U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANY

Investment Company Act File Number 811-23460

IDR Core Property Index Fund Ltd

(Exact name of registrant as specified in charter)

3 Summit Park Drive

Suite 450

Independence, OH 44131

(Address of Principal Executive Offices)

Gary A. Zdolshek

IDR Investment Management, LLC

3 Summit Park Drive

Suite 450

Independence, OH 44131

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (216) 622-0004

Date of fiscal year end: June 30

Date of reporting period: June 30, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Report to Shareholders |

Core Property Index Fund Ltd

Core Property Index Fund Ltd

Annual Report

For the Year Ended June 30, 2023

IDR Core Property Index Fund Ltd

TABLE OF CONTENTS

For the Year Ended June 30, 2023

| | |

Management’s Discussion of Fund Performance | 1 |

Report of Independent Registered Public Accounting Firm | 2 |

Company Performance | 3 |

Schedule of Investments | 4 |

Statement of Assets and Liabilities | 6 |

Statement of Operations | 7 |

Statements of Changes in Net Assets | 8 |

Statement of Cash Flows | 9 |

Financial Highlights | 10 |

Notes to Financial Statements | 11 |

Other Information | 20 |

Management | 23 |

This report is submitted for the general information of the stockholders of the Fund. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus, which includes information regarding the Fund’s risks, objectives, fees and expenses, experience of its management and other information.

IDR Core Property Index Fund Ltd

Management’s Discussion of Fund Performance

June 30, 2023 (Unaudited)

Please find herein the summary of operations and audited financial statements of the IDR Core Property Index Fund LTD (“Index Fund”, “Fund” or “CPIF”) for the fiscal year ended June 30, 2023. Over the trailing 1-year period, financial markets shifted including the Fund’s Index, the National Council of Investment Fiduciaries Open End Diversified Core Equity Index (“NFI-ODCE X Index”). The net total return of the NFI-ODCE X Index Fund was -10.6% compared to the Fund’s net return of -11.0%. The Fund continues to execute its strategy of seeking to track the Index with low tracking error. For the quarter ended June 30, 2023, the Fund’s -3.0% net total return tracked the NFI-ODCE X Index net total return of -2.9%.

The Fund’s distribution policy is to make quarterly distributions to shareholders. During the twelve-month period ended June 30, 2023, the Fund made distributions to shareholders totaling $.50 per share, of which we expect a portion will be treated as a return of capital for tax purposes. There is no assurance that the Fund will continue to declare distributions or that they will continue at these rates.

Despite uncertainty with rising rates, the S&P 500 posted a total return of 8.7% in the second quarter and 19.6% over the trailing year as public equities rebounded from cyclical lows. The Federal Reserve has steadily raised their target interest rate by 350 basis points during the fiscal year to reduce inflation. This has raised lending costs for real estate investors with higher levered borrowers being most negatively affected. Core real estate investors with low leverage remain mostly insulated from rising rates. Private real estate market fundamentals and operating performance remain mostly healthy for institutional quality properties, with the exception of the broader office market, however the Fund remains more insulated due to lower leverage. Key operating metrics of the index remained relatively unchanged with occupancy and leverage at 93% and 25%, respectively. Same-store net operating income (“NOI”) for the Index grew 4.5% over the trailing year and continued to keep pace with inflation (4.1%). Over the past 40 years the index has only experienced 5 calendar years of negative total returns and each of those periods have proven to be an attractive buying opportunity at lower pricing. We remain confident that patient investors will be rewarded in this market environment once again.

1

IDR Core Property Index Fund Ltd

Report of Independent Registered Public Accounting Firm

To the Stockholders and the Board of Directors of

IDR Core Property Index Fund Ltd.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of IDR Core Property Index Fund Ltd. (the Company), including the schedule of investments, as of June 30, 2023, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the related notes to the financial statements (collectively, the financial statements), and the financial highlights for each of the two years in the period then ended and for the period from April 1, 2021 (commencement of operations) through June 30, 2021. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Company as of June 30, 2023, the results of its operations and its cash flows for the year then ended, the changes in net assets for each of the two years in the period then ended and the financial highlights for each of the two years then ended and for the period from April 1, 2021 (commencement of operations) through June 30, 2021, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of investments owned as of June 30, 2023, by correspondence with the custodian and the underlying fund advisors. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

/s/ RSM US LLP

We have served as the auditor of one or more IDR Investment Management, LLC investment companies since 2020.

Denver, Colorado

August 29, 2023

2

IDR Core Property Index Fund Ltd

Company Performance

June 30, 2023 (Unaudited)

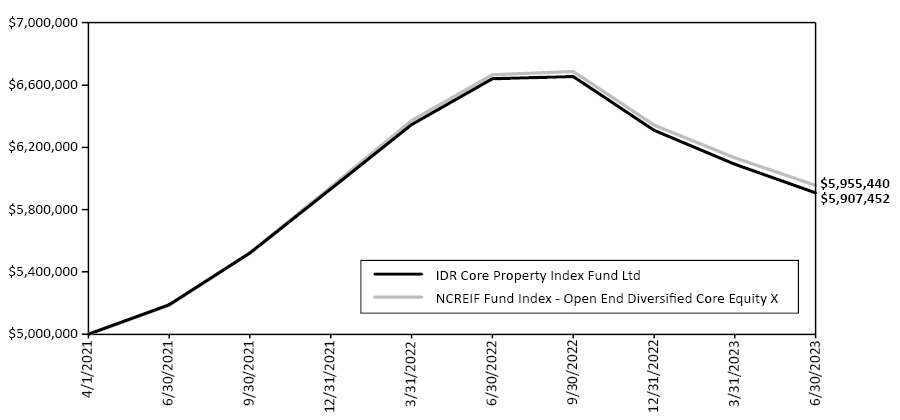

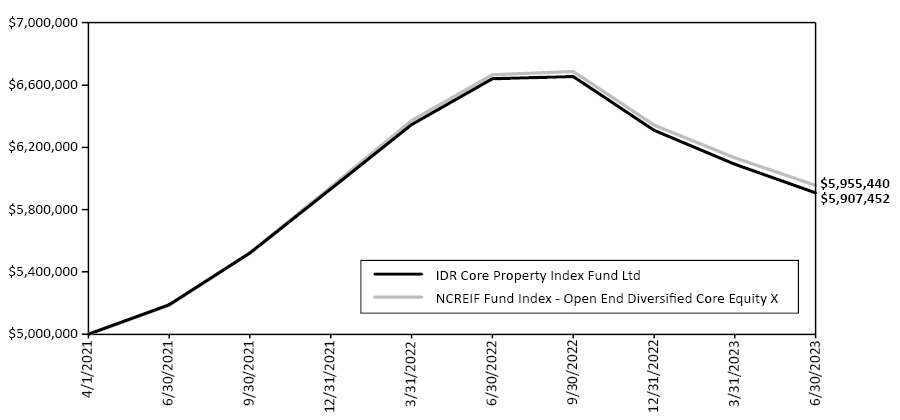

Performance of a $5,000,000 Investment

This graph compares a hypothetical $5,000,000 investment in the Fund’s shares, made at its inception, with a similar investment in the NCREIF Fund Index - Open End Diversified Core Equity X. Results include the reinvestment of all dividends and capital gains.

The NCREIF Fund Index - Open End Diversified Core Equity X is an index of investment returns reporting on both a historical and current basis the results of open-end commingled funds pursuing a core real estate investment strategy, some of which have performance histories dating back to the 1970s. The index does not reflect expenses, fees or sales charge, which would lower performance. The index is unmanaged and it is not possible to invest in an index.

Average Annual Total Returns as June 30, 2023 | | 1 Year | | | Since Inception* | |

IDR Core Property Index Fund Ltd | | | (11.03 | )% | | | 7.71 | % |

NCREIF Fund Index - Open End Diversified Core Equity X | | | (10.65 | )% | | | 8.08 | % |

* | Commencement of operations for the IDR Core Property Index Fund Ltd was April 1, 2021. |

The performance data quoted here represents past performance and past performance is not a guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance information quoted. The most recent quarter end performance may be obtained by calling 1.210.459.7781.

For the Fund’s current expense ratios, please refer to the Financial Highlights Section of this report. The Manager and the Company have entered into an operational expense limitation agreement (the “Expense Limitation”) under which the Manager has agreed, during the calendar quarter commencing July 1, 2021 and ending September 30, 2021 and during the calendar quarter commencing October 1, 2021 and ending December 31, 2021 and during the calendar quarter commencing January 1, 2022 and ending March 31, 2022 and during the calendar quarter commencing April 1, 2022 and ending June 30, 2022 and during the calendar quarter commencing July 1, 2022 and ending September 30, 2022 and during the calendar quarter commencing January 1, 2023 and ending March 31, 2023 and during the calendar quarter commencing April 1, 2023 and ending June 30, 2023 (each a “Limitation Period”), to absorb the ordinary operating expenses of the Company (excluding interest, brokerage commissions and extraordinary expenses of the Company) (“Operating Expenses”) that exceed 0.20%, 0.00%, 0.00%, 0.02%, 0.15%, 0.34% and 0.10% per quarter, respectively, of the Company’s net assets attributable to interests in the Company at the end of the Limitation Period.

Returns reflect the reinvestment of distributions made by the Fund, if any. The graph and the performance table above do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

IDR Core Property Index Fund Ltd

Schedule of Investments

As of June 30, 2023

| | | Original

Acquisition

Date | | | Shares/

Units | | | Percent of

Net Assets | | | Cost | | | Fair Value | |

PRIVATE REAL ESTATE INVESTMENT FUNDS – 94.8% | | | | | | | | | | | | | | | | | | | | |

UNITED STATES OF AMERICA (a)(b) – 94.8% | | | | | | | | | | | | | | | | | | | | |

ARA Core Property Fund, LP | | | 10/3/2022 | | | | 6 | | | | 2.8 | % | | $ | 1,000,000 | | | $ | 866,901 | |

ASB Allegiance Real Estate Fund, LP | | | 12/31/2021 | | | | 706 | | | | 3.8 | % | | | 1,222,500 | | | | 1,173,451 | |

BGO Diversified U.S. Property Fund, LP | | | 10/1/2021 | | | | 546 | | | | 4.9 | % | | | 1,400,000 | | | | 1,507,252 | |

Blackrock US Core Property Fund, L.P. | | | 1/1/2022 | | | | n/a | | | | 3.8 | % | | | 1,222,500 | | | | 1,147,660 | |

CBRE U.S. Core Partners, LP | | | 12/31/2021 | | | | 1,489,378 | | | | 8.8 | % | | | 2,960,000 | | | | 2,698,736 | |

Clarion Lion Properties Fund, LP | | | 4/1/2021 | | | | 1,376 | | | | 7.6 | % | | | 2,143,899 | | | | 2,329,096 | |

Invesco Core Real Estate - U.S.A., L.P. | | | 4/1/2021 | | | | 12 | | | | 8.0 | % | | | 2,238,286 | | | | 2,463,927 | |

JP Morgan Strategic Property Fund FIV2 (U.S.), LP | | | 10/1/2021 | | | | 330,052 | | | | 13.3 | % | | | 3,949,472 | | | | 4,063,495 | |

Prime Property Fund, LLC | | | 6/30/2021 | | | | 342 | | | | 18.3 | % | | | 5,321,187 | | | | 5,589,600 | |

PRISA LP (c) | | | 4/1/2021 | | | | 1,117 | | | | 8.1 | % | | | 2,041,381 | | | | 2,474,382 | |

RREEF America REIT II, Inc.d | | | 1/1/2022 | | | | 11,263 | | | | 5.3 | % | | | 1,775,000 | | | | 1,616,511 | |

Smart Markets Fund, L.P. | | | 9/1/2021 | | | | 959 | | | | 5.8 | % | | | 1,695,279 | | | | 1,782,596 | |

US Real Estate Investment Fund, LLC | | | 7/1/2022 | | | | 969 | | | | 4.3 | % | | | 1,551,875 | | | | 1,311,180 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL PRIVATE REAL ESTATE INVESTMENT FUNDS | | | | | | | | | | | | | | | 28,521,379 | | | | 29,024,787 | |

| | | | | | | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS – 94.8% | | | | | | | | | | | | | | | 28,521,379 | | | | 29,024,787 | |

Other assets in excess of liabilities – 5.2% | | | | | | | | | | | | | | | | | | | 1,607,552 | |

NET ASSETS – 100% | | | | | | | | | | | | | | | | | | $ | 30,632,339 | |

(a) | Restricted security. The total cost and fair value of these restricted investments as of June 30, 2023 was $28,521,379 and $29,024,787, respectively, which represents 94.8% of total net assets of the Company. |

(b) | Redemptions permitted quarterly and redemption notices for the private real estate investment funds is 90 days or less. |

(c) | As of June 30, 2023, PRISA LP held an investment in PRISA UHC LP, a U.S. domiciled private real estate investment fund. The fair value of the Company’s proportionate ownership of PRISA UHC LP as of June 30, 2023, was approximately $2.47 million, approximately 8.08% of the Company’s Net Assets. |

(d) | The Company held unfunded commitments $675,000 as of June 30, 2023. |

4

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

SUMMARY OF INVESTMENTS

As of June 30, 2023

Security Type/Country of Incorporation | Percent of

Net Assets |

Private Real Estate Investment Funds | |

United States | 94.8% |

Total Private Real Estate Investment Funds | 94.8% |

Total Investments | 94.8% |

Other assets in excess of liabilities | 5.2% |

Net Assets | 100.0% |

5

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

Statement of Assets and Liabilities

As of June 30, 2023

Assets: | | | | |

Investments, at value (cost $28,521,379) | | $ | 29,024,787 | |

Cash | | | 2,116,817 | |

Receivable from Manager | | | 545,038 | |

Distributions from investments receivable | | | 230,205 | |

Prepaid expenses | | | 2,650 | |

Total assets | | | 31,919,497 | |

| | | | | |

Liabilities: | | | | |

Capital withdrawals payable | | | 447,579 | |

Professional fees payable | | | 446,854 | |

Directors’ fees payable | | | 303,750 | |

Chief Compliance Officer fees payable | | | 6,646 | |

Accrued other expenses | | | 82,329 | |

Total liabilities | | | 1,287,158 | |

| | | | | |

Net Assets | | $ | 30,632,339 | |

| | | | | |

Components of Net Assets: | | | | |

Paid-in capital (Common stock, $0.001 par value; 1,000,000,000 shares authorized) | | $ | 29,863,038 | |

Total distributable earnings | | | 769,301 | |

Net Assets | | $ | 30,632,339 | |

| | | | | |

Class A Common Stock: | | | | |

Net assets applicable to common shares outstanding | | $ | 30,632,339 | |

Common shares issued and outstanding | | | 2,802,369 | |

Net asset value per share | | $ | 10.93 | |

6

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

Statement of Operations

For the Year Ended June 30, 2023

Investment Income: | | | | |

Dividend income | | $ | 723,023 | |

Total investment income | | | 723,023 | |

| | | | | |

Expenses: | | | | |

Professional fees | | | 566,458 | |

Directors’ fees | | | 135,000 | |

Management fees | | | 122,319 | |

Accounting and administration fees | | | 90,043 | |

Chief Compliance Officer fees | | | 76,899 | |

Tax expense | | | 18,772 | |

Custodian fees | | | 4,931 | |

Other expenses | | | 107,546 | |

Total expenses | | | 1,121,968 | |

Management fees waived and other expenses reimbursed | | | (860,391 | ) |

Other expenses recovered | | | 168,133 | |

Net expenses | | | 429,710 | |

Net investment income | | | 293,313 | |

| | | | | |

Net Realized Gain and Change in Unrealized Depreciation: | | | | |

Net realized gain on investments | | | 91,254 | |

Net change in unrealized depreciation on investments | | | (4,116,737 | ) |

Net realized gain and change in unrealized depreciation | | | (4,025,483 | ) |

| | | | | |

Net Decrease in Net Assets from Operations | | $ | (3,732,170 | ) |

7

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

Statements of Changes in Net Assets

| | | For the

Year Ended

June 30, 2023 | | | For the

Year Ended

June 30, 2022 | |

Changes in Net Assets from: | | | | | | | | |

Operations: | | | | | | | | |

Net investment income | | $ | 293,313 | | | $ | 414,033 | |

Net realized gain on investments | | | 91,254 | | | | 14,820 | |

Net change in unrealized appreciation (depreciation) on investments | | | (4,116,737 | ) | | | 4,391,003 | |

Net increase (decrease) in Net Assets from operations | | | (3,732,170 | ) | | | 4,819,856 | |

| | | | | | | | | |

Distributions to Shareholders: | | | | | | | | |

Distributions: | | | | | | | | |

Class A common stock | | | (339,480 | ) | | | (197,967 | ) |

Return of capital: | | | | | | | | |

Class A common stock | | | (881,055 | ) | | | (310,786 | ) |

Total distributions to shareholders | | | (1,220,535 | ) | | | (508,753 | ) |

| | | | | | | | | |

Capital Transactions: | | | | | | | | |

Proceeds from sale of shares: | | | | | | | | |

Class A common stock | | | 9,510,000 | | | | 17,807,500 | |

Reinvestment of distributions: | | | | | | | | |

Class A common stock | | | 303,798 | | | | 84,956 | |

Payments for shares repurchased: | | | | | | | | |

Class A common stock | | | (2,432,031 | ) | | | — | |

Net increase in Net Assets from capital transactions | | | 7,381,767 | | | | 17,892,456 | |

| | | | | | | | | |

Total increase in Net Assets | | | 2,429,062 | | | | 22,203,559 | |

| | | | | | | | | |

Net Assets: | | | | | | | | |

Beginning of year | | | 28,203,277 | | | | 5,999,718 | |

End of year | | $ | 30,632,339 | | | $ | 28,203,277 | |

| | | | | | | | | |

Capital Share Transactions: | | | | | | | | |

Shares sold: | | | | | | | | |

Class A common stock | | | 778,183 | | | | 1,613,818 | |

Shares reinvested: | | | | | | | | |

Class A common stock | | | 25,341 | | | | 7,314 | |

Shares repurchased: | | | | | | | | |

Class A common stock | | | (205,952 | ) | | | — | |

Net increase in capital share transactions | | | 597,572 | | | | 1,621,132 | |

8

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

Statement of Cash Flows

For the Year Ended June 30, 2023

Cash flows from operating activities: | | | | |

Net decrease in Net Assets from operations | | $ | (3,732,170 | ) |

Adjustments to reconcile net decrease in net assets from operations to net cash used in operating activities: | | | | |

Capital called by Investment Funds | | | (6,029,405 | ) |

Capital distributions received from Investment Funds | | | 888,240 | |

Net realized gain on investments | | | (91,254 | ) |

Net change in unrealized depreciation on investments | | | 4,116,737 | |

Changes in operating assets and liabilities: | | | | |

Decrease in receivable from Manager | | | 719,087 | |

Increase in distributions from investments receivable | | | (104,725 | ) |

Increase in prepaid expenses | | | (2,650 | ) |

Decrease in offering costs payable | | | (284,020 | ) |

Decrease in organizational costs payable | | | (383,735 | ) |

Increase in professional fees payable | | | 95,408 | |

Increase in directors’ fees payable | | | 135,000 | |

Increase in Chief Compliance Officer fees payable | | | 317 | |

Increase in accrued other expenses | | | 13,924 | |

Net cash used in operating activities | | | (4,659,246 | ) |

| | | | | |

Cash flows from financing activities: | | | | |

Proceeds from shares sold, net of change in proceeds from sale of shares received in advance | | | 7,735,000 | |

Payments for shares repurchased, net of change in capital withdrawals payable | | | (1,984,452 | ) |

Distributions paid to shareholders, net of reinvestments and change in distributions payable | | | (916,737 | ) |

Net cash provided by financing activities | | | 4,833,811 | |

| | | | | |

Net increase in cash | | | 174,565 | |

| | | | | |

Cash: | | | | |

Beginning of year | | | 1,942,252 | |

End of year | | $ | 2,116,817 | |

| | | | | |

Supplemental disclosure of cash flow information: | | | | |

Reinvestments of distributions | | $ | 303,798 | |

Cash paid during the year for taxes | | $ | 18,772 | |

9

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

Financial Highlights

Class A Common Stock

Per share operating performance.

For a capital share outstanding throughout each period.

| | | For the

Year Ended

June 30, 2023 | | | For the

Year Ended

June 30, 2022 | | | For the Period

April 1, 2021*

through

June 30, 2021 | |

Net asset value, beginning of period | | $ | 12.79 | | | $ | 10.28 | | | $ | 10.00 | |

Income from Investment Operations: | | | | | | | | | | | | |

Net investment income (loss) | | | 0.12 | | | | 0.24 | | | | (0.01 | ) |

Net realized and unrealized gain (loss) | | | (1.48 | ) | | | 2.60 | | | | 0.39 | |

Total from investment operations | | | (1.36 | ) | | | 2.84 | | | | 0.38 | |

| | | | | | | | | | | | | |

Less Distributions: | | | | | | | | | | | | |

From net investment income | | | (0.15 | ) | | | (0.13 | ) | | | — | 1 |

From return of capital | | | (0.35 | ) | | | (0.20 | ) | | | (0.10 | ) |

Total distributions | | | (0.50 | ) | | | (0.33 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | |

Net asset value, end of period | | $ | 10.93 | | | $ | 12.79 | | | $ | 10.28 | |

| | | | | | | | | | | | | |

Total Return2 | | | (11.03 | )% | | | 27.96 | % | | | 3.79 | %5 |

| | | | | | | | | | | | | |

Ratios and Supplemental Data: | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | $ | 30,632 | | | $ | 28,203 | | | $ | 6,000 | |

Net investment income (loss) to average net assets3 | | | 0.93 | % | | | 2.05 | % | | | (0.58 | )%6 |

Ratio of gross expenses to average net assets3,4 | | | 3.55 | % | | | 6.66 | % | | | 45.52 | %6 |

Ratio of expense waiver to average net assets3 | | | (2.19 | )% | | | (6.52 | )% | | | (42.78 | )%6 |

Ratio of net expenses to average net assets3 | | | 1.36 | % | | | 0.14 | % | | | 2.74 | %6 |

Portfolio Turnover | | | 2.98 | % | | | 0.39 | % | | | 0 | %5 |

* | Commencement of operations. |

1 | Amount represents less than $0.01 per share. |

2 | Total Return based on net asset value per share is the combination of changes in net asset value per share and reinvested dividend income at net asset value per share, if any. Total returns would have been lower had the Manager not waived its fees and reimbursed expenses. |

3 | The ratios do not include investment income, management fees, performance fees or incentive allocations, or other expenses of the Investment Funds in which the Company invests. |

4 | Represents the ratio of expenses to average Net Assets absent fee waivers and/or expense reimbursement by the Adviser. |

6 | Annualized, except for non-recurring expenses. |

10

The accompanying notes are an integral part of these Financial Statements.

IDR Core Property Index Fund Ltd

Notes to Financial Statements

June 30, 2023

1. Organization

IDR Core Property Index Fund Ltd was organized as a Maryland corporation (the “Company”) on April 11, 2019 and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), that operates as a closed-end non-diversified, management investment company. The Company intends to elect to be treated for U.S. federal income tax purposes, and to continue to qualify annually, as a “real estate investment trust” pursuant to the Internal Revenue Code of 1986, as amended (the “Code”), Sections 856 through 860 (a “REIT”). The Company is managed by IDR Investment Management, LLC (the “Manager”). The Company’s registration statement permits it to offer two classes of shares known as the Class A Common Stock and Class B Common Stock. The Company commenced investment operations on April 1, 2021 with the Class A Common Stock. As of June 30, 2023, no Class B Common Stock had been sold.

The Company’s investment objective is to employ an indexing investment approach that seeks to track the NCREIF Fund Index — Open End Diversified Core Equity X (the “NFI-ODCE X” or the “NFI-ODCE X Index”) on a net-of-fee basis while minimizing tracking error. The Company will pursue its investment objective by investing primarily in real estate investment vehicles that comprise the NFI-ODCE X Index (the “Eligible Component Funds”), actively managing allocations to such Eligible Component Funds to approximate the relative weighting of such Eligible Component Funds within the NFI-ODCE X Index, and investing in short-term temporary investments and cash equivalents on an interim basis pending investment in Eligible Component Funds. In accordance with the foregoing, pending investment in Eligible Component Funds, the Company may invest excess cash in cash equivalents, U.S. government securities or high-quality debt securities maturing in one year or less from the time of investment. The Company will attempt to replicate the target index by investing all, or substantially all, of its assets in the Eligible Component Funds that make up the NFI-ODCE X Index, holding each Eligible Component Fund in approximately the same proportion as its weighting in the NFI-ODCE X Index. The Company anticipates investing, under normal circumstances, at least 80% of its total assets in Eligible Component Funds that comprise the NFI-ODCE X Index. There can be no assurance the Company will achieve its investment objective. There were no material changes to the Company’s investment objective or principal investment strategies over the past year.

As a matter of fundamental policy, the Company will not: (1) act as an underwriter of securities of other issuers (except to the extent that it may be deemed an “underwriter” of securities it purchases that must be registered under the Securities Act of 1933, as amended (the “Securities Act”), before they may be offered or sold to the public); (2) sell securities short (except with regard to managing the risks associated with publicly-traded securities the Company may hold in its portfolio); (3) purchase securities on margin (except to the extent that the Company may purchase securities with borrowed money); or (4) engage in the purchase or sale of commodities or commodity contracts, including futures contracts (except where necessary in working out distressed investment situations or in hedging the risks associated with interest rate fluctuations, and, in such cases, only after all necessary registrations (or exemptions from registration) with the Commodity Futures Trading Commission have been obtained). Furthermore, as a matter of fundamental policy, the Company may make loans and purchase or sell real estate and real estate mortgage loans, except as prohibited under the 1940 Act, the rules and regulations thereunder (except as permitted by an exemption therefrom), as such statute, rules or regulations may be amended or interpreted by the Securities and Exchange Commission from time to time. The Company has also adopted a fundamental policy with respect to concentration in which it must, under normal market conditions, invest more than 25% of its total assets in real estate investment vehicles or companies that otherwise operate in the real estate industry. The Company’s policy of investing, under normal circumstances, at least 80% of its total assets in Eligible Component Funds that comprise the NFI-ODCE X Index is also a fundamental policy.

The NCREIF Fund Index — Open End Diversified Core Equity (the “NFI-ODCE”) is the first fund index promulgated by the National Council of Real Estate Investment Fiduciaries (“NCREIF”). The NFI-ODCE is an index of investment returns reporting on both a historical and current basis the results of open-end commingled funds pursuing a core real estate investment strategy, some of which have performance histories dating back to the 1970s.

The NFI-ODCE is currently comprised of twenty-five component funds (the “Component Funds”). These Component Funds are generally defined as funds which purchase the four main property types (office, retail, apartments and industrial) in the U.S. using less than 35% leverage. The NFI-ODCE performance is reported on a capitalization-weighted and equal-weighted basis and returns are reported gross and net of fees. Performance measurement and reporting is time-weighted. The Manager has signed a licensing agreement with NCREIF to also provide the NFI-ODCE X Index as a secondary index which tracks only “Eligible Component Funds” (i.e., only those Component Funds that are not considered “group trusts”) that rely on Internal Revenue Service’s Revenue Ruling 81-100, as modified, from time to time, by the Internal Revenue Service. Under the above Revenue Ruling, the only investors that are

11

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

permitted to invest in such group trusts are U.S. public and private pension plans and individual retirement accounts. The NFI-ODCE X Index is designed to provide investors that are not able to access all Component Funds in the NFI-ODCE Index a more accurate index to benchmark their core holdings.

2. Significant Accounting Policies

Basis of Preparation and Use of Estimates

The Company is an investment company and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies and Accounting Standards Update (“ASU”) 2013-08. The accompanying financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Valuation of Investments

The Board of Directors (“Board”) has established an Audit Committee to oversee the valuation of the Company’s investments on behalf of the Company. The Board has approved a valuation policy for the Company (the “Fair Valuation Policy”). The Audit Committee recommends and the Board determines the fair value of the Company’s portfolio of assets on a quarterly basis in connection with the preparation of the Company’s financial statements and SEC reports as required by the 1940 Act. Among other factors, the Audit Committee and the Board may consider reports prepared by an independent valuation firm with respect to some or all of the Company’s portfolio assets when determining the value of the Company’s portfolio assets. All investments are recorded at fair value, as described in Note 5.

Investment Transactions, Interest and Dividends

Investment transactions are recorded on trade date. Realized gains and losses on investment transactions are determined on a specific identification basis and are included as net realized gain (loss) on investments in the accompanying statement of operations. The difference between the cost and the fair value of open investments is reflected as unrealized appreciation (depreciation) on investments, and any change in that amount from the prior period is reflected in the accompanying statement of operations. Interest income and expense is recognized under the accrual basis. Dividend income is recognized on the ex-dividend date.

Income from Investment Companies

Distributions received or receivable from investments in investment companies are evaluated by the Manager to determine if the distribution is income or a return of capital. Generally, income is not recorded unless the manager of the investment company has declared the distribution, there is cash available to make the distribution and there are accumulated earnings in excess of the amount recorded as income. Distributions classified as a return of capital are a reduction in the cost basis of the investment.

Amounts shown as expenses in the statement of operations and financial highlights include only those expenses charged directly to the Company and do not reflect management fees, advisory fees, performance fees or incentive allocations, brokerage commissions and other expenses incurred by investment companies in which the Company is invested. These amounts are included in net change in unrealized appreciation on investments in the accompanying statement of operations. Also, included in the net change in unrealized appreciation on underlying investments is the Company’s allocable share of realized and unrealized gains or losses from underlying investments held by the investment companies.

Federal Income Taxes

The Company intends to qualify as a “real estate investment trust“ pursuant to the Code. The Company will be organized and operated in such a manner as to qualify for taxation as a REIT under the applicable provisions of the Code.

The Company’s qualification as a REIT depends upon the continuing satisfaction by the Company of requirements of the Code relating to qualification for REIT status. Some of these requirements depend upon actual operating results, distribution levels, diversity of stock ownership, asset composition, source of income and record keeping. Accordingly, while the Company intends to continue to qualify to be taxed as a REIT, the actual results of the Company or of certain subsidiaries that are also REITs (“REIT Subsidiaries”) for any

12

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

particular year might not satisfy these requirements since the ability to satisfy such requirements depends on the operations of the underlying Eligible Component Funds over which the Company has no control. The Company will not monitor the REIT Subsidiaries’ compliance with the requirements for REIT qualification.

The Company recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Company’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the open tax year ended December 31, 2022 or expected to be taken in the Company’s December 31, 2023 year-end tax returns. The Company identified its major tax jurisdictions as U.S. federal and Ohio where the Company makes significant investments; however, the Company is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Distributions to Shareholders

To the extent the Company has earnings available for distribution, it expects to distribute quarterly dividends. The specific tax characteristics of the Company’s distributions will be reported to shareholders after the end of the calendar year. The Company’s quarterly dividends, if any, will be authorized and determined by the Board.

The Company determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses (including capital loss carryover); however, it may distribute any excess annually to its shareholders.

The Company has adopted a tax year end of December 31. The exact amount of distributable income for each tax year can only be determined at the end of the Company’s tax year ended December 31. Under Section 19 of the Investment Company Act, the Company is required to indicate the sources of certain distributions to shareholders. The estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Company assets are denominated.

The Company, in order to qualify as a REIT, is required to distribute dividends, other than capital gain dividends, to the Company’s shareholders in an amount at least equal to (1) the sum of (a) 90% of the Company’s “real estate investment trust taxable income,” computed without regard to the dividends paid deduction and the Company’s net capital gain, and (b) 90% of the Company’s net after-tax income, if any, from foreclosure property minus (2) the sum of certain items of non-cash income.

3. Principal Risks

Non-Diversified Status

The Company is a “non-diversified” management investment company. Thus, there are no percentage limitations imposed by the Investment Company Act on the Company’s assets that may be invested, directly or indirectly, in the securities of any one issuer. Consequently, if one or more securities are allocated a relatively large percentage of the Company’s assets, losses suffered by such securities could result in a higher reduction in the Company’s capital than if such capital had been more proportionately allocated among a larger number of securities. The Company may also be more susceptible to any single economic or regulatory occurrence than a diversified investment company.

Limited Liquidity

Stockholders (each, a “Stockholder” and collectively, the “Stockholders”) will have limited rights to redeem capital from the Company. As a result, a Stockholder that desires to liquidate his or her investment in the Company may be unable to do so within a given timeframe, if at all. Therefore, Stockholders must be prepared to bear the financial risks of an investment in shares of the Company for an indefinite period of time.

Credit Risk

Financial assets which potentially expose the Company to credit risk consist principally of cash and investments. The Company, at times, may maintain deposits with a single high-quality financial institution in amounts that are in excess of federally insured limits; however, the Company has not experienced, nor does it anticipate, incurring any losses in its cash accounts. Investments in other investment companies are subject to credit risk should those other investment companies be unable to fulfill their redemption obligations.

13

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

Market Risk

The Company invests in other investment companies which are subject to the terms of the respective investment companies’ agreements, private placement memoranda and other governing agreements. The Company’s investments in other investment companies are subject to the market and credit risks of investments held by those entities. The Company bears the risk of loss only to the extent of the cost of its respective investment in the other investment companies.

There were no material changes to the Company’s principal risks over the past year.

4. Investment Advisory Agreement and Other Agreements with Related Parties

IDR Investment Management, LLC serves as the Company’s investment adviser. Pursuant to the Management Agreement, the Company has agreed to pay the Manager the Management Fee for services rendered under the Management Agreement. The Management Fee is payable quarterly in arrears. Management Fees for any partial quarter will be appropriately prorated and adjusted for any share issuances or repurchases during the relevant quarter. The Management Fee will be calculated at an annual rate of 0.40% of the Company’s net assets at the end of the most recently completed calendar quarter. The Manager has agreed to waive 0.10% of its management fee that it would otherwise be entitled to under the Management Agreement during the first twenty-four months following the Company’s initial closing. As a result, the base management fee due under the Management Agreement was 0.30% during such period through quarter ending March 31, 2023. For the year ended June 30, 2023, the Manager waived $30,580 of its management fee which is included in management fees waived and other expenses reimbursed in the statement of operations. The Manager will not be entitled to receive any other advisory fees (including any incentive fee) under the Management Agreement, other than the Management Fee.

The Manager has incurred and/or paid certain organizational and offering-related expenses (“O&O Expenses”) on behalf of the Company in connection with its formation and the private placement offering of shares of its Class A Common Stock, which amounts are reimbursable by the Company. The Manager and the Company have entered into an organization and offering expense limitation agreement (the “O&O Expense Limitation”), which was amended in 2023, and is effective for periods after June 30, 2023, under which the Company shall only be required to reimburse the Manager for aggregate O&O Expenses incurred and/or paid on the Company’s behalf in an amount equal to 0.50% of the aggregate gross proceeds raised by the Company in connection with offer and sale of its shares of Class A Common Stock (the “Reimbursement Limit”) until all of the O&O Expenses incurred and/or paid by the Manager have been recovered; provided, that the reimbursement of any O&O Expenses in excess of the then current Reimbursement Limit shall be deferred until otherwise payable for a period of up to three (3) years following the date on which such O&O Expenses were originally incurred and/or paid by the Manager. For the year ended June 30, 2023, the Manager recovered O&O expenses in the amount of $96,116 which is included in other expenses recovered in the statement of operations. At June 30, 2023, the total amount of these potentially recoverable O&O expenses is $1,347,124, which expire as follows:

June 30, 2024 | | $ | 747,642 | |

June 30, 2025 | | | 599,482 | |

Total | | $ | 1,347,124 | |

The Manager and the Company have entered into an operational expense limitation agreement (the “Expense Limitation”) under which the Manager has agreed, during the calendar quarter commencing July 1, 2021 and ending September 30, 2021 and during the calendar quarter commencing October 1, 2021 and ending December 31, 2021 and during the calendar quarter commencing January 1, 2022 and ending March 31, 2022 and during the calendar quarter commencing April 1, 2022 and ending June 30, 2022 and during the calendar quarter commencing July 1, 2022 and ending September 30, 2022 and during the calendar quarter commencing January 1, 2023 and ending March 31, 2023 and during the calendar quarter commencing April 1, 2023 and ending June 30, 2023 (each a “Limitation Period”), to absorb the ordinary operating expenses of the Company (excluding interest, brokerage commissions and extraordinary expenses of the Company) (“Operating Expenses”) that exceed 0.20%, 0.00%, 0.00% , 0.02%, 0.15%, 0.34% and 0.10% per quarter, respectively, of the Company’s net assets attributable to interests in the Company at the end of the Limitation Period.

For the year ended June 30, 2023, the Manager absorbed operational expenses totaling $829,811 which is included in management fees waived and other expenses reimbursed in the statement of operations and the Manager recovered $72,017 in operational expenses previously absorbed which is included in other expenses recovered in the statement of operations. The Company agrees to carry forward for a period not to exceed three (3) years from the end of the Limitation Period (the “Subsequent Reimbursement

14

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

Period”) any Operating Expenses in excess of the Expense Limitation incurred during the Limitation Period that are paid or assumed by the Manager (or an affiliate of the Manager) pursuant to this Agreement (“Excess Operating Expenses”) and to reimburse the Manager (or an affiliate of the Manager) in the amount of such Excess Operating Expenses as set forth herein. Such reimbursement will be made as promptly as possible, but only to the extent it does not cause the Operating Expenses for any calendar quarter subsequent to the Limitation Period (a “Subsequent Quarter”) to exceed the applicable limitation on the Company’s Operating Expenses set forth in any expense limitation agreement in form and substance similar to this Agreement (a “Subsequent Expense Limitation Agreement”) in effect with respect to such Subsequent Quarter (a “Subsequent Expense Limitation”), or in the absence of any Subsequent Expense Limitation Agreement, the Expense Limitation. At June 30, 2023, the total amount of these potentially recoverable expenses is $1,699,947, which expire as follows:

June 30, 2024 | | $ | 173,703 | |

September 30, 2024 | | | 256,844 | |

December 31, 2024 | | | 31,485 | |

March 31, 2025 | | | 185,650 | |

June 30, 2025 | | | 222,454 | |

September 30, 2025 | | | 163,377 | |

March 31, 2026 | | | 96,490 | |

June 30, 2026 | | | 569,944 | |

Total | | $ | 1,699,947 | |

ACA Group (Formerly Foreside Fund Officer Services, LLC) provides Chief Compliance Officer (“CCO”) services to the Company; UMB Fund Services, Inc. (“UMBFS”) serves as the Company’s fund accountant, transfer agent and administrator; Wilmington Savings Fund Society, FSB, serves as the Company’s custodian. The Company’s allocated fees incurred for services provided for the year ended June 30, 2023, are reported on the Statement of Operations.

Two Directors and certain Officers of the Company are also Officers of the Adviser. Trustees and Officers, who are affiliated with the Adviser are not compensated by the Company for their services.

5. Fair Value of Investments

ASC 820, Fair Value Measurements (“ASC 820”), defines fair value as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. ASC 820 establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing the use of the most observable input when available. Observable inputs are inputs that market participants would use in pricing the asset and liability based on market data obtained from sources independent of the reporting entity; unobservable inputs are inputs that reflect the Company’s own assumptions about the assumptions market participants would use in pricing the asset or liability.

A financial instrument level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the fair value hierarchy, the hierarchy level is determined based on the lowest level input(s) that is (are) significant to the fair value measurement in its entirety.

The three levels of the fair value hierarchy that prioritize inputs to the valuation methods are as follows:

| | ● | Level 1 – Valuations based on quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| | ● | Level 2 – Valuations based on quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or liability, either directly or indirectly. |

| | ● | Level 3 – Valuations based on inputs that are unobservable and deemed significant to the overall fair value measurement. This includes situations where there is little, if any, market activity for the asset or liability. |

15

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

Investments in other investment companies are valued at fair value based on the Company’s applicable percentage of ownership of the investment companies’ reported net assets as of the measurement date, which is a practical expedient for valuation and does not require these investments to be categorized within the fair value hierarchy as determined by the Manager. In determining fair value, the Manager utilizes valuations provided by the underlying investment companies. The underlying investment companies value securities, real estate and other financial instruments at fair value. The estimated fair values of certain investments of the underlying investment companies, which may include private placements, real estate and other securities for which prices are not readily available, are determined by the general partner or sponsor of the respective investment company and may not reflect amounts that could be realized upon immediate sale, nor amounts that ultimately may be realized. Accordingly, the estimated fair values may differ significantly from the values that would have been used had ready market existed for these investments. The fair value of the Company’s investments in other investment companies generally represents the amount the Company would expect to receive if it were to liquidate its investment in the other investment companies excluding any redemption charges that may apply. As of June 30, 2023, the fair value of investments valued by the Company using the net asset value (“NAV”) per share (or its equivalent) as a practical expedient for fair value is $29,024,787.

6. Federal Income Taxes

The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gains or loss items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature.

The Company’s tax year end is December 31, 2022. As such, the information in this section is as of the Company’s most recent tax year end.

The tax character of distributions paid for the tax years ended December 31, 2022 and December 31, 2021, were as follows:

Distributions paid from: | | Tax Year Ended

December 31, 2022 | | | Tax Year Ended

December 31, 2021 | |

Ordinary income | | $ | 329,273 | | | $ | 89,391 | |

Long-term capital gains | | | — | | | | — | |

Total distributions paid | | $ | 329,273 | | | $ | 89,391 | |

The cost of investments for federal income tax purposes is adjusted for items of taxable income allocated to the Company from the Investment Funds. The allocated taxable income is reported to the Fund by the Investment Funds on Schedule K-1. The Company will not receive such Schedules K-1 for the year ended December 31, 2023 (the underlying Investment Funds’ year-end) until 2024; therefore, the tax basis of investments for 2023 activity will not be finalized by the Company until after December 31, 2023. As of December 31, 2022 and adjusted for activity known by the Company through fiscal year ended June 30, 2023, the tax cost, gross unrealized appreciation and depreciation, and net unrealized are as follows:

Cost of investments | | $ | 25,930,475 | |

Gross unrealized appreciation | | | 3,862,495 | |

Gross unrealized depreciation | | | (768,182 | ) |

Net unrealized appreciation on investments | | $ | 3,094,313 | |

7. Private Placements and Repurchases of Common Shares

The Company intends to conduct one or more private offerings (each, a “Private Placement”) of its Common Shares from time to time in order raise capital to invest in accordance with its investment objective. The Company intends to conduct such Private Placements in conformity with Section 4(2) under the Securities Act or Regulation D promulgated thereunder, in order to permit the offer, issuance and sale of its Common Shares in connection therewith without registration under the Securities Act.

16

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

Eligible Investors

Common Shares will be offered only to eligible investors. This means that to purchase Common Shares of the Company, a prospective Stockholder will be required to certify that the Common Shares are being acquired by an “accredited investor”, as defined in Rule 501(a) of Regulation D promulgated under the Securities Act. An “accredited investor” includes, among other investors, a natural person who has a net worth (or a joint net worth with that person’s spouse), excluding the value of such natural person’s primary residence, immediately prior to the time of purchase in excess of $1 million, or income in excess of $200,000 (or joint income with the investor’s spouse in excess of $300,000) in each of the two preceding years and has a reasonable expectation of reaching the same income level in the current year, and certain legal entities with total assets exceeding $5 million. Existing Stockholders seeking to purchase additional Common Shares will be required to qualify as eligible investors at the time of the additional purchase. The Manager may from time to time impose stricter or less stringent eligibility requirements. Common Shares may not be purchased by nonresident aliens, foreign corporations, foreign partnerships, foreign trusts or foreign estates, all as defined in the Code.

Investor Subscriptions and Capital Calls

The Company intends to accept subscriptions from investors in connection with each Private Placement, pursuant to which such investors will commit to purchase up to an aggregate dollar amount of the Common Shares from time to time in one or more draw-downs of capital by the Company. The Company will generally draw down capital from subscribing investors and issue Common Shares to such investors on a quarterly basis (each, a “Capital Call”), depending upon availability of investments in Eligible Component Funds and the overall weighting of the Company’s portfolio relative to the NFI-ODCE Index. A portion of the proceeds of such Capital Calls may also be used by the Company to pay expenses, including any fees or expenses payable to the Manager under the Management Agreement or Administration Agreement. The Company will provide subscribing investors with no less than five (5) business days’ prior written notice of a Capital Call prior to the date on which any such capital contribution is due. Such Common Shares will initially be issued at a purchase price equal to $10 per Common Share, and thereafter at a purchase price equal to the Company’s then current NAV per Common Share. As a result, the number of Common Shares investors will receive in connection with each Capital Call will vary depending upon the Company’s then current NAV per Common Share.

Share Repurchase Program and Redemption Shares

The Company intends to offer to repurchase Common Shares on a quarterly basis and on such terms as may be determined by its Board, in its sole discretion, unless, in the judgment of the Board, such repurchases would not be in the Company’s best interests or would violate applicable law (the “Share Repurchase Program”). The Company will conduct such repurchase offers in accordance with the requirements of Regulation 14E and Rule 13e-4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in reliance on Section 4(2) under the Securities Act, or Regulation D thereunder, the Securities Act and Section 23(c)(1) the 1940 Act. Any offer to repurchase shares will be conducted solely through tender offer materials delivered to each Stockholder and is not being made through this Registration Statement. In accordance with the requirements of Regulation M, the Company will not issue new Common Shares while a repurchase offer remains open.

The Company will limit the number of Common Shares to be repurchased under the Share Repurchase Program in any calendar year to 20% of the weighted average number of Common Shares outstanding in the prior calendar year, or 5% in each quarter, though the actual number of Common Shares that the Company offers to repurchase may be less in light of the limitations noted below. While the Company may, at the discretion of the Board, use cash on hand, cash available from borrowings and cash from the sale of investments as of the end of the applicable quarter to repurchase Common Shares, given the illiquid nature of the Company’s investments, it generally expects to issue redeeming Stockholders shares of its Class B Common Stock (the “Redemption Shares”) on a one for one basis for each of its Common Shares repurchased in connection with the Share Repurchase Program. The Company expects to issue such Redemption Shares in connection with such repurchase offers in accordance with Section 4(2) under the Securities Act or Regulation D promulgated thereunder in order to permit the offer and issuance of such Redemption Shares without registration under the Securities Act.

Each Redemption Share will have the same NAV and be entitled to the same distributions as each of the Company’s Common Shares while outstanding. Such Redemption Shares will be redeemable at the Company’s discretion at their then current NAV per Redemption Share, and the Company will generally commit, in connection with each repurchase offer to use any available funds, either from new investor subscriptions or the disposition of the Company’s investments, to redeem such Redemption Shares within one year after their issuance. Pursuant to the Charter, the Company will redeem Redemption Shares in the order in which they were issued, provided, that to the extent the Company redeems less than the full number of Redemption Shares issued on a specific date, it will do so on a pro rata basis. The Company intends to treat the Redemption Shares as a “senior security” for purposes of the 1940 Act. As a result, the

17

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

Company must generally have an asset coverage ratio of at least 200%, taking into account the aggregate repurchase obligation with respect to its outstanding Redemption Shares and any other senior securities it may have outstanding, which will limit the number of Redemption Shares the Company may have outstanding at any one time. In addition, in accordance with the 1940 Act, at any time the Company has Redemption Shares outstanding, two of the members of its Board will be designated as subject to election by the holders of such outstanding Redemption Shares, voting as a separate class. A majority of the outstanding voting securities of a company is defined under the 1940 Act as the lesser of: (a) 67% or more of such Company’s voting securities present at a meeting if more than 50% of the outstanding voting securities of such company are present or represented by proxy, or (b) more than 50% of the outstanding voting securities of such company.

In connection with its consideration of whether to offer to exchange Common Shares for Redemption Shares, the Board will consider any requests it has received from Stockholders. If the amount of repurchase requests exceeds the number of Common Shares the Company seeks to repurchase, the Company will repurchase or exchange such Common Shares on a pro rata basis. As a result, the Company may repurchase less than the full amount of Common Shares that a Stockholder requests to have repurchased. Further, the Company will not be obligated to repurchase Common Shares or redeem Redemption Shares issued in any repurchase offers if doing so would violate restrictions on distributions under applicable federal or Maryland law, including Section 2-311 of the Maryland General Corporation Law, prohibiting distributions that would cause the Company to fail to meet statutory tests of solvency. If the Company does not repurchase the full amount of a Stockholder’s shares that such Stockholder has requested to be repurchased, or the Board determines not to make repurchases of its Common Shares or to redeem any Redemption Shares issued in connection with prior repurchase offers, Stockholders may not be able to dispose of their Common Shares or Redemption Shares. In addition, any redemption of Redemption Shares issued in connection with repurchase offers will be subject in part to the Company’s available cash and compliance with the REIT qualification rules promulgated under the Code and the 1940 Act. The Company will not borrow funds to redeem Redemption Shares.

While the Company intends to conduct quarterly repurchases of its Common Shares as described above, the Company is not required to do so, and the Board may suspend or terminate the share repurchase program at any time. While it is unlikely to do so, the Company may also conduct repurchases of its Common Stock at other times outside the Share Repurchase Program if it determines that doing so would be in the best interests of the Company.

Redemption Shares are also subject to a number of further significant limitations which preclude redemption by the Company if such redemption (i) could cause the Company to fail to maintain its qualification as a REIT or as a “domestically controlled qualified investment entity” within the meaning of Section 897(h)(4)(B) of the Code, (ii) may cause the Company to be treated as a “pension-held REIT” within the meaning of Section 856(h)(3)(D) of the Code, or (iii) together with all other repurchase offers during any applicable fiscal quarter would require the Company to pay less than $250,000 in respect of such requests.

The results of the repurchase offers conducted for the year ended June 30, 2023 are as follows:

Commencement

Date | Repurchase Request

Deadline | Repurchase Pricing

Date | Net Asset

Value as of

Repurchase

Offer Date | Shares

Repurchased | Amount

Repurchased | Percentage of

Outstanding

Shares

Repurchased |

August 29, 2022 | September 26, 2022 | June 30, 2022 | $12.6695 | 6,078.000 | $77,005.22 | 0.26% |

November 23, 2022 | December 30, 2022 | September 30, 2022 | $12.5718 | 23,495.350 | $295,378.84 | 0.85% |

March 3, 2023 | March 30, 2023 | December 31, 2022 | $11.7955 | 136,668.001 | $1,612,067.41 | 4.92% |

June 1, 2023 | June 29, 2023 | March 31, 2023 | $11.2712 | 39,710.001 | $447,579.36 | 1.40% |

Default by a Subscribing Investor

All capital commitments by an investor to the Company are irrevocable. Upon any default by an investor to make a capital contribution when due that is not cured within five business days, such defaulting investor shall be deemed a “Defaulted Stockholder” and the Company may take any or all of the following actions, in the Company’s discretion: (i) cause the amount due to bear interest payable to the Company at a rate of the higher of (x) 12% per annum and (y) any default rate per annum that may be imposed by any Eligible Component Fund on the Company in connection with a default by the Company to make a capital contribution when due to

18

IDR Core Property Index Fund Ltd

NOTES TO FINANCIAL STATEMENTS - Continued

June 30, 2023

such Eligible Component Fund that was caused by the default of the Defaulted Stockholder; (ii) cancel the Defaulted Stockholder’s remaining capital commitment in whole or in part; or (iii) acquire all of the Common Shares and/or Redemption Shares of the Defaulted Stockholder for a price equal to 70% of the then current NAV per share. As of June 30, 2023, there were no unfunded commitments.

8. Investment Transactions

For the year ended June 30, 2023, total capital called by Investment Funds amounted to $6,029,405 and total capital distributions received from Investment Funds amounted to $888,240.

9. Indemnifications

In the normal course of business, the Company enters into contracts that contain a variety of representations which provide general indemnifications. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred. However, the Company expects the risk of loss to be remote.

10. Subsequent Events

In preparing these financial statements, management has evaluated subsequent events through the date of issuance of the financial statements included herein.

At a meeting held on May 31, 2023, the Board approved, among other things, the conversion of the Company from a Maryland corporation to a Delaware statutory trust in accordance with the Plan of Conversion (the “Conversion,” and such proposal, the “Conversion Proposal”); and the Company’s organizational documents under Delaware law, including a Declaration of Trust and By-laws. In connection with the Conversion, the Board also approved a name change of the Company to be included in its Declaration of Trust and By-laws. A Special Meeting of Stockholders of the Company will be held on August 31, 2023, at 1:00 p.m., Eastern Time. If the Stockholders approve the Conversion Proposal, the Company will be known as the Accordant ODCE Index Fund. The following matters were also approved at the board meeting held on May 31, 2023 and will be considered for approval at the Special Meeting of Stockholders: (i) to approve a new investment advisory agreement between the Company and Accordant Investments LLC; (ii) to approve a new sub-advisory agreement by and among Accordant Investments, the Company and IDR Investment Management, LLC; (iii) to approve a new expense limitation and reimbursement agreement; (iv) to approve a change in the Company’s investment objective and make the investment objective non-fundamental; (v) to approve the adoption of a fundamental policy to make quarterly repurchase offers for the Company’s shares; (vi) to approve certain changes to make the Company’s current fundamental investment policy to invest, under normal circumstances, at least 80% of its total assets in real estate investment vehicles that comprise the NFI-ODCE X Index a non-fundamental investment policy, and modify the reference index to the NFI-ODCE Index; (vii) to approve a modification of the Company’s fundamental investment policy regarding investment concentration; (viii) to elect five (5) individuals as directors, with each to serve as a member of the Board of the Company and each of whom will commence his term upon election at the Meeting for an indefinite term and until his successor is duly elected and qualifies.

There have been no other subsequent events that occurred during such period that would require disclosure or would be required to be recognized in the financial statements.

19

IDR Core Property Index Fund Ltd

Other Information

June 30, 2023 (Unaudited)

Proxy Voting

The Company is required to file Form N-PX, with its complete proxy voting record for the 12 months ended June 30, no later than August 31. The Company’s Form N-PX filing and a description of the Company’s proxy voting policies and procedures are available: (i) without charge, upon request, by calling the Fund at 1.210.459.0596 or (ii) by visiting the SEC’s website at www.sec.gov.

Availability of Quarterly Portfolio Schedules

The Company files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. The Company’s Form N-PORT is available, without charge and upon request, on the SEC’s website at www.sec.gov.

Board Approval of the Investment Advisory Agreement

New Investment Advisory Agreement with Accordant Investments, LLC (“Accordant Investments”)

The Board, including a majority of the directors who are not “interested persons” of the Company as such term is defined under the 1940 Act (the “Independent Board Members”), unanimously approved a new investment advisory agreement between the Company and Accordant Investments (the “New Advisory Agreement”), as well as a reduction in the proposed management fee payable thereunder, at meetings held on May 31, 2023 and July 17, 2023. The New Advisory Agreement remains subject to approval by the Company’s shareholders at a special meeting which is scheduled to occur on August 31, 2023.

In making its determination regarding the New Advisory Agreement, the Company’s Board considered, among other things, information furnished by Accordant Investments, including information concerning a proposed conversion of the Company from a Maryland corporation to a Delaware statutory trust (the “Conversion”), as well as other information that it deemed relevant. The Company’s Board also requested and received responses from Accordant Investments to a series of questions encompassing a variety of topics prepared by the Company’s Board, in consultation with counsel to the Company. Attention was given by the Independent Board Members to all information furnished. However, no single factor reviewed and discussed by the Company’s Board was identified as the principal factor in determining whether to approve the New Advisory Agreement. The following discussion notes the primary considerations relevant to the Company’s Board’s deliberations and determinations.

Nature, Scope and Quality of Services. In assessing the nature, scope and quality of services to be provided by Accordant Investments, the Independent Board Members considered the anticipated structure and capabilities of Accordant Investments following the Conversion, as well as the professional experiences and qualifications of Accordant Investments’ personnel that would be providing advisory services to the Company. The Independent Board Members considered the structure and capabilities of Accordant Investments in view of the anticipated capitalization of its indirect parent, Emphasis Capital LLC (“Emphasis Capital”). They also considered Accordant Investments’ research and portfolio management capabilities, as well as its respective administrative and compliance infrastructure. The Independent Board Members also specifically reviewed and considered the increase in management fees under the New Advisory Agreement. They noted that the increase in management fees under the New Advisory Agreement was reasonable and appropriate in light of the nature, extent and quality of services to be provided by Accordant Investments under the New Advisory Agreement in anticipation of shareholder approval of proposed changes to the Company’s fundamental investment policies regarding investment concentration, policy to invest at least 80% of its total assets in real estate investment vehicles that comprise the NFI-ODCE X Index, quarterly repurchase offers, and its investment objective, and compared to those which are currently provided by the Manager under the current Management Agreement. The Board further considered the oversight services Accordant Investments will provide the Company in addition to the anticipated increased complexity of complying with Rule 23c-3 under the 1940 Act applicable to interval funds in the event the changes to the Company’s fundamental policies are approved by shareholders, including managing a continuously offered closed-end fund required to calculate a daily net asset value (NAV) and maintaining compliance with applicable requirements of the additional oversight services that Accordant Investments would provide as the Company’s investment adviser.

Comparative Advisory Fees and Expenses. The Independent Board Members considered the proposed management fee and expenses of the Company under the New Advisory Agreement compared to both the current Management Agreement and to the advisory fees or similar expenses paid by other registered investment companies with similar investment objectives. The Independent Board Members considered the reasonableness of the proposed management fee under the New Advisory Agreement in light of the nature, scope and quality of the services anticipated to be provided under the New Advisory Agreement compared to those provided under the current Management Agreement.

20

IDR Core Property Index Fund Ltd

OTHER INFORMATION - Continued

June 30, 2023 (Unaudited)

Profitability. The Independent Board Members considered the expected profits to Accordant Investments under the New Advisory Agreement, in light of the amount of the Company’s total net assets over recent years.

Benefits to the Adviser and Sub-Adviser. The Independent Board Members determined that Accordant Investments would not receive any significant direct or indirect benefits from its relationship with the Company, other than the payment of fees and other amounts under the New Advisory Agreement.

Economies of Scale. The Independent Board Members noted that economies of scale in an investment adviser’s costs of services may be realized when a fund’s assets increase significantly. They determined that the proposed advisory fee rate under the New Advisory Agreement, and aggregate fees payable by the Company to Accordant Investments as a percent of the net assets of the Company, would continue to reflect a sharing with the Company of the benefit of economies of scale previously realized by the Manager under the current Management Agreement. The Independent Board Members further considered the additional economies of scale that were expected to be realized by Accordant Investments as a result of the capitalization of its indirect parent, Emphasis Capital, and the extent to which these economies of scale would be shared with the Company and its shareholders through the terms of the New Advisory Agreement.

Investment Performance. The Independent Board Members considered the gross and net performance of the Company under the current Management Agreement, and how this was anticipated to change, if at all, under the New Advisory Agreement. The Independent Board Members noted that Accordant Investments did not advise any registered investment companies with sufficient performance history to assess the quality or degree of such history as of the date of the meeting. Notwithstanding this, the Independent Board Members concluded from the other materials presented that: Accordant Investments was expected to provide high quality investment advisory services to the Company; the Company benefits from the high ethical standards that would be adhered to by Accordant Investments and its personnel; and the key principal at Accordant Investments, Mr. Stark, has extensive professional experience and familiarity with the markets in which the Company invests.

General Conclusions. The Independent Board Members determined that the services proposed to be provided by Accordant Investments pursuant to the New Advisory Agreement to the Company were expected to be of very high quality and concluded that they were very satisfied with the proposed services to be provided to the Company by Accordant Investments, and further that they were satisfied with the proposed fees and expenses under the New Advisory Agreement. No single factor reviewed by the Independent Board Members was identified by them as the principal factor in determining whether to approve the New Advisory Agreement.

New Sub-Advisory Agreement with IDR Investment Management, LLC

The Board, including the Independent Board Members, unanimously approved a new sub-advisory agreement between the Company and the Manager (the “New Sub-Advisory Agreement”) at meetings held on May 31, 2023 and July 17, 2023 and has determined that the Company’s entry into such agreement is in the best interests of the Company and its shareholders. The New Sub-Advisory Agreement remains subject to approval by the Company’s shareholders at a special meeting which is scheduled to occur on August 31, 2023.