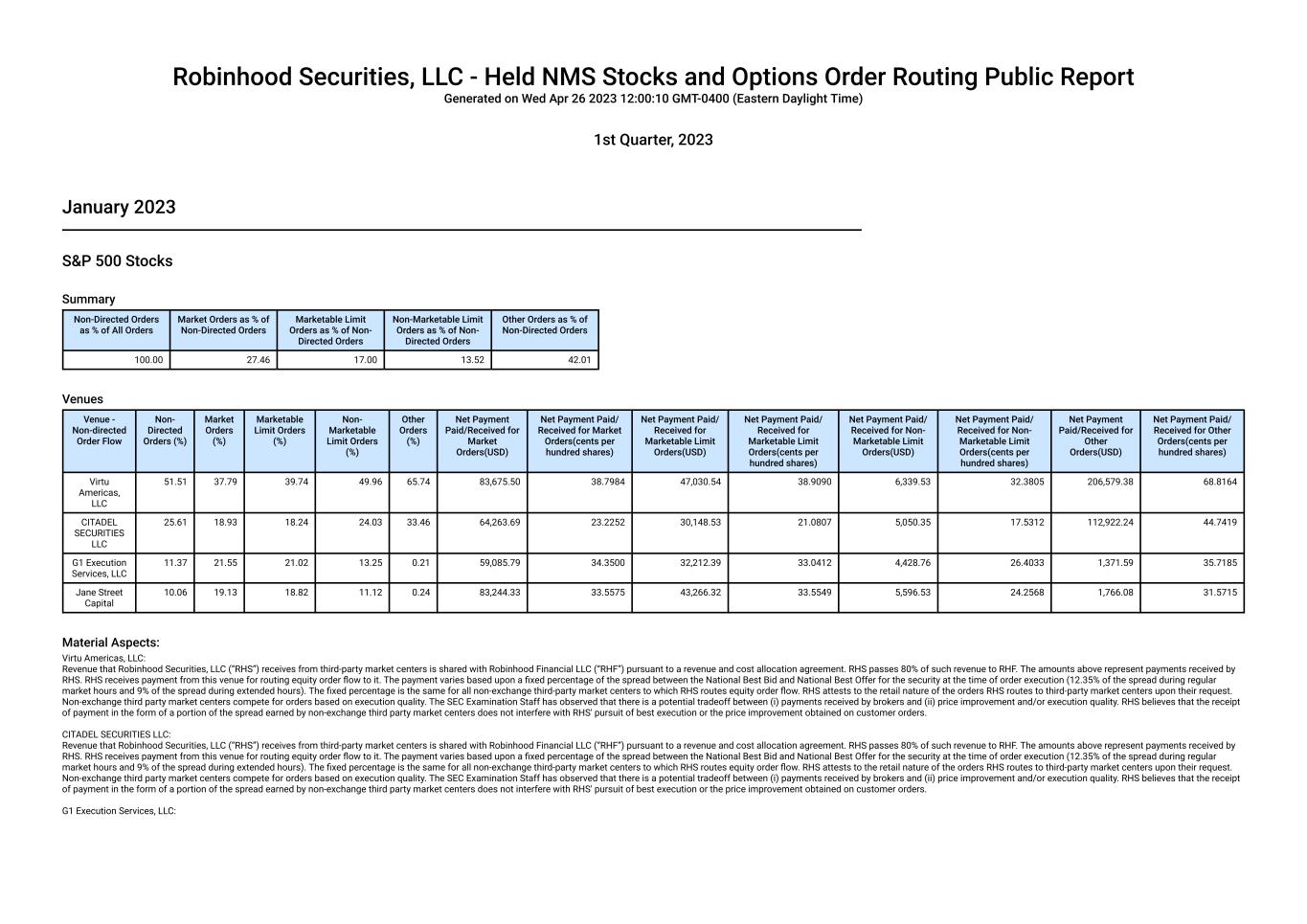

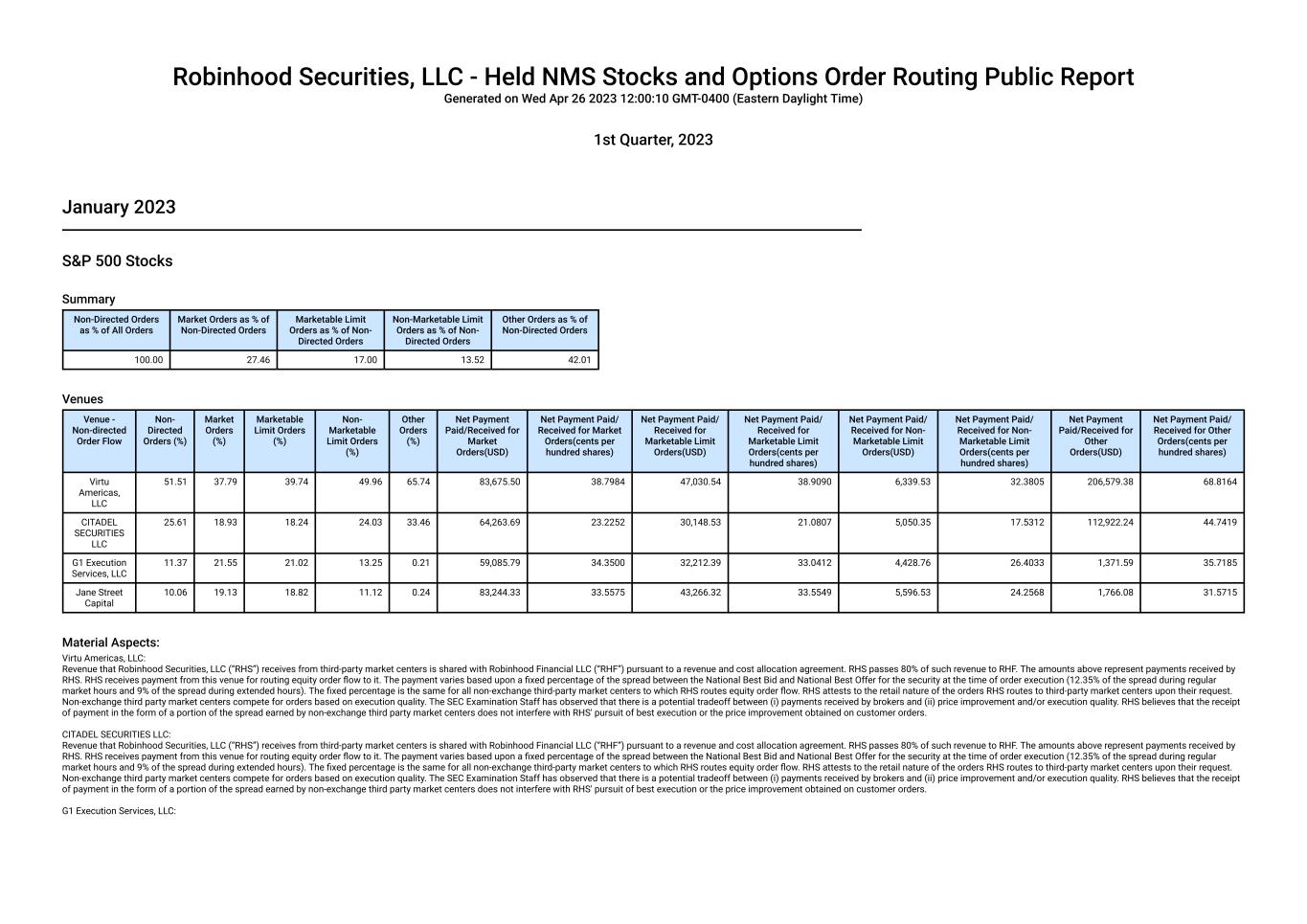

Robinhood Securities, LLC - Held NMS Stocks and Options Order Routing Public Report Generated on Wed Apr 26 2023 12:00:10 GMT-0400 (Eastern Daylight Time) 1st Quarter, 2023 January 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 27.46 17.00 13.52 42.01 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 51.51 37.79 39.74 49.96 65.74 83,675.50 38.7984 47,030.54 38.9090 6,339.53 32.3805 206,579.38 68.8164 CITADEL SECURITIES LLC 25.61 18.93 18.24 24.03 33.46 64,263.69 23.2252 30,148.53 21.0807 5,050.35 17.5312 112,922.24 44.7419 G1 Execution Services, LLC 11.37 21.55 21.02 13.25 0.21 59,085.79 34.3500 32,212.39 33.0412 4,428.76 26.4033 1,371.59 35.7185 Jane Street Capital 10.06 19.13 18.82 11.12 0.24 83,244.33 33.5575 43,266.32 33.5549 5,596.53 24.2568 1,766.08 31.5715 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC:

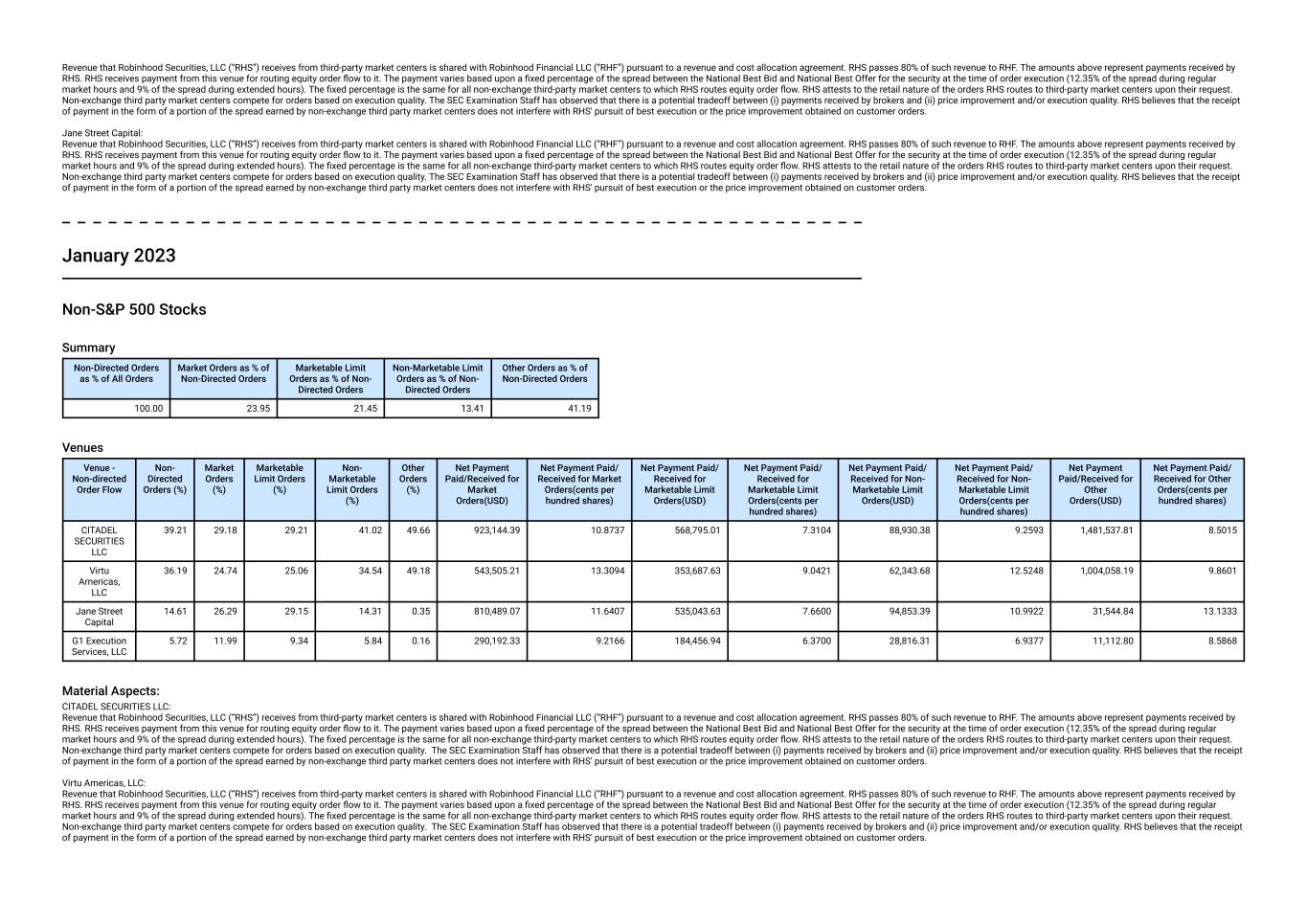

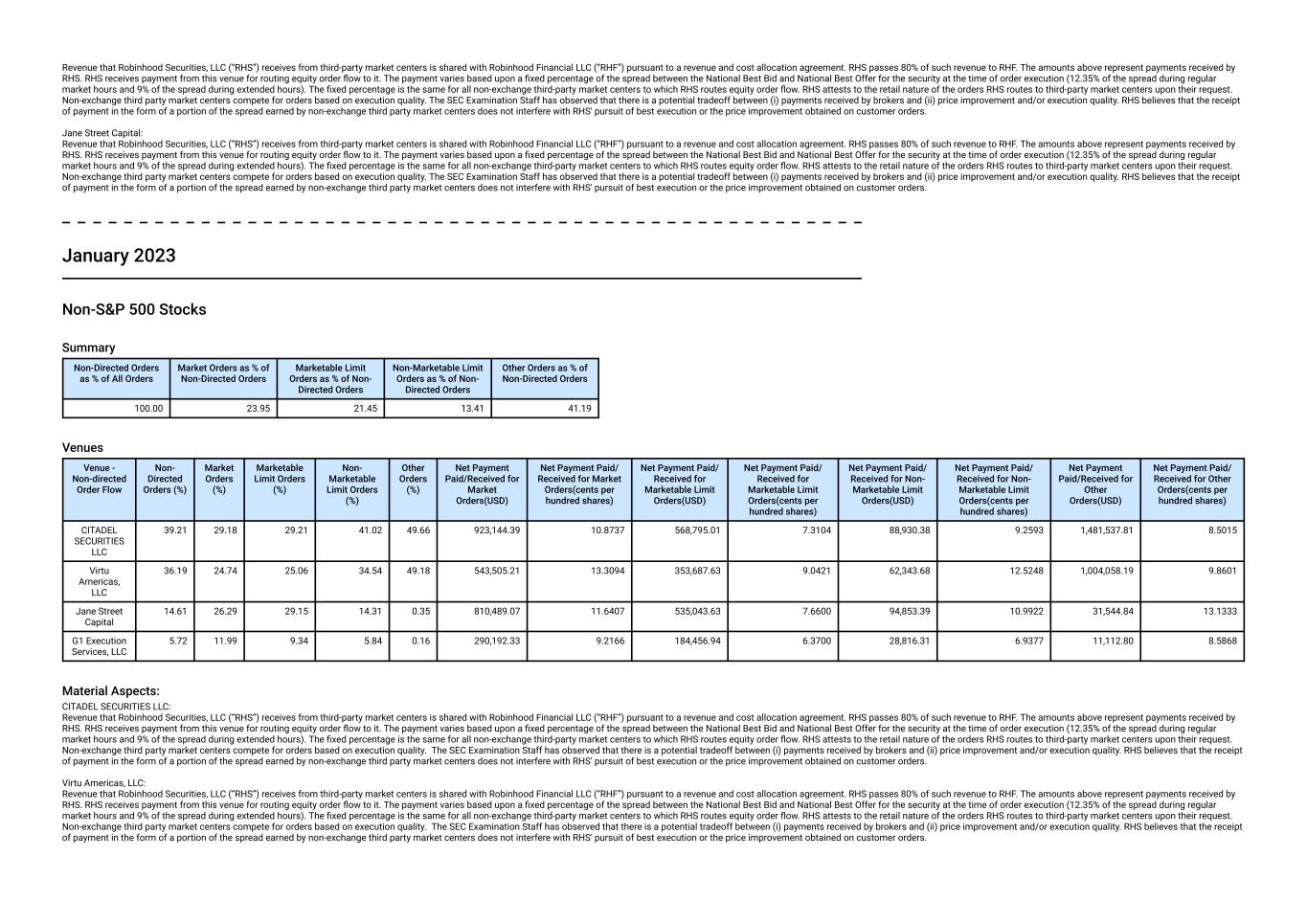

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. January 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 23.95 21.45 13.41 41.19 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 39.21 29.18 29.21 41.02 49.66 923,144.39 10.8737 568,795.01 7.3104 88,930.38 9.2593 1,481,537.81 8.5015 Virtu Americas, LLC 36.19 24.74 25.06 34.54 49.18 543,505.21 13.3094 353,687.63 9.0421 62,343.68 12.5248 1,004,058.19 9.8601 Jane Street Capital 14.61 26.29 29.15 14.31 0.35 810,489.07 11.6407 535,043.63 7.6600 94,853.39 10.9922 31,544.84 13.1333 G1 Execution Services, LLC 5.72 11.99 9.34 5.84 0.16 290,192.33 9.2166 184,456.94 6.3700 28,816.31 6.9377 11,112.80 8.5868 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. January 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.02 34.92 44.78 20.29 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 30.60 35.26 28.13 32.04 31.64 792.13 58.8070 7,813,610.10 46.9142 4,347,031.57 54.1050 1,215,257.70 42.1639 Dash/IMC Financial Markets 29.69 21.39 28.86 31.38 27.36 1,120.57 56.3951 5,660,641.15 51.8644 3,251,298.30 58.6880 860,379.50 45.7316 Wolverine Execution Services, LLC 23.79 28.39 27.67 20.50 24.39 271.98 55.9630 4,346,762.40 42.3619 2,231,763.52 45.3571 902,614.85 39.3855 Global Execution Brokers, LP 8.55 8.82 8.15 8.65 9.04 819.70 40.9645 3,122,359.85 46.5848 1,534,488.60 51.7449 569,009.80 40.7780 Morgan Stanley & Co., LLC 7.37 6.13 7.19 7.43 7.56 142.20 59.7479 1,928,359.42 46.5487 1,050,013.35 52.5566 399,189.70 41.3701 Material Aspects: CITADEL SECURITIES LLC:

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In January, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In January, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In January, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Global Execution Brokers, LP: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In January, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In January, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. February 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 26.70 17.59 13.92 41.79 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares)

Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 47.08 33.69 33.62 45.12 61.95 100,926.78 47.8869 58,562.01 46.0738 7,374.42 34.7447 254,132.84 88.3683 CITADEL SECURITIES LLC 28.60 20.09 21.86 27.95 37.07 77,511.06 25.7355 43,138.77 24.3610 7,029.85 18.9262 189,454.46 56.0938 G1 Execution Services, LLC 11.95 22.85 22.00 13.44 0.27 85,639.50 42.0766 49,314.66 40.3768 5,908.44 30.2104 2,230.95 38.6232 Jane Street Capital 10.70 20.45 20.09 11.53 0.24 103,284.15 41.4675 57,187.49 39.0089 7,245.37 26.2710 2,409.76 35.3463 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. February 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 23.37 21.47 13.42 41.74

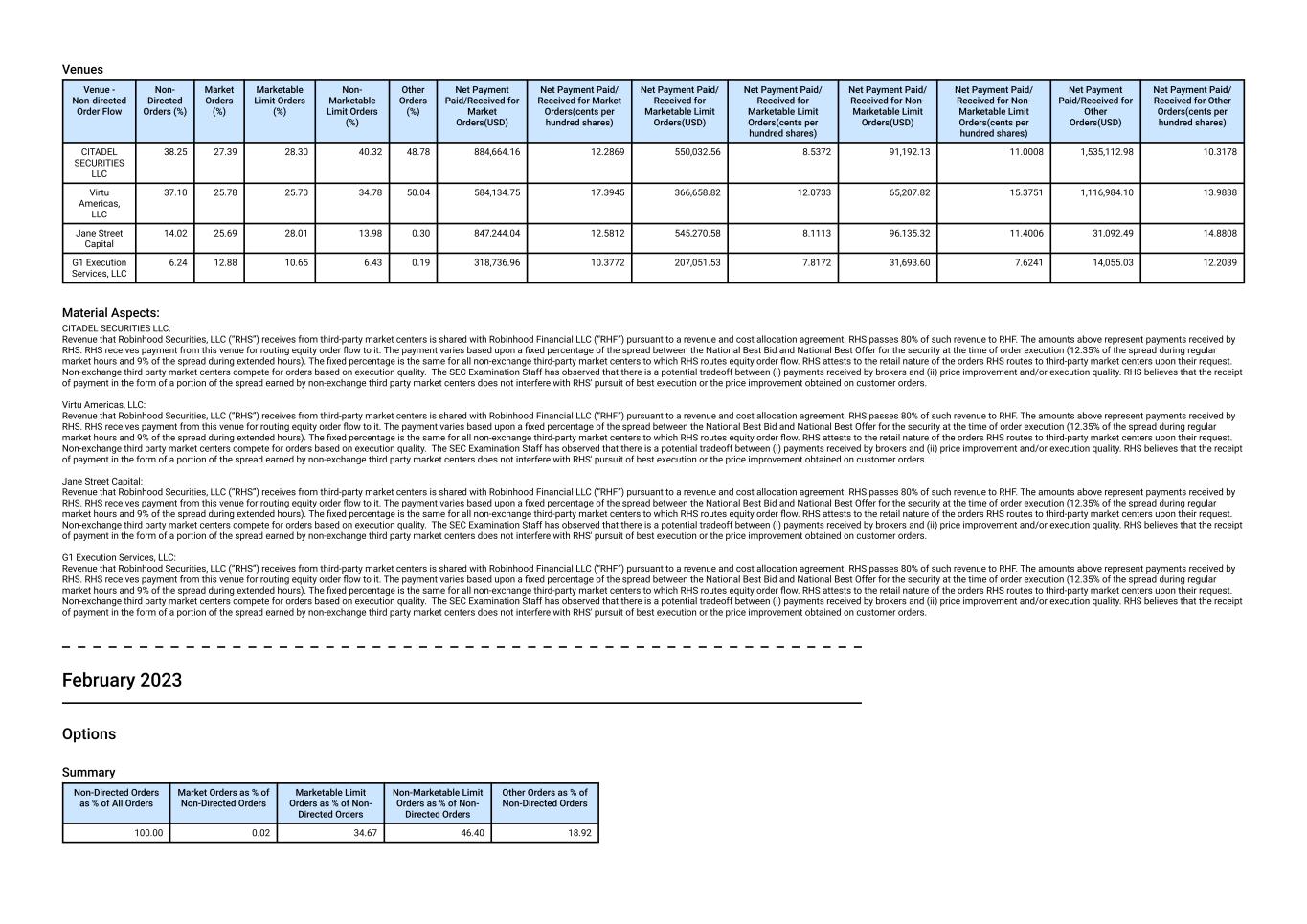

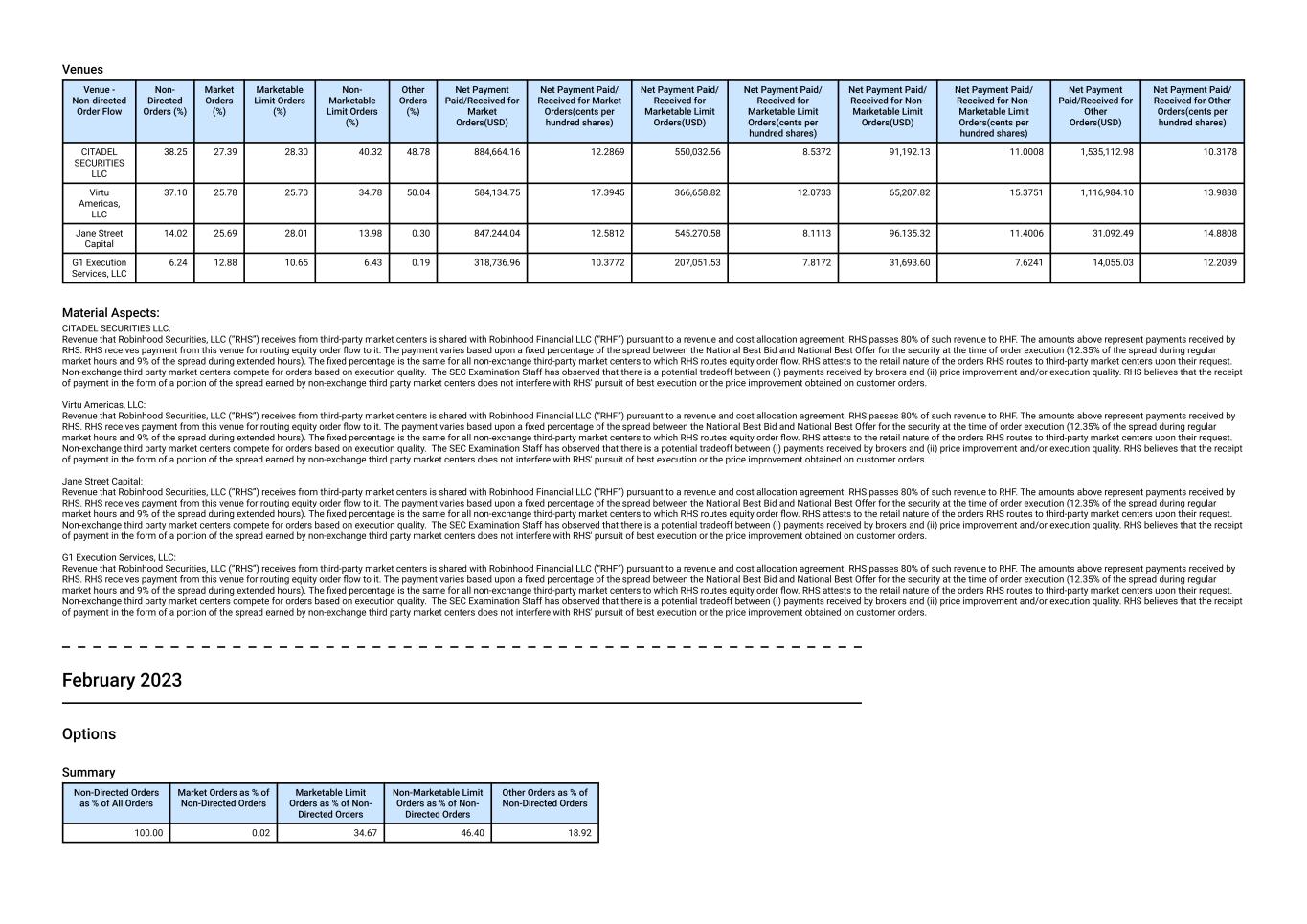

Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 38.25 27.39 28.30 40.32 48.78 884,664.16 12.2869 550,032.56 8.5372 91,192.13 11.0008 1,535,112.98 10.3178 Virtu Americas, LLC 37.10 25.78 25.70 34.78 50.04 584,134.75 17.3945 366,658.82 12.0733 65,207.82 15.3751 1,116,984.10 13.9838 Jane Street Capital 14.02 25.69 28.01 13.98 0.30 847,244.04 12.5812 545,270.58 8.1113 96,135.32 11.4006 31,092.49 14.8808 G1 Execution Services, LLC 6.24 12.88 10.65 6.43 0.19 318,736.96 10.3772 207,051.53 7.8172 31,693.60 7.6241 14,055.03 12.2039 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. February 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.02 34.67 46.40 18.92

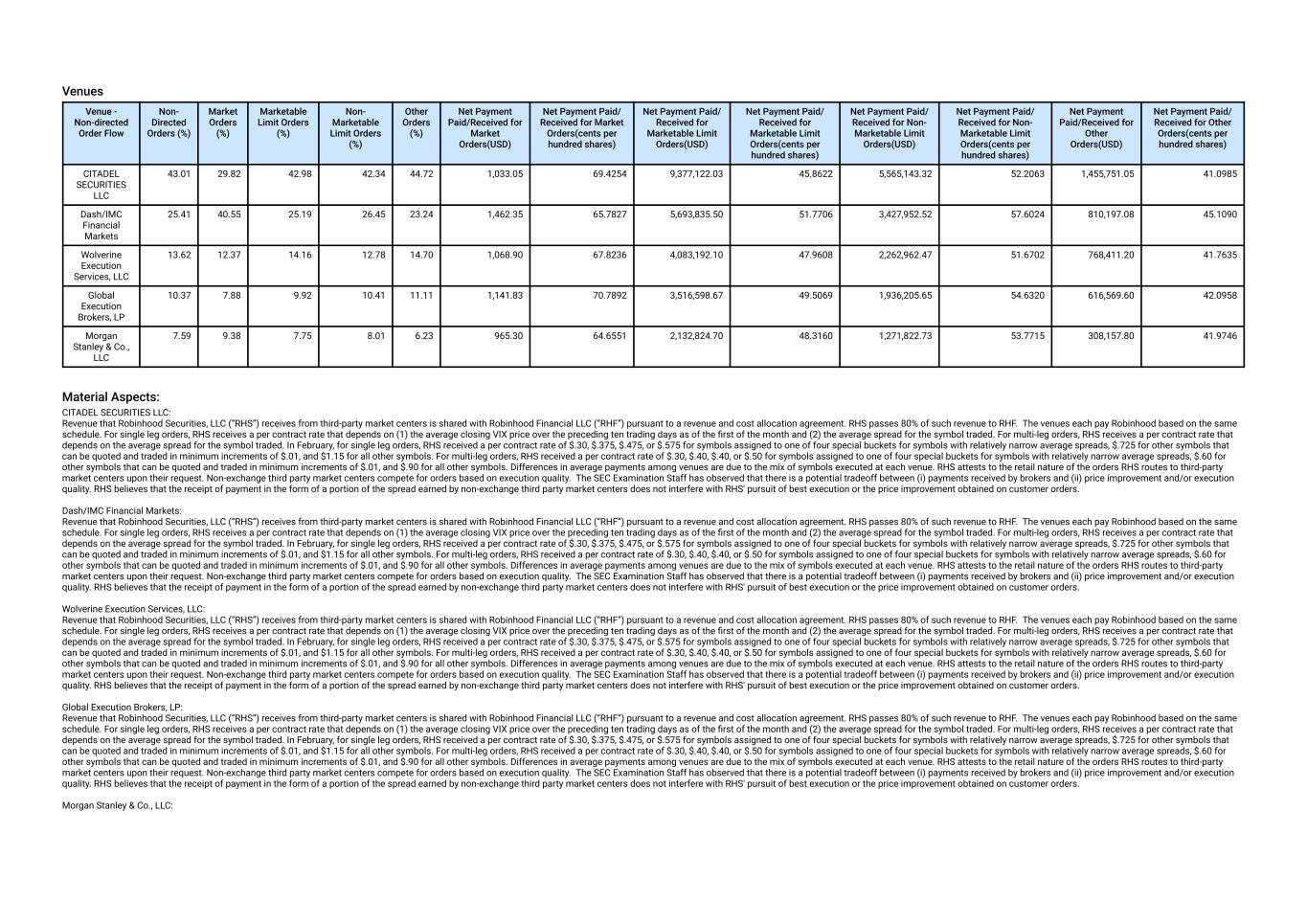

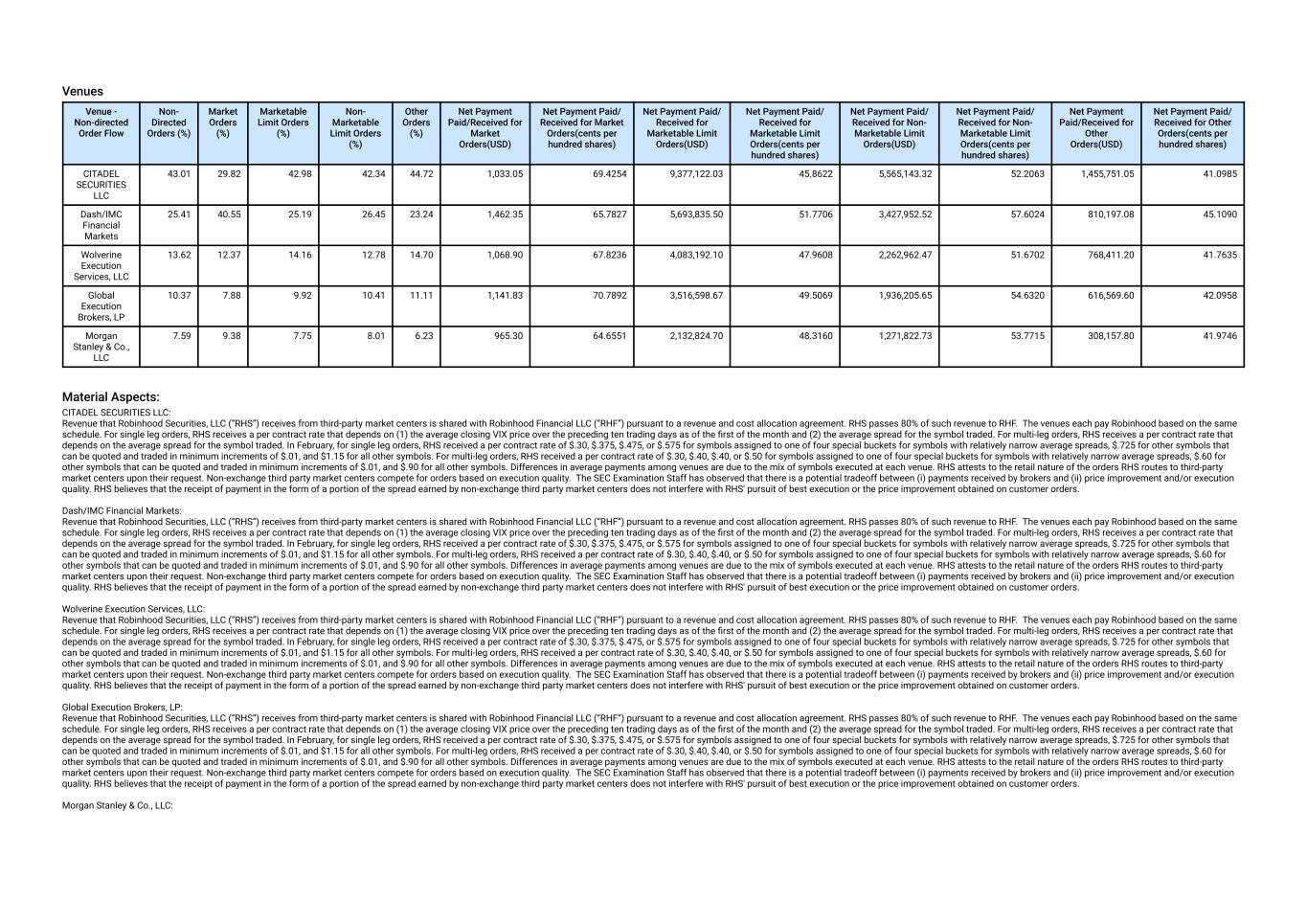

Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 43.01 29.82 42.98 42.34 44.72 1,033.05 69.4254 9,377,122.03 45.8622 5,565,143.32 52.2063 1,455,751.05 41.0985 Dash/IMC Financial Markets 25.41 40.55 25.19 26.45 23.24 1,462.35 65.7827 5,693,835.50 51.7706 3,427,952.52 57.6024 810,197.08 45.1090 Wolverine Execution Services, LLC 13.62 12.37 14.16 12.78 14.70 1,068.90 67.8236 4,083,192.10 47.9608 2,262,962.47 51.6702 768,411.20 41.7635 Global Execution Brokers, LP 10.37 7.88 9.92 10.41 11.11 1,141.83 70.7892 3,516,598.67 49.5069 1,936,205.65 54.6320 616,569.60 42.0958 Morgan Stanley & Co., LLC 7.59 9.38 7.75 8.01 6.23 965.30 64.6551 2,132,824.70 48.3160 1,271,822.73 53.7715 308,157.80 41.9746 Material Aspects: CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In February, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In February, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In February, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Global Execution Brokers, LP: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In February, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Morgan Stanley & Co., LLC:

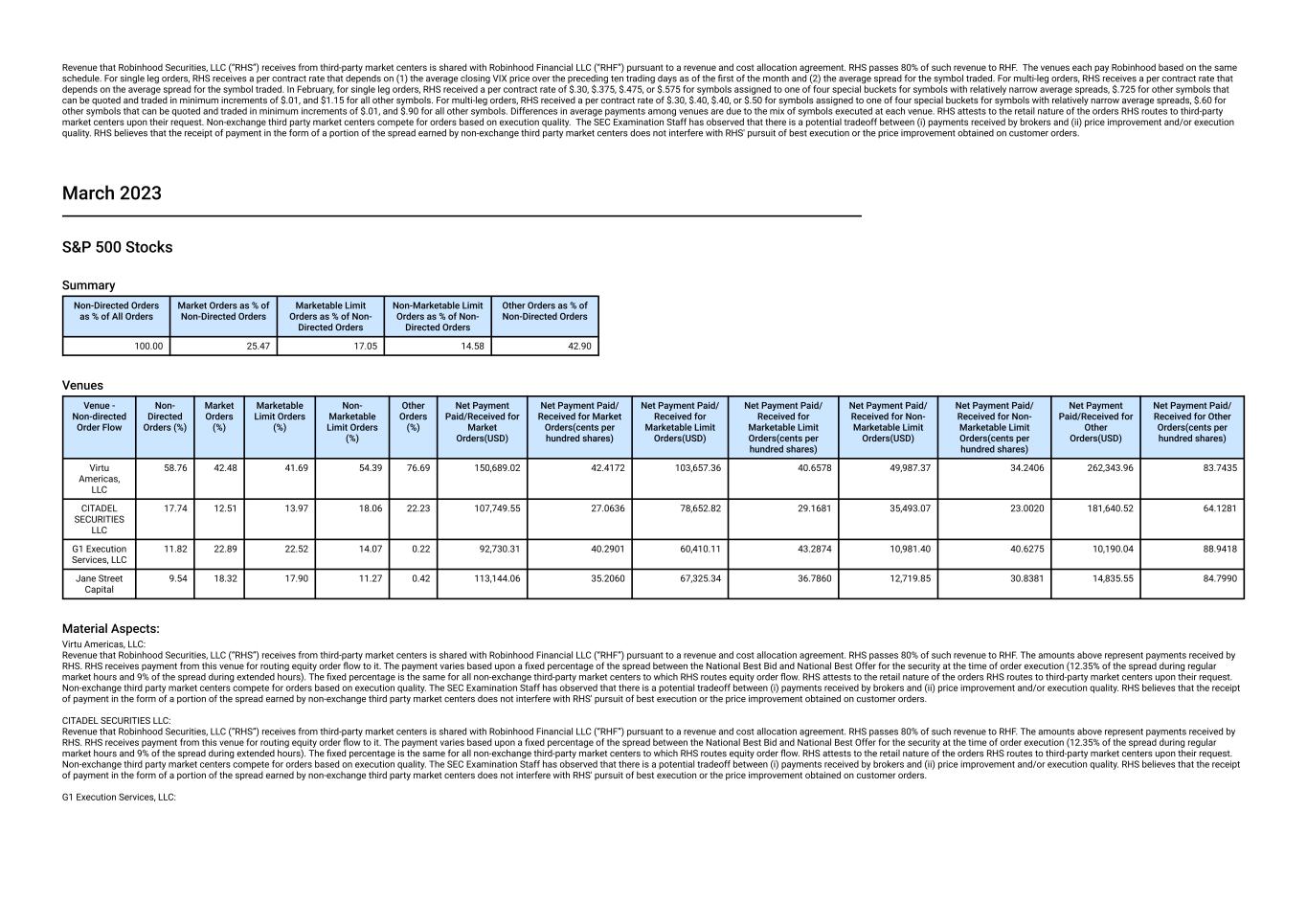

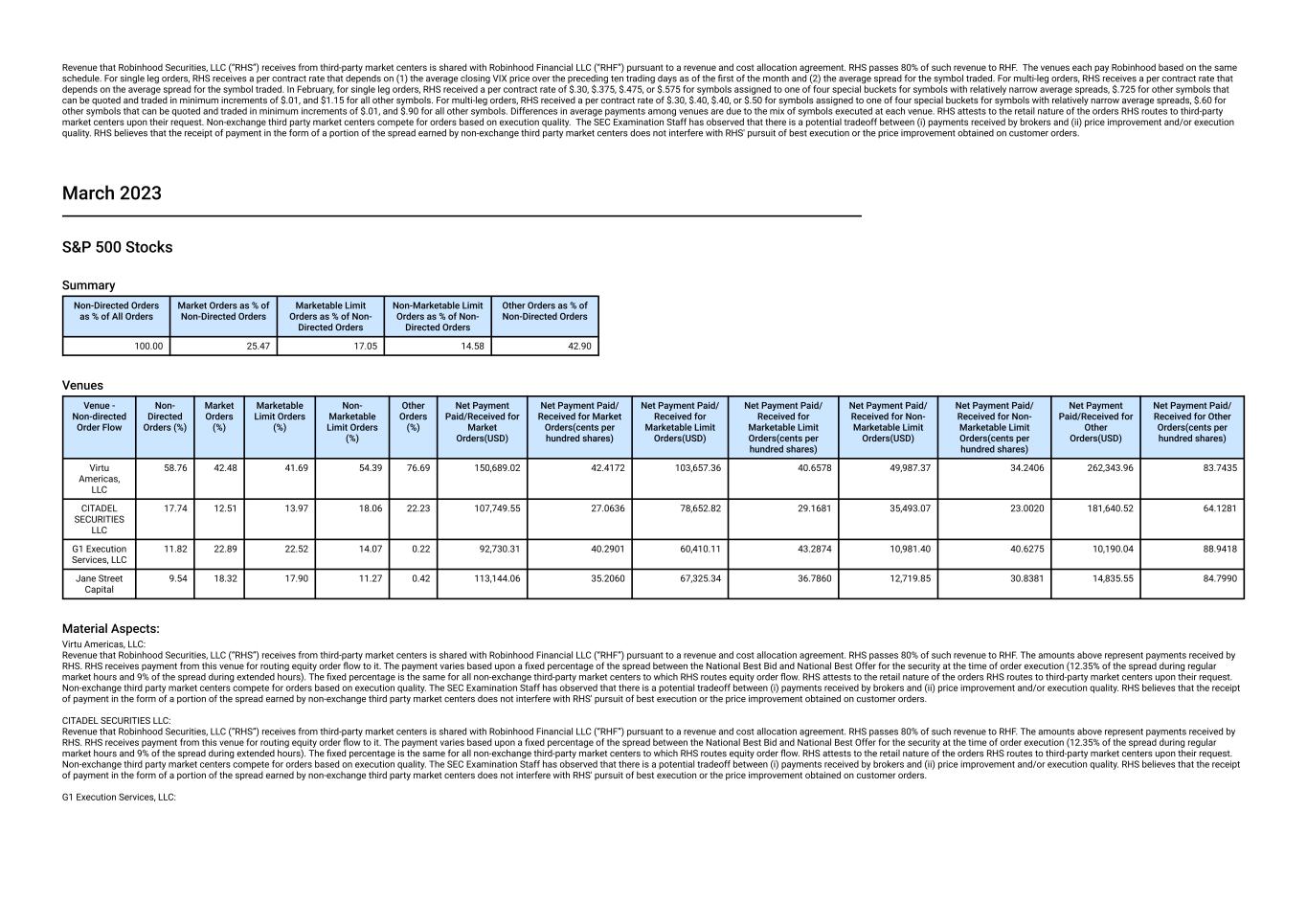

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In February, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. March 2023 S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 25.47 17.05 14.58 42.90 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 58.76 42.48 41.69 54.39 76.69 150,689.02 42.4172 103,657.36 40.6578 49,987.37 34.2406 262,343.96 83.7435 CITADEL SECURITIES LLC 17.74 12.51 13.97 18.06 22.23 107,749.55 27.0636 78,652.82 29.1681 35,493.07 23.0020 181,640.52 64.1281 G1 Execution Services, LLC 11.82 22.89 22.52 14.07 0.22 92,730.31 40.2901 60,410.11 43.2874 10,981.40 40.6275 10,190.04 88.9418 Jane Street Capital 9.54 18.32 17.90 11.27 0.42 113,144.06 35.2060 67,325.34 36.7860 12,719.85 30.8381 14,835.55 84.7990 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC:

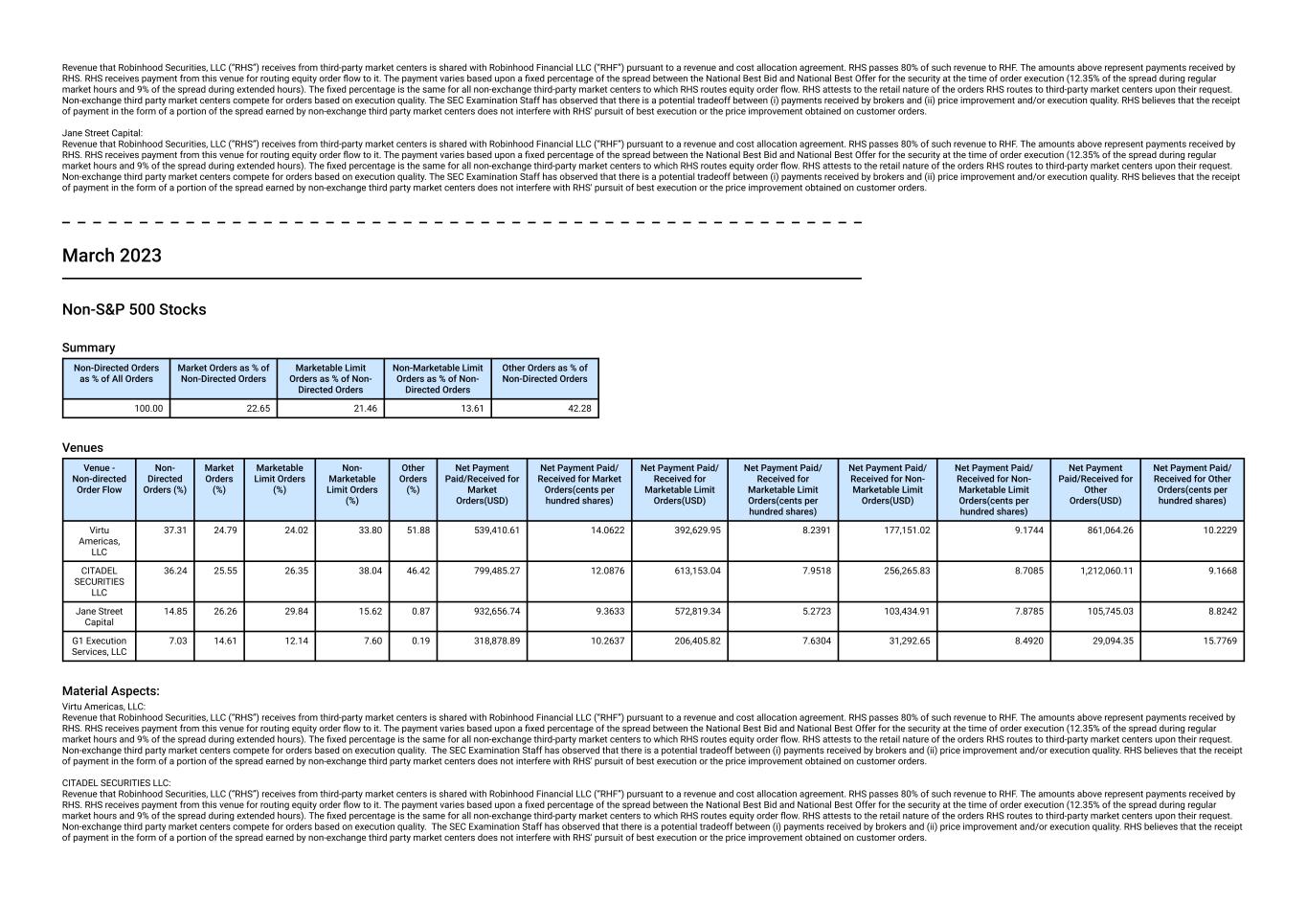

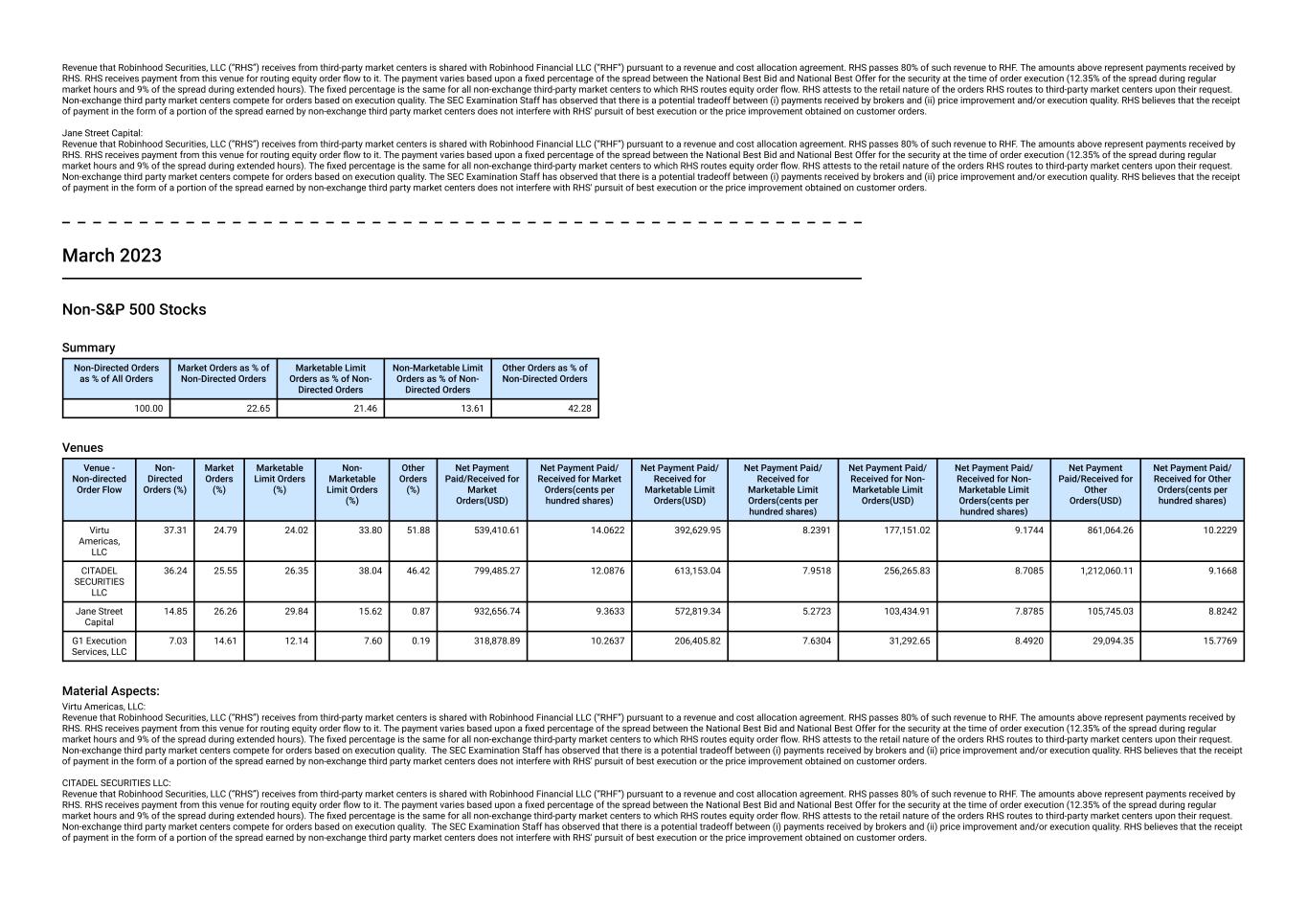

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. March 2023 Non-S&P 500 Stocks Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 22.65 21.46 13.61 42.28 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) Virtu Americas, LLC 37.31 24.79 24.02 33.80 51.88 539,410.61 14.0622 392,629.95 8.2391 177,151.02 9.1744 861,064.26 10.2229 CITADEL SECURITIES LLC 36.24 25.55 26.35 38.04 46.42 799,485.27 12.0876 613,153.04 7.9518 256,265.83 8.7085 1,212,060.11 9.1668 Jane Street Capital 14.85 26.26 29.84 15.62 0.87 932,656.74 9.3633 572,819.34 5.2723 103,434.91 7.8785 105,745.03 8.8242 G1 Execution Services, LLC 7.03 14.61 12.14 7.60 0.19 318,878.89 10.2637 206,405.82 7.6304 31,292.65 8.4920 29,094.35 15.7769 Material Aspects: Virtu Americas, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. CITADEL SECURITIES LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.

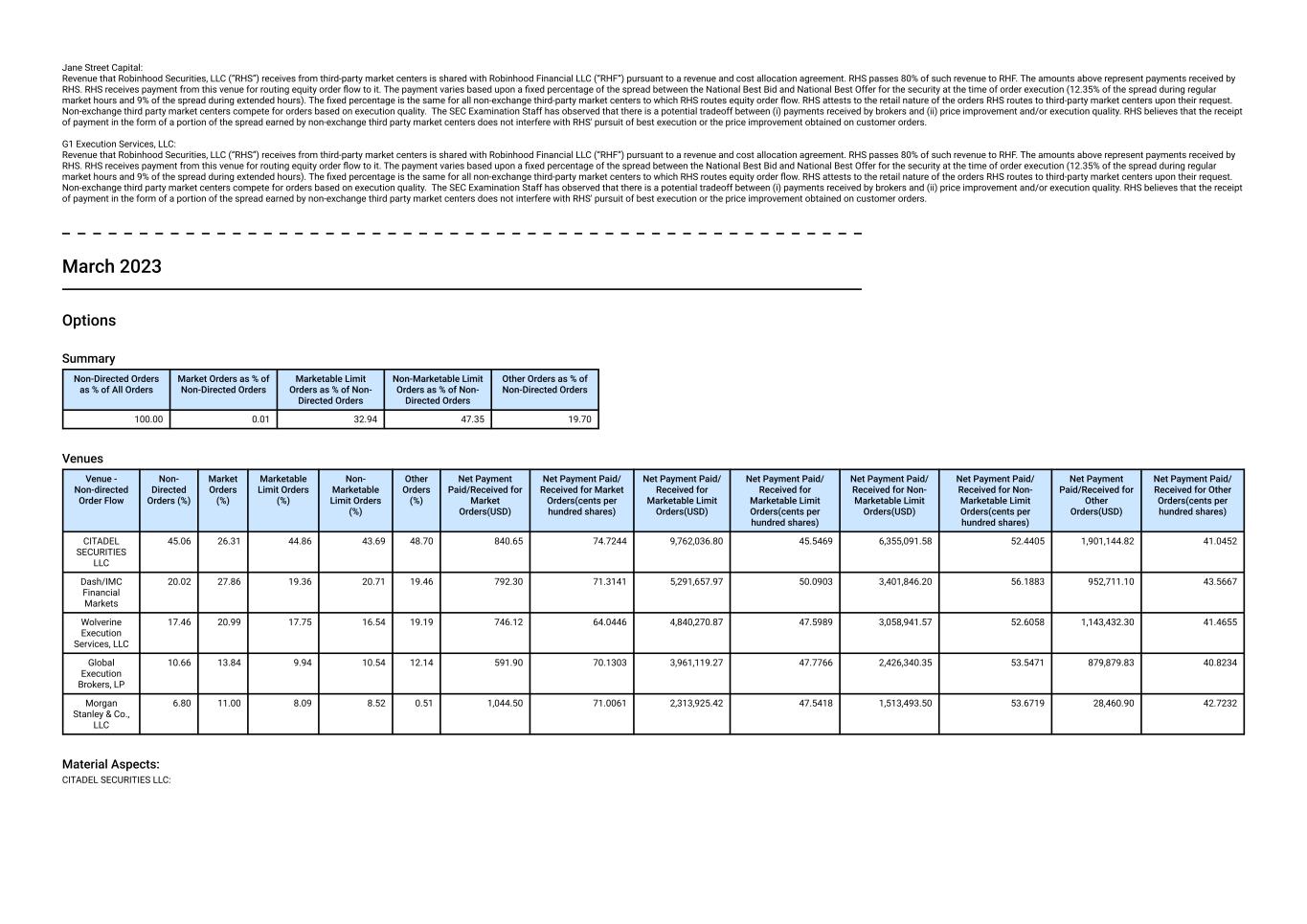

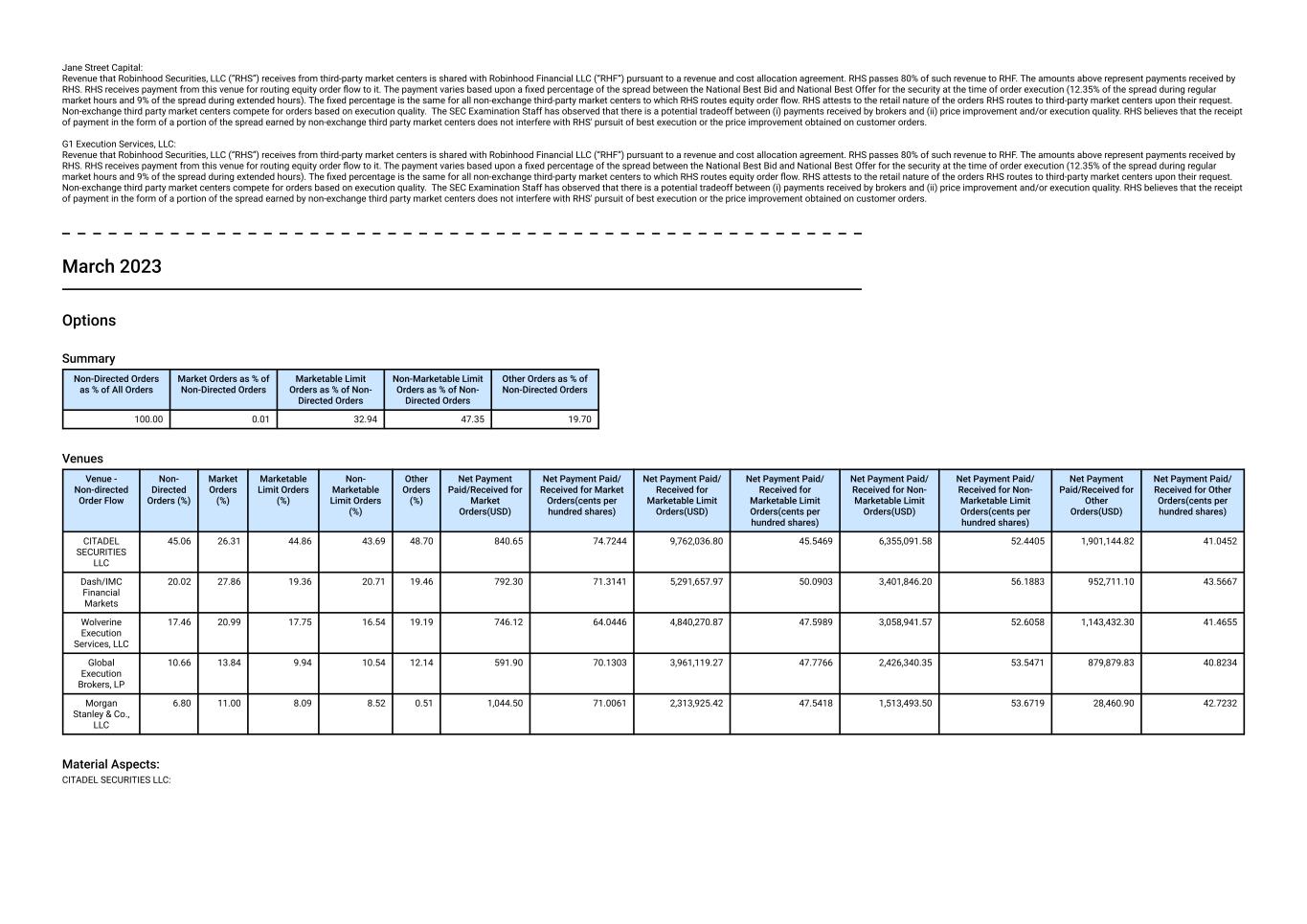

Jane Street Capital: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. G1 Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The amounts above represent payments received by RHS. RHS receives payment from this venue for routing equity order flow to it. The payment varies based upon a fixed percentage of the spread between the National Best Bid and National Best Offer for the security at the time of order execution (12.35% of the spread during regular market hours and 9% of the spread during extended hours). The fixed percentage is the same for all non-exchange third-party market centers to which RHS routes equity order flow. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. March 2023 Options Summary Non-Directed Orders as % of All Orders Market Orders as % of Non-Directed Orders Marketable Limit Orders as % of Non- Directed Orders Non-Marketable Limit Orders as % of Non- Directed Orders Other Orders as % of Non-Directed Orders 100.00 0.01 32.94 47.35 19.70 Venues Venue - Non-directed Order Flow Non- Directed Orders (%) Market Orders (%) Marketable Limit Orders (%) Non- Marketable Limit Orders (%) Other Orders (%) Net Payment Paid/Received for Market Orders(USD) Net Payment Paid/ Received for Market Orders(cents per hundred shares) Net Payment Paid/ Received for Marketable Limit Orders(USD) Net Payment Paid/ Received for Marketable Limit Orders(cents per hundred shares) Net Payment Paid/ Received for Non- Marketable Limit Orders(USD) Net Payment Paid/ Received for Non- Marketable Limit Orders(cents per hundred shares) Net Payment Paid/Received for Other Orders(USD) Net Payment Paid/ Received for Other Orders(cents per hundred shares) CITADEL SECURITIES LLC 45.06 26.31 44.86 43.69 48.70 840.65 74.7244 9,762,036.80 45.5469 6,355,091.58 52.4405 1,901,144.82 41.0452 Dash/IMC Financial Markets 20.02 27.86 19.36 20.71 19.46 792.30 71.3141 5,291,657.97 50.0903 3,401,846.20 56.1883 952,711.10 43.5667 Wolverine Execution Services, LLC 17.46 20.99 17.75 16.54 19.19 746.12 64.0446 4,840,270.87 47.5989 3,058,941.57 52.6058 1,143,432.30 41.4655 Global Execution Brokers, LP 10.66 13.84 9.94 10.54 12.14 591.90 70.1303 3,961,119.27 47.7766 2,426,340.35 53.5471 879,879.83 40.8234 Morgan Stanley & Co., LLC 6.80 11.00 8.09 8.52 0.51 1,044.50 71.0061 2,313,925.42 47.5418 1,513,493.50 53.6719 28,460.90 42.7232 Material Aspects: CITADEL SECURITIES LLC:

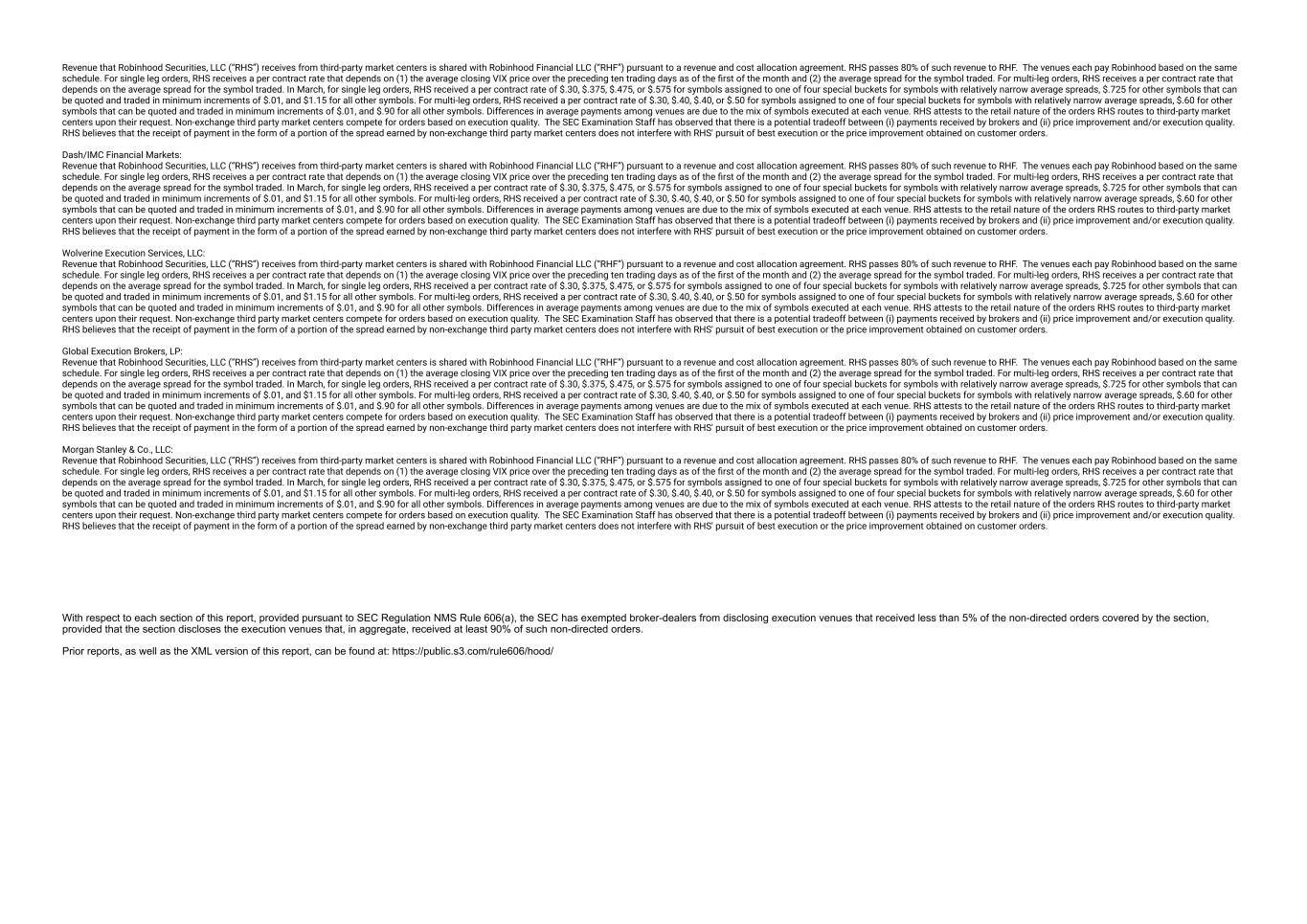

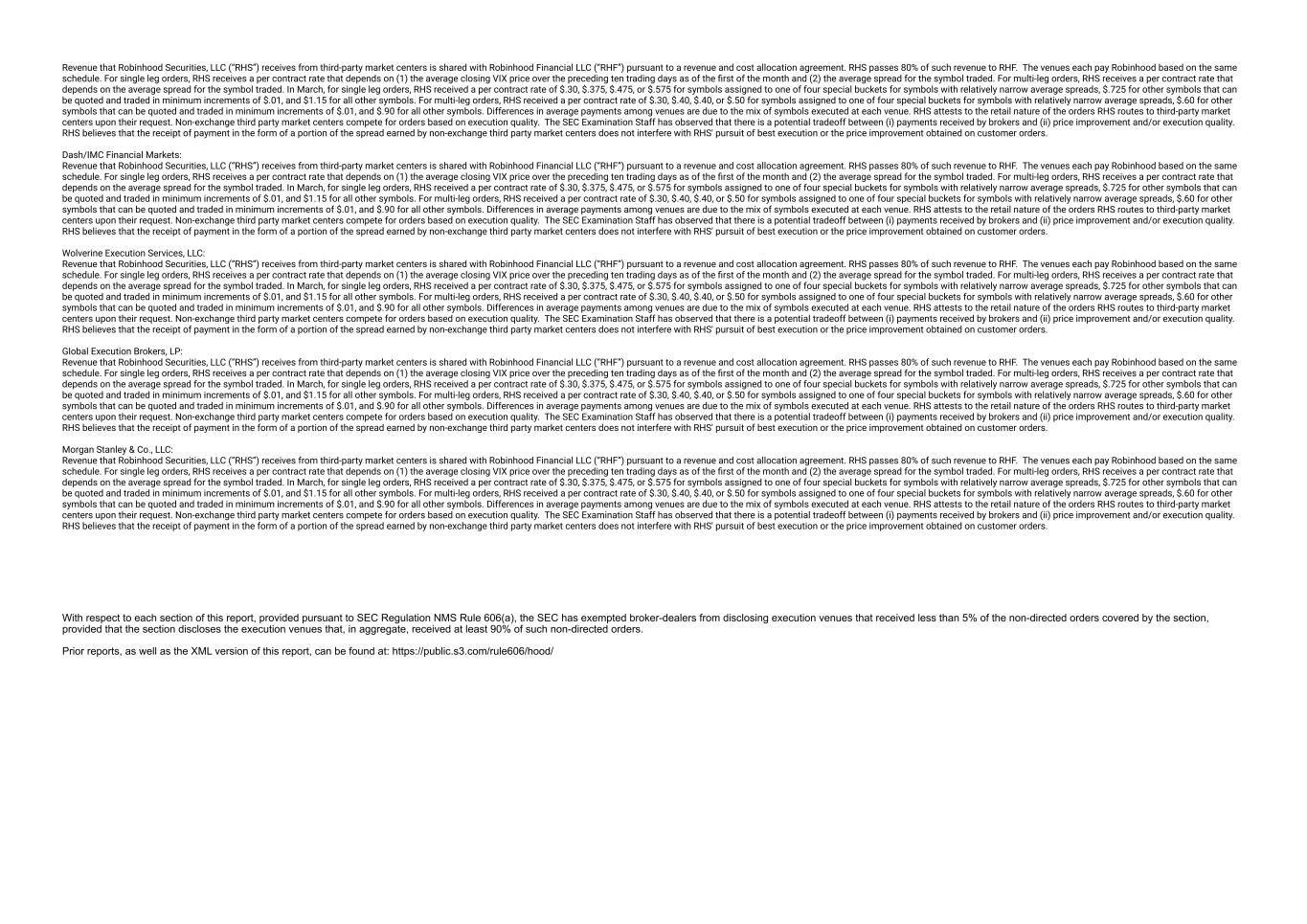

Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In March, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Dash/IMC Financial Markets: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In March, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Wolverine Execution Services, LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In March, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Global Execution Brokers, LP: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In March, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders. Morgan Stanley & Co., LLC: Revenue that Robinhood Securities, LLC (“RHS”) receives from third-party market centers is shared with Robinhood Financial LLC (“RHF”) pursuant to a revenue and cost allocation agreement. RHS passes 80% of such revenue to RHF. The venues each pay Robinhood based on the same schedule. For single leg orders, RHS receives a per contract rate that depends on (1) the average closing VIX price over the preceding ten trading days as of the first of the month and (2) the average spread for the symbol traded. For multi-leg orders, RHS receives a per contract rate that depends on the average spread for the symbol traded. In March, for single leg orders, RHS received a per contract rate of $.30, $.375, $.475, or $.575 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.725 for other symbols that can be quoted and traded in minimum increments of $.01, and $1.15 for all other symbols. For multi-leg orders, RHS received a per contract rate of $.30, $.40, $.40, or $.50 for symbols assigned to one of four special buckets for symbols with relatively narrow average spreads, $.60 for other symbols that can be quoted and traded in minimum increments of $.01, and $.90 for all other symbols. Differences in average payments among venues are due to the mix of symbols executed at each venue. RHS attests to the retail nature of the orders RHS routes to third-party market centers upon their request. Non-exchange third party market centers compete for orders based on execution quality. The SEC Examination Staff has observed that there is a potential tradeoff between (i) payments received by brokers and (ii) price improvement and/or execution quality. RHS believes that the receipt of payment in the form of a portion of the spread earned by non-exchange third party market centers does not interfere with RHS' pursuit of best execution or the price improvement obtained on customer orders.