UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

Certified Shareholder Report of

Registered Management Investment Companies

Investment Company Act File Number: 811-23467

American Funds International Vantage Fund

(Exact Name of Registrant as Specified in Charter)

6455 Irvine Center Drive

Irvine, California 92618

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (949) 975-5000

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Gregory F. Niland

American Funds International Vantage Fund

5300 Robin Hood Road

Norfolk, Virginia 23513

(Name and Address of Agent for Service)

ITEM 1 – Reports to Stockholders

American Funds

Annual report |  |

A prudent approach

to international

growth investing

American Funds International Vantage Fund seeks to provide you with prudent growth of capital and conservation of principal.

This fund is one of more than 40 offered by Capital Group, home of American Funds, one of the nation’s largest mutual fund families. For nearly 90 years, Capital Group has invested with a long-term focus based on thorough research and attention to risk.

Fund results shown in this report, unless otherwise indicated, are for Class F-3 shares at net asset value. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit capitalgroup.com.

Here are the average annual total returns on a $1,000 investment with all distributions reinvested for periods ended September 30, 2020 (the most recent calendar quarter-end):

| Class F-3 shares* | 1 year | 5 years | Lifetime (since 4/1/11) | |||

| 12.98% | 9.50% | 6.16% |

| * | The fund was organized for the purpose of effecting the reorganization of Capital Group International Equity Fund (the “predecessor fund”) into a new Delaware statutory trust on November 8, 2019. In connection with the reorganization, former shareholders of the predecessor fund received Class F-3 shares of the fund. The performance of Class F-3 shares of the fund includes the performance of the predecessor fund prior to the reorganization. The inception date shown in the table for Class F-3 shares is that of the predecessor fund. |

For other share class results, visit capitalgroup.com and americanfundsretirement.com.

The fund’s gross expense ratio is 0.70%, and the net expense ratio is 0.65% for Class F-3 shares as of the prospectus dated January 1, 2021. The expense ratio is based on estimated amounts for the current fiscal year.

The fund began investment operations on April 1, 2011, but was only available to a limited number of investors. Now available on the American Funds platform, the reorganized fund has adopted the results and financial history of the original fund.

The investment adviser is currently reimbursing a portion of other expenses for Class F-3 shares so that total expenses do not exceed 0.65%. This reimbursement will be in effect through at least January 1, 2024, without which the results would have been lower and net expense ratios higher. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit capitalgroup.com for more information.

Investing outside the United States may be subject to risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Refer to the fund prospectus and the Risk Factors section of this report for more information on these and other risks associated with investing in the fund.

Investments are not FDIC-insured, nor are they deposits of or guaranteed by a bank or any other entity, so they may lose value.

Contents

| 1 | Letter to investors |

| 3 | The value of a $10,000 investment |

| 4 | Investment portfolio |

| 8 | Financial statements |

| 27 | Board of trustees and other officers |

Fellow investors:

In a volatile period characterized by a global pandemic, the American Funds International Vantage Fund generated solid results, returning 5.33% — outpacing its primary benchmark, the MSCI Europe, Australasia, Far East (EAFE) Index, which fell -6.86% for the fiscal year ended October 31, 2020.

Volatility spurred by pandemic

The past fiscal year has been particularly volatile in equity markets around the globe, as countries managed their various responses to the spread of the novel coronavirus. Stock markets gained in the last quarter of 2019, supported by indications of improving trade relations between the U.S. and China, as well as the increasing likelihood of a negotiated withdrawal of the U.K. from the European Union.

This end-of-year upswing came to an abrupt end in the first months of 2020 amid the severe outbreak of COVID-19. In China, aggressive quarantine measures implemented earlier in the year helped the country rebound faster than many others, with some workers returning to work by early March.

Elsewhere in the Asia-Pacific region, countries experienced severe market downturns. While the stock market was strong in the fourth quarter and initial signs were positive, the Japanese economy ultimately contracted by an annualized 7.1% as a consumption tax hike in October weighed on household spending. Japan officially entered a recession as the economy contracted by 2.2% in the first quarter, driven by the postponement of the Summer Olympics and the manufacturing disruption in China, their largest trading partner. Stocks in Hong Kong retreated as well, pushing an economy already suffering from months of domestic political protests and the U.S.-China trade dispute.

Among major developed markets, this first-quarter wave struck hardest in Europe, particularly Italy and Spain. Central banks and national leaders responded with significant new monetary and fiscal stimulus measures in an attempt to lessen the severity of an expected recession amid government-imposed lockdowns meant to combat the spread of the coronavirus.

By April, nearly all markets reversed their trajectory, driven by broad-reaching

Results at a glance

(for periods ended October 31, 2020, with all distributions reinvested)

| Cumulative total returns | Average annual total returns | |||||||||||

| 1 year | 5 years | Lifetime (since 4/1/11) | ||||||||||

| American Funds International Vantage Fund* (Class F-3 shares) | 5.33 | % | 7.54 | % | 5.73 | % | ||||||

| MSCI EAFE (Europe, Australasia, Far East) Index† | -6.86 | 2.85 | 3.28 | |||||||||

| * | The fund was organized for the purpose of effecting the reorganization of Capital Group International Equity Fund (the “predecessor fund”) into a new Delaware statutory trust on November 8, 2019. In connection with the reorganization, former shareholders of the predecessor fund received Class F-3 shares of the fund. The performance of Class F-3 shares of the fund includes the performance of the predecessor fund prior to the reorganization. The inception date shown in the table for Class F-3 shares is that of the predecessor fund. |

| † | MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. |

| Source: MSCI. |

| American Funds International Vantage Fund | 1 |

stimulus efforts focused on easing the economic impact of the pandemic. European stocks posted their best quarterly returns in nearly 10 years as investors reacted to the implementation of additional stimulus measures, including a massive new bond-buying effort from the European Central Bank (ECB).

Equities in Asia picked up as well, helped by signs of increased containment of the virus in Japan, China and Hong Kong. In Japan, the government lifted a seven-week state of emergency, helping to drive an upswing in equity markets; however, economic forecasts remain negative, with the International Monetary Fund (IMF) projecting that Japan’s economy will contract by 5.8% in 2020. While markets in Hong Kong rebounded somewhat, they trailed gains seen elsewhere in the region as renewed civil unrest and international responses weighed on the territory. Gross domestic product (GDP) fell 8.9% in the first quarter, the worst drop on record at the time, extending the recession that began in the second half of 2019.

In the third quarter, European markets extended their upward trajectory on signs of improving economic activity; however, concerns over a second wave of infections tempered gains in September. Markets in Asia were mixed. Stocks rose in Japan despite continued economic weakness. Hong Kong continued to face escalating geopolitical tensions while the recession extended to a full year, as the GDP declined 9% in the second quarter. Meanwhile, stocks in China rose on strong economic data, as the country’s pandemic recovery accelerated and in spite of rising geopolitical tensions with the U.S., Europe and India.

Inside the portfolio

The strategy seeks to provide a smoother return profile over a full market cycle, targeting less volatility and better downside capture than the market by focusing on companies with the potential for long-term growth and resilience to market declines.

The fund has achieved its goal, providing downside protection during the market’s abrupt sell off early in the first quarter, as well as in the last two months of the fiscal year. The fund was also able to capitalize on the market upswings going into the second quarter. In some months, the fund was able to outpace the MSCI EAFE, but occasionally lagged as well.

For the fiscal year, holdings in the information technology sector were top contributors, led by Taiwan Semiconductor Manufacturing Co. (TSMC) and Keyence Corporation. Strong stock selection in financials and the fund’s health care holdings were beneficial as well. On the other hand, exposure to sectors meant to help avoid volatility, including particular holdings in the industrials sector, weighed on the fund.

Looking ahead

The outlook for the remainder of 2020 and into 2021 is cloudy at best. The International Monetary Fund (IMF) has downgraded its global economic forecast and warned of a long, slow recovery that is “likely to be long, uneven, and highly uncertain.” That being said, the organization’s October statement revised its June outlook, predicting the economy will contract by 4.4% versus its earlier statement of 4.9%.

Recent news of a promising COVID-19 vaccine from Pfizer and BioNTech has buoyed markets; however, ongoing geopolitical tensions and risks of a new wave of coronavirus infections as the northern hemisphere enters winter are likely to incite ongoing volatility.

As always, we appreciate your continued support and long-term investment perspective.

Cordially,

John S. Armour

President

December 10, 2020

For current information about the fund, visit capitalgroup.com.

| 2 | American Funds International Vantage Fund |

The value of a $10,000 investment

How a hypothetical $10,000 investment has grown (for the period April 1, 2011, to October 31, 2020, with all distributions reinvested)

Fund results shown are for Class F-3 shares. Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. Prices and returns will vary, so investors may lose money. Investing for short periods makes losses more likely. For current information and month-end results, visit capitalgroup.com.

| 1 | Includes reinvested dividends and capital gain distributions for Class F-3 shares. |

| 2 | MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada. Results reflect dividends net of withholding taxes. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. Source: MSCI. |

Results are for past periods and are not predictive of results for future periods. Current and future results may be lower or higher than those shown. The results shown are before taxes on fund distributions and sale of fund shares.

Average annual total returns based on a $1,000 investment (for periods ended October 31, 2020)*

| 1 year | 5 years | Lifetime | ||||

| American Funds International Vantage Fund | 5.33% | 7.54% | 5.73% |

| * | Assumes reinvestment of all distributions. |

The investment adviser is currently reimbursing a portion of other expenses so that total expenses do not exceed 0.65%. This reimbursement will be in effect through at least January 1, 2024, without which the results would have been lower and net expense ratios higher. The adviser may elect at its discretion to extend, modify or terminate the reimbursement at that time. Visit capitalgroup.com for more information.

| American Funds International Vantage Fund | 3 |

Investment portfolio October 31, 2020

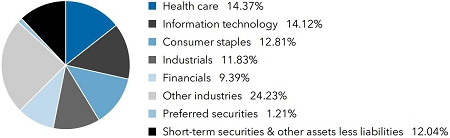

| Industry sector diversification | Percent of net assets |

| Country diversification by domicile | Percent of net assets | |||

| Eurozone* | 25.51 | % | ||

| Japan | 19.52 | |||

| United Kingdom | 10.23 | |||

| Switzerland | 7.37 | |||

| Denmark | 7.14 | |||

| Hong Kong | 5.59 | |||

| Taiwan | 3.25 | |||

| China | 3.16 | |||

| Canada | 1.65 | |||

| Other countries | 4.54 | |||

| Short-term securities & other assets less liabilities | 12.04 | |||

| * | Countries using the euro as a common currency; those represented in the fund’s portfolio are Belgium, Finland, France, Germany, Ireland, Italy, the Netherlands and Spain. |

| Common stocks 86.75% | Shares | Value (000) | ||||||

| Health care 14.37% | ||||||||

| Novo Nordisk A/S, Class B1 | 355,648 | $ | 22,744 | |||||

| AstraZeneca PLC1 | 218,150 | 21,958 | ||||||

| Genmab A/S1,2 | 42,377 | 14,133 | ||||||

| BeiGene, Ltd. (ADR)2 | 37,100 | 11,001 | ||||||

| Shionogi & Co., Ltd.1 | 197,100 | 9,305 | ||||||

| Straumann Holding AG1 | 7,729 | 8,061 | ||||||

| Galapagos NV1,2 | 63,112 | 7,456 | ||||||

| Terumo Corp.1 | 198,000 | 7,296 | ||||||

| HOYA Corp.1 | 57,500 | 6,510 | ||||||

| Hutchison China MediTech Ltd. (ADR)2 | 180,700 | 5,320 | ||||||

| Koninklijke Philips NV (EUR denominated)1,2 | 114,322 | 5,311 | ||||||

| Daiichi Sankyo Company, Ltd.1 | 169,200 | 4,456 | ||||||

| Sonova Holding AG1,2 | 14,243 | 3,372 | ||||||

| Novartis AG1 | 42,635 | 3,328 | ||||||

| Roche Holding AG, nonvoting, non-registered shares1 | 7,598 | 2,439 | ||||||

| Asahi Intecc Co., Ltd.1 | 38,600 | 1,198 | ||||||

| 133,888 | ||||||||

| Information technology 14.12% | ||||||||

| Taiwan Semiconductor Manufacturing Company, Ltd. (ADR) | 361,200 | 30,294 | ||||||

| Keyence Corp.1 | 64,220 | 29,122 | ||||||

| ASML Holding NV1 | 56,961 | 20,709 | ||||||

| Hamamatsu Photonics KK1 | 368,100 | 18,369 | ||||||

| SAP SE1 | 148,399 | 15,815 | ||||||

| OBIC Co., Ltd.1 | 49,600 | 8,808 | ||||||

| Murata Manufacturing Co., Ltd.1 | 62,200 | 4,314 | ||||||

| STMicroelectronics NV1 | 78,471 | 2,397 | ||||||

| Atlassian Corp. PLC, Class A2 | 9,108 | 1,745 | ||||||

| 131,573 | ||||||||

| 4 | American Funds International Vantage Fund |

| Common stocks (continued) | Shares | Value (000) | ||||||

| Consumer staples 12.81% | ||||||||

| Nestlé SA1 | 165,494 | $ | 18,594 | |||||

| Carlsberg A/S, Class B1 | 137,360 | 17,396 | ||||||

| L’Oréal SA, non-registered shares1 | 45,448 | 14,719 | ||||||

| Uni-Charm Corp.1 | 303,300 | 14,082 | ||||||

| Reckitt Benckiser Group PLC1 | 155,500 | 13,702 | ||||||

| British American Tobacco PLC1 | 372,000 | 11,819 | ||||||

| Pernod Ricard SA1 | 49,184 | 7,937 | ||||||

| Anheuser-Busch InBev SA/NV1 | 143,966 | 7,476 | ||||||

| Diageo PLC1 | 214,245 | 6,930 | ||||||

| Unilever PLC1 | 55,100 | 3,142 | ||||||

| Associated British Foods PLC1 | 102,000 | 2,244 | ||||||

| Shiseido Company, Ltd.1 | 21,200 | 1,312 | ||||||

| 119,353 | ||||||||

| Industrials 11.83% | ||||||||

| Safran SA1,2 | 158,308 | 16,823 | ||||||

| SMC Corp.1 | 26,500 | 13,992 | ||||||

| ABB Ltd1 | 464,163 | 11,255 | ||||||

| DSV Panalpina A/S1 | 58,585 | 9,493 | ||||||

| RELX PLC1 | 464,000 | 9,184 | ||||||

| Airbus SE, non-registered shares1,2 | 116,889 | 8,586 | ||||||

| Nidec Corp.1 | 82,300 | 8,273 | ||||||

| Canadian National Railway Company | 43,900 | 4,366 | ||||||

| Canadian National Railway Company (CAD denominated) | 21,900 | 2,175 | ||||||

| DKSH Holding AG1 | 80,890 | 5,200 | ||||||

| TFI International Inc. (CAD denominated) | 103,374 | 4,603 | ||||||

| Jardine Matheson Holdings Ltd.1 | 102,100 | 4,542 | ||||||

| MTU Aero Engines AG1 | 24,209 | 4,134 | ||||||

| Recruit Holdings Co., Ltd.1 | 76,200 | 2,911 | ||||||

| ASSA ABLOY AB, Class B1 | 119,210 | 2,560 | ||||||

| Daikin Industries, Ltd.1 | 11,200 | 2,097 | ||||||

| 110,194 | ||||||||

| Financials 9.39% | ||||||||

| London Stock Exchange Group PLC1 | 217,400 | 23,323 | ||||||

| AIA Group Ltd.1 | 2,361,700 | 22,274 | ||||||

| Hong Kong Exchanges and Clearing Ltd.1 | 217,300 | 10,423 | ||||||

| Euronext NV1 | 51,675 | 5,392 | ||||||

| HDFC Bank Ltd. (ADR)2 | 81,300 | 4,670 | ||||||

| DNB ASA1,2 | 314,862 | 4,254 | ||||||

| Banco Bilbao Vizcaya Argentaria, SA1 | 1,369,970 | 3,944 | ||||||

| Deutsche Boerse AG1 | 26,333 | 3,876 | ||||||

| Aon PLC, Class A | 20,100 | 3,698 | ||||||

| Svenska Handelsbanken AB, Class A1,2 | 389,572 | 3,159 | ||||||

| Partners Group Holding AG1 | 2,627 | 2,365 | ||||||

| Sampo Oyj, Class A1 | 2,990 | 113 | ||||||

| 87,491 | ||||||||

| Consumer discretionary 8.22% | ||||||||

| Kering SA1 | 29,722 | 17,982 | ||||||

| LVMH Moët Hennessy-Louis Vuitton SE1 | 24,668 | 11,581 | ||||||

| EssilorLuxottica1,2 | 91,825 | 11,376 | ||||||

| MercadoLibre, Inc.2 | 8,000 | 9,712 | ||||||

| Hermès International1 | 9,549 | 8,899 | ||||||

| Nitori Holdings Co., Ltd.1 | 23,500 | 4,850 | ||||||

| Suzuki Motor Corp.1 | 107,400 | 4,625 | ||||||

| Flutter Entertainment PLC (EUR denominated)1 | 14,577 | 2,540 | ||||||

| Cie. Financière Richemont SA, Class A1 | 29,708 | 1,861 | ||||||

| adidas AG1,2 | 5,907 | 1,755 | ||||||

| Prosus NV (ADR) | 73,050 | 1,462 | ||||||

| 76,643 | ||||||||

| American Funds International Vantage Fund | 5 |

| Common stocks (continued) | Shares | Value (000) | ||||||

| Communication services 6.09% | ||||||||

| Tencent Holdings Ltd.1 | 229,500 | $ | 17,604 | |||||

| SoftBank Group Corp.1 | 180,900 | 11,888 | ||||||

| Adevinta ASA1,2 | 457,044 | 7,070 | ||||||

| China Tower Corp. Ltd., Class H1 | 41,588,000 | 6,494 | ||||||

| Nippon Telegraph and Telephone Corp.1 | 263,000 | 5,553 | ||||||

| Koninklijke KPN NV1 | 1,308,074 | 3,536 | ||||||

| América Móvil, SAB de CV, Series L (ADR) | 219,100 | 2,612 | ||||||

| Nordic Entertainment Group AB, Class B1,2 | 54,970 | 1,964 | ||||||

| 56,721 | ||||||||

| Materials 4.63% | ||||||||

| Givaudan SA1 | 2,991 | 12,174 | ||||||

| Shin-Etsu Chemical Co., Ltd.1 | 80,200 | 10,732 | ||||||

| Kansai Paint Co., Ltd.1 | 259,520 | 6,716 | ||||||

| Asahi Kasei Corp.1 | 628,500 | 5,458 | ||||||

| Air Liquide SA, non-registered shares1 | 34,928 | 5,112 | ||||||

| Rio Tinto PLC1 | 52,490 | 2,975 | ||||||

| 43,167 | ||||||||

| Utilities 4.05% | ||||||||

| Enel SpA1 | 2,293,198 | 18,264 | ||||||

| Iberdrola, SA, non-registered shares1 | 1,016,347 | 11,989 | ||||||

| Engie SA1,2 | 386,641 | 4,687 | ||||||

| Ørsted AS1 | 17,663 | 2,806 | ||||||

| 37,746 | ||||||||

| Energy 0.83% | ||||||||

| Enbridge Inc. (CAD denominated) | 153,000 | 4,216 | ||||||

| Total SE1 | 116,168 | 3,518 | ||||||

| 7,734 | ||||||||

| Real estate 0.41% | ||||||||

| Link Real Estate Investment Trust REIT1 | 499,700 | 3,816 | ||||||

| Total common stocks (cost: $496,912,000) | 808,326 | |||||||

| Preferred securities 1.21% | ||||||||

| Health care 1.11% | ||||||||

| Sartorius AG, nonvoting preferred, non-registered shares1 | 16,786 | 7,100 | ||||||

| Grifols, SA, Class B, nonvoting preferred, non-registered shares1 | 190,956 | 3,231 | ||||||

| 10,331 | ||||||||

| Information technology 0.10% | ||||||||

| Samsung Electronics Co., Ltd., preferred shares (GDR)1 | 802 | 902 | ||||||

| Total preferred securities (cost: $6,264,000) | 11,233 | |||||||

| Short-term securities 11.14% | ||||||||

| Money market investments 11.14% | ||||||||

| Capital Group Central Cash Fund 0.11%3,4 | 1,037,850 | 103,795 | ||||||

| Total short-term securities (cost: $103,783,000) | 103,795 | |||||||

| Total investment securities 99.10% (cost: $606,959,000) | 923,354 | |||||||

| Other assets less liabilities 0.90% | 8,415 | |||||||

| Net assets 100.00% | $ | 931,769 | ||||||

| 6 | American Funds International Vantage Fund |

Investments in affiliates4

| Value of | Net | Net | Value of | |||||||||||||||||||||||||

| affiliates at | realized | unrealized | affiliates at | Dividend | ||||||||||||||||||||||||

| 11/1/2019 | Additions | Reductions | loss | appreciation | 10/31/2020 | income | ||||||||||||||||||||||

| (000) | (000) | (000) | (000) | (000) | (000) | (000) | ||||||||||||||||||||||

| Short-term securities 11.14% | ||||||||||||||||||||||||||||

| Money market investments 11.14% | ||||||||||||||||||||||||||||

| Capital Group Central Cash Fund 0.11%3 | $ | 45,294 | $ | 461,285 | $ | 402,774 | $ | (17 | ) | $ | 7 | $ | 103,795 | $ | 593 | |||||||||||||

| 1 | Valued under fair value procedures adopted by authority of the board of trustees. The total value of all such securities was $733,685,000, which represented 78.74% of the net assets of the fund. This entire amount relates to certain securities trading outside the U.S. whose values were adjusted as a result of significant market movements following the close of local trading. |

| 2 | Security did not produce income during the last 12 months. |

| 3 | Rate represents the seven-day yield at 10/31/2020. |

| 4 | Part of the same group of investment companies as the fund as defined under the Investment Company Act of 1940. |

Key to abbreviations

ADR = American Depositary Receipts

CAD = Canadian dollars

EUR = Euros

GDR = Global Depositary Receipts

See notes to financial statements.

| American Funds International Vantage Fund | 7 |

Financial statements

| Statement of assets and liabilities | ||||||||

| at October 31, 2020 | (dollars in thousands) | |||||||

| Assets: | ||||||||

| Investment securities, at value: | ||||||||

| Unaffiliated issuers (cost: $503,176) | $ | 819,559 | ||||||

| Affiliated issuers (cost: $103,783) | 103,795 | $ | 923,354 | |||||

| Cash | 39 | |||||||

| Receivables for: | ||||||||

| Sales of fund’s shares | 8,534 | |||||||

| Dividends | 2,686 | |||||||

| Other | 70 | 11,290 | ||||||

| 934,683 | ||||||||

| Liabilities: | ||||||||

| Payables for: | ||||||||

| Purchases of investments | 1,242 | |||||||

| Repurchases of fund’s shares | 1,009 | |||||||

| Investment advisory services | 495 | |||||||

| Services provided by related parties | 44 | |||||||

| Trustees’ deferred compensation | 17 | |||||||

| Other | 107 | 2,914 | ||||||

| Net assets at October 31, 2020 | $ | 931,769 | ||||||

| Net assets consist of: | ||||||||

| Capital paid in on shares of beneficial interest | $ | 586,691 | ||||||

| Total distributable earnings | 345,078 | |||||||

| Net assets at October 31, 2020 | $ | 931,769 | ||||||

(dollars and shares in thousands, except per-share amounts)

Shares of beneficial interest issued and outstanding (no stated par value) —

unlimited shares authorized (64,151 total shares outstanding)

| Net assets | Shares outstanding | Net asset value per share | ||||||||||

| Class A | $ | 21,298 | 1,472 | $ | 14.47 | |||||||

| Class C | 941 | 65 | 14.39 | |||||||||

| Class T | 10 | 1 | 14.47 | |||||||||

| Class F-1 | 1,163 | 80 | 14.48 | |||||||||

| Class F-2 | 178,508 | 12,301 | 14.51 | |||||||||

| Class F-3 | 667,016 | 45,904 | 14.53 | |||||||||

| Class 529-A | 1,506 | 104 | 14.46 | |||||||||

| Class 529-C | 52 | 4 | 14.37 | |||||||||

| Class 529-E | 20 | 1 | 14.47 | |||||||||

| Class 529-T | 10 | 1 | 14.48 | |||||||||

| Class 529-F-1 | 11 | 1 | 14.50 | |||||||||

| Class 529-F-2 | 303 | 21 | 14.47 | |||||||||

| Class 529-F-3 | 10 | 1 | 14.47 | |||||||||

| Class R-1 | 10 | 1 | 14.52 | |||||||||

| Class R-2 | 12 | 1 | 14.50 | |||||||||

| Class R-2E | 99 | 7 | 14.49 | |||||||||

| Class R-3 | 32 | 2 | 14.51 | |||||||||

| Class R-4 | 189 | 13 | 14.50 | |||||||||

| Class R-5E | 34 | 2 | 14.52 | |||||||||

| Class R-5 | 20 | 1 | 14.52 | |||||||||

| Class R-6 | 60,525 | 4,168 | 14.52 | |||||||||

See notes to financial statements.

| 8 | American Funds International Vantage Fund |

Financial statements (continued)

| Statement of operations for the year ended October 31, 2020 | (dollars in thousands) | |||||||

| Investment income: | ||||||||

| Income: | ||||||||

| Dividends (net of non-U.S. taxes of $1,194; also includes $593 from affiliates) | $ | 13,850 | ||||||

| Interest | 19 | $ | 13,869 | |||||

| Fees and expenses: | ||||||||

| Investment advisory services | 5,418 | |||||||

| Distribution services | 36 | |||||||

| Transfer agent services | 147 | |||||||

| Administrative services | 270 | |||||||

| Reports to shareholders | 22 | |||||||

| Registration statement and prospectus | 376 | |||||||

| Trustees’ compensation | 69 | |||||||

| Auditing and legal | 75 | |||||||

| Custodian | 88 | |||||||

| Other | 3 | |||||||

| Total fees and expenses before reimbursements | 6,504 | |||||||

| Less reimbursements of fees and expenses: | ||||||||

| Miscellaneous fee reimbursement | 495 | |||||||

| Transfer agent services fee reimbursements | — | † | ||||||

| Total fees and expenses after reimbursements | 6,009 | |||||||

| Net investment income | 7,860 | |||||||

| Net realized gain and unrealized appreciation: | ||||||||

| Net realized gain (loss) on: | ||||||||

| Investments: | ||||||||

| Unaffiliated issuers | 34,230 | |||||||

| Affiliated issuers | (17 | ) | ||||||

| Currency transactions | (220 | ) | 33,993 | |||||

| Net unrealized appreciation on: | ||||||||

| Investments: | ||||||||

| Unaffiliated issuers | 6,368 | |||||||

| Affiliated issuers | 7 | |||||||

| Currency translations | 90 | 6,465 | ||||||

| Net realized gain and unrealized appreciation | 40,458 | |||||||

| Net increase in net assets resulting from operations | $ | 48,318 | ||||||

| * | Additional information related to class-specific fees and expenses is included in the notes to financial statements. |

| † | Amount less than one thousand. |

See notes to financial statements.

| American Funds International Vantage Fund | 9 |

Financial statements (continued)

Statements of changes in net assets

(dollars in thousands)

| Year ended October 31, | ||||||||

| 2020 | 2019 | |||||||

| Operations: | ||||||||

| Net investment income | $ | 7,860 | $ | 14,417 | ||||

| Net realized gain | 33,993 | 55,743 | ||||||

| Net unrealized appreciation | 6,465 | 99,653 | ||||||

| Net increase in net assets resulting from operations | 48,318 | 169,813 | ||||||

| Distributions paid to shareholders | (51,765 | ) | (30,004 | ) | ||||

| Net capital share transactions | 16,843 | (383,614 | ) | |||||

| Total increase (decrease) in net assets | 13,396 | (243,805 | ) | |||||

| Net assets: | ||||||||

| Beginning of year | 918,373 | 1,162,178 | ||||||

| End of year | $ | 931,769 | $ | 918,373 | ||||

See notes to financial statements.

| 10 | American Funds International Vantage Fund |

Notes to financial statements

1. Organization

American Funds International Vantage Fund (the “fund”) is registered under the Investment Company Act of 1940 as an open-end, diversified management investment company. On September 16, 2019, the fund’s board approved the reorganization of Capital Group International Equity Fund (the “predecessor fund”) into American Funds International Vantage Fund, a new Delaware statutory trust. On November 8, 2019, the fund acquired the assets and assumed the liabilities of the predecessor fund through which the legacy share class (“Class M”) of the predecessor fund was closed and all existing shares were converted to Class F-3 shares. The fund’s fiscal year ends on October 31. The fund seeks to provide prudent growth of capital and conservation of principal.

The fund has 21 share classes consisting of six retail share classes (Classes A, C, T, F-1, F-2 and F-3), seven 529 college savings plan share classes (Classes 529-A, 529-C, 529-E, 529-T, 529-F-1, 529-F-2 and 529-F-3) and eight retirement plan share classes (Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6). The 529 college savings plan share classes can be used to save for college education. The retirement plan share classes are generally offered only through eligible employer-sponsored retirement plans. The fund’s share classes are described further in the following table:

| Share class | Initial sales charge | Contingent deferred sales charge upon redemption | Conversion feature | ||||

| Classes A and 529-A | Up to 5.75%1 | None (except 1% for certain redemptions within 18 months of purchase without an initial sales charge) | None | ||||

| Classes C and 529-C | None | 1% for redemptions within one year of purchase | Class C converts to Class F-1 and Class 529-C converts to Class 529-A after 10 years2 | ||||

| Class 529-E | None | None | None | ||||

| Classes T and 529-T3 | Up to 2.50% | None | None | ||||

| Classes F-1, F-2, F-3, 529-F-1, 529-F-2 and 529-F-3 | None | None | None | ||||

| Classes R-1, R-2, R-2E, R-3, R-4, R-5E, R-5 and R-6 | None | None | None |

| 1 | Up to 3.50% for Class 529-A shares purchased on or after June 30, 2020. |

| 2 | Effective June 30, 2020, Class C converts to Class A after eight years and Class 529-C converts to Class 529-A after five years. |

| 3 | Class T and 529-T shares are not available for purchase. |

Holders of all share classes have equal pro rata rights to the assets, dividends and liquidation proceeds of the fund. Each share class has identical voting rights, except for the exclusive right to vote on matters affecting only its class. Share classes have different fees and expenses (“class-specific fees and expenses”), primarily due to different arrangements for distribution, transfer agent and administrative services. Differences in class-specific fees and expenses will result in differences in net investment income and, therefore, the payment of different per-share dividends by each share class.

2. Significant accounting policies

The fund is an investment company that applies the accounting and reporting guidance issued in Topic 946 by the U.S. Financial Accounting Standards Board. The fund’s financial statements have been prepared to comply with U.S. generally accepted accounting principles (“U.S. GAAP”). These principles require the fund’s investment adviser to make estimates and assumptions that affect reported amounts and disclosures. Actual results could differ from those estimates. Subsequent events, if any, have been evaluated through the date of issuance in the preparation of the financial statements. The fund follows the significant accounting policies described in this section, as well as the valuation policies described in the next section on valuation.

Security transactions and related investment income — Security transactions are recorded by the fund as of the date the trades are executed with brokers. Realized gains and losses from security transactions are determined based on the specific identified cost of the securities. In the event a security is purchased with a delayed payment date, the fund will segregate liquid assets sufficient to meet its payment obligations. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis. Market discounts, premiums and original issue discounts on fixed-income securities are amortized daily over the expected life of the security.

| American Funds International Vantage Fund | 11 |

Class allocations — Income, fees and expenses (other than class-specific fees and expenses), realized gains and losses and unrealized appreciation and depreciation are allocated daily among the various share classes based on their relative net assets. Class-specific fees and expenses, such as distribution, transfer agent and administrative services, are charged directly to the respective share class.

Distributions paid to shareholders — Income dividends and capital gain distributions are recorded on the ex-dividend date.

Currency translation — Assets and liabilities, including investment securities, denominated in currencies other than U.S. dollars are translated into U.S. dollars at the exchange rates supplied by one or more pricing vendors on the valuation date. Purchases and sales of investment securities and income and expenses are translated into U.S. dollars at the exchange rates on the dates of such transactions. The effects of changes in exchange rates on investment securities are included with the net realized gain or loss and net unrealized appreciation or depreciation on investments in the fund’s statement of operations. The realized gain or loss and unrealized appreciation or depreciation resulting from all other transactions denominated in currencies other than U.S. dollars are disclosed separately.

3. Valuation

Capital Research and Management Company (“CRMC”), the fund’s investment adviser, values the fund’s investments at fair value as defined by U.S. GAAP. The net asset value per share is calculated once daily as of the close of regular trading on the New York Stock Exchange, normally 4 p.m. New York time, each day the New York Stock Exchange is open.

Methods and inputs — The fund’s investment adviser uses the following methods and inputs to establish the fair value of the fund’s assets and liabilities. Use of particular methods and inputs may vary over time based on availability and relevance as market and economic conditions evolve.

Equity securities are generally valued at the official closing price of, or the last reported sale price on, the exchange or market on which such securities are traded, as of the close of business on the day the securities are being valued or, lacking any sales, at the last available bid price. Prices for each security are taken from the principal exchange or market on which the security trades.

Fixed-income securities, including short-term securities, are generally valued at prices obtained from one or more pricing vendors. Vendors value such securities based on one or more of the inputs described in the following table. The table provides examples of inputs that are commonly relevant for valuing particular classes of fixed-income securities in which the fund is authorized to invest. However, these classifications are not exclusive, and any of the inputs may be used to value any other class of fixed-income security.

| Fixed-income class | Examples of standard inputs | |

| All | Benchmark yields, transactions, bids, offers, quotations from dealers and trading systems, new issues, spreads and other relationships observed in the markets among comparable securities; and proprietary pricing models such as yield measures calculated using factors such as cash flows, financial or collateral performance and other reference data (collectively referred to as “standard inputs”) | |

| Corporate bonds, notes & loans; convertible securities | Standard inputs and underlying equity of the issuer | |

| Bonds & notes of governments & government agencies | Standard inputs and interest rate volatilities |

When the fund’s investment adviser deems it appropriate to do so (such as when vendor prices are unavailable or deemed to be not representative), fixed-income securities will be valued in good faith at the mean quoted bid and ask prices that are reasonably and timely available (or bid prices, if ask prices are not available) or at prices for securities of comparable maturity, quality and type.

Securities with both fixed-income and equity characteristics, or equity securities traded principally among fixed-income dealers, are generally valued in the manner described for either equity or fixed-income securities, depending on which method is deemed most appropriate by the fund’s investment adviser. The Capital Group Central Cash Fund (“CCF”), a fund within the Capital Group Central Fund Series (“Central Funds”), is valued based upon a floating net asset value, which fluctuates with changes in the value of CCF’s portfolio securities. The underlying securities are valued based on the policies and procedures in CCF’s statement of additional information.

Securities and other assets for which representative market quotations are not readily available or are considered unreliable by the fund’s investment adviser are fair valued as determined in good faith under fair valuation guidelines adopted by authority of the fund’s board of trustees as further described. The investment adviser follows fair valuation guidelines, consistent with U.S. Securities and Exchange Commission rules and guidance, to consider relevant principles and factors when making fair value determinations. The investment adviser considers relevant indications of value that are reasonably and timely available to it in determining the fair value to be assigned to

| 12 | American Funds International Vantage Fund |

a particular security, such as the type and cost of the security; contractual or legal restrictions on resale of the security; relevant financial or business developments of the issuer; actively traded similar or related securities; conversion or exchange rights on the security; related corporate actions; significant events occurring after the close of trading in the security; and changes in overall market conditions. In addition, the closing prices of equity securities that trade in markets outside U.S. time zones may be adjusted to reflect significant events that occur after the close of local trading but before the net asset value of each share class of the fund is determined. Fair valuations and valuations of investments that are not actively trading involve judgment and may differ materially from valuations that would have been used had greater market activity occurred.

Processes and structure — The fund’s board of trustees has delegated authority to the fund’s investment adviser to make fair value determinations, subject to board oversight. The investment adviser has established a Joint Fair Valuation Committee (the “Fair Valuation Committee”) to administer, implement and oversee the fair valuation process, and to make fair value decisions. The Fair Valuation Committee regularly reviews its own fair value decisions, as well as decisions made under its standing instructions to the investment adviser’s valuation teams. The Fair Valuation Committee reviews changes in fair value measurements from period to period and may, as deemed appropriate, update the fair valuation guidelines to better reflect the results of back testing and address new or evolving issues. The Fair Valuation Committee reports any changes to the fair valuation guidelines to the board of trustees. The fund’s board and audit committee also regularly review reports that describe fair value determinations and methods.

The fund’s investment adviser has also established a Fixed-Income Pricing Review Group to administer and oversee the fixed-income valuation process, including the use of fixed-income pricing vendors. This group regularly reviews pricing vendor information and market data. Pricing decisions, processes and controls over security valuation are also subject to additional internal reviews, including an annual control self-evaluation program facilitated by the investment adviser’s compliance group.

Classifications — The fund’s investment adviser classifies the fund’s assets and liabilities into three levels based on the inputs used to value the assets or liabilities. Level 1 values are based on quoted prices in active markets for identical securities. Level 2 values are based on significant observable market inputs, such as quoted prices for similar securities and quoted prices in inactive markets. Certain securities trading outside the U.S. may transfer between Level 1 and Level 2 due to valuation adjustments resulting from significant market movements following the close of local trading. Level 3 values are based on significant unobservable inputs that reflect the investment adviser’s determination of assumptions that market participants might reasonably use in valuing the securities. The valuation levels are not necessarily an indication of the risk or liquidity associated with the underlying investment. For example, U.S. government securities are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market. The following table presents the fund’s valuation levels as of October 31, 2020 (dollars in thousands):

| Investment securities | ||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets: | ||||||||||||||||

| Common stocks: | ||||||||||||||||

| Health care | $ | 16,321 | $ | 117,567 | $ | — | $ | 133,888 | ||||||||

| Information technology | 32,039 | 99,534 | — | 131,573 | ||||||||||||

| Consumer staples | — | 119,353 | — | 119,353 | ||||||||||||

| Industrials | 11,144 | 99,050 | — | 110,194 | ||||||||||||

| Financials | 8,368 | 79,123 | — | 87,491 | ||||||||||||

| Consumer discretionary | 11,174 | 65,469 | — | 76,643 | ||||||||||||

| Communication services | 2,612 | 54,109 | — | 56,721 | ||||||||||||

| Materials | — | 43,167 | — | 43,167 | ||||||||||||

| Utilities | — | 37,746 | — | 37,746 | ||||||||||||

| Energy | 4,216 | 3,518 | — | 7,734 | ||||||||||||

| Real estate | — | 3,816 | — | 3,816 | ||||||||||||

| Preferred securities | — | 11,233 | — | 11,233 | ||||||||||||

| Short-term securities | 103,795 | — | — | 103,795 | ||||||||||||

| Total | $ | 189,669 | $ | 733,685 | $ | — | $ | 923,354 | ||||||||

4. Risk factors

Investing in the fund may involve certain risks including, but not limited to, those described below.

Market conditions — The prices of, and the income generated by, the securities held by the fund may decline — sometimes rapidly or unpredictably — due to various factors, including events or conditions affecting the general economy or particular industries; overall market changes; local, regional or global political, social or economic instability; governmental, governmental agency or central bank responses to economic conditions; and currency exchange rate, interest rate and commodity price fluctuations.

| American Funds International Vantage Fund | 13 |

Economies and financial markets throughout the world are highly interconnected. Economic, financial or political events, trading and tariff arrangements, wars, terrorism, cybersecurity events, natural disasters, public health emergencies (such as the spread of infectious disease) and other circumstances in one country or region, including actions taken by governmental or quasi-governmental authorities in response to any of the foregoing, could have impacts on global economies or markets. As a result, whether or not the fund invests in securities of issuers located in or with significant exposure to the countries affected, the value and liquidity of the fund’s investments may be negatively affected by developments in other countries and regions.

Issuer risks — The prices of, and the income generated by, securities held by the fund may decline in response to various factors directly related to the issuers of such securities, including reduced demand for an issuer’s goods or services, poor management performance, major litigation, investigations or other controversies related to the issuer, changes in government regulations affecting the issuer or its competitive environment and strategic initiatives such as mergers, acquisitions or dispositions and the market response to any such initiatives.

Investing in growth-oriented stocks — Growth-oriented common stocks and other equity-type securities (such as preferred stocks, convertible preferred stocks and convertible bonds) may involve larger price swings and greater potential for loss than other types of investments.

Investing outside the U.S. — Securities of issuers domiciled outside the U.S., or with significant operations or revenues outside the U.S., may lose value because of adverse political, social, economic or market developments (including social instability, regional conflicts, terrorism and war) in the countries or regions in which the issuers operate or generate revenue. These securities may also lose value due to changes in foreign currency exchange rates against the U.S. dollar and/or currencies of other countries. Issuers of these securities may be more susceptible to actions of foreign governments, such as nationalization, currency blockage or the imposition of price controls or punitive taxes, each of which could adversely impact the value of these securities. Securities markets in certain countries may be more volatile and/or less liquid than those in the U.S. Investments outside the U.S. may also be subject to different accounting practices and different regulatory, legal and reporting standards and practices, and may be more difficult to value, than those in the U.S. In addition, the value of investments outside the U.S. may be reduced by foreign taxes, including foreign withholding taxes on interest and dividends. Further, there may be increased risks of delayed settlement of securities purchased or sold by the fund. The risks of investing outside the U.S. may be heightened in connection with investments in emerging markets.

Management — The investment adviser to the fund actively manages the fund’s investments. Consequently, the fund is subject to the risk that the methods and analyses, including models, tools and data, employed by the investment adviser in this process may be flawed or incorrect and may not produce the desired results. This could cause the fund to lose value or its investment results to lag relevant benchmarks or other funds with similar objectives.

5. Certain investment techniques

Securities lending — The fund has entered into securities lending transactions in which the fund earns income by lending investment securities to brokers, dealers or other institutions. Each transaction involves three parties: the fund, acting as the lender of the securities, a borrower, and a lending agent that acts as an intermediary.

Securities lending transactions are entered into by the fund under a securities lending agent agreement with the lending agent. The lending agent facilitates the exchange of securities between the fund and approved borrowers, ensures that securities loans are properly coordinated and documented, marks-to-market the value of collateral daily, secures additional collateral from a borrower if it falls below preset terms, and may reinvest cash collateral on behalf of the fund according to agreed parameters. The lending agent provides indemnification to the fund against losses resulting from a borrower default. Although risk is mitigated by the collateral and indemnification, the fund could experience a delay in recovering its securities and a potential loss of income or value if a borrower fails to return securities, collateral investments decline in value or the lending agent fails to perform.

The borrower is required to post highly liquid assets, such as cash or U.S. government securities, as collateral for the loan in an amount at least equal to the value of the securities loaned. Investments made with cash collateral are recognized as assets in the fund’s investment portfolio. The same amount is recorded as a liability in the fund’s statement of assets and liabilities. While securities are on loan, the fund will continue to receive the equivalent of the interest, dividends or other distributions paid by the issuer, as well as a portion of the interest on the investment of the collateral. Additionally, although the fund does not have the right to vote on securities while they are on loan, the fund has a right to consent on corporate actions and a right to recall loaned securities to vote. A borrower is obligated to return loaned securities at the conclusion of a loan or, during the pendency of a loan, on demand from the fund.

As of October 31, 2020, the fund did not have any securities out on loan.

| 14 | American Funds International Vantage Fund |

6. Taxation and distributions

Federal income taxation — The fund complies with the requirements under Subchapter M of the Internal Revenue Code applicable to mutual funds and intends to distribute substantially all of its net taxable income and net capital gains each year. The fund is not subject to income taxes to the extent such distributions are made. Therefore, no federal income tax provision is required.

As of and during the year ended October 31, 2020, the fund did not have a liability for any unrecognized tax benefits. The fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the fund did not incur any significant interest or penalties.

The fund’s tax returns are not subject to examination by federal, state and, if applicable, non-U.S. tax authorities after the expiration of each jurisdiction’s statute of limitations, which is generally three years after the date of filing but can be extended in certain jurisdictions.

Non-U.S. taxation — Dividend and interest income are recorded net of non-U.S. taxes paid. The fund may file withholding tax reclaims in certain jurisdictions to recover a portion of amounts previously withheld. As a result of rulings from European courts, the fund filed for additional reclaims related to prior years. These reclaims are recorded when the amount is known and there are no significant uncertainties on collectability. During the year ended October 31, 2020, the fund recognized $431,000 in reclaims related to European court rulings, net of fees, which is included in dividend income in the fund’s statement of operations. Gains realized by the fund on the sale of securities in certain countries, if any, may be subject to non-U.S. taxes. If applicable, the fund records an estimated deferred tax liability based on unrealized gains to provide for potential non-U.S. taxes payable upon the sale of these securities.

Distributions — Distributions paid to shareholders are based on net investment income and net realized gains determined on a tax basis, which may differ from net investment income and net realized gains for financial reporting purposes. These differences are due primarily to different treatment for items such as currency gains and losses; short-term capital gains and losses; cost of investments sold and income on certain investments. The fiscal year in which amounts are distributed may differ from the year in which the net investment income and net realized gains are recorded by the fund for financial reporting purposes. The fund may also designate a portion of the amount paid to redeeming shareholders as a distribution for tax purposes.

During the year ended October 31, 2020, the fund reclassified $10,951,000 from total distributable earnings to capital paid in on shares of beneficial interest to align financial reporting with tax reporting.

As of October 31, 2020, the tax basis components of distributable earnings, unrealized appreciation (depreciation) and cost of investments were as follows (dollars in thousands):

| Undistributed ordinary income | $ | 6,665 | ||

| Undistributed long-term capital gains | 22,539 | |||

| Gross unrealized appreciation on investments | 325,990 | |||

| Gross unrealized depreciation on investments | (10,168 | ) | ||

| Net unrealized appreciation on investments | 315,822 | |||

| Cost of investments | 607,532 |

| American Funds International Vantage Fund | 15 |

Distributions paid were characterized for tax purposes as follows (dollars in thousands):

| Year ended October 31, 2020 | Year ended October 31, 2019 | |||||||||||||||||||||||

| Share class | Ordinary income | Long-term capital gains | Total distributions paid | Ordinary income | Long-term capital gains | Total distributions paid | ||||||||||||||||||

| Class A1 | $ | — | 2 | $ | 1 | $ | 1 | |||||||||||||||||

| Class C1 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class M3 | $ | 30,004 | $ | — | $ | 30,004 | ||||||||||||||||||

| Class T1 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class F-11 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class F-21 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class F-33 | 15,482 | 36,273 | 51,755 | |||||||||||||||||||||

| Class 529-A1 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class 529-C1 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class 529-E1 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class 529-T1 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class 529-F-11 | — | 2 | 1 | 1 | ||||||||||||||||||||

| Class 529-F-24 | — | — | — | |||||||||||||||||||||

| Class 529-F-34 | — | — | — | |||||||||||||||||||||

| Class R-11 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class R-21 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class R-2E1 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class R-31 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class R-41 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class R-5E1 | — | 2 | — | 2 | — | 2 | ||||||||||||||||||

| Class R-51 | 1 | — | 2 | 1 | ||||||||||||||||||||

| Class R-61 | 1 | —2 | 1 | |||||||||||||||||||||

| Total | $ | 15,484 | $ | 36,281 | $ | 51,765 | $ | 30,004 | $ | — | $ | 30,004 | ||||||||||||

| 1 | This share class began investment operations on November 8, 2019. |

| 2 | Amount less than one thousand. |

| 3 | Class M shares were converted to Class F-3 shares on November 8, 2019. |

| 4 | Class 529-F-2 and 529-F-3 shares began investment operations on October 30, 2020. |

7. Fees and transactions with related parties

CRMC, the fund’s investment adviser, is the parent company of American Funds Distributors®, Inc. (“AFD”), the principal underwriter of the fund’s shares, and American Funds Service Company® (“AFS”), the fund’s transfer agent. CRMC, AFD and AFS are considered related parties to the fund.

Investment advisory services — The fund has an investment advisory and service agreement with CRMC that provides for monthly fees accrued daily. These fees are based on a series of decreasing annual rates beginning with 0.603% on the first $1.5 billion of daily net assets and decreasing to 0.500% on such assets in excess of $1.5 billion. For the year ended October 31, 2020, the investment advisory services fee was $5,418,000, which was equivalent to an annualized rate of 0.605% of average daily net assets.

Class-specific fees and expenses — Expenses that are specific to individual share classes are accrued directly to the respective share class. The principal class-specific fees and expenses are further described below:

Distribution services — The fund has plans of distribution for all share classes, except Class F-2, F-3, 529-F-2, 529-F-3, R-5E, R-5 and R-6 shares. Under the plans, the board of trustees approves certain categories of expenses that are used to finance activities primarily intended to sell fund shares and service existing accounts. The plans provide for payments, based on an annualized percentage of average daily net assets, ranging from 0.25% to 1.00% as noted in this section. In some cases, the board of trustees has limited the amounts that may be paid to less than the maximum allowed by the plans. All share classes with a plan may use up to 0.25% of average daily net assets to pay service fees, or to compensate AFD for paying service fees, to firms that have entered into

| 16 | American Funds International Vantage Fund |

agreements with AFD to provide certain shareholder services. The remaining amounts available to be paid under each plan are paid to dealers to compensate them for their sales activities.

| Share class | Currently approved limits | Plan limits | ||||||

| Class A | 0.25% | 0.30% | ||||||

| Class 529-A | 0.25 | 0.50 | ||||||

| Classes C, 529-C and R-1 | 1.00 | 1.00 | ||||||

| Class R-2 | 0.75 | 1.00 | ||||||

| Class R-2E | 0.60 | 0.85 | ||||||

| Classes 529-E and R-3 | 0.50 | 0.75 | ||||||

| Classes T, F-1, 529-T, 529-F-1 and R-4 | 0.25 | 0.50 | ||||||

For Class A and 529-A shares, distribution-related expenses include the reimbursement of dealer and wholesaler commissions paid by AFD for certain shares sold without a sales charge. These share classes reimburse AFD for amounts billed within the prior 15 months but only to the extent that the overall annual expense limits are not exceeded. As of October 31, 2020, unreimbursed expenses subject to reimbursement totaled $21,000 for Class A shares. There were no unreimbursed expenses subject to reimbursement for Class 529-A shares.

Transfer agent services — The fund has a shareholder services agreement with AFS under which the fund compensates AFS for providing transfer agent services to each of the fund’s share classes. These services include recordkeeping, shareholder communications and transaction processing. In addition, the fund reimburses AFS for amounts paid to third parties for performing transfer agent services on behalf of fund shareholders. For the year ended October 31, 2020, AFS voluntarily waived transfer agent services fees of less than $1,000 for Class F-3 shares and CRMC reimbursed transfer agent services fees of less than $1,000 for various share classes. Neither AFS nor CRMC intends to recoup the waiver or reimbursement.

Administrative services — The fund has an administrative services agreement with CRMC under which the fund compensates CRMC for providing administrative services to all share classes. Administrative services are provided by CRMC and its affiliates to help assist third parties providing non-distribution services to fund shareholders. These services include providing in-depth information on the fund and market developments that impact fund investments. Administrative services also include, but are not limited to, coordinating, monitoring and overseeing third parties that provide services to fund shareholders. The agreement provides the fund the ability to charge an administrative services fee at the annual rate of 0.05% of the daily net assets attributable to each share class of the fund. Currently the fund pays CRMC an administrative services fee at the annual rate of 0.03% of average daily net assets attributable to each share class of the fund for CRMC’s provision of administrative services.

529 plan services — Each 529 share class is subject to service fees to compensate the Virginia College Savings Plan (“Virginia529”) for its oversight and administration of the CollegeAmerica 529 college savings plan. The fee is based on the combined net assets invested in Class 529 and ABLE shares of the American Funds. Class ABLE shares are offered on other American Funds by Virginia529 through ABLEAmerica®, a tax-advantaged savings program for individuals with disabilities. Prior to January 1, 2020, the quarterly fee was based on a series of decreasing annual rates beginning with 0.10% on the first $20 billion of the combined net assets invested in the American Funds and decreasing to 0.03% on such assets in excess of $100 billion. Effective January 1, 2020, the quarterly fee was amended to a series of decreasing annual rates beginning with 0.09% on the first $20 billion of the combined net assets invested in the American Funds and decreasing to 0.03% on such assets in excess of $100 billion. The fee for any given calendar quarter is accrued and calculated on the basis of the average net assets of Class 529 and ABLE shares of the American Funds for the last month of the prior calendar quarter. The fee is included in other expenses in the fund’s statement of operations. Virginia529 is not considered a related party to the fund.

| American Funds International Vantage Fund | 17 |

For the year ended October 31, 2020, class-specific expenses under the agreements were as follows (dollars in thousands):

| Share class | Distribution services | Transfer agent services | Administrative services | 529 plan services | |||||

| Class A1 | $29 | $ 12 | $ 3 | Not applicable | |||||

| Class C1 | 4 | — | 2 | — | 2 | Not applicable | |||

| Class T1 | — | — | 2 | — | 2 | Not applicable | |||

| Class F-11 | 1 | 1 | — | 2 | Not applicable | ||||

| Class F-21 | Not applicable | 58 | 22 | Not applicable | |||||

| Class F-33 | Not applicable | 75 | 231 | Not applicable | |||||

| Class 529-A1 | 2 | 1 | — | 2 | $1 | ||||

| Class 529-C1 | — | 2 | — | 2 | — | 2 | — | 2 | |

| Class 529-E1 | — | 2 | — | 2 | — | 2 | — | 2 | |

| Class 529-T1 | — | — | 2 | — | 2 | — | 2 | ||

| Class 529-F-11 | — | — | 2 | — | 2 | — | 2 | ||

| Class 529-F-2 | Not applicable | — | — | — | |||||

| Class 529-F-3 | Not applicable | — | — | — | |||||

| Class R-11 | — | 2 | — | 2 | — | 2 | Not applicable | ||

| Class R-21 | — | 2 | — | 2 | — | 2 | Not applicable | ||

| Class R-2E1 | — | 2 | — | 2 | — | 2 | Not applicable | ||

| Class R-31 | — | 2 | — | 2 | — | 2 | Not applicable | ||

| Class R-41 | — | 2 | — | 2 | — | 2 | Not applicable | ||

| Class R-5E1 | Not applicable | — | 2 | — | 2 | Not applicable | |||

| Class R-51 | Not applicable | — | 2 | — | 2 | Not applicable | |||

| Class R-61 | Not applicable | — | 2 | 14 | Not applicable | ||||

| Total class-specific expenses | $36 | $147 | $270 | $1 |

| 1 | This share class began investment operations on November 8, 2019. |

| 2 | Amount less than one thousand. |

| 3 | Class M shares were converted to Class F-3 shares on November 8, 2019. |

| 4 | Class 529-F-2 and 529-F-3 shares began investment operations on October 30, 2020. |

Miscellaneous fee reimbursements — Expense limitations have been imposed through at least January 1, 2024, to limit the Class F-3 total annual operating expense to 0.65% as a percentage of net assets. For the year ended October 31, 2020, CRMC reimbursed miscellaneous fees of $495,000 for Class F-3 shares, which CRMC does not intend to recoup. Fees and expenses in the statement of operations are presented gross of any reimbursements from CRMC.

Trustees’ deferred compensation — Trustees who are unaffiliated with CRMC may elect to defer the cash payment of part or all of their compensation. These deferred amounts, which remain as liabilities of the fund, are treated as if invested in shares of the fund or other American Funds. These amounts represent general, unsecured liabilities of the fund and vary according to the total returns of the selected funds. Trustees’ compensation of $69,000 in the fund’s statement of operations reflects $67,000 in current fees (either paid in cash or deferred) and a net increase of $2,000 in the value of the deferred amounts.

Affiliated officers and trustees — Officers and certain trustees of the fund are or may be considered to be affiliated with CRMC, AFD and AFS. No affiliated officers or trustees received any compensation directly from the fund.

Investment in CCF — The fund holds shares of CCF, an institutional prime money market fund managed by CRMC. CCF invests in high-quality, short-term money market instruments. CCF is used as the primary investment vehicle for the fund’s short-term investments. CCF shares are only available for purchase by CRMC, its affiliates, and other funds managed by CRMC or its affiliates, and are not available to the public. CRMC does not receive an investment advisory services fee from CCF.

Security transactions with related funds — The fund purchased securities from, and sold securities to, other funds managed by CRMC (or funds managed by certain affiliates of CRMC) under procedures adopted by the fund’s board of trustees. The funds involved in such transactions are considered related by virtue of having a common investment adviser (or affiliated investment advisers), common trustees and/or common officers. Each transaction was executed at the current market price of the security and no brokerage commissions or fees were paid in accordance with Rule 17a-7 of the 1940 Act. During the year ended October 31, 2020, the fund engaged in such purchase and sale transactions with related funds in the amounts of $126,000 and $5,064,000, respectively, which generated $281,000 of net realized gains from such sales.

Interfund lending — Pursuant to an exemptive order issued by the SEC, the fund, along with other CRMC-managed funds (or funds managed by certain affiliates of CRMC), may participate in an interfund lending program. The program provides an alternate credit facility that permits the funds to lend or borrow cash for temporary purposes directly to or from one another, subject to the conditions of the

| 18 | American Funds International Vantage Fund |

exemptive order. The fund did not lend or borrow cash through the interfund lending program at any time during the year ended October 31, 2020.

8. Capital share transactions

Capital share transactions in the fund were as follows (dollars and shares in thousands):

| Sales1 | Reinvestments of distributions | Repurchases1 | Net increase (decrease) | |||||||||||||||||||||||||||||

| Share class | Amount | Shares | Amount | Shares | Amount | Shares | Amount | Shares | ||||||||||||||||||||||||

| Year ended October 31, 2020 | ||||||||||||||||||||||||||||||||

| Class A2 | $ | 23,839 | 1,733 | $ | — | — | $ | (3,554 | ) | (261 | ) | $ | 20,285 | 1,472 | ||||||||||||||||||

| Class C2 | 1,043 | 74 | — | — | (124 | ) | (9 | ) | 919 | 65 | ||||||||||||||||||||||

| Class M3 | 13 | 1 | — | — | (927,806 | ) | (62,859 | ) | (927,793 | ) | (62,858 | ) | ||||||||||||||||||||

| Class T2 | 10 | 1 | — | — | — | — | 10 | 1 | ||||||||||||||||||||||||

| Class F-12 | 1,417 | 101 | — | — | (287 | ) | (21 | ) | 1,130 | 80 | ||||||||||||||||||||||

| Class F-22 | 175,444 | 13,020 | — | — | (10,234 | ) | (719 | ) | 165,210 | 12,301 | ||||||||||||||||||||||

| Class F-33 | 1,047,801 | 71,576 | 51,747 | 3,609 | (405,408 | ) | (29,281 | ) | 694,140 | 45,904 | ||||||||||||||||||||||

| Class 529-A2 | 1,582 | 113 | — | — | 4 | (131 | ) | (9 | ) | 1,451 | 104 | |||||||||||||||||||||

| Class 529-C2 | 119 | 9 | — | — | 4 | (78 | ) | (5 | ) | 41 | 4 | |||||||||||||||||||||

| Class 529-E2 | 20 | 1 | 1 | — | 4 | — | — | 21 | 1 | |||||||||||||||||||||||

| Class 529-T2 | 10 | 1 | 1 | — | 4 | — | — | 11 | 1 | |||||||||||||||||||||||

| Class 529-F-12 | 323 | 23 | 1 | — | 4 | (326 | ) | (22 | ) | (2 | ) | 1 | ||||||||||||||||||||

| Class 529-F-25 | 303 | 21 | — | — | — | — | 303 | 21 | ||||||||||||||||||||||||

| Class 529-F-35 | 10 | 1 | — | — | — | — | 10 | 1 | ||||||||||||||||||||||||

| Class R-12 | 10 | 1 | — | — | — | 4 | — | 4 | 10 | 1 | ||||||||||||||||||||||

| Class R-22 | 13 | 1 | — | — | — | 4 | — | 4 | 13 | 1 | ||||||||||||||||||||||

| Class R-2E2 | 103 | 7 | — | — | — | 4 | — | 4 | 103 | 7 | ||||||||||||||||||||||

| Class R-32 | 32 | 2 | — | — | — | 4 | — | 4 | 32 | 2 | ||||||||||||||||||||||

| Class R-42 | 187 | 13 | — | — | (1 | ) | — | 4 | 186 | 13 | ||||||||||||||||||||||

| Class R-5E2 | 40 | 2 | — | — | (5 | ) | — | 4 | 35 | 2 | ||||||||||||||||||||||

| Class R-52 | 21 | 1 | — | — | — | 4 | — | 4 | 21 | 1 | ||||||||||||||||||||||

| Class R-62 | 71,284 | 4,880 | — | — | (10,577 | ) | (712 | ) | 60,707 | 4,168 | ||||||||||||||||||||||

| Total net increase (decrease) | $ | 1,323,624 | 91,582 | $ | 51,750 | 3,609 | $ | (1,358,531 | ) | (93,898 | ) | $ | 16,843 | 1,293 | ||||||||||||||||||

| Year ended October 31, 2019 | ||||||||||||||||||||||||||||||||

| Class M | $ | 68,929 | 5,394 | $ | 29,053 | 2,447 | $ | (481,596 | ) | (36,746 | ) | $ | (383,614 | ) | (28,905 | ) | ||||||||||||||||

| 1 | Includes exchanges between share classes of the fund. |

| 2 | This share class began investment operations on November 8, 2019. |

| 3 | Class M shares were converted to Class F-3 shares on November 8, 2019. |

| 4 | Amount less than one thousand. |

| 5 | Class 529-F-2 and 529-F-3 shares began investment operations on October 30, 2020. |

9. Investment transactions

The fund made purchases and sales of investment securities, excluding short-term securities and U.S. government obligations, if any, of $165,605,000 and $271,620,000, respectively, during the year ended October 31, 2020.

10. Advisory platform concentration

Most of the shares of Capital Group International Equity Fund are held through a single advisory platform (more than 58% of the fund as of October 31, 2020). If the platform sponsor decides to move a significant number of its clients out of the fund it could have an adverse impact by causing the fund to have to sell securities in order to meet redemptions. The fund’s investment adviser monitors the fund’s asset allocation and the liquidity of the fund’s portfolio in seeking to mitigate this risk.

| American Funds International Vantage Fund | 19 |

Financial highlights

| Income (loss) from investment operations1 | Dividends and distributions | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Period ended | Net asset value, beginning of period | Net investment income (loss) | Net gains (losses) on securities (both realized and unrealized) | Total from investment operations | Dividends (from net investment income) | Distributions (from capital gains) | Total dividends and distributions | Net asset value, end of period | Total return2,3 | Net assets, end of period (in millions) | Ratio of expenses to average net assets before reimburse- ments4 | Ratio of expenses to average net assets after reimburse- ments3,4 | Ratio of net income (loss) to average net assets3 | |||||||||||||||||||||||||||||||||||||||

| Class A: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | $ | 14.76 | $ | .04 | $ | .51 | $ | .55 | $ | (.25 | ) | $ | (.59 | ) | $ | (.84 | ) | $ | 14.47 | 3.81 | %7 | $ | 21 | 1.12 | %8 | 1.12 | %8 | .32 | %8 | |||||||||||||||||||||||

| Class C: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | (.06 | ) | .53 | .47 | (.25 | ) | (.59 | ) | (.84 | ) | 14.39 | 3.24 | 7 | 1 | 1.79 | 8 | 1.79 | 8 | (.42 | )8 | |||||||||||||||||||||||||||||||

| Class T: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .07 | .48 | .55 | (.25 | ) | (.59 | ) | (.84 | ) | 14.47 | 3.82 | 7,9 | — | 10 | 1.05 | 8,9 | 1.04 | 8,9 | .54 | 8,9 | |||||||||||||||||||||||||||||||

| Class F-1: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .05 | .51 | .56 | (.25 | ) | (.59 | ) | (.84 | ) | 14.48 | 3.88 | 7 | 1 | 1.06 | 8 | 1.06 | 8 | .36 | 8 | ||||||||||||||||||||||||||||||||

| Class F-2: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .09 | .50 | .59 | (.25 | ) | (.59 | ) | (.84 | ) | 14.51 | 4.10 | 7 | 179 | .77 | 8 | .77 | 8 | .65 | 8 | ||||||||||||||||||||||||||||||||

| Class F-3: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/202011 | 14.61 | .13 | .63 | .76 | (.25 | ) | (.59 | ) | (.84 | ) | 14.53 | 5.33 | 667 | .72 | .65 | .91 | ||||||||||||||||||||||||||||||||||||

| 10/31/201911 | 12.67 | .20 | 2.10 | 2.30 | (.36 | ) | — | (.36 | ) | 14.61 | 18.95 | 918 | .70 | .65 | 1.47 | |||||||||||||||||||||||||||||||||||||

| 10/31/201811 | 13.67 | .24 | (1.05 | ) | (.81 | ) | (.19 | ) | — | (.19 | ) | 12.67 | (6.09 | ) | 1,162 | .65 | .65 | 12 | 1.71 | |||||||||||||||||||||||||||||||||

| 10/31/201711 | 11.23 | .20 | 2.42 | 2.62 | (.18 | ) | — | (.18 | ) | 13.67 | 23.73 | 1,584 | .73 | .73 | 12 | 1.64 | ||||||||||||||||||||||||||||||||||||

| 10/31/201611 | 11.50 | .16 | (.30 | ) | (.14 | ) | (.13 | ) | — | (.13 | ) | 11.23 | (1.20 | ) | 1,366 | .85 | .85 | 12 | .85 | |||||||||||||||||||||||||||||||||

| Class 529-A: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .05 | .49 | .54 | (.25 | ) | (.59 | ) | (.84 | ) | 14.46 | 3.73 | 7 | 2 | 1.18 | 8 | 1.18 | 8 | .33 | 8 | ||||||||||||||||||||||||||||||||

See end of table for footnotes.

| 20 | American Funds International Vantage Fund |

Financial highlights (continued)

| Income (loss) from investment operations1 | Dividends and distributions | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Period ended | Net asset value, beginning of period | Net investment income (loss) | Net gains (losses) on securities (both realized and unrealized) | Total from investment operations | Dividends (from net investment income) | Distributions (from capital gains) | Total dividends and distributions | Net asset value, end of period | Total return2,3 | Net assets, end of period (in millions) | Ratio of expenses to average net assets before reimburse- ments4 | Ratio of expenses to average net assets after reimburse- ments3,4 | Ratio of net income (loss) to average net assets3 | |||||||||||||||||||||||||||||||||||||||

| Class 529-C: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | $ | 14.76 | $ | (.03 | ) | $ | .48 | $ | .45 | $ | (.25 | ) | $ | (.59 | ) | $ | (.84 | ) | $ | 14.37 | 3.09 | %7,9 | $ | — | 10 | 1.89 | %8,9 | 1.87 | %8,9 | (.25 | )%8,9 | |||||||||||||||||||||

| Class 529-E: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .06 | .49 | .55 | (.25 | ) | (.59 | ) | (.84 | ) | 14.47 | 3.81 | 7,9 | — | 10 | 1.17 | 8,9 | 1.12 | 8,9 | .45 | 8,9 | |||||||||||||||||||||||||||||||

| Class 529-T: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .08 | .48 | .56 | (.25 | ) | (.59 | ) | (.84 | ) | 14.48 | 3.88 | 7,9 | — | 10 | 1.10 | 8,9 | 1.02 | 8,9 | .55 | 8,9 | |||||||||||||||||||||||||||||||

| Class 529-F-1: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .07 | .51 | .58 | (.25 | ) | (.59 | ) | (.84 | ) | 14.50 | 3.95 | 7,9 | — | 10 | .88 | 8,9 | .88 | 8,9 | .48 | 8,9 | |||||||||||||||||||||||||||||||

| Class 529-F-2: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,13 | 14.47 | — | — | — | — | — | — | 14.47 | — | 7 | — | 10 | — | 7 | — | 7 | — | 7 | ||||||||||||||||||||||||||||||||||

| Class 529-F-3: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,13 | 14.47 | — | — | — | — | — | — | 14.47 | — | 7 | — | 10 | — | 7 | — | 7 | — | 7 | ||||||||||||||||||||||||||||||||||

| Class R-1: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | 14.76 | .12 | .48 | .60 | (.25 | ) | (.59 | ) | (.84 | ) | 14.52 | 4.17 | 7,9 | — | 10 | .98 | 8,9 | .71 | 8,9 | .86 | 8,9 | |||||||||||||||||||||||||||||||

See end of table for footnotes.

| American Funds International Vantage Fund | 21 |

Financial highlights (continued)

| Income (loss) from investment operations1 | Dividends and distributions | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Period ended | Net asset value, beginning of period | Net investment income (loss) | Net gains (losses) on securities (both realized and unrealized) | Total from investment operations | Dividends (from net investment income) | Distributions (from capital gains) | Total dividends and distributions | Net asset value, end of period | Total return2,3 | Net assets, end of period (in millions) | Ratio of expenses to average net assets before reimburse- ments4 | Ratio of expenses to average net assets after reimburse- ments3,4 | Ratio of net income (loss) to average net assets3 | |||||||||||||||||||||||||||||||||||||||

| Class R-2: | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 10/31/20205,6 | $ | 14.76 | $ | .09 | $ | .49 | $ | .58 | $ | (.25 | ) | $ | (.59 | ) | $ | (.84 | ) | $ | 14.50 | 3.99 | %7,9 | $ | — | 10 | 1.02 | %8,9 | .92 | %8,9 | .63 | %8,9 | ||||||||||||||||||||||

| Class R-2E: | ||||||||||||||||||||||||||||||||||||||||||||||||||||