- NREF Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

NexPoint Real Estate Finance (NREF) CORRESPCorrespondence with SEC

Filed: 4 Feb 20, 12:00am

February 4, 2020

BY EDGAR

Ronald Alper

Office of Real Estate and Construction

United States Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Re: NexPoint Real Estate Finance, Inc.

Amendment No. 2 to Registration Statement on FormS-11

Filed January 27, 2020

FileNo. 333-235698

Ladies and Gentlemen:

On behalf of the Company, we are responding to the comments of the staff of the Division of Corporation Finance of the Securities and Exchange Commission (the “Staff”) contained in its letter dated February 3, 2020. For ease of reference, the text of the Staff’s comments are included in bold-face type below, followed by the Company’s response. Additionally, attached to this letter as Exhibit A is a draft free writing prospectus that includes the changes discussed in this letter. Except as otherwise provided, page references included in the body of the Company’s response and in the body of the draft free writing prospectus are to Amendment No. 2 to the Company’s Registration Statement on FormS-11.

Amendment No. 2 to FormS-11 filed January 27, 2020

Unaudited Pro Forma Consolidated Financial Statement Information, pageF-6

| 1. | We note your disclosure on page 82 that your operating partnership will own an approximate 26.4% interest in the subsidiary partnerships after your offering. Please tell us what consideration you have giving to adjusting your pro forma income statement to reflect the allocation of net earnings between controlling andnon-controlling interest. Additionally, tell us what consideration you have given to adding footnote disclosure to your pro forma financial statement information to more fully describe the operating partnership’s ownership interest in the subsidiary partnerships. |

Response:The Company acknowledges the Staff’s comment and advises the Staff that the Company intends to add footnote (p) (as set forth in the draft free writing prospectus attached to this letter as Exhibit A) to the pro forma income statement to illustrate the effect of the estimated initial public offering proceeds on the income allocation between thenon-controlling interests and the common stockholders. The Company believes this disclosure provides investors an understanding of what will be allocated to common stockholders following the completion of the Formation Transaction and offering. Given that the pro formas give effect to the Formation Transaction but not the offering, the presentation on the face of the pro forma income statement shows that all net earnings will be attributable tonon-controlling interests. The Company believes that the new disclosure in footnote (p), combined with the overall disclosure included in the prospectus, gives investors all material information regarding the expected allocation of financial performance among the Company’s stockholders andnon-controlling interests.

There are multiple variables including the size and price of the offering that would factor into adjusting the pro forma income statement to reflect the allocation of net earnings between controlling andnon-controlling interests. The Company considered that adjusting the pro forma presentation would be complicated, involve assumptions that would change upon pricing of the offering, and on balance would not provide investors with meaningfully improved disclosure at the time of investment. After discussions with its advisors, the Company believes that investors understand the concept of increasing and decreasing the relative ownership percentages of the Company’s stockholders and thenon-controlling interests based on the size and price of the offering and application of the net proceeds as described in the prospectus. Based on the foregoing and the burden involved in further revising the pro forma disclosure at this time, the Company believes that the additional footnote disclosure and current pro forma presentation provides investors with the most beneficial practical presentation available under the circumstances.

United States Securities and Exchange Commission

February 4, 2020

Page 2 of 2

General

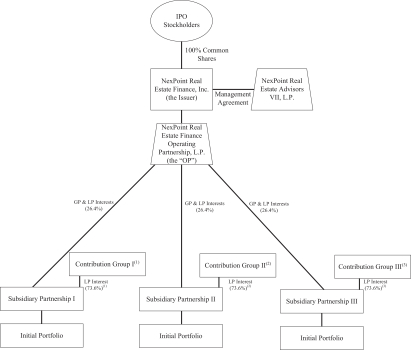

| 2. | We note your revised disclosure on page 82 that the OP will contribute the net proceeds in an amount equal to 28.0% to its first subsidiary partnership, 39.3% to its second subsidiary partnership and 32.7% to its third subsidiary partnership and will own approximately 26.4% of each of the subsidiary partnerships (assuming the underwriters do not exercise their option to purchase additional shares). We further note your disclosure on page 2 that, upon the completion of this offering, you will hold all of the limited partnership interests in your OP. Please revise your summary and throughout the prospectus to clarify, if true, that your OP will own approximately 26.4% of each of the subsidiary partnerships, including revising the structure charts on pages 20 and 121 to include the ownership percentages and identify the owners of thenon-controlling interests. In addition, please clarify throughout, if true, that you only hold the economic interest in approximately 26.4% of your initial portfolio. |

Response:The Company acknowledges the Staff’s comment and advises the Staff that it intends to revise pages 2, 82, 87, 101 and 200 (as set forth in the draft free writing prospectus attached to this letter as Exhibit A) to clarify that following the Formation Transaction and the offering, the Company’s operating partnership is expected to own approximately 26.4% of each of the subsidiary partnerships and will have an approximately 26.4% economic interest in the Initial Portfolio. Additionally, the Company intends to revise pages 20 and 121 (as set forth in the draft free writing prospectus attached to this letter as Exhibit A) to revise its structure charts to include the percentage ownership and identities of the owners of the subsidiary partnerships.

* * * * * * *

If you have any questions, please feel free to contact me at 214.453.6494. Thank you for your cooperation and prompt attention to this matter.

Sincerely,

/s/ Charles T. Haag

| cc: | Brian Mitts, President, NexPoint Real Estate Finance, Inc. |

Justin S. Reinus, Partner, Winston & Strawn LLP |

Robert K. Smith, Partner, Hunton Andrews Kurth LLP |

James V. Davidson, Partner, Hunton Andrews Kurth LLP |

Exhibit A

Filed Pursuant to Rule 433

Issuer Free Writing Prospectus dated February , 2020

RegistrationNo. 333-235698

NexPoint Real Estate Finance, Inc.

Free Writing Prospectus

February 4, 2020

This free writing prospectus is being filed to advise you of the availability of a revised preliminary prospectus, subject to completion, dated February 4, 2020, included in Amendment No. 3 to the Registration Statement on FormS-11 (FileNo. 333-235698) of NexPoint Real Estate Finance, Inc. (the “Company”), as filed with the Securities and Exchange Commission (the “SEC”) on February 4, 2020 (as so amended, the “Registration Statement”), relating to the Company’s proposed offering of its common stock, and to provide you with a hyperlink to the current version of the Registration Statement. The revised preliminary prospectus included in the Registration Statement has been filed with the SEC to make the changes described in this free writing prospectus. Except for the changes described in this free writing prospectus, no other material changes have been made to the revised preliminary prospectus included in the Registration Statement. Defined terms used in this free writing prospectus, but not defined herein, have the meanings ascribed to them in the preliminary prospectus.

To review the revised preliminary prospectus included in the Registration Statement, click the following link on the SEC web site at www.sec.gov (or if such address has changed, by reviewing the Company’s filings for the relevant date on the SEC web site):

[insert link]

The following has been added at the end of the first paragraph on page 2, at the end of the fourth paragraph on page 87, and at the end of the fourth paragraph on page 101:

“and our operating partnership will own approximately 26.4% of each of its subsidiary partnerships. Following the Formation Transaction and this offering, we, through our Operating Partnership, will have an approximately 26.4% economic interest in our Initial Portfolio. The percentage of subsidiary partnership units owned by our OP assumes (1) the Contribution Group contributes $252.7 million of net value, (2) a $20.00 per share value, the midpoint of the range set forth on the cover of this prospectus and (3) the underwriters do not exercise their option to purchase additional shares and is subject to change based on these assumptions and changes in the subsidiary partnerships’ working capital balance.”

The following has replaced the structure chart on page 20 and 121:

| (1) | Contribution Group I consists of the following entities that have the following ownership of Subsidiary Partnership I units: NexPoint Strategic Opportunities Fund (8.1%); Highland Global Allocation Fund (2.6%); NexPoint Real Estate Strategies Fund (0.3%); and NexPoint WLIF, LLC, Series I (62.6%). |

| (2) | Contribution Group II consists of the following entities that have the following ownership of Subsidiary Partnership II units: Highland Income Fund (9.3%); and NexPoint WLIF, LLC, Series II (64.3%). |

| (3) | Contribution Group III consists of the following entities that have the following ownership of Subsidiary Partnership III units: NexPoint Capital (3.6%); NexPoint Capital REIT (2.0%); NREC TRS, Inc. (4.3%); NexPoint Real Estate Capital (15.0%); NexPoint Strategic Opportunities Fund (38.1%); Highland Income Fund (8.9%); and NexPoint Real Estate Strategies Fund (1.7%). |

The percentage of subsidiary partnership units owned by our OP and the other entities listed above assumes (1) the Contribution Group contributes $252.7 million of net value, (2) a $20.00 per share value, the midpoint of the range set forth on the cover of this prospectus and (3) the underwriters do not exercise their option to purchase additional shares and is subject to change based on these assumptions and changes in the subsidiary partnerships’ working capital balance.”

The following has replaced the second paragraph on page 82:

“We intend to contribute the net proceeds from this offering to our OP in exchange for limited partnership interests in the OP and our OP intends to contribute the net proceeds from this offering to our subsidiary partnerships for limited partnership interests in the subsidiary partnerships. Pursuant to the terms of the OP’s limited partnership agreement, the OP will contribute the net proceeds in an amount equal to 28.0% to its first subsidiary partnership, 39.3% to its second subsidiary partnership and 32.7% to its third subsidiary partnership and will own approximately 26.4% of each of the subsidiary partnerships. The percentage of subsidiary partnership units owned by our OP assumes (1) the Contribution Group contributes $252.7 million of net value, (2) a $20.00 per share value, the midpoint of the range set forth on the cover of this prospectus and (3) the underwriters do not exercise their option to purchase additional shares and is subject to change based on these assumptions and changes in the subsidiary partnerships’ working capital balance.”

2

The following has been added after the fourth sentence of the second paragraph on page 200:

“in our operating partnership and our operating partnership will own approximately 26.4% of each of its subsidiary partnerships. Following the Formation Transaction and this offering, we, through our Operating Partnership, will have an approximately 26.4% economic interest in our Initial Portfolio. The percentage of subsidiary partnership units owned by our OP assumes (1) the Contribution Group contributes $252.7 million of net value, (2) a $20.00 per share value, the midpoint of the range set forth on the cover of this prospectus and (3) the underwriters do not exercise their option to purchase additional shares and is subject to change based on changes in the subsidiary partnerships’ working capital balance.”

The following has replaced the line item heading entitled “Net income attributable to redeemable noncontrolling interests” on pageF-8:

“Net income attributable to redeemable noncontrolling interests (p)”

The following has been added after footnote (o) on pageF-23:

(p) Upon completion of the IPO, the Company will contribute the net IPO proceeds of approximately $90.6 million (assuming $100.0 million in proceeds net of underwriting discounts and commission and offering expenses of $9.4 million) to the OP and then 28.0% to the first subsidiary partnership, 39.3% to the second subsidiary partnership and 32.7% to the third subsidiary partnership. Following the contributions, the Company, through its ownership in the OP, will have an approximately 26.4% ownership in each of the subsidiary partnerships. Income and expenses at the subsidiary partnerships will be allocated to thenon-controlling interests and OP on a pro rata basis, with the OP receiving approximately 26.4% of the $28.9 million shown on the pro forma income statement.”

Where to Find Additional Information

The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Raymond James & Associates, Inc. at1-800-248-8863; Keefe, Bruyette & Woods, Inc.,A Stifel Company, at1-800-966-1559; or Robert W. Baird & Co. Incorporated, at1-800-792-2473.

3