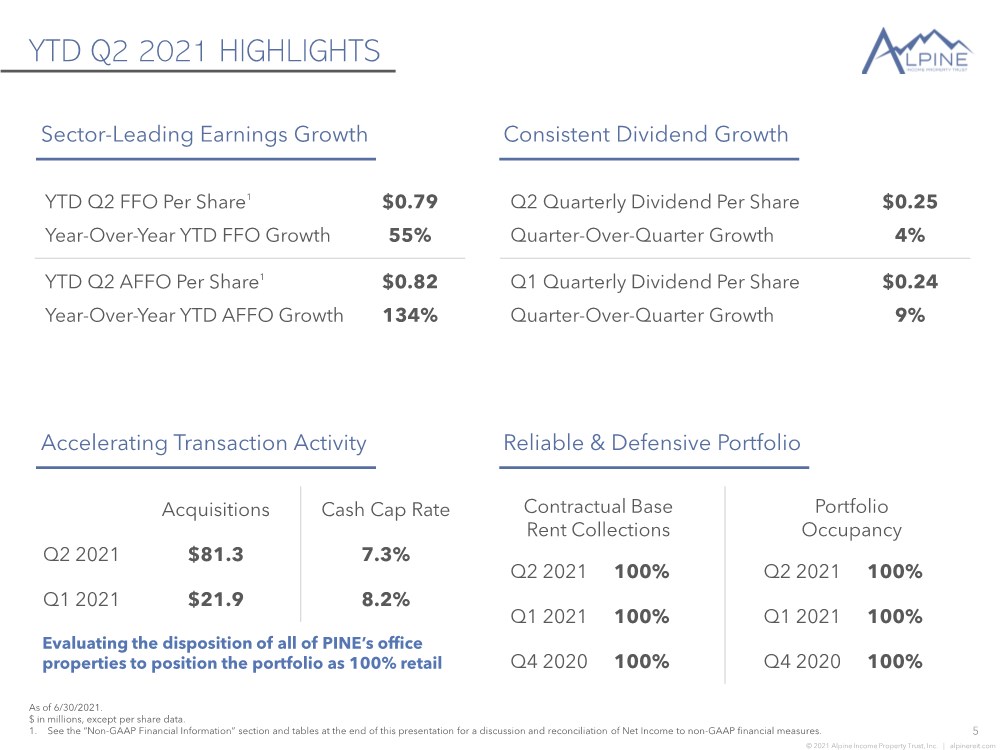

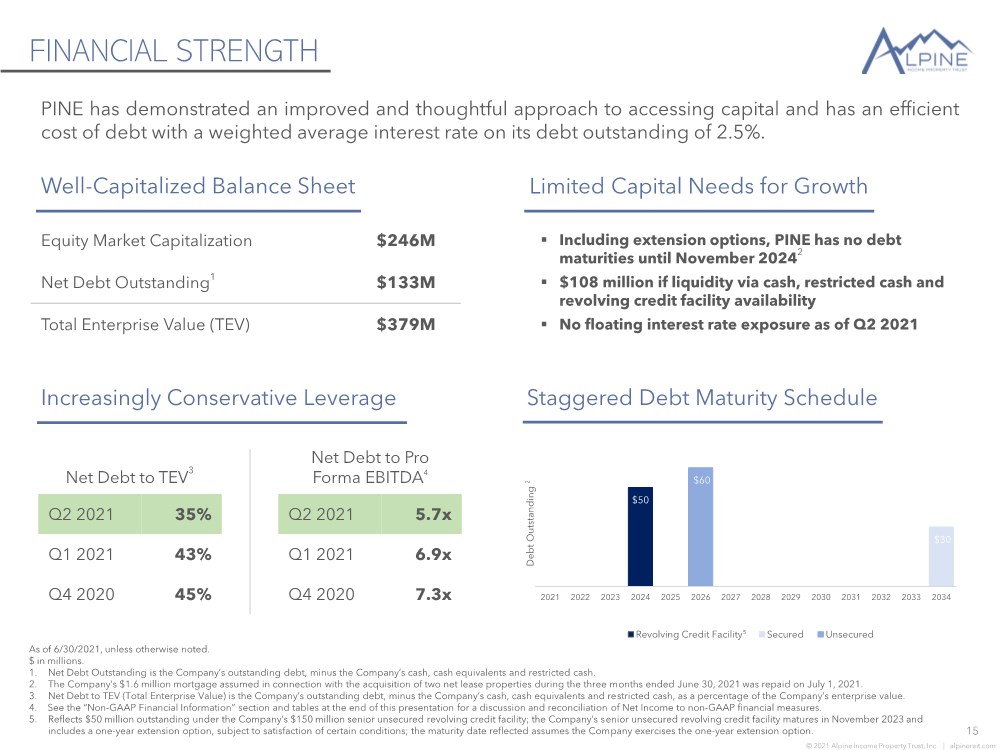

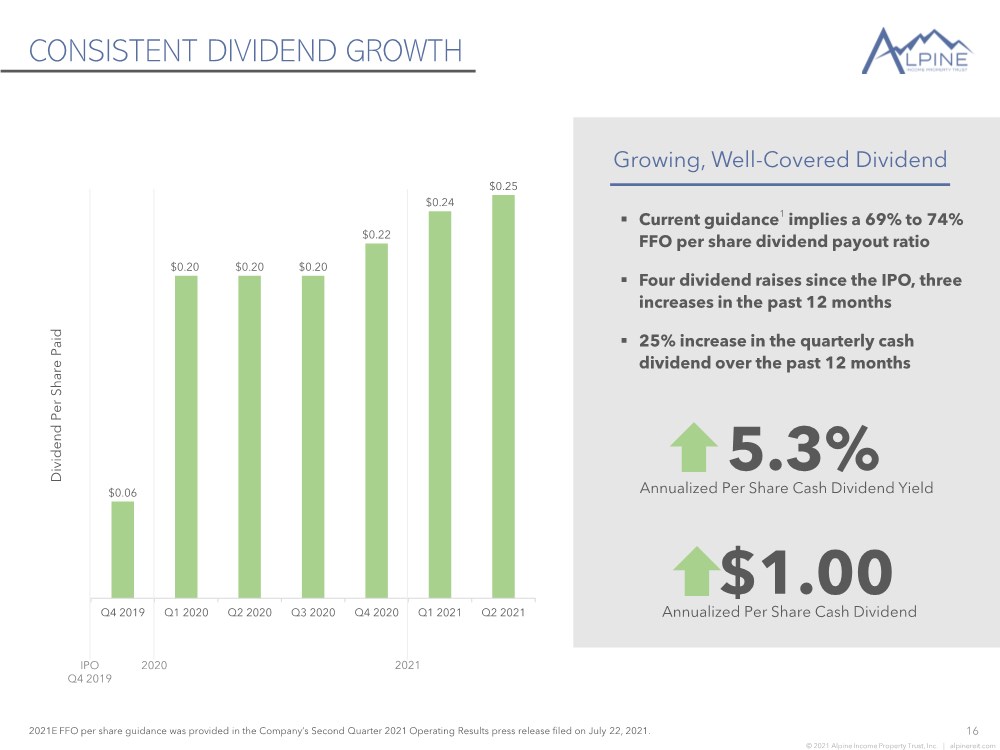

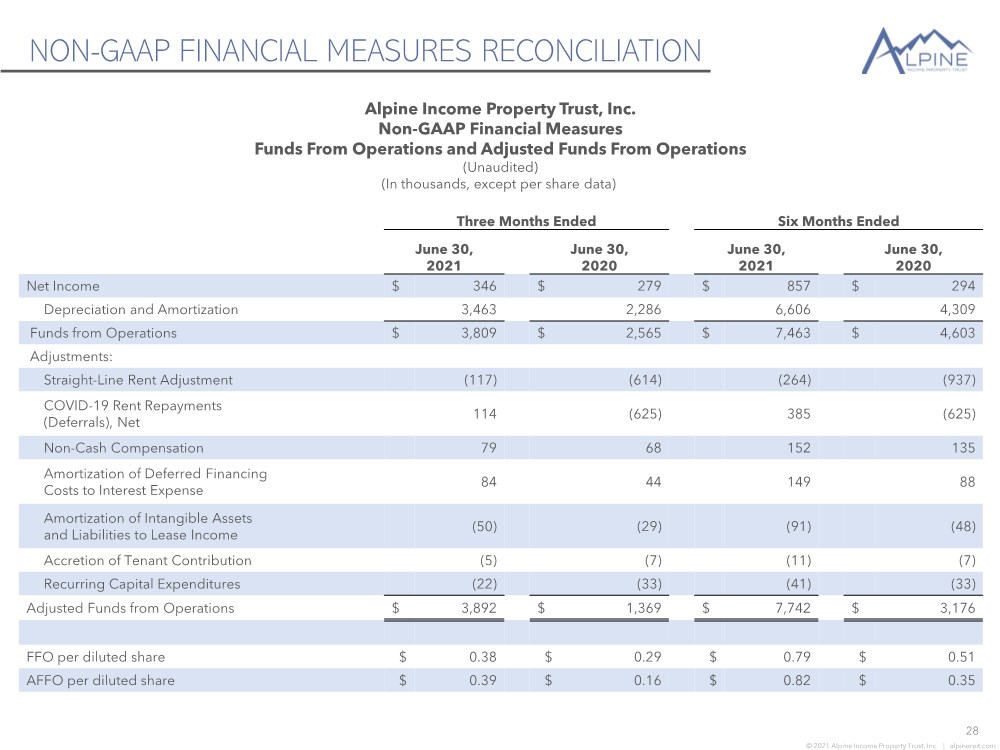

| © 2021 Alpine Income Property Trust, Inc. | alpinereit.com NON-GAAP FINANCIAL MEASURES RECONCILIATION 27 Alpine Income Property Trust, Inc. Consolidated Statements of Operations (Unaudited) (In thousands, except share, per share and dividend data) Three Months Ended Six Months Ended June 30, 2021 June 30, 2020 June 30, 2021 June 30, 2020 Revenues: Lease Income $ 6,597 $ 4,591 $ 12,487 $ 8,762 Total Revenues 6,597 4,591 12,487 8,762 Operating Expenses: Real Estate Expenses 824 550 1,475 1,150 General and Administrative Expenses 1,286 1,132 2,316 2,416 Depreciation and Amortization 3,463 2,286 6,606 4,309 Total Operating Expenses 5,573 3,968 10,397 7,875 Net Income from Operations 1,024 623 2,090 887 Interest Expense 678 344 1,233 593 Net Income 346 279 857 294 Less: Net Income Attributable to Noncontrolling Interest (42) (39) (113) (41) Net Income Attributable to Alpine Income Property Trust, Inc. $ 304 $ 240 $ 744 $ 253 Per Common Share Data: Net Income Attributable to Alpine Income Property Trust, Inc. Basic $ 0.03 $ 0.03 $ 0.09 $ 0.03 Diluted $ 0.03 $ 0.03 $ 0.08 $ 0.03 Weighted Average Number of Common Shares: Basic 8,853,259 7,544,991 8,212,902 7,721,835 Diluted1 10,081,783 8,768,845 9,439,104 8,945,689 Dividends Declared and Paid $ 0.25 $ 0.20 $ 0.49 $ 0.40 1. Includes the weighted average impact of 1,648,805 shares underlying OP units including (i) 1,223,854 shares underlying OP Units issued to CTO Realty Growth, Inc. in connection with our formation transactions and (ii) 424,951 shares underlying OP Units issued to an unrelated third party in connection with the acquisition of nine net lease properties during the three months ended June 30, 2021. |