August 25, 2022

Convey Health Solutions Holdings, Inc.

Amendment No. 1 to Schedule 13E-3 and Schedule 14C

Submitted August 25, 2022

CIK No. 0001787640

Dear Mr. Killoy and Ms. Chalk:

Convey Health Solutions Holdings, Inc. (the “Company”) has filed today with the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”), via EDGAR, this letter and the Company’s amended Schedule 13E-3 and Schedule 14C (the “Amended Schedule 13E-3 and Schedule 14C”). This letter and the Amended Schedule 13E-3 and Schedule 14C set forth the Company’s responses to the comments of the Staff contained in your letter dated August 18, 2022 (the “Comment Letter”), relating to the Company’s Schedule 13E-3 and Schedule 14C submitted to the SEC on July 25, 2022 (the “Initial Schedule 13E-3 and Initial Schedule 14C”).

The numbered paragraphs and headings below correspond to those set forth in the Comment Letter. Each of the Staff’s comments is set forth in bold, followed by the Company’s response to each comment. Capitalized terms used in this letter but not defined herein have the meaning given to such terms in the Initial Schedule 13E-3 and Initial Schedule 14C. All references to page numbers in these responses are to pages of the Initial Schedule 13E-3 and Initial Schedule 14C, as applicable.

Initial Schedule 13E-3 and Schedule 14C filed July 25, 2022

Cautionary Statement Regarding Forward-Looking Statements, page 16

| 1. | The safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 does not by its terms apply to statements made in connection with a going-private transaction such as this Merger. Please delete the references to the Reform Act or make clear that its safe harbor provisions do not apply to disclosure in the information statement or Schedule 13E-3. |

Response: The Company has revised its disclosure on page 16 to address the Staff’s comments.

Reasons for the Merger; Recommendation of the Special Committee; Recommendation of the Board, page 33

| 2. | We note that the Special Committee lists as a factor the fairness opinion provided by Centerview. When any filing person has based its fairness determination on the analysis of factors undertaken by others, such person must expressly adopt such analysis as their own in order to satisfy their disclosure obligation. Refer to Question 20 of Exchange Act Release No. 34-17719 (April 13, 1981). Accordingly, please revise to state, if true, that the Special Committee has adopted Centerview’s analysis as its own. Alternatively, describe its own analysis of the report. |

Response: The Company has revised its disclosure on page 36 to address the Staff’s comments.

Certain Financial Projections, page 46

| 3. | Expand to describe the assumptions and underlying limitations that form the basis for the projections, which you reference generically in this section. |

Response: The Company has revised its disclosure on page 49 to address the Staff’s comments.

Purposes and Reasons of the Top Management Rollover Stockholders in Connection with the Merger, page 53

| 4. | Revise to state the reasons of these parties for engaging in the going-private transaction, and for the timing of the Merger. The current disclosure focuses on other filing parties’ stated reasons, rather than those of the Rollover Stockholders. See also, our comment below regarding cursory statements about the effect, rather than the reason for, engaging in the transaction. |

Response: The Company has revised its disclosure on page 55 to address the Staff’s comments.

Purposes and Reasons of the TPG Parties in Connection with the Merger, page 53

| 5. | We note the disclosure here that “the primary purpose of the Merger is to allow Parent to own equity interests in the Company and to bear the rewards and risks of such ownership after the Merger is completed...” Revise to explain why the TPG Parties are seeking 100% ownership of a Company they already control, and why they are seeking it now. See Item 1013(c) of Regulation M-A. We note for example, the statement in the Centerview materials filed as an exhibit to the Schedule 13E-3 that TPG expressed as a reason for the transaction its inability to obtain financing on favorable terms. See the May 31, 2022 materials from Centerview filed as exhibit 99(c)(3) to the Schedule 13E-3. |

Response: The Company has revised its disclosure on pages 55-56 to address the Staff’s comments.

General

| 6. | Please explain supplementally why you have not included TPG Global, LLC as a filer on the Schedule 13E-3. We note that TPG initiated, negotiated and structured the Merger Agreement with the Company and has been a major shareholder of the Company since 2019. It also controls filers Parent and Merger Sub. Alternatively, revise the Schedule 13E-3 to add TPG Global as a filer and revise the information statement (as needed) to add all of the required disclosure as to that filing person (to the extent not already provided). |

Response: The Company has revised its disclosure on pages 22, 23, 51, 52, 53, 54, 55, 56, 87 and 88 to address the Staff’s comments.

| 7. | We note that the only Rollover Stockholders included as filers on the Schedule are Stephen C. Farrell and Timothy Fairbanks. Please supplementally explain why the other directors and affiliates who are parties to that Agreement are not filers, or revise to add them on the Schedule 13E-3 and amend the information statement to include all of the required additional information as to each individually, to the extent not already provided in the information statement. |

Response: We respectfully advise the Staff that the Filing Persons set forth in the Initial Schedule 13E-3 considered the issue of whether the Company’s rollover stockholders who are not Top Management Rollover Stockholders (the “Other Rollover Stockholders”) should be Filing Persons for Schedule 13E-3 and concluded that none of such Other Rollover Stockholders have been or are “engaged” in the pending take private transaction within the meaning of Rule 13e-3, and therefore none of such Other Rollover Stockholders should be a Filing Person for purposes of the Schedule 13E-3. The Filing Persons respectfully submit that Stephen C. Farrell and Timothy Fairbanks are the only members of the Company’s senior management that are both affiliates and “engaged” in the pending take private transaction within the meaning of Rule 13e-3 by virtue of the equity rollover and their roles with the Company.

As noted in Section 201.05 of the Compliance & Disclosure Interpretation issued by the SEC’s Division of Corporation Finance on January 26, 2009, whether members of senior management, such as the Other Rollover Stockholders, are deemed to be engaged in the transaction is dependent on the facts and circumstances of the transaction. Relevant factors include whether the senior management of the company going private will ultimately hold a material amount of the surviving company’s outstanding equity securities, occupy seats on the board of the company in addition to senior management positions, and otherwise be in a position to “control” the surviving company within the meaning of Exchange Act Rule 12b-2 (i.e., “possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether through the ownership of voting securities, by contract, or otherwise”).

As disclosed in the Initial Schedule 14C, the Other Rollover Stockholders entered into rollover and support agreements (the “Rollover and Support Agreements”) with Parent, pursuant to which Rollover Shares will be converted into shares of common stock of the Surviving Corporation. Upon the effectiveness of the pending going-private transaction, after giving effect to the conversion of the Rollover Shares into shares of common stock of the Surviving Corporation pursuant to the terms of the Merger Agreement and the Rollover and Support Agreements, the Other Rollover Stockholders will collectively hold less than approximately 3.0% of the outstanding shares of the Surviving Corporation’s common stock and no Other Rollover Stockholder will individually hold more than approximately 1.1% of the outstanding shares of the Surviving Corporation’s common stock, whereas affiliates of TPG will hold approximately 95.8% of the outstanding shares of the Surviving Corporation’s common stock and therefore control all voting decisions of the stockholders of the Surviving Corporation, including the ability to appoint and remove the directors of the Surviving Corporation. Therefore, the Other Rollover Stockholders will not, individually or in the aggregate, hold a material amount of the Surviving Corporation’s equity securities and will not have the ability to control the Surviving Corporation through share ownership.

None of the Other Rollover Stockholders discussed or negotiated continuing employment terms with the Surviving Corporation prior to the execution of the Merger Agreement. Nor do any of the Other Rollover Stockholders have any contractual right to occupy a seat on the board of directors of the Surviving Corporation. Pursuant to the terms of the Merger Agreement, the officers of the Company will remain the officers of the Surviving Corporation in a substantially similar capacity. The Other Rollover Stockholders will be employed by the Surviving Corporation in the same position as such individuals are currently employed by the Company and none should be deemed to be in a position of control of the Surviving Corporation based on such employment alone (as compared to Mr. Farrell and Mr. Fairbanks, who will remain in their respective roles as chief executive officer and chief financial officer of the Company and the Surviving Corporation). The terms of the pending going-private transaction do not provide for a guarantee of future employment or any material increase in compensation or other favorable changes to the terms of employment of any of the Other Rollover Stockholders.

Of the Other Rollover Stockholders, eight are currently officers of the Company, one is a former officer of the Company and one is a director of the Company. The Other Rollover Stockholders have been involved in the pending transaction solely in their capacity as officers or directors of the Company and no Other Rollover Stockholder has a control relationship with the Company other than pursuant solely to his or her officer or director position with the Company. Moreover, the pending take private transaction was initially proposed by TPG to the Board, which subsequently established the Special Committee (i) to consider and evaluate all proposals that might be received by the Company in connection with a possible transaction involving all or substantially all of the Company’s equity or assets, (ii) to establish, authorize, modify, monitor and exercise general oversight on behalf of the Company of any and all agreements, proceedings and activities of the Company involving, responding to or relating to any such possible transaction or any other alternatives, (iii) to participate in, direct and control the negotiations of the terms and conditions of any such possible transaction, (iv) to consider any other alternatives, to terminate any negotiations, discussions or consideration of, or reject, on behalf of the Company, any such possible transaction or other alternatives, and (v) to engage such advisors, consultants and agents as the Special Committee may deem necessary or appropriate. None of the Other Rollover Stockholders were appointed to the Special Committee, nor did they direct or participate in the negotiation of the material terms, discussion or planning of the proposed transaction. The formal decision to undertake the pending take private transaction was made by the Board, acting upon the unanimous recommendation of the Special Committee. None of the Other Rollover Stockholders were involved in the consideration and ultimate adoption of the Merger Agreement by the Company’s stockholders, as required by Delaware law and the Company’s certificate of incorporation, and thus none of the Other Rollover Stockholders were in a position to “control” the Company’s decision to undertake the pending take private transaction within the meaning of Exchange Act Rule 12b-2. Further, none of the Rollover Stockholders had any discussions with Parent regarding a potential equity rollover until after the Special Committee and Parent had negotiated the material terms of the pending take private transaction. Pursuant to the terms of the Merger Agreement, the officers of the Company will remain the officers of the Surviving Corporation in a substantially similar capacity and therefore no Other Rollover Stockholder will have a control relationship with the Surviving Corporation other than pursuant solely to his or her officer or director position with the Surviving Corporation. In light of these and other factors, none of the Other Rollover Stockholders are in a position to control the Surviving Company within the meaning of Exchange Act Rule 12b-2.

Based on the facts and circumstances outlined above and consistent with the Staff’s views in applicable SEC Guidance, the Filing Persons respectfully submit that none of the Other Rollover Stockholders have been or are “engaged” in the proposed transaction in a manner requiring any of them to comply with the disclosure, dissemination and filing requirements of Rule 13e-3 and are therefore not required to be a Filing Person for purposes of Schedule 13E-3.

* * *

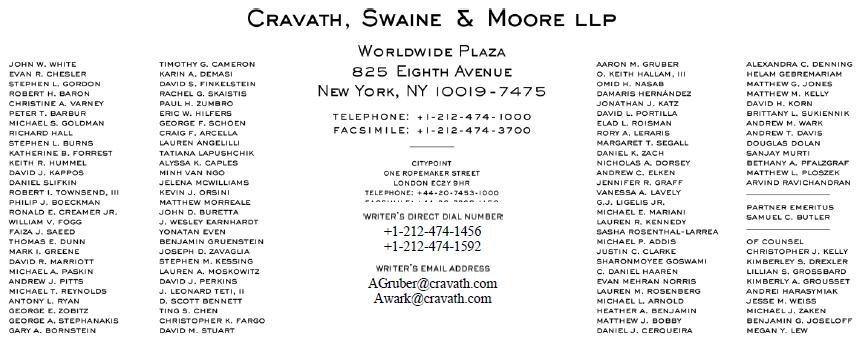

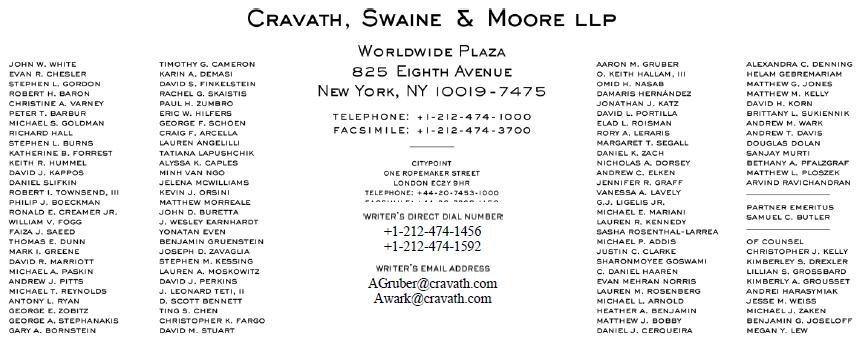

Should you have any questions or comments with respect to the Amended Schedule 13E-3 and Schedule 14C or this letter, please contact Aaron M. Gruber at 212-474-1456.

| VIA EDGAR | Sincerely, |

| | |

| | /s/ Aaron M. Gruber |

| Copy to: | |

| | Aaron M. Gruber |

| | |

| Timothy Fairbanks, Chief Financial Officer & Executive Vice President | | |

| Convey Health Solutions Holdings, Inc. | | |

| 100 SE 3rd Avenue, 26th Floor | | |

| Fort Lauderdale, FL 33394 | | |

| | |

| VIA E-MAIL | |