- MCFE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

McAfee (MCFE) DEFA14AAdditional proxy soliciting materials

Filed: 23 Nov 21, 5:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☒ | Soliciting Material Pursuant to §240.14a-12 | |

McAfee Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

McAfee Equity Treatment Overview McAfee Confidential

Summary of Equity Treatment ▪︎ Equity not yet granted will be submitted for approval by the Compensation Committee on regular approval cadence ▪︎ All unvested equity will be converted to cash- based awards at $26 / share payable on same vesting schedule after Close ▪︎ Employees must continue to be actively employed through each vesting date to be eligible to receive cash-based awards McAfee Confidential

What does this look like? Let’s take a look at Jane… McAfee Confidential

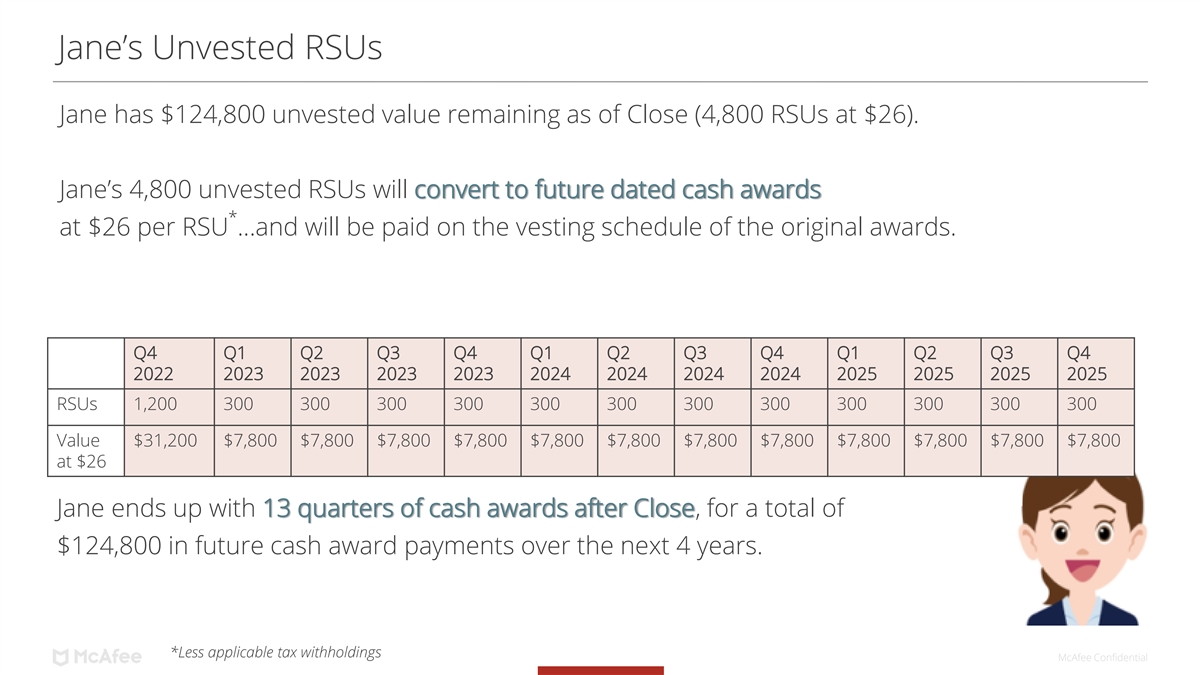

Jane’s Unvested RSUs Jane has $124,800 unvested value remaining as of Close (4,800 RSUs at $26). Jane’s 4,800 unvested RSUs will convert to future dated cash awards * at $26 per RSU …and will be paid on the vesting schedule of the original awards. Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2022 2023 2023 2023 2023 2024 2024 2024 2024 2025 2025 2025 2025 RSUs 1,200 300 300 300 300 300 300 300 300 300 300 300 300 Value $31,200 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 $7,800 at $26 Jane ends up with 13 quarters of cash awards after Close, for a total of $124,800 in future cash award payments over the next 4 years. *Less applicable tax withholdings McAfee Confidential

Next Steps Things that Don’t Change ▪︎ Q3 QIP bonus attained at 137% paying in November ▪︎ Q4 QIP bonus paying in March ▪︎ 2021 AIP bonus paying in March ▪︎ Focal increases effective April 1 Cash Award Statement ▪︎ Prior to Close, each participant will receive a Cash Award statement outlining schedule of converted cash vesting awards to be received upon original vesting schedule after Close Workday Update anticipated upon Close ▪︎ Following Close, all future dated cash vesting awards will be loaded into Workday as future One Time Payment awards McAfee Confidential

Cautionary Statement Regarding Forward-Looking Statements This communication contains “forward-looking statements.” Such forward-looking statements include statements relating to McAfee’s strategy, goals, future focus areas, and the value of, timing and prospects of the proposed merger transaction (the “Merger”). These forward-looking statements are based on McAfee management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include all statements that are not historical facts and may be identified by terms such as “expects,” “believes,” “plans,” or similar expressions and the negatives of those terms. These forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements, expressed or implied by the forward-looking statements, including: (a) risks related to the satisfaction of the conditions to the closing of the Merger (including the failure to obtain necessary regulatory approvals and the requisite approval of the stockholders) in the anticipated timeframe or at all; (b) the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement; (c) risks related to disruption of management’s attention from McAfee’s ongoing business operations due to the Merger; (d) disruption from the Merger making it difficult to maintain business and operational relationships, including retaining and hiring key personnel and maintaining relationships with McAfee’s customers, vendors and others with whom it does business; (e) significant transaction costs; (f) the risk of litigation and/or regulatory actions related to the Merger; (g) the possibility that general economic conditions and conditions and uncertainty caused by the COVID-19 pandemic, could cause information technology spending to be reduced or purchasing decisions to be delayed; (h) an increase in insurance claims; (i) an increase in customer cancellations; (j) the inability to increase sales to existing customers and to attract new customers; (k) McAfee’s failure to integrate recent or future acquired businesses successfully or to achieve expected synergies; (l) the timing and success of new product introductions by McAfee or its competitors; (m) changes in McAfee’s pricing policies or those of its competitors; (n) developments with respect to legal or regulatory proceedings; (o) the inability to achieve revenue growth or to enable margin expansion; (p) changes in McAfee’s estimates with respect to its long-term corporate tax rate; and (q) such other risks and uncertainties described more fully in documents filed with or furnished to the SEC by McAfee, including under the heading “Risk Factors” in McAfee’s Annual Report on Form 10-K previously filed with the SEC on March 1, 2021 and under Item 1A “Risk Factors” in its Quarterly Report on Form 10-Q previously filed with the SEC on November 9, 2021. All information provided in this communication is as of the date hereof and McAfee undertakes no duty to update this information except as required by law. Additional Information and Where to Find It In connection with the Merger, McAfee will file with the SEC a preliminary Proxy Statement (the “Proxy Statement”). McAfee plans to mail to its stockholders a definitive Proxy Statement in connection with the Merger. McAfee URGES YOU TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MCAFEE, THE SPONSORS, THE MERGER AND RELATED MATTERS. You will be able to obtain a free copy of the Proxy Statement and other related documents (when available) filed by McAfee with the SEC at the website maintained by the SEC at www.sec.gov. You also will be able to obtain a free copy of the Proxy Statement and other documents (when available) filed by McAfee with the SEC by accessing the Investor Relations section of McAfee’s website at https://ir.mcafee.com/. Participants in the Solicitation McAfee and certain of its directors, executive officers and employees may be considered to be participants in the solicitation of proxies from McAfee’s stockholders in connection with the Merger. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the stockholders of McAfee in connection with the Merger, including a description of their respective direct or indirect interests, by security holdings or otherwise will be included in the Proxy Statement when it is filed with the SEC. You may also find additional information about McAfee’s directors and executive officers in McAfee’s proxy statement for its 2021 Annual Meeting of Stockholders, which was filed with the SEC on April 22, 2021 and in subsequently filed Current Reports on Form 8-K and Quarterly Reports on Form 10-Q. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and McAfee’s website at https://ir.mcafee.com/.