Q3 2024 Varagon Capital Corporation Earnings Presentation

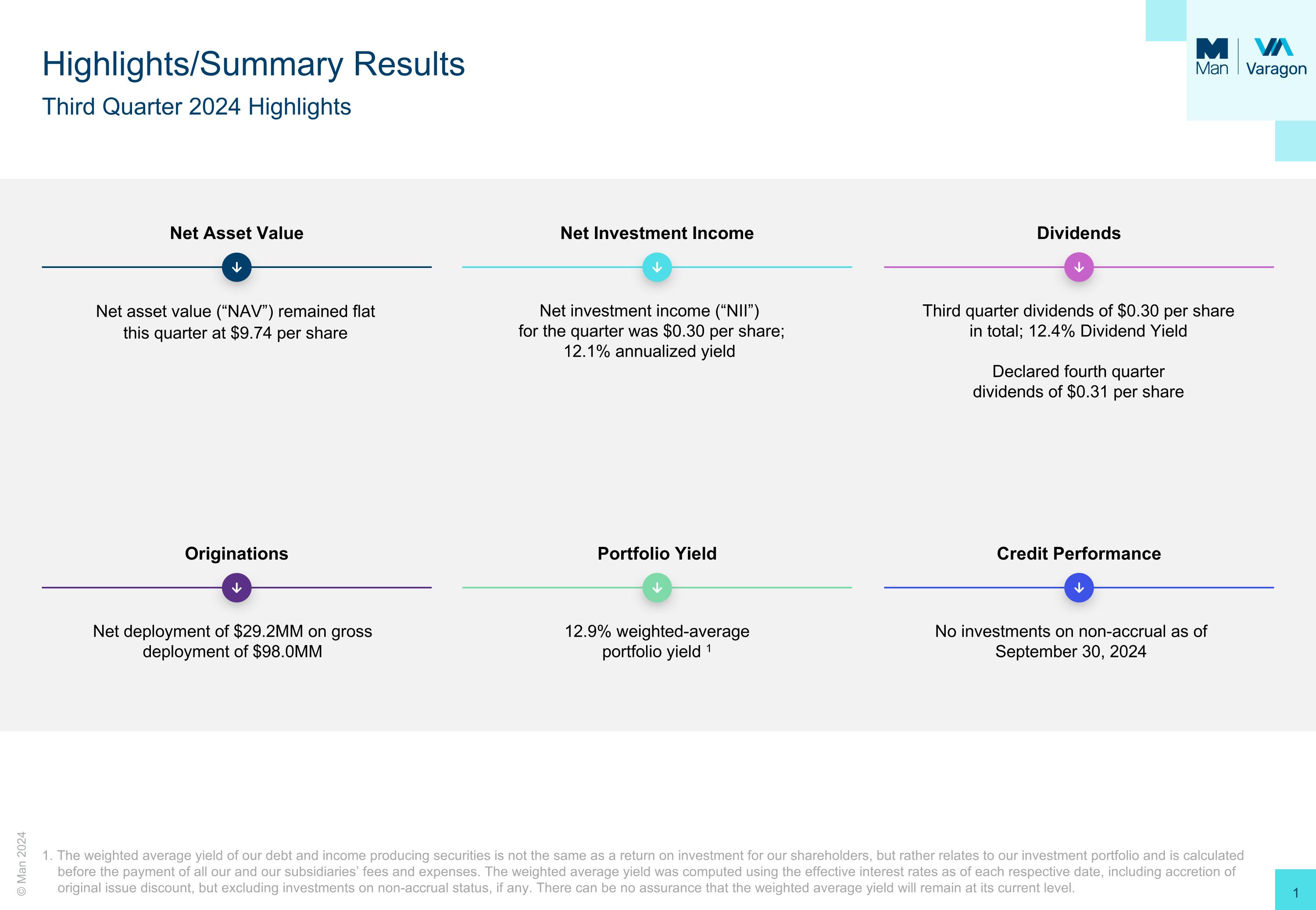

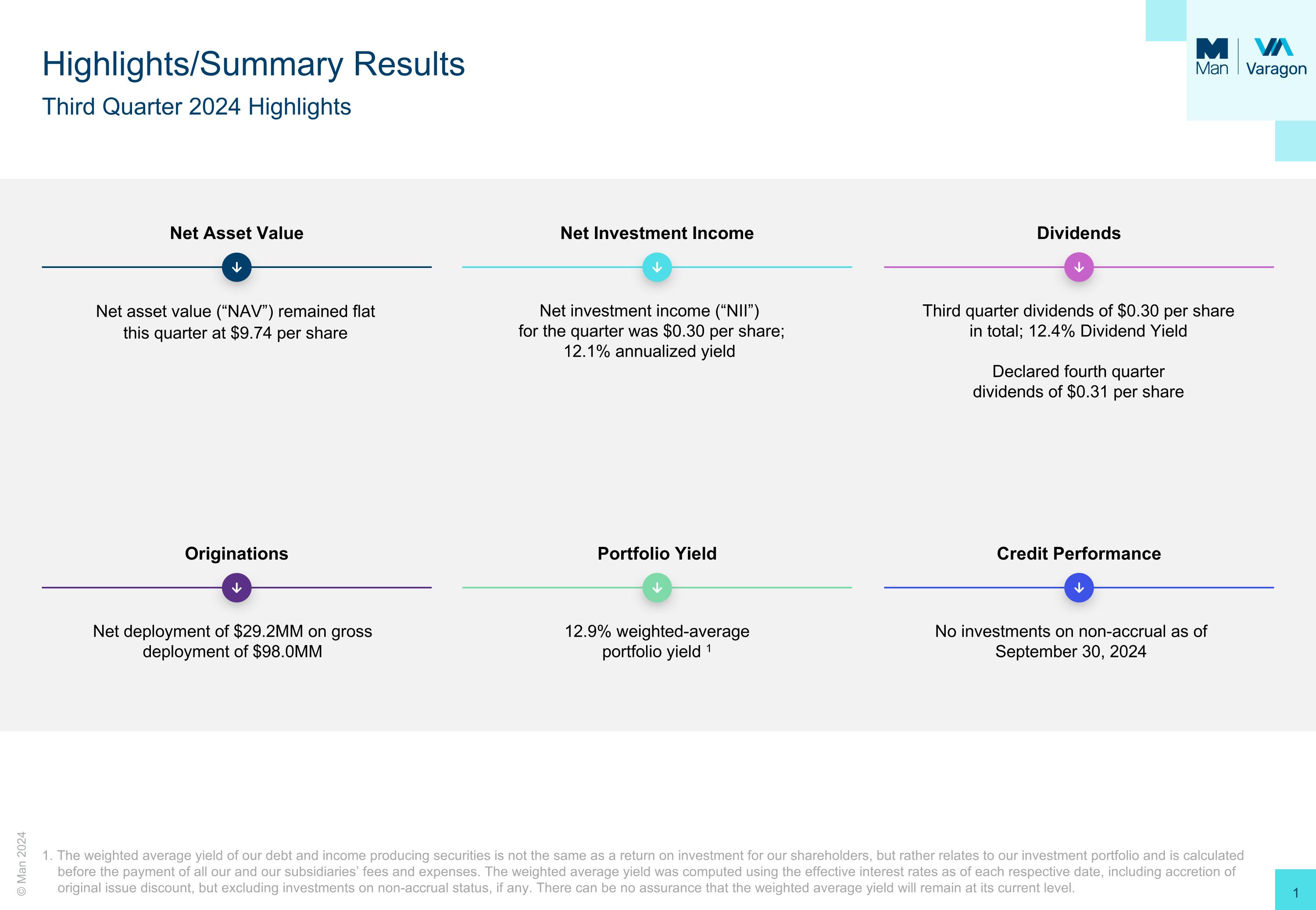

Highlights/Summary Results Third Quarter 2024 Highlights 1. The weighted average yield of our debt and income producing securities is not the same as a return on investment for our shareholders, but rather relates to our investment portfolio and is calculated before the payment of all our and our subsidiaries’ fees and expenses. The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount, but excluding investments on non-accrual status, if any. There can be no assurance that the weighted average yield will remain at its current level. Dividends Net asset value (“NAV”) remained flat this quarter at $9.74 per share Net investment income (“NII”)� for the quarter was $0.30 per share;�12.1% annualized yield Third quarter dividends of $0.30 per share�in total; 12.4% Dividend Yield Declared fourth quarter�dividends of $0.31 per share Portfolio Yield Credit Performance Net deployment of $29.2MM on gross deployment of $98.0MM 12.9% weighted-average�portfolio yield 1 No investments on non-accrual as of September 30, 2024 Net Asset Value Net Investment Income Originations

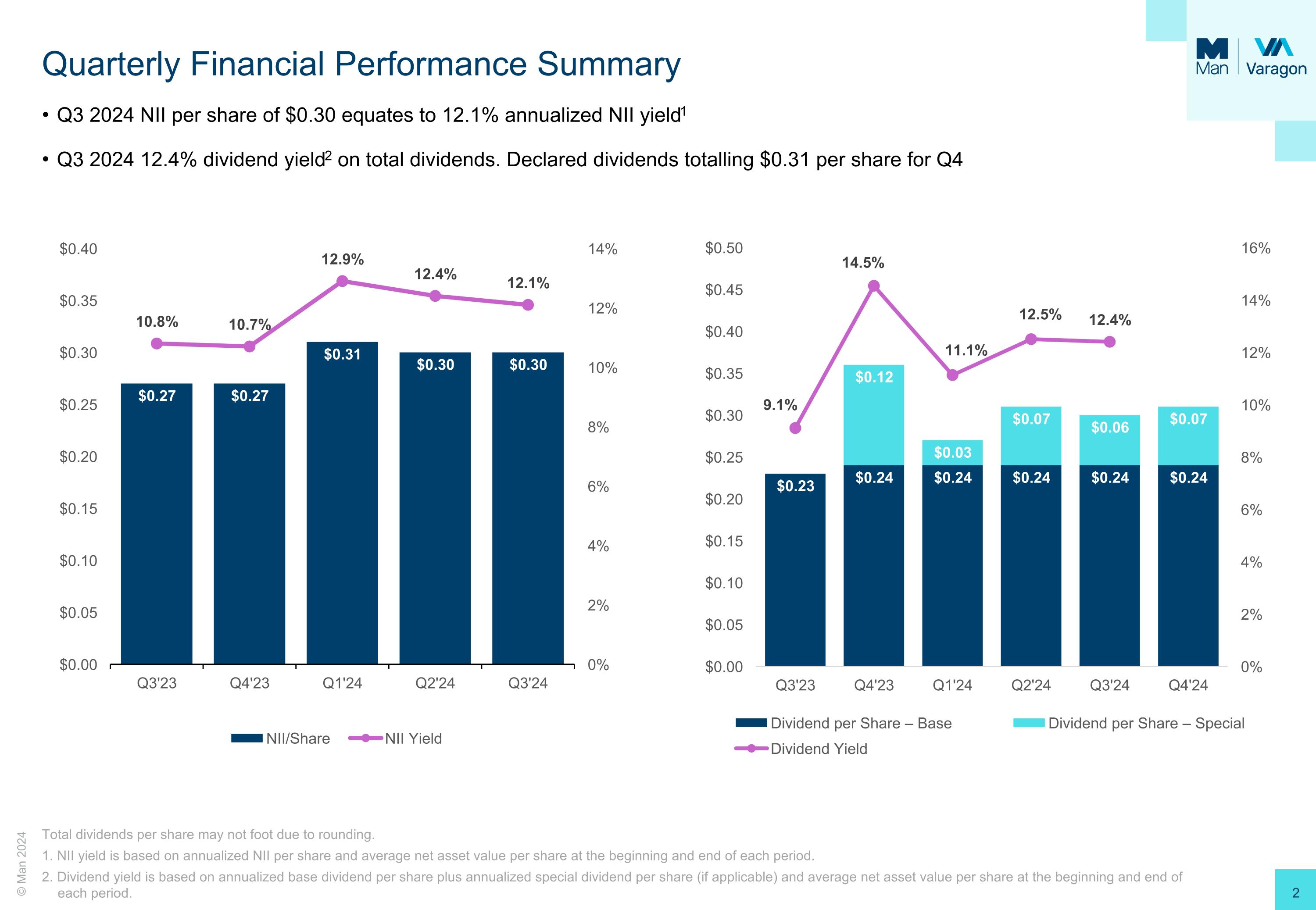

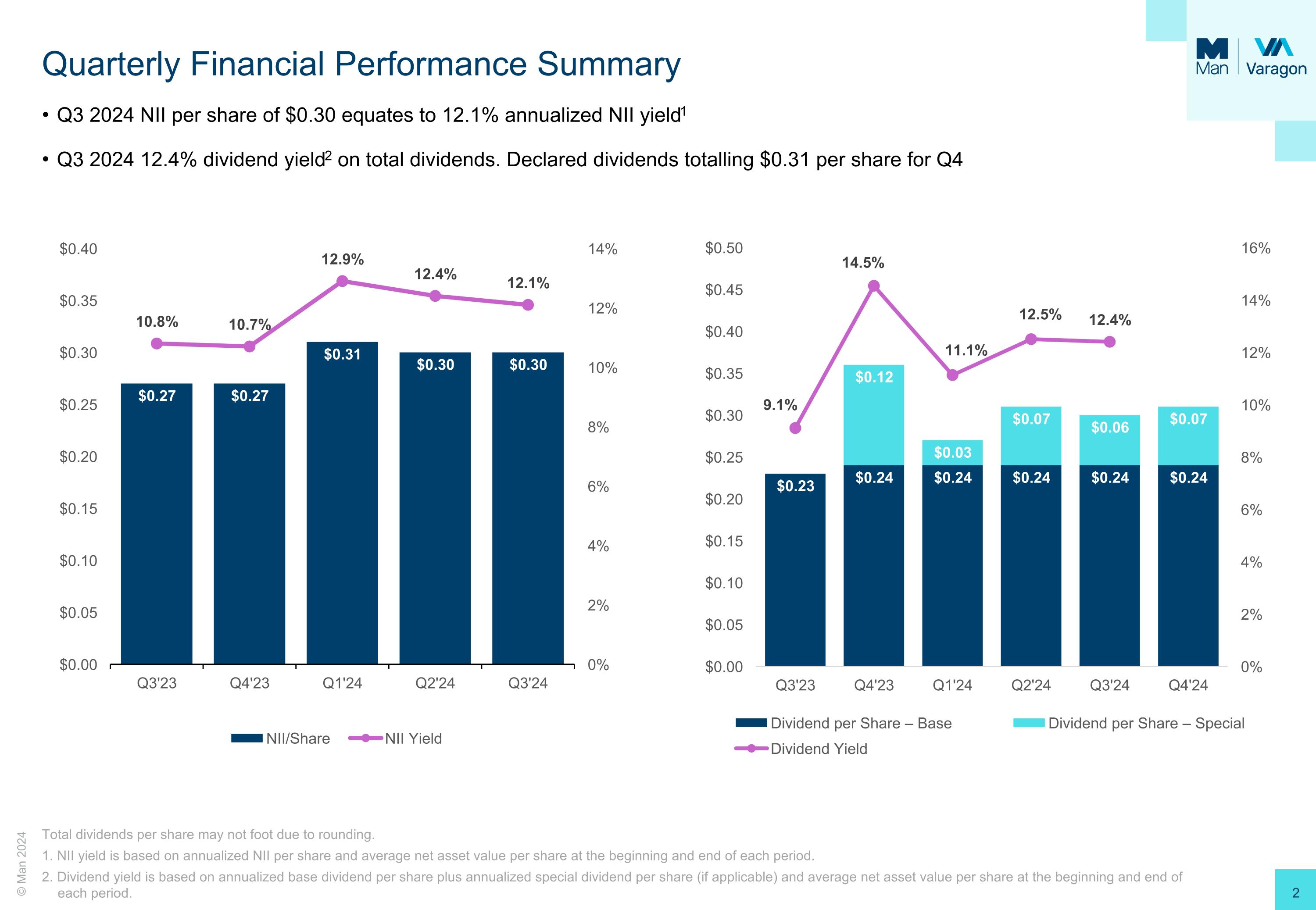

Total dividends per share may not foot due to rounding. 1. NII yield is based on annualized NII per share and average net asset value per share at the beginning and end of each period. 2. Dividend yield is based on annualized base dividend per share plus annualized special dividend per share (if applicable) and average net asset value per share at the beginning and end of each period. Quarterly Financial Performance Summary Q3 2024 NII per share of $0.30 equates to 12.1% annualized NII yield1 Q3 2024 12.4% dividend yield2 on total dividends. Declared dividends totalling $0.31 per share for Q4

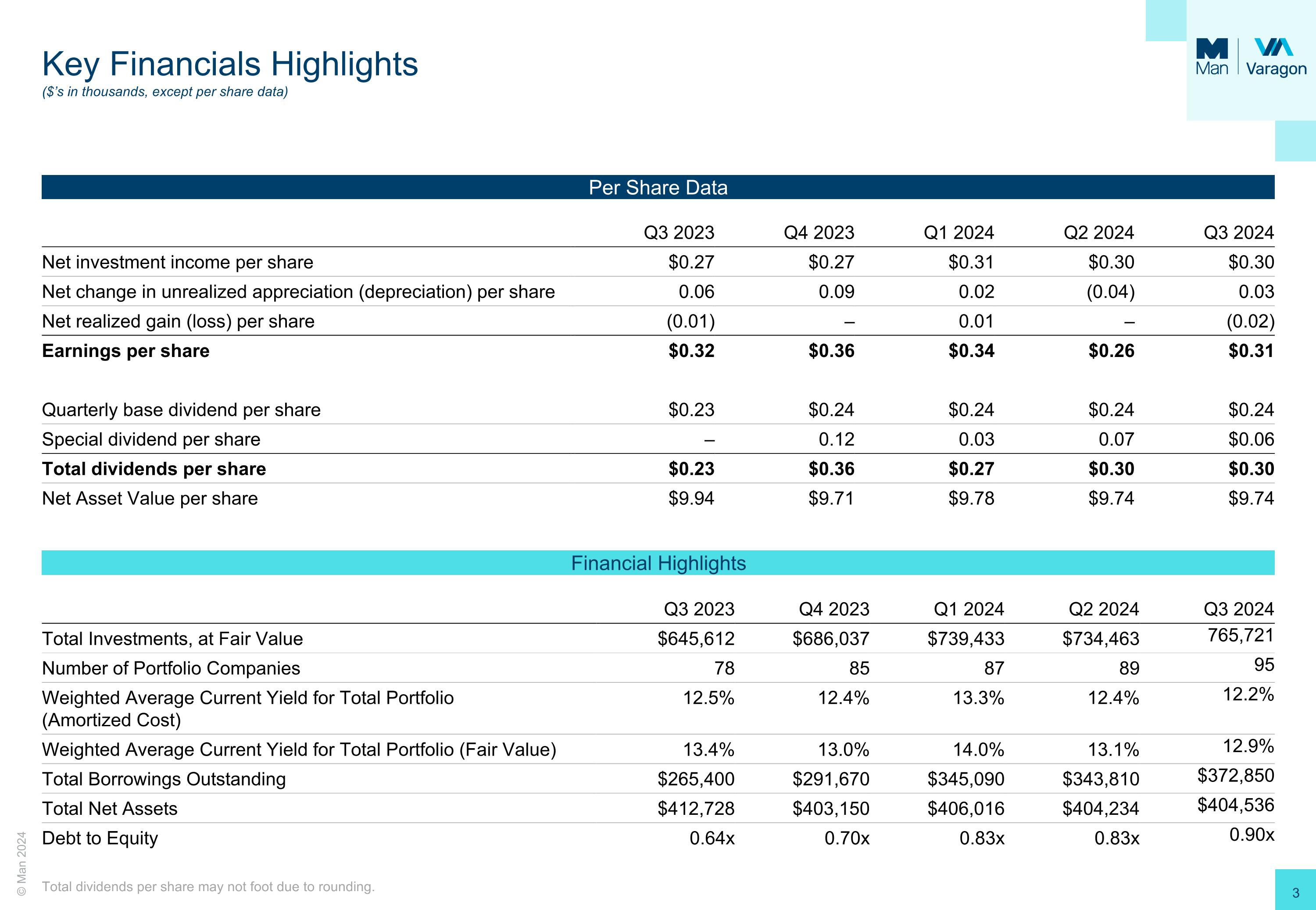

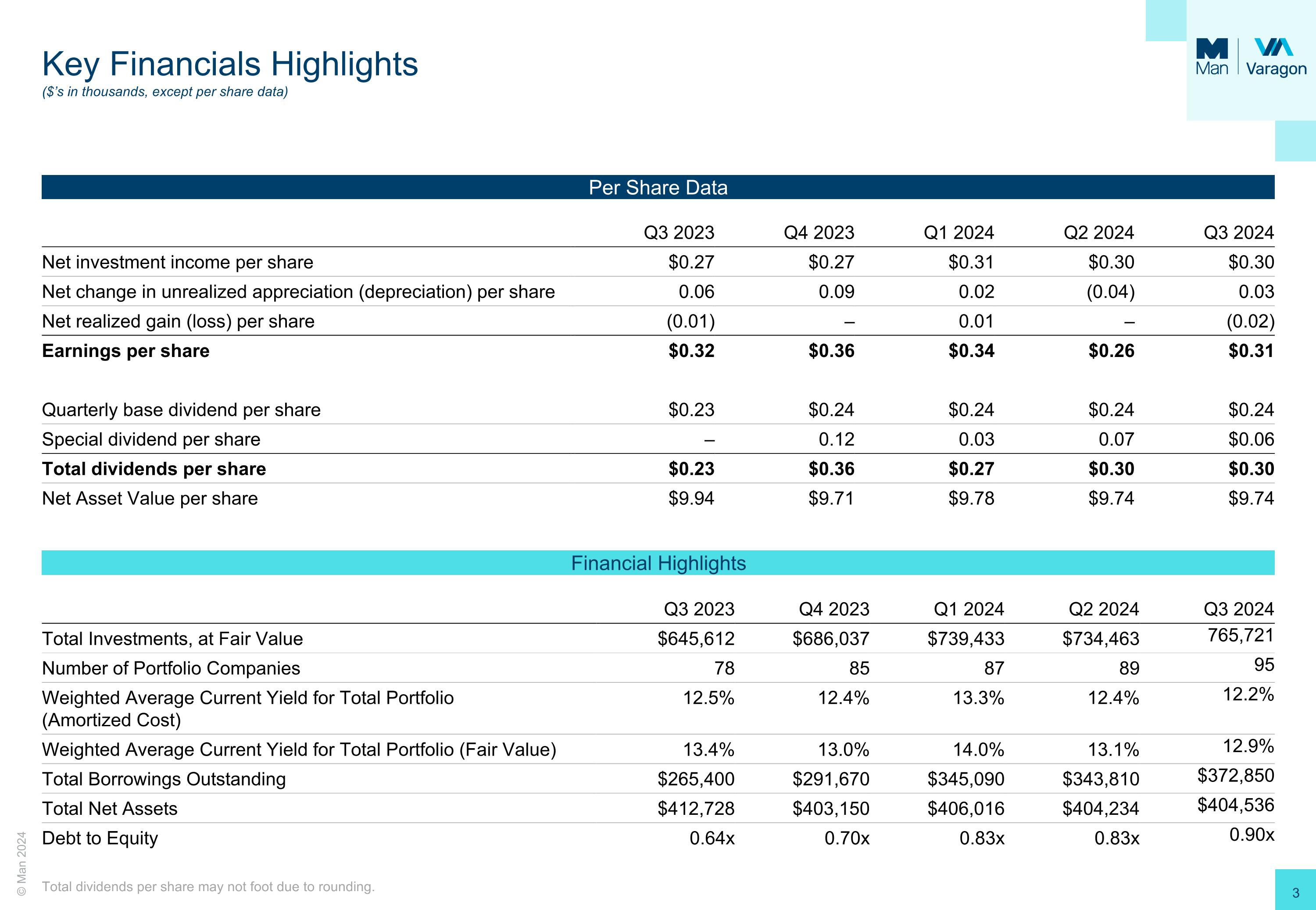

Key Financials Highlights�($’s in thousands, except per share data) Total dividends per share may not foot due to rounding. Per Share Data Financial Highlights Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Net investment income per share $0.27 $0.27 $0.31 $0.30 $0.30 Net change in unrealized appreciation (depreciation) per share 0.06 0.09 0.02 (0.04) 0.03 Net realized gain (loss) per share (0.01) – 0.01 – (0.02) Earnings per share $0.32 $0.36 $0.34 $0.26 $0.31 Quarterly base dividend per share $0.23 $0.24 $0.24 $0.24 $0.24 Special dividend per share – 0.12 0.03 0.07 $0.06 Total dividends per share $0.23 $0.36 $0.27 $0.30 $0.30 Net Asset Value per share $9.94 $9.71 $9.78 $9.74 $9.74 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Total Investments, at Fair Value $645,612 $686,037 $739,433 $734,463 765,721 Number of Portfolio Companies 78 85 87 89 95 Weighted Average Current Yield for Total Portfolio�(Amortized Cost) 12.5% 12.4% 13.3% 12.4% 12.2% Weighted Average Current Yield for Total Portfolio (Fair Value) 13.4% 13.0% 14.0% 13.1% 12.9% Total Borrowings Outstanding $265,400 $291,670 $345,090 $343,810 $372,850 Total Net Assets $412,728 $403,150 $406,016 $404,234 $404,536 Debt to Equity 0.64x 0.70x 0.83x 0.83x 0.90x

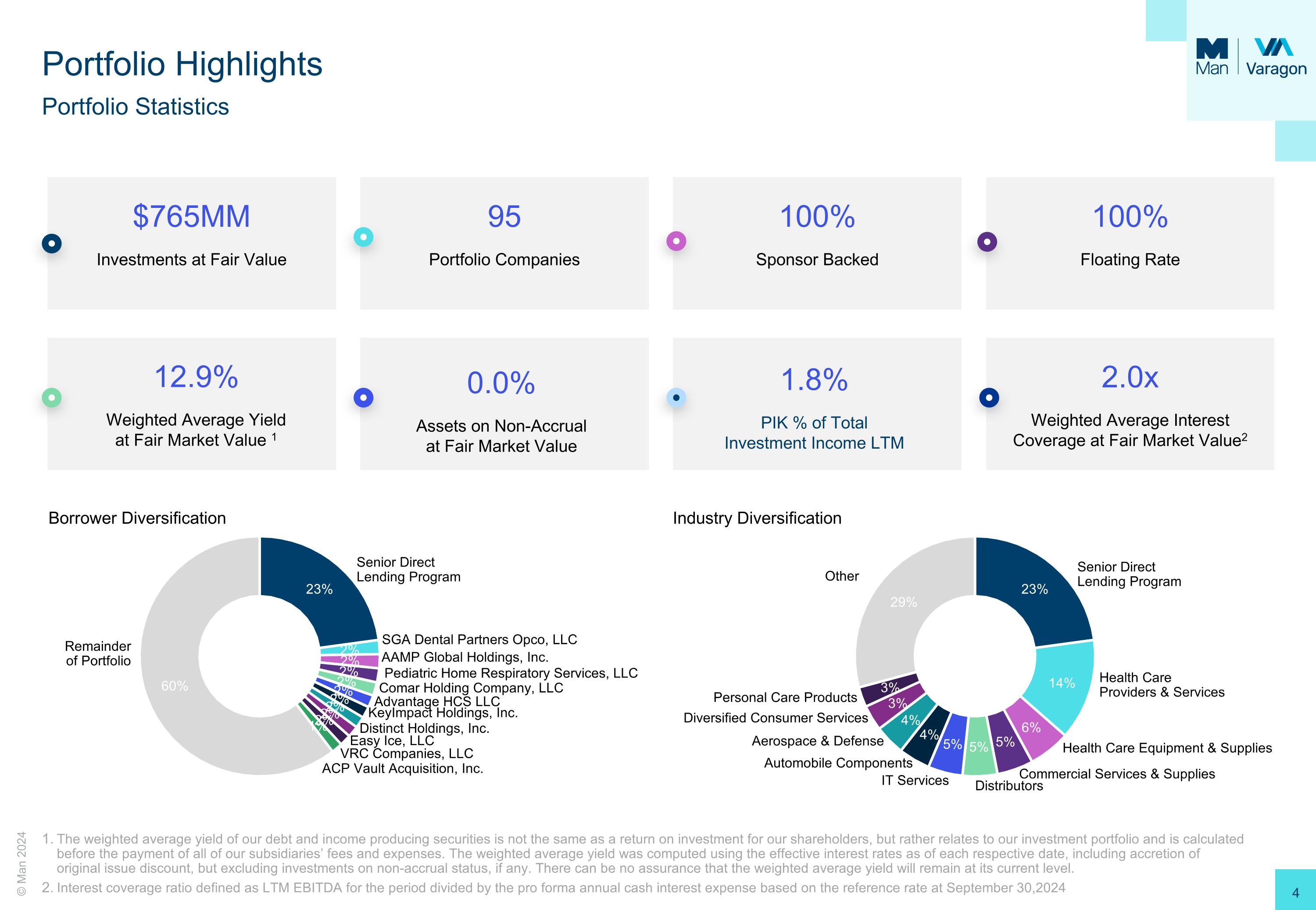

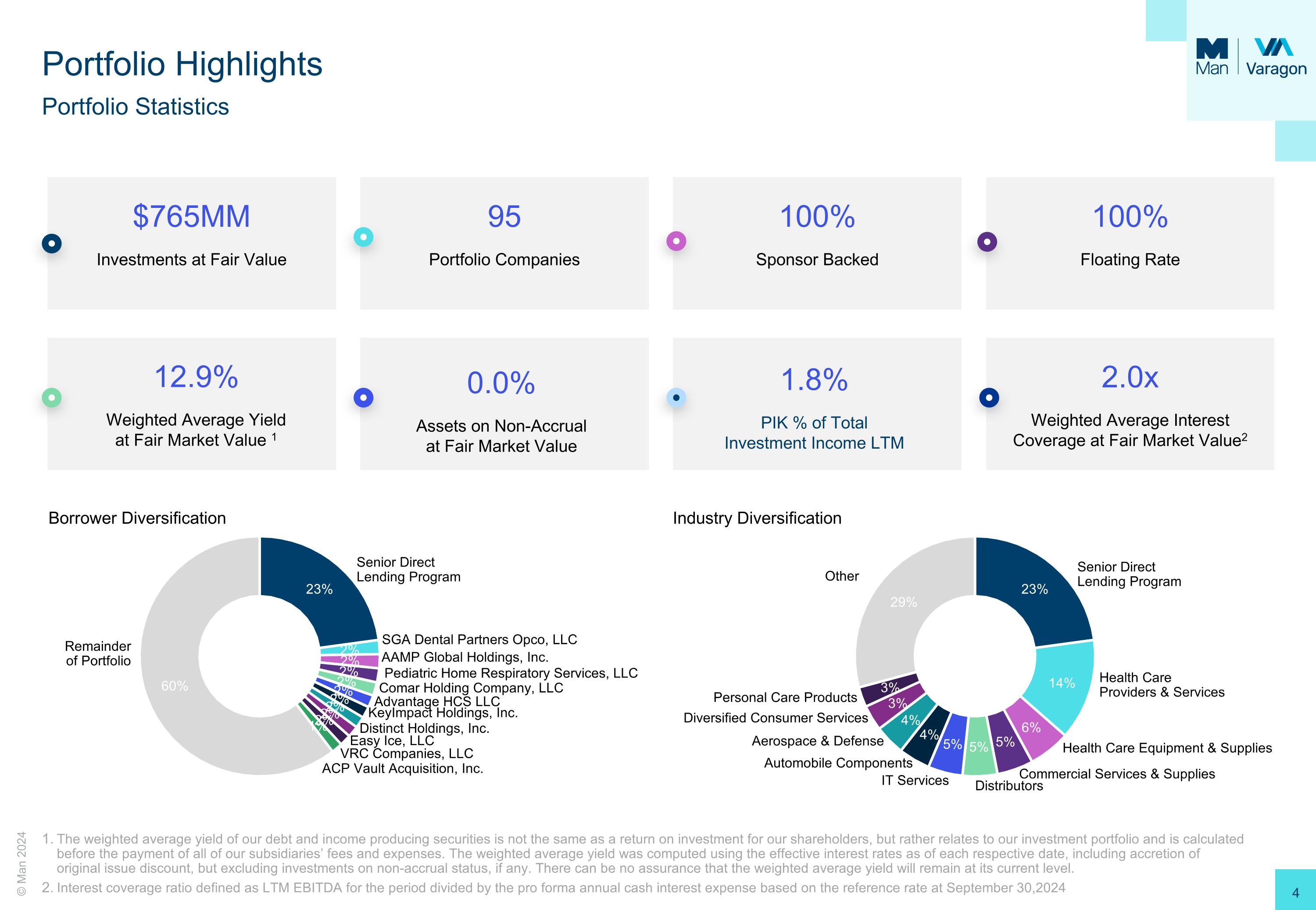

Portfolio Highlights Portfolio Statistics $765MM Investments at Fair Value 95 Portfolio Companies 100% Sponsor Backed 100% Floating Rate 1.8% PIK % of Total�Investment Income LTM 0.0% Assets on Non-Accrual at Fair Market Value 2.0x Weighted Average Interest Coverage at Fair Market Value2 The weighted average yield of our debt and income producing securities is not the same as a return on investment for our shareholders, but rather relates to our investment portfolio and is calculated before the payment of all of our subsidiaries’ fees and expenses. The weighted average yield was computed using the effective interest rates as of each respective date, including accretion of original issue discount, but excluding investments on non-accrual status, if any. There can be no assurance that the weighted average yield will remain at its current level. Interest coverage ratio defined as LTM EBITDA for the period divided by the pro forma annual cash interest expense based on the reference rate at September 30,2024 Borrower Diversification Senior Direct�Lending Program ACP Vault Acquisition, Inc. SGA Dental Partners Opco, LLC Pediatric Home Respiratory Services, LLC Advantage HCS LLC Comar Holding Company, LLC KeyImpact Holdings, Inc. Distinct Holdings, Inc. AAMP Global Holdings, Inc. Easy Ice, LLC VRC Companies, LLC Remainder�of Portfolio Industry Diversification Other Senior Direct�Lending Program Health Care�Providers & Services IT Services Health Care Equipment & Supplies Aerospace & Defense Diversified Consumer Services Automobile Components Distributors Personal Care Products Commercial Services & Supplies 12.9% Weighted Average Yield�at Fair Market Value 1

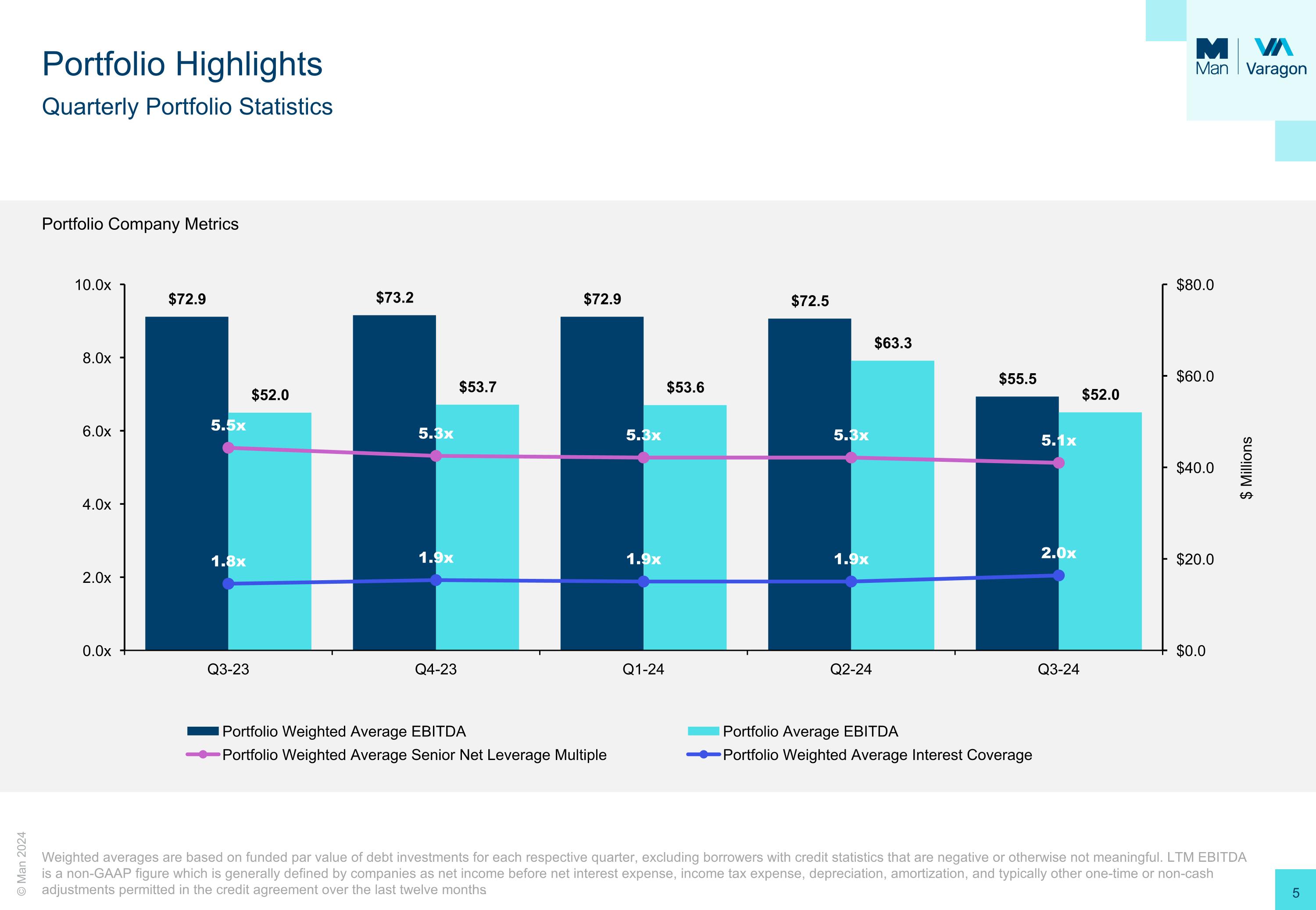

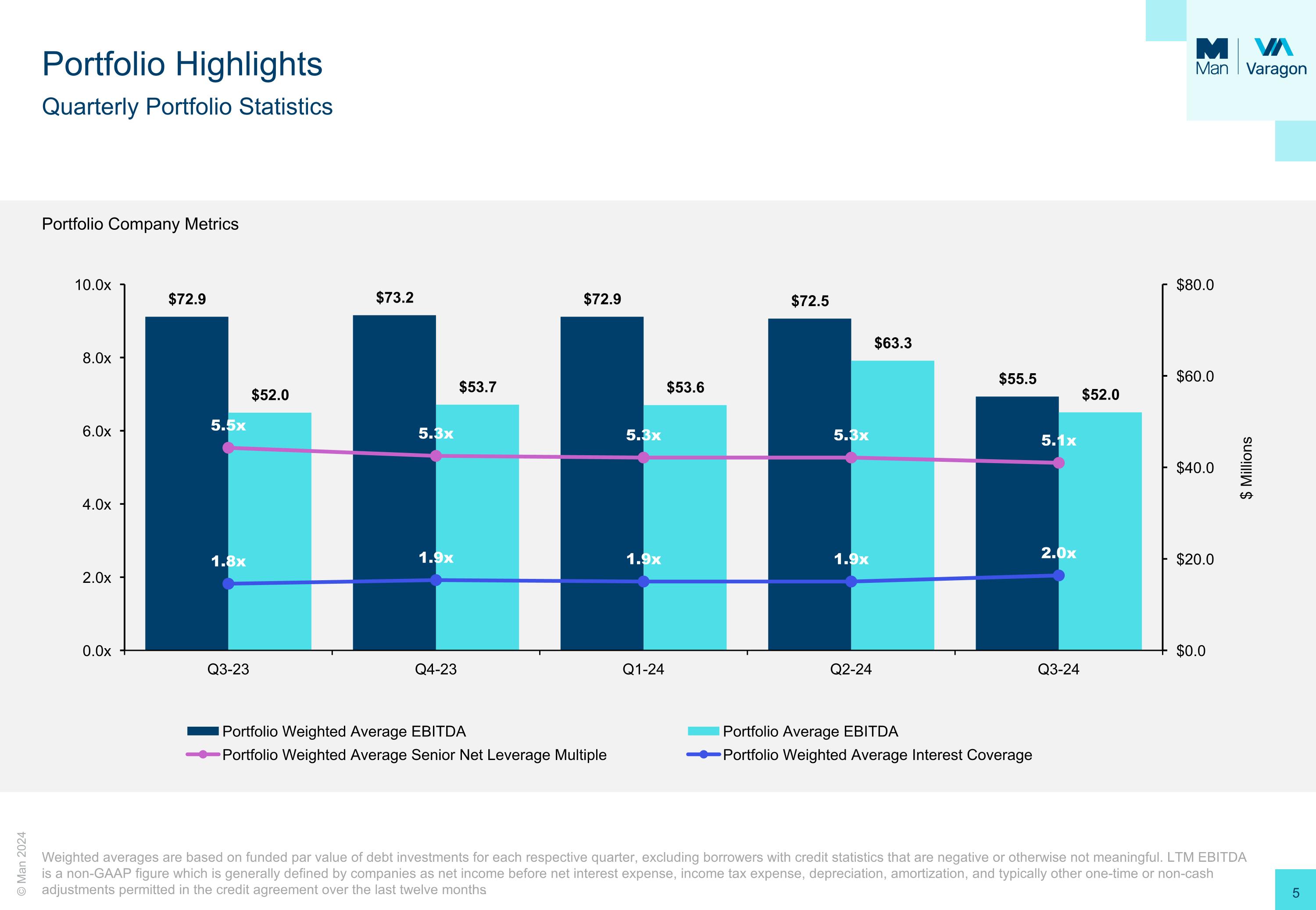

Portfolio Highlights Quarterly Portfolio Statistics Weighted averages are based on funded par value of debt investments for each respective quarter, excluding borrowers with credit statistics that are negative or otherwise not meaningful. LTM EBITDA is a non-GAAP figure which is generally defined by companies as net income before net interest expense, income tax expense, depreciation, amortization, and typically other one-time or non-cash adjustments permitted in the credit agreement over the last twelve months. $ Millions Portfolio Company Metrics

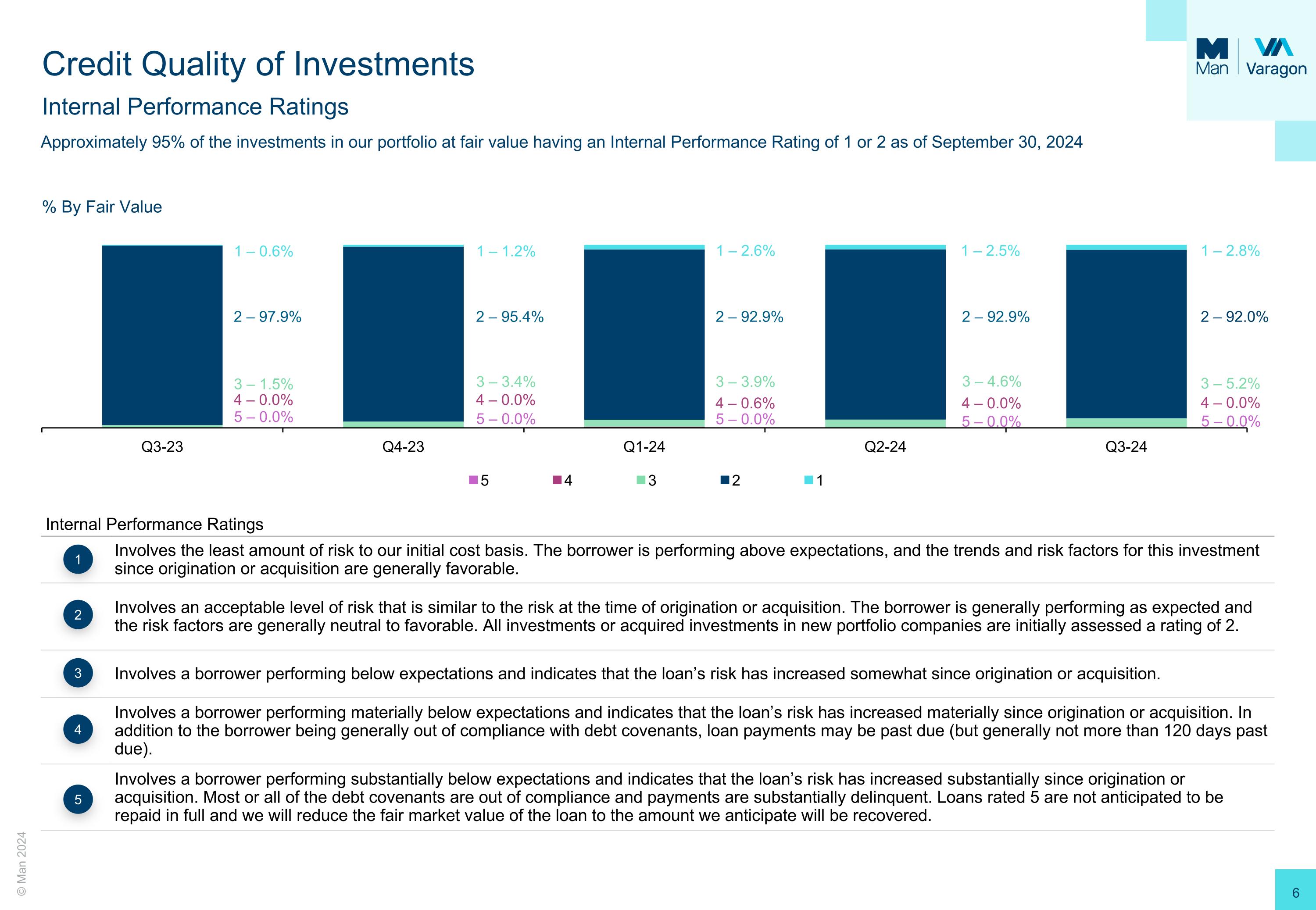

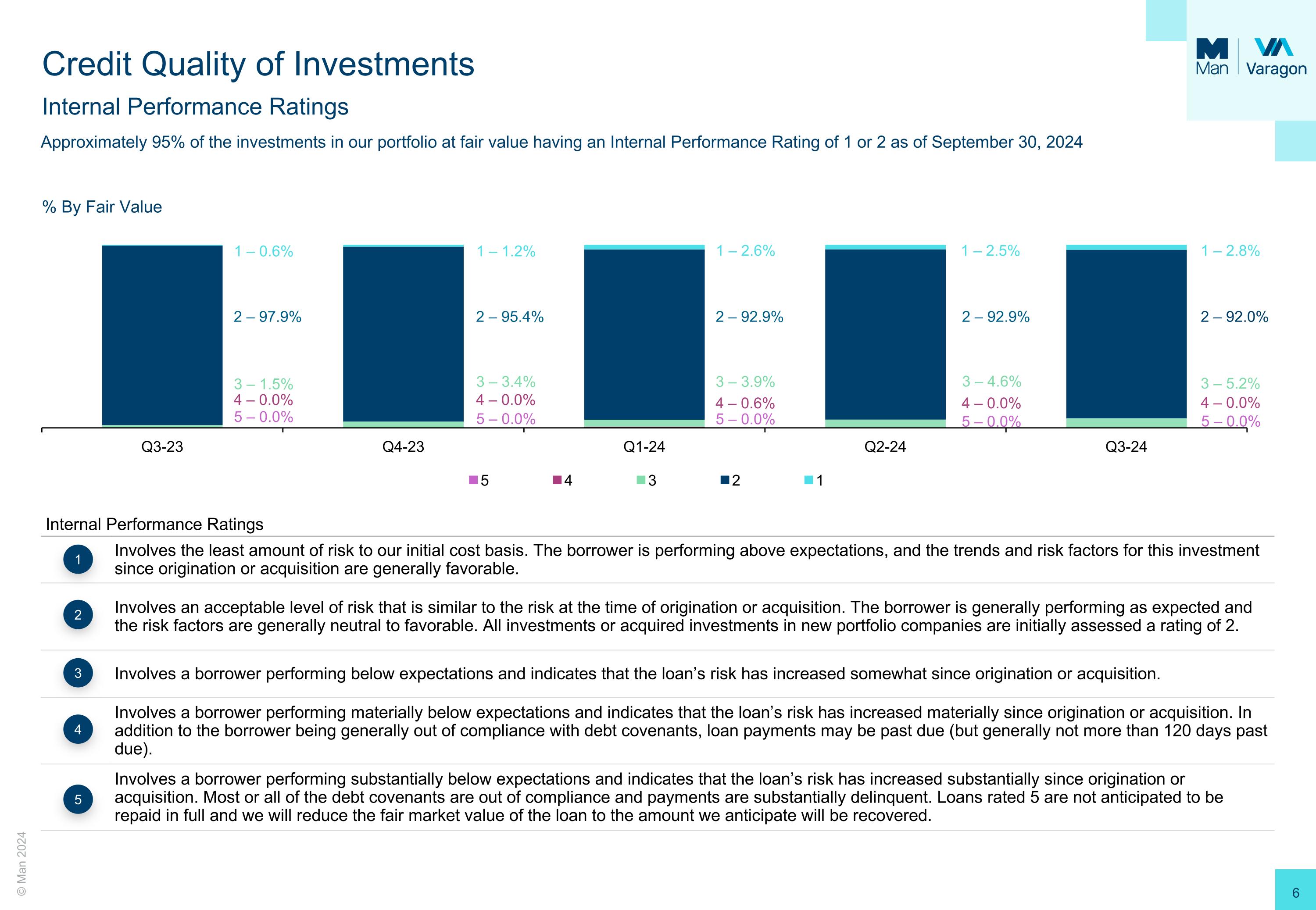

Credit Quality of Investments Internal Performance Ratings Internal Performance Ratings Involves the least amount of risk to our initial cost basis. The borrower is performing above expectations, and the trends and risk factors for this investment since origination or acquisition are generally favorable. Involves an acceptable level of risk that is similar to the risk at the time of origination or acquisition. The borrower is generally performing as expected and the risk factors are generally neutral to favorable. All investments or acquired investments in new portfolio companies are initially assessed a rating of 2. Involves a borrower performing below expectations and indicates that the loan’s risk has increased somewhat since origination or acquisition. Involves a borrower performing materially below expectations and indicates that the loan’s risk has increased materially since origination or acquisition. In addition to the borrower being generally out of compliance with debt covenants, loan payments may be past due (but generally not more than 120 days past due). Involves a borrower performing substantially below expectations and indicates that the loan’s risk has increased substantially since origination or acquisition. Most or all of the debt covenants are out of compliance and payments are substantially delinquent. Loans rated 5 are not anticipated to be repaid in full and we will reduce the fair market value of the loan to the amount we anticipate will be recovered. 1 2 3 4 5 1 – 0.6% 1 – 1.2% 1 – 2.6% 1 – 2.5% 2 – 97.9% 2 – 95.4% 2 – 92.9% 2 – 92.9% 3 – 1.5% 3 – 3.4% 3 – 3.9% 3 – 4.6% 4 – 0.0% 4 – 0.0% 4 – 0.6% 4 – 0.0% 5 – 0.0% 5 – 0.0% 5 – 0.0% 5 – 0.0% % By Fair Value Approximately 95% of the investments in our portfolio at fair value having an Internal Performance Rating of 1 or 2 as of September 30, 2024 1 – 2.8% 2 – 92.0% 3 – 5.2% 4 – 0.0% 5 – 0.0%

Credit Quality of Investments Non-accrual Investments Amortized Cost Fair Value Investments on Non-Accrual Status Percentage of Total Investment Portfolio There were no VCC investments on non-accrual as of September 30, 2024 $ Millions $ Millions

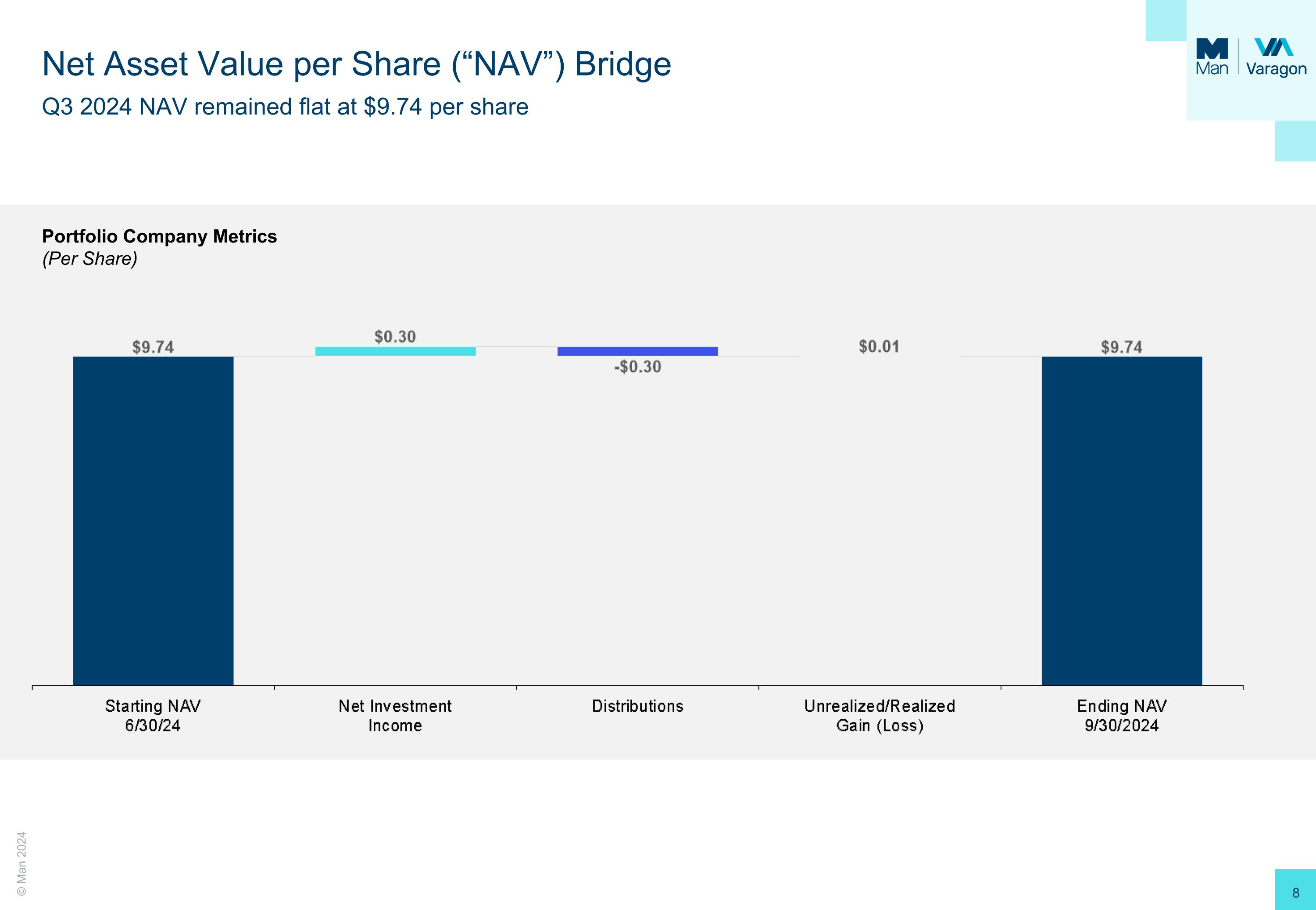

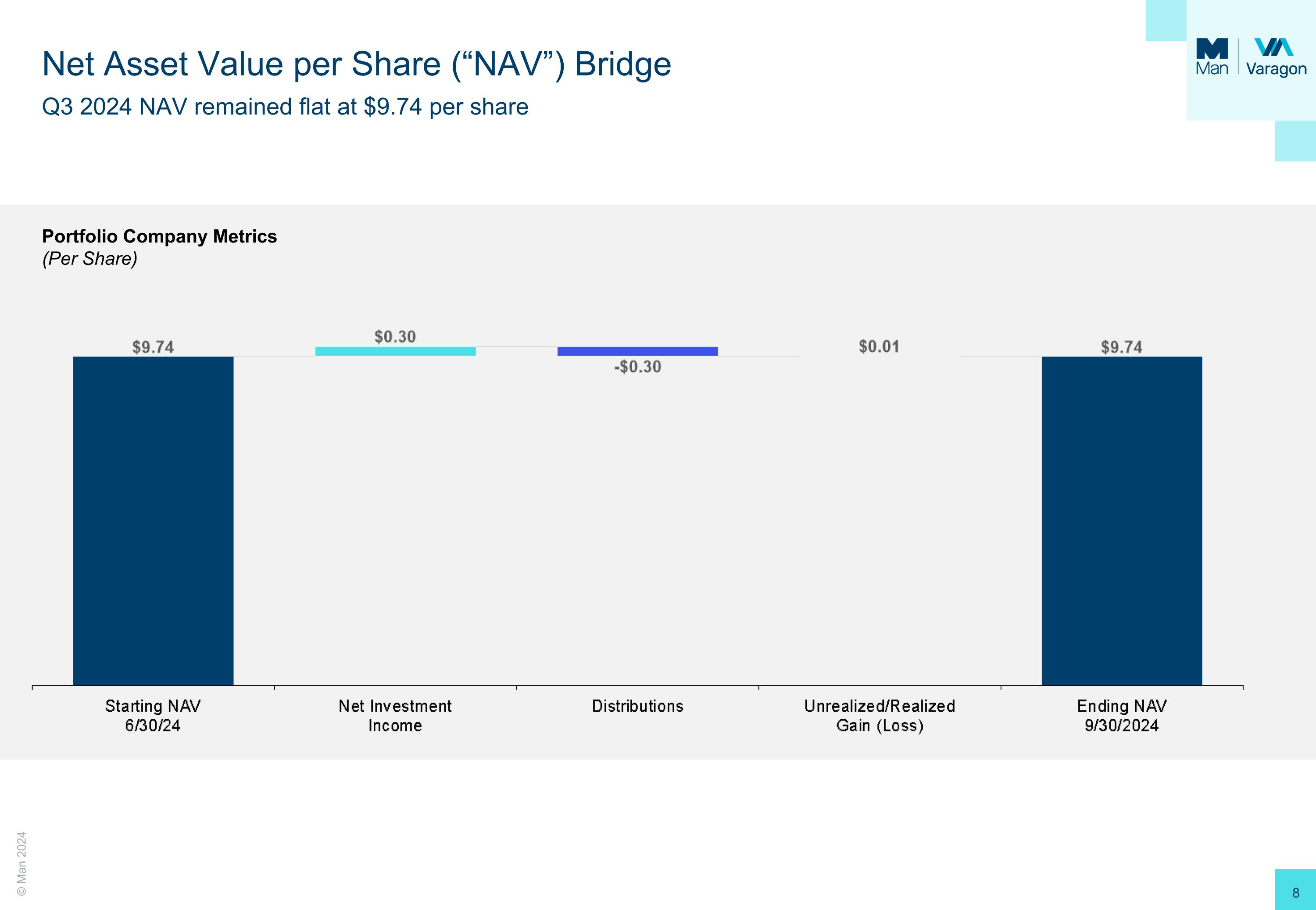

Net Asset Value per Share (“NAV”) Bridge Q3 2024 NAV remained flat at $9.74 per share Portfolio Company Metrics (Per Share)

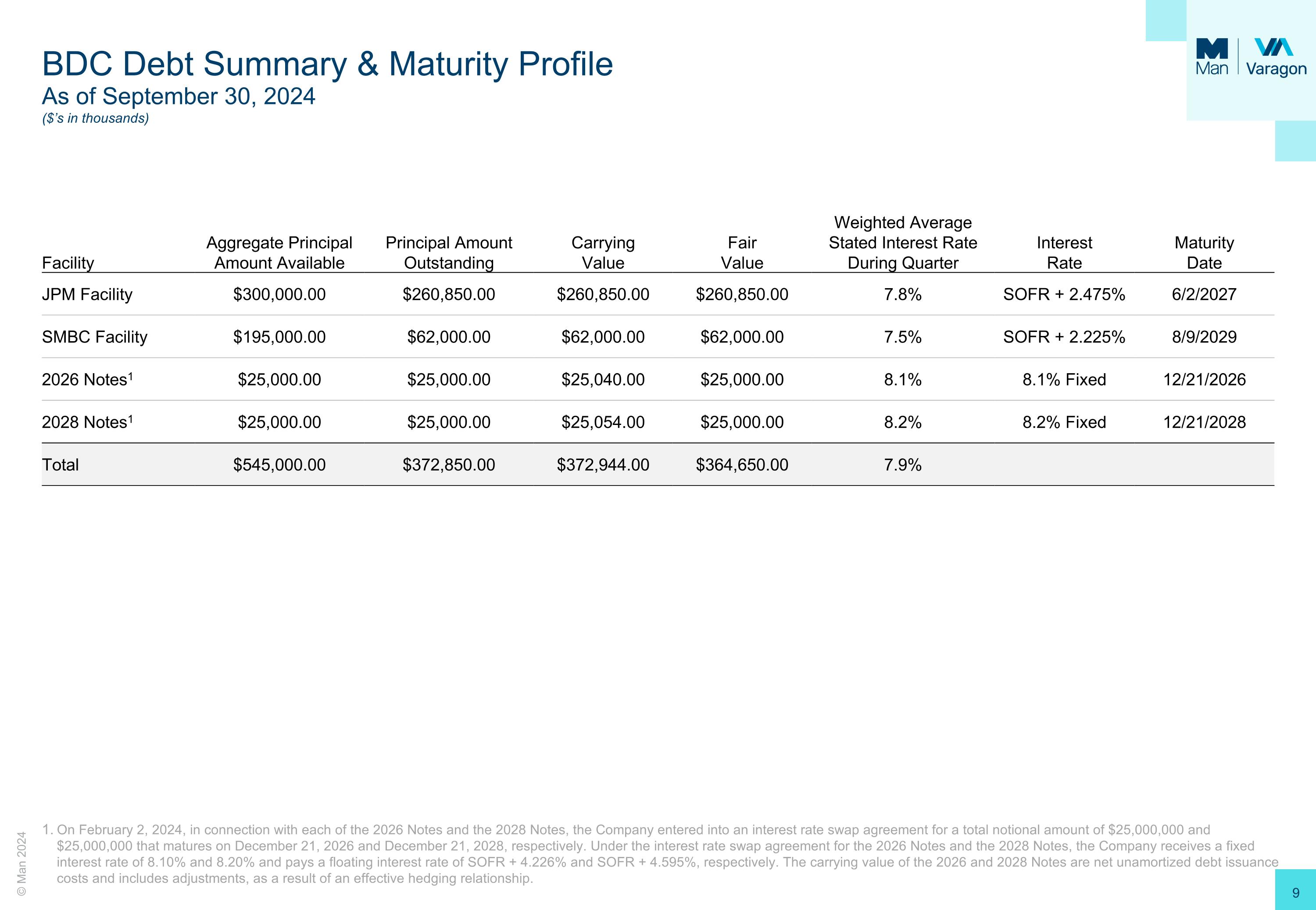

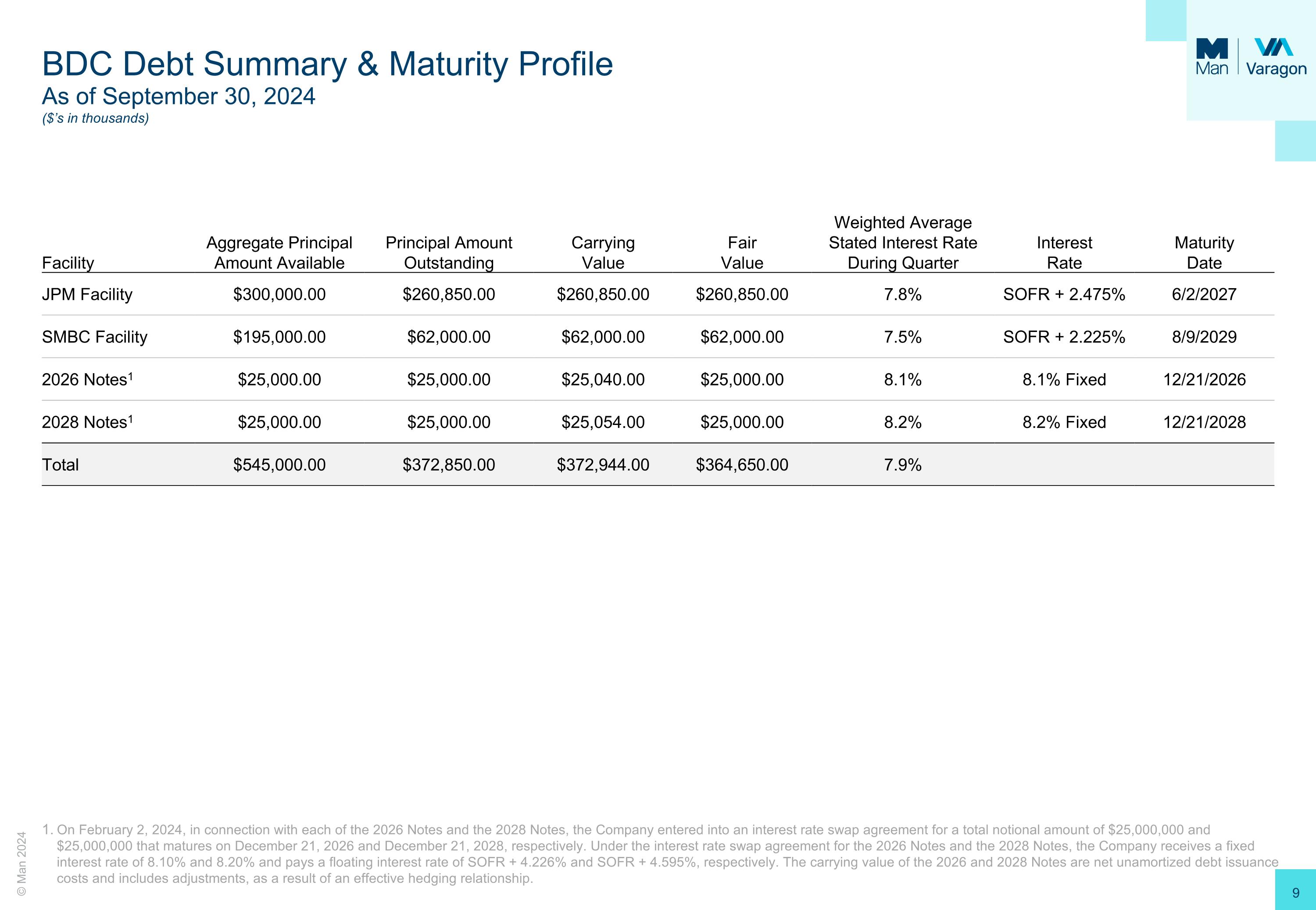

BDC Debt Summary & Maturity Profile As of September 30, 2024�($’s in thousands) Facility Aggregate Principal�Amount Available Principal Amount Outstanding Carrying�Value Fair�Value Weighted Average Stated Interest Rate During Quarter Interest�Rate Maturity�Date JPM Facility $300,000.00 $260,850.00 $260,850.00 $260,850.00 7.8% SOFR + 2.475% 6/2/2027 SMBC Facility $195,000.00 $62,000.00 $62,000.00 $62,000.00 7.5% SOFR + 2.225% 8/9/2029 2026 Notes1 $25,000.00 $25,000.00 $25,040.00 $25,000.00 8.1% 8.1% Fixed 12/21/2026 2028 Notes1 $25,000.00 $25,000.00 $25,054.00 $25,000.00 8.2% 8.2% Fixed 12/21/2028 Total $545,000.00 $372,850.00 $372,944.00 $364,650.00 7.9% On February 2, 2024, in connection with each of the 2026 Notes and the 2028 Notes, the Company entered into an interest rate swap agreement for a total notional amount of $25,000,000 and $25,000,000 that matures on December 21, 2026 and December 21, 2028, respectively. Under the interest rate swap agreement for the 2026 Notes and the 2028 Notes, the Company receives a fixed interest rate of 8.10% and 8.20% and pays a floating interest rate of SOFR + 4.226% and SOFR + 4.595%, respectively. The carrying value of the 2026 and 2028 Notes are net unamortized debt issuance costs and includes adjustments, as a result of an effective hedging relationship.

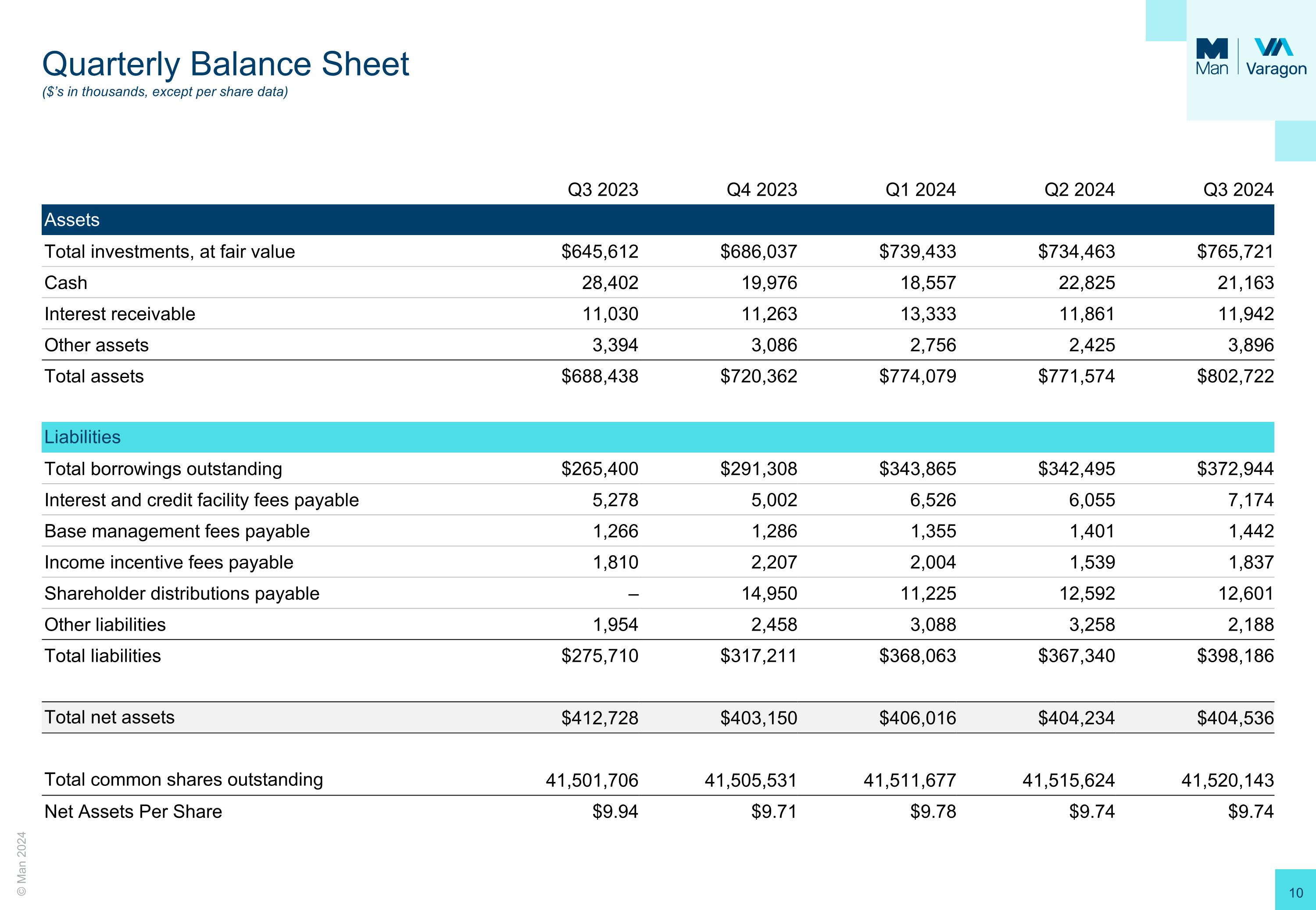

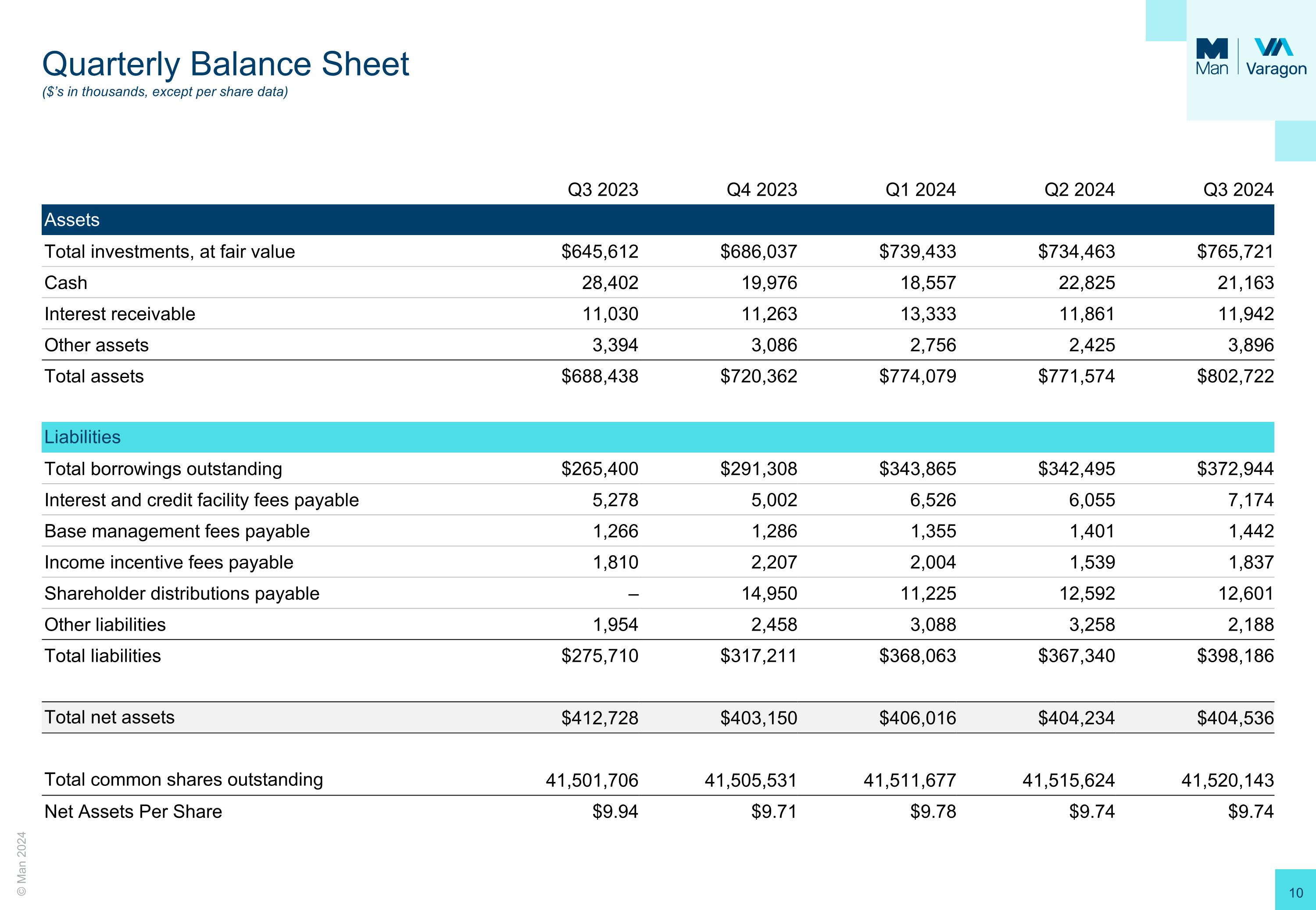

Quarterly Balance Sheet�($’s in thousands, except per share data) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Assets Total investments, at fair value $645,612 $686,037 $739,433 $734,463 $765,721 Cash 28,402 19,976 18,557 22,825 21,163 Interest receivable 11,030 11,263 13,333 11,861 11,942 Other assets 3,394 3,086 2,756 2,425 3,896 Total assets $688,438 $720,362 $774,079 $771,574 $802,722 Liabilities Total borrowings outstanding $265,400 $291,308 $343,865 $342,495 $372,944 Interest and credit facility fees payable 5,278 5,002 6,526 6,055 7,174 Base management fees payable 1,266 1,286 1,355 1,401 1,442 Income incentive fees payable 1,810 2,207 2,004 1,539 1,837 Shareholder distributions payable – 14,950 11,225 12,592 12,601 Other liabilities 1,954 2,458 3,088 3,258 2,188 Total liabilities $275,710 $317,211 $368,063 $367,340 $398,186 Total net assets $412,728 $403,150 $406,016 $404,234 $404,536 Total common shares outstanding 41,501,706 41,505,531 41,511,677 41,515,624 41,520,143 Net Assets Per Share $9.94 $9.71 $9.78 $9.74 $9.74

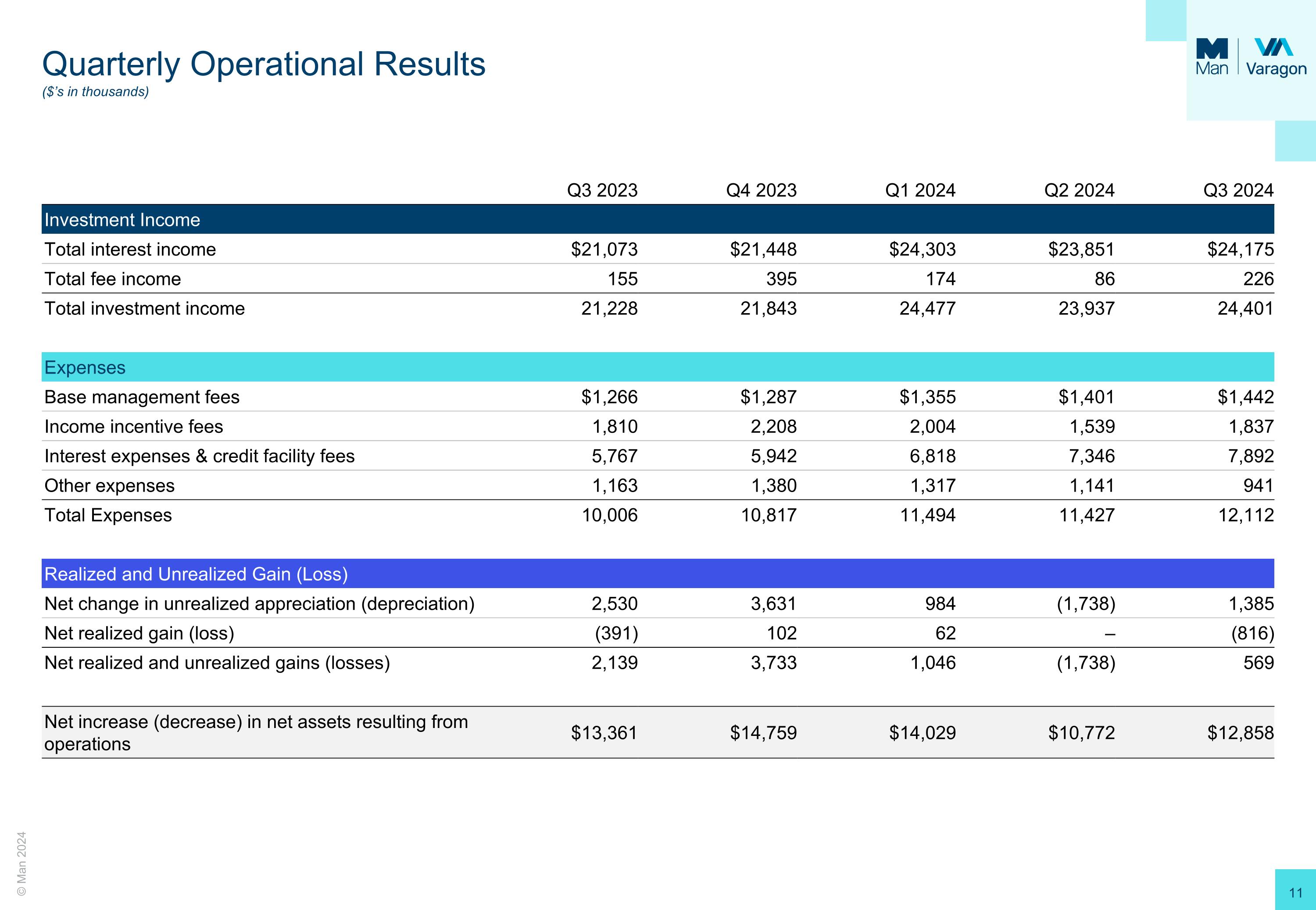

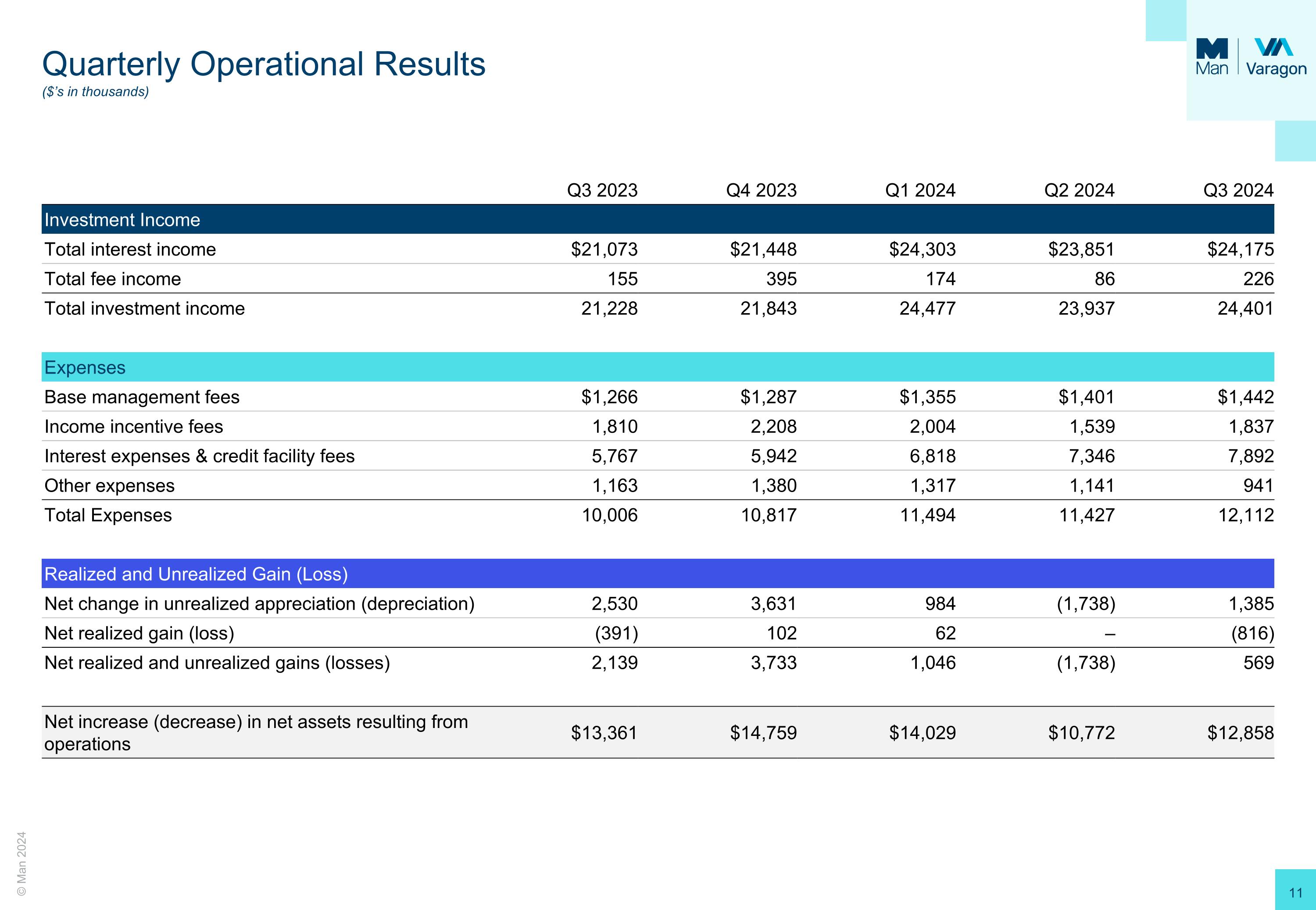

Quarterly Operational Results�($’s in thousands) Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Investment Income Total interest income $21,073 $21,448 $24,303 $23,851 $24,175 Total fee income 155 395 174 86 226 Total investment income 21,228 21,843 24,477 23,937 24,401 Expenses Base management fees $1,266 $1,287 $1,355 $1,401 $1,442 Income incentive fees 1,810 2,208 2,004 1,539 1,837 Interest expenses & credit facility fees 5,767 5,942 6,818 7,346 7,892 Other expenses 1,163 1,380 1,317 1,141 941 Total Expenses 10,006 10,817 11,494 11,427 12,112 Realized and Unrealized Gain (Loss) Net change in unrealized appreciation (depreciation) 2,530 3,631 984 (1,738) 1,385 Net realized gain (loss) (391) 102 62 – (816) Net realized and unrealized gains (losses) 2,139 3,733 1,046 (1,738) 569 Net increase (decrease) in net assets resulting from operations $13,361 $14,759 $14,029 $10,772 $12,858

This presentation is for informational purposes only. It does not convey an offer of any type and is not intended to be, and should not be construed as, an offer to sell, or the solicitation of an offer to buy, any securities of Varagon Capital Corporation (the “Company,” “we,” “us” or “our”). Any such offering can be made only at the time an offeree receives a private placement memorandum relating to such offering and other operative documents that contain more details with respect to risks associated with the Company and should be carefully read. In addition, the information in this presentation is qualified in its entirety by reference to the more detailed discussions contained in the Company’s public filings with the Securities and Exchange Commission (the “SEC”), including without limitation, the risk factors. Nothing in this presentation constitutes investment advice. You may lose money by investing in the Company. The Company is not intended to be a complete investment program and, due to the uncertainty inherent in all investments, there can be no assurance that the Company will achieve its investment objective. The information contained herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Prospective investors also should seek advice from their own independent tax, accounting, financial, investment and legal advisors to properly assess the merits and risks associated with an investment in the Company in light of their own financial condition and other circumstances. These materials and the presentations of which they are a part, and the summaries contained herein, do not purport to be complete and no obligation to update or otherwise revise such information is being assumed. Nothing shall be relied upon as a promise or representation as to the future performance of the Company. Such information is qualified in its entirety by reference to the more detailed discussions contained elsewhere in the Company’s public filings with the SEC. An investment in the Company is speculative and involves a high degree of risk. There can be no guarantee that the Company’s investment objective will be achieved. The Company may engage in other investment practices that may increase the risk of investment loss. An investor could lose all or substantially all of his, her or its investment. There is no guarantee that any of the estimates, targets or projections illustrated in this presentation will be achieved. Any references herein to any of the Company’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by the Company will be profitable or will equal the performance of these investments. Diversification of an investor’s portfolio does not assure a profit or protect against loss in a declining market. Opinions expressed reflect the current opinions of the Company as of the date appearing in the materials only and are based on the Company’s opinions of the current market environment, which is subject to change. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market conditions and should not be construed as research or investment advice. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results. This presentation includes forward-looking statements about the Company that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about us, our current and prospective portfolio investments, our industry, our beliefs, and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “would,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties, and other factors, some of which are beyond our control and difficult to predict, that could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Such factors include, but are not limited to: changes in the financial, capital, and lending markets; general economic, political and industry trends and other external factors, and the dependence of our future success on the general economy and its impact on the industries in which we invest; and other risks, uncertainties and other factors we identify in the section entitled “Risk Factors” in our most recent Annual Report on Form 10-K, which are accessible on the SEC’s website at www.sec.gov. Investors should not place undue reliance on these forward-looking statements, which apply only as of the date on which the Company makes them. The Company does not undertake any obligation to update or revise any forward-looking statements or any other information contained herein, except as required by applicable law. We have based the forward-looking statements included in this presentation on information available to us on the date of this presentation, and we assume no obligation to update any such forward-looking statements. Should the Company’s estimates, projections and assumptions or these other uncertainties and factors materialize in ways that the Company did not expect, actual results could differ materially from the forward-looking statements in this presentation. Important Considerations MKT013586/NS/GL/1-1