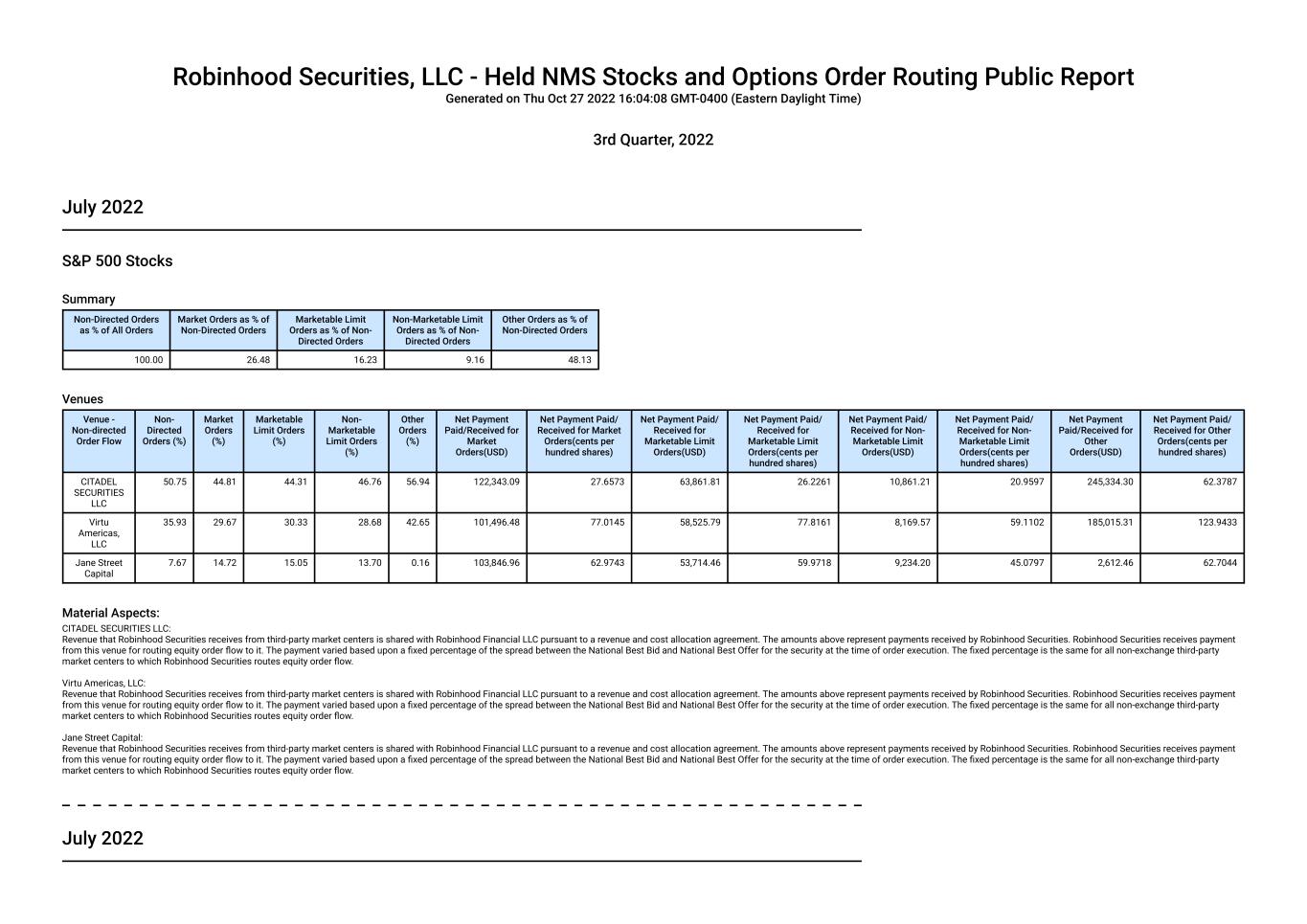

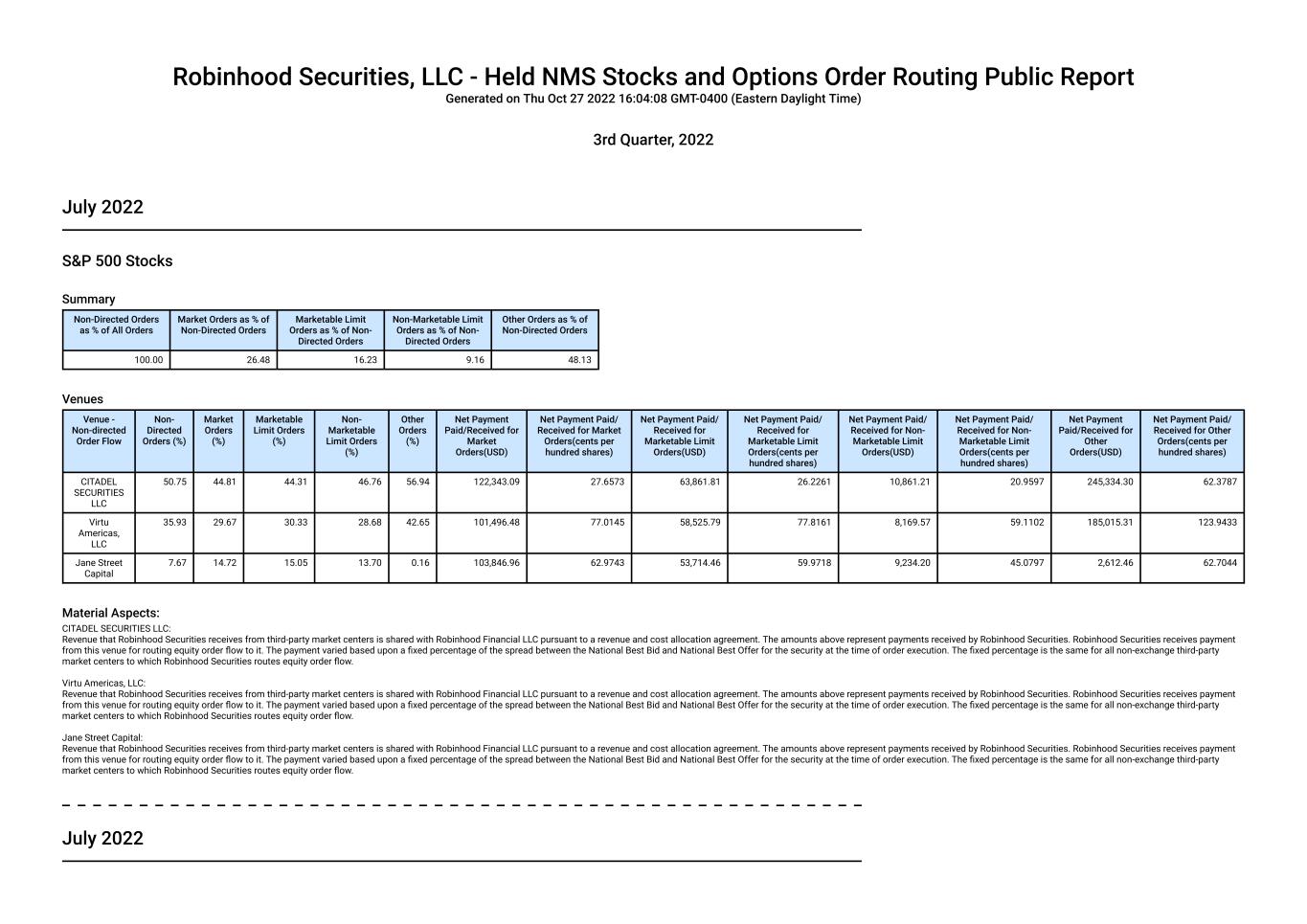

Robinhood Securities, LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Thu Oct 27 2022 16:04:08 GMT-0400 (Eastern Daylight Time) 3rd Quarter, 2022 July 2022 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 26.48 16.23 9.16 48.13 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 50.75 44.81 44.31 46.76 56.94 122,343.09 27.6573 63,861.81 26.2261 10,861.21 20.9597 245,334.30 62.3787 Virtu Americas, LLC 35.93 29.67 30.33 28.68 42.65 101,496.48 77.0145 58,525.79 77.8161 8,169.57 59.1102 185,015.31 123.9433 Jane Street Capital 7.67 14.72 15.05 13.70 0.16 103,846.96 62.9743 53,714.46 59.9718 9,234.20 45.0797 2,612.46 62.7044 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. July 2022

Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 23.43 19.34 8.29 48.94 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 47.19 38.31 35.27 38.57 57.60 1,185,147.93 18.2388 606,557.82 12.7642 108,849.89 16.4084 1,487,267.10 14.5902 Virtu Americas, LLC 33.28 25.01 25.34 25.17 41.76 605,292.25 17.1417 318,363.06 10.6458 62,885.24 14.4003 815,693.21 11.4371 Jane Street Capital 12.86 23.70 27.03 23.49 0.27 993,511.63 16.5846 512,004.87 10.5170 95,637.39 14.9199 29,179.10 19.3668 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. July 2022 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.22 29.28 48.25 22.26

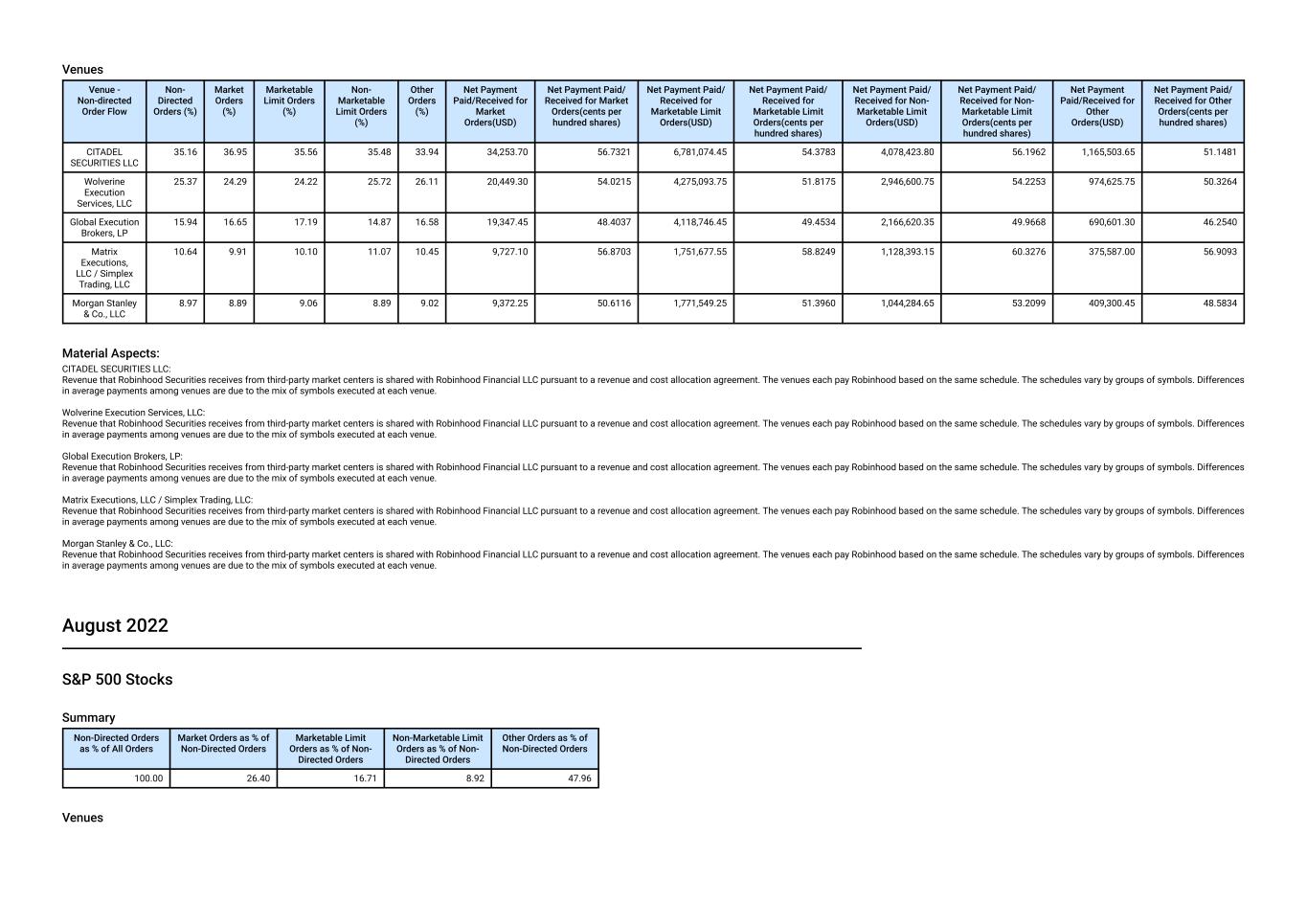

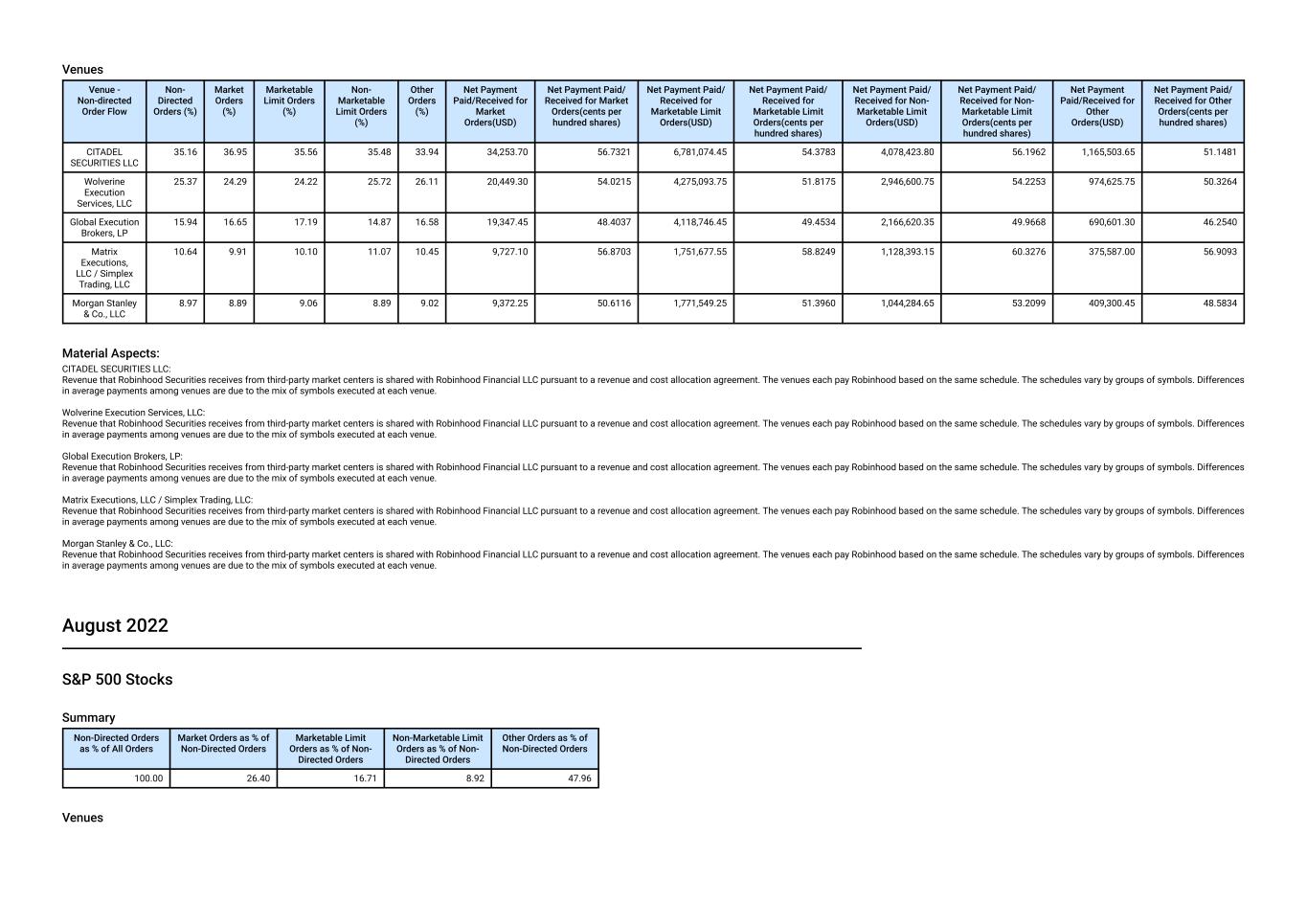

Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 35.16 36.95 35.56 35.48 33.94 34,253.70 56.7321 6,781,074.45 54.3783 4,078,423.80 56.1962 1,165,503.65 51.1481 Wolverine Execution Services, LLC 25.37 24.29 24.22 25.72 26.11 20,449.30 54.0215 4,275,093.75 51.8175 2,946,600.75 54.2253 974,625.75 50.3264 Global Execution Brokers, LP 15.94 16.65 17.19 14.87 16.58 19,347.45 48.4037 4,118,746.45 49.4534 2,166,620.35 49.9668 690,601.30 46.2540 Matrix Executions, LLC / Simplex Trading, LLC 10.64 9.91 10.10 11.07 10.45 9,727.10 56.8703 1,751,677.55 58.8249 1,128,393.15 60.3276 375,587.00 56.9093 Morgan Stanley & Co., LLC 8.97 8.89 9.06 8.89 9.02 9,372.25 50.6116 1,771,549.25 51.3960 1,044,284.65 53.2099 409,300.45 48.5834 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Wolverine Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Global Execution Brokers, LP: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Matrix Executions, LLC / Simplex Trading, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. August 2022 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 26.40 16.71 8.92 47.96 Venues

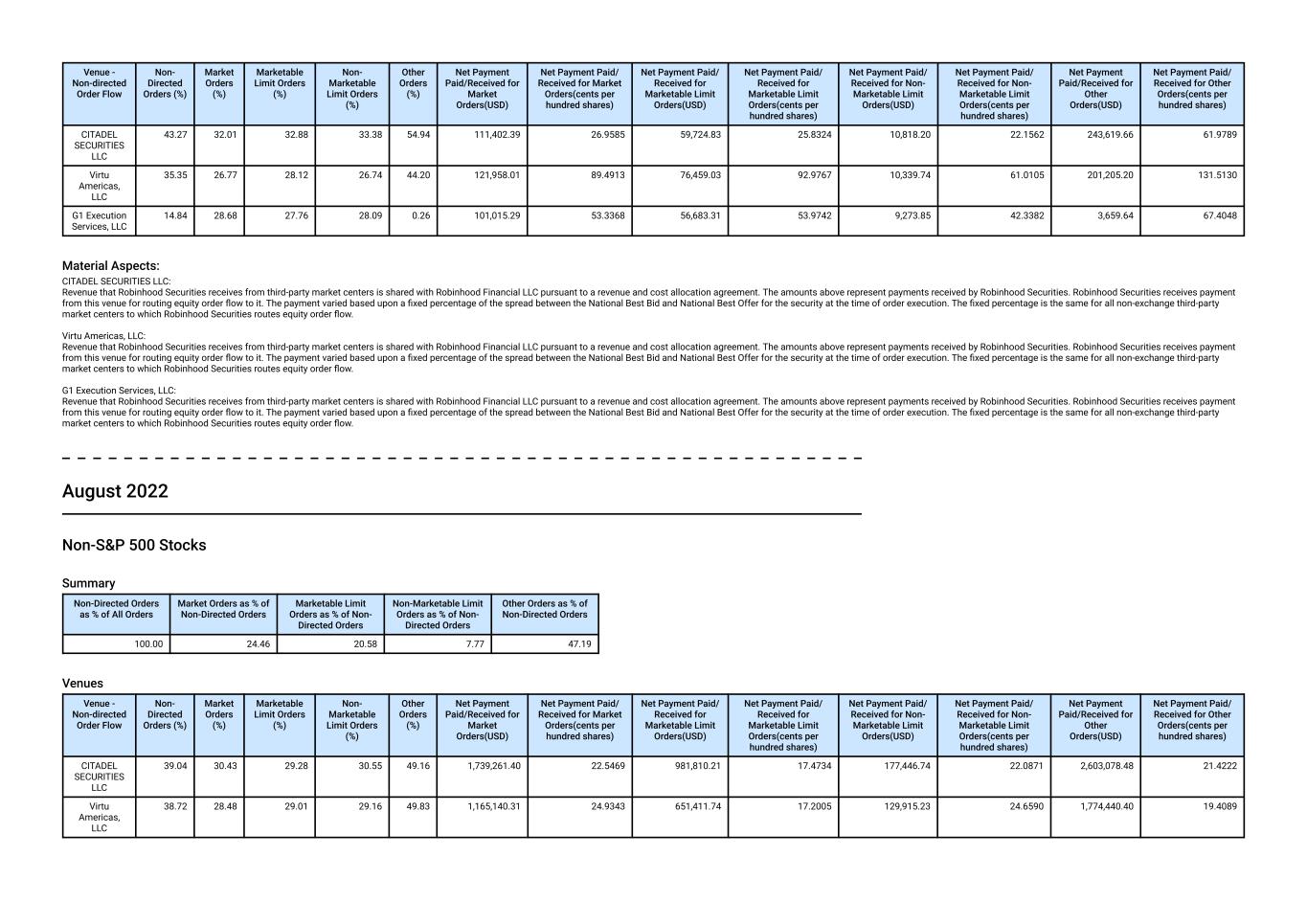

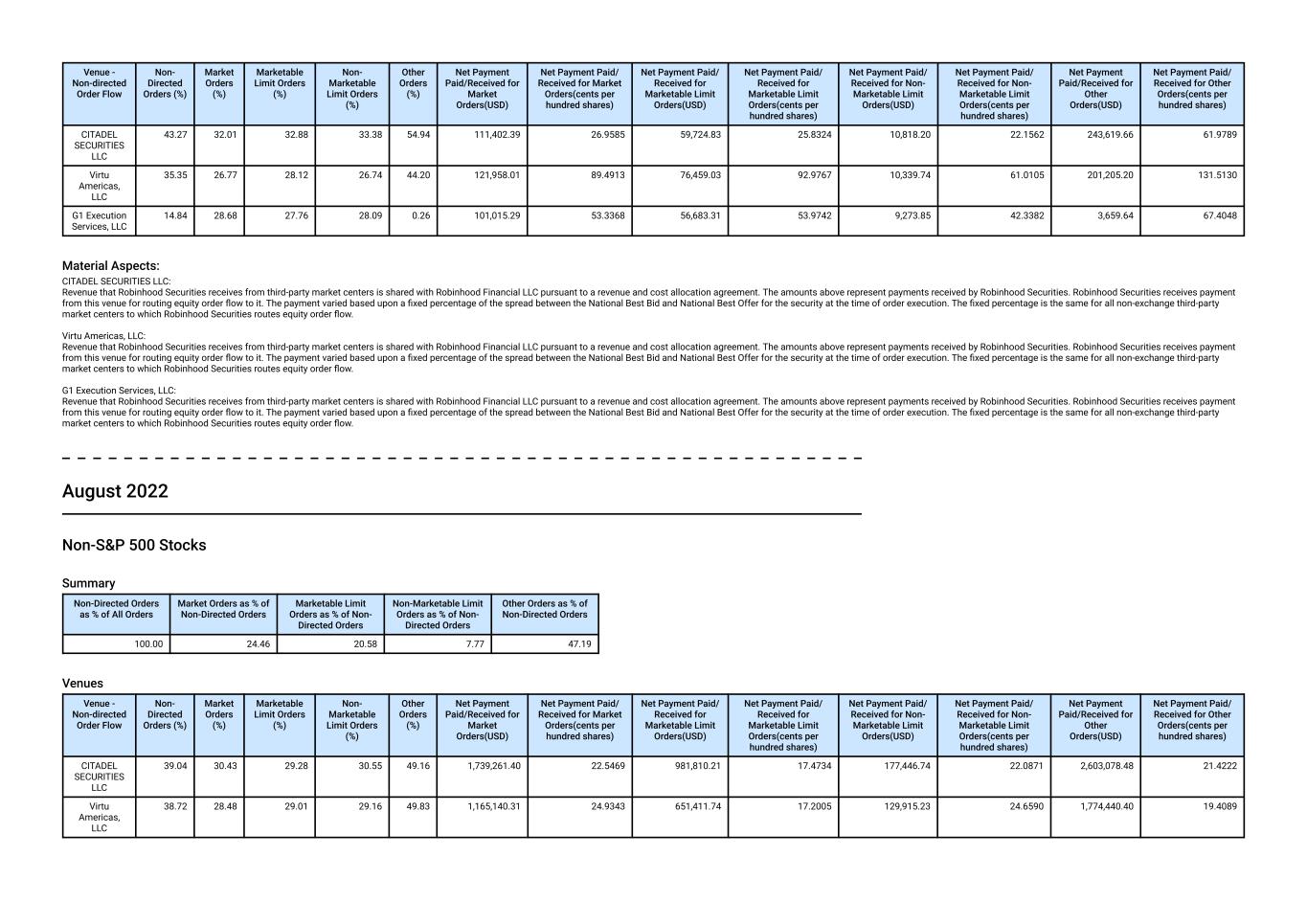

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 43.27 32.01 32.88 33.38 54.94 111,402.39 26.9585 59,724.83 25.8324 10,818.20 22.1562 243,619.66 61.9789 Virtu Americas, LLC 35.35 26.77 28.12 26.74 44.20 121,958.01 89.4913 76,459.03 92.9767 10,339.74 61.0105 201,205.20 131.5130 G1 Execution Services, LLC 14.84 28.68 27.76 28.09 0.26 101,015.29 53.3368 56,683.31 53.9742 9,273.85 42.3382 3,659.64 67.4048 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1 Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. August 2022 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 24.46 20.58 7.77 47.19 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 39.04 30.43 29.28 30.55 49.16 1,739,261.40 22.5469 981,810.21 17.4734 177,446.74 22.0871 2,603,078.48 21.4222 Virtu Americas, LLC 38.72 28.48 29.01 29.16 49.83 1,165,140.31 24.9343 651,411.74 17.2005 129,915.23 24.6590 1,774,440.40 19.4089

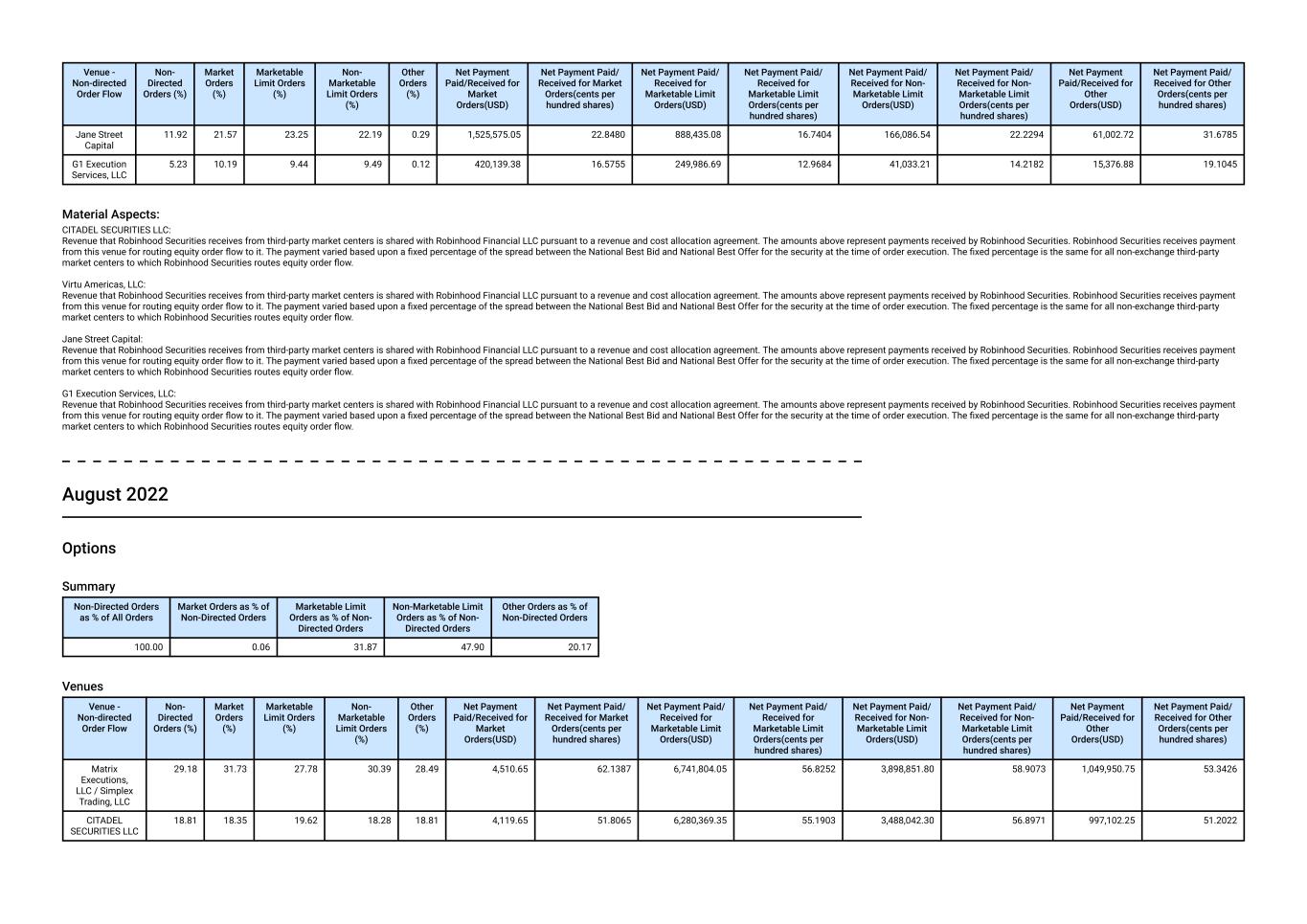

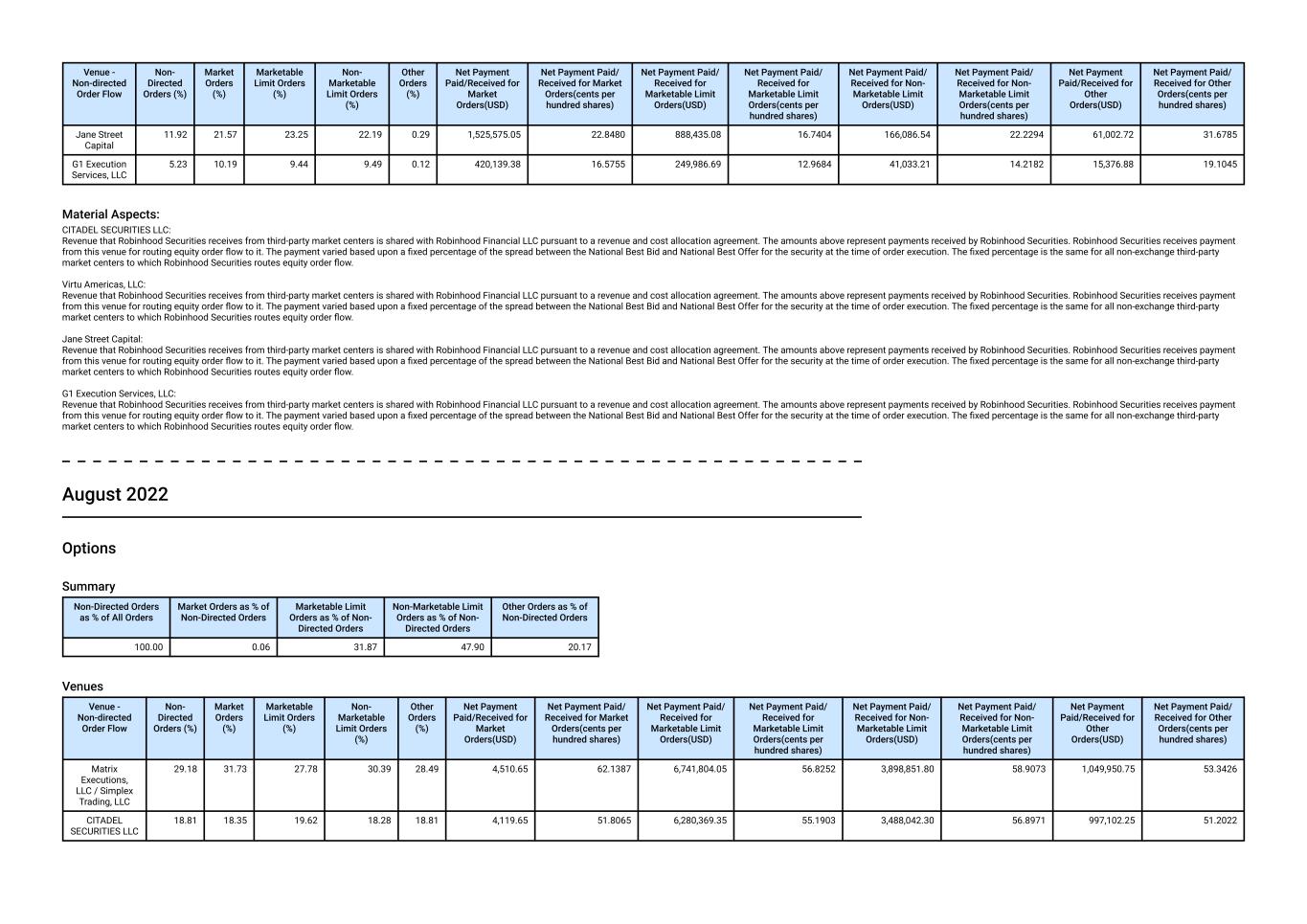

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Jane Street Capital 11.92 21.57 23.25 22.19 0.29 1,525,575.05 22.8480 888,435.08 16.7404 166,086.54 22.2294 61,002.72 31.6785 G1 Execution Services, LLC 5.23 10.19 9.44 9.49 0.12 420,139.38 16.5755 249,986.69 12.9684 41,033.21 14.2182 15,376.88 19.1045 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1 Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. August 2022 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.06 31.87 47.90 20.17 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Matrix Executions, LLC / Simplex Trading, LLC 29.18 31.73 27.78 30.39 28.49 4,510.65 62.1387 6,741,804.05 56.8252 3,898,851.80 58.9073 1,049,950.75 53.3426 CITADEL SECURITIES LLC 18.81 18.35 19.62 18.28 18.81 4,119.65 51.8065 6,280,369.35 55.1903 3,488,042.30 56.8971 997,102.25 51.2022

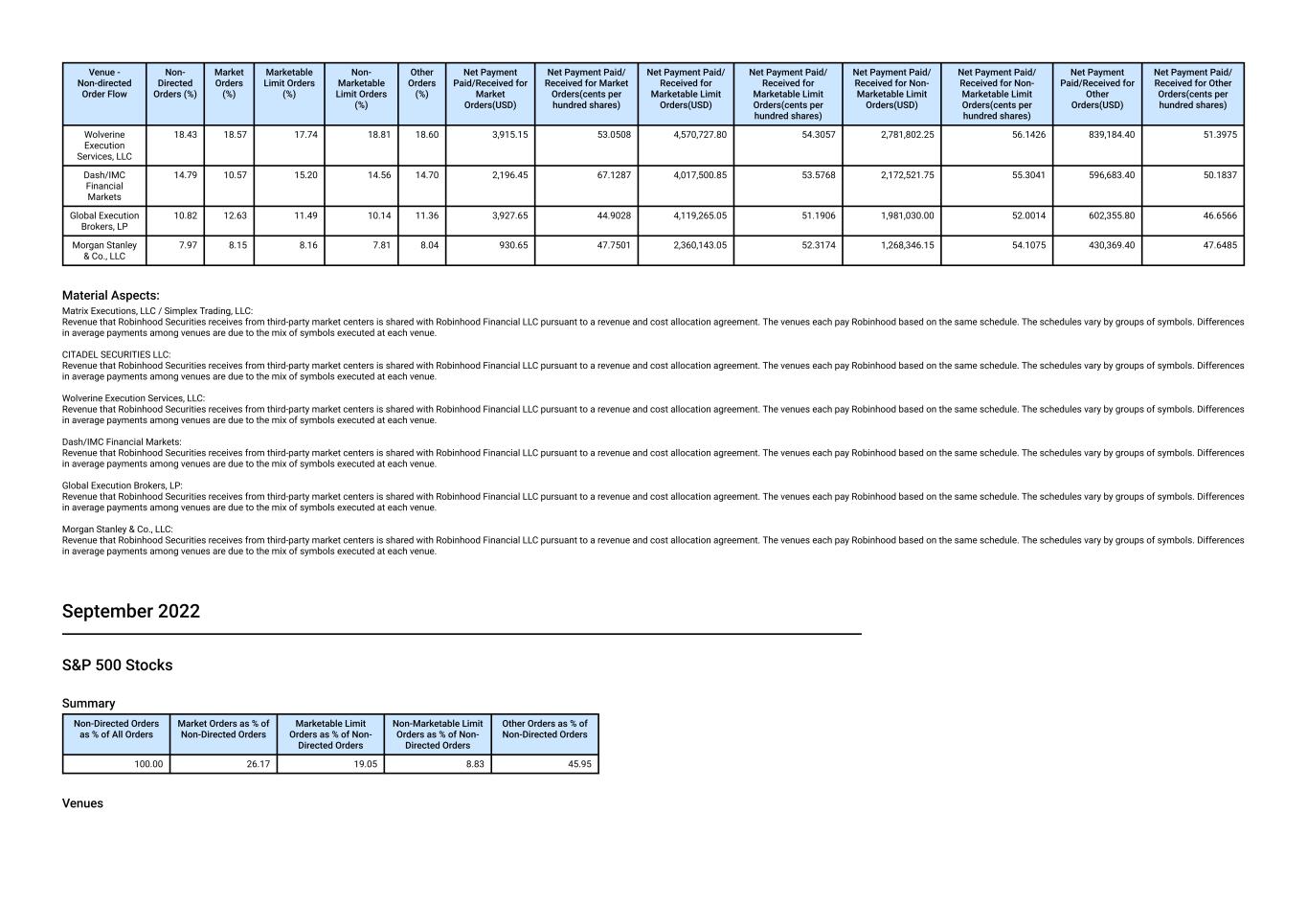

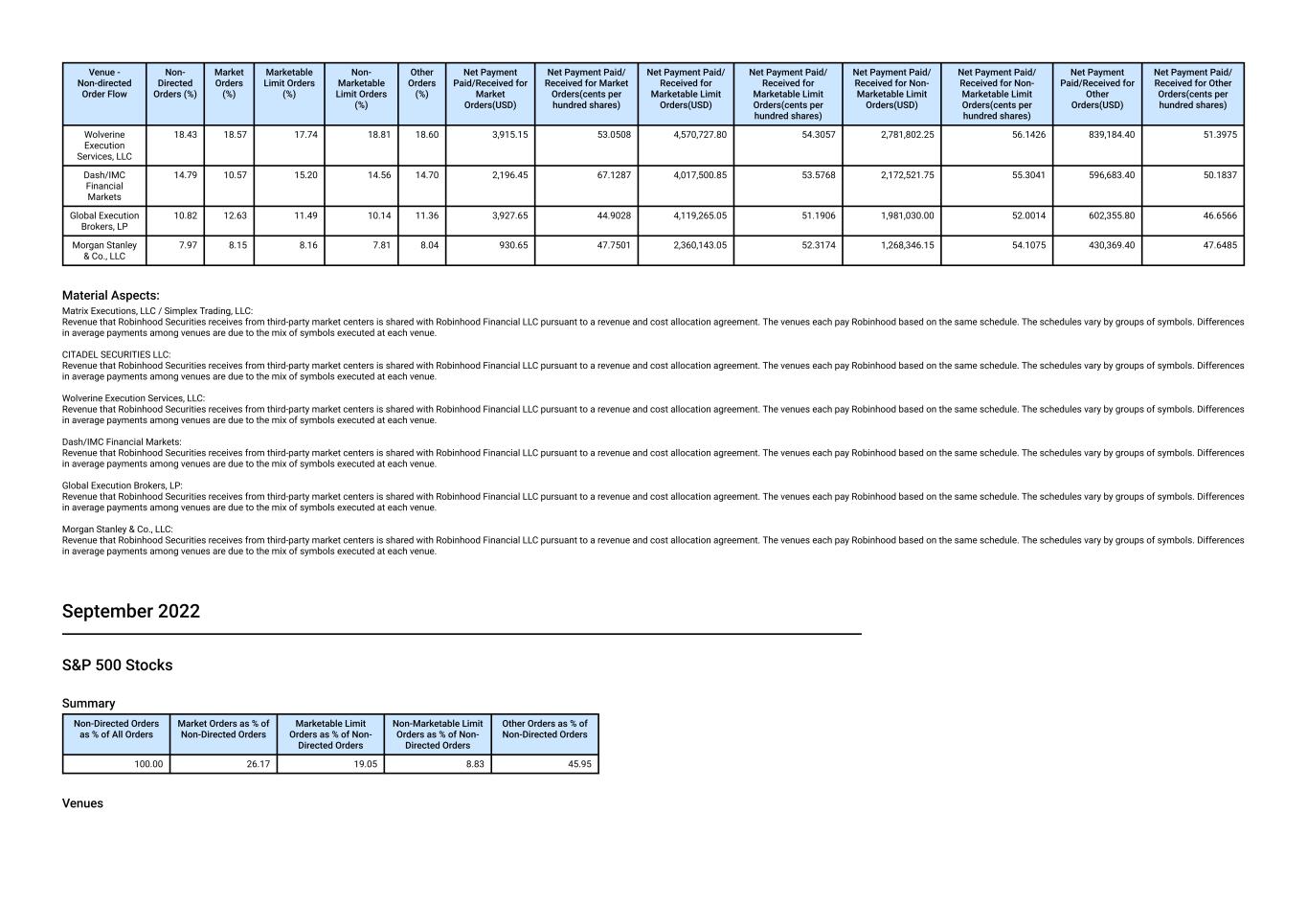

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Wolverine Execution Services, LLC 18.43 18.57 17.74 18.81 18.60 3,915.15 53.0508 4,570,727.80 54.3057 2,781,802.25 56.1426 839,184.40 51.3975 Dash/IMC Financial Markets 14.79 10.57 15.20 14.56 14.70 2,196.45 67.1287 4,017,500.85 53.5768 2,172,521.75 55.3041 596,683.40 50.1837 Global Execution Brokers, LP 10.82 12.63 11.49 10.14 11.36 3,927.65 44.9028 4,119,265.05 51.1906 1,981,030.00 52.0014 602,355.80 46.6566 Morgan Stanley & Co., LLC 7.97 8.15 8.16 7.81 8.04 930.65 47.7501 2,360,143.05 52.3174 1,268,346.15 54.1075 430,369.40 47.6485 Material Aspects: Matrix Executions, LLC / Simplex Trading, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Wolverine Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Dash/IMC Financial Markets: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Global Execution Brokers, LP: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. September 2022 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 26.17 19.05 8.83 45.95 Venues

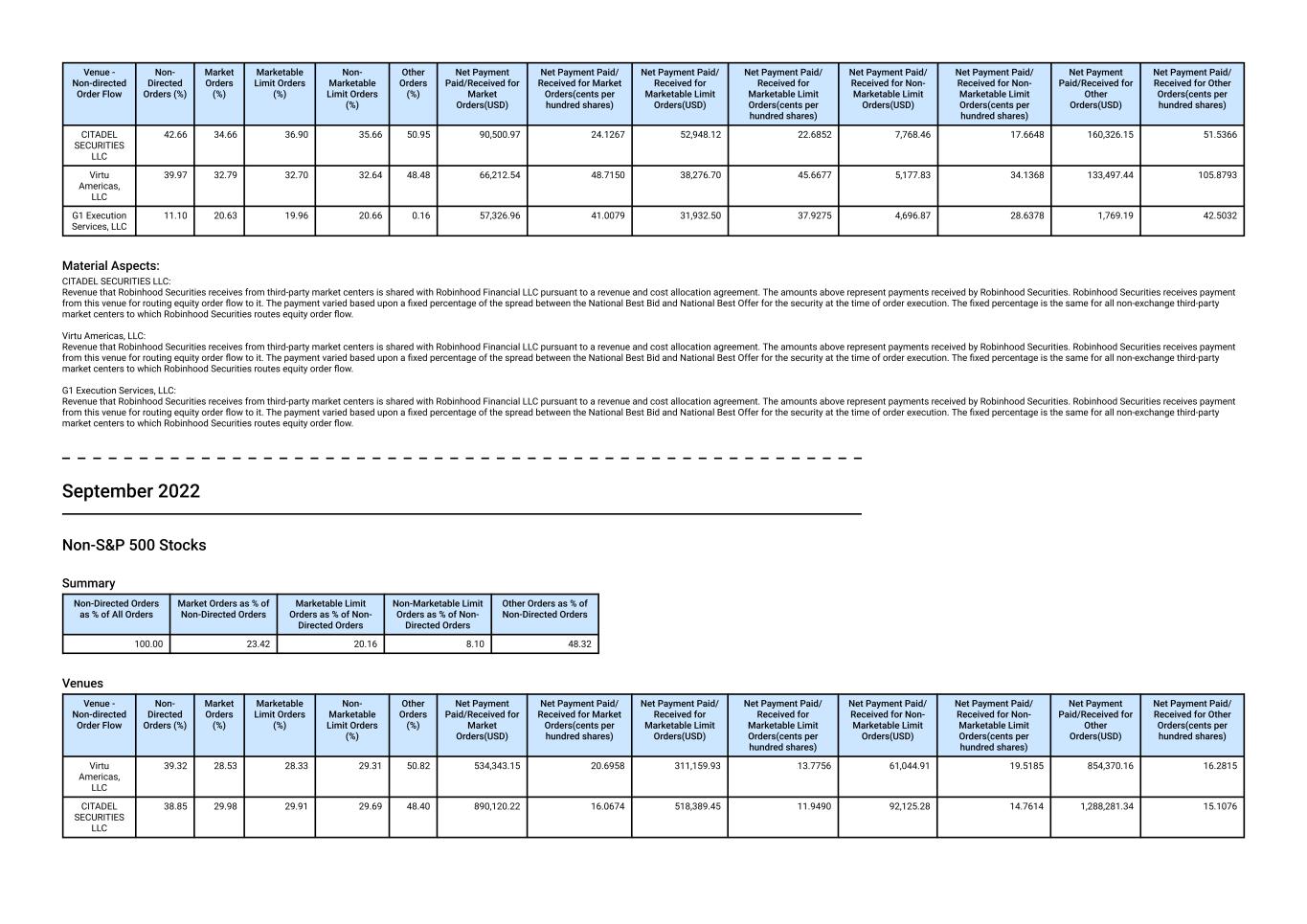

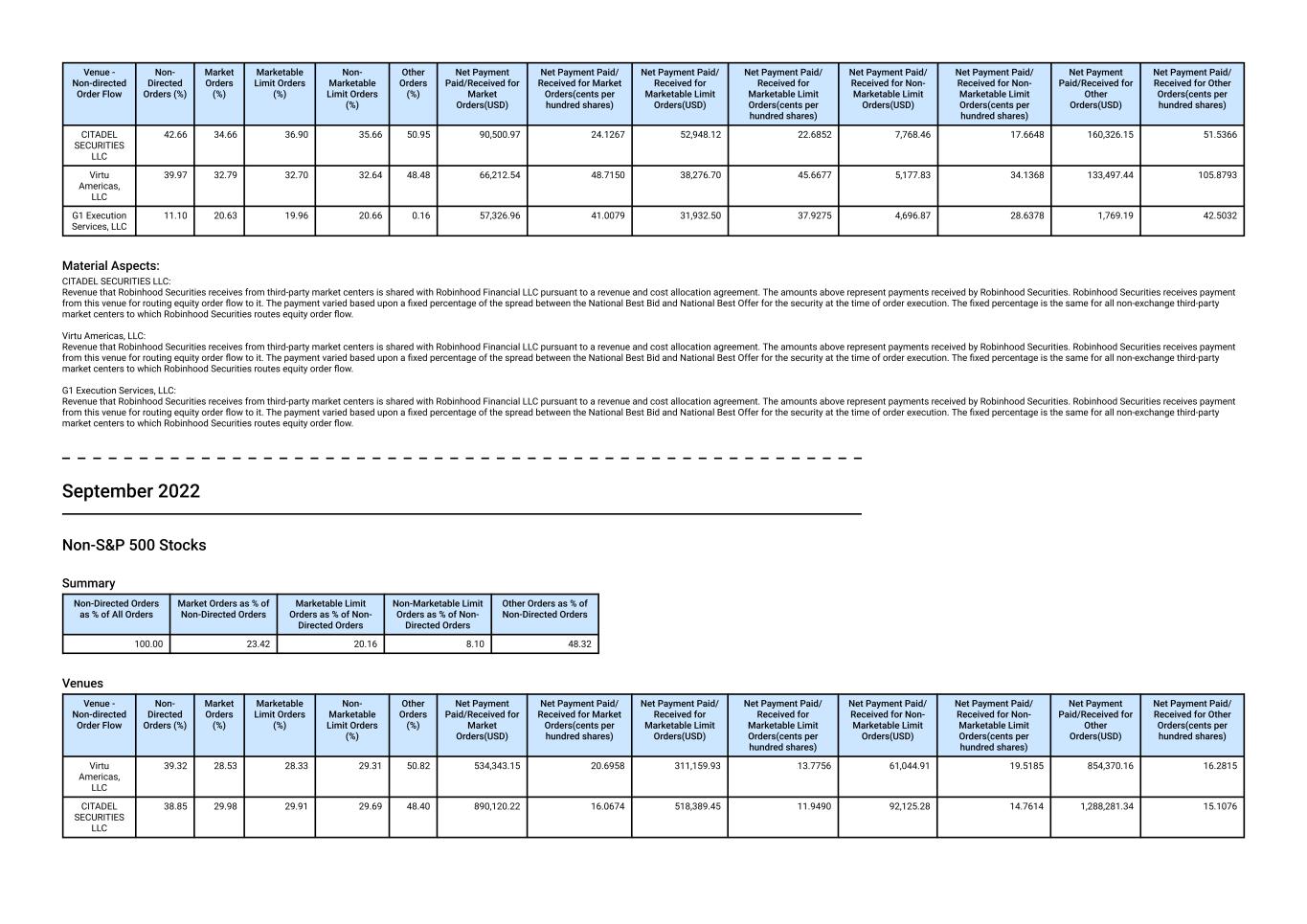

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 42.66 34.66 36.90 35.66 50.95 90,500.97 24.1267 52,948.12 22.6852 7,768.46 17.6648 160,326.15 51.5366 Virtu Americas, LLC 39.97 32.79 32.70 32.64 48.48 66,212.54 48.7150 38,276.70 45.6677 5,177.83 34.1368 133,497.44 105.8793 G1 Execution Services, LLC 11.10 20.63 19.96 20.66 0.16 57,326.96 41.0079 31,932.50 37.9275 4,696.87 28.6378 1,769.19 42.5032 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1 Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. September 2022 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 23.42 20.16 8.10 48.32 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 39.32 28.53 28.33 29.31 50.82 534,343.15 20.6958 311,159.93 13.7756 61,044.91 19.5185 854,370.16 16.2815 CITADEL SECURITIES LLC 38.85 29.98 29.91 29.69 48.40 890,120.22 16.0674 518,389.45 11.9490 92,125.28 14.7614 1,288,281.34 15.1076

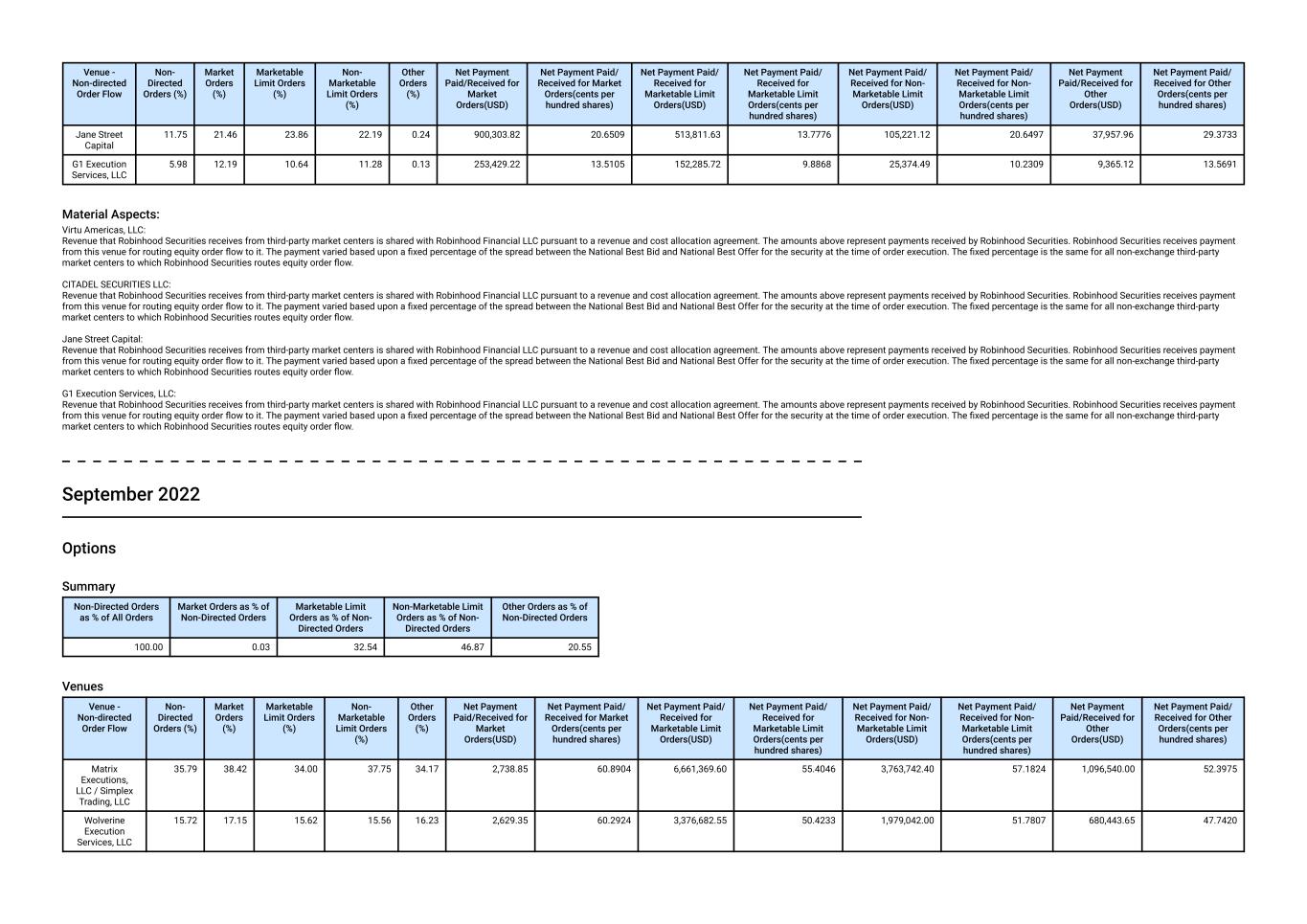

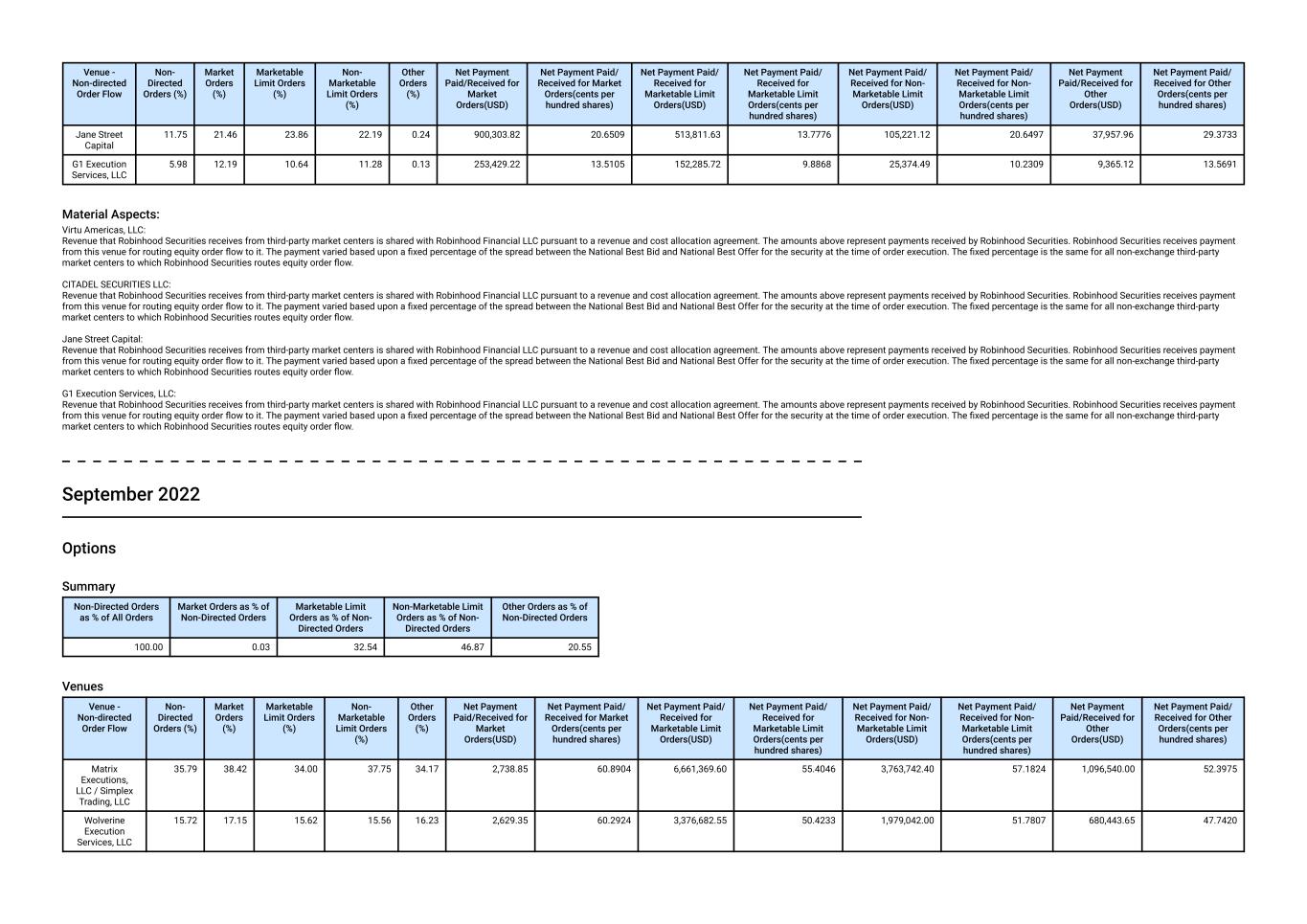

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Jane Street Capital 11.75 21.46 23.86 22.19 0.24 900,303.82 20.6509 513,811.63 13.7776 105,221.12 20.6497 37,957.96 29.3733 G1 Execution Services, LLC 5.98 12.19 10.64 11.28 0.13 253,429.22 13.5105 152,285.72 9.8868 25,374.49 10.2309 9,365.12 13.5691 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. Jane Street Capital: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. G1 Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The amounts above represent payments received by Robinhood Securities. Robinhood Securities receives payment from this venue for routing equity order flow to it. The payment varied based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution. The fixed percentage is the same for all non-exchange third-party market centers to which Robinhood Securities routes equity order flow. September 2022 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.03 32.54 46.87 20.55 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Matrix Executions, LLC / Simplex Trading, LLC 35.79 38.42 34.00 37.75 34.17 2,738.85 60.8904 6,661,369.60 55.4046 3,763,742.40 57.1824 1,096,540.00 52.3975 Wolverine Execution Services, LLC 15.72 17.15 15.62 15.56 16.23 2,629.35 60.2924 3,376,682.55 50.4233 1,979,042.00 51.7807 680,443.65 47.7420

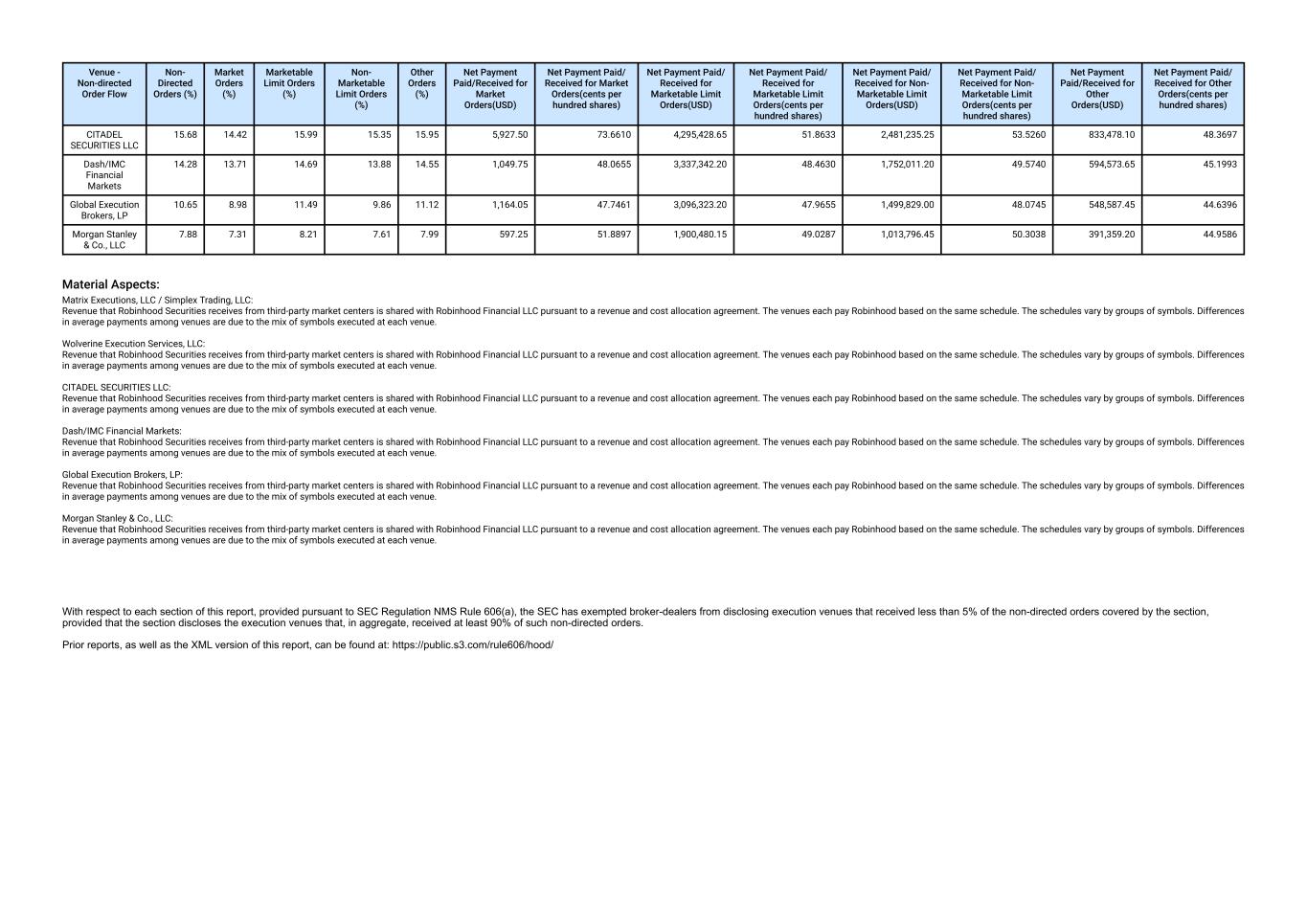

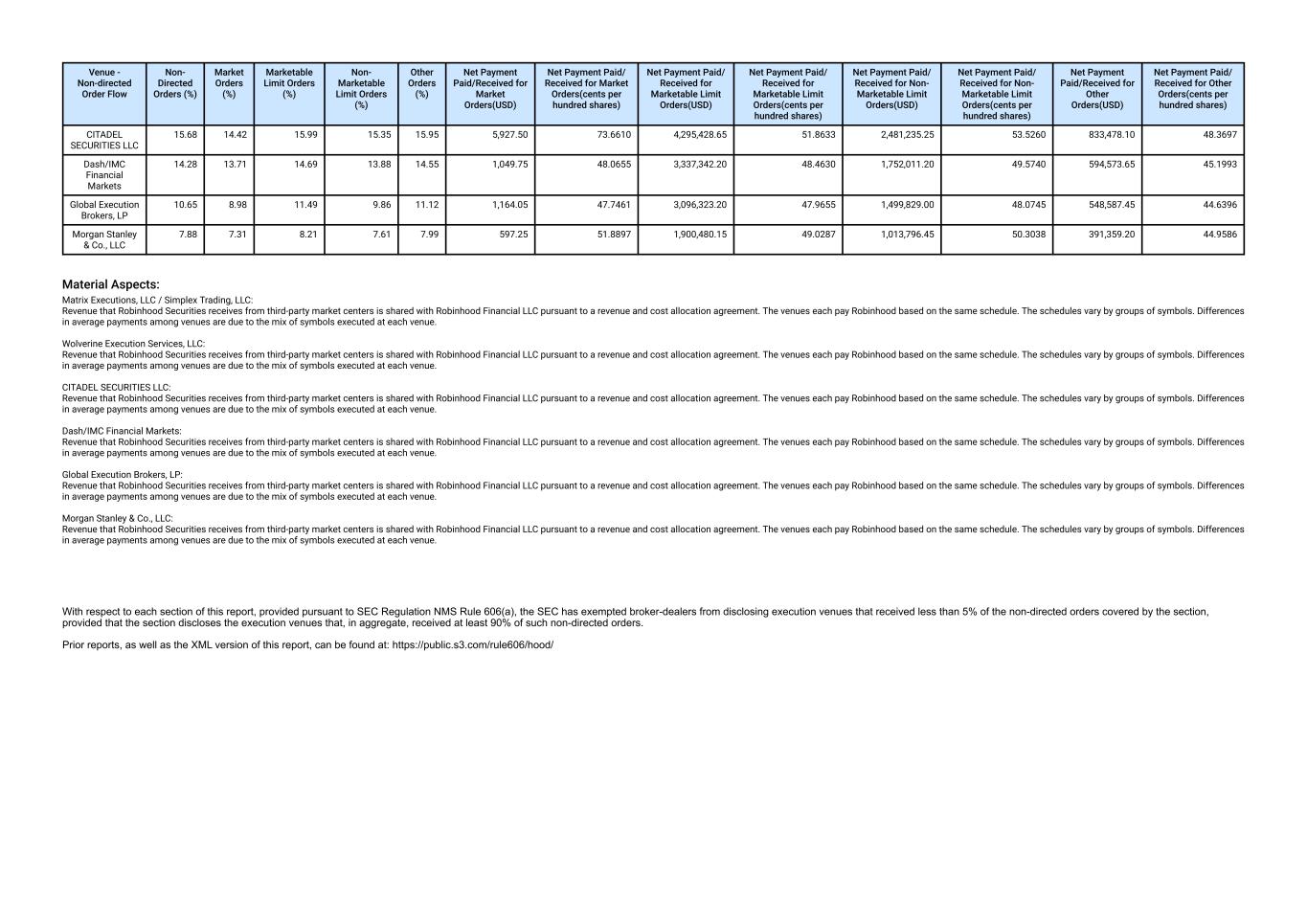

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 15.68 14.42 15.99 15.35 15.95 5,927.50 73.6610 4,295,428.65 51.8633 2,481,235.25 53.5260 833,478.10 48.3697 Dash/IMC Financial Markets 14.28 13.71 14.69 13.88 14.55 1,049.75 48.0655 3,337,342.20 48.4630 1,752,011.20 49.5740 594,573.65 45.1993 Global Execution Brokers, LP 10.65 8.98 11.49 9.86 11.12 1,164.05 47.7461 3,096,323.20 47.9655 1,499,829.00 48.0745 548,587.45 44.6396 Morgan Stanley & Co., LLC 7.88 7.31 8.21 7.61 7.99 597.25 51.8897 1,900,480.15 49.0287 1,013,796.45 50.3038 391,359.20 44.9586 Material Aspects: Matrix Executions, LLC / Simplex Trading, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Wolverine Execution Services, LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. CITADEL SECURITIES LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Dash/IMC Financial Markets: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Global Execution Brokers, LP: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities receives from third-party market centers is shared with Robinhood Financial LLC pursuant to a revenue and cost allocation agreement. The venues each pay Robinhood based on the same schedule. The schedules vary by groups of symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue.