Filed by: Brookfield Infrastructure Corporation

(Commission File No. 001-39250)

and

Brookfield Infrastructure Partners L.P.

(Commission File No. 001-33632)

Pursuant to Rule 425 under the Securities Act of 1933

Subject Company: Inter Pipeline Ltd.

No securities tendered to the Offer (as defined below) will be taken up until (a) more than 50% of the outstanding securities of the class sought (excluding those securities beneficially owned, or over which control or direction is exercised, by the Offeror or any person acting jointly or in concert with the Offeror) have been tendered to the Offer, (b) the minimum deposit period under the applicable securities laws has elapsed, and (c) any and all other conditions of the Offer have been complied with or waived, as applicable. If these criteria are met, the Offeror will take up securities deposited under the Offer in accordance with applicable securities laws and extend the Offer for an additional minimum period of 10 days to allow for further deposits of securities.

The information contained in this Offer to Purchase and Circular is not complete and may be changed. A registration statement relating to these securities has been filed with the U.S. Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This Offer to Purchase and Circular is not an offer to sell these securities, and no person is soliciting an offer to buy these securities, nor shall there be any sale of these securities, in any jurisdiction where such offer, solicitation or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Shareholders (as defined below) in the United States should read the “Notice to Shareholders in the United States” on page xii of this Offer to Purchase and Circular.

This document is important and requires your immediate attention. If you are in doubt as to how to deal with it, you should consult your investment advisor, stockbroker, bank manager, trust company manager, accountant, lawyer or other professional advisor. If you have any questions or require assistance with tendering your shares, please contact Laurel Hill Advisory Group, the Information Agent and Depositary in connection to the Offer, by telephone at 1-877-452-7184 (North American Toll Free Number) or 1-416-304-0211 (outside North America) or by email at assistance@laurelhill.com. To keep current with further developments and information about the Offer, visit www.ipl-offer.com.

The Offer has not been approved or disapproved by any Securities Regulatory Authority (as defined below), nor has any Securities Regulatory Authority in any manner expressed an opinion or passed judgment upon the fairness or merits of the Offer, the securities offered pursuant to the Offer or the adequacy of the information contained in this document. Any representation to the contrary is an offence. Information has been incorporated by reference in this document from documents filed with securities commissions or similar authorities in Canada. Copies of the documents of Brookfield Infrastructure Partners L.P. incorporated herein by reference may be obtained on request without charge from the office of Brookfield Infrastructure Partners L.P.’s Corporate Secretary at 73 Front Street, 5th Floor, Hamilton, HM 12, Bermuda, + 1 441 294 3309, and are also available electronically at www.sedar.com. Copies of the documents of Brookfield Infrastructure Corporation incorporated herein by reference may be obtained on request without charge from the office of Brookfield Infrastructure Corporation’s Corporate Secretary at 250 Vesey Street, 15th Floor, New York, NY 10281, +61 2-9158-5254, and are also available electronically at www.sedar.com.

Neither the U.S. Securities and Exchange Commission nor any U.S. state or Canadian provincial or territorial securities commission has approved or disapproved of the securities to be issued under this Offer to Purchase and Circular or determined that this Offer to Purchase and Circular is truthful or complete. Any representation to the contrary is a criminal offense.

This document does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. The Offer is not being made to, nor will deposits be accepted from or on behalf of, Shareholders in any jurisdiction in which the making or acceptance of the Offer would not be in compliance with the Laws (as defined herein) of such jurisdiction. However, the Offeror may, in its sole discretion, take such action as it may deem necessary to extend the Offer to Shareholders in any such jurisdiction.

February 22, 2021

OFFER TO PURCHASE

all of the outstanding Common Shares of

INTER PIPELINE LTD.

by BISON ACQUISITION CORP.

for consideration per Common Share, at the choice of each holder, of

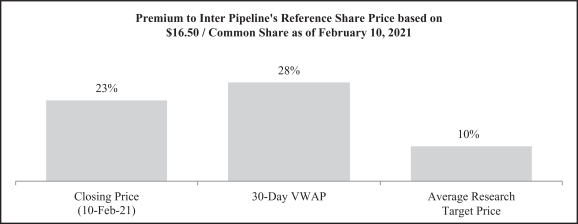

(i) $16.50 in cash (the “Cash Consideration”); or

(ii) 0.206 of a Brookfield Infrastructure Corporation (“BIPC”) class A exchangeable subordinate voting share

(the “Share Consideration”),

subject, in each case, to pro-ration as set out herein

Bison Acquisition Corp. (the “Offeror”) hereby offers to purchase (the “Offer” or “Offer to Purchase”), on the terms and subject to the conditions of the Offer, all of the issued and outstanding common shares (the “Common Shares”) of Inter Pipeline Ltd. (“IPL”), together with the associated rights (the “SRP Rights”) issued and outstanding under the Shareholder Rights Plan (as defined herein) of IPL, including any Common Shares that may become issued and outstanding after the date of the Offer but prior to the Expiry Time (as defined herein) upon any exercise, exchange or conversion of securities of IPL into Common Shares (other than pursuant to the SRP Rights).

The Offer is open for acceptance until 5:00 p.m. (Mountain Standard Time) on June 7, 2021 (the “Expiry Time”), unless the Offer is extended, accelerated or withdrawn by the Offeror in accordance with its terms.