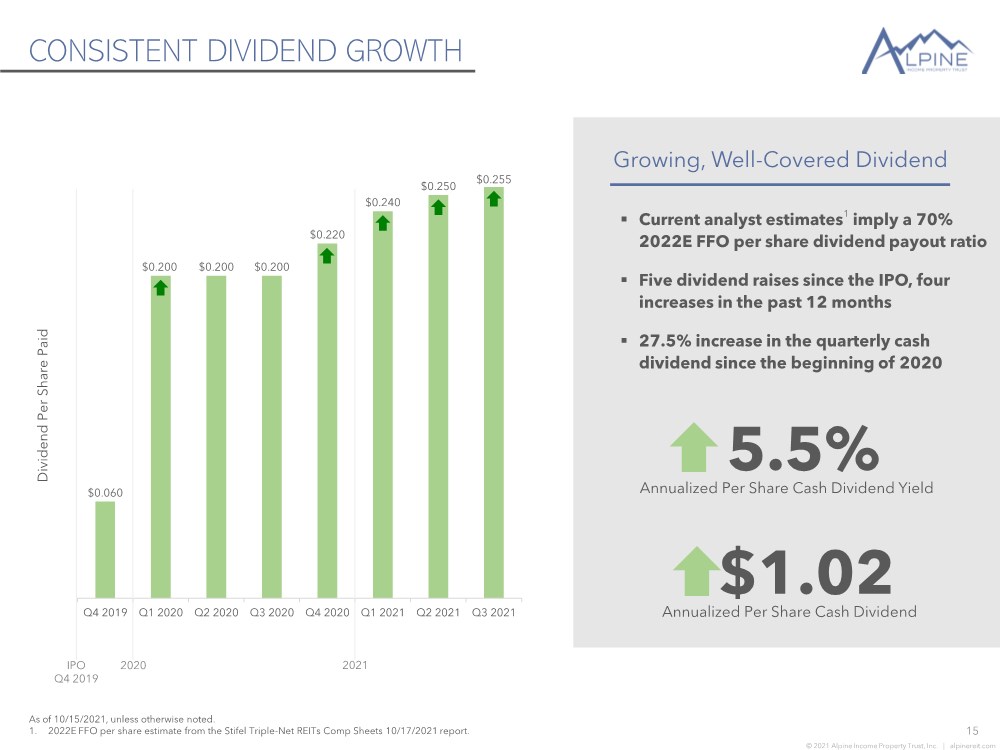

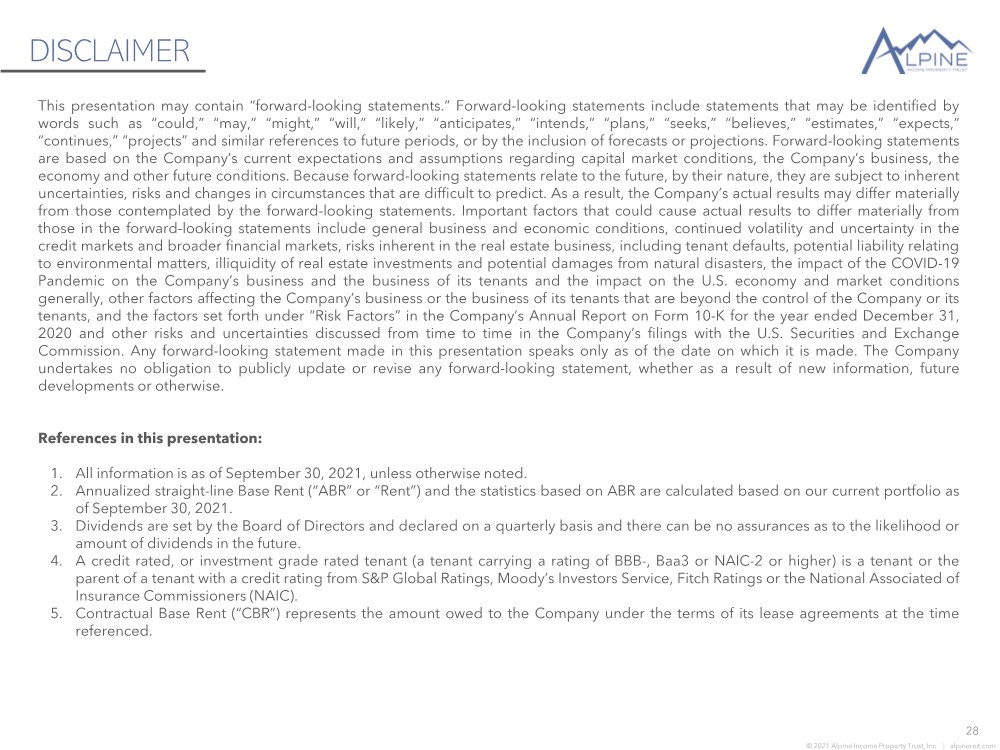

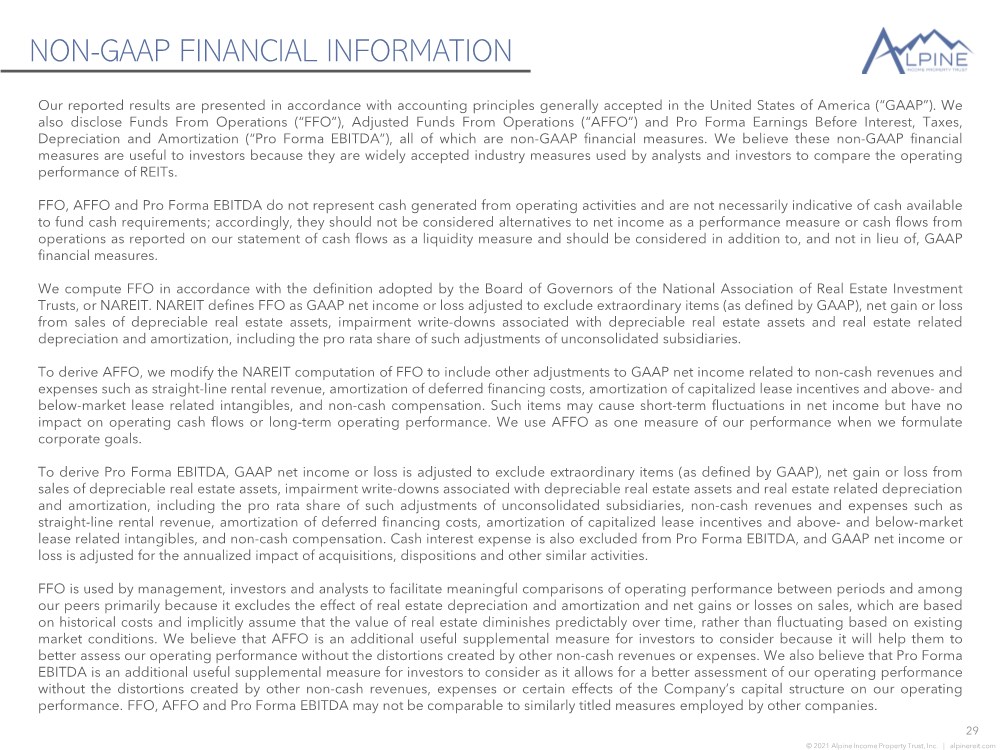

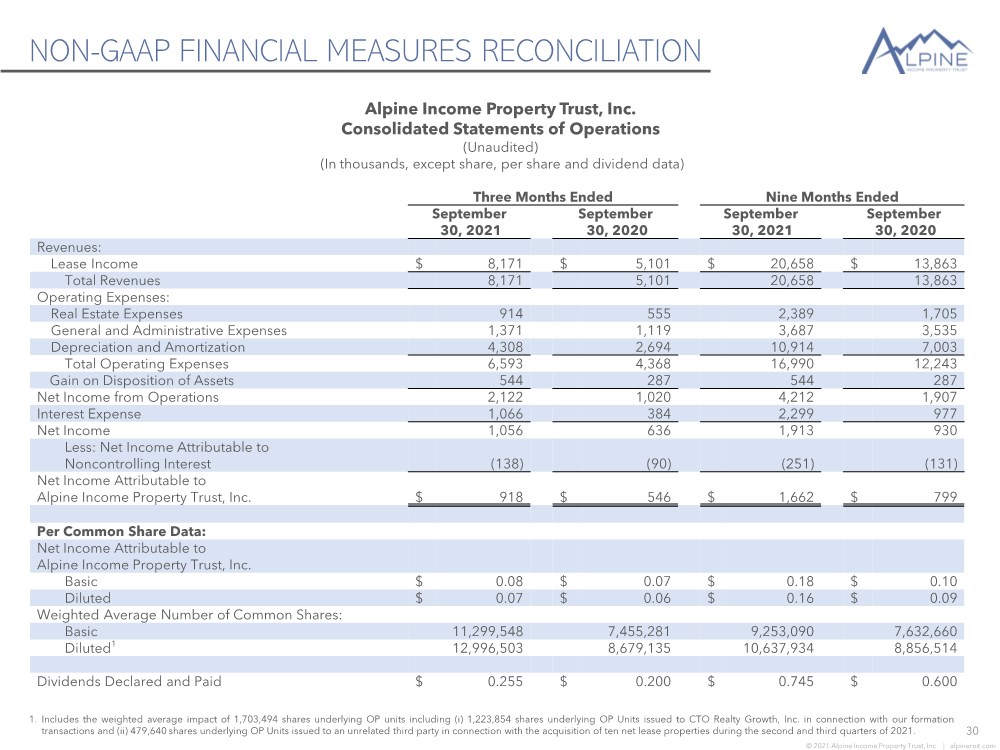

| © 2021 Alpine Income Property Trust, Inc. | alpinereit.com NON-GAAP FINANCIAL MEASURES RECONCILIATION 30 Alpine Income Property Trust, Inc. Consolidated Statements of Operations (Unaudited) (In thousands, except share, per share and dividend data) Three Months Ended Nine Months Ended September 30, 2021 September 30, 2020 September 30, 2021 September 30, 2020 Revenues: Lease Income $ 8,171 $ 5,101 $ 20,658 $ 13,863 Total Revenues 8,171 5,101 20,658 13,863 Operating Expenses: Real Estate Expenses 914 555 2,389 1,705 General and Administrative Expenses 1,371 1,119 3,687 3,535 Depreciation and Amortization 4,308 2,694 10,914 7,003 Total Operating Expenses 6,593 4,368 16,990 12,243 Gain on Disposition of Assets 544 287 544 287 Net Income from Operations 2,122 1,020 4,212 1,907 Interest Expense 1,066 384 2,299 977 Net Income 1,056 636 1,913 930 Less: Net Income Attributable to Noncontrolling Interest (138) (90) (251) (131) Net Income Attributable to Alpine Income Property Trust, Inc. $ 918 $ 546 $ 1,662 $ 799 Per Common Share Data: Net Income Attributable to Alpine Income Property Trust, Inc. Basic $ 0.08 $ 0.07 $ 0.18 $ 0.10 Diluted $ 0.07 $ 0.06 $ 0.16 $ 0.09 Weighted Average Number of Common Shares: Basic 11,299,548 7,455,281 9,253,090 7,632,660 Diluted1 12,996,503 8,679,135 10,637,934 8,856,514 Dividends Declared and Paid $ 0.255 $ 0.200 $ 0.745 $ 0.600 1. Includes the weighted average impact of 1,703,494 shares underlying OP units including (i) 1,223,854 shares underlying OP Units issued to CTO Realty Growth, Inc. in connection with our formation transactions and (ii) 479,640 shares underlying OP Units issued to an unrelated third party in connection with the acquisition of ten net lease properties during the second and third quarters of 2021. |