Total capital expenditure was US$133 million for H1 2020 with US$78 million (59%) of the expenditure project in nature. Both sustaining and project capital are below budget for the quarter and half year due to the impact of COVID-19. Capital expenditure for 2020 is forecast to be between US$250 million and US$270 million.

SA PGM operations

4E PGM production of 657,828 4Eoz for H1 2020, was 5% higher than for the comparable period in 2019, benefiting from the inclusion of the Marikana operation for the entire period, as opposed to just one month in 2019. Production for Q2 2020 was severely impacted by the COVID-19 lock down, declining by 43% from 418,072 4Eoz for Q1 2020 to 239,756 4Eoz for Q2 2020. AISC increased by 46% year-on-year to R19,277/4Eoz (US$1,156/4Eoz) predominantly due to the COVID-19 related disruptions and the inclusion of relatively higher cost of Marikana production (due to entirely conventional production, which is higher cost relative to the significant amount of lower cost mechanised production at Rustenburg and Kroondal and the cost of the Marikana smelting and refining operations) which comprised 42% of production for the period compared with 13% of production for H1 2019. AISC for Q2 2020 of R24,011/4Eoz (US$1,338/4Eoz) was 43% higher than for Q1 2010 due to significant COVID-19 disruption during the quarter. By the end of H1 2020, approximately 65% of the workforce had been recalled with production at approximately 73% of planned levels.

The average 4E PGM basket price realised for H1 2020 of R33,375/4Eoz (US$2,002/4Eoz) was 92% higher than for H1 2019, mainly due to significant increases in palladium (up 51%) and rhodium (up 211%) prices and 17% depreciation of the rand. These metals respectively comprised 30% and 8% of the SA PGM operations’ 4E PGM production for H1 2020, but due to the higher metal prices made up approximately 28% and 45% of revenue at spot prices.

4E PGM Production from Rustenburg was 35% lower than for H1 2019 at 224,182 4Eoz, with underground production 37% lower than H1 2019 as a result of the national COVID-19 lockdown, which also affected surface production. 4E PGM production of 69,614 4Eoz for Q2 2020 (which was impacted by COVID-19 restrictions), was 55% lower than for Q1 2020. During the initial relaxation of restrictions on operations, production from the more efficient mechanised mines, which were able to observe social distancing rules easier, was prioritised. UG2 production from these mines is lower grade than Merensky reef mined at the conventional sections, resulting in a 15% decline in underground yield for Q2 2020 relative to Q1 2020. The higher relative proportion of palladium and rhodium in UG2 however, means that unit revenue from this source is currently 34% higher than from the platinum dominated Merensky reef. AISC at the Rustenburg operations increased by 44% year-on-year to R19,655/4Eoz (US$1,179/4Eoz), mainly as a result of production volume variances due to COVID-19 and higher royalties due to the significant increase (100%) in the average realised 4E PGM basket price from R16,845/4Eoz (US$1,186/4Eoz) for H1 2019 to R33,676/4Eoz (US$2,020/4Eoz for H1 2020).

Attributable 4E PGM production from Kroondal of 82,435 4Eoz for H1 2020, was 37% lower than the comparable period in 2019 due to the impact of COVID-19 lockdown from March 2020. AISC of R14,132/4Eoz (US$848/4Eoz), was 38% higher than the comparable period in 2019, primarily due to the production volume variance.

4E PGM production from the Marikana operation was 274,637 4Eoz in H1 2020 and PoC production was 48,219 4Eoz. Mined production of 102,640 4Eoz for Q2 2020 was 40% lower than for Q1 2020. AISC for the period was R21,041/4Eoz (US$1,262/4Eoz]) with AISC for Q2 2020 of R27,596/4Eoz (US$1,537/4Eoz) significantly higher than AISC of R17,128/4Eoz (US$1,114/4Eoz) for Q1 2020.

H1 2020 chrome sales of 795k tonnes were 73% higher than the 459k tonnes in H1 2019 due to improved production and logistics, as well as the inclusion of Marikana. Chrome revenue was R666 million (US$40 million) for H1 2020, lower than the H1 2019 of R847 million (US$60 million) due to the Chrome price reducing from US$163/ton [dry metric tonne] in H1 2019 to US$138/ton in H1 2020.

Attributable 4E PGM production from Mimosa of 60,353oz was 1% lower than for H1 2019, performing steadily, with AISC of US$638/4Eoz (R10,629/4Eoz) 23% lower than for H1 2019.

Capital expenditure of R813 million (US$49 million) for H1 2020, was lower than plan due to the COVID-19 lockdown. Capital expenditure for the year is forecast at approximately R2,300 million (US$135 million), compared with guidance of R3,100 million prior to COVID-19.

SA gold operations

Production from the SA gold operations of 12,554kg (403,621oz) for H1 2020 was 17% higher than for the comparable period in 2019, with AISC decreasing by 8% to R800,048/kg (US$1,493/oz) compared to the same period in 2019, which was severely impacted by the AMCU strike across the managed SA gold operations (excluding DRDGOLD). AISC for Q2 2020 of R890,444/kg (US$1,543/oz) was 20% higher than R741,858/kg (US$1,500/oz) for Q1 2020, due to the COVID-19 production disruptions. Gold production from the managed gold operations (excluding DRDGOLD), increased by 24% to 10,167kg (326,877oz), primarily due to the strike which affected H1 2019 and offset by disruptions caused by the national lockdown. AISC for the managed SA gold operations for H1 2020 decreased by 14% to R846,741/kg (US$1,580/oz) compared to the same period in 2019.

COVID-19 disrupted most of the April milling period with a steady build-up from May into June. By the end of H1 2020 almost 73% of the workforce had been recalled with production at approximately 86% of planned levels.

Approximately R74 million (US$4 million) was spend on COVID-19 related PPE, securing of beds at medical facilities, preparation of quarantine facilities and getting workplaces and buildings ready to accommodate employees returning to work during H1 2020.

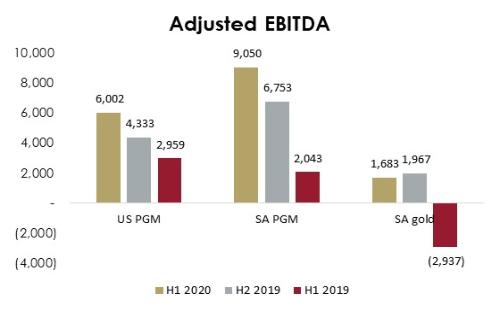

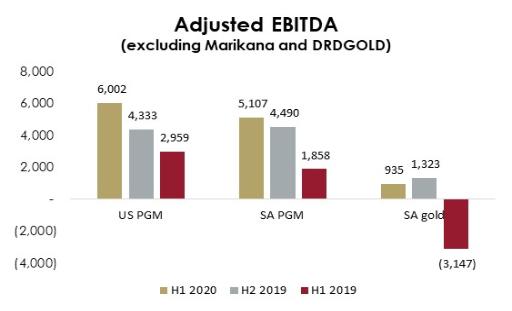

The average rand gold price realised for H1 2019 of R864,679/kg (US$1,613/oz) was 45% higher than for the same period in 2019, which, combined with a 24% increase in gold sales, resulted in adjusted EBITDA from the SA gold operations increasing to R1,683 million (US$101 million) from an adjusted EBITDA loss of R2,937 million (US$207 million) for 2019.

Capital expenditure (excluding DRDGOLD) of R969 million (US$58 million) was R581 million (US$35 million) higher than for the same period in 2019 mainly due to a R411 million (US$25 million) increase in ore reserve development cost to R685 million (US$41 million) for H1 2020 following the return to normalised operations from the strike affected H1 2019, although momentum was again lost in Q2 2020 due to the lockdown.