Exhibit 99.1 Corporate Presentation December 2022

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than statements of historical facts contained in this presentation, including statements regarding the anticipated completion of our proposed collaboration with Kite and the proposed concurrent equity investment by Kite; the potential benefits, value, synergies and results that may be achieved through the proposed collaboration; the anticipated payments that may be received by us in connection with the collaboration, including potential milestones and royalties; our and Kite's respective rights and obligations under the transaction agreements; expectations of our ability to benefit from Kite's capabilities, including operational, manufacturing and commercialization expertise and infrastructure; expected costs and expenses to be incurred and shared with Kite; our future financial condition, results of operations, business strategy, operations, timelines and prospects; the potential of and expectations regarding our product candidates and programs; the mission, plans and objectives of management; industry trends, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “can,” “contemplate,” “continue,” “could,” “design,” “estimate,” “expect,” “imagine,” “intend,” “likely,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will” or “would,” or the negative of these terms or other similar expressions or other comparable terminology are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs, and these statements represent our views as of the date of this presentation. We may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Information regarding certain risks, uncertainties and assumptions may be found in our filings with the Securities and Exchange Commission. New risk factors emerge from time to time and it is not possible for our management team to predict all risk factors or assess the impact of all factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements. While we may elect to update these forward-looking statements at some point in the future, we specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date of this presentation. This presentation discusses product candidates that are under preclinical or clinical evaluation and that have not yet been approved for marketing by the U.S. Food and Drug Administration or any other regulatory authority. The presentation also includes select interim and preliminary results from an ongoing clinical trial as of specific data cutoff dates. Such results should be viewed with caution as final results may differ as additional data becomes SOLID available. Until finalized in a clinical study report, clinical trial data presented herein remain subject to adjustment as a result of clinical site audits and TUMORS 90% other review processes. No representation is made as to the safety or effectiveness of these product candidates for the use for which such product candidates are being studied. This presentation also contains estimates and other statistical data made by independent parties or publicly available information, as well as other information based on our internal sources. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we makes no representations as to the accuracy or completeness of that data. 2 Arcellx Corporate Presentation | December 2022

Reimagining Cell Therapy Platform Partnered Lead Novel Synthetic Positive Preliminary Built for Potential Program Binding Domain Clinical Results Success ARC-SparX Phase 1 clinical Strong investor base Combining potential best in Demonstrated 100% overall Single-infusion ddCAR and trial in multiple myeloma class program with Kite’s response rate and deep dosable, controllable Exceptional team initiated in 2Q22 commercial and durability in multiple ARC-SparX platforms manufacturing expertise myeloma Phase 1 study. Wholly owned IP ARC-SparX Phase 1 clinical trial in acute myelogenous Pivotal study enrolling Well capitalized leukemia / myelodysplastic initiated in 4Q22 3 Arcellx Corporate Presentation | December 2022

Maximizing the Value of MM Opportunity with Kite Partnership Positioned for Leadership Long-term Value Global Collaboration in CAR-T Space ‣ Arcellx to receive $225M upfront ‣ Combining a potential best-in-‣ Co-development and co- payment and $100M equity class therapy with Kite’s commercialization of CAR-T investment operational capabilities ddBCMA with split profits in the U.S. ‣ Kite will manufacture following tech ‣ Proven manufacturing and ‣ Arcellx to receive low to mid-teen transfer and bear the CMC commercial infrastructure with royalties ex-U.S. commercial readiness costs global cell therapy leader, Kite ‣ Arcellx and Kite to collaborate on ‣ Arcellx will continue to independently ‣ Leveraging synergies across both next generation autologous and progress its development pipeline for companies to accelerate patient non-autologous programs new product candidates beyond access incorporating ddBCMA myeloma ‣ Kite to have exclusive option rights ‣ Arcellx is well capitalized to fund to ARC-SparX programs targeting operations through BLA filing BCMA or CS1 for use in myeloma 4 Arcellx Corporate Presentation | December 2022

Kite – The Cell Therapy Partner of Choice Manufacturing Commercial Pipeline Investment ‣ Largest dedicated in-house global cell ‣ More than 11,000 patients treated ‣ Kite may integrate complementary therapy manufacturing network (clinical trial and commercial patients) technologies with Arcellx’s platform to create next-generation autologous ‣ Investing in internal vector ‣ +315 ATCs globally with leading and allogenic candidates across development and manufacturing support hub: Kite Konnect® various cell types ‣ 96% manufacturing success rate ‣ 5 indications launched in multiple geographies ‣ 16-day median turnaround time in U.S. ‣ CAR-T reimbursement in more than 20 ‣ Continues to increase its countries manufacturing network capacity to ‣ Gilead commercial operations in over meet demandand 40 countries worldwide 5 Arcellx Corporate Presentation | December 2022

Kite Partnership Summary ‣ Topline economics: ‒ Total upfront consideration: $325Mn ‣ Upfront payment: $225Mn ‣ Equity Investment (3,478,261 shares): $100Mn ‒ Contingent milestones across all programs ‣ Up to $335M, $635M and $508M for each ddBCMA, next-generation autologous, and non-autologous product, respectively ‒ Royalties in tiered, low-to-mid-teens percentages for co-promote products outside the US and for non-co-promote products worldwide (including next-gen autologous products if Arcellx does not elect to co-promote) ‣ For Co-promote products, including CART-ddBCMA and any next-generation autologous products that Arcellx elects to co-promote: ‒ Development: ‣ Joint development ‣ Arcellx will continue to run iMMagine-1 pivotal trial ‣ Out-of-pocket development costs will be shared (including clinical manufacturing costs): • 50/50 in the US • 40/60 (Arcellx/Kite) outside the US, only for global studies • Kite will be solely responsible for the costs for country-specific clinical studies outside the US ‒ CMC (commercial readiness): ‣ Kite will solely bear the CMC commercial readiness costs and any associated capital expenses ‣ Following tech transfer, Kite will manufacture ‒ Commercialization: ‣ In the US, Arcellx and Kite will be jointly responsible for commercialization ‣ In the US, from time of commercialization, Arcellx and Kite will equally share profits and losses from directly-related myeloma commercialization activities ‣ Outside the US, Kite will be responsible (at its sole cost) for commercialization activities 6 Arcellx Corporate Presentation | December 2022

Partnership Structure Creates Value While Maximizing Runway ‣ Limiting outflows of capital related to CMC: CMC commercial readiness are borne by Kite; leveraging Kite’s prior investments in CMC helps us realize downstream benefits in COGS and timelines to scale-up to meet demand ‣ Reducing costs prior to commercialization: Cost split for development includes Kite and Arcellx each contributing to funding 50% of-out-of-pocket costs in the US, including 50% of iMMagine-1 ‣ Managing P&L while leveraging Kite infrastructure: ‒ Cost split for development is limited to out-of-pocket costs and batch costs for clinical manufacturing ‒ Cost split for commercial is limited to only directly-related myeloma activities with defined expense categories ‣ Accelerating global timelines: Utilizing existing Kite infrastructure to achieve quicker access to ex-US markets at tiered low-to-mid teen royalty rates without any upfront Arcellx investments required to build global infrastructure ‣ Maximizing Cash runway: Along with upfront cash infusion and reducing CapEx, other mechanisms are built into both stretch our runway and limit development and commercial expenses 7 Arcellx Corporate Presentation | December 2022

OUR MISSION Advance humanity by engineering cell therapies that are safer, more effective, and more broadly accessible

Multiple Myeloma is a Significant Market Opportunity 3rd most Impacting Limited Therapies common 100,000 patients comprise $18B global blood cancer annually market today Growing opportunity Incurable for CAR-T solutions Total addressable disease with as more effective market of $10B life expectancy therapies move to in CAR-T of 5 years earlier line patients 9 Arcellx Corporate Presentation | December 2022

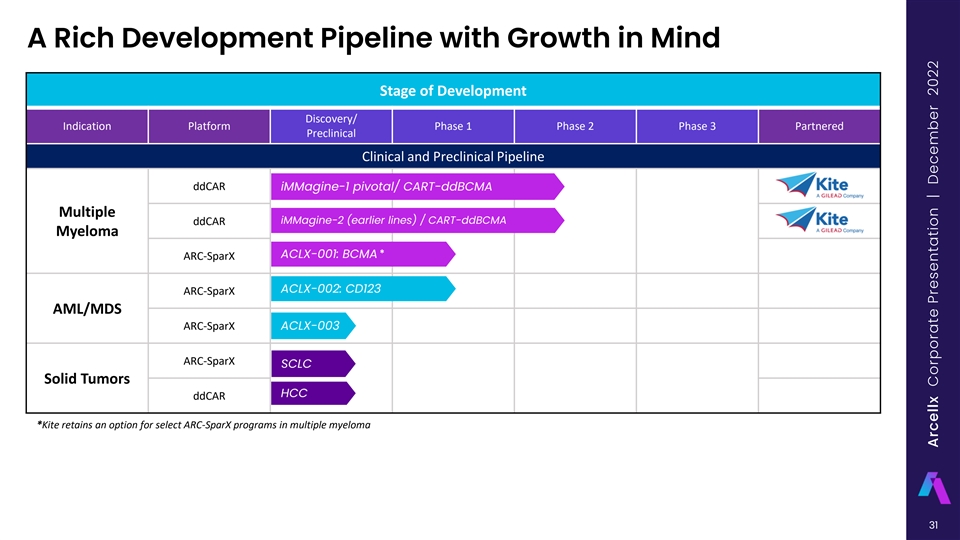

A Rich Development Pipeline with Growth in Mind Stage of Development Discovery/ Indication Platform Phase 1 Phase 2 Phase 3 Partnered Preclinical Clinical and Preclinical Pipeline ddCAR iMMagine-1 pivotal/ CART-ddBCMA Multiple iMMagine-2 (earlier lines) / CART-ddBCMA ddCAR Myeloma * ACLX-001: BCMA ARC-SparX ACLX-002: CD123 ARC-SparX AML/MDS ARC-SparX ACLX-003 ARC-SparX SCLC Solid Tumors HCC ddCAR *Kite retains an option for select ARC-SparX programs in multiple myeloma 10 Arcellx Corporate Presentation | December 2022

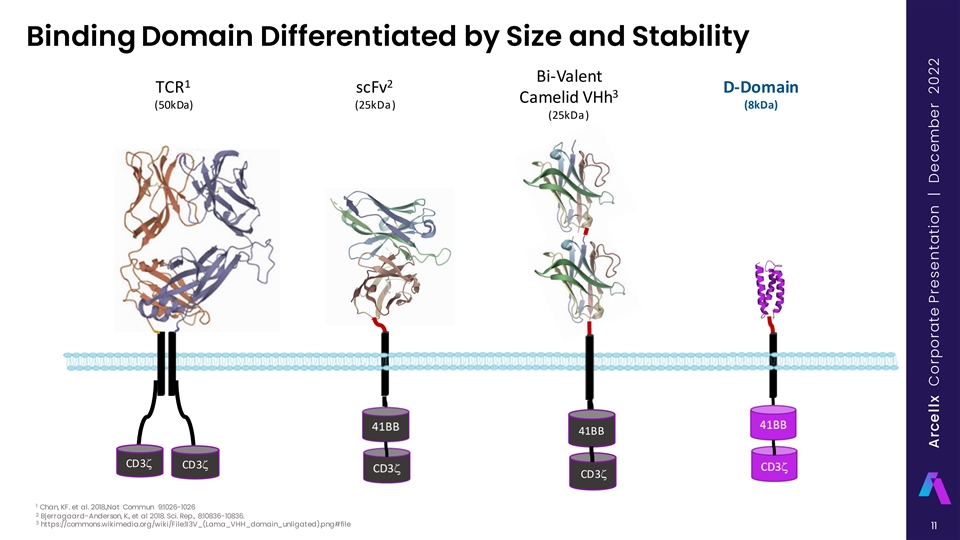

Binding Domain Differentiated by Size and Stability Bi-Valent 1 2 TCR scFv D-Domain 3 Camelid VHh (50kDa) (25kDa) (8kDa) (25kDa) 41BB CD3z CD3z CD3z 1 Chan, KF. et al. 2018.,Nat Commun 9:1026-1026 2 Bjerragaard-Anderson, K., et al 2018. Sci. Rep., 8:10836-10836. 3 https://commons.wikimedia.org/wiki/File:1I3V_(Lama_VHH_domain_unligated).png#file 11 Arcellx Corporate Presentation | December 2022

D-Domain Designed To Enhance Safety, Efficacy, and Availability D-Domain Hydrophobic Core & Stable Low Tonic Signaling High Transduction Efficiency High Surface Expression Potentially improved binding Lower dose may lead to lower toxicity Reduced T cell exhaustion The simple structure of D-Domains Preclinical and clinical evidence D-Domains have biophysical properties facilitates high cell surface expression demonstrate CARs constructed with D- that reduce high levels of aggregation of CAR constructs on the T cell surface. Domains have higher rates of transduction leading to low tonic signaling that compared to scFv-based CARs could lead to premature T cell exhaustion 12 Arcellx Corporate Presentation | December 2022

D-Domain Technology: Expansive Platform ddCAR Classical Single Infusion CAR-T ARC-SparX Dosable CAR-T • Ability to leverage autologous or allogeneic strategies • Therapeutic potential across liquid and solid tumors as well as non-oncology indications 13 Arcellx Corporate Presentation | December 2022

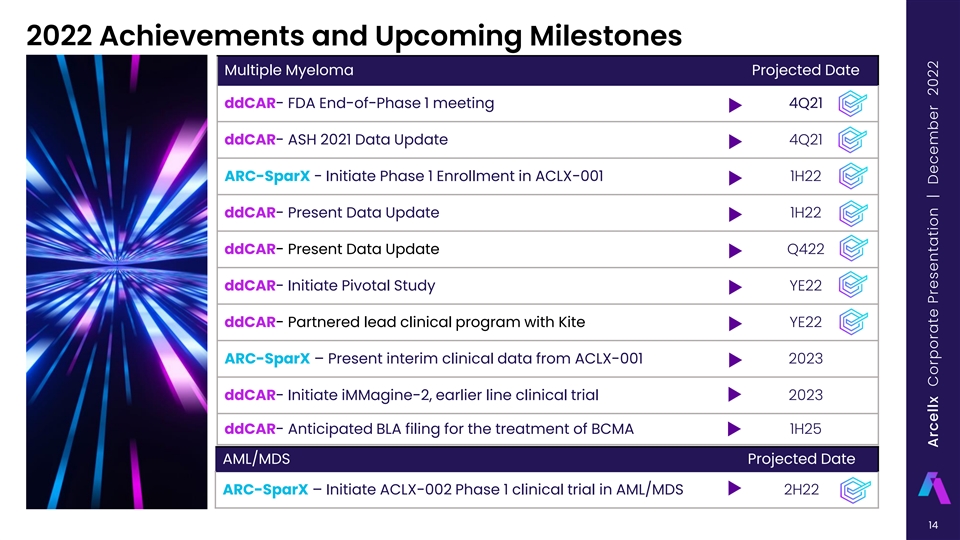

2022 Achievements and Upcoming Milestones Multiple Myeloma Projected Date ddCAR- FDA End-of-Phase 1 meeting 4Q21 ddCAR- ASH 2021 Data Update 4Q21 ARC-SparX - Initiate Phase 1 Enrollment in ACLX-001 1H22 ddCAR- Present Data Update 1H22 ddCAR- Present Data Update Q422 ddCAR- Initiate Pivotal Study YE22 ddCAR- Partnered lead clinical program with Kite YE22 ARC-SparX – Present interim clinical data from ACLX-001 2023 ddCAR- Initiate iMMagine-2, earlier line clinical trial 2023 ddCAR- Anticipated BLA filing for the treatment of BCMA 1H25 AML/MDS Projected Date ARC-SparX – Initiate ACLX-002 Phase 1 clinical trial in AML/MDS 2H22 14 Arcellx Corporate Presentation | December 2022

OUR LEAD CLINICAL PROGRAM Looking at best-in-class potential for patient outcomes for those who previously failed multiple lines of multiple myeloma therapy

Best-in-Class Potential Phase 1 Study Preliminary Results 100% ORR 115M (+/- 10) Cells 0% Grade 3 CRS 71% CR/sCR RP2D RP2D Overall response rate (ORR) per Ongoing Phase 1 expansion at Toxicities including CRS and 100 (+/- 20) million CAR+ T cells IMWG across both dose levels; deep ICANS have been manageable and durable responses observed in given favorable safety profile at both dose levels observed to date and 100% ORR patients with poor prognostic factors Phase 2 Pivotal Study Initiated by YE22 October 31, 2022, data cut-off; ASH Annual Meeting, December 2022, publication #3313 16 Dose level 1 of 115 (+/- 10) million CAR+ T cells is recommended Phase 2 Pivotal dose (RP2D) Arcellx Corporate Presentation | December 2022

Background and Methods CART-ddBCMA is an autologous CAR-T 1,2 containing a novel synthetic protein binding domain (non-scFv) engineered to reduce the risk of immunogenicity and is highly stable Phase 1 first-in-human trial has completed enrollment of relapsed and/or refractory myeloma • Prior IMiD, PI, and CD38-targeted therapy required • Received ≥3 prior therapies or triple refractory 2 Dose Levels evaluated, 6 subjects in each dose escalation cohort 6 • DL1 = 100 x 10 CAR+ cells; 6 DL2 = 300 x 10 CAR+ cells 1 Chan, KF. et al. 2018.,Nat Commun 9:1026-1026 2 Bjerragaard-Anderson, K., et al 2018. Sci. Rep., 8:10836-10836. 3 https://commons.wikimedia.org/wiki/File:1I3V_(Lama_VHH_domain_unligated).png#file Expansion cohort is enrolled at DL1 Cell processing Consent, CART-ddBCMA Response and 1 Rotte, et al. “BCMA targeting CAR T cells using a novel D-domain & release Long term Safety screening, cell infusion, Safety binder for multiple myeloma: clinical development update.” Follow-up Bridging enrollment Day 0 Assessments Immuno-Oncology Insights 2022; 3(1), 13–24 Therapy 2 Frigault et al. “Phase 1 Study of CART-ddBCMA for the treatment of subjects with relapsed and refractory Multiple Myeloma.” Blood Advances 2022; bloodadvances.2022007210. doi: https://doi.org/10.1182/bloodadvances.2022007210. LD Chemo Apheresis Cy (300mg/m2), Flu (30 mg/m2) Day -5, -4, -3 17 Arcellx Corporate Presentation | December 2022

Patient Disposition Enrolled and Leukapheresed n=40 Successful Manufacture of CART-ddBCMA n=40 Discontinued: Active infection, n=1 Lymphodepletion n=39 Discontinued: Active infection, n=1 Total Dosed n=38 6 6 DL1, 100x10 CAR+ cells DL2, 300x10 CAR+ cells n=32 n=6 Dose escalation Expansion cohort Dose escalation n=6 n=26 n=6 Total Safety and Efficacy evaluable n=38 Evaluable Evaluable Evaluable n=6 n=26 n=6 18 Arcellx Corporate Presentation | December 2022

Patient Demographics (as of 31 Oct 2022) Dose Level 1 Dose Level 2 Total Characteristics 100 million CAR-T 300 million CAR-T (n=38) (n=32) (n=6) Age, median (min - max) 66 (44 - 76) 60 (52 - 65) 66(44 - 76) 18 Male (56%) 5 Male (83%) 23 Male (61%) Gender 14 Female (44%) 1 Female (17%) 15 Female (39%) ECOG PS* 0 9/32 (28%) 3/6 (50%) 12/38(32%) 1 23/32 (72%) 3/6 (50%) 26/38 (68%) High Risk Prognostic Feature 16/32 (50%) 6/6 (100%) 22/38 (58%) BMPC ≥60% 6/32 (19%) 3/6 (50%) 9/38 (24%) ISS Stage III (B2M ≥ 5.5) 3/32 (9%) 2/6 (33%) 5/38 (13%) 10/32 (31%) 3/6 (50%) 13/38 (34%) Extra-medullary disease High Risk Cytogenetics** 9/32 (28%) 2/6 (33%) 11/38 (29%) Prior Lines of Therapy, 5 (3 - 7) 4 (3 - 16) 4 (3 - 16) Median (min - max) Triple refractory*** 32/32 (100%) 6/6 (100%) 38/38 (100%) Penta refractory 21/32 (66%) 5/6 (83%) 26/38 (68%) IgG myeloma 19 5 24 IgA myeloma 6 0 6 Light chain only 5 1 6 *Eastern Cooperative Oncology Group Performance Status Scale **Defined as Del 17p, t(14;16), t(4;14). ***Note: modified from ASCO 2022 due to data cleaning efforts. 19 Arcellx Corporate Presentation | December 2022

CART-ddBCMA Manufacturability: Reliable Process, Consistent Product Cell Viability CAR Positivity 100% 100% 90% Low inter-patient 80% 80% High cell viability: + variability in CAR Acceptance Limit 70% median 98% cells: median 70% 60% 60% viable cells + 50% CAR cells 40% 40% 30% Acceptance Limit 20% 20% 98% 70% 10% 0% 0% 0 2 4 6 8 10 12 14 16 18 20222426283032343638 0 2 4 6 8 10 12 14 16 18 20222426283032343638 Vector Copy Number Total Manufactured Cells 1800 5 Acceptance Limit 1500 4 Low inter-patient High yield: ≥3 1200 variability in CAR doses of DL1 can 3 900 expression/cell: be administered 2 median 2.2 from a single 600 copies/cell manufacture run 1 300 DL2 DL1 0 0 0 2 4 6 8 10 12 14 16 18 20222426283032343638 0 2 4 6 8 10 12 14 16 18 20222426283032343638 20 VCN/Cell Cell Viability (%) CAR+ Cells at Harvest (%) CAR+ Cell Count (Millions) Arcellx Corporate Presentation | December 2022

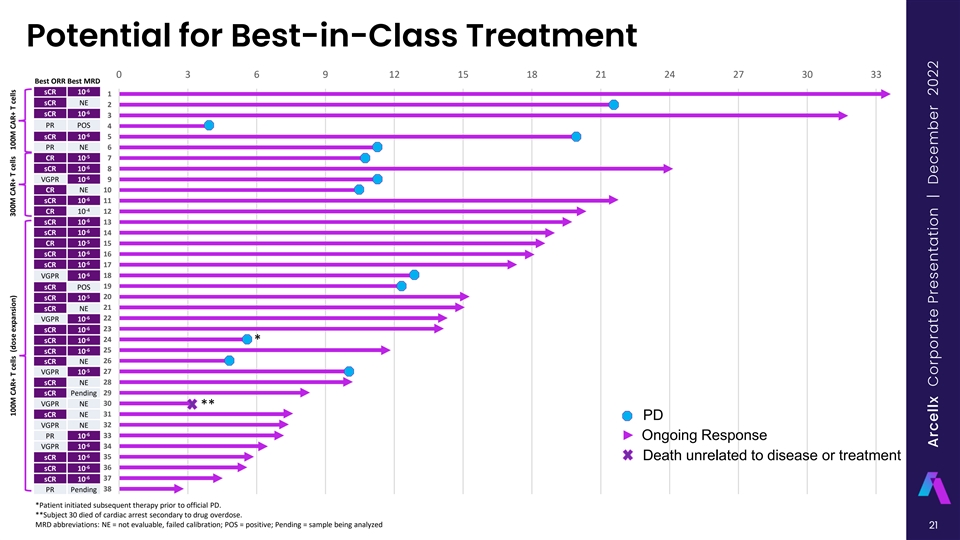

Potential for Best-in-Class Treatment 0 3 6 9 12 15 18 21 24 27 30 33 Best ORR Best MRD -6 sCR 10 1 sCR NE 2 -6 sCR 10 3 PR POS 4 -6 sCR 10 5 PR NE 6 -5 CR 10 7 -6 sCR 10 8 -6 VGPR 10 9 CR NE 10 -6 sCR 10 11 -4 CR 10 12 -6 sCR 10 13 -6 sCR 10 14 -5 CR 10 15 -6 sCR 10 16 -6 sCR 10 17 -6 VGPR 10 18 sCR POS 19 -5 sCR 10 20 sCR NE 21 -6 VGPR 10 22 -6 sCR 10 23 -6 sCR 10 24 * -6 sCR 10 25 sCR NE 26 -5 VGPR 10 27 sCR NE 28 sCR Pending 29 VGPR NE 30 ** sCR NE 31 PD VGPR NE 32 -6 PR 10 33 Ongoing Response -6 VGPR 10 34 -6 sCR 10 35 Death unrelated to disease or treatment -6 sCR 10 36 -6 sCR 10 37 PR Pending 38 *Patient initiated subsequent therapy prior to official PD. **Subject 30 died of cardiac arrest secondary to drug overdose. MRD abbreviations: NE = not evaluable, failed calibration; POS = positive; Pending = sample being analyzed 21 100M CAR+ T cells (dose expansion) 300M CAR+ T cells 100M CAR+ T cells Arcellx Corporate Presentation | December 2022

CART-ddBCMA Responses Deepen Over Time 8% 9% 11% 13% 100% 12% 6% 20% 18% 75% 50% 81% 80% 71% 71% 25% 0% 1 month; (n=38) 6 months; (n=35) 12 months; (n=25) 18 months; (n=16) CR/sCR VGPR PR Minimum months since infusion (M) 1 6 12 18 38 35 25 16 Sample Size (n)* Median Follow-up (mo) 15.0 16.4 18.9 22.9 High Risk Features** # (%) 22 (58%) 21 (60%) 19 (76%) 13 (81%) ORR 100% 100% 100% 100% CR/sCR rate*** 27 (71%) 25(71%) 20 (80%) 13 (81%) *Includes patients who were dosed at least M months prior or have had follow visit at Mth-month as of 11/22/22. **High risk features defined as presence of EMD, BMPC ≥ 60, or B2M ≥ 5.5 ***Calculated using number of patients who reached CR/sCR divided by number treated at least 1, 6, 12, or 18 months prior 22 Arcellx Corporate Presentation | December 2022

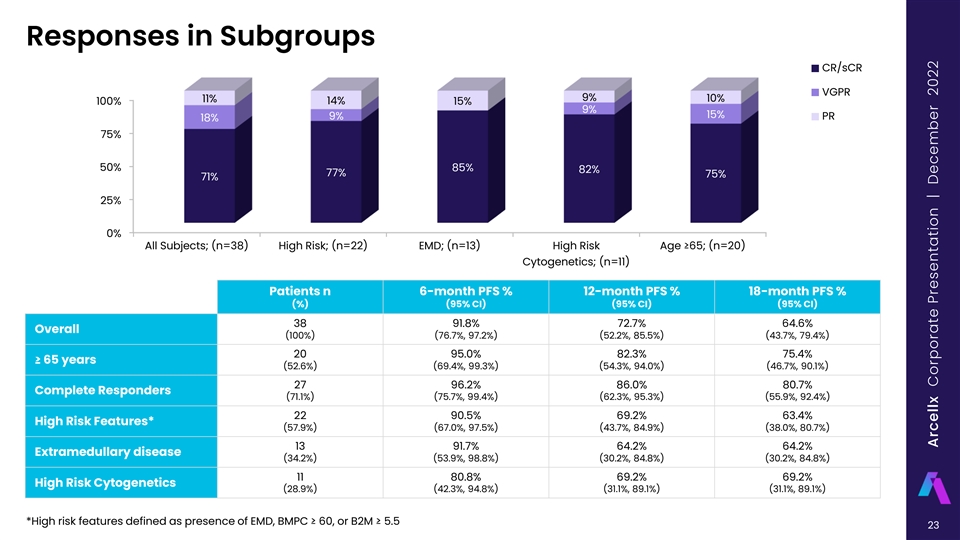

Responses in Subgroups CR/sCR VGPR 9% 10% 11% 14% 100% 15% 9% 15% 9% PR 18% 75% 50% 85% 82% 77% 75% 71% 25% 0% All Subjects; (n=38) High Risk; (n=22) EMD; (n=13) High Risk Age ≥65; (n=20) Cytogenetics; (n=11) Patients n 6-month PFS % 12-month PFS % 18-month PFS % (%) (95% CI) (95% CI) (95% CI) 38 91.8% 72.7% 64.6% Overall (100%) (76.7%, 97.2%) (52.2%, 85.5%) (43.7%, 79.4%) 20 95.0% 82.3% 75.4% ≥ 65 years (52.6%) (69.4%, 99.3%) (54.3%, 94.0%) (46.7%, 90.1%) 27 96.2% 86.0% 80.7% Complete Responders (71.1%) (75.7%, 99.4%) (62.3%, 95.3%) (55.9%, 92.4%) 22 90.5% 69.2% 63.4% High Risk Features* (57.9%) (67.0%, 97.5%) (43.7%, 84.9%) (38.0%, 80.7%) 13 91.7% 64.2% 64.2% Extramedullary disease (34.2%) (53.9%, 98.8%) (30.2%, 84.8%) (30.2%, 84.8%) 11 80.8% 69.2% 69.2% High Risk Cytogenetics (28.9%) (42.3%, 94.8%) (31.1%, 89.1%) (31.1%, 89.1%) *High risk features defined as presence of EMD, BMPC ≥ 60, or B2M ≥ 5.5 23 Arcellx Corporate Presentation | December 2022

CART-ddBCMA: 100% ORR, High CR Rate, and Durable Responses Demonstrate Potential for Best-in-Class Treatment CART-ddBCMA LEGEND-2 CARTITUDE-1 Minimum follow-up (mo.) 1 18 1 1.5 13.5 (est.) Sample Size (n) 38 16 57 97 Median Follow-up (mo.) 15.0 22.9 8 12.4 24 EMD % 34% 50% 30% 13% 13% ORR 100% 100% 88% 97% 98% CR rate 71% 81% 68% 67% 83% LEGEND-2 CARTITUDE-1 Kaplan Meier Estimate PFS Rate All subjects All subjects All subjects 91.8% @ 6 months ~82% 87% (76.7%, 97.2%) 72.7% @ 12 months ~70% ~75% (52.2%, 85.5%) 64.6% @18 months ~41% ~67% (43.7%, 79.4%) Based on preliminary data cut October 31, 2022 LEGEND-2 estimates are based on KM curves from Zhao BMC 2018 (Figure 2a) and CARTITUDE-1 estimates are based on KM curves from Martin JCO 2022 (Fig 2a). 24 Arcellx Corporate Presentation | December 2022

Adverse Event Profile (as of 31 Oct 2022) Grade 3/4 AEs (non-CRS/ICANS) CAR-T-associated AEs 100 million 300 million ≥5% after cell infusion Per ASTCT criteria (N=32) (N=6) (N=38) Hematologic Grade 1/2 Grade 3 Grade 1/2 Grade 3 Cytokine Release Neutrophil count decreased 29 (76.3%) Syndrome (CRS) 30 (94%) 0 5 (83%) 1 (17%) Anemia 22 (57.9%) Median onset (min-max)* 2 days (1-12 days) 2 day (1-2 days) Thrombocytopenia 15 (39.4%) Median duration (min-max) 8 days (2-14 days) 5 days (3-10 days) Lymphocyte count decreased 13 (36.8%) White blood cell count decreased 7 (18.4%) Grade 1/2 Grade 3 Grade 1/2 Grade 3 Neurotoxicity (ICANs) Febrile Neutropenia 6 (15.8%) 5 (16%) 1 (3%) 0 1 (17%) Median onset (min-max)* 4.5 days (3-6 days) 7 days Non-hematologic Hypertension 3 (7.9%) Median duration (min-max) 7.5 days (4 - 11 days) 23 days Hyponatremia 2 (5.3%) Toxicity Management Pain in extremity 2 (5.3%) Tocilizumab 27 (84%) 5 (83%) Cellulitis 2 (5.3%) Dexamethasone 20 (63%) 2 (33%) Sepsis 2 (5.3%) *Infusion Day 0 is considered Study Day 1 25 Arcellx Corporate Presentation | December 2022

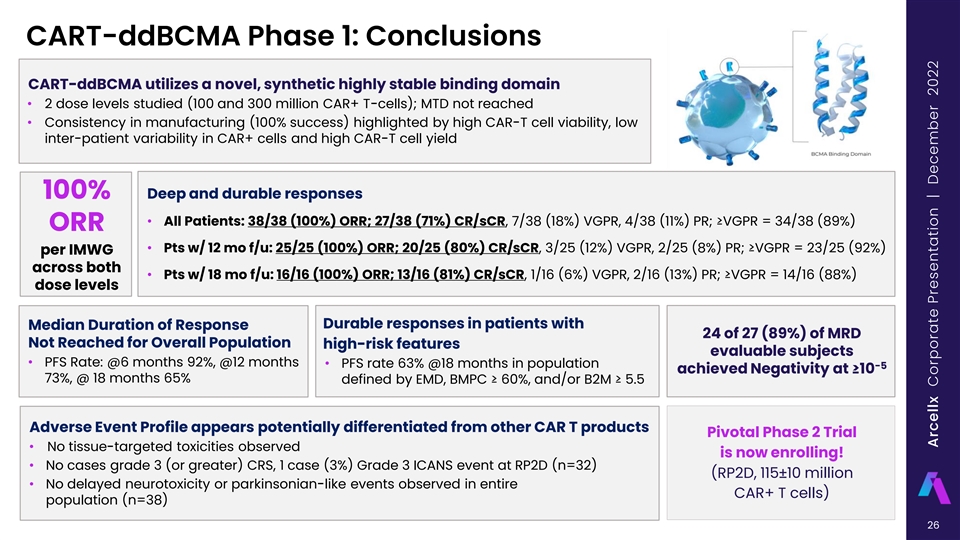

CART-ddBCMA Phase 1: Conclusions CART-ddBCMA utilizes a novel, synthetic highly stable binding domain • 2 dose levels studied (100 and 300 million CAR+ T-cells); MTD not reached • Consistency in manufacturing (100% success) highlighted by high CAR-T cell viability, low inter-patient variability in CAR+ cells and high CAR-T cell yield 100% Deep and durable responses • All Patients: 38/38 (100%) ORR; 27/38 (71%) CR/sCR, 7/38 (18%) VGPR, 4/38 (11%) PR; ≥VGPR = 34/38 (89%) ORR • Pts w/ 12 mo f/u: 25/25 (100%) ORR; 20/25 (80%) CR/sCR, 3/25 (12%) VGPR, 2/25 (8%) PR; ≥VGPR = 23/25 (92%) per IMWG across both • Pts w/ 18 mo f/u: 16/16 (100%) ORR; 13/16 (81%) CR/sCR, 1/16 (6%) VGPR, 2/16 (13%) PR; ≥VGPR = 14/16 (88%) dose levels Durable responses in patients with Median Duration of Response 24 of 27 (89%) of MRD Not Reached for Overall Population high-risk features evaluable subjects • PFS Rate: @6 months 92%, @12 months • PFS rate 63% @18 months in population -5 achieved Negativity at ≥10 73%, @ 18 months 65% defined by EMD, BMPC ≥ 60%, and/or B2M ≥ 5.5 Adverse Event Profile appears potentially differentiated from other CAR T products Pivotal Phase 2 Trial • No tissue-targeted toxicities observed is now enrolling! • No cases grade 3 (or greater) CRS, 1 case (3%) Grade 3 ICANS event at RP2D (n=32) (RP2D, 115±10 million • No delayed neurotoxicity or parkinsonian-like events observed in entire CAR+ T cells) population (n=38) 26 Arcellx Corporate Presentation | December 2022

OUR TECHNOLOGY With our novel synthetic binding scaffold, we are supercharging how the world treats diseases, by engineering transformative treatment platforms

D-Domain Designed To Enhance Safety, Efficacy, and Availability D-Domain Hydrophobic Core & Stable Low Tonic Signaling High Transduction Efficiency High Surface Expression Lower dose may lead to lower toxicity Potentially improved binding Reduced T cell exhaustion . 180000 160000 140000 Donor 1 120000 2 100000 80000 3 60000 4 40000 5 20000 6 0 ddBCMA scFv ddBCMA scFv 28 MFI (Mean Fluorescence Intensity) Arcellx Corporate Presentation | December 2022

Our ARC-SparX Platform Powered by the D-Domain Novel CAR-T modular solution that is CONTROLLABLE and ADAPTABLE Multiple SparX for Patient X Single infusion of ARC-T Periodic intravenous injection or Continue, switch, in outpatient setting self-administration by subcutaneous or stop… injection of SparX (e.g., weekly) 29 Arcellx Corporate Presentation | December 2022

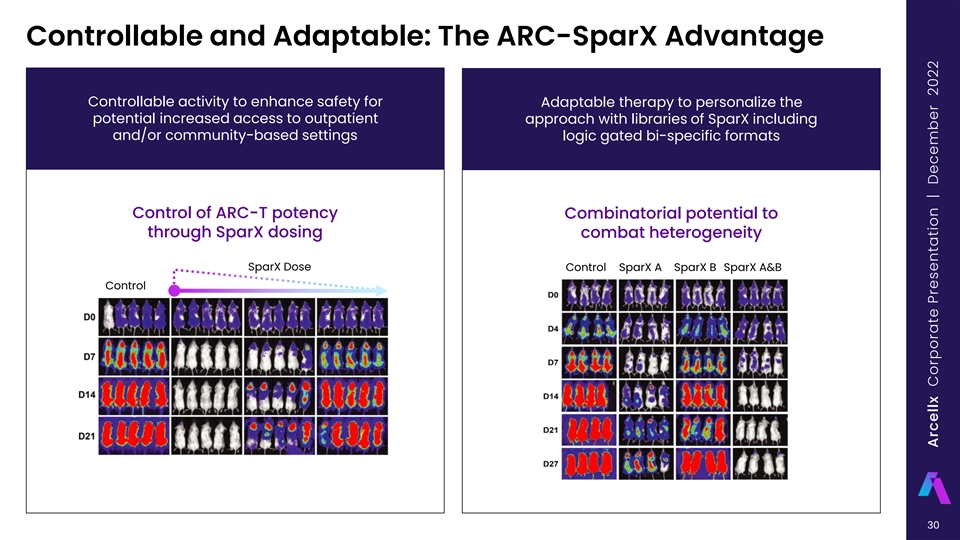

Controllable and Adaptable: The ARC-SparX Advantage Controllable activity to enhance safety for Adaptable therapy to personalize the potential increased access to outpatient approach with libraries of SparX including and/or community-based settings logic gated bi-specific formats Control of ARC-T potency Combinatorial potential to through SparX dosing combat heterogeneity SparX Dose Control SparX A SparX B SparX A&B Control 30 Arcellx Corporate Presentation | December 2022

A Rich Development Pipeline with Growth in Mind Stage of Development Discovery/ Indication Platform Phase 1 Phase 2 Phase 3 Partnered Preclinical Clinical and Preclinical Pipeline ddCAR iMMagine-1 pivotal/ CART-ddBCMA Multiple iMMagine-2 (earlier lines) / CART-ddBCMA ddCAR Myeloma * ACLX-001: BCMA ARC-SparX ACLX-002: CD123 ARC-SparX AML/MDS ARC-SparX ACLX-003 ARC-SparX SCLC Solid Tumors HCC ddCAR *Kite retains an option for select ARC-SparX programs in multiple myeloma 31 Arcellx Corporate Presentation | December 2022

OUR BUSINESS Our team blends vision with results, to achieve the kind of technological, mission-critical breakthroughs that reward investment and improve lives

Our Global Patent Portfolio Worldwide patent coverage with issued and pending applications in major market/manufacturing countries 16+ Patents Granted Worldwide Broad Patent Coverage, including: ‣ Developing D-Domain Libraries ‣ Therapeutic and other use of D-Domains ‣ Adapter Platforms 50+ Worldwide Rights expanding to D- Patent Applications Domain platform applications for Pending Worldwide ddCARs and ARC-SparX 33 Arcellx Corporate Presentation | December 2022

A Team United Under a Shared Mission Maryam Abdul- Rami Elghandour Kate Aiken Michael Dombeck Aileen Fernandes Michelle Gilson Chris Heery, MD Narinder Singh Kareem, JD, MS Neeraj Teotia David Tice, PhD Doug Alleavitch Brad Gliner Myesha Lacy Shashi Kaithamana, PhD Brian Murphy, PhD 34 Arcellx Corporate Presentation | December 2022

Reimagining Cell Therapy with Every Cell of Our Being Technology & IP Team Strategy CMC Pipeline Wholly owned Aligned leaders building a Focused on attractive Foundations for scale and Exploring new frontiers differentiated technology diverse best place to work markets commercial launch including AML, solid tumors, A.I. powered discovery and next gen tools 35 Arcellx Corporate Presentation | December 2022

OUR MISSION Advance humanity by engineering cell therapies that are safer, more effective, and more broadly accessible

Thank you