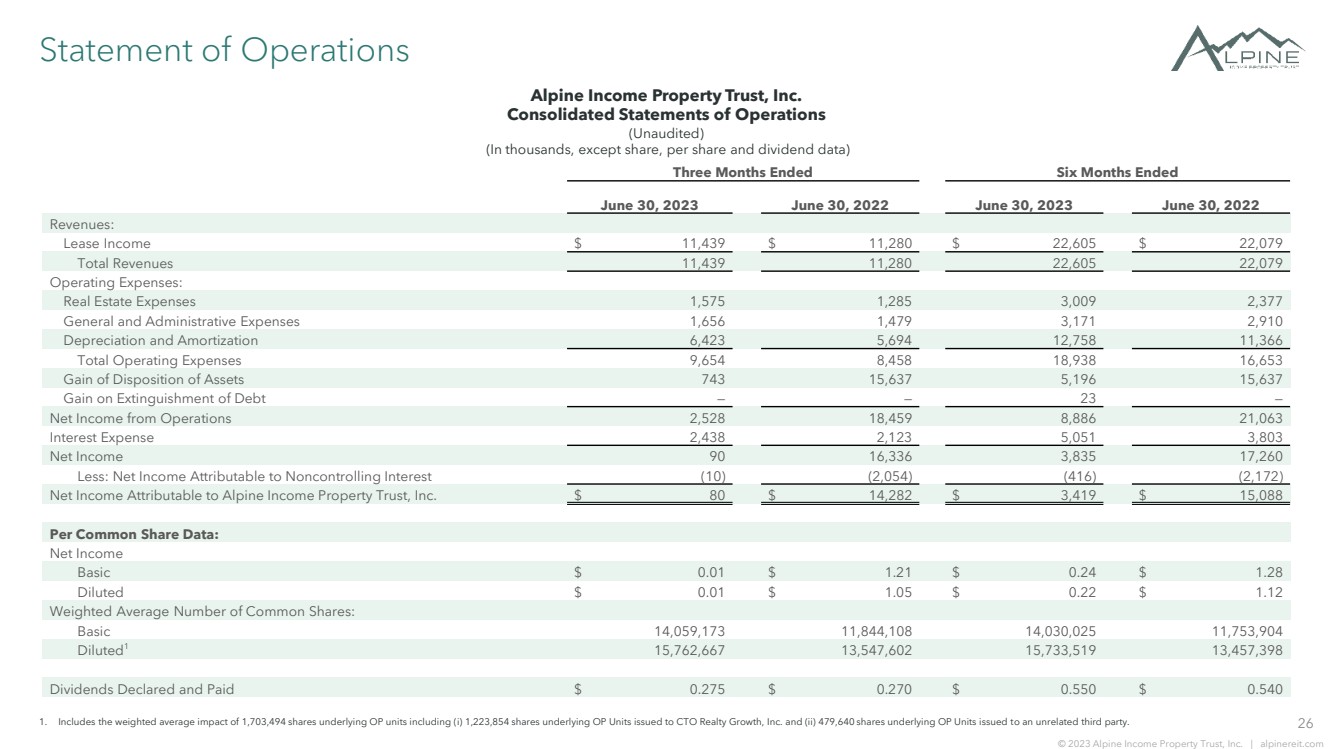

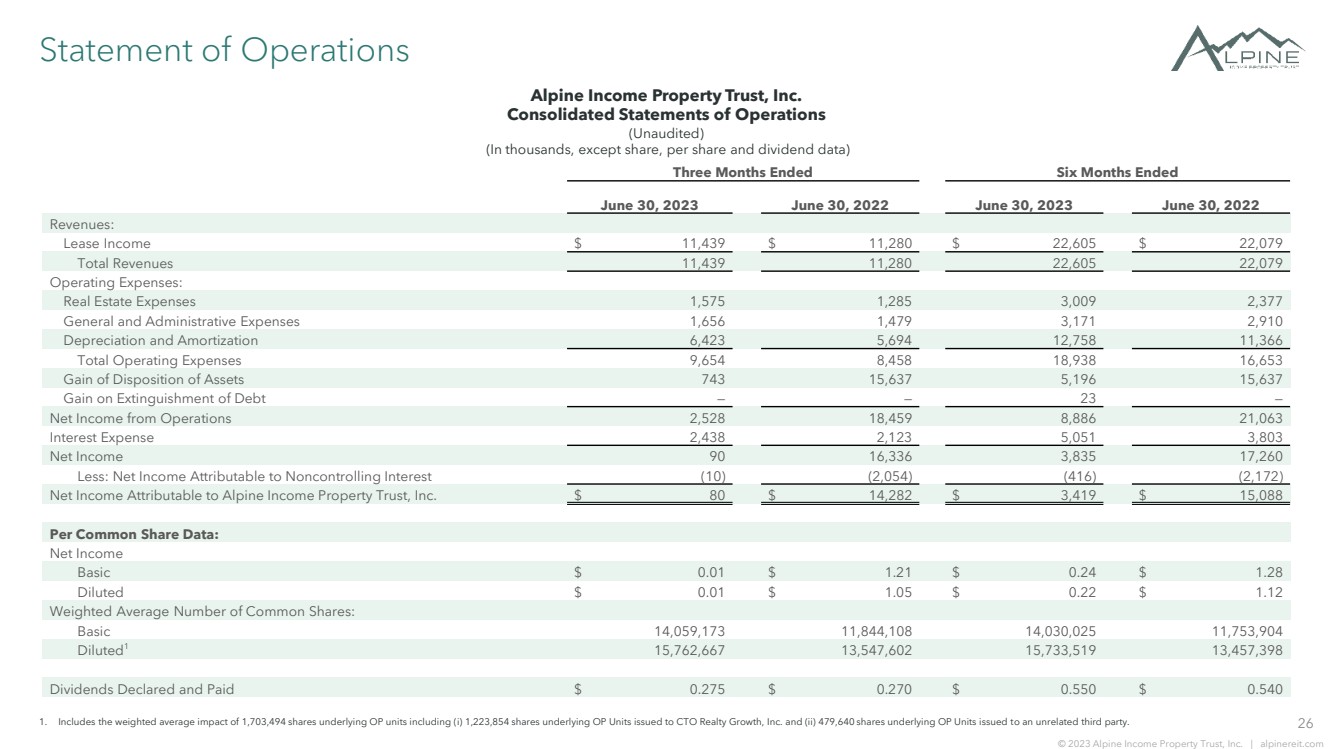

| 26 © 2023 Alpine Income Property Trust, Inc. | alpinereit.com Statement of Operations Alpine Income Property Trust, Inc. Consolidated Statements of Operations (Unaudited) (In thousands, except share, per share and dividend data) 1. Includes the weighted average impact of 1,703,494 shares underlying OP units including (i) 1,223,854 shares underlying OP Units issued to CTO Realty Growth, Inc. and (ii) 479,640 shares underlying OP Units issued to an unrelated third party. Three Months Ended Six Months Ended June 30, 2023 June 30, 2022 June 30, 2023 June 30, 2022 Revenues: Lease Income $ 11,439 $ 11,280 $ 22,605 $ 22,079 Total Revenues 11,439 11,280 22,605 22,079 Operating Expenses: Real Estate Expenses 1,575 1,285 3,009 2,377 General and Administrative Expenses 1,656 1,479 3,171 2,910 Depreciation and Amortization 6,423 5,694 12,758 11,366 Total Operating Expenses 9,654 8,458 18,938 16,653 Gain of Disposition of Assets 743 15,637 5,196 15,637 Gain on Extinguishment of Debt — — 23 — Net Income from Operations 2,528 18,459 8,886 21,063 Interest Expense 2,438 2,123 5,051 3,803 Net Income 90 16,336 3,835 17,260 Less: Net Income Attributable to Noncontrolling Interest (10) (2,054) (416) (2,172) Net Income Attributable to Alpine Income Property Trust, Inc. $ 80 $ 14,282 $ 3,419 $ 15,088 Per Common Share Data: Net Income Basic $ 0.01 $ 1.21 $ 0.24 $ 1.28 Diluted $ 0.01 $ 1.05 $ 0.22 $ 1.12 Weighted Average Number of Common Shares: Basic 14,059,173 11,844,108 14,030,025 11,753,904 Diluted1 15,762,667 13,547,602 15,733,519 13,457,398 Dividends Declared and Paid $ 0.275 $ 0.270 $ 0.550 $ 0.540 |