The following has replaced the line item heading entitled “Net income attributable to redeemable noncontrolling interests” on page 86:

“Net income attributable to redeemable noncontrolling interests (1)”

The following has been added as footnote (1) on page 86:

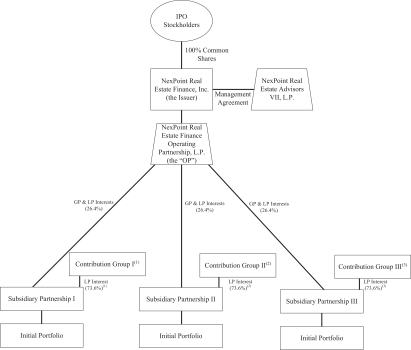

“(1) Upon completion of the IPO, the Company will contribute the net IPO proceeds of approximately $90.6 million (assuming $100.0 million in proceeds net of underwriting discounts and commission and offering expenses of $9.4 million) to the OP and then 28.0% to the first subsidiary partnership, 39.3% to the second subsidiary partnership and 32.7% to the third subsidiary partnership. Following the contributions, the Company, through its ownership in the OP, will have an approximately 26.4% ownership in each of the subsidiary partnerships. Income and expenses at the subsidiary partnerships will be allocated to the non-controlling interests and OP on a pro rata basis, with the OP receiving approximately 26.4% of the $28.9 million shown on the pro forma income statement, meaning approximately $7.6 million will be allocated to the controlling interests and approximately $21.3 million will be allocated to the non-controlling interests.”

The following has been added after the fourth sentence of the second paragraph on page 200:

“in our operating partnership and our operating partnership will own approximately 26.4% of each of its subsidiary partnerships. Following the Formation Transaction and this offering, we, through our Operating Partnership, will have an approximately 26.4% economic interest in our Initial Portfolio. The percentage of subsidiary partnership units owned by our OP assumes (1) the Contribution Group contributes $252.7 million of net value, (2) a $20.00 per share value, the midpoint of the range set forth on the cover of this prospectus and (3) the underwriters do not exercise their option to purchase additional shares and is subject to change based on changes in the subsidiary partnerships’ working capital balance.”

The following has been added at the end of the second paragraph on page F-6 and at the end of the fifth paragraph on page F-9:

“The pro forma financial statements do not give effect to the IPO, however, for a discussion of the effects of the IPO, see footnote (p) under “Assumptions in regard to unaudited pro forma consolidated statement of operations for the year ended December 31, 2019” in Note 4. Pro Forma Adjustments.”

The following has replaced the line item heading entitled “Net income attributable to redeemable noncontrolling interests” on pageF-8:

“Net income attributable to redeemable noncontrolling interests (p)”

The following has been added after footnote (o) on pageF-23:

“(p) Upon completion of the IPO, the Company will contribute the net IPO proceeds of approximately $90.6 million (assuming $100.0 million in proceeds net of underwriting discounts and commission and offering expenses of $9.4 million) to the OP and then 28.0% to the first subsidiary partnership, 39.3% to the second subsidiary partnership and 32.7% to the third subsidiary partnership. Following the contributions, the Company, through its ownership in the OP, will have an approximately 26.4% ownership in each of the subsidiary partnerships. Income and expenses at the subsidiary partnerships will be allocated to thenon-controlling interests and OP on a pro rata basis, with the OP receiving approximately 26.4% of the $28.9 million shown on the pro forma income statement, meaning approximately $7.6 million will be allocated to the controlling interests and approximately $21.3 million will be allocated to the non-controlling interests.”

Where to Find Additional Information

The Company has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Raymond James & Associates, Inc. at1-800-248-8863; Keefe, Bruyette & Woods, Inc.,A Stifel Company, at1-800-966-1559; or Robert W. Baird & Co. Incorporated, at1-800-792-2473.

3