SA PGM operations

The SA PGM operations delivered another strong operational performance for H1 2021, with 4E PGM production of 894,165 4Eoz 42% higher than for the comparable period in 2020, following normalisation of production rates in November 2020. Mined underground 4E PGM production increased by 43% year-on-year to 817,369 4Eoz, with 4E PGM production from surface of 76,796 4Eoz, 34% higher. Third-party concentrate processed at the Marikana smelting and refining operations, increased by 29% to 34,827 4Eoz.

AISC for the SA PGM operations for H1 2021 (excluding third party concentrate purchase costs) of R16,921/4Eoz (US$1,163/4Eoz), was 10% lower than for the comparable period in 2020 despite royalties increasing by 308% to R1,571 million (US$108 million) or R1,211/4Eoz (US$83/4Eoz), as a result of significantly higher revenue for the period. Increased third party concentrate purchase costs added R1,526/4Eoz to AISC, due to higher prevailing PGM prices for the period and increased volumes of third party concentrate purchased and processed but with a notable increase in profit from third party processing.

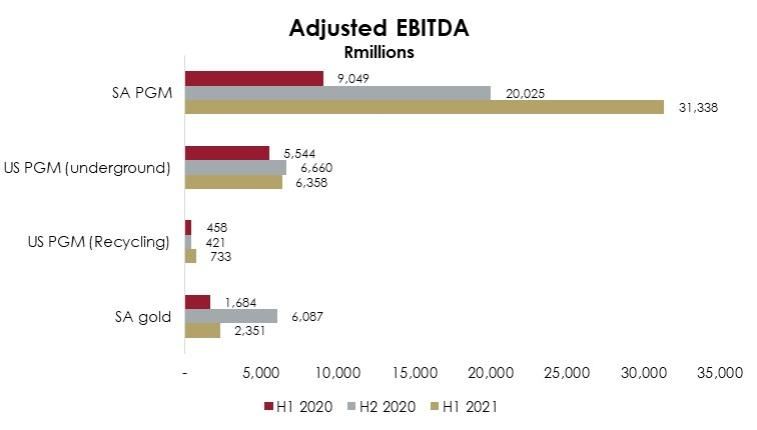

The recovery in production and solid cost management ensured full financial benefits from the 61% higher average 4E PGM price of R53,629/4Eoz (US$3,686/4Eoz) for H1 2021, resulting in adjusted EBITDA for H1 2021 increasing by 246% to R31,338 million (US$2,154 million) compared with R9,049 million (US$544 million) for H1 2020 and the average adjusted EBITDA margin increasing from 42% for H1 2020 to 66% forH1 2021.

4E PGM production from the Rustenburg operation of 328,554 4Eoz for H1 of 2021 was 47% higher year-on-year, with both surface and underground mined production increasing by over 40% compared with H1 2020. This reflects the normalisation of production from the COVID-19 disruptions in 2020 as well as a 7% improvement in plant recoveries from 71 % for H1 2020 to 76% for H1 2021 due to a recovery in higher grade underground production following the COVID-19 disruptions, during which period more surface material was processed. AISC of R18,061/4Eoz (US$1,241/4Eoz) declined by 8% year-on-year, with increased production offsetting a R571 million (US$39 million) or R1,283/4Eoz (US$88/4Eoz) increase in royalties due to higher revenues.

Kroondal delivered another consistent operating result, with 4E PGM production of 113,496 4Eoz, 38% higher than for the comparable period in 2020. AISC of R12,115/4Eoz (US$833/4Eoz), was 14% lower than H1 2020 as a result of the increase in production, which offset a 142% increase in royalties of R5 million (US$0.3 million) or R30/4Eoz (US$2/4Eoz).

The Marikana operation continued to perform strongly, with 4E PGM production of 369,559 4Eoz for H1 2021, 49% higher than for H1 2020. Underground mined production increased by 51% to 347,765 4Eoz and surface production increased by 24% to 21,794 4Eoz. Third party purchased concentrate processed at the Marikana smelting and refining operation increased by 29% year-on-year to 34,827 4Eoz compared to 26,916 4Eoz for H1 2020. Processing of third party material allows for better utilisation of available capacity and generates positive margins for the Marikana smelting and refining operation. AISC for the Marikana operations (excluding third party concentrate) of R17,745/4Eoz (US$1,220/4Eoz), was 12% lower than for the comparable period in 2020, primarily due to the increase in production, which offset a R610 million (US$42 million) or R1,572/4Eoz (US$108/4Eoz) increase in royalties due to increased revenue for the period.

Attributable 4E PGM production from Mimosa of 60,714 4Eoz was 1% higher than for H1 of 2020, with Mimosa maintaining a steady performance with AISC increasing by 8% to US$912/4Eoz (R13,275/4Eoz) due to a 56% increase in sustaining capital.

Chrome sales of 978,823 tonnes for H1 2021, were 23% higher than for H1 2020. Chrome revenue of R1,032 million (US$71 million) for H1 2021, was considerably higher than chrome revenue of R666 million (US$40 million) for H1 2020, due to higher production output and improved chrome prices. The chrome price received improved by 14% from US$138/tonne in the comparable period during 2020 to US$157/tonne for H1 of 2021.

Significant progress was made on catch-up of sustaining and ORD capital from 2020, which was impacted by the COVID-19 lockdown. R1,412 million (US97 million) of capital was spent for H1 2021 compared with R794 million (US$48 million) for H1 2020.

SA gold operations

Production from the SA gold operations (including DRDGOLD) for H1 2021 of 16,138kg (518,848oz) was 29% higher than for the comparable period in 2020, reflecting a return to more normalised operations from the COVID-19 disruptions in early 2020. AISC of R791,171/kg (US$1,691/oz) was only marginally lower year-on-year with a 66% increase in capex to R1,735 million (US$119 million) for H1 2021 due to a carry-over of sustaining and ORD capex from 2020 and above inflation electricity costs offsetting higher production. Despite a 3% decline in the average gold price to R838,088/kg (US$1,792/oz) for H1 2021 the increase in production resulted in adjusted EBITDA increasing by 40% to R2,351 million (US$162 million) from R1,684 million (US$100 million) for H1 2020.

Production from the managed SA Gold operations (excluding DRDGOLD) of 13,399kg (430,788oz) was 32% higher than for H1 2020, despite the loss of high grade panels at Kloof 3 shaft following a seismic event during Q1 2021 resulting in approximately 191kg (6,141oz) less production, and safety stoppages at Beatrix 3 shaft, resulting in approximately 166kg (5,337oz) less production for the period. This was comprised of 11,853kg (381,082oz) from underground mining and 1,546kg (49,705oz) from surface sources, with the AISC of R818,645/kg (US$1,750/oz), 3% lower than for H1 2020.

Underground production from the Driefontein operations increased by 54% to 4,409kg (141,753oz), due to better efficiencies from reorganisation of underground teams and improved mine-call-factor, resulting in consistent grades. AISC for H1 2021 of R777,018/kg (US$1,661/oz) was 17% lower than for H1 2020, with increased production offsetting higher operating costs on the back of above inflation electricity cost increases and a 90% increase in capital (R672 million (US$46 million) compared to R355 million (US$21 million)) due to a carry-over from 2020.

Despite the loss of high grade panels which resulted in approximately 191kg (6,141oz) less production for the period, underground production from the Kloof operation increased by 27% year-on-year, to 4,525kg (145,482oz). Surface production of 828kg (26,621oz) was 7% lower than for H1 2020, when surface production was prioritized to utilise capacity and generate production during the COVID-19

www.sibanyestillwater.com

www.sibanyestillwater.com