The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 15, 2020

Shares

| | | | |

| | |

| PRELIMINARY PROSPECTUS | | | | |

| |  | | |

NEXPOINT REAL ESTATE FINANCE, INC.

% Series A Cumulative Redeemable Preferred Stock

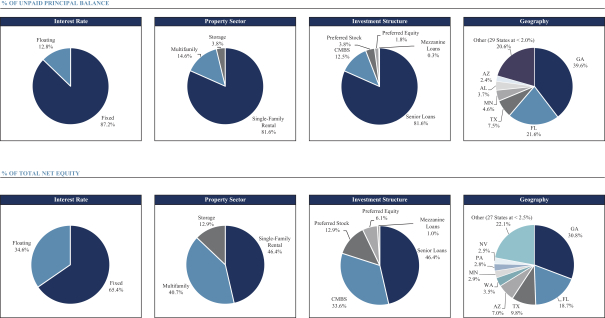

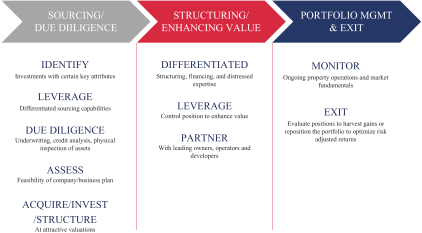

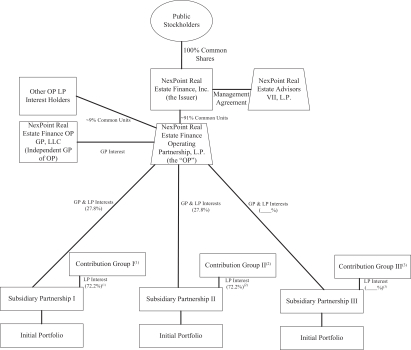

NexPoint Real Estate Finance, Inc., or we, us or our, is a newly formed commercial mortgage real estate investment trust. Our strategy is to originate, structure and invest in first-lien mortgage loans, mezzanine loans, preferred equity and preferred stock, as well as multifamily commercial mortgage-backed securities. We are externally managed by NexPoint Real Estate Advisors VII, L.P., or our Manager, a subsidiary of NexPoint Advisors, L.P., or our Sponsor.

We are offering shares of our % Series A Cumulative Redeemable Preferred Stock, or the Series A Preferred Stock, in this offering. We intend to list the Series A Preferred Stock on the New York Stock Exchange, or NYSE, under the symbol “NREF PRA.” Our common stock is listed on the NYSE under the symbol “NREF.” This is the original issuance of the Series A Preferred Stock.

Dividends on the Series A Preferred Stock will be payable quarterly in arrears on or about the 25th day of January, April, July and October of each year. The dividend rate is % per annum of the $25.00 liquidation preference, which is equivalent to $ per share of Series A Preferred Stock. The first dividend on the Series A Preferred Stock sold in this offering will be paid on , 2020, will cover the period from, but not including, , 2020 to, but not including, , 2020 and will be in the amount of $ per share.

Generally, we may not redeem the Series A Preferred Stock until , 2025. On and after , 2025, we may, at our option, redeem the Series A Preferred Stock, in whole or in part from time to time, by paying $25.00 per share, plus any accrued and unpaid dividends (whether or not declared) to, but not including, the date of redemption. In addition, upon the occurrence of a Change of Control (as defined herein), as a result of which our common stock and the common securities of the acquiring or surviving entity (or American Depositary Receipts, or ADRs, representing such common securities) are not listed on the NYSE, the NYSE American LLC, or the NYSE American, or the NASDAQ Stock Market, or NASDAQ, or listed or quoted on a successor exchange or quotation system, we may, at our option, redeem the Series A Preferred Stock, in whole or in part within 120 days after the first date on which such Change of Control occurred, by paying $25.00 per share, plus any accrued and unpaid dividends (whether or not declared) to, but not including, the date of redemption. To the extent we exercise our redemption right relating to the Series A Preferred Stock, the holders of Series A Preferred Stock will not be permitted to exercise the conversion right described below in respect of their shares called for redemption. The Series A Preferred Stock has no maturity date and will remain outstanding indefinitely unless redeemed by us or converted in connection with a Change of Control by the holders of Series A Preferred Stock.

Beginning on the first anniversary of the first date on which any shares of Series A Preferred Stock are issued, upon the occurrence of a Change of Control, as a result of which our common stock and the common securities of the acquiring or surviving entity (or ADRs representing such common securities) are not listed on the NYSE, the NYSE American or NASDAQ, or listed or quoted on a successor exchange or quotation system, each holder of Series A Preferred Stock will have the right (subject to our right to redeem the Series A Preferred Stock in whole or in part, as described above, prior to the Change of Control Conversion Date (as defined herein)) to convert some or all of the Series A Preferred Stock held by such holder on the Change of Control Conversion Date into a number of shares of our common stock per share of Series A Preferred Stock to be converted equal to the lesser of:

| | • | | the quotient obtained by dividing (i) the sum of the $25.00 liquidation preference plus the amount of any accrued and unpaid dividends (whether or not declared) to, but not including, the Change of Control Conversion Date (unless the Change of Control Conversion Date is after a record date for a Series A Preferred Stock dividend payment and prior to the corresponding Series A Preferred Stock dividend payment date, in which case no additional amount for such accrued and unpaid dividend will be included in this sum) by (ii) the Common Stock Price (as defined herein); and |

| | • | | , or the Share Cap, subject to certain adjustments; |

subject, in each case, to provisions for the receipt of alternative consideration as described in this prospectus.

The Series A Preferred Stock is subject to certain restrictions on ownership designed to, among other things, preserve our qualification as a real estate investment trust, or REIT, for U.S. federal income tax purposes. See “Description of Capital Stock—Series A Preferred Stock—Restrictions on Ownership and Transfer” in this prospectus.

At our request, the underwriters have reserved for sale, at the public offering price, up to 200,000 shares of Series A Preferred Stock, or the Reserved Shares, offered by this prospectus for sale to our Sponsor and its affiliates. No underwriting discounts or commissions will be applied to the Reserved Shares.

We intend to elect to be treated as a REIT for U.S. federal income tax purposes commencing with our taxable year ending December 31, 2020.

We are an “emerging growth company” and a “smaller reporting company” under the federal securities laws and are subject to reduced public company reporting requirements. Investing in our shares of Series A Preferred Stock involves a high degree of risk. See “Risk Factors” beginning on page 42 of this prospectus.

| | | | | | | | |

| | | Per Share | | | Total | |

| | |

Price to the public | | $ | | | | $ | | |

| | |

Underwriting discounts and commissions (1)(2) | | $ | | | | $ | | |

| | |

Proceeds, before expenses, to us (2) | | $ | | | | $ | | |

| (1) | Excludes certain compensation payable to the underwriters. See “Underwriting” for a detailed description of compensation payable to the underwriters. |

| (2) | Total reflects that no underwriting discounts or commissions will be applied to the Reserved Shares. |

We have granted the underwriters an option to purchase up to an additional shares of the Series A Preferred Stock on the same terms and conditions set forth above within 30 days of the date of this prospectus solely to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2020.

| | | | |

| RAYMOND JAMES | | KEEFE, BRUYETTE & WOODS A STIFEL COMPANY | | BAIRD |

The date of this prospectus is , 2020