June 15, 2021

Robinhood Markets, Inc.

Confidential Submission of Amendment No. 3 to Draft Registration Statement on

Form S-1 CIK No. 0001783879

Dear Mr. McWilliams, Ms. Berkheimer, Mr. Thomas and Mr. West:

Robinhood Markets, Inc. (the “Company”) has confidentially submitted today pursuant to Section 6(e) of the Securities Act of 1933, as amended (the “Securities Act”), via EDGAR, this letter and Amendment No. 3 to the draft Registration Statement on Form S-1 (the “Revised Registration Statement”) for non-public review by the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) prior to the public filing of the Registration Statement. This letter and the Revised Registration Statement set forth the Company’s responses to the comments of the Staff contained in your letter dated June 11, 2021 (the “Comment Letter”), relating to the Company’s Amendment No 2. to the draft Registration Statement submitted to the SEC on May 28, 2021 (the “Amendment No. 2”).

Amended Draft Registration Statement on Form S-1

The numbered paragraphs and headings below correspond to those set forth in the Comment Letter. Each of the Staff’s comments is set forth in bold, followed by the Company’s response to each comment. Capitalized terms used in this letter but not defined herein have the meaning given to such terms in the Revised Registration Statement. All references to page numbers in these responses are to pages of the Revised Registration Statement.

General

1.We note your revised disclosures and response to comment 3. Please revise and provide us with additional information, as requested, addressing the following:

•Reconcile your assertion that users are not customers with the disclosures throughout your draft registration statement that identifies users as customers. If your assertion is correct, it appears your draft registration statement may require revision to clarify that users are not customers;

Response: The Company respectfully advises the Staff that although users of Robinhood do not meet the definition of a “customer” as defined in ASC 606, Revenue from Contracts with Customers (“ASC 606”), as the Company previously noted in its response to comment 3, the Company generally uses the term “customer” in the Revised Registration Statement in the colloquial sense, to refer to an individual who holds an account on the Company’s platform, consistent with the manner in which such term is typically used in the business context. Additionally, the FINRA definition of “customer” under SEA Rule 15c3-3 would apply to users of Robinhood although they do not meet the definition under ASC 606. As disclosed on page 1 of the Revised Registration Statement, the Company uses the terms “users” and “customers” interchangeably in this manner in the Revised Registration Statement. The Company believes that it is helpful to investors’ understanding of the Company’s business, and consistent with plain English disclosure, to refer to “users” as “customers” in the Revised Registration Statement regardless of the technical meaning prescribed to the term “customer” under ASC 606.

•Provide a more fulsome evaluation and accounting analysis supporting your assertion that users are not customers, your analysis should include, but not be limited to, the following:

◦Identifying any explicit and implied promises Robinhood makes in its user agreements or business practices to deliver goods or services to users. For example, we note an explicit reference to Robinhood acting as the users’ agent for purposes of carrying out users’ instructions as well as providing the platform and investment tools, custody, clearance and settlement. This is also referenced in Section 4d of the Robinhood crypto user agreement in regard to filling customer orders. If implied promises differ by user agreement because of applicable law or business practice, please separately identify them; and

•Explain in your evaluation whether "consideration" exists. For example, how did you contemplate whether the rebate and pass-through fees disclosed in the Robinhood crypto user agreement constituted consideration for services provided to users.

Response: ASC 606 defines a customer as “a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration.” “Ordinary activities” is not defined in ASC 606; instead, the definition of revenue in the FASB’s CON 6 is used, which refers to the notion of an entity’s “ongoing major or central operations.” An entity only accounts for a contract with a customer under the scope of ASC 606 if it meets all the criteria of a contract as per ASC 606-10-25-1. Further, within AICPA broker dealer industry guidance the Financial Reporting Executive Committee (“FinRec”) states that if a “user” has no obligation to pay the broker dealer consideration, the contract would not have commercial substance.

Robinhood is a commission-free trading platform that users can download for free. Users can use the platform for purchasing equities, options and cryptocurrencies at quoted market prices sourced from third parties. As users are purchasing and selling securities at market prices and the Company does not charge commissions to the users, we concluded we do not receive consideration from users for their trading activity.

In addition to allowing users to purchase equities, options and cryptocurrencies on the platform, Robinhood clears users’ trades and custodies their assets. The Robinhood platform also includes features that allow users to perform various activities outside of trading, such as reading educational articles, researching individual companies and sectors and reading news articles. However, these activities also do not result in the Company receiving consideration from users. Based on this analysis, the Company concluded the users were not customers as defined under ASC 6061. The Company notes it does have other revenue streams, such as margin interest income, that are not within the scope of ASC 606.

The Company’s ongoing major central operations is the routing of equity, option and cryptocurrency orders initiated by users to market makers that execute the order. The Company’s order flow arrangements with market makers are a matter of practice and business understanding and not documented by binding contracts. Despite not being documented, we concluded that the arrangements meet the requirements of a contract as established by ASC 606-10-25-1.

1 The Company notes that users who become Robinhood Gold subscribers do meet the definition of a customer under ASC 606. As discussed below, referral services are considered a distinct service and therefore the classification of the Gold users as customers would not have an impact on the Company’s financial statements.

The promise of routing each individual order on a trade-by-trade basis is the promise of Robinhood to the market maker that creates a distinct performance obligation. The market maker may earn a spread in its capacity as the principal in fulfilling the user order. The market maker pays consideration to Robinhood when Robinhood has successfully routed an executable trade as an agent of the user and the trade is executed.

Ancillary promises to users, including acting as the users’ agent for purposes of carrying out users’ instructions as well as providing the platform and investment tools, custody, clearance and settlement, are not considered distinct performance obligations. Based on the above analysis, market makers meet the definition of a customer under ASC 606, whereas users of the platform do not.

With regard to Section 4(d) of the Robinhood Crypto User Agreement (the “User Agreement”), we advise the Staff that the reference noted by the Staff was a scrivener’s error and has since been updated in the User Agreement currently listed in the Company’s disclosure library. Additionally, Robinhood has not historically passed on fees of cryptocurrency transactions to users, though it reserves the right to do so in the future. As discussed in our letter dated May 7, 2021 relating to the Company’s Amendment No 1. to the draft Registration Statement, the Company does pass-through Trading Activity Fees, which comprised less than 1% of total revenue in 2020. Activity-based rebates is consideration received from venues, as discussed above.

•Tell us whether the referral service received is a distinct service, as defined in ASC 606, and whether the fair value of the service can be reasonably estimated;

Response: The Company respectfully advises the Staff that it has concluded that the referral service is a user acquisition activity and is deemed a distinct service as defined in ASC 606. The Company contracts with a number of third parties to provide user acquisition services and estimated the fair value of the referral services based on the prices it pays for user acquisition services to these third parties. The Company notes that this is consistent with the conclusion reached by other technology platform companies.

•Tell us and revise your disclosure to clarify the obligation you incur to the referring customer upon a referred customer fulfilling the specified conditions of a promotion, including whether it is a fixed monetary amount. Consider providing a representative example of a promotion that illustrates the obligation you incur and the conditions precedent to it; and

Response: The Company provides the representative example below:

•A user refers an individual to the Robinhood platform by sharing a link to create an account

•The referred individual creates a new Robinhood account and, upon account approval, links their bank account to their new Robinhood account

•Per the terms and conditions of the Robinhood Referral Program, a referred user must sign up, be approved and then link their bank account before the free stock is earned

•Robinhood’s system assigns a specific stock to the referring user at the time the bank account is linked

•The referring user can claim the stock within the Robinhood app for 60 days after it has been earned

•After 60 days, if the stock reward expires unclaimed, Robinhood is no longer obligated to provide the stock to the referring user

Based upon the above example, the Company is obligated to provide the referring user a free stock once bank linking has taken place as this is the point at which the stock has been earned and it is probable, based on historical activity, that the stock will be claimed. The Company settles the liability with the assigned stock when claimed. As explained in the letter dated May 28, 2021 relating to Amendment No. 2, the Company marks the liability to fair value until claimed.

In response to the Staff’s comment, the Company has revised the disclosure on page F-16 of the Revised Registration Statement.

•Explain why gains and losses on ownership interests that occur prior to a reward being earned and assigned represent operating rather than nonoperating gains and losses. As part of your response, tell us the various classifications you considered and rejected and the reasons why there are analogies you relied upon to support your conclusion. In addition, tell us the frequency with which your inventory of ownership interests turns.

Response: The Company respectfully advises the Staff that its inventory of ownership interests supporting the stock referral program turned 31 times (approximately every one and a half weeks) during the year ended December 31, 2020. The Company does not purchase or sell stock for the purposes of realizing appreciation on a proprietary basis. As the share inventory is used exclusively for the Robinhood Referral Program, the Company believes all costs associated with the program should be treated as marketing

expense. Additionally, the Company believes recording gains or losses in two separate line items of the income statement, as non-operating income/expense prior to being earned and then within operating upon being earned, would not be beneficial to the users of the financial statements and would in fact result in an over- or understatement of the true cost of the Robinhood Referral Program.

2.We continue to evaluate your response to comment 26 and we may have further comments.

Cryptocurrency, page 191

3.Please refer to your response to comment 11. Please make a conforming revision to the cross-reference to the risk factor in the first full paragraph on page 192.

Response: In response to the Staff’s comment, the Company has revised the cross-reference on page 193 of the Revised Registration Statement.

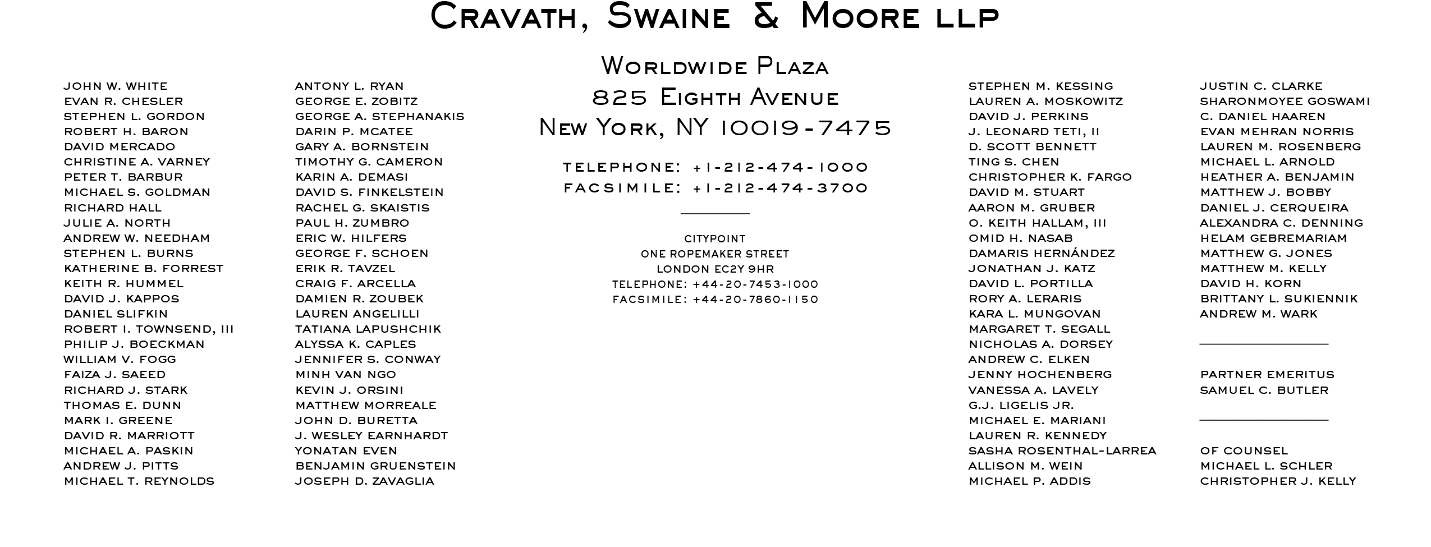

Should you have any questions or comments with respect to the Revised Registration Statement or this response letter, please contact D. Scott Bennett at 212-474-1132.

| | |

| Sincerely, |

|

| /s/ D. Scott Bennett |

|

| D. Scott Bennett |

| | | | | | | | | | | | | | |

| J. Nolan McWilliams |

| | | | |

| Sandra Hunter Berkheimer |

| | | | |

| Marc Thomas |

| | | | |

| Hugh West |

| | | | |

| Division of Corporate Finance |

| | | | |

| | Office of Corporate Finance |

| | | | |

| | | Securities and Exchange Commission |

| | | | |

| | | | 100 F Street, NE |

| | | | |

| | | | Washington, D.C. 20549 |

| | | | | | | | | | | | | | | | | |

| VIA EDGAR |

| | | | | |

| | | | | |

| Copies to: |

| | | | | |

| Daniel Gallagher, Chief Legal Officer |

| | | | | |

| Christina Y. Lai, Vice President, Deputy General Counsel and Corporate Secretary |

| | | | | |

| Weilyn Wood, Associate General Counsel |

| | | | | |

| Robinhood Markets, Inc. |

| | | | | |

| | 85 Willow Road |

| | | | | |

| | | Menlo Park, California 94025 |

VIA EMAIL