properties that management deems to be in the “affordable” or “workforce” category with a focus on “value-add” potential. As of September 30, 2019, VineBrook had an enterprise value of $514.8 million, total debt of approximately $307.2 million, owned and operated 6,392 homes in primarily Midwestern cities and had 269 homes under contract.

NexPoint Hospitality Trust, Inc., or NHT (TSXV: NHT-U), is a publicly traded REIT. NHT is primarily focused on acquiring, owning, renovating, and operating select-service, extended-stay and efficient full-service hotels located in attractive U.S. markets. As of September 30, 2019, NHT had an enterprise value of $390.7 million, total debt of approximately $259.6 and owned 11 hotel properties encompassing 1,607 rooms across the United States. On July 21, 2019, NHT entered into an agreement to acquire Condor Hospitality Trust, Inc. (NYSE: CDOR), which had an enterprise value of $271 million, total debt of approximately $135.2 million and owned 15 select service and extended stay properties, encompassing 1,908 rooms as of September 30, 2019.

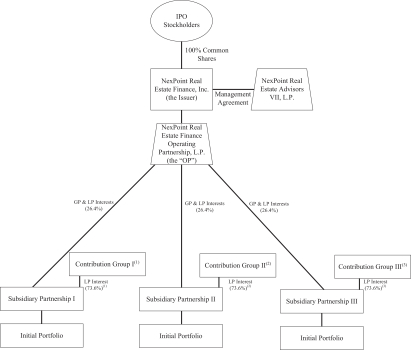

Affiliates of our Sponsor manage multiple privately held REITs that are wholly owned by funds managed by affiliates of our Sponsor, including (1) NexPoint Real Estate Opportunities, or NREO, (2) NexPoint Real Estate Capital, or NREC, (3) NFRO REIT Sub, LLC, (4) NexPoint Capital REIT, LLC, (5) NRESF REIT Sub, LLC and (6) GAF REIT, LLC, and manage multiple Delaware Statutory Trusts, or DSTs.

Experience in Target Property Sectors

Our Sponsor and its affiliates have extensive experience in our target property sectors and as of September 30, 2019 have completed approximately $9.0 billion in gross real estate transactions since 2012. These transactions include activity in the following sectors:

Multifamily

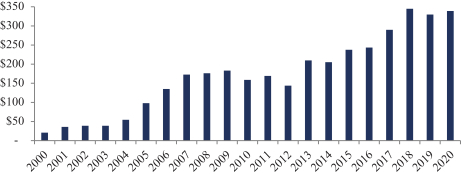

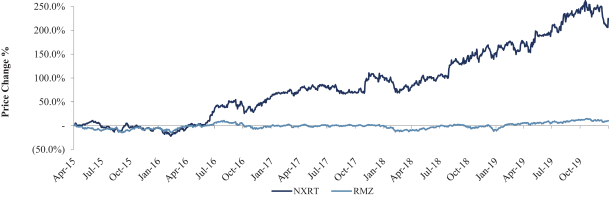

Affiliates of our Sponsor have been active in the multifamily sector since 2013 and have invested or loaned approximately $5.7 billion in the multifamily sector, including in NXRT with $2.3 billion in enterprise value and total debt of approximately $1.2 billion as of September 30, 2019, six separate multifamily CMBS B-Piece securitizations totaling approximately $292.3 million as of September 30, 2019, preferred equity investments in 28 multifamily properties with approximately $1.0 billion of gross real estate value as of September 30, 2019, 14 multifamily properties in DSTs with $668.3 million in gross real estate value as of September 30, 2019 and NexBank’s outstanding loans in the multifamily sector as of September 30, 2019.

Single-Family Rental

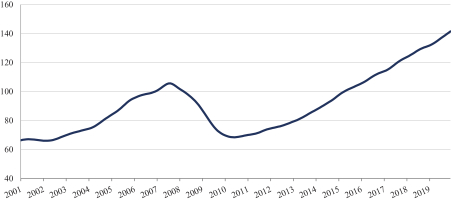

Affiliates of our Sponsor have been active in the SFR sector, investing or loaning approximately $2.1 billion as a continuation of our Sponsor’s affordable housing investment thesis, including approximately $1.2 billion in SFR mortgages, an investment in VineBrook, which owns SFR assets directly, and NexBank’s outstanding loans in the SFR sector as of September 30, 2019. VineBrook is externally managed by an affiliate of our Sponsor and our Sponsor plays an integral role in the expansion of VineBrook’s business.

Self-Storage

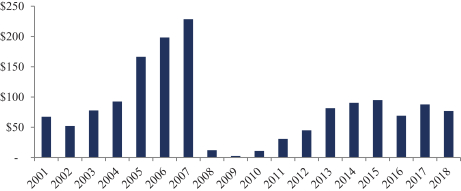

Affiliates of our Sponsor have invested or loaned approximately $211 million in the self-storage sector, including a $125 million preferred equity investment in Jernigan Capital, Inc., or JCAP (NYSE: JCAP), a publicly traded REIT that provides capital to private developers, owners and operators of self-storage facilities, approximately $77.4 million of equity invested directly into self-storage developments and NexBank’s outstanding loans in the self-storage sector as of September 30, 2019.

108