U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF REGISTERED MANAGEMENT

INVESTMENT COMPANY

Investment Company Act File Number 811-23460

Accordant ODCE Index Fund

(Exact name of registrant as specified in charter)

6710 E. Camelback Rd.

Suite 100

Scottsdale, AZ 85251

(Address of Principal Executive Offices)

Greg Stark

Accordant Investments LLC

6710 E. Camelback Rd.

Suite 100

Scottsdale, AZ 85251

(Name and address of agent for service)

Registrant’s Telephone Number, including Area Code: (216) 622-0004

Date of fiscal year end: June 30

Date of reporting period: July 1, 2023 - December 31, 2023

Item 1. Report to Shareholders

| (a) | Report of Shareholders. |

This document supplements, and should be read in conjunction with, the semi-annual report of Accordant ODCE Index Fund dated December 31, 2023. The following information supersedes and replaces the table and footnotes in our semi-annual report captioned “Company Performance — Average Annual Total Returns” and the graph captioned “Company Performance — Performance of $10,000 Initial Investment” each on page 6 of the semi-annual report. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the semi-annual report.

Net Total Returns (as of December 31, 2023)*

| | 6 Month | 1 Year | Since Inception | Inception Date |

| Accordant ODCE Index Fund - A - NAV | -6.76% | -12.69% | 3.61% | November 1, 2023 |

| Accordant ODCE Index Fund - A-LOAD** | -12.12% | -17.71% | 1.40% | November 1, 2023 |

| Accordant ODCE Index Fund -1 - NAV | -6.72% | -12.65% | 3.63% | September 11, 2023 |

| Accordant ODCE Index Fund - Y - NAV | -6.76% | -12.69% | 3.61% | November 1, 2023 |

| NFI-ODCE Net Total Return Index(a) | -7.00% | -12.73% | 3.68% | December 31, 1977 |

| FTSE NAREIT All Equity REITs TR Index(b) | 8.15% | 11.36% | 2.49% | December 31, 1971 |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost. Performance may' be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling 888.778.7781 or by visiting www.accordantinvestments.com.

| * | The Accordant ODCE Index Fund (the “Fund”) was previously registered as the IDR Core Property Index Fund, Ltd. (the "Predecessor Fund "). The Predecessor Fund previously charged a management fee of 40 bps while the Fund now charges 60 bps. Fund returns shown in this report is net of fees and for prior to September 11, 2023, reflects a 40 bps management fee and for performance on and after September 11, 2023, reflects a 60 bps management fee. The performance shown reflects a continuation of performance from the Predecessor Fund to the Fund. While the Fund has a different investment advisor than the Predecessor Fund, the Fund’s portfolio management is substantially similar to the Predecessor Fund. Inception date of the I shares is September 11, 2023. Class A shares and Class Y shares are available as of November 1, 2023. |

| ** | Adjusted for maximum sales charge of 5.75%. |

| | |

| (a) | The NFI-ODCE is a capitalization-weighted, gross and net of fee, time-weighted return index with an inception date of December 31, 1977. |

| (b) | The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property. |

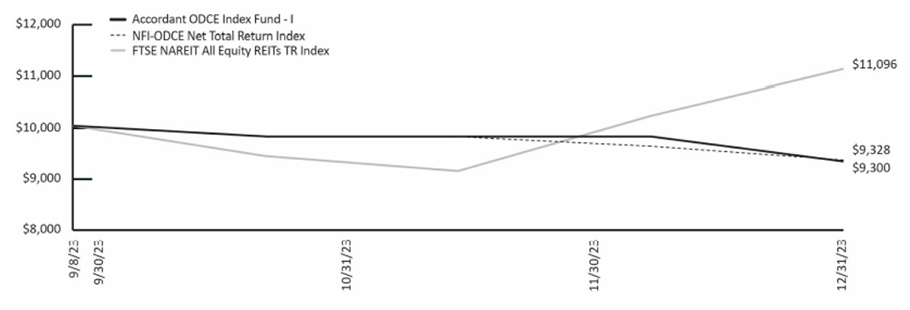

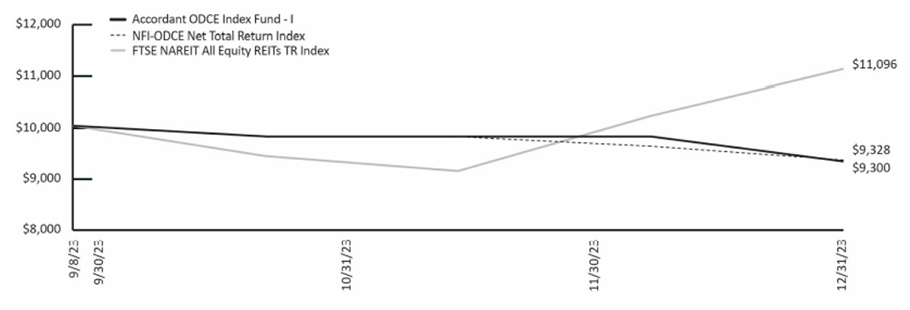

Performance of $10,000 Initial Investment (as of December 31, 2023)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Accordant ODCE Index Fund

888.778.7781 | www.accordantinvestments.com

| Shareholder Letter | 2 |

| Company Performance | 6 |

| Schedule of Investments | 8 |

| Statement of Assets and Liabilities | 9 |

| Statement of Operations | 10 |

| Statements of Changes in Net Assets | 11 |

| Statement of Cash Flows | 12 |

| Financial Highlights | 13 |

| Notes to Financial Statements | 16 |

| Renewal of Investment Advisory Agreement and Sub-Advisory Agreements | 23 |

| Additional Information | 25 |

| Service Providers | 26 |

| Privacy Notice | 27 |

| Accordant ODCE Index Fund | Shareholder Letter |

December 31, 2023 (Unaudited)

January 30, 2024 (Unaudited)

Dear Shareholder,

We are pleased to present this semi-annual report for the Accordant ODCE Index Fund (“Fund”) for the period ending December 31, 2023 (the “Reporting Period”). This report includes a discussion of the Fund’s investment strategy, macroeconomic perspective, real estate outlook, and return performance.

Fund Strategy

The Fund seeks to provide shareholders with a non-correlated allocation to core real estate that offers reliable income, portfolio diversification, attractive risk-adjusted returns, and an inflation hedge. To achieve this goal, the Fund utilizes an indexing investment approach that seeks to track the NFI-ODCE Index Fund – Open End Diversified Core Equity (“NFI-ODCE Index” or “Index”). The NFI-ODCE Index is recognized as the premier “core” institutional real estate index in the U.S., and institutional investors widely use it as the benchmark for private real estate performance. The Index has a 45-year track record, and its inclusion criteria are tightly defined, requiring managers to adhere to strict reporting standards and invest within conservative guidelines. This approach helps guard against high-risk investment tactics, such as overleveraging. Therefore, the Fund seeks to have attributes comparable to the NFI-ODCE Index, given that it exclusively invests in private real estate funds that are constituents of the Index.

Fund Performance

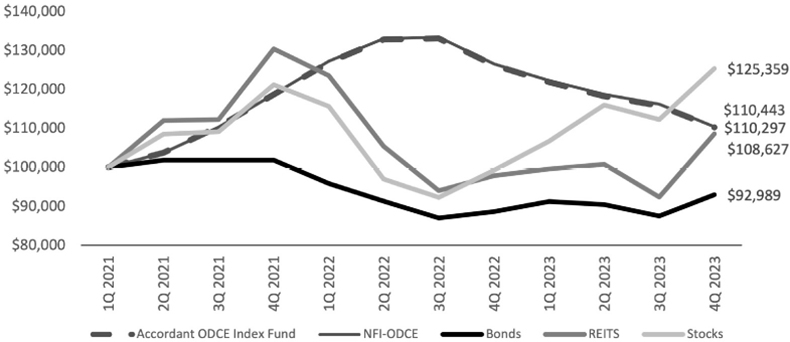

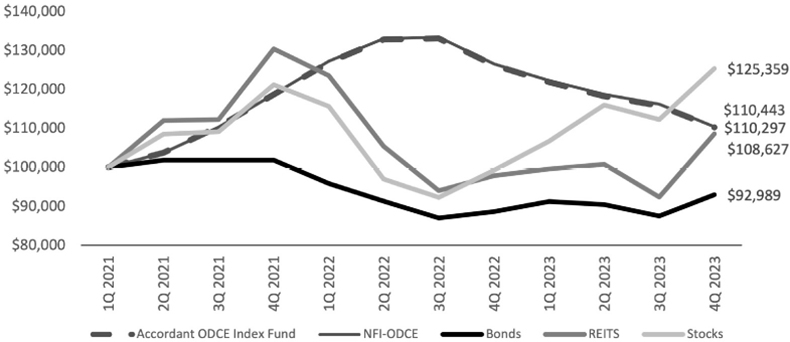

Despite real estate values declining in recent quarters, the sector has produced non-correlated portfolio outcomes. In fact, since its launch in April 2021, the Fund and the NFI-ODCE Index have outperformed the traditional bond, REIT, and public equities indices, at least until the most recent quarter. Furthermore, it continues to be an accretive allocation to a multi-asset portfolio primarily due to the attributes mentioned earlier (i.e., reliable income, portfolio diversification, attractive risk-adjusted returns, and an inflation hedge). The following chart shows the Fund’s performance since inception versus other major asset classes:

Exhibit 1: Growth of $100,000 (Since Inception Total Return 4/1/2021 - 12/31/2023: 10.44%)

Over the six months ending December 31, 2023, the Fund delivered a total return of -6.7%.1 For comparison, during the same period, broad-based equity markets provided a positive return of 8.0% (S&P 500), while fixed income posted a positive return of 2.8% (S&P U.S. Aggregate Bond Index). Again, this divergence in return performance highlights how an allocation to private core real estate, which historically has a low correlation with public markets, can offer healthy diversification to a multi-asset portfolio.

| 1 | All Q4 2023 return data referenced in this document is preliminary and reflective of I-shares performance. |

| 2 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Shareholder Letter |

December 31, 2023 (Unaudited)

The following summary highlights the sector returns during the Reporting Period. Industrial and retail were the strongest performers, declining -2.2% and -1.2%, respectively. Residential properties decreased -3.9% while office properties experienced negative returns of approximately -6.0%. The other sector (mainly consisting of alternative property types such as self-storage) experienced a -2.3% decline over the period. Notably, the Fund’s sector returns were consistent with the performance of the NFI-ODCE Index.

The Fund also seeks to make quarterly distributions to shareholders. During the Reporting Period, the Fund made dividends totaling $0.10 per share, which equates to an annualized distribution rate of approximately 4.0%. While future distributions are not guaranteed, the Fund has made 11 consecutive quarterly distributions since its inception on April 1, 2021.

Overall, the Fund continued to deliver on its objective – offering investors diversification within a multi-asset portfolio while providing a stable quarterly dividend. Furthermore, while real estate managers tend to use varying degrees of leverage to enhance returns, NFI-ODCE managers generally invest at low leverage levels (approximately 25% on average), and most of their outstanding debt is held at fixed rates, which significantly mitigates the risk of default. Therefore, even in the current high interest rate environment, core real estate investors can rest well knowing the sector is performing as expected.

Exhibit 2: Return Attributes by Asset Class (Since Fund Inception 4/1/2021 - 12/31/2023)

| 2Q 2021 - 4Q 2023 | | Drawdown | | Annualized

Return | | Volatility | | Correlation

to S&P 500 |

| Accordant ODCE Index Fund (ODCEX) TR | | | -17.2% | | | | 3.6% | | | | 9.4% | | | | -0.36 | |

| NFI-ODCE Index TR | | | -17.2% | | | | 3.7% | | | | 9.5% | | | | -0.36 | |

| S&P U.S. Agg Bond Index TR | | | -14.6% | | | | -2.6% | | | | 7.2% | | | | 0.82 | |

| NAREIT U.S. Real Estate Index TR | | | -27.9% | | | | 3.1% | | | | 20.4% | | | | 0.90 | |

| S&P 500 TR | | | -23.9% | | | | 8.6% | | | | 16.7% | | | | 1.00 | |

Macro-Economic Perspective

Heading into the Reporting Period, concerns over persistent inflation and how the Federal Reserve’s (Fed’s) interest rate policy would respond remained top of mind for market participants. The Consumer Price Index (CPI) declined by 3.1 percentage points to 3.3% from December 2022 to December 2023.2 While this figure remains well above the Fed’s 2% inflation target, it is decidedly lower than the recent high of 8.9% that occurred in 2022.3 Similarly, the Personal Consumption Expenditures excluding food and energy (Core PCE), the Fed’s preferred measure of inflation, fell from 4.9% to 2.9% over the same period.4 Thus, inflation continues to show signs of moderating by almost all key measures.

Meanwhile, the Fed continued its restrictive monetary policy while maintaining a healthy economic outlook. Throughout most of the Reporting Period, the Fed held rates constant at 5.25% - 5.50%, the highest benchmark rate since 2007.5 Given that inflation numbers are trending lower, the broad market consensus is that the rate hiking cycle has peaked, and the Fed will likely begin cutting interest rates at some point in 2024.

For now, the U.S. economy remains stable. The nation’s gross domestic product (GDP) grew at a healthy annualized rate of 3.3% in the fourth quarter of 2023, down from the blistering 4.9% pace in the third quarter. Still, it was the strongest fourth-quarter GDP figure since 2021.6 The unemployment rate held steady at 3.7% in December 2023, completing the 23rd consecutive month in which the rate has been below 4% – the longest such stretch in half a century.7 With the labor market arguably at or near full employment, there has been a gradual slowdown in new entries into the labor force. However, the economy still added 216,000 jobs in December 2023, slightly above the 200,000 jobs threshold economists often cite as the amount needed to support a healthy economy.

Looking ahead, in our view, the Fed seems poised to hold short-term rates steady until they are confident that inflation has been contained. However, it remains to be seen whether the Fed’s policy will succeed in achieving a soft landing (disinflation without an economic downturn).

| 2 | Bureau of Labor Statistics. |

| 3 | Bureau of Labor Statistics. |

| 4 | Bureau of Economic Analysis. |

| 5 | Federal Reserve Bank of New York. |

| 6 | Bureau of Economic Analysis. |

| 7 | FRED Economic Data | St. Louis Fed. |

| Semi-Annual Report | December 31, 2023 | 3 |

| Accordant ODCE Index Fund | Shareholder Letter |

December 31, 2023 (Unaudited)

Real Estate Market Update

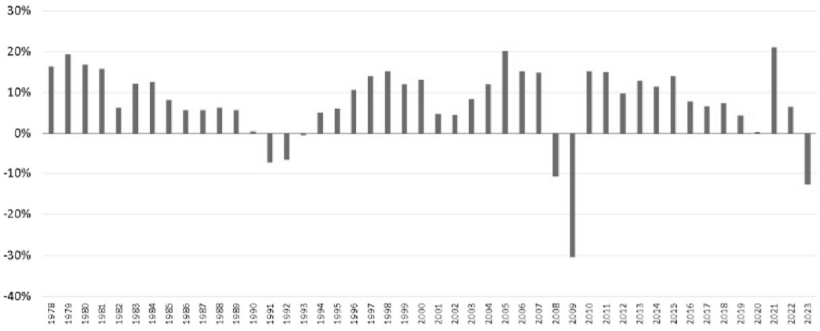

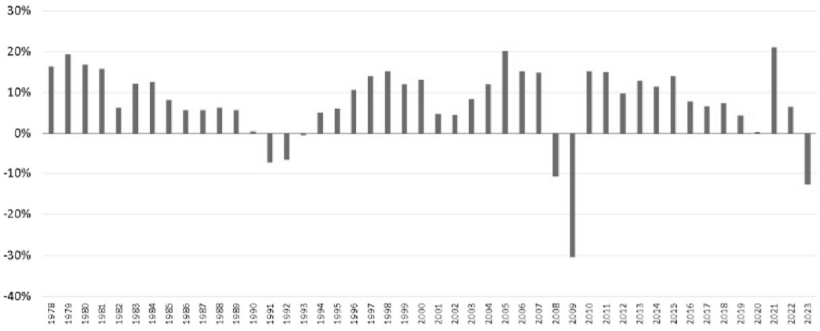

In terms of historical performance, the Index has delivered a healthy average annual total return of 7.7% with modest volatility over the last 45 years. However, core real estate values have recently fallen for five consecutive quarters, resulting in a peak-to-trough value decline of -17.2% as of Q4 2023. For context, real estate hasn’t revalued at such a pace since the Global Financial Crisis (GFC) of 2008-09, which saw six quarters of negative returns. In fact, before 2023, the NFI-ODCE Index had experienced only five years of negative performance over the past 45 years, and even those occurrences were clustered around two generation-defining downturns – Savings and Loan Crisis of the early 1990s and, more recently, during the GFC (see Exhibit 3). Thus, today’s market conditions offer an exceedingly rare buying opportunity (one that only occurs every 15 years on average) as some of the best quality real estate in the world is trading at a considerable discount from previous highs.

Exhibit 3: NFI - ODCE Index Historical Returns (1978 - 2023)8

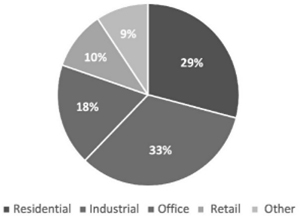

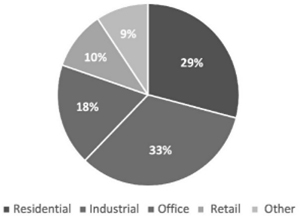

The recent value decline is primarily a result of cap rates edging higher due to the elevated interest rate environment. Nevertheless, operating fundamentals have remained relatively healthy across most property types except for the office sector. Additionally, managers continue to cycle out of office exposure to higher conviction sectors such as industrial and residential. Over the past five years, managers have reoriented their portfolios, culling underperforming office in particular. Office now accounts for less than 18% of the NFI-ODCE Index, more than a 50% decrease compared to five years ago.

EXHIBIT 4: NFI - ODCE Index Property Type Diversification 12/31/20239

| 8 | IDR Investment Management, NCREIF. |

| 9 | IDR Investment Management, NCREIF. |

| 4 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Shareholder Letter |

December 31, 2023 (Unaudited)

Below is a brief synopsis of the four major property types in the NFI-ODCE Index:

| | ● | Industrial: The industrial sector primarily consists of warehouses and distribution facilities. These assets continued to see above-average rent growth due to robust tenant demand. NFI-ODCE Index industrial occupancy levels remained strong at approximately 98% at year-end 2023 and have been above 95% for over nine consecutive years. At over 33%, industrial assets represent the largest property type in the Index. Going forward, pockets of oversupply may impact certain markets, but demand for high-quality Class A warehouses shows little sign of waning. |

| | | |

| | ● | Residential: Similar to industrial, the residential sector has seen outsized capital flows in recent years. Much of this investor optimism is due to the supply and demand imbalance in the U.S. housing stock. According to one estimate, the U.S. housing shortage may be as high as 5.5 million units.10 This dynamic has spurred investor interest in recent years, evidenced by the residential sector now representing over 29% of the overall NFI-ODCE Index, trailing only the industrial sector. While occupancy levels remain stable at approximately 94%, the delivery of the new supply currently in the construction pipeline will likely weigh on rent growth over the next 12-24 months. Nevertheless, market participants widely view the residential sector as a defensive holding in the current environment and will likely continue to be net buyers going forward. |

| | | |

| | ● | Retail: Retail properties will likely experience muted rent growth over the near term; however, the sector has stabilized after a multi-year revaluation. Once constituting over 20% of the Index at its peak in 2017 (third only to the office and residential sectors, respectively), retail now makes up 10%. Many traditional retail establishments fell out of favor and were ultimately pruned from the Index as consumer behavior shifted toward e-commerce. The upshot, however, is that retail properties (particularly grocery-anchored and community/neighborhood centers) that have weathered the sector’s downturn are somewhat insulated as new supply has been slow to come online. Thus, NFI-ODCE Index retail occupancy levels remain steady at approximately 92%. Yet, the near-term concern for the sector continues to be whether consumers’ robust spending will be derailed by a potential recession in 2024. |

| | | |

| | ● | Office: The office sector faces headwinds centered mainly around the pandemic-era remote/hybrid work policies that have persisted in some markets. Still, it is essential to note that many NFI-ODCE Index managers have already significantly written down or pruned their office portfolios. Therefore, the Index’s exposure to the sector has decreased significantly, from an all-time high of 39% in 2014 to only 18% as of Q4 2023. Thus, while the office sector remains a cause for concern, the highest quality properties (newer amenity-rich office projects, life science, and medical office properties) should continue outperforming and capturing a larger share of tenant demand. |

Again, core real estate fundamentals, excluding office, are generally stable despite the volatility in capital markets. As we enter 2024, in our view interest rates seem poised to moderate, which could benefit NFI-ODCE Index managers, most of whom have taken a responsible investing approach (staying well-capitalized and using reasonable, long-term fixed-rate debt). As a result, they have been able to hold assets through what has been a less-than-favorable selling period and have suffered neither income erosion nor a rash of foreclosures despite the historically high interest rate environment. Ultimately, core real estate seems poised to recover as interest rates and market conditions normalize.

Concluding Thoughts

As for the broader real estate outlook, a wide range of factors are at play. For starters, the Fed has been steadfast in its efforts to quell inflation, even at the risk of overtightening. Therefore, it is impossible to rule out the possibility of a recession despite increasing predictions of a soft landing. Still, if inflation continues on its current trajectory, we believe rate cuts will likely occur at some point in 2024, which could be a significant tailwind for real estate investors. While 2023 saw real estate values meaningfully reset after 13 consecutive years of positive returns, 2024 could prove to be an inflection point as the sector shifts toward a recovery phase. In that event, in our view the Fund is well positioned to capitalize on this opportunity as a new cycle emerges.

On behalf of the team at Accordant Investments, we look forward to engaging with you in 2024 as the real estate market continues to evolve.

| |

| | |

| Garrett Zdolshek | |

| Chief Investment Officer | |

| 10 | McCue, Huang, “Estimating the National Housing Shortfall,” Joint Center for Housing Studies, 1-29-2024, jchs.harvard.edu. |

| Semi-Annual Report | December 31, 2023 | 5 |

| Accordant ODCE Index Fund | Company Performance |

December 31, 2023 (Unaudited)

Average Annual Total Returns (as of December 31, 2023)

| | | 6 Month | | 1 Year | | Since Inception* |

| Accordant ODCE Index Fund - A - NAV | | | -6.76 | % | | | -12.69 | % | | | 3.61 | % |

| Accordant ODCE Index Fund - A – LOAD** | | | -12.12 | % | | | -17.71 | % | | | 1.40 | % |

| Accordant ODCE Index Fund - I - NAV | | | -6.72 | % | | | -12.65 | % | | | 3.63 | % |

| Accordant ODCE Index Fund - Y - NAV | | | -6.76 | % | | | -12.69 | % | | | 3.61 | % |

| FTSE NAREIT All Equity REITs TR Index(a) | | | 8.15 | % | | | 11.36 | % | | | 2.49 | % |

| NCREIF Property Index(b) | | | 49.98 | % | | | 44.35 | % | | | 22.88 | % |

The performance data quoted above represents past performance. Past performance is not a guarantee of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. Fund performance current to the most recent month-end is available by calling 888.778.7781 or by visiting www.accordantinvestments.com.

| * | Fund’s inception date is April 1, 2021. |

| ** | Adjusted for maximum sales charge of 5.75%. |

| (a) | The FTSE Nareit All Equity REITs Index is a free-float adjusted, market capitalization-weighted index of U.S. equity REITs. Constituents of the index include all tax-qualified REITs with more than 50 percent of total assets in qualifying real estate assets other than mortgages secured by real property. |

| (b) | The NCREIF Property Index (NPI) is a quarterly, unleveraged composite total return for private commercial real estate properties held for investment purposes only. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors and held in a fiduciary environment. |

Performance of $10,000 Initial Investment (as of December 31, 2023)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund since inception. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

| 6 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Company Performance |

December 31, 2023 (Unaudited)

| Top Ten Holdings (as a % of Net Assets)* | |

| Prime Property Fund, LLC | 17.94% |

| JP Morgan Strategic Property Fund FIV 2 (US) LP | 12.52% |

| CBRE U.S. Core Partners, LP | 8.44% |

| Invesco Core Real Estate - U.S.A., L.P. | 7.76% |

| Prisa LP | 7.25% |

| Clarion Lion Properties Fund, LP | 7.11% |

| RREEF America REIT II, Inc. | 6.14% |

| Smart Markets Fund, L.P. | 5.67% |

| BGO Diversified US Property Fund LP | 4.75% |

| US Real Estate Investment Fund, LLC | 4.19% |

| Top Ten Holdings | 81.78% |

| * | Holdings are subject to change, and may not reflect the current or future position of the portfolio. Tables present indicative values only. |

Asset Allocation (as a % of Net Assets)*

| Semi-Annual Report | December 31, 2023 | 7 |

| Accordant ODCE Index Fund | Schedule of Investments |

December 31, 2023 (Unaudited)

| | | Original Acquisition Date | | Shares/ Units | | Percent of Net Assets | | Cost | | Fair Value |

| PRIVATE REAL ESTATE INVESTMENT FUNDS (91.56%) | | | |

| United States (91.56%)(a)(b) | | | | | | | | | | | | | | | | | | | | |

| ARA Core Property Fund LP | | | 10/3/2022 | | | | 6 | | | | 2.71 | % | | $ | 1,000,000 | | | $ | 780,406 | |

| ASB Allegiance Real Estate Fund LP | | | 12/31/2021 | | | | 702 | | | | 3.59 | % | | | 1,222,500 | | | | 1,034,551 | |

| BGO Diversified US Property Fund LP | | | 10/1/2021 | | | | 546 | | | | 4.75 | % | | | 1,400,000 | | | | 1,369,165 | |

| Blackrock US Core Property Fund, L.P. | | | 1/1/2022 | | | | 1,000 | | | | 3.49 | % | | | 1,222,500 | | | | 1,007,301 | |

| CBRE U.S. Core Partners, LP | | | 12/31/2021 | | | | 1,489,378 | | | | 8.44 | % | | | 2,960,000 | | | | 2,434,056 | |

| Clarion Lion Properties Fund, LP | | | 4/1/2021 | | | | 1,304 | | | | 7.11 | % | | | 2,030,100 | | | | 2,050,754 | |

| Invesco Core Real Estate - U.S.A., L.P. | | | 4/1/2021 | | | | 12 | | | | 7.76 | % | | | 2,179,627 | | | | 2,238,078 | |

| JP Morgan Strategic Property Fund FIV 2 (US) LP | | | 10/1/2021 | | | | 321,993 | | | | 12.52 | % | | | 3,942,236 | | | | 3,612,009 | |

| Prime Property Fund, LLC | | | 6/30/2021 | | | | 256 | | | | 17.94 | % | | | 5,151,215 | | | | 5,176,091 | |

| Prisa LP (c) | | | 4/1/2021 | | | | 1,022 | | | | 7.25 | % | | | 1,901,739 | | | | 2,092,538 | |

| RREEF America REIT II, Inc. (d) | | | 1/1/2022 | | | | 13,649 | | | | 6.14 | % | | | 2,112,500 | | | | 1,770,086 | |

| Smart Markets Fund, L.P. | | | 9/1/2021 | | | | 933 | | | | 5.67 | % | | | 1,649,626 | | | | 1,636,377 | |

| US Real Estate Investment Fund, LLC | | | 7/1/2022 | | | | 969 | | | | 4.19 | % | | | 1,551,875 | | | | 1,209,769 | |

| TOTAL United States | | | | | | | | | | | | | | $ | 28,323,918 | | | $ | 26,411,181 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL Private Real Estate Investment Funds | | | | | | | | | | | | | | $ | 28,323,918 | | | $ | 26,411,181 | |

| | | Yield | | | Shares | | | Percent of Net Assets | | | Cost | | | Fair Value | |

| Short Term Security (6.61%) | | | | | | | | | | | | | | | | | | | | |

| MONEY MARKET FUND (6.61%) | | | | | | | | | | | | | | | | | | | | |

| Fidelity Investments Money Market | | | | | | | | | | | | | | | | | | | | |

| Government Portfolio | | | 5.230 | % | | | 1,906,303 | | | | 6.61 | % | | $ | 1,906,303 | | | $ | 1,906,303 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL Short Term Security | | | | | | | | | | | | | | $ | 1,906,303 | | | $ | 1,906,303 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL INVESTMENTS (98.17%) | | | | | | | | | | | | | | $ | 30,230,221 | | | $ | 28,317,484 | |

| | | | | | | | | | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (1.83%) | | | | | | | | | | | | | | | | | | | 527,892 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | | | | | | | | | | | | | $ | 28,845,376 | |

| (a) | Restricted security. The total cost and fair value of these restricted investments as of December 31, 2023 was $28,323,918 and $26,411,181, respectively, which represents 91.56% of total net assets of the Company. |

| (b) | Redemptions permitted quarterly and redemption notices for the private real estate investment funds is 90 days or less. |

| (c) | Non-Income Producing Security. |

| (d) | The Company held unfunded commitments $337,500 as of December 31, 2023. |

See Notes to Financial Statements.

| 8 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Statement of Assets and Liabilities |

December 31, 2023 (Unaudited)

| ASSETS | | |

| Investments, at value (Cost $30,230,221) | | $ | 28,317,484 | |

| Receivable for investments sold | | | 57,127 | |

| Receivable for shares sold | | | 11,089 | |

| Dividends and interest receivable | | | 134,679 | |

| Receivable due from adviser | | | 609,669 | |

| Other assets | | | 3,771 | |

| Total assets | | | 29,133,819 | |

| | | | | |

| LIABILITIES | | | | |

| Payable for administration fees | | | 83,369 | |

| Payable for transfer agency fees | | | 46,512 | |

| Payable to trustees | | | 76,626 | |

| Payable to Chief Compliance Officer | | | 1,646 | |

| Accrued expenses and other liabilities | | | 80,290 | |

| Total liabilities | | | 288,443 | |

| NET ASSETS | | $ | 28,845,376 | |

| | | | | |

| NET ASSETS CONSIST OF | | | | |

| Paid-in capital (Note 5) | | $ | 31,051,125 | |

| Distributable Earnings | | | (2,205,749 | ) |

| NET ASSETS | | $ | 28,845,376 | |

| | | | | |

| PRICING OF SHARES | | | | |

| Class A: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 9.89 | |

| Net Assets | | $ | 9,521 | |

| Shares of beneficial interest outstanding | | | 963 | |

| Maximum offering price per share | | $ | 10.52 | |

| Class I: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 9.89 | |

| Net Assets | | $ | 28,708,480 | |

| Shares of beneficial interest outstanding | | | 2,904,105 | |

| Class Y: | | | | |

| Net Asset Value, offering and redemption price per share | | $ | 9.89 | |

| Net Assets | | $ | 127,375 | |

| Shares of beneficial interest outstanding | | | 12,883 | |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2023 | 9 |

| Accordant ODCE Index Fund | Statement of Operations |

For the Six Months Ended December 31, 2023 (Unaudited)

| INVESTMENT INCOME | | | | |

| Dividends | | $ | 401,668 | |

| Interest | | | 23,239 | |

| Total investment income | | | 424,907 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 77,307 | |

| Administrative fees | | | 111,402 | |

| Transfer agency fees | | | 128,297 | |

| Professional fees | | | 70,789 | |

| Legal Expense | | | 549,469 | |

| Custodian fees | | | 11,325 | |

| Trustees' fees and expenses | | | 151,626 | |

| Other | | | 79,873 | |

| Total expenses before waiver | | | 1,180,088 | |

| Less fees waived/reimbursed by investment adviser | | | (1,073,741 | ) |

| Total expenses | | | 106,347 | |

| NET INVESTMENT INCOME | | | 318,560 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/LOSS ON INVESTMENTS | | | | |

| Net realized gain on investments | | | 31,094 | |

| Net change in unrealized depreciation on investments | | | (2,416,145 | ) |

| NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (2,385,051 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (2,066,491 | ) |

See Notes to Financial Statements.

| 10 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended December 31, 2023 | | For the Year Ended June 30, 2023 |

| OPERATIONS | | | | | | | | |

| Net investment income | | $ | 318,560 | | | $ | 293,313 | |

| Net realized gain | | | 31,094 | | | | 91,254 | |

| Net change in unrealized depreciation | | | (2,416,145 | ) | | | (4,116,737 | ) |

| Net decrease in net assets resulting from operations | | | (2,066,491 | ) | | | (3,732,170 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| Class A | | | (96 | ) | | | – | |

| Class I | | | (907,178 | ) | | | (339,480 | ) |

| Class Y | | | (1,285 | ) | | | – | |

| Return of capital: | | | | | | | | |

| Class I | | | – | | | | (881,055 | ) |

| Net decrease in net assets from distributions | | | (908,559 | ) | | | (1,220,535 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from sales of shares | | | | | | | | |

| Class A | | | 9,859 | | | | – | |

| Class I | | | 872,831 | | | | 9,510,000 | |

| Class Y | | | 131,279 | | | | – | |

| Issued to shareholders in reinvestment of distributions | | | | | | | | |

| Class A | | | 96 | | | | – | |

| Class I | | | 172,759 | | | | 303,798 | |

| Class Y | | | 1,285 | | | | – | |

| Cost of shares redeemed | | | | | | | | |

| Class A | | | (22 | ) | | | – | |

| Class I | | | – | | | | (2,432,031 | ) |

| Class Y | | | – | | | | – | |

| Net increase from capital share transactions | | | 1,188,087 | | | | 7,381,767 | |

| | | | | | | | | |

| Net increase/(decrease) in net assets | | | (1,786,963 | ) | | | 2,429,062 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 30,632,339 | | | | 28,203,277 | |

| End of period | | $ | 28,845,376 | | | $ | 30,632,339 | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Shares Sold: | | | | | | | | |

| Class A | | | 954 | | | | – | |

| Class I | | | 84,915 | | | | 778,183 | |

| Class Y | | | 12,753 | | | | – | |

| Shares reinvested: | | | | | | | | |

| Class A | | | 10 | | | | – | |

| Class I | | | 16,823 | | | | 25,341 | |

| Class Y | | | 129 | | | | – | |

| Shares repurchased: | | | | | | | | |

| Class A | | | (2 | ) | | | – | |

| Class I | | | – | | | | (205,952 | ) |

| Class Y | | | – | | | | – | |

| Net increase in capital share transactions | | | 115,582 | | | | 597,572 | |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2023 | 11 |

| Accordant ODCE Index Fund | Statement of Cash Flows |

For the Six Months Ended December 31, 2023 (Unaudited)

| | | For the Six Months Ended December 31, 2023 |

| Cash Flows from Operating Activities: | | | | |

| Net decrease in net assets resulting from operations | | $ | (2,066,491 | ) |

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investment securities | | | (337,500 | ) |

| Proceeds from disposition of investment securities | | | 508,928 | |

| Net purchases of short-term investment securities | | | (1,906,303 | ) |

| Net realized gain on investments | | | (31,094 | ) |

| Net change in unrealized appreciation/(depreciation) on investments | | | 2,416,145 | |

| (Increase)/Decrease in Assets: | | | | |

| Dividends and interest receivable | | | 95,526 | |

| Prepaid expenses and other assets | | | (1,121 | ) |

| Receivable due from adviser | | | (64,631 | ) |

| Increase/(Decrease) in Liabilities: | | | | |

| Payable to adviser | | | (446,854 | ) |

| Payable for administration fees | | | 83,369 | |

| Payable for transfer agency fees | | | 46,512 | |

| Chief compliance officer fees payable | | | (5,000 | ) |

| Payable to trustees | | | 76,626 | |

| Accrued expenses and other liabilities | | | (305,789 | ) |

| Net Cash Provided by Operating Activities | | | (1,937,677 | ) |

| | | | | |

| Cash Flows from Financing Activities: | | | | |

| Proceeds from shares sold | | | 1,002,880 | |

| Issued to shareholders in reinvestment of distributions | | | 174,140 | |

| Payment on shares redeemed | | | (22 | ) |

| Cash distributions paid | | | (908,559 | ) |

| Capital withdrawal payable | | | (447,579 | ) |

| Net Cash Used in Financing Activities | | | (179,140 | ) |

| | | | | |

| Net Change in Cash | | | (2,116,817 | ) |

| | | | | |

| Cash Beginning of Period | | $ | 2,116,817 | |

| Cash End of Period | | $ | – | |

| | | | | |

| Non-cash financing activities not included herein consist of reinvestment of distributions of: | | $ | 174,140 | |

See Notes to Financial Statements.

| 12 | www.accordantinvestments.com |

| Accordant ODCE Index Fund – Class A | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the period November 2, 2023 to December 31, 2023 (Unaudited) |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.33 | |

| | | | | |

| INCOME FROM OPERATIONS | | | | |

| Net investment income(a) | | | 0.03 | |

| Net realized and unrealized loss on investments | | | (0.37 | ) |

| Total from investment operations | | | (0.34 | ) |

| | | | | |

| DISTRIBUTIONS | | | | |

| From net investment income | | | (0.10 | ) |

| Total distributions | | | (0.10 | ) |

| | | | | |

| DECREASE IN NET ASSET VALUE | | | (0.44 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 9.89 | |

| | | | | |

| TOTAL RETURN | | | (6.76 | %)(b) |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (000's) | | $ | 9,521 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Ratio of expenses to average net assets including fee waivers/reimbursements | | | 1.35 | %(c) |

| Ratio of expenses to average net assets without fee waivers/reimbursements | | | 13.55 | %(c) |

| | | | | |

| Net investment income | | | 1.72 | %(c) |

| Net investment loss, after waiver | | | (10.46 | )%(c) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 1 | %(b) |

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Not annualized. |

| (c) | Annualized. |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2023 | 13 |

| Accordant ODCE Index Fund – Class I | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended December 31, 2023 (Unaudited) | | For the Year Ended

June 30, 2023 | | For the Year Ended June 30, 2022 | | For the Period April 1, 2021* through June 30, 2021 |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.93 | | | $ | 12.79 | | | $ | 10.28 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | |

| INCOME FROM OPERATIONS | | | | | | | | | | | | | | | | |

| Net investment income (loss)(a) | | | 0.11 | | | | 0.12 | | | | 0.24 | | | | (0.01 | ) |

| Net realized and unrealized gain (loss) on investments | | | (0.94 | ) | | | (1.48 | ) | | | 2.60 | | | | 0.39 | |

| Total from investment operations | | | (0.83 | ) | | | (1.36 | ) | | | 2.84 | | | | 0.38 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS | | | | | | | | | | | | | | | | |

| From net investment income (loss) | | | (0.21 | ) | | | (0.15 | ) | | | (0.13 | ) | | | - | |

| From Return of Capital | | | - | | | | (0.35 | ) | | | (0.20 | ) | | | (0.10 | ) |

| Total distributions | | | (0.21 | ) | | | (0.50 | ) | | | (0.33 | ) | | | (0.10 | ) |

| | | | | | | | | | | | | | | | | |

| INCREASE/DECREASE IN NET ASSET VALUE | | | (1.04 | ) | | | (1.86 | ) | | | 2.51 | | | | 0.28 | |

| NET ASSET VALUE, END OF PERIOD | | $ | 9.89 | | | $ | 10.93 | | | $ | 12.79 | | | $ | 10.28 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | (6.72 | %)(b) | | | (11.03 | %)(b) | | | 27.96 | %(b) | | | 3.79 | %(b) |

| | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | | | | | | | | | | | | | |

| Net assets, end of period (000's) | | $ | 28,708 | | | $ | 30,632 | | | $ | 28,203 | | | $ | 6,000 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets including fee waivers/reimbursements | | | 1.15 | %(c) | | | 1.36 | % | | | 0.14 | % | | | 2.74 | % |

| Ratio of expenses to average net assets without fee waivers/reimbursements | | | 12.71 | %(c) | | | 3.55 | % | | | 6.66 | % | | | 45.52 | % |

| | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | 3.43 | %(c) | | | 0.93 | % | | | 2.05 | % | | | (0.58 | %) |

| Net investment income, excluding waiver | | | (8.13 | %)(c) | | | (1.26 | %) | | | (4.47 | %) | | | (42.20 | %) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 1 | %(b) | | | 2.98 | % | | | 0.39 | % | | | 0 | % |

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Not annualized. |

| (c) | Annualized. |

See Notes to Financial Statements.

| 14 | www.accordantinvestments.com |

| Accordant ODCE Index Fund – Class Y | Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the period November 2, 2023 to December 31, 2023 (Unaudited) |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 10.33 | |

| | | | | |

| INCOME FROM OPERATIONS | | | | |

| Net investment income(a) | | | 0.03 | |

| Net realized and unrealized loss on investments | | | (0.37 | ) |

| Total from investment operations | | | (0.34 | ) |

| | | | | |

| DISTRIBUTIONS | | | | |

| From net investment income | | | (0.10 | ) |

| Total distributions | | | (0.10 | ) |

| | | | | |

| DECREASE IN NET ASSET VALUE | | | (0.44 | ) |

| NET ASSET VALUE, END OF PERIOD | | $ | 9.89 | |

| | | | | |

| TOTAL RETURN | | | (6.76 | %)(b) |

| | | | | |

| RATIOS AND SUPPLEMENTAL DATA | | | | |

| Net assets, end of period (000's) | | $ | 127 | |

| | | | | |

| RATIOS TO AVERAGE NET ASSETS | | | | |

| Ratio of expenses to average net assets including fee waivers/reimbursements | | | 1.10 | %(c) |

| Ratio of expenses to average net assets without fee waivers/reimbursements | | | 16.21 | %(c) |

| | | | | |

| Net investment income | | | 1.98 | %(c) |

| Net investment loss, excluding waiver | | | (13.14 | %)(c) |

| | | | | |

| PORTFOLIO TURNOVER RATE | | | 1 | %(b) |

| (a) | Per share numbers have been calculated using the average shares method. |

| (b) | Not annualized. |

| (c) | Annualized. |

See Notes to Financial Statements.

| Semi-Annual Report | December 31, 2023 | 15 |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

1. ORGANIZATION

Accordant ODCE Index Fund (the “Fund”) is a non-diversified, closed-end management investment fund registered under the Investment Company Act of 1940, as amended (the “1940 Act”), that operates as an “interval fund.” The Fund was formed as a Maryland corporation on April 11, 2019 and converted to a Delaware statutory trust on September 1, 2023. The Fund’s investment objective is to employ an indexing investment approach that seeks to track the NCREIF Fund Index – Open End Diversified Core Equity (the “NFI-ODCE Index”) on a net-of-fee basis while minimizing tracking error. The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its net assets, plus the amount of any borrowings for investment purposes, in real estate investment vehicles that comprise the NFI-ODCE Index (the “Eligible Component Funds”). The NFI-ODCE Index performance is reported on a capitalization-weighted and equal-weighted basis and returns are reported gross and net of fees. Performance measurement and reporting is time-weighted. The National Council of Real Estate Investment Fiduciaries has established inclusion criteria guidelines for the NFI-ODCE Index, which similarly apply to each of the Eligible Component Funds in which the Fund invests. The NFI-ODCE Index is currently comprised of 26 Eligible Component Funds and the number of Eligible Component Funds the Fund expects to invest in may range from 18 to 26 under normal circumstances. Accordant Investments LLC (the “Adviser”) serves as the investment adviser to the Fund, and IDR Investment Management, LLC (“IDR” or “Sub-Adviser,” and together with the Adviser, the “Advisers”) serves as the sub-adviser to the Fund. The Sub-Adviser of the Fund previously served as the adviser to the Fund prior to its conversion to a Delaware statutory trust on September 1, 2023. The Fund has been structured with the intent of providing exposure and streamlining investor access to real estate investment vehicles (the “Underlying Funds”). These Underlying Funds are those that invest in interests in real estate equity and debt, including mortgages and other interests therein, commonly through entities qualifying as real estate investment trusts (“REITs”). The Underlying Funds’ investments may be targeted in any one or more of the many sectors of the real estate market, including, but not limited to, the retail, office, multifamily, hospitality, industrial, residential, medical and self-storage sectors. The Fund is a Delaware statutory trust and intends to continue to qualify as a “real estate investment trust” (“REIT”) for U.S. federal income tax purposes under the Internal Revenue Code of 1986, as amended (the “Code”).

The Fund currently offers three classes of shares: Class A shares (“Class A Shares”), Class I shares (“Class I Shares”), and Class Y shares (“Class Y Shares” and together with the Class A and Class I Shares, the “Shares”). The Fund currently relies on exemptive relief granted by the SEC on October 24, 2023, permitting the Fund to issue multiple classes of shares with varying sales loads and asset based service and/or distribution fees. Class A Shares, Class I Shares and Class Y Shares will be continuously offered at the Fund’s net asset value (“NAV”) per share, plus, in the case of Class A Shares, a maximum sales load of up to 5.75%, from which a dealer-manager fee of up to 0.75% of offering proceeds may also be paid. Holders of Class A Shares, Class I Shares, and Class Y Shares have equal rights and privileges with each other, except that Class I Shares and Class Y Shares do not pay a sales load or dealer manager fees. Class I Shares and Class Y Shares are each not subject to a sales load; however, investors could be required to pay brokerage commissions on purchases and sales of Class I or Class Y Shares to their selling agents. Shareholders will be entitled to the payment of dividends and other distributions when, as and if declared by the Fund’s Board of Trustees (the “Board”). All shares have equal rights to the payment of dividends and the distribution of assets upon liquidation.

2. SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation and Use of Estimates – The Fund is an investment fund and follows the accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, Financial Services – Investment Companies and Accounting Standards Update (“ASU”) 2013-08. The Fund financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The preparation of the financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from these estimates.

Determination of the Fund’s Net Asset Value – The Fund determines the NAV of its shares daily, as of the close of regular trading on the New York Stock Exchange (normally, 4:00 p.m. Eastern Time). The calculation of NAV is made by the Fund’s sub-administrator, subject to the oversight of the Advisers and the administrator, based on valuation information provided by the Advisers. The NAV per share of the Fund’s shares is determined by dividing the total assets of the Fund (the value of investments, plus cash or other assets, including interest and distributions accrued but not yet received) less the value of any liabilities (including accrued expenses or distributions), by the total number of shares outstanding.

Valuation of the Fund's Portfolio – The Board has designated the Adviser as the valuation designee to perform fair valuations pursuant to Rule 2a-5 under the 1940 Act. The Board has adopted policies and procedures for determining the fair value of the Fund’s assets, and has delegated responsibility for applying the valuation policies to the Adviser. The Adviser, pursuant to the policies adopted by the Board, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s valuation policies, overseeing the calculation of the NAV per share for each class of shares and reporting to the Board. A large percentage of the assets in which the Underlying Funds invest will not have a readily ascertainable market price and will be fair-valued by the Underlying Fund. The Adviser provides the Board with periodic reports on a quarterly basis, or more frequently if necessary, describing the valuation process applicable to that period.

| 16 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

Valuation of Private Investment Funds – The Fund’s investments generally include open-end and closed-end private investment companies. The sponsors or managers of these investment companies measure their investment assets at fair value and report a NAV per share at least quarterly (the “Investment NAV”). These funds have generally adopted valuation practices consistent with the valuation standards and techniques established by professional industry associations that advise the institutional real estate investment community. Such valuation standards seek general application of U.S. GAAP fair value standards, uniform appraisal standards and the engagement of independent valuation advisory firms. In accordance with ASC 820, Fair Value Measurements (“ASC 820”), the Fund has elected to apply the practical expedient, and to value its investments at their respective NAVs or NAV equivalents at each quarter.

Underlying Funds – The valuation of the Fund’s investments in the Underlying Funds is based upon valuations provided by the underlying fund managers on a daily or quarterly basis. Such Investment NAVs are reviewed by the Adviser upon receipt and subsequently applied to the Fund’s NAV following consultation with the fund manager, if necessary. To the extent that the Fund does not receive timely information from the underlying funds regarding their valuations, and the net asset value of the Fund’s own investment in such underlying Fund, the Adviser, who has been named as the valuation designee by the Board, shall inform the Valuation Committee and a meeting may be called to determine fair value, and the Fund’s ability to accurately calculate the Fund’s net asset value may be impaired.

Fair valuation procedures may be used to value a substantial portion of the assets of the Fund. The Fund may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided by a broker-dealer or independent pricing service is inaccurate.

Investment Transactions, Interest and Dividends – Investment transactions are recorded on trade date. Realized gains and losses on investment transactions are determined on a specific identification. Interest income and expense is recognized under the accrual basis. Dividend income is recognized on the ex-dividend date.

Income from Investment Companies – Distributions received or receivable from investments in investment companies are evaluated to determine if the distribution is income or a return of capital. Generally, income is not recorded unless the manager of the investment Fund has declared the distribution, there is cash available to make the distribution and there are accumulated earnings in excess of the amount recorded as income. Distributions classified as a return of capital are a reduction in the cost basis of the investment. Amounts shown as expenses in the statement of operations and financial highlights include only those expenses charged directly to the Fund and do not reflect management fees, advisory fees, performance fees or incentive allocations, brokerage commissions and other expenses incurred by investment companies in which the Fund is invested. These amounts are included in net change in unrealized depreciation on investments in the accompanying statement of operations. Also, included in the net change in unrealized appreciation on underlying investments is the Fund’s allocable share of realized and unrealized gains or losses from underlying investments held by the investment companies.

Unfunded Commitments – Typically, when the Fund invests in an underlying fund, the Fund makes a binding commitment to invest a specified amount of capital in the applicable Underlying Fund. The capital commitment may be drawn by the general partner of the Underlying Fund either all at once or through a series of capital calls at the discretion of the general partner. As such, an unfunded commitment represents the portion of the Fund’s overall capital commitment to a particular underlying manager that has not yet been called by the general partner of the Underlying Fund. Unfunded commitment may subject the Fund to certain risks. Further, the organizational documents of the Private Fund in which the Fund invests typically have set redemption schedules and notification requirements. As of December 31, 2023, the Fund had total unfunded commitments in the amount of $337,500.

Indemnification – The Fund indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on industry experience, the Fund expects the risk of loss due to these warranties and indemnities to be remote.

Federal Income Taxes – The Fund intends to continue to qualify as a REIT pursuant to the Code. The Fund will continue to be organized and operate in such a manner as to qualify for taxation as a REIT under the applicable provisions of the Code. The Fund’s qualification as a REIT depends upon the continuing satisfaction by the Fund of requirements of the Code relating to qualification for REIT status. Some of these requirements depend upon actual operating results, distribution levels, diversity of stock ownership, asset composition, source of income and record keeping. Accordingly, while the Fund intends to continue to qualify to be taxed as a REIT, the actual results of the Fund or of certain subsidiaries that are also REITs (“REIT Subsidiaries”) for any particular year might not satisfy these requirements since the ability to satisfy such requirements depends on the operations of the underlying Eligible Component Funds over which the Fund has no control.

| Semi-Annual Report | December 31, 2023 | 17 |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

The Fund will not monitor the REIT Subsidiaries’ compliance with the requirements for REIT qualification. The Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions taken on returns filed for the tax year ended December 31, 2022 or expected to be taken in the Fund’s December 31, 2023 year-end tax returns. The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

Distributions to Shareholders – To the extent the Fund has earnings available for distribution, it expects to distribute quarterly dividends. The specific tax characteristics of the Fund’s distributions will be reported to shareholders after the end of the calendar year. The Fund’s quarterly dividends, if any, will be authorized and determined by the Board. Cash distributions to holders of the Fund’s Shares will automatically be reinvested under the Fund’s distribution reinvestment plan (the “DRIP”) in additional whole and fractional shares unless the investor elects to receive distributions in cash. Investors may terminate their participation in the DRIP with prior written notice to the Fund. Under the DRIP, shareholders’ distributions are reinvested in Shares of the same class of Shares owned by the shareholder for a purchase price equal to the NAV per share (for the class of Shares being purchased) on the date that the distribution is paid.

The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses (including capital loss carryover); however, it may distribute any excess annually to its shareholders.

The Fund has adopted a tax year end of December 31. The exact amount of distributable income for each tax year can only be determined at the end of the Fund’s tax year ended December 31. Under Section 19 of the 1940 Act, the Fund is required to indicate the sources of certain distributions to shareholders. The estimated distribution composition may vary from quarter to quarter because it may be materially impacted by future income, expenses and realized gains and losses on securities and fluctuations in the value of the currencies in which Fund assets are denominated.

The Fund, in order to qualify as a REIT, is required to distribute dividends, other than capital gain dividends, to the Fund’s shareholders in an amount at least equal to (1) the sum of (a) 90% of the Fund’s “real estate investment trust taxable income,” computed without regard to the dividends paid deduction and the Fund’s net capital gain, and (b) 90% of the Fund’s net after-tax income, if any, from foreclosure property minus (2) the sum of certain items of non-cash income.

Fair Value Measurements – ASC 820, Fair Value Measurements (“ASC 820”), defines fair value as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. ASC 820 establishes a fair value hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing the use of the most observable input when available. Observable inputs are inputs that market participants would use in pricing the asset and liability based on market data obtained from sources independent of the reporting entity; unobservable inputs are inputs that reflect the Fund’s own assumptions about the assumptions market participants would use in pricing the asset or liability.

A financial instrument level within the fair value hierarchy is based on the lowest level of any input that is deemed significant to the fair value hierarchy, the hierarchy level is determined based on the lowest level input(s) that is (are) significant to the fair value measurement in its entirety.

The three levels of the fair value hierarchy that prioritize inputs to the valuation methods are as follows:

| • | Level 1 – Valuations based on quoted prices (unadjusted) in active markets for identical assets or liabilities. |

| • | Level 2 – Valuations based on quoted prices for similar assets and liabilities in active markets and inputs that are observable for the asset or liability, either directly or indirectly. |

| • | Level 3 – Valuations based on inputs that are unobservable and deemed significant to the overall fair value measurement. This includes situations where there is little, if any, market activity for the asset or liability. |

Investments in other investment companies are valued at fair value based on the Fund’s applicable percentage of ownership of the investment companies’ reported net assets as of the measurement date, which is a practical expedient for valuation and does not require these investments to be categorized within the fair value hierarchy. In determining fair value, valuations provided by the underlying investment companies are utilized. The underlying investment companies value securities, real estate and other financial instruments at fair value. The estimated fair values of certain investments of the underlying investment companies, which may include private placements, real estate and other securities for which prices are not readily available, are determined by the general partner or sponsor of the respective investment Fund and may not reflect amounts that could be realized upon immediate sale, nor amounts that ultimately may be realized. Accordingly, the estimated fair values may differ significantly from the values that would have been used had a ready market existed for these investments. The fair value of the Fund’s investments in other investment companies generally represents the amount the Fund would expect to receive if it were to liquidate its investment in the other investment companies excluding any redemption charges that may apply.

| 17 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

The following tables summarize the inputs used as of December 31, 2023 for the Fund's assets measured at fair value:

| Investments in Securities at Value | | Level 1 - Quoted Prices | | Level 2 - Other Significant Observable Inputs | | Level 3 - Significant Unobservable Inputs | | Total | |

| Private Real Estate Securities(a) | | $ | – | | | $ | – | | | $ | – | | | $ | 26,411,181 | |

| Short Term Investment | | | 1,906,303 | | | | – | | | | – | | | | 1,906,303 | |

| Total | | $ | 1,906,303 | | | $ | – | | | $ | – | | | $ | 28,317,484 | |

| (a) | In accordance with ASC 820-10, certain investments that are measured at fair value using the NAV per share (or its equivalent), practical expedient, have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Portfolio of Investments. |

For the period ended December 31, 2023, the Fund did not use any significant unobservable inputs (Level 3) when determining fair value.

3. ADVISORY FEES, ADMINISTRATION FEES AND OTHER AGREEMENTS

Accordant Investment Management, LLC serves as the Fund’s investment adviser. Pursuant to the Management Agreement, the Fund has agreed to pay the Adviser the Management Fee for services rendered under the Management Agreement. The Management Fee is payable monthly in arrears. The Management Fee will be calculated at an annual rate of 0.60% of the Fund’s end of calendar month net assets.

The Adviser and the Fund have entered into an operational expense limitation agreement (the “Expense Limitation”) under which the Adviser has agreed to absorb the ordinary operating expenses of the Fund (excluding interest, brokerage commissions and extraordinary expenses of the Fund) (“Operating Expenses”) that exceed 1.35% per annum of Class A net assets as determined as of the each calendar month, 1.10% per annum of Class I net assets as determined as of the each calendar month and 1.10% per annum Class Y net assets as determined as of the each calendar month. The Expense Limitation Agreement will remain in effect until July 1, 2024, unless and until the Trustees approve its modification or termination. The Fund does not anticipate that the Trustees will terminate the Expense Limitation Agreement during this period. In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the date on which they were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitations in place at the time of waiver or at the time of reimbursement to be exceeded: and (3) the reimbursement is approved by the Board. In addition to the foregoing, amounts payable to the Sub-Adviser that were waived and/or reimbursed by the Sub-Adviser under any of the Fund’s prior Operational Expense Limitation Agreements with the Sub-Adviser (“Prior Operating Expenses”) and the Fund’s prior Organizational and Offering Expense Limitation Agreement with the Sub-Adviser (“Prior O&O Expenses”) will be payable to the Sub-Adviser. The Fund has agreed to pay the Sub-Adviser in the amount of any fees that the Sub-Adviser previously waived or deferred under the prior Operational Expense Limitation Agreement and prior Organizational and Offering Expense Limitation Agreement, subject to the limitations that: (1) the payment will be made if payable not more than three years from the date incurred with respect to Prior O&O Expenses and Prior Operating Expenses; (2) the reimbursement may not be made if it would cause the expense limitation then in effect or in effect at the time of the waiver to be exceeded; and (3) the reimbursement is approved by the Board.

Sub-Advisory Agreements

Sub-advisory services are provided to the Fund pursuant to agreement between the Adviser and IDR. Under the terms of the sub-advisory agreement, the Adviser compensates the Sub-Adviser with a management fee for services provided under the Sub-Advisory agreement. Fees paid to the Sub-Adviser are not an expense of the Fund.

Fund Administrator and Accounting Fees and Expenses

ALPS Fund Services, Inc. serves as the Fund’s administrator and accounting agent (the “Administrator”) and receives customary fees from the Fund for such services. The Administrator is also reimbursed by the Fund for certain out of pocket expenses.

Transfer Agency Fees and Expenses

SS&C GIDS, Inc. (formerly known as DST Systems, Inc.) serves as transfer, distribution paying and shareholder servicing agent for the Fund and receives customary fees from the Fund for such services.

| Semi-Annual Report | December 31, 2023 | 19 |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

Custody Fees and Expenses

UMB Bank, N.A. serves as the Fund’s custodian and receives customary fees from the Fund for such services.

Distribution and Shareholder Servicing Fees and Expenses

The Fund has entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”) to provide distribution services to the Fund. The Distributor serves as principal underwriter of shares of the Fund. Under the Distribution Agreement the Fund’s Class A pay to the Distributor a Distribution Fee that will accrue at an annual rate equal to 0.75% of the Fund’s average daily net assets attributable to Class A and payable monthly. No sales load or dealer manager fee is paid with respect to purchases of Class I and Y or any Shares sold pursuant to the DRIP.

Officer and Trustee Compensation

Each Independent Trustee receives an annual retainer of $75,000, paid quarterly, as well as reimbursement for any reasonable expenses incurred attending Board meetings. None of the executive officers receive compensation from the Fund. Certain Trustees and officers of the Fund are also officers of the Adviser and are not paid by the Fund for serving in such capacities.

4. PURCHASES AND SALES OF INVESTMENT SECURITIES

The cost of purchases and proceeds from the sale of securities, other than short-term securities, for the period ended December 31, 2023 were as follows:

| | | Purchases of Securities | | Proceeds from Sales of Securities | |

| | | $ | 337,500 | | | $ | 562,895 | |

5. TAX BASIS INFORMATION

Distributions are determined in accordance with federal income tax regulations, which differ from U.S. GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The tax character of distributions paid for the period ended December 31, 2023 were as follows:

| 2023 | | Ordinary Income | | Long-Term Capital Gain | | Return of Capital |

| Class A (IDR Core Property Index Fund Ltd.) | | $ | 151,957 | | | $ | 2,606 | | | $ | 815,416 | |

| Class I | | $ | 94,227 | | | $ | – | | | $ | 497,089 | |

| Class A | | $ | 15 | | | $ | – | | | $ | 81 | |

| Class Y | | $ | 205 | | | $ | – | | | $ | 1,081 | |

As of December 31, 2023, net unrealized appreciation of investments based on the federal tax cost was as follows:

Gross Appreciation (excess of value over tax cost) | | Gross Depreciation (excess of tax cost over value) | | Net Unrealized Appreciation/(Depreciation) | | Cost of Investments for Income Tax Purposes |

| $ | 568,900 | | | $ | (1,695,606 | ) | | $ | (1,126,706 | ) | | $ | 29,444,190 | |

The difference between book basis and tax basis distributable earnings and unrealized appreciation/(depreciation) is primarily attributable to the tax deferral of losses on wash sales, investments in partnerships, and certain other investments.

6. REPURCHASE OFFERS

As a closed-end interval fund, the Fund has adopted a fundamental policy pursuant to Rule 23c-3 under the 1940 Act in which it offers to repurchase at net asset value no less than 5% and at most 25% of the outstanding shares of the Fund once each quarter. In the event that a repurchase offer by the Fund is oversubscribed, the Fund may repurchase, but is not required to repurchase, additional shares up to a maximum amount of 2% of the outstanding shares of the Fund. If the Fund determines not to repurchase additional shares beyond the repurchase offer amount, or if shareholders tender an amount of shares greater than that which the Fund is entitled to repurchase, the Fund will repurchase the shares tendered on a prorata basis. The Fund may, in its sole discretion, and for administrative convenience, accept all shares tendered by shareholders who own less than 200 shares and who tender all of their shares, before prorating other amounts tendered. Liquidity will be provided to shareholders only through the Fund’s quarterly repurchase offers. Shareholders will receive written notice of each quarterly repurchase offer ("Repurchase Offer Notice") that includes the date the repurchase offer period ends ("Repurchase Request Deadline") and the date the repurchase price will be determined ("Repurchase Pricing Date"). Shares will be repurchased at the NAV per share determined on the Repurchase Pricing Date.

| 20 | www.accordantinvestments.com |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

During the six months ended December 31, 2023, the Fund had no repurchases. Prior to the Fund's conversion to an interval fund in September 2023, the Fund conducted the following repurchase offers.

| Commencement Date | Repurchase Request Deadline | Repurchase Pricing Date | Net Asset Value as of Repurchase Offer Date | Shares

Repurchased | Amount

Repurchased | Percentage of Outstanding Shares Repurchased |

| August 29, 2022 | September 26, 2022 | June 30, 2022 | $ 12.6695 | 6,078.00 | $ 77,005.22 | 0.26% |

| November 23, 2022 | December 30, 2022 | September 30, 2022 | $ 12.5718 | 23,495.35 | $ 295,378.84 | 0.85% |

| March 3, 2023 | March 30, 2023 | December 31, 2022 | $ 11.7955 | 136,668.00 | $ 1,612,067.41 | 4.92% |

| June 1, 2023 | June 29, 2023 | March 31, 2023 | $11.2712 | 39,710.00 | $447,579.36 | 1.40% |

7. PRINCIPAL RISK FACTORS

The following list is not intended to be a comprehensive listing of all of the potential risks associated with the Fund. For a more comprehensive list of potential risks the Fund may be subject to, please refer to the Fund’s Prospectus and Statement of Additional Information (“SAI”).

Credit Risk – Financial assets which potentially expose the Fund to credit risk consist principally of cash and investments. The Fund, at times, may maintain deposits with a single high-quality financial institution in amounts that are in excess of federally insured limits; however, the Fund has not experienced, nor does it anticipate, incurring any losses in its cash accounts. Investments in other investment companies are subject to credit risk should those other investment companies be unable to fulfill their redemption obligations.

Distribution Policy Risk – The Fund’s distribution policy is to make quarterly distributions to shareholders. All distributions will be paid at the sole discretion of the Board and will depend on the Fund’s earnings, financial condition, maintenance of REIT status, compliance with applicable investment company regulations and such other factors as the Board may deem relevant from time to time. In the event that the Fund encounters delays in locating suitable investment opportunities, the Fund may pay its distributions from the proceeds of the offering or from borrowings in anticipation of future cash flow, which may constitute a return of capital. Such a return of capital is not immediately taxable, but reduces a shareholder’s tax basis in the Fund’s shares, which may result in a shareholder recognizing more gain (or less loss) when its shares are sold. Distributions from the proceeds of the Fund’s offering or from borrowings also could reduce the amount of capital the Fund ultimately invests in its investments.

Limited Liquidity – Shareholders will have limited rights to redeem capital from the Fund. As a result, a Shareholder that desires to liquidate his or her investment in the Fund may be unable to do so within a given timeframe, if at all. Therefore, Shareholders must be prepared to bear the financial risks of an investment in shares of the Fund for an indefinite period of time.

LIBOR Risk – The Fund’s investments, payment obligations and financing terms may be based on floating rates, such as LIBOR, Secured Overnight Financing Rate (“SOFR”), Euro Interbank Offered Rate and other similar types of reference rates (each, a “Reference Rate”). Certain LIBORs were generally phased out by the end of 2021, and some regulated entities have ceased to enter into new LIBOR-based contracts beginning January 1, 2022. On March 15, 2022, the Adjustable Interest Rate (LIBOR) Act was signed into law. This law provides a statutory fallback mechanism on a nationwide basis to replace LIBOR with a benchmark rate that is selected by the Board of Governors of the Federal Reserve System and based on SOFR which measures the cost of overnight borrowings through repurchase agreement transactions collateralized with U.S. Treasury securities for certain contracts that reference LIBOR and contain no, or insufficient, fallback provisions. Although the transition process away from LIBOR has become increasingly well-defined in advance of the anticipated discontinuation date, there remains uncertainty regarding the future use of LIBOR, and the nature of any replacement rate. As such, the potential effect of a transition away from LIBOR on the Fund or the LIBOR-based instruments in which the Fund invests cannot yet be determined, and it is not possible to completely identify or predict any establishment of alternative Reference Rates or any other reforms to Reference Rates that may be enacted in the UK or elsewhere. The termination of certain Reference Rates presents risks to the Fund. The elimination of a Reference Rate or any other changes or reforms to the determination or supervision of Reference Rates could have an adverse impact on the market for or value of any securities or payments linked to those Reference Rates and other financial obligations held by the Fund or on its overall financial condition or results of operations. In addition, any substitute Reference Rate and any pricing adjustments imposed by a regulator or by counterparties or otherwise may adversely affect the Fund’s performance and/or NAV. The transition process away from LIBOR may involve, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR. The transition process may also result in a reduction in the value of certain instruments held by the Fund or reduce the effectiveness of related Fund transactions. While some instruments in which the Fund invests may contemplate a scenario where LIBOR is no longer available by providing for an alternative rate setting methodology, not all instruments in which the Fund invests may have such provisions and there is significant uncertainty regarding the effectiveness of any such alternative methodologies. Any potential effects of the transition away from LIBOR on the Fund or on financial instruments in which the Fund invests, as well as other unforeseen effects, could result in losses to the Fund.

| Semi-Annual Report | December 31, 2023 | 21 |

| Accordant ODCE Index Fund | Notes to Financial Statements |

December 31, 2023 (Unaudited)

Market Risk – The Fund invests in other investment companies which are subject to the terms of the respective investment companies’ agreements, private placement memoranda and other governing agreements. The Fund’s investments in other investment companies are subject to the market and credit risks of investments held by those entities. The Fund bears the risk of loss only to the extent of the cost of its respective investment in the other investment companies.

In addition, the following risks may affect real estate markets generally or specific assets and include, without limitation, general economic and social climate, regional and local real estate conditions, the supply of and demand for properties, the financial resources of tenants, competition for tenants from other available properties, the ability of the Underlying Funds to manage the real properties, changes in building, environmental, tax or other applicable laws, changes in real property tax rates, changes in interest rates, negative developments in the economy that depress travel activity, uninsured casualties, natural disasters and other factors which are beyond the control of the Fund, and the Adviser. Furthermore, changes in interest rates or the availability of debt may render the investment in real estate assets difficult or unattractive.