UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

ANNUAL REPORT

ANNUAL REPORT PURSUANT TO REGULATION CROWDFUNDING OF THE SECURITIES ACT OF 1933

For the fiscal year ended December 31, 2019

ADV3NTURE, INC.

321 S. Beverly Dr. Ste. M

Beverly Hills, CA 90212

www.adv3nture.com

This Annual Report is dated April 29, 2019

In this Annual Report, references to “Adv3nture,” “we,” “us,” “our,” or the “company” mean Adv3nture, Inc.

The company, having offered and sold its Class B Common Stock pursuant to Regulation Crowdfunding under the Securities Act of 1933, as amended (the “Securities Act”) is filing this annual report pursuant to Rule 202 of Regulation Crowdfunding for the fiscal year ended December 31, 2019. A copy of this report will be made available on the company's website

athttp://www.adv3nture.com/.

FORWARD-LOOKING STATEMENTS

THIS ANNUAL REPORT MAY CONTAIN FORWARD-LOOKING STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,” “INTEND,” “EXPECT”

AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE ON WHICH THEY ARE MADE

THE COMPANY’S BUSINESS

Adv3nture, Inc is an apparel lifestyle brand that makes innovative apparel and backpacks for travel and exploration. For more details, please see the Company’s Form C filing.

PREVIOUS OFFERINGS

Between 8/28/19 and 12/20/2019, Adv3nture sold 342,021 shares of Class B Common Stock in exchange for $2 per share under Regulation Crowdfunding.

REGULATORY INFORMATION

The company has not previously failed to comply with the requirements of Regulation Crowdfunding;

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Operating Results – 2019 Compared to 2018

Liquidity and Capital Resources

On December 31, 2018, the Company had cash of $1,410.59.

On December 31, 2019, the Company had cash of $6,296.17.

Debt

On December 31, 2019, the Company had debt of $183,551.02.

See attached financial statements for additional details.

DIRECTORS, EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

Our directors and executive officers as of the date hereof, are as follows:

Zane Lamprey

CEO and Director / Board of Directors

Melissa Lamprey

Director / Board of Directors

Garrett Marrero

Director / Board of Directors

PRINCIPAL SECURITY HOLDERS

Set forth below is information regarding the beneficial ownership of our Common Stock, our only outstanding class of capital stock, as of December 31, 2019, by (i) each person whom we know owned, beneficially, more than 10% of the outstanding shares of our Common Stock, and (ii) all of the current officers and directors as a group. We believe that each named beneficial owner has sole voting and investment power with respect to the shares listed. Unless otherwise indicated herein, beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and includes voting or investment power with respect to shares beneficially owned.

Title | Name and address of beneficial owner | Amount and nature of Beneficial ownership | Percent of class |

Class A Common Stock | Zane Lamprey 321 S. Beverly Dr. Suite M Beverly Hills, CA 90212 | 51 Shares | 51% |

Class A Common Stock | Melissa Lamprey 321 S. Beverly Dr. Suite M Beverly Hills, CA 90212 | 49 Shares | 49% |

Title | Name and address of beneficial owner | Amount and nature of Beneficial ownership | Percent of class |

Class B Common Stock | Zane Lamprey 321 S. Beverly Dr. Suite M Beverly Hills, CA 90212 | 1,979,674 Shares | 41.2% |

Class B Common Stock | Melissa Lamprey 321 S. Beverly Dr. Suite M Beverly Hills, CA 90212 | 1,979,674 Shares | 41.2% |

Title | Name and address of beneficial owner | Amount and nature of Beneficial ownership | Percent of class |

Class A Common Stock | All Officers and Directors As A Group | 100 Shares | 100% |

Class B Common Stock | All Officers and Directors As A Group | 4,015,161 Shares | 83.65% |

RELATED PARTY TRANSACTIONS

None.

OUR SECURITIES

Our authorized capital stock consists of 6,000,000 shares of Class B Common Stock, par value $0.00001 per share, and 500 shares of Class A Common Stock. As of December 31, 2019, 4,806,921 shares of Class B Common Stock, and 100 shares of Class A Common Stock are outstanding. The following is a summary of the rights of our capital stock as provided in our certificate of incorporation and bylaws.

The Company has authorized Class A Common Stock, and Class B Common Stock.

Class A Common Stock

The amount of security authorized is 500 with a total of 100 outstanding.

Voting Rights

Full voting rights

Material Rights

All voting rights belong to this class, other than those which are required for all shareholders under Delaware law.

No liquidation preference - both classes treated equally as to liquidation rights.

Right of First Refusal

No holder of common stock of the corporation (a "Common Holder") shall sell, assign, pledge, or in any manner transfer any of the shares of common stock of the corporation ("Common Stock") or any right or interest therein, whether voluntarily or by operation of law, or by gift or otherwise, except by a transfer which meets the requirements hereinafter set forth in the company's

Drag Along Rights

Right to Sell Corporation. The holder or holders of at least a majority of the outstanding Class A Common Stock and at least a majority of the outstanding Class B Common Stock (together, the "Drag-Along Seller") have the right to seek and approve a Drag-Along Sale of the corporation. If at any time, the Drag-Along Seller receives a bona fide offer from an Independent Purchaser for a Drag-Along Sale, the Drag-Along Seller shall have the right to require that each other shareholder participate in the sale in the manner provided in this Article XV, Section I; provided, however, that no shareholder is required to transfer or sell any of its shares if the consideration for the Drag-Along Sale is other than cash or registered securities listed on an established U.S. securities exchange or traded on the NASDAQ National Market. Every shareholder shall promptly deliver to the Board a written notice of any offeror indication of interest for a Drag-Along Sale that it receives from a third party, whether the offeror indication of interest is formal or informal, binding or non-binding, or submitted orally or in writing, and a copy of the offer or indication of interest, if it is in writing.

The foregoing written notice must state the name and address of the prospective acquiring party and, if the offer or indication of interest is not in writing, describe the principal terms and conditions of the proposed Drag-Along Sale. Notwithstanding any provision of the Bylaws to the contrary, the provisions of Article XIV (Right of First Refusal) do not apply to any transfers made pursuant to Article XV, Section 1.

Class B Common Stock

The amount of security authorized is 6,000,000 with a total of 4,806,921 outstanding.

Voting Rights

There are no voting rights associated with Class B Common Stock.

Material Rights

Voting rights are limited to those rights expressly required by Delaware law.

No liquidation preference - both classes treated equally as to liquidation rights.

Right of First Refusal

No holder of common stock of the corporation (a "Common Holder") shall sell, assign, pledge, or in any manner transfer any of the shares of common stock of the corporation ("Common Stock") or any right or interest therein, whether voluntarily or by operation of law, or by gift or otherwise, except by a transfer which meets the requirements hereinafter set forth in the company's Bylaws:

Drag Along Rights

Right to Sell Corporation. The holder or holders of at least a majority of the outstanding Class A Common Stock and at least a majority of the outstanding Class B Common Stock (together, the "Drag-Along Seller") have the right to seek and approve a Drag-Along Sale of the corporation. If at any time, the Drag-Along Seller receives a bona fide offer from an Independent Purchaser for a Drag-Along Sale, the Drag-Along Seller shall have the right to require that each other shareholder participate in the sale in the manner provided in Article XV, Section l; provided, however, that no shareholder is required to transfer or sell any of its shares if the consideration for the Drag-Along Sale is other than cash or registered securities listed on an established U.S. securities exchange or traded on the NASDAQ National Market. Every shareholder shall promptly deliver to the Board a written notice of any offeror indication of interest for a Drag-Along Sale that it receives from a third party, whether the offeror indication of interest is formal or informal, binding or non-binding, or submitted orally or in writing, and a copy of the offer or indication of interest, if it is in writing.

The foregoing written notice must state the name and address of the prospective acquiring party and, if the offer or indication of interest is not in writing, describe the principal terms and conditions of the proposed Drag-Along Sale. Notwithstanding any provision of the Bylaws to the contrary, the provisions of Article XIV (Right of First Refusal) do not apply to any transfers made pursuant to Article XV, Section I.

WHAT IT MEANS TO BE A MINORITY SHAREHOLDER

As a minority shareholder you will have limited ability, if at all, to influence our policies or any other corporate matter, including the election of directors, changes to our company’s governance documents, additional issuances of securities, company repurchases of securities, a sale of the company or of assets of the company or transactions with related parties.

DILUTION

The term "dilution” refers to the reduction (as a percentage of the aggregate shares outstanding) that occurs for any given share of stock when additional shares are issued.

The Company anticipates that it may require additional capital and such capital may take the form of shares of Class B Common Stock, other stock, securities or debt convertible into equity. Your stake in the Company could be diluted due to the Company issuing additional shares of Class B Common Stock or other securities such as other stock, securities or debt convertible into equity. When the Company issues more securities, the percentage of the Company that you own will

decrease, even though the value of the Company may increase. If this event occurs, you may own a smaller piece of a larger company. An increase in number of shares of stock could also result from a securities offering (such as an initial public offering, an additional equity crowdfunding round, a venture capital round, or an angel investment), employees or others exercising stock or other equity options, or by conversion of certain instruments such as convertible bonds, other convertible classes of stock or warrants into other equity. If the Company decides to issue more stock or other securities, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share, although this typically occurs only if the Company offers dividends, and most early stage companies like the Company are unlikely to offer dividends, preferring to invest any earnings into the Company.

The type of dilution that negatively affects early-stage investors most occurs when the Company sells more shares of stock or securities in a "down round," meaning at a lower valuation than in earlier offerings. This type of dilution might also happen upon conversion of convertible notes into shares of stock. Typically, the terms of convertible notes issued by early-stage companies provide that in the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a "discount" to the price paid by the new investors, i.e., they get more shares of stock than the new investors would for the same price. Additionally, convertible notes may have a " price cap" on the conversion price, which effectively acts as a stock price ceiling. Either way, the holders of the convertible notes get more shares of stock for their money than would new investors in that subsequent round. In the event that the financing is a "down round" the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more shares of stock for their money. Investors should pay careful attention to the amount of convertible notes that a company has issued and may issue in the future, and the terms of those notes.

If you are making an investment expecting to own a certain percentage of the Company or expecting each share to hold a certain amount of value, it's important to realize how the value of those shares of common stock can decrease by actions taken by the Company. Dilution can make drastic changes to the value of each share, ownership percentage, control, share of revenues and earnings per share.

RESTRICTIONS ON TRANSFER

The common stock sold in the Regulation CF offering, may not be transferred by any purchaser, for a period of one-year beginning when the securities were issued, unless such securities are transferred:

(1) to the Company;

(2) to an accredited investor;

(3) as part of an offering registered with the SEC; or

(4) to a member of the family of the purchaser or the equivalent, to a trust controlled by the purchaser, to a trust created for the benefit of a member of the family of the purchaser or the equivalent, or in connection with the death or divorce of the purchaser or other similar circumstance.

SIGNATURES

Pursuant to the requirements of Sections 4(a)(6) and 4A of the Securities Act of 1933 and Regulation Crowdfunding (§ 227.100-503), the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form C and has duly caused this Form to be signed on its behalf by the duly authorized undersigned, on May 31, 2018.

/s/ Zane Lamprey

_____________________________

Zane Lamprey

Principal Executive Officer

ADV3NTURE, INC

Exhibit A

FINANCIAL STATEMENTS

CERTIFICATION

I, Zane Lamprey, Principal Executive Officer of Adv3nture, Inc, hereby certify that the financial statements of Adv3nture, Inc, included in this report are true and complete in all material respects.

/s/ Zane Lamprey

_____________________________

Zane Lamprey

Principal Executive Officer

ADV3NTURE, INC

ADV3NTURE |

BALANCE SHEET |

AS OF DECEMBER 31, 2019 AND 2018 |

| 2018 | 2019 |

ASSETS | | |

Current Assets: | | |

Cash and Cash Equivalents | 1,411.00 | 6,296.17 |

Accounts Receivable | 131,573.00 | 357,639.79 |

Inventory | | 230,866.30 |

Property, Plant, and Equipment | 1,212.49 | 1,212.49 |

Total Current Assets | 134,196.49 | 596,014.75 |

Total Assets | 134,196.49 | 596,014.75 |

LIABILITIES AND MEMBER'S CAPITAL | | |

Liabilities: | | |

Current Liabilities | | |

Accounts Payable | 134,489.00 | 33,551.20 |

Notes | 75,000.00 | 150,000.00 |

TOTAL LIABILITIES | 209,489.00 | 183,551.20 |

Members' Capital | | |

Retained Earnings | (75,293.00) | 362,463.73 |

Stock | - | 50,000.00 |

Total Members' Capital | (75,293.00) | 412,463.73 |

Total Liabilities and Member's Capital | 134,196.00 | 596,014.93 |

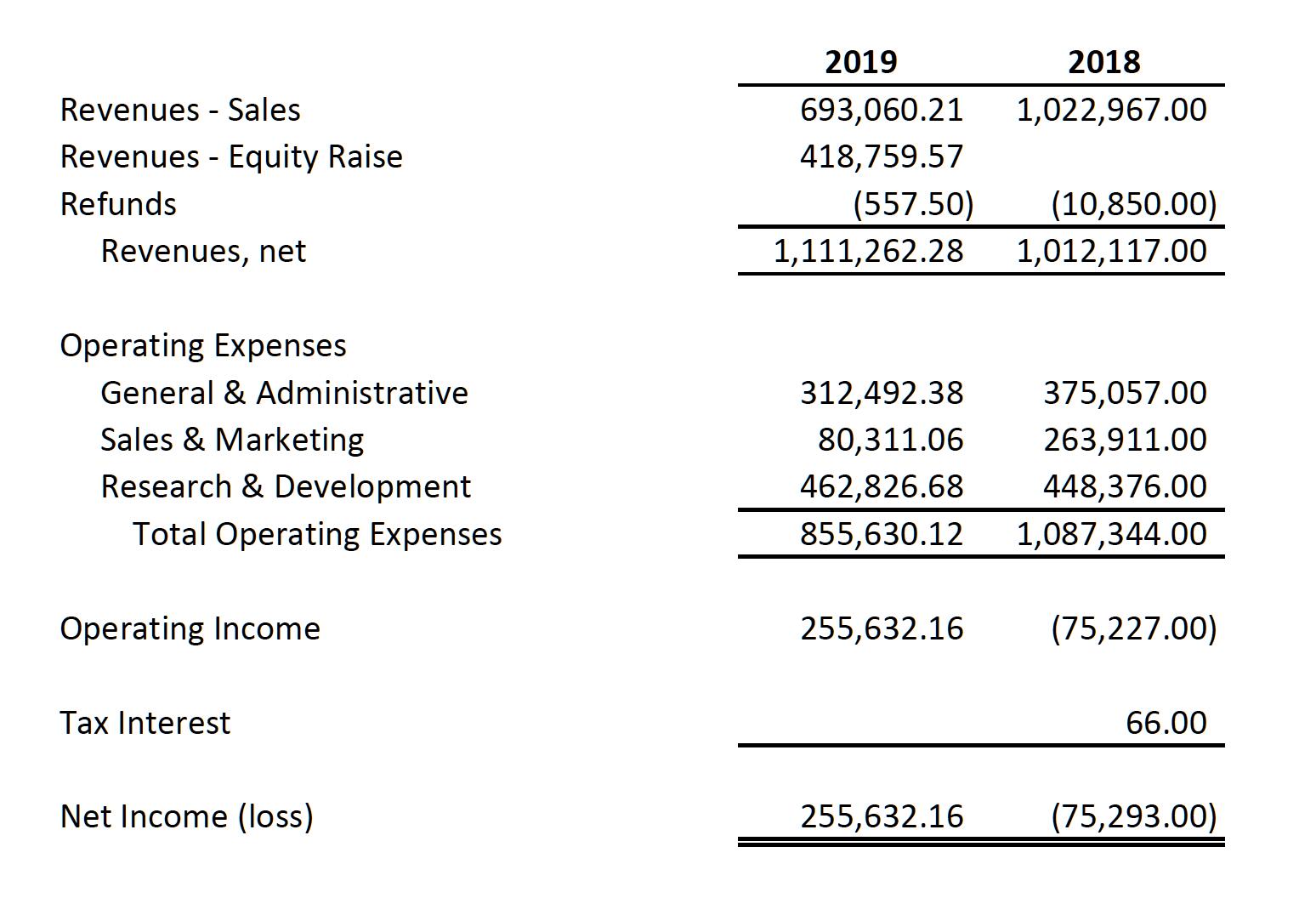

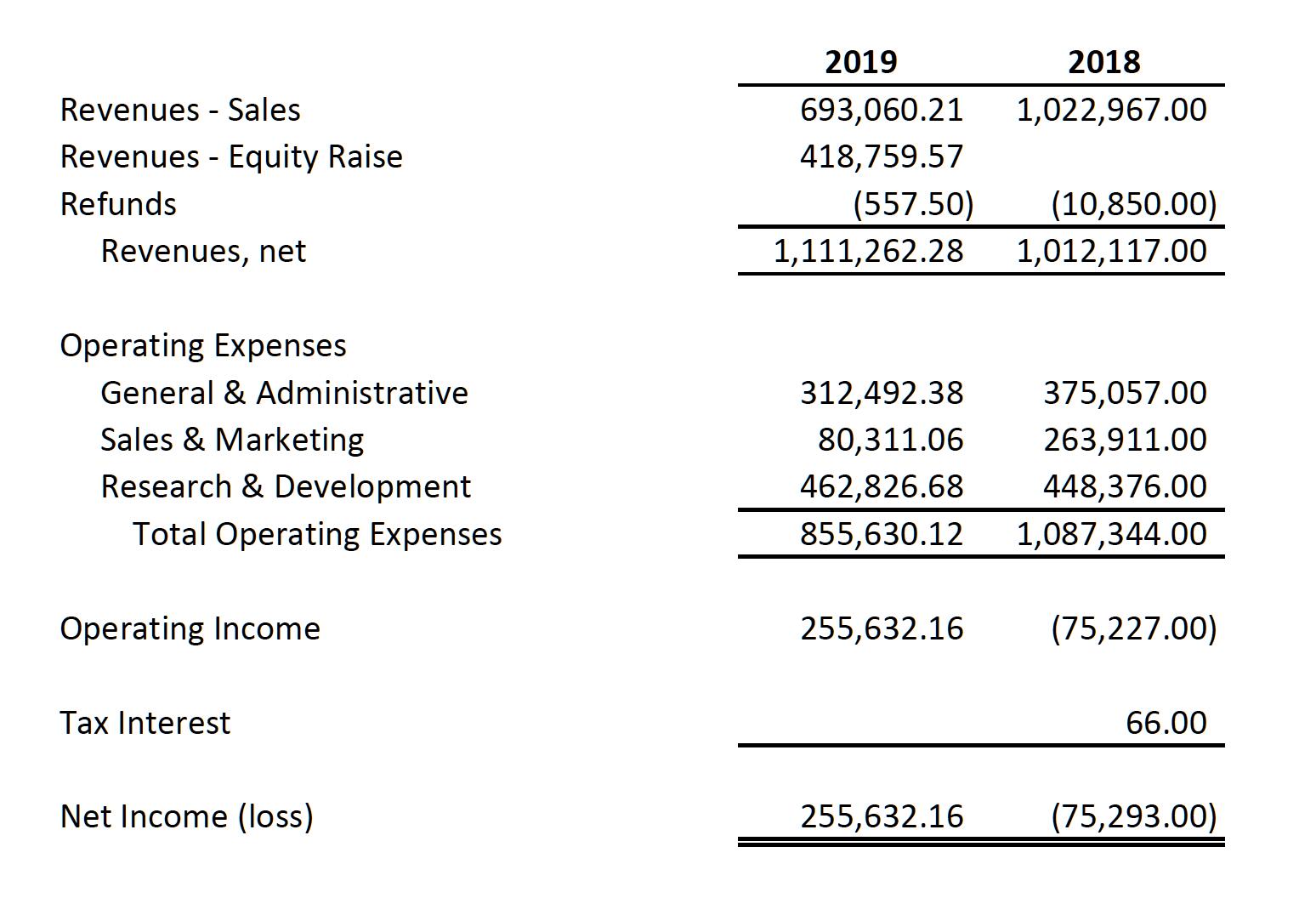

ADV3NTURE |

STAEMENT OF OPERATIONS |

FOR THE YEAR ENDED DECEMBER 31 , 2019 AND 2018 |

| 2019 | 2018 |

Revenues - Sales | 693,060.21 | 1,022,967.00 |

Revenues - Equity Raise | 418,759.57 | |

Refunds | (557.50) | (10,850.00) |

Revenues, net | 1,111,262.28 | 1,012,117.00 |

Operating Expenses | | |

General & Administrative | 312,492.38 | 375,057.00 |

Sales & Marketing | 80,311.06 | 263,911.00 |

Research & Development | 462,826.68 | 448,376.00 |

Total Operating Expenses | 855,630.12 | 1,087,344.00 |

Operating Income | 255,632.16 | (75,227.00) |

Tax Interest | 66.00 |

Net Income (loss) | 255,632.16 | (75,293.00) |

ADV3NTURE | |

SCHEDULE OF ASSETS AND LIABILITIES |

AS OF 12/31/19 | |

CURRENT ASSETS | |

CASH-COMMERCIAL ACCOUNTS | 6,296.17 |

ACCOUNTS RECEIVABLE | 46,746.68 |

LOANS TO OFFICERS | 310,893.11 |

TOTAL CURRENT ASSETS | 363,935.96 |

INVESTMENTS-OTHER | |

INVENTORY | 230,866.30 |

TOTAL INVESTMENTS-OTHER | 230,866.30 |

PROPERTY AND EQUIPMENT | |

PROFESSIONAL EQUIPMENT | 1,212.49 |

TOTAL PROPERTY AND EQUIPMENT | 1,212.49 |

TOTAL ASSETS | 596,014.75 |

LIABILITIES AND CAPITAL | |

CURRENT LIABILITIES | |

ACCOUNTS PAYABLE | 33,551.02 |

NOTES AND LOANS PAYABLE | 150,000.00 |

TOTAL CURRENT LIABILITIES | 183,551.02 |

TOTAL LIABILITIES | 183,551.02 |

CAPITAL | |

CAPITAL-BEGINNING BALANCE | 106,831.57 |

CURRENT YEAR EARNINGS | 255,632.16 |

CAPITAL STOCK | 50,000.00 |

TOTAL CAPITAL | 412,463.73 |

TOTAL LIABILITIES AND CAPITAL | 596,014.75 |

ADV3NTURE | |

SCHEDULE OF INCOME AND EXPENSES |

AS OF 12/31/2019 | |

INCOME FROM PROFESSION | |

SALES | 1,111,819.78 |

REFUNDS | (557.50) |

TOTAL INCOME FROM PROFESSION | 1,111,262.28 |

TOTAL INCOME | 1,111,262.28 |

BUSINESS EXPENSES | |

ACCOUNTING | 3,500.00 |

ADVERTISING | 40,459.65 |

AUTO EXPENSES | 282.60 |

BANKING COSTS | 1,015.57 |

BUSINESS MANAGEMENT | 5,000.00 |

COMMISSIONS | 1,321.79 |

COMPUTER SERVICES | 1,069.62 |

CONSULTATION FEES | 11,076.96 |

ENTERTAINMENT | 1,951.57 |

FULLFILLMENT/TRANSPORTATION | 120,791.23 |

GIFTS | 76.41 |

INDEPENDENT CONTRACTORS | 800.00 |

INSURANCE-MEDICAL | 15,747.79 |

INTEREST | 18,877.79 |

LEGAL FEES AND EXPENSES | 10,496.00 |

MARKETING FEES | 39,151.41 |

MATERIAL-T.V., FILM, MUSIC ETC | 6,065.36 |

MEDICAL EXPENSES | 3,024.32 |

MESSENGER SERVICE | 2,665.61 |

OFFICE SUPPLIES AND EXPENSES | 262.50 |

OUTSIDE SERVICES | 4,091.15 |

PARKING EXPENSES | 36.00 |

PHOTOS | 3,675.00 |

POSTAGE | 3,368.97 |

PRODUCT DEVELOPMENT | 348.52 |

PRODUCTION COST | 462,478.16 |

PROMOTION | 700.00 |

RESEARCH-CHARACTERS,T.V., FILM MUSIC ETC | 97.94 |

SALARIES | 71,944.79 |

TAXES-FRANCHISE | 300.00 |

TAXES-LICENSES,PERMITS & MISC. | 765.61 |

TAXES-PAYROLL | 6,387.63 |

TAXES-STATE ESTIMATE | 6,800.00 |

TAXES-STATE PRIOR YEARS | 6,800.00 |

TELEPHONE | 595.00 |

TRAVEL | 3,605.17 |

TOTAL BUSINESS EXPENSES | 855,630.12 |

| |

NET INCOME | 255,632.16 |