OFFUTT SECURITIES, INC.

September 2, 2004

Slide 1

Forward - Looking Statements

Some of Carpenter’s statements will be forward-looking statements, which are based on current expectations. Risk factors that could cause actual results to differ materially from these forward-looking statements can be found in Carpenter’s recent SEC filings, including the company’s June 30, 2003, 10-K, third quarter form 10-Q and S-4 Registration Statement and the exhibits attached to those filings.

© 2004 Carpenter Technology Corporation

Slide 2

AGENDA

Bob Torcolini Carpenter Overview

Chairman, President & CEO Market Overview Operating Highlights

Terry Geremski Financial Highlights

Sr. VP - Finance & CFO

Bob Torcolini Corporate Initiatives

© 2004 Carpenter Technology Corporation

Slide 3

Key Characteristics of Carpenter Technology

Leading manufacturer of specialty materials

High performance metals Engineered products

Sales and distribution system supports growth

Customer oriented

Front-line field metallurgists / sales engineers

Diverse and attractive end-use markets

Leading provider in niche markets

© 2004 Carpenter Technology Corporation

Slide 4

Key Characteristics of Carpenter Technology $500 million investment program completed

Expansion of product line Lower capex requirements

Geographically diverse

27% of sales derived from international markets Expansion into low cost / developing markets

Strong capital base

Consistent cash flow generator Commitment to credit quality

© 2004 Carpenter Technology Corporation

Slide 5

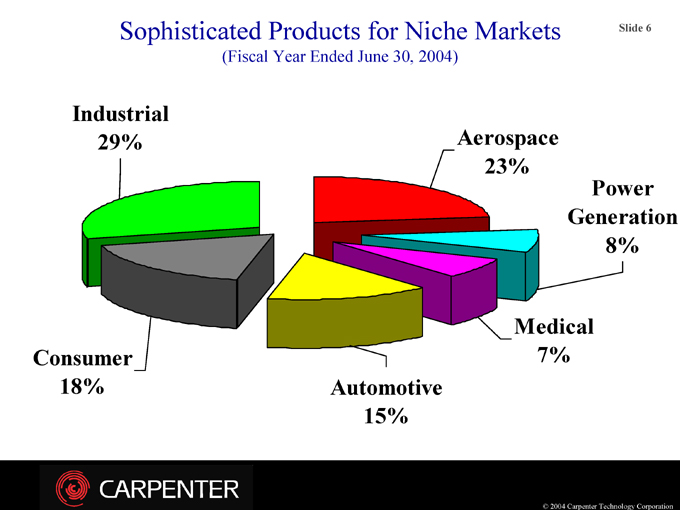

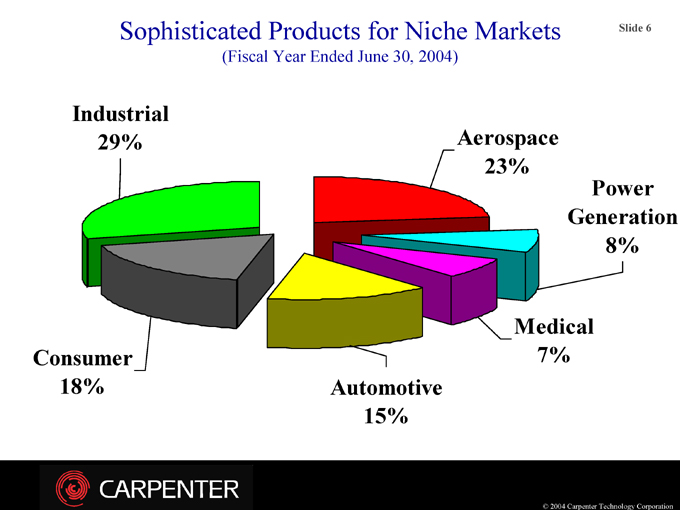

Sophisticated Products for Niche Markets

(Fiscal Year Ended June 30, 2004)

Industrial 29%

Consumer 18%

Aerospace 23%

Power Generation 8%

Medical 7%

Automotive 15%

© 2004 Carpenter Technology Corporation

Slide 6

Market Overview

© 2004 Carpenter Technology Corporation

Slide 7

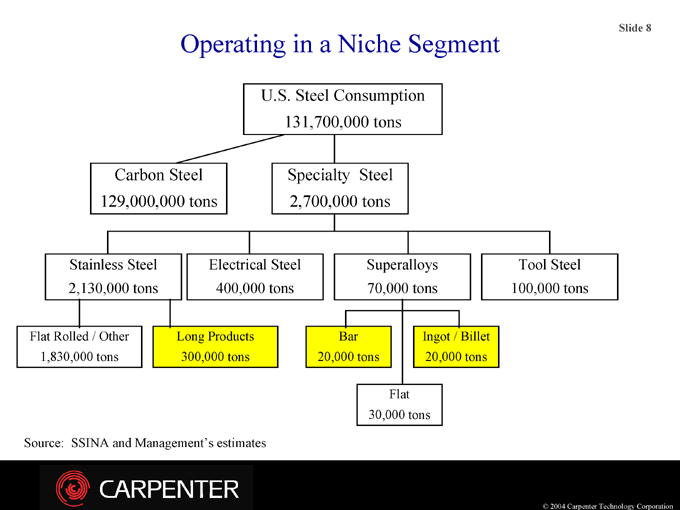

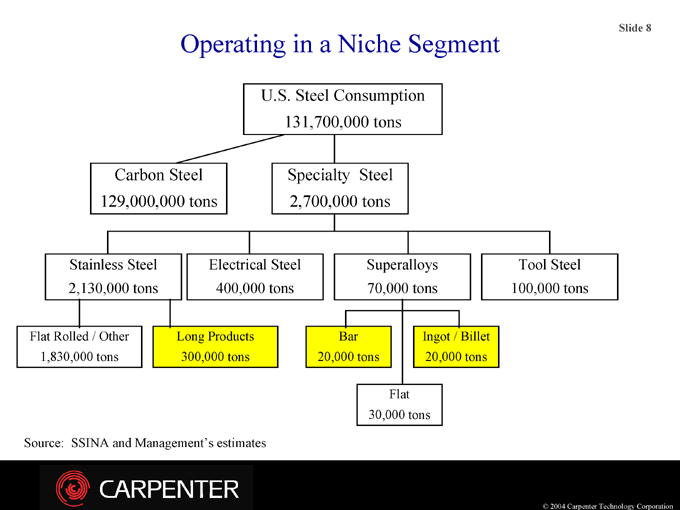

Operating in a Niche Segment

U.S. Steel Consumption 131,700,000 tons

Carbon Steel 129,000,000 tons

Specialty Steel 2,700,000 tons

Stainless Steel 2,130,000 tons

Electrical Steel 400,000 tons

Superalloys 70,000 tons

Tool Steel 100,000 tons

Flat Rolled / Other 1,830,000 tons

Long Products 300,000 tons

Bar 20,000 tons

Ingot / Billet 20,000 tons

Flat 30,000 tons

Source: SSINA and Management’s estimates

© 2004 Carpenter Technology Corporation

Slide 8

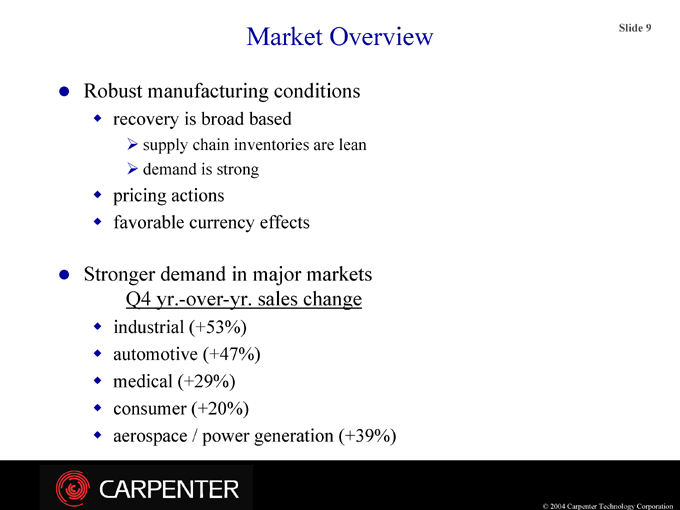

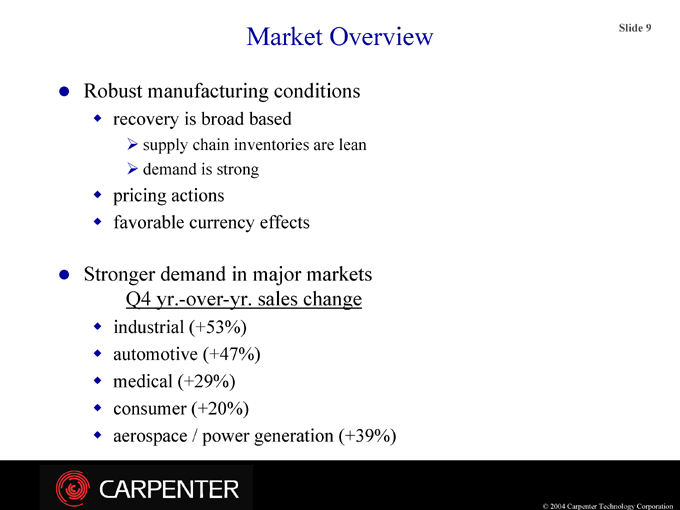

Market Overview

Robust manufacturing conditions

recovery is broad based

supply chain inventories are lean demand is strong

pricing actions

favorable currency effects

Stronger demand in major markets Q4 yr.-over-yr. sales change

industrial (+53%) automotive (+47%) medical (+29%) consumer (+20%)

aerospace / power generation (+39%)

© 2004 Carpenter Technology Corporation

Slide 9

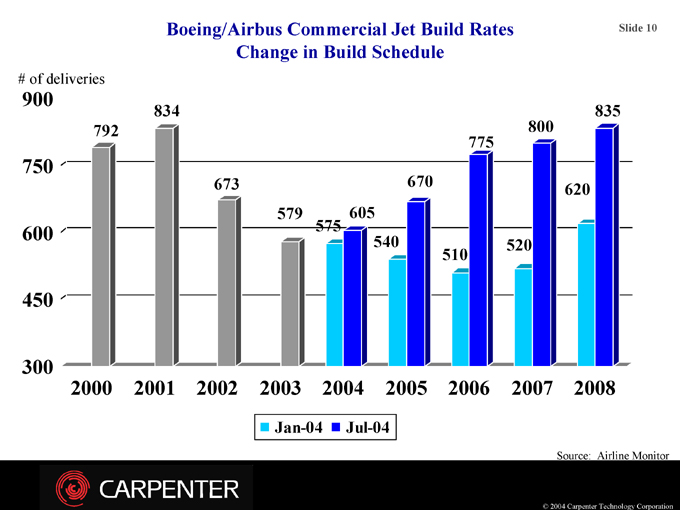

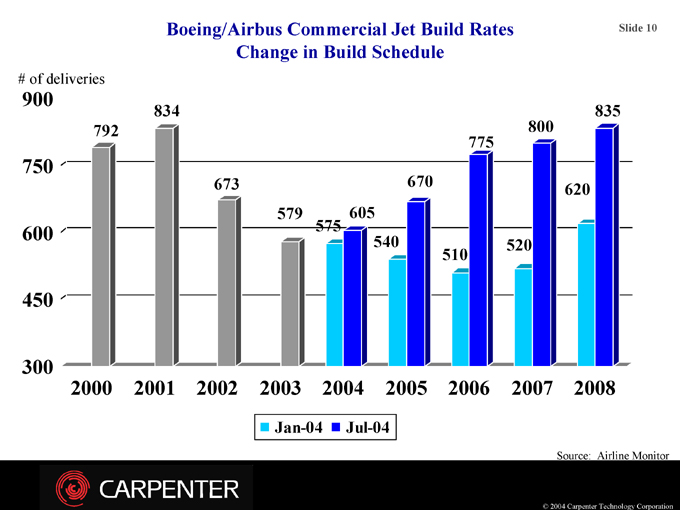

Boeing/Airbus Commercial Jet Build Rates Change in Build Schedule

# of deliveries

900 750 600 450 300

2000 2001 2002 2003 2004 2005 2006 2007 2008

792

834

673

579

575

605

540

670

510

775

520

800

620

835

Jan-04 Jul-04

Source: Airline Monitor

© 2004 Carpenter Technology Corporation

Slide 10

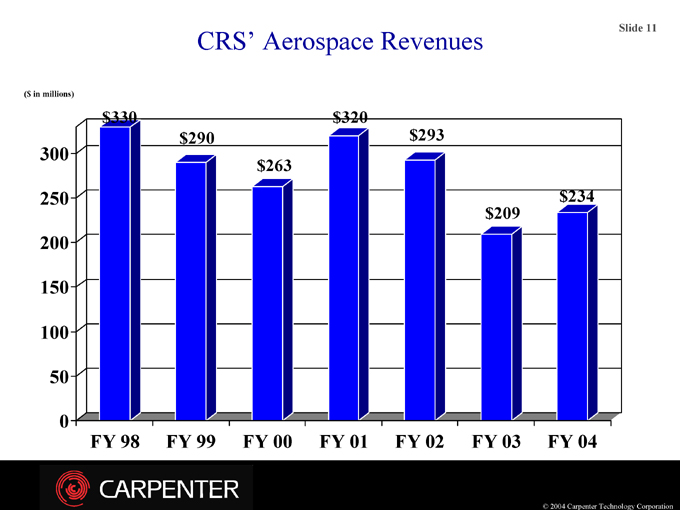

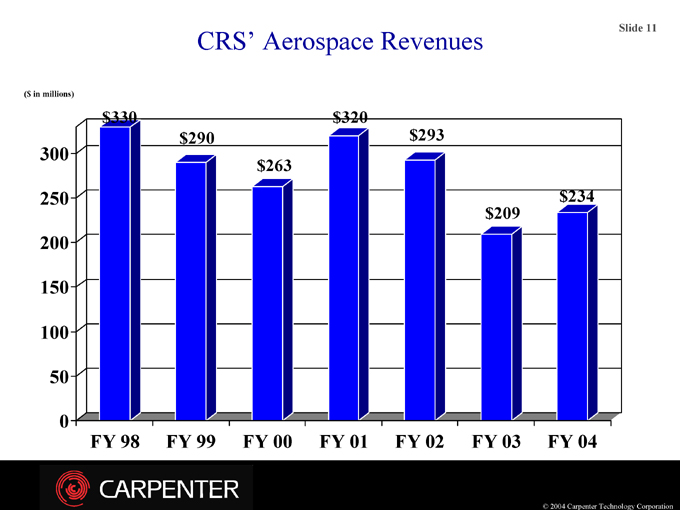

CRS’ Aerospace Revenues

($ in millions)

300 250 200 150 100 50 0

FY 98 FY 99 FY 00 FY 01 FY 02 FY 03 FY 04 $330 $290 $263 $320 $293 $209 $234

© 2004 Carpenter Technology Corporation

Slide 11

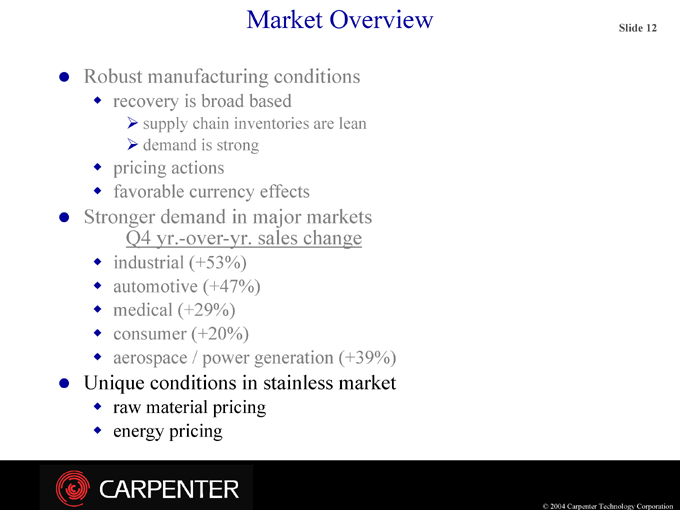

Market Overview

Robust manufacturing conditions

recovery is broad based

supply chain inventories are lean demand is strong

pricing actions

favorable currency effects

Stronger demand in major markets Q4 yr.-over-yr. sales change

industrial (+53%) automotive (+47%) medical (+29%) consumer (+20%)

aerospace / power generation (+39%)

Unique conditions in stainless market

raw material pricing energy pricing

© 2004 Carpenter Technology Corporation

Slide 12

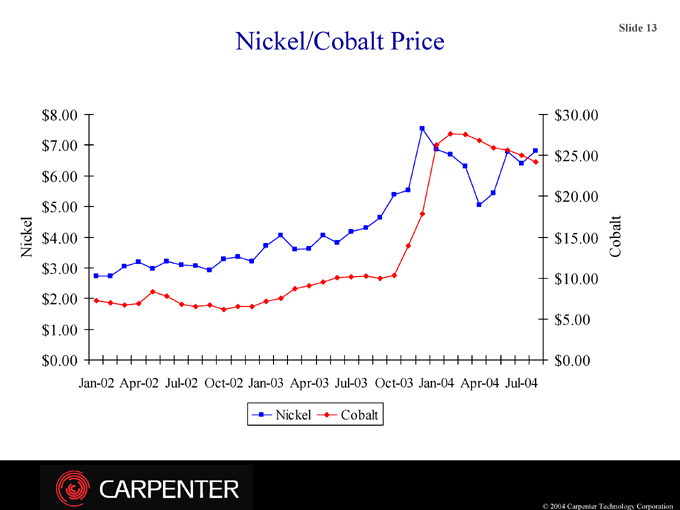

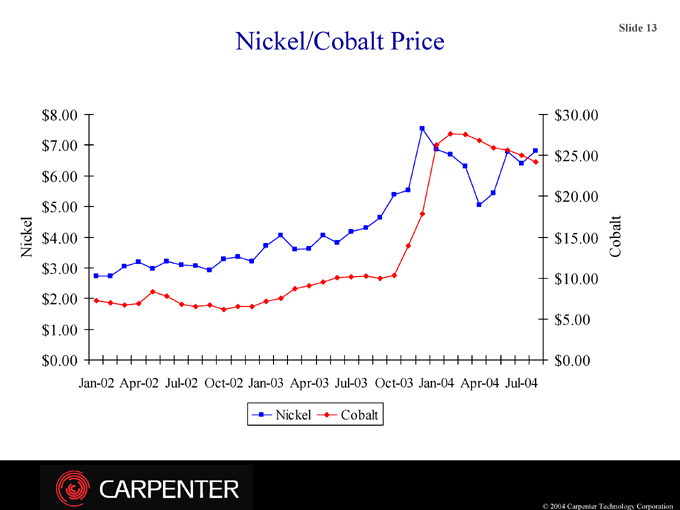

Nickel/Cobalt Price

Nickel $8.00 $7.00 $6.00 $5.00 $4.00 $3.00 $2.00 $1.00 $0.00

Jan-02 Apr-02 Jul-02 Oct-02 Jan-03 Apr-03 Jul-03 Oct-03 Jan-04 Apr-04 Jul-04 $30.00 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00

Cobalt

Nickel Cobalt

© 2004 Carpenter Technology Corporation

Slide 13

Operating Highlights

© 2004 Carpenter Technology Corporation

Slide 14

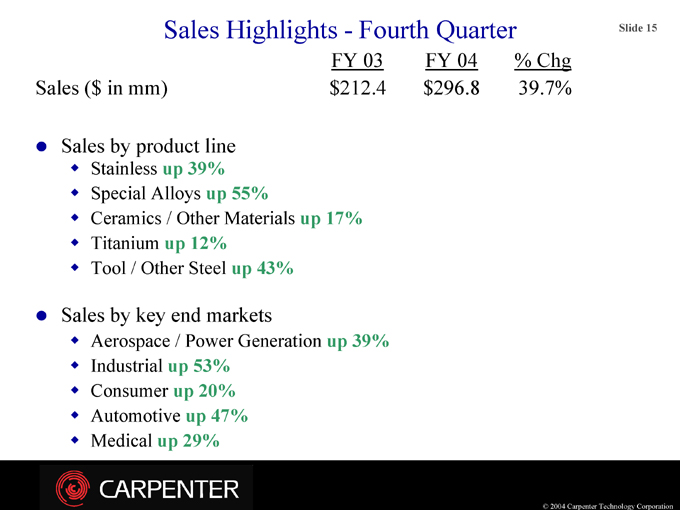

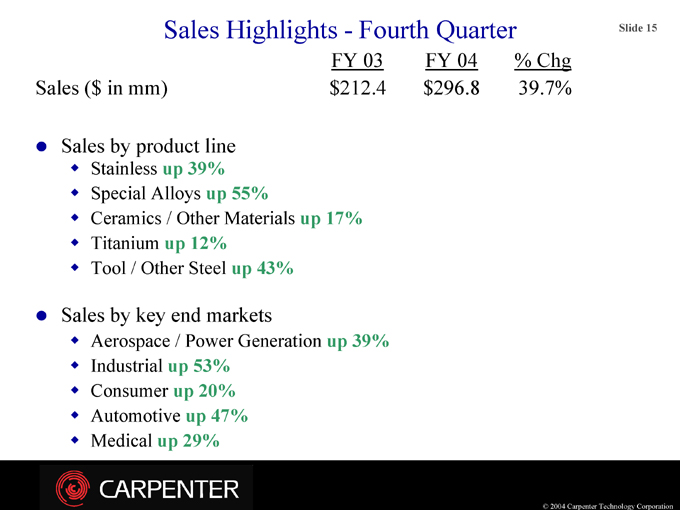

Sales Highlights - Fourth Quarter

FY 03 FY 04 % Chg

Sales ($ in mm) $212.4 $296.8 39.7%

Sales by product line

Stainless up 39% Special Alloys up 55%

Ceramics / Other Materials up 17% Titanium up 12% Tool / Other Steel up 43%

Sales by key end markets

Aerospace / Power Generation up 39% Industrial up 53% Consumer up 20% Automotive up 47% Medical up 29%

© 2004 Carpenter Technology Corporation

Slide 15

Sales Highlights - Fourth Quarter

Improving Aerospace Sales

Customer inventories in-line with demand Share gain with new and existing customers Spares - commercial/military aircraft engines Accelerated build rate

Recovery in Power Generation Sales

New IGT build rates still relatively low

Foreign demand and scheduled maintenance projects stabilizing market Nuclear remains stable

Strong Automotive Market Sales

Growth with key customers Favorable effects of a weaker dollar Increased U.S. parts production

© 2004 Carpenter Technology Corporation

Slide 16

Sales Highlights - Fourth Quarter

Growth and Recovery in Medical Sales renewed demand in market new product and customer success increased international market share

Strengthening Industrial Sales increased capital investments by manufacturers market share gains

Increasing Consumer Sales consumer durables electronic applications

© 2004 Carpenter Technology Corporation

Slide 17

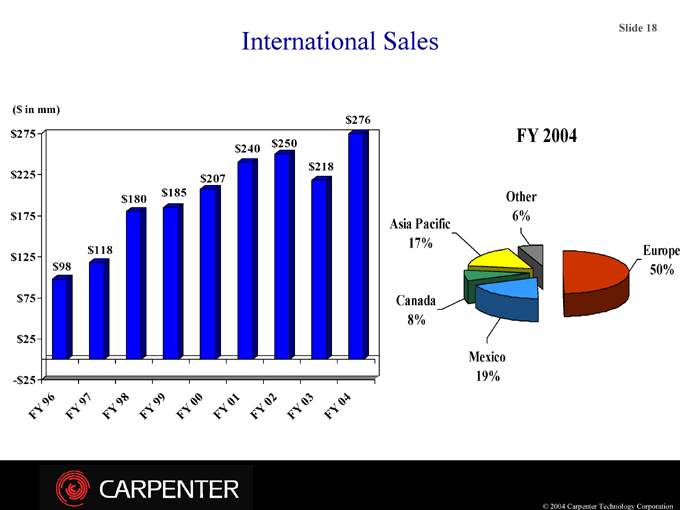

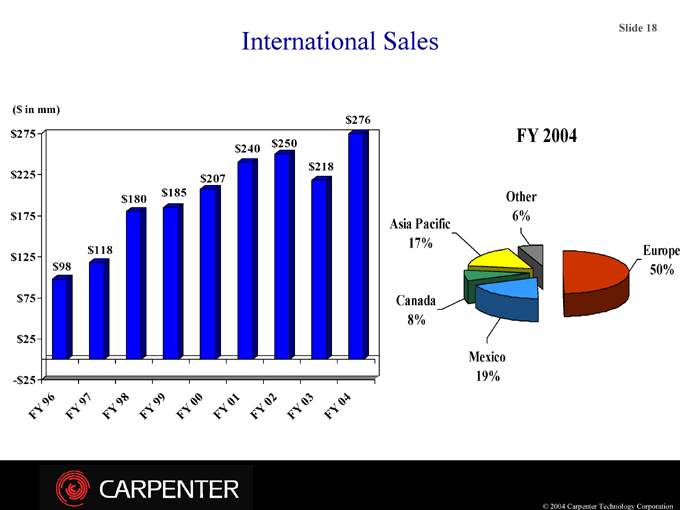

International Sales

($ in mm) $275 $225 $175 $125 $75 $25

-$25

FY 04

FY 96

FY 97

FY 98

FY 99

FY 00

FY 01

FY 02

FY 03

$98 $118 $180 $185 $207 $240 $250

$218 $276

Asia Pacific 17%

Other 6%

Europe 50%

Canada 8%

Mexico 19%

FY 2004

© 2004 Carpenter Technology Corporation

Slide 18

Financial Highlights

© 2004 Carpenter Technology Corporation

Slide 19

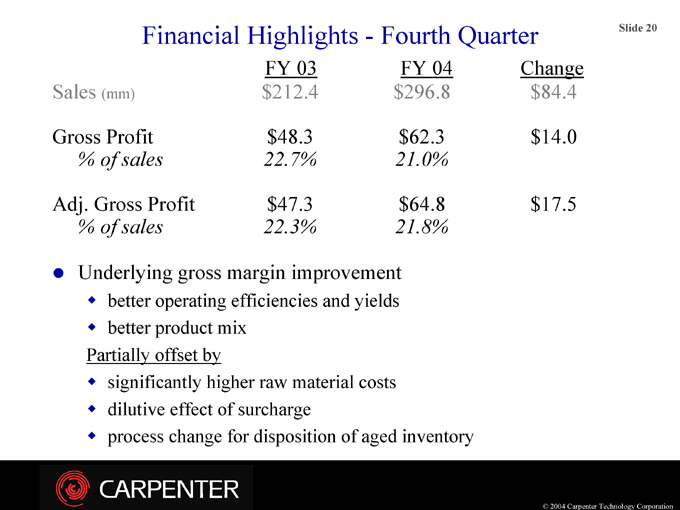

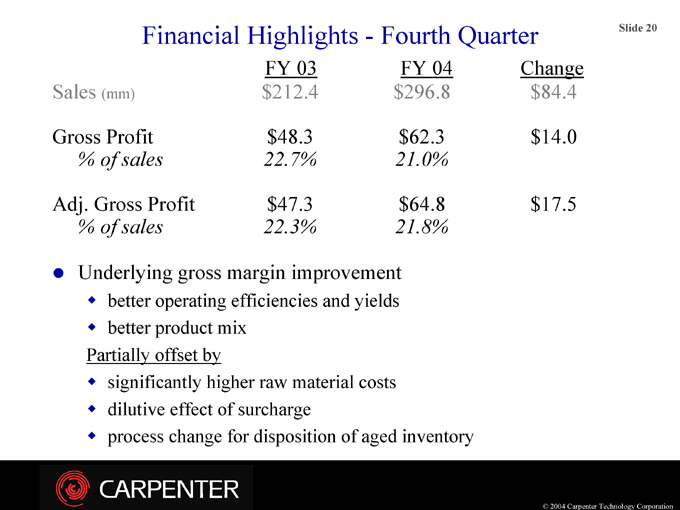

Financial Highlights - - Fourth Quarter

FY 03 FY 04 Change Sales (mm) $212.4 $296.8 $84.4

Gross Profit $48.3 $62.3 $14.0

% of sales 22.7% 21.0%

Adj. Gross Profit $47.3 $64.8 $17.5

% of sales 22.3% 21.8%

Underlying gross margin improvement better operating efficiencies and yields better product mix

Partially offset by significantly higher raw material costs dilutive effect of surcharge process change for disposition of aged inventory

© 2004 Carpenter Technology Corporation

Slide 20

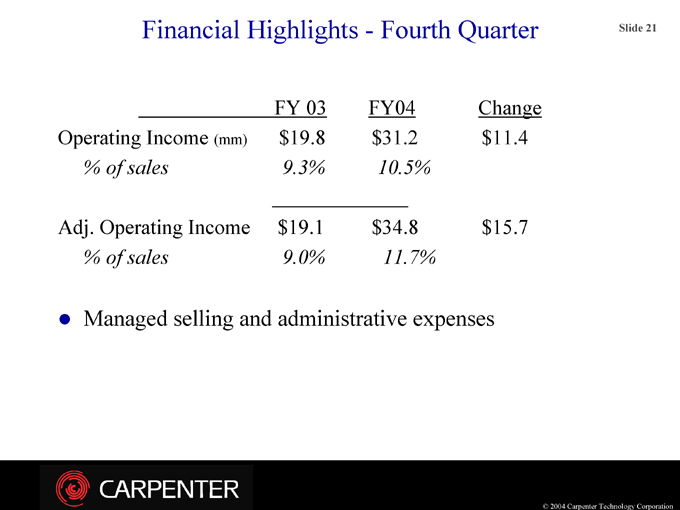

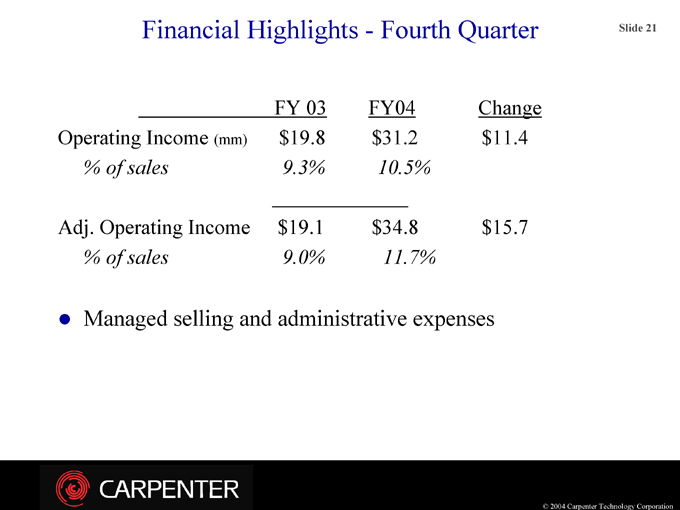

Financial Highlights - - Fourth Quarter

FY 03 FY04

Change Operating Income (mm) $19.8 $31.2 $11.4

% of sales 9.3% 10.5%

Adj. Operating Income $19.1 $34.8 $15.7

% of sales 9.0% 11.7%

Managed selling and administrative expenses

© 2004 Carpenter Technology Corporation

Slide 21

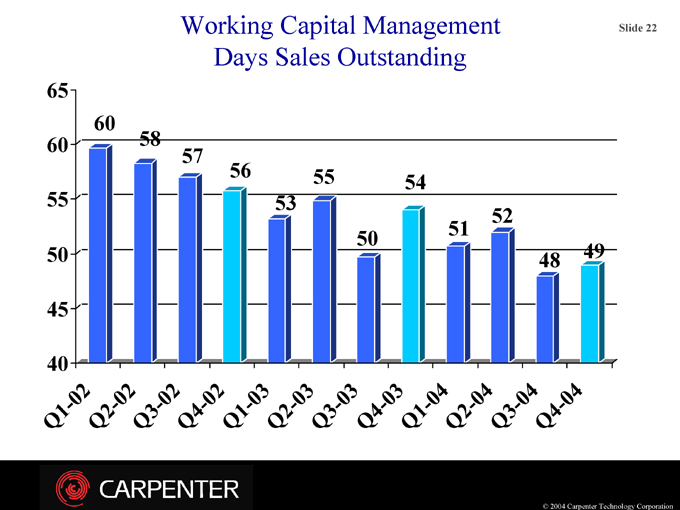

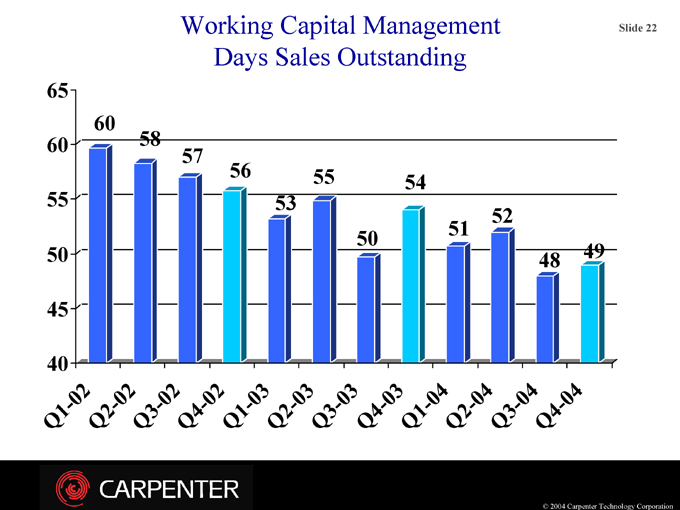

Working Capital Management Days Sales Outstanding

65 60 55 50 45 40

Q1-02 Q2-02 Q3-02 Q4-02 Q1-03 Q2-03 Q3-03 Q4-03 Q1-04 Q2-04 Q3-04 Q4-04

60

58

57

56

53

55

50

54

51

52

48

49

© 2004 Carpenter Technology Corporation

Slide 22

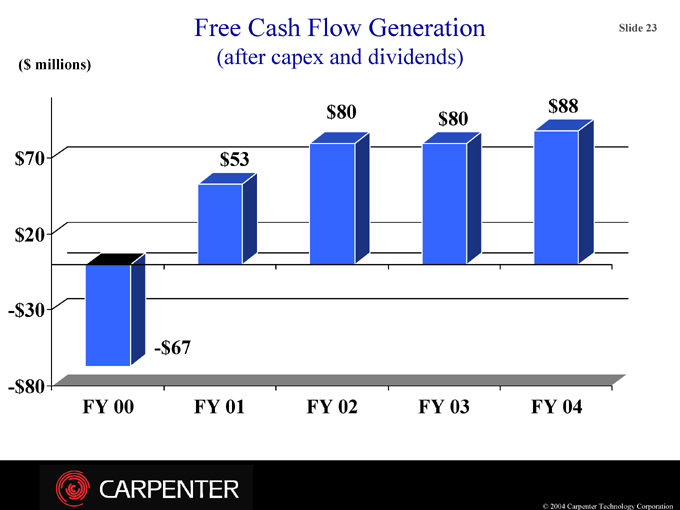

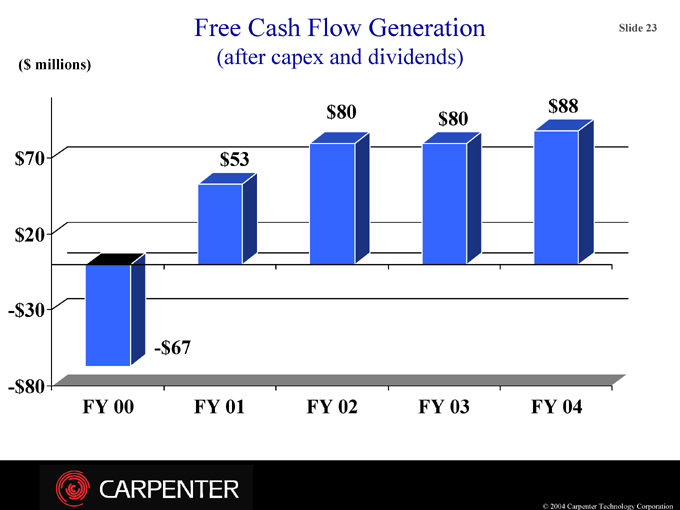

Free Cash Flow Generation

(after capex and dividends)

($ millions) $70

$20

-$30

-$80

FY 00 FY 01 FY 02 FY 03 FY 04

-$67 $53 $80 $80 $88

© 2004 Carpenter Technology Corporation

Slide 23

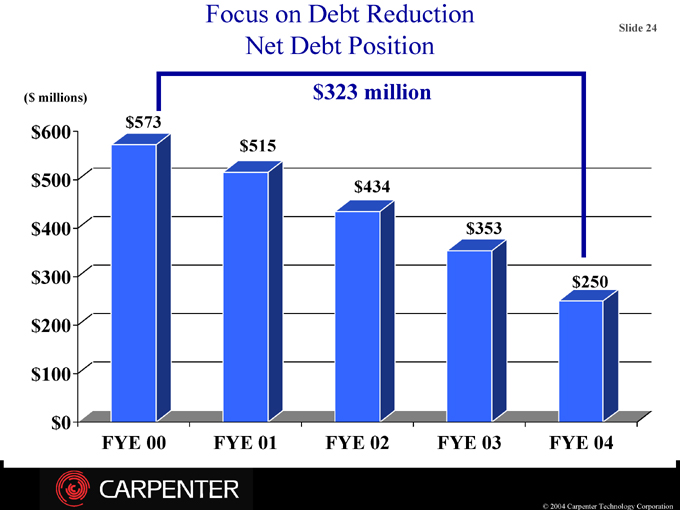

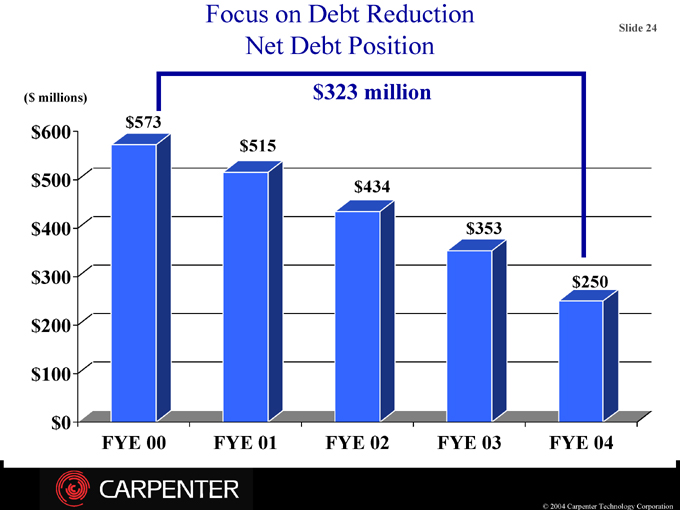

Focus on Debt Reduction Net Debt Position $323 million

($ millions)

$600 $500 $400 $300 $200 $100 $0

FYE 00 FYE 01 FYE 02 FYE 03 FYE 04 $573 $515 $434 $353 $250

© 2004 Carpenter Technology Corporation

Slide 24

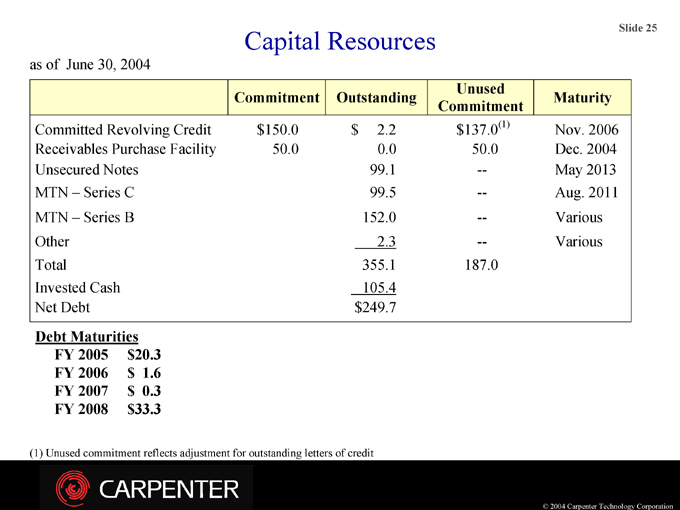

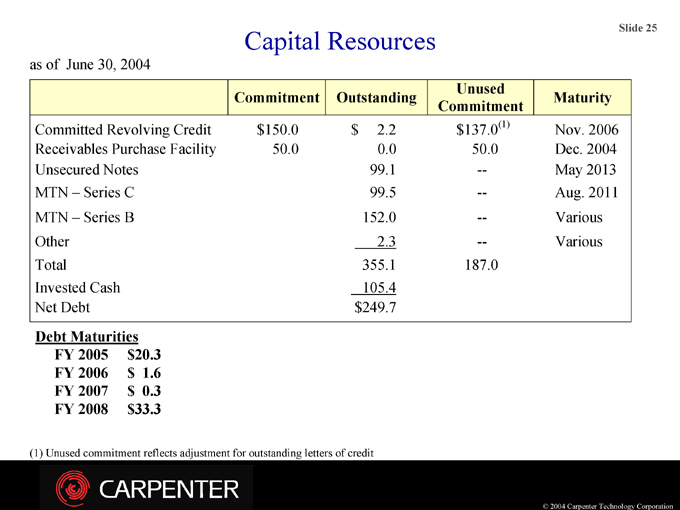

Capital Resources as of June 30, 2004

Commitment Outstanding Unused Commitment Maturity

Committed Revolving Credit $150.0 $2.2 $137.0(1) Nov. 2006 Receivables Purchase Facility 50.0 0.0 50.0 Dec. 2004 Unsecured Notes 99.1 — May 2013 MTN – Series C 99.5 — Aug. 2011 MTN – Series B 152.0 — Various Other 2.3 — Various Total 355.1 187.0 Invested Cash 105.4 Net Debt $249.7

Debt Maturities FY 2005 $20.3 FY 2006 $ 1.6 FY 2007 $ 0.3 FY 2008 $33.3

(1) Unused commitment reflects adjustment for outstanding letters of credit

© 2004 Carpenter Technology Corporation

Slide 25

Corporate Initiatives

© 2004 Carpenter Technology Corporation

Slide 26

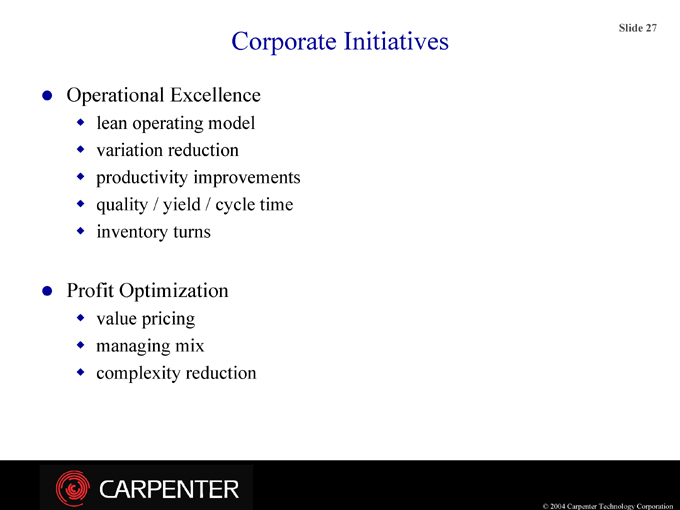

Corporate Initiatives

Operational Excellence

lean operating model variation reduction productivity improvements quality / yield / cycle time inventory turns

Profit Optimization

value pricing managing mix complexity reduction

© 2004 Carpenter Technology Corporation

Slide 27

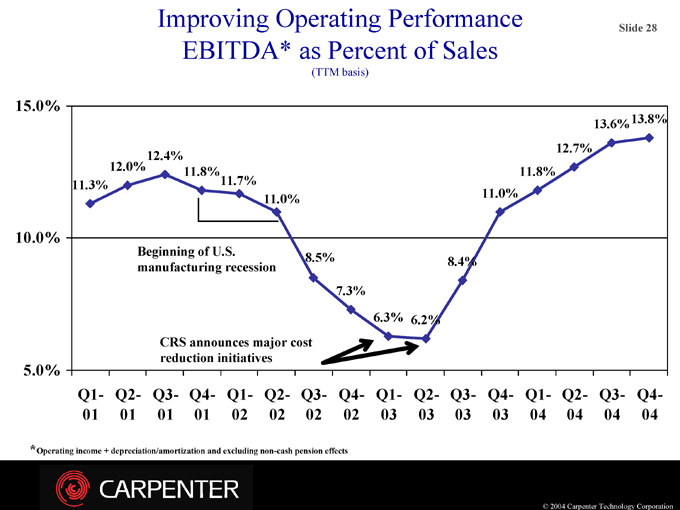

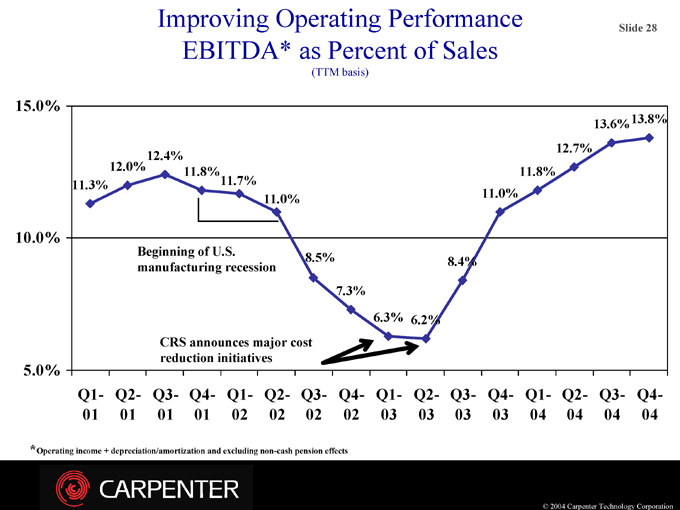

Improving Operating Performance EBITDA* as Percent of Sales

(TTM basis)

15.0% 10.0% 5.0%

Q1-01 Q2-01 Q3-01 Q4-01 Q1-02 Q2-02 Q3-02 Q4-02 Q1-03 Q2-03 Q3-03 Q4-03 Q1-04 Q2-04 Q3-04 Q4-04

11.3%

12.0%

12.4%

11.8%

11.7%

11.0%

8.5%

7.3%

6.3%

6.2%

8.4%

11.0%

11.8%

12.7%

13.6%

13.8%

* Operating income + depreciation/amortization and excluding non-cash pension effects

Beginning of U.S. manufacturing recession

CRS announces major cost reduction initiatives

© 2004 Carpenter Technology Corporation

Slide 28

Corporate Initiatives

Growth and Innovation

Focus on specialty materials

Continue to invest in R&D and technical service Service development - VMI and supply chain services Leverage international opportunities Realize additional value of component manufacturing

© 2004 Carpenter Technology Corporation

Slide 29

Summary

Favorable economic conditions Aerospace market improving

Further cost reduction is necessary and possible Profit optimization Improve working capital turns Achieve financial goals. At a minimum,

12% operating margin 9% RONA

© 2004 Carpenter Technology Corporation

Slide 30