May 21, 2021

Convey Holding Parent, Inc.

Amendment No. 1 to Draft Registration Statement on Form S-1

Submitted May 5, 2021

CIK No. 0001787640

Dear Messrs. Gabor and Kluck:

Convey Holding Parent, Inc. (formerly known as Cannes Holding Parent, Inc.) (the “Company”) has filed today with the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”), via EDGAR, this letter and the Company’s Registration Statement on Form S-1 (the “Registration Statement”). This letter and the Registration Statement set forth the Company’s responses to the comments of the Staff contained in your letter dated May 19, 2021 (the “Comment Letter”), relating to the Company’s Amendment No. 1 to its draft Registration Statement on Form S-1 submitted to the SEC on May 5, 2021.

Amendment No. 1 to Draft Registration Statement on Form S-1

The numbered paragraphs and headings below correspond to those set forth in the Comment Letter. Each of the Staff’s comments is set forth in bold, followed by the Company’s response to each comment. Capitalized terms used in this letter but not defined herein have the meaning given to such terms in the Registration Statement. All references to page numbers in these responses are to pages of the Registration Statement.

Our History and Principal Stockholder

| 1. | We note your response to prior comment 7 and reissue in part. Please revise to state the consideration paid for acquiring Convey Health Solutions, Inc. |

Response: The Company has revised its disclosure on page 13 to address the Staff’s comments.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Non-GAAP Financial Measures

| 2. | We reference your response to prior comment 12 related to the Non-GAAP Cost of COVID-19 adjustment. Please revise your disclosure to provide a more detailed discussion of each adjustment, including how the amount was calculated, similar to the response. In addition, tell us if you identified and/or considered any impacts of COVID-19 that may have reduced your costs and positively contributed to EBITDA during the year ended December 31, 2020. |

Response: The Company has revised its disclosure on pages 21, 76 and 82 to address the Staff’s comments. The Company advises the Staff that it has evaluated whether there were any impacts of the COVID-19 pandemic that may have reduced its costs and positively contributed to the Company’s calculation of EBITDA for the year ended December 31, 2020, and has determined that there were no impacts that positively contributed to EBITDA.

Results of Operations

Three Months Ended March 31, 2021 Compared with the Three Months Ended March 31, 2020

Selling, General and Administrative

| 3. | Reference the disclosure that the decrease in selling, general and administrative expenses was offset by higher incremental debt financing cost associated with the incremental term loan that went into effect in February 2021. Please explain why debt financing costs were classified within selling, general and administrative expenses rather than interest expense, as disclosed on page F-36 and F-68 of the financial statements. |

Response: The Company has revised its disclosure on page 86 to address the Staff’s comments.

Segment Information, Segment Revenues

| 4. | We see that you attribute the increase in Technology Enabled Solutions revenue for the three months ended March 31, 2021 compared to 2020, respectively to increased sales of technology solutions to existing clients, shipments of formulary catalogs to members and increased membership. Please revise to explain the underlying reasons, such as changes in trends, for the increased sales, shipments and memberships. In addition, revise to quantify the impact of each item discussed. |

Response: The Company has revised its disclosure on page 87 to address the Staff’s comments.

Our Clients

| 5. | We note your response to prior comment 20 and reissue in part. Please revise to identify the clients which comprised approximately 46% of your total revenue. In this regard, we note the identities of these key clients appear to be material to an understanding of the business taken as a whole. |

Response: The Company has revised its disclosure on page 120 to address the Staff’s comments.

Audited Consolidated Financial Statements of Cannes Holding Parent, Inc.

Note 18. Segment Information

| 6. | Please address the following regarding your response to prior comment 13, as previously requested: |

| · | Please revise to more clearly disclose the nature of the reconciling line item titled “Consultant lower utilization due to COVID-19, including the description of the calculation provided in your response to comment 13. |

| · | To the extent such amounts represent the hypothetical, estimated incremental cost allocated to or assumed to be related to revenue volume that was lost during the COVID pandemic, more clearly disclose that. |

| · | Revise to more clearly disclose the basis for and purpose of this adjustment, including the reasons the Company believes it is meaningful as a segment profit measure to adjust out costs that were actually incurred as allocated to foregone revenues. |

Response: The Company has revised its disclosure on page F-50 to address the Staff’s comments.

Exhibits

| 7. | We note your response to prior comment 24. Please provide us supplementally with a copy of the Merger Agreement. |

Response: The Company respectfully advises the Staff that it will supplementally provide the Staff with a copy of the Merger Agreement.

| 8. | We note your revised disclosure on page 139 that Carl Whitmer is a party to the Management Services Agreement. Please file this agreement as an exhibit. See Item 601(b)(10) of Regulation S-K. |

Response: The Company has revised its disclosure on page 141 to address the Staff’s comments. The Company respectfully advises the Staff that Carl Whitmer will not be a party to the Management Services Agreement. As disclosed on page 141, the Management Services Agreement will terminate pursuant to its terms upon the completion of the Company’s initial public offering.

* * *

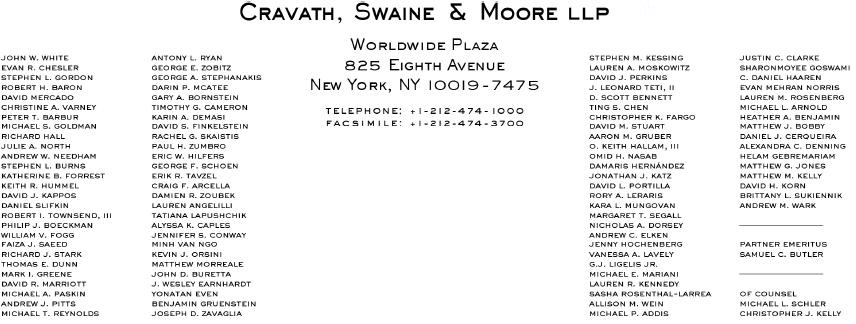

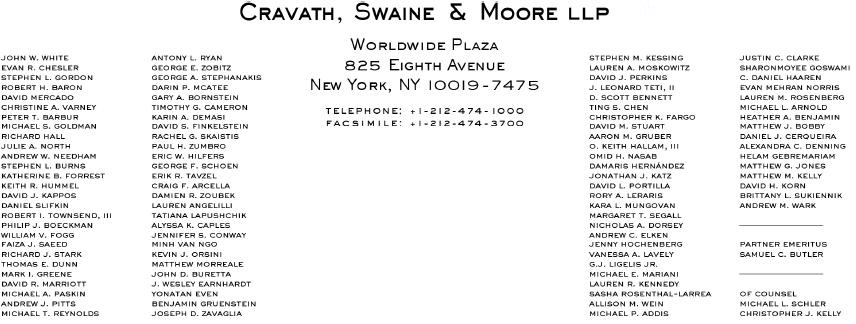

Should you have any questions or comments with respect to the Registration Statement or this letter, please contact Michael E. Mariani at 212-474-1007.

| | Sincerely, |

| | |

| | /s/ Michael E. Mariani |

| | |

| | Michael E. Mariani |

VIA EDGAR

Copy to:

Stephen C. Farrell, Chief Executive Officer

Convey Holding Parent, Inc.

100 SE 3rd Avenue, 26th Floor

Fort Lauderdale, FL 33394

VIA E-MAIL