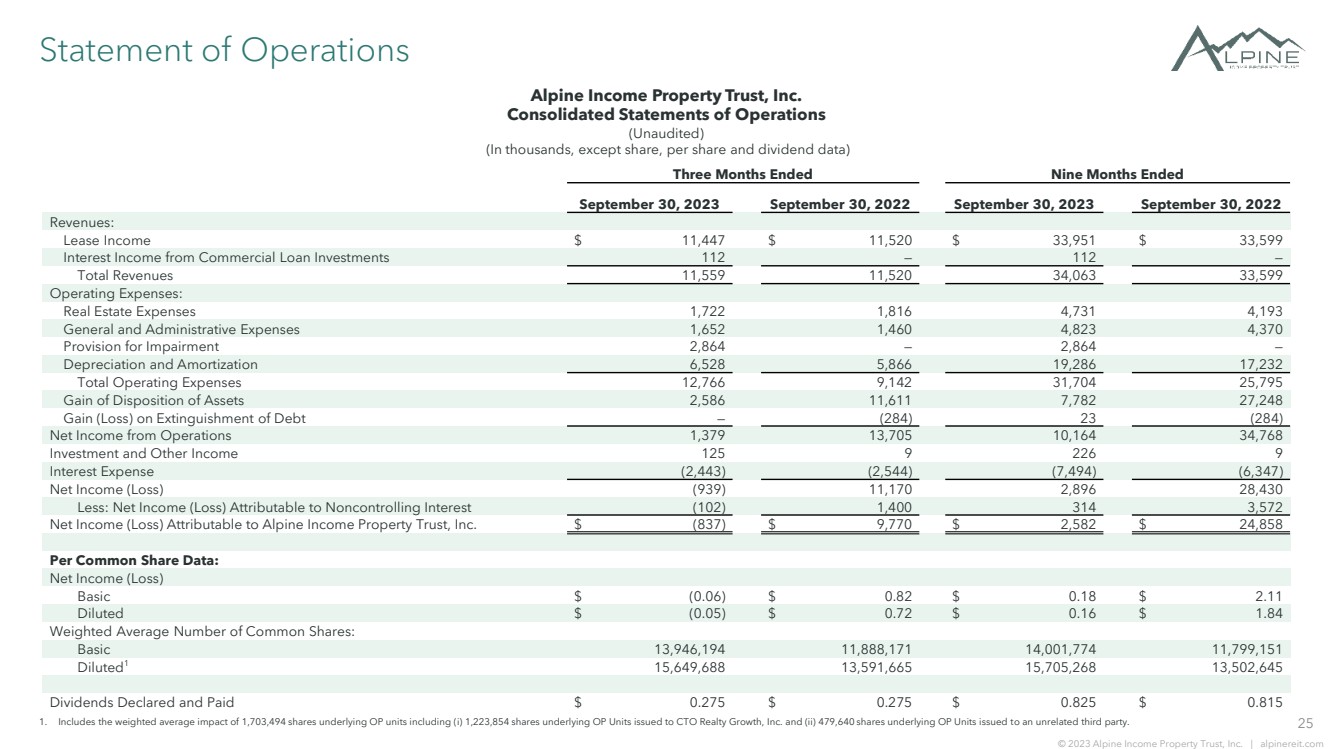

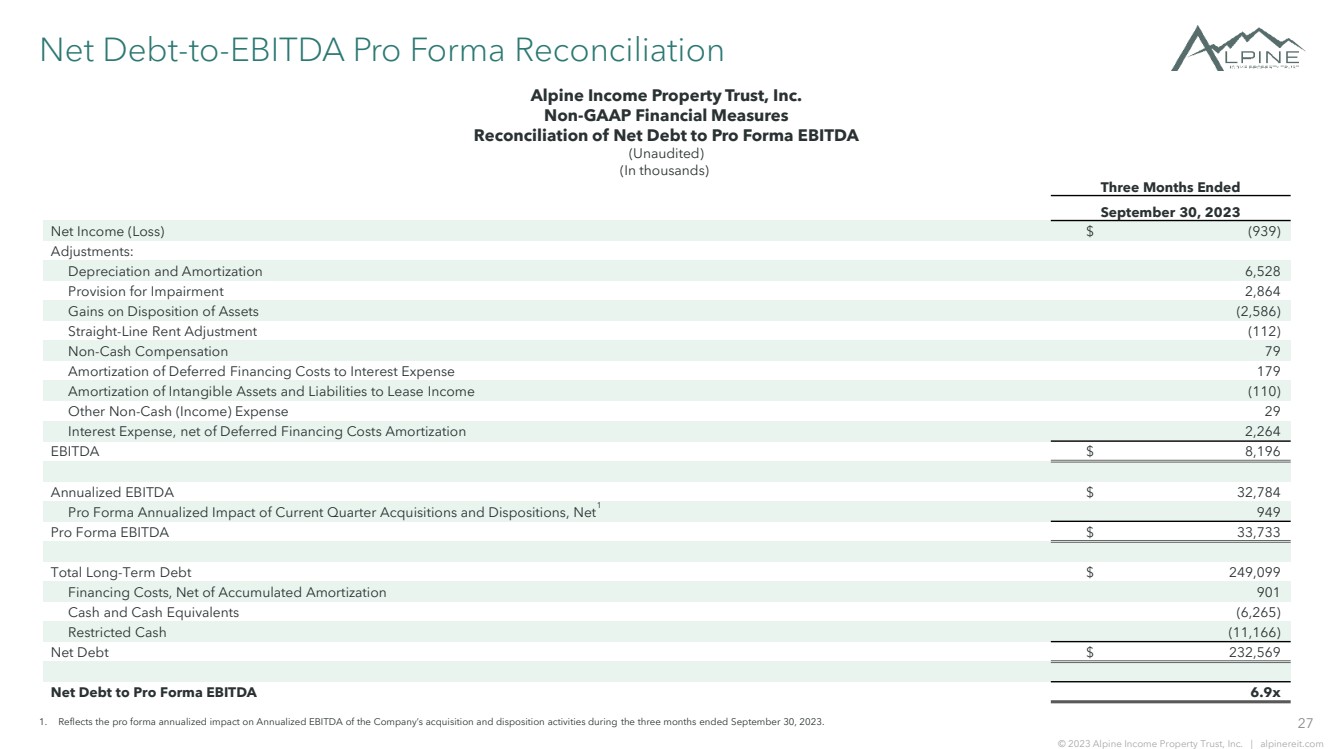

| 25 © 2023 Alpine Income Property Trust, Inc. | alpinereit.com Statement of Operations Alpine Income Property Trust, Inc. Consolidated Statements of Operations (Unaudited) (In thousands, except share, per share and dividend data) 1. Includes the weighted average impact of 1,703,494 shares underlying OP units including (i) 1,223,854 shares underlying OP Units issued to CTO Realty Growth, Inc. and (ii) 479,640 shares underlying OP Units issued to an unrelated third party. Three Months Ended Nine Months Ended September 30, 2023 September 30, 2022 September 30, 2023 September 30, 2022 Revenues: Lease Income $ 11,447 $ 11,520 $ 33,951 $ 33,599 Interest Income from Commercial Loan Investments 112 — 112 — Total Revenues 11,559 11,520 34,063 33,599 Operating Expenses: Real Estate Expenses 1,722 1,816 4,731 4,193 General and Administrative Expenses 1,652 1,460 4,823 4,370 Provision for Impairment 2,864 — 2,864 — Depreciation and Amortization 6,528 5,866 19,286 17,232 Total Operating Expenses 12,766 9,142 31,704 25,795 Gain of Disposition of Assets 2,586 11,611 7,782 27,248 Gain (Loss) on Extinguishment of Debt — (284) 23 (284) Net Income from Operations 1,379 13,705 10,164 34,768 Investment and Other Income 125 9 226 9 Interest Expense (2,443) (2,544) (7,494) (6,347) Net Income (Loss) (939) 11,170 2,896 28,430 Less: Net Income (Loss) Attributable to Noncontrolling Interest (102) 1,400 314 3,572 Net Income (Loss) Attributable to Alpine Income Property Trust, Inc. $ (837) $ 9,770 $ 2,582 $ 24,858 Per Common Share Data: Net Income (Loss) Basic $ (0.06) $ 0.82 $ 0.18 $ 2.11 Diluted $ (0.05) $ 0.72 $ 0.16 $ 1.84 Weighted Average Number of Common Shares: Basic 13,946,194 11,888,171 14,001,774 11,799,151 Diluted1 15,649,688 13,591,665 15,705,268 13,502,645 Dividends Declared and Paid $ 0.275 $ 0.275 $ 0.825 $ 0.815 |