stock outstanding on such date. McAfee Corp. expects to use the proceeds it receives from such quarterly distribution to declare a cash dividend on its shares of Class A common stock. We intend to fund any future dividends from distributions made by Foundation Technology Worldwide LLC from its available cash generated from operations. |

| In addition, in connection with the consummation of the sale of our Enterprise Business to STG, we declared a one-time special dividend of $4.50 to holders of record of our Class A common stock as of August 13, 2021, paid on August 27, 2021. Purchasers of shares in this offering will not be entitled to receive such special dividend with the respect to the shares of Class A common stock that they purchase in this offering. |

| The timing, declaration, amount of, and payment of any such dividends will be made at the discretion of McAfee Corp.’s board of directors, subject to applicable laws, and will depend upon many factors, including the amount of the distribution received by McAfee Corp. from Foundation Technology Worldwide LLC, our financial condition, results of operations, capital requirements, contractual restrictions, general business conditions, and other factors that McAfee Corp.’s board of directors may deem relevant. Moreover, if, as expected, McAfee Corp. determines to initially pay a dividend following any quarterly distributions from Foundation Technology Worldwide LLC, there can be no assurance that McAfee Corp. will continue to pay dividends in the same amounts or at all thereafter. See “Dividend Policy.” |

Controlled Company | Following this offering, our Sponsors and Intel and certain of its affiliates will control approximately 77.7% of the combined voting |

power of our outstanding common stock. As a result, we will continue to be a “controlled company” under the Exchange’s corporate governance standards. Under these standards, a company of which more than 50% of the voting power is held by an individual, group, or another company is a “controlled company” and may elect not to comply with certain corporate governance standards. |

Risk factors | You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our Class A common stock. |

Exchange symbol | “MCFE” |

| • | 265,376,691 shares of Class A common stock issuable upon exchange or redemption of LLC Units, together with corresponding shares of Class B common stock; |

| • | 5,854,008 shares of Class A common stock that would be outstanding if all vested MIUs were exchanged for shares of Class A common stock, and 6,814,340 shares of Class A common stock that would be outstanding if all unvested MIUs were exchanged for shares of Class A common stock; |

| • | 23,847,140 shares of Class A common stock issuable upon vesting of outstanding RSUs; |

| • | 1,834,063 shares of Class A common stock issuable upon vesting of outstanding PSUs; |

| • | 482,231 shares of Class A common stock issuable upon exercise of vested option awards having a weighted average exercise price of $19.88 and 1,350,954 shares of Class A common stock issuable upon exercise of unvested option awards having a weighted average exercise price of $19.38; |

| • | 43,130,213 shares of Class A common stock reserved for future issuance under our 2020 equity incentive plan, without taking into account the “evergreen” provision of our 2020 equity incentive plan; and |

| • | 9,389,809 shares of Class A common stock authorized for sale under the Employee Stock Purchase Plan (“ESPP”) without taking into account the “evergreen” provision of our ESPP; |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions expect per share data) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 1,558 | $ | 737 | $ | 909 | ||||||||||

Cost of sales (2) | 386 | 391 | 444 | 209 | 232 | |||||||||||||||

Gross profit | 775 | 912 | 1,114 | 528 | 677 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Sales and marketing (2) | 348 | 299 | 348 | 140 | 174 | |||||||||||||||

Research and development (2) | 186 | 161 | 188 | 75 | 92 | |||||||||||||||

General and administrative (2) | 170 | 182 | 235 | 100 | 93 | |||||||||||||||

Amortization of intangibles | 153 | 146 | 143 | 72 | 49 | |||||||||||||||

Restructuring charges | 19 | 6 | 2 | 1 | 8 | |||||||||||||||

Total operating expenses | 876 | 794 | 916 | 388 | 416 | |||||||||||||||

Operating income (loss) | (101 | ) | 118 | 198 | 140 | 261 | ||||||||||||||

Interest (expense) and other, net | (308 | ) | (296 | ) | (307 | ) | (149 | ) | (118 | ) | ||||||||||

Foreign exchange gain (loss), net | 30 | 21 | (104 | ) | (6 | ) | 15 | |||||||||||||

Income (loss) from continuing operations before income taxes | (379 | ) | (157 | ) | (213 | ) | (15 | ) | 158 | |||||||||||

Provision for income tax expense (benefit) | 29 | 38 | 5 | (5 | ) | 7 | ||||||||||||||

Income (loss) from continuing operations | (408 | ) | (195 | ) | (218 | ) | (10 | ) | 151 | |||||||||||

Income (loss) from discontinued operations, net of taxes | (104 | ) | (41 | ) | (71 | ) | 41 | 51 | ||||||||||||

Net income (loss) | $ | (512 | ) | $ | (236 | ) | $ | (289 | ) | $ | 31 | $ | 202 | |||||||

Less: Net income (loss) attributable to redeemable noncontrolling interests | N/A | N/A | (171 | ) | N/A | 136 | ||||||||||||||

Net income (loss) attributable to McAfee Corp. | N/A | N/A | $ | (118 | ) | N/A | $ | 66 | ||||||||||||

Net income (loss) attributable to McAfee Corp.: | ||||||||||||||||||||

Income (loss) from continuing operations attributable to McAfee Corp. | N/A | N/A | $ | (55 | ) | N/A | $ | 50 | ||||||||||||

Income (loss) from discontinued operations attributable to McAfee Corp. | N/A | N/A | (63 | ) | N/A | 16 | ||||||||||||||

Net income (loss) attributable to McAfee Corp. | N/A | N/A | $ | (118 | ) | N/A | $ | 66 | ||||||||||||

Earnings (loss) per share attributable to McAfee Corp., basic: | ||||||||||||||||||||

Continuing operations | N/A | N/A | $ | (0.34 | ) | N/A | $ | 0.31 | ||||||||||||

Discontinued operations | N/A | N/A | (0.39 | ) | N/A | 0.10 | ||||||||||||||

Earnings (loss) per share, basic (1) | N/A | N/A | $ | (0.73 | ) | N/A | $ | 0.40 | ||||||||||||

Earnings (loss) per share attributable to McAfee Corp., diluted: | ||||||||||||||||||||

Continuing operations | N/A | N/A | $ | (0.34 | ) | N/A | $ | 0.30 | ||||||||||||

Discontinued operations | N/A | N/A | (0.39 | ) | N/A | 0.09 | ||||||||||||||

Earnings (loss) per share, diluted (1) | N/A | N/A | $ | (0.73 | ) | N/A | $ | 0.39 | ||||||||||||

Weighted-average shares outstanding, basic | N/A | N/A | 162.3 | N/A | 163.7 | |||||||||||||||

Weighted-average shares outstanding, diluted | N/A | N/A | 162.3 | N/A | 179.5 | |||||||||||||||

Statements of Cash Flows Data | ||||||||||||||||||||

Net cash provided by (used in): | ||||||||||||||||||||

Operating activities | $ | 319 | $ | 496 | $ | 760 | $ | 288 | $ | 448 | ||||||||||

Investing activities | (677 | ) | (63 | ) | (51 | ) | (33 | ) | (18 | ) | ||||||||||

Financing activities | 459 | (734 | ) | (651 | ) | (162 | ) | (239 | ) | |||||||||||

| (1) | Basic and diluted earnings (loss) per share of Class A common stock are applicable only for periods after October 22, 2020, which is the period following our IPO and related Reorganization Transactions. Refer to Note 17 in our audited consolidated financial statements included elsewhere in this prospectus |

| for information about the Net Loss Per Share during fiscal 2020. Refer to Note 15 Earnings Per Share in the notes to the unaudited condensed consolidated financial statements included elsewhere in this prospectus for information about the Earnings Per Share during the six months ended June 26, 2021. |

| (2) | Includes equity-based compensation expense as follows: |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Cost of sales | $ | 1 | $ | — | $ | 5 | $ | — | $ | 2 | ||||||||||

Sales and marketing | 1 | 1 | 23 | 1 | 7 | |||||||||||||||

Research and development | 1 | 1 | 40 | — | 10 | |||||||||||||||

General and administrative | 3 | 3 | 45 | 15 | 14 | |||||||||||||||

Total equity-based compensation expense from continuing operations | 6 | 5 | 113 | 16 | 33 | |||||||||||||||

Discontinued operations | 22 | 20 | 200 | 3 | 45 | |||||||||||||||

Total equity-based compensation expense | $ | 28 | $ | 25 | $ | 313 | $ | 19 | $ | 78 | ||||||||||

(in millions) | As of June 26, 2021 | |||

Cash and cash equivalents | $ | 420 | ||

Working capital (1) | (1,351 | ) | ||

Total assets | 5,437 | |||

Current and long-term deferred revenue | 1,019 | |||

Current and long-term debt, net of borrowing costs (2) | 3,948 | |||

Redeemable noncontrolling interests | 7,687 | |||

Accumulated deficit | (52 | ) | ||

| (1) | Working capital is comprised of current assets less current liabilities. |

| (2) | In connection with the consummation of the sale of our Enterprise Business to STG, we repaid $332 million of our First Lien USD Term Loan and €563 million of our First Lien EUR Term Loan in August 2021. See “Capitalization”. |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 1,558 | $ | 737 | $ | 909 | ||||||||||

Operating income (loss) | $ | (101 | ) | $ | 118 | $ | 198 | $ | 140 | $ | 261 | |||||||||

Operating income (loss) margin | (8.7 | )% | 9.1 | % | 12.7 | % | 19.0 | % | 28.7 | % | ||||||||||

Net income (loss) | $ | (512 | ) | $ | (236 | ) | $ | (289 | ) | $ | 31 | $ | 202 | |||||||

Net income (loss) margin | (44.1 | )% | (18.1 | )% | (18.5 | )% | 4.2 | % | 22.2 | % | ||||||||||

Adjusted operating income | $ | 220 | $ | 427 | $ | 624 | $ | 303 | $ | 403 | ||||||||||

Adjusted operating income margin | 18.9 | % | 32.8 | % | 40.1 | % | 41.1 | % | 44.3 | % | ||||||||||

Adjusted EBITDA | $ | 247 | $ | 455 | $ | 651 | $ | 317 | $ | 417 | ||||||||||

Adjusted EBITDA margin | 21.3 | % | 34.9 | % | 41.8 | % | 43.0 | % | 45.9 | % | ||||||||||

Adjusted net income (loss) | $ | (57 | ) | $ | 116 | $ | 278 | $ | 127 | $ | 235 | |||||||||

Adjusted net income (loss) margin | (4.9 | )% | 8.9 | % | 17.8 | % | 17.2 | % | 25.9 | % | ||||||||||

Net cash provided by operating activities | 319 | 496 | 760 | 288 | 448 | |||||||||||||||

Net cash used in investing activities | (677 | ) | (63 | ) | (51 | ) | (33 | ) | (18 | ) | ||||||||||

Net cash provided by (used in) financing activities | 459 | (734 | ) | (651 | ) | (162 | ) | (239 | ) | |||||||||||

Free cash flow | 257 | 435 | 714 | 260 | 430 | |||||||||||||||

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | adjusted operating income and adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; |

| • | adjusted operating income and adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | adjusted operating income and adjusted EBITDA do not reflect income tax payments that may represent a reduction in cash available to us; and |

| • | other companies, including companies in our industry, may calculate adjusted operating income and adjusted EBITDA differently, which reduce their usefulness as comparative measures. |

| • | although amortization is non-cash charge, the assets being amortized may have to be replaced in the future, and adjusted net income does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | adjusted net income does not reflect changes in, or cash requirements for, our working capital needs; |

| • | other companies, including companies in our industry, may calculate adjusted net income differently, which reduce its usefulness as comparative measures. |

| • | the level of competition in our markets, including the effect of new entrants, consolidation, and technological innovation; |

| • | macroeconomic conditions in our markets, both domestic and international, as well as the level of discretionary technology spending; |

| • | fluctuations in demand for our solutions; |

| • | disruptions in our business operations or target markets caused by, among other things, terrorism or other intentional acts, pandemics, such as the COVID-19 pandemic, riots, protests or political unrest, or earthquakes, floods, or other natural disasters; |

| • | variability and unpredictability in the rate of growth in the markets in which we compete; |

| • | technological changes in our markets; |

| • | our ability to renew existing subscribers, acquire new subscribers, and sell additional solutions; |

| • | execution of our business strategy and operating plan, and the effectiveness of our sales and marketing programs; |

| • | product announcements, introductions, transitions, and enhancements by us or our competitors, which could result in deferrals of customer orders; |

| • | the impact of our recent divesture of our enterprise business, and any stranded or other costs incurred in connection with the transaction and the efficacy of our cost optimization efforts following the transaction; |

| • | the impact of future acquisitions or divestitures; |

| • | changes in accounting rules and policies that impact our future results of operations compared to prior periods; and |

| • | the need to recognize certain revenue ratably over a defined period or to defer recognition of revenue to a later period, which may impact the comparability of our results of operations across those periods. |

| • | our channel partners are generally not subject to minimum sales requirements or any obligation to market our solutions to their customers; |

| • | many channel partner agreements are nonexclusive and may be terminated at any time without cause and or renegotiated with us on new terms that may be less favorable due to competitive conditions in our markets and other factors; |

| • | our channel partners may encounter issues or have violations of applicable law or regulatory requirements or otherwise cause damage to our reputation through their actions; |

| • | certain of our channel partners market and distribute competing solutions and may, from time to time, may place greater emphasis on the sale of these competing solutions due to pricing, promotions, and other terms offered by our competitors; |

| • | any consolidation of electronics retailers can increase their negotiating power with respect to software providers such as us and any decline in the number of physical retailers could decrease the channels of distribution for us; |

| • | the continued consolidation of online sales through a small number of larger channels has been increasing, which could reduce the channels available for online distribution of our solutions; and |

| • | sales through our partners are subject to changes in general economic conditions, strategic direction, competitive risks, and other issues that could result in a reduction of sales, or cause our partners to suffer financial difficulty which could delay payments to us, affecting our operating results. |

| • | global and local economic conditions; |

| • | differing employment practices and labor issues; |

| • | formal or informal imposition of new or revised export and/or import and doing-business regulations, including trade sanctions, taxes, and tariffs, which could be changed without notice; |

| • | regulations or restrictions on the use, import, or export of encryption technologies that could delay or prevent the acceptance and use of encryption products and public networks for secure communications; |

| • | compliance with evolving foreign laws, regulations, and other government controls addressing privacy, data protection, data localization, and data security; |

| • | ineffective legal protection of our intellectual property rights in certain countries; |

| • | increased uncertainties regarding social, political, immigration, and trade policies in the United States and abroad, such as those caused by recent U.S. legislation and the withdrawal of the United Kingdom (the “U.K.”) from the European Union (the “E.U.”), which is commonly referred to as “Brexit;” |

| • | geopolitical and security issues, such as armed conflict and civil or military unrest, crime, political instability, human rights concerns, and terrorist activity; |

| • | natural disasters, public health issues, pandemics (such as the COVID-19 pandemic), and other catastrophic events; |

| • | inefficient infrastructure and other disruptions, such as supply chain interruptions and large-scale outages or unreliable provision of services from utilities, transportation, data hosting, or telecommunications providers; |

| • | other government restrictions on, or nationalization of, our operations in any country, or restrictions on our ability to repatriate earnings from a particular country; |

| • | seasonal reductions in business activity in the summer months in Europe and in other periods in other countries; |

| • | costs and delays associated with developing software and providing support in multiple languages; |

| • | greater difficulty in identifying, attracting, and retaining local qualified personnel, and the costs and expenses associated with such activities; |

| • | longer payment cycles and greater difficulties in collecting accounts receivable; and |

| • | local business and cultural factors that differ from our normal standards and practices, including business practices that we are prohibited from engaging in by U.S. Foreign Corrupt Practices Act of 1977 (“FCPA”) and other anti-corruption laws and regulations. |

| • | making it more difficult for us to make payments on the Senior Secured Credit Facilities and our other obligations; |

| • | increasing our vulnerability to general economic and market conditions and to changes in the industries in which we compete; |

| • | requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, thereby reducing our ability to use our cash flow to fund our operations, future working capital, capital expenditures, investments or acquisitions, future strategic business opportunities, or other general corporate requirements; |

| • | restricting us from making acquisitions or causing us to make divestitures or similar transactions; |

| • | limiting our ability to obtain additional financing for working capital, capital expenditures, debt service requirements, investments, acquisitions, and general corporate or other purposes; |

| • | limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged; and |

| • | increasing our cost of borrowing. |

| • | incur additional indebtedness; |

| • | create or incur liens; |

| • | engage in consolidations, amalgamations, mergers, liquidations, dissolutions, or dispositions; |

| • | pay dividends and distributions on, or purchase, redeem, defease, or otherwise acquire or retire for value, our capital stock; |

| • | make acquisitions, investments, loans (including guarantees), advances, or capital contributions; |

| • | create negative pledges or restrictions on the payment of dividends or payment of other amounts owed from subsidiaries; |

| • | sell, transfer, or otherwise dispose of assets, including capital stock of subsidiaries; |

| • | make prepayments or repurchases of debt that is contractually subordinated with respect to right of payment or security; |

| • | engage in certain transactions with affiliates; |

| • | modify certain documents governing debt that is subordinated with respect to right of payment; |

| • | change our fiscal year; and |

| • | change our material lines of business. |

| • | limited in how we conduct our business; |

| • | unable to raise additional debt or equity financing to operate during general economic or business downturns; |

| • | unable to compete effectively or to take advantage of new business opportunities; and/or |

| • | limited in our ability to grow in accordance with, or otherwise pursue, our business strategy. |

| • | changes in the valuation of our deferred tax assets and liabilities; |

| • | expected timing and amount of the release of any tax valuation allowances; |

| • | tax effects of equity-based compensation; |

| • | costs related to intercompany restructurings; |

| • | changes in tax laws, regulations, or interpretations thereof; or |

| • | lower than anticipated future earnings in jurisdictions where we have lower statutory tax rates and higher than anticipated future earnings in jurisdictions where we have higher statutory tax rates. |

| • | a board of directors that is composed of a majority of “independent directors,” as defined under rules; |

| • | a compensation committee that is composed entirely of independent directors; and |

| • | a nominating and corporate governance committee that is composed entirely of independent directors. |

| • | actual or anticipated changes or fluctuations in our results of operations and whether our results of operations meet the expectations of securities analysts or investors; |

| • | actual or anticipated changes in securities analysts’ estimates and expectations of our financial performance; |

| • | announcements of new solutions, commercial relationships, acquisitions, or other events by us or our competitors; |

| • | general market conditions, including volatility in the market price and trading volume of technology companies in general and of companies in the IT security industry in particular; |

| • | changes in how current and potential customers perceive the effectiveness of our platform in protecting against advanced cyberattacks or other reputational harm; |

| • | network outages or disruptions of our solutions or their availability, or actual or perceived privacy, data protection, or network information breaches; |

| • | investors’ perceptions of our prospects and the prospects of the businesses in which we participate; |

| • | sales of large blocks of our Class A common stock, including sales by our executive officers, directors, and significant stockholders; |

| • | announced departures of any of our key personnel; |

| • | lawsuits threatened or filed against us or involving our industry, or both; |

| • | changing legal or regulatory developments in the United States and other countries; |

| • | any default or anticipated default under agreements governing our indebtedness; |

| • | adverse publicity about us, our products and solutions, or our industry; |

| • | effects of public health crises, such as the COVID-19 pandemic; |

| • | general economic conditions and trends; and |

| • | other events or factors, including those resulting from major catastrophic events, war, acts of terrorism, or responses to these events. |

| • | any derivative action or proceeding brought on our behalf; |

| • | any action asserting a claim of breach of a fiduciary duty owed by any of our directors, officers or other employees to us or our stockholders; |

| • | any action asserting a claim against us arising pursuant to any provision of the General Corporation Law of the State of Delaware, our certificate of incorporation or our bylaws; |

| • | any action to interpret, apply, enforce or determine the validity of our certificate of incorporation or bylaws; and |

| • | any other action asserting a claim against us that is governed by the internal affairs doctrine (each, a “Covered Proceeding”). |

| • | the efficiency and success of our transition to a pure-play Consumer cybersecurity company following the sale of our Enterprise Business; |

| • | plans to develop and offer new products and services and enter new markets; |

| • | our expectations with respect to the continued stability and growth of our customer base; |

| • | anticipated trends, growth rates, and challenges in our business and in domestic and international markets; |

| • | our financial performance, including changes in and expectations with respect to revenues, and our ability to maintain profitability in the future; |

| • | investments or potential investments in new or enhanced technologies; |

| • | market acceptance of our solutions; |

| • | the success of our business strategy, including the growth in the market for cloud-based security solutions, acceptance of our own cloud-based solutions, and changes in our business model and operations; |

| • | our ability to cross-sell and up-sell to our existing subscribers; |

| • | our ability to maintain and expand our relationships with partners and on commercially acceptable terms, including our channel and strategic partners; |

| • | the effectiveness of our sales force, distribution channel, and marketing activities; |

| • | the growth and development of our direct and indirect channels of distribution; |

| • | our response to emerging and future cybersecurity risks; |

| • | our ability to continue to innovate and enhance our solutions; |

| • | our ability to develop new solutions and bring them to market in a timely manner; |

| • | our ability to prevent serious errors, defects, or vulnerabilities in our solutions; |

| • | our ability to develop solutions that interoperate with our subscribers’ existing systems and devices; |

| • | our ability to maintain, protect, and enhance our brand and intellectual property; |

| • | our continued use of open source software; |

| • | our ability to compete against established and emerging cybersecurity companies; |

| • | risks associated with fluctuations in exchange rates of the foreign currencies in which we conduct business; |

| • | past and future acquisitions, investments, and other strategic investments; |

| • | our ability to remain in compliance with laws and regulations that currently apply or become applicable to our business both domestically and internationally; |

| • | the attraction, transition, and retention of management and other qualified personnel; |

| • | economic and industry trend analysis; |

| • | litigation, investigations, regulatory inquiries, and proceedings; |

| • | the increased expenses associated with being a public company; |

| • | our estimated total addressable market; |

| • | the future trading prices of our Class A common stock; |

| • | the impact of macroeconomic conditions on our business, including the impact of the COVID-19 on economic activity and financial markets; |

| • | our expectation regarding the impact of the COVID-19 pandemic, including its geographic spread and severity, and the related responses by governments and private industry on our business and financial condition, as well as the businesses and financial condition of our subscribers and partners; |

| • | the adequacy of our capital resources to fund operations and growth; |

| • | our Sponsors’ and Intel’s significant influence over us and our status as a “controlled company” under the rules of the Exchange; |

| • | risks relating to our corporate structure, tax rates, and tax receivable agreement; and |

| • | the other factors identified under the heading “Risk Factors” appearing elsewhere in this prospectus. |

| • | eMarketer, Global Commerce 2020, Ecommerce Decelerates amid Global Retail Contraction but Remains a Bright Spot, June 2020; |

| • | eMarketer, US Mobile Time Spent 2020, Lockdowns augment Gains in Time Spent with Mobile Devices, June 2020; |

| • | eMarketer, US Time Spent with Media 2020, Gains in Consumer Usage During the Year of COVID-19 and Beyond, April 2020; |

| • | Frost & Sullivan, Total Addressable Market (TAM) for the Global Consumer Cyber Security and Privacy Market, August 31, 2020; |

| • | ForgeRock, 2021 ForgeRock Consumer Identity Breach Report, The Year of the Great Digital Migration: How Usernames and Passwords Found Their Way Into the Crosshairs of Attackers, June 7, 2021; |

| • | Identity Theft Resource Center, Identity Theft Resource Center Reports 33 Percent Decrease in Data Breaches in the First Half of 2020, July 14, 2019 (https://www.idtheftcenter.org/identity-theft-resource-center-reports-33-percent-decrease-in-data-breaches-in-the-first-half-of-2020/); |

| • | IDC, New Media Market Model 1Q20 Deliverable, 12 June 2020; |

| • | IDC, Public Cloud Services Spending Guide Forecast Pivot, June 2020; |

| • | IDC, The State of U.S. Enterprise Mobile Workers: Information, Frontline, and Work from Home Trends in 2020, 28 July 2020; |

| • | IDC, Total Addressable Market (TAM) Calculator, 2020; |

| • | IDC, Worldwide Mobile Phone Forecast Update, 2020-2024, June 2020; |

| • | McAfee ATR Threats Report, April 2021; |

| • | RiskBased Security, 2020 Year End Data Breach QuickView Report, 2021; and |

| • | Statista, Global Consumer Survey - Average for 5 Countries (US, Japan, Germany, Australia, United Kingdom), 2018 & 2019. |

| • | the consummation of the sale of our Enterprise Business to STG on July 27, 2021; and |

| • | the application of the proceeds from the sale of our Enterprise Business to STG, including (i) the declaration and payment of a one time special dividend of $4.50 per share to holders of record of Class A common stock as of August 13, 2021 and a one-time special cash distribution to FTW members and (ii) the repayment of $332 million of our First Lien USD Term Loan and €563 million of our First Lien EUR Term Loan in August 2021. |

As of June 26, 2021 | ||||||||||||

(in millions) | Actual | Pro Forma Adjustments | Pro Forma | |||||||||

Cash and cash equivalents | $ | 420 | $ | 63 | (6) | $ | 483 | |||||

Long-term debt: | ||||||||||||

First Lien USD Term Loan | 2,717 | (1) | (332 | ) (3) | 2,385 | |||||||

First Lien EUR Term Loan | 1,276 | (2) | (673 | ) (3) | 603 | |||||||

Second Lien USD Term Loan | — | — | — | |||||||||

Revolving Credit Facility | — | — | — | |||||||||

Redeemable noncontrolling interests | 7,687 | (1,710 | ) (4) | 5,977 | ||||||||

Equity (deficit): | ||||||||||||

Class A common stock, $0.001 par value - 1,500,000,000 shares authorized, 166,004,840 shares issued and outstanding as of June 26, 2021 | — | — | — | |||||||||

Class B common stock, $0.001 par value - 300,000,000 shares authorized, 265,376,691 shares issued and outstanding as of June 26, 2021 | — | — | — | |||||||||

Additional paid-in capital | (9,306 | ) | (747 | ) (4) | (10,053 | ) | ||||||

Accumulated other comprehensive income (loss) | (33 | ) | — | (33 | ) | |||||||

Accumulated deficit | (52 | ) | (475 | ) (5) | (527 | ) | ||||||

Total deficit | (9,391 | ) | (1,222 | ) | (10,613 | ) | ||||||

Total capitalization | $ | 2,289 | $ | (3,937 | ) | $ | (1,648 | ) | ||||

| (1) | First Lien USD Term Loan of $2,717 million excludes discount and issuance costs of $33 million. |

| (2) | First Lien EUR Term Loan of $1,276 million excludes discount and issuance costs of $11 million. |

| (3) | Represents prepayment of $332 million of First Lien USD Term Loan and €563 million of First Lien EUR Term Loan ($673 million using our June 26, 2021 exchange rate of 1.1951), representing a total of $1,005 million on our condensed consolidated balance sheet as of June 26, 2021, excluding related discount and issuance costs. |

| (4) | Represents approximate paid distributions to LLC Unit holders ($1,710 million) along with dividend of $4.50 per share of Class A common stock based on Class A shares outstanding at June 26, 2021. |

| (5) | Includes estimated $300 million in required corporate taxes and related payments and $175 million in customary transaction and one-time charges. This amount excludes gain on sale of Enterprise Business expected to be in excess of $2 billion, net of taxes. |

| (6) | Includes the proceeds of $4.0 billion from sale of the Enterprise Business less the amounts described in footnotes (3), (4), and (5) above. |

| • | Device Security, home-use, protected from viruses, ransomware, malware, spyware, and phishing. |

| • | Online Privacy and Comprehensive Internet Security, Wi-Fi connections safe with our bank-grade AES256-bit encryption, keeping personal data protected while keeping IP addresses and physical locations private. |

| • | Identity Protection, |

| • | Net revenue increased by 20% to $1.6 billion |

| • | Net loss increased 22% to $289 million |

| • | Loss from continuing operations increased 12% to a loss of $218 million |

| • | Adjusted EBITDA increased 43% to $651 million |

| • | Cash provided by operating activities increased by 53% to $760 million |

| • | Free cash flow increased by 64% to $714 million |

| • | Net revenue increased by 23% to $909 million |

| • | Net income increased by 552% to $202 million |

| • | Income from continuing operations increased by 1,610% to $151 million |

| • | Adjusted EBITDA increased by 32% to $417 million |

| • | Net cash provided by operating activities increased by 56% to $448 million |

| • | Free cash flow increased by 65% to $430 million |

December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | ||||||||||||||||

Core Direct to Consumer Customers (in millions) | 14.1 | 15.2 | 18.0 | 16.6 | 19.4 | |||||||||||||||

TTM Dollar Based Retention—Core Direct to Consumer Customers | 93 | % | 97 | % | 100 | % | 98 | % | 100 | % | ||||||||||

Fiscal Year Ended | Three Months Ended | |||||||||||||||||||

December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | ||||||||||||||||

Monthly ARPC | $ | 5.79 | $ | 5.96 | $ | 6.01 | $ | 6.06 | $ | 5.99 | ||||||||||

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | adjusted operating income and adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; |

| • | adjusted operating income and adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | adjusted operating income and adjusted EBITDA do not reflect income tax payments that may represent a reduction in cash available to us; and |

| • | other companies, including companies in our industry, may calculate adjusted operating income and adjusted EBITDA differently, which reduce their usefulness as comparative measures. |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Net income (loss) | $ | (512 | ) | $ | (236 | ) | $ | (289 | ) | $ | 31 | $ | 202 | |||||||

Add: Amortization | 260 | 253 | 251 | 126 | 98 | |||||||||||||||

Add: Equity-based compensation | 6 | 5 | 113 | 16 | 33 | |||||||||||||||

Add: Cash in lieu of equity awards (1) | 5 | 3 | 1 | 1 | — | |||||||||||||||

Add: Acquisition and integration costs (2) | 7 | 8 | 8 | 3 | 2 | |||||||||||||||

Add: Restructuring charges (3) | 19 | 6 | 2 | 1 | 8 | |||||||||||||||

Add: Management fees (4) | 7 | 11 | 28 | 4 | — | |||||||||||||||

Add: Transformation (5) | 17 | 23 | 20 | 9 | 1 | |||||||||||||||

Add: Executive severance (6) | — | — | 3 | 3 | — | |||||||||||||||

Add: Interest expense and other, net | 308 | 296 | 307 | 149 | 118 | |||||||||||||||

Add: Provision for income tax expense (benefit) | 29 | 38 | 5 | (5 | ) | 7 | ||||||||||||||

Add: Foreign exchange loss (gain), net | (30 | ) | (21 | ) | 104 | 6 | (15 | ) | ||||||||||||

Less: (Income) loss from discontinued operations, net of taxes | 104 | 41 | 71 | (41 | ) | (51 | ) | |||||||||||||

Adjusted operating income | 220 | 427 | 624 | 303 | 403 | |||||||||||||||

Add: Depreciation | 28 | 29 | 28 | 14 | 14 | |||||||||||||||

Less: Other expense | (1 | ) | (1 | ) | (1 | ) | — | — | ||||||||||||

Adjusted EBITDA | $ | 247 | $ | 455 | $ | 651 | $ | 317 | $ | 417 | ||||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 1,558 | $ | 737 | $ | 909 | ||||||||||

Net income (loss) margin | (44.1 | )% | (18.1 | )% | (18.5 | )% | 4.2 | % | 22.2 | % | ||||||||||

Adjusted operating income margin | 18.9 | % | 32.8 | % | 40.1 | % | 41.1 | % | 44.3 | % | ||||||||||

Adjusted EBITDA margin | 21.3 | % | 34.9 | % | 41.8 | % | 43.0 | % | 45.9 | % | ||||||||||

| • | although amortization is a non-cash charge, the assets being amortized may have to be replaced in the future, and adjusted net income does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | adjusted net income does not reflect changes in, or cash requirements for, our working capital needs; |

| • | other companies, including companies in our industry, may calculate adjusted net income differently, which reduce its usefulness as comparative measures. |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Net income (loss) | $ | (512 | ) | $ | (236 | ) | $ | (289 | ) | $ | 31 | $ | 202 | |||||||

Add: Amortization of debt discount and issuance costs | 15 | 17 | 36 | 9 | 8 | |||||||||||||||

Add: Amortization | 260 | 253 | 251 | 126 | 98 | |||||||||||||||

Add: Equity-based compensation | 6 | 5 | 113 | 16 | 33 | |||||||||||||||

Add: Cash in lieu of equity awards (1) | 5 | 3 | 1 | 1 | — | |||||||||||||||

Add: Acquisition and integration costs (2) | 7 | 8 | 8 | 3 | 2 | |||||||||||||||

Add: Restructuring charges (3) | 19 | 6 | 2 | 1 | 8 | |||||||||||||||

Add: Management fees (4) | 7 | 11 | 28 | 4 | — | |||||||||||||||

Add: Transformation (5) | 17 | 23 | 20 | 9 | 1 | |||||||||||||||

Add: Executive severance (6) | — | — | 3 | 3 | — | |||||||||||||||

Add: TRA adjustment (7) | — | — | 2 | — | 8 | |||||||||||||||

Add: Other | — | — | 2 | — | — | |||||||||||||||

Add: Provision for income taxes (benefit) | 29 | 38 | 5 | (5 | ) | 7 | ||||||||||||||

Add: Foreign exchange loss (gain), net (8) | (30 | ) | (21 | ) | 104 | 6 | (15 | ) | ||||||||||||

Less: (Income) loss from discontinued operations, net of taxes | 104 | 41 | 71 | (41 | ) | (51 | ) | |||||||||||||

Adjusted income (loss) before taxes | (73 | ) | 148 | 357 | 163 | 301 | ||||||||||||||

Adjusted provision for income taxes (9) | (16 | ) | 32 | 79 | 36 | 66 | ||||||||||||||

Adjusted net income (loss) | $ | (57 | ) | $ | 116 | $ | 278 | $ | 127 | $ | 235 | |||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 1,558 | $ | 737 | $ | 909 | ||||||||||

Net income (loss) margin | (44.1 | )% | (18.1 | )% | (18.5 | )% | 4.2 | % | 22.2 | % | ||||||||||

Adjusted net income (loss) margin | (4.9 | )% | 8.9 | % | 17.8 | % | 17.2 | % | 25.9 | % | ||||||||||

| (1) | As a result of the Sponsor Acquisition, cash awards were provided to certain employees who held Intel equity awards in lieu of equity in FTW. |

| (2) | Represents both direct and incremental costs in connection with business acquisitions, including acquisition consideration structured as cash retention, third party professional fees, and other integration costs. |

| (3) | Represents both direct and incremental costs associated with our separation from Intel as well as subsequent costs incurred to realign toward our core business and realign staffing. It includes implementing our stand alone back office and costs to execute strategic restructuring events, including third-party professional fees and services, transition services provided by Intel, severance, and facility restructuring costs. |

| (4) | Represents management fees paid to certain affiliates of our Sponsors and Intel pursuant to the Management Services Agreement. The Management Services Agreement has been terminated subsequent to the IPO and we paid a one-time fee of $22 million to such parties in October 2020. |

| (5) | Represents costs incurred in connection with transformation of the business post-Intel separation. Also includes the cost of workforce restructurings involving both eliminations of positions and relocations to lower cost locations in connection with our transformational initiatives, strategic initiatives to improve customer retention, activation to pay and cost synergies, inclusive of duplicative run rate costs related to facilities and data center rationalization, and other one-time costs. |

| (6) | Represents severance for executive terminations not associated with a strategic restructuring event. |

| (7) | Represents the impact on net income of adjustments to liabilities under our tax receivable agreement. |

| (8) | Represents foreign exchange gain (loss), net as shown on in our audited consolidated statement of operations and condensed consolidated statements of operations. This amount is attributable to gains or losses on non-U.S. Dollar denominated balances and is primarily due to unrealized gains or losses associated with our 1st Lien Euro Term Loan. |

| (9) | Prior to our IPO, our structure was that of a pass-through entity for U.S. federal income tax purposes with certain U.S. and foreign subsidiaries subject to income tax in their respective jurisdictions. Subsequent to the IPO, McAfee Corp. is taxed as a corporation and pays corporate federal, state, and local taxes on income allocated to it from FTW. This amount has been recast for periods reported previously. The adjusted provision for income taxes and adjusted provision for income taxes now represent the tax effect on net income, adjusted for all of the listed adjustments, assuming that all consolidated net income was subject to corporate taxation for all periods presented. We have assumed an annual effective tax rate of 22%, which represents our long term expected corporate tax rate excluding discrete and non-recurring tax items. |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Net cash provided by operating activities | $ | 319 | $ | 496 | $ | 760 | $ | 288 | $ | 448 | ||||||||||

Less: Capital expenditures (1) | (62 | ) | (61 | ) | (46 | ) | (28 | ) | (18 | ) | ||||||||||

Free cash flow (2) | $ | 257 | $ | 435 | $ | 714 | $ | 260 | $ | 430 | ||||||||||

| (1) | Capital expenditures includes payments for property and equipment and capitalized labor costs incurred in connection with certain software development activities. |

| (2) | Free cash flow includes $290 million, $281 million, and $268 million in cash interest payments for fiscal 2018, fiscal 2019, fiscal 2020, respectively, and $141 million and $101 million in cash interest payments for the six months ended June 27, 2020 and June 26, 2021, respectively. |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Impact of purchase accounting on net revenue | $ | (32 | ) | $ | (1 | ) | $ | — | $ | — | $ | — | ||||||||

Purchase accounting adjustments to cost of sales | (14 | ) | (1 | ) | 1 | 1 | — | |||||||||||||

Amortization of acquired and developed technologies | 107 | 107 | 108 | 54 | 49 | |||||||||||||||

Impact of purchase accounting on cost of sales | 93 | 106 | 109 | 55 | 49 | |||||||||||||||

Purchase accounting adjustments to operating expenses | (1 | ) | (1 | ) | — | — | — | |||||||||||||

Amortization of customer relationships | 153 | 146 | 143 | 72 | 49 | |||||||||||||||

Impact of purchase accounting on operating expenses | 152 | 145 | 143 | 72 | 49 | |||||||||||||||

Impact of purchase accounting on operating loss related to continuing operations | (277 | ) | (252 | ) | (252 | ) | (127 | ) | (98 | ) | ||||||||||

Impact of purchase accounting on operating loss related to discontinued operations | (322 | ) | (252 | ) | (187 | ) | (99 | ) | (36 | ) | ||||||||||

Total impact of purchase accounting | $ | (599 | ) | $ | (504 | ) | $ | (439 | ) | $ | (226 | ) | $ | (134 | ) | |||||

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Cost of sales | $ | 1 | $ | — | $ | 5 | $ | — | $ | 2 | ||||||||||

Sales and marketing | 1 | 1 | 23 | 1 | 7 | |||||||||||||||

Research and development | 1 | 1 | 40 | — | 10 | |||||||||||||||

General and administrative | 3 | 3 | 45 | 15 | 14 | |||||||||||||||

Total equity-based compensation expense from continuing operations | 6 | 5 | 113 | 16 | 33 | |||||||||||||||

Discontinued operations | 22 | 20 | 200 | 3 | 45 | |||||||||||||||

Total equity-based compensation expense | $ | 28 | $ | 25 | $ | 313 | $ | 19 | $ | 78 | ||||||||||

| • | Recognition of certain deferred tax assets and corresponding discrete income tax benefit up to $125 million. |

| • | Recognition of a long-term TRA liability and corresponding TRA expense of $170 million to $260 million, including the TRA liability recorded directly as a result of tax attributes utilized from the Enterprise Business divestiture. This TRA liability relates to net deferred tax assets that did not meet the probable recognition criteria as of December 26, 2020 and thus was not recorded in our consolidated balance sheet as of that date. |

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

(in millions) | December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | |||||||||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 1,558 | $ | 737 | $ | 909 | ||||||||||

Cost of sales | 386 | 391 | 444 | 209 | 232 | |||||||||||||||

Gross profit | 775 | 912 | 1,114 | 528 | 677 | |||||||||||||||

Operating expenses: | ||||||||||||||||||||

Sales and marketing | 348 | 299 | 348 | 140 | 174 | |||||||||||||||

Research and development | 186 | 161 | 188 | 75 | 92 | |||||||||||||||

General and administrative | 170 | 182 | 235 | 100 | 93 | |||||||||||||||

Amortization of intangibles | 153 | 146 | 143 | 72 | 49 | |||||||||||||||

Restructuring charges | 19 | 6 | 2 | 1 | 8 | |||||||||||||||

Total operating expenses | 876 | 794 | 916 | 388 | 416 | |||||||||||||||

Operating income (loss) | (101 | ) | 118 | 198 | 140 | 261 | ||||||||||||||

Interest (expense) and other, net | (308 | ) | (296 | ) | (307 | ) | (149 | ) | (118 | ) | ||||||||||

Foreign exchange gain (loss), net | 30 | 21 | (104 | ) | (6 | ) | 15 | |||||||||||||

Income (loss) from continuing operations before income taxes | (379 | ) | (157 | ) | (213 | ) | (15 | ) | 158 | |||||||||||

Provision for income tax expense (benefit) | 29 | 38 | 5 | (5 | ) | 7 | ||||||||||||||

Income (loss) from continuing operations | (408 | ) | (195 | ) | (218 | ) | (10 | ) | 151 | |||||||||||

Income (loss) from discontinued operations, net of taxes | (104 | ) | (41 | ) | (71 | ) | 41 | 51 | ||||||||||||

Net income (loss) | $ | (512 | ) | $ | (236 | ) | $ | (289 | ) | $ | 31 | $ | 202 | |||||||

Less: Net income (loss) attributable to redeemable noncontrolling interests | N/A | N/A | (171 | ) | N/A | 136 | ||||||||||||||

Net income (loss) attributable to McAfee Corp. | N/A | N/A | $ | (118 | ) | N/A | $ | 66 | ||||||||||||

Fiscal Year Ended | Six Months Ended | |||||||||||||||||||

December 29, 2018 | December 28, 2019 | December 26, 2020 | June 27, 2020 | June 26, 2021 | ||||||||||||||||

Net revenue | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | ||||||||||

Cost of sales | 33.2 | % | 30.0 | % | 28.5 | % | 28.4 | % | 25.5 | % | ||||||||||

Gross profit | 66.8 | % | 70.0 | % | 71.5 | % | 71.6 | % | 74.5 | % | ||||||||||

Operating expenses: | ||||||||||||||||||||

Sales and marketing | 30.0 | % | 22.9 | % | 22.3 | % | 19.0 | % | 19.1 | % | ||||||||||

Research and development | 16.0 | % | 12.4 | % | 12.1 | % | 10.2 | % | 10.1 | % | ||||||||||

General and administrative | 14.6 | % | 14.0 | % | 15.1 | % | 13.6 | % | 10.2 | % | ||||||||||

Amortization of intangibles | 13.2 | % | 11.2 | % | 9.2 | % | 9.8 | % | 5.4 | % | ||||||||||

Restructuring charges | 1.6 | % | 0.5 | % | 0.1 | % | 0.1 | % | 0.9 | % | ||||||||||

Total operating expenses | 75.5 | % | 60.9 | % | 58.8 | % | 52.6 | % | 45.8 | % | ||||||||||

Operating income (loss) | (8.7 | )% | 9.1 | % | 12.7 | % | 19.0 | % | 28.7 | % | ||||||||||

Interest (expense) and other, net | (26.5 | )% | (22.7 | )% | (19.7 | )% | (20.2 | )% | (13.0 | )% | ||||||||||

Foreign exchange gain (loss), net | 2.6 | % | 1.6 | % | (6.7 | )% | (0.8 | )% | 1.7 | % | ||||||||||

Income (loss) from continuing operations before income taxes | (32.6 | )% | (12.0 | )% | (13.7 | )% | (2.0 | )% | 17.4 | % | ||||||||||

Provision for income tax expense (benefit) | 2.5 | % | 2.9 | % | 0.3 | % | (0.7 | )% | 0.8 | % | ||||||||||

Income (loss) from continuing operations | (35.1 | )% | (15.0 | )% | (14.0 | )% | (1.4 | )% | 16.6 | % | ||||||||||

Income (loss) from discontinued operations, net of taxes | (9.0 | )% | (3.1 | )% | (4.6 | )% | 5.6 | % | 5.6 | % | ||||||||||

Net income (loss) | (44.1 | )% | (18.1 | )% | (18.5 | )% | 4.2 | % | 22.2 | % | ||||||||||

Less: Net income (loss) attributable to redeemable noncontrolling interests | N/A | N/A | (11.0 | )% | N/A | 15.0 | % | |||||||||||||

Net income (loss) attributable to McAfee Corp. | N/A | N/A | (7.6 | )% | N/A | 7.3 | % | |||||||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Net revenue | $ | 1,161 | $ | 1,303 | $ | 142 | 12.2 | % | ||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Cost of sales | $ | 386 | $ | 391 | $ | 5 | 1.3 | % | ||||||||

Gross profit margin | 66.8 | % | 70.0 | % | ||||||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Sales and marketing | $ | 348 | $ | 299 | $ | (49 | ) | (14.1 | )% | |||||||

Research and development | 186 | 161 | (25 | ) | (13.4 | )% | ||||||||||

General and administrative | 170 | 182 | 12 | 7.1 | % | |||||||||||

Amortization of intangibles | 153 | 146 | (7 | ) | (4.6 | )% | ||||||||||

Restructuring charges | 19 | 6 | (13 | ) | (68.4 | )% | ||||||||||

Total | $ | 876 | $ | 794 | $ | (82 | ) | (9.4 | )% | |||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Operating income (loss) | $ | (101 | ) | $ | 118 | $ | 219 | (216.8 | )% | |||||||

Operating income (loss) margin | (8.7 | )% | 9.1 | % | ||||||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Interest (expense) and other, net | $ | (308 | ) | $ | (296 | ) | $ | 12 | (3.9 | )% | ||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Provision for income tax expense | $ | 29 | $ | 38 | $ | 9 | 31.0 | % | ||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 29, 2018 | December 28, 2019 | Dollars | Percent | ||||||||||||

Net revenue | $ | 1,248 | $ | 1,332 | $ | 84 | 6.7 | % | ||||||||

Operating income (loss) | (72 | ) | 8 | 80 | (111.1 | )% | ||||||||||

Income (loss) from discontinued operations before income taxes | (71 | ) | 8 | 79 | (111.3 | )% | ||||||||||

Income tax expense | 33 | 49 | 16 | 48.5 | % | |||||||||||

Loss from discontinued operations, net of tax | (104 | ) | (41 | ) | 63 | (60.6 | )% | |||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Net revenue | $ | 1,303 | $ | 1,558 | $ | 255 | 19.6 | % | ||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Cost of sales | $ | 391 | $ | 444 | $ | 53 | 13.6 | % | ||||||||

Gross profit margin | 70.0 | % | 71.5 | % | ||||||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Sales and marketing | $ | 299 | $ | 348 | $ | 49 | 16.4 | % | ||||||||

Research and development | 161 | 188 | 27 | 16.8 | % | |||||||||||

General and administrative | 182 | 235 | 53 | 29.1 | % | |||||||||||

Amortization of intangibles | 146 | 143 | (3 | ) | (2.1 | )% | ||||||||||

Restructuring charges | 6 | 2 | (4 | ) | (66.7 | )% | ||||||||||

Total | $ | 794 | $ | 916 | $ | 122 | 15.4 | % | ||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Operating income | $ | 118 | $ | 198 | $ | 80 | 67.8 | % | ||||||||

Operating income margin | 9.1 | % | 12.7 | % | ||||||||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Interest (expense) and other, net | $ | (296 | ) | $ | (307 | ) | $ | (11 | ) | 3.7 | % | |||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Provision for income tax expense | $ | 38 | $ | 5 | $ | (33 | ) | (86.8 | )% | |||||||

Fiscal Year Ended | Variance in | |||||||||||||||

(in millions except percentages) | December 28, 2019 | December 26, 2020 | Dollars | Percent | ||||||||||||

Net revenue | $ | 1,332 | $ | 1,348 | $ | 16 | 1.2 | % | ||||||||

Operating income (loss) | 8 | (46 | ) | (54 | ) | (675.0 | )% | |||||||||

Income (loss) from discontinued operations before income taxes | 8 | (46 | ) | (54 | ) | (675.0 | )% | |||||||||

Income tax expense | 49 | 25 | (24 | ) | (49.0 | )% | ||||||||||

Loss from discontinued operations, net of tax | (41 | ) | (71 | ) | (30 | ) | 73.2 | % | ||||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Net revenue | $ | 737 | $ | 909 | $ | 172 | 23.3 | % | ||||||||

Six Months Ended | ||||||||||||||||

(in millions except percentages) | June 27, 2020 | % of Total | June 26, 2021 | % of Total | ||||||||||||

Americas | $ | 482 | 65.4 | % | $ | 601 | 66.1 | % | ||||||||

EMEA | 175 | 23.7 | % | 213 | 23.4 | % | ||||||||||

APJ | 80 | 10.9 | % | 95 | 10.5 | % | ||||||||||

Total net revenue | $ | 737 | 100.0 | % | $ | 909 | 100.0 | % | ||||||||

Six Months Ended | ||||||||||||||||

(in millions except percentages) | June 27, 2020 | % of Total | June 26, 2021 | % of Total | ||||||||||||

Direct to Consumer | $ | 575 | 78.0 | % | $ | 673 | 74.0 | % | ||||||||

Indirect | 162 | 22.0 | % | 236 | 26.0 | % | ||||||||||

Total net revenue | $ | 737 | 100.0 | % | $ | 909 | 100.0 | % | ||||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Cost of sales | $ | 209 | $ | 232 | $ | 23 | 11.0 | % | ||||||||

Gross profit margin | 71.6 | % | 74.5 | % | ||||||||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Sales and marketing | $ | 140 | $ | 174 | $ | 34 | 24.3 | % | ||||||||

Research and development | 75 | 92 | 17 | 22.7 | % | |||||||||||

General and administrative | 100 | 93 | (7 | ) | (7.0 | )% | ||||||||||

Amortization of intangibles | 72 | 49 | (23 | ) | (31.9 | )% | ||||||||||

Restructuring charges | 1 | 8 | 7 | 700.0 | % | |||||||||||

Total | $ | 388 | $ | 416 | $ | 28 | 7.2 | % | ||||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Operating income | $ | 140 | $ | 261 | $ | 121 | 86.4 | % | ||||||||

Operating income margin | 19.0 | % | 28.7 | % | ||||||||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Interest (expense) and other, net | $ | (149 | ) | $ | (118 | ) | $ | 31 | (20.8 | )% | ||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Provision for income tax (benefit) | $ | (5 | ) | $ | 7 | $ | 12 | (240.0 | )% | |||||||

Six Months Ended | Variance in | |||||||||||||||

(in millions except percentages) | June 27, 2020 | June 26, 2021 | Dollars | Percent | ||||||||||||

Net revenue | $ | 664 | $ | 677 | $ | 13 | 2.0 | % | ||||||||

Operating income | 58 | 73 | 15 | 25.9 | % | |||||||||||

Income from discontinued operations before income taxes | 58 | 69 | 11 | 19.0 | % | |||||||||||

Income tax expense | 17 | 18 | 1 | 5.9 | % | |||||||||||

Income from discontinued operations, net of tax | 41 | 51 | 10 | 24.4 | % | |||||||||||

Three Months Ended | ||||||||||||||||||||||||||||||||

(in millions except per share data) | September 28, 2019 | December 28, 2019 | March 28, 2020 | June 27, 2020 | September 26, 2020 | December 26, 2020 | March 27, 2021 | June 26, 2021 | ||||||||||||||||||||||||

Net revenue | $ | 322 | $ | 347 | $ | 354 | $ | 383 | $ | 395 | $ | 426 | $ | 442 | $ | 467 | ||||||||||||||||