Highland Income Fund, or HFRO (NYSE: HFRO), is aclosed-end fund managed by Highland Capital Management Fund Advisors, L.P., an affiliate of Highland. As of September 30, 2019, HFRO had $1.3 billion of assets under management. HFRO seeks to provide a high level of current income consistent with preservation of capital. HFRO pursues its investment objectives by investing primarily in floating-rate loans and other securities deemed to be floating-rate investments.

NexPoint Strategic Opportunities Fund, or NHF(NYSE: NHF), is aclosed-end fund managed by our Sponsor. As of September 30, 2019, NHF had $1.5 billion in assets under management. NHF’s investment objectives are to provide both current income and capital appreciation. NHF is invested primarily in (i) secured and unsecured floating and fixed rate loans; (ii) bonds and other debt obligations; (iii) debt obligations of stressed, distressed and bankrupt issuers; (iv) structured products, including but not limited to, mortgage-backed and other asset-backed securities and collateralized debt obligations; (v) equities; (vi) other investment companies, including business development companies; and (vii) REITs.

Leading Real Estate Focused Platform

Our Sponsor is an experienced manager of real estate. Our Sponsor and its affiliates manage approximately $7.3 billion of gross value in real estate related investments as of September 30, 2019. Our Sponsor and its affiliates’ real estate related investments are primarily managed through the following entities:

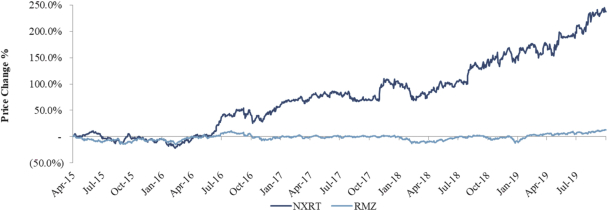

NexPoint Residential Trust, Inc., or NXRT (NYSE: NXRT), is a publicly traded REIT. NXRT is primarily focused on acquiring, renovating, owning and operating well-located, middle-income multifamily properties with“value-add” potential in large cities and suburban submarkets of large cities, primarily in the Southeastern and Southwestern United States. As of September 30, 2019, NXRT owned37 properties encompassing13,757 units.

VineBrook Homes Trust, Inc., or VineBrook, is a privately held REIT and is a leading owner and operator of workforce SFR properties. VineBrook acquires, renovates, owns and manages SFR properties that management deems to be in the “affordable” or “workforce” category with a focus on“value-add” potential. As of September 30, 2019, VineBrook owned and operated6,392 homes in primarily Midwestern cities and had258 homes under contract.

NexPoint Hospitality Trust, Inc., or NHT (TSXV:NHT-U), is a publicly traded REIT. NHT is primarily focused on acquiring, owning, renovating, and operating select-service, extended-stay and efficient full-service hotels located in attractive U.S. markets. As of September 30, 2019, NHT owned 11 hotel properties encompassing 1,607 rooms across the United States. On July 21, 2019, NHT entered into an agreement to acquire Condor Hospitality Trust, Inc. (NYSE: CDOR), which owned 15 select service and extended stay properties, encompassing 1,908 rooms as of September 30, 2019.

Affiliates of our Sponsor manage multiple privately held REITs that are wholly owned by funds managed by affiliates of our Sponsor, including (1) NexPoint Real Estate Opportunities, or NREO, (2) NexPoint Real Estate Capital, or NREC, (3) NFRO REIT Sub, LLC, (4) NexPoint Capital REIT, LLC, (5) NRESF REIT Sub, LLC and (6) GAF REIT, LLC, and manage multiple Delaware Statutory Trusts, or DSTs.