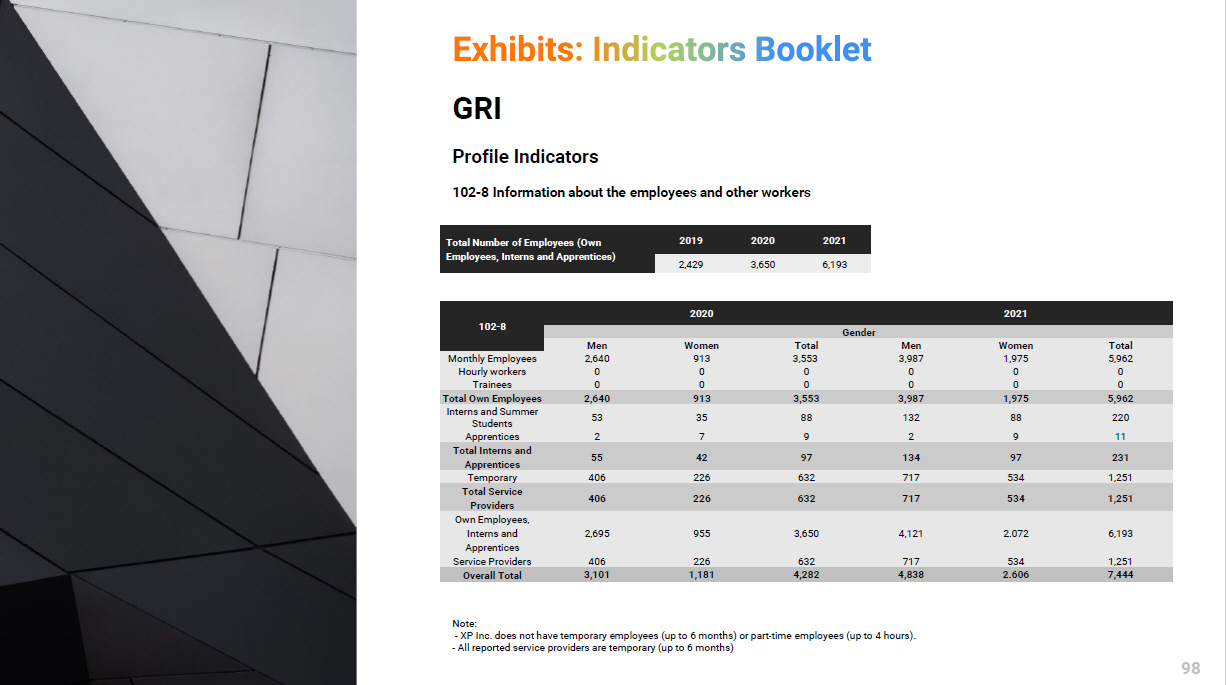

Exhibit 99.1

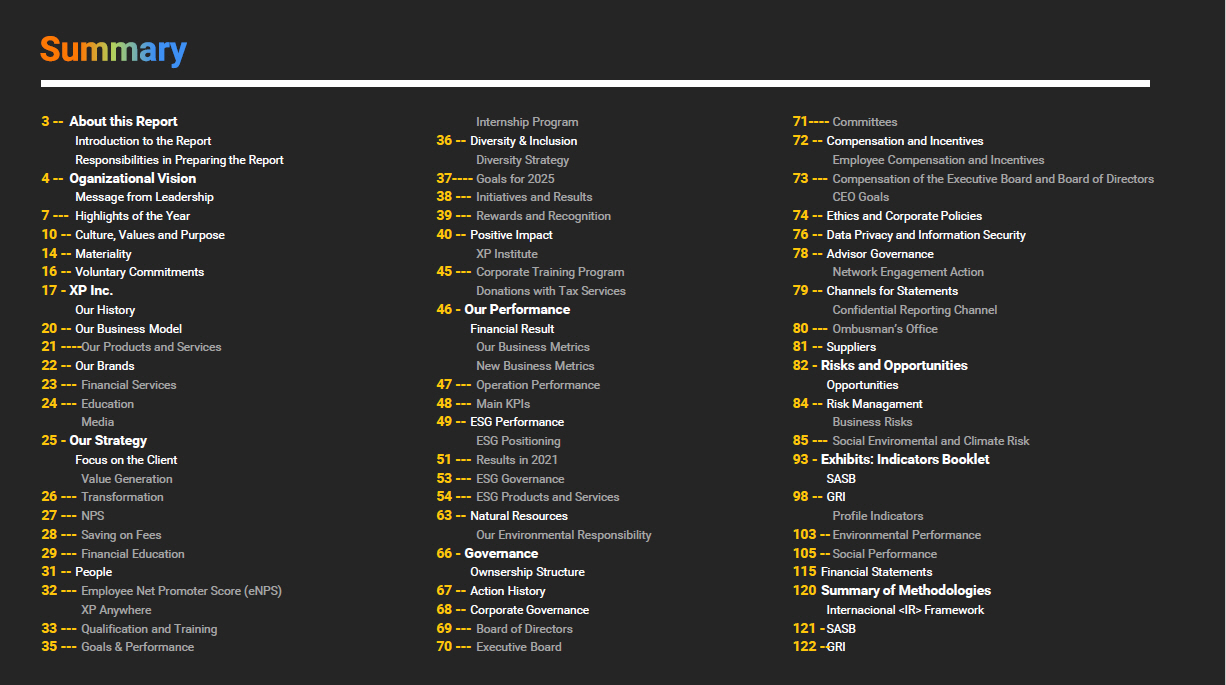

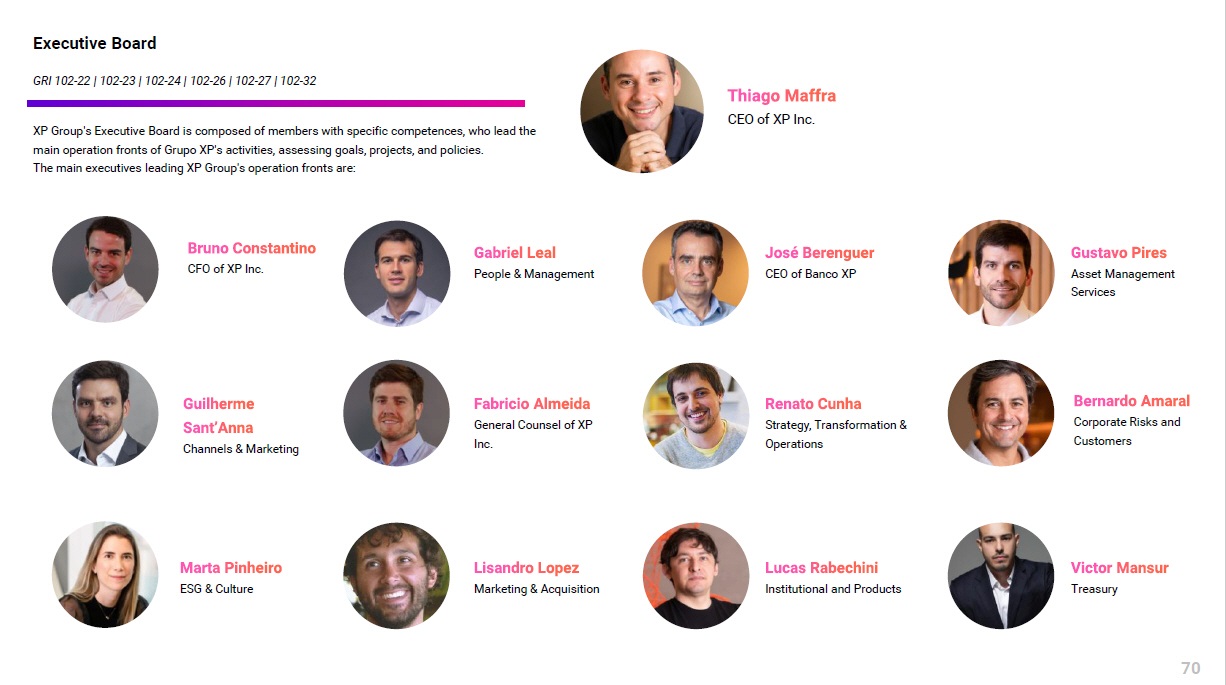

Committees Compensation and Incentives Employee Compensation and Incentives C ompensation of the Executive Board and Board of Directors CEO Goals Ethics and Corporate Policies Data Privacy and Information Security Advisor Governance Network Engagement Action Channels for Statements Confidential Reporting Channel Ombusman’s Office Suppliers Risks and Opportunities Opportunities Risk Managament Business Risks Social Enviromental and Climate Risk Exhibits: Indicators Booklet SASB GRI Profile Indicators Environmental Performance Social Performance Financial Statements Summary of Methodologies Internacional <IR> Framework SASB GRI 3 -- 4 -- 7 --- 10 -- 14 -- 16 -- 17 - 20 -- 21 ---- 22 -- 23 --- 24 --- 25 - 26 --- 27 --- 28 --- 29 --- 31 -- 32 --- 33 --- 35 --- 36 -- 37 ---- 38 --- 39 --- 40 -- 45 --- 46 - 47 --- 48 --- 49 -- 51 --- 53 --- 54 --- 63 -- 66 - 67 -- 68 -- 69 --- 70 --- 71 ---- 72 -- 73 --- 74 -- 76 -- 78 -- 79 -- 80 --- 81 -- 82 - 84 -- 85 --- 93 - 98 -- 103 -- 105 -- 115 120 121 - 122 -- About this Report Introduction to the Report Responsibilities in Preparing the Report Oganizational Vision Message from Leadership Highlights of the Year Culture, Values and Purpose Materiality Voluntary Commitments XP Inc. Our History Our Business Model Our Products and Services Our Brands Financial Services Education Media Our Strategy Focus on the Client Value Generation Transformation NPS Saving on Fees Financial Education People Employee Net Promoter Score ( eNPS ) XP Anywhere Qualification and Training Goals & Performance Internship Program Diversity & Inclusion Diversity Strategy Goals for 2025 Initiatives and Results Rewards and Recognition Positive Impact XP Institute Corporate Training Program Donations with Tax Services Our Performance Financial Result Our Business Metrics New Business Metrics Operation Performance Main KPIs ESG Performance ESG Positioning Results in 2021 ESG Governance ESG Products and Services Natural Resources Our Environmental Responsibility Governance Ownsership Structure Action History Corporate Governance Board of Directors Executive Board

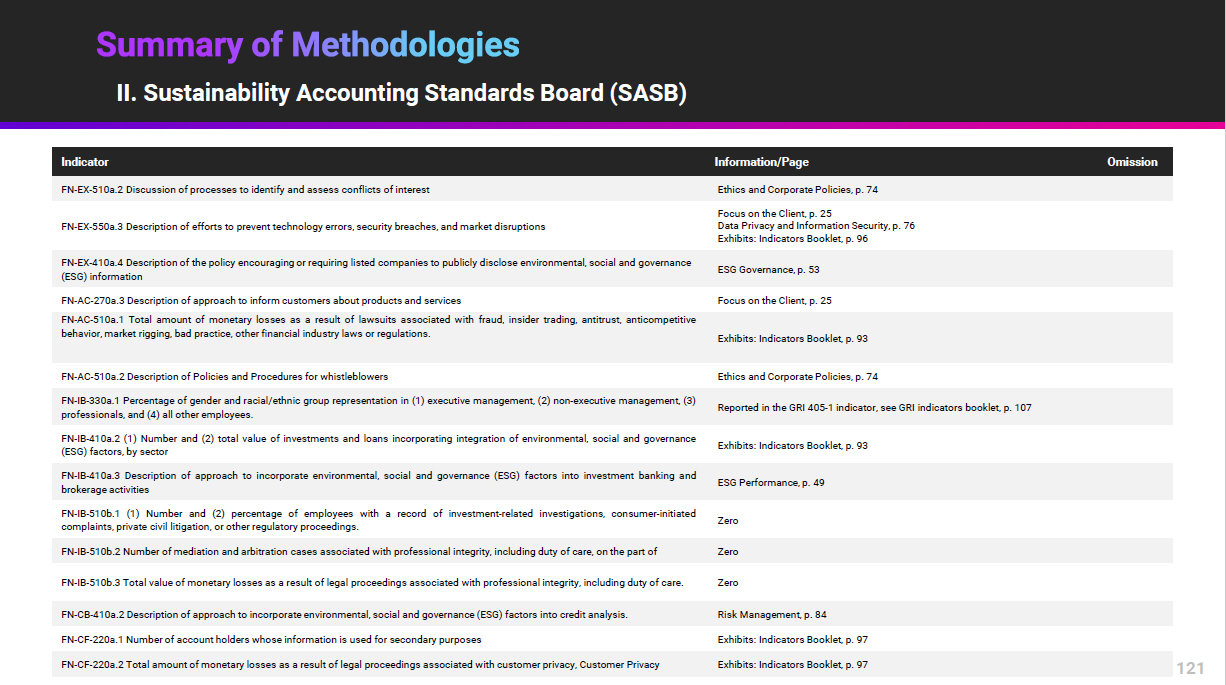

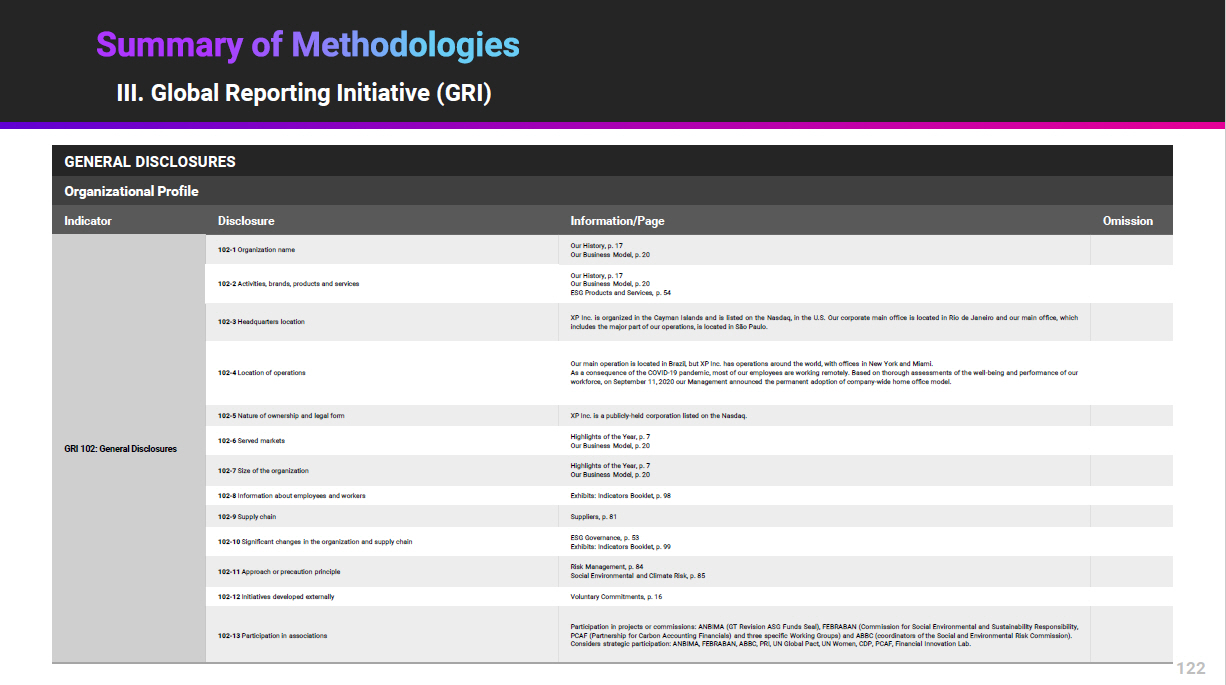

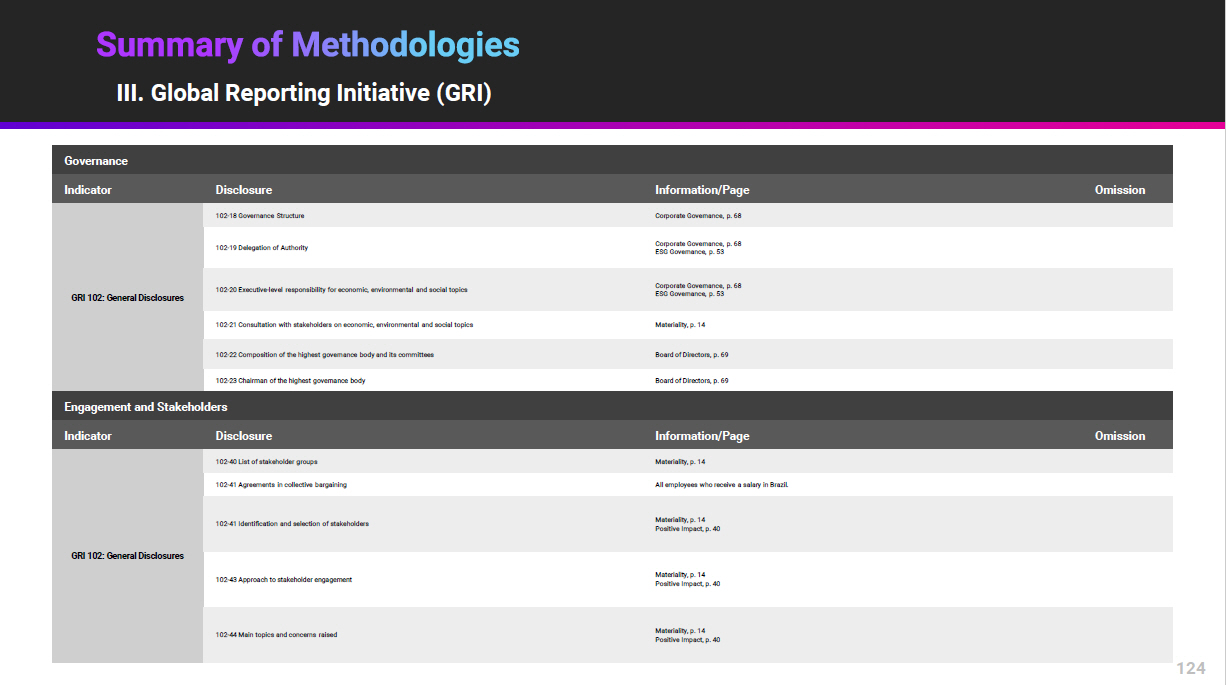

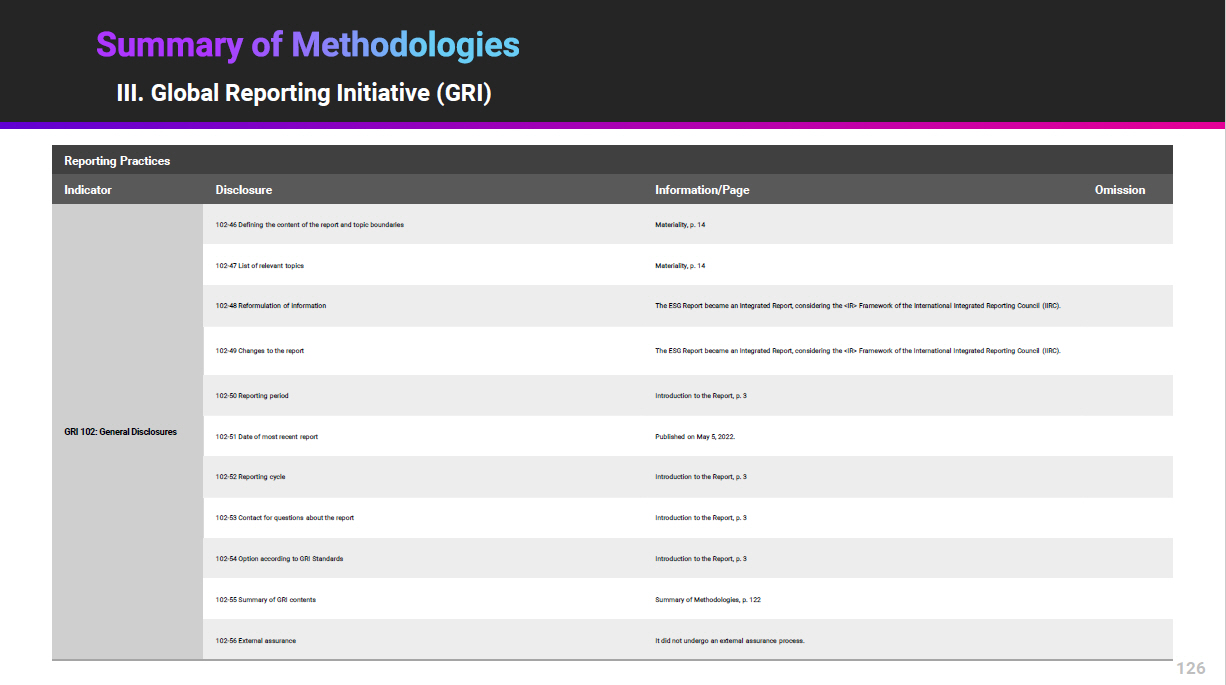

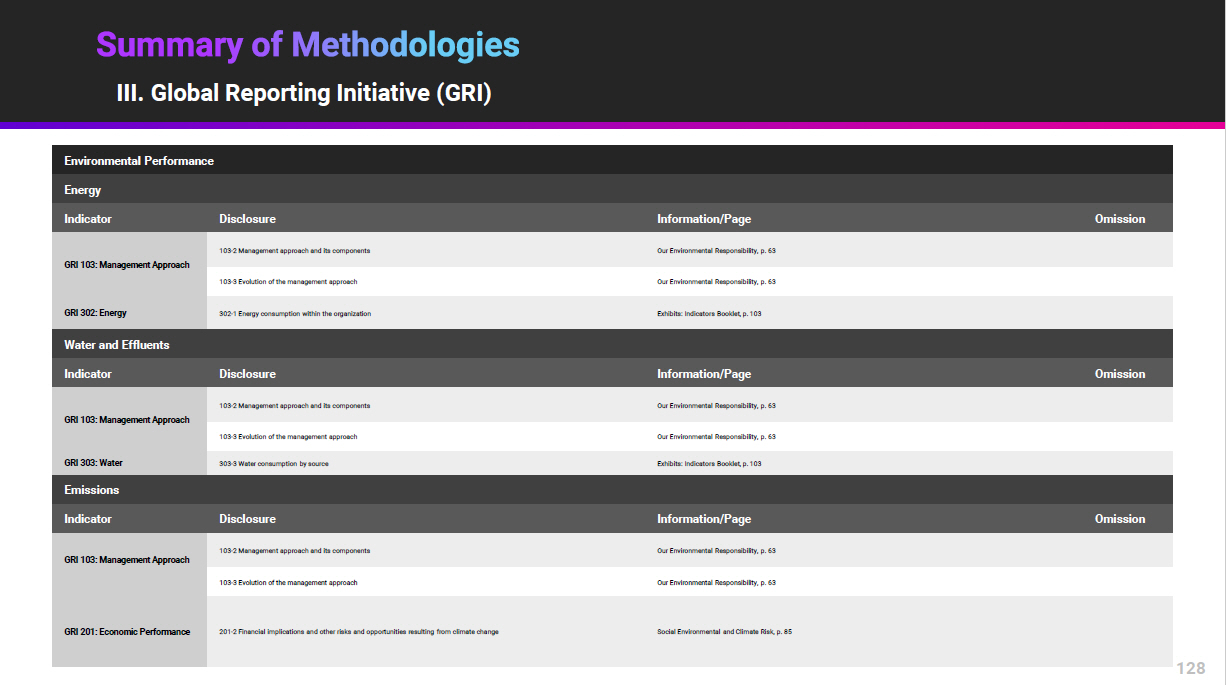

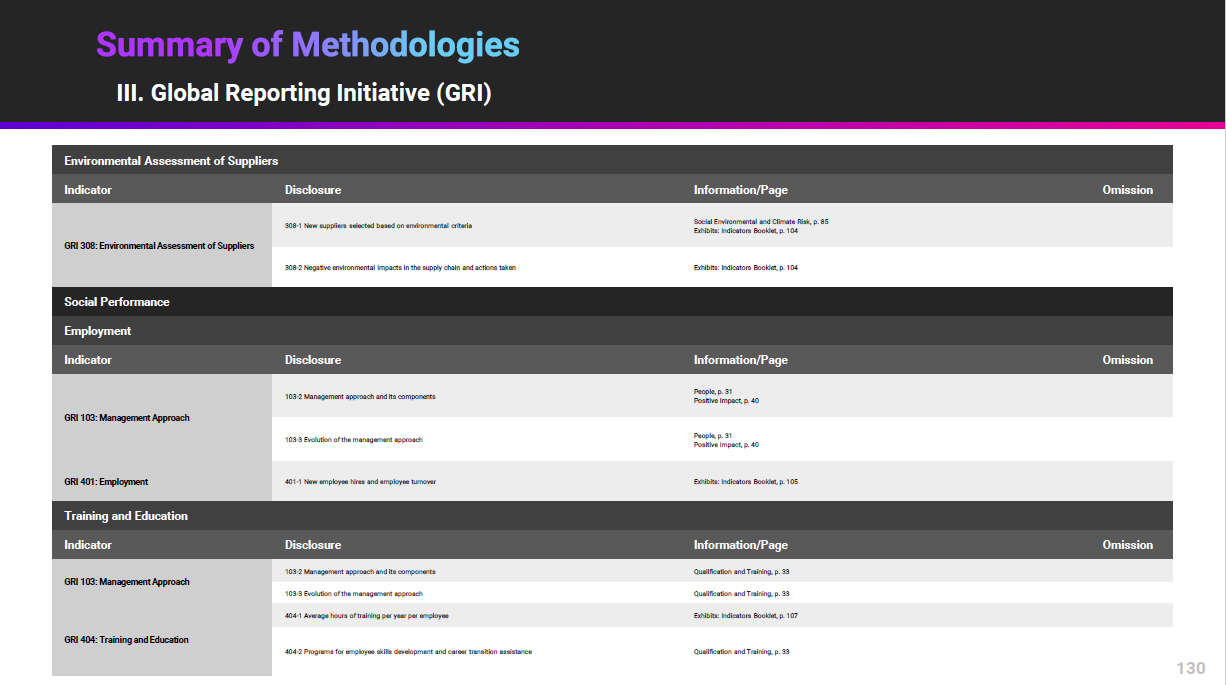

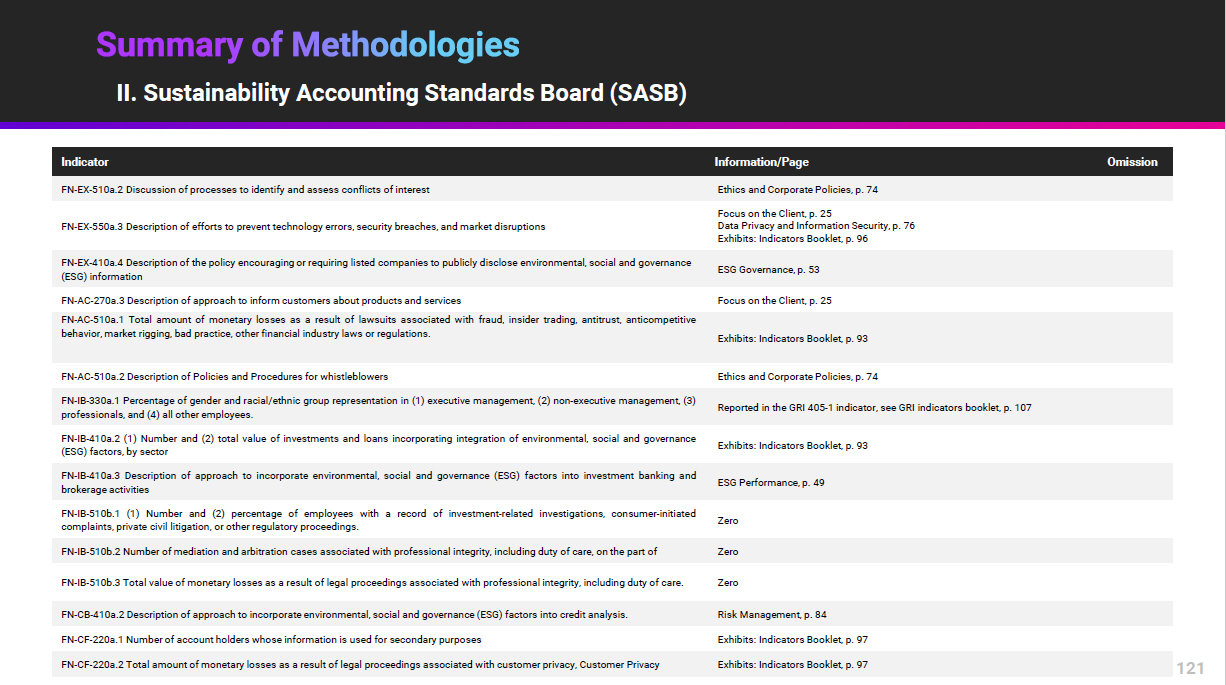

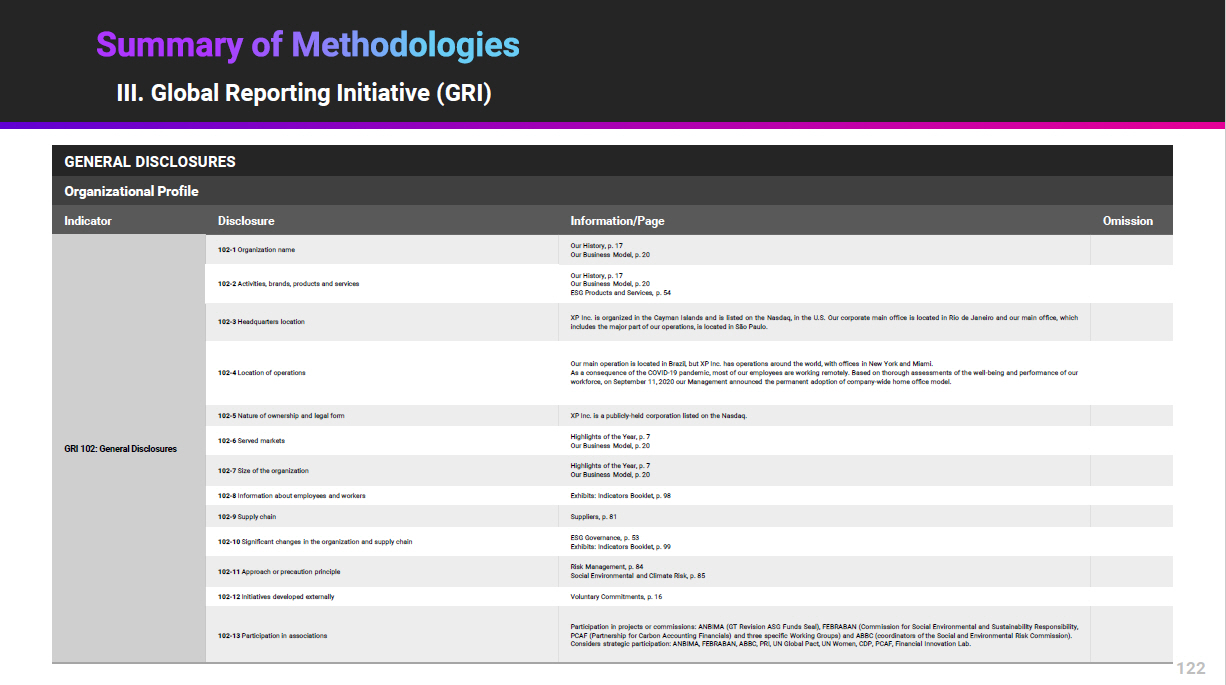

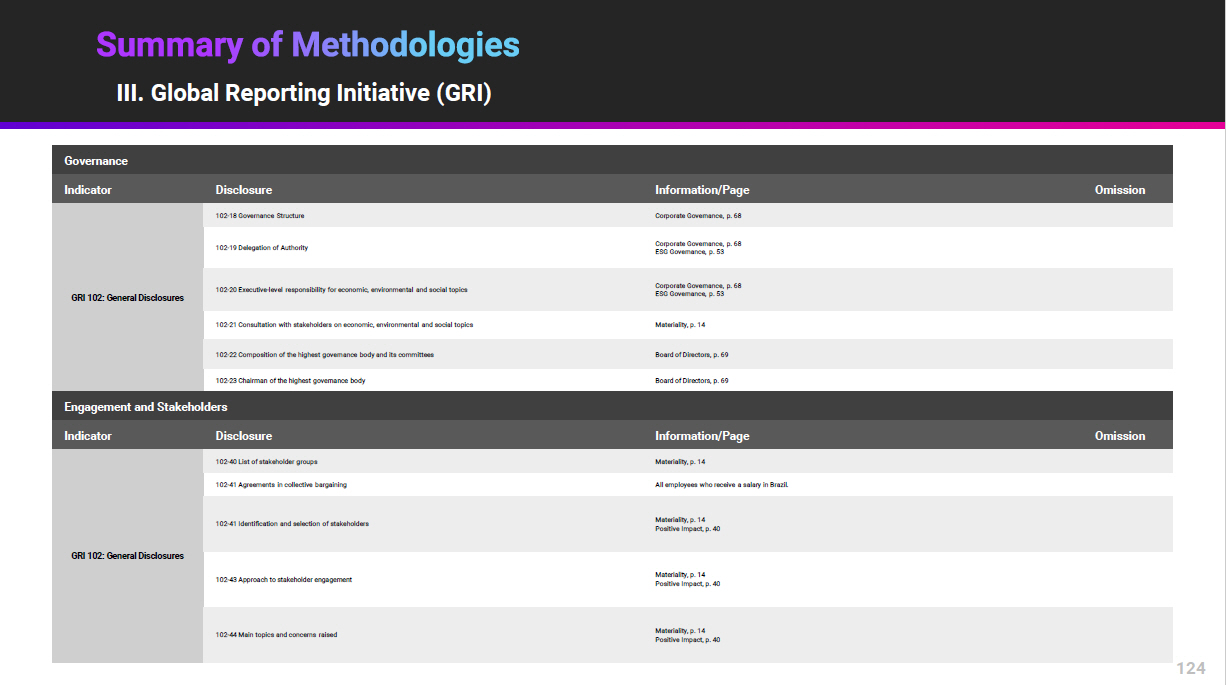

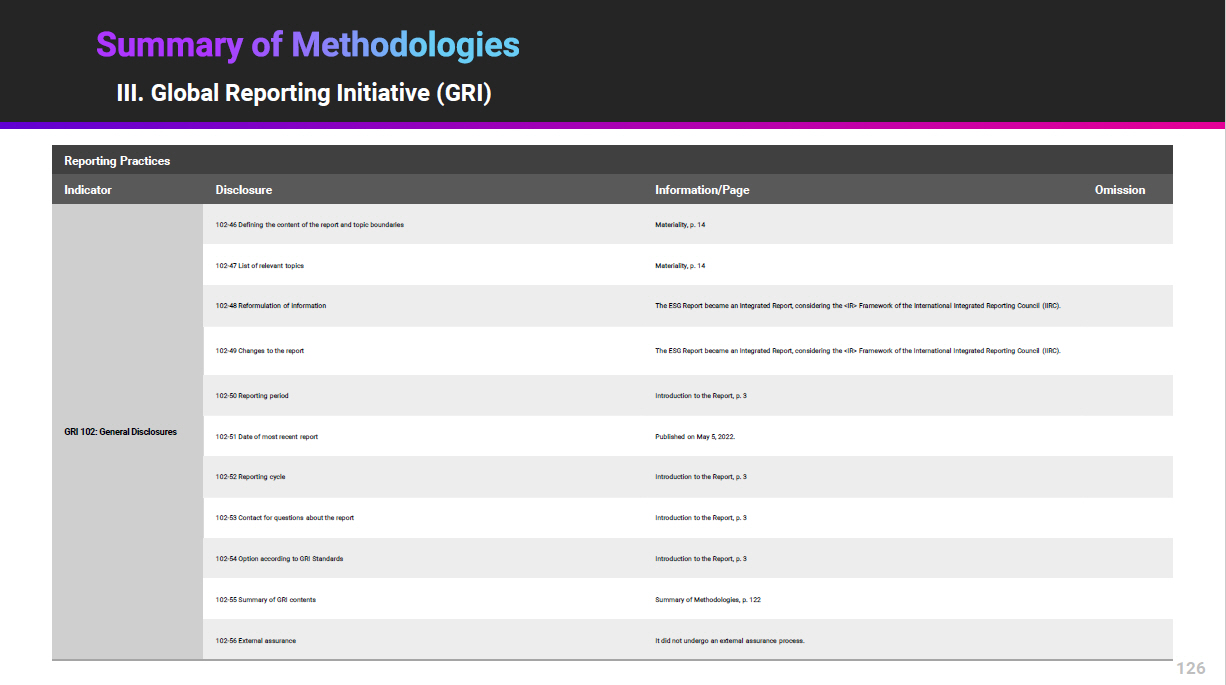

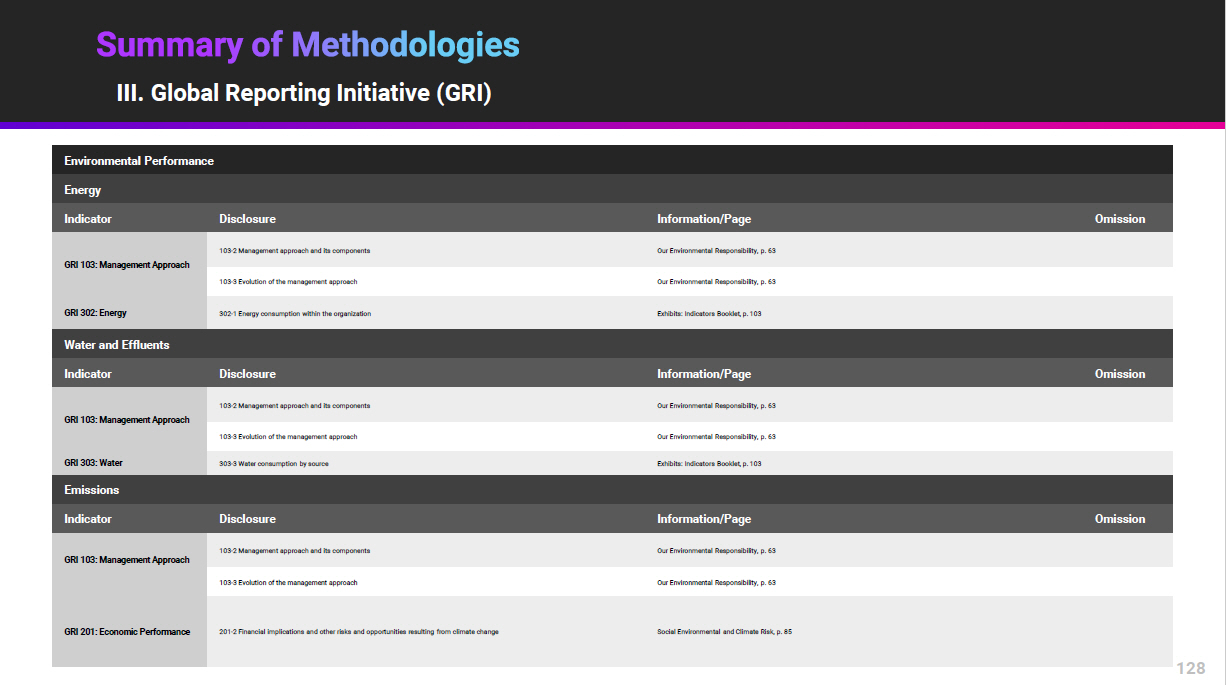

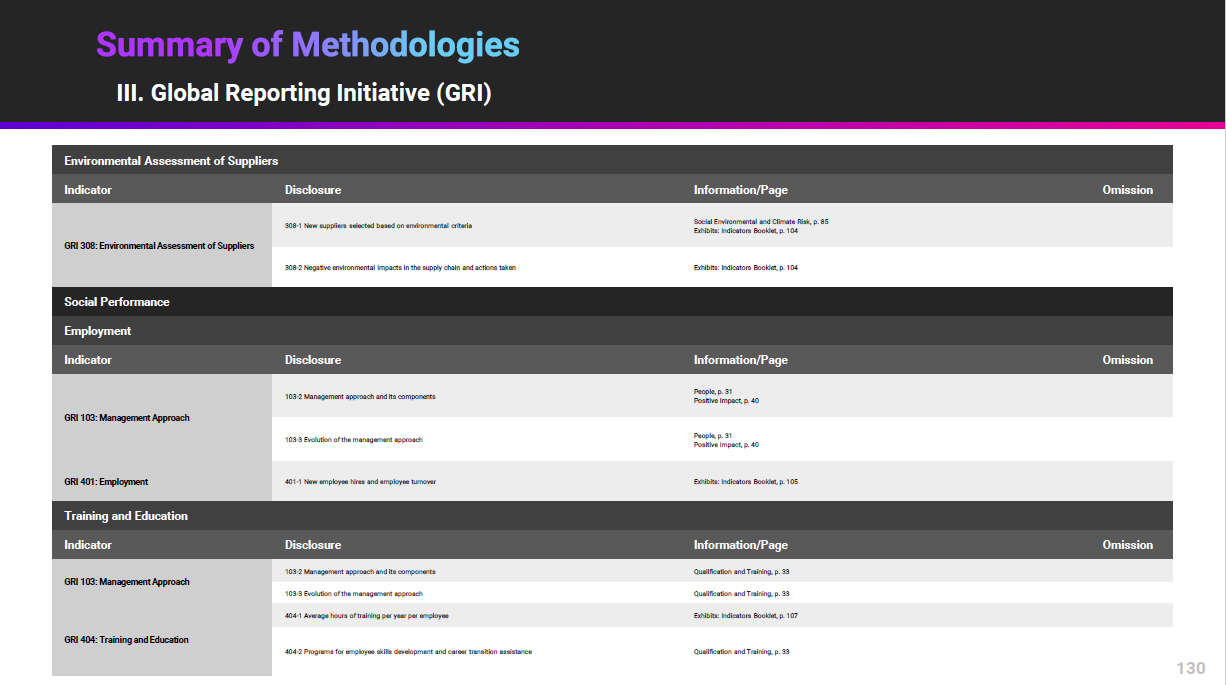

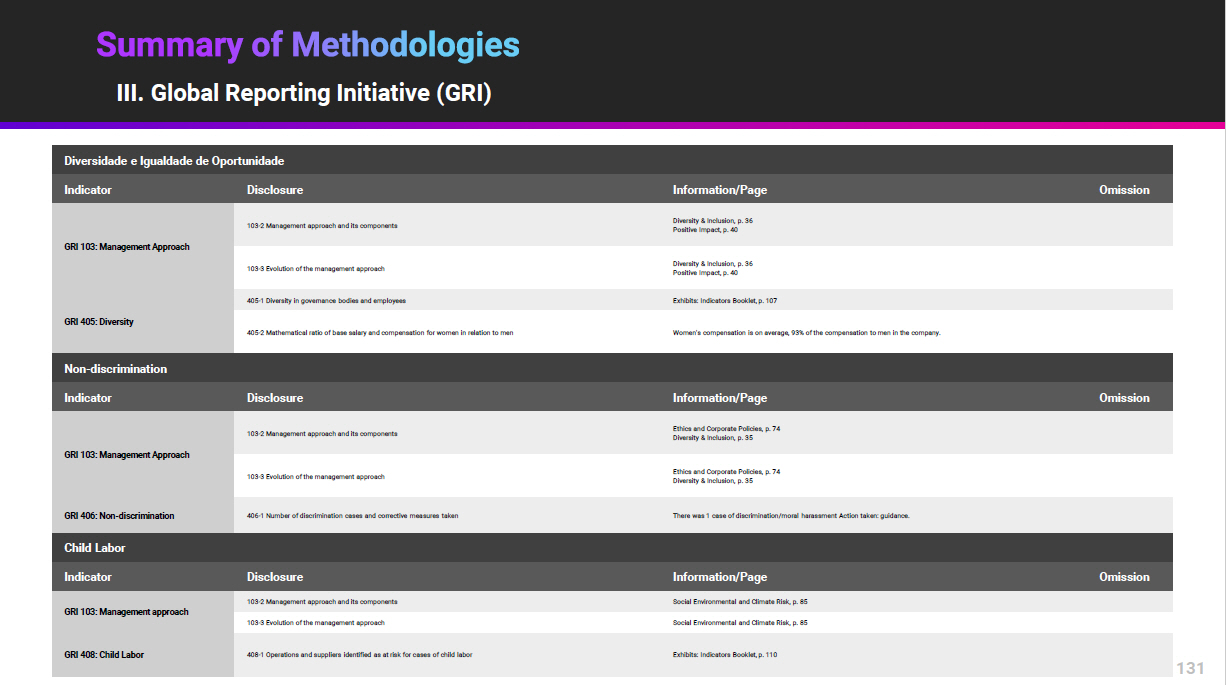

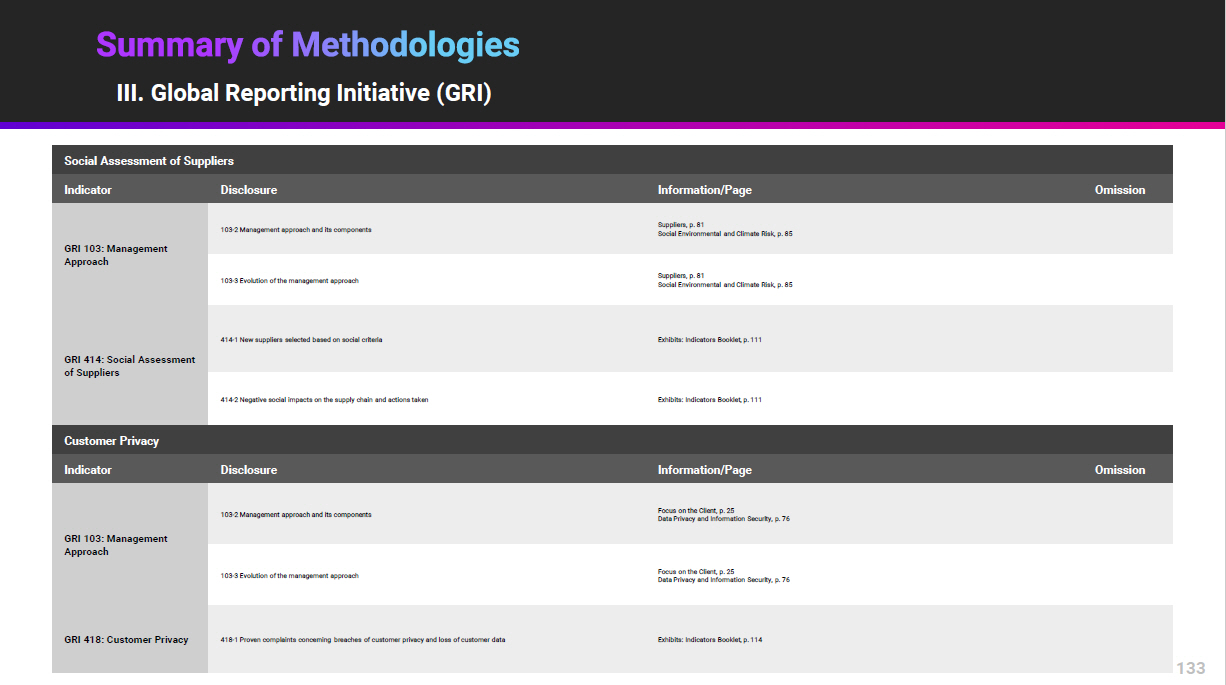

Welcome to XP Inc.’s first Integrated Report (also referred to as "Company" or "XP Group"). This Report comprises a vision of our business, strategy, and performance. The Integrated Annual Report presents the Group's financial and non - financial information, as well as its strategic vision and organization that allow us to create value over the long term. Its main objective is to ensure the commitment to transparency and to explain how, over time, we create value for society and our stakeholders through our brands, business model, and performance, investing our time and making all efforts to improve people's lives. XP Inc.'s Integrated Report was prepared based on The International <IR Framework> protocol, updated in January 2021, a framework of the International Integrated Reporting Council (IIRC). It was prepared using the essential standards of the Global Reporting Initiative (GRI), in addition to, where applicable, standards of the Sustainability Accounting Standards Board (SASB) applied to the financial sector. The financial information considers XP Inc. and its subsidiaries, as identified on form 20 - F, available on XP Inc.’s Investor Relations website and the US Securities and Exchange Commission (SEC), and comply with SEC standards. The Exhibits and a Summary of Methodologies, distributed according to GRI and SASB indicators are at the end of this document. GRI 102 - 32 | 102 - 50 | 102 - 52 | 102 - 53 | 102 - 54 Introduction to the Report Responsibilities in Preparing the Report The Board of Directors of XP Inc. and the ESG Commission are responsible for the content, accuracy and completeness of this Report. In our opinion, it represents a fair and balanced impression of the Company's performance, strategy and management, as well as its ability to create value for stakeholders. The Report also addresses important opportunities and risks arising from our strategy. 3

GRI 102 - 14 | 102 - 15 I am very proud of the ecosystem we are creating and I know we are just getting started.” Chat with our CEO Thiago Maffra , CEO of XP Inc. thinks about the year 2021 and the plans to make XP Inc. increasingly diversified and technological, generating a positive impact on all of its stakeholders. Message from Leadership 4

Does the Integrated Report also illustrate this evolution of XP Inc.? How do you see the accountability to the market and the company's governance and what is the importance of this document for all stakeholders? Transparency is fundamental for us and the Integrated Report is a natural path to provide a complete X - ray of the company to all our stakeholders, which goes beyond accounting and financial information. But more than that, it allows us to have a 360 ° view of all our actions, and not only communicate what has been done in environmental, social and governance (ESG) dimensions, but also look back and think over what we have built so far in an integrated way. For me, this is the main value of a document like the Integrated Report: an in - depth look at our culture, our way of making decisions, our way of thinking and managing our business, our standpoint on diversity, society and the future. This document ultimately helps us explain how, over time, we create value for everyone. 2021 was certainly a remarkable year for several reasons. What assessment do you make of the past year? The year 2021 brought several challenges, but I believe that the entire team at XP Inc. knew how to face each one of them with resilience and tenacity. Even with our country still suffering the consequences of the pandemic, with effects on people, the market and the economy, we continue to work remotely, increasingly integrated and efficient. This connection between all of us was the driving force behind many achievements that certainly make a difference for our customers and society. We can mention, for example, the launch of the XP Card with no annuity and with Investback , the first in the market to return part of the expenses in the form of investments. We also accelerated our growth on new verticals, such as Pensions Funds, Credit and Insurance. The expansion and diversification of our businesses made us rethink our purpose in an ambitious way: to improve people's lives. This goes for everything we do, inside and outside XP Inc. This purpose is a huge responsibility that I assume, along with all the company's employees, in my first year as CEO. Undoubtedly, we had many achievements, such as a record adjusted net income of BRL 4 billion, BRL 815 billion in assets under custody and 3.4 million active clients. And our goal goes beyond taking care of the financial lives of our customers, but also involves our big dream of financially educating 50 million Brazilians through XP Institute, which, by the way, was also born in 2021. I am very proud of the ecosystem we are creating and I know we are only at the beginning. 5

How do you see the future of XP Inc., in a scenario marked by constant technological innovations, driven by Open Finance, for example, in which the ESG agenda becomes increasingly relevant? Technological innovations within the scope of Open Finance are growth catalysts for XP Inc. Just as the ESG agenda allows us to continue leading the way in offering products to investors, such as thematic funds and ETFs (carbon emission reduction, water treatment technology, gender equality, among others). I have no doubts that technology and management based on the ESG agenda will be great differentials for XP Inc., further accelerating our growth. In the case of Open Finance, we have a competitive differential inherent to the size and relevance of our platform, with more than 3.4 million customers, and the largest offer of investment products in the Brazilian market. With the countless opportunities to be made possible by Open Finance, and the consent of our customers for us to learn more about their financial life outside XP, we will be able to have an in - depth understanding of their needs that can be addressed through more targeted and assertive offers. Open Finance is perfectly aligned with our daily efforts to make it happen: democratization of the banking sector, technological modernization and innovation in improving customer experience. With respect to the ESG agenda, I can assure you that we invest energy and resources to ensure that our policies and processes are in line with the ESG criteria in every decision - making. This will certainly be clear and latent in this report. For this reason, I see the future of XP Inc. with enthusiasm and optimism, the past years of growth were also years dedicated to building solid foundations for even greater achievements, positively impacting employees, clients and society in general. And talking about essence, how to ensure that it doesn't get lost with such an accelerated growth? After all, today XP Inc. has over 6,000 employees, triple since the IPO at the end of 2019. How to keep values and culture intact in view of this growth? Our culture is the most important thing we have. Dreaming big, having an open mind, entrepreneurial spirit and focus on the client is our identity, they are our values. Therefore, recruiting people aligned with these values is what will allow us to grow with quality, even working remotely in our "XP from Anywhere" model. This way of working allowed us to attract diverse talents from all corners of Brazil and even the world. Today, we have around 30% of employees outside the state of São Paulo, a number that previously did not reach 2%. And the more we grow in the number of professionals, the more energy we put into the People & Management area and the more we invest in our leadership. We work every day to strengthen our culture. For this, we listen to our employees monthly through surveys, monitor indicators such as eNPS and take data - based actions. Improving people's lives starts with taking a closer look at our people and we are focused on that. XP Inc. turned 20 in 2021. In these two decades, what can you highlight from the company's history and how do you see the next 20 years? In two decades, we made great strides in our journey of transformation in the Brazilian financial market. Undoubtedly, our main legacy was to have empowered clients by offering qualified advisory services, eliminating many abusive fees that were charged and having offered investment options that went far beyond savings. We pushed the big banks out of their comfort zones. In the next 20 years, we will further accelerate our technological transformation, offering increasingly better solutions, to enable our clients to focus their entire financial lives with XP Inc. In the past two years, we expanded our businesses in new verticals: pension funds, credit cards, credit, and insurance. These verticals, added to our Investment core business, represent approximately BRL 800 billion of total annual revenue in the Brazilian financial system, BRL 500 billion of which we intend to address in the short to medium term. Looking ahead, I am sure that what got us here will not define our success for the next 20 years. Society and the market have changed. Transformations will take place at a much faster pace and will require new knowledge and skills. Our ability to reinvent ourselves without losing our essence is what will make us go much further. Improving people's lives starts with taking a closer look at our people and we are focused on that.” 6

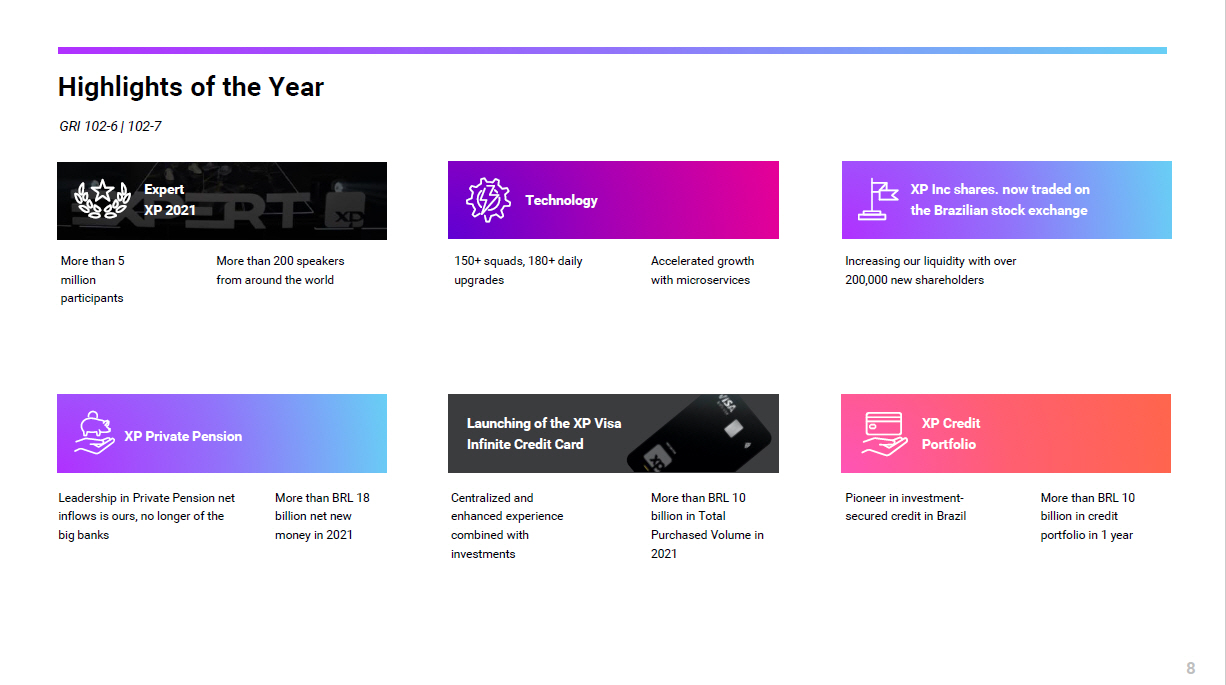

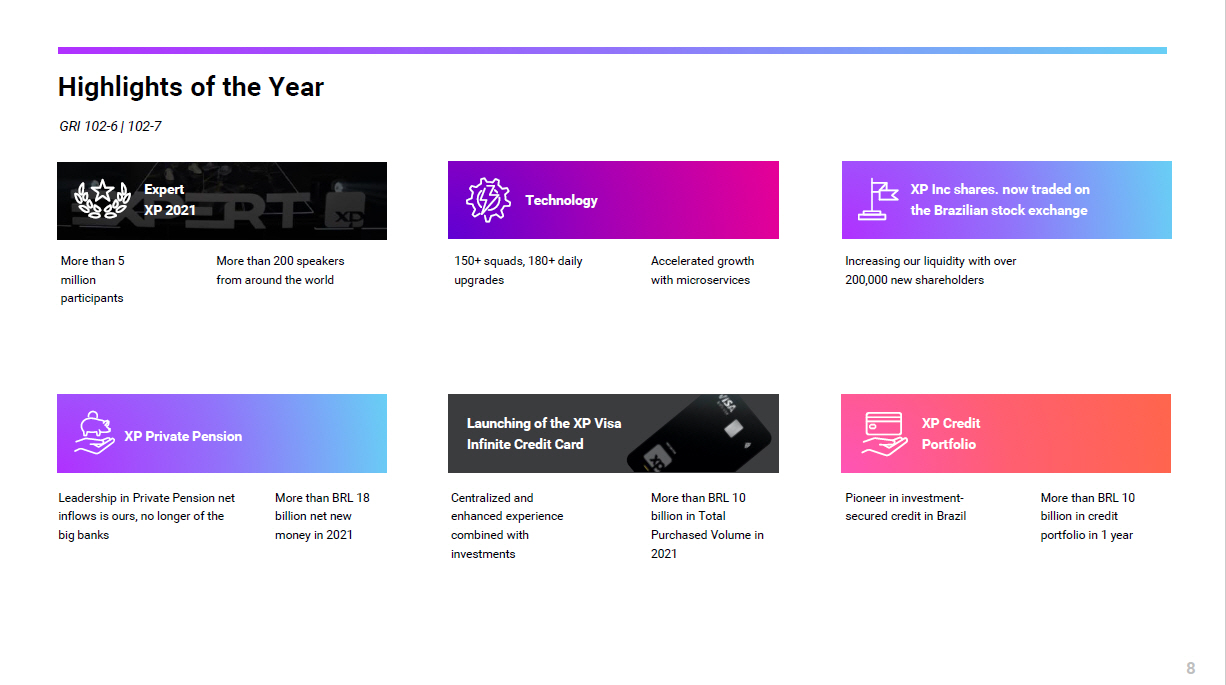

GRI 102 - 6 | 102 - 7 Highlights of the Year 20 years of XP and our new CEO Our leadership is renewed as our culture strengthens Launching of our revised purpose: improve people's lives! We formalize as a value what has always been part of our culture: Focus on the Client XP Inc. Culture Financial Education Xpeed completes 1 year, with more than 50 courses Launch of the XP Institute: our big dream of providing financial education to 50 million people throughout 10 years! Investment in Resilia and Trybe and partnership with Tera 2025 Commitments for women, black people, PwD , and LGBTQI+ We reached 33.4% women, 19.9% self - declared black people and 1.13% people with disabilities at XP Inc. Women in leadership : 71.4% growth from December 2020 to December 2021. XP as sponsor - investor of the Brazilian Olympic Committee and Team Brazil Investing in sports transforms our country! Evolution of our ESG Strategy Democratizatio n of ESG investments: BRL 8.8 billion AUC ESG on the XP platform, with more than 50 investment product options 20 fixed income ESG themed issues and 31 fixed income issues aligned with the green economy and good ESG practices. Organizati on of the first thematic Expert, the Expert ESG Commitment to Diversity 7

GRI 102 - 6 | 102 - 7 Highlights of the Year Expert XP 2021 More than 5 million participants 150+ squads, 180+ daily upgrades Accelerated growth with microservices Technolog y XP Inc shares. now traded on the Brazilian stock exchange Increasing our liquidity with over 200,000 new shareholders Centralized and enhanced experience combined with investments More than BRL 10 billion in Total Purchased Volume in 2021 XP Credit Portfolio Pioneer in investment - secured credit in Brazil XP Private Pension Leadership in Private Pension net inflows is ours, no longer of the big banks More than BRL 18 billion net new money in 2021 Launching of the XP Visa Infinite Credit Card More than 200 speakers from around the world More than BRL 10 billion in credit portfolio in 1 year 8

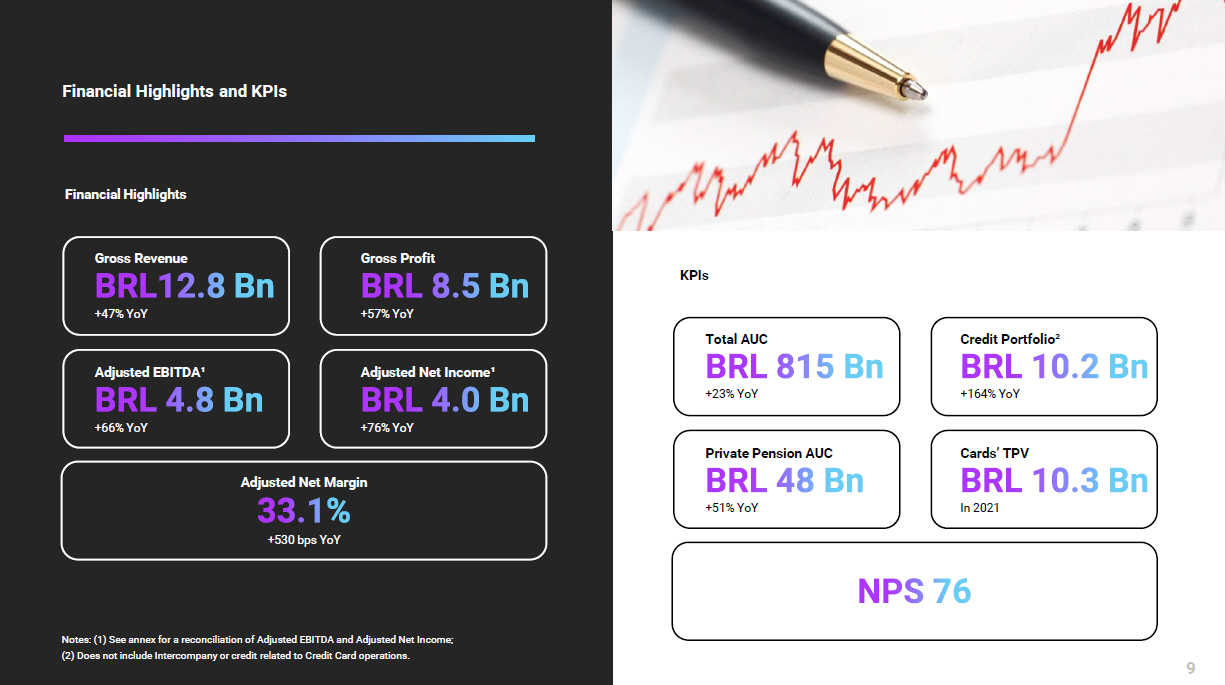

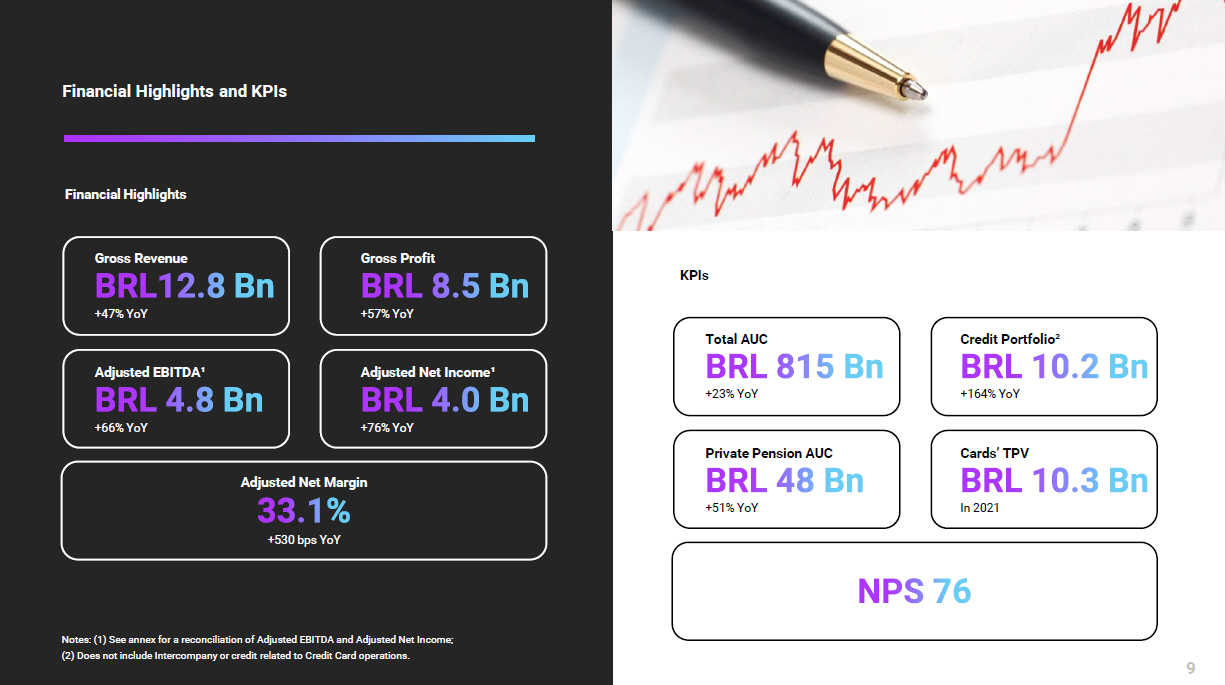

Financial Highlights and KPIs Financial Highlights KPIs Gross Revenue +47% YoY Gross Profit +57% YoY Adjusted EBITDA¹ +66% YoY Adjusted Net Income¹ +76% YoY Adjusted Net Margin +530 bps YoY Total AUC +23% YoY Credit Portfolio² +164% YoY Private Pension AUC +51% YoY Cards’ TPV In 2021 Notes: (1) See annex for a reconciliation of Adjusted EBITDA and Adjusted Net Income; (2) Does not include Intercompany or credit related to Credit Card operations. 9

Since our foundation in 2001 in a small office of independent financial advisors in Porto Alegre, the culture and purpose of our company are experienced daily. And that is precisely why more than 20 years later we can say that they were differentiating factors for our successful history until today. GRI 102 - 1 | 102 - 2 | 102 - 6 | 102 - 7 Culture, Values and Purpose In 2021, we revised our purpose, to better reflect our impact. From transform the financial market to improve people's lives to only improve people's lives. A change full of meanings. After all, we know that XP Inc. influences and has influenced the financial markets to be more transparent and democratic. Today, we know that we can go much further than that. 10

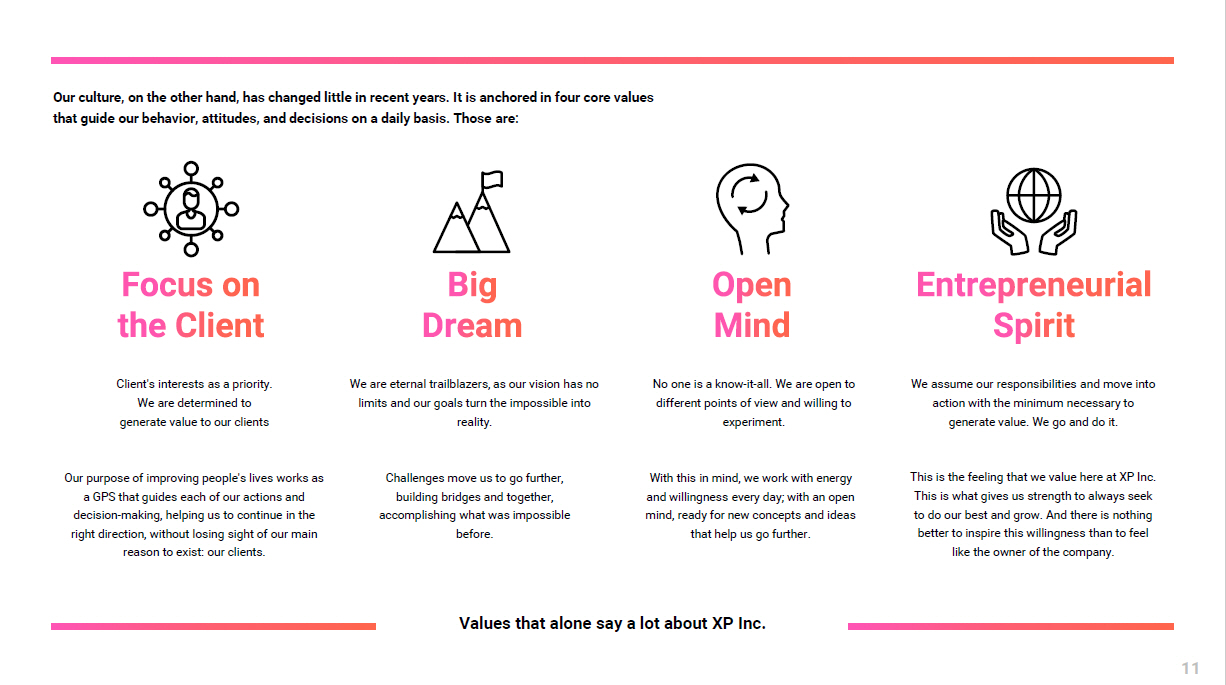

No one is a know - it - all. We are open to different points of view and willing to experiment . With this in mind, we work with energy and willingness every day; with an open mind, ready for new concepts and ideas that help us go further. Our culture, on the other hand, has changed little in recent years. It is anchored in four core values that guide our behavior, attitudes, and decisions on a daily basis. Those are: Client's interests as a priority. We are determined to generate value to our clients Our purpose of improving people's lives works as a GPS that guides each of our actions and decision - making, helping us to continue in the right direction, without losing sight of our main reason to exist: our clients. We are eternal trailblazers, as our vision has no limits and our goals turn the impossible into reality. Challenges move us to go further, building bridges and together, accomplishing what was impossible before. We assume our responsibilities and move into action with the minimum necessary to generate value. We go and do it. This is the feeling that we value here at XP Inc. This is what gives us strength to always seek to do our best and grow. And there is nothing better to inspire this willingness than to feel like the owner of the company. Values that alone say a lot about XP Inc. 11

We are open to innovation always based on facts and data, with no fear of making mistakes and willing to correct. We take a leading role in decision - making and focus our time on long - term generation. This is how we define our values. And how do we manage this culture? How do we ensure that everyone is following what we call the XP Inc.’s Culture Code? With metrics and data, but also with examples to be followed. We know that an attentive look at the company's culture is what leads us even further, with team spirit, persistence, and resilience. That is why we have tools on which we rely on to manage our culture: Market Survey: A systemic quantitative and qualitative view with a comparative basis within the financial services, technology and startups market in Brazil and worldwide, carried out every two years. 360 Appraisal: Takes place every six months with the objective of measuring the cultural alignment of our employees with an appraisal of their leaders, peers, team and stakeholders (on average 20 appraisers per employee). This appraisal is used in the performance and meritocracy cycle and directly impacts each employee's compensation. Pulse Survey: Carried out monthly, it has 3 dimensions – leadership, company, and team. Pulse is the basis for all improvement action plans carried out by the People & Management area, as well as the leaders of XP Inc.'s areas, with the support of its HR Business Partners. e - NPS: The Employee Net Promoter Score and the Leadership Net Promoter Score are measured systematically throughout the year. The eNPS , measured monthly, is a final goal present in the People & Management team up to the top leadership, as well as part of our CEO's goal. Glassdoor : Follow - up, monitoring, and analysis of comments on the platform, regarding points that mention XP Inc.’s culture. 12

The challenge of XP Inc.'s exponential growth and 100% remote work (XP Anywhere) The challenge of XP Inc.'s exponential growth and 100% remote work (XP Anywhere) makes managing culture on a day - to - day basis a responsibility for everyone, People & Management team and leaders, including initiatives on the selection process, onboarding, development, belonging and recognition. At each such initiative we place culture as the central thread of the product development and narrative construction. Culture at XP is lived and managed 13

XP Inc. considers that the financial sector has a unique role in the interaction of environmental, social, and corporate governance issues, mainly due to the influence it can exert on its customers and market. GRI 102 - 21 | 102 - 40 | 102 - 42 | 102 - 43 | 102 - 44 |102 - 46 | 102 - 47 Materiality The methodology behind XP Inc.'s materiality survey considered both the direct impacts (of its activities) and the indirect ones (of its operations) in the analysis and identification of ESG issues relevant to the Company. In order to identify the material themes for XP Inc., both aspects of organizational culture, strategy and the Company's business vision were considered, through interviews with our leaders and key professionals in various business areas, as well as an analysis of the positioning and demands of our main stakeholders. Priority was given to topics that underpin our strategy and action with all our stakeholders. After reviewing this analysis in 2021 with our stakeholders, it was decided that the parent company remains the same as that disclosed in 2020. We categorize the topics according to their level of priority, relevance to internal and external audiences, and indicated which Sustainable Development Goals ("SDGs") they relate to, not categorized in any special order within each prioritization band. 14

4 Topics that base our strategy and action together were prioritized. 5 Gender equality 8 Decent work and economic growth 8 Trabalho decente e crescimento Econômico 9 Industry, innovation and infrastructure 1 1 Sustainable cities and communities 1 3 Action against Global Climate Change 1 6 Peace Justice and Effective Institutions 1 3 Action against Global Climate Change 1 2 Responsible Consumption and Production Priority Topics ESG integration into XP Inc.'s products and services Financial Education Diversity & Inclusion Our Customers' Data Privacy and Security Topics with High Relevance Ethics in Business Relationship with our Employees Working with our Clients Transparency in Business Practices and Communication of Conditions for Products and Services Risk Management Processes and Practices Monitoring the Regulatory Environment Impacts of Climate Change Social Action Topics with Medium Relevance Management of Environmental Impacts (use of natural resources and waste management) Relationship with our Suppliers 15

XP Inc. believes that for a stronger environmental, social, and corporate governance strategy, it is essential to adhere to and support voluntary commitments, programs, and international covenants. As a result, we were able to strengthen ESG practices in our business decisions and internal practices GRI 102 - 12 Voluntary Commitments XP Inc. is a signatory to the following initiatives: : Joined in 2021: 16

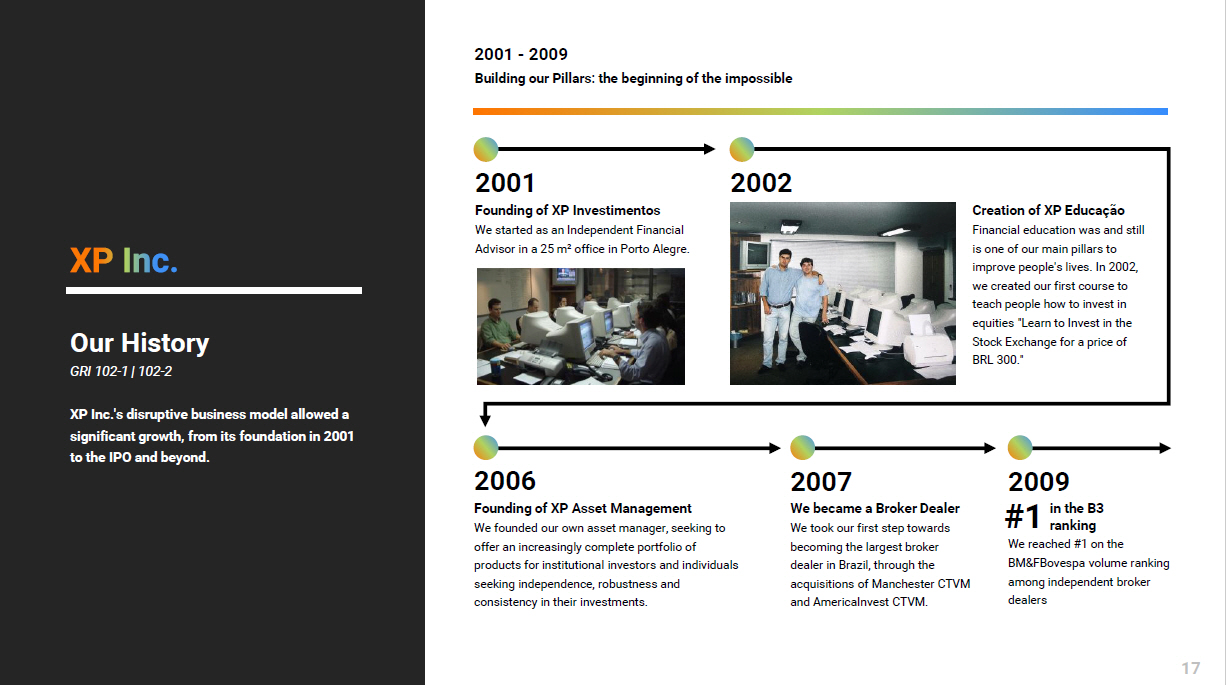

XP Inc.'s disruptive business model allowed a significant growth, from its foundation in 2001 to the IPO and beyond. GRI 102 - 1 | 102 - 2 Our History 2001 - 2009 Building our Pillars: the beginning of the impossible Founding of XP Investimentos We started as an Independent Financial Advisor in a 25 m² office in Porto Alegre. Creation of XP Educação Financial education was and still is one of our main pillars to improve people's lives. In 2002, we created our first course to teach people how to invest in equities "Learn to Invest in the Stock Exchange for a price of BRL 300." 200 1 200 2 Founding of XP Asset Management We founded our own asset manager, seeking to offer an increasingly complete portfolio of products for institutional investors and individuals seeking independence, robustness and consistency in their investments. 200 6 200 7 We became a Broker Dealer We took our first step towards becoming the largest broker dealer in Brazil, through the acquisitions of Manchester CTVM and AmericaInvest CTVM. 200 9 We reached #1 on the BM&FBovespa volume ranking among independent broker dealers #1 in the B3 ranking 17

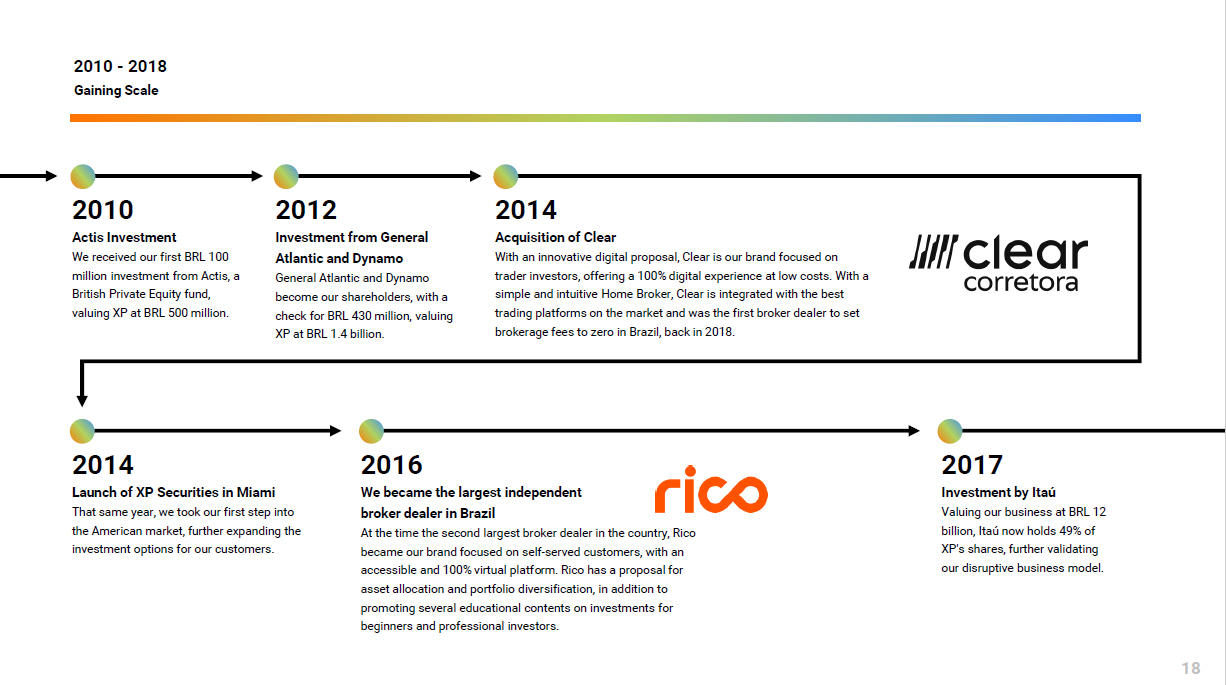

2010 - 2018 Gaining Scale Actis Investment We received our first BRL 100 million investment from Actis , a British Private Equity fund, valuing XP at BRL 500 million. 201 0 Investment from General Atlantic and Dynamo General Atlantic and Dynamo become our shareholders, with a check for BRL 430 million, valuing XP at BRL 1.4 billion. 201 2 Acquisition of Clear With an innovative digital proposal, Clear is our brand focused on trader investors, offering a 100% digital experience at low costs. With a simple and intuitive Home Broker, Clear is integrated with the best trading platforms on the market and was the first broker dealer to set brokerage fees to zero in Brazil, back in 2018. 201 4 We became the largest independent broker dealer in Brazil At the time the second largest broker dealer in the country, Rico became our brand focused on self - served customers, with an accessible and 100% virtual platform. Rico has a proposal for asset allocation and portfolio diversification, in addition to promoting several educational contents on investments for beginners and professional investors. 201 6 Investment by Itaú Valuing our business at BRL 12 billion, Itaú now holds 49% of XP's shares, further validating our disruptive business model. 201 7 Launch of XP Securities in Miami That same year, we took our first step into the American market, further expanding the investment options for our customers. 201 4 18

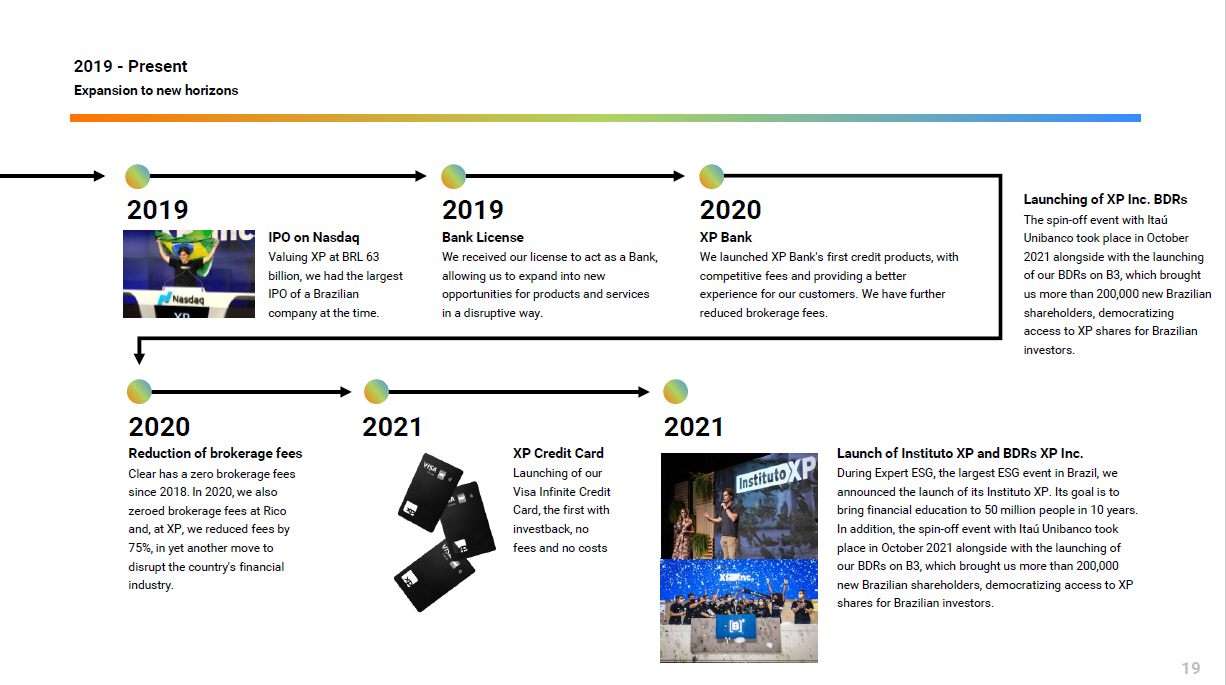

2019 - Present Expansion to new horizons IPO on Nasdaq Valuing XP at BRL 63 billion, we had the largest IPO of a Brazilian company at the time. 201 9 Bank License We received our license to act as a Bank, allowing us to expand into new opportunities for products and services in a disruptive way. XP Bank We launched XP Bank's first credit products, with competitive fees and providing a better experience for our customers. We have further reduced brokerage fees. 202 0 Reduction of brokerage fees Clear has a zero brokerage fees since 2018. In 2020, we also zeroed brokerage fees at Rico and, at XP, we reduced fees by 75%, in yet another move to disrupt the country's financial industry. 201 9 202 0 XP Credit Card Launching of our Visa Infinite Credit Card, the first with investback , no fees and no costs 202 1 Launching of XP Inc. BDRs The spin - off event with Itaú Unibanco took place in October 2021 alongside with the launching of our BDRs on B3, which brought us more than 200,000 new Brazilian shareholders, democratizing access to XP shares for Brazilian investors. 202 1 19 Launch of Instituto XP and BDRs XP Inc. During Expert ESG, the largest ESG event in Brazil, we announced the launch of its Instituto XP. Its goal is to bring financial education to 50 million people in 10 years. In addition , the spin - off event with Itaú Unibanco took place in October 2021 alongside with the launching of our BDRs on B3, which brought us more than 200,000 new Brazilian shareholders, democratizing access to XP shares for Brazilian investors.

XP Inc.'s purpose is to improve people's lives We are a holding company with more than 20 years of history, owner of technological platforms for investments, financial services and education, in addition to media & content platforms, encompassing brands such as XP, Rico, Clear, Infomoney , XPeed and IM+. We are dedicated to being transparent, focusing on our clients, through innovation and technology, providing financial education, sustainable growth, and a robust business ecosystem through a high - performance team aligned with our dream. GRI 102 - 1 | 102 - 2 | 102 - 6 | 102 - 7 Our Business Model To deliver the best solutions for our clients, we need to go beyond and offer solutions that leave a positive legacy for our society. To build our business and compete with the major Brazilian banks, we seek to leverage state - of - the - art technologies that bring differentiation and operational efficiencies to scale the business. In recent years, we have been able to consistently innovate, develop our own technological solutions and evolve Our Business Model in several integrated phases that complement each other and increase our capabilities. We believe that this evolution has enabled us to achieve consumer confidence in XP Inc.'s brands and companies, contributing to the revolution in the way financial services are offered in Brazil. 20

Financial Education and Digital Content Platform Xpeed is the largest financial education platform in Brazil. It offers courses, MBAs and learning tools that seek to teach its students about a variety of topics related to the investment world, from basics to most sophisticated techniques and advanced strategies. We believe that offering solutions focused on financial education is an effective way to bring familiarity and trust to the world of XP Inc. companies for Xpeed students. In addition, we have a variety of digital contents aimed at educating our clients and providing democratic access to information about the financial markets in Brazil. This universe includes the IM+, EXPERT (digital platform and annual conference), the group Primo and the team of digital influencers at XP Inc. Financial Advisory Services Our experts advise and support our customers in a variety of activities related to the financial universe. Such services include, for example, advisory services for institutional clients, private banking for high income clients, international financial services, structuring and issuance of financial products for corporate clients and issuers. Open Product Platform We offer an open financial product platform to our clients, encompassing both proprietary and partnership products. The open nature of our platform was the first of its kind in Brazil, and a key driver of XP Inc.'s success. Investors may access our services through different channels: via direct channels of XP Inc. companies (XP, Rico or Clear) or via our Independent Financial Advisors, which stood at approximately 10,000 in December 2021, located in more than 1,400 offices in 217 cities in Brazil. Our Products and Services We distribute a wide range of financial products and services, seeking to offer our clients solutions with a differentiated value proposition compared to the offers from traditional banks. Among the main solutions offered, the following stand out: (1) Financial Education and Digital Content Platform; (2) Financial Advisory Services; and (3) Open Financial Product Platform. 21

Our Brands Financial Services Media 22 Education

Financial Services XP Investimentos was how we first started and is still our main brand up to this day. With transparency and a wide variety of investment products, XP offers the best solutions aligned with the interests and profile of each individual investor. Besides investment products, the XP brand also offers banking products, like our credit card and digital account. This is the brand available for Independent Financial Advisors linked to XP Inc. The first broker dealer in Brazil specialized in Equities. The traders' preferred brand, it is the one that most leads Brazilians to invest in the Stock Exchange. Clear, which became part of XP Inc. in 2014, was the first broker dealer to offer zero brokerage fees in Brazil. Rico is our 100% digital investment platform. We offer simple and uncomplicated content about the universe of investments, as well as a complete portfolio of products for clients to invest more and better. Since 2020, brokerage fees are not charged for online stock trading at Rico, reinforcing the commitment to democratization of investments in Brazil. 23

Education Xpeed School is the financial education and entrepreneurship school of XP Inc. With a modern methodology focused on the future of students, our purpose is to give financial education to Brazilians of all socioeconomic classes and educational levels. The main mission of XP Institute is to "Transform financial education to improve people's lives and build the Brazil we dream of." The entity is focused on carrying out programs and projects whose final beneficiaries are minority groups, primarily young people, students from the public school system and women. All courses and projects are 100% free to their beneficiaries. Media InfoMoney , acquired in 2011, is the largest investment website in Latin America. It reached approximately 6 million monthly unique visitors in 2021 and the "top 10" in Google search results for an average of approximately 66,000 keywords IM+ is born from the merger of our brands InfoMoney and Fliper , and has the purpose of helping people make better financial decisions. In a single app, this unprecedented platform brings together features such as: management of earnings and expenses (personal expenses), automatic consolidation of investments, market news and exclusive financial communities. 24

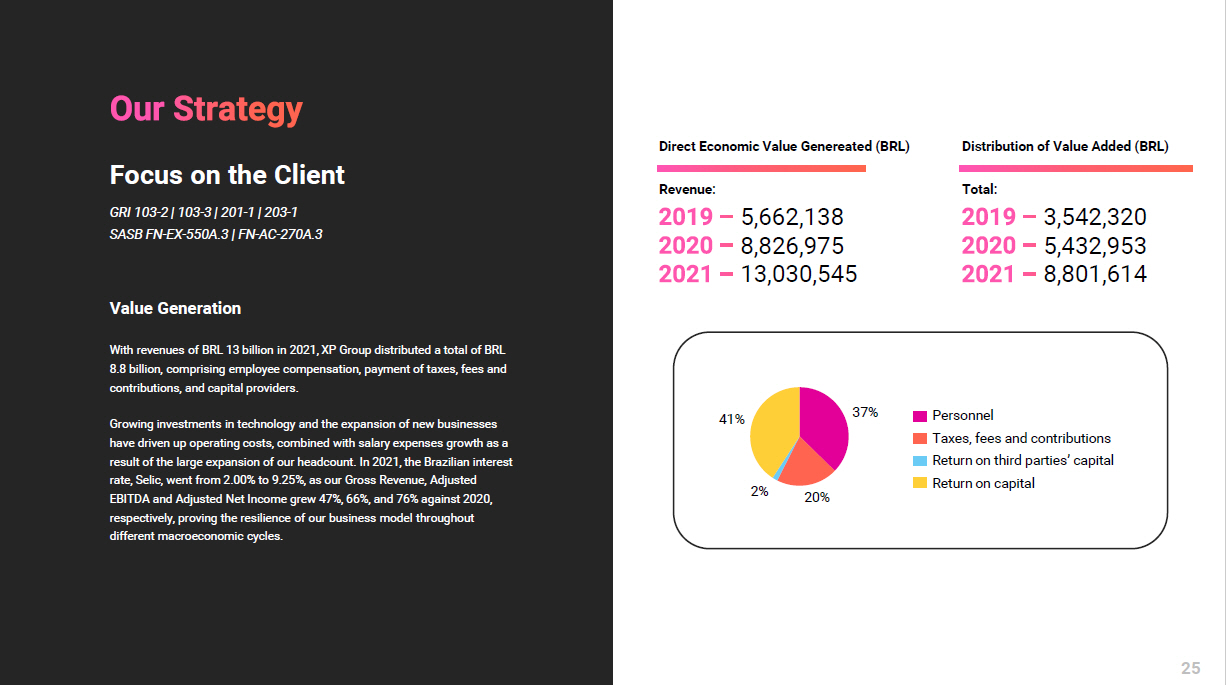

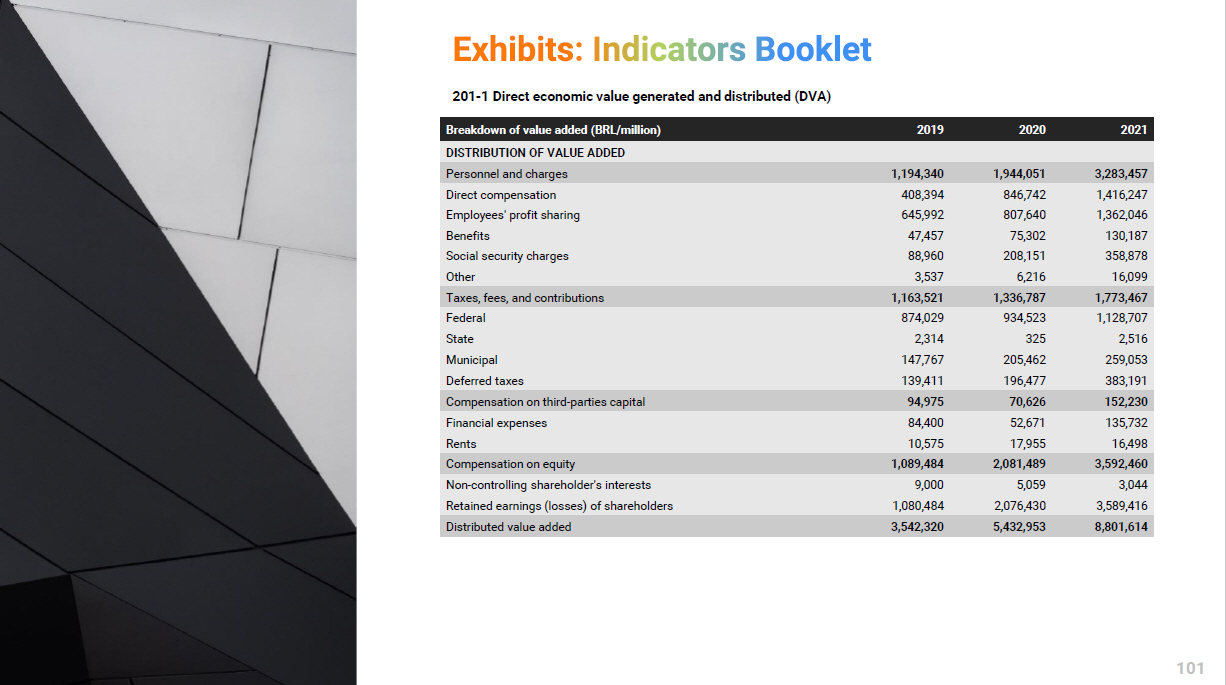

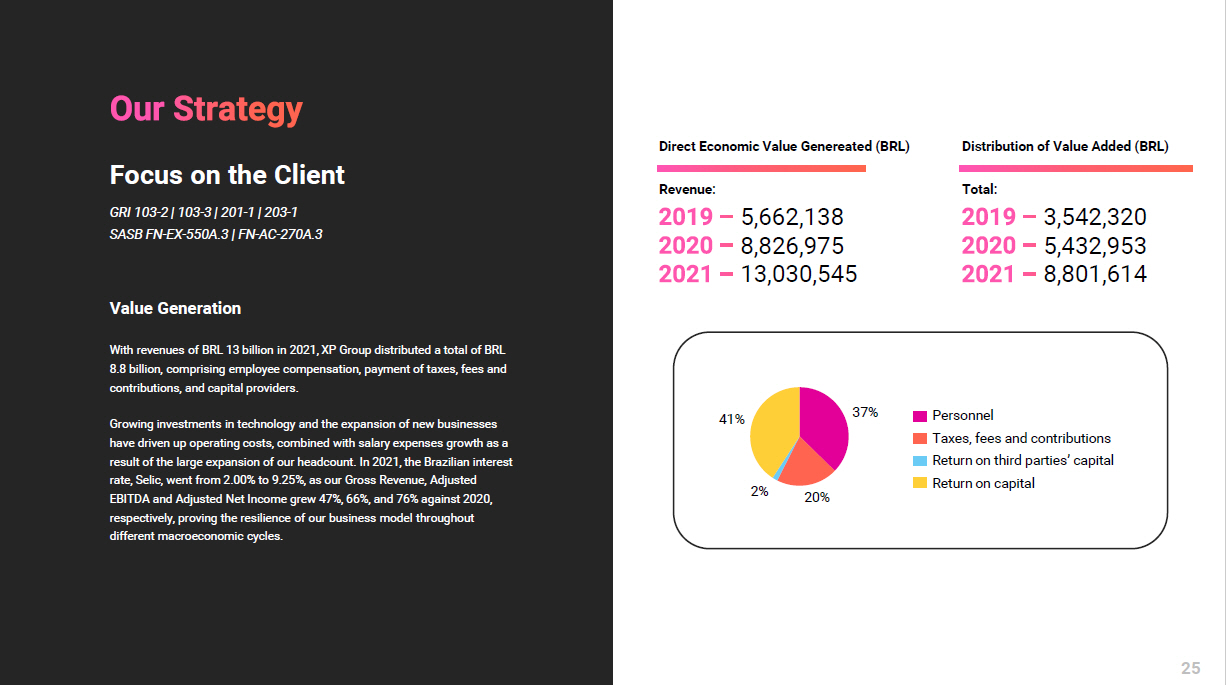

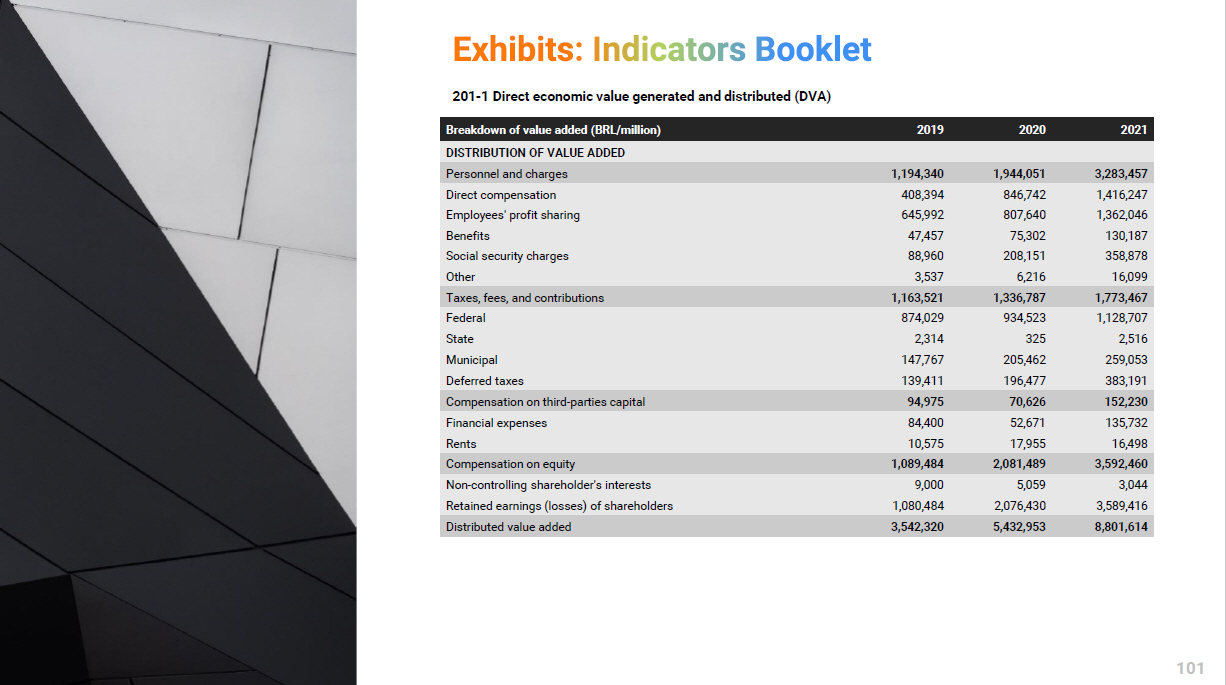

37% 20% 2% 41% Value Generation GRI 103 - 2 | 103 - 3 | 201 - 1 | 203 - 1 SASB FN - EX - 550A.3 | FN - AC - 270A.3 With revenues of BRL 13 billion in 2021, XP Group distributed a total of BRL 8.8 billion, comprising employee compensation, payment of taxes, fees and contributions, and capital providers. Growing investments in technology and the expansion of new businesses have driven up operating costs, combined with salary expenses growth as a result of the large expansion of our headcount. In 2021, the Brazilian interest rate, Selic , went from 2.00% to 9.25%, as our Gross Revenue, Adjusted EBITDA and Adjusted Net Income grew 47%, 66%, and 76% against 2020, respectively, proving the resilience of Our Business Model throughout different macroeconomic cycles. Direct Economic Value Genereated (BRL) Revenue: 5,662,138 8,826,975 13,030,545 Distribution of Value Added (BRL) Total: 3,542,320 5,432,953 8,801,614 Focus on the Client 25 Personnel Taxes, fees and contributions Return on third parties’ capital Return on capital

Transformation We intend to fulfill our purpose of improving people's lives and achieve our big dream of becoming the most valuable and profitable financial institution in Latin America over the next few years, continuing our history as the a revolutionary and transforming company. In this journey, we will ensure the best experience for our clients and partners, encourage entrepreneurship, build the best company for our employees, and generate even more value for our shareholders. We understand that there are important developments calling for great effort and coordination from our team, but that can make all the difference in achieving our big dream. Therefore, we have structured a Transformation Program that strikes these evolutions through the following main pillars: ( i ) Strategy; (ii) Client Vision; (iii) Culture and People; (iv) Operating Model; (v) Digitalization; (vi) Evolution of Tech, Operations, and Data. In October 2021, we launched our company - wide Transformation Program, the XPace . We started a roadshow going through all areas to present the program and ensure that our entire team has this vision of Transformation, and we have implemented the new operating model in, so far, 20% of the company, and our whole team remains focused in the mission of transforming XP Inc. 26

Everything that we have built over the last 20 years and that we continue to innovate daily across different fronts was and still is always with one primary focus: to improve our clients' lives. We take our customers' satisfaction very seriously, from the ideation of new products to the implementation of each project in practice. The largest proof of our commitment to our clients’ experience is our focus on the Net Promoter Score (NPS), a survey methodology widely used to measure customer satisfaction Our NPS is measured on a daily basis across all our brands and channels, and the metric also has a relevant weight in our CEO’s goals dashboard. We publish our NPS for the last six months quarterly, as we understand that it is one of the most important KPIs of our business. Since we started reporting this metric, our NPS has increased from 73 in December 2019 to 76 in December 2021. Maintaining a high NPS score remains a priority for XP, as Our Business Model is built around customer experience. 2019 2020 2021 73 71 76 NPS 27

The reduction and zeroing of fees for our customers is in line with the proposal of the XP Inc. brands, to increasingly facilitate access by Brazilians to the investment market The total estimated fee savings we generated for our clients in 2020 and 2021 (considering TED, credit card and brokerage fees) was Savings on Fees¹ 28 Notes: (1) Considers ( i ) brokerage fees that are no longer charged on the Rico and Clear brands; (ii) market average of credit card annual fees; and (iii) average fee of BRL 9.90 per TED performed. XP Inc. does not charge annual fees for credit cards or TED fees.

GRI 413 - 1 Financial Education For those who seek to understand the world of finance in order to grow exponentially, Xpeed is the leading learning experience that provides quality tools that help its users to reach their financial goals. At Xpeed , method and technology are always in favor of a fluid and personalized experience for the student. In an attractive way – entertaining while educating – it offers light and accessible formats, which fit into the routine, and awakens the desire to learn. Financial Education School Our days are immersed in financial decisions – pay in cash or in installments, cook or dine out, buy today or postpone. By bringing knowledge and awareness of our personal finance, we manage our choices better and realize dreams faster. Investment School In the financial markets, investors are those who want to multiply their income through investments that offer appreciation and risk. By willingly allocating their funds, they ensure the creation of a solid wealth in the medium and long - term. Entrepreneurship School Xpeed believes in a better future based on entrepreneurship, which why we are creating this school. To help our students learn about the techniques and models that solve the problems of the main entrepreneurs in the country, we are developing practical and applicable content, which will be our students’ business partners on a daily basis. Xpeed Pro Focused on MBAs to leverage its clients' careers. This program allows students to level up, learn from real - life experts and gain real knowledge about the financial markets. 29

XP Institute XP Institute was created in March 2021 and aims to bring financial education to 50 million people within 10 years. Find out more in the "Positive Impact" chapter of this Report. Digital Content InfoMoney is currently the largest success case of digital financial journalism in Brazil. A benchmark in technology, editorial content and distribution of innovative products such as the Top Finance and Business Podcasts in the country: From Zero to Top, StockPickers , as well as events, forums, guides, among others. In all the main existing content platforms you will find the journalistic quality of InfoMoney , whether with: Videos on Youtube , with more than 10 million views; Instagram, with more than 24 million views; Platform, with 6 million unique accesses per month; Podcasts, with more than 5 million downloads with quality information on everything investors needs to know. 30

People Those at XP Inc. speak on equal terms and are open to new ideas and opinions. Learn and grow fast, experiencing, making mistakes and improving. Do not conform to status quo and propose practical and simple improvements. Seek challenges larger than their abilities and deliver. We know that currently, health and wellness are increasingly important topics. For this reason, at XP Inc. we are looking carefully at this issue, raising this topic to our leadership, reassessing our benefits and redesigning our wellness strategy as a whole. We want to encourage our employees to seek sustainable balance and quality of life. We are aware that there are still several challenges ahead, which is why one of our priorities for 2022 is to evolve in this agenda. Preserve Health: Health and Dental plans, Gympass , running group, psychological and legal support. Save Money: Meal voucher, food voucher, day care allowance, legal support, home office furniture, monthly home office allowance, exclusive investment advice, access to exclusive investment funds. Optimize Time: 6 - month maternity leave, 20 - day paternity leave, breastfeeding support room, bike parking with locker room. Invest in You : Xpeed education courses free of charges or with up to 80% discount, exclusive investment advice, access to exclusive investment products. 31

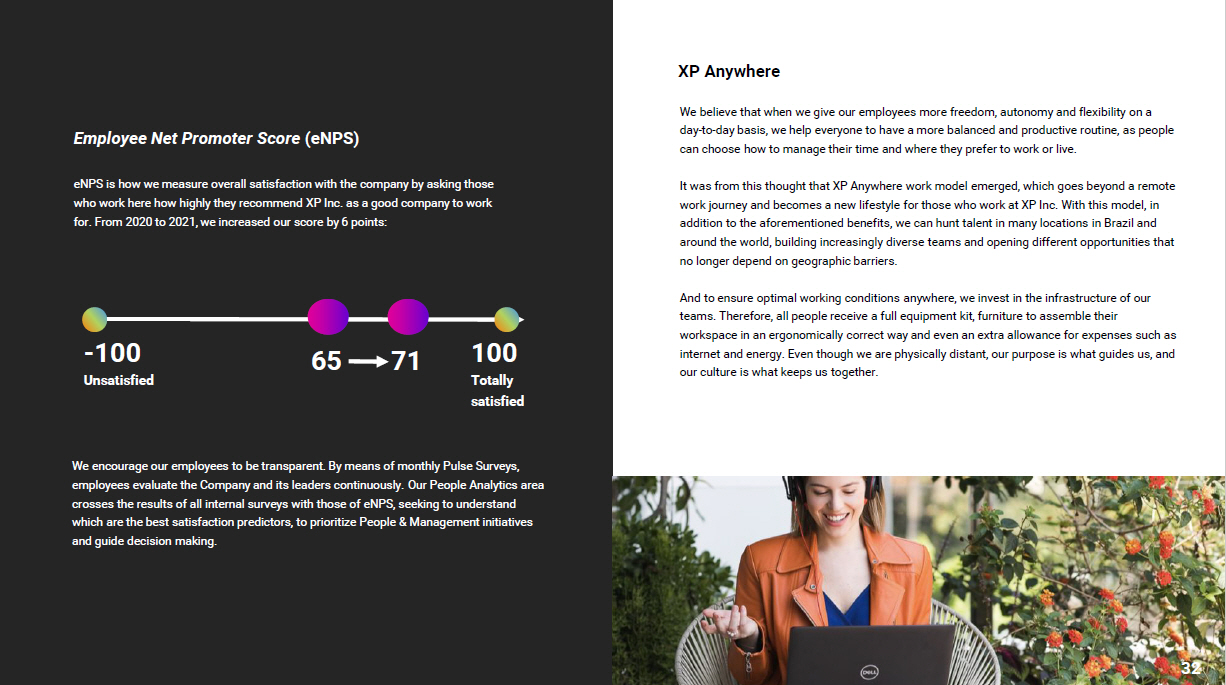

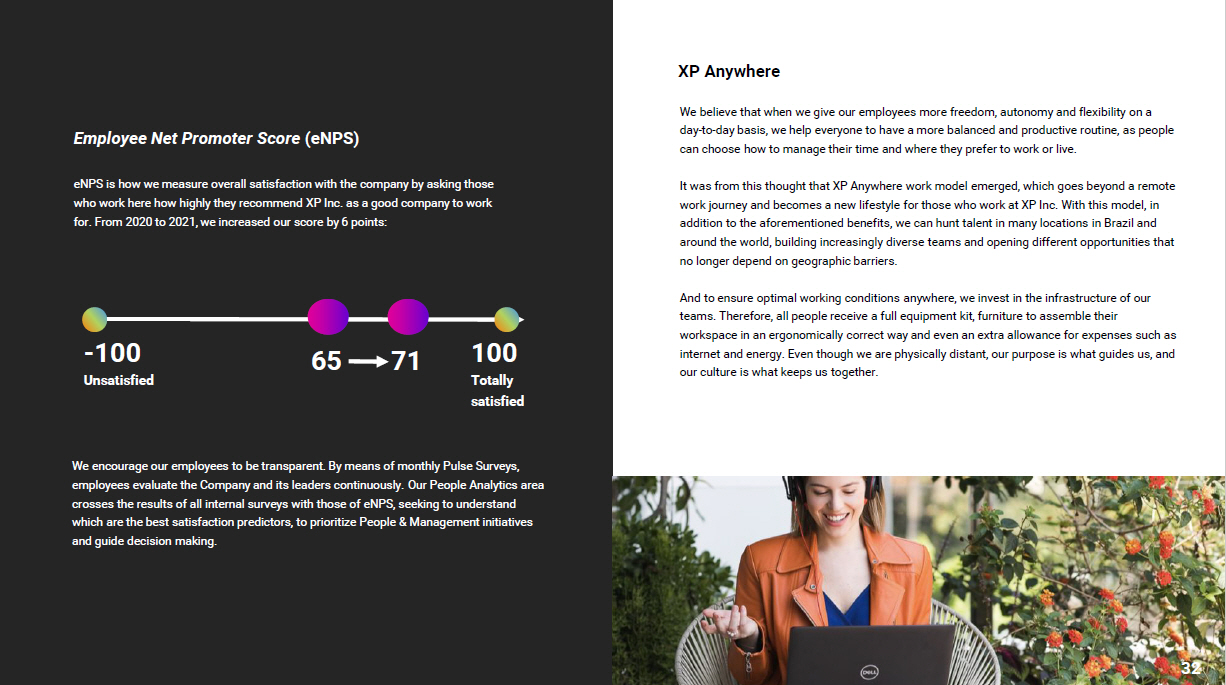

Employee Net Promoter Score ( eNPS ) eNPS is how we measure overall satisfaction with the company by asking those who work here how highly they recommend XP Inc. as a good company to work for. From 2020 to 2021, we increased our score by 6 points: Unsatisfied - 100 Totally satisfied 100 We encourage our employees to be transparent. By means of monthly Pulse Surveys, employees evaluate the Company and its leaders continuously. Our People Analytics area crosses the results of all internal surveys with those of eNPS , seeking to understand which are the best satisfaction predictors, to prioritize People & Management initiatives and guide decision making. 65 71 32 XP Anywhere We believe that when we give our employees more freedom, autonomy and flexibility on a day - to - day basis, we help everyone to have a more balanced and productive routine, as people can choose how to manage their time and where they prefer to work or live. It was from this thought that XP Anywhere work model emerged, which goes beyond a remote work journey and becomes a new lifestyle for those who work at XP Inc. With this model, in addition to the aforementioned benefits, we can hunt talent in many locations in Brazil and around the world, building increasingly diverse teams and opening different opportunities that no longer depend on geographic barriers. And to ensure optimal working conditions anywhere, we invest in the infrastructure of our teams. Therefore, all people receive a full equipment kit, furniture to assemble their workspace in an ergonomically correct way and even an extra allowance for expenses such as internet and energy. Even though we are physically distant, our purpose is what guides us, and our culture is what keeps us together.

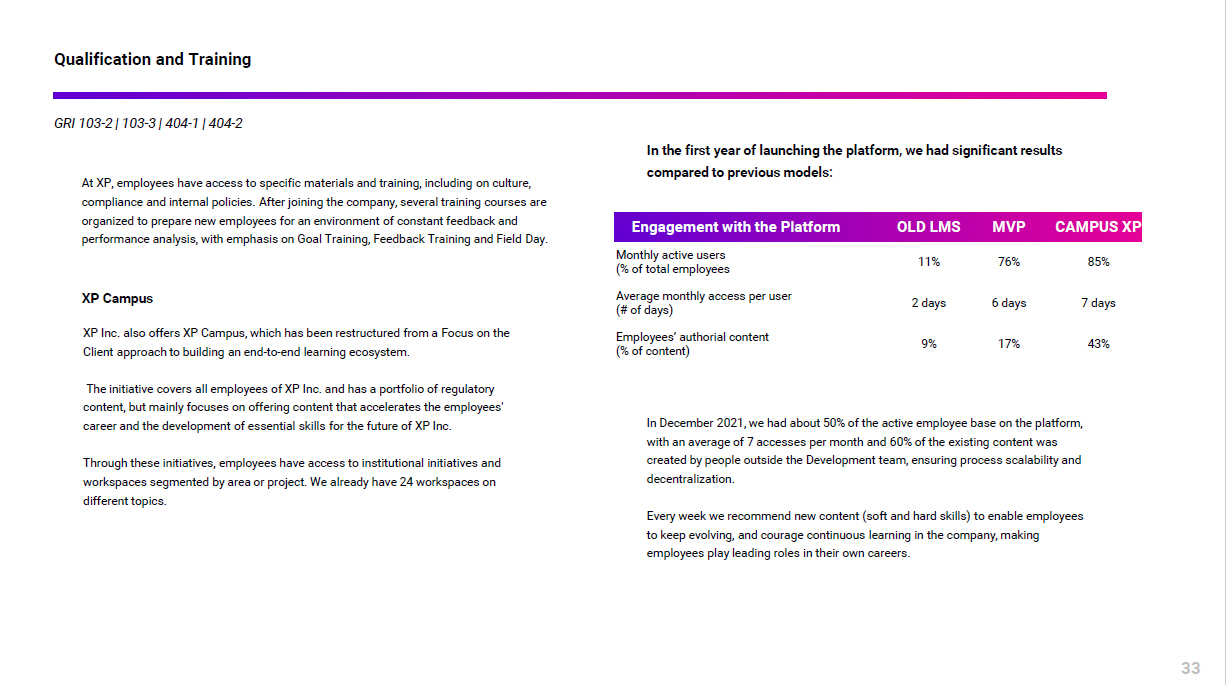

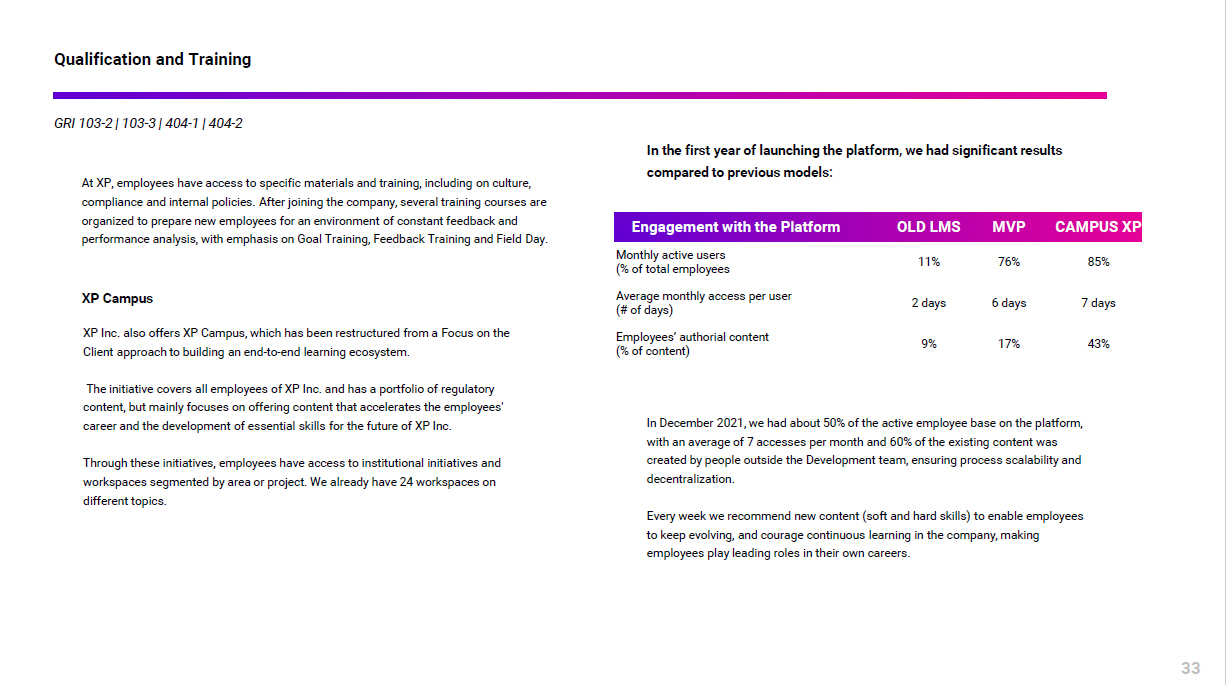

Qualification and Training GRI 103 - 2 | 103 - 3 | 404 - 1 | 404 - 2 At XP, employees have access to specific materials and training, including on culture, compliance and internal policies. After joining the company, several training courses are organized to prepare new employees for an environment of constant feedback and performance analysis, with emphasis on Goal Training, Feedback Training and Field Day. XP Campus XP Inc. also offers XP Campus, which has been restructured from a Focus on the Client approach to building an end - to - end learning ecosystem. The initiative covers all employees of XP Inc. and has a portfolio of regulatory content, but mainly focuses on offering content that accelerates the employees' career and the development of essential skills for the future of XP Inc. Through these initiatives, employees have access to institutional initiatives and workspaces segmented by area or project. We already have 24 workspaces on different topics. In the first year of launching the platform, we had significant results compared to previous models: Engagement with the Platform OLD LMS MVP CAMPUS XP Monthly active users (% of total employees 11% 76% 85% Average monthly access per user (# of days) 2 days 6 days 7 days Employees’ authorial content (% of content) 9% 17% 43% 33 In December 2021, we had about 50% of the active employee base on the platform, with an average of 7 accesses per month and 60% of the existing content was created by people outside the Development team, ensuring process scalability and decentralization. Every week we recommend new content (soft and hard skills) to enable employees to keep evolving, and courage continuous learning in the company, making employees play leading roles in their own careers.

Onboarding Leaderships New employee onboarding is the integration of a new employee with the company and its culture, as well as guidance and training on tools and processes. We work in a company where we seek to innovate every day, we always seek to ensure that our employees have the best possible experiences. After a lot of research, several studies, and idea maps, we identified that our Onboarding had to evolve. New employees need to be aligned with our culture, purpose, way of working, customer centricity, diversity, XP Inc. ecosystem, history, practical knowledge and lots of inspiration. Each day was built based on organizational values. Everything done was based on research and mapping the needs of employees and areas. In addition, subject to the cognitive capacity of new hires, the journey will always mix synchronous and asynchronous moments. In late November, Onboarding switched to a 4 - day immersion, where each day we focused on one of XP Inc.’s purposes. The average hours per participant in XP Onboarding was 11 hours per new employee For leaders, in addition to the roundtable between leaders and lectures, there is also the Xponencial Program, which has 3 initiatives aimed at delivering a differentiated development experience to high - performance leaders. In addition to exponentially enhancing the leadership capacity of managers who are already seen as talents, holding relevant positions in the organization, whom we believe are the future of XP Inc. The average hours per participant in leadership programs was 14.7 hours per leader. 34

Goals & Performance We breathe meritocracy at XP. We have a robust Meritocracy Cycle. We asked about meritocracy in our Pulse Survey. The topic is key to our XP Inc.’s Culture CodeXP Code. Not for nothing: meritocracy is one of the pillars underpinning the way we think about People in the Company. We reward extraordinary people by paying in line with the market, offering partnership, giving bigger challenges and promotions. To attract and retain the best talents, we need them to know that they will receive these rewards according to their commitment, culture and results they bring to the company. To this end, we use well - defined and unfolded goals within the teams, ensuring the Company's good direction , constant results, continuous improvement and transparency about the results that need to be achieved. At XP Inc., we rely on a 360 Appraisal to understand how much people live our purpose and values every day and we measure the most important aspects we look for in the performance of our leaders. Resulting in a meritocratic appraisal that seeks to recognize those who have achieved their goals and are in line with the company's culture. We also have "People's Forums," which calibrate the performance of the 360 appraisals and goal scores, improving accuracy of the process. As a result, we remove appraisal biases and the impact of external factors (such as the market or a crisis) on performance. Internship Program In 2021, we launched the first Internship Program at XP Inc., with more than 10,000 applicants, and we hired 85 interns of 53 different cities and with a representation of 42% women, 44% black people, 12% LGBTQIA+ people and 3.5% PwDs , who are helping to build our future in more than 30 areas of the company. Through synchronous and asynchronous stages, our selection process focused on identifying and prioritizing culture, skills, and diversity in choosing the best people for our challenges. 35

Diversity & Inclusion GRI 103 - 2 | 103 - 3 Since 2020, XP Inc.'s ESG strategy has a goal of impacting more than 500 thousand people by 2025, with an investment of BRL 35 million in diversity . The company intends to reach the entire financial market with its actions, including the encouragement to quality training in technology and data analysis. Diversity Strategy At XP Inc., Diversity & Inclusion ("D&I") theme is always focused on encouraging an inclusive and healthy work environment, with a focus on improving people's lives. The Diversity Commission brings together members of the Executive Board to monitor the development of this agenda in the Company. Affinity groups foster advancement in the D&I theme: MLHR 3 is the women's collective BLACK S é o coletivo de People negras Inclu ir é o coletivo pela inclusão de People com deficiência e acessibilidade; SEJA é o coletivo pela criação de um ambiente seguro e diverso para People LGBTQIA+. A XP Inc. fechou parcerias com instituições já reconhecidas pelo trabalho na questão da equidade racial, e com outras focadas em desenvolver um ambiente mais inclusivo e capacitar, profissionalmente, People com deficiência. INCLUI R is the collective for the inclusion of people with disabilities and accessibility; BLACK S is the collective of black people SEJA is the collective for the creation of a safe and diverse environment for LGBTQIA+ persons. XP Inc. entered into partnerships with institutions already recognized for their work on the racial equality issue, as well as with other institutions focused on the development of a more inclusive environment and professionally training persons with disabilities. 36

50% women at all hierarchical levels; 32% of black people on the staff of XP Inc. and 23% of black people in leadership Exceed the 5% PwDs required by law; Combat LGBTQIA+phobia in the financial market Diversity & Inclusion GRI 103 - 2 | 103 - 3 37 Goals for 2025 XP Inc. defined a public commitment to be achieved by 2025 on the topic of D&I:

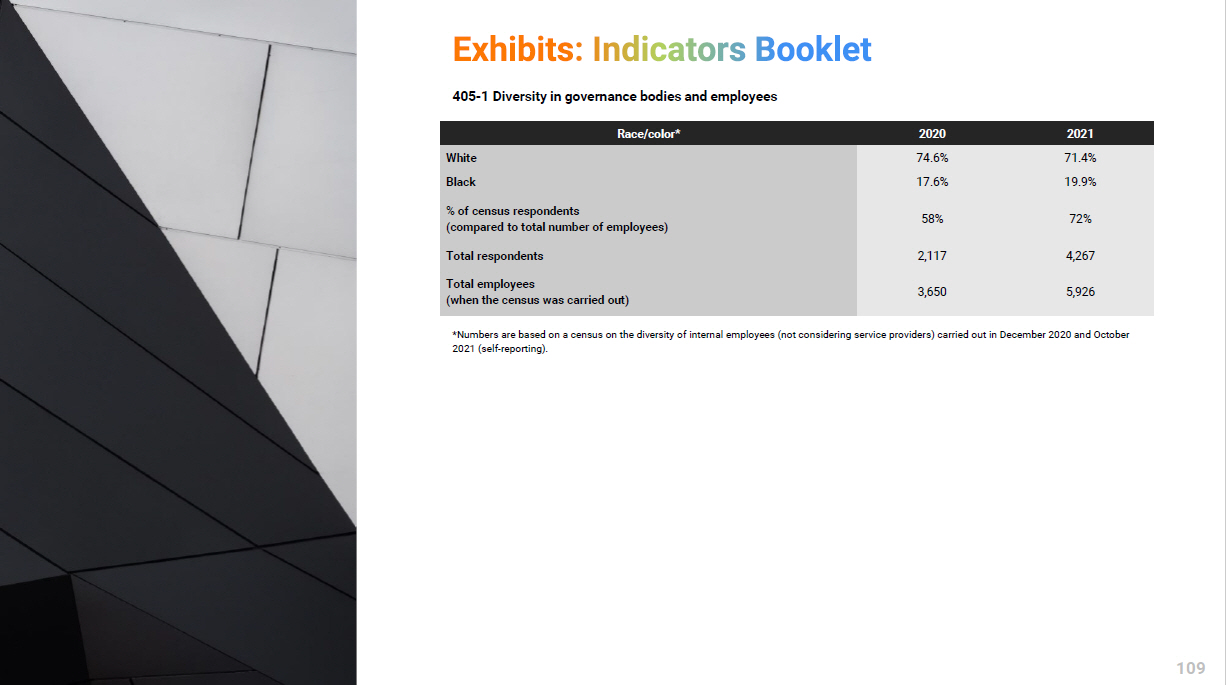

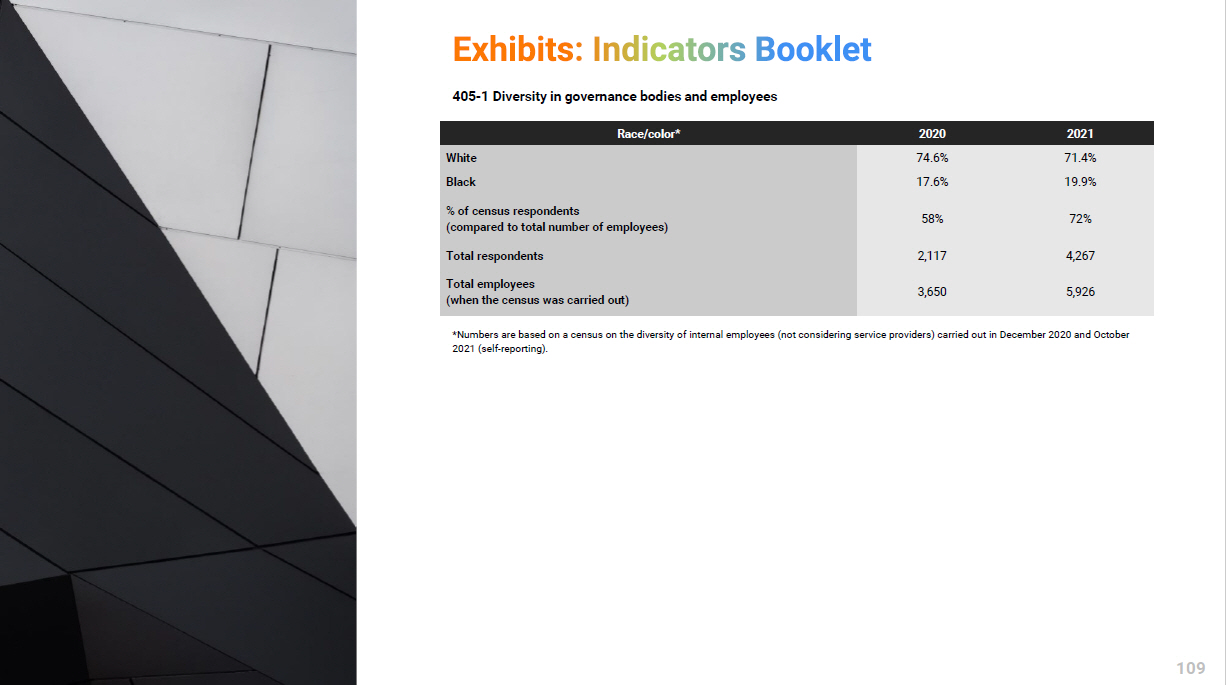

In January 2021, women represented 26.5% of the total number of employees, in December, the percentage increased to 33.4% . We had 120% growth in women in leadership: As of January 2021, 12% of XP Inc. was made up of women. We ended 2021 with women representing 26.5% of leadership positions . From January 2020 to December 2021, XP Inc. achieved a 500% growth in the number of women mothers within the company's female workforce . In December 2021, the representation of mothers among women was 29% . In early 2021, XP Inc.'s workforce was composed of 17.6% of black people, which was increased to 19.9% at the end of the year, (based on self - declaration). 1.13% of employees were people with disabilities at the end of 2021. In that same year, 22% of the hiring of PwDs were people with visual and cognitive disabilities , seeking to fulfill the commitment to the inclusion of all people with disabilities. XP Inc. made progress in 2021 on the topic of Women, Women in Leadership, Black People and Persons with Disabilities: Diversity & Inclusion The Diversity and Inclusion Commission (D&I) supports the evolution of the theme at XP Inc. It brings together members of the Executive Board, to validate and direct action plans for the Company's diversity agenda, with the support of affinity groups. With the creation of the Diversity Area , consulting company RM Consulting , led by Rachel Maia , with extensive experience in the corporate market, was contracted. Literacy and leveling actions on diversity concepts were carried out for more than 900 people. Jointly with the D&I collectives, for six months several Officers of XP Inc. acted as mentors to diversity and potential leaders . In 2021 we included diversity criteria in the evaluation and selection of suppliers during the procurement process , as well as in the evaluation and selection of IFA partner offices . In addition, we organized awareness talks for the entire Company on diversity, equity and inclusion, with names such as Ruth Manus, Mafoane Odara , Marcelo Cosme , Rapping Hood, and an exclusive session for leaders with Djamila Ribeiro. We also organized the "Be who you are" campaign, organized jointly with the SEJA group, which expanded the discussion on a safe environment for LGBTQIA+ people at work. The SEJA e - NPS , which measures how much people in XP Inc's LGBTQIA+ group feel they are in a safe environment to work, grew by 39 points from January to December 2021. GRI 103 - 2 | 103 - 3 38 Initiatives and Results * *Data considering own employees, including interns and apprentices.

During 2021 we entered into important partnerships with organizations that are benchmarks in racial equality, inclusion and good ESG practices, supported and organized projects dedicated to the theme and were recognized in relation to our D&I practices. Rewards and Recognition in partnership with UN Women, we organized the Mulheres que Transformam (Women who Transform) Award, which recognized women who are transforming the market in several areas: technology, education, finance, entrepreneurship, culture, and economy. There were more than 30 nominees, with the participation of the external audience in the voting, which reached 28 thousand votes, with 8 winners being selected and receiving a replica trophy by artist Sara Rosemberg , mentoring with executives from XP Inc. and a notebook. Women that Transform Award In partnership with Fin4She, the financial world connection platform for women, XP Inc. donated 300 subscriptions of Valor Econômico S/A to university female students, 30% of them for black women. The Minas de Valor campaign had more than 4 thousand accesses and more than 650 applications. Minas de Valor Project We support this institution of Rio de Janeiro, with a donation of 100 thousand reais. It has been, since 2017, providing support to the LGBTQIA+ population, in particular those exposed to situations of vulnerability and violations of rights. Casinha Is a non - profit organization whose mission is to help every person with a disability to have a quality education in an ordinary school. XP Inc. supports its Endowment Fund to reinforce actions for Inclusive Education. As a result, the Company received the Inclusive Education Seal. Rodrigo Mendes Institute Initiative recognized by the UN through the Global Compact, which encourages and recognizes actions by companies that enhance the culture of gender equality and the empowerment of women in Brazil. In its 1st year of participation, XP Inc. was recognized in the Silver category for its projects aimed at female empowerment. WEPs Brazil 2021 Award XP Inc. became one of the signatory companies to the movement, whose main pillars are: Leadership, Awareness, Employment, and Training. The main goals of the group include the generation of 10,000 new positions for black people in leadership positions by 2030. By participating in MOVER, a public commitment was made as agents of transformation to collectively evolve in an anti - racist journey; ; MOVER XP Inc.'s adhesion in 2021, and as a result, assumed commitments to promote the rights of Persons with Disabilities. Pact for Inclusion of People with Disabilities Diversity & Inclusion GRI 103 - 2 | 103 - 3 39 XP Inc.'s adhesion in 2021. This Pact encourages the voluntary adhesion of companies interested in meeting social demands for greater racial equality, social awareness and transparency; Pact for Racial Equality

Positive Impact GRI 102 - 42 | 102 - 43 | 102 - 44 | 413 - 1 Instituto XP XP Inc. launched the XP Institute in March 2021, with the following main mission : "Transform financial education to improve people's lives and build the Brazil we dream of." Its goal is to bring financial education to 50 million people within 10 years. The entity acts as a grantmaker to support civil society programs and organizations whose final beneficiaries are minority groups, primarily children and youth, public school students and women. All courses and projects are 100% free to their beneficiaries. The work of Instituto XP is aimed at giving our country a strong impulse for financial education, a subject that is not by chance present in at least 8 of the 17 Sustainable Development Goals (SDGs). Financial education is about enabling Brazilians to have a more dignified life, with more freedom of choice and better conditions to fulfill their dreams and live in their power of contribution to society. As defined by Adriana Toledo in the book National Strategy for Financial Education (ENEF): In search of a better Brazil: “A financially well - educated society paves the way for sustained socioeconomic development, helps to reduce inequalities and promotes citizenship.” We have the dream of transforming Brazil into a financially educated nation, because we know that Financial Education Transforms. People with knowledge about financial education are able to set a budget, deal with day - to - day expenses and spending, save and invest financial resources and, most importantly, make dreams come true. Some data from surveys carried out in Brazil show us how much financial education affects not only the organization of finances at home, but also people's mental health. 40

Faced with such a huge challenge, XP Institute seeks to promote Financial Education in Brazil based on the strategy of the 4 pillars below: EDUCATE Rolling up our sleeves with the right partners to develop educators and foster and disseminate financial skills for all. INSPIRE By supporting initiatives and real cases, XP Institute shows that this transformation is possible and necessary, engaging employees, educators, researchers, parents, public, social, and private leaders, organizations, entrepreneurs, customers, volunteers, and society as a whole. MOBILIZE Acting in partnership and network. Instituto XP encourages people, social organizations – public and private – and all their knowledge to co - create innovative solutions and drive new practices and policies for a single purpose. ACT Based on professional management, we establish clear goals and results to act consistently and give the movement a long life. Below are more details and highlights of the main projects: 41

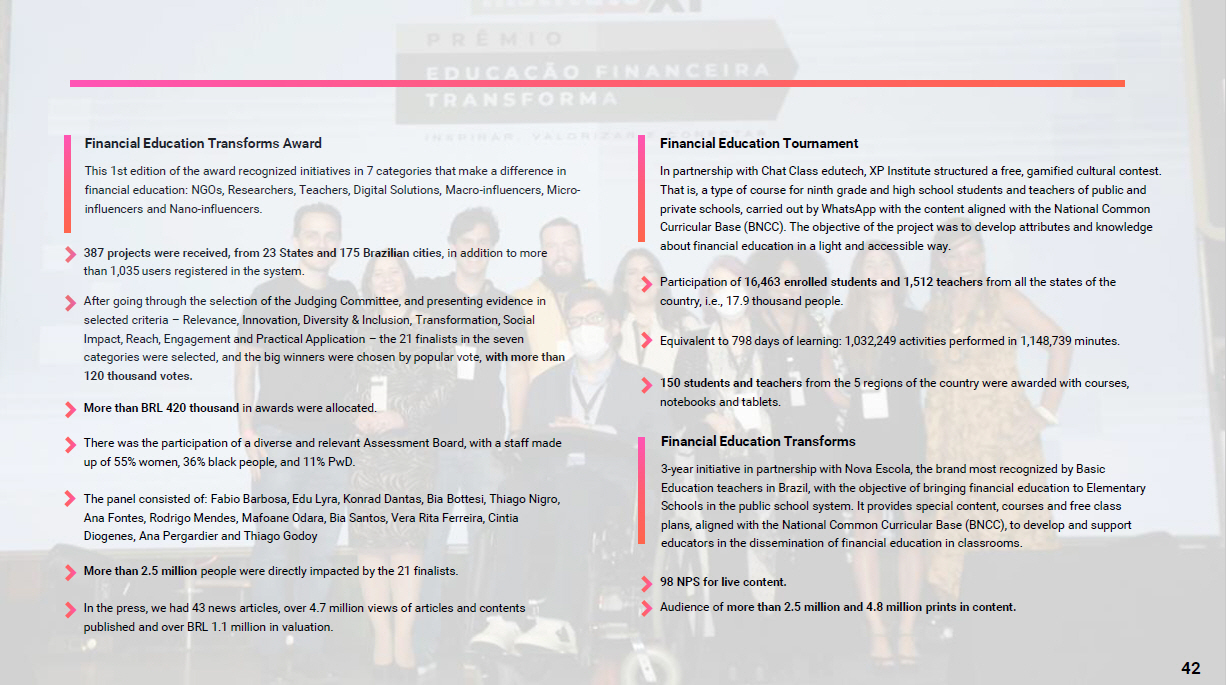

This 1st edition of the award recognized initiatives in 7 categories that make a difference in financial education: NGOs, Researchers, Teachers, Digital Solutions, Macro - influencers, Micro - influencers and Nano - influencers. Financial Education Transforms Award 387 projects were received, from 23 States and 175 Brazilian cities , in addition to more than 1,035 users registered in the system. After going through the selection of the Judging Committee, and presenting evidence in selected criteria – Relevance, Innovation, Diversity & Inclusion, Transformation, Social Impact, Reach, Engagement and Practical Application – the 21 finalists in the seven categories were selected, and the big winners were chosen by popular vote, with more than 120 thousand votes. More than BRL 420 thousand in awards were allocated. More than 2.5 million people were directly impacted by the 21 finalists. In the press, we had 43 news articles, over 4.7 million views of articles and contents published and over BRL 1.1 million in valuation. 42 There was the participation of a diverse and relevant Assessment Board, with a staff made up of 55% women, 36% black people, and 11% PwD . The panel consisted of : Fabio Barbosa, Edu Lyra, Konrad Dantas, Bia Bottesi , Thiago Nigro, Ana Fontes, Rodrigo Mendes, Mafoane Odara , Bia Santos, Vera Rita Ferreira, Cintia Diogenes , Ana Pergardier and Thiago Godoy In partnership with Chat Class edutech , XP Institute structured a free, gamified cultural contest. That is, a type of course for ninth grade and high school students and teachers of public and private schools, carried out by WhatsApp with the content aligned with the National Common Curricular Base (BNCC). The objective of the project was to develop attributes and knowledge about financial education in a light and accessible way. Financial Education Tournament Participation of 16,463 enrolled students and 1,512 teachers from all the states of the country, i.e., 17.9 thousand people. Equivalent to 798 days of learning: 1,032,249 activities performed in 1,148,739 minutes. 150 students and teachers from the 5 regions of the country were awarded with courses, notebooks and tablets. 3 - year initiative in partnership with Nova Escola, the brand most recognized by Basic Education teachers in Brazil, with the objective of bringing financial education to Elementary Schools in the public school system. It provides special content, courses and free class plans, aligned with the National Common Curricular Base (BNCC), to develop and support educators in the dissemination of financial education in classrooms. Financial Education Transforms 98 NPS for live content. Audience of more than 2.5 million and 4.8 million prints in content.

In partnership with the company Alicerce Educação , the action aims to provide free and face - to - face knowledge about financial education, to help people learn about subjects such as investments, means of payment and indebtedness, basic economics, retirement, monthly financial planning at home. Financial Education Course More than 200 educators were selected and trained to facilitate the course, disseminate and enhance the impact. The partnership brings financial education through a 16 - hour face - to - face course, to young people and adults of different ages, in 93 Alicerce centers , in different peripheral regions of Brazil. held by Artemísia , in partnership with coalition organizations - Accenture, B3 Social , Casas Bahia, Arymax Foundation, Tide Setubal Foundation, Humanize, Lenovo Foundation, Meta e Potência Ventures - , the coalition will last for 3 years, to promote the productive inclusion theme through a direct support to entrepreneurs ( Programa JÁ É in scale for vulnerable entrepreneurs with a focus on digital literacy), connection with public administrators (Open Innovation platform in the public sector), and advocacy of productive inclusion, to influence key actors with relevant activities on the subject in Brazil. Productive Inclusion and Financial Education Coalition In September 2021 the XP Corporate Volunteer program was launched, in which XP Inc. provided online mentorships to young people in vulnerable situations. The program was structured with 3 recurring programs and 3 one - off actions, with an extra group to cover the waiting list, and had the operational support of the Atados organization. XP Corporate Volunteering 100 NPS and 100% of volunteers say they felt very motivated or motivated to engage in future volunteering initiatives. Mentorships were carried out in partnership with the following institutions: Vida Jovem , AFESU, Generation, CEAP, and Gerando Falcões . "I thought it was super cool and a rich exchange of feedback and experience. I was thrilled to hear the young women's dreams and perspectives. I tried to give support and guidance that I thought was relevant for their moment. It was a very light and nice moment." – AFESU volunteer. "Wonderful. I learned a lot from the exchange I had with the group and I felt that I actually managed to be provocative to the point where they opened up and shared with me what that conversation was arousing in them!" – CEAP volunteer 43

Developed with Instituto da Criança , the project aims to provide quality educational development, offering full scholarships to children from vulnerable families, to prevent school dropouts. Educação Garantida From March 2018 to 2021, more than 31,000 scholarships were sponsored for children and teenagers between 6 and 11 years old. From the program, there was an improvement in academic performance in 77.5% of the benefited students 30% of scholarship holders are people with disabilities or have a medical issue. The average family income of the families impacted by the project is BRL 1,759.43. 42% of the benefited children are part of a family with no father figure. To enhance the positive social impact in all its areas of activity, XP Institute offered technical, administrative, financial, and organizational support to other organizations, acting as a platform to catalyze other donations and promote projects from strategic partners: Competition held by the Rio de Janeiro Municipal Department of Education among students from the public school system, to encourage learning, engage, have fun and identify talents, in addition to showing students a path to their professional development. Mathematics Olympiad in Rio de Janeiro Transportation allowance and physical infrastructure loan from partner offices for students who want to take the entrance exam for courses at the Insper institution and are in a vulnerable situation. Support for young people who want to take the college admission exam Due to the worsening of the pandemic in early 2021, XP Institute was responsible for several donations to third sector institutions to combat vulnerabilities of the crisis, including donations to FIOTEC and the vaccine plant of Instituto Butantan . In total, there were about BRL 3.7 million in donations. COVID - 19 Pandemic Donations: We also donated staple food baskets in partnership with Gerando Falcões to the municipality of São Roque (city of XP Inc.'s new headquarters) and to charitable institutions, such as the LGBTQIA+ NGO Casinha . We support the construction of 2 solidarity kitchens with the NGO Gastromotiva . We donate clothes and sweaters jointly with União SP. 44

At XP Inc., we use technology as a lever for growth and development. Therefore, in 2021, we launched the Corporate Training Program, which has 3 initiatives to support the Brazilian market with the training of digital professionals, in addition to enabling the productive insertion of hundreds of Brazilians who would not have access to this type of education. Corporate Training Program XP Inc., in partnership with Tera, a technology education company, launched a program of 50 scholarships, focused on free training free to women (cis or transgender), non - binary people and black people (and/or indigenous), irrespective of gender self - declaration, who want to become data scientists and transform technology, bringing more diversity and representation in tech careers. DiversiTera We invested in the training of professionals in software development, based on a program in partnership with Trybe , a technology school that is a reference in the training of professionals in the area. This program involved the formation of a class of 300 people, for which XP paid for 50% of the course for all students and offered an allowance of one salary, for 50 people . The class is made up of 40% women and 49% black people and training is in progress, with completion expected in the second half of 2022. Developer Training Program A program focused on training in Business Analytics was launched, in which 30 people formed an exclusive Tera class for training in data for 6 months , with mentoring follow - up, access to financial education and an English course. This class, which has already been contracted by XP Inc., was formed with 70% of the vacancies for women and black people, who are under training and expect to complete the course in April 2022. Data Analyst Training In addition to having invested in Trybe by obtaining a stake in the Company, XP Inc. made a minority investment in Resilia edtech , a company that operates in the insertion of potential young people into the job market through programming and behavioral skills courses. After all, investing in education transforms a country and is part of our purpose as a company. Regarding the use of tax incentives to direct resources to social, sports, cultural and health projects, in 2021, XP Inc. directed more than Donations with Tax Incentives BRL 13 million to various projects. 45

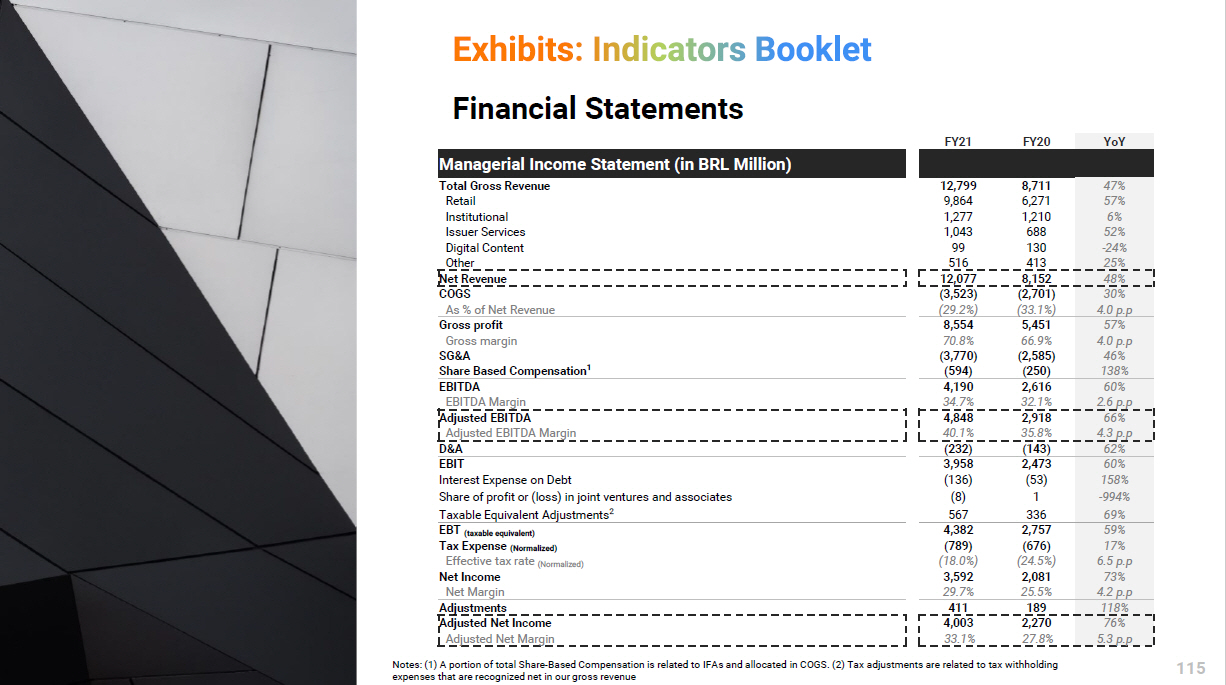

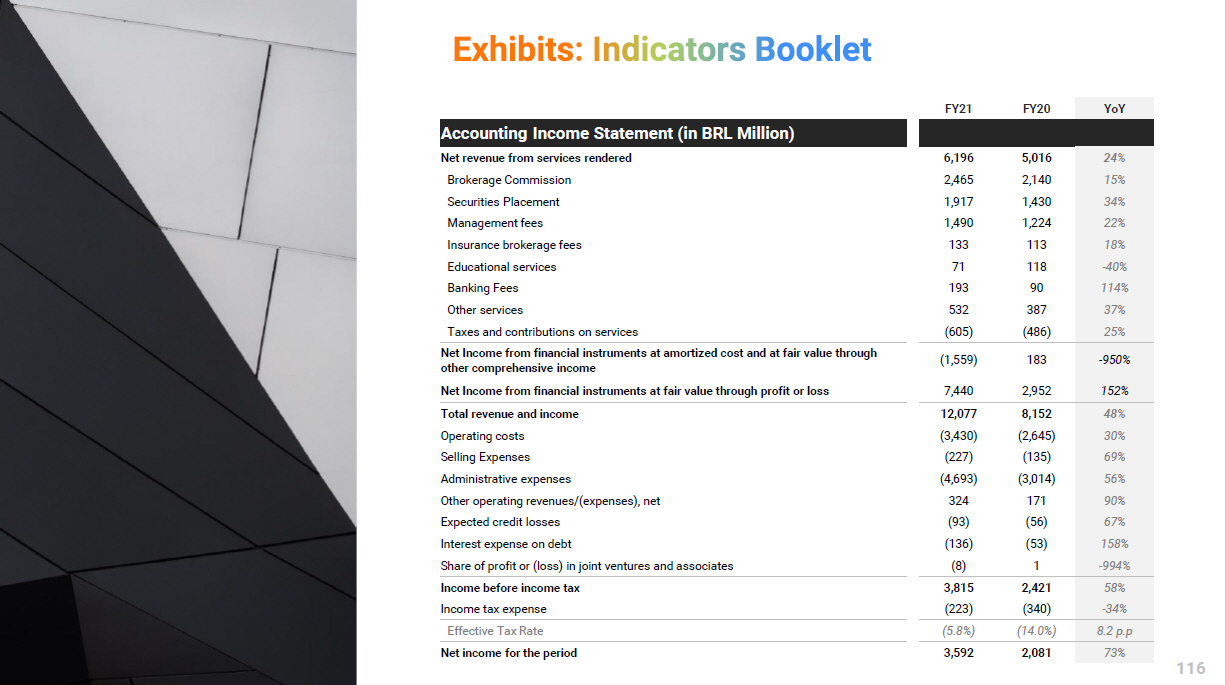

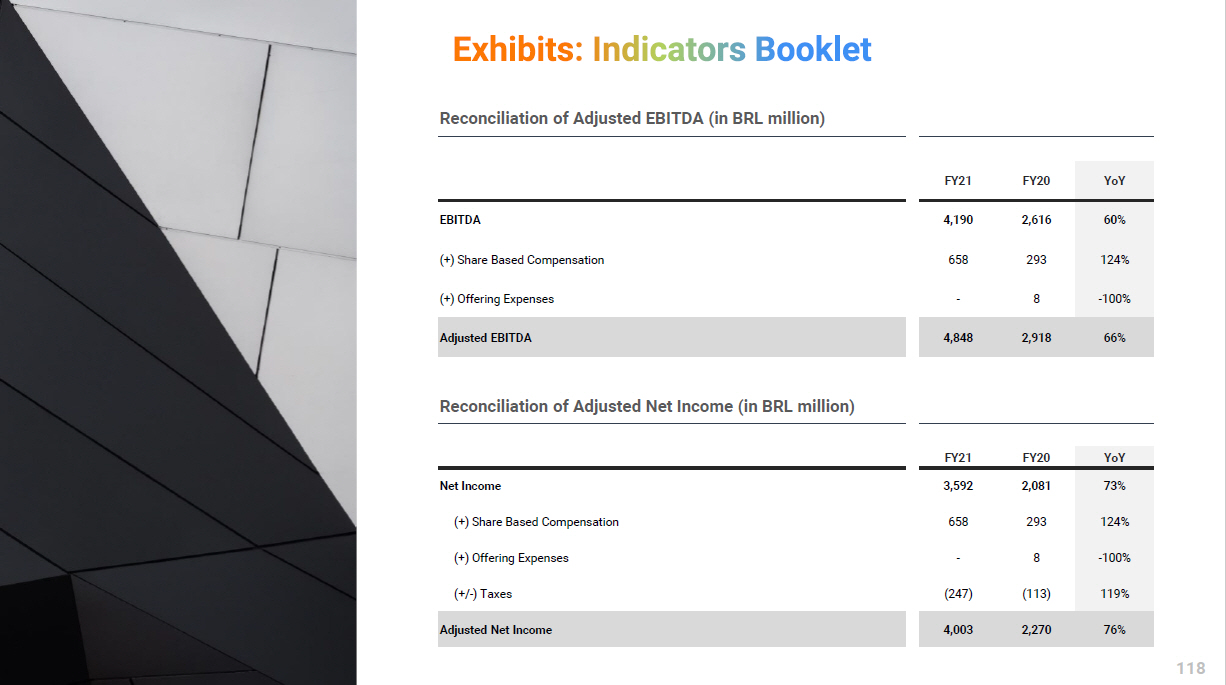

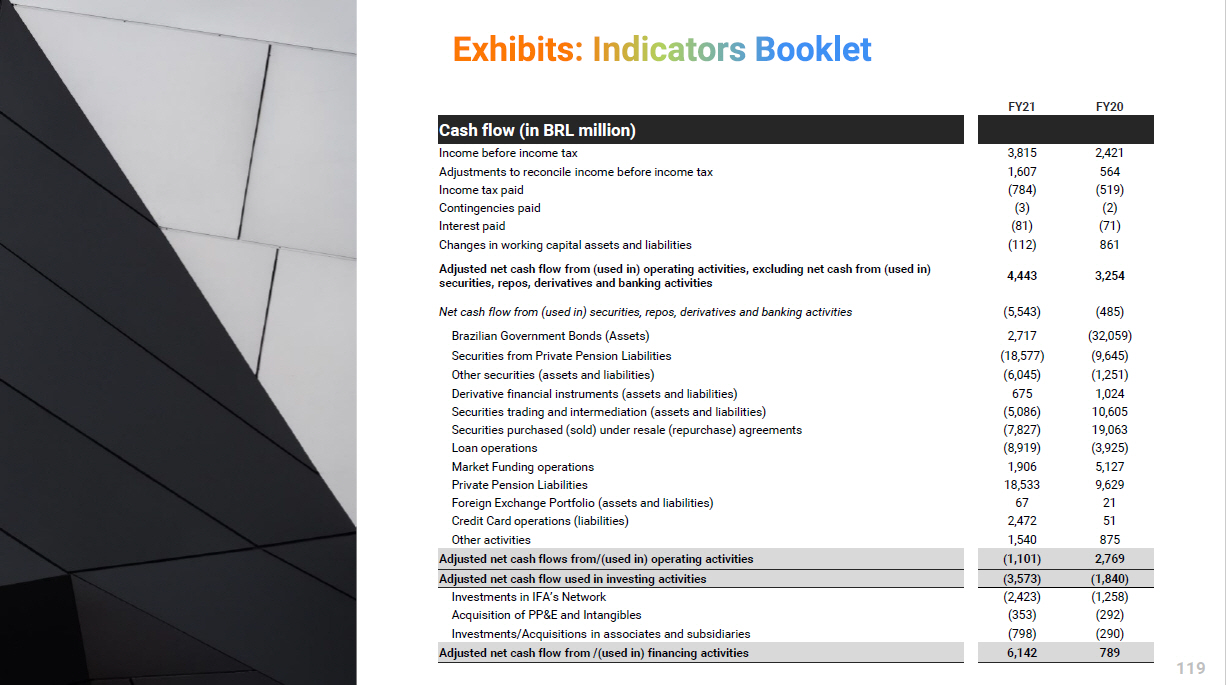

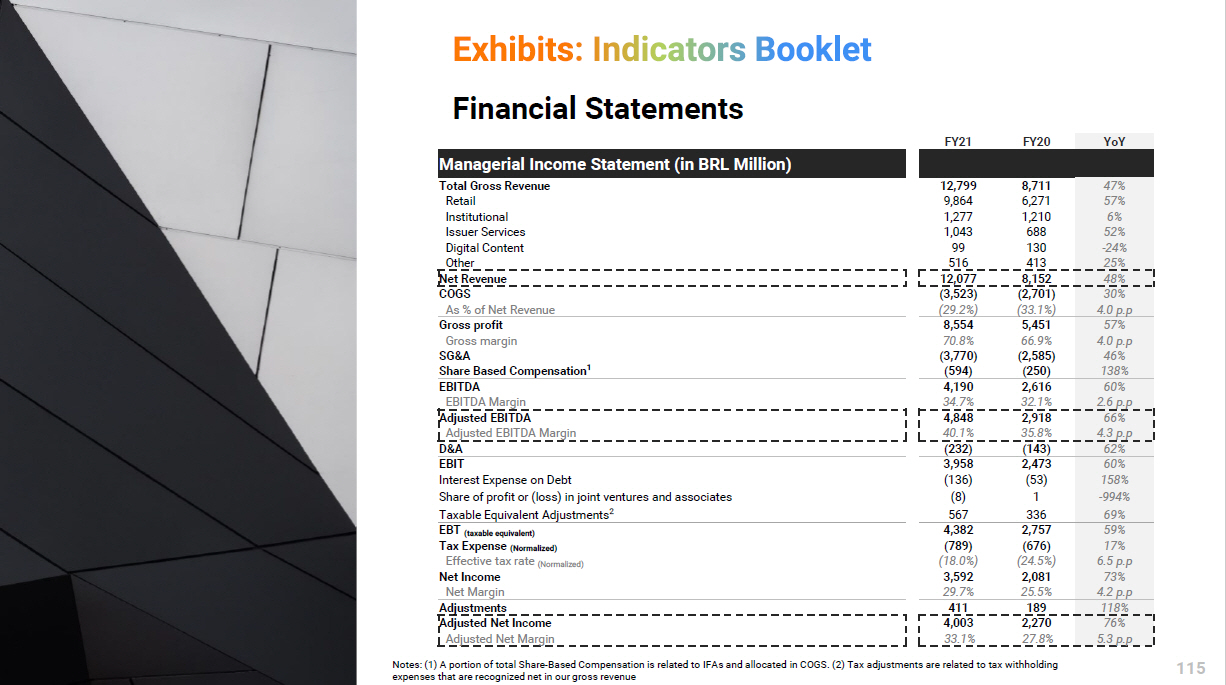

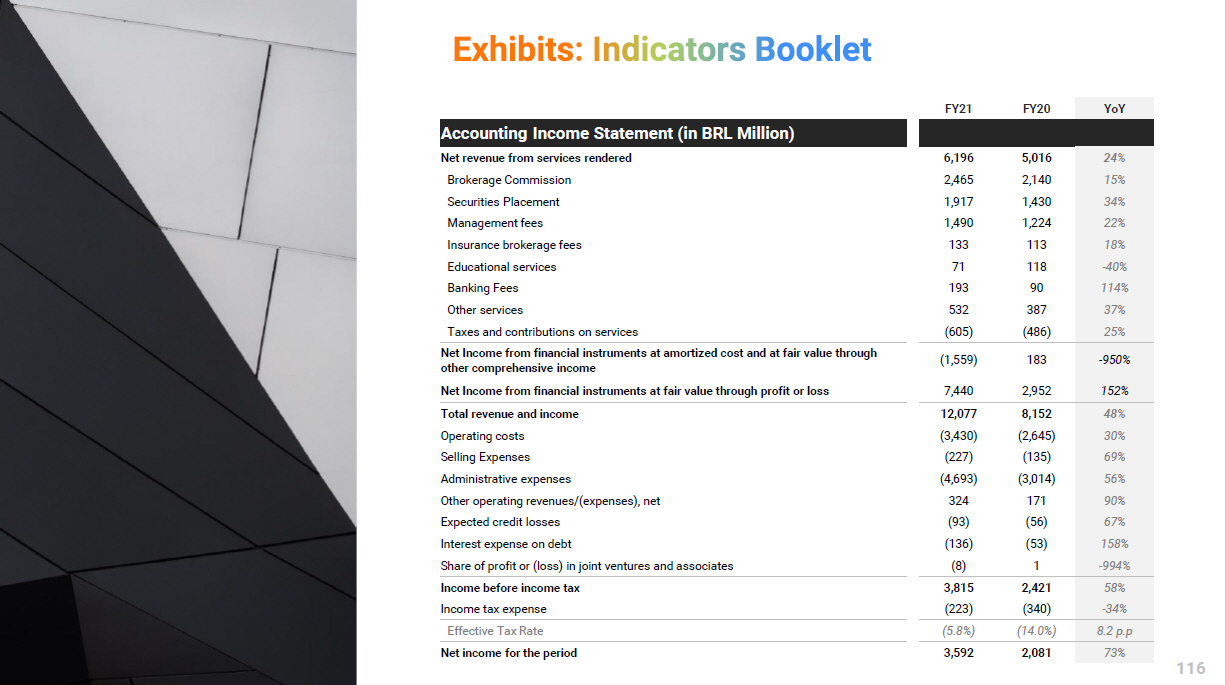

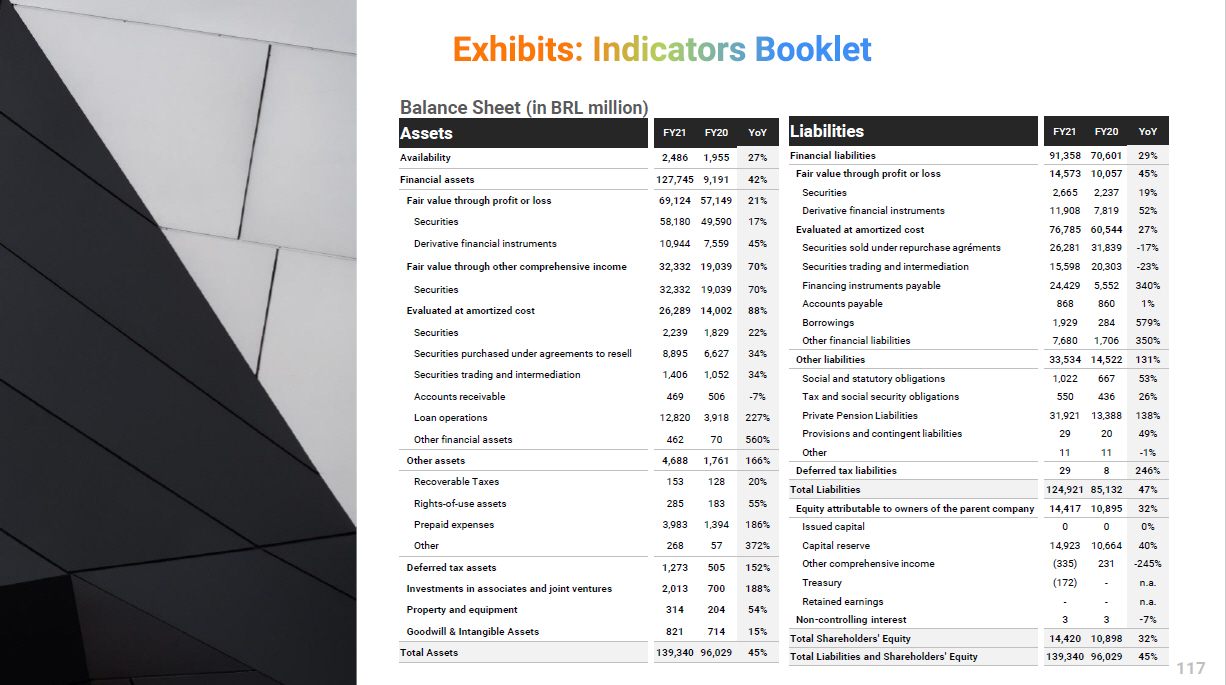

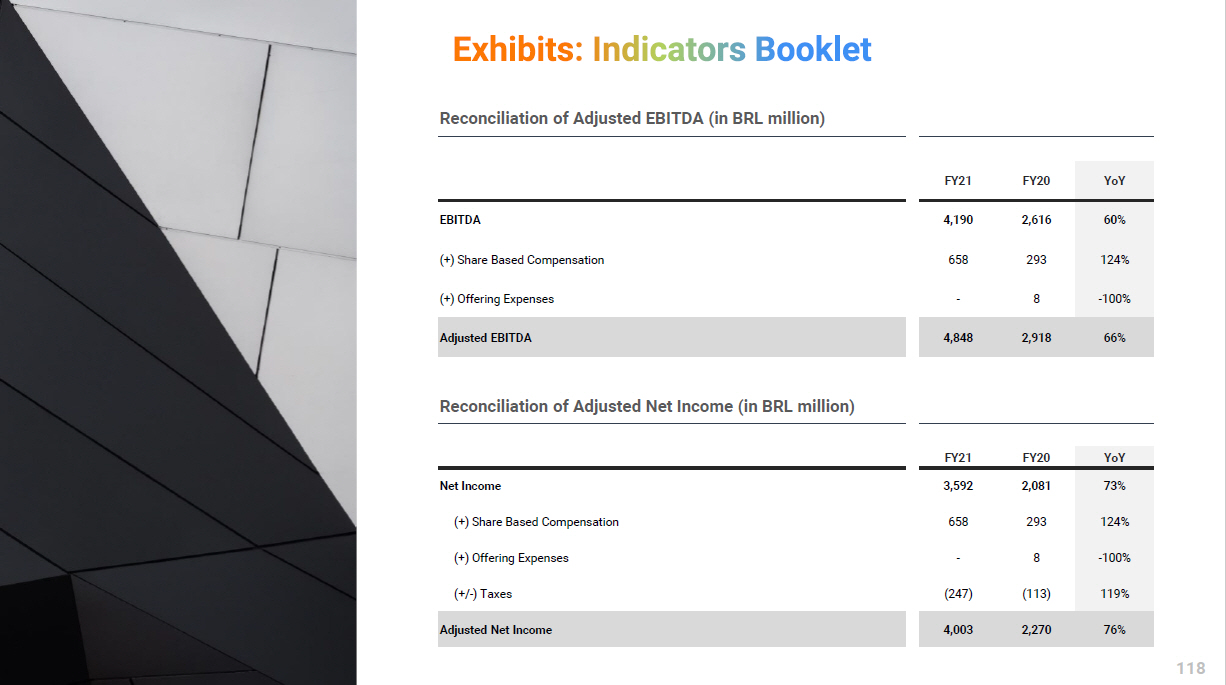

Our Business Metrics New Verticals Metrics Operating and Financial Metrics (unauditaded) FY21 FY20 YoY Total AUC (in BRL bn) 815 660 23% Active Clients (in ‘000s) 3,416 2,777 23% Retail - gross total revenue (in BRL mn) 9,864 6,271 57% Institutional - gross total revenue (in BRL mn) 1,277 1,210 6% Issuer Services - gross total revenue (in BRL mn) 1,043 688 52% Digital Content - gross total revenue (in BRL mn) 99 130 - 24% Other - gross total revenue (in BRL mn) 516 413 25% Company Financial Metrics FY21 FY20 YoY Gross Revenue (in BRL mn) 12,799 8,711 47% Net Revenue (in BRL mn) 12,077 8,152 48% Gross Profit (in BRL mn) 8,554 5,451 57% Gross Margin 70.8% 66.9% 396 bps Adjusted EBITIDA 1 (in BRL mn) 4,848 2,918 66% Adjusted EBITIDA margin 40.1% 35.8% 435 bps Adjusted Net Income 1 (in BRL mn) 4,003 2,270 76% Adjusted Net Margin 33.1% 27.8% 530 bps Revenue from New Verticals (unaudited) FY2 1 FY2 0 YoY Total Gross Revenue from Selected Products (in BRL mn) 582 194 200 % Pension Funds (in BRL mn) 227 134 69% Credit Cards (in BRL mn) 180 - n.a. Credit (in BRL mn) 116 17 586 % Insurance (in BRL mn) 60 43 39% As s % of total gross revenue 4.5% 2.2% 2 p.p. Other Selected KPIs Pension Funds AUC (in BRL bn) 48 - n.a . Cards TPV (in BRL bn) 10 - n.a. Credit Portfolio ² (in BRL bn) 10 4 164 % Financial Results Notes: (1) See annex for a reconciliation of Adjusted EBITDA and Adjusted Net Income; (2) Does not include Intercompany or cr edi t related to Credit Card operations. 46

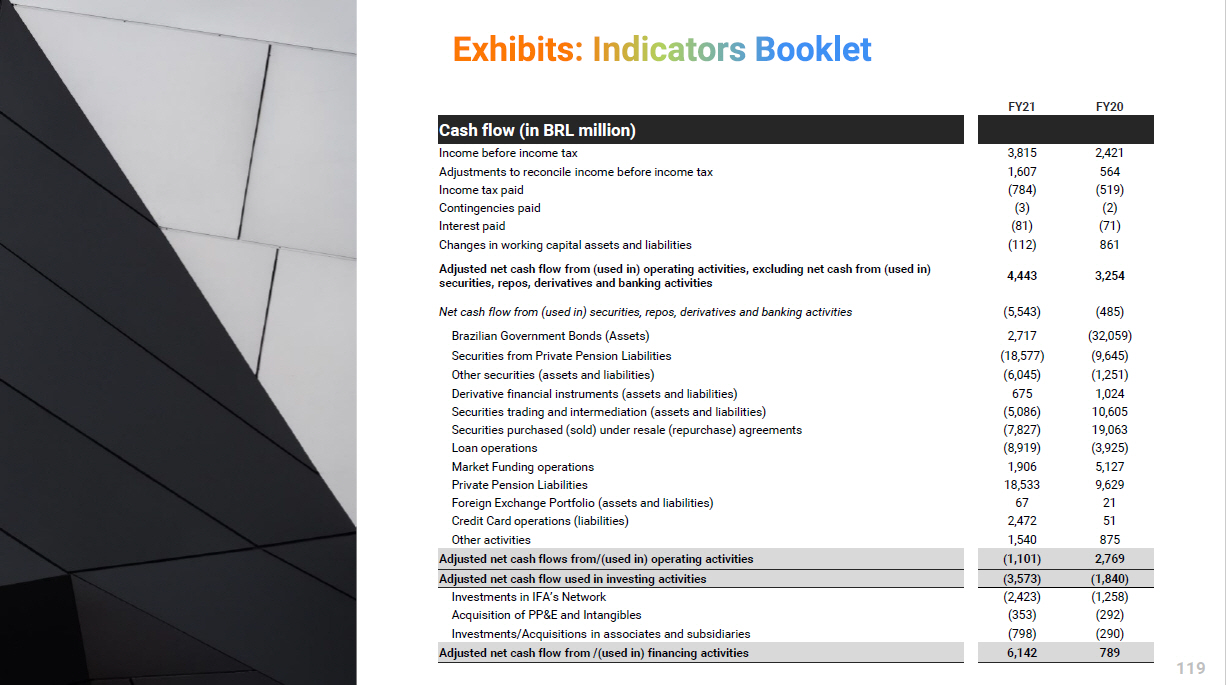

Operating Performance Retail The Retail segment accounted for approximately 77% of our total revenues for 2021, contributing with 88% of our year - over - year revenue growth. In addition to the growing revenue contribution from the new businesses (Pension Funds, Credit Cards, Credit and Insurance), our resilient growth also shows how our core business has adapted to different economic cycles. The reduction in trading volume and its consequent impact on equities and futures revenue, seen since 1Q21, was more than offset by the positive performance of revenue lines directly benefited from higher interest rates, such as Fixed Income, Structured Products and Issuance of Debts. Our strong distribution channel, coupled with a comprehensive product offering and focus on the customer experience, are key factors for such adaptability of Our Business Model. Institutional The Institutional segment represented almost 10% of our total revenues for 2021, with a 6% growth year - over - year. This result came mainly from the increase in the result with Fixed Income, FX and Commodities, or FICC Trading Desk. Issuer Services Issuer services revenue grew significantly by 52% in the year, already representing around 8% of our total revenues in 2021. Despite the more challenging scenario for ECM, we highlight that our revenue profile is more exposed to DCM revenues, which tend to be less volatile in different macroeconomic scenarios. Our Issuer Services business is key to foster our product offering and contribute to the development of Capital Markets in Brazil. Although market conditions may affect our ECM results in the short - term, the DCM division is expected to benefit from the demand of corporate clients for alternative funding sources. Furthermore, as we see our recent M&A initiative starting to flourish, we consolidate ourselves as one of the main players in Investment Banking services in Brazil, with a complete and robust offer of services for our clients. Digital Content The result of Digital Content fell by 24% in the year, mainly impacted by the absence of courses and in - person events. Our digital content plays an important role in educating Brazilians and making them more proficient in financial products and services. It also enhances client’s relationships and attracts new clients that grow our retail platform. Operating Costs and General Administrative Expenses In 2021, operating costs reached BRL 3.5 billion, a 30% increase against the previous year, with a gross margin of 70.8%, and approximately 400bps of expansion in the year. The lower growth in operating costs versus revenue reflects a better mix of products and channels throughout the year. General administrative expenses reached BRL 3.8 billion in 2021, a 46% increase against 2020, reflecting our investments in a headcount growth of over 70% in the last 12 months Adjusted Net Income In 2021, our Adjusted Net Income reached BRL 4,003 million, a 76% growth against 2020 and 4x larger than the result of 2019, the year of our IPO. Our adjusted net margin reached a record 33.1%, reinforcing the operating leverage of our business. Despite investments in technology and new verticals, our mid - term guidance for adjusted net margin remains unchanged. 47

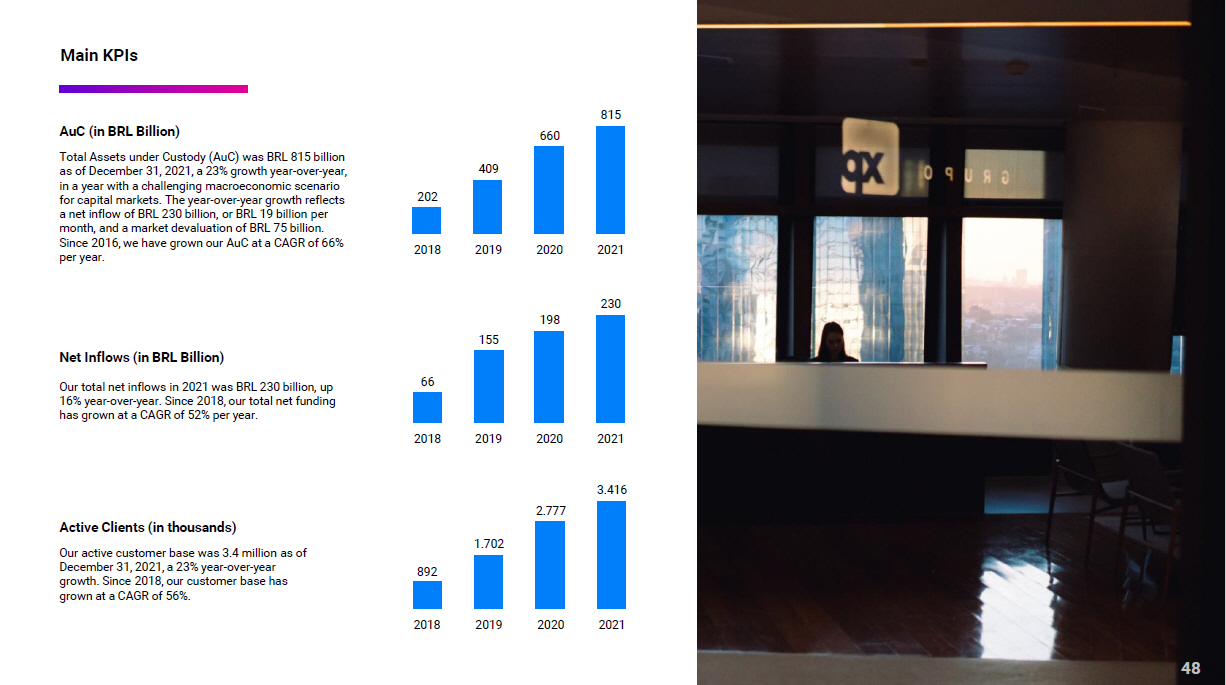

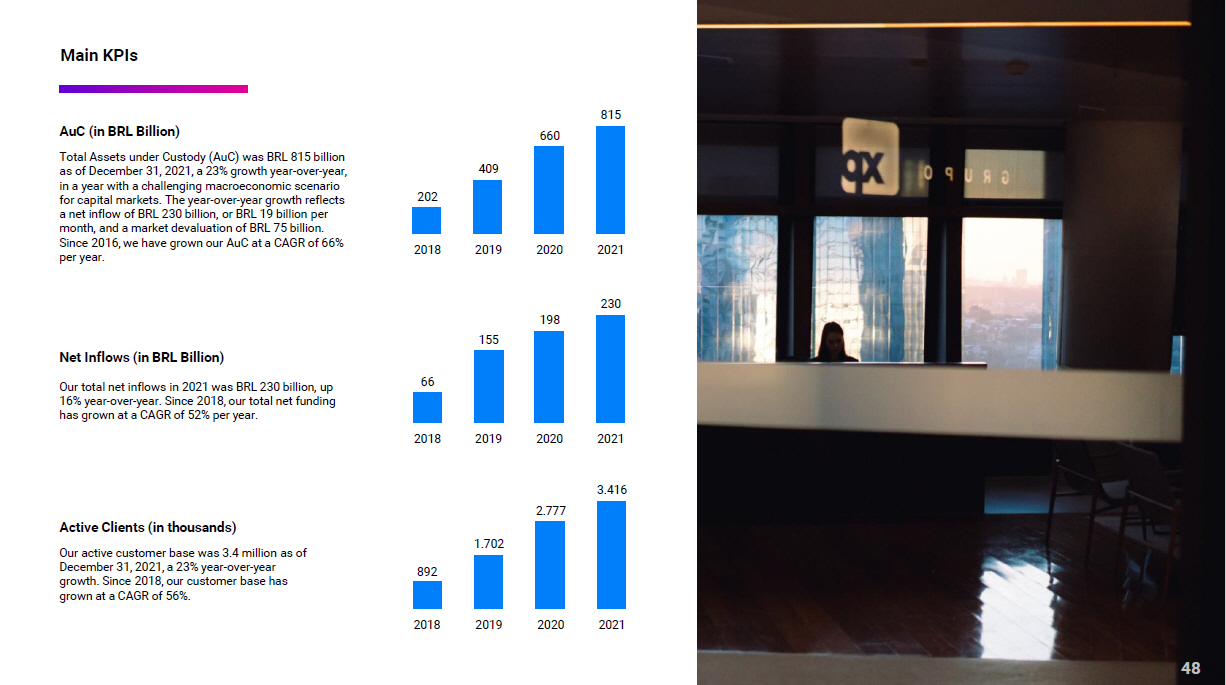

AuC (in BRL Billion) Net Inflows (in BRL Billion) Active Clients (in thousands) Total Assets under Custody ( AuC ) was BRL 815 billion as of December 31, 2021, a 23% growth year - over - year, in a year with a challenging macroeconomic scenario for capital markets. The year - over - year growth reflects a net inflow of BRL 230 billion, or BRL 19 billion per month, and a market devaluation of BRL 75 billion. Since 2016, we have grown our AuC at a CAGR of 66% per year. Our total net inflows in 2021 was BRL 230 billion, up 16% year - over - year. Since 2018, our total net funding has grown at a CAGR of 52% per year. Our active customer base was 3.4 million as of December 31, 2021, a 23% year - over - year growth. Since 2018, our customer base has grown at a CAGR of 56%. 201 8 201 9 202 0 202 1 202 409 660 815 201 8 201 9 202 0 202 1 66 155 198 230 201 8 201 9 202 0 202 1 892 1.70 2 2.77 7 3.41 6 Main KPIs 48

ESG Performance XP Inc. recognizes that the ESG agenda is a journey. In order to move consistently in this direction, the entire Company is engaged in integrating ESG issues into both our internal activities and our business. ESG Positioning ESG XP Inc. Statement To deliver the best solutions for our customers, we need to go beyond and understand how these solutions leave a positive legacy for our society. Changes are necessary and urgent. But for transformation to happen, we cannot rely only on the government and specific initiatives. We all need to be protagonists in building a better world. We recognize our role in supporting the transition to a more sustainable world. We know that this is a journey. It will be walked together with our employees, customers, investors, partners, and the market. We are a company of people for people. Therefore, we want to inspire Brazilians on the journey of transforming Brazil. We believe that investments generate value for society and the environment. We want to increase the knowledge, engagement, and development of effective solutions so that the ESG agenda is at the core of business models and the decision - making process. Make investments your voice. XP Inc. FN - IB - 410a.3 49

Our Pillars XP Inc. wants to be a company that takes responsibility for its legacy and that inspires others to also follow this path. Therefore, throughout our entire business ecosystem, we seek to be protagonists and lead the ESG agenda. • Asset issuance and ESG - labelled product launch • Exclusive solutions for private and institutional customers • ESG Education for stakeholders • Dedicated ESG Research • Search for recognition from third parties with international visibility • Adherence to Commitments, Pacts and Working Groups • Implementation of governance processes and ESG methodologies • Offsetting our carbon footprint • Internal and public goals to become a more diverse company • Creation of inclusive programs and vacancies • Support to affinity groups and creation of the Diversity Comission • Projects with a network of partners and reference institutions on the subject �� XP Institute: financial education for 50 million people • Partnerships with local players focused on educational solutions • National Award and Financial Education Tournament • Launching of technology education programs Provide sustainable investment solutions Prioritize our sustainable transition Achieve diversity & inclusion goals Democratize financial and technological education In 2021 we further accelerated our ESG agenda within XP Inc., focusing on four pillars of action: 50

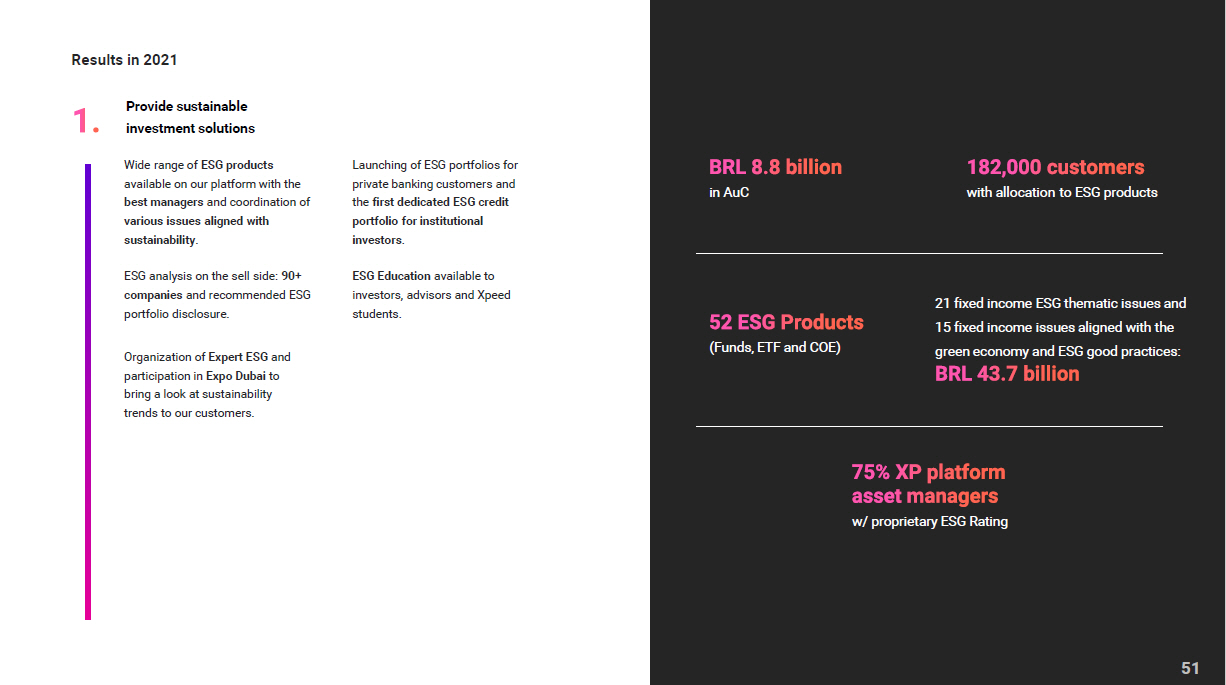

Results in 2021 Provide sustainable investment solutions Wide range of ESG products available on our platform with the best managers and coordination of various issues aligned with sustainability . Launching of ESG portfolios for private banking customers and the first dedicated ESG credit portfolio for institutional investors . ESG analysis on the sell side: 90+ companies and recommended ESG portfolio disclosure. ESG Education available to investors, advisors and Xpeed students. Organization of Expert ESG and participation in Expo Dubai to bring a look at sustainability trends to our customers. in AuC with allocation to ESG products (Funds, ETF and COE) w/ proprietary ESG Rating 51 21 fixed income ESG thematic issues and 15 fixed income issues aligned with the green economy and ESG good practices:

Prioritize our sustainable transition Achieve diversity & inclusion goals Democratize financial and technological education See our results in the "Diversity & Inclusion" chapter. See our results in the "Positive Impact" chapter. Creation and adjustments of internal policies and processes, especially our ESG Policy and Responsible Investment Policy Implementation of internal ESG methodologies, with emphasis on the ESG XP Rating. Launch of our first GRI and SASB - based ESG Report in 2020 and this Integrated Report in 2021. Disclosure of our institutional carbon inventory, with carbon credits acquired for offsetting. Climate risk: first carbon inventory of Banco XP's credit portfolio. XP BIO: internal environmental group. Best ESG: Latin America Executive Team 2021 100% active suppliers and customers with an internal Social Environmental Risk & ESG rating Results in 2021 52

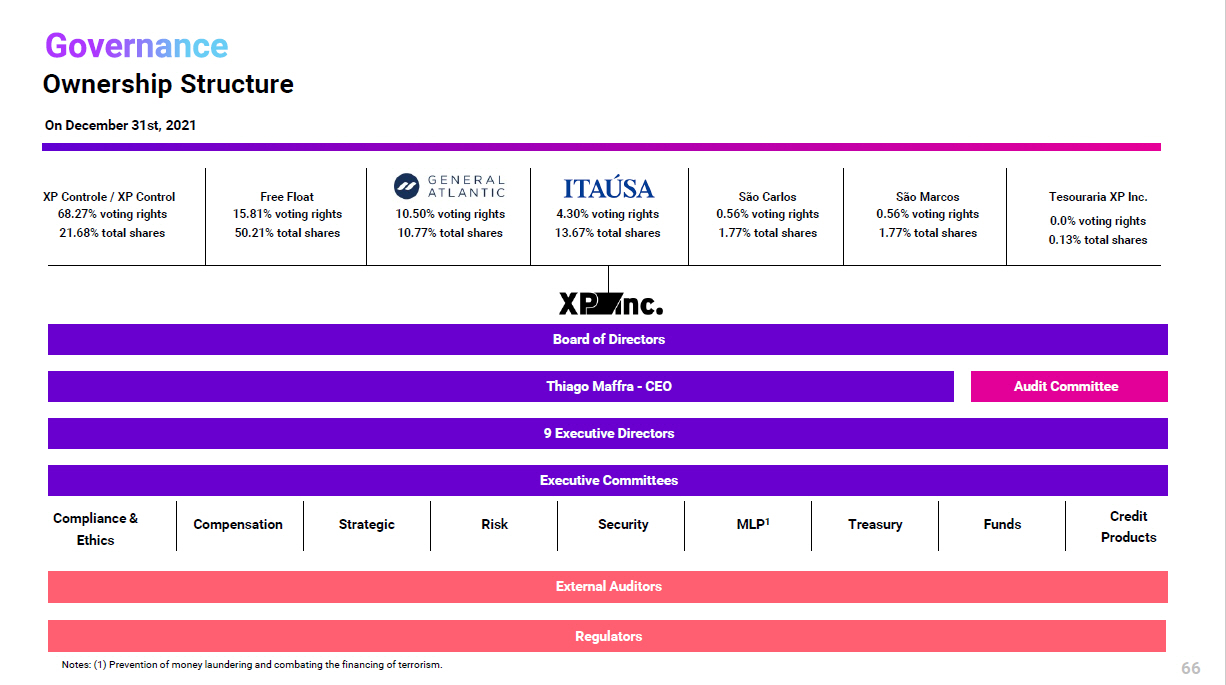

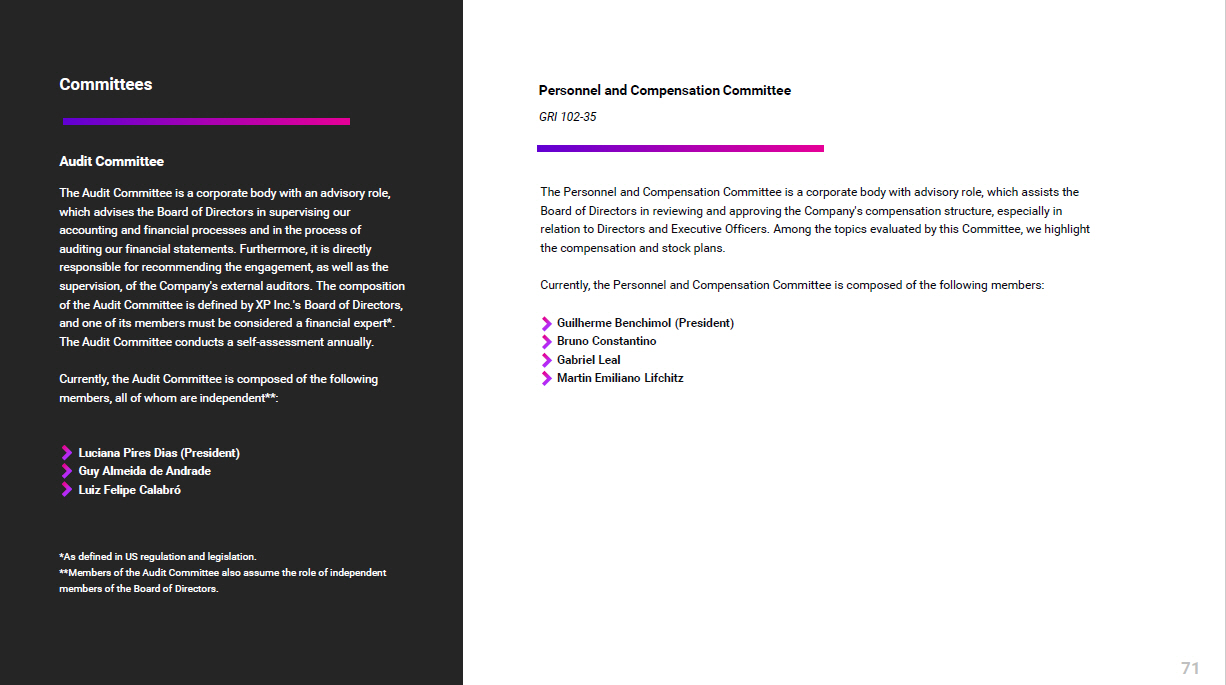

ESG Governance Roles and Responsibilities The ESG Executive Board, created in 2020 under the responsibility of Marta Pinheiro, is responsible for organizing the ESG strategy, institutional representation, articulation and alignment of XP Inc's internal areas and companies in relation to the topic. GRI 102 - 10 | 102 - 19 | 102 - 20 | 102 - 29 SASB FN - EX - 410A.4 53 In addition, we believe that this agenda should not be away from the other areas of the Company, thus we have technical specialists together with some of our internal areas and subsidiaries, which we call ESG Chapter. This model supports the integration of the topic into business practices, with emphasis on Research, Investment Banking and Social Environmental and Climate Risk. XP Inc. has specific governance structures for decision - making related to ESG factors, such as the ESG Commission , within the scope of the Social Environmental & ESG Risk Rating process, to decide on the Company's position in relation to a product or operation in which significant ESG controversies and/or relevant social environmental risks are identified. The ESG Commission meets without specific frequency, whenever there is a need to discuss a relevant case or transaction in relation to notes or controversies related to ESG issues. The Diversity and Inclusion Commission (D&I) aims to support the evolution of the D&I theme at XP Inc. The Commission meets monthly and brings together members of the Executive Board to validate and direct action plans for this agenda in the Company.

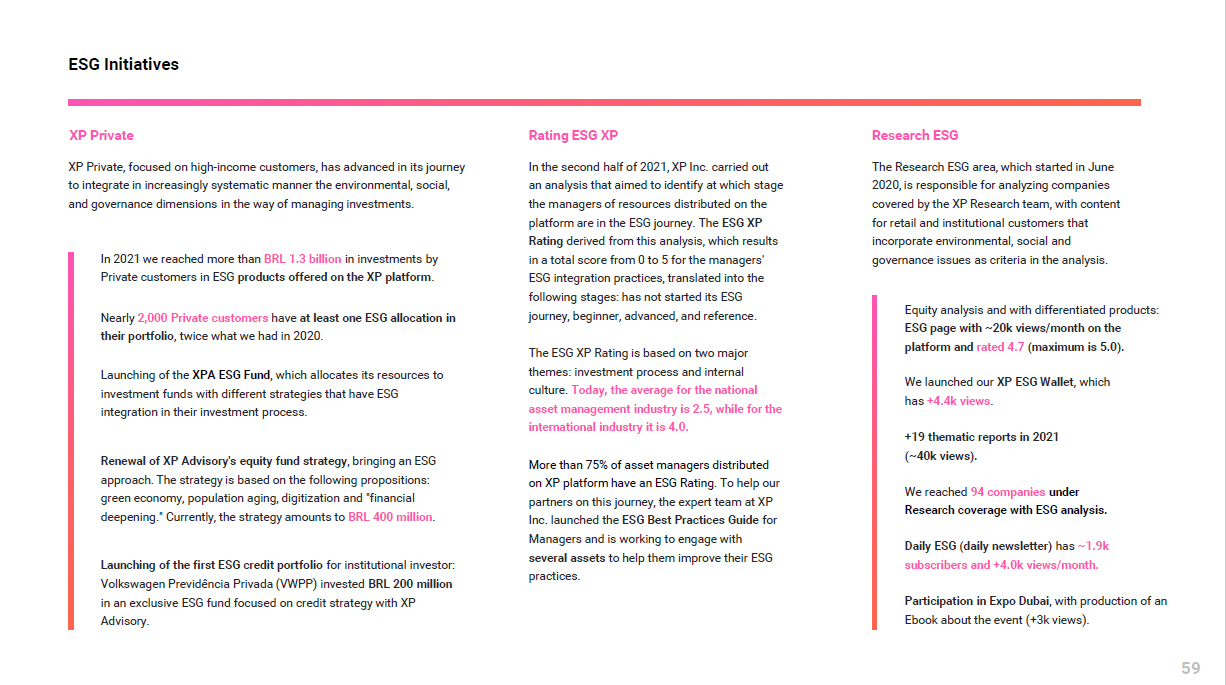

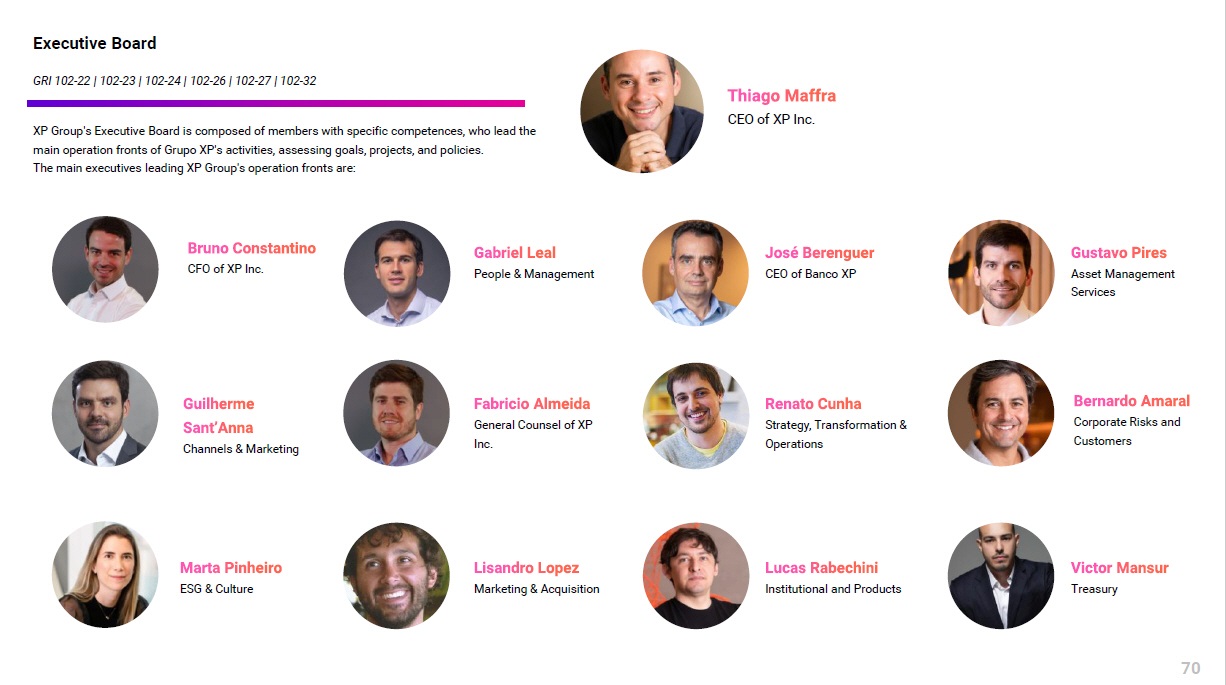

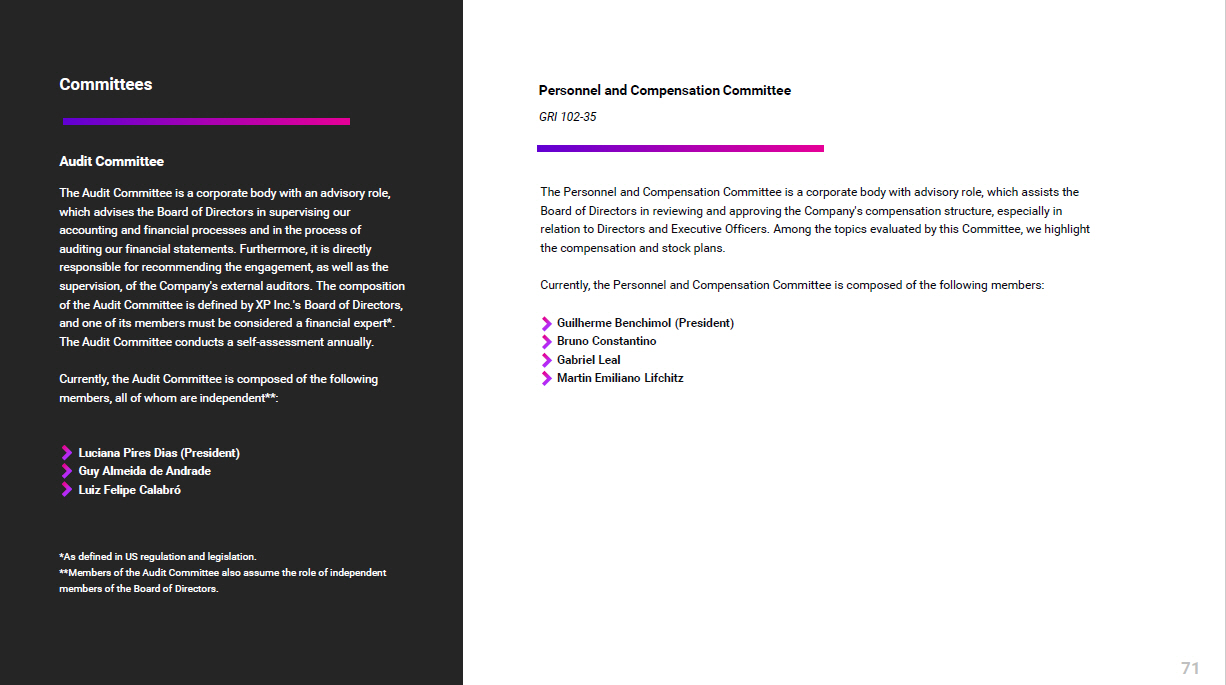

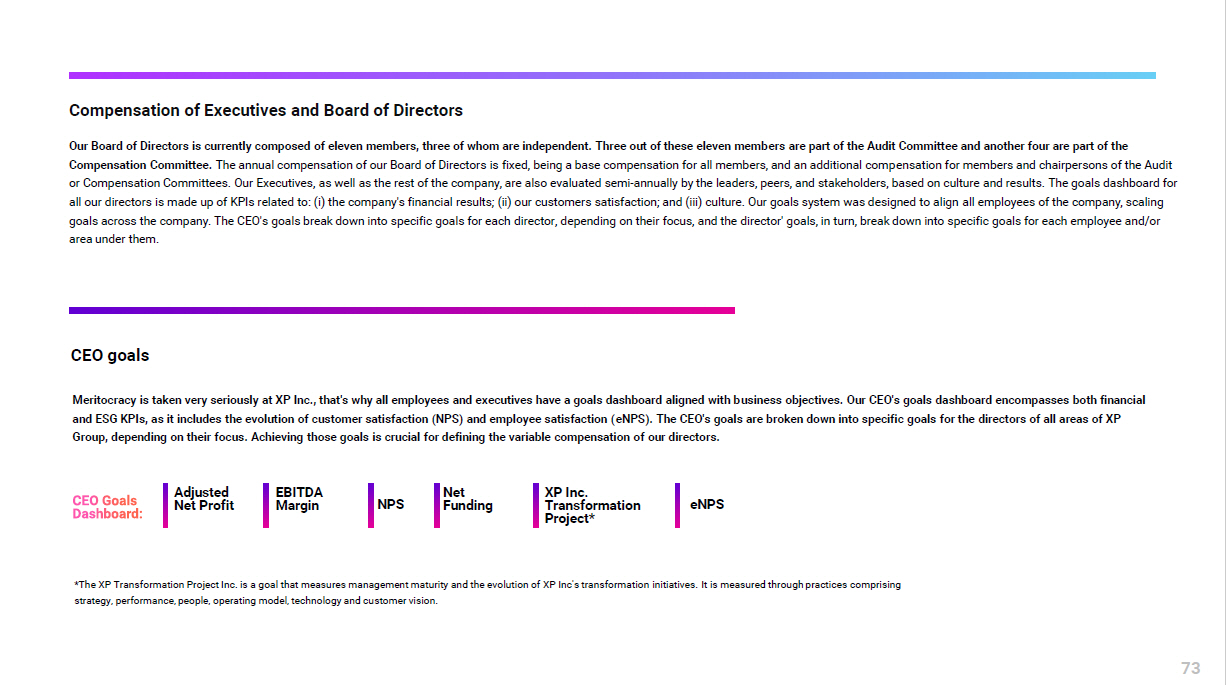

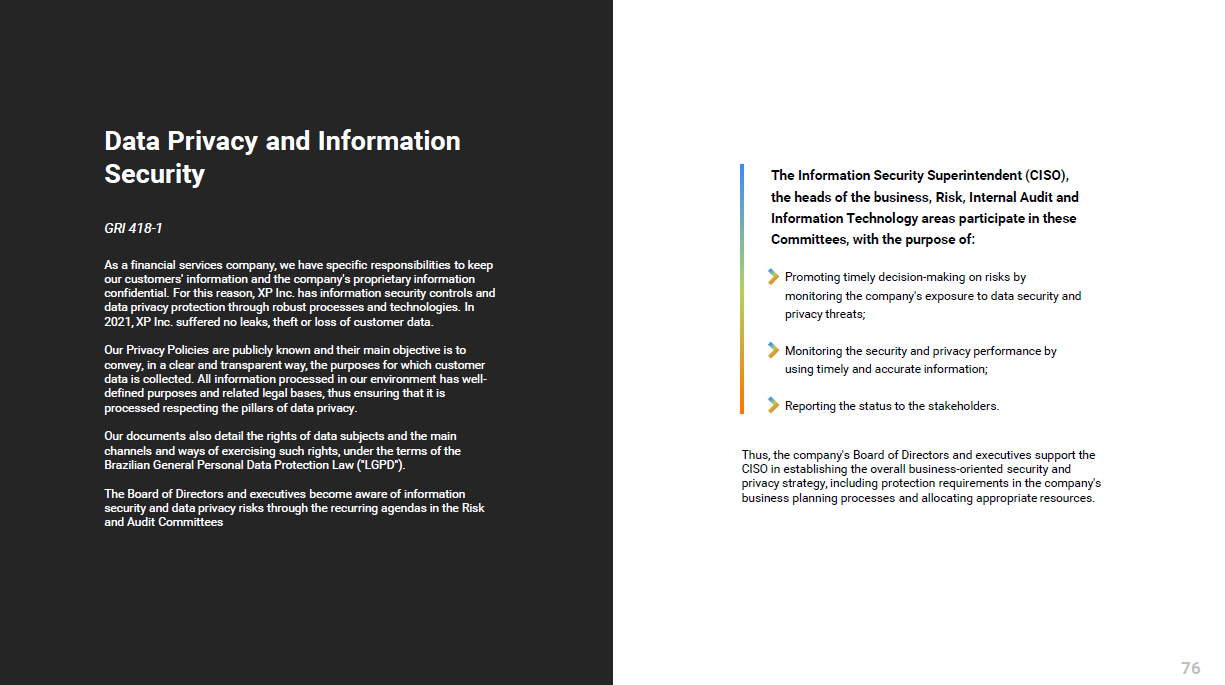

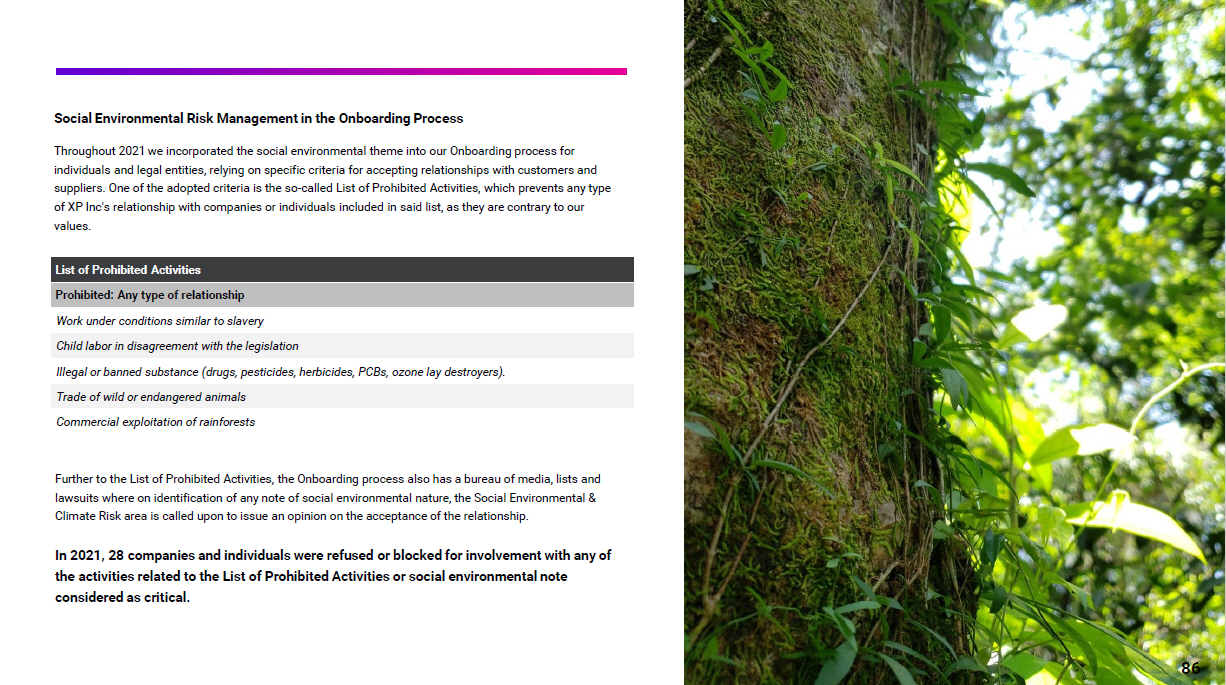

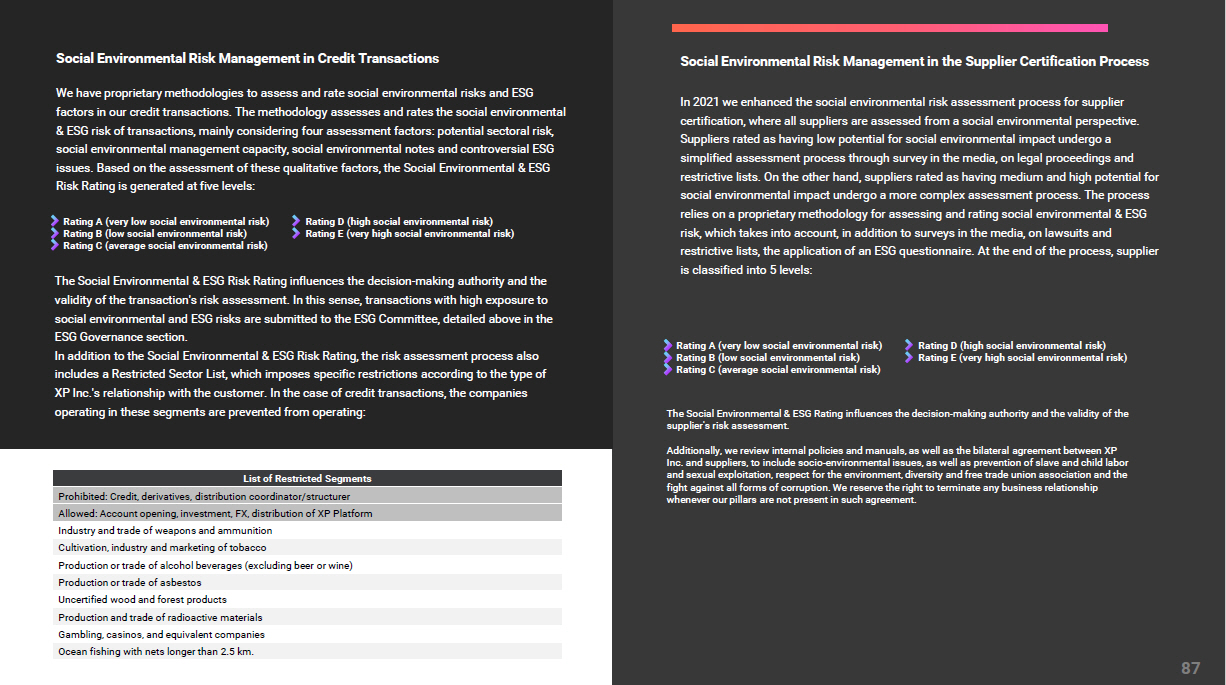

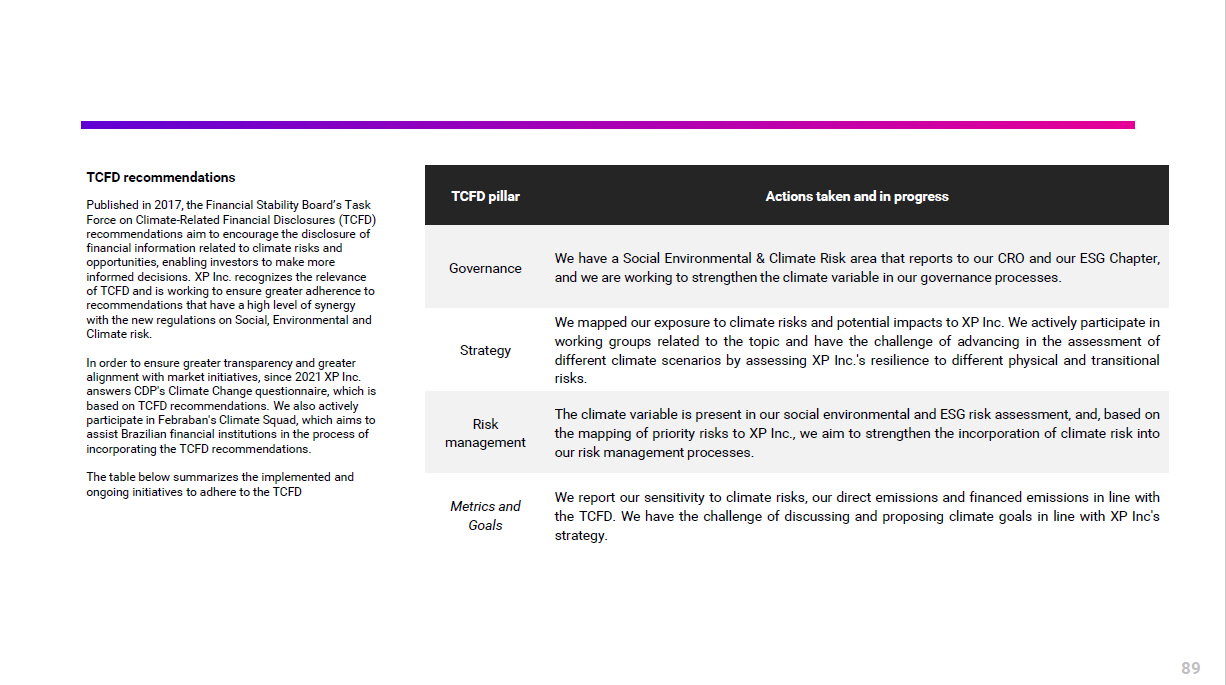

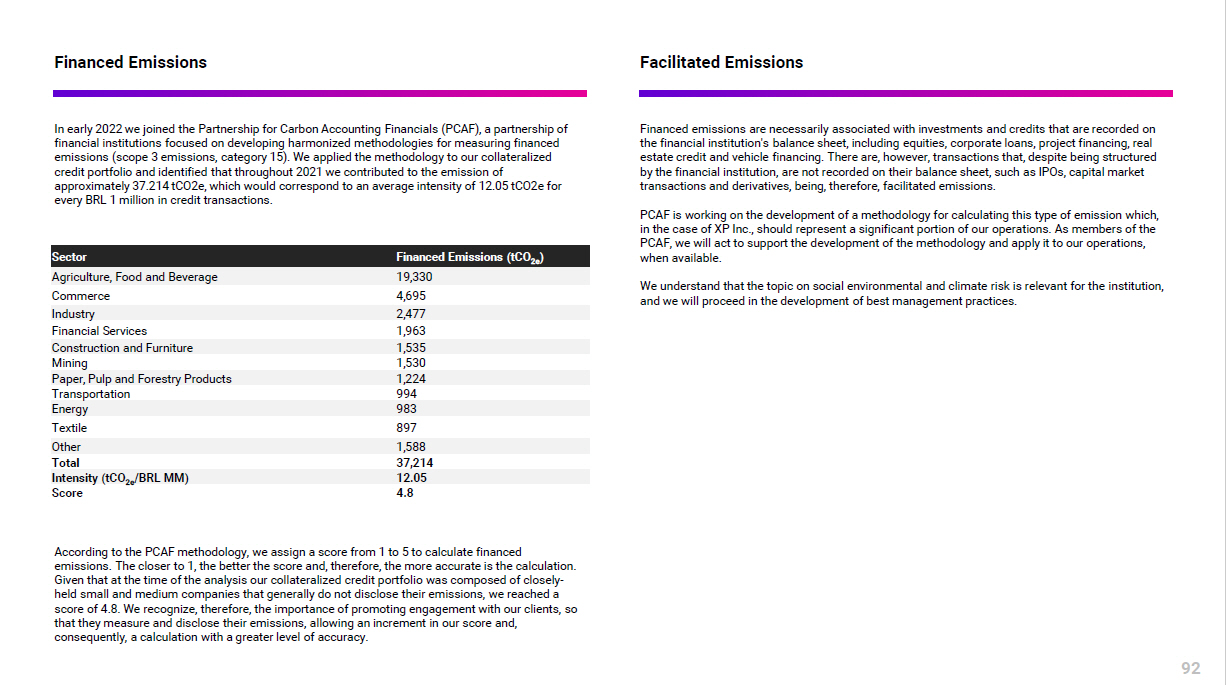

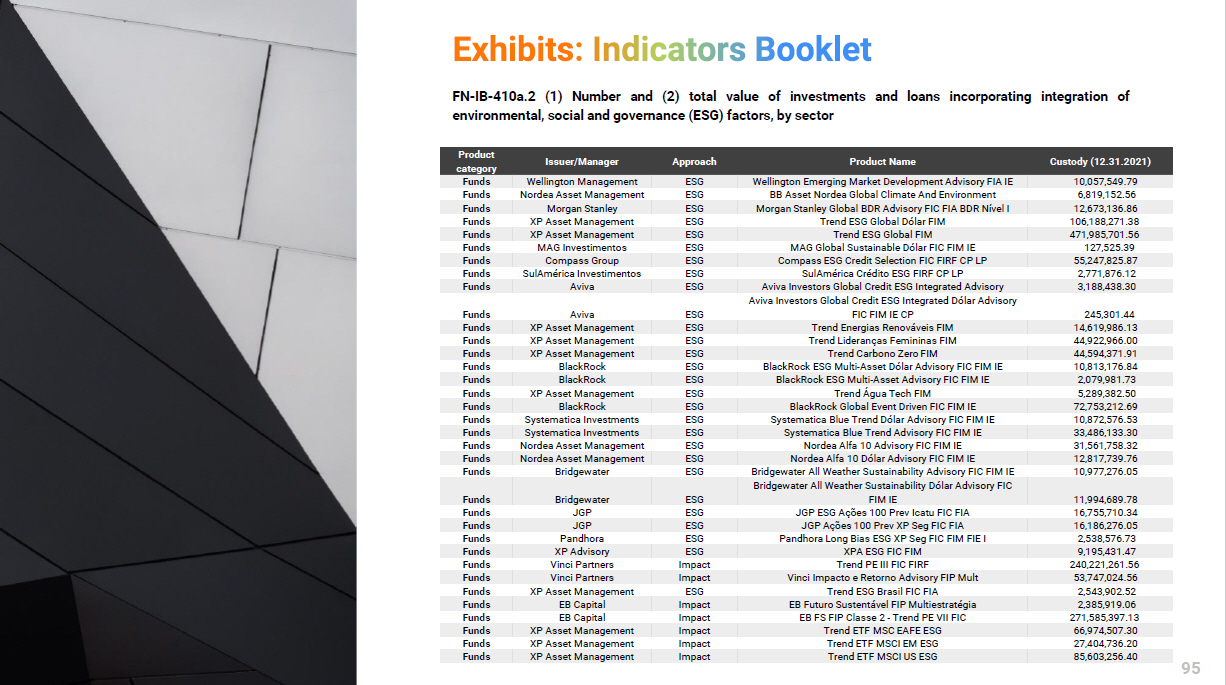

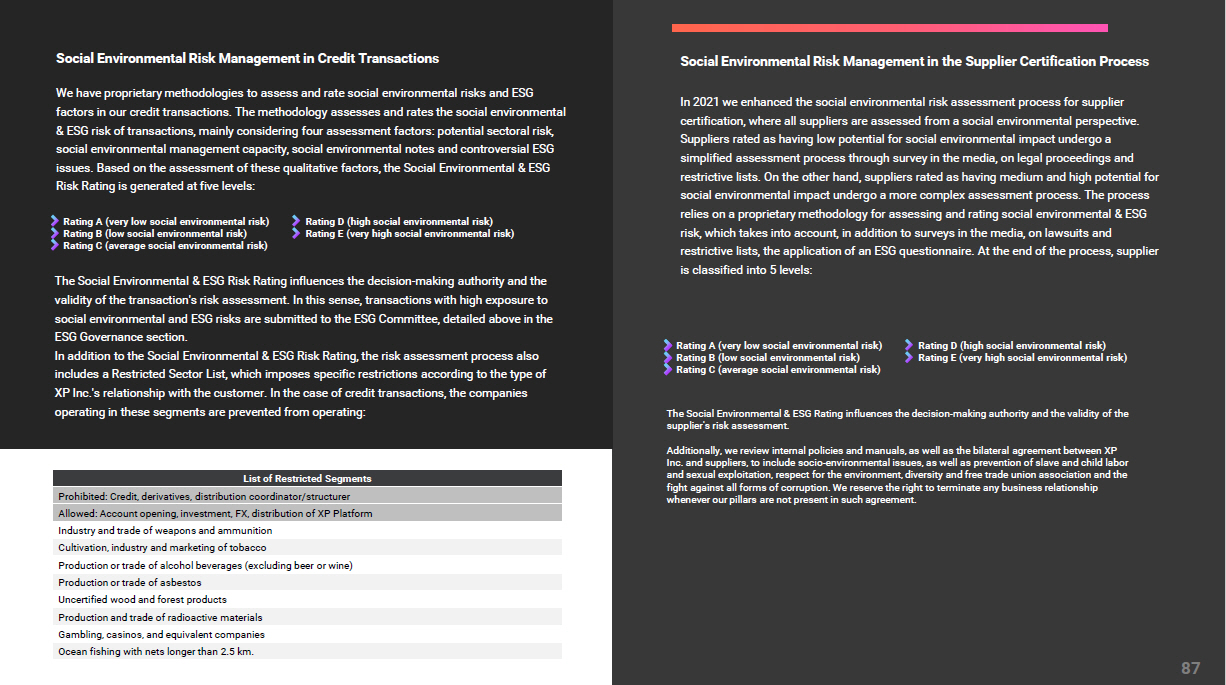

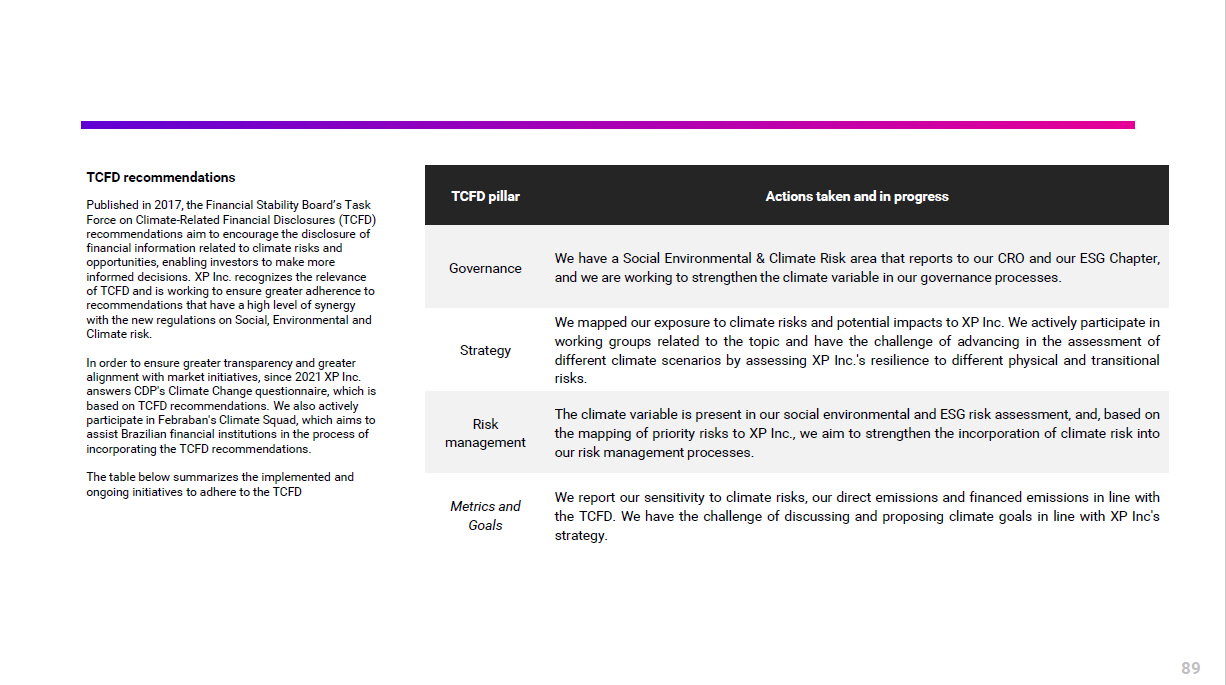

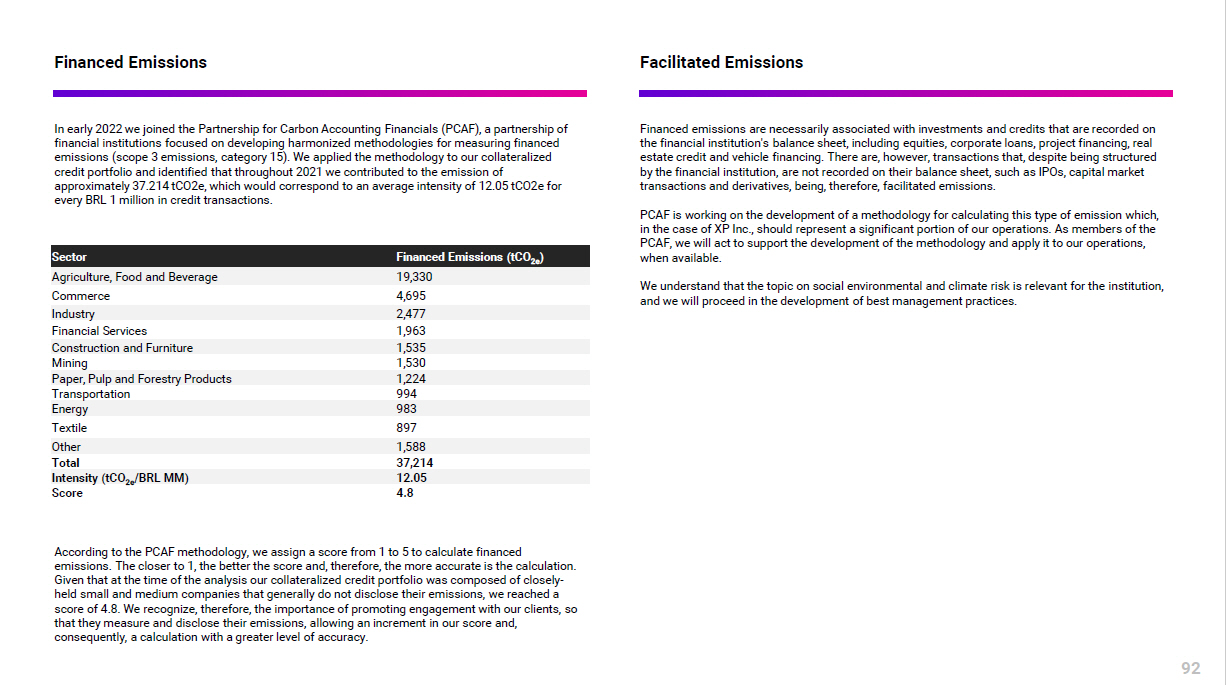

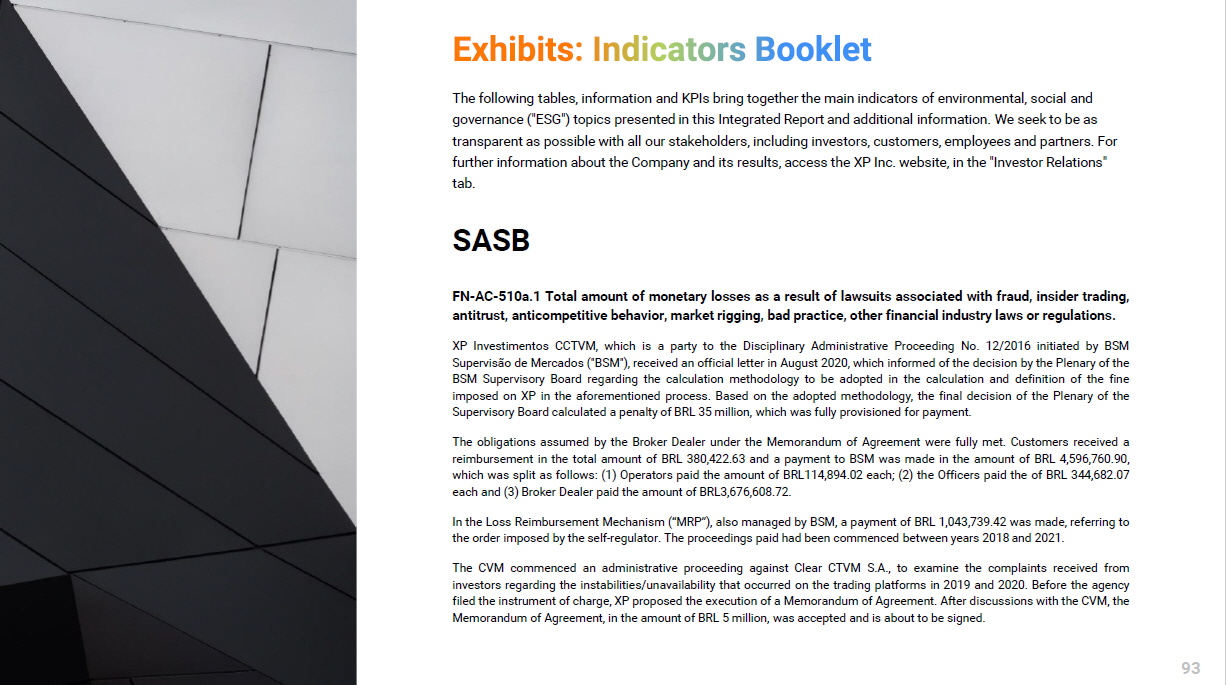

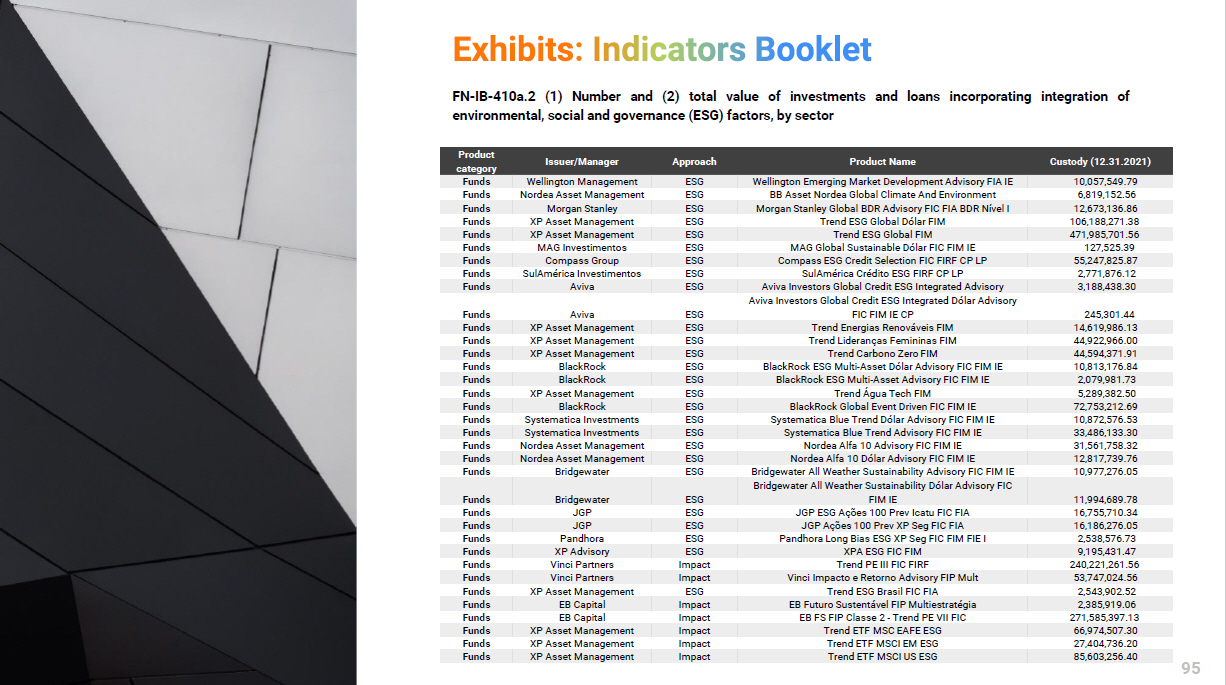

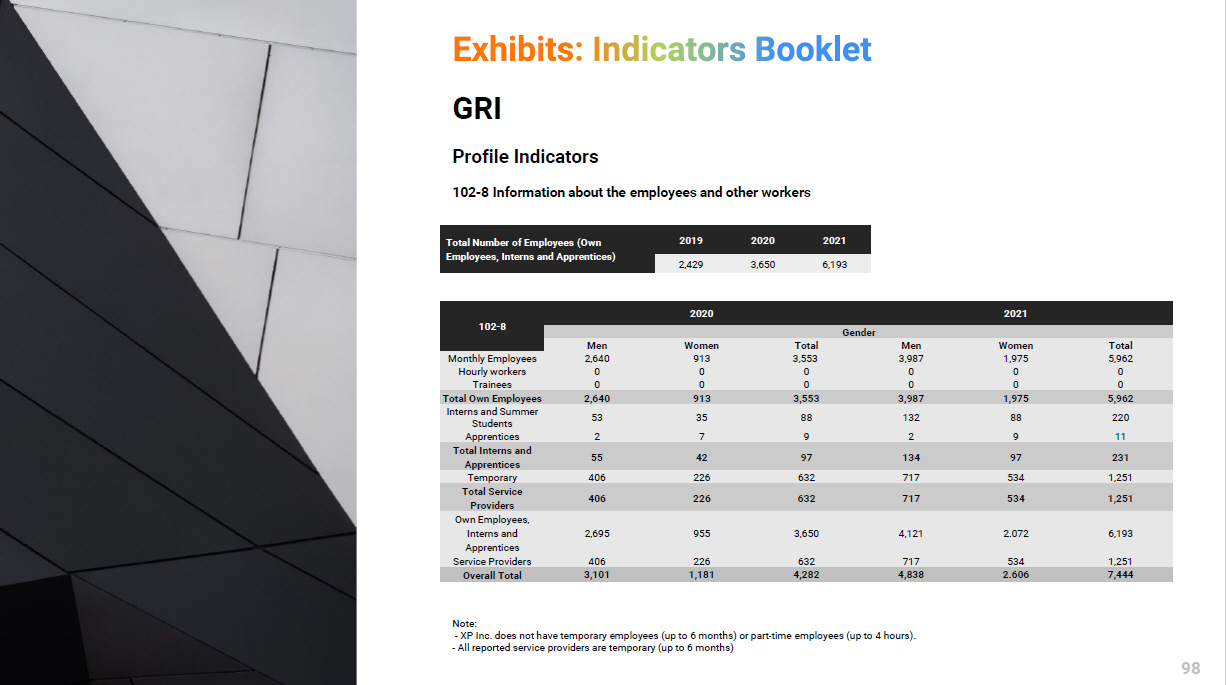

ESG Products and Services ESG integration into XP Inc.'s business lines continues to grow. In 2021, XP Inc. played its role in developing, originating, structuring, and distributing a range of national and international financial products labeled as ESG, including investment funds, fixed income assets and COE, to foster the Sustainable Investments ecosystem. Our broad portfolio of ESG products is defined based on international sustainable finance classification references, such as the European Union's Green Finance Taxonomy, and on the self - regulation of the Brazilian Association of Financial and Capital Market Entities (ANBIMA). In this sense, investments labeled as ESG are subject to an internal due diligence process with experts in the field. 46 ESG - labeled investment funds available on the platform, including equity, fixed income, hedge fund, index, private equity, and pension funds, with local and global strategies. ESGE11, ESGD11, and ESGU11 offer exposure to the equity performance of companies around the world with ESG best practices, as measured by MSCI. In structured products, the launching of three COEs stands out: We ended December 2021 with representing 1.03% of XP's total custody in December 2021, and In fixed income, we participated in more than considering the local and international debt markets, we also started to monitor issuances by companies in sectors of the green economy that have good ESG practices, in line with XP Inc.'s proprietary methodology, GRI 102 - 2 | 102 - 13 | 102 - 15 54