- MGX Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Metagenomi, Inc. Common Stock (MGX) S-1IPO registration

Filed: 5 Jan 24, 5:16pm

Exhibit 10.9

• 1545 PARK AVENUE •

• EMERYVILLE, CALIFORNIA •

• NET LEASE •

BASIC LEASE INFORMATION

| Date of Lease: | January 22, 2021 | |

| Landlord: | EPL HALLECK INVESTORS LLC, a California limited liability company | |

| Landlord’s Notice Address: | EPL Halleck Investors LLC c/o Ellis Partners LLC 111 Sutter Street, Suite 800 San Francisco, CA 94104 Attn: James F. Ellis E-mail: Telephone: | |

| Tenant: | METAGENOMI, INC., a Delaware corporation | |

| Tenant’s Notice Address: | Prior to the Rent Commencement Date (as defined herein):

5980 Horton Street Emeryville, CA 94608 Attn: Brian Thomas

After the Rent Commencement Date:

1545 Park Avenue Emeryville, California 94608 Attn: Brian Thomas E-mail: Telephone:

with a copy to (except for notices to access the Leased Premises):

Dalsin Law 1630 N. Main Street, No. 221 Walnut Creek, CA 94596 Attn: Ann Dalsin E-mail: Telephone: | |

i

| Building: | The building whose address is 1545 Park Avenue, Emeryville, California. | |

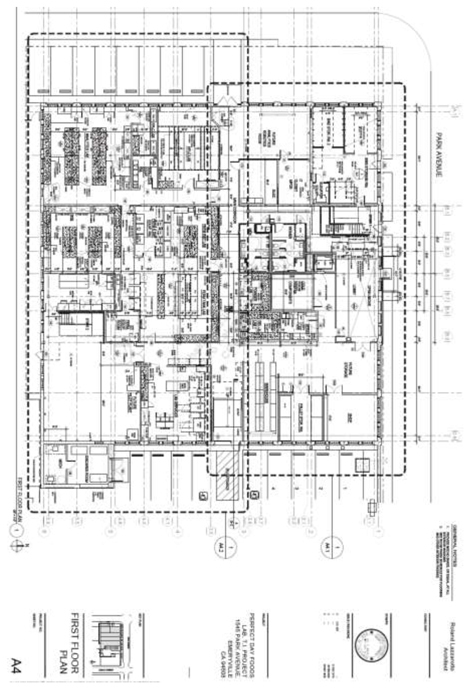

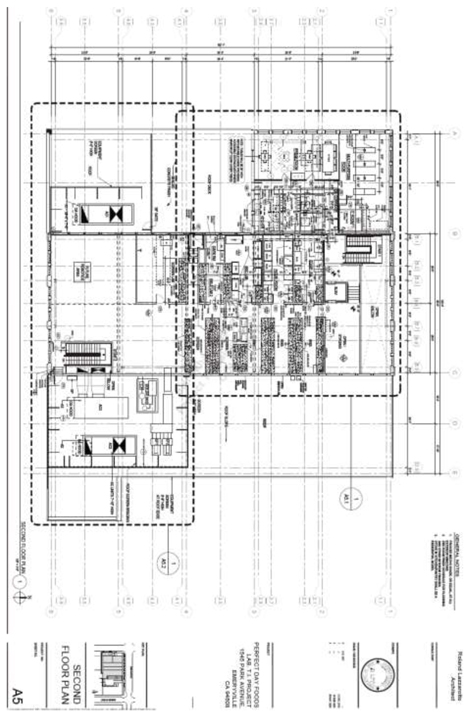

| Leased Premises: | Approximately 23,851 rentable square feet consisting of the entire Building (as defined herein). The Leased Premises (as defined herein) contains the following: (i) approximately 22,519 rentable square feet of office and R&D space (the “Office Premises”) and (ii) approximately 1,332 rentable square feet of a roof deck (the “Roof Deck Premises”), all as approximately shown on the floor plan attached hereto as Exhibit A-1. | |

| Rentable Area: | ||

| Leased Premises: | Approximately 23,851 rentable square feet. | |

| Building: | Approximately 23,851 rentable square feet. | |

| Term Commencement Date (and Rent Commencement Date): | The later of (i) February 1, 2021, or (ii) the earlier of (x) the date that the punchlist items set forth in Schedule 2.20 are substantially complete, or (y) the date that a temporary or permanent certificate of occupancy or its equivalent has been obtained from the City of Emeryville. | |

| Term Expiration Date: | The last day of the one hundred twentieth (120th) full calendar month after the Term Commencement Date (meaning if the Term Commencement Date shall occur on a date other than the first day of a calendar month, the Term shall be one hundred twenty (120) full calendar months plus a partial month). | |

| Option to Extend: | Number of Extension Periods: One (1) | |

| Years per Extension Period: Five (5) | ||

| Base Rent: | Rent Commencement Date through the last day of the 12th full calendar month after the Rent Commencement Date = $149,068.75 per month. | |

ii

| Notwithstanding the foregoing, provided that no event of default beyond any applicable cure period is occurring, Base Rent shall be abated for the first fifty-seven (57) days after the Rent Commencement Date (the “Base Rent Abatement Period”) (the collective Base Rent abatement during the Base Rent Abatement Period is equivalent to $279,350.75). | ||

| Month 13 through Month 24 = $153,540.81 per month. | ||

| Month 25 through Month 36 = $158,147.04 per month. | ||

| Month 37 through Month 48 = $162,891.45 per month. | ||

| Month 49 through Month 60 = $167,778.19 per month. | ||

| Month 61 through Month 72 = $172,811.54 per month. | ||

| Month 73 through Month 84 = $177,995.88 per month. | ||

| Month 85 through Month 96 = $183,335.76 per month. | ||

| Month 97 through Month 108 = $188,835.83 per month. | ||

| Month 109 through the Term Expiration Date = $194,500.91 per month. | ||

| Tenant’s Proportionate Share: | 100% of the Building. | |

| Landlord estimates that Tenant’s Proportionate Share of Basic Operating Costs will be approximately $1.57 per rentable square foot per month for the initial year of the Term. | ||

| The foregoing amount does not include HVAC Maintenance [as defined in Section 5.4(b)], Elevator Maintenance [as defined in Section 5.4(c)], and fire/life safety monitoring of the Building, which costs shall be paid by Tenant to Landlord as set forth in the Lease. | ||

iii

| Landlord does not represent, warrant or guarantee to Tenant that Tenant’s Proportionate Share of Operating Costs will be the above-stated amount during the term of the Lease. Landlord’s estimate is merely intended to be Landlord’s reasonable estimate, based upon information presently available to Landlord. Tenant acknowledges and agrees to the foregoing limitation with respect to Landlord’s estimate. | ||

| Utilities, Janitorial, and Refuse Removal: | In addition to payment of Tenant’s Proportionate Share of Basic Operating Costs, HVAC Maintenance, Elevator Maintenance, and fire/life safety monitoring of the Building and other expenses, Tenant shall be responsible for, among other things, the payment of all separately- metered utilities for the Leased Premises, janitorial services for the Leased Premises, and refuse removal for the Leased Premises. | |

| Parking Spaces: | Tenant shall have the use of all parking spaces on the Project at no cost for the initial Term and the Option Term (as defined in Section 8.1). | |

| Security Deposit: | $3,300,000.00, which shall be provided in the form of a letter of credit (amount is subject to reduction; see Section 5.14). | |

| Guarantor: | None | |

| Landlord’s Broker: | None | |

| Tenant’s Broker: | Kidder Matthews | |

EXHIBITS:

| Exhibit A-1 | - | Floor Plan of the Leased Premises | ||

| Exhibit A-2 | - | Legal Description of Project | ||

| Exhibit B | - | Landlord Improvements and Tenant’s Work | ||

| Exhibit B-1 | - | Base Building Upgrades | ||

| Exhibit C | - | Confirmation of Term of Lease | ||

| Exhibit D | - | Building Rules and Regulations | ||

| Exhibit E | - | Asbestos Notification | ||

| Exhibit F | - | Hazardous Materials Questionnaire |

iv

SCHEDULES

| Schedule 1.20 | - | Form of Letter of Credit | ||

| Schedule 2.20 | - | List of Punchlist Items |

The foregoing BASIC LEASE INFORMATION is incorporated herein and made a part of the LEASE to which it is attached. If there is any conflict between the BASIC LEASE INFORMATION and the LEASE, the BASIC LEASE INFORMATION shall control.

v

NET LEASE

THIS NET LEASE (this “Lease”) is made as of the date specified in the BASIC LEASE INFORMATION sheet, by and between the landlord specified in the BASIC LEASE INFORMATION sheet (“Landlord”) and the tenant specified in the BASIC LEASE INFORMATION sheet (“Tenant”).

Article I

Definitions

1.1 Definitions: Terms used herein shall have the following meanings:

1.2 “Additional Rent” shall mean all monetary obligations of Tenant under this Lease other than the obligation for payment of Net Rent.

1.3 Intentionally deleted.

1.4 “Base Rent” shall mean the minimum monthly rental amounts set forth in the Basic Lease Information due from time to time as rental for the Leased Premises.

1.5 Intentionally deleted.

1.6 “Basic Operating Costs” shall have the meaning given in Section 3.5.

1.7 “Building” shall mean the building and other improvements associated therewith identified on the Basic Lease Information sheet.

1.8 “Building Standard Improvements” shall mean the standard materials ordinarily used by Landlord in the improvement of the Building and leased premises within the Building.

1.9 Intentionally Omitted.

1.10 “Computation Year” shall mean a fiscal year consisting of the calendar year commencing January 1st of each year during the Term and continuing through the Term with a short or stub fiscal year in (i) the period between the Rent Commencement Date and December 31 of such year and (ii) any partial year in which the Lease expires or is terminated for the period between January 1 of such year and the date of lease termination or expiration.

1.11 Intentionally deleted.

1.12 “Landlord’s Broker” shall mean the individual or corporate broker identified on the Basic Lease Information sheet as the broker for Landlord.

1.13 Intentionally deleted.

1.14 “Leased Premises” shall mean the floor area more particularly shown on the floor plan attached hereto as Exhibit A-1, containing the Rentable Area (as such term is defined in Section 1.19 below) specified on the Basic Lease Information sheet.

1

1.15 “Net Rent” shall mean the total of Base Rent and Tenant’s Proportionate Share of Basic Operating Costs calculated in accordance with Section 3.4.

1.16 “Permitted Use” for the Office Premises shall mean general office and administrative use, and other ancillary uses, all legally permitted functions of a life science or research and development company, including, without limitation, chemistry labs, biology labs, protein production, pilot plant, and related or ancillary uses, and warehouse use, and ancillary uses. Except as set forth above or approved by Landlord, the Leased Premises shall not be used for any other purpose.

1.17 “Project” shall mean the Building, adjoining parking areas, and the real property on which the Building and the parking are located. The Project is located on a legal parcel of land described on Exhibit A-2.

1.18 “Rent” shall mean Net Rent plus Additional Rent.

1.19 “Rentable Area” shall mean the area or areas of space in the Building/Leased Premises as calculated in accordance with BOMA 2017 office standard measurement methods. The Rentable Area of the Building/Leased Premises shall not be subject to re-measurement or modification during the Term of this Lease.

1.20 “Security Deposit” shall mean the amount specified on the Basic Lease Information sheet to be delivered by Tenant to Landlord in the form of a clean and irrevocable letter of credit, substantially in the form attached hereto as Schedule 1.20 and held and applied pursuant to Section 5.14.

1.21 Intentionally deleted.

1.22 Intentionally deleted.

1.23 Intentionally deleted.

1.24 “Tenant’s Broker” shall mean the individual or corporate broker identified on the Basic Lease Information sheet as the broker for Tenant.

1.25 Intentionally deleted.

1.26 “Tenant’s Proportionate Share” is specified on the Basic Lease Information sheet and is based on the percentage which the Rentable Area of the Leased Premises bears to the total Rentable Area of the Building.

1.27 “Term” shall mean the period commencing with the Term Commencement Date and ending at midnight on the Term Expiration Date.

1.28 “Term Commencement Date” shall be the date set forth on the Basic Lease Information sheet.

2

1.29 “Term Expiration Date” shall be the date set forth on the Basic Lease Information sheet, unless sooner terminated pursuant to the terms of this Lease or unless extended pursuant to the provisions of Section 8.1.

1.30 Other Terms. Other terms used in this Lease and on the Basic Lease Information sheet shall have the meanings given to them herein and thereon.

Article II

Leased Premises

2.1 Lease. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord the Leased Premises upon all of the terms, covenants and conditions set forth in this Lease.

2.2 Current Tenant; Acceptance of Leased Premises.

(a) Tenant acknowledges that (i) Perfect Day, Inc., a Delaware corporation, is the current tenant of the Leased Premises (the “Current Tenant”) under that certain Net Lease Agreement dated as of June 26, 2019, between Current and Landlord, as amended by that certain First Amendment to Net Lease dated as of August 1, 2019 (the “First Amendment”), by that certain Second Amendment to Net Lease dated as of February 24, 2020 (the “Second Amendment”), and by that certain Third Amendment to Net Lease dated as of September 21, 2020 (the “Third Amendment”) (as so amended, the “PD Lease”). Current Tenant performed substantial improvements to the Building (the “PD Tenant Improvements”), and (ii) concurrently with Current Tenant’s performance of the PD Tenant Improvements, Landlord performed numerous upgrades to the Building (the “Base Building Upgrades”) as set forth in Exhibit B-1.

(b) Tenant acknowledges that (a) it has satisfied itself with respect to the condition of the Leased Premises (including, without limitation, the PD Tenant Improvements, the Base Building Upgrades, HVAC, electrical, plumbing and other mechanical installations, fire sprinkler systems, security, environmental aspects, and compliance with applicable laws, ordinances, rules and regulations) and the present and future suitability of the Leased Premises for Tenant’s intended use; (b) Tenant has made such inspection and investigation as it deems necessary with reference to such matters and assumes all responsibility therefor as the same relate to Tenant’s occupancy of the Leased Premises for the Term of this Lease; and (c) neither Landlord nor any of Landlord’s agents has made any oral or written representations or warranties with respect to the condition, suitability or fitness of the Leased Premises other than as may be specifically set forth in this Lease. Tenant accepts the Leased Premises in its AS IS condition existing on the date Tenant executes this Lease, subject to all matters of record and applicable laws, ordinances, rules and regulations. Tenant acknowledges that neither Landlord nor any of Landlord’s agents has agreed to undertake any alterations or additions or to perform any maintenance or repair of the Leased Premises except for the routine maintenance specified herein and except as may be expressly set forth herein and in Exhibit B. If Landlord, for any reason whatsoever, cannot deliver possession of the Leased Premises to Tenant on the Term Commencement Date in the condition specified in this Section 2.2, Landlord shall neither be subject to any liability nor shall the validity of this Lease be affected; provided, the Term and the obligation to pay Net Rent shall commence on the date possession is actually tendered to Tenant

3

and the Term Expiration Date shall be extended commensurately and Tenant shall not have any obligation to perform the covenants or observe the conditions herein contained until the Leased Premises have been so delivered. When the Term Commencement Date, the Rent Commencement Date, and the Term Expiration Date have been ascertained, the parties shall promptly execute a Confirmation of Term of Lease substantially in the form attached as Exhibit C. Tenant shall execute and return such Confirmation of Term of Lease to Landlord within fifteen (15) days after Tenant’s receipt thereof. If Tenant fails to execute and return (or reasonably object in writing to) the Confirmation of Term of Lease within fifteen (15) days after receiving it, Tenant shall be deemed to have executed and returned it without exception. Notwithstanding anything to the contrary set forth herein, except to the extent caused by Tenant and excluding the PD Tenant Improvements, the base Building electrical, heating, ventilation and air conditioning systems, mechanical systems, plumbing systems, and fire sprinkler, fire alarm monitoring and smoke detector systems and the Building roof, curtain wall, and envelope shall be in good working order and leak-free as of the Rent Commencement Date. If the foregoing are not in good and working order as provide above, Landlord shall be responsible for repairing or restoring same at its sole cost and expense promptly, provided that Tenant has delivered written notice thereof to Landlord. In addition, Landlord represents and warrants to Tenant that the Base Building Upgrades were performed substantially in accordance with the plans submitted to and the permit issued by the City of Emeryville.

(c) Landlord shall use good faith and diligent efforts to cause the contractor that constructed and performed the PD Tenant Improvements to assign to Landlord and/or Tenant all warranties, rights and remedies provided to the Current Tenant under the construction contract between the contractor and the Current Tenant relating to construction defects and similar claims, and Landlord shall use good faith and diligent efforts to enforce any such warranties, rights and remedies.

2.3 Intentionally Omitted.

2.4 Reservation of Rights. Landlord reserves the right from time to time, to install, use, maintain, repair, relocate and/or replace pipes, conduits, wires and equipment within and around the Building and the Project and to do and perform such other acts and make such other changes, additions, improvements, repairs and/or alterations in, to or with respect to the Building and the Project (including without limitation with respect to the driveways, parking areas, walkways and entrances to the Project) as Landlord may, in the exercise of sound business judgment, deem to be appropriate (“Landlord Alterations”); provided, however that Landlord shall give Tenant written notice at least ten (10) business days prior to the commencement of any Landlord Alterations and Landlord shall not unreasonably interfere with Tenant’s access, use and enjoyment of the Leased Premises, Building or Top Roof Deck. Notwithstanding the foregoing, any Landlord Alterations that would materially impact Tenant’s access, use and enjoyment of the Leased Premises, the Building or the Building Top Roof Deck shall require Tenant’s written approval, in its sole and absolute discretion; however, any Landlord Alterations that are necessitated to comply with laws or to maintain or repair the Building or the Project as required of Landlord under this Lease shall not require Tenant’s consent.

4

2.5 Roof Deck Premises. Tenant shall have exclusive access and use of the Building Top Roof Deck, subject to Landlord’s right of entry as set forth in Section 5.11 below. Tenant’s planned uses of the Building Top Roof Deck are subject to Tenant obtaining all necessary governmental approvals and permits, if any, as well as Landlord’s prior written approval, which approval shall not be unreasonably withheld. Tenant shall maintain the Building Top Roof Deck in a clean, attractive and orderly condition and Tenant shall not commit any waste in or upon the Building Top Roof Deck.

Article III

Term, Use and Rent

3.1 Term. Except as otherwise provided in this Lease, the Term shall commence upon the Term Commencement Date, and unless sooner terminated, shall end on the Term Expiration Date. Subject to Landlord’s reasonable security precautions and factors beyond the reasonable control of Landlord, Tenant shall have access to the Leased Premises twenty-four (24) hours per day, seven (7) days per week, and fifty-two (52) weeks per year. Any entry and possession of the Leased Premises by Tenant prior to the Term Commencement Date shall be on all terms and conditions of the Lease, except that the obligation to pay Base Rent and Tenant’s Proportionate Share of Basic Operating Costs shall commence on the Rent Commencement Date.

3.2 Use of the Office Premises. Tenant shall use the Office Premises solely for the Permitted Use and for no other use or purpose. Tenant shall not commit waste, overload the Building’s structure or the Building’s systems or subject the Leased Premises to any use that would materially damage the Leased Premises, normal wear and tear excepted. Tenant shall maintain a ratio of not more than one Occupant (defined as employees and contractors of Tenant working at the Office Premises) for each two hundred fifty (250) rentable square feet of the Office Premises. Tenant acknowledges that increased numbers of Occupants causes additional wear and tear on the Office Premises and the Building systems. Tenant’s failure to comply with the requirements of this Section 3.2 shall constitute an event of default under Section 7.8 and Landlord shall have the right, in addition to any other remedies it may have at law or equity, to specifically enforce Tenant’s obligations under this Section 3.2.

3.3 Base Rent.

(a) Tenant shall pay the Base Rent to Landlord in accordance with the schedule set forth on the Basic Lease Information sheet and in the manner described below. Tenant shall prepay $149,068.75 of Base Rent (for the first (1st) month of the Term that Base Rent is payable after the Base Rent Abatement Period expires) upon execution of this Lease (the “Prepaid Rent”). Tenant shall pay the Net Rent (consisting of Base Rent plus, when applicable in accordance with Section 3.4 below, Tenant’s Proportionate Share of Basic Operating Costs) in monthly installments on or before the first day of each calendar month during the Term and any extensions or renewals thereof, in advance without demand and, except as set forth herein, without any reduction, abatement, counterclaim or setoff, in lawful money of the United States at Landlord’s address specified on the Basic Lease Information sheet or at such other address as may be designated by Landlord in the manner provided for giving notice under Section 9.11 hereof.

5

(b) If the Term commences on other than the first day of a month, then the Base Rent provided for such partial month shall be prorated based upon a thirty (30)-day month. If the Term terminates on other than the last day of a calendar month, then the Net Rent provided for such partial month shall be prorated based upon a thirty (30)-day month and the prorated installment shall be paid on the first day of the calendar month in which the date of termination occurs.

3.4 Tenant’s Proportionate Share of Basic Operating Costs.

(a) Commencing on the Rent Commencement Date and continuing through the remainder of the Term, Tenant shall pay to Landlord Tenant’s Proportionate Share of Basic Operating Costs.

(b) During the first Computation Year, on or before the first day of each month during such Computation Year, Tenant shall pay to Landlord one-twelfth (1/12th) of Landlord’s estimate of the amount payable by Tenant under Section 3.4(a) as set forth in Landlord’s written notice to Tenant delivered prior to the Rent Commencement Date. During the last month of each Computation Year (or as soon thereafter as practicable), Landlord shall give Tenant notice of Landlord’s estimate of the amount payable by Tenant under Section 3.4(a) for the following Computation Year. On or before the first day of each month during the following Computation Year, Tenant shall pay to Landlord one-twelfth (1/12) of such estimated amount, provided that if Landlord fails to give such notice in the last month of the prior year, then Tenant shall continue to pay on the basis of the prior year’s estimate until the first day of the calendar month next succeeding the date such notice is given by Landlord; and from the first day of the calendar month following the date such notice is given, Tenant’s payments shall be adjusted so that the estimated amount for that Computation Year will be fully paid by the end of that Computation Year. If at any time or times Landlord reasonably determines that the amount payable under Section 3.4(a) for the current Computation Year will vary from its estimate given to Tenant, Landlord, by notice to Tenant, may revise its estimate for such Computation Year, and subsequent payments by Tenant for such Computation Year shall be based upon such revised estimate.

(c) Following the end of each Computation Year, Landlord shall deliver to Tenant a statement of amounts payable under Section 3.4(a) for such Computation Year. If such statement shows an amount owing by Tenant that is less than the payments for such Computation Year previously made by Tenant, and if no event of default (as defined below) is outstanding at the time such statement is delivered, Landlord shall credit such amount to the next payment(s) of Net Rent falling due under this Lease. If such statement shows an amount owing by Tenant that is more than the estimated payments for such Computation Year previously made by Tenant, Tenant shall pay the deficiency to Landlord within thirty (30) days after delivery of such statement. The respective obligations of Landlord and Tenant under this Section 3.4(c) shall survive the Term Expiration Date, and, if the Term Expiration Date is a day other than the last day of a Computation Year, the adjustment in Tenant’s Proportionate Share of Basic Operating Costs pursuant to this Section 3.4(c) for the Computation Year in which the Term Expiration Date occurs shall be prorated in the proportion that the number of days in such Computation Year preceding the Term Expiration Date bears to three hundred sixty-five (365).

6

(1) If, within ninety (90) days of Tenant’s receipt of Landlord’s statement, Tenant notifies Landlord that Tenant desires to audit or review Landlord’s statement, Landlord shall cooperate with Tenant to permit such audit or review during normal business hours. Landlord shall make available in the San Francisco Bay Area at Landlord’s, or at Landlord’s election at Landlord’s property manager’s, place of business, such books and records as are reasonably necessary for Tenant to conduct and complete such audit. Tenant shall have the right to examine and make copies of such books and records at Tenant’s sole cost and expense. Tenant shall bear all other costs and expenses associated with Tenant’s audit (including fees of Tenant’s auditor), unless such audit shall conclude that Tenant was overcharged by an amount in excess of three percent (3%) of the amount charged to Tenant hereunder as Tenant’s Proportionate Share of Basic Operating Costs, in which event Landlord shall bear the reasonable out-of-pocket costs of the audit up to a maximum amount of $5,000.00.

(2) Within ten (10) business days of completion of the audit, if Tenant desires to challenge Landlord’s statement, then Tenant shall provide Landlord with a copy of Tenant’s auditor’s report. Within twenty (20) days of Landlord’s receipt of Tenant’s auditor’s report, Landlord shall notify Tenant as to whether Landlord agrees or disagrees with the conclusions reached in Tenant’s auditor’s report. Landlord’s failure to respond (where such failure continues for three (3) business days after Landlord’s receipt of a notice that Landlord failed to respond within such twenty (20) day period) shall be deemed to constitute an agreement with the Tenant’s auditor’s report. After Landlord’s notice, Landlord and Tenant shall endeavor to resolve any disagreements regarding Tenant’s auditor’s report. If Landlord and Tenant are unable to resolve such disagreement regarding Tenant’s auditor’s report within twenty (20) business days of the completion of such audit, then Landlord and Tenant shall submit the matter to an independent audit conducted by an independent nationally recognized accounting firm or a nationally recognized real estate management or consulting firm that has been mutually selected by Tenant and Landlord. If Landlord and Tenant fail to agree upon and appoint such auditor/arbitrator, then the appointment shall be made by Judicial Arbitration and Mediation Services (“JAMS”). The results of such independent audit shall be conclusive and binding upon Landlord and Tenant. In the event Tenant’s audit reveals a discrepancy in Tenant’s favor, and Landlord agrees with the conclusions of Tenant’s auditor, or in the event that the independent audit determines a discrepancy in Tenant’s favor, then Landlord shall credit the amount of such discrepancy to the next payment(s) of Net Rent falling due under this Lease. In the event such audit reveals a discrepancy in Landlord’s favor, Tenant shall pay the amount of the discrepancy to Landlord within ten (10) business days of completion of the audit. Any such audit may only be conducted by an independent nationally recognized accounting firm or a nationally recognized real estate management or consulting firm that is not being compensated by Tenant on a contingency fee basis.

(3) The failure of Tenant to notify Landlord that Tenant desires an audit within ninety (90) days of Tenant’s receipt of Landlord’s statement under this Section 3.4(c) shall constitute an acceptance by Tenant of Landlord’s statement and a waiver by Tenant of its right to audit for such Computation Year. If Tenant commences an audit in accordance with this Section 3.4(c), then such audit and the Tenant’s auditor’s report must be completed within forty-five (45) days of Landlord’s books and records reasonably requested by Tenant’s auditor being made available by Landlord. Failure of Tenant to complete the audit within such forty-five (45) day period shall constitute an acceptance by Tenant of Landlord’s statement for such Computation Year unless such failure was caused by the failure of Landlord to make its books and records available to Tenant as required under this Section 3.4.

7

(d) Landlord shall have the same remedies for a default in the payment of Tenant’s Proportionate Share of Basic Operating Costs as for a default in the payment of Base Rent.

3.5 Basic Operating Costs.

(a) Basic Operating Costs shall mean all expenses and costs (but not specific costs which are separately billed to and paid by particular tenants of the Project) of every kind and nature which Landlord shall pay or become obligated to pay because of or in connection with the management, ownership, maintenance, repair, replacement, preservation and operation of the Leased Premises, the Building, the Project and its supporting facilities directly servicing the Building and/or the Project (determined in accordance with generally accepted accounting principles, consistently applied) including, but not limited to, the following:

(1) Fair market wages, salaries and related expenses and benefits of all employees and personnel engaged in the operation, maintenance, repair and security of the Project (prorated based on the percentage of time spent working for the Project) that are normally incurred by owners of Comparable Buildings (as defined in Section 8.1) providing comparable services.

(2) Intentionally Omitted.

(3) All supplies, materials, equipment and equipment rental to the extent specifically used in the operation, maintenance, repair, replacement and preservation of the Project.

(4) Intentionally Omitted.

(5) All maintenance and service agreements for the Project, including, without limitation, HVAC Maintenance and Elevator Maintenance (as such terms are defined in Section 5.4 below, however only to the extent Landlord, and not Tenant, is maintaining), exterior window cleaning, landscaping, pest control, and roof maintenance (provided, however, that Tenant shall employ (i) its own bonded and reputable janitorial service, subject to Landlord’s reasonable prior written approval, to clean the Leased Premises, at Tenant’s sole cost and expense), and (ii) its own refuse collection [the foregoing janitorial expenses and refuse collection for the Leased Premises shall be paid by Tenant separately and shall not be part of Basic Operating Costs]).

(6) A property management fee in an amount not to exceed three percent (3%) of all gross revenues derived from the Project.

(7) Legal and accounting services for the Project, including the costs of audits by certified public accountants; provided, however, that legal expenses shall not include the cost of lease negotiations, termination of leases, extension of leases or legal costs incurred in proceedings by or against any specific tenant, or for the defense of Landlord’s legal title to the Project.

8

(8) All insurance premiums and costs, including, but not limited to, the cost of property and liability coverage and rental income and earthquake and flood insurance applicable to the Project and Landlord’s personal property used in connection therewith, as well as deductible amounts applicable to such insurance; provided, however, that Landlord may, but shall not be obligated to, carry earthquake or flood insurance. Landlord may elect to self-insure for the coverages required herein; provided, however, Landlord may not self-insure unless it has a net worth of at least $500,000,000.00. Any undertaking by Landlord to self-insure with respect to some or all the insurance coverage otherwise required to be maintained by Landlord under this Lease will not adversely affect Tenant, and Tenant will be protected against loss or damage in the same manner as if Landlord had obtained separate insurance as provided herein (including the equivalent of any benefits Tenant would have received from additional insured status under a third-party insurance policy). A non-Affiliate assignee of Landlord may not self-insure without the prior written approval of Tenant, which approval will not be unreasonably withheld.

(9) Repairs, replacements and general maintenance (except to the extent paid by proceeds of insurance or by Tenant or other tenants of the Project or third parties).

(10) All real estate or personal property taxes, possessory interest taxes, business or license taxes or fees, service payments in lieu of such taxes or fees, annual or periodic license or use fees, excises, transit charges, housing fund assessments, open space charges, assessments, bonds, levies, fees or charges, general and special, ordinary and extraordinary, unforeseen as well as foreseen, of any kind which are assessed, levied, charged, confirmed or imposed by any public authority upon the Project (or any portion or component thereof), its operations, this Lease, or the Rent due hereunder (or any portion or component thereof) (collectively “Project Taxes”), except: (i) inheritance or estate taxes imposed upon or assessed against the Project, or any part thereof or interest therein, and (ii) Landlord’s personal or corporate income, gift or franchise taxes. Project Taxes shall not be subject to the property management fee set forth in Section 3.5(a)(6)).

(11) Amortized costs (together with reasonable financing charges) of capital improvements made to the Project subsequent to the Term Commencement Date which are primarily designed to achieve energy or carbon reduction or to reduce current or future Basic Operating Costs or otherwise improve the operating efficiency of the Building (and approved by Tenant in writing, in Tenant’s reasonable discretion), or which may be required by governmental authorities, including, but not limited to, those improvements required for the benefit of individuals with disabilities (capital improvements made to the Project subsequent to the Term Commencement Date which may be required by governmental authorities shall not be subject to Tenant’s approval), such amortization to be taken in accordance with generally accepted accounting principles.

(b) In the event any of the Basic Operating Costs are not provided on a uniform basis, Landlord shall make an appropriate and equitable adjustment, in Landlord’s discretion reasonably exercised.

(c) Notwithstanding any other provision of this Lease to the contrary, in the event that the Building is not fully occupied during any year of the Term, an adjustment shall be made in computing Basic Operating Costs for such year so that Basic Operating Costs shall be computed as though the Building had been 95% occupied during such year.

9

(d) The following items shall be excluded from Basic Operating Costs: (i) depreciation on the Building and the Project; (ii) debt service or interest on debt or amortization payments on any mortgages or deeds of trust; (iii) rental under any ground or underlying lease; (iv) attorneys’ fees and expenses incurred in connection with lease negotiations with prospective Building tenants or enforcement of leases; (v) the cost of any improvements or equipment which would be properly classified as capital expenditures (except for any capital expenditures expressly included in Section 3.5(a), including, without limitation, Section 3.5(a)(11)); (vi) the cost of decorating, improving for tenant occupancy, painting or redecorating portions of the Building to be demised to tenants; (vii) advertising and publicity expenditures; (viii) real estate brokers’ or other leasing commissions and other similar payments; (ix) costs of restoration to the extent of net insurance proceeds received by Landlord with respect thereto; (x) repairs or other work occasioned by fire, windstorm or other casualty or damage to the extent Landlord is reimbursed by insurance; (xi) Landlords’ reserve accounts; (xii) costs of correcting construction or latent defects in the Building; (xiii) costs of cleaning up or removing asbestos or hazardous materials not directly attributable to the activities of Tenant, its agents, employees or contractors; (xiv) costs incurred by Landlord due to the violation by Landlord of the terms and conditions of any lease of space in the Project; (xv) costs incurred in connection with upgrading the Building to comply with disability, life, fire and safety codes in effect prior to the Rent Commencement Date (unless such compliance is triggered by Tenant’s Work or alterations or improvements performed by or for Tenant, in which case such compliance shall be Tenant’s responsibility); (xvi) Landlord’s general corporate overhead and general administrative expenses not related to the operation of the Building; (xvii) all compensation to executives, officers or partners of Landlord or to any other person at or above the level of property manager (or the person fulfilling the function of property manager, notwithstanding his or her actual title); (xviii) salaries of service personnel to the extent that such service personnel perform services not attributable to the management, repair or operation of the Building; (xix) the cost of any political or charitable donations or contributions; (xx) costs of purchasing, installing and replacing art work or decorative features; and (xxi) costs incurred by Landlord to appeal the amount of Project Taxes payable for the Project to the extent that Landlord does not receive a refund produced by such appeal.

Article IV

Landlord’s Covenants

4.1 Basic Services. Tenant acknowledges that this Lease is a net lease, it being understood that Landlord shall receive the Base Rent specified in the Basic Lease Information sheet free and clear of any and all expenses, costs, impositions, taxes, assessments, liens or charges of any nature whatsoever, which shall be payable by Tenant unless otherwise set forth in this Lease. Accordingly, Tenant shall be solely responsible for and promptly pay the appropriate utility company directly for all water, gas, HVAC, light, power, telephone, and other utilities and services supplied to the Leased Premises for which there is a separate meter or submeter to the Leased Premises [if separate metering is available, Tenant shall pay for such separate metering] and Tenant shall pay Landlord for Tenant’s share, as reasonably determined by Landlord, of all utilities and services furnished to the Leased Premises for which there is no separate meter or submeter, within thirty (30) days after billing by Landlord [the foregoing utility and service expenses for the Leased Premises shall be paid by Tenant separately and shall not be part of Tenant’s Proportionate Share of Basic Operating Costs]). With respect to janitorial, Tenant shall employ its own bonded

10

and reputable janitorial service, subject to Landlord’s reasonable prior written approval, to clean the Leased Premises on all business days (including, without limitation, cleaning and providing supplies for the restrooms and break rooms), at Tenant’s sole cost and expense; and with respect to refuse collection, Tenant shall employ its own reputable refuse collection service, subject to Landlord’s reasonable prior written approval, to collect refuse from the Leased Premises on all business days, at Tenant’s sole cost and expense (the foregoing janitorial expenses and refuse collection for the Leased Premises shall be paid by Tenant separately and shall not be part of Tenant’s Proportionate Share of Basic Operating Costs). Tenant shall also be responsible for fire/life safety monitoring of the Building and the applicable fees and costs; notwithstanding the foregoing, Tenant has requested that Landlord undertake the foregoing on behalf of Tenant and Tenant shall pay Landlord for the actual costs related to the fire/life safety monitoring of the Building and the applicable fees and costs within ten (10) days after billing by Landlord. Subject to inclusion in Basic Operating Costs, Landlord agrees to furnish Tenant only with the following services: maintenance, repair and replacement of all Building systems (including without limitation, fire/life safety systems, mechanical, electrical, and plumbing systems), structural portions of the Building, including the structural walls, exterior walls, foundation and roof of the Building (not including the Roof Deck Premises), exterior window cleaning, landscaping, parking lot lighting, and sidewalk and parking lot cleaning and sweeping, all of the foregoing in the manner and to the extent reasonably determined by Landlord to be consistent with those standards of Comparable Buildings (as defined below). Notwithstanding anything in this Lease to the contrary, Tenant’s use of electrical service shall not exceed, either in voltage, rated capacity, or overall load, its pro-rata share of the Building capacity. Except as specifically set forth in this Lease or to the extent caused by any negligence, willful misconduct or breach of this Lease by Landlord, Landlord shall not be liable for damages to either person or property, nor shall Landlord be deemed to have evicted Tenant, nor shall there be any abatement of Rent, nor shall Tenant be relieved from performance of any covenant on its part to be performed under this Lease by reason of any (i) deficiency in the provision of basic services; (ii) breakdown of equipment or machinery utilized in supplying services; or (iii) curtailment or cessation of services due to causes or circumstances beyond the reasonable control of Landlord or by the making of the necessary repairs or improvements. Landlord shall use reasonable diligence to make such repairs as may be required to machinery or equipment within the Project to provide restoration of services and, where the cessation or interruption of service has occurred due to circumstances or conditions beyond Project boundaries, to cause the same to be restored, by diligent application or request to the provider thereof.

Notwithstanding the foregoing or anything in this Lease to the contrary, if any such deficiency, breakdown, or curtailment described above is within the reasonable control of Landlord to correct and continues for five (5) or more consecutive business days after Landlord becomes aware thereof, whether by Tenant’s written notice to Landlord thereof or otherwise, and Tenant is unable to reasonably conduct and does not conduct any business in a material portion of the Leased Premises as a result thereof including interference to Tenant’s business, then Tenant shall be entitled to an abatement of Base Rent, which abatement shall commence as of the first day after the expiration of such five (5) business day period and terminate upon the cessation of such deficiency, breakdown, curtailment or interference and which abatement shall be based on the portion of the Leased Premises rendered unusable for Tenant’s business by such deficiency, breakdown, curtailment or interference. The rental abatement rights set forth above shall be inapplicable to any interruption, failure or inability described in this grammatical paragraph that is caused by (i) damage from fire or other casualty (it being acknowledged that such situation shall be governed by Section 7.7 below), or (ii) to any deficiency, breakdown, or curtailment caused by the negligence or willful misconduct of Tenant or its agents, employees or contractors.

11

4.2 Extra Services. The cost chargeable to Tenant for all extra services requested by Tenant in writing and provided by Landlord, if any, shall constitute Additional Rent and shall include a management fee payable to Landlord of five percent (5%) (extra services shall not be subject to an additional property management fee set forth in Section 3.5(a)(6)). Additional Rent shall be paid monthly by Tenant to Landlord concurrently with the payment of Base Rent.

4.3 Window Coverings. All window coverings for the Office Premises shall be those approved by Landlord, in its reasonable discretion not to be reasonably withheld, conditioned or delayed. Tenant shall not place or maintain any window coverings, blinds, curtains or drapes other than those approved by Landlord on any exterior window without Landlord’s prior written approval, which Landlord shall have the right to grant or withhold in its reasonable discretion not to be reasonably withheld, conditioned or delayed. Notwithstanding anything to the contrary herein, Landlord hereby conceptually approves Tenant’s right to install window coverings to block visual monitoring of the Leased Premises and/or control the temperature and sunlight entering the Leased Premises through the windows.

4.4 Graphics and Signage. All signs, notices, advertisements and graphics of every kind or character, visible in or from the exterior of the Leased Premises shall be subject to Landlord’s prior written reasonable approval, which Landlord approval shall not be unreasonably withheld, conditioned or delayed. Landlord may remove, upon reasonable prior written notice to Tenant and at the expense of Tenant, any sign, notice, advertisement or graphic of any kind inscribed, displayed or affixed in violation of the foregoing requirement. All approved signs, notices, advertisements or graphics shall be printed, affixed or inscribed at Tenant’s expense by a sign company selected by or approved by Landlord. Landlord shall be entitled to revise the Project graphics and signage standards at any time. The location, design, content and size of any signage shall be subject to Landlord’s reasonable approval as well as the approval of the City of Emeryville. Tenant shall remove Tenant’s signs and repair any damage caused by the installation or removal of such signage and shall restore the area of such signage to the condition existing prior to installation of the signs at the expiration or earlier termination of this Lease. Installation, fabrication, maintenance and removal of Tenant’s signs shall be at Tenant’s sole cost and expense.

4.5 Intentionally deleted.

4.6 Repair Obligation. Landlord’s obligation under this Lease with respect to maintenance, repair, and replacement shall be limited to the items set forth in Section 4.1 above. However, Landlord shall not have any obligation to repair actual damage directly caused by Tenant, its agents, employees, contractors, invitees or licensees, unless otherwise excepted under this Lease. Landlord shall have the right, but not the obligation, to undertake work of repair which Tenant is required to perform under this Lease or which Landlord deems necessary, in Landlord’s reasonable discretion, including, but not limited to, the painting and refinishing of the exterior areas of the Building and Project, so as to impede, to the extent possible, deterioration by ordinary wear and tear and to keep the same in attractive condition, and which Tenant fails or refuses to perform in a timely and efficient manner after Tenant’s receipt of written notice. Tenant shall

12

reimburse Landlord upon demand, as Additional Rent, for all costs incurred by Landlord in performing any such repair for the account of Tenant, together with an amount equal to five percent (5%) of such costs to reimburse Landlord for its administration and managerial effort (the foregoing costs incurred by Landlord in performing any such repair for the account of Tenant shall not be subject to an additional property management fee set forth in Section 3.5(a)(6)). Except as specifically set forth in this Lease, Landlord shall have no obligation whatsoever to maintain or repair the Leased Premises or the Project. The parties intend that the terms of this Lease govern their respective maintenance and repair obligations. Tenant expressly waives the benefit of any statute now or hereafter in effect to the extent it is inconsistent with the terms of this Lease with respect to such obligations or which affords Tenant the right to make repairs at the expense of Landlord or terminate this Lease by reason of the condition of the Leased Premises or any needed repairs. All costs in performing the work described in this Section 4.6 shall be included in Basic Operating Costs.

4.7 Peaceful Enjoyment. Landlord covenants with Tenant that upon Tenant paying the Rent and all other charges required under this Lease and performing all of Tenant’s covenants and agreements herein contained, Tenant shall peacefully have, hold and enjoy the Leased Premises subject to all of the terms of this Lease and to any deed of trust, mortgage, ground lease or other agreement to which this Lease may be subordinate. This covenant and the other covenants of Landlord contained in this Lease shall be binding upon Landlord and its successors only with respect to breaches occurring during its or their respective ownerships of Landlord’s interest hereunder.

Article V

Tenant’s Covenants

5.1 Payments by Tenant. Tenant shall pay Rent at the times and in the manner provided in this Lease. All obligations of Tenant hereunder to make payments to Landlord shall constitute Rent and failure to pay the same when due shall give rise to the rights and remedies provided for in Section 7.8.

5.2 Tenant’s Work. Tenant’s Work, if any, shall be installed and constructed pursuant to Exhibit B.

5.3 Taxes on Personal Property. In addition to, and wholly apart from its obligation to pay Tenant’s Proportionate Share of Basic Operating Costs, Tenant shall be responsible for, and shall pay prior to delinquency, all taxes or governmental service fees, possessory interest taxes, fees or charges in lieu of any such taxes, capital levies, and any other charges imposed upon, levied with respect to, or assessed against Tenant’s personal property, and on its interest pursuant to this Lease. To the extent that any such taxes are not separately assessed or billed to Tenant, Tenant shall pay the amount thereof as invoiced to Tenant by Landlord.

13

5.4 Repairs by Tenant.

(a) Tenant shall be obligated to maintain and repair, at Tenant’s sole cost and expense, the Leased Premises (except the items that are Landlord’s responsibility to maintain and repair) and Tenant’s personal property, trade fixtures and any improvements or alterations installed by or on behalf of Tenant), to keep the same at all times in good order, condition and repair, and, upon expiration of the Term, to surrender the same to Landlord in the same condition as on the Term Commencement Date, reasonable wear and tear, taking by condemnation, and damage by casualty not caused by Tenant, its agents, employees, contractors, invitees and licensees excepted. Tenant’s obligations shall include, without limitation, the obligation to maintain and repair all walls, floors, ceilings and fixtures and to repair all damage caused by Tenant, its agents, employees, contractors, invitees and others using the Leased Premises with Tenant’s expressed or implied permission. At the request of Tenant, but without obligation to do so, Landlord may perform the work of maintenance and repair constituting Tenant’s obligation under this Section 5.4 at Tenant’s sole cost and expense and as an extra service to be rendered pursuant to Section 4.2. Any work of repair and maintenance performed by or for the account of Tenant by persons other than Landlord shall be performed by contractors approved by Landlord and in accordance with procedures Landlord shall from time to time reasonably establish. Tenant shall give Landlord prompt notice of any damage to or defective condition in any part of the mechanical, electrical, plumbing, fire/life safety or other system servicing or located in the Leased Premises. As set forth in Section 4.1, Landlord shall be responsible for the repair and maintenance of the structural parts of the Building, including structural walls, exterior walls, structural portions of the floors of the Building, foundation and roof of the Building (except for structural improvements performed by or for Tenant).

(b) Notwithstanding anything in this Lease to the contrary, Tenant shall enter into and continue in force throughout the term of this Lease a regularly scheduled (at least once every three (3) months) preventive maintenance/service contract, with a maintenance contractor approved by Landlord, for servicing all HVAC units serving the Leased Premises (“HVAC Maintenance”), and Tenant shall promptly provide Landlord a copy of the contract and all quarterly service reports and other service reports. The service contract must include, at a minimum, all services suggested by the equipment manufacturer. Tenant shall be responsible for any repair, replacement and maintenance of the HVAC units serving the Leased Premises and shall surrender the HVAC units on the Term Expiration Date (or earlier termination of this Lease) in good working order with no deferred maintenance. Notwithstanding the foregoing, Tenant has requested that Landlord undertake the HVAC Maintenance on behalf of Tenant and Tenant shall pay Landlord for the actual costs related to the HVAC Maintenance, including without limitation the repair or replacement of parts and equipment within ten (10) days after billing by Landlord; Landlord has agreed to undertake the HVAC Maintenance on behalf of Tenant.

(c) Notwithstanding anything in this Lease to the contrary, Tenant shall enter into and continue in force throughout the term of this Lease a regularly scheduled preventive maintenance/service contract, with a maintenance contractor approved by Landlord, for servicing the Building elevator system (“Elevator Maintenance”). The service contract shall include, at a minimum, all services suggested by the equipment manufacturer. Since Tenant is the sole user of the Building elevator system, Tenant shall pay for all costs related to Elevator Maintenance, including without limitation the repair or replacement of parts and equipment. Notwithstanding the foregoing, Tenant has requested that Landlord undertake the Elevator Maintenance on behalf of Tenant and Tenant shall pay Landlord for the actual costs related to the Elevator Maintenance, including without limitation the repair or replacement of parts and equipment within ten (10) days after billing by Landlord; Landlord has agreed to undertake the Elevator Maintenance on behalf of Tenant.

14

(d) Notwithstanding anything to the contrary set forth in this Lease, in the event that the originally named Tenant in this Lease develops the capacity and facilities management expertise necessary to perform facilities management of the Leased Premises in accordance with prevailing industry standards and can provide reasonable evidence to Landlord of such capacity, the originally named Tenant in this Lease may elect (on any January 1 during the Term of this Lease by providing Landlord at least sixty (60) days prior written notice of such election) to assume the obligations of Landlord under service contracts for HVAC Maintenance, Elevator Maintenance and fire/life safety monitoring and pay such costs directly to the providers of those services. During all periods following any such election by Tenant, Tenant shall maintain records of its performance of its maintenance obligations under this Lease and shall provide reasonable access to Landlord to inspect such maintenance records, and, with respect to Tenant’s payment obligations under this Lease, Landlord shall adjust Basic Operating Costs and/or Additional Rent payable by Tenant accordingly.

5.5 Waste. Tenant shall not commit or allow any waste or damage to be committed in any portion of the Leased Premises or the Project.

5.6 Assignment or Sublease.

(a) Tenant shall not voluntarily or by operation of law assign, transfer or encumber (collectively “Assign”) or sublet all or any part of Tenant’s interest in this Lease or in the Leased Premises, or allow any third party to use any portion of the Leased Premises (which for purposes of the balance of this Section 5.6 shall be deemed to be a “sublet” or “sublease” of the Leased Premises), without Landlord’s prior written consent given under and subject to the terms of this Section 5.6. Tenant may not sublease the Roof Deck Premises separately from the Office Premises.

(b) If Tenant desires to Assign this Lease or any interest herein or sublet the Leased Premises or any part thereof, Tenant shall give Landlord a request for consent to such transaction, in writing. Tenant’s written request for consent shall specify the date the proposed assignment or sublease would be effective and be accompanied by information pertinent to Landlord’s determination as to the financial and operational responsibility and appropriateness of the proposed assignee or subtenant, including, without limitation, its name, business and financial condition, financial details of the proposed transfer, the intended use (including any modification) of the Leased Premises, and exact copies of all of the proposed agreement(s) between Tenant and the proposed assignee or subtenant. Tenant shall promptly provide Landlord with (i) such other or additional information or documents reasonably requested (within ten (10) days after receiving Tenant’s consent request) by Landlord, and (ii) an opportunity to meet and interview the proposed assignee or subtenant, if requested by Landlord.

(c) Landlord shall have until the later of (x) ten (10) business days following such interview and receipt of all such additional information and (y) thirty (30) days from the date of Tenant’s original notice if Landlord does not request additional information or an interview, within which to notify Tenant in writing that Landlord elects either (i) to terminate this Lease as

15

to the space so affected as of the effective date of the proposed assignment or sublease specified by Tenant, in which event Tenant will be relieved of all further obligations hereunder as to such space as of such date, other than those obligations which survive termination of the Lease, or (ii) to consent to or withhold consent to Tenant’s request to Assign this Lease or sublet such space, such consent not to be withheld so long as the proposed assignee or sublessee is approved by Landlord and is of sound financial condition as determined by Landlord in its absolute and sole discretion, the use of the Leased Premises by such proposed assignee or sublessee would be a Permitted Use, the proposed assignee or sublessee executes such reasonable assumption documentation as Landlord shall require, and the proposed assignee or sublessee is not (x) already a tenant in the Building or (y) a party with whom Landlord has been discussing the leasing of space in the Building. Failure by Landlord to approve a proposed subtenant or assignee shall not cause a termination of this Lease.

(d) In the event Tenant shall request the consent of Landlord to any assignment or subletting hereunder, Tenant shall pay Landlord a processing fee of $2,500.00 and such fee shall be deemed Additional Rent under this Lease.

(e) Any rent or other consideration realized by Tenant under any such sublease or assignment in excess of (i) the proportionate Rent payable for the applicable subleased space, (ii) any reasonable tenant improvement allowance or other economic concession (e.g., space planning allowance, moving expenses, free or reduced rent periods, etc.), and (iii) any advertising costs and brokerage commissions associated with such assignment or sublease (“Profit”), shall be divided and paid as follows: fifty percent (50%) to Tenant and fifty percent (50%) to Landlord; provided, however, that if Tenant is in default hereunder beyond any applicable cure period, Landlord shall be entitled to all such Profit.

(f) In any subletting undertaken by Tenant, Tenant shall use commercially reasonable efforts to obtain not less than fair market rent for the space to be sublet. In any assignment of this Lease in whole or in part, Tenant shall seek to obtain from the assignee consideration reflecting a value of not less than fair market rent for the space subject to such assignment.

(g) The consent of Landlord to any assignment or subletting shall not constitute a consent to any subsequent assignment or subletting by Tenant or to any subsequent or successive assignment or subletting by the assignee or subtenant.

(h) No assignment or subletting by Tenant shall relieve Tenant of any obligation under this Lease. In the event of default by an assignee or subtenant of Tenant or any successor of Tenant in the performance of any of the terms hereof, Landlord may proceed directly against Tenant without the necessity of exhausting remedies against such assignee, subtenant or successor. Any assignment or subletting made without Landlord’s consent or which conflicts with the provisions hereof shall be void and, at Landlord’s option, shall constitute a default under this Lease.

16

(i) Notwithstanding anything to the contrary contained in this Lease, Tenant may (with ten (10) business days’ prior written notice to Landlord) assign this Lease or sublet the Leased Premises, without Landlord’s consent (or sharing of Profit, or recapture right by Landlord), to any entity controlling, controlled by, or under common control with Tenant, or to a successor of Tenant resulting from a merger or consolidation of Tenant, or to the purchaser of all or substantially all of Tenant’s assets or stock (each, a “Permitted Transfer”); provided, however, that (i) no such assignment, sublease, or change of control shall relieve Tenant from any liability under this Lease, whether accrued to the date of such assignment, sublease, or change of control, or thereafter accruing (unless Tenant is a “disappearing” entity in a transaction otherwise allowed hereunder, except if such transaction(s) is/are entered into to evade Tenant’s obligations hereunder), (ii) if an assignment or sublease, such assignee or sublessee expressly assumes, in writing, all of Tenant’s obligations under this Lease, in form and content reasonably acceptable to Landlord (except, as between a sublessee and Tenant, for the specific business deal between Tenant and such sublessee), and (iii) no series of one or more of such transactions shall be used by Tenant to “spin off” this Lease to independent third parties if such transactions are entered into to evade Tenant’s obligations hereunder, and (iv) Tenant shall give Landlord ten (10) business days’ prior written notice of any such transaction not requiring Landlord’s consent (or if Tenant is unable to disclose an impending transaction due to legal requirements, then Tenant shall notify Landlord in writing within five (5) days after the transaction). In addition, any change in the controlling interest in the stock of Tenant as a result of an initial public offering of Tenant’s stock, and any transfer of the capital stock of Tenant by persons or parties through the “over the counter market” or through any recognized stock exchange, shall not be deemed to be an assignment or transfer requiring Landlord’s consent.

5.7 Alterations, Additions and Improvements.

(a) Except as set forth in Exhibits B and B-1, Tenant shall not make or allow to be made any alterations, additions or improvements in or to the Leased Premises without first obtaining the written consent of Landlord, provided that Tenant shall be permitted, without Landlord’s consent, to make non-structural alterations or additions to the Leased Premises that do not affect any of the Building systems, cost less than $25,000.00 in the aggregate per project, or $50,000.00 in the aggregate per calendar year, do not require a building permit, and are of a cosmetic nature (e.g., painting, carpeting, etc.; any such alteration complying with all of the foregoing constituting a “Cosmetic Alteration”). Landlord’s consent will not be unreasonably withheld, conditioned or delayed with respect to proposed alterations, additions or improvements which (i) comply with all applicable laws, ordinances, rules and regulations; (ii) are compatible with and do not adversely affect the Building and its mechanical, telecommunication, electrical, HVAC and fire/life safety systems; (iii) will not affect the structural or exterior portions of the Building; and (iv) will not trigger any material costs to Landlord. Specifically, but without limiting the generality of the foregoing, Landlord’s right of consent shall encompass plans and specifications for the proposed alterations, additions or improvements, construction means and methods, the identity of any contractor or subcontractor to be employed on the work of alterations, additions or improvements, and the time for performance of such work. Tenant shall supply to Landlord any additional documents and information requested by Landlord in connection with Tenant’s request for consent hereunder. If Tenant performs any alterations or additions permitted under this Section 5.7, Tenant shall, in addition to complying with the provisions of this Section 5.7, perform such alterations or additions in a manner that avoids disturbing any asbestos containing materials present in the Building. If asbestos containing materials are likely to be disturbed in the course of such work, Tenant shall encapsulate or remove the asbestos containing materials in accordance with an asbestos-removal plan approved by Landlord and otherwise in accordance with all applicable laws.

17

(b) Any consent given by Landlord under this Section 5.7 shall be deemed conditioned upon: (i) Tenant’s acquiring all applicable permits required by governmental authorities; (ii) Tenant’s furnishing to Landlord copies of such permits, together with copies of the approved plans and specifications, prior to commencement of the work thereon; and (iii) the compliance by Tenant with the conditions of all applicable permits and approvals in a prompt and expeditious manner.

(c) Tenant shall provide Landlord with not less than fifteen (15) days prior written notice of commencement of the work so as to enable Landlord to post and record appropriate notices of non-responsibility. Except as set forth in Exhibits B and B-1, all alterations, additions and improvements permitted hereunder shall be made and performed by Tenant without cost or expense to Landlord and in strict accordance with plans and specifications approved by Landlord. Tenant shall pay the contractors and suppliers all amounts due to them when due and keep the Leased Premises and the Project free from any and all mechanics’, materialmen’s and other liens and claims arising out of any work performed, materials furnished or obligations incurred by or for Tenant. Landlord may require, at its sole option, that Tenant provide to Landlord, at Tenant’s expense, a lien and completion bond in an amount equal to the total estimated cost of any alterations, additions or improvements to be made in or to the Leased Premises, to protect Landlord against any liability for mechanics’, materialmen’s and other liens and claims, and to ensure timely completion of the work. In the event any alterations, additions or improvements to the Leased Premises are performed by Landlord hereunder, whether by prearrangement or otherwise, Landlord shall be entitled to charge Tenant a five percent (5%) administration fee in addition to the actual costs of labor and materials provided. Such costs and fees shall be deemed Additional Rent under this Lease, and may be charged and payable prior to commencement of the work.

(d) Any and all alterations, additions or improvements made to the Leased Premises by Tenant shall become the property of Landlord upon installation and shall be surrendered to Landlord without compensation to Tenant upon the termination of this Lease by lapse of time or otherwise unless (i) Landlord conditioned its approval of such alterations, additions or improvements on Tenant’s agreement to remove them, or (ii) if Tenant did not provide a Removal Determination Request (as defined below), Landlord notifies Tenant prior to (or promptly after) the Term Expiration Date that the alterations, additions and/or improvements must be removed, in which case Tenant shall, by the Term Expiration Date, remove such alterations, additions and improvements (which includes, without limitation, Tenant’s Work), repair any damage resulting from such removal and restore the Leased Premises to their condition existing prior to the date of installation of such alterations, additions and improvements, ordinary wear and tear excepted. Prior to making any alterations, additions or improvements to the Leased Premises, Tenant may make a written request that Landlord determine in advance whether or not Tenant must remove such alterations, additions or improvements on or prior to the Term Expiration Date or any earlier termination of this Lease (“Removal Determination Request”). Notwithstanding anything to the contrary set forth above, this clause shall not apply to movable equipment or furniture owned by Tenant. Tenant shall repair, at its sole cost and expense, all damage caused to the Leased Premises and the Project by removal of Tenant’s movable equipment or furniture and such other alterations, additions and improvements as Tenant shall be required or allowed by Landlord to remove from the Leased Premises.

18

(e) All alterations, additions and improvements permitted under this Section 5.7 shall be constructed diligently, in a good and workmanlike manner with new, good and sufficient materials and in compliance with all applicable laws, ordinances, rules and regulations (including, without limitation, building codes and those related to accessibility and use by individuals with disabilities). Tenant shall, promptly upon completion of the work, furnish Landlord with “as built” drawings for any alterations, additions or improvements performed under this Section 5.7.

(f) Notwithstanding anything in this Lease to the contrary, Tenant shall construct all alterations, additions and improvements and perform all repairs and maintenance under this Lease (all contractors to be approved in writing in advance by Landlord or, at Landlord’s option, designated by Landlord) in conformance with any and all applicable laws, including, without limitation, pursuant to a valid building permit issued by the applicable municipality, in conformance with Landlord’s construction rules and regulations.

(g) All alterations, additions and improvements permitted under this Section 5.7 shall be completed using Building standards and all vendors (including, without limitation, Tenant’s cabling contractors and subcontractors) accessing areas above the ceiling grid shall be certified to work in an asbestos containing setting.

(h) Tenant shall have the right to install a wireless intranet, internet, and communications network (also known as “Wi-Fi”) within the Leased Premises for the use of Tenant and its employees (the “Network”) subject to this subsection and all the other clauses of this Lease as are applicable. Tenant shall not solicit, suffer, or permit other tenants or occupants of the Building to use the Network or any other communications service, including, without limitation, any wired or wireless internet service that passes through, is transmitted through, or emanates from the Leased Premises. Tenant agrees that Tenant’s communications equipment and the communications equipment of Tenant’s service providers located in or about the Leased Premises, including, without limitation, any antennas, switches, or other equipment (collectively, “Tenant’s Communications Equipment”) shall be of a type and, if applicable, a frequency that will not cause material radio frequency, electromagnetic, or other interference to any other party or any equipment of Landlord at the Building. In the event that Tenant’s Communications Equipment causes or is believed to cause any such material interference, upon receipt of notice from Landlord of such interference, Tenant will take commercially reasonable steps necessary, at Tenant’s sole cost and expense, to mitigate the interference. If the interference is not mitigated within forty-eight (48) hours (or a shorter period if Landlord believes a shorter period to be appropriate) then, upon request from Landlord, Tenant shall shut down the Tenant’s Communications Equipment pending resolution of the material interference, with the exception of intermittent testing upon prior notice to and with the approval of Landlord.

5.8 Compliance With Laws and Insurance Standards. Tenant shall not occupy or use, or permit any portion of the Leased Premises to be occupied or used in a manner that violates any applicable law, ordinance, rule, regulation, order, permit, covenant, easement or restriction of record, or the recommendations of Landlord’s engineers or consultants, relating in any manner to the Project, or for any business or purpose which is disreputable, objectionable or productive of fire hazard.

19

Tenant shall not do or permit anything to be done which would result in the cancellation, or in any way increase the cost, of the property insurance coverage on the Project and/or its contents. If Tenant does or permits anything to be done which increases the cost of any insurance covering or affecting the Project, then Tenant shall reimburse Landlord, upon demand, as Additional Rent, for such additional costs. Landlord shall deliver to Tenant a written statement setting forth the amount of any such insurance cost increase and showing in reasonable detail the manner in which it has been computed. Tenant shall, at Tenant’s sole cost and expense, comply with all laws, ordinances, rules, regulations and orders (state, federal, municipal or promulgated by other agencies or bodies having or claiming jurisdiction) related to the use, condition or occupancy of the Leased Premises now in effect or which may hereafter come into effect including, but not limited to, (a) accessibility and use by individuals with disabilities, and (b) environmental conditions in, on or about the Leased Premises. If anything done by Tenant in its specific and unique use or operation of the Leased Premises (as opposed to general office use or general research and development use as contemplated herein) after the Rent Commencement Date or alterations performed by or for Tenant shall create, require or cause imposition of any requirement by any public authority for structural or other upgrading of or alteration or improvement to the Project, Tenant shall, at Landlord’s option, either perform the upgrade, alteration or improvement at Tenant’s sole cost and expense or reimburse Landlord upon demand, as Additional Rent, for the cost to Landlord of performing such work. The judgment of any court of competent jurisdiction or the admission by Tenant in any action against Tenant, whether Landlord is a party thereto or not, that Tenant has violated any law, ordinance, rule, regulation, order, permit, covenant, easement or restriction shall be conclusive of that fact as between Landlord and Tenant.

5.9 No Nuisance; No Overloading. Tenant shall use and occupy the Leased Premises, and control its agents, employees, contractors, invitees and visitors in such manner so as not to create any nuisance, or interfere with, annoy or disturb (whether by noise, odor, vibration or otherwise) any other tenant or occupant of the Project or Landlord in its operation of the Project. Tenant shall not place or permit to be placed any loads upon the floors, walls or ceilings in excess of the maximum designed load specified by Landlord or which might damage the Leased Premises, the Building, or any portion thereof.

5.10 Furnishing of Financial Statements; Tenant’s Representations. In order to induce Landlord to enter into this Lease, Tenant agrees that it shall promptly furnish Landlord, from time to time, within ten (10) days of receipt of Landlord’s written request therefor (but no more than once each calendar year, unless requested by Landlord because of a bona fide financing or sale of the Building or a bona fide request by Landlord’s financial partners or lender, in which case Tenant shall be required to furnish more than one time per calendar year), with financial statements in form and substance reasonably satisfactory to Landlord reflecting Tenant’s current financial condition. Tenant represents and warrants that all financial statements, records and information furnished by Tenant to Landlord in connection with this Lease are true, correct and complete in all material respects.

20

5.11 Entry by Landlord. Landlord, its employees, agents and consultants, shall have the right to enter the Leased Premises at any time, in cases of an emergency, and otherwise at reasonable times after at least twenty-four (24) hours advance written notice to Tenant (which written notice may be via email) to inspect the same, to clean, to perform such work as may be permitted or required under this Lease, to make repairs to or alterations of the Leased Premises or other portions of the Project or other tenant spaces therein, to deal with emergencies, to post such notices as may be permitted or required by law to prevent the perfection of liens against Landlord’s interest in the Project or to show the Leased Premises to prospective tenants, purchasers, encumbrancers or others, or for any other purpose as Landlord may deem reasonably necessary or desirable; provided, however that Landlord shall not unreasonably interfere with Tenant’s access, use and enjoyment of the Leased Premises or Building Top Roof Deck. Tenant shall not be entitled to any abatement of Rent or damages by reason of the exercise of any such right of entry or performance of any such work by Landlord.