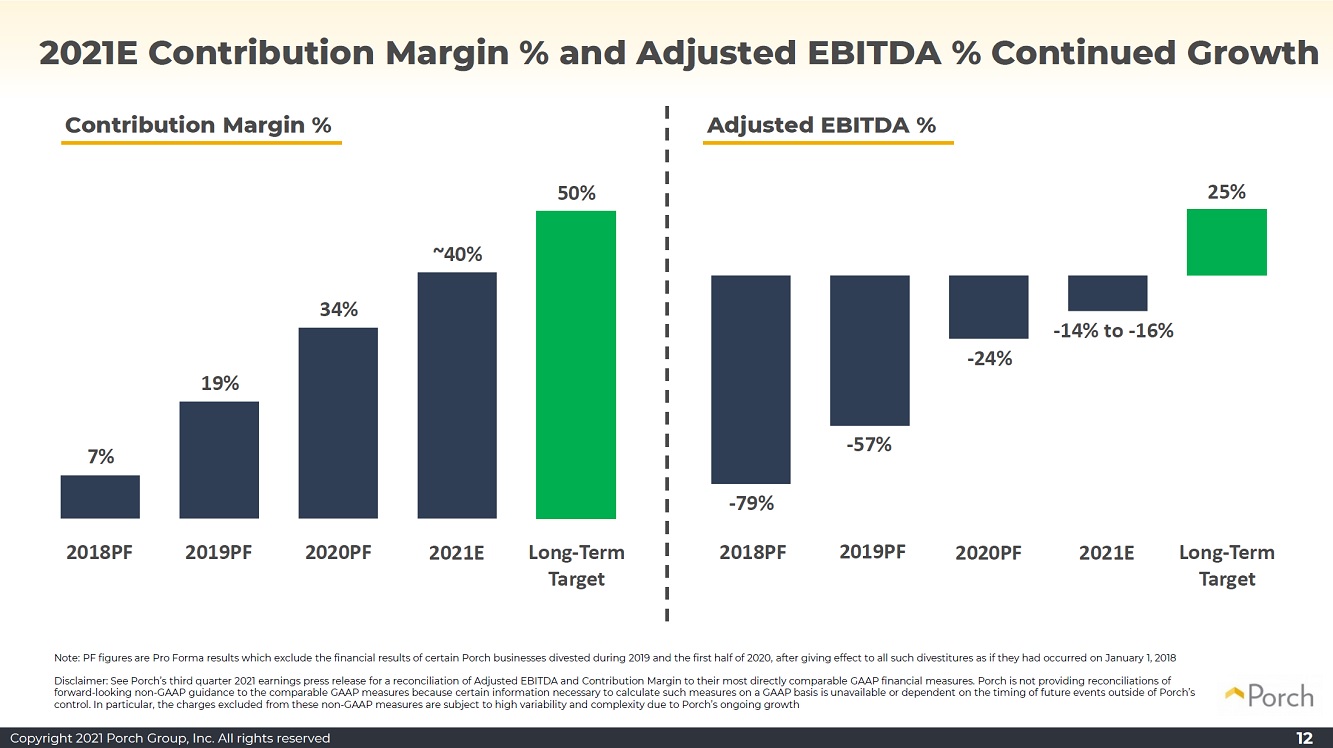

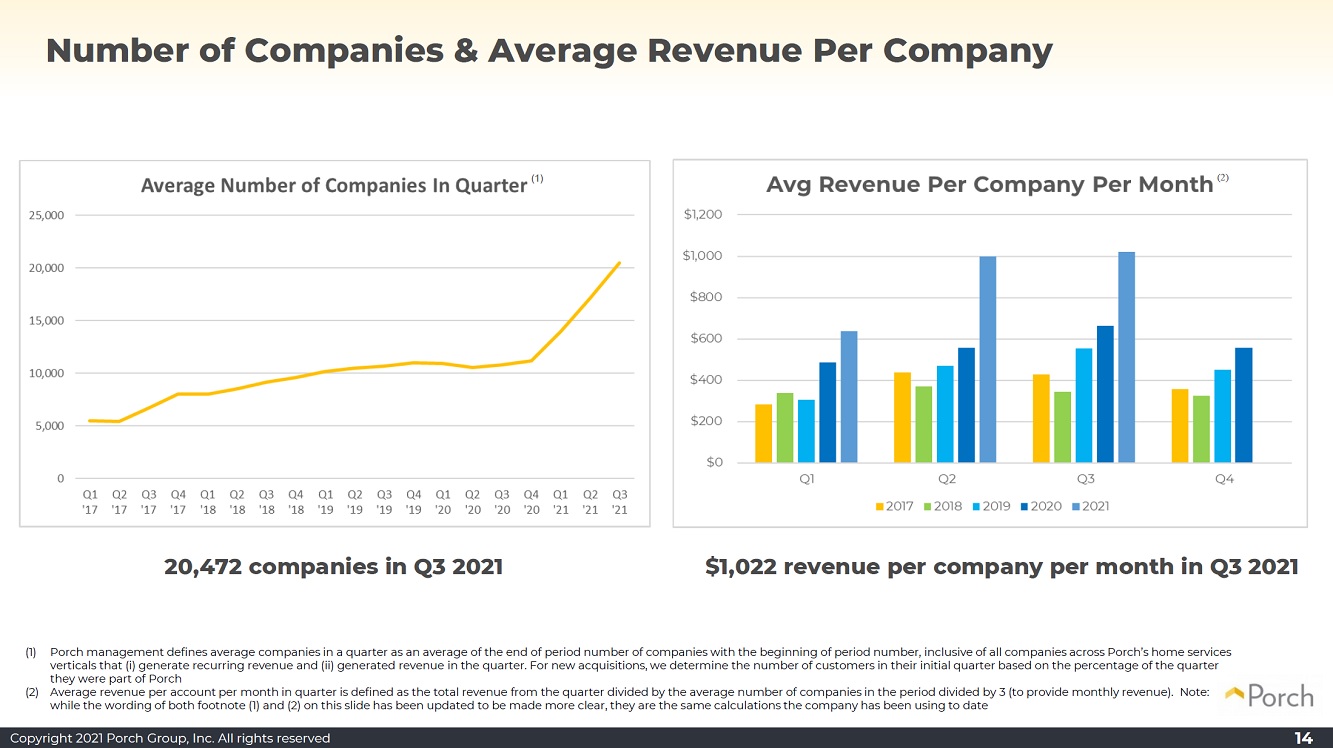

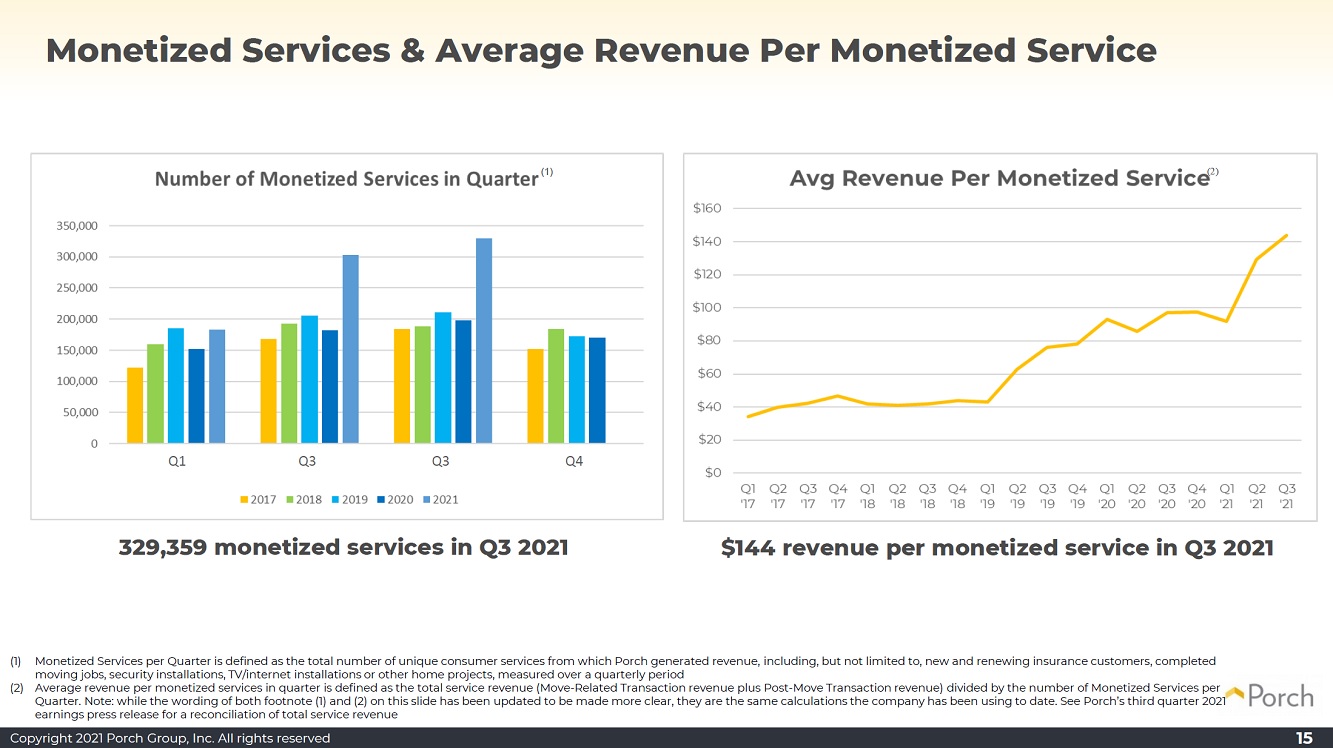

| Copyright 2021 Porch Group, Inc. All rights reserved 3 DISCLAIMERS 3 Forward-Looking Statements Certain statements in this presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Porch Group, Inc.’s (“Porch”) future financial or operating performance. For example, projections of future revenue, contribution margin, Adjusted EBITDA and other metrics, business strategy and plans, and anticipated impacts from pending or completed acquisitions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Porch and its management at the time they are made, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1) the ability to recognize the anticipated benefits of Porch’s December 2020 business combination (the “Merger”) with PropTech Acquisition Corporation (“PropTech”), which may be affected by, among other things, competition and the ability of the combined company to grow and manage growth profitably, maintain key commercial relationships and retain its management and key employees; (2) expansion plans and opportunities, including recently completed acquisitions as well as future and pending acquisitions or additional business combinations; (3) costs related to the Merger and being a public company; (4) litigation, complaints, and/or adverse publicity; (5) the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability; (6) privacy and data protection laws, privacy or data breaches, or the loss of data; (7) the impact of the COVID-19 pandemic and its effect on the business and financial conditions of Porch; and (8) other risks and uncertainties described in Porch’s most recent Form 10-K/A and subsequent reports filed with the Securities and Exchange Commission (the “SEC”), such as Porch’s quarterly reports on Form 10-Q for the quarters ended June 30, 2021 and September 30, 2021, which are available on the SEC’s website at www.sec.gov. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Unless specifically indicated otherwise, the forward-looking statements in this release do not reflect the potential impact of any divestitures, mergers, acquisitions, or other business combinations that have not been completed as of the date of this presentation. Porch does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events or otherwise, except as may be required by law. Non-GAAP Financial Measures This presentation includes one or more non-GAAP financial measures, such as Adjusted EBITDA (loss), Adjusted EBITDA (loss) as a percentage of revenue, contribution margin, and average revenue per monetized service. Porch defines Adjusted EBITDA (loss) as net income (loss) adjusted for interest expense, net, income taxes, other expenses, net, depreciation and amortization, certain non-cash long-lived asset impairment charges, stock-based compensation expense and acquisition-related impacts, including compensation to the sellers that requires future service, amortization of intangible assets, gains (losses) recognized on changes in the value of contingent consideration arrangements, if any, gain or loss on divestures and certain transaction costs. Adjusted EBITDA (loss) as a percentage of revenue is defined as Adjusted EBITDA (loss) divided by GAAP total revenue. Contribution margin is defined as revenue less all variable expenses, including cost of revenue, variable marketing and sales. Average revenue per monetized services in quarter is the average revenue generated per monetized service performed in a quarterly period. When calculating average revenue per monetized service in quarter, average revenue is defined as total quarterly monetized service revenues generated from monetized services. Porch’s management and Board of Directors use these non-GAAP financial measures as supplemental measures of Porch’s operating and financial performance for historical and forward-looking periods, for internal budgeting and forecasting purposes, to evaluate financial and strategic planning matters, and for certain measures, to establish performance goals for incentive programs. Porch believes that the use of these non-GAAP financial measures provides investors with useful information to evaluate projected operating results and trends and in comparing Porch’s financial measures with competitors, other similar companies and companies across different industries, many of which present similar non-GAAP financial measures to investors. However, Porch's definitions and methodology in calculating these non-GAAP measures may not be comparable to those used by other companies. In addition, Porch may modify the presentation of these non-GAAP financial measures in the future, and any such modification may be material. You should not consider these non-GAAP financial measures in isolation, as a substitute to or superior to financial performance measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude specified income and expenses, some of which may be significant or material, that are required by GAAP to be recorded in Porch’s consolidated financial statements. Porch may also incur future income or expenses similar to those excluded from these non- GAAP financial measures, and Porch’s presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or non-recurring items. In addition, these non-GAAP financial measures reflect the exercise of management judgment about which income and expense are included or excluded in determining these non-GAAP financial measures. You should review the tables accompanying Porch’s earnings release available at www.sec.gov for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure. Porch is not providing reconciliations of non- GAAP financial measures for future periods to the most directly comparable measures prepared in accordance with GAAP. Porch is unable to provide these reconciliations without unreasonable effort because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of Porch’s control. |