UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23465

Pioneer Securitized Income Fund

(Exact name of registrant as specified in charter)

60 State Street, Boston, MA 02109

(Address of principal executive offices) (ZIP code)

Terrence J. Cullen, Amundi Pioneer Asset Management, Inc.,

60 State Street, Boston, MA 02109

(Name and address of agent for service)

Registrant’s telephone number, including area code: (617) 742-7825

Date of fiscal year end: July 31, 2021

Date of reporting period: August 1, 2020 through January 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

Pioneer Securitized

Income Fund

Semiannual Report | January 31, 2021

Ticker Symbol: XSILX

Paper copies of the Fund’s shareholder reports may no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, bank or insurance company. Instead, the reports will be made available on the Fund’s website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

You may elect to receive shareholder reports and other communications electronically by contacting your financial intermediary or, if you invest directly with the Fund, by calling 1-844-391-3034.

You may elect to receive all future reports in paper free of charge. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by calling 1-844-391-3034. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held within the Pioneer Fund complex if you invest directly.

visit us: www.amundi.com/us

| | |

Table of Contents | |

| | |

| 2 |

| | |

| 4 |

| | |

| 9 |

| | |

| 10 |

| | |

| 11 |

| | |

| 12 |

| | |

| 17 |

| | |

| 22 |

| | |

| 31 |

| | |

| 36 |

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 1

President’s LetterDear Shareholders,

The first several weeks of 2021 have brought some better news on the COVID-19 global pandemic front, as the deployment of the first approved COVID-19 vaccines is well underway, with expectations for widespread vaccine distribution by the middle of the year. In general, COVID-19 cases and related hospitalizations have been on the decline in the US, and that has had a positive effect on overall market sentiment.

While there may finally be a light visible at the end of the pandemic tunnel, the long-term impact on the global economy from COVID-19, while currently unknown, is likely to be considerable. It is clear that several industries have already felt greater effects than others, and the markets, which do not thrive on uncertainty, have been volatile. With that said, in these still-early days of 2021, equity markets and other so-called “riskier” assets, such as high-yield bonds, have outperformed investments regarded as less risky, such as government debt. In addition, we’ve witnessed the long-awaited rebound in the performance of cyclical stocks, or stocks of companies with greater exposure to the ebbs and flows of the economic cycle, as investors have appeared to embrace the potential for a more widespread reopening of the economy in the coming months. Additional fiscal stimulus from the US government has also helped provide some market momentum.

However, despite the dramatic market rebound since its March 2020 low point, volatility has remained elevated, with momentum rising and falling on seemingly every bit of positive or negative news about the virus. In addition, the recent US Presidential and Congressional elections have resulted in a power shift in Washington, DC, and that most likely portends some changes in fiscal policy above and beyond just additional pandemic-related stimulus. That, too, could lead to increased market volatility as investors analyze the various tax and spending plans, and wait to see what proposed policy alterations actually become law.

With the advent of COVID-19 in early 2020, we implemented our business continuity plan according to the new COVID-19 guidelines, and most of our employees have been working remotely since March 2020. To date, our operating environment has faced no interruption. I am proud of the careful planning that has taken place and confident we can maintain this environment for as long as is prudent. History in the making for a company that first opened its doors way back in 1928.

2 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

Since 1928, Amundi US’s investment process has been built on a foundation of fundamental research and active management, principles which have guided our investment decisions for more than 90 years. We believe active management – that is, making active investment decisions – can help mitigate the risks during periods of market volatility. As 2020 has reminded us, investment risk can arise from a number of factors in today’s global economy, including slower or stagnating growth, changing U.S. Federal Reserve policy, oil price shocks, political and geopolitical factors and, unfortunately, major public health concerns such as a viral pandemic.

At Amundi US, active management begins with our own fundamental, bottom-up research process. Our team of dedicated research analysts and portfolio managers analyzes each security under consideration, communicating directly with the management teams of the companies issuing the securities and working together to identify those securities that best meet our investment criteria for our family of funds. Our risk management approach begins with each and every security, as we strive to carefully understand the potential opportunity, while considering any and all risk factors.

Today, as investors, we have many options. It is our view that active management can serve shareholders well, not only when markets are thriving, but also during periods of market stress.

As you consider your long-term investment goals, we encourage you to work with your financial professional to develop an investment plan that paves the way for you to pursue both your short-term and long-term goals.

We remain confident that the current crisis, like others in human history, will pass, and we greatly appreciate the trust you have placed in us and look forward to continuing to serve you in the future.

Sincerely,

Lisa M. Jones

Head of the Americas, President and CEO of US.

Amundi Asset Management US, Inc.

March 2021

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 3

Portfolio Management Discussion |

1/31/21 In the following interview, portfolio managers Noah Funderburk and Nicolas Pauwels discuss the market environment and the factors that affected the performance of Pioneer Securitized Income Fund during the six-month period ended January 31, 2021. Mr. Funderburk, CFA, a vice president and portfolio manager at Amundi Asset Management US, Inc. (Amundi US), and Mr. Pauwels, CFA, a vice president and portfolio manager at Amundi US, are responsible for the day-to-day management of the Fund.

Q How did the Fund perform during the six-month period ended January 31, 2021?

A The Fund produced a total return of 18.78% at net asset value (NAV) during the six-month period ended January 31, 2021, while the Fund’s benchmark, the Bloomberg Barclays US Securitized MBS/ABS/CMBS Index, returned 0.36%.

Q What factors drove the performance of securitized assets during the six-month period ended January 31, 2021?

A The broader securitized asset classes performed very well during the six-month period. The combination of favorable US Federal Reserve (Fed) monetary policy, extensive fiscal stimulus from the government, and the Food and Drug Administration’s emergency-use approval of multiple vaccines for COVID-19 led to an improving economic outlook and fostered a significant increase in investors’ appetite for risk. Those developments fueled a sizable contraction in spreads for securitized assets, which more than offset the effect of rising US Treasury yields. (Credit spreads, or spreads, are commonly defined as the differences in yield between Treasuries and other types of fixed-income securities with similar maturities.)

Mortgage-backed securities (MBS) were the strongest-performing area of the three major market segments in which the Fund invests, with both agency and non-agency MBS notes posting meaningful gains for the six-month period. The strong advance in home prices across the United States was particularly beneficial for the performance of the MBS segment. According to Standard & Poor’s CoreLogic Case-Shiller Home Price Indices, home prices had risen by 9.5% nationally on a year-over-year basis as of November 2020, up from 8.4% in October 2020. The November 2020 number marked the strongest annual growth rate for home prices in more than six years, and one of the largest advances in the history of the index. Those trends supported the performance of MBS,

4 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

since the risk of mortgage defaults has generally declined when home prices have been on the rise. MBS received a further boost from the fact that the worst-case scenarios regarding mortgage forbearance that had weighed on the market in the first half of 2020 have not come to fruition.

Asset-backed securities (ABS) also benefited from the improving economy during the six-month period. The personal savings rate has recovered to levels not seen since the 1970s as consumers have retrenched in the face of the COVID-19 restrictions on many businesses and leisure activities. While that headline number may be somewhat misleading within the context of the “K-shaped” recovery (a post-recession scenario in which one segment of the economy begins to climb back upward, while another segment continues to suffer), the government’s first stimulus checks last summer did provide some relief to people in lower-income brackets who had been among the most vulnerable to slowing economic growth. In addition, almost all US consumer metrics, such as credit card and auto loan delinquencies, have remained low, and the expiration of the initial CARES Act unemployment benefits in July 2020 resulted in only a modest uptick in borrower stress. In most cases, the ongoing labor market recovery and fiscal stimulus checks have allowed borrowers to keep current on their credit cards, car payments, and rents. Securities backed by sub-prime auto loans were particularly strong performers within the ABS segment during the six-month period.

Commercial MBS (CMBS), while posting gains, lagged other segments of the securitized market during the six-month period. The relative underperformance of CMBS reflected ongoing market concerns about certain property types, especially those linked to retail, travel, and leisure. However, the rollout of the COVID-19 vaccines has appeared to breathe new life into investors’ appetite for bonds backed by those types of exposures. For instance, returns for securities linked to economy hotels outpaced the broader CMBS category for the period, due to optimism regarding a revival in travel and tourism as the economy gradually re-opens.

Q What elements of the Fund’s positioning played the largest role in its performance during the six-month period ended January 31, 2021?

A The Fund’s holdings in residential MBS (RMBS), which represented more than half of the portfolio’s invested assets, made the largest positive contribution to performance during the six-month period. Holdings of ABS also added value as a group, led by securities backed by auto loans and unsecured consumer loans. Consistent with the broader market environment as well as a modest portfolio allocation, the Fund’s CMBS exposure made the smallest positive contribution to returns.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 5

Given the positive market conditions that characterized the six-month period, no aspect of the Fund’s positioning stood out as being a major detractor from returns. However, the Fund did experience some performance shortfalls from holdings in fixed-rate securities, due to their relative weakness as compared to floating-rate debt.

Q Did the Fund have any exposure to derivative investments during the six-month period ended January 31, 2020? If so, did the derivatives have an effect on performance?

A The Fund had no exposure to derivatives during the six-month period.

Q How would you characterize the Fund’s distributions* to shareholders during the six-month period ended January 31, 2021?

A The Fund’s monthly distributions generally remained stable during the six-month period ended January 31, 2021.

Q Did you make any notable changes to the Fund’s positioning during the six-month period ended January 31, 2021?

A We maintained the Fund’s broader positioning during the period, with a focus on keeping a core exposure to the US housing market. The portfolio shifts made during the period derived largely from our bottom-up security selection process as well as our efforts to enhance the Fund’s diversification**. We added agency MBS to the portfolio during the period, but later closed the position to pursue what we felt were better value propositions. We also added specific positions in CMBS, primarily those related to multi-family housing. Conversely, we have continued to avoid areas that we believe may face ongoing pressures in the post-pandemic world, such as the enclosed-mall retail segment. More broadly speaking, we have continued to pursue opportunistic repositioning within the Fund, as we seek to generate performance in excess of that produced by a static portfolio.

Q Do you have any closing thoughts?

A We believe the market for securitized assets has remained well supported by a backdrop of positive, and improving economic growth, as well as a strengthening labor market. At the same time, we think the Fed is unlikely to tighten monetary policy in the near future. The prospect of additional fiscal stimulus from the US government is another factor that could

* Distributions are not guaranteed.

** Diversification does not assure a profit nor protect against loss.

6 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

support the economy as we move through 2021. Although yield spreads on securitized assets have already compressed quite a bit over the past six months, they have not declined to the same extent as spreads in other segments of the fixed-income markets. In our view, that could represent a source of continued investor demand. Finally, we hold a particularly favorable outlook on the prospects for residential-credit securities, given that yield spreads have remained wide versus historical levels.

Please refer to the Schedule of Investments on pages 12–16 for a full listing of Fund securities.

All investments are subject to risk, including the possible loss of principal. In the past several years, financial markets have experienced increased volatility and heightened uncertainty. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. These conditions may continue, recur, worsen or spread.

The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment. The Fund is not a complete investment program.

The Fund is operated as an interval fund, meaning the Fund will seek to conduct quarterly repurchase offers for a percentage of the Fund’s outstanding shares. Although the Fund will make quarterly repurchase offers, the Fund’s shares should be considered illiquid.

The Fund invests primarily in mortgage-backed securities, asset-backed securities and other securitized asset instruments. A substantial portion of the Fund’s assets ordinarily will consist of high yield debt securities that involve substantial risk of loss.

Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.

Investments in high yield or lower-rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default. When interest rates rise, the prices of fixed-income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed-income securities in the Fund will generally rise.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 7

The value of mortgage-related and asset backed securities will be influenced by factors affecting the real estate market and the assets underlying those securities. These securities are also subject to prepayment and extension risks and risk of default.

Certain securities and derivatives held by the Fund may be impossible or difficult to purchase, sell or unwind. Such securities may also be difficult to value. The use of interest rate futures and options and other derivatives can increase fund losses and reduce opportunities for gain. The Fund may invest in credit-default swaps, inverse floating-rate obligations, and other derivative instruments. Derivatives may have a leveraging effect on the Fund.

As a non-diversified Fund, the Fund can invest a higher percentage of its assets in the securities of any one or more issuers than a diversified fund. Being non-diversified may magnify the Fund’s losses from adverse events affecting a particular issuer.

These risks may increase share price volatility.

Before investing, consider the product’s investment objectives, risks, charges and expenses. Contact your financial professional or Amundi Asset Management US, Inc., for a prospectus or summary prospectus containing this information. Read it carefully.

Any information in this shareowner report regarding market or economic trends or the factors influencing the Fund’s historical or future performance are statements of opinion as of the date of this report. Past performance is no guarantee of future results.

8 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

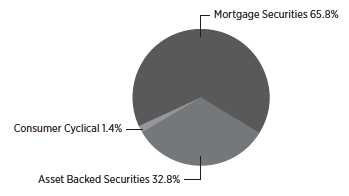

Portfolio Summary |

1/31/21 Sector Distribution

(As a percentage of total investments)*

| 10 Largest Holdings | |

(As a percentage of total investments)* | |

| | | |

| 1. | CFMT LLC, Series 2019-HB1, Class M5, 6.0%, 12/25/29 (144A) | 4.52% |

| 2. | Freddie Mac Stacr Trust, Series 2019-FTR3, Class B2, 4.948% | |

| (1 Month USD LIBOR + 480 bps), 9/25/47 (144A) | 4.26 |

| 3. | STACR Trust, Series 2018-DNA3, Class B2, 7.88% (1 Month USD | |

| LIBOR + 775 bps), 9/25/48 (144A) | 3.93 |

| 4. | RMF Buyout Issuance Trust, Series 2020-1, Class M5, 6.0%, 2/25/30 (144A) | 3.54 |

| 5. | Continental Credit Card ABS LLC, Series 2019-1A, Class C, 6.16%, 8/15/26 (144A) | 3.54 |

| 6. | Velocity Commercial Capital Loan Trust, Series 2020-1, Class M6, | |

| 5.69%, 2/25/50 (144A) | 3.48 |

| 7. | Freddie Mac Stacr Trust, Series 2019-FTR2, Class B1, 3.13% (1 Month USD | |

| LIBOR + 300 bps), 11/25/48 (144A) | 3.47 |

| 8. | Freddie Mac Stacr Trust, Series 2019-HRP1, Class B1, 4.18% (1 Month USD | |

| LIBOR + 405 bps), 2/25/49 (144A) | 3.13 |

| 9. | Mortgage Insurance-Linked Notes Series, Series 2020-1, Class B1, 3.13% | |

| (1 Month USD LIBOR + 300 bps), 2/25/30 (144A) | 3.05 |

| 10. | Foursight Capital Automobile Receivables Trust, Series 2020-1, Class F, | |

| 4.62%, 6/15/27 (144A) | 2.97 |

* | Excludes temporary cash investments and all derivative contracts except for options purchased. The Fund is actively managed, and current holdings may be different. The holdings listed should not be considered recommendations to buy or sell any securities. |

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 9

Prices and Distributions | 1/31/21 | |

|

| Net Asset Value per Share | | |

| | | |

| 1/31/21 | | 7/31/20 |

| $9.88 | | $8.67 |

| Distributions per Share: 8/1/20–1/31/21 | |

| | | |

| Net | | |

| Investment | Short-Term | Long-Term |

| Income | Capital Gains | Capital Gains |

| $0.2251 | $0.1631 | $ — |

Bloomberg Barclays US Securitized MBS/ABS/CMBS Index tracks agency mortgage backed pass-through securities (both fixed-rate and hybrid ARM) guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC); investment-grade debt asset-backed securities; and investment-grade commercial mortgage backed securities. The index is constructed by grouping individual pools into aggregates or generics based on program, coupon, and vintage. Index returns are calculated monthly, assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees, expenses or sales charges. It is not possible to invest directly in an index.

10 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

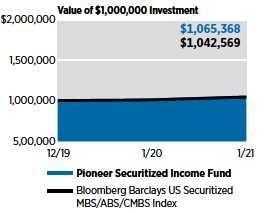

Performance Update |

1/31/21 Investment Returns

The mountain chart on the right shows the change in market value, plus reinvested dividends and distributions, of a $1,000,000 investment made in common shares of Pioneer Securitized Income Fund during the periods shown, compared to that of the Bloomberg Barclays US Securitized MBS/ABS/CMBS Index.

| Average Annual Total Returns |

(As of January 31, 2021) | |

| | Bloomberg |

| Net | Barclays US |

| Asset | Securitized |

| Value | MBS/ABS/CMBS |

| Period | (NAV) | Index |

Life of Fund | | |

(12/10/19) | 5.68% | 3.96% |

1 Year | 3.45 | 3.40 |

| Expense Ratio | | |

(Per prospectus dated December 1, 2020) |

| Gross | Net | |

2.62% | 0.99% | |

Call 1-844-391-3034 or visit www.amundi.com/us for the most recent month-end performance results. Current performance may be lower or higher than the performance data quoted.

Performance data shown represents past performance. Past performance is no guarantee of future results. Investment return and market price will fluctuate, and shares, when redeemed, may be worth more or less than their original cost.

NAV results represent the percent change in net asset value per share. Performance, including short-term performance, is not indicative of future results. Performance is net of all fees. All results are historical and assume the reinvestment of dividends and capital gains.

The Fund has no sales charges. Performance results reflect any applicable expense waivers in effect during the periods shown. Without such waivers Fund performance would be lower. Waivers may not be in effect for all funds. Certain fee waivers are contractual through a specified period. Otherwise, fee waivers can be rescinded at any time. See the prospectus and financial statements for more information.

The net expense ratio reflects the contractual expense limitation currently in effect through December 1, 2022. There can be no assurance that Amundi Pioneer will extend the expense limitation beyond such time. Please see the prospectus and financial statements for more information.

The performance table and graph do not reflect the deduction of fees and taxes that a shareowner would pay on Fund distributions.

Please refer to the financial highlights for more current expense ratios.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 11

Schedule of Investments |

1/31/21 (unaudited)

| Principal | | |

| Amount | | |

| USD ($) | | Value |

| UNAFFILIATED ISSUERS — 99.8% | |

| | ASSET BACKED SECURITIES — 32.7% | |

| of Net Assets | |

| 400,000 | Arivo Acceptance Auto Loan Receivables Trust, Series | |

| 2021-1A, Class D, 5.83%, 1/18/28 (144A) | $ 405,645 |

| 500,000 | Carvana Auto Receivables Trust, Series 2019-4A, Class E, | |

| 4.7%, 10/15/26 (144A) | 534,160 |

| 950,000(a) | CFMT LLC, Series 2019-HB1, Class M5, 6.0%, | |

| 12/25/29 (144A) | 931,950 |

| 700,000 | Continental Credit Card ABS LLC, Series 2019-1A, | |

| Class C, 6.16%, 8/15/26 (144A) | 729,927 |

| 400,000 | Crossroads Asset Trust, Series 2021-A, Class E, 5.48%, | |

| 1/20/28 (144A) | 398,818 |

| 360,137 | Diamond Resorts Owner Trust, Series 2018-1, Class D, | |

| 5.9%, 1/21/31 (144A) | 365,340 |

| 234,904 | Diamond Resorts Owner Trust, Series 2019-1A, Class D, | |

| 5.25%, 2/20/32 (144A) | 230,846 |

| 500,000 | Fair Square Issuance Trust, Series 2020-AA, Class D, | |

| 6.86%, 9/20/24 (144A) | 510,210 |

| 500,000 | First Investors Auto Owner Trust, Series 2021-1A, | |

| Class F, 5.37%, 4/17/28 (144A) | 505,873 |

| 600,000 | Foursight Capital Automobile Receivables Trust, Series | |

| 2020-1, Class F, 4.62%, 6/15/27 (144A) | 612,274 |

| 500,000 | Republic Finance Issuance Trust, Series 2019-A, Class C, | |

| 5.1%, 11/22/27 (144A) | 507,167 |

| 500,000 | Upstart Securitization Trust, Series 2019-3, Class C, | |

| 5.381%, 1/21/30 (144A) | 516,360 |

| 500,000 | Upstart Securitization Trust, Series 2020-1, Class C, | |

| 4.899%, 4/22/30 (144A) | 512,323 |

| TOTAL ASSET BACKED SECURITIES | |

| (Cost $6,654,290) | $ 6,760,893 |

| COLLATERALIZED MORTGAGE OBLIGATIONS — | |

| 62.4% of Net Assets | |

| 150,000(b) | Bellemeade Re Ltd., Series 2020-2A, Class B1, 8.63% (1 | |

| Month USD LIBOR + 850 bps), 8/26/30 (144A) | $ 157,194 |

| 545,912(a) | Cascade Funding Mortgage Trust, Series 2018-RM2, | |

| Class D, 4.0%, 10/25/68 (144A) | 535,420 |

| 480,000(a) | CFMT LLC, Series 2020-HB4, Class M5, 6.0%, | |

| 12/26/30 (144A) | 463,865 |

| 500,000(a) | COMM Mortgage Trust, Series 2020-CBM, Class F, 3.633%, | |

| 2/10/37 (144A) | 463,568 |

| 400,000(b) | Eagle Re, Series 2020-2, Class B1, 7.13% (1 Month USD | |

| LIBOR + 700 bps), 10/25/30 (144A) | 401,422 |

| 500,000(b) | Freddie Mac Stacr Remic Trust, Series 2020-DNA2, | |

| Class B2, 4.93% (1 Month USD LIBOR + 480 bps), | |

| 2/25/50 (144A) | 464,957 |

The accompanying notes are an integral part of these financial statements.

12 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

| | | |

| Principal | | |

| Amount | | |

| USD ($) | | Value |

| COLLATERALIZED MORTGAGE | |

| OBLIGATIONS — (continued) | |

| 150,000(b) | Freddie Mac Stacr Remic Trust, Series 2020-DNA3, | |

| Class B2, 9.48% (1 Month USD LIBOR + 935 bps), | |

| 6/25/50 (144A) | $ 176,207 |

| 180,000(b) | Freddie Mac Stacr Remic Trust, Series 2020-DNA5, | |

| | Class B2, 11.582% (SOFR30A + 1,150 bps), | |

| 10/25/50 (144A) | 221,870 |

| 250,000(b) | Freddie Mac Stacr Remic Trust, Series 2020-DNA6, | |

| Class B2, 5.732% (SOFR30A + 565 bps), | |

| 12/25/50 (144A) | 260,007 |

| 220,000(b) | Freddie Mac Stacr Remic Trust, Series 2020-HQA4, | |

| Class B2, 9.53% (1 Month USD LIBOR + 940 bps), | |

| 9/25/50 (144A) | 254,102 |

| 200,000(b) | Freddie Mac Stacr Remic Trust, Series 2021-DNA1, | |

| Class B2, 4.829% (SOFR30A + 475 bps), | |

| 1/25/51 (144A) | 201,477 |

| 500,000(b) | Freddie Mac Stacr Trust, Series 2018-HQA2, Class B2, | |

| | 11.13% (1 Month USD LIBOR + 1,100 bps), | |

| 10/25/48 (144A) | 574,783 |

| 750,000(b) | Freddie Mac Stacr Trust, Series 2019-FTR2, Class B1, | |

| 3.13% (1 Month USD LIBOR + 300 bps), 11/25/48 (144A) | 715,534 |

| 900,000(b) | Freddie Mac Stacr Trust, Series 2019-FTR3, Class B2, | |

| 4.948% (1 Month USD LIBOR + 480 bps), 9/25/47 (144A) | 879,750 |

| 650,000(b) | Freddie Mac Stacr Trust, Series 2019-HRP1, Class B1, | |

| 4.18% (1 Month USD LIBOR + 405 bps), 2/25/49 (144A) | 645,531 |

| 300,000(b) | Freddie Mac Structured Agency Credit Risk Debt Notes, | |

| Series 2020-HQA5, Class B2, 7.482% (SOFR30A + | |

| 740 bps), 11/25/50 (144A) | 329,267 |

| 200,000(a) | GS Mortgage-Backed Securities Trust, Series 2020-NQM1, | |

| Class B1, 5.143%, 9/27/60 (144A) | 211,137 |

| 500,000(b) | GS Mortgage Securities Corp. Trust, Series 2020-DUNE, | |

| Class G, 4.126% (1 Month USD LIBOR + 400 bps), | |

| 12/15/36 (144A) | 422,191 |

| 300,000(b) | Home Re, Ltd., Series 2020-1, Class B1, 7.13% (1 Month | |

| USD LIBOR + 700 bps), 10/25/30 (144A) | 309,358 |

| 650,000(b) | Mortgage Insurance-Linked Notes Series, Series 2020-1, | |

| Class B1, 3.13% (1 Month USD LIBOR + 300 bps), | |

| 2/25/30 (144A) | 628,823 |

| 500,000(a) | Natixis Commercial Mortgage Securities Trust, Series | |

| 2019-FAME, Class E, 4.398%, 8/15/36 (144A) | 409,677 |

| 500,000(b) | Natixis Commercial Mortgage Securities Trust, Series | |

| 2019-MILE, Class E, 3.626% (1 Month USD LIBOR | |

| + 350 bps), 7/15/36 (144A) | 481,185 |

| 180,000(b) | Radnor Re, Ltd., Series 2020-2, Class B1, 7.73% (1 Month | |

| USD LIBOR + 760 bps), 10/25/30 (144A) | 183,510 |

| 750,000(a) | RMF Buyout Issuance Trust, Series 2020-1, Class M5, | |

| 6.0%, 2/25/30 (144A) | 731,252 |

| 780,000(b) | STACR Trust, Series 2018-DNA3, Class B2, 7.88% | |

| (1 Month USD LIBOR + 775 bps), 9/25/48 (144A) | 811,248 |

The accompanying notes are an integral part of these financial statements.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 13

Schedule of Investments | 1/31/21

(unaudited) (continued)

| Principal | | |

| Amount | | |

| USD ($) | | Value |

| COLLATERALIZED MORTGAGE | |

| OBLIGATIONS — (continued) | |

| 291,086(b) | STACR Trust, Series 2018-HRP1, Class B2, 11.88% | |

| (1 Month USD LIBOR + 1,175 bps), 5/25/43 (144A) | $ 319,696 |

| 500,000(b) | STACR Trust, Series 2018-HRP2, Class B1, 4.33% | |

| (1 Month USD LIBOR + 420 bps), 2/25/47 (144A) | 510,321 |

| 150,000(b) | Traingle Re, Ltd., Series 2020-1, Class B1, 7.88% (1 | |

| Month USD LIBOR + 775 bps), 10/25/30 (144A) | 154,930 |

| 745,756(a) | Velocity Commercial Capital Loan Trust, Series 2020-1, | |

| Class M6, 5.69%, 2/25/50 (144A) | 718,672 |

| 250,000(a) | Vista Point Securitization Trust, Series 2020-1, | |

| Class B1, 5.375%, 3/25/65 (144A) | 262,456 |

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | |

| (Cost $13,101,301) | $12,899,410 |

| COMMERCIAL MORTGAGE-BACKED SECURITIES — | |

| 3.3% of Net Assets | |

| 150,000(b) | Freddie Mac Multifamily Structured Credit Risk, Series | |

| 2021-MN1, Class B1, 7.836% (SOFR30A + | |

| 775 bps), 1/25/51 (144A) | $ 165,790 |

| 500,000(b) | Multifamily Connecticut Avenue Securities Trust, Series | |

| | 2020-01, Class M10, 3.88% (1 Month USD LIBOR | |

| + 375 bps), 3/25/50 (144A) | 521,718 |

| TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES | |

| (Cost $555,916) | $ 687,508 |

| CORPORATE BONDS — 1.4% of Net Assets | |

| Airlines — 1.4% | |

| 180,000 | British Airways 2020-1 Class B Pass Through Trust, | |

| 8.375%, 11/15/28 (144A) | $ 205,608 |

| 78,000 | United Airlines 2020-1 Class B Pass Through Trust, | |

| 4.875%, 1/15/26 | 79,755 |

| Total Airlines | $ 285,363 |

| TOTAL CORPORATE BONDS | |

| (Cost $258,000) | $ 285,363 |

| TOTAL INVESTMENTS IN UNAFFILIATED ISSUERS — 99.8% | |

| (Cost $20,569,507) | $20,633,174 |

| OTHER ASSETS AND LIABILITIES — 0.2% | $ 49,965 |

| NET ASSETS — 100.0% | $20,683,139 |

| |

| bps | Basis Points. |

| LIBOR | London Interbank Offered Rate. |

| SOFR30A | Secured Overnight Financing Rate 30-day Average. |

| (144A) | Security is exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold normally to qualified institutional buyers in a transaction exempt from registration. At January 31, 2021, the value of these securities amounted to $20,553,419, or 99.4% of net assets. |

The accompanying notes are an integral part of these financial statements.

14 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

| |

| (a) | The interest rate is subject to change periodically. The interest rate and/or reference index and spread shown at January 31, 2021. |

| (b) | Floating rate note. Coupon rate, reference index and spread shown at January 31, 2021. |

Purchases and sales of securities (excluding temporary cash investments) for the six months ended January 31, 2021, aggregated $5,963,224 and $5,863,879, respectively.

The Fund is permitted to engage in purchase and sale transactions (“cross trades”) with certain funds and accounts for which Amundi Asset Management US, Inc. (the “Adviser”) serves as the Fund’s investment adviser, as set forth in Rule 17a-7 under the Investment Company Act of 1940, pursuant to procedures adopted by the Board of Trustees. Under these procedures, cross trades are effected at current market prices. During the six months ended January 31, 2021, the Fund did not engage in any cross trade activity.

At January 31, 2021, the net unrealized appreciation on investments based on cost for federal tax purposes of $20,569,507 was as follows:

| Aggregate gross unrealized appreciation for all investments in which | | | |

| there is an excess of value over tax cost | | $ | 564,399 | |

| Aggregate gross unrealized depreciation for all investments in which | | | | |

| there is an excess of tax cost over value | | | (500,732 | ) |

| Net unrealized appreciation | | $ | 63,667 | |

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels below.

Level 1 – unadjusted quoted prices in active markets for identical securities.

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.). See Notes to Financial Statements — Note 1A.

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments). See Notes to Financial Statements — Note 1A.

The following is a summary of the inputs used as of January 31, 2021, in valuing the Fund’s investments:

| | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Asset Backed Securities | | $ | — | | | $ | 6,760,893 | | | $ | — | | | $ | 6,760,893 | |

Collateralized Mortgage Obligations | | | — | | | | 12,899,410 | | | | — | | | | 12,899,410 | |

Commercial Mortgage-Backed Securities | | | — | | | | 687,508 | | | | — | | | | 687,508 | |

Corporate Bonds | | | — | | | | 285,363 | | | | — | | | | 285,363 | |

| Total Investments in Securities | | $ | — | | | $ | 20,633,174 | | | $ | — | | | $ | 20,633,174 | |

The accompanying notes are an integral part of these financial statements.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 15

Schedule of Investments | 1/31/21

(unaudited) (continued)

The following is a reconciliation of assets valued using significant unobservable inputs (Level 3):

| | Asset | |

| | Backed | |

| | Securities | |

Balance as of 7/31/20 | | $ | 739,670 | |

Realized gain (loss) (1) | | | — | |

Change in unrealized appreciation (depreciation) (2) | | | — | |

Accrued discounts/premiums | | | — | |

Purchases | | | — | |

Sales | | | — | |

Transfers in to Level 3* | | | — | |

Transfers out of Level 3* | | | (739,670 | ) |

| Balance as of 1/31/21 | | $ | — | |

(1) | Realized gain (loss) on these securities is included in the realized gain (loss) from investments on the Statement of Operations. |

(2) | Unrealized appreciation (depreciation) on these securities is included in the change in unrealized appreciation (depreciation) from investments on the Statement of Operations. |

* | Transfers are calculated on the beginning of period value. For the six months ended January 31, 2021, securities with an aggregate market value of $739,670 was transferred from Level 3 to Level 2, due to valuing the security using observable inputs. There were no other transfers in or out of Level 3. |

Net change in unrealized appreciation (depreciation) of Level 3 investments still held and considered Level 3 at January 31, 2021: $—

The accompanying notes are an integral part of these financial statements.

16 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

Statement of Assets and Liabilities |

1/31/21 (unaudited)

| ASSETS: | | | |

| Investments in unaffiliated issuers, at value (cost $20,569,507) | | $ | 20,633,174 | |

| Cash | | | 513,476 | |

| Receivables — | | | | |

| Interest | | | 36,447 | |

| Due from the Adviser | | | 44,810 | |

| Other assets | | | 23,040 | |

| Total assets | | $ | 21,250,947 | |

| LIABILITIES: | | | | |

| Payables — | | | | |

| Investment securities purchased | | $ | 477,949 | |

| Distributions | | | 7,804 | |

| Trustees’ fees | | | 736 | |

| Administrative fees | | | 10,988 | |

| Professional fees | | | 36,263 | |

| Due to affiliates | | | 14,625 | |

| Accrued expenses | | | 19,443 | |

| Total liabilities | | $ | 567,808 | |

| NET ASSETS: | | | | |

| Paid-in capital | | $ | 20,710,917 | |

| Distributable earnings (loss) | | | (27,778 | ) |

| Net assets | | $ | 20,683,139 | |

| NET ASSET VALUE PER SHARE: | | | | |

No par value | | | | |

| (based on $20,683,139/2,092,766 shares) | | $ | 9.88 | |

The accompanying notes are an integral part of these financial statements.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 17

Statement of Operations (unaudited)

FOR THE SIX MONTHS ENDED 1/31/21

| INVESTMENT INCOME: | | | | | | |

| Interest from unaffiliated issuers | | $ | 545,025 | | | | |

| Total investment income | | | | | | $ | 545,025 | |

| EXPENSES: | | | | | | | | |

| Management fees | | $ | 80,381 | | | | | |

| Administrative expense | | | 33,629 | | | | | |

| Transfer agent fees | | | 28 | | | | | |

| Shareowner communications expense | | | 2,237 | | | | | |

| Custodian fees | | | 5 | | | | | |

| Registration fees | | | 16,004 | | | | | |

| Professional fees | | | 50,526 | | | | | |

| Printing expense | | | 6,978 | | | | | |

| Pricing fees | | | 2,200 | | | | | |

| Trustees’ fees | | | 3,591 | | | | | |

| Miscellaneous | | | 10 | | | | | |

| Total expenses | | | | | | $ | 195,589 | |

| Less fees waived and expenses reimbursed | | | | | | | | |

| by the Adviser | | | | | | | (101,969 | ) |

| Net expenses | | | | | | $ | 93,620 | |

| Net investment income | | | | | | $ | 451,405 | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | | |

| Net realized gain (loss) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | | | | $ | (55,331 | ) |

| Change in net unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments in unaffiliated issuers | | | | | | $ | 2,884,199 | |

| Net realized and unrealized gain (loss) on investments | | | | | | $ | 2,828,868 | |

| Net increase in net assets resulting from operations | | | | | | $ | 3,280,273 | |

The accompanying notes are an integral part of these financial statements.

18 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

Statements of Changes in Net Assets

| | Six Months | | | | |

| | Ended | | | 12/10/19 | |

| | 1/31/21 | | | to | |

| | (unaudited) | | | 7/31/20 | |

| FROM OPERATIONS: | | | | | | |

Net investment income (loss) | | $ | 451,405 | | | $ | 549,956 | |

Net realized gain (loss) on investments | | | (55,331 | ) | | | 304,483 | |

Change in net unrealized appreciation (depreciation) | | | | | | | | |

| on investments | | | 2,884,199 | | | | (2,820,532 | ) |

| Net increase (decrease) in net assets resulting | | | | | | | | |

| from operations | | $ | 3,280,273 | | | $ | (1,966,093 | ) |

| DISTRIBUTIONS TO SHAREOWNERS: | | | | | | | | |

| ($0.39 and $0.28 per share, respectively) | | $ | (792,045 | ) | | $ | (549,913 | ) |

| Total distributions to shareowners | | $ | (792,045 | ) | | $ | (549,913 | ) |

| FROM FUND SHARE TRANSACTIONS: | | | | | | | | |

Net proceeds from sales of shares | | $ | 55,000 | | | $ | 19,630,451 | |

Reinvestment of distributions | | | 783,514 | | | | 546,954 | |

Cost of shares repurchased | | | (299,218 | ) | | | (5,784 | ) |

| Net increase in net assets resulting from Fund | | | | | | | | |

| share transactions | | $ | 539,296 | | | $ | 20,171,621 | |

| Net increase in net assets | | $ | 3,027,524 | | | $ | 17,655,615 | |

| NET ASSETS: | | | | | | | | |

Beginning of period | | $ | 17,655,615 | | | $ | — | |

End of period | | $ | 20,683,139 | | | $ | 17,655,615 | |

The accompanying notes are an integral part of these financial statements.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 19

Statements of Changes in Net Assets

(unaudited)

| | Six Months | | | Six Months | | | | | | | |

| | Ended | | | Ended | | | 12/10/19 | | | 12/10/19 | |

| | 1/31/21 | | | 1/31/21 | | | to | | | to | |

| | Shares | | | Amount | | | 7/31/20 | | | 7/31/20 | |

| | (unaudited) | | | (unaudited) | | | Shares | | | Amount | |

Shares sold | | | 6,308 | | | $ | 55,000 | | | | 1,969,894 | | | $ | 19,630,451 | |

Reinvestment of distributions | | | 84,509 | | | | 783,514 | | | | 67,229 | | | | 546,954 | |

Less shares repurchased | | | (34,305 | ) | | | (299,218 | ) | | | (868 | ) | | | (5,784 | ) |

| Net increase | | | 56,512 | | | $ | 539,296 | | | | 2,036,255 | | | $ | 20,171,621 | |

The accompanying notes are an integral part of these financial statements.

20 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

| | Six Months | | | | |

| | Ended | | | | |

| | 1/31/21 | | | 12/10/19 to | |

| | (unaudited) | | | 7/31/20* | |

Net asset value, beginning of period | | $ | 8.67 | | | $ | 10.00 | |

Increase (decrease) from investment operations: | | | | | | | | |

| Net investment income (loss) (a) | | $ | 0.22 | | | $ | 0.28 | |

| Net realized and unrealized gain (loss) on investments | | | 1.38 | | | | (1.33 | ) |

| Net increase (decrease) from investment operations | | $ | 1.60 | | | $ | (1.05 | ) |

Distributions to shareowners: | | | | | | | | |

| Net investment income | | $ | (0.23 | ) | | $ | (0.28 | ) |

| Net realized gain | | | (0.16 | ) | | | — | |

| Total distributions | | $ | (0.39 | ) | | $ | (0.28 | ) |

| Net increase (decrease) in net asset value | | $ | 1.21 | | | $ | (1.33 | ) |

Net asset value, end of period | | $ | 9.88 | | | $ | 8.67 | |

| Total return (b) | | | 18.78 | %(c) | | | (10.30 | )%(c) |

Ratio of net expenses to average net assets | | | 0.99 | %(d) | | | 0.99 | %(d) |

Ratio of net investment income (loss) to average net assets | | | 4.77 | %(d) | | | 5.06 | %(d) |

Portfolio turnover rate | | | 31 | %(c) | | | 82 | %(c) |

Net assets, end of period (in thousands) | | $ | 20,683 | | | $ | 17,656 | |

| Total expenses to average net assets | | | 2.06 | %(d) | | | 2.62 | %(d) |

| Net investment income (loss) to average net assets | | | 3.70 | %(d) | | | 3.43 | %(d) |

* | Commenced operations on December 10, 2019. |

(a) | The per-share data presented above is based on the average shares outstanding for the period presented. |

(b) | Assumes initial investment at net asset value at the beginning of each period, reinvestment of all distributions, the complete redemption of the investment at net asset value at the end of each period and no sales charges. Total return would be reduced if sales charges were taken into account. |

(c) | Not annualized. |

(d) | Annualized. |

The accompanying notes are an integral part of these financial statements.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 21

Notes to Financial Statements |

1/31/21 (unaudited)

1. Organization and Significant Accounting Policies

Pioneer Securitized Income Fund (the “Fund”) was organized as a Delaware statutory trust on July 16, 2019. Prior to commencing operations on December 10, 2019, the Fund had no operations other than matters relating to its organization and registration as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The investment objective of the Fund is to seek total return. Amundi Asset Management US, Inc. agreed to pay all organizational and offering expenses of the Fund related to the commencement of operations. The Fund is not obligated to repay any such organizational expenses or offering costs paid by the Adviser.

The Fund offers shares through Amundi Distributor US, Inc. (the “Distributor”). Shares are offered at the Fund’s current net asset value (“NAV”) per share. The Fund’s ability to accept offers to purchase shares may be limited when appropriate investments for the Fund are not available. Shares are generally available for purchase by registered investment advisers broker-dealers and by or through other financial intermediaries and programs sponsored by such financial intermediaries. Shares are also available to certain direct investors, which may be individuals, trusts, foundations and other institutional investors. Initial investments are subject to investment minimums described in the prospectus. Registered investment advisers and other financial intermediaries may impose different or additional minimum investment and eligibility requirements from those of the fund. Amundi Asset Management US, Inc. (the “Adviser”) or the Distributor may waive the Fund’s minimum investment requirements. The Fund is an “interval” fund and makes periodic offers to repurchase shares (See Note 5). Except as permitted by the Fund’s structure, no shareowner will have the right to require the Fund to repurchase its shares. No public market for shares exists, and none is expected to develop in the future. Consequently, shareowners generally will not be able to liquidate their investment other than as a result of repurchases of their shares by the Fund.

Amundi Asset Management US, Inc., an indirect, wholly owned subsidiary of Amundi and Amundi’s wholly owned subsidiary, Amundi USA, Inc., serves as the Fund’s investment adviser (the “Adviser”). Prior to January 1, 2021, the Adviser was named Amundi Pioneer Asset Management, Inc. Amundi Distributor US, Inc., an affiliate of Amundi Asset Management US, Inc., serves as the Fund’s distributor (the “Distributor”).

22 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

In August 2018, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update 2018-13 “Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement” (“ASU 2018-13”) which modifies disclosure requirements for fair value measurements, principally for Level 3 securities and transfers between levels of the fair value hierarchy. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019 and for interim periods within those fiscal years. The Fund has adopted ASU 2018-13 for the year ended January 31, 2021. The impact to the Fund’s adoption was limited to changes in the Fund’s disclosures regarding fair value, primarily those disclosures related to transfers between levels of the fair value hierarchy and disclosure of the range and weighted average used to develop significant unobservable inputs for Level 3 fair value investments, when applicable.

In March 2020, FASB issued an Accounting Standard Update, ASU 2020-04, Reference Rate Reform (Topic 848) — Facilitation of the Effects of Reference Rate Reform on Financial Reporting (“ASU 2020-04”), which provides optional, temporary relief with respect to the financial reporting of contracts subject to certain types of modifications due to the planned discontinuation of the London Interbank Offered Rate (“LIBOR”) and other LIBOR-based reference rates at the end of 2021. The temporary relief provided by ASU 2020-04 is effective for certain reference rate-related contract modifications that occur during the period from March 12, 2020 through December 31, 2022. Management is evaluating the impact of ASU 2020-04 on the Fund’s investments, derivatives, debt and other contracts, if applicable, that will undergo reference rate-related modifications as a result of the reference rate reform.

The Fund is an investment company and follows investment company accounting and reporting guidance under U.S. Generally Accepted Accounting Principles (“U.S. GAAP”). U.S. GAAP requires the management of the Fund to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of income, expenses and gain or loss on investments during the reporting period. Actual results could differ from those estimates.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

A. Security Valuation

The net asset value of the Fund is computed once daily, on each day the New York Stock Exchange (“NYSE”) is open, as of the close of regular trading on the NYSE.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 23

Fixed-income securities are valued by using prices supplied by independent pricing services, which consider such factors as market prices, market events, quotations from one or more brokers, Treasury spreads, yields, maturities and ratings, or may use a pricing matrix or other fair value methods or techniques to provide an estimated value of the security or instrument. A pricing matrix is a means of valuing a debt security on the basis of current market prices for other debt securities, historical trading patterns in the market for fixed-income securities and/or other factors. Non-U.S. debt securities that are listed on an exchange will be valued at the bid price obtained from an independent third party pricing service. When independent third party pricing services are unable to supply prices, or when prices or market quotations are considered to be unreliable, the value of that security may be determined using quotations from one or more broker-dealers.

Securities for which independent pricing services or broker-dealers are unable to supply prices or for which market prices and/or quotations are not readily available or are considered to be unreliable are valued by a fair valuation team comprised of certain personnel of the Adviser pursuant to procedures adopted by the Fund’s Board of Trustees. The Adviser’s fair valuation team uses fair value methods approved by the Valuation Committee of the Board of Trustees. The Adviser’s fair valuation team is responsible for monitoring developments that may impact fair valued securities and for discussing and assessing fair values on an ongoing basis, and at least quarterly, with the Valuation Committee of the Board of Trustees.

Inputs used when applying fair value methods to value a security may include credit ratings, the financial condition of the company, current market conditions and comparable securities. The Fund may use fair value methods if it is determined that a significant event has occurred after the close of the exchange or market on which the security trades and prior to the determination of the Fund’s net asset value. Examples of a significant event might include political or economic news, corporate restructurings, natural disasters, terrorist activity or trading halts. Thus, the valuation of the Fund’s securities may differ significantly from exchange prices, and such differences could be material.

At January 31, 2021, no securities were valued using fair value methods (other than securities valued using prices supplied by independent pricing services, broker-dealers or using a third party insurance industry pricing model).

24 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

B. Investment Income and Transactions

Interest income, including interest on income-bearing cash accounts, is recorded on the accrual basis. Dividend and interest income are reported net of unrecoverable foreign taxes withheld at the applicable country rates and net of income accrued on defaulted securities.

Interest and dividend income payable by delivery of additional shares is reclassified as PIK (payment-in-kind) income upon receipt and is included in interest and dividend income, respectively.

Principal amounts of mortgage-backed securities are adjusted for monthly paydowns. Premiums and discounts related to certain mortgage-backed securities are amortized or accreted in proportion to the monthly paydowns. All discounts/premiums on purchase prices of debt securities are accreted/amortized for financial reporting purposes over the life of the respective securities, and such accretion/amortization is included in interest income.

Security transactions are recorded as of trade date. Gains and losses on sales of investments are calculated on the identified cost method for both financial reporting and federal income tax purposes.

C. Federal Income Taxes

It is the Fund’s policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its net taxable income and net realized capital gains, if any, to its shareowners. Therefore, no provision for federal income taxes is required. As of July 31, 2020, the Fund did not accrue any interest or penalties with respect to uncertain tax positions, which, if applicable, would be recorded as an income tax expense on the Statement of Operations. Tax returns filed within the prior three years remain subject to examination by federal and state tax authorities.

The amount and character of income and capital gain distributions to shareowners are determined in accordance with federal income tax rules, which may differ from U.S. GAAP. Distributions in excess of net investment income or net realized gains are temporary over distributions for financial statement purposes resulting from differences in the recognition or classification of income or distributions for financial statement and tax purposes. Capital accounts within the financial statements are adjusted for permanent book/tax differences to reflect tax character, but are not adjusted for temporary differences.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 25

The tax character of current year distributions payable will be determined at the end of the current taxable year. The tax character of distributions paid during the year ended July 31, 2020 was as follows:

| | 2020 | |

| Distributions paid from: | | | |

| Ordinary income | | $ | 549,913 | |

| Total | | $ | 549,913 | |

The following shows the components of distributable earnings on a federal income tax basis at July 31, 2020:

| | 2020 | |

| Distributable earnings: | | | |

| Undistributed ordinary income | | $ | 305,851 | |

| Capital loss carryforward | | | — | |

| Current year dividend payable | | | (1,325 | ) |

| Net unrealized depreciation | | | (2,820,532 | ) |

| Total | | $ | (2,516,006 | ) |

D. Risks

The value of securities held by the Fund may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political or regulatory conditions, recessions, the spread of infectious illness or other public health issues, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. In the past several years, financial markets have experienced increased volatility, depressed valuations, decreased liquidity and heightened uncertainty. These conditions may continue, recur, worsen or spread. A general rise in interest rates could adversely affect the price and liquidity of fixed-income securities and could also result in increased redemptions from the Fund.

At times, the Fund’s investments may represent industries or industry sectors that are interrelated or have common risks, making the Fund more susceptible to any economic, political, or regulatory developments or other risks affecting those industries and sectors. The Fund’s investments in foreign markets and countries with limited developing markets may subject the Fund to a greater degree of risk than investments in a developed market. These risks include disruptive political or economic conditions and the imposition of adverse governmental laws or currency exchange restrictions.

The Fund’s investments, payment obligations and financing terms may be based on floating rates, such as LIBOR (London Interbank Offered Rate). Plans are underway to phase out the use of LIBOR by the end of 2021. The

26 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

administrator of LIBOR recently announced a possible delay in the phase out of a majority of the U.S. dollar LIBOR publications until mid-2023, with the remainder of the LIBOR publications to end at the end of 2021. There remains uncertainty regarding the nature of any replacement rate and the impact of the transition from LIBOR on the fund, issuers of instruments in which the fund invests, and financial markets generally.

With the increased use of technologies such as the Internet to conduct business, the Fund is susceptible to operational, information security and related risks. While the Fund’s Adviser has established business continuity plans in the event of, and risk management systems to prevent, limit or mitigate, such cyber-attacks, there are inherent limitations in such plans and systems, including the possibility that certain risks have not been identified. Furthermore, the Fund cannot control the cybersecurity plans and systems put in place by service providers to the Fund such as Brown Brothers Harriman & Co., the Fund’s custodian and accounting agent, and DST Systems, Inc., the Fund’s transfer agent. In addition, many beneficial owners of Fund shares hold them through accounts at broker-dealers, retirement platforms and other financial market participants over which neither the Fund nor Amundi exercises control. Each of these may in turn rely on service providers to them, which are also subject to the risk of cyber-attacks. Cybersecurity failures or breaches at Amundi or the Fund’s service providers or intermediaries have the ability to cause disruptions and impact business operations, potentially resulting in financial losses, interference with the Fund’s ability to calculate its net asset value, impediments to trading, the inability of Fund shareowners to effect share purchases or redemptions or receive distributions, loss of or unauthorized access to private shareowner information and violations of applicable privacy and other laws, regulatory fines, penalties, reputational damage, or additional compliance costs. Such costs and losses may not be covered under any insurance. In addition, maintaining vigilance against cyber-attacks may involve substantial costs over time, and system enhancements may themselves be subject to cyber-attacks.

COVID-19

The respiratory illness COVID-19 caused by a novel coronavirus has resulted in a global pandemic and major disruption to economies and markets around the world, including the United States. Global financial markets have experienced extreme volatility and severe losses, and trading in many instruments has been disrupted. Liquidity for many instruments has been greatly reduced for periods of time. Some interest rates are very low and in some cases yields are negative. Some sectors of the economy and individual issuers have experienced particularly large losses. These circumstances may continue for an extended period of time, and may continue to affect adversely the value and liquidity of the Fund’s investments. The ultimate

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 27

economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. Governments and central banks, including the Federal Reserve in the U.S., have taken extraordinary and unprecedented actions to support local and global economies and the financial markets. These actions have resulted in significant expansion of public debt, including in the U.S. The impact of these measures, and whether they will be effective to mitigate the economic and market disruption, will not be known for some time. The consequences of high public debt, including its future impact on the economy and securities markets, likewise may not be known for some time.

The Fund’s prospectus contains unaudited information regarding the Fund’s principal risks. Please refer to that document when considering the Fund’s principal risks.

2. Management Agreement

The Adviser manages the Fund’s portfolio. Management fees are calculated daily and paid monthly at the annual rate of 0.85% of the Fund’s average daily net assets. For the six month period ended January 31, 2021, the effective management fee was equivalent to 0.85% (annualized) of the Fund’s average daily net assets.

The Adviser has contractually agreed to limit ordinary operating expenses (ordinary operating expenses means all fund expenses other than extraordinary expenses, such as litigation, taxes, brokerage commissions and acquired fund fees and expenses) to the extent required to reduce fund expenses to 0.99% of the average daily net assets attributable to fund shares. This expense limitation is in effect through December 1, 2022. There can be no assurance that the Adviser will extend the expense limitation beyond December 1, 2022.

In addition, under the management and administration agreements, certain other services and costs, including accounting, regulatory reporting and insurance premiums, are paid by the Fund as administrative reimbursements. Included in “Due to affiliates” reflected on the Statement of Assets and Liabilities is $14,625 in management fees, administrative costs and certain other reimbursements payable to the Adviser at January 31, 2021.

3. Compensation of Trustees and Officers

The Fund pays an annual fee to its Trustees. The Adviser reimburses the Fund for fees paid to the Interested Trustees. The Fund does not pay any salary or other compensation to its officers. For the six months ended January 31, 2021, the Fund paid $3,591 in Trustees’ compensation, which is

28 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

reflected on the Statement of Operations as Trustees’ fees. At January 31, 2021, the Fund had a payable for Trustees’ fees on its Statement of Assets and Liabilities of $736.

4. Transfer Agent

DST Systems, Inc. serves as the transfer agent to the Fund at negotiated rates. Transfer agent fees and payables shown on the Statement of Operations and the Statement of Assets and Liabilities, respectively, include sub-transfer agent expenses incurred through the Fund’s omnibus relationship contracts.

5. Repurchase Offers

The Fund is a closed-end “interval” fund. The Fund has adopted, pursuant to Rule 23c-3 under the 1940 Act, a fundamental policy, which cannot be changed without shareowner approval, requiring the Fund to offer to repurchase at least 5% and up to 25% of the Fund’s outstanding shares at NAV on a regular schedule.

The Fund is required to make repurchase offers every three months. Quarterly repurchase offers occur in the months of March, June, September and December. The Fund will typically seek to conduct quarterly repurchase offers for 15% of the Fund’s outstanding shares at their NAV per share unless the Fund’s Board of Trustees has approved a higher or lower amount for that repurchase offer. Repurchase offers in excess of 5% are made solely at the discretion of the Fund’s Board of Trustees and investors should not rely on any expectation of repurchase offers in excess of 5%. Even though the Fund makes quarterly repurchase offers investors should consider the Fund’s shares illiquid.

In the event a repurchase offer by the Fund is oversubscribed, the Fund may repurchase, but is not required to repurchase, additional shares up to a maximum amount of 2% of the outstanding shares of the Fund. If the Fund determines not to repurchase additional shares beyond the repurchase offer amount, or if shareowners submit for repurchase an amount of shares greater than that which the Fund is entitled to repurchase, the Fund will repurchase the shares submitted for repurchase on a pro rata basis.

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 29

Shares repurchased during the six months ended January 31, 2021 were as follows:

| | | | Percentage | | | |

| | | | of | | | |

| | | | Outstanding | Amount | | |

| | | NAV on | Shares | of Shares | | |

| Repurchase

| Repurchase | Repurchase | the Fund

| the Fund | Percentage | Number |

| Commencement | Request

| Pricing | Pricing | Offered to | Offered to | of Shares | of Shares |

| Date | Deadline | Date | Date | Repurchase | Repurchase | Tendered

| Tendered |

9/25/20 | 10/23/20 | 11/5/20 | $9.13 | 15% | 303,063.213 | 1.2869% | 3,900.000 |

12/16/20 | 1/22/21 | 2/5/21 | $9.89 | 15% | 312,807.950 | 0.0320% | 100.000 |

Effective August 24, 2020, the Fund no longer intends to borrow for leverage purposes in an amount equal to approximately 30% of the Fund’s net assets.

If approved by the board, include a subsequent event note with respect to the upcoming conversion of the fund into an open-end fund:

The Board of Trustees of Fund has unanimously approved the conversion of the Fund into an open-end fund. The conversion will be accomplished through the reorganization of the Fund with and into a newly-organized open-end fund, also called Pioneer Securitized Income Fund (the “Successor Fund”). The Reorganization is expected to occur in the third quarter of 2021.

Shareholders of the Successor Fund will be able to redeem their shares at the share price next calculated after the Successor Fund receives the redemption request in good order. The Successor Fund calculates its share price every day the New York Stock Exchange is open for trading. In contrast, shareholders of the Fund generally are not able to liquidate their investment other than as a result of repurchases of shares by the Fund. The Fund currently makes a repurchase offer of 15% of its outstanding shares every three months.

The Successor Fund will have the same investment objective and substantially similar investment strategies and investment policies as the Fund.

The Reorganization generally is not expected to result in income, gain or loss being recognized for federal income tax purposes by the Funds or by the shareholders of the Fund as a direct result of the Reorganization.

Additional information about the Reorganization and the Successor Fund will be provided to shareholders prior to the consummation of the Reorganization.

30 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

Approval of Investment Management Agreement

Amundi Pioneer Asset Management, Inc.1 (“APAM”) serves as the investment adviser to Pioneer Securitized Income Fund (the “Fund”) pursuant to an investment management agreement between APAM and the Fund. In order for APAM to remain the investment adviser of the Fund, the Trustees of the Fund must determine annually whether to renew the investment management agreement for the Fund.

The contract review process began in January 2020 as the Trustees of the Fund agreed on, among other things, an overall approach and timeline for the process. Contract review materials were provided to the Trustees in March 2020, July 2020 and September 2020. In addition, the Trustees reviewed and discussed the Fund’s performance at regularly scheduled meetings throughout the year, and took into account other information related to the Fund provided to the Trustees at regularly scheduled meetings, in connection with the review of the Fund’s investment management agreement.

In March 2020, the Trustees, among other things, discussed the memorandum provided by Fund counsel that summarized the legal standards and other considerations that are relevant to the Trustees in their deliberations regarding the renewal of the investment management agreement, and reviewed and discussed the qualifications of the investment management teams for the Fund, as well as the level of investment by the Fund’s portfolio managers in the Fund. In July 2020, the Trustees, among other things, reviewed the Fund’s management fees and total expense ratios, the financial statements of APAM and its parent companies, profitability analyses provided by APAM, and analyses from APAM as to possible economies of scale. The Trustees also reviewed the profitability of the institutional business of APAM and APAM’s affiliate, Amundi Pioneer Institutional Asset Management, Inc.2 (“APIAM” and, together with APAM, “Amundi Pioneer”), as compared to that of APAM’s fund management business, and considered the differences between the fees and expenses of the Fund and the fees and expenses of APAM’s and APIAM’s institutional accounts, as well as the different services provided by APAM to the Fund and by APAM and APIAM to the institutional accounts. The Trustees further considered contract review materials, including additional materials received in response to the Trustees’ request, in September 2020.

1 | Effective January 1, 2021, Amundi Pioneer Asset Management, Inc. changed its name to Amundi Asset Management US, Inc. (“Amundi US”). |

2 | Effective January 1, 2021, Amundi Pioneer Institutional Asset Management, Inc. (“APIAM”) merged with and into Amundi US. After the Merger, the investment advisory services previously provided by APIAM are now provided through Amundi US. |

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 31

At a meeting held on September 15, 2020, based on their evaluation of the information provided by APAM and third parties, the Trustees of the Fund, including the Independent Trustees voting separately, unanimously approved the renewal of the investment management agreement for another year. In approving the renewal of the investment management agreement, the Trustees considered various factors that they determined were relevant, including the factors described below. The Trustees did not identify any single factor as the controlling factor in determining to approve the renewal of the agreement.

Nature, Extent and Quality of Services

The Trustees considered the nature, extent and quality of the services that had been provided by APAM to the Fund, taking into account the investment objective and strategy of the Fund. The Trustees also reviewed APAM’s investment approach for the Fund and its research process. The Trustees considered the resources of APAM and the personnel of APAM who provide investment management services to the Fund. They also reviewed the amount of non-Fund assets managed by the portfolio managers of the Fund. They considered the non-investment resources and personnel of APAM that are involved in APAM’s services to the Fund, including APAM’s compliance, risk management, and legal resources and personnel. The Trustees noted the substantial attention and high priority given by APAM’s senior management to the Pioneer Fund complex. The Trustees considered the implementation and effectiveness of APAM’s business continuity plan in response to the COVID-19 pandemic.

The Trustees considered that APAM supervises and monitors the performance of the Fund’s service providers and provides the Fund with personnel (including Fund officers) and other resources that are necessary for the Fund’s business management and operations. The Trustees also considered that, as administrator, APAM is responsible for the administration of the Fund’s business and other affairs. The Trustees considered the fees paid to APAM for the provision of administration services.

Based on these considerations, the Trustees concluded that the nature, extent and quality of services that had been provided by APAM to the Fund were satisfactory and consistent with the terms of the investment management agreement.

32 Pioneer Securitized Income Fund | Semiannual Report | 1/31/21

Performance of the Fund

In considering the Fund’s performance, the Trustees regularly review and discuss throughout the year data prepared by APAM and information comparing the Fund’s performance with the performance of its peer group of funds, as classified by Morningstar, Inc. (Morningstar), and with the performance of the Fund’s benchmark index. They also discuss the Fund’s performance with APAM on a regular basis. The Trustees’ regular reviews and discussions were factored into the Trustees’ deliberations concerning the renewal of the investment management agreement.

Management Fee and Expenses

The Trustees noted that comparative information was not available for this Fund as the Fund commenced operations on December 10, 2019. In initially approving the Fund’s management fee, the Trustees considered information presented by APAM to compare the Fund’s proposed management fee and anticipated expense ratio with other closed-end and interval funds that have at least 80% of their underlying holdings in securitized assets. The Trustees considered that the Fund’s proposed management fee would be low compared to the management fee charged by such closed-end and interval funds. The Trustees noted that APAM had agreed to waive fees and/or reimburse expenses in order to limit the ordinary operating expenses of the Fund. The Trustees noted that they separately review and consider the impact of the Fund’s transfer agency and Fund- and APAM-paid expenses for sub-transfer agency and intermediary arrangements, and that the results of the most recent such review were considered in the consideration of the Fund’s expense ratio.

The Trustees reviewed management fees charged by APAM and APIAM to institutional and other clients, including publicly offered European funds sponsored by APAM’s affiliates, unaffiliated U.S. registered investment companies (in a sub-advisory capacity), and unaffiliated foreign and domestic separate accounts. The Trustees also considered APAM’s costs in providing services to the Fund and APAM’s and APIAM’s costs in providing services to the other clients and considered the differences in management fees and profit margins for fund and non-fund services. In evaluating the fees associated with APAM’s and APIAM’s client accounts, the Trustees took into account the respective demands, resources and complexity associated with the Fund and other client accounts. The Trustees noted that, in some instances, the fee rates for those clients were lower than the management fee for the Fund and considered that, under the investment management agreement with the Fund, APAM performs additional services for the Fund that it does not provide to those other clients or services that

Pioneer Securitized Income Fund | Semiannual Report | 1/31/21 33

are broader in scope, including oversight of the Fund’s other service providers and activities related to compliance and the extensive regulatory and tax regimes to which the Fund is subject. The Trustees also considered the entrepreneurial risks associated with APAM’s management of the Fund.

The Trustees concluded that the management fee payable by the Fund to APAM was reasonable in relation to the nature and quality of the services provided by APAM.

Profitability