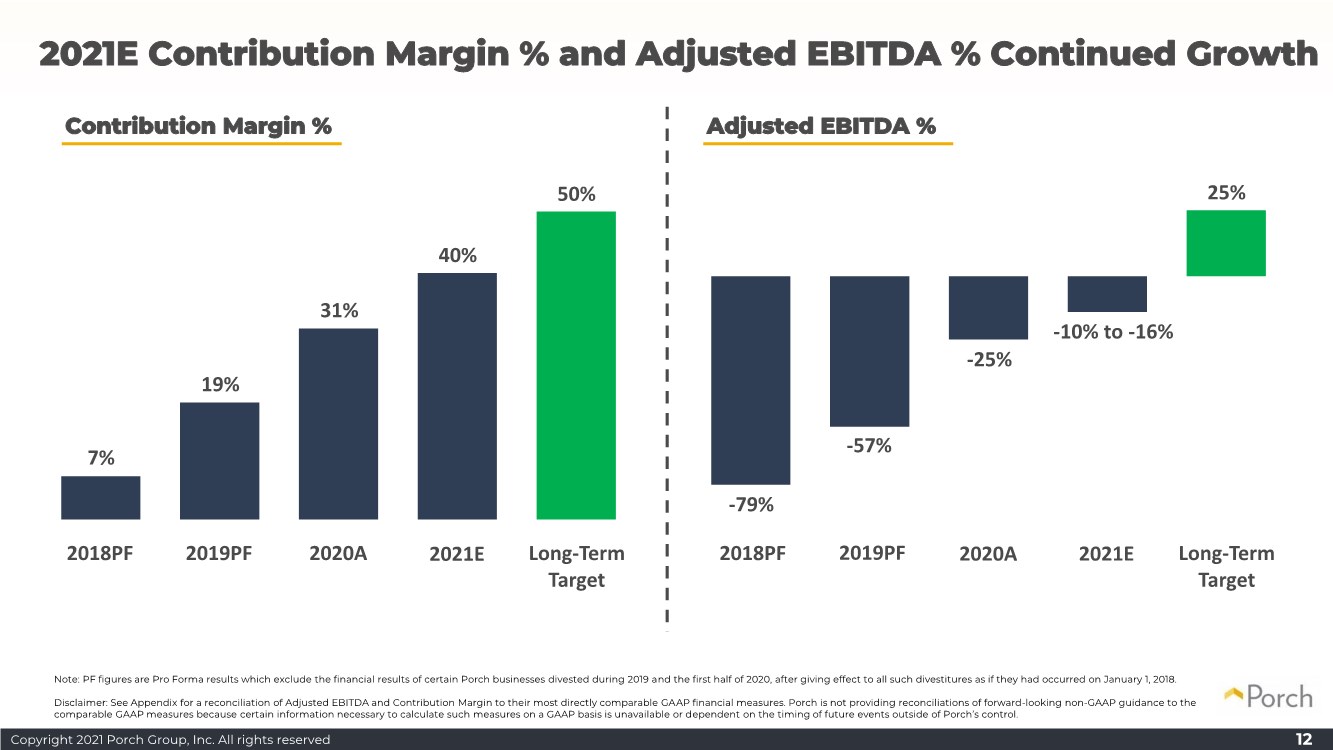

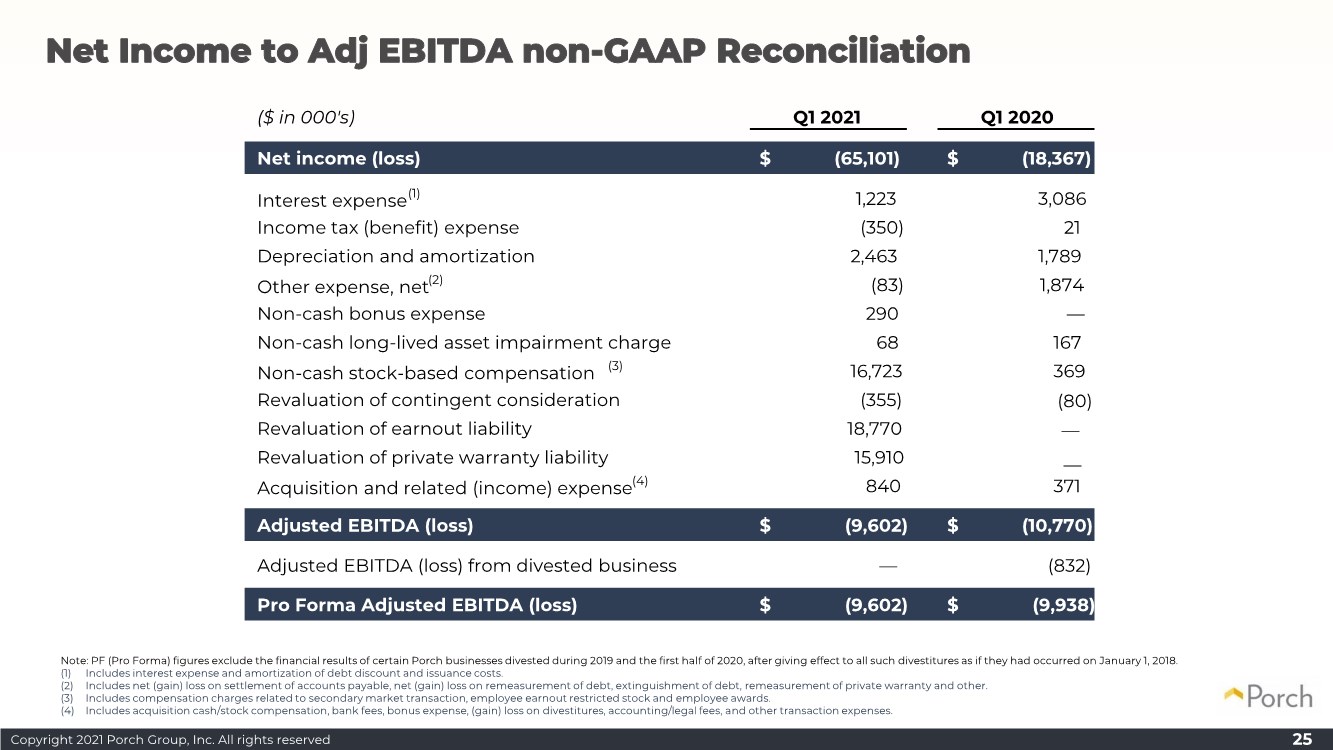

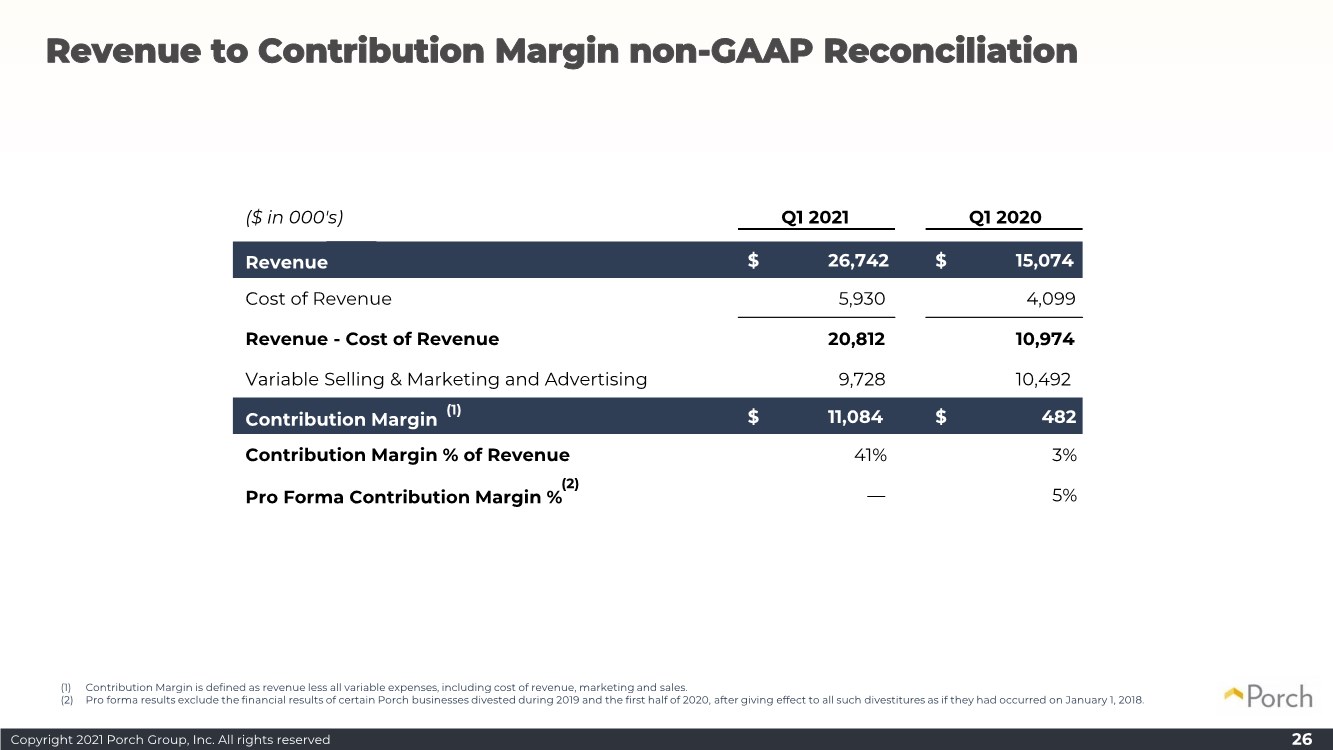

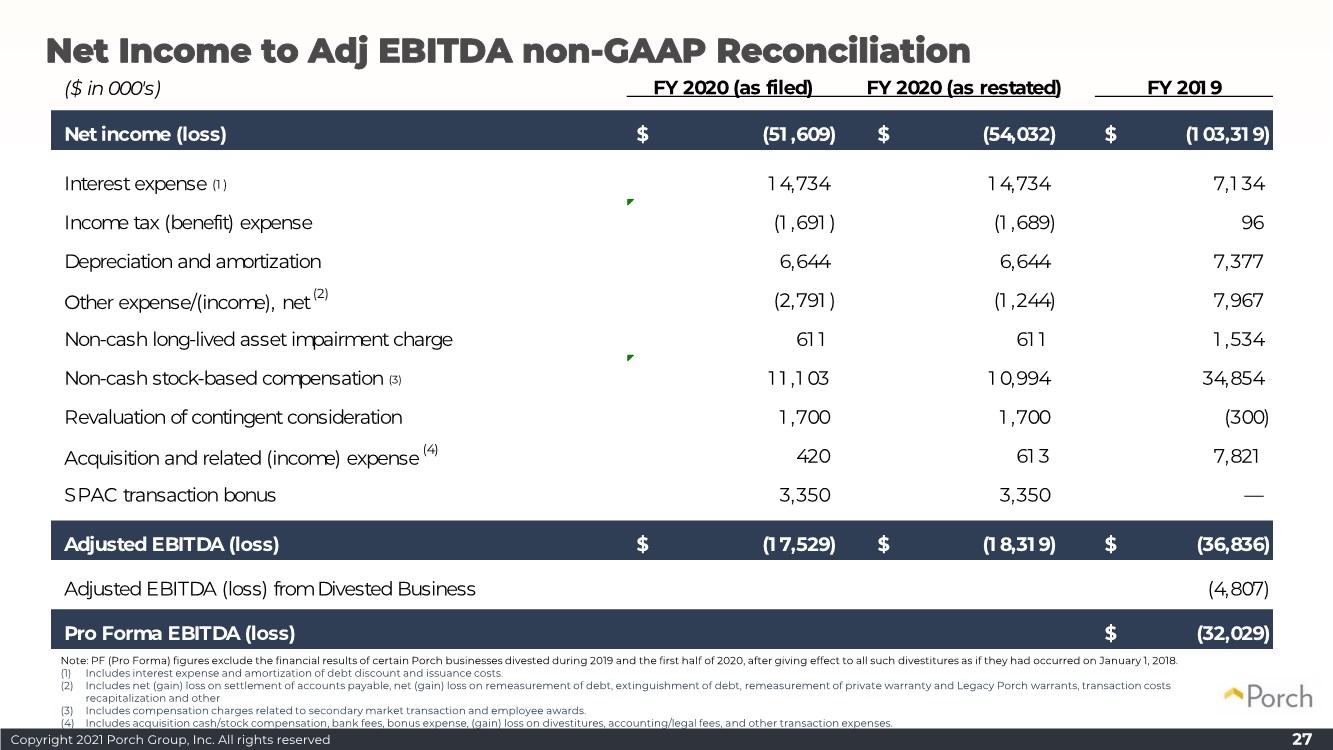

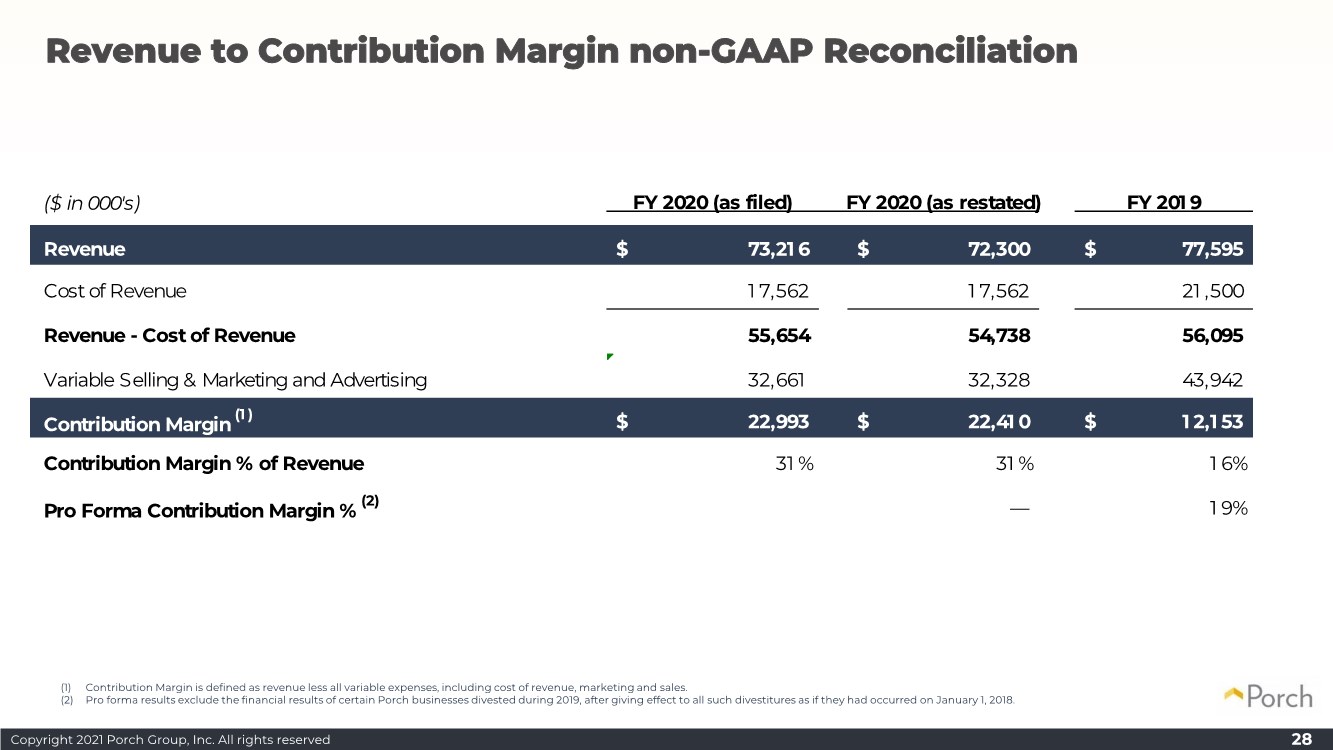

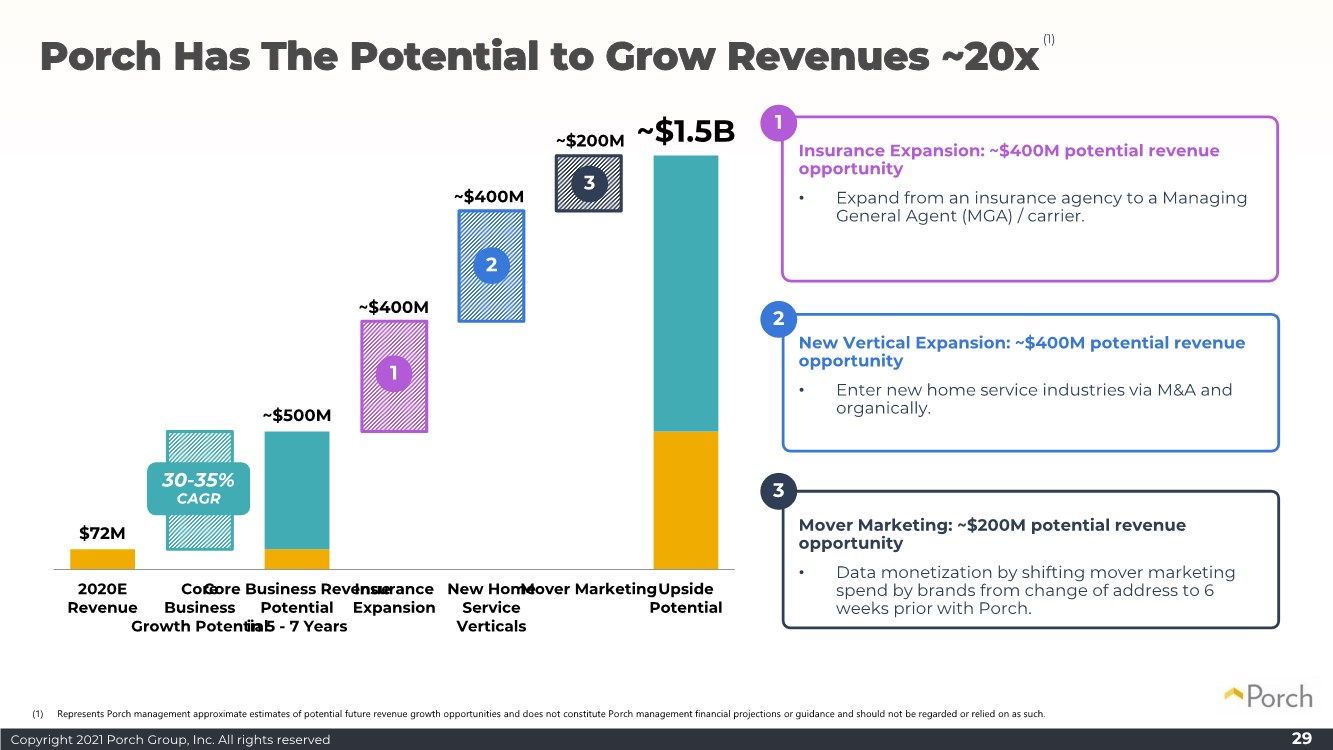

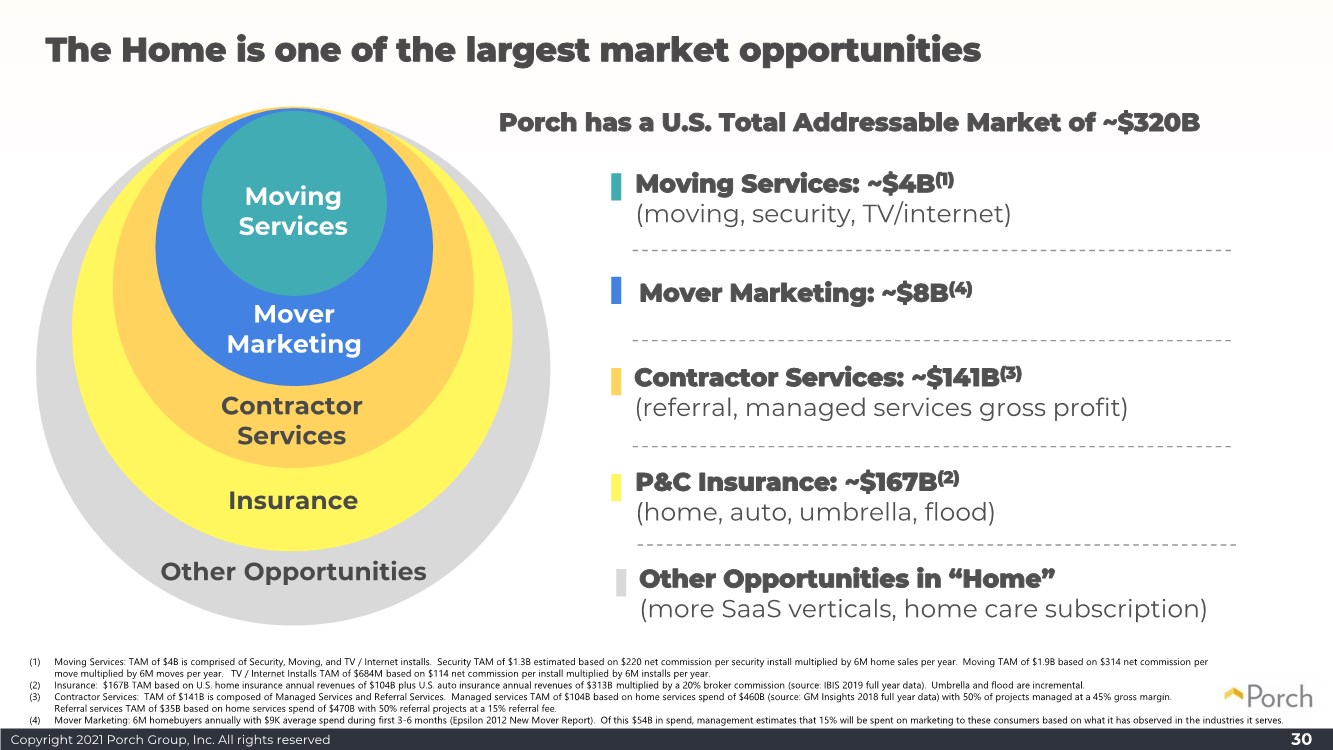

| Copyright 2021 Porch Group, Inc. All rights reserved 2 DISCLAIMERS 2 Forward-Looking Statements Certain statements in this presentation may be considered “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Porch Group, Inc.’s (“Porch”) future financial or operating performance. For example, projections of future revenue, contribution margin, Adjusted EBITDA and other metrics, business strategy and plans, and anticipated impacts from pending or completed acquisitions, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expect,” “intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,” “potential” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Porch and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to:(1) the ability to recognize the anticipated benefits of Porch’s December 2020 business combination (the “Merger”) with PropTech Acquisition Corporation (“PropTech”), which may be affected by, among other things, competition and the ability of the combined company to grow and manage growth profitably, maintain key commercial relationships and retain its management and key employees;(2) expansion plans and opportunities, including future and pending acquisitions or additional business combinations;(3) costs related to the Merger and being a public company;(4) litigation, complaints, and/or adverse publicity;(5) the impact of changes in consumer spending patterns, consumer preferences, local, regional and national economic conditions, crime, weather, demographic trends and employee availability;(6) privacy and data protection laws, privacy or data breaches, or the loss of data;(7) the impact of the COVID-19 pandemic and its effect on the business and financial conditions of Porch; and (8) other risks and uncertainties described in Porch’s most recent Form 10-K and quarterly report on Form 10-Q, filed with the Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov. Nothing in this presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date of this presentation. Porch does not undertake any duty to update these forward-looking statements, whether as a result of changed circumstances, new information, future events or otherwise, except as may be required by law. 2020 Financial Information; Non-GAAP Financial Measures Some of the financial information and data contained in this presentation, such as Adjusted EBITDA, Adjusted EBITDA Margin, Contribution Margin, and Gross Written Premium have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). Porch defines Adjusted EBITDA as net income (loss) plus interest expense, net, income tax expense (benefit), other expense, net, and depreciation and amortization, certain non-cash long-lived asset impairment charges, stock- based compensation expense and acquisition-related impacts, including compensation to the sellers that requires future service, amortization of intangible assets, gains (losses) recognized on changes in the value of contingent consideration arrangements, if any, gain or loss on divestures and certain transaction costs. Adjusted EBITDA Margin is defined as Adjusted EBITDA as a percentage of total revenue. Contribution Margin is defined as revenue less all variable expenses, including cost of revenue, marketing and sales. Gross Written Premium represents the total dollars of insurance premium sales based on date of contract execution. The effects of these excluded items may be significant. Porch is not providing reconciliations of expected Adjusted EBITDA, Adjusted EBITDA Margin, Contribution Margin, or Gross Written Premium for future periods to the most directly comparable measures prepared in accordance with GAAP because Porch is unable to provide these reconciliations without unreasonable effort because certain information necessary to calculate such measures on a GAAP basis is unavailable or dependent on the timing of future events outside of our control. Porch uses these non-GAAP measures to compare Porch’s performance to that of prior periods for budgeting and planning purposes. Porch believes these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Porch’s results of operations. Porch believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Porch’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Porch's method of determining these non-GAAP measures may be different from other companies' methods and, therefore, may not be comparable to those used by other companies and Porch does not recommend the sole use of these non-GAAP measures to assess its financial performance. Porch management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in Porch’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. In order to compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. |