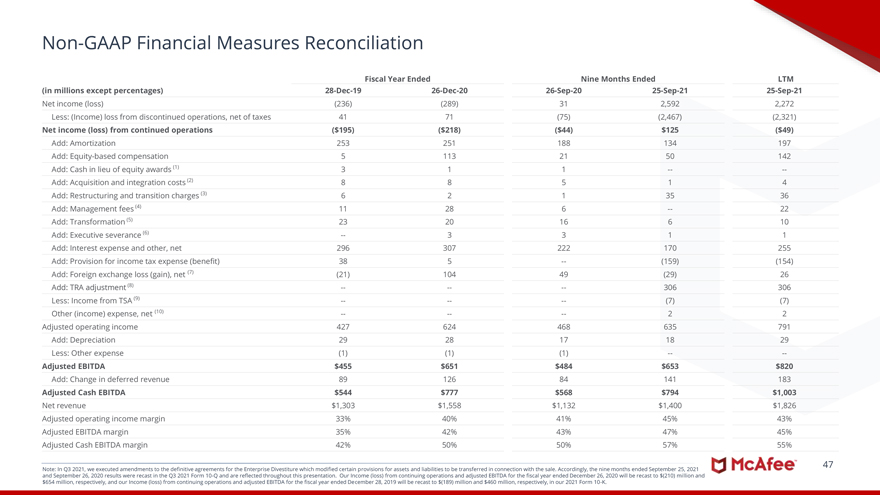

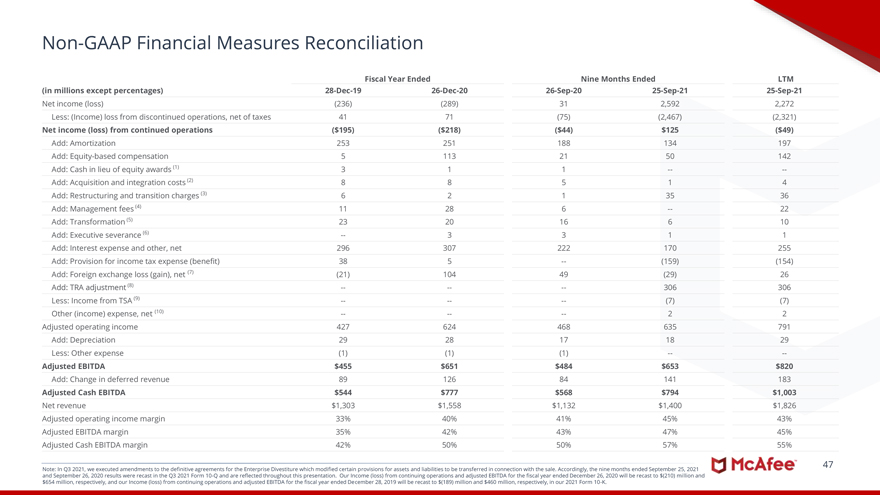

Non-GAAP Financial Measures Reconciliation Fiscal Year Ended Nine Months Ended LTM (in millions except percentages) 28-Dec-19 26-Dec-20 26-Sep-20 25-Sep-21 25-Sep-21 Net income (loss) (236) (289) 31 2,592 2,272 Less: (Income) loss from discontinued operations, net of taxes 41 71 (75) (2,467) (2,321) Net income (loss) from continued operations ($195) ($218) ($44) $125 ($49) Add: Amortization 253 251 188 134 197 Add: Equity-based compensation 5 113 21 50 142 Add: Cash in lieu of equity awards (1) 3 1 1 -—-Add: Acquisition and integration costs (2) 8 8 5 1 4 Add: Restructuring and transition charges (3) 6 2 1 35 36 Add: Management fees (4) 11 28 6 — 22 Add: Transformation (5) 23 20 16 6 10 Add: Executive severance (6) — 3 3 1 1 Add: Interest expense and other, net 296 307 222 170 255 Add: Provision for income tax expense (benefit) 38 5 — (159) (154) Add: Foreign exchange loss (gain), net (7) (21) 104 49 (29) 26 Add: TRA adjustment (8) -——- 306 306 Less: Income from TSA (9) -——- (7) (7) Other (income) expense, net (10) -——- 2 2 Adjusted operating income 427 624 468 635 791 Add: Depreciation 29 28 17 18 29 Less: Other expense (1) (1) (1) -—- Adjusted EBITDA $455 $651 $484 $653 $820 Add: Change in deferred revenue 89 126 84 141 183 Adjusted Cash EBITDA $544 $777 $568 $794 $1,003 Net revenue $1,303 $1,558 $1,132 $1,400 $1,826 Adjusted operating income margin 33% 40% 41% 45% 43% Adjusted EBITDA margin 35% 42% 43% 47% 45% Adjusted Cash EBITDA margin 42% 50% 50% 57% 55% Note: In Q3 2021, we executed amendments to the definitive agreements for the Enterprise Divestiture which modified certain provisions for assets and liabilities to be transferred in connection with the sale. Accordingly, the nine months ended September 25, 2021 and September 26, 2020 results were recast in the Q3 2021 Form 10-Q and are reflected throughout this presentation. Our Income (loss) from continuing operations and adjusted EBITDA for the fiscal year ended December 26, 2020 will be recast to $(210) million and $654 million, respectively, and our Income (loss) from continuing operations and adjusted EBITDA for the fiscal year ended December 28, 2019 will be recast to $(189) million and $460 million, respectively, in our 2021 Form 10-K. 47