- CRS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Carpenter Technology (CRS) DEF 14ADefinitive proxy

Filed: 23 Sep 02, 12:00am

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 |

| x | No Fee Required |

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

| • | The election of four directors; and |

| • | Approval of the appointment of PricewaterhouseCoopers LLP as Carpenter’s independent public accountants for fiscal 2003. |

Page | ||

| ii | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 2 | ||

| 2 | ||

| 3 | ||

| 3 | ||

| 3 | ||

| 4 | ||

| 5 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 11 | ||

| 11 | ||

| 12 | ||

| 12 | ||

| 13 | ||

| 16 | ||

| 20 | ||

| 21 | ||

| 22 | ||

| 22 | ||

| Appendix A -1 |

| 1. | The election of four directors; |

| 2. | Approval of independent accountants for the fiscal year ending June 30, 2003; and |

| 3. | Any other business that is properly presented at the meeting. |

| • | The election of four directors to three-year terms, which will expire in 2005; and |

| • | Approval of the appointment of PricewaterhouseCoopers LLP as Carpenter’s independent accountants for the fiscal year ending June 30, 2003. |

| • | If your shares are held in the name of a broker, bank or other nominee: Vote your Carpenter shares over the Internet by accessing the website given on the proxy card you received from such broker, bank, or other nominee. You will need the control number that appears on your proxy card when you access the web page. |

| • | If your shares are registered in your name: Vote your Carpenter shares over the Internet by accessing American Stock Transfer & Trust Company’s Proxy Vote Online website atwww.voteproxy.com and following the on-screen instructions. You will need the control number that appears on your proxy card when you access the web page. |

| • | If your shares are held in the name of a broker, bank, or other nominee: Vote your Carpenter shares over the telephone by following the telephone voting instructions, if any, provided on the proxy card you received from such broker, bank or other nominee. |

| • | If your shares are registered in your name: Vote your Carpenter shares over the telephone by accessing the telephone voting system toll-free at 1-800-PROXIES and following the telephone voting instructions. The telephone instructions will lead you through the voting process. You will need the control number that appears on your proxy card when you call. |

| • | For each person you propose to nominate for election or re-election as a director specify: |

| (i) | name, age, business address, and residence address; |

| (ii) | principal occupation or employment; |

| (iii) | number of shares of Carpenter stock beneficially owned by the person; and |

| (iv) | any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to Schedule 14A under the proxy rules. |

| • | A signed statement from the person recommended for nomination indicating that he or she consents to being considered as a nominee. |

| (i) | a brief description of the business and the reason for bringing it to the meeting; |

| (ii) | your name and record address; |

| (iii) | the number of shares of Carpenter stock which you own; and |

| (iv) | any material interest (such as financial or personal interest) that you have in the matter. |

Name and Address of Beneficial Owner | Number of Shares Beneficially Owned | Percent (1) of Class | ||

Peter C. and Ada E. Rossin 1500 Oliver Building Pittsburgh, PA 15222 | 2,278,420(2) | 9.9% | ||

Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | 1,679,000(3) | 7.3% | ||

Boston Safe Deposit and Trust Company 525 William Penn Place Suite 3631 Pittsburgh, PA 15259 | 1,356,401(4) | 5.9% |

| (1) | The percentages are calculated on the basis of the common stock outstanding plus the common stock that would be outstanding if the shares of convertible preferred stock in the ESOP were converted, using the conversion ratio of one preferred share equal to 2,000 shares of common stock. |

| (2) | These shares are subject to a standstill agreement between Carpenter and the Rossins. This agreement was entered into when Carpenter purchased Dynamet Incorporated in 1997. The standstill agreement provides certain limitations on the Rossins’ ability to buy or sell the common stock, solicit proxies, participate in a tender offer, business combination, or restructuring of voting securities affecting Carpenter and on the Rossins’ ability to seek control of or influence Carpenter’s Board or Management. In addition, the standstill agreement provides that the Board will recommend the election, as a director of Carpenter, of Mr. Rossin or another person that Mr. Rossin and the other former Dynamet shareholders designate, if the person is reasonably acceptable to the Board. The standstill agreement expires in 2007, unless terminated earlier because of a change in control of Carpenter or a reduction below 5% of the voting power of the former Dynamet shareholders. Such number does not include 3,807 director stock units held by Mr. Rossin, the value of which will be paid to Mr. Rossin in cash upon his retirement or termination of service as a director. |

| (3) | This information, supplied to Carpenter by Dimensional Fund Advisors Inc. (“Dimensional”), is as of June 30, 2002. Dimensional is an investment advisor registered under the Federal Investment Advisors Act. It furnishes investment advice to four investment companies and serves as investment manager to certain other investment vehicles, including commingled group trusts. In its role as investment advisor and investment manager, Dimensional possesses sole voting power and investment power over all of these shares of Carpenter stock. The investment companies and investment vehicles own all these shares of Carpenter stock. Dimensional disclaims beneficial ownership of these shares. |

| (4) | These shares are held for the accounts of employee-participants under Carpenter’s employee benefit plans. This number does not include additional shares which Boston Safe Deposit and Trust Company may hold for its own account or on behalf of other third parties. |

Name | Number of Shares Beneficially Owned(1) | Director Stock Units(2) | Shares and Units Beneficially Owned(1) | Percentage of Outstanding Shares(3) | ||||||

| Bennett, M. C. | 18,068 | 3,009 | 21,077 | |||||||

| Dietrich, W. S. | 19,248 | 2,842 | 22,090 | |||||||

| Draeger, D. M. | 238,569 | (4) | n/a | 238,569 | (4) | 1.0 | ||||

| Fitzpatrick, J. M. | 14,504 | 2,365 | 16,868 | |||||||

| Hudson, W. J. | 20,332 | 4,392 | 24,724 | |||||||

| Lawless, R. J. | 14,718 | 2,344 | 17,062 | |||||||

| Miller, M. | 22,440 | 3,903 | 26,343 | |||||||

| Pokelwaldt, R. N. | 13,323 | 2,140 | 15,463 | |||||||

| Pratt, G. A. | 0 | 240 | 240 | |||||||

| Rossin, P. C. | 2,278,420 | (5),(6) | 3,807 | 2,282,227 | (5),(6) | 9.9 | ||||

| Torcolini, R. J. | 136,821 | (4),(5) | n/a | 136,821 | (4),(5) | .6 | ||||

| Turner, K. C. | 17,905 | 2,543 | 20,448 | |||||||

| Ward, Jr., S. M. | 6,000 | 1,623 | 7,623 | |||||||

| Wolfe, K. L. | 19,290 | 2,661 | 21,951 | |||||||

| Geremski, T. E. | 47,933 | (4) | n/a | 47,933 | (4) | .2 | ||||

| Shor, M. L. | 87,322 | (4) | n/a | 87,322 | (4) | .4 | ||||

| Welty, J. R. | 62,899 | (4),(5) | n/a | 62,899 | (4),(5) | .3 | ||||

| All directors and officers as a group (24 in all) | 3,207,991 | (4),(5) | 31,869 | 3,239,860 | (4),(5) | 14.0 |

| (1) | The amounts include the following shares of common stock that the individuals have the right to acquire by exercising outstanding stock options within 60 days after August 30, 2002: |

| M. C. Bennett | 16,000 | R. J. Lawless | 12,000 | S. M. Ward, Jr. | 6,000 | |||||||||

| W. S. Dietrich | 16,000 | M. Miller | 19,000 | K. L. Wolfe | 18,000 | |||||||||

| D. M. Draeger | 168,700 | R. N. Pokelwaldt | 12,000 | T. E. Geremski | 39,000 | |||||||||

| J. M. Fitzpatrick | 13,000 | R. J. Torcolini | 112,520 | M. L. Shor | 67,600 | |||||||||

| W. J. Hudson | 16,000 | K. C. Turner | 16,502 | J. R. Welty | 48,380 | |||||||||

| All directors and officers as a group | 739,002 | |||||||||||||

| (2) | These stock units convert to an equivalent number of shares of common stock upon the director’s retirement or termination of service due to disability. Because of the standstill agreement with Carpenter, the value of Mr. Rossin’s stock units will be paid in cash. The value of the stock units tracks the value of the common stock, but the units have no voting rights. |

| (3) | Ownership is rounded to the nearest 0.1% and is less than 0.1% except where stated. Stock units are not included in the calculation of percentage of outstanding shares owned. |

| (4) | The amounts include the following shares of common stock held in the Savings Plan and the ESOP (if the preferred stock actually held in the ESOP were converted into common stock using the ratio of one preferred share equal to 2,000 shares of common stock): |

| D. M. Draeger | 6,182 | |

| T. E. Geremski | 33 | |

| M. L. Shor | 6,509 | |

| R. J. Torcolini | 2,513 | |

| J. R. Welty | 6,551 | |

| All officers as a group | 36,467 |

| (5) | Voting and investment power is shared with respect to the following shares of common stock: |

| P. C. Rossin | 2,278,420 | |

| R. J. Torcolini | 6,671 | |

| J. R. Welty | 260 | |

| All directors and officers as a group | 2,290,504 |

| (6) | Mr. Rossin’s shares are subject to an agreement with Carpenter. See footnote 2 on page 4. |

| DENNIS M. DRAEGER, age 61, is Chairman and Chief Executive Officer and a director of Carpenter Technology Corporation. Prior to his current position, Mr. Draeger was Chairman, President and Chief Executive Officer from July 1, 2001 through June 30, 2002, and President and Chief Operating Officer from June 1999 through June 2001. Mr. Draeger became Senior Vice President-Specialty Alloys Operations for Carpenter in 1996 and Executive Vice President of Carpenter in 1998. He was a director of Carpenter from 1992 through June 1996, at which time he resigned from the Board. He was re-elected as a director effective June 1, 1999. Previously, Mr. Draeger became Group Vice President for Armstrong World Industries, Inc., in 1988, and President of Worldwide Floor Products Operations for Armstrong World Industries, Inc., in 1994. | |

| J. MICHAEL FITZPATRICK, age 55, is President and Chief Operating Officer and a director of Rohm and Haas, a specialty chemicals company. Dr. Fitzpatrick was elected Vice President and Director of Research in 1993 and served as Vice President and Chief Technology Officer from 1995 through 1998. He is also a director of McCormick & Company, Incorporated, and the Green Chemistry Institute, Chairman of the Pennsylvania Division of the American Cancer Society, and a member of the Board of Trustees of the Franklin Institute and Science Museum. Dr. Fitzpatrick has been a director of Carpenter since 1997, is a member of the Corporate Governance Committee and chairs the Human Resources Committee. |

| GREGORY A. PRATT, age 53, is Vice Chairman and a director of OAO Technology Solutions, Inc. (OAOT), an information technology and professional services company. He joined OAOT in 1998 as President and CEO after OAOT acquired Enterprise Technology Group, Inc., a software engineering firm founded by Mr. Pratt. Mr. Pratt served as President and COO of Intelligent Electronics, Inc. from 1991 through 1996, and was co-founder, and served variously as CFO and President of Atari Corporation from 1984 through 1991. He also serves as a director of Elderport, Inc. and the US Chess Center. Mr. Pratt has been a director of Carpenter since June 2002 and is a member of the Audit/Finance Committee. | |

| MARILLYN A. HEWSON, age 48, is Senior Vice President for Corporate Shared Services at Lockheed Martin Corporation, a position she has held since May 2001. Lockheed Martin researches, designs, develops, manufactures and integrates advanced technology systems, products and services. Ms. Hewson joined Lockheed Aeronautical Systems Company, Marietta, Georgia in 1983 as a senior industrial engineer. She held a variety of increasingly responsible management positions in industrial engineering, operations control and business management until 1993, when she was promoted to Director of Operations Control. In 1995, she was named Director of Commercial Practices and in September 1995, she transferred to the Aeronautics Material Management Center in Fort Worth, Texas as Director of Consolidated Material Systems and Business Management. Ms. Hewson was named Vice President, Internal Audit of Lockheed Martin Corporation in September 1998 and became Vice President, Global Supply Chain Management beginning in August 2000. Ms. Hewson is also a member of the Board of Directors of Exostar Corporation. Lockheed Martin is one of the five founding partners of the Exostar Aerospace & Defense Global Trading Exchange, which is an integral component of the B2B and eBusiness initiatives managed by Corporate Shared Services. Ms. Hewson became a Director of Carpenter in September 2002 and is a member of the Corporate Governance and Human Resources Committees. |

| WILLIAM J. HUDSON JR., age 68, retired as Vice Chairman and a director of AMP Incorporated in April 1999. AMP is a manufacturer of electrical and electronic connectors and interconnection systems. Mr. Hudson joined AMP Incorporated in 1961 and held a variety of management positions, becoming Executive Vice President, International, in 1991, a director in 1992, and Chief Executive Officer and President in 1993, a position he held until 1998. He also served as Chairman of the Pacific Basin Economic Council, Vice Chairman of the National Association of Manufacturers, and is a member of the Executive Committee of the U.S. Council of International Business. Previously, he was a member of the Board of Governors of the National Electrical Manufacturers Association and the Business Roundtable, as well as a Presidential Appointee to the Advisory Council on U.S. Trade Policy. He also serves as a director of The Goodyear Tire & Rubber Company and Keithley Instruments, Inc., Elderport, Inc., Applied Systems Intelligence, Inc., and High Street Capital. Mr. Hudson has been a director of Carpenter since 1992, is a member of the Human Resources Committee and chairs the Corporate Governance Committee. |

| PETER C. ROSSIN, age 78, is the former Chairman, Chief Executive Officer and founder of Dynamet Incorporated, a subsidiary of Carpenter. Before founding Dynamet, a maker of titanium bar and wire and specialty alloy powder products, in 1967, Mr. Rossin held various production and operations positions at Crucible Steel Corporation, Fansteel Metallurgical Corporation, and Cyclops Corporation. Mr. Rossin has been a director of Carpenter since 1997 and is a member of the Corporate Governance and Human Resources Committees. | |

| ROBERT J. TORCOLINI, age 51, is President and Chief Operating Officer and a director of Carpenter Technology Corporation. Prior to his current position, Mr. Torcolini was Senior Vice President-Engineered Products Operations, a position he held from February 2000 to June 2002. Mr. Torcolini was President of Dynamet Incorporated, a subsidiary of Carpenter, from March 1997 through January 2000 and Vice President — Manufacturing Operations Steel Division from January 1993 through February 1997. He is a member of the American Iron and Steel Institute and the American Society for Metals International. Mr. Torcolini has been a director of Carpenter since July 2002. |

| KENNETH L. WOLFE, age 63, retired as Chairman of the Board of Hershey Foods Corporation on December 31, 2001. Hershey Foods Corporation is a producer of chocolate and confectionery products. Mr. Wolfe was elected Vice President, Finance and Chief Financial Officer of Hershey in 1981; Senior Vice President, Chief Financial Officer and a director in 1984; and President and Chief Operating Officer in 1985, a position he held through 1993. He also serves as a director of Bausch & Lomb Inc. Mr. Wolfe has been a director of Carpenter since 1995 and chairs the Audit/Finance Committee. |

| ROBERT J. LAWLESS, age 55, is Chairman, President and Chief Executive Officer and a director of McCormick & Company, Incorporated, a supplier of spices, seasonings, flavorings and specialty foods. Mr. Lawless became Executive Vice President and Chief Operating Officer of McCormick in 1995 and President and Chief Operating Officer in 1996. He serves as Vice Chair of the Board of Directors of Kennedy Krieger Institute, and as a member of the Board of Directors of the Grocery Manufacturers of America, Inc., Grant-A-Wish Foundation, Maryland Business Roundtable for Education, Inc. and the Junior Achievement of Central Maryland Executive Council. He also serves on the Board of The Baltimore Life Companies, Owings Mills, MD. Mr. Lawless has been a director of Carpenter since 1997 and is a member of the Audit/Finance Committee. |

| ROBERT N. POKELWALDT, age 66, retired as Chairman and Chief Executive Officer and a director of York International Corporation in November 1999. York International Corporation is a manufacturer of heating, ventilating, air conditioning, and refrigeration products. Mr. Pokelwaldt joined Applied Systems Worldwide, a division of York International, as Vice President in 1988. He was named President and Chief Operating Officer in 1990, President and Chief Executive Officer in 1991, and Chairman and Chief Executive Officer in 1993. Mr. Pokelwaldt also serves as a director of Mohawk Industries, Inc., First Energy, Inc., Intersil Corporation, and Susquehanna Pfaltzgraff Corporation. Mr. Pokelwaldt has been a director of Carpenter since 1998 and is a member of the Audit/Finance Committee. | |

| KATHRYN C. TURNER, age 55, is Chairperson, Chief Executive Officer and President of Standard Technology, Inc. Ms. Turner founded Standard Technology, Inc., a management and technology solutions firm with a focus in the healthcare sector, in 1985. Standard Technology, Inc. is headquartered in Falls Church, VA, with employees in over 12 states. Ms. Turner also serves on the Boards of Directors of Phillips Petroleum Company, Schering-Plough Corporation, the National Capital Area Council of the Boy Scouts of America and Children’s Hospice International and she has served as a director for the Urban League (Northern Virginia Chapter). In 1994, she received a Presidential appointment to serve on the President’s Export Council, after serving a one-year term on the ExIm Bank Advisory Committee. In 1993, she was appointed to the Commission on the Future of Worker-Management Relations, a joint commission of the Departments of Labor and Commerce, established by President Clinton. In 1992, she was the first woman appointed by Secretary Cheney to the Defense Policy Advisory Committee on Trade (DPACT). Ms. Turner is the 1998 Black Engineer Entrepreneur of the Year, a 1994 recipient of the Northern Virginia Urban League’s Shining Star Award, and a 1994 recipient of the National Association of Black Telecommunications Professionals, Inc.’s Granville T. Woods Award. Ms. Turner has been a director of Carpenter since 1994 and is a member of the Audit/Finance Committee. | |

| STEPHEN M. WARD, JR., age 47, is General Manager, Industrial Sector for International Business Machines Corporation (IBM). IBM uses advanced information technology, including systems, products, services, software and financing, to provide customer information and business process solutions. Prior to assuming his current position, Mr. Ward was Vice President, Business Transformation and Chief Information Officer, with responsibility for overseeing IBM’s e-business initiatives. Mr. Ward joined IBM in 1978 as an engineer and has held various management positions in manufacturing, production control and product development. He served as an administrative assistant to the IBM Chairman in 1985 and was named Program Director, Customer Satisfaction in 1990. Mr. Ward was named Director of System Manufacturing and Production Process in 1992 and became Director of Manufacturing and Development Systems in 1993. He was appointed Vice President, Information Technology, IBM Personal Computer Company, in 1994 and named General Manager, IBM Mobile Computing, IBM Personal Computing Company, in 1996. Mr. Ward is a member of the Board of Directors of e2open, a market exchange for high technology corporations. Mr. Ward has been a director of Carpenter since 2001 and is a member of the Human Resources and Corporate Governance Committees. |

Committee and Members | Selected Functions of the Committee | 2002 Meetings | |||

Audit/Finance Committee | |||||

Kenneth L. Wolfe, Chairperson Marcus C. Bennett William S. Dietrich II Robert J. Lawless Robert N. Pokelwaldt Gregory A. Pratt Kathryn C. Turner | • Reviews the adequacy of Carpenter’s financial reporting, accountingsystems and controls • Recommends independent accountants for financial audits • Evaluates Carpenter’s internal and external auditing proceduresand security of information systems • Reviews Carpenter’s environmental compliance activities • Maintains a direct line of communication with independent accountantsand the Director-Internal Audit • Reviews and recommends actions to the Board of Directors relatingto Carpenter’s capital structure, pension fund asset management,and dividend policy | 5 | * | ||

| * Includes two Audit Committee meetings and one Finance Committee meeting held prior to combining these committees. | |||||

Corporate Governance Committee | |||||

William J. Hudson, Jr., Chairperson J. Michael Fitzpatrick Marillyn A. Hewson Marlin Miller, Jr. Peter C. Rossin Stephen M. Ward, Jr. | • Reviews and recommends proposed changes to the Certificate ofIncorporation and By-Laws • Reviews stockholder proposals • Recommends Board size, composition, and committee structure • Reviews, evaluates, and recommends nominees for election or re-electionto the Board and assignment to the Committees • Maintains guidelines for directors’ duties and obligations | 3 | |||

Human Resources Committee | |||||

J. Michael Fitzpatrick, Chairperson William J. Hudson, Jr. Marillyn A. Hewson Marlin Miller, Jr. Peter C. Rossin Stephen M. Ward, Jr. | • Reviews and recommends to the Board the salary of the CEO andother executive officers, approves salary and other compensationof other officers • Oversees Carpenter’s various benefit pension plans • Reviews officers’ succession plans • Administers stock and stock option plans • Reviews Carpenter’s progress on equal opportunity matters, employeehealth and safety, and workers’ compensation costs | 2 | |||

| Kenneth L. Wolfe, Chairperson | Robert N. Pokelwaldt | |

| Marcus C. Bennett | Gregory A. Pratt | |

| William S. Dietrich II | Kathryn C. Turner | |

| Robert J. Lawless |

| • | Attract, retain, and motivate highly effective executives; |

| • | Link executive reward with enhanced stockholder value and profitability; |

| • | Reward sustained corporate, functional, and/or individual performance with an appropriate base salary and incentive opportunity; |

| • | Link pay to Carpenter’s financial performance and the achievement of Carpenter’s strategic business objectives; and |

| • | Stimulate and sustain significant management ownership in Carpenter. |

| J. Michael Fitzpatrick, Chairperson | Marlin Miller, Jr. | |

| Marillyn A. Hewson | Peter C. Rossin | |

| William J. Hudson, Jr. | Stephen M. Ward, Jr. |

Annual Compensation(1) | Long Term Compensation | |||||||||||||||

Awards | Payouts | |||||||||||||||

Name and Principal Position | Fiscal Year | Salary ($) | Bonus ($) | Restricted Stock(2) ($) | Securities Underlying Options (#) | LTIP Payouts ($) | All Other Compensation(3), (4) ($) | |||||||||

| Dennis M. Draeger Chairman, President and Chief Executive Officer | 2002 2001 2000 | 496,155 400,000 392,308 | 0 0 184,786 | 280,863 601,000 0 | 80,000 70,000 20,000 | 0 0 0 | 16,420 13,191 12,845 | |||||||||

| Robert J. Torcolini Senior Vice President Engineered Products Operations | 2002 2001 2000 | 318,461 280,000 270,892 | 0 144,300 110,026 | 107,806 90,150 0 | 40,000 20,000 32,700 | 0 0 0 | 10,954 9,346 8,989 | |||||||||

| Michael L. Shor Senior Vice President Specialty Alloys Operations | 2002 2001 2000 | 283,174 220,000 202,308 | 0 0 68,244 | 141,850 90,150 108,000 | 40,000 20,000 24,200 | 0 0 0 | 9,500 7,429 6,795 | |||||||||

| Terrence E. Geremski* Senior Vice President- Finance and Chief Financial Officer | 2002 2001 2000 | * * | 272,789 100,000 0 | 0 0 0 | 110,643 134,850 0 | 30,000 39,000 0 | 0 0 0 | 70,271 29,917 0 | (5) (5) | |||||||

| John R. Welty Vice President, General Counsel and Secretary | 2002 2001 2000 | 211,308 194,939 191,000 | 0 0 70,069 | 76,599 0 0 | 20,000 10,000 8,000 | 0 0 0 | 7,147 6,620 6,501 | |||||||||

| * | Mr. Geremski began employment on January 29, 2001. |

| (1) | There is no “Other Annual Compensation” to report and this column has been omitted pursuant to SEC rules. |

| (2) | Messrs. Draeger, Torcolini, Shor, Geremski, and Welty were awarded restricted stock in fiscal 2002. The restricted stock awarded in 2002 will vest 50% annually over a 2-year period or 100% at retirement, whichever comes first. Messrs. Draeger, Torcolini, Shor, and Geremski were awarded restricted stock in fiscal 2001. The restricted stock awarded to Messrs. Torcolini and Shor in 2001 will vest over a 3-year period, with one-third of the award vesting each year. The restricted stock awarded to Mr. Draeger in 2001 will vest over a 4-year period, with one-fourth of the award vesting each year, or 100% upon retirement, whichever comes first. The restricted stock awarded to Mr. Geremski in 2001 will vest in 2006. Mr. Shor was also awarded restricted stock in fiscal 2000 that will vest in 2005. The value of restricted stock reported in the table is based on the closing price of the stock on the date that the stock was granted. At the end of the fiscal year, the total restricted stock granted to Messrs. Draeger, Torcolini, Shor, Geremski, and Welty was valued at $1,149,519, $411,983, $331,315, $256,409 and $77,787, respectively, based on the June 28, 2002 closing price of $28.81. Carpenter does pay dividend equivalents on these shares of restricted stock. |

| (3) | Amounts include contributions by Carpenter for fiscal years 2002, 2001, and 2000 for the Named Executive Officers under the Savings Plan, the Deferred Compensation Plan for Officers and Key Employees and the ESOP (ESOP units contributed because of dividend equivalents on the ESOP account balance are not included). Due to the timing of contributions on a fiscal year basis, some of the amounts contributed under the Savings Plan exceed the IRS calendar year limit. For fiscal 2002, these contributions were as follows: |

| Savings Plan: | ||||||||||||||

| Draeger | $6,000 | Shor | $6,164 | Welty | $5,439 | |||||||||

| Torcolini | $6,000 | Geremski | $6,383 | |||||||||||

| Deferred Compensation Plan: | ||||||||||||||

| Draeger | $8,886 | Shor | $2,330 | Welty | $ 901 | |||||||||

| Torcolini | $3,852 | Geremski | $1,800 | |||||||||||

| (4) | Amounts include premiums paid by Carpenter on term life insurance policies for the Named Executive Officers. For fiscal 2002, these premiums were as follows: Mr. Draeger — $1,200; Mr. Torcolini — $768; Mr. Shor — $672; Mr. Geremski — $624; and Mr. Welty — $473. |

| (5) | Amounts include $61,130 for fiscal 2002 and $26,402 for fiscal 2001 paid by Carpenter for expenses, including relocation and temporary living expenses, incurred by Mr. Geremski in connection with his commencement of employment on January 29, 2001. |

Name | Number of Securities Underlying Options Granted(1) | % of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/SH) | Expiration Date | Grant Date Present Value(2) | |||||

| Dennis M. Draeger | 80,000 | 13.5% | $23.21 | 01/28/2012 | $409,600 | |||||

| Robert J. Torcolini | 40,000 | 6.8% | $23.21 | 01/28/2012 | $204,800 | |||||

| Michael L. Shor | 40,000 | 6.8% | $23.21 | 01/28/2012 | $204,800 | |||||

| Terrence E. Geremski | 30,000 | 5.1% | $23.21 | 01/28/2012 | $153,600 | |||||

| John R. Welty | 20,000 | 3.4% | $23.21 | 01/28/2012 | $102,400 |

| (1) | Options are granted at the market value on the date of grant, are exercisable after one year of employment following the date of grant, and will expire no more than ten years after the date of grant. |

| (2) | Based on the Black-Scholes option-pricing model adapted for use in valuing officer stock options. The actual value, if any, an executive may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised, so that there is no assurance that the value realized by an executive will be at or near the value estimated by the Black-Scholes model. The estimated values under this model are based on certain assumptions for stock price volatility, risk-free interest rates, and future dividend yield. Specifically, the Black-Scholes valuation employed the following factors: risk-free rate of return of 4.3% based upon the five-year Treasury rates as of grant date, a dividend yield of 4.4% based upon the annualized value of the quarterly dividend preceding the option grant date, exercise term of five years, stock price volatility of 36.1% based upon the variance in daily stock price changes for the five years preceding the option grant date, and that no adjustments have been made for transferability or risk of option forfeiture. |

Number of Securities Underlying Unexercised Options at Fiscal Year End | Value of Unexercised In-The-Money Options at Fiscal Year End(1) | ||||||||||||||

Name | Shares Acquired on Exercise (#) | Value Realized ($) | Exercisable | Unexercisable | Exercisable | Unexercisable | |||||||||

| Dennis M. Draeger | 0 | $ | 0 | 168,700 | 80,000 | $ | 196,084 | $ | 448,000 | ||||||

| Robert J. Torcolini | 5,060 | $ | 23,144 | 112,520 | 40,000 | $ | 222,322 | $ | 224,000 | ||||||

| Michael L. Shor | 0 | $ | 0 | 67,600 | 40,000 | $ | 172,697 | $ | 224,000 | ||||||

| Terrence E. Geremski | 0 | $ | 0 | 39,000 | 30,000 | $ | 46,000 | $ | 168,000 | ||||||

| John R. Welty | 8,000 | $ | 77,212 | 48,380 | 20,000 | $ | 9,386 | $ | 112,000 | ||||||

| (1) | Based on June 28, 2002 closing price of $28.81 per share. |

Average Annual Earnings(1) for the Applicable Years of Service Period Preceding Retirement | Annual Gross Benefits from all Pension Plans for Years of Service Shown(2)(3) | |||||||||||||||||

10 Years | 15 Years | 20 Years | 25 Years | 30 Years | 35 Years | |||||||||||||

| $150,000 | $ | 75,000 | $ | 84,750 | $ | 90,000 | $ | 90,000 | $ | 90,000 | $ | 91,875 | ||||||

| $175,000 | $ | 87,500 | $ | 98,875 | $ | 105,000 | $ | 105,000 | $ | 105,000 | $ | 107,188 | ||||||

| $200,000 | $ | 100,000 | $ | 113,000 | $ | 120,000 | $ | 120,000 | $ | 120,000 | $ | 122,500 | ||||||

| $250,000 | $ | 125,000 | $ | 141,250 | $ | 150,000 | $ | 150,000 | $ | 150,000 | $ | 153,125 | ||||||

| $300,000 | $ | 150,000 | $ | 169,500 | $ | 180,000 | $ | 180,000 | $ | 180,000 | $ | 183,750 | ||||||

| $400,000 | $ | 200,000 | $ | 226,000 | $ | 240,000 | $ | 240,000 | $ | 240,000 | $ | 245,000 | ||||||

| $500,000 | $ | 250,000 | $ | 282,500 | $ | 300,000 | $ | 300,000 | $ | 300,000 | $ | 306,250 | ||||||

| $600,000 | $ | 300,000 | $ | 339,000 | $ | 360,000 | $ | 360,000 | $ | 360,000 | $ | 367,500 | ||||||

| $700,000 | $ | 350,000 | $ | 395,500 | $ | 420,000 | $ | 420,000 | $ | 420,000 | $ | 428,750 | ||||||

| $800,000 | $ | 400,000 | $ | 452,000 | $ | 480,000 | $ | 480,000 | $ | 480,000 | $ | 490,000 | ||||||

| $1,000,000 | $ | 500,000 | $ | 565,000 | $ | 600,000 | $ | 600,000 | $ | 600,000 | $ | 612,500 | ||||||

| $1,500,000 | $ | 750,000 | $ | 847,500 | $ | 900,000 | $ | 900,000 | $ | 900,000 | $ | 918,750 | ||||||

| (1) | Average Annual Earnings are determined as described under the first paragraph of Retirement Benefits using Annual Compensation as described in the Summary Compensation Table on page 16. |

| (2) | As of June 30, 2002, the years of service credited under the Plan for the Named Executive Officers were as follows: Mr. Draegar — 6 years; Mr. Torcolini — 28 years; Mr. Shor — 21 years; Mr. Geremski — 1 year; and Mr. Welty — 26 years. |

| (3) | All of these retirement plans are payable for the life of the participant and, if applicable, the life of the survivor with the exception of the Supplemental Retirement Plan for Executives, which is payable for 15 years certain. Social Security and pensions from prior employment (except as noted) are deducted from the SERP benefit. |

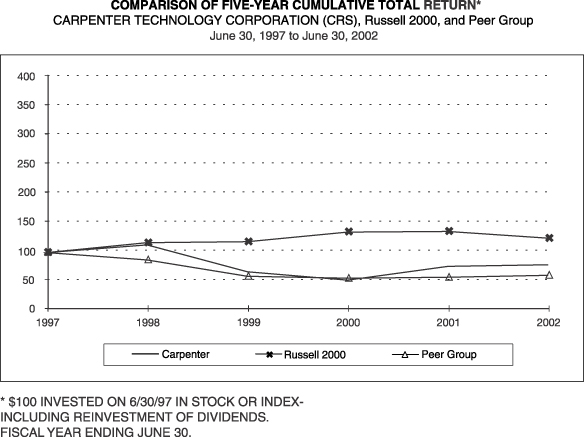

1997 | 1998 | 1999 | 2000 | 2001 | 2002 | |||||||

| Carpenter | 100.00 | 112.87 | 66.73 | 52.29 | 75.83 | 78.60 | ||||||

| Russell 2000 | 100.00 | 116.51 | 118.26 | 135.19 | 136.08 | 124.28 | ||||||

| Peer Group | 100.00 | 87.12 | 59.01 | 55.50 | 57.22 | 60.82 |

| Audit Fees | $ | 417,600 | |

| Financial Information Systems Design and Implementation Fees | 0 | ||

| All other fees | $ | 1,522,000 | |

| Total | $ | 1,939,600 | |

| 1. | a. Recommend to the Board of Directors each year the firm to be employed as the External |

| b. | Approve the appointment of other external auditors employed for specific audit purposes other than that listed in 1.a. |

| c. | Meet in separate executive sessions with the Manager-Internal Audit, the External Auditor and management to discuss any matters that the Committee or these groups believe should be discussed privately with the Committee. |

| 2. | Meet with the External Auditor prior to the commencement of the annual audit examination each year and discuss: |

| a. | The adequacy of the scope of the audit. |

| b. | The adequacy of the Company’s accounting principles, policies, security and practices, and any contemplated material changes thereto. |

| c. | New developments in accounting principles or reporting practices which may materially affect the Company. |

| d. | The audit and non-audit fees paid to the External Auditor — but not to set same. |

| 3. | Review the scope and associated expenses of the internal audit program to be performed each year. |

| 4. | Review and approve non-audit activities to be performed by the External Auditor prior to the commencement of such activities, when the fees for any one activity or project will aggregate $100,000 or more. The Committee will consider what effect, if any, the total of all such activities could have on the External Auditor’s independence. When no Committee meeting is scheduled in sufficient time for review and approval of an activity, management will review the activity with the Committee Chairperson and discuss the activity at the next Committee meeting. For purposes of this section, the following are considered audit services: |

| a. | Annual audits of the Company and its subsidiaries. |

| b. | Reviews of quarterly financial statements. |

| c. | Services related to the audit of the income tax accrual. |

| d. | Consultations on audit or accounting matters that arise during or as a result of an audit or financial statement review. |

| e. | Attendance at Committee meetings at which matters related to the audit or financial statement reviews are discussed. |

| f. | Any other services performed by the External Auditor that are customary under generally accepted auditing standards or that are customary for the purpose of rendering an opinion or report on the financial statements. |

| 5. | Review all internal and external audit reports and any written management responses thereto. |

| 6. | Review annually: |

| a. | A formal written statement from the External Auditor, as required by generally accepted auditing standards, which delineates all relationships between the External Auditor and the Company. Also, actively engage in a dialogue with the External Auditor with respect to any disclosed relationships or services which may impact the objectivity and independence of the External Auditor and take, or recommend that the full Board take, appropriate action in response to the External Auditor’s statement to satisfy itself of the External Auditor’s independence. |

| b. | The adequacy of the Audit/Finance Committee charter. |

| c. | A report of the Company on environmental matters. |

| d. | The expense reports of the Chairperson of the Board and Chief Executive Officer. |

| 7. | Periodically review the following: |

| a. | The aggregate amount of non-audit services performed by the External Auditor. |

| b. | Compliance with conflict of interest statements. |

| c. | Litigation in which the Company is involved or may become involved. |

| d. | Compliance with the Guidelines of Business Conduct. |

| 8. | Prior to submitting the annual consolidated financial statements to the Board of Directors for final approval, review and discuss with the External Auditor and Company financial management: |

| a. | The results of the completed annual audit. |

| b. | The External Auditor’s overall evaluation of the annual financial statements. |

| c. | Financial management’s overall evaluation of the annual financial statements. |

| d. | Matters relating to the conduct of the annual audit that are required to be communicated to the Committee under generally accepted auditing standards. |

| e. | Each capitalized long-term lease over $1,000,000. |

| 9. | Discuss with External and internal auditors annually prior to the Company’s filing the Annual Report on Form 10-K: |

| a. | The adequacy of internal accounting controls and procedures. |

| b. | Suggestions for improvements in accounting, information systems, and financial and operating controls, as expressed in the External Auditor’s annual letter to management. |

| c. | The extent to which any previously identified control and procedural weaknesses have not been corrected and the reasons therefore. |

| d. | The adequacy of the Company’s annual and interim reporting practices and the External Auditor’s views concerning the quality of financial reporting to the stockholders and the Securities and Exchange Commission. |

| 10. | On a quarterly basis, prior to the Company’s filing of Form 10-Q, the Chairperson of the Committee, and if the Chairperson deems it advisable to convene the Committee, a discussion with the External Auditor and management: |

| a. | Matters that are required to be communicated to the Committee under generally accepted auditing standards. |

| b. | The adequacy of the Company’s interim reporting practices and the External Auditor’s views concerning the quality of financial reporting to the stockholders and the Securities and Exchange Commission. |

| 11. | Review with the External Auditor, at least annually, the External Auditor’s evaluation of the technical competence and adequacy of the Company’s Financial Department staff. |

| 12. | Examine and consider such other matters in relation to the internal and external audits of the Company’s accounts and in relation to Corporate accounting and reporting matters, as the Committee may, in its own discretion, determine to be desirable. |

| 13. | Prepare a report for inclusion in the Company’s proxy statement, as required by the Securities and Exchange Commission. |

| 14. | Hold Regular Committee meetings as follows: |

| a. | Prior to the beginning of the annual audit. |

| b. | After completion of the annual audit and preparation of the annual consolidated financial statements. |

| c. | After completion of the External Auditor’s management letter and the Company’s response thereto. |

| 15. | Review all proposed changes to the capital structure of the Corporation, including the issuance of long-term indebtedness and the issuance of additional equity securities, and make recommendations to the Board of Directors. Periodically review the Corporation’s cash management strategies and financing requirements (at least annually) with respect to cash utilization, including short-term borrowings, consistent with sound financial policy and return on investment goals, as outlined in the one and five-year business plan. |

| 16. | Recommend to the Board, where appropriate, the selection, appointment, or removal of trustees and investment managers for each of the Corporation’s employee benefit plan funds. Review and approve Investment Policy Guidelines to be followed by each investment manager and trustee. Review and monitor the performance of the investment managers and trustees in relation to the requirements of the Investment Policy Guidelines and the Employee Retirement Security Act (ERISA). Review and approve the asset allocation for the pension funds and the associated actuarial assumptions. Review projected annual pension fund contributions for each plan year and approve the appropriate percentage allocation of such payments to the investment managers and trustees. |

| 17. | Review dividend practice. |

| 18. | Perform such other functions which from time to time may be assigned to it by the Board of Directors. |

| • | Election of four directors. |

| • | Approve the appointment of PricewaterhouseCoopers LLP as independent accountants of Carpenter for the fiscal year ending June 30, 2003. |

| • | Transact such other business as may properly come before the meeting. |

| x | Please mark your votes as in this example | |||||||||||||||||||

| The Board of Directors recommends a vote FOR all nominees and FOR proposal 2. | ||||||||||||||||||||

| FOR | WITHHELD | FOR | AGAINST | ABSTAIN | ||||||||||||||||

| 1. | Election of directors listed at right | ¨ | ¨ | Nominees- Terms to Expire 2005: | 2. | Approval of PricewaterhouseCoopers LLP as independent accountants. | ¨ | ¨ | ¨ | |||||||||||

| To withhold your vote for any nominee(s), write the name(s) here: | Dennis M. Draeger J. Michael Fitzpatrick Marillyn A. Hewson Gregory A. Pratt | |||||||||||||||||||

| This proxy, when properly executed, will be voted in the manner directed herein. If no direction is made, this proxy will be voted FOR election of the nominees for directors and FOR proposal 2. | ||||||||||||||||||||

| The signer hereby revokes all proxies heretofore given by the signer to vote at said meeting or any adjournments thereof. | ||||||||||||||||||||

| YES | NO | |||||||||||||||||||

| I plan to attend the meeting | ¨ | ¨ | ||||||||||||||||||

SIGNATURE(S) DATE , 2002 | ||||||||||||||||||||

| NOTE: Please sign exactly as your name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or Guardian, please give full title as such. | ||||||||||||||||||||