Exhibit 99.1

JOHANNESBURG, 3 March 2022: Sibanye Stillwater Limited (Sibanye-Stillwater or the Group) (JSE: SSW and NYSE: SBSW) is pleased to report operating and financial results for the six months ended 31 December 2021, and reviewed condensed consolidated provisional financial statements for the year ended 31 December 2021.

SALIENT FEATURES FOR THE SIX MONTHS AND YEAR ENDED 31 DECEMBER 2021

•Record financial results:

–Profit attributable to owners of Sibanye-Stillwater increased by 13% to R33.1 bn (US$2.2 bn) from R29.3 bn (US$1.8 bn) for 2020

–Headline earnings for the year increased by 27% to R36.9 bn (US$2.5 bn) from R29.1 bn (US$1,8 bn) for 2020

•Solid operational performance with all operating segments achieving annual production guidance

•SA PGMs achieved lower AISC of R16,982/4Eoz (US$1,148/4Eoz), against industry trends. Consolidation synergy cost benefits continue

•19% increase in net cashflow from operating activities to R32.3 bn (US$2.2 bn) and an 88% increase in adjusted Free Cash Flow to R37.4 bn (US$2.5 bn)

•Strong balance sheet: net cash increased further to R11.5 bn (US$719 m) on 31 December 2021

•Final dividend of R5,3 bn (US$342 m) or 187cps (US48.68 cents per ADR). Full year dividend yield of 9.8%*

•Significant progress made on green metals strategy. Strategic positions secured in key jurisdictions

•Commenced with project capital expenditure on K4, Burnstone and Klipfontein projects for future operational sustainability

•BioniCCubE – new innovation and market development fund (R&D fund) approved

* Based on the closing share price of R49.10 for the year end 31 December 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| US dollar | | | | | | SA rand |

| Year ended | Six months ended | | | | | | Six months ended | Year ended |

| Dec 2020 | Dec 2021 | Dec 2020 | Jun 2021 | Dec 2021 | | KEY STATISTICS | | Dec 2021 | Jun 2021 | Dec 2020 | Dec 2021 | Dec 2020 |

| | | | | | UNITED STATES (US) OPERATIONS | | | | | | |

| | | | | | PGM underground operations1,2 | | | | | | |

| 603,067 | | 570,400 | | 305,327 | | 298,301 | | 272,099 | | oz | 2E PGM production2 | kg | 8,463 | | 9,278 | | 9,497 | | 17,741 | | 18,758 | |

| 1,906 | | 2,097 | | 1,970 | | 2,286 | | 1,913 | | US$/2Eoz | Average basket price | R/2Eoz | 28,755 | | 33,261 | | 32,026 | | 31,021 | | 31,373 | |

| 741 | | 727 | | 409 | | 437 | | 290 | | US$m | Adjusted EBITDA3 | Rm | 4,408 | | 6,358 | | 6,661 | | 10,766 | | 12,205 | |

| 61 | | 59 | | 63 | | 65 | | 51 | | % | Adjusted EBITDA margin3 | % | 51 | | 65 | | 63 | | 59 | | 61 | |

| 874 | | 1,004 | | 882 | | 973 | | 1,039 | | US$/2Eoz | All-in sustaining cost4 | R/2Eoz | 15,619 | | 14,153 | | 14,342 | | 14,851 | | 14,385 | |

| | | | | | PGM recycling1,2 | | | | | | |

| 840,170 | | 755,148 | | 442,698 | | 402,872 | | 352,276 | | oz | 3E PGM recycling2 | kg | 10,957 | | 12,531 | | 13,769 | | 23,488 | | 26,132 | |

| 2,237 | | 3,515 | | 2,236 | | 3,159 | | 3,932 | | US$/3Eoz | Average basket price | R/3Eoz | 59,098 | | 45,963 | | 36,357 | | 51,987 | | 36,821 | |

| 54 | | 101 | | 27 | | 50 | | 51 | | US$m | Adjusted EBITDA3 | Rm | 757 | | 733 | | 420 | | 1,490 | | 878 | |

| 3 | | 4 | | 4 | | 4 | | 4 | | % | Adjusted EBITDA margin3 | % | 4 | | 4 | | 4 | | 4 | | 3 | |

| 11 | 21 | 7 | 12 | 9 | US$m | Net interest received | Rm | 144 | 171 | 113 | 315 | 181 |

| 65 | 122 | 34 | 62 | 60 | US$m | Profit before tax | Rm | 899 | 903 | 531 | 1,802 | 1,054 |

| | | | | | SOUTHERN AFRICA (SA) OPERATIONS | | | | | | |

| | | | | | PGM operations2 | | | | | | |

| 1,526,372 | | 1,836,138 | | 895,459 | | 894,165 | | 941,973 | | oz | 4E PGM production2,5 | kg | 29,299 | | 27,812 | | 27,852 | | 57,110 | | 47,475 | |

| 2,227 | | 3,182 | | 2,396 | | 3,686 | | 2,696 | | US$/4Eoz | Average basket price | R/4Eoz | 40,517 | | 53,629 | | 38,954 | | 47,066 | | 36,651 | |

| 1,765 | | 3,490 | | 1,221 | | 2,154 | | 1,336 | | US$m | Adjusted EBITDA3 | Rm | 20,270 | | 31,338 | | 20,025 | | 51,608 | | 29,074 | |

| 53 | | 61 | | 60 | | 66 | | 54 | | % | Adjusted EBITDA margin3 | % | 54 | | 66 | | 60 | | 61 | | 53 | |

| 1,081 | | 1,148 | | 1,053 | | 1,163 | | 1,134 | | US$/4Eoz | All-in sustaining cost4 | R/4Eoz | 17,037 | | 16,921 | | 17,123 | | 16,982 | | 17,792 | |

| | | | | | Gold operations | | | | | | |

| 982,559 | | 1,072,934 | | 578,939 | | 518,848 | | 554,086 | | oz | Gold produced | kg | 17,234 | | 16,138 | | 18,007 | | 33,372 | | 30,561 | |

| 1,747 | | 1,787 | | 1,850 | | 1,792 | | 1,780 | | US$/oz | Average gold price | R/kg | 860,303 | | 838,088 | | 967,229 | | 849,703 | | 924,764 | |

| 471 | | 346 | | 371 | | 162 | | 184 | | US$m | Adjusted EBITDA3 | Rm | 2,762 | | 2,351 | | 6,087 | | 5,113 | | 7,771 | |

| 28 | | 18 | | 36 | | 18 | | 18 | | % | Adjusted EBITDA margin3 | % | 18 | | 18 | | 36 | | 18 | | 28 | |

| 1,406 | | 1,689 | | 1,347 | | 1,691 | | 1,685 | | US$/oz | All-in sustaining cost4 | R/kg | 814,347 | | 791,171 | | 704,355 | | 803,260 | | 743,967 | |

| | | | | | GROUP | | | | | | |

| 1,782 | 2,234 | 1,220 | 1,707 | 527 | US$m | Basic earnings | Rm | 8,218 | 24,836 | 19,927 | 33,054 | 29,312 |

| 1,771 | 2,493 | 1,209 | 1,707 | 787 | US$m | Headline earnings | Rm | 12,045 | 24,833 | 19,785 | 36,878 | 29,146 |

| 2,998 | 4,639 | 2,008 | 2,787 | 1,852 | US$m | Adjusted EBITDA3 | Rm | 28,057 | 40,549 | 32,871 | 68,606 | 49,385 |

| 16.46 | | 14.79 | 16.26 | | 14.55 | | 15.03 | R/US$ | Average exchange rate using daily closing rate | | | | | | |

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 1

Previously, the level of rounding applied in the Group’s condensed consolidated provisional financial statements included a decimal for the nearest hundred thousand. During the year ended 31 December 2021, the Group changed the level of rounding to only reflect the nearest million by removing the hundred thousand decimal space. Immaterial rounding adjustments were made to comparative information as a result of this change.

1The US PGM operations’ underground production is converted to metric tonnes and kilograms, and performance is translated to SA rand (rand). In addition to the US PGM operations’ underground production, the operation treats recycling material which is excluded from the 2E PGM production, average basket price and All-in sustaining cost statistics shown. PGM recycling represents palladium, platinum, and rhodium ounces on spent autocatalysts fed to the furnace

2The Platinum Group Metals (PGM) production in the SA operations is principally platinum, palladium, rhodium and gold, referred to as 4E (3PGM+Au), and in the US operations is principally platinum and palladium, referred to as 2E (2PGM) and US PGM recycling is principally platinum, palladium and rhodium referred to as 3E (3PGM)

3The Group reports adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) based on the formula included in the facility agreements for compliance with the debt covenant formula. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of performance under IFRS and should be considered in addition to and not as a substitute for other measures of financial performance and liquidity. For a reconciliation of profit/loss before royalties and tax to adjusted EBITDA, see note 11.1 of the condensed consolidated provisional financial statements. Adjusted EBITDA margin is calculated by dividing adjusted EBITDA by revenue

4See “Salient features and cost benchmarks” sections for the definition of All-in sustaining cost (AISC) and the “Reconciliation of AISC and AIC excluding third party PoC for Total US and SA PGM, Total SA PGM and Marikana” sections

5The SA PGM production excludes the production associated with the purchase of concentrate (PoC) from third parties. For a reconciliation of the production including third party PoC, refer to the "Reconciliation of operating cost excluding third party PoC for Total US and SA PGM, Total SA PGM and Marikana" sections

| | | | | | | | | | | |

| Stock data for the six months ended 31 December 2021 | | JSE Limited - (SSW) | |

| Number of shares in issue | | Price range per ordinary share (High/Low) | R45.58 to R64.52 |

| - at 31 December 2021 | 2,808,406,269 | Average daily volume | 13,508,180 |

| - weighted average | 2,853,494,503 | NYSE - (SBSW); one ADR represents four ordinary shares | |

| Free Float | 99 | % | Price range per ADR (High/Low) | US$11.51 to US$17.59 |

| Bloomberg/Reuters | SSWSJ/SSWJ.J | Average daily volume | 2,890,341 |

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 2

STATEMENT BY NEAL FRONEMAN, CHIEF EXECUTIVE OFFICER OF SIBANYE-STILLWATER

The Group delivered another record financial performance for 2021, with revenue of R172.2 billion (US$11.6 billion) and adjusted EBITDA of R68.6 billion (US$4.6 billion), respectively 35% and 39% higher than for 2020. Record profit attributable to shareholders of Sibanye-Stillwater of R33.1 billion (US$2.2 billion) and adjusted free cash flow (AFCF) of R37.4 billion million (US$2.5 billion), underpinned increased returns to shareholders and successful delivery of all other elements of the Group's capital allocation framework exceeding expectations that were set at the beginning of the year. Our green metals strategy also advanced significantly during the year, with strategic positions secured in key jurisdictions close to rapidly growing battery production markets in Europe and North America.

Annual production guidance was achieved by all the operating segments for 2021, providing a solid base for improved Group profitability on the back of robust commodity prices. The operating performance from the SA PGM operations for 2021 was particularly strong, with production of 1,836,138 4Eoz above the upper end of the guided range for 2021 and all-in sustaining cost (AISC) well below the lower end of annual guidance and lower year-on-year. Gold production of 27,747kg (892,087oz) from the SA gold operations (excluding DRDGOLD) for 2021 was within annual guidance with production of 14,348kg (461,299oz) for H2 2021, 7% higher than for H1 2021, despite approximately 600kg (19,300oz) less production as a result of the safety stoppages towards the end of the year. 2E PGM production of 570,400 2Eoz from the US PGM operations for 2021 was within the lower end of revised annual guidance, with ongoing regulatory and self imposed restrictions after the fatal accident at the Stillwater West mine during June 2021 impacting throughout H2 2021. The US recycling business had another strong year, achieving planned throughput and generating strong cash flow through active supplier management and the drawdown of spent catalyst inventory towards the end of the year.

Normalised earnings for 2021 increased by 27% to R38.9 billion (US$2.6 billion) year-on-year , driven by the strong performance during H1 2021, with normalised earnings of R14.5 billion (US$963 million) for H2 2021, 34% lower than for H2 2020, primarily due to a sharp decline in precious metals prices during the period.

The Board approved a final dividend for H2 2021 of R5.3 billion (US$342 million) or 187 SA cents per share (48.68 US cents* per ADR), which is at the upper end of the Group dividend policy range of 25% to 35% of normalised earnings. Together with the record interim dividend of R8.5 billion (US$565 million) (292 SA cents per share/77.2 US cents per ADR) for H1 2021, this represents a leading annual dividend yield of 9.8% for 2021 (at the closing JSE share price of R49.10/share on 31 December 2021). In addition to the record dividends, the Group repurchased 5% of its issued capital between June and October 2021, signifying a substantial return of value for shareholders.

The Group ended the year in a robust financial position, with cash and cash equivalents of R30.3 billion (US$1.9 billion) exceeding borrowings (excluding non-recourse Burnstone debt) of R18.8 billion (US$1.2 billion), resulting in a R11.5 billion (US$719 million) net cash position with the net cash: Adjusted EBITDA ratio at 0.17x.

SAFE PRODUCTION

Following the implementation of additional, targeted safety initiatives, including our "Rules of Life" campaign towards the end of H1 2021, there has been a consistent improvement in all safety injury indicators which has continued during Q1 2022. These positive safety trends included a 27% improvement in the Serious Injury Frequency Rate (SIFR), a 33% improvement in the Lost Day Injury Frequency Rate (LDIFR) and a 31% improvement in the Total Recordable Injury Frequency Rate (TRIFR) from H1 2021 to H2 2021. These improved lagging safety indicators represent the best that the Group has achieved since 2013 and provide a strong indication of a likely reduction in high potential incident risks, in line with our overall focus on adherence to safety standards.

Tragically, and in direct contrast to these improving safety trends, fatal incidents persisted during H2 2021. Tragically, 12 colleagues were lost during the period. In total, the Group experienced 20 fatalities during 2021, which was inconsistent with previous Group performance, and a significant deterioration from the nine fatalities which occurred during 2020 and six fatalities during 2019. A similar regression in fatal incidents was evident throughout the South African mining industry in 2021, with 74 fatalities experienced in total compared with 60 lives lost during 2020. The reasons for this industry wide regression are unclear, but the extended burden of COVID-19 has been a mentally, emotionally and physically depleting factor.

The safety and health of our workforce of more than 80,000 people is our foremost priority and during Q4 2021, decisive action was taken to address the ongoing occurrence of fatal safety incidents. The interventions initiated by management included safety stoppages across the Group for a five-day period to enable full and comprehensive audits of all the operating areas and to re-emphasise the primary focus on safety for all employees. Subsequent to this Group wide intervention however, a series of fatal incidents occurred towards the end of November at the SA operations, and a decision was made to suspend specific high incident shafts which collectively accounted for 12 of the Group fatalities for 2021. On 3 December 2021, operations at the Kloof 1 and Beatrix 1 and 3 shafts at the SA Gold operations and the Rustenburg Khuseleka shaft at the SA PGM operations were suspended to address the regression in safety. In addition, the Omicron variant of the COVID-19 virus resulted in an increase in infections towards year end which impacted the availability of supervisor and senior management at the Rustenburg Thembelani shaft. In the interests of the safety of employees, production at this shaft was also suspended. Our primary objective is to continuously reduce operational risk and the company will not hesitate to halt operations should elevated risk require appropriate remedial action.

The disconnect between the increase in fatal incidents and ongoing improvements in underlying injury statistics has required an increased emphasis on eliminating fatalities while continuing to institutionalise the "Rules of Life" and other successful initiatives implemented earlier in the year. A recent independent review of our safety strategy and protocols, confirmed the suitability of our strategy and its alignment with global best practice, including the ICMM principles to which we subscribe. This study was supported by the noteworthy achievement of ISO 45001 and 14001 accreditation or recommendations for accreditation across all Group operations, confirming alignment with global best practice.

We are committed to achieving our goal of zero harm and the milestones achieved in 2019 to 2020 at our SA gold operations, which operated without any fatalities for close to two years, suggests that this goal is achievable. Some notable safety milestones have been achieved, including the Marikana operations recording 4 million fatality free shifts and the Kloof lower section (deepest operation) was injury free for six weeks, with the SA PGM concentrating and processing section achieving 13 million fatality free shifts.

Creating a pandemic resilient operating environment

Our efforts to reduce the risk of the COVID-19 pandemic in the workplace have met with significant success over the course of the last two years. During 2021, our operations in South Africa successfully managed to navigate another three waves of the COVID-19 pandemic with relatively minor disruptions.

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 3

Pleasingly, our vaccination roll-out has been industry-leading with over 53,000 employees and 12,000 contractors at our SA operations, fully vaccinated as of 27 February 2022. This equates to 83% of total SA employees (excluding contractors) being fully vaccinated, with 88% having received at least one dose of the vaccine. We continue to drive the vaccine roll out through high visibility communication campaigns and have extended it to dependents of our employees. There has however, been a noticeable slow-down in vaccination rates and due consideration has been given to the next steps that will be required to ensure healthy and safe working environments at our operations and to ensure that we create a culture and environment that is less susceptible to the risk associated with possible future pandemics.

In this regard, we have been engaging with the unions at our South African operations in preparation for the roll out of our COVID-19 certification checks policy, which will, from 1 April 2022, require people entering Sibanye-Stillwater workplaces to either furnish a valid vaccination certificate or a current negative COVID-19 test, to be granted access.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

The Group made steady progress towards “embedding ESG excellence as our way of doing business” during 2021. Active steps have been taken to establish private renewable power production facilities at our operations with notable progress achieved in securing water independence at our SA gold and PGM operations.

Defining our path to carbon neutral by 2040

Primarily due to the exposure of our SA gold and PGM operations to unreliable supply, rising tariffs and carbon-intensive electricity generation from Eskom, our primary focus is on reducing the relatively high energy consumption and carbon footprint of. The SA operations account for 92% of total Group energy demand and contribute 89% and 97% of our Group scope 1 and 2 emissions respectively.

Focussed interventions during 2021 at the SA operations achieved a 201GWh reduction in energy consumption against the production adjusted energy plan. This reduction is equivalent to avoidance of 212,954 tCO2e in scope 2 emissions. In total, the Group achieved a commendable reduction in total energy intensity to 0.56 GJ/ tonne milled for 2021, which represented a 7.1% decline compared with 2020 and a 2.4% decline compared with the average total Group energy intensity for the last three years.

Grid-supplied electricity from Eskom accounted for approximately 93% of Group greenhouse gas emissions (scope 1 and 2) for 2021. As a result, the deployment of renewable energy remains our strongest decarbonisation lever. Easing regulatory constraints, including the "power for own use" generation license threshold being lifted to 100MW and positive indications on wheeling and the ability to trade surplus power with third parties, along with the approval of the K4 project which has significantly extended the life of the Marikana operation, has facilitated an increase in the scope of our planned renewable energy projects in South Africa to a total generation capacity of 557MW. This includes:

•50MW of solar generation at the SA gold operations: a local project developer has been appointed on the basis of a 20-year Power Purchase Agreement (PPA), with construction scheduled to begin during H2 2022 and commercial production planned for H2 2023

•175MW of solar generation at the SA PGM operations: An RFP process to appoint project developers for three separate sites will be held in H2 2022, with commercial operation planned for early 2025

•332MW of remote wind energy generation: three ‘shovel-ready’ projects have been secured through local project developers on a 15-year PPA basis. Financial close of these projects is targeted for H2 2022 with commercial operation anticipated during H2 2024

The total capital cost of the renewable projects is forecast at approximately R11 billion which will be fully funded through off-balance sheet PPA financing over a 15 to 20-year terms. The cost of power from the solar projects is expected to be 30% to 50% lower than forecast Eskom tariffs (escalating at CPI) from commercial production, with wind power expected to be 20% to 30% lower and allow partial reduction of operational risk associated with exposure to erratic supply and escalating energy costs in South Africa. Once fully operational, these projects will enable a 25% reduction in Scope 2 emissions by 2025 and exceed our target of 20% of total energy production from renewable energy by 2030.

The planned renewable projects will also create employment within our host communities during construction and operation and we are advancing plans to foster local socio-economic development through our ‘Infrastructure for Impact’ programme, which includes the provision of excess electricity supply to communities and social-development projects post the closure of the operations.

Effective management of our water resources

The responsible use and management of water resources at our operations is a critical component of our overall ESG strategy. We are committed to the efficient and effective utilisation and management of water resources in the regions we operate, to ensure sufficient availability for doorstep communities and to minimise the environmental impact of our operating activities.

The implementation of modern monitoring technology at our South African operations has resulted in an 8% reduction in potable water purchases for 2021. This included a 1,278 Ml (2021: 6,289 Ml; 2020: 7,567Ml; 2019: 8,735Ml) or 17% reduction in potable water purchases from our SA gold operations for 2021, with our SA PGM operations purchasing 344Ml (2.8%) less, despite the SA Gold and SA PGM operations respectively processing 4% and 15% more ore tonnes during the year.

Our SA gold operations on the West Rand are overlain by a substantial regional dolomitic aquifer, requiring continual pumping of significant volumes of fissure water from the operations. Better utilisation of this abundance of ground/fissure water presents an opportunity to significantly reduce the usage of potable water by our SA gold operation, with consequent cost benefits. Progress in this regard during 2021 included:

•The Cooke operations have largely achieved water independence through the commissioning of borehole supply to the plant and Cooke 2 and 3 shafts during 2021

•The upgrade of the Driefontein water treatment plant from 20Ml per day to 25Ml per day is in progress and will ensure complete independence from municipal supply by Q3 2022, delivering an annual cost benefit of R4 million per annum

•The commissioning of phase 1 of the Kloof water treatment plant (2.7Ml) during H2 2021 reduced requirements for Rand Water supply at the Kloof operations by approximately 33%, resulting in approximately R13 million of annual cost benefits. Full independence from Rand Water supply is expected by Q1 2023 on completion of the next 7Ml phase, with annualised savings expected to increase to R45 million

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 4

Pleasingly, our water management efforts resulted in the Group being awarded an A- rating for “Water Security” by CDP, a non-profit global environmental disclosure platform. It was the first time that the Group participated in the Water Security category and achieving a higher rating than the Global and Africa regional average of ‘B’, and the metallic mineral mining sector average of ‘B-‘ was a positive outcome.

OPERATING REVIEW

The SA PGM operations continued to deliver solid operating results, with 4E PGM production increasing by 20% year-on-year to 1,896,670 4Eoz (including 60,532 4Eoz of third-party concentrate treated at the Marikana smelting and refining operations). This was despite significant operational headwinds, including safety stoppages, employee unavailability due to the COVID-19 virus and ongoing power disruptions in South Africa.

Contrary to prevailing trends across the global mining industry, ongoing cost management and higher by-product revenues offset significant inflationary cost pressures and higher royalties, resulting in AISC for 2021 declining by 5% to R16,982/4Eoz (US$1,148/4Eoz) compared with 2020. This consistent cost management continues to enhance the relative competitiveness of the SA PGM operations, which have moved significantly towards the lower half of the global industry cost curves over the last five years, from the upper end of the curves prior to integration into the Group. This is the outcome of the ongoing realisation of synergies as envisaged, prior to consolidation of these assets. The SA PGM operations generated adjusted EBITDA of R51.6 billion (US$3.5 billion) for 2021 which was 78% higher than for the previous year and four-fold higher than the total acquisition cost of these assets, a substantial return on investment.

On 31 January 2022 the Group announced that agreements had been reached with Anglo American Platinum Limited (Anglo Plat) which:

•allow for the immediate and more efficient exploitation, from the Kroondal operation, of parts of the Rustenburg operation’s orebody across the boundary. This ore would otherwise only have been mined from the existing Rustenburg operation infrastructure much later in the future

•enable the full consolidation of the Kroondal operation under the Rustenburg operation, once certain conditions precedent have been met, (see https://thevault.exchange/?get_group_doc=245/1643606711-ssw-assume-full-ownership-kroondal-doubling-its-life-mine-31jan2022.pdf for more detail)

This has enabled the early conversion of approximately 1.32 million 4Eoz (attributable to Sibanye-Stillwater: 1.79Moz at 100%) of Rustenburg operation’s Mineral Resources into additional Mineral Reserves and, by allowing the lower cost and more efficient extraction of the project area orebody from the mechanised Kroondal infrastructure, will more than double the life of the Kroondal operation, thereby deferring the imminent closure of some of the Kroondal shafts. These mutually beneficial and rational agreements should sustain much needed employment and community development in the region and ensure significant value creation for all stakeholders.

Mined PGM production from the US PGM operations in 2021 of 570,400 2Eoz was towards the lower end of revised annual guidance, primarily due to the ongoing impact of the rail collision safety incident in June 2021, with production of 272,099 2Eoz for H2 2021, 9% lower than for H1 2021 as a result. The implementation of rail safety enhancements following the safety incident in June 2021, has necessitated shutting down mining blocks at the Stillwater West mine, which remains constrained by Mine Safety and Health Administration (MSHA) stop orders and new operating procedures. Additionally, production from the East Boulder mine was impacted by electrical outages in December 2021 because of severe weather conditions. AISC for the US PGM operations increased by 15% to US$1,004/2Eoz (R14,851/2Eoz), primarily due to the shortfall in production and above inflation cost increases on consumables due to global logistical constraints. Increasing skills shortages in North America and high employee attrition rates have also resulted in an increased reliance on contract employment at significantly higher costs. Adjusted EBITDA for the US PGM underground operations of US$727 million (R10.8 billion) was 2% lower year-on-year as a result.

3E PGM recycled production for 2021 declined by 10% to 755,148 3Eoz due to a reduction in concentrate feed from underground affecting blending, a slowdown in used car scrapping rates globally and continued supply chain logistic constraints affecting autocatalyst deliveries towards year end. The recycling operations fed an average of 23.8 tonnes per day of spent autocatalyst for 2021, 10% lower than for 2020 with the rate declining over the year from 24.7 tonnes per day for H1 2021 to 22.8 tonnes per day for H2 2021. This was however offset by a drawdown on recycling inventory from 432 tonnes at H1 2021 to 25 tonnes at year end, enabling a release of working capital and a 16% increase in recycling 3Eoz sold to 782,552 3Eoz. Recycling inventory is expected to normalise at around 200 tonnes once autocatalyst delivery backlogs dissipate. Adjusted EBITDA of US$101 million (R1.5 billion) increased by 87% compared with 2020. This was primarily due to the higher PGM basket prices, with interest on recycle supplier advances adding a further US$21 million (R315 million), partly offsetting the impact of the operational shortfall.

Gold production from the SA gold operations (excluding DRDGOLD) for 2021 of 27,747kg (892,087oz), was above the lower end of annual guidance, despite H2 2021 being impacted by safety stoppages. These included the self-imposed Group safety intervention and suspension of operations at Beatrix 1 and 3 shafts and Kloof 1 shaft, which resulted in approximately 600kg (19,300oz) less production during Q4 2021. AISC for the SA gold operations (excluding DRDGOLD) increased by 7% year-on-year to R831,454/kg (US$1,749) as a result of the shortfall in planned production and above inflation cost increases on electricity and some consumables. ORD expenditure and sustaining capital increased by 46% and 45% respectively due to increased spend to restore operational flexibility following constraints during 2020 due to COVID-19.

Wage negotiations

Wage negotiations with organised labour at our SA gold operations and East Boulder mine in the US commenced during H2 2021 and continued into Q1 2022.

Pleasingly, we were able to ratify a new collective bargaining agreement with the United Steel Workers International Union (USW) for the East Boulder mine on 23 February 2022. The contract, which is effective from 16 February 2022 through to 31 July 2024, covers a broad range of terms including average annual wage increases of 2.5% in 2022, 3% in 2023 and 3% in 2024. In addition to the base increase in 2022, an increase to benefits and incentive has been agreed, which will result in an effective average increase of 5.4% for 2022 if all safety and quality deliverables are met. This settlement amounts to an annual average increase of 3.8% per year for the next 3 years, which compares favourably with US inflation rates and is consistent with our approach to enter into agreements which are linked to inflation.

Despite extended negotiations, we have been unable to reach agreement with organised labour representatives at our SA gold operations. We continued to engage constructively with the unions during Q1 2022 in an effort to settle on increases that are fair, in line with inflation and take the long-term sustainability of our operations into consideration for the benefit of all stakeholders.

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 5

FINANCIAL OVERVIEW

Group revenue for 2021 increased by 35% year-on-year to a record R172.2 billion (US$11.6 billion), primarily due to a 20% increase in 4E PGM production from the SA PGM operations and a significantly higher average rhodium price for 2021 (80% increase compared with 2020), which drove higher average PGM basket prices for the SA PGM operations and US recycling operation. Revenue for H2 2021 of R82.2 billion (US$5.5 billion) was 8% lower than record revenues of R90.0 billion (US$6.2 billion) for H1 2021 due to lower PGM production from the US PGM and recycling operations and the sharp pullback in PGM prices during H2 2021 as the chip shortage impacted negatively on automotive manufacturing volumes.

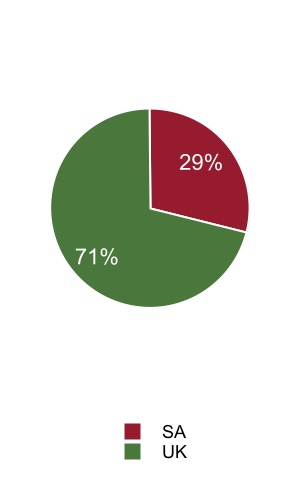

Record Group adjusted EBITDA of R68.6 billion (US$4.6 billion) for 2021 was 39% higher than for 2020, primarily driven by the SA PGM operations, which comprised 75% of total Group adjusted EBITDA with the US PGM and SA gold operations comprising 18% and 7% of the Group total respectively.

Profit attributable to owners of Sibanye-Stillwater (attributable profit), increased by 13% from R29.3 billion (US$1.8 billion) for 2020 to R33.1 billion (US$2.2 billion) for 2021. Attributable profit for 2021 was impacted by substantial differences in income statement line items year-on-year, including:

•R656 million (US$22 million) or 21% lower finance expenses, primarily due to the further redemption of high-cost debt, which was restructured on more favourable terms during Q3 2021

•A R3.8 billion (US$276 million) increase in the “fair value loss on financial instruments" to R6.3 billion (US$425 million), primarily due to a revaluation of the Rustenburg liability (outstanding deferred payments to Anglo Platinum in terms of the purchase agreement, which will terminate in November 2022) due to a significant increase in forecast cash flow from the Rustenburg operation

•A R5.1 billion (US$348 million) impairment of the carrying value of property, plant and equipment to its deemed recoverable amount at the SA gold operations due to assumed above inflation increases in electricity and labour costs and an assumed long-term gold price forecast (based on sell side analyst consensus) of approximately R725,000/kg (US$1,500/oz) in real terms, which negatively affected the forecast cash flows from these operations

•A R9.9 billion (US$712 million) or 149% increase in royalties and mining and income taxes, primarily due to a significant increase in profitability at the SA PGM operations, along with the absence of unrecognised deferred tax assets from the Marikana operation, which were utilised during 2020, and the derecognition of deferred tax assets for the SA gold operations due to the impairment of the value of these operations

More detail on the above items are available in the Financial Review section.

Basic earnings per share (EPS) of 1,140 SA cents (77 US cents/308 US cents/ADR) and headline earnings per share (HEPS) of 1,272 SA cents (86 US cents/344 US cents/ADR), increased by 6% and 19% year-on-year respectively, but impacted by the items above which offset the benefits of the 5% buyback of issued shares which was concluded during Q3 2021.

Normalised earnings1, which are the basis for the declaration of dividends as per the Group dividend policy (see note 9 of the condensed consolidated provisional financial statements), and excludes many of these once off items, was significantly higher than profit attributable to shareholders, increasing by R8.3 billion (US$560 million) to R38.9 billion (US$2.6 billion) for 2021.

The Board approved a final dividend at the upper end of the 25% to 35% dividend pay-out range as per the Group dividend policy for 2021 of R5.3 billion (US$342 million) (187 SA cents per share/48.68 US cents per ADR), resulting in a substantial R13,796 million (US$907 million) (479 SA cents per share/125.89 US cents per ADR) total dividend for 2021. This is equivalent to a 9.8%2 dividend yield at the closing share price of R49.10 at 31 December 2021. The approximately R8.5 billion ($575 million) share buyback program for 5% of shares in issue at an average purchase cost of R57.57/share (compared with the closing price on 1 March 2022 of R74.13/share), further enhanced shareholder returns for the year. Total value accruing to shareholders for 2021 amounted to a substantial R22.3 billion (US$1.5 billion), consistent with Sibanye-Stillwater's commitment to create superior value for all stakeholders.

Group adjusted free cash flow3 increased substantially year-on-year, with AFCF for 2021 almost doubling to a record of R37.4 billion (US$2.5 billion) compared with R19.9 billion (US$1.2 billion) for 2020.

AFCF from the US PGM operations increased from R2.8 billion (US$169 million) for 2020 to R8.1 billion (US$551 million) for 2021, a 193% increase. This was primarily due to the release of R6.4 billion (US$425 million) from working capital due to the reduction in spent autocatalyst inventory at the US recycling operation, which had accumulated during 2020 and H1 2021.

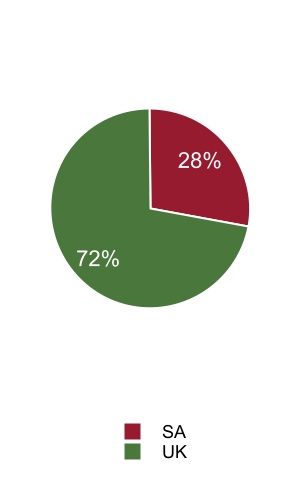

AFCF from the SA PGM operations more than doubled year-on-year to R26.9 billion (US$1.8 billion) (before intercompany working capital account adjustments) for 2021, accounting for 72% of Group AFCF for the period. Adjusting for an intercompany working capital account outflow of R4.3 billion (US$288 million) to the SA gold operations, net AFCF for 2021 was R22.6 billion (US$1.5 billion) compared with R11.7 billion (US$714 million) for 2020. Notably, the AFCF generated by the SA PGM operations and is notably higher than the nominal purchase consideration for the SA PGM operations between 2016 and 2021.

As a result of production disruptions and a decline in the rand gold price, AFCF from the SA gold operations was negative for H1 2021, although the intercompany contribution of R4.3 billion (US$288 million) for H2 2021 from the SA PGM operations referred to above and net dividends received from Sibanye Gold subsidiary companies of R6.8 billion (US$454 million) resulted in positive reported AFCF for the year of R7.8 billion (US$526 million).

The Group ended 2021 in a robust financial position, with the balance sheet reflecting a net cash position of R11.5 billion (US$719 million), despite significant disbursements to shareholders and investment in the sustainability of the business. The improved financial position and favourable interest rates enabled the replacement of higher cost debt with the Group replacing its 2022 and 2025 notes raised at the time of the Stillwater acquisition, with new 2026 and 2029 notes, raising US$1.2 billion on significantly better terms.

Cash and cash equivalents increased to R30.3 billion (US$1.9 billion), well above the R20.0 billion reserve position defined in the capital allocation, which together with borrowings at the end of 2021 of R20.3 billion (US$1.3 billion), resulted in the Group ending 2021 in a net cash position. On a trailing 12-month basis, adjusted EBITDA increased by 39% to R68.6 billion (US$4.6 billion) resulting in a net cash: adjusted EBITDA ratio of 0.17x compared to net cash: adjusted EBITDA of 0.06x at the end of 2020.

In line with the Group commitment to embedding ESG excellence and being a Force for Good, the capital allocation framework has been extended to include ESG capital investments as a third constituent of the "stakeholder shared value" component of the

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 6

framework. We firmly believe that in addition to returning cash to shareholders in the form of superior dividends, appropriate ESG capital investment is likely to deliver additional sustainable shareholder value. More detail on the projects we have identified and will be focusing our capital allocation to, will be provided in due course.

Reference notes

1.Normalised earnings is defined as earnings attributable to the owners of Sibanye-Stillwater excluding gains and losses on financial instruments and foreign exchange differences, impairments, gain/loss on disposal of property, plant and equipment, occupational healthcare expense, restructuring costs, transactions costs, share-based payment on BEE transaction, gain on acquisition, net other business development costs, share of results of equity-accounted investees, all after tax and the impact of non-controlling interest, and changes in estimated deferred tax rate. This measure constitutes proforma financial information in terms of the JSE listings requirements and is the responsibility of the Board. For a reconciliation of profit attributable to shareholders to normalised earnings, see note 9 of the condensed consolidated provisional financial statements

2.Based on a closing exchange rate of R15.3650/US$ at 28 February 2022 from IRESS. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion

3.Group adjusted free cash flow includes adjustments to segmental free cash flow for Group treasury and shared services activities, which eliminate on consolidation but are included in the segment totals

STRATEGY REVIEW

Strategic M&A

Significant progress was made advancing our green metals strategy during 2021, with a series of transactions announced during H2 2021 following the acquisition of an initial 26.6% holding in the Keliber lithium project during H1 2021. These transactions represent the outcome of two years of careful market analysis and engagement in our strategic path towards building a climate change resilient business, enabling further international diversification in high quality and strategic assets that is set to deliver substantial future value and earnings diversification.

In summary the transactions comprise:

•During 2021, the Group acquired a 26.6% stake in the Keliber Lithium project for EUR25 million. A further EUR5 million payment in March 2022 will secure a 30% interest in the project, with the option to increase this interest to over 50% following the conclusion of a definitive feasibility study which will dictate the funding requirements. Keliber is planned as the 1st fully integrated lithium producer in Europe with direct access to key European battery markets from the Port of Kokkola in Finland

•The acquisition of 100% of Eramet’s Sandouville nickel processing facilities in Le Havre, France was concluded on 4 February 2022 for an effective cash consideration of EUR85 million (adjusting for closing net debt and working capital). Following the investment in the Keliber lithium project in Finland, this acquisition consolidates Sibanye-Stillwater's presence in Europe, securing another strategic footprint in a favourable jurisdiction with strategic access to rapidly developing battery metal end user markets in Europe. Integration of the existing facility into the Group is underway with internal studies on optimisation of the facility and options for development of an adjacent property into a possible battery metals and recycling facility in progress

•On 16 September 2021 the Group announced a proposed 50:50 joint venture (JV) with ioneer with respect to the Rhyolite Ridge Lithium-Boron project in Nevada, USA. During Q4 2021, the Group acquired a 7.1% direct equity interest in ioneer for approximately US$70 million. The Group’s option to acquire a 50% interest in the Rhyolite Ridge project JV for a US$490 million contribution for the development of the proposed project, remains subject to various conditions being met, including obtaining all relevant permits required to develop the project. Rhyolite Ridge is a world-class lithium project with the potential to become the largest and lowest cost lithium mine in the US and is strategically positioned close to the rapidly developing battery production facilities in the region. ioneer management continues to work closely with the US Fish and Wildlife Services and Bureau of Land Management on the current propagation studies for the Tiehm's buckwheat as part of the conservation plan being developed for the project. The first seedling and propagation studies undertaken in 2020 were conducted by the University of Nevada – Reno

•In December 2021, the Group acquired a 19.9% stake in New Century, a leading Australian tailings reprocessing business for a cash consideration of A$61 million. The New Century investment is complementary to and enhances Sibanye-Stillwater’s established position as a leading global tailings retreatment business uniquely positioned to play a key role in green metal supply chains together with its investment in DRDGOLD, a leading international gold tailings retreatment business

On 24 January 2022 the Group announced the termination of the proposed acquisitions of the Santa Rita nickel and Serrote copper mines in Brazil from Appian Capital, which had been announced on 26 October 2021. Shortly after the announcement of the proposed transaction, Appian informed the Group that a geotechnical event had occurred at the Santa Rita mine. The Company subsequently assessed the event and concluded that it was likely to have a material and adverse effect on the business, financial condition, results of operations, the properties, assets, liabilities or operations of Santa Rita. As a result, a decision was taken to terminate the proposed transaction.

Key appointments

In December 2021, the Group appointed Mika Seitovirta as Chief Regional Officer: Europe to lead and drive strategic delivery for the Group in the European region, in line with the company’s growth strategy in battery and green metals focused predominantly on the European and North American regions. Mika’s expertise and experience will allow us to build a solid base for participating in the emerging European battery material supply chains that have been established through the recent acquisitions of Keliber in Finland and the Sandouville refinery in France. Mika will initially serve on a part time basis to allow him to honour his existing commitments, transitioning to a full-time Group executive appointment from 1 July 2022.

R&D innovation and market development

The Board has approved a new fund, the “BioniCCube” to foster research and development of new innovation/technologies and market development, by investing in and leveraging strategic partnerships. This will support the company on its path to becoming a climate change resilient business and a leading supplier of green metals and energy solutions. BioniCCube will operate as a closed end fund, fully financed by Sibanye-Stillwater with a capital budget of up to 1.5% per annum of Group adjusted EBITDA for appropriate investments.

Two initial investments have been made by the Group:

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 7

•Glint Pay Ltd. (Glint - glintpay.com): Glint is a fintech company, based in London, Boulder (US) and Tokyo, that uses gold as an alternative global currency to enable its clients instantly to buy, sell, save, spend, and send their physical gold and other currencies, through the Glint Mastercard® and Glint App. Glint offers no credit facilities, it allows users to transfer, receive and save real gold, which is secured in Brink’s vaults in Switzerland. The partnership with Glint enables Sibanye-Stillwater to support new end markets for gold on an innovative, digital and highly regulated platform, backed by physical gold supervised by a world-class regulator in Switzerland

•Verkor S.A. (Verkor): Verkor is a French industrial company that has the support of the Renault Group, Demeter, EIT InnoEnergy Groupe IDEC, Schneider Electric, Capgemini, Arkema and Tokai COBEX. Verkor intends to ramp up low-carbon battery manufacturing facilities in France and southern Europe to meet the growing demand for electric mobility and stationary battery storage in Europe. Verkor’s first Gigafactory will be built at the port city of Dunkirk (Hauts de France), with first delivery of low-carbon high performance batteries for electric vehicles planned for July 2025. Initial manufacturing capacity of 16 GWh in 2025 is expected to expand to 50 GWh by 2030. Sibanye-Stillwater has made a strategic EUR25 million investment in Verkor through a new convertible bond issuance. This strategic investment will pave the way for further technical and commercial cooperation between the Group and Verkor, with the timeline for the Keliber lithium project, the Sandouville extension to target specific nickel battery metal products and Verkor’s first Gigafactory largely in sync

The global shift towards more socially and environmentally aware behaviours and policies continues to gain momentum, with emphasis on climate change. Future investment in and renewable energy and other green industrial activity is likely to support the prices of commodities required for the green energy economy, and those produced in an environmentally friendly manner over an extended period. In particular, this includes the essential metals that Sibanye-Stillwater produces and is targeting as we position ourselves to create sustainable value through further delivery on our green metals strategy.

MARKET OVERVIEW

Green Metals

PGM market update

PGM prices increased significantly during Q1 2021 primarily due to ongoing primary supply constraints, with a shortfall in PGMs supply from South Africa during Q1 2021 due to further technical issues at Anglo Platinum’s Anglo Converter Plant (ACP) during Q4 2020. Despite the ACP coming back online during December 2020, PGM supply remained constrained during Q1 2021 with primary supply of rhodium, ruthenium and iridium particularly affected due to their longer refining lead times. Furthermore, in February 2021, flooding at Norilsk Nickel’s Oktyabrsky and Taimyrsky mines resulted in production being partially suspended and a fatal accident at its concentrator in the same month impacted palladium and platinum supply. Oktyabrsky resumed operations in May 2021, with Taimyrsky only back to full production in December 2021. Overall, primary supply had largely recovered to pre-COVID levels by year end.

The global semi-conductor chip shortage which began to emerge in 2020 worsened during H1 2021 and was at its most severe just as primary PGM supply began to normalise globally. The global supply of semi-conductor chips was impacted by severe winter storms in the US, ongoing COVID-19 disruptions in South East Asia and a fire at a chip fabrication facility in Japan. The chip shortages, combined with more general supply chain constraints which impacted OEMs across the world, resulting in temporary stoppages at many automobile production facilities. Light duty vehicle (LDV) production of approximately 74.5 million units is forecast for 2021, well below 2019 levels of 86.5 million and only 3% higher than 2020 levels of 72.2 million. Sales of LDVs were up by 4% to 25.5 million units in China, with sharply higher battery electric vehicle (BEV) sales driving the growth. Sales in the US were up by only 2.8% as the market was affected by low inventories and high vehicle prices (average new car price of $45,283 in December 2021). Sales in Western Europe were flat in 2021 as the semi-conductor shortages negatively impacted the market, especially in the second half of the year. BEV sales grew from 3% in 2020 to 5% of total LDV sales in 2021, primarily at the expense of gasoline LDV sales, further impacting palladium and rhodium demand.

Secondary supply was also constrained due to global logistical challenges during 2021. Port congestions, a shortage of trucks and truck drivers in the US remain key bottlenecks which are likely to continue during 2022. These factors may yield potential downside risk for global secondary PGM supply in 2022, with the palladium and rhodium markets most vulnerable. Supply chain and logistic challenges eased up somewhat during Q4 2021 at our US recycling operation, although receipt rates from collectors still remained below budgeted levels.

LDV production is expected to recover to 82.7 million units in 2022 which, along with the implementation of tighter emissions regulation over the rest of the decade in both the light and heavy duty vehicle sectors, should drive increased demand for PGMs. This is despite forecasts of further acceleration in BEV sales to 7% of the global LDV market for 2022 (vs 5% for 2021). Refined PGM production has returned to normal levels from the COVID-19 disruptions in 2020 and the operational disruptions at Anglo Platinum and Norilsk Nickel which impacted supply during 2021. The conflict in Ukraine and sanctions being imposed on Russia could impact on supply of palladium and platinum from Russia, which accounts for 37% and 9% of global production respectively, supporting higher PGM prices. Secondary supply is also expected to recover as supply chain challenges abate. Overall, platinum is forecast to remain in an industrial (excluding investment) surplus of approximately 1moz while palladium moves further into deficit of approximately 145koz and rhodium moves into a small surplus.

Battery Metals

BEV sales for 2021 beat market consensus forecasts, with BEV LDV sales increasing to an estimated 4.4 million units for the year, equivalent to 8% of total LDV sales from 2.0 million units or 4% for 2020. Market expectations regarding future BEV penetration have increased substantially over the last 12 months, with current forecasts for BEV’s share of total global auto production by 2030 ranging from 25% to 30%, significantly higher than pre-COVID levels, driven by increased global legislation and ICE bans driving adoption of BEVs by auto manufacturers. Increasingly however, concerns are building about the ability of supply to match projected demand for critical battery metals such as lithium, nickel and cobalt. And with the prices of many of the key metals increasing sharply during 2021, there are increasing concerns that elevated commodity prices could retard the further introduction of new competitive technologies and cap the rate of BEV market penetration. This is particularly relevant in the context of limited capital investment in new battery metal projects in recent years, which together with the long lead times required to ramp up the supply of relevant metals and the increasing difficulty of permitting new projects are becoming critical constraints, leading to significant deficits in most of these metals from 2025, with prices likely to increase further as a result and remain at elevated levels for an extended period.

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 8

For the first year in many, it is projected that the price per kWh of lithium-ion batteries will not decline year on year as a result of elevated lithium ore pricing despite ongoing technical improvement. In parallel, there is increasing uncertainty on the evolution of battery chemistries which could substantially affect the demand profile for key commodities, and especially nickel and cobalt. Absolute physical shortfalls of key metals may even necessitate the adoption of alternative routes to decarbonisation such as biofuels and synfuels that can prolong the era of the internal combustion engine into a circular low carbon economy with positive implications for the longer-term future of PGMs.

OPERATING GUIDANCE FOR 2022

Operational guidance for the US PGM operations for 2022, has taken into account current operational constraints. Mined 2E PGM production from the US PGM operations is forecast to be between 550,000 2Eoz and 580,000 2Eoz for 2022, with AISC of between US$980/2Eoz to US$1,030/2Eoz. Capital expenditure is forecast to be between US$290 million and US$310 million, including approximately US$70 million project capital.

Restrictions imposed by MSHA and management at the US PGM operations continue to constrain production, and together with the increased reliance on higher cost contract labour due to the skills shortage in Montana and the prevailing high inflation environment, have resulted in costs increasing well above planned and historical levels. This has prompted a need to reassess the optimal future production output from the US PGM operations, taking into account the current constraints, as well as the medium-term outlook for the palladium market. Management is currently undertaking an optimisation planning process to ensure an appropriate ongoing return on capital invested is achieved in the current and medium-term environment. The results of this study are expected by mid 2022.

3E PGM production for the US PGM recycling operations is forecast to be between 750,000 and 800,00 3Eoz fed for 2022. Capital expenditure is forecast at US$3 million.

After an initial slow return to work and start up at the Marikana operation, the SA PGM operations have ramped up well following the December 2021 break with the Khuseleka shaft (post the management-imposed safety suspension) and Thembelani shaft (temporarily suspended due to an increase in COVID-19 infections among supervisor and senior management), both resuming production as planned during January 2022. 4E PGM production from the SA PGM operations for 2022 is forecast to be between 1,750,000 4Eoz and 1,850,000 4Eoz (benefiting from additional production from the Klipfontein open cast operation and from mining into Rustenburg reserves from Kroondal) with AISC between R18,500/4Eoz and R19,200/4Eoz (US$1,233/4Eoz and US$1,280/4Eoz). Capital expenditure is forecast at R4.8 billion (US$317 million) for 2022, including R950 million (US$63 million) on the K4 project.

Processing operations at Beatrix have been temporarily suspended for approximately three months from 28 December 2021 whilst rehabilitation work is undertaken on a limited portion of an active tailings storage facility (TSF). A limited portion of the Beatrix TSF requires precautionary reinforcement and buttressing work. A decision to cease deposition while this work is being completed was taken in December 2021. It is expected that this work will be completed by April 2022 and during this period underground mining activities will continue with stockpiled ore processed over the remainder of 2022, once the TSF remediation has been completed. As a result of this, there will be no gold sales reported from the Beatrix operation during Q1 2021 and hence no financial contribution to the Group. Processing of stockpiled ore over the remainder of the year however, should result in the financial impact normalising resulting in a limited financial impact over the 2022 reporting period.

The suspension of production activity at the Beatrix operation from 3 December 2021 to address the prevalence of serious safety incidents, continued during Q1 2022, with underground operations resuming in February 2022. As a consequence, production from Beatrix is forecast to be approximately 1,400Kg (45,000oz) lower than planned. Gold production from the managed SA gold operations (excluding DRDGOLD) for 2022 is forecast at between 25,000kg (813,000oz) and 27,000kg (873,000oz) with AISC between R875,000/kg and R925,000/kg (US$1,810/oz and US$1,920/oz). Capital expenditure is forecast at R5.2 billion (US$347 million), including R1.5 billion (US$97 million) of project capital expenditure provided for the Burnstone project and R350 million (US$23 million) on the Kloof 4 deepening project).

The dollar costs are based on an average exchange rate of R15.00/US$.

NEAL FRONEMAN

CHIEF EXECUTIVE OFFICER

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 9

SIBANYE-STILLWATER GROUP SAFETY AND OPERATING REVIEW

Safety

The health and safety of our employees is our first priority and we are committed to ensuring a safe work environment at all our operations. Additional Group safety interventions including implementing the “Rules of Life” campaign since June 2021 have positively impacted safety indicators during H2 2021, resulting in a 27% improvement in the Serious Injury Frequency Rate (SIFR) from 4.39 (per million hours worked) for H1 2021 to 3.20 for H2 2021, a 33% improvement in the Lost Day Injury Frequency Rate (LDIFR) from 7.23 in H1 2021 to 4.85 in H2 2021 and a 31% improvement in the Total Recordable Injury Frequency Rate (TRIFR) from 8.43 in H1 2021 to 5.82 in H2 2021. Despite this improved lagging indicator trend however, we experienced an increase in fatal incidents at our operations, with nine employees losing their lives in accidents during Q4 2021, in addition to the three employees who passed away in Q3 2021, taking the total number of fatalities to twenty for the year.

On 13 October 2021 at Kroondal Simunye shaft Mr. Tebogo Motlogelwa, a general worker passed away in a LHD related accident. On 25 October 2021 at Rustenburg Khuseleka Shaft Mr Pitso Maifala, an underground loco driver passed away when he fell down a shaft ore pass during tipping arrangements. On 27 October 2021 at Kroondal Kwezi shaft Mr Philasande Xabanisa, a general worker passed away when he was struck by a fall of ground whilst barring the hanging wall during entry examination. On 22 November 2021 at Marikana E3 shaft, Mr Motseki Langeni, a rock drill operator passed away when he was struck during a fall of ground while attempting to tension a support net. On 30 November 2021 at Beatrix 3 shaft, Mr. Stephen Nyoni, a winch operator passed away when a shot hole exploded while he was charging the hole with explosives. On 3 December 2021 at Beatrix 3 shaft, Mr Frank Swart, an underground fitter, Mr Alfred Ngalo, a secondary rock drill operator and Ms Mabohlokoa Tsoafo, a pump attendant passed away when a LHD ran out of control in a shaft bottom decline and collided with the employees. On 3 December 2021 at Rustenburg Khuseleka shaft, Mr Raimundo Augusto, a team supervisor passed away when he was struck by a fall of ground whilst barring the sidewall during entry examinations.

The Board and management of Sibanye-Stillwater extend their sincere condolences to the family, friends, and colleagues of our departed employees.

We remain committed to continuous improvement in health and safety at our operations. We are enhancing our risk approach to make fatality prevention our main priority.

US PGM operations

Mined 2E PGM production from the US PGM operations of 570,400 2Eoz for 2021 was 5% lower than for 2020, and at the lower end of revised guidance of 570,000 to 580,000 2Eoz, primarily due to the ongoing impact of the fatal incident in June 2021. Operational stop orders imposed by MSHA after the incident and ongoing operational constraints significantly impacted production during H2 2021 and continue to affect production and operational flexibility. In addition, during H2 2021, the operations were further affected by self-imposed Group wide safety stoppages, a high employee attrition rate and a critical skills shortage especially relating to miners, resulting in the reliance on higher cost contract labour, replacement of a bridge between Stillwater East and the concentrator which temporarily affected processing of ore from Stillwater East and electrical outages at the East Boulder mine during December 2021 as a result of severe weather conditions.

AISC for 2021 increased by 15% to US$1,004/2Eoz (R14,851/2Eoz) primarily due to the shortfall in production, increased labour costs, a 22% increase in ore reserve development costs to US$92 million (R1.4 billion) and sustaining capital (mining equipment and environmental) which increased by 11% to US$53 million (R791 million). In line with many other industries in the USA and globally, the US PGM Operations have experienced underlying inflationary pressures due to persistent supply chain issues, input price inflation and higher labour costs due to staffing shortages, which has resulted in an increased reliance on higher cost contractors. In addition, royalties, taxes and insurance increased by approximately US$6 million (R89 million) equivalent to US$16/2Eoz (R237/2Eoz) of the AISC increase, due to an increase in revenue due to the higher average 2E PGM price for 2021.

The average 2E PGM basket price increased by 10% to US$2,097/2Eoz (R31,021/2Eoz) compared with 2020 resulting in adjusted EBITDA from the US PGM operations of US$727 million (R10.8 billion).

Mined 2E PGM production for H2 2021of 272,099 2Eoz was 11% lower than for the comparable period in 2020 and 9% lower than H1 2021 as a result of the operational issues highlighted above. As a result of lower production, particularly in H2 2021, and inflationary costs pressures, AISC in H2 2021 increased by 18% year-on-year to US$1,039/2Eoz (R15,619/2Eoz) with ORD spending increasing by 34% to US$51 million (R772 million) as a result of having to use more contractors to do primary development but sustaining capital declined by 36% year-on-year to US$19 million (R290 million) as a result of the impact of global supply chain production delays and transport constraints. Growth capital increased by 18% year-on-year in H2 2021 to US$79 million (R1.2 billion).

US PGM recycling operation

Average spent autocatalyst fed by the US recycling operation declined by 10% to 23.8 tonnes per day for 2021 compared with 26.4 tonnes per day fed for 2020, with total 3E PGM ounces fed of 755,149 3Eoz, 10% lower year-on-year due to lower deliveries of autocatalysts towards year end due to continued supply chain logistic issues and lower than planned blending of concentrate feed from underground sources. Feed rates were also impacted by an industry wide slowdown in scrapping rates due to the ongoing chip shortage. Pleasingly 3E PGM sold in 2021 increased by 16% year-on-year to 782,552 3Eoz due to a drawdown of recycling inventory from approximately 400 tonnes at the end of 2020 to 25 tonnes at the end of 2021, resulting in a release of working capital which is discussed below. Recycling inventory is expected to normalise to around 200 tonnes once autocatalyst delivery backlogs dissipate.

The average 3E PGM basket price for the US recycling operations increased by 57% year-on-year to US$3,515/3Eoz (R51,987/3Eoz) due outturn delay in realizing prices, thereby capitalizing on higher palladium and rhodium prices earlier in the year, with adjusted EBITDA increasing by 87% to US$101 million (R1.5 billion).

For H2 2021 the Recycling operation fed 352,276 3Eoz, a 20% decline versus H2 2020, with a further decline in the feed rate from 24.7 tonnes per day in H1 2021 to 22.8 tonnes per day in H2 2021 as a result of inter alia the challenges highlighted above. This was a 17% decrease when compared to H2 2020, attributed to the 7% decrease in tonnes milled from underground and therefore lower concentrate produced for blending purposes, planned maintenance at the Columbus Met Complex, compounded by ongoing logistic challenges and lower vehicle scrapping rates globally. These factors saw receipt rates 19% lower than plan at 21 tonnes per day (tpd).

By using available inventory, the recycling operation maintained sales during H2 2021, ultimately delivering total sales of 360,167 3Eoz, a 13% increase compared to H2 2020. Given these production constraints, the operation focussed on inventory management during H2 2021 and pleasingly reduced working capital significantly year-on-year. This saw a favourable crystallisation of US$381 million (R5.7 billion)

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 10

in working capital for the half year. The focus on inventory management, with a particular focus on high carbon containing material, saw our recycling inventory reduce by 407 tonnes in H2 2021. At year end, recycling inventory approximated 25 tonnes, compared to 358 tonnes at the end of H2 2020.

The Recycling operation delivered a record financial performance in H2 2021, aided by strong sales and continued PGM price support. For H2 2021, the operation delivered EBITDA of US$51 million (R757 million), at an EBITDA margin of 4%. On a net profit basis, after net-financing income, the Recycling operation delivered US$60 million (R899 million) in H2 2021, 76% higher than H2 2020. Net profit margins approximated 4% for the majority of the financial half year under review.

At the end of H2 2021, recycle advances approximated US$441 million (R6.6 billion), a notable reduction from the US$822 million (R12.0 billion) in advances reported at H1 2021. The US$381 million (R5.7 billion) reduction in the Recycling operations customer advance balance has reduced the significant increase in working capital earlier in the year, resulting in stronger cashflow.

Given recycle receipt rates and current PGM prices, the Recycling operation is currently expending approximately US$7 million (R104 million) per day on recycle advances. The average purchase price on spent catalyst approximated US$3,993/3Eoz (R59,056/3Eoz) in H2 2021. This compares to US$3,247/3Eoz (R49,225/3Eoz) in January 2021 and US$2,170/3Eoz (R32,550/3Eoz) in January 2020. The operation remains completely self-funded, with no lines of credit currently drawn.

In order to further enhance the Group’s exposure to a circular economy, the Recycling operation continues to investigate growth options, across geographies and commodities. Although the global chip shortage crisis appears to be alleviating, recycle receipt rates in the United States are expected to remain constrained, driven by ongoing shipping constraints and logistic challenges. Port congestions, a shortage of trucks and haulage bottlenecks in the US and this is likely to remain for the foreseeable future.

SA PGM operations

The SA PGM operations again delivered consistently solid operating results despite the Group wide safety interventions and the suspension of operations at Khuseleka and Thembelani at the Rustenburg operations during December 2021, which resulted in approximately 21,000 4Eoz less production than planned. PGM production of 1,896,670 4Eoz for 2021 (including attributable ounces from Mimosa and third party purchase of concentrate (PoC) was 3% above the upper level of guidance. Production of 1,836,138 4Eoz for 2021, excluding PoC) was 20% higher year-on-year. 4E PGM PoC production increased by 21% to 60,532 4Eoz. All operations with the exception of Mimosa increased 4E PGM production by between 15% (Kroondal) and 35% (Platinum Mile), with only Mimosa reporting a decline of 3% year-on- year. 4E PGM sold increased by 20% to 1,885,610 oz which was around 49,000 4E oz higher than produced over the year.

Costs for 2021 were well contained with AISC (excluding PoC) of R16,982/4Eoz (US$1,148/4Eoz), 5% lower year-on-year and 8% below the lower level of market guidance of R18,500 to R19,500/4Eoz. AISC (including PoC) declined by 1% to R18,051/4Eoz (US$1,221/4Eoz). This was driven by significantly higher production and by-product credits which increased by 45% year-on-year, which offset higher royalties (57% higher year-on-year), ORD (40% higher year-on-year) and sustaining capital (92% higher year-on-year). This is an impressive achievement considering increasing global inflationary costs pressures which have impacted costs across the global mining industry recently. In particular Marikana's AISC (excluding PoC) declined by 8% year-on-year to R17,394/4Eoz (US$1,176/4Eoz).

Consistent with the messaging at the end of the 2020 year, the capital underspend in 2020 due largely to COVID-19 disruptions was carried over into 2021. As a result, capital expenditure for the SA PGM operations in 2021 increased by 73% to R3.8 billion (US$257 million) which was in line with guidance of R3.9 billion (US$257 million) with ore reserve development 40% higher at R1.6 billion (US$107 million), sustaining capital 92% higher at R2.0 billion (US$137 million) and project spend increasing from R20 million (US$1 million) in 2020 to R203 million (US$14 million) on the Kroondal Klipfontein and Marikana K4 projects.

The average PGM basket price for 2021 of R47,066/4Eoz (US$3,182/4Eoz) was 28% higher than for 2020 which, underpinned by the very strong operational performance from the SA PGM operations, resulted in the adjusted EBITDA margin increasing by 8% to 61% and adjusted EBITDA increasing by 78% year-on-year to R51.6 billion (US$3.5 billion). This is a significant achievement given that the entire SA PGM business was acquired for a total acquisition price of around R20.3 billion (US$1.4 billion) between April 2016 and December 2021.

With the recovery in PGM prices from Q4 2021 and the continuing strong operational momentum in the SA PGM, the outlook remains very positive.

4E PGM production from Rustenburg was 2% higher in H2 2021 year-on-year at 343,820oz, with surface production 3% higher and underground production 2% higher as a result of an improvement in output and build-up after the easing of COVID-19 lockdown regulations in H2 2020. The AISC for the Rustenburg operations increased only 5% year-on-year in H2 2021 to R18,835/4Eoz (US$1,253/4Eoz) as a result of a slight increase in unit operating costs, 22% higher ORD costs, 105% increase in sustaining capital but offset by lower royalties and significantly higher by-product credits. The 4E metal basket price increased by 3% from R38,903/4Eoz (US$2,393/4Eoz) in H2 2020 to R40,056/4Eoz (US$2,665/4Eoz).

Kroondal 4E PGM production for H2 2021 at 113,035oz, was 1% lower than the comparable period in 2020. The reduction can be mainly attributed to Kroondal mining through adverse ground conditions negatively affecting quality and output. Kroondal AISC of R13,774/4Eoz (US$916/4Eoz), was 5% higher than H2 2020 as a result of lower production and additional support required to mine through adverse ground conditions. The 4E metal basket price increased to R44,108/4Eoz (US$2,935/4Eoz), 3% higher year-on-year.

The Marikana operations continued to perform strongly , producing 421,632oz of 4E metals (including PoC) for H2 2021, 10% higher than for H2 2021 (381,836 4Eoz), with underground production 10% higher to 380,832 4Eoz and surface production 12% higher to 40,800 4Eoz, as a result of production having returned to normalised pre-COVID-19 levels during H2 2020. During H2 2021, the Marikana operation processed 25,705 4Eoz from third party sources,11% higher year-on-year. AISC (excluding PoC) of R17,069/4Eoz (US$1,136/4Eoz), was 5% lower than H2 2020 AISC of R17,983/4Eoz (US$1,106/4Eoz) primarily due to the increase in production and higher by-product credits. Project capital at Marikana increased to R196 million (US$13 million) in H2 2021 with expenditure ramping up at the Marikana K4 project.

Attributable 4E PGM production from Mimosa for H2 2021 declined by 6% year-on-year to 58,537 4Eoz due to slightly lower grades and plant recoveries. H2 2021 AISC increased by 17% year-on-year to US$1,055/4Eoz (R15,853/4Eoz) with lower production and sustaining capital increasing by 16% year-on-year. The current focus is to optimise the reagent suite and cell settings across the flotation circuit to improve recoveries.

Attributable 4E PGM production from Platinum Mile of 30,654 oz in H2 2021was 36% higher than H2 2020 due to additional surface tonnes added to the flotation output from the Rustenburg concentrator operations, coupled with 6% higher head grade and plant recoveries

Sibanye-Stillwater Operating and financial results | Six months and year ended 31 December 2021 11

which increased from 20% to 24%. The AISC at R8,482/4Eoz (US$564/4Eoz) was 28% lower than comparable period and is the lowest in the group.

H2 2021 Chrome sales of 1,116kt were 1% higher than H2 2020 (1,108kt). Chrome revenue of R1.2 billion (US$82 million) for H2 2021 was 33% higher year-on-year, mainly due to a 17% increase at Rustenburg in which all the metal was sold and the Kroondal and Marikana operations maintaining steady performance, as well as improved prices received. The Chrome price received improved by 19% from US$140/tonne in the comparable period to US$166/tonne in H2 2021.

Capital expenditure for H2 2021 was 72% higher at R2.4 billion (US$158 million) year-on-year with ORD expenditure increasing by 21% to R831 million (US$55 million) and sustaining capital 94% higher at R1.4 billion (US$90 million). The significant increase in H2 2021 sustaining capital expenditure was on projects to support safety initiatives, winch signalling upgrades and trackless mobile machinery (TMM) collision avoidance systems. ORD capital expenditure increased by 21% mainly due to the ramp up in production and return to normal output levels after the lockdown restrictions were lifted in November 2020. R196 million (US$13 million) of project capital was invested at the K4 project at Marikana. .

The K4 and Klipfontein PGM projects

The project setup phase that involved the approval of the scheduling and costing systems and development of the required Management plan documentation has been completed.

The following actions were also completed during H2 2021:

•Contracts for building works and electrical work for the upgrade and completion of the industrial change-houses, whilst on-boarding of these contractors completed and work commenced

•The tenders for the underground infrastructural work as well as for the electrical and Instrumentation work were adjudicated, on-boarding commenced

•Upgrades for the winder control systems design work was completed and contracts placed

•Various underground equipment orders have been placed and majority of the equipment has been delivered

The engineering design and compiling of scope of works and procurement is currently proceeding as per schedule. The K4 Project is on target to start capital development during Q2 2022.

The Klipfontein lay-down areas and site establishment were completed in Q4 2021 and the first blast was taken on 7 January 2022. The project is on track and is ramping up with full production expected in Q2 2022.

SA gold operations

Gold production from the SA gold operations (including DRDGOLD) for 2021 increased by 9% to 33,372kg (1,072,934oz) year-on-year with production from the managed SA gold operations (excluding DRDGOLD) increasing by 10% to 27,747kg (892,087oz). Production from the Beatrix and Kloof operations was impacted by several safety incidents during the year including the suspension of operations at Beatrix 1 and 3 shafts and Kloof 1 shaft on 3 December 2021, which reduced production by approximately 19,000 oz during Q4 2021. Tons milled from underground increased by 23% as the operations resumed normalised production rates, accompanied by a 8% decline in the average grade compared with 2020 when employees returning from the COVID-19 lockdowns were deployed to the higher grade mining areas in order to maximise revenue.