higher than for H1 2020. Mined PGM production from the US PGM operations of 603,067 2Eoz in 2020 was marginally higher year-on-year, but below revised guidance of between 620,000 and 650,000 2Eoz, primarily due to the impact of a spike in COVID-19 infections at the US PGM operations in Q4 2020, associated with a severe wave of COVID-19 infections in Montana. Despite the COVID-19 disruptions, H2 2020 production of 305,327 2Eoz was 3% higher than for H1 2020, with most operating trends improving towards the end of the year. Production from the SA Gold operations (excluding DRDGOLD) of 25,190kg (809,877oz) was 3% above revised guidance of between 23,500 and 24,500kg (756,000oz and 788,000oz), with production of 15,023kg (483,001oz) for H2 2020, 48% higher than for H1 2020.

This solid operational performance underpinned the record financial results by obtaining full exposure to higher average precious metal prices. The average 4E PGM basket price increased by 83% to R36,651/4Eoz (US$2,227/4Eoz) for 2020 with the average 2E PGM basket price increasing by 36% to US$1,906/2Eoz (R31,373/2Eoz) and the average rand gold price increasing by 43% to R924,764/kg (US$1,747/oz). The average SA exchange rate depreciated by 14% to R16.46/US$ for the year.

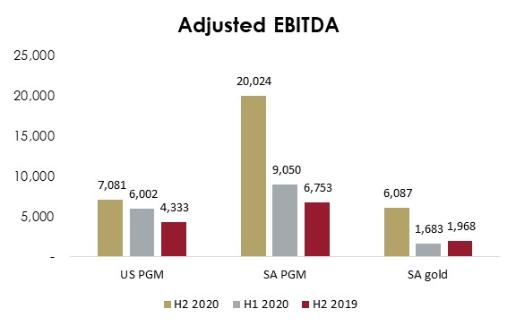

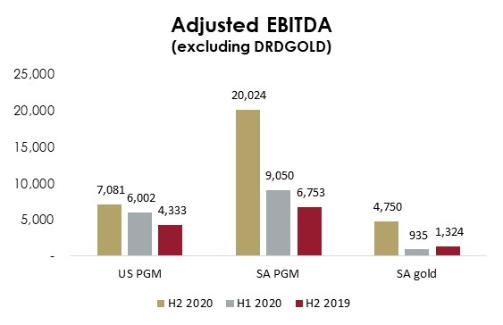

Group revenue increased by 75% year-on-year to R127,392 million (US$7,740 million), with H2 2020 revenue of R72,374 million (US$4,439 million) on par with full year revenue of R72,925 million (US$5,043 million) for 2019. Group adjusted EBITDA for 2020 increased by 230% year-on-year to R49,385 million (US$3,000 million) compared to R14,956 million (US$1,034 million) for 2019.

This resulted in profit attributable to owners of Sibanye-Stillwater, increasing 472 fold from R62 million (US$5 million) for 2019 to R29,312 million (US$1,781 million). Basic earnings per share (EPS) of 1,074 cents (US 65 cents/US 261 cents/ADR) and headline earnings per share (HEPS) of R1,068 cents (US 65 cents/US 260 cents/ADR) increased by 53,600% and 2,770% respectively year-on year.

Sibanye-Stillwater’s economic contribution to the regions in which we operate grew commensurately to our profitability, with royalties increasing by 310% to R1,765 million (US$107million) for 2020 from R431 million (US$30 million) for 2019 and current mining tax increasing from R1,849 million (US$128 million) for 2019 to R5,374 million (US$327 million) for 2020. Along with other taxes, this R4,859 million (US$295 million) higher fiscal contribution is significant, particularly during a period when many countries have experienced economic devastation associated with the COVID-19 pandemic.

The Group deleveraging was successfully achieved during the year, with borrowings reducing by R5,354 million (US$444 million) to R18,383 million (US$1,251 million) and cash and cash equivalents increasing to R20,240 million (US$1,378 million). On a trailing 12 month basis, adjusted EBITDA increased by 230% to R49,385 million (US$3,000 million) resulting in a net cash: adjusted EBITDA ratio of 0.06x compared to net debt: adjusted EBITDA of 1.25x at the end of 2019.

This accelerated deleveraging has significantly de-risked the Group from a financial perspective, addressing what market analysts have continually highlighted as a primary concern and a justification for a relative discount in our investment rating since 2017. Completing this strategic priority allows for a shift in the strategic focus from deleveraging to capital allocation - securing an appropriate balance between consistent and sustained flows of value to stakeholders and allocating capital to ensure the sustainability of the Group and support strategic growth.

After giving due consideration to the successful resumption of operations to normalised operating levels during H2 2020 and the robust financial position of the Group, the Board declared a year-end dividend which delivers a full year dividend to shareholders at the top end of the Group policy range.

Normalised earnings** which are the basis for the declaration of dividends as per the Group dividend policy (see note 9 of the condensed consolidated provisional financial statements), increased by R28,247 million (US$1,696 million), to R30,607 million (US$1,860 million) for 2020 from R2,360 million (US$163 million) in 2019, resulting in the Board declaring full year dividends of R10,713 million (US$649 million) or 371 cents per share (US$25.15 cents per share or US$100.62 cents per ADR). This is equivalent to an approximate dividend yield of 6% at the prevailing share price, well ahead of most peers. Adjusting for the 50 cent per share interim dividend (US$2.94 cents per share or US$11.79 cents per ADR) results in a final dividend for 2020 of approximately R9,375 million (US$649 million) or 321 cents per share. (US$22.21 cents per share or US$88.83 cents per ADR)

** Normalised earnings is defined as earnings attributable to the owners of Sibanye-Stillwater excluding gains and losses on financial instruments and foreign exchange differences, impairments, gains and losses on disposal of property, plant and equipment, occupational healthcare expense, restructuring costs, transactions costs, share-based payment on BEE transaction, gain on acquisition, net other business development costs, share of results of equity-accounted investees, after tax, and changes in estimated deferred tax rate. This measure constitutes pro forma financial information in terms of the JSE Listings Requirements and is the responsibility of the board of directors (Board)

INVESTING FOR SUSTAINABLE VALUE

On 15 February 2020 Group Mineral Resources and Reserves were updated for the year ended 31 December 2020. Of primary significance was the 40% increase in the 4E PGM Mineral reserves at the SA PGM operations to 39.5M 4Eoz, primarily due to the inclusion of 12.7M 4Eoz PGM Mineral Reserves from the K4 project at the Marikana operation and the Klipfontein opencast project (0.1Moz) at the Kroondal operation. Gold Mineral Reserves at the SA gold operations and 2E PGM reserves at the US PGM operations remained stable at 11.3Moz and 26.9M 2Eoz respectively. Following the optimisation of the mining layout and scheduling at the Burnstone Project, combined with estimation model improvements, gold Mineral Reserves for the SA gold projects increased by 8% or 0.3Moz to 4.3Moz.

On 16 February 2021 the Board approved the development of the K4 and Klipfontein projects at the SA PGM operations and the resumption of capital development and equipping at the Burnstone gold project. This represents a significant capital investment of approximately R6.8 billion in high return organic projects in South Africa. The projects have a combined NPV of R5.1 biillion at conservative project prices assumed for the evaluations, which increases significantly to R26.9 billion at current spot prices. In addition to this value add for investors in Sibanye Stillwater, the ancillary benefits for communities and other stakeholders will be significant. Approximately 7,000 jobs will be created and sustained over the life of the projects, with significant financial benefits likely to accrue to local communities and regional and national government

The K4 project is a tier one, low cost, brownfields PGM expansion project at the Marikana operations. The project entails completion of the project, which was significantly advanced by Lonmin with R4.4bn of sunk capex before Lonmin suspended the project due to capital constraints. The K4 project has low execution risk and is expected to be brought into first production within 12 months and reach sustainable annual production of approximately 250,000 4Eoz and at average operating costs of approximately R16,000/4Eoz