Third Quarter 2020 Financial Results November 19, 2020 Exhibit – 99.2

Disclaimers In addition to historical consolidated financial information, certain statements in this presentation may contain “forward-looking statements” within the meaning U.S. federal securities laws that involve substantial risks and uncertainties. All statements other than statements of historical fact included in this press release and on the related teleconference call are forward-looking statements. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. For example, all statements McAfee makes relating to its estimated and projected costs, expenditures, cash flows, growth rates and financial results or its plans and objectives for future operations, growth initiatives, or strategies are forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that the Company expected. Specific factors that could cause such a difference include, but are not limited to, those disclosed previously in the Company’s other filings with the SEC which include, but are not limited to: the impact of the COVID-19 outbreak; our ability to adapt to rapid technological change, evolving industry standards and changing customer needs, requirements or preferences; our ability to enhance and deploy our cloud-based offerings while continuing to effectively offer our on-premise offerings; our ability to maintain or improve our competitive position; the impact on our business of a network or data security incident or unauthorized access to our network or data or our customers’ data; the effects on our business if we are unable to acquire new customers, if our customers do not renew their arrangements with us, or if we are unable to expand sales to our existing customers or develop new solutions or solution packages that achieve market acceptance; our ability to manage our growth effectively, execute our business plan, maintain high levels of service and customer satisfaction or adequately address competitive challenges; our dependence on our senior management team and other key employees; our ability to enhance and expand our sales and marketing capabilities; our ability to attract and retain highly qualified personnel to execute our growth plan; the risks associated with interruptions or performance problems of our technology, infrastructure and service providers; our dependence on Amazon Web Services cloud infrastructure services; the impact of data privacy concerns, evolving regulations of cloud computing, cross-border data transfer restrictions and other domestic and foreign laws and regulations; the impact of volatility in quarterly operating results; the risks associated with our revenue recognition policy and other factors may distort our financial results in any given period; the effects on our customer base and business if we are unable to enhance our brand cost-effectively; our ability to comply with anti-corruption, anti-bribery and similar laws; our ability to comply with governmental export and import controls and economic sanctions laws; the potential adverse impact of legal proceedings; the impact of our frequently long and unpredictable sales cycle; our ability to identify suitable acquisition targets or otherwise successfully implement our growth strategy; the impact of a change in our pricing model; our ability to meet service level commitments under our customer contracts; the impact on our business and reputation if we are unable to provide high-quality customer support; our dependence on strategic relationships with third parties; the impact of adverse general and industry-specific economic and market conditions and reductions in IT and identity spending; the ability of our platform, solutions and solution packages to interoperate with our customers’ existing or future IT infrastructures; our dependence on adequate research and development resources and our ability to successfully complete acquisitions; our dependence on the integrity and scalability of our systems and infrastructures; our reliance on software and services from other parties; the impact of real or perceived errors, failures, vulnerabilities or bugs in our solutions; our ability to protect our proprietary rights; the impact on our business if we are subject to infringement claim or a claim that results in a significant damage award; the risks associated with our use of open source software in our solutions, solution packages and subscriptions; our reliance on SaaS vendors to operate certain functions of our business; the risks associated with indemnity provisions in our agreements; the risks associated with liability claims if we breach our contracts; the impact of the failure by our customers to pay us in accordance with the terms of their agreements; our ability to expand the sales of our solutions and solution packages to customers located outside of the United States; the risks associated with exposure to foreign currency fluctuations; the impact of Brexit; the impact of potentially adverse tax consequences associated with our international operations; the impact of changes in tax laws or regulations; the impact of the Tax Act; our ability to maintain our corporate culture; our ability to develop and maintain proper and effective internal control over financial reporting; our management team’s limited experience managing a public company; the risks associated with having operations and employees located in Israel; the risks associated with doing business with governmental entities; and the impact of catastrophic events on our business. Given these factors, as well as other variables that may affect McAfee’s operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, or use historical trends to anticipate results or trends in future periods. The forward-looking statements included in this press release and on the related teleconference call relate only to events as of the date hereof. The Company undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. In addition to McAfee’s results determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company believes the following non-GAAP measures presented in this presentation are useful in evaluating its operating performance: Adjusted EBITDA, and Adjusted EBITDA Margin. The non-GAAP financial information is presented for supplemental informational purposes only, and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly titled non-GAAP measures used by other companies A reconciliation has been provided in an appendix to this presentation for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP. Readers are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. This presentation includes historical results, for the periods presented, of Foundation Technology Worldwide LLC, the predecessor McAfee Corp. for financial reporting purposes. The financial results of McAfee Corp. have not been included in this presentation as it is a recently incorporated entity and had no material assets or liabilities and no material business transactions or activities during the periods presented. Accordingly, these historical results do not purport to reflect what the results of operations of McAfee Corp. or Foundation Technology Worldwide LLC would have been had the IPO and related recapitalization transactions occurred prior to such periods. Information in this presentation, including any statements regarding McAfee’s market position, customer data, and other metrics, is based on statistical data, estimates and forecasts, that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness or the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data not do we undertake to update such data after the date of this presentation. Unless otherwise indicated, all references in this presentation to “McAfee”, “we”, “our”, “us”, or similar terms refer to McAfee Corp. and Foundation Technology Worldwide LLC and its subsidiaries.

McAfee Investment Highlights Trusted global brand and provider of cybersecurity solutions in large and growing markets Consumer market leader with large and sustained revenue and core subscriber base growth Holistic Consumer cybersecurity platform with differentiated omni-channel go-to-market strategy Driving Enterprise EBITDA growth through focusing on core customers and device to cloud portfolio Highly attractive financial profile featuring consistent growth and profitability at scale with strong uFCF

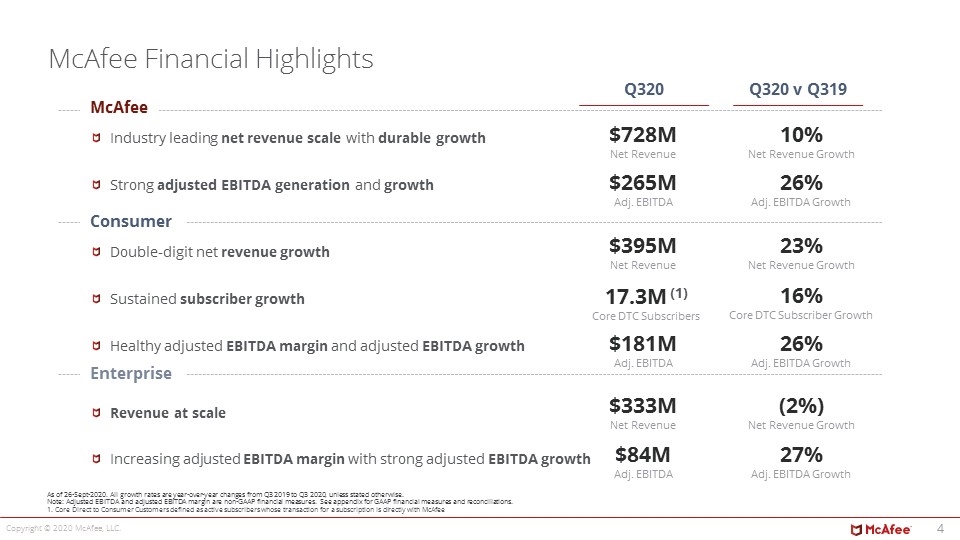

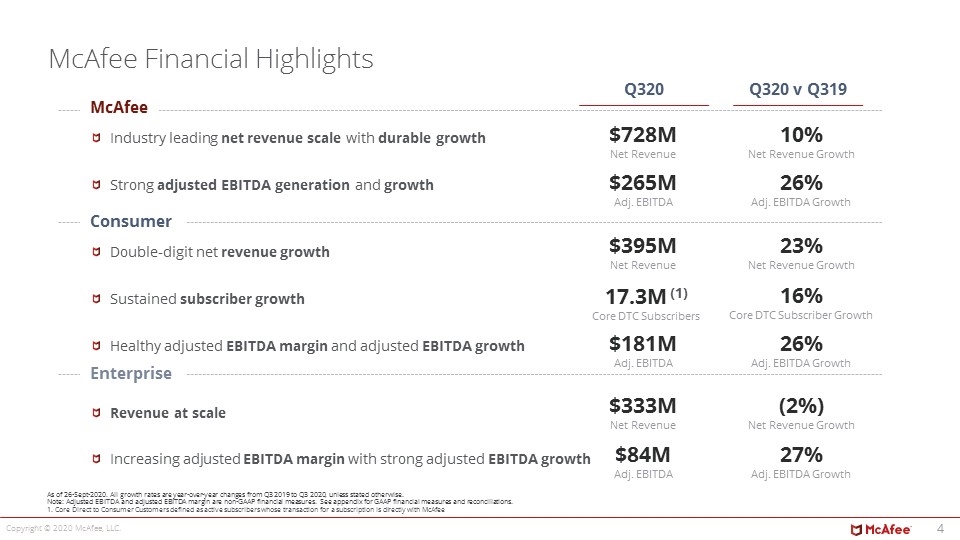

McAfee Financial Highlights Industry leading net revenue scale with durable growth Strong adjusted EBITDA generation and growth Double-digit net revenue growth Sustained subscriber growth Healthy adjusted EBITDA margin and adjusted EBITDA growth Revenue at scale Increasing adjusted EBITDA margin with strong adjusted EBITDA growth McAfee Consumer Enterprise As of 26-Sept-2020. All growth rates are year-over-year changes from Q3 2019 to Q3 2020, unless stated otherwise. Note: Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. See appendix for GAAP financial measures and reconciliations. 1. Core Direct to Consumer Customers defined as active subscribers whose transaction for a subscription is directly with McAfee $728M Net Revenue $265M Adj. EBITDA $181M Adj. EBITDA 23% Net Revenue Growth 27% Adj. EBITDA Growth 10% Net Revenue Growth 26% Adj. EBITDA Growth 26% Adj. EBITDA Growth $395M Net Revenue $84M Adj. EBITDA Q320 Q320 v Q319 17.3M (1) Core DTC Subscribers 16% Core DTC Subscriber Growth (2%) Net Revenue Growth $333M Net Revenue

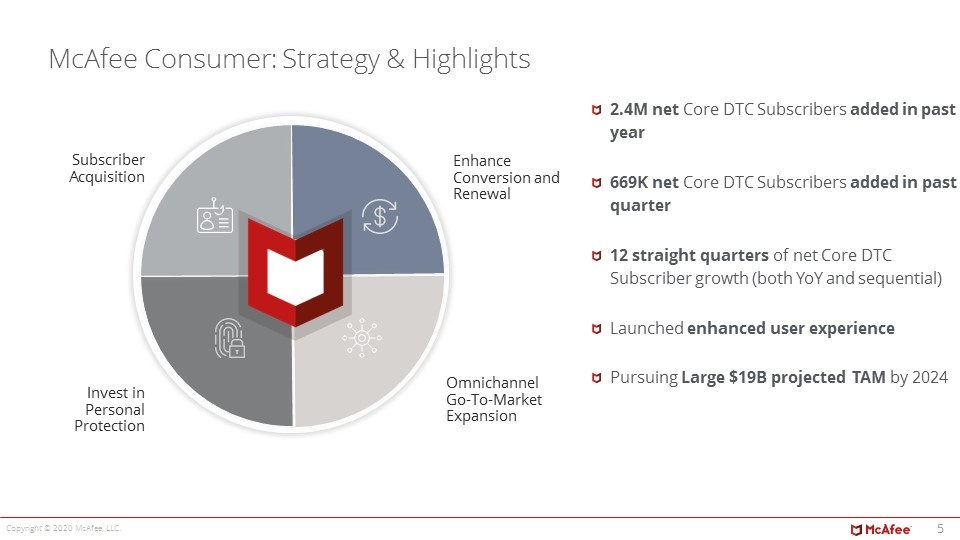

McAfee Consumer: Strategy & Highlights Omnichannel Go-To-Market Expansion Invest in Personal Protection Enhance Conversion and Renewal Subscriber Acquisition 2.4M net Core DTC Subscribers added in past year 669K net Core DTC Subscribers added in past quarter 12 straight quarters of net Core DTC Subscriber growth (both YoY and sequential) Launched enhanced user experience Pursuing Large $19B projected TAM by 2024

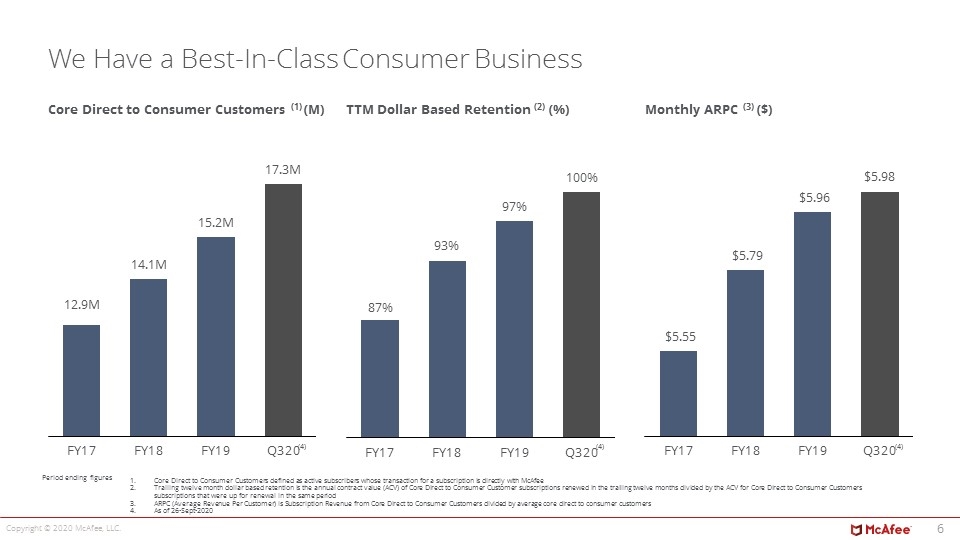

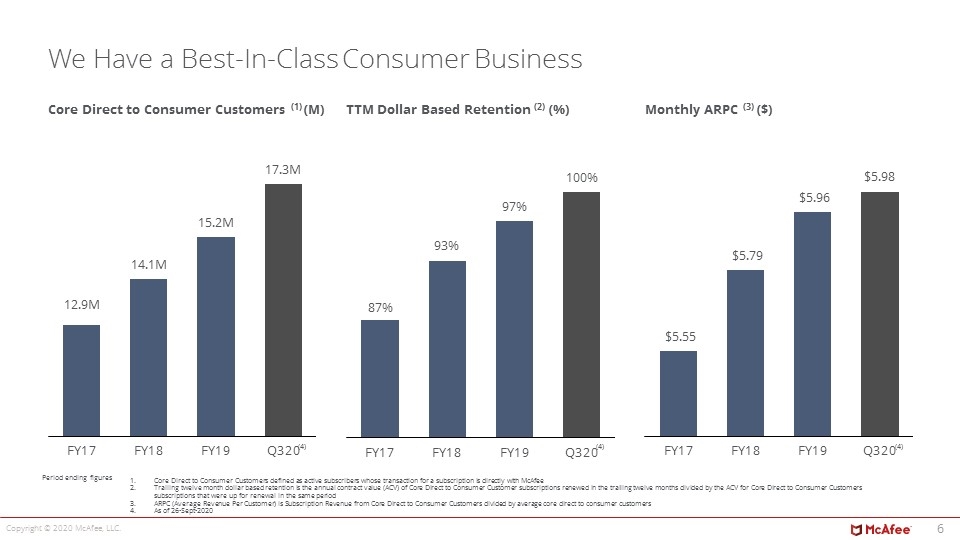

We Have a Best-In-Class Consumer Business Core Direct to Consumer Customers (1) (M) Period ending figures TTM Dollar Based Retention (2) (%) Core Direct to Consumer Customers defined as active subscribers whose transaction for a subscription is directly with McAfee Trailing twelve month dollar based retention is the annual contract value (ACV) of Core Direct to Consumer Customer subscriptions renewed in the trailing twelve months divided by the ACV for Core Direct to Consumer Customers subscriptions that were up for renewal in the same period ARPC (Average Revenue Per Customer) is Subscription Revenue from Core Direct to Consumer Customers divided by average core direct to consumer customers As of 26-Sept-2020 Monthly ARPC (3) ($) (4) (4) (4)

McAfee Enterprise: Strategy & Highlights Focus on Core Enterprise Customers Innovate in Device to Cloud Drive EBITDA Growth Through Product and Market Focus >80% of Enterprise revenue from Core Customers Leader in 2020 Gartner MQ for CASB for fourth consecutive year Pursuing Large $23B projected TAM by 2024

McAfee Financial Principles Committed to organic revenue growth at scale Deliberate resource allocation by investing in highest priority areas yielding high expected returns Strong operational and financial management with strict adherences to margin discipline Strategy for capital allocation to drive shareholder value via dividends and debt paydown over time

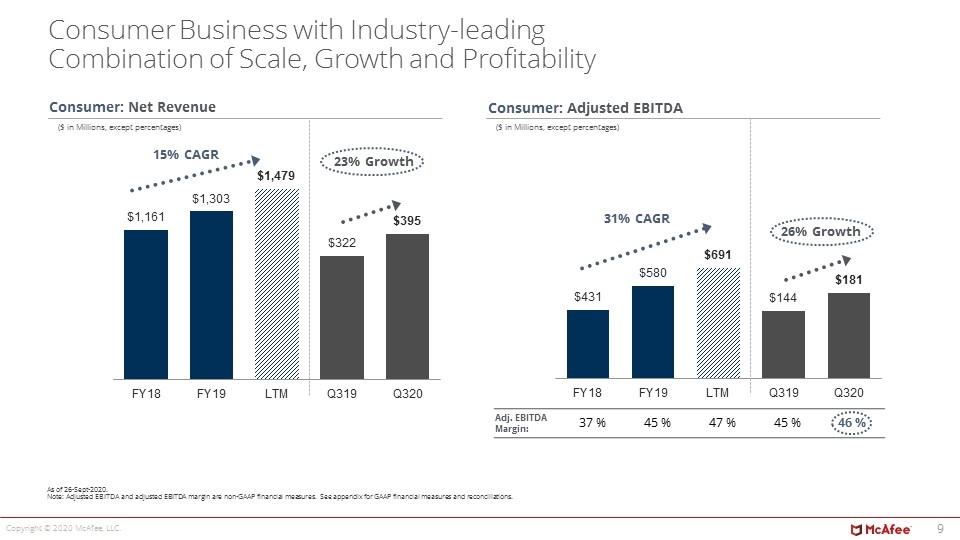

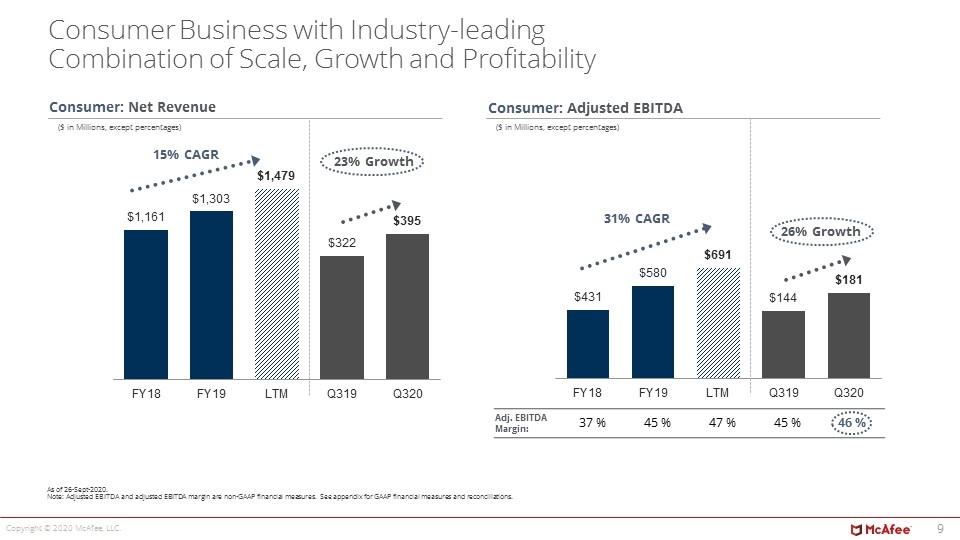

Consumer: Net Revenue Consumer: Adjusted EBITDA Consumer Business with Industry-leading Combination of Scale, Growth and Profitability ($ in Millions, except percentages) ($ in Millions, except percentages) As of 26-Sept-2020. Note: Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. See appendix for GAAP financial measures and reconciliations. Adj. EBITDA Margin: 37 % 45 % 47 % 45 % 46 % 15% CAGR 23% Growth 31% CAGR 26% Growth

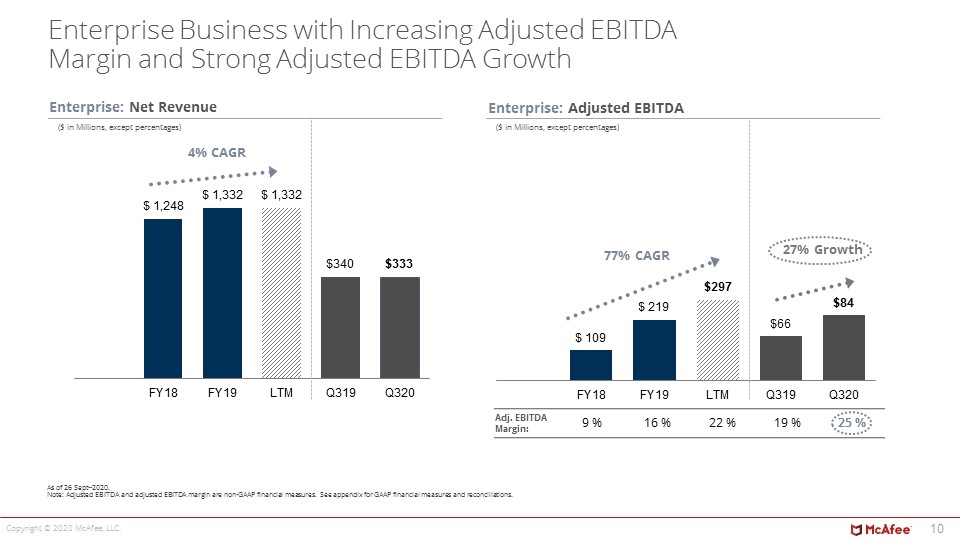

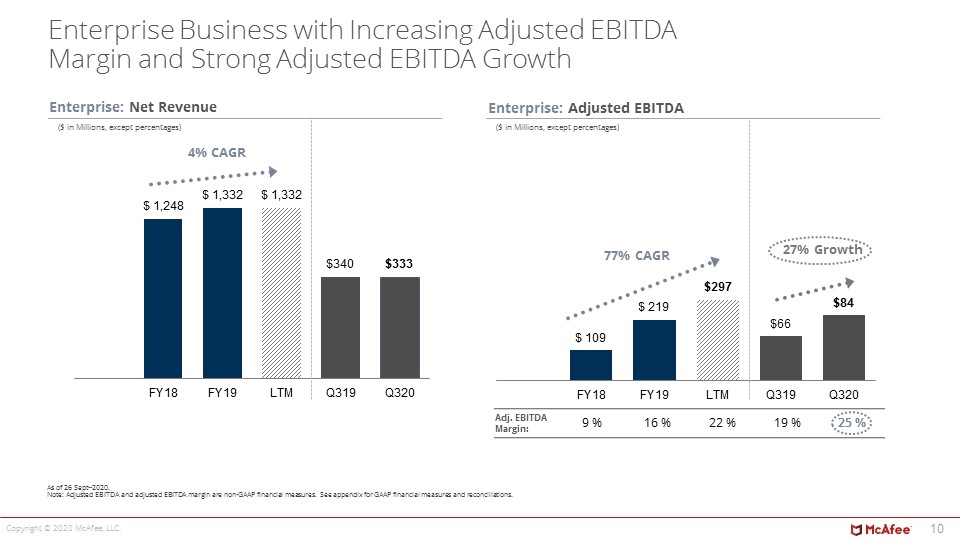

Enterprise: Net Revenue Enterprise: Adjusted EBITDA Enterprise Business with Increasing Adjusted EBITDA Margin and Strong Adjusted EBITDA Growth 27% Growth 4% CAGR ($ in Millions, except percentages) ($ in Millions, except percentages) As of 26 Sept--2020. Note: Adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. See appendix for GAAP financial measures and reconciliations. Adj. EBITDA Margin: 9 % 16 % 22 % 19 % 25 % 77% CAGR

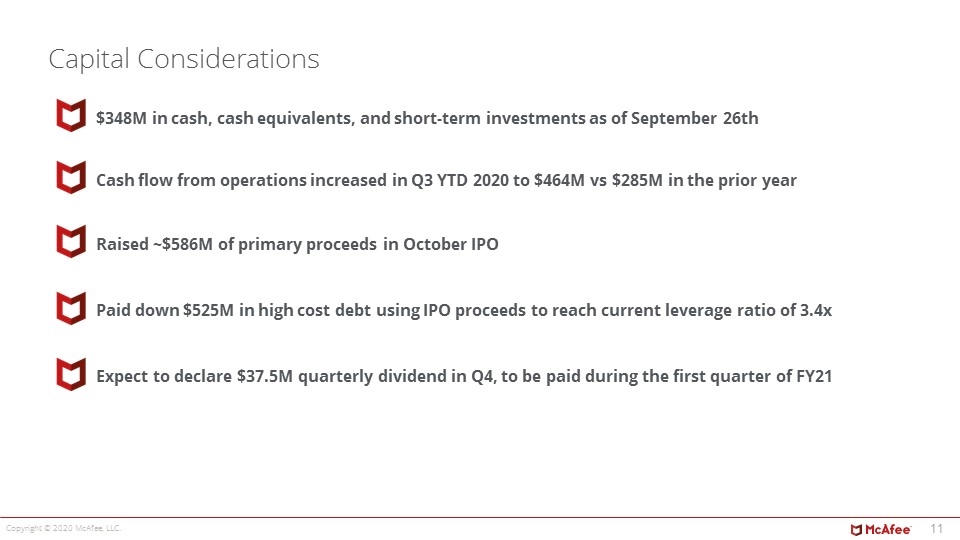

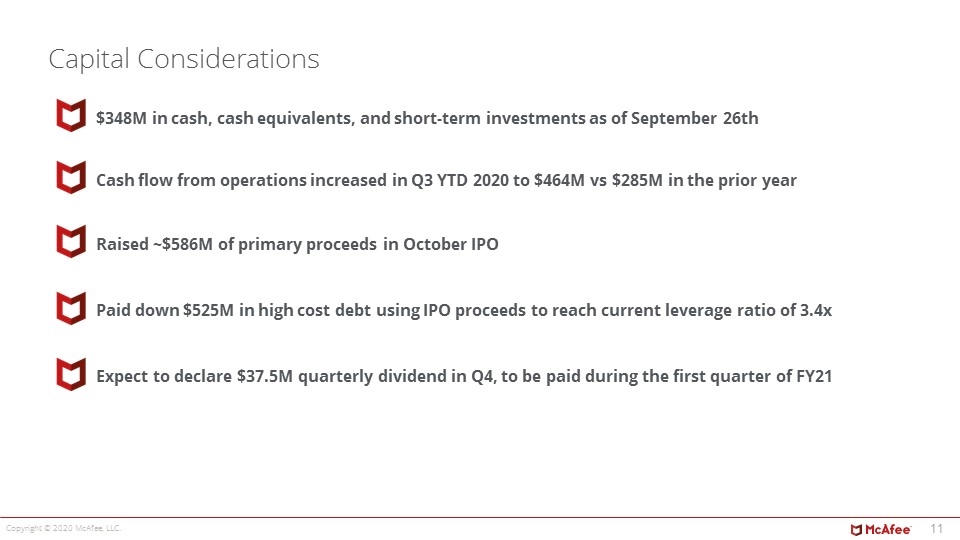

Capital Considerations $348M in cash, cash equivalents, and short-term investments as of September 26th Raised ~$586M of primary proceeds in October IPO Paid down $525M in high cost debt using IPO proceeds to reach current leverage ratio of 3.4x Expect to declare $37.5M quarterly dividend in Q4, to be paid during the first quarter of FY21 Cash flow from operations increased in Q3 YTD 2020 to $464M vs $285M in the prior year

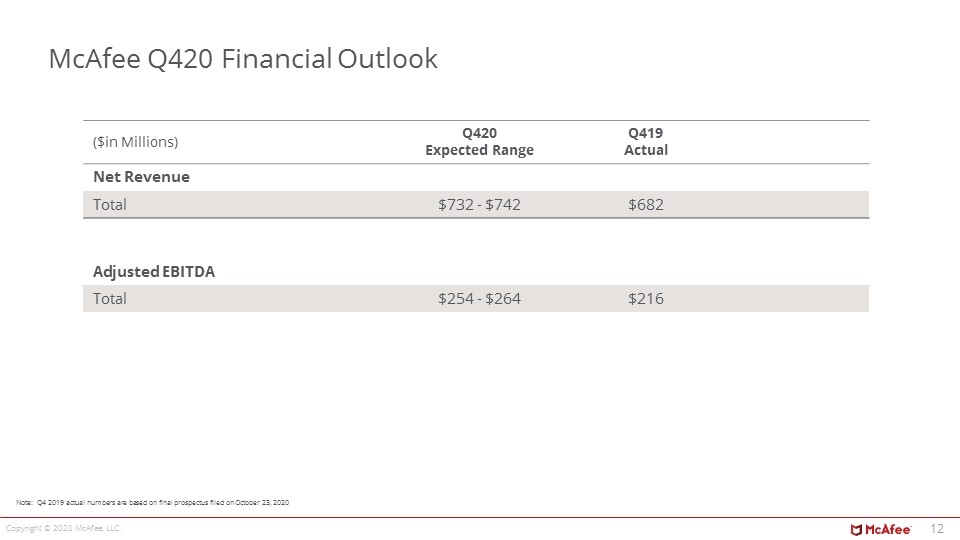

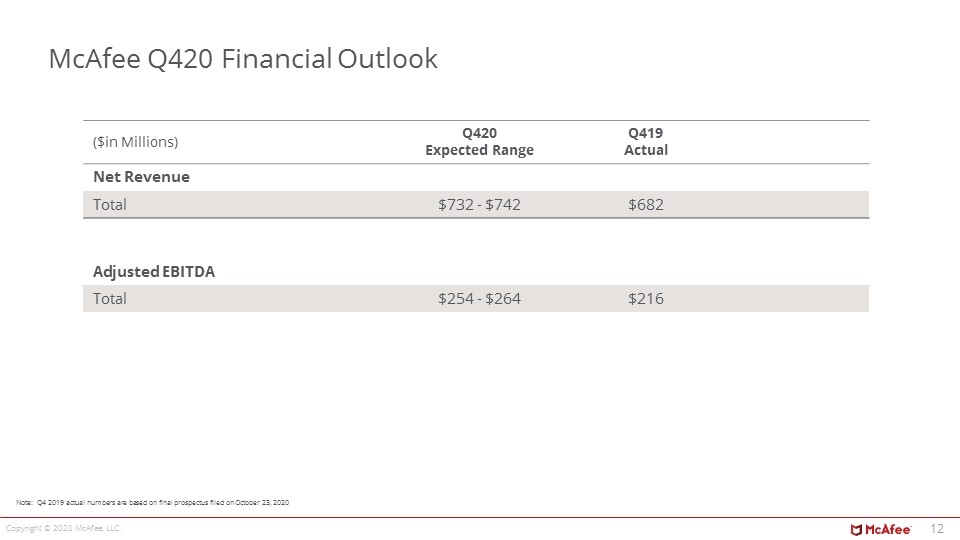

McAfee Q420 Financial Outlook ($in Millions) Q420 Expected Range Q419 Actual Net Revenue Total $732 - $742 $682 Adjusted EBITDA Total $254 - $264 $216 Note: Q4 2019 actual numbers are based on final prospectus filed on October 23, 2020

IR contact: investor@mcafee.com

Appendix

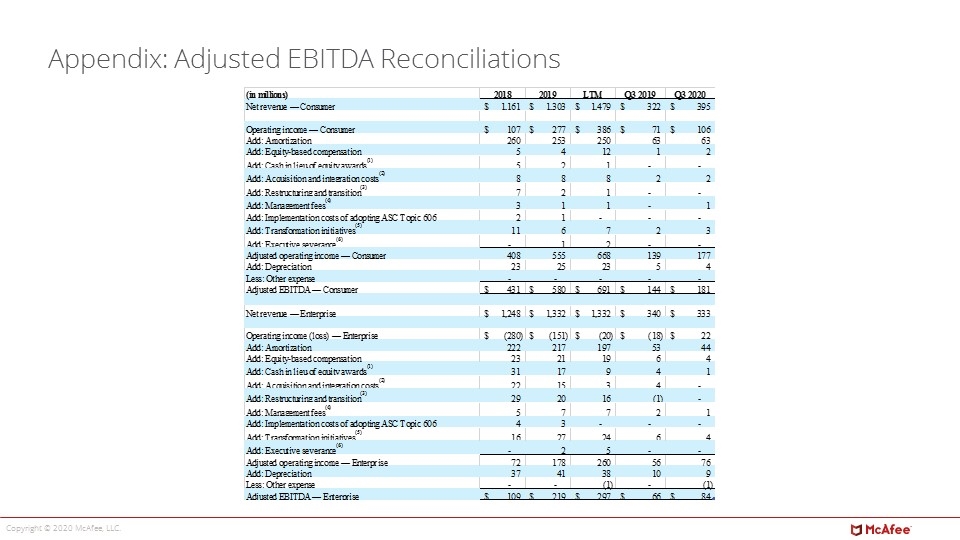

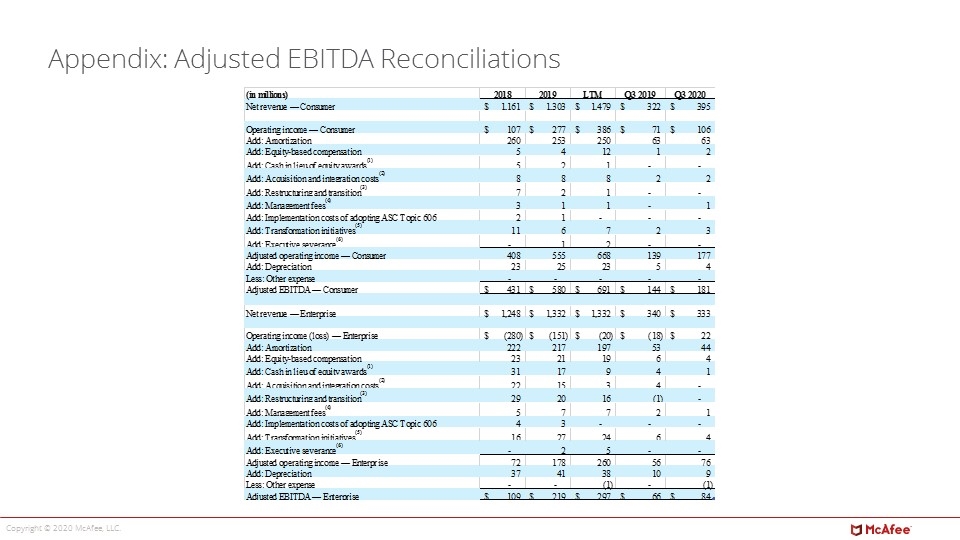

Appendix: Adjusted EBITDA Reconciliations

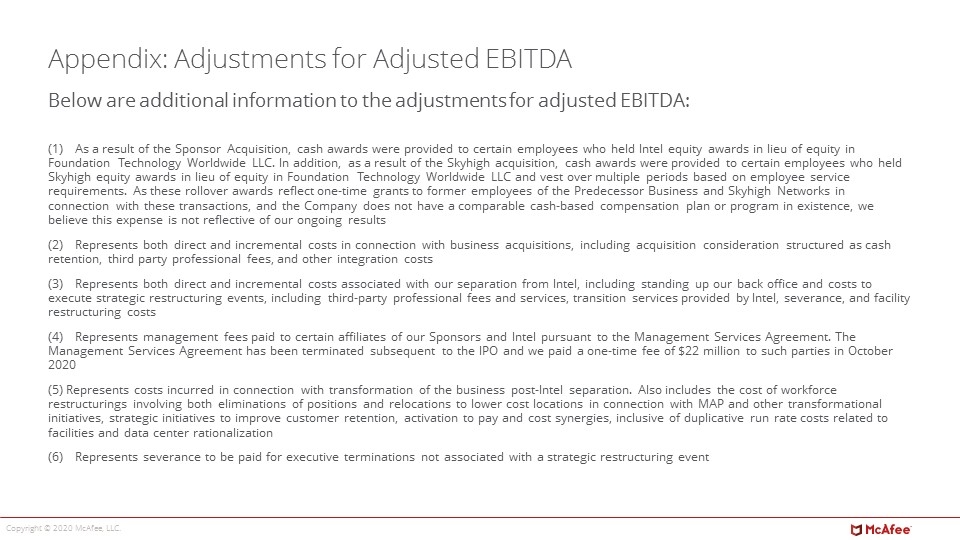

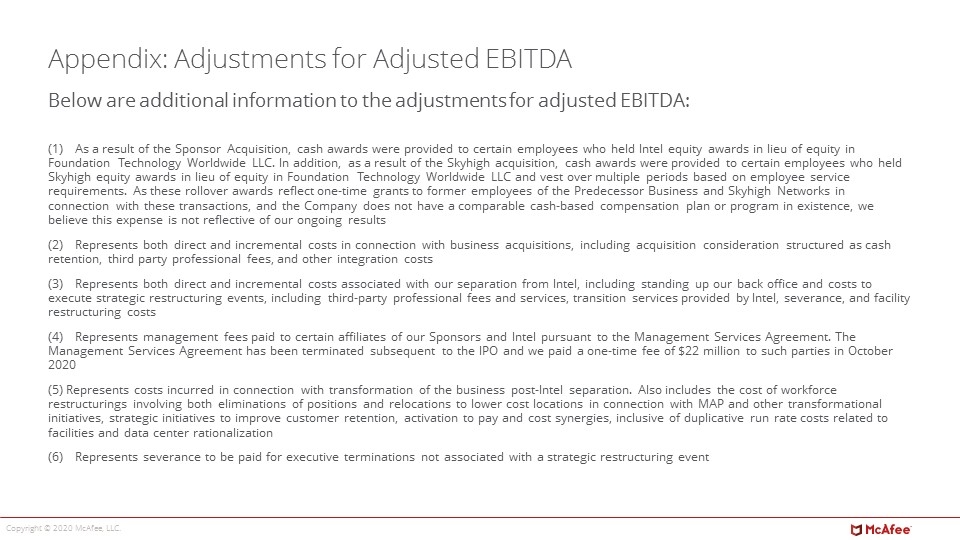

Appendix: Adjustments for Adjusted EBITDA Below are additional information to the adjustments for adjusted EBITDA: (1) As a result of the Sponsor Acquisition, cash awards were provided to certain employees who held Intel equity awards in lieu of equity in Foundation Technology Worldwide LLC. In addition, as a result of the Skyhigh acquisition, cash awards were provided to certain employees who held Skyhigh equity awards in lieu of equity in Foundation Technology Worldwide LLC and vest over multiple periods based on employee service requirements. As these rollover awards reflect one-time grants to former employees of the Predecessor Business and Skyhigh Networks in connection with these transactions, and the Company does not have a comparable cash-based compensation plan or program in existence, we believe this expense is not reflective of our ongoing results (2) Represents both direct and incremental costs in connection with business acquisitions, including acquisition consideration structured as cash retention, third party professional fees, and other integration costs (3) Represents both direct and incremental costs associated with our separation from Intel, including standing up our back office and costs to execute strategic restructuring events, including third-party professional fees and services, transition services provided by Intel, severance, and facility restructuring costs (4) Represents management fees paid to certain affiliates of our Sponsors and Intel pursuant to the Management Services Agreement. The Management Services Agreement has been terminated subsequent to the IPO and we paid a one-time fee of $22 million to such parties in October 2020 (5) Represents costs incurred in connection with transformation of the business post-Intel separation. Also includes the cost of workforce restructurings involving both eliminations of positions and relocations to lower cost locations in connection with MAP and other transformational initiatives, strategic initiatives to improve customer retention, activation to pay and cost synergies, inclusive of duplicative run rate costs related to facilities and data center rationalization (6) Represents severance to be paid for executive terminations not associated with a strategic restructuring event