Exhibit 99.2

ESG Report | 2020

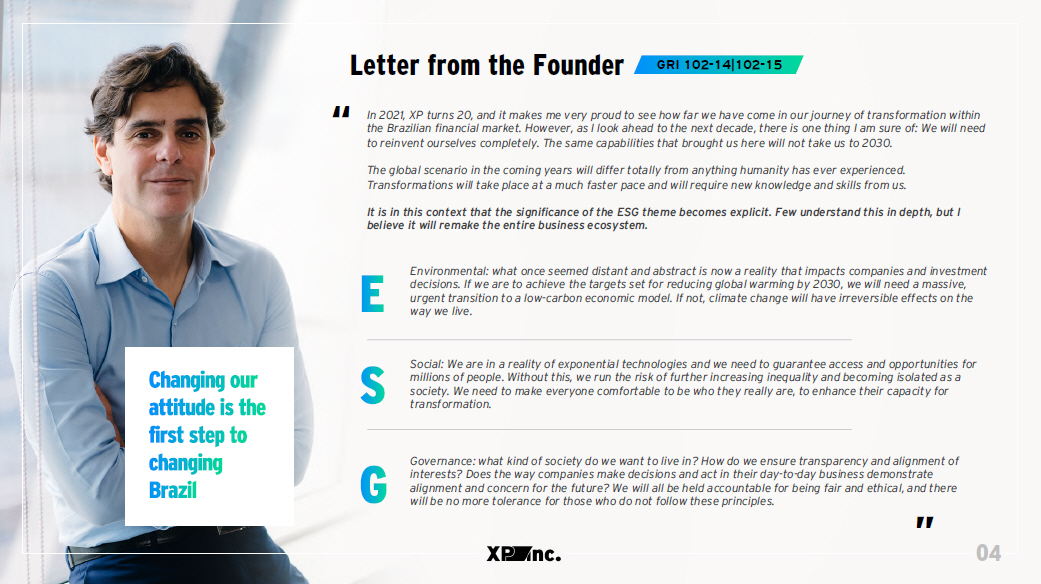

Letter from the Founder 04 “ “ In 2021, XP turns 20, and it makes me very proud to see how far we have come in our journey of transformation within the Brazilian financial market. However, as I look ahead to the next decade, there is one thing I am sure of: We will need to reinvent ourselves completely. The same capabilities that brought us here will not take us to 2030. The global scenario in the coming years will differ totally from anything humanity has ever experienced. Transformations will take place at a much faster pace and will require new knowledge and skills from us. It is in this context that the significance of the ESG theme becomes explicit. Few understand this in depth, but I believe it will remake the entire business ecosystem. Environmental: what once seemed distant and abstract is now a reality that impacts companies and investment decisions. If we are to achieve the targets set for reducing global warming by 2030, we will need a massive, urgent transition to a low - carbon economic model. If not, climate change will have irreversible effects on the way we live. Social: We are in a reality of exponential technologies and we need to guarantee access and opportunities for millions of people. Without this, we run the risk of further increasing inequality and becoming isolated as a society. We need to make everyone comfortable to be who they really are, to enhance their capacity for transformation. Governance: what kind of society do we want to live in? How do we ensure transparency and alignment of interests? Does the way companies make decisions and act in their day - to - day business demonstrate alignment and concern for the future? We will all be held accountable for being fair and ethical, and there will be no more tolerance for those who do not follow these principles. GRI 102 - 14|102 - 15

Letter from the Founder “ “ Guilherme Benchimol, founder and Chairman of the Board of XP Inc. I know it may sound crazy for an entrepreneur to talk about solving these challenges, but this is part of the resignification that the private sector will need to experience in order to thrive going forward. In the past, companies were valued only for their ability to generate profit, but this is over. Only those that take responsibility for their surroundings and seek to deliver value to everyone in their ecosystem (clients, employees, suppliers, and communities) will be able to truly compete and deliver consistent, long - term results responsibly. Those who do not perceive this new reality will have serious difficulties with the new generations of clients, who are increasingly demanding in relation to these issues. It will not be enough just to deliver an amazing experience and competitive prices to consumers if there is not also a strong commitment to leave the world better than we found it. In our case, this is even more relevant. The financial market plays a fundamental role in directing and allocating capital. For this reason, we, the largest company specialized in investment and financial services technology in the country, are committed to helping to promote this issue in Brazil. ESG (Environmental, Social, and Governance) and impact - oriented investments are here to stay and are the investor's chance to align profitability with making a difference. It is important to reflect that the leading role is not only down to the companies and the financial market. Each one of us, through our life, consumption, and investment choices, can signal what future we want to build. By daily example, we all need to be responsible for and protagonists of Brazil and of the world we want to build. After all, it is long - term vision and consistency that turn impossible dreams into reality. Your role in this journey is much bigger than you think! #invistanatransforma ção GRI 102 - 14|102 - 15 5

Message from the CEO When we think about recent decades of human life on the planet, it is striking how far we have come in terms of technology. It is amazing how quickly technology has advanced. Who would have thought that Moore's Law would last for more than 50 years? For those who don't know, in 1965, Gordon Moore, then CEO of Intel, stated that the processing power of computers would double every 18 months for the same manufacturing cost, resulting in Moore's Law, which persists to this day. And it is even more impressive that, so far, we have done very well combining technology and capitalism to meet human needs while using fewer and fewer natural resources. Progressively we are able to consume more and more while taking less from the planet. Think how much we have advanced in recent years in terms of agricultural productivity and energy efficiency, for example. Although I consider myself an optimist, in the sense that I see a green and inclusive future aligned with technological bases, it is undeniable that we still have a lot of work ahead of us to avoid major social and environmental disasters - and the pandemic we are living through is undeniable proof of this reality. Companies and individuals are key players to enable us to construct a world prepared to deal with the socio - environmental challenges facing us. We need to work together to tackle complex problems of global proportion. We can no longer rely only on isolated initiatives and outsource our responsibility to governments or supranational entities. We must all be part of the transformation we want - and need - to see in the world. “ “ GRI 102 - 14|102 - 15 6

Our purpose is to transform the financial market to improve people's lives, and today, more than ever, innovation is an indispensable component of this equation. Today, for example, it is not enough to provide cheap and reliable energy for everyone, it must also be clean. But for this clean energy to be scalable and cheap, we need to invest in innovation. Therefore, I believe that technology can help liberate the environment, in the sense of enabling responsible, ongoing use of natural resources, as well as protecting us from the probable devastating effects of climate change. It is important to point out that we will not achieve a bright future if many of us are left to our own devices. Innovation must and should be inclusive. It is incredible to think that in the 21st century we have achieved unimaginable things with technologies based on robotics, artificial intelligence and nanotechnology, but millions of people still lack the basics to enjoy a decent life, such as food, water, energy and sanitation At XP Inc. we want to be part of the transformation, building an innovative future that considers the needs of the human being and the planet, in harmony. And you, have you thought about what you can do? “ “ Let's go together. Thiago Maffra, future CEO of XP Inc.* *As disclosed to the market, as of May 2021, the position of CEO of XP Inc. will be assumed by Thiago Maffra, current Chief Technology Officer who led the digital transformation of XP Inc. Message from the CEO GRI 102 - 14|102 - 15 7

The purpose of XP Inc. is to transform the financial market to improve people's lives. We are a 20 - year - old Group, with technology platforms for investments, financial services, education and media & content, such as XP, Rico, Clear, Infomoney, XPeed, Flipper and Spiti brands. We are dedicated to being transparent, placing the client at the center through innovation and technology, providing financial education, sustainable growth, and a robust business ecosystem through a high - performance team aligned with our dream. XP INC. GRI 102 - 1|102 - 2|102 - 6|102 - 7 8

XP Group has more than 2.8 million clients and R$ 660 billion in assets under custody To deliver the best solutions for our clients, we need to go beyond and understand how these solutions leave a positive legacy for our society. Changes are necessary and urgent. But, for transformation to happen, we cannot rely only on the government and specific initiatives. We all need to be protagonists in building a better world. We recognize our role in supporting the transition to a more sustainable world. We know that this is a journey. It will be travelled together with our employees, clients, investors, partners, and the market. We are a company of the people for the people. That is why we want to inspire Brazilians on the journey to transform Brazil. We believe that investments generate value for society and the environment . We want to increase knowledge, engagement, and development of effective solutions so that the ESG agenda is at the core of business models and the decision - making process. XP ESG MAKE INVESTMENTS YOUR VOICE GRI 102 - 15|102 - 16 9

Environmental We will seek to minimize our environmental impact and expand our contribution to clients and partners through financial products that promote positive impacts on the environment. Social We will be the protagonists in promoting education and diversity, in our practices, and among all those whom we relate with. 10 Governance Our corporate governance will reference the best market practices, maintaining our entrepreneurial culture and the autonomy of our teams.

BIG DREAM Be a reference by doing the right thing in the right way! We have come this far seeking the impossible. We seek challenges beyond our capabilities and do not settle for the status quo. We will be a global leader in ESG issues, transforming social and environmental problems into business opportunities, inspiring companies and people to build a better future, and positioning ourselves as a company that takes responsibility for its legacy. ENTREPRENEURIAL SPIRIT We seek to innovate in sustainable solutions in the financial market At XP Inc. we encourage a constructive attitude that focuses on the solution, not the problem. This is evident in the autonomy of our teams and the collaborative spirit we put into everything we do, both inside and outside the company. We will act in the same way on ESG issues, undertaking a leading role in building solutions that support the directing of resources to companies, projects, and institutions that address the world's biggest environmental and social challenges. OPEN MIND We want to inspire and engage people to become protagonists in the transformation We know that this path is not new, but there is still a long way to go. The construction of the ESG journey is, by essence, collaborative and plural. We want to bring together the best market references and practices in the design, implementation, and acceleration of ESG issues. We will promote the debate and development of solutions that address socio - environmental challenges. Our Values GRI 102 - 16 11

Creation of ESG Executive Board, Sustainable Wealth Area and ESG Analysis in Research Adequacy of Policies, Processes and Governance ESG XP Inc. Positioning and Adherence Commitments Launch of ESG & Impact Labeled Products + 20 new products in 2020 + 1,3 bi under custody Diversity & Inclusion as a Priority Commitment to have 50 % women in the workforce by 2025 Consolidation of Corporate Actions: Transform Together and Instituto XP R$ 33 million that already impacted 1,3 million 12 Highlight s in 2020 GRI | 102 - 10

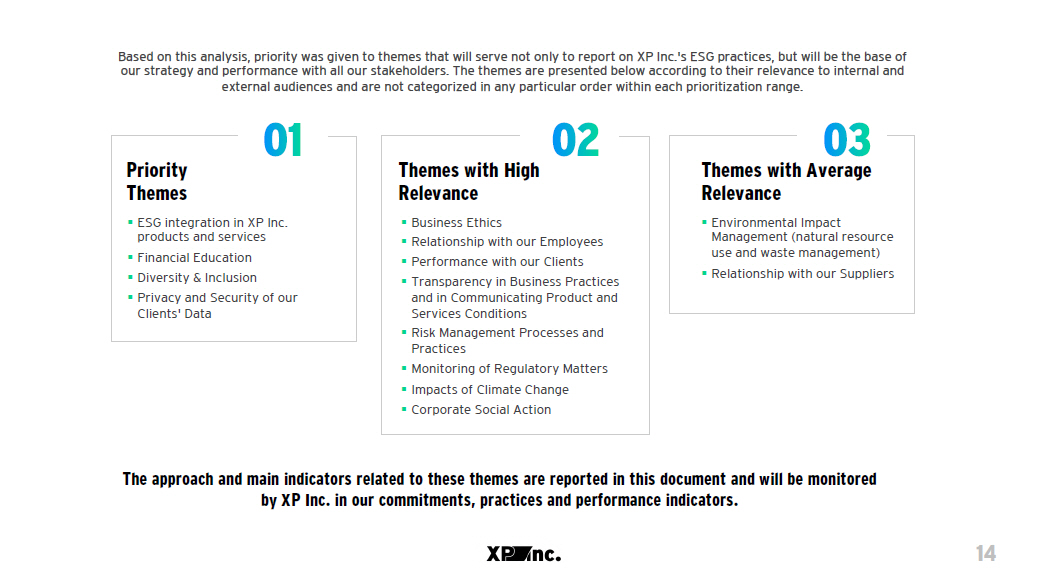

MATERIALITY We understand that the financial sector plays a unique role in the articulation of ESG issues because of the influence it can exert on its clients and on the market. In this sense, the XP Inc. materiality survey considered both direct impacts (of its activities) and indirect impacts (of its operations) in analyzing and identifying ESG themes relevant to the Company. To identify the material issues for XP Inc., we considered both the aspects of organizational culture, strategy, and business vision of the company itself, through interviews with our leaders and key professionals in several business departments, as well as analysis of the positioning and demands of our main stakeholders. We surveyed: Methodologies and international references: SASB, GRI, and sustainability indexes (ISE and DJSI); Online surveys with our clients on the awareness and relevance of ESG issues; Profile and criticality of suppliers on ESG issues, based on our ESG institutional positioning project, which also considered looking at this audience; Materiality matrix of banks and asset managers operating in the Brazilian and international markets. GRI 102 - 21 | 102 - 40 | 102 - 42 | 102 - 43 | 102 - 44 |102 - 46 | 102 - 47 13

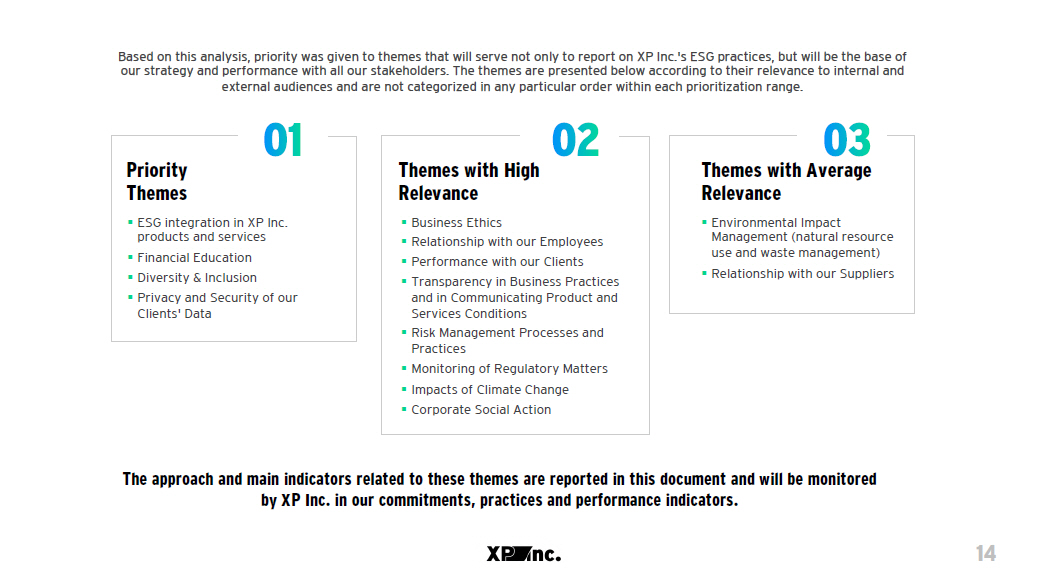

Based on this analysis, priority was given to themes that will serve not only to report on XP Inc.'s ESG practices, but will be the base of our strategy and performance with all our stakeholders. The themes are presented below according to their relevance to internal and external audiences and are not categorized in any particular order within each prioritization range. The approach and main indicators related to these themes are reported in this document and will be monitored by XP Inc. in our commitments, practices and performance indicators. Priority Themes ▪ ESG integration in XP Inc. products and services ▪ Financial Education ▪ Diversity & Inclusion ▪ Privacy and Security of our Clients' Data Themes with High Relevance ▪ Business Ethics ▪ Relationship with our Employees ▪ Performance with our Clients ▪ Transparency in Business Practices and in Communicating Product and Services Conditions ▪ Risk Management Processes and Practices ▪ Monitoring of Regulatory Matters ▪ Impacts of Climate Change ▪ Corporate Social Action Themes with Average Relevance ▪ Environmental Impact Management (natural resource use and waste management) ▪ Relationship with our Suppliers 14

GRI 102 - 18 | 102 - 19 | 102 - 20 Governance Corporate Governance XP Inc, its Subsidiaries and Affiliates (jointly referred to herein as "Company", "XP Group" or "XP Inc.") are committed to the highest standards of ethical conduct and continuously seek to improve their corporate governance practices, based on national and international benchmarks. GRI 102 - 22 | 102 - 23 | 102 - 24 | 102 - 26 | 102 - 27 | 102 - 32 The highest governance body of XP Inc. is the Board of Directors, which oversees the work of the Executive Board and makes strategic decisions about the XP Group's business, including environmental, social and economic issues. Its members are elected by XP Inc. shareholders, according to the rules established in the Shareholders' Agreement entered into by the main shareholders of XP Inc. Today, it has 12 members, 25% of whom are independent*. In addition, every year the Board of Directors undertakes a self - assessment regarding its performance. *Members are considered independent under US law and regulation. 15

*It is important to highlight that the members of the Board of Directors who also hold executive positions at XP Inc. do not receive compensation for the positions they hold on the Board of Directors, so they are not doubly compensated for their executive functions. Guilherme Benchimol Chairman of the Board of Directors and, currently, also Chief Executive Officer ("CEO") of XP Inc. Bruno Constantino currently, also Chief Financial Officer (" CFO") of XP Inc. Fabricio Almeida currently, also General Counsel of XP Inc. Bernardo Amaral Carlos Alberto Ferreira Guilherme Sant’Anna Gabriel Leal Geraldo Carbone Martin Emiliano Lifchitz Ricardo Baldin independent member of the Board of Directors and independent member of the Audit Committee Maria Helena Fernandes de Santana independent member of the Board of Directors and independent member of the Audit Committee Luiz Felipe Calabró independent member of the Board of Directors and independent member of the Audit Committee 16

*As defined in US regulation and legislation. **Members of the Audit Committee also serve as independent members of the Board of Directors. Audit Committee The Audit Committee is a corporate body with an advisory function, which assists the Board of Directors in overseeing our accounting and financial processes and auditing our financial statements. In addition, it is directly responsible for the selection, compensation and supervision of the Company's external auditors. The composition of the Audit Committee is defined by the Board of Directors of XP Inc. and one of its members must be considered a financial expert*. The Audit Committee undertakes a self - assessment annually. Maria Helena Fernandes de Santana Ricardo Baldin: Luiz Felipe Calabró 17

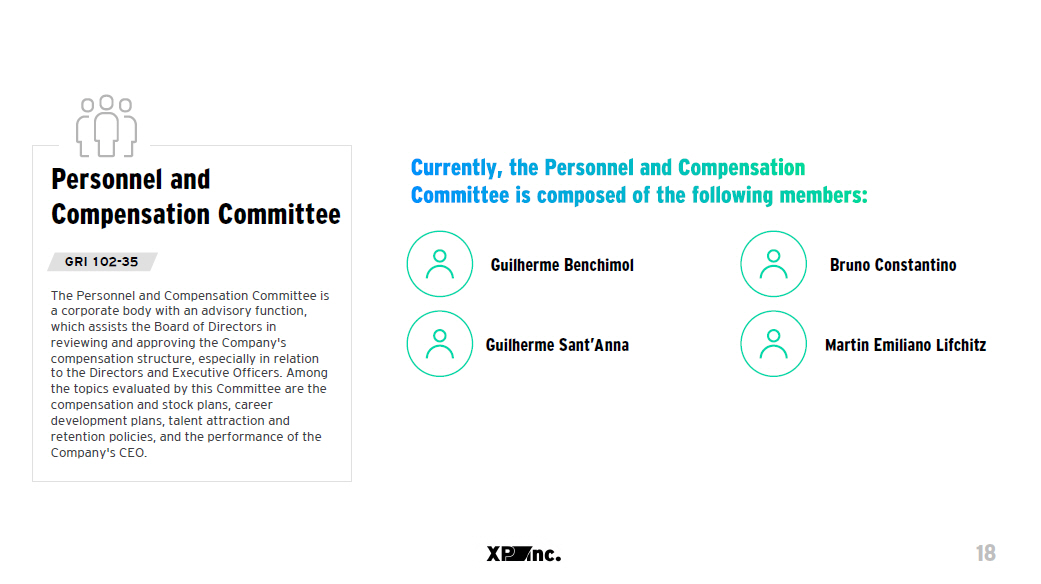

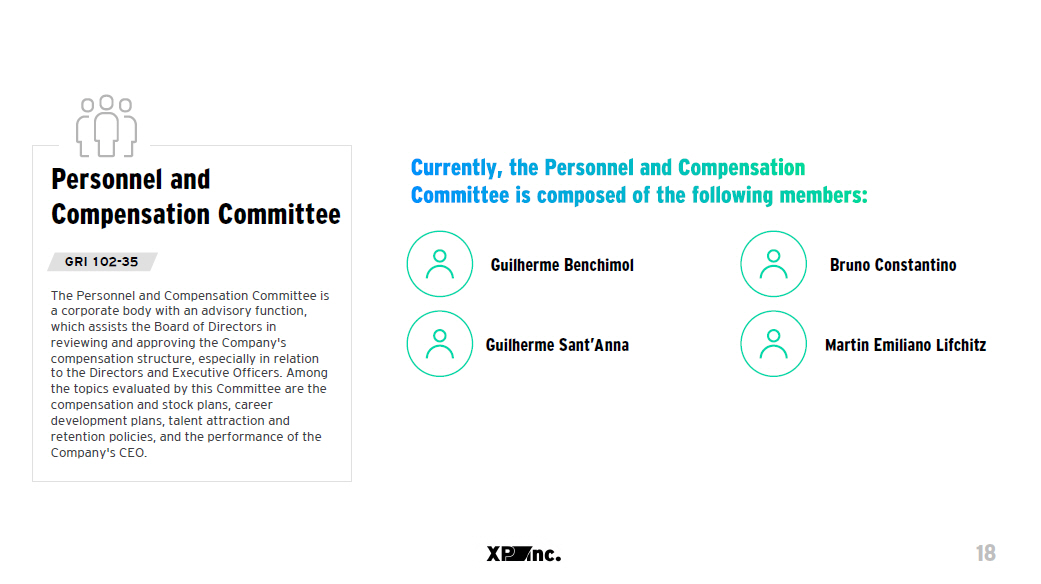

Personnel and Compensation Committee GRI 102 - 35 The Personnel and Compensation Committee is a corporate body with an advisory function, which assists the Board of Directors in reviewing and approving the Company's compensation structure, especially in relation to the Directors and Executive Officers. Among the topics evaluated by this Committee are the compensation and stock plans, career development plans, talent attraction and retention policies, and the performance of the Company's CEO. Guilherme Benchimol Bruno Constantino Martin Emiliano Lifchitz Guilherme Sant’Anna 18

Guilherme Benchimol Current CEO of XP Inc. As disclosed to the market, as of May 2021, this position will be held by Thiago Maffra, current Chief Technology Officer who led the digital transformation of XP Inc., and Guilherme Benchimol will remain as Chairman of the Board of Directors. Bruno Constantino CFO of XP Inc. Fabricio Almeida General Counsel of XP Inc . Bernardo Amaral Corporate and Client Risks Gabriel Leal People, Management & Strategy Gustavo Pires Investment Funds Karel Luketic Martech and Digital Content Marcos Peixoto Manager of XP Asset Marta Pinheiro ESG Thiago Maffra Technology & Operations Rafael Furlanetti Institutional Renato Cunha Transformation Executive Board The XP Group Executive Board is composed of members with specific skills, who lead the main fronts on which the XP Group operates, evaluating goals, projects, and policies. Carlos Alberto Ferreira Institutional and Products Fausto Assis Qualified Services José Berenguer XP Bank Guilherme Sant’Anna Channels and Marketing 19

In our business operations, we deal fairly and equitably with our clients, co - workers, and suppliers. We keep accurate business records and comply with laws and regulations regarding financial disclosures and audits. We pay special attention to human rights, repudiating any practice that disrespects the minimum rights of each individual, including, but not limited to, any discriminatory act. Ethics and Corporate Policies GRI 102 - 17 | 102 - 25 | 102 - 33 | 103 - 2 | 103 - 3 | 205 - 2 SASB FN - EX - 510a.2 | FN - AC - 510a.2 20

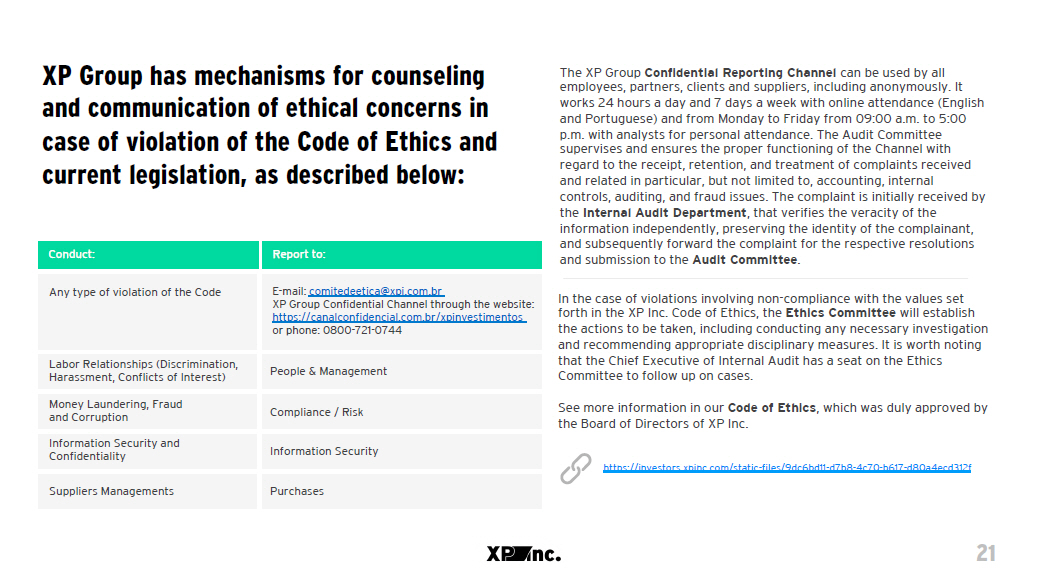

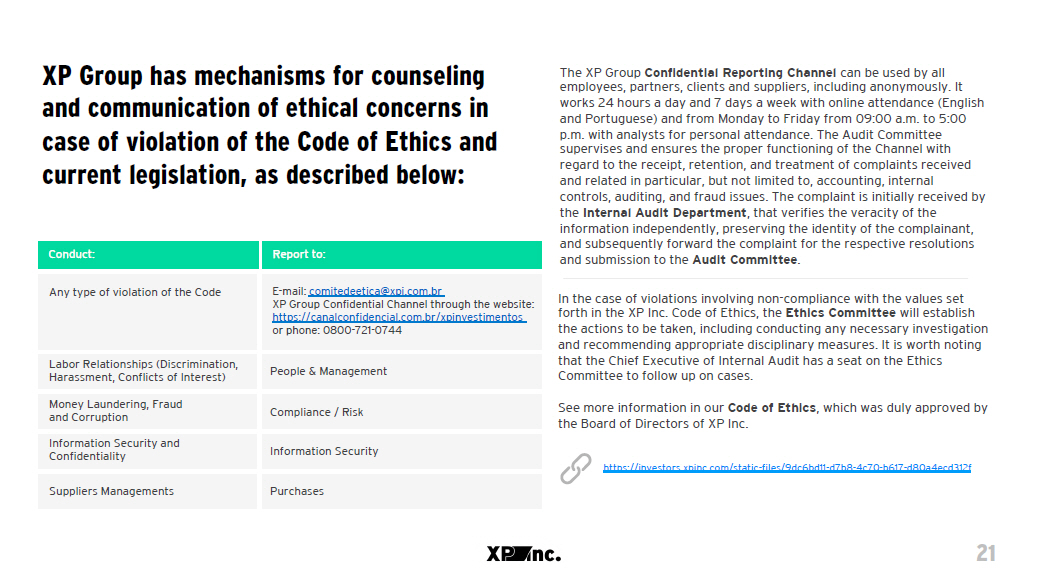

XP Group has mechanisms for counseling and communication of ethical concerns in case of violation of the Code of Ethics and current legislation, as described below: The XP Group Confidential Reporting Channel can be used by all employees, partners, clients and suppliers, including anonymously. It works 24 hours a day and 7 days a week with online attendance (English and Portuguese) and from Monday to Friday from 09:00 a.m. to 5:00 p.m. with analysts for personal attendance. The Audit Committee supervises and ensures the proper functioning of the Channel with regard to the receipt, retention, and treatment of complaints received and related in particular, but not limited to, accounting, internal controls, auditing, and fraud issues. The complaint is initially received by the Internal Audit Department , that verifies the veracity of the information independently, preserving the identity of the complainant, and subsequently forward the complaint for the respective resolutions and submission to the Audit Committee . In the case of violations involving non - compliance with the values set forth in the XP Inc. Code of Ethics, the Ethics Committee will establish the actions to be taken, including conducting any necessary investigation and recommending appropriate disciplinary measures. It is worth noting that the Chief Executive of Internal Audit has a seat on the Ethics Committee to follow up on cases. See more information in our Code of Ethics , which was duly approved by the Board of Directors of XP Inc. https://investors.xpinc.com/static - files/9dc6bd11 - d7b8 - 4c70 - b617 - d80a4ecd312 f Conduct: Report to: Any type of violation of the Code E - mail: comitedeetica@xpi.com.br XP Group Confidential Channel through the website: https://canalconfidencial.com.br/xpinvestimentos or phone: 0800 - 721 - 0744 Labor Relationships (Discrimination, Harassment, Conflicts of Interest) People & Management Money Laundering, Fraud and Corruption Compliance / Risk Information Security and Confidentiality Information Security Suppliers Managements Purchases 21

For more information about guidelines and procedures related to conflicts of interest and related parties, please see our Compliance Policy. https://www.xpi.com.br/assets/documents/manual - compliance - 2020.pdf Compliance Policy employees must not engage in outside business or other activities that may interfere with their exercise of good judgment in the conduct of XP Inc. business. Any material transaction or relationship that could reasonably create a conflict of interest with group companies must be reported, including outside business or other activities, corporate opportunities, inside information, acceptance of gifts and entertainment, associations (sic) and class entities, and political parties. It should be noted that members of the Board of Directors are not required to (i) have the position of director as their primary professional association, or (ii) obtain prior approval from Compliance before participating in outside business or taking an officer or board position with outside organizations. To avoid any possibility of conflict of interest, the situations indicated in items (i) and (ii) can be subject to evaluation by the Board of Directors of XP Inc. Under XP Group corporate policies 22

Regarding the ESG risks and opportunities agenda, The ESG Policy of XP Group aims to reinforce the commitment to social and environmental responsibility for our activities, business, and relationship with stakeholders, in compliance with the regulators' requirements. In this policy, we address management of socio - environmental risk and business opportunities, aiming at preventing negative socio - environmental impacts and increasing positive impacts on the environment and society, based on the principles of relevance, proportionality, and taking into account the other specific internal policies of the XP Group. Access our ESG Policy at: https://lp.xpi.com.br/ESG/ 23

GRI 102 - 31 GRI | 102 - 10 | 102 - 19 | 102 - 20 | 102 - 29 • SASB FN - EX - 410A.4 We recognize that the ESG agenda is a journey. In order to move consistently in this direction, the entire Company is engaged in understanding how we can integrate ESG issues into both our internal activities and our business. In 2020, the ESG Executive Board was created, under the responsibility of Marta Pinheiro, a partner of the Company. The ESG Executive Board is responsible for organizing the ESG strategy, institutional representation, coordination of a range of initiatives, articulation and alignment of internal areas and XP Inc. companies in relation to the subject. We understand that this is not an agenda for a single Executive Board and, therefore, we have technical specialists in some of our internal areas and companies who support the integration of the theme into business practices, especially in Research, Private Banking, and Social and Environmental Risk . XP Inc. has specific governance structures for decision making related to ESG factors, such as the ESG Commission in the scope of the Social and Environmental Risk & ESG Rating process of credit and capital markets operations, to deliberate on the Company's positioning in relation to a product or operation in which significant ESG controversies and/or relevant social and environmental risks are identified. The ESG Commission does not meet on a regular basis, but rather whenever there is a need to discuss a relevant case or operation regarding notes or controversies related to ESG issues. ESG Governance 24

Commitments and Working Groups GRI 102 - 12 XP Asset and XP Advisory, as the main asset managers of XP Inc., jointly became signatories of the Principles for Responsible Investment (PRI) in November 2020. XP Inc. encourages the adoption of ESG best practices by the Brazilian financial sector, participating collaboratively in workgroups, forums, and networks on ESG and social and environmental risk in alignment with its strategy. PRI is an investor initiative in partnership with the UN Environment Program Financial Initiative (UNEP FI) and the UN Global Compact. It works with its international network of signatories to ensure that the six Principles for Responsible Investment are applied. The purpose of these Principles is to understand the implications of environmental, social, and governance issues for investments , with an eye toward integrating these themes into investment decisions and ownership of financial assets. 25

Such initiatives are important to align XP Inc. strategy with the Sustainable Development Goals (SDGs) of the UN, especially the themes of inclusive education, diversity and gender equality, which have become a priority in the agenda of XP Inc. In 2020, XP Inc. joined the UN Global Compact and UN Women. An exercise was performed to prioritize the SDGs considering international studies and the XP Inc. performance model, both in internal activities and in the development of products and services. Activities of XP Inc.: Operations with the Market: SDG 4 Quality Education SDG 5 Gender Equality SDG 16 Peace, Justice and Effective Institutions SDG 9 Industry, Innovation and Infrastructure SDG 11 Sustainable Cities and Communities SDG 12 Responsible Consumption and Production SDG 13 Climate Action SDG 8 Decent Work and Economic Growth The UN Global Compact is the world's largest corporate sustainability initiative. It is a call for companies of different sizes, sectors, and countries to help achieve the 17 SDGs by 2030. The SDGs aim to end poverty and hunger, provide access to health, education, water, sanitation, clean energy, and decent work, in addition to promoting a new way of living in cities in a more sustainable and conscious way. 26

CDP , an international, non - profit organization, aims to mobilize investors, companies, and governments to build and accelerate collaborative action for sustainable development. Through questionnaires, companies, cities, states and regions provide CDP with data on their footprint and environmental performance. CDP analyzes such data, with an eye to risks and opportunities, so that decision makers can use them. XP Inc. also formalized its adhesion to CDP (initially, Carbon Disclosure Project), recognizing the importance of climate change in its operations and in the world. In addition, we began to participate in working groups of the Financial Innovation Lab (LAB) , an initiative coordinated by ABDE, IDB, CVM and GIZ. Our professionals are working in different LAB working groups, promoting the generation and dissemination of knowledge to advance the sustainable finance agenda in Brazil. 27

Risk Management GRI 102 - 11 | 102 - 13 | 102 - 15 | 102 - 30 | 103 - 2 | 103 - 3 SASB FN - CB - 410A.2 Thinking about the importance of the ESG theme in XP Inc. business, in the last quarter of 2020, we created a Social and Environmental Risk department, directly integrated to the Risks & Compliance Executive Board, with governance assigned to the Risks Committee. This mission of the department is to identify, classify, analyze, monitor, mitigate, and control the social and environmental risk of the company's operations. XP Inc. also manages the social and environmental risk in our company's activities and operations, including recording occurrences of social and environmental losses and damage. In 2020, we began constructing proprietary methodologies for assessing and rating social and environmental risks and ESG factors in our financial operations. Regarding internal risk analysis for the approval of credit operations and capital markets, the proprietary methodology developed, called Social and Environmental Risk & ESG Rating , assesses and classifies the ESG risk of operations mainly considering four assessment factors: potential sector risk, social and environmental management capacity, social and environmental notes, and controversial ESG issues. 28

Based on the evaluation of these qualitative factors the Social and Environmental Risk & ESG Rating is generated in five levels, from A to E: ESG Risk: very low R ating The Social and Environmental Risk & ESG Rating influences the decision scope and validity of the risk assessment of the operation. Likewise, transactions with high exposure to ESG risks are submitted to the ESG Commission, composed of XP Inc. Officers. In addition to the Social and Environmental Risk & ESG Rating, currently, the risk analysis process also includes (1) list of prohibited activities , that is, which prevents any level of relationship between XP Inc. and companies or individuals included on that list; and (2) list of restricted sectors , which imposes specific restrictions according to the type of relationship XP Inc. has with the client. E ESG Risk: very high D ESG Risk: high C ESG Risk: medium B ESG Risk: low A 29

Furthermore, in 2020, we held several conceptual and practical training courses on Social and Environmental Risk for the departments involved in the process, developed tools for assessing social and environmental risk, such as the Social and Environmental Questionnaire, and evolved in the process of hiring a specific social and environmental risk bureau. In 2020, XP Inc. participated in several committees and working groups related to social and environmental risk . Within FEBRABAN (Brazilian Banks Federation), we participate in the Social, Environmental Responsibility, and Sustainability Commission and three specific Working Groups. At ABBC (Brazilian Association of Banks), we are coordinators of the Social and Environmental Risk Commission. In the Financial Innovation Lab, we are part of the ASG Risk Working Group. For the year 2021, we have committed to carrying out a social and environmental risk analysis for all credit operations in the wholesale category and suppliers, in addition to analyzing the entire stock of operations in relation to the topic. With the implementation of this process next year, we expect to create social and environmental risk indicators for monitoring and reporting to the Risks Committee and for monitoring and management of the theme by the company's Executive Board. 30

Social and Environmental Risk System For more information, access our ESG Policy at: https://lp.xpi.com.br/ESG/ Also in 2021 the XP Inc. proprietary Social and Environmental Risk System will be implemented. We understand that such system will be fundamental for our evolution in managing the theme, including managing social and environmental risk within the scope of XP Inc. portfolio, identifying social and environmental and climate risks and opportunities, and preparing indicator reports for the Company's Committees. We understand that the topic of social and environmental risk is material to XP Inc. and we will continue to develop 31

GRI 103 - 2 | 103 - 3 | 203 - 1 SASB FN - EX - 550A.3 | FN - IB - 410A.3| FN - AC - 270A.3 We aim to provide the best products and services to our clients. We understand that clients must be at the center of the business model. To this end, we invest in proximity, transparency, and a wide variety of products and services, always seeking to act impartially and offer solutions aligned to the interests and profile of each of our clients. Social Clients XP Inc. values ethics, clarity, and impartiality in exchanging information with our clients and in marketing, advertising, and engagement, guiding them to the best conditions and products most suitable to their actual needs. Innovation: we aim to improve and create solutions to address the needs of our clients Interbrand Ranking: we seek to be a reference in what we do. We are among the 10 most valuable Brazilian brands NPS We seek maximum client satisfaction. Current grade: 71 Reclame Aqui Award, in the Digital Platforms category, 2020 North American Customer Centricity Awards, best company, 2020 32

We have several relationship channels available for information, doubts, requests, suggestions, and complaints, such as call centers, the Customer Service Center (SAC), the internet (website, FAQ, social networks, chat), the “Fale com Guilherme” and the Ombudsman . There is a specialized call center for each XP Inc. brand. We are investing to make the service channels’ experience entirely omnichannel , as we believe that the customer should be served by the channel that is most convenient for him. We are also seeking to offer more self - service solutions, with a focus on transparency, agility and convenience for our customers. XP Inc.’s Ombudsman has the mission to represent clients’ interests impartially and ensure good service . The Ombudsman is responsible for providing last resort service to clients who are dissatisfied with the solution presented in the primary channels of XP Inc. companies, acting in order to resolve the demands received within the stipulated period in accordance with current regulations. Access is available by phone or via the Internet using a specialized form available on our websites. 10.41 3 99% 2 100% 38 100% XP Investimentos CCTVM S.A. Banco XP S.A. XP Vida e Previdência S.A. # Demands % On Time Service *Includes demands related to the XP, Rico, and Clear brands. Prioritizing our Clients' Interests 33

Moreover, IFAs undertake, through the applicable regulation, XP Inc.'s internal policies and the contract signed with XP, to act ethically, with honesty and good faith , employing all the care and diligence expected of these professionals in relation to their clients (CVM Resolution 16/2021, Article 15). IFAs do not have powers to act on behalf of the client, only intermediating the client's orders , who have complete freedom of choice and decision on their investment portfolio . The role is limited to helping the client, providing information about the products and services offered by XP. The client is the manager of their own portfolio. In this sense, due to this intermediation, client acquisition and information provision, IFAs generally receive a percentage of XP's compensation, which may vary according to product. Nevertheless, in order to make it even clearer that the interest of the IFA is not conflicting when providing information about each product or service offered by XP, a new compensation method was created, which can be chosen at the client's discretion, based on a fixed percentage that is applied on the integrality of the client's resources, applications and assets, on an annual basis, the “fixed fee”. In this case, the IFA would not be remunerated according to product, but according to the client's portfolio , so that there would be no unfounded discourse about any possibility of the IFA giving information on a certain product in order to obtain greater remuneration. Independent Financial Advisors Independent Financial Advisors (“IFAs”) are regulated and supervised by CVM, B3 – Bolsa de Valores, ANCORD and the institution that is part of the distribution system to which they are linked, so that there are rules, procedures and controls that identify and manage possible situations of conflicts of interest involving IFAs (CVM Resolution No. 16 of February 9, 2021, Article 22 Paragraph 4). 34

XP Inc. has an Advisory Governance Department , responsible for supervising IFAs in order to prevent disappointing situations with clients related to conflict - of - interest situations. Among the various controls, there is specific monitoring to identify operations with churning characteristics (doing business excessively in order to generate higher revenues - brokerage fees and commissions - without taking the client's interest into account). Such monitoring is in line with the best governance practices established by the self - regulation of BSM Supervisão de Mercado (“BSM”), a self - regulatory body linked to B3. Governanc e of Advisors Finally, clients are also offered the opportunity to report any behavior characteristic of a conflict of interest through the Confidential Channel , for reporting behaviors that violate the Code of Ethics, the Compliance Policy and other internal policies of XP Inc., as well as any law or regulation to which XP Inc. is subject. All complaints are received by a specialized and independent third party, to understand the report and request information and treatment through the internal audit department and/or other departments involved in investigating the complaint, always observing its confidentiality. The interest of XP Inc. and all its partners is always to help Brazilians to invest better, offering quality products and services and always aiming at the benefit of the client. To act otherwise would not be in line with the company's culture and would be unsustainable in an environment in which we work every day to offer better investment conditions to clients. 35

36 As a financial services company, we have specific responsibilities to keep our clients' information and the company's proprietary information confidential. That is why XP Inc. has information security controls and data privacy protection through robust processes and technologies. We have implemented a series of processes and controls that allow us to manage privacy and protect personal data. We periodically report indicators to XP Group's Executive Board, which provide a complete view of the environment's operation, in addition to enabling us to identify problems and outline action plans quickly. Our Privacy Policies are public and have the main objective of transmitting, clearly and transparently, the purposes for which client data is collected. All information processed in our environment has well - defined purposes and related legal bases, thus ensuring that they are processed respecting the pillars of data privacy. Our documents also detail the rights of data subjects and the main channels and ways for them to exercise such rights, under the terms of the Brazilian General Personal Data Protection Law (“LGPD”). Since LGPD came into effect in August 2020, we have received only one case of an external complaint (via the Reclame Aqui website). Last year, no regulatory complaints or cases of data leaks were identified and we did not suffer any monetary losses as a result of legal procedures associated with privacy. GRI 418 - 1 Personal Data Protection and Privacy

37 GRI 413 - 1 CONHECIMENTO PARA OCUOPAR QUALQUER LUGAR Xpeed is XP Inc.'s educational portal focused on financial education and entrepreneurship. It has courses at all levels and for all pockets, including free courses. We understand that with financial education we will be able to attract new clients and generate loyalty. By the end of 2020, we had provided 192 courses and 4 MBAs and we had more than 146,000 students. XPeed and XP Inc.'s internal women's collective, MLHR3, developed the “ Knowledge to Occupy Any Position ” journey, aimed at the female audience. The content seeks to encourage more and more women to seek financial independence, providing content about financial planning, career, impact of the theme on family life, among others. Financial Education

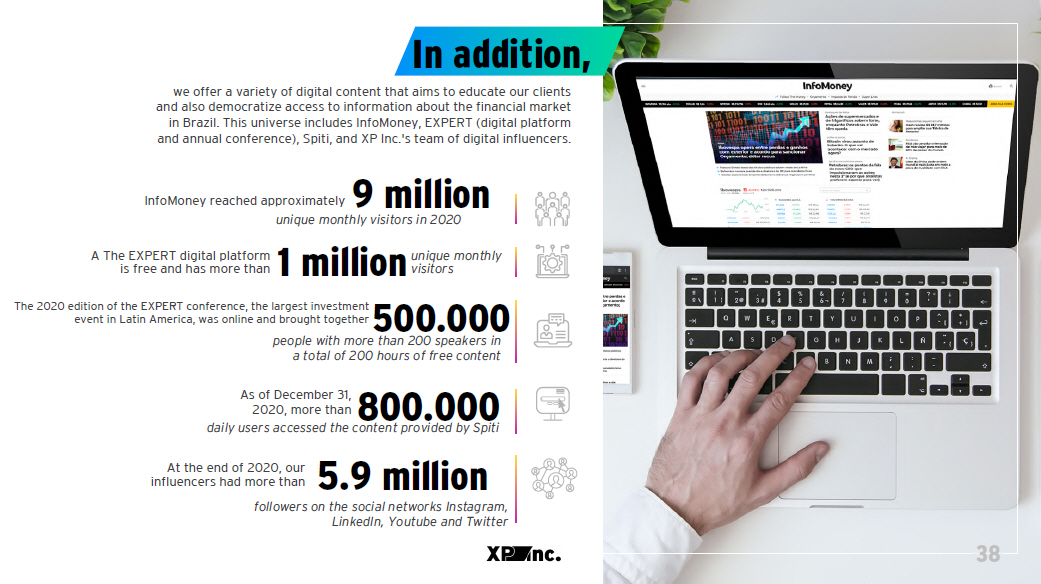

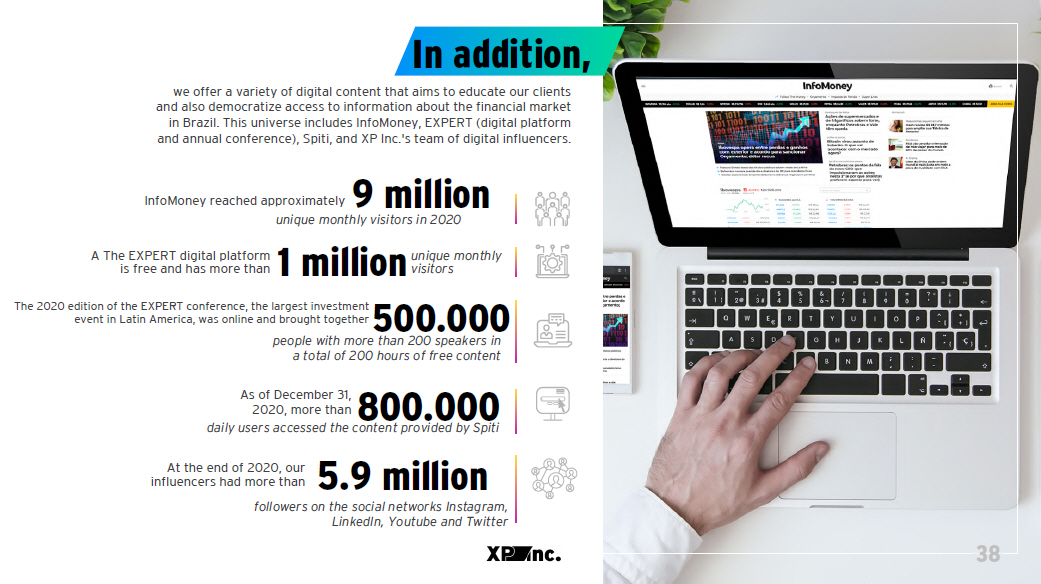

38 A The EXPERT digital platform is free and has more than unique monthly visitors 1 million The 2020 edition of the EXPERT conference, the largest investment event in Latin America, was online and brought together people with more than 200 speakers in a total of 200 hours of free content 500.00 0 daily users accessed the content provided by Spiti As of December 31, 2020, more than 800.00 0 followers on the social networks Instagram, LinkedIn, Youtube and Twitter At the end of 2020, our influencers had more than 5.9 million In addition, we offer a variety of digital content that aims to educate our clients and also democratize access to information about the financial market in Brazil. This universe includes InfoMoney, EXPERT (digital platform and annual conference), Spiti, and XP Inc.'s team of digital influencers. InfoMoney reached approximately 9 million unique monthly visitors in 2020

ESG & Impact Product Prioritization In 2020, we integrated the ESG agenda into the Company's business lines. As a distributor, we know that we must always be aware of the risk of greenwashing, which means “green makeup” on products that are not a concrete addition to the ESG agenda. For this, we use international sustainable finance classification references, such as the European Union's Green Finance Taxonomy. In addition, we are monitoring the discussion within ANBIMA about reviewing the ESG classification for investment funds. We have developed a proprietary questionnaire to support the classification of products that have an ESG or Impact Investing label and the prioritization in their launch by XP Inc. The asset managers and their respective investment funds labeled as ESG or Impact Investing are subject to an internal due diligence process with specialists on the subject, and the decision on whether to distribute this product is subject to a specific governance process. We believe that financial capital is a great lever to help solve the structural problems of Brazil and the world. Therefore, we conducted an in - depth study to define our ESG solutions strategy. GRI 102 - 2 102 - 13 102 - 15 Democratizing the market for ESG & Impact Investing products: +R$ 600 million raised between funds and COE ESG (retail) Largest ESG platform in the country! +13 ESG & Impact Investing focused funds available on the platform, including equity, fixede income, hedge and private equity funds, with local and global strategies. We created a thematic investment fund focused on gender equality, which donates part of the management fee to the “As Valquirias” institute. In fixed income, XP acted as bookrunner of 4 ESG offers, global and local, promoting bond emissions in the sector of energy, pulp and paper and sanitation, totaling approximately R$ 1.5 bi and USD 500 mi . 39

1. XP Asset Based on this strategy, we started to build our shelf of ESG products. In 2020, we launched several sustainable investment options on the XP platform, including local funds, international funds, index funds, pension funds and COE. Among these, five products in the Active Equities and Passive Equities categories were created by XP Asset, a brand of XP Inc. dedicated to the management of third - party resources, which started to construct its Responsible Investment Policy with the support of specialized external consultancy and the ESG integration of its equities, credit and infrastructure funds. ▪ Investor ESG FIA ▪ Selection ESG FIC FIA ▪ Trend ESG Global Dólar FIM and Trend ESG Global FIM ▪ Trend Lideranças Femininas FIM 2. Debt Capital Markets (DCM) Local and Offshore USD 500mm 3.75% Sr. Unsecured SLB due 2031 Reopening XP Joint Bookrunner 2020 2020 3. Asset Management Services R$ 620.5mm Debentures of infrastructure XP as Bookrunner 2020 R$ 280mm Debentures of infrastructure XP as Bookrunner 2020 R$ 574mm Debentures of infrastructure XP as Bookrunner 4. Structured Products COE linked to ETF iShares MSCI KLD 400 Social ETF 5. XP Private In the second half of 2020, the construction process for the ESG portfolios - onshore and offshore - started, which were launched in the beginning of 2021. To this end, the investment team actively participated in developing a proprietary rating methodology to evaluate and select funds and assets to compose diversified 100% ESG mandates for clients. 2020 Equities ~6 local equities funds 7 international funds Fixed Income 1 global credit fund Alternatives 1 Impact investing PE fund 40

EMPLOYEES At XP Inc., there are thousands of us, but we are connected for the same purpose. This is what moves us, what makes us unique in the market. This is how we got here and this is how we are going to get to where many say it is impossible. We believe that our people need to feel at ease to be who they are in the work environment, that's why we take the issue of diversity & inclusion so seriously. We seek to enable everyone to exercise their unique abilities and talents, as well as achieve their professional goals, without giving up quality of life and well - being. GRI 103 - 2 103 - 3 Benefits: Preserving Health: Health and dental plan, gympass, running group, psychological support. Saving Money: Meal vouchers, food vouchers, transportation vouchers, day care assistance, legal support. Optimizing the Time: 6 - month maternity leave, 20 - day paternity leave, breastfeeding support room, bicycle parking with locker room. Investir em Você: free Xpeed educational courses with discounts of up to 80%, exclusive investment advisory, access to exclusive investment funds. 41

42 Those who are a part of XP speak to each other as equals and are open to new ideas and opinions . They learn and grow fast, experimenting, making mistakes, and improving . They do not conform to the status quo and propose more practical and simpler improvements . They seek challenges that stretch their skills . And they deliver . At XP Inc., employees are, in fact, owners of the Company: Employee Net Promoter Score (eNPS) eNPS is how we measure overall satisfaction with the company, asking those who work here to what extent they recommend XP Inc. as a good company to work for. We encourage our employees to be transparent. Through monthly Pulse Surveys, employees continuously evaluate the Company and its leaders. Our People Analytics department cross references the results of all internal surveys with those of eNPS, seeking to understand which are the greatest predictors of satisfaction, to prioritize People & Management initiatives and guide decision making. 500 + employees are partners The youngest person to be a partner of the Company was just 20 There is no minimum time to be eligible to be a partner of the Company 100 + people who are partners in the company do not hold leadership positions 2.1 years is the average time to become a partner of the Company 40 % of the company's partners are from the backoffice - 100 Dissatisfied 100 Completely Satisfied 65 Our People

43 We believe that everyone should have ambitious goals and continually challenge themselves. At XP Inc., variable remuneration is based on the goals achieved each semester, based on a process of monthly monitoring of results and 360º evaluation with leaders, team, peers, and internal stakeholders. For support and follow - up, individual performance talks are held, 1:1 “One on One” . We believe that leaders and subordinates need to talk individually with a certain frequency to ensure that everyone is on the right path. At XP Inc., we provide the tools necessary for everyone to be able to own their own journey. Everyone is free to seek to grow vertically in the structure of their department and move internally. For this reason, we organize events called “Na Prática” , in which representatives from a certain department tell in detail what it is like to work there and the profile of those who do well in the department. All employees can access the Internal Openings section on XP Inc.'s internal network to look at possibilities for internal movements. We also have “XP Talks” , a forum in which we talk about culture and career, every two weeks. Here, some of our employees with remarkable and inspirational trajectories give a talk, ensuring that our best examples are shared with the entire company. Goals & Performance

44 All employees have access to Campus XP , with specific materials and training, including on culture, compliance, and internal policies. After joining the Company, several training events are organized to prepare new employees for an environment of constant feedback and performance analysis, with details for Goal Training, Feedback Training, and Field Day. Regarding the ESG theme, we have material for internal training on the subject, the Book ESG , so that all our employees have a complete understanding of ESG factors from the institutional perspective. Also, throughout the second half of 2020, we held specific events with internal departments to disseminate XP Inc.'s ESG concept and positioning. GRI 103 - 2 103 - 3 404 - 1 Training

45 Diversity & Inclusion GRI 103 - 2 103 - In 2020, the Diversity & Inclusion theme became a priority on the agenda of XP Inc. We seek to foster a healthy and safe work environment, in an attempt to eliminate any form of threat or aggression, such as bullying or sexual harassment or any form of discrimination. For this reason, we combat and reject any type of discrimination in relation to gender, race, color, disability, political orientation, sexual orientation, age, religion, HIV status, among other discriminatory aspects. In October, we launched our Manifesto on Diversity: What is DIVERSITY for XP Inc . ? At XP Inc . , we want to transform the financial market to improve the lives of all Brazilians . We believe that for this to happen, the diversity of our country must be reflected in our work environment, and that only then will we be able to develop the best financial solutions for different needs and people . We seek, every day, the responsibility to break away from biases inside and outside XP through our people and commitments to our society. Our employees feel free to be who they really are because they are happier and able to release their transformative power. XP is for me, for you, and for whoever wants to be part of it.

46 XP Inc. Women's Collective XP Inc. Black People's Collective XP Inc.'s Collective for the inclusion of people with disabilities and accessibility XP Inc.'s Collective for creating a safer, more respectful and diverse environment for LGBTQ+ people We have implemented strategies to consider the theme of diversity & inclusion in our internal processes, including the creation of internal affinity groups (MLHR3, Incluir, Seja and Blacks), evaluation and review of our hiring process and inclusion of clauses related to diversity in policies, protocols, and agreements. We also have a Diversity Commission with members of the Executive Board, which address and leverage the theme strategically within the Company.

47 Last year, we made a commitment to have at least 50% women on the staff at all levels of the company by 2025. Over the past semester, we have increased the percentage of women at XP Inc. from 22 % to 26 % . During this period, we had an increase of 22 percentage points in the hiring of women. We also had a 92 % increase in the entry of new female partners at XP Inc ., which represent 17.4% of the Company's total partners. XP Inc . understands that there is a great opportunity for evolution on the subject, mainly because we do not have a significant number of women in leadership . We do not practice wage distinction by gender and work on the objective of having 50 % of female leaders by 2025 . In 2020, we also supported specific education programs with a view to diversity, such as Reprograma , which offers training in programming for cis and trans women, and Instituto As Valquírias , through donating a fraction of the management fee from the Trends Lideranças Femininas fund, a financial product linked to the cause of gender diversity. 50 % Commitment to have 50 % women in the workforce by 2025

48 The procurement, competition, and negotiation process is centralized by the Purchasing Team. The objective is to serve all areas of the Company, generating greater value to the process. Therefore, it is based on our internal Policies and Manuals and also on technical opinions from other departments, such as Information Security, Risks, Business Continuity, among others. XP Inc. manages the supplier registration and approval process with a view to social and environmental risks and ESG factors. We favor, whenever possible, the purchase of products and services from local suppliers from the communities in which our companies are located. In the last quarter of 2020, we developed a process that takes into account social and environmental information when analyzing and choosing suppliers. We reviewed internal policies and manuals, as well as the bilateral agreement between XP Inc. and suppliers, for the inclusion of social and environmental issues , including the prevention of slave, child, and sexual exploitation, respect for the environment, diversity and free union association and fighting all forms of corruption. We reserve the right to terminate any business relationship whenever our pillars are not present in such an agreement. GRI 102 - 9 103 - 2 103 - 3 204 - 1 308 - 2 414 - 2 PARTNERS Suppliers XP Inc.'s supply chain is mainly comprised of 3 macro categories: Technology, Marketing, and Corporate. Suppliers are evaluated by the ratification process and monitored periodically. Other departments are involved in this process, such as Compliance and Money Laundering Prevention. Hiring is governed by the Purchasing Team, dedicated to serving with better quality, deadline, and cost.

Education ESG We believe that we have the role of challenging and educating our stakeholders about the ESG agenda. For this reason, XP Inc. invested in several educational initiatives on the subject throughout 2020, with an emphasis on: Education ESG for Asset Managers We carried out a program for XP's partner asset managers with 2 modules of 7 events on the ESG concept, which had specialists looking more in depth at this concept and bringing examples and benchmarks. In the program, pioneering ESG asset managers in Brazil and around the world shared their experiences and reflections on this agenda. Education ESG for Independent Financial Advisors (IFAs) In partnership with Nordea Asset Management, at Universidade XP (“UXP”), we offer a 4 - hour course on ESG concepts and different approaches, including videos prepared by XP itself for practical application of the ESG concept in the Brazilian financial market, dedicated to IFAs. This strategy aims to train more than 7 thousand IFAs, with the potential to impact more than half a million clients in relation to the ESG agenda. Research ESG We started covering Research ESG at XP, with a dedicated team, being the first research sell - side house with ESG analyses for Brazilian companies. We have created a section dedicated to the topic on the Expert content platform, with content dissemination ranging from thematic reports, to a detailed ESG analysis of companies under the coverage of XP Research. From the beginning, in September 2020, until the end of the year, more than 24 reports were published, 16 companies analyzed and more than 59.7 thousand unique users visited the page, with a satisfaction score of 4.6 (vs. 5.0 maximum). Education for Private Clients and Advisors XP Private, XP Inc.'s private banking, which focus on clients with more than 10 million reais in wealth, sought to raise awareness and train both the internal team and clients on the ESG theme as part of its education strategy. In relation to private banking advisors, an offsite was made on the topic with all bankers and lives were organized with the advisors of the main IFAs offices. Also, with the investment team, a working group was set up to deepen and support the integration of the ESG approach in XP Private's policies and processes. Education ESG for Managers Research XP ESG Education ESG IFAs Education for Private Clients and Advisors 49

WITH PRIVATE CLIENTS, THE FOLLOWING INITIATIVES STAND OUT: New Legacy Academy The objective of the program was to contribute to the formation of new generations of client families. There were two editions with around 16 hours of content focused on the future of business, ESG & Impact investments and philanthropy, totaling some 50 young participants. Women v s Impact Program that brought together around 30 female clients in a space to exchange experiences on female challenges in balancing their different roles and finding their voice in investments. Not Obvious Investments Lives 4 editions were held in this series of lives that aimed to shed light on sustainability issues not often discussed in the financial market, such as oceans, forests, and climate change. Master Class “Sustainable Future” We invited one of the most renowned strategists of the future, Gerd Leonhard, to give a master class on post - pandemic challenges and the role of sustainability in building a positive future. 50

Alternative Week Week with content about alternative funds, with a session dedicated to ESG & Impact Investment. Pitch Day ESG Holding an event in partnership with XP Ventures, XP Inc.'s innovation branch, to give visibility to companies with social and environmental impact. We reached more than 3 thousand views. Evento C - Level We held an event to introduce the ESG agenda for decision makers in companies of the XP Inc. network. XP Events We included sessions at XP events and we hold specific events to deepen the ESG and Impact Investment concepts, with emphasis on: 51

COMMUNITY XP Inc. seeks to take an active position in relation to quality financial education and diversity & inclusion, as it understands that these are important guidelines for its stakeholders and that they generate value for the Company. We seek to fulfill our role as a responsible company in Brazil, doing the right thing and setting an example. In 2020 , we raised more than R $ 33 million for the Juntos Transformamos (Transform Together) project to support philanthropic institutions working on the front lines to fight the effects of the pandemic . +1,3 MM people assisted +R$ 33 MM in funding Regarding the use of tax incentives to direct funds to social, sports, cultural, and health projects, in 2020, XP Inc. directed more than R$ 20mm to various projects. On the Educação Garantida (Guaranteed Education) project, carried out in partnership with Instituto da Criança, in 2018, 2019 and 2020, we school fees to scholarship students from families in economic hardship. We also supported the Instituto Gerando Falcões in its Varejo Social project, carrying out an internal campaign to collect items and donating infrastructure items from our physical offices. 52 donated the equivalent of 27mil

G R I 1 0 3 - 2 | 1 0 3 - 3 Among environmental issues, climate change is recognized as a significant challenge for drawing up public policies, implementing private sector initiatives and creating feasible and identifying solutions in the the financial sector. XP Inc. recognizes the importance of the theme in its business agenda. Since 2020, sectors that are critical in relation to exposure to climate risks , defined by the recommendations of the Task Force for Climate - related Financial Disclosure (TCFD), are been monitored in the products and services agenda of XP Inc., considering our internal practices and risk management methodology. We are analyzing our exposure to climate risks based on our adherence to initiatives such as the CDP, with the aim of structuring a transition strategy and preparing for the advancement of regulatory requirements on this agenda. We are committed to studying how the impact of climate change may affect XP Inc.'s business. Moreover, we increasingly seek to prioritize products that have positive contributions to the climate agenda, in order to encourage this agenda to be properly considered by our clients and stakeholders. 53 ENVIRONMENTAL

In the construction of our new headquarters, Villa XP, we are privileging the use of building infrastructures and obtaining environmental certifications in line with the best environmental management practices in the world . The project fully complies with Brazilian legislation, including, in particular, environmental legislation. But it is not restricted to this, it follows internationally recognized sustainability protocols, such as LEED, and it will have a program for the recovery of native vegetation and the gradual suppression of the eucalyptus currently existing on the ground, as it is an invasive species that harms our biomes. We aim to ensure that construction will follow international sustainability standards, including rational use of water, energy efficiency, reduction, reuse and recycling of materials and resources, quality of the building's internal environments, sustainable space, innovation, and technology. VILLA XP 54

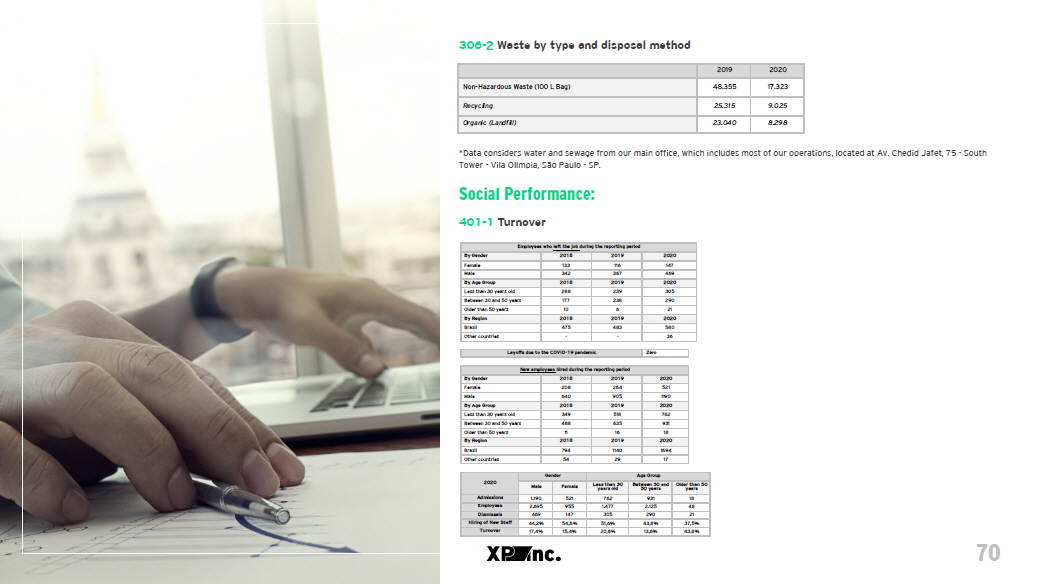

ENVIRONMENTAL FOOTPRINT The Company adopted remote work for all employees, indefinitely . This means that we can now hire and work from anywhere ("XP Anywhere Policy"). This strategy significantly reduced staff travel to our offices, as well as business and commercial meetings, reducing XP Inc.'s carbon footprint. To help us reflect on our role and responsibility in relation to the topic , in 2020 we created XP Bio, an environmental group dedicated to XP Inc. employees. Group members help us to reflect on initiatives that can engage different stakeholders in relation to the environment and initiatives that we should adopt as a responsible company. Furthermore, in 2020, electronic waste without classification of environmental interest by XP Inc. was disposed of in partnership with a specialized company and in an appropriate manner , in accordance with the applicable legislation and regulation. To promote the circular economy and socio - environmental actions, this destination resulted in the donation of 25 computer kits (sets of computers, monitors, cabling and peripherals) to philanthropic institutions and in the planting of 83 tree seedlings through Instituto Refloresta. XP Inc. started the inventory process for its 2019 and 2020 emissions , aiming to identify opportunities to reduce emissions by setting this baseline . The inventory is expected to be completed in May 2021. *Manureversa is a process management company for the disposal of technological waste from the IT, Telecom and Data Center environments interpreted by CETESB without a hazard classification in post or pre - consumption processes, when companies go through their rollout processes (replacement of their technology park) or discard for some quality/obsolescence issue. 55

ESG are 3 letters that bring prominence to people and companies, they end the culture of placing blame. “ “ WHAT COME S NEXT 56

Exper t ESG We have organized a four - day event with national and international experts to deepen the impact of social, environmental and governance factors in the business and investment world. We had Yuval Harari, John Elkington, Jean Case, Fiona Reynolds, among other big names on the subject. Institut o XP Did you know that 7 out of 10 people claim to have no basic knowledge of personal finance and only 3% of people have mastered compound interest? In 2021, we want to help solve this challenge with Instituto XP, the purpose of which will be to transform financial education to improve people's lives and build the Brazil we dream of. ESG Course by XP, B3 & BlackRock We want to make investors aware of their role as an agent of change and the impact of their investments on the world. Therefore, in 2021, we will launch a free educational course on the ESG theme with two strong partners, B3 and BlackRock. New Product Launches Several products labeled as ESG or Impact Investment will be launched in 2021, including proprietary products structured within the scope of XP Asset and customized portfolios for XP Private clients. As a highlight, at XP Asset, we expect to launch a passive fund dedicated to renewable energy and an active managed forest fund. At XP Private, we launched the ESG Portfolios in Brazil and offshore versions for clients, as well as the possibility of customizing the investment mandates based on the ESG & Impact preferences of each private banking client. 57

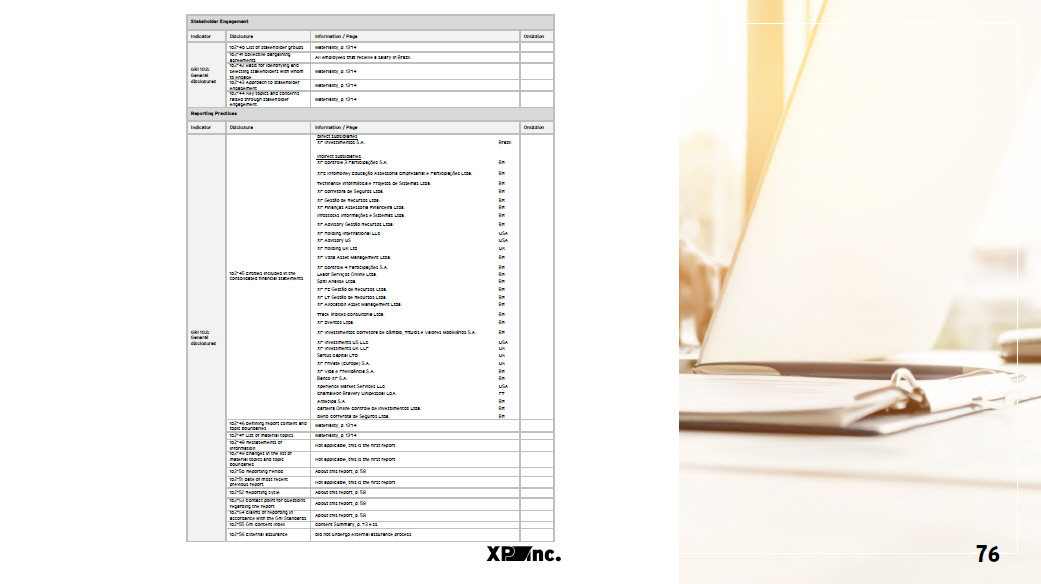

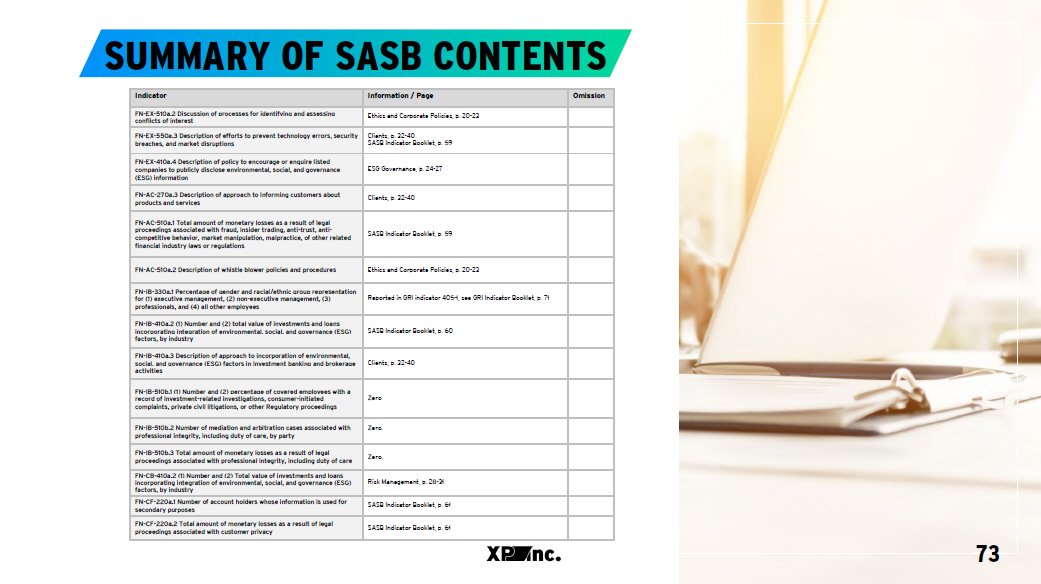

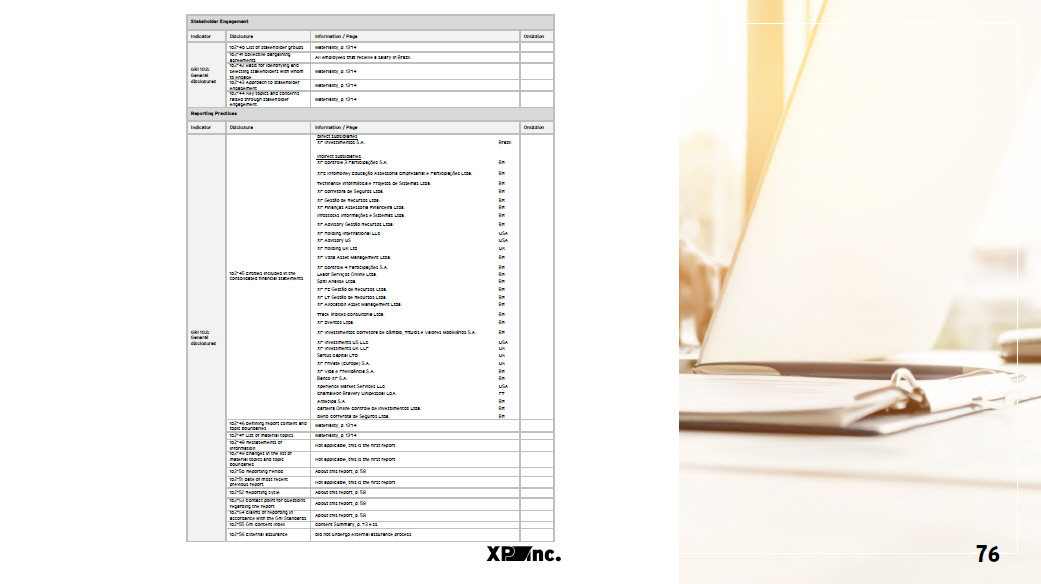

XP Inc. presents its first ESG Report, which covers the period between January 1 and December 31, 2020. It was guided and inspired by the Standards of the Global Reporting Initiative (GRI) and, when applicable, by the indicators of the Sustainability Accounting Standards Board (SASB) assigned to the financial sector, in line with good market practices. The document presents the company's strategy and its socio - environmental impacts, in addition to measures to mitigate possible risks inherent to the business. The ESG Report is intended for all stakeholders, such as investors, suppliers, employees, clients, among others. It was carefully reviewed by the Executive Board and includes environmental, social and governance information, in addition to relevant market data. Doubts, suggestions or more information about the XP Inc. ESG Report 2020 can be obtained through the email Investor Relations - XP Inc. <ir@xpi.com.br> ABOUT THIS REPORT 58 G R I 1 0 2 - 3 2 | 1 0 2 - 5 0 | 1 0 2 - 5 2 | 1 0 2 - 5 3 | 1 0 2 - 5 4

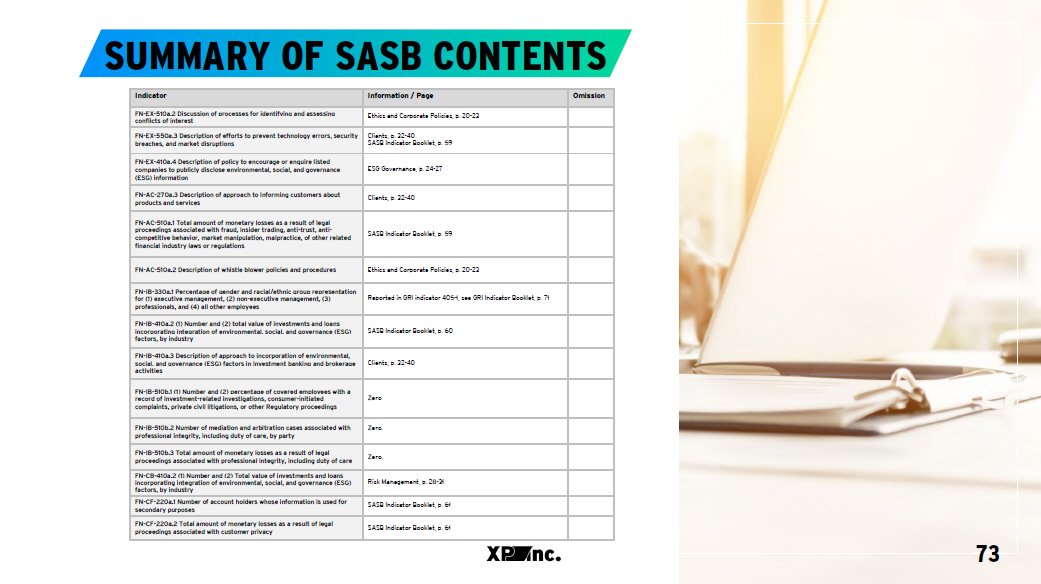

ANEXO: CADERNO DE INDICADORES SASB E GRI 59 The following tables, information and KPIs bring together the main indicators of environmental, social and governance (“ESG”) themes present in the ESG Report and additional information. We strive to be as transparent as possible with all of our stakeholders, including investors, clients, employees, and partners. For more information about the Company and its results, visit the XP Inc. website, under the "Investor Relations" tab. SASB: FN - EX - 550a.3 Description of efforts to prevent technology errors, security breaches, and market disruptions XP Inc. implemented information security controls and data privacy protection through processes and technologies, as well as systems for monitoring actions taken in the internal environment. These controls are constantly evaluated to ensure that they have been implemented correctly and are being used in accordance with the best market practices. We have a structured department responsible for monitoring and responding to malicious actions, with teams working 24/7, as well as reviewing the controls implemented based on the lessons learned. FN - AC - 510a.1 Total amount of monetary losses as a result of legal proceedings associated with fraud, insider trading, anti - trust, anti - competitive behavior, market manipulation, malpractice, of other related financial industry laws or regulations In August 2020, XP CCTVM, subsidiary of the Group, which is a party to Disciplinary Administrative Proceeding n ƒ 12/2016 established by BSM – Supervisão de Mercados, or BSM, a non - profit organization that forms part of the B3 group, received a letter communicating the final decision of the BSM Supervisory Board regarding the calculation methodology to be adopted for purposes of calculating and defining the fine applied to XP CCTVM. Based on the methodology adopted by BSM, the final decision of the Supervisory Board established a penalty equivalent to R$ 35 million, which was fully provisioned for payment.

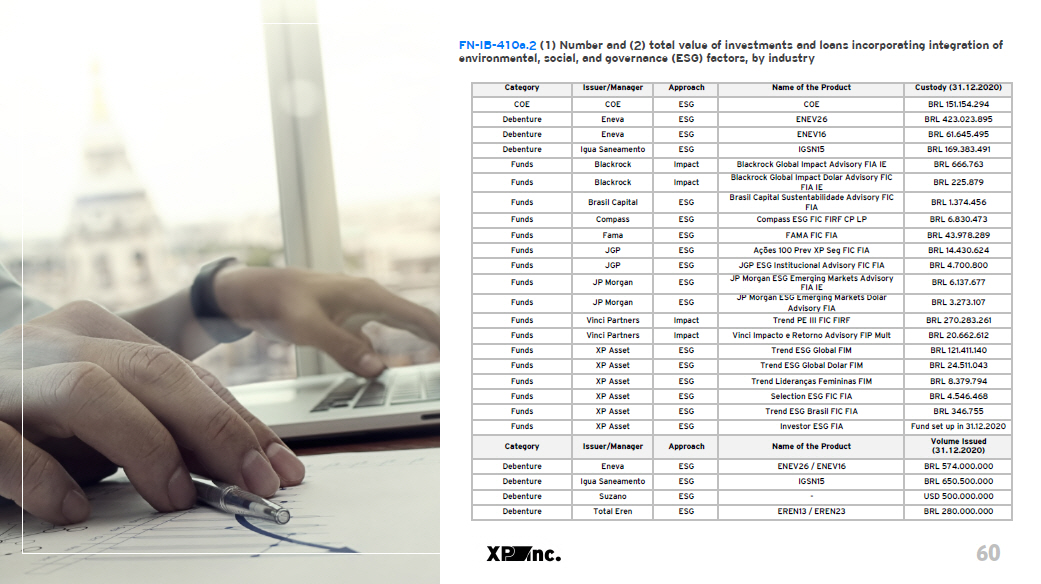

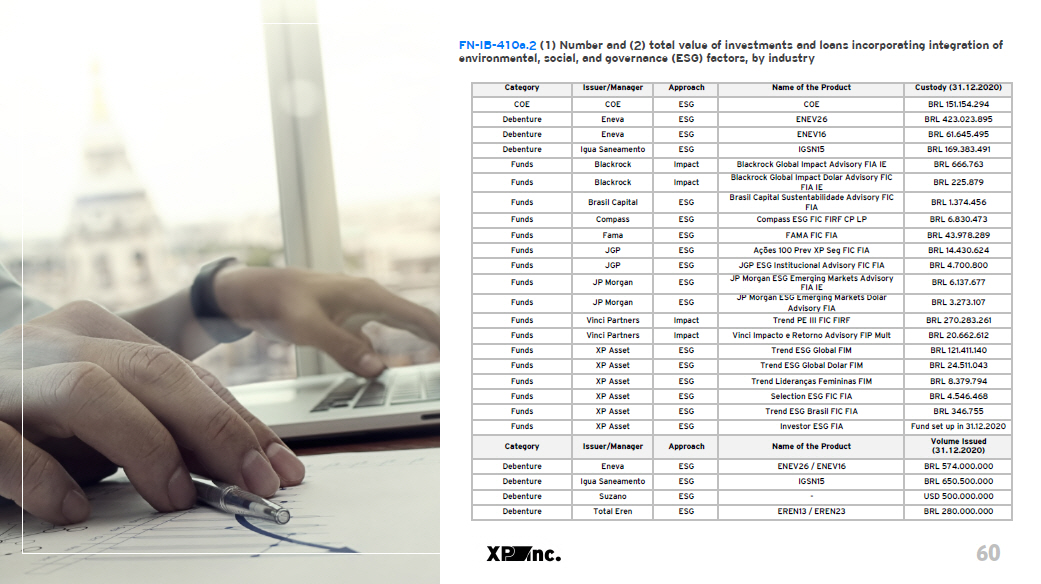

FN - IB - 410a.2 (1) Number and (2) total value of investments and loans incorporating integration of environmental, social, and governance (ESG) factors, by industry 60 Category Issuer/Manager Approach Name of the Product Custody (31.12.2020) COE COE ESG COE BRL 151.154.294 Debenture Eneva ESG ENEV26 BRL 423.023.895 Debenture Eneva ESG ENEV16 BRL 61.645.495 Debenture Igua Saneamento ESG IGSN15 BRL 169.383.491 Funds Blackrock Impact Blackrock Global Impact Advisory FIA IE BRL 666.763 Funds Blackrock Impact Blackrock Global Impact Dolar Advisory FIC FIA IE BRL 225.879 Funds Brasil Capital ESG Brasil Capital Sustentabilidade Advisory FIC FIA BRL 1.374.456 Funds Compass ESG Compass ESG FIC FIRF CP LP BRL 6.830.473 Funds Fama ESG FAMA FIC FIA BRL 43.978.289 Funds JGP ESG Ações 100 Prev XP Seg FIC FIA BRL 14.430.624 Funds JGP ESG JGP ESG Institucional Advisory FIC FIA BRL 4.700.800 Funds JP Morgan ESG JP Morgan ESG Emerging Markets Advisory FIA IE BRL 6.137.677 Funds JP Morgan ESG JP Morgan ESG Emerging Markets Dolar Advisory FIA BRL 3.273.107 Funds Vinci Partners Impact Trend PE III FIC FIRF BRL 270.283.261 Funds Vinci Partners Impact Vinci Impacto e Retorno Advisory FIP Mult BRL 20.662.612 Funds XP Asset ESG Trend ESG Global FIM BRL 121.411.140 Funds XP Asset ESG Trend ESG Global Dolar FIM BRL 24.511.043 Funds XP Asset ESG Trend Lideranças Femininas FIM BRL 8.379.794 Funds XP Asset ESG Selection ESG FIC FIA BRL 4.546.468 Funds XP Asset ESG Trend ESG Brasil FIC FIA BRL 346.755 Funds XP Asset ESG Investor ESG FIA Fund set up in 31.12.2020 Category Issuer/Manager Approach Name of the Product Volume Issued (31.12.2020) Debenture Eneva ESG ENEV26 / ENEV16 BRL 574.000.000 Debenture Igua Saneamento ESG IGSN15 BRL 650.500.000 Debenture Suzano ESG - USD 500.000.000 Debenture Total Eren ESG EREN13 / EREN23 BRL 280.000.000

FN - CF - 220a.1 Number of account holders whose information is used for secondary purposes; and FN - CF - 220a.2 Total amount of monetary losses as a result of legal proceedings associated with customer privacy We have implemented a series of processes and controls that allow us to manage privacy and protect personal data. We periodically report indicators to XP Group's Executive Board, which provide a complete view of the environment's operation, in addition to enabling us to identify problems and outline action plans quickly. We emphasize that there were no monetary losses as a result of legal procedures associated with privacy. 61 GRI: Profile Indicators: 102 - 2 Activities, brands, products, and services To build our business and compete with the large Brazilian banks, we seek to leverage state - of - the - art technologies that bring differentiation and operational efficiencies to scale the business. In recent years, we have been able to consistently innovate, develop our own technological solutions, and evolve our business model in several integrated phases that have supplemented each other and increased our capabilities. We believe this evolution has enabled us to achieve consumer trust in XP Inc. brands and companies, contributing to revolutionize the way financial services are offered in Brazil. XP Inc. is a holding company of companies that are technology platforms and distribute low - cost financial products to their clients. We seek to educate new generations of investors and democratize access to a wide range of financial solutions. We believe that our culture and innovative business model provide strong competitive advantages in the marketplace. Through the development of financial solutions and technology applications aimed at empowering our clients, we seek to provide the best service and user experience in the Brazilian industry. Throughout our history, we have built a broad ecosystem that currently encompasses R$660 billion in assets under custody and serves 2.8 million active clients, including retail investors, institutional investors, and corporate issuers.

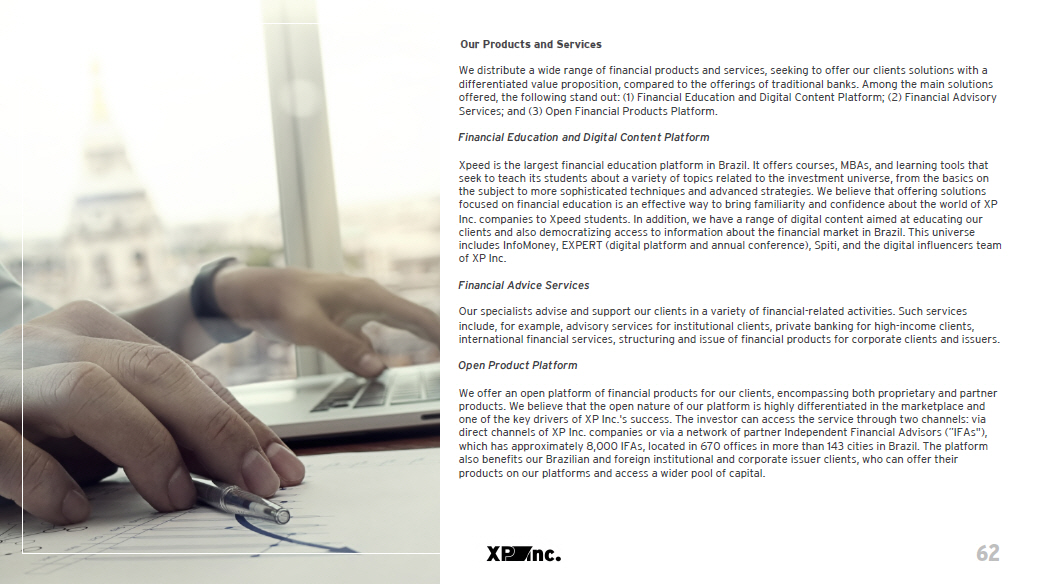

Our Products and Services We distribute a wide range of financial products and services, seeking to offer our clients solutions with a differentiated value proposition, compared to the offerings of traditional banks. Among the main solutions offered, the following stand out: (1) Financial Education and Digital Content Platform; (2) Financial Advisory Services; and (3) Open Financial Products Platform. Financial Education and Digital Content Platform Xpeed is the largest financial education platform in Brazil. It offers courses, MBAs, and learning tools that seek to teach its students about a variety of topics related to the investment universe, from the basics on the subject to more sophisticated techniques and advanced strategies. We believe that offering solutions focused on financial education is an effective way to bring familiarity and confidence about the world of XP Inc. companies to Xpeed students. In addition, we have a range of digital content aimed at educating our clients and also democratizing access to information about the financial market in Brazil. This universe includes InfoMoney, EXPERT (digital platform and annual conference), Spiti, and the digital influencers team of XP Inc. Financial Advice Services Our specialists advise and support our clients in a variety of financial - related activities. Such services include, for example, advisory services for institutional clients, private banking for high - income clients, international financial services, structuring and issue of financial products for corporate clients and issuers. Open Product Platform We offer an open platform of financial products for our clients, encompassing both proprietary and partner products. We believe that the open nature of our platform is highly differentiated in the marketplace and one of the key drivers of XP Inc.'s success. The investor can access the service through two channels: via direct channels of XP Inc. companies or via a network of partner Independent Financial Advisors (”IFAs"), which has approximately 8,000 IFAs, located in 670 offices in more than 143 cities in Brazil. The platform also benefits our Brazilian and foreign institutional and corporate issuer clients, who can offer their products on our platforms and access a wider pool of capital. 62

Our Brands Distribution Network XP Our website and service application for high - income clients, which provides access to all our products and more sophisticated features. Besides XP's internal services, this is the brand available in the offices of independent agents linked to XP Inc. companies. Rico Our online solution for investors who prefer to build their own investment portfolio, providing quality investment services in an easy way, with customized decision - making tools and educational software applications. On September 14, 2020, we announced the elimination of brokerage fees for online stock trading at Rico, reinforcing our commitment towards democratic investments in Brazil. Clear Clear, which was integrated into XP Inc. in 2014, was the first brokerage firm to offer zero brokerage fees in Brazil. Clear's goal is to provide its clients, professional or new investors, with the best investment experience at a low cost, with a focus on Equities. Financial Education and Digital Content Xpeed See description in previous pages. InfoMoney InfoMoney, acquired in 2011, is the largest investment website in Latin America. It reached approximately 9 million monthly single visitors in 2020 and reached the "top 10" in Google search results for an average of approximately 65,000 keywords. Spiti Spiti is a digital platform that produces high - quality content for retail clients and relies on the reputation and expertise of Luciana Seabra and her team. As of December 31, 2020, more than 800,000 daily users accessed the content provided by Spiti. 63

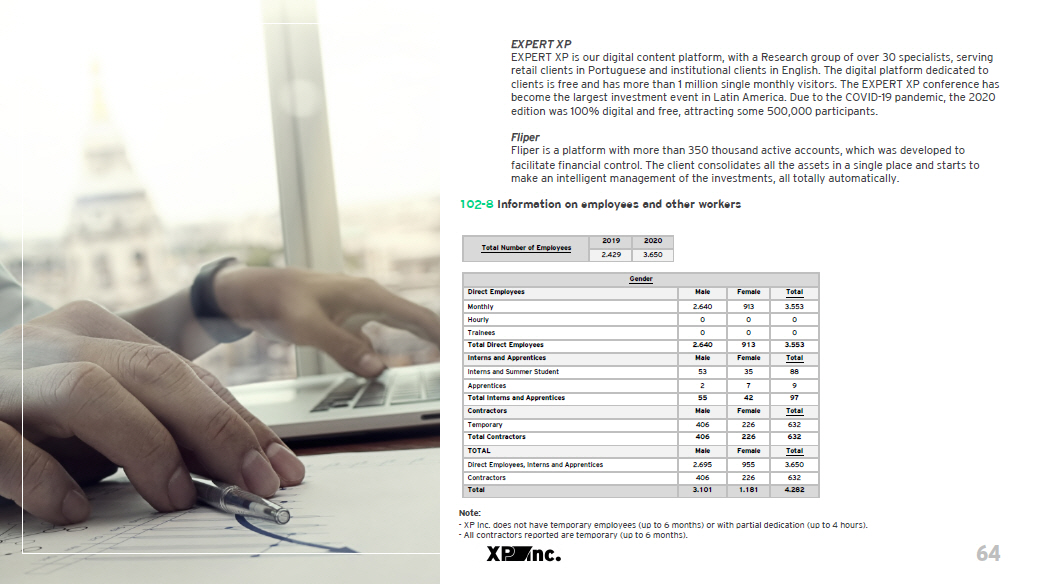

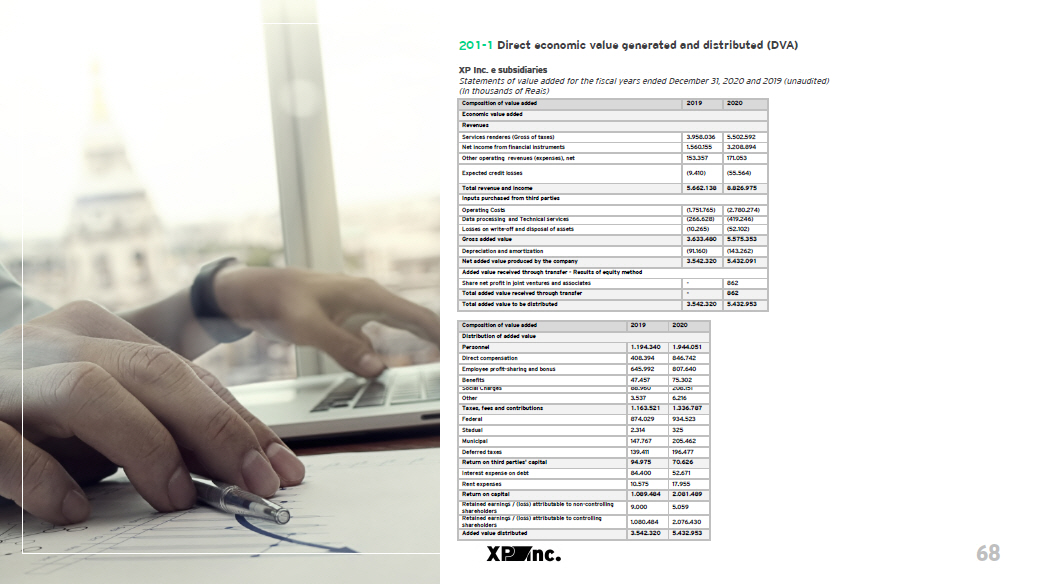

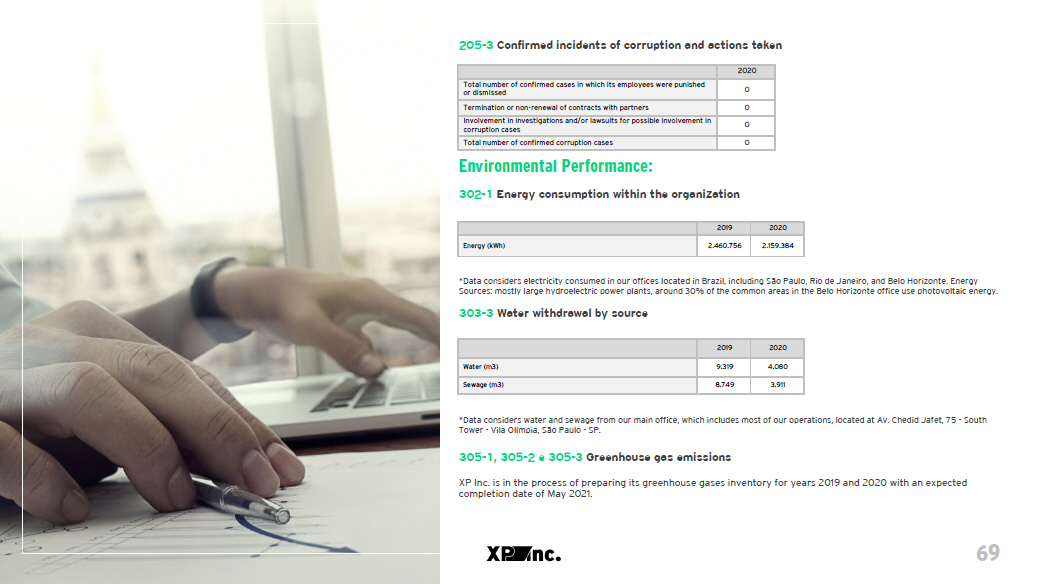

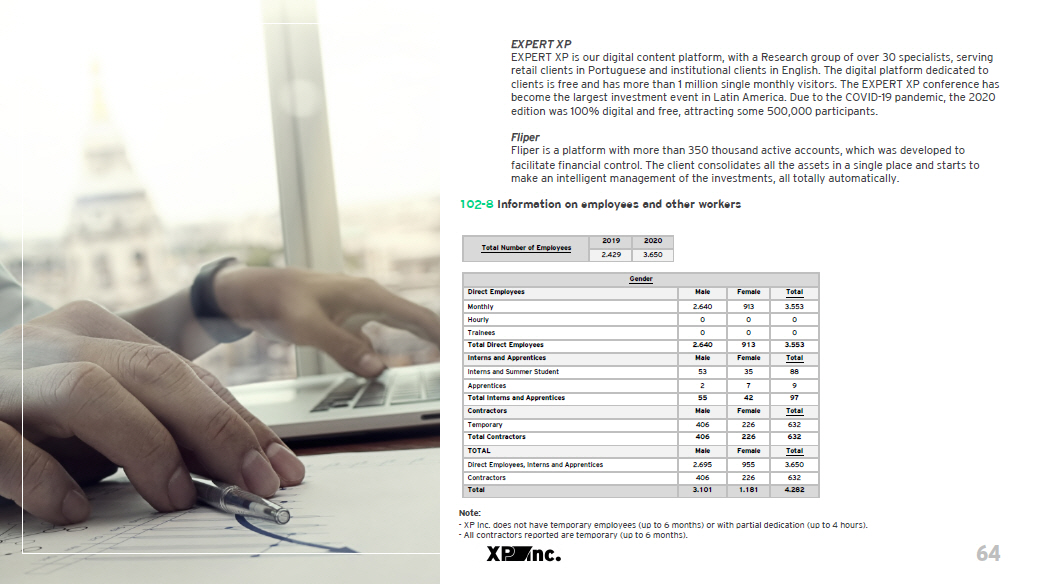

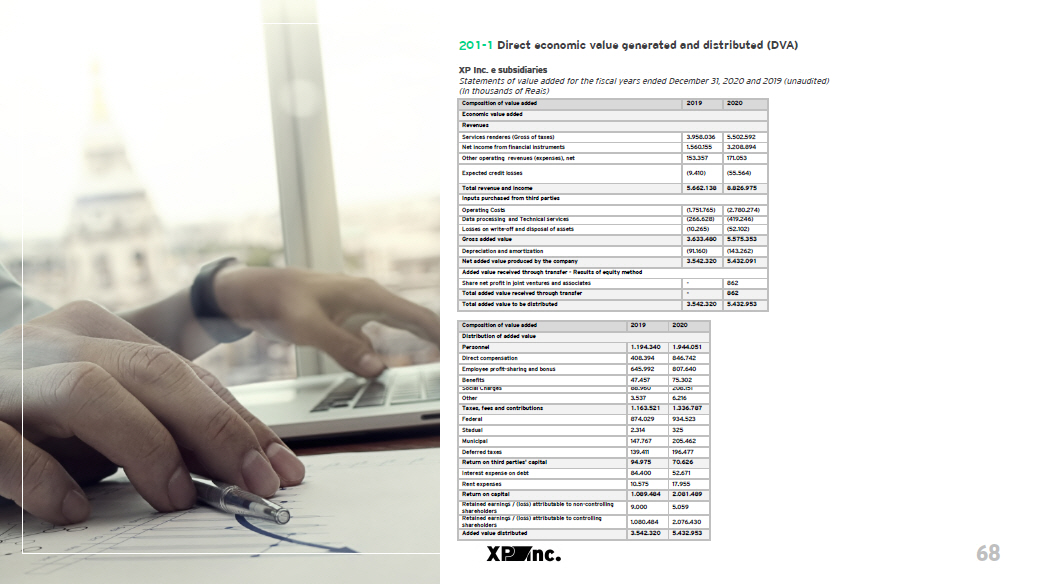

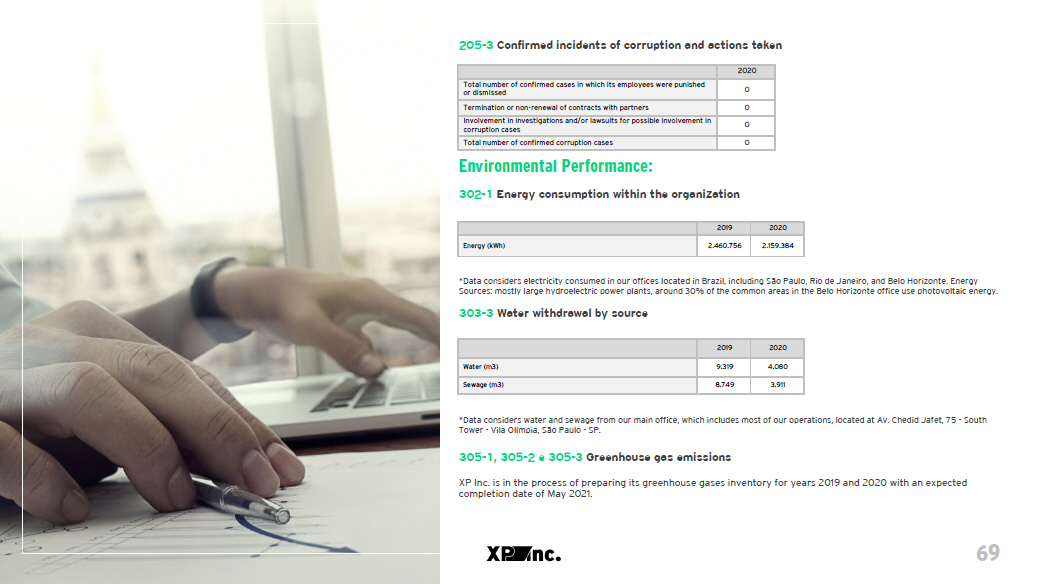

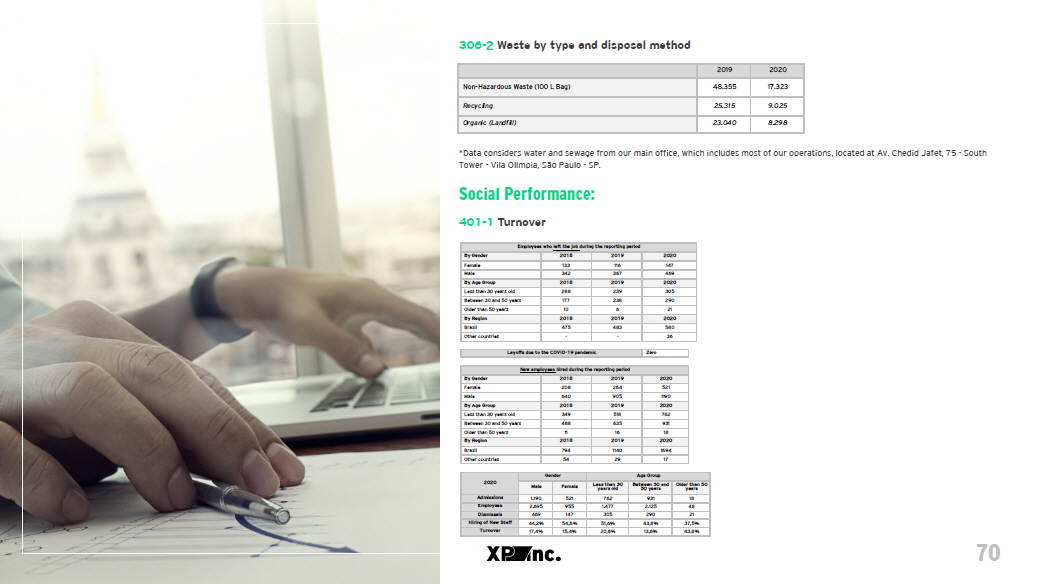

EXPERT XP EXPERT XP is our digital content platform, with a Research group of over 30 specialists, serving retail clients in Portuguese and institutional clients in English. The digital platform dedicated to clients is free and has more than 1 million single monthly visitors. The EXPERT XP conference has become the largest investment event in Latin America. Due to the COVID - 19 pandemic, the 2020 edition was 100% digital and free, attracting some 500,000 participants. Fliper Fliper is a platform with more than 350 thousand active accounts, which was developed to facilitate financial control. The client consolidates all the assets in a single place and starts to make an intelligent management of the investments, all totally automatically. 102 - 8 Information on employees and other workers Note: - XP Inc. does not have temporary employees (up to 6 months) or with partial dedication (up to 4 hours). - All contractors reported are temporary (up to 6 months). Total Number of Employees 2019 2020 2.429 3.650 Gender Direct Employees Male Female Total Monthly 2.640 913 3.553 Hourly 0 0 0 Trainees 0 0 0 Total Direct Employees 2.640 913 3.553 Interns and Apprentices Male Female Total Interns and Summer Student 53 35 88 Apprentices 2 7 9 Total Interns and Apprentices 55 42 97 Contractors Male Female Total Temporary 406 226 632 Total Contractors 406 226 632 TOTAL Male Female Total Direct Employees, Interns and Apprentices 2.695 955 3.650 Contractors 406 226 632 Total 3.101 1.181 4.282 64

102 - 10 Significant changes to the organization and its supply chain The major highlight in terms of significant changes in the Company throughout 2020 and the first few months of 2021 was the announcement of CEO Change: on March 12, 2021, we announced that Guilherme Benchimol will take on the new role of Executive Chairman of the Board of Directors to focus on developing new growth and expansion initiatives, effective May 12, 2021. Thiago Maffra, current Chief Technology Officer, who led the digital transformation of XP Inc., will be the new CEO. 102 - 15 Main impacts, risks, and opportunities Opportunities According to an Oliver Wyman report published in 2019, the five largest Brazilian banks together account for 93% of the R$8.6 trillion in investment assets under custody in the country. Therefore, the addressable market of financial services in Brazil presents a great growth opportunity for XP, Inc. Our business model allows us to operate in the market in a very different way from the large traditional financial institutions. We offer a unique value proposition for clients and partners that incorporates a combination of features, services, and proprietary technologies to provide a highly customized and integrated experience. We rely on a highly efficient model from an operational perspective, which allows us to scale and grow profitably. The key components of our model include: (1) a strong culture focused on our long - term purpose; (2) a synergistic ecosystem; (3) a platform of superior products and services; and (4) differentiated technology. We believe that our model will increasingly benefit from market trends, including some that we have spearheaded, such as the formation of new investors; and the macroeconomic environment in Brazil. Given our leadership, scale, brand and competitive advantages we believe we will benefit from and continue to be a catalyst for: • Continuous growth of the addressable investment market (Assets under Custody); • Continuous shift of custody from banks to independent investment platforms; • Migration from simple products, such as savings, to more sophisticated alternatives; • Continuous expansion of our addressable market into new verticals. We have prepared ourselves over the past two decades to take on the role of our clients' ecosystem. With the launch of the XP Visa credit card and new financial products, we have an immediate opportunity to increase the share - of - wallet of our clients, as well as to attract new clients. We will continue to focus on addressing new opportunities in the financial services market in Brazil and in new markets. 65