Exhibit 99.2

Brookfield Infrastructure

Corporation

MANAGEMENT INFORMATION

CIRCULAR

Annual General Meeting – June 18, 2024

Notice of Annual General Meeting of Shareholders

and

Availability of Investor Materials

An Annual General Meeting of Shareholders of Brookfield Infrastructure Corporation (the “Corporation” or “BIPC”) will be held on Tuesday, June 18, 2024 at 9:00 a.m. (New York time) in a virtual meeting format to:

| 1. | receive the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2023, including the external auditor’s report thereon; |

| 2. | elect the board of directors of the Corporation; and |

| 3. | appoint the external auditor of the Corporation and authorize the board of directors of the Corporation to set its remuneration. |

We will also consider any other business that may properly come before the meeting.

This year’s meeting will be held in a virtual meeting format only. Shareholders will be able to listen to, participate in and vote at the meeting in real time through a web-based platform instead of attending the meeting in person.

You can attend and vote at the virtual meeting by visiting https://web.lumiagm.com/495810962 and entering your control number and password “BIPC2024” (case sensitive). See “Q&A on Voting” in our management information circular dated May 6, 2024 (the “Circular”) for more information on how to listen, register for and vote at the meeting.

You have the right to vote at the meeting if you were a shareholder at the close of business on April 23, 2024. Before casting your vote, we encourage you to review the Circular, including the section entitled “Business of the Meeting”.

We are posting electronic versions of the Circular, a form of proxy or voting instruction form, and our annual report on Form 20-F (which includes our financial statements for the fiscal year ended December 31, 2023 and related management’s discussion and analysis) (collectively, the “investor materials”) on our website for shareholder review – a process known as “Notice and Access.” Electronic copies of the investor materials may be accessed at https://bip.brookfield.com/bipc under “Notice and Access 2024” and at www.sedarplus.ca and www.sec.gov/edgar.

If you would like paper copies of any investor materials please contact us at 1-866-989-0311 or bip.enquiries@brookfield.com and we will mail materials free of charge within three business days of your request, provided the request is made before the date of the meeting or any adjournment thereof. In order to receive investor materials in advance of the deadline to submit your vote, we recommend that you contact us before 9:00 a.m. (New York time) on June 4, 2024.

Instructions on Voting at the Virtual Meeting

Registered shareholders and duly appointed proxyholders will be able to attend the virtual meeting and vote in real time, provided they are connected to the internet and follow the instructions in the Circular. See “Q&A on Voting” in the Circular. Non-registered shareholders who have not duly appointed themselves as proxyholder will be able to attend the virtual meeting as guests but will not be able to ask questions or vote at the meeting.

If you wish to appoint a person other than the Management Representatives identified in the form of proxy or voting instruction form (including if you are a non-registered shareholder who wishes to appoint yourself as proxyholder in

order to attend the virtual meeting) you must carefully follow the instructions in the Circular and on the form of proxy or voting instruction form. See “Q&A on Voting” in the Circular. These instructions include the additional step of registering your proxyholder with our transfer agent, Computershare Trust Company of Canada, after submitting the form of proxy or voting instruction form. Failure to register the proxyholder (including, if you are a non-registered shareholder, failure to appoint yourself as proxyholder) with our transfer agent will result in the proxyholder not receiving a user name to participate in the virtual meeting and only being able to attend as a guest. Guests will be able to listen to the virtual meeting but will not be able to ask questions or vote.

Information for Registered Shareholders

Registered shareholders and duly appointed proxyholders (including non-registered shareholders who have duly appointed themselves as proxyholder) that attend the meeting online will be able to vote by completing a ballot online during the meeting through the live webcast platform.

If you are not attending the virtual meeting and wish to vote by proxy, we must receive your vote by 5:00 p.m. (New York time) on June 14, 2024 or, in the event the virtual meeting is adjourned or postponed, not less than two business days prior to the time of the adjourned or postponed meeting (the “Proxy Deadline”). You can cast your proxy vote in the following ways:

| ● | On the Internet at www.investorvote.com; |

| ● | Mail your signed proxy using the business reply envelope accompanying your proxy; or |

| ● | By telephone at 1-866-732-8683 (toll-free in North America) or 1-312-588-4290 (direct dial outside North America). |

Information for Non-Registered Shareholders

Non-registered shareholders will receive a voting instruction form with their physical copy of this notice. If you wish to vote, but not attend the meeting, the voting instruction form must be completed, signed and returned in accordance with the directions on the form.

If you wish to appoint a proxyholder, you must complete the additional step of registering the proxyholder with our transfer agent, Computershare Trust Company of Canada at www.computershare.com/BIPC by no later than the Proxy Deadline.

By Order of the Board

Michael Ryan

Corporate Secretary

May 6, 2024

Letter to Shareholders

To our shareholders,

On behalf of your Board of Directors, we are pleased to invite you to attend the 2024 annual meeting of Brookfield Infrastructure Corporation (the “Corporation” or “BIPC”). The annual meeting will occur by webcast at 9:00 a.m. (New York time) on Tuesday, June 18, 2024. You can read about the business of the meeting beginning on page ten of the accompanying Management Information Circular (the “Circular”). The Circular also provides important information on voting your shares at the meeting, our eight (8) director nominees, our corporate governance practices, and director and executive compensation. Additional details on how to access our live audio and participate in our annual meeting can be found in the “Q&A on Voting” section of the Circular.

2023 Highlights

BIPC reported net income of $606 million compared to $1.6 billion in the prior year. After removing the impact of the revaluation on our exchangeable shares that are classified as liabilities under IFRS, underlying earnings were modestly above the prior year. Earnings benefited from the acquisition of Triton International, our global intermodal logistics operation, inflation indexation across our businesses and capital commissioned into rate base at our U.K. regulated distribution business. These benefits were partially offset by one-time transaction costs associated with the acquisition of our global intermodal logistics operation and higher financing costs at our U.K. regulated distribution business as a result of incremental borrowings incurred to fund growth capital projects.

Our U.K. regulated distribution operation is performing well despite a softening in construction activity and the overall housing market in the U.K. during 2023. The business had a record year for connections at over 210,000, with notable outperformance in the installation of water connections that contributed to an installed connection base that is nearing 3 million. Our orderbook remains strong at over 1.5 million connections and, when combined with our existing connections base, represents a 5% increase over last year.

Our Brazilian regulated gas transmission business continues to perform well. Today, the business is 100% contracted on an availability basis, with no volume exposure and full inflation indexation. During our ownership, revenues have grown at a 13% compound annual growth rate that has led to meaningful dividends. In fact, we have already realized a 2.4x multiple of our initial investment following the completion of a dividend recapitalization subsequent to year end, while still owning our 31% interest in the perpetual regulated utility. We believe the business is the best positioned platform in the Brazilian gas transportation sector, with strong growth potential over the next decade as natural gas plays an increasingly important role as a reliable transition fuel powering industrial growth and expanding electricity grid capacity needs.

The take-private of Triton, our global intermodal logistics operation, closed on September 28. We invested approximately $1.2 billion for a 28% interest, funded primarily using new BIPC shares as transaction consideration. The business is performing ahead of our expectations, and we expect to generate a base case internal rate of return above our targets, derived largely from the in-place cash yield.

As a result of Brookfield Infrastructure Partners L.P.’s (together with its subsidiaries and operating entities, “Brookfield Infrastructure”) strong financial and operating performance, our Board of Directors approved a quarterly dividend increase of 6% to $0.405 per share in February 2024.

Brookfield Infrastructure executed many of its strategic priorities during 2023. First, it closed over $2 billion of new investments in the transport and data segments. Second, it finalized capital recycling initiatives for total proceeds of $1.9 billion. Third, it maintained significant liquidity and proactively refinanced debt maturities during a capital constrained year. Lastly, Brookfield Infrastructure obtained a second investment grade credit rating of BBB+ from Fitch, with a stable outlook.

These accomplishments demonstrate Brookfield Infrastructure’s commitment to achieving strong financial results while strategically positioning itself for continued success.

Shareholder Meeting

Please take the time to read our Management Information Circular and determine how you will vote your shares.

The Board wishes to express our appreciation for your continued faith in us and we look forward to meeting with you (virtually) on June 18th.

Yours truly,

Anne C Schaumburg

Brookfield Infrastructure Corporation

Board Chair

May 6, 2024

Management Information Circular

Table of Contents

PART ONE – VOTING INFORMATION | 2 | |||

Who Can Vote | 2 | |||

Notice and Access | 3 | |||

Q & A on Voting | 3 | |||

Principal Holders of Voting Shares | 9 | |||

PART TWO – BUSINESS OF THE MEETING | 10 | |||

1. Receiving the Consolidated Financial Statements | 10 | |||

2. Election of Directors | 10 | |||

Voting by Proxy | 11 | |||

Director Nominees | 11 | |||

Summary of 2024 Nominees for Director | 18 | |||

2023 Director Attendance | 19 | |||

3. Appointment of External Auditor | 20 | |||

Principal Accounting Firm Fees | 20 | |||

PART THREE – STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 22 | |||

Overview | 22 | |||

Board of Directors | 22 | |||

Management Diversity | 29 | |||

Sustainability | 29 | |||

Code of Business Conduct and Ethics | 33 | |||

Personal Trading Policy | 34 | |||

PART FOUR – DIRECTOR COMPENSATION AND EQUITY OWNERSHIP | 35 | |||

Director Compensation | 35 | |||

Equity Ownership of Directors | 36 | |||

PART FIVE – REPORT ON EXECUTIVE COMPENSATION | 37 | |||

Executive Overview | 37 | |||

Compensation Elements Paid by Brookfield | 38 | |||

Base Salaries | 38 | |||

Cash Bonus and Long-Term Incentive Plans | 38 | |||

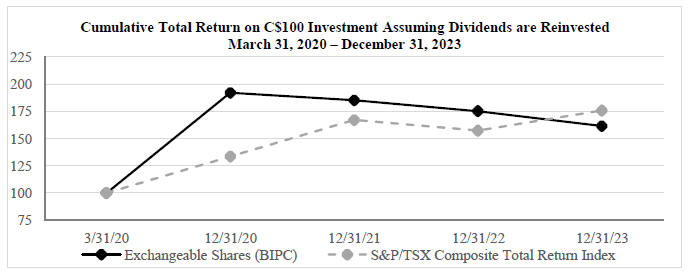

Performance Graph | 40 | |||

Summary of Compensation | 41 | |||

Pension and Retirement Benefits | 46 | |||

Termination and Change of Control Provisions | 46 | |||

PART SIX – OTHER INFORMATION | 48 | |||

Indebtedness of Directors, Officers and Employees | 48 | |||

Audit Committee | 48 | |||

Related Party Transactions | 48 | |||

Management Contracts | 49 | |||

Normal Course Issuer Bid | 49 | |||

Availability of Disclosure Documents | 50 | |||

Other Business | 50 | |||

Directors’ Approval | 51 | |||

APPENDIX A – CHARTER OF THE BOARD | A-1 | |||

Part One – Voting Information

This Management Information Circular (“Circular”) is provided in connection with the solicitation by management of Brookfield Infrastructure Corporation (“we,” “our” or the “Corporation”) of proxies for the Annual General Meeting of Shareholders of the Corporation (the “meeting”) referred to in the Corporation’s Notice of Annual General Meeting of Shareholders and Availability of Investor Materials dated May 6, 2024 (the “Notice”) to be held in a virtual meeting format only on June 18, 2024 at 9:00 a.m. (New York time). See “Q&A on Voting” on page 3 of this Circular for further information.

This solicitation will be made primarily by sending proxy materials to shareholders by mail and email, and in relation to the delivery of this Circular, by posting this Circular on our website at https://bip.brookfield.com/bipc under “Notice and Access 2024”, on our System for Electronic Data Analysis and Retrieval + (“SEDAR+”) profile at www.sedarplus.ca and on our Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) profile at www.sec.gov/edgar pursuant to Notice and Access. See “Notice and Access” below for further information. The cost of solicitation will be borne by the Corporation.

The information in this Circular is given as at May 6, 2024, unless otherwise indicated. As the Corporation operates in U.S. dollars and reports its financial results in U.S. dollars, all financial information in this Circular is denominated in U.S. dollars, unless otherwise indicated. All references to AUD$ are to Australian dollars and all references to C$ are to Canadian dollars. For comparability, all Canadian dollar amounts in this Circular have been converted to U.S. dollars at the average exchange rate for 2023 as reported by Bloomberg L.P. (“Bloomberg”) of C$1.00 = US$0.7411, unless otherwise indicated.

Who Can Vote

As at April 23, 2024, the Corporation had 131,915,764 class A exchangeable subordinate voting shares (“exchangeable shares”), 2 class B multiple voting shares (“class B shares”) and 11,117,660 class C non-voting shares (“class C shares”) outstanding. The exchangeable shares are listed on the New York Stock Exchange (“NYSE”) and the Toronto Stock Exchange (“TSX”) under the symbol “BIPC.” The class B shares and class C shares are all held by a subsidiary of Brookfield Infrastructure Partners L.P. (“BIP” or the “partnership”) (see “Principal Holders of Voting Shares” on page 9 of this Circular for further information). Each registered holder of record of exchangeable shares or class B shares as at the close of business on Tuesday, April 23, 2024 is entitled to receive notice of and to vote at the meeting. Except as otherwise provided in this Circular, each holder of an exchangeable share or a class B share on such date is entitled to vote on all matters to come before the meeting or any adjournment thereof, either in person or by proxy. Except as otherwise provided in our articles or as required by law, holders of class C shares are entitled to notice of, and to attend, any meetings of shareholders of the Corporation, but are not entitled to vote at any such meetings.

The share conditions for the exchangeable shares and class B shares provide that, subject to applicable law and in addition to any other required shareholder approvals, (i) each holder of exchangeable shares is entitled to cast one vote for each exchangeable share held at the record date for determination of shareholders entitled to vote on any matter and (ii) each holder of class B shares is entitled to cast a number of votes for each class B share held at the record date for determination of shareholders entitled to vote on any matter equal to: (A) the number that is three times the number of exchangeable shares then issued and outstanding divided by (B) the number of class B shares then issued and outstanding. The effect of the foregoing is that the holders of the class B shares are entitled to cast, in the aggregate, a number of votes equal to three times the number of votes attached to the exchangeable shares. Except as otherwise expressly provided in the Corporation’s articles or as required by law, the holders of exchangeable shares and class B shares will vote together and not as separate classes.

2024 MANAGEMENT INFORMATION CIRCULAR / 2

Each exchangeable share has been structured with the intention of providing an economic return equivalent to one non-voting limited partnership unit of BIP (each, a “BIP Unit”). We therefore expect that the market price of our exchangeable shares will be significantly impacted by the market price of the BIP Units and the combined business performance of our group (as defined below) as a whole. In addition to carefully considering the disclosure made in this Circular, you should carefully consider the disclosure made by BIP in its continuous disclosure filings. Copies of BIP’s continuous disclosure filings are available electronically on BIP’s SEDAR+ profile at www.sedarplus.ca and on BIP’s EDGAR profile at www.sec.gov/edgar.

Notice and Access

The Corporation is using the Notice and Access provisions of National Instrument 54-101 — Communication with Beneficial Owners of Securities of a Reporting Issuer and National Instrument 51-102 — Continuous Disclosure Obligations (“Notice and Access”) to provide meeting materials electronically for both registered and non-registered shareholders. Instead of mailing meeting materials to shareholders, we have posted this Circular and form of proxy on our website at https://bip.brookfield.com/bipc under “Notice and Access 2024”, in addition to posting it on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar. The Corporation has sent the Notice and a form of proxy or voting instruction form (collectively, the “Notice Package”) to all shareholders informing them that this Circular is available online and explaining how this Circular may be accessed. The Corporation will not directly send the Notice Package to non-registered shareholders. Instead, the Corporation will pay Intermediaries (as defined on page 5 of this Circular) to forward the Notice Package to all non-registered shareholders.

The Corporation has elected to utilize Notice and Access because it allows for a reduction in the use of printed paper materials, is consistent with our focus on sustainability and results in significantly lower printing and mailing costs in connection with the meeting.

Registered and non-registered shareholders who have signed up for electronic delivery of this Circular and our annual report on Form 20-F (which includes our financial statements for the fiscal year ended December 31, 2023 and related management’s discussion and analysis) (the “Annual Report on Form 20-F”) will continue to receive them by email. No shareholders will receive a paper copy of this Circular unless they contact the Corporation at 1-866-989-0311 or bip.enquiries@brookfield.com, in which case the Corporation will mail this Circular within three business days of any request, provided the request is made before the date of the meeting or any adjournment thereof. We must receive your request before 9:00 a.m. (New York time) on June 4, 2024 to ensure you will receive paper copies in advance of the deadline to submit your vote. If your request is made after the meeting and within one year of this Circular being filed, the Corporation will mail this Circular within 10 calendar days of such request.

The deadline for shareholder proposals for the Corporation’s 2025 Annual General Meeting of Shareholders is March 18, 2025. Shareholder proposals should be submitted to the Corporation’s registered office at 1055 West Georgia Street, 1500 Royal Centre, P.O. Box 11117, Vancouver, British Columbia, Canada, V6E 4N7.

Q & A on Voting

What am I voting on?

| Resolution | Who Votes | Board Recommendation | ||

Election of the Directors | exchangeable shareholders; class B shareholders | FOR each director nominee | ||

| Appointment of the External Auditor and authorizing Directors to set its remuneration | exchangeable shareholders; class B shareholders | FOR the resolution |

2024 MANAGEMENT INFORMATION CIRCULAR / 3

Who is entitled to vote?

Holders of exchangeable shares at the close of business on Tuesday, April 23, 2024 are entitled to one vote per share on the items of business as identified above. Holders of class B shares at the close of business on Tuesday, April 23, 2024 are collectively entitled to cast, in the aggregate, a number of votes equal to three times the number of votes attached to the exchangeable shares issued and outstanding on the items of business as identified above. Holders of class C shares are not entitled to vote on the items of business as identified above.

Registered shareholders and duly appointed proxyholders will be able to attend the virtual meeting, submit questions and vote, provided they are connected to the internet, have a control number and follow the instructions in the Circular. Non-registered shareholders who have not duly appointed themselves as proxyholder will be able to attend the virtual meeting as guests but will not be able to ask questions or vote at the virtual meeting.

Shareholders who wish to appoint a person other than the Management Representatives identified in the form of proxy or voting instruction form (including a non-registered shareholder who wishes to appoint themselves to attend the virtual meeting) must carefully follow the instructions in the Circular and on their form of proxy or voting instruction form. These instructions include the additional step of registering such proxyholder with our transfer agent, Computershare Trust Company of Canada (“Computershare”), after submitting the form of proxy or voting instruction form by visiting www.computershare.com/BIPC no later than 5:00 p.m. (New York time) on June 14, 2024 or, in the event the virtual meeting is adjourned or postponed, not less than two business days prior to the time of the adjourned or postponed meeting (the “Proxy Deadline”) and providing Computershare with the name and email address of your appointee. Computershare will provide your appointee with a user name which will allow your appointee to log in to and vote at the meeting. Failure to register the proxyholder with our transfer agent will result in the proxyholder not receiving a user name to participate in the virtual meeting and only being able to attend as a guest. Guests will be able to listen to the virtual meeting but will not be able to ask questions or vote.

How do I vote?

Shareholders can vote in one of two ways, as follows:

| ● | by submitting your proxy or voting instruction form (by Internet, by mail or by telephone) prior to the meeting; or |

| ● | during the meeting by online ballot through the live webcast platform. |

What if I plan to attend the meeting and vote by online ballot?

If you are a registered shareholder or a duly appointed proxyholder, you can attend and vote during the meeting by completing an online ballot through the live webcast platform. Guests (including non-registered shareholders who have not duly appointed themselves as proxyholder) can log into the meeting. Guests will be able to listen to the meeting but will not be able to ask questions or vote during the virtual meeting.

In order to attend the virtual meeting, you will need to complete the following steps:

Step 1: Log in online at: https://web.lumiagm.com/495810962

Step 2: Follow these instructions:

Registered shareholders: Click “I have a Login” and then enter your 15-digit control number found on your form of proxy and the password “BIPC2024” (case sensitive) and click the “Login” button. You will be able to vote by online ballot during the meeting by clicking on the “Voting Icon” on the meeting centre site. If you log in and vote on any

2024 MANAGEMENT INFORMATION CIRCULAR / 4

matter at the meeting, you will be revoking any and all previously submitted proxies. If you voted by proxy in advance of the meeting and do not wish to revoke all previously submitted proxies, do not vote by online ballot on any matter at the meeting.

Duly appointed proxyholders: Click “I have a Login” and then enter your user name provided to you by Computershare and the password “BIPC2024” (case sensitive) and click the “Login” button. You will be able to vote by online ballot during the meeting by clicking on the “Voting Icon” on the meeting centre site.

Guests: Click “I am a guest” and then complete the online form.

It is your responsibility to ensure internet connectivity for the duration of the meeting and you should allow ample time to log in to the meeting online before it begins.

What if I plan to vote by proxy in advance of the meeting?

You can also vote by proxy prior to the Proxy Deadline as follows:

| ● | by Internet: access www.investorvote.com and follow the instructions on the screen. You will need your 15-digit control number, which is printed on the bottom of the first page of the form of proxy sent to you. |

| ● | by mail: complete, sign and date your form of proxy and return it in the envelope provided or in one addressed to Computershare Trust Company of Canada: |

Attention: Proxy Department

100 University Avenue, 8th Floor

Toronto, Ontario

M5J 2Y1

| ● | by telephone: call toll-free in North America at 1-866-732-8683 or outside North America at 1-312-588-4290. You will be prompted to provide the 15-digit control number printed on the bottom of the first page of the form of proxy sent to you. Please note that you cannot appoint anyone other than the directors and officers named on your form of proxy as your proxyholder if you vote by telephone. |

If you vote by proxy, your proxy must be received no later than the Proxy Deadline, regardless of the method you choose. If you do not date your proxy, we will assume the date to be the date it was received by Computershare. If you vote by telephone or via the Internet, do not return your form of proxy.

You can appoint the persons named in the form of proxy or some other person (who need not be a shareholder of the Corporation) to represent you as proxyholder at the meeting by writing the name of this person in the blank space on the form of proxy. If you wish to appoint a person other than the Management Representatives identified in the form of proxy you will need to complete the additional step of registering your proxyholder with Computershare at www.computershare.com/BIPC by no later than the Proxy Deadline.

If you are a non-registered shareholder and your shares are held in the name of an intermediary such as a bank, trust company, securities dealer, broker or other intermediary (each, an “Intermediary”), and you would like to know how to direct the votes of shares beneficially owned, see “If my shares are not registered in my name but are held in the name of an Intermediary, how do I vote my shares?” on page 7 of this Circular for voting instructions.

2024 MANAGEMENT INFORMATION CIRCULAR / 5

Who is soliciting my proxy?

The proxy is being solicited by management of the Corporation and the associated costs will be borne by the Corporation.

What happens if I sign the proxy sent to me?

Signing the proxy appoints David Krant, Chief Financial Officer of the Corporation, or in the alternative, Michael Ryan, Corporate Secretary of the Corporation (collectively, the “Management Representatives”), or another person you have appointed, to vote or withhold from voting your shares at the meeting in accordance with your instructions.

Can I appoint someone other than the Management Representatives to vote my shares?

Yes, you may appoint another person other than the Management Representatives named on the form of proxy to be your proxyholder. Write the name of this person in the blank space on the form of proxy. The person you appoint does not need to be a shareholder. Please make sure that such other person you appoint is attending the meeting and knows he or she has been appointed to vote your shares. You will need to complete the additional step of registering such proxyholder with our transfer agent, Computershare, after submitting the form of proxy or voting instruction form. See “If my shares are not registered in my name but are held in the name of an Intermediary, how do I vote my shares?” on page 7 of this Circular for instructions on registering your proxy with Computershare. Registered shareholders may not appoint another person or company as proxyholder other than the Management Representatives named in the form of proxy when voting by telephone.

What do I do with my completed form of proxy?

Return it to Computershare in the envelope provided to you by mail to Computershare Trust Company of Canada: Attention: Proxy Department, 100 University Avenue, 8th Floor, Toronto, Ontario, M5J 2Y1; by no later than the Proxy Deadline. A completed form of proxy should only be returned if you are voting by mail or appointing a proxyholder.

Can I vote by Internet in advance of the meeting?

Yes. If you are a registered shareholder, go to www.investorvote.com and follow the instructions on the screen. You will need your 15-digit control number, which is printed on the bottom of the first page of the form of proxy sent to you. You must submit your vote by no later than the Proxy Deadline.

If I change my mind, can I submit another proxy or take back my proxy once I have given it?

Yes. If you are a registered shareholder, you may deliver another properly executed form of proxy with a later date to replace the original proxy in the same way you delivered the original proxy. If you wish to revoke your proxy, prepare a written statement to this effect signed by you (or your attorney as authorized in writing) or, if the shareholder is a corporation, under its corporate seal or by a duly authorized officer or attorney of the corporation. This statement must be delivered to the Corporate Secretary of the Corporation at the address below no later than 5:00 p.m. (New York time) on Friday, June 14, 2024, or, in the event the virtual meeting is adjourned or postponed, not less than two business days prior to the time of the adjourned or postponed meeting. You may also log in, accept the terms and conditions and vote by online ballot at the meeting. Voting on any online ballot will revoke your previous proxy.

2024 MANAGEMENT INFORMATION CIRCULAR / 6

Attention: Corporate Secretary

Brookfield Infrastructure Corporation c/o Computershare Trust Company of Canada

100 University Avenue, 8th Floor

Toronto, Ontario M5J 2Y1

If you are a non-registered shareholder, you may revoke a voting instruction form previously given to an Intermediary at any time by written notice to the Intermediary. An Intermediary is not required to act on a revocation of a voting instruction form unless they receive it at least seven calendar days before the meeting. A non-registered shareholder may then submit a revised voting instruction form in accordance with the directions on the form.

How will my shares be voted if I give my proxy?

The persons named on the form of proxy must vote your shares for or against or withhold from voting, in accordance with your directions, or you can let your proxyholder decide for you. If you specify a choice with respect to any matter to be acted upon, your shares will be voted accordingly. In the absence of voting directions, proxies received by management will be voted in favour of all resolutions put before shareholders at the meeting. See “Business of the Meeting” on page 10 of this Circular for further information.

What if amendments are made to these matters or if other matters are brought before the meeting?

The persons named on the proxy will have discretionary authority with respect to amendments or variations to matters identified in the Notice and with respect to other matters which may properly come before the meeting.

As at the date of this Circular, management of the Corporation is not aware of any amendment, variation or other matter expected to come before the meeting. If any other matters properly come before the meeting, the persons named on the form of proxy will vote on them in accordance with their best judgment.

Who counts the votes?

The Corporation’s transfer agent, Computershare, counts and tabulates the proxies.

How do I contact the transfer agent?

For general shareholder enquiries, you can contact Computershare as follows:

| Telephone | Online | |||

Computershare Trust Company of Canada 100 University Avenue, 8th Floor Toronto, Ontario M5J 2Y1 | Direct dial outside North America at 514-982-7555 within Canada and the United States toll free at 1-800-564-6253 | Email: service@computershare.com

Website: http://www.investorcentre.com/ | ||

If my shares are not registered in my name but are held in the name of an Intermediary,

how do I vote my shares?

In many cases, exchangeable shares that are beneficially owned by a non-registered shareholder are registered either:

| ● | in the name of an Intermediary or a trustee or administrator of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

2024 MANAGEMENT INFORMATION CIRCULAR / 7

| ● | in the name of a depository, such as CDS Clearing and Depository Services Inc. or the Depository Trust Company, of which the Intermediary is a participant. |

Your Intermediary is required to send you a voting instruction form for the number of shares you beneficially own.

Since the Corporation has limited access to the names of its non-registered shareholders, if you attend the virtual meeting, the Corporation may have no record of your shareholdings or of your entitlement to vote unless your Intermediary has appointed you as proxyholder. Therefore, if you wish to vote by online ballot at the meeting, you will need to complete the following steps:

Step 1: Insert your name in the space provided on the voting instruction form and return it by following the instructions provided therein.

Step 2: You must complete the additional step of registering yourself (or your appointees other than if your appointees are the Management Representatives) as the proxyholder with Computershare at www.computershare.com/BIPC no later than the Proxy Deadline and providing Computershare with your name and email address or the name and email address of your appointee. Computershare will provide you or your appointee with a user name which will allow you or your appointee to log in to and vote at the meeting.

If you are a non-registered shareholder located in the United States and you wish to appoint yourself as a proxyholder, in addition to the steps above, you must first obtain a valid legal proxy from your Intermediary. To do so, please follow these steps:

Step 1: Follow the instructions from your Intermediary included with the legal proxy form and the voting information form sent to you or contact your Intermediary to request a legal proxy form or a legal proxy if you have not received one.

Step 2: After you receive a valid legal proxy from your Intermediary, you must then submit the legal proxy to Computershare. You can send the legal proxy by e-mail or by courier to: uslegalproxy@computershare.com (if by e-mail), or Computershare Trust Company of Canada, Attention: Proxy Department, 100 University Avenue, 8th Floor Toronto, Ontario M5J 2Y1, Canada (if by courier). The legal proxy in both cases must be labeled “Legal Proxy” and received no later than the Proxy Deadline.

Step 3: Computershare will provide duly appointed proxyholders with a username by e-mail after the voting deadline has passed. Please note that you are also required to register your appointment as a proxyholder at www.computershare.com/BIPC as noted above.

Failing to register online as a proxyholder will result in the proxyholder not receiving a control number, which is required to vote at the meeting. Non-registered shareholders who have not duly appointed themselves as proxyholder will not be able to vote at the meeting but will be able to participate as a guest.

A non-registered shareholder who does not wish to attend and vote at the meeting and wishes to vote prior to the meeting must complete and sign the voting instruction form and return it in accordance with the directions on the form.

The Corporation has distributed copies of the Notice Package to Intermediaries for onward distribution to non-registered shareholders. Intermediaries are required to forward the Notice Package to non-registered shareholders.

Non-registered shareholders who have not opted for electronic delivery will receive a voting instruction form to permit them to direct the voting of the shares they beneficially own. Non-registered shareholders should follow the instructions on the forms they receive and contact their Intermediaries promptly if they need assistance.

2024 MANAGEMENT INFORMATION CIRCULAR / 8

Principal Holders of Voting Shares

The following table presents information regarding the beneficial ownership of the exchangeable shares by Brookfield Corporation (together with any affiliate thereof other than our group (as defined below), including Brookfield Asset Management Ltd. (“Brookfield Asset Management”), unless the context requires otherwise, “Brookfield”). The exchangeable shares held by Brookfield do not entitle Brookfield to different voting rights than those of other holders of the exchangeable shares. However, the exchangeable shares and the class B shares have different voting rights. Holders of exchangeable shares hold a 25% voting interest in the Corporation and holders of the class B shares hold a 75% voting interest in the Corporation.

| Exchangeable Shares | ||||

Name | Shares Owned | Percentage | ||

Brookfield Corporation(a) | 13,012,789 | 9.9% | ||

Notes:

| (a) | Brookfield may be deemed the beneficial owner of 13,012,789 exchangeable shares that it holds directly and through its wholly-owned subsidiary BIPC Holding LP. In addition, all of the issued and outstanding Class B limited voting shares of Brookfield Corporation are held by BAM Partners Trust (the “Brookfield Partnership”), which may be deemed a beneficial owner of such exchangeable shares. The Brookfield Partnership has the ability to appoint one half of the board of directors of Brookfield Corporation and approve all other matters requiring shareholder approval of Brookfield Corporation. The trustee votes the Class B Shares with no single individual or entity controlling the Brookfield Partnership. As such, the Brookfield Partnership may be deemed to have indirect beneficial ownership of 13,012,789 exchangeable shares. The business address of each of Brookfield Corporation, the Brookfield Partnership and BIPC Holding LP is Brookfield Place, 181 Bay Street, Suite 100, Toronto, Ontario M5J 2T3. |

Brookfield Infrastructure Holdings (Canada) Inc. (“Can HoldCo”), which is controlled by Brookfield Infrastructure L.P. (“Holding LP”), which is controlled by BIP (together with Can HoldCo, Holding LP, certain subsidiaries of Holding LP and the entities which directly or indirectly hold the partnership’s current operations and assets that the partnership may acquire in the future, including any assets held through joint ventures, partnerships and consortium arrangements (other than the Corporation), “Brookfield Infrastructure”. Brookfield Infrastructure, together with the Corporation, is referred to herein as our “group”), which itself is controlled by Brookfield, holds all of the issued and outstanding class B shares, having a 75% voting interest in the Corporation, and all of the issued and outstanding class C shares, which entitle the partnership to all of the residual value in the Corporation after payment in full of the amount due to holders of exchangeable shares and class B shares and subject to the prior rights of holders of preferred shares. Together, Brookfield and Brookfield Infrastructure hold an approximate 77.5% voting interest in the Corporation.

To the knowledge of the directors and officers of the Corporation, there are no other persons or corporations that beneficially own, exercise control or direction over, have contractual arrangements such as options to acquire, or otherwise hold voting securities of the Corporation carrying more than 10% of the votes attached to any class of outstanding voting securities of the Corporation.

2024 MANAGEMENT INFORMATION CIRCULAR / 9

Part Two – Business of the Meeting

We will address three items at the meeting:

| 1. | receive the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2023, including the external auditor’s report thereon; |

| 2. | elect directors who will serve until the next annual meeting of shareholders or until their successors are elected or appointed; and |

| 3. | appoint the external auditor who will serve until the next annual meeting of shareholders and authorize the directors to set its remuneration. |

We will also consider other business that may properly come before the meeting.

As at the date of this Circular, management is not aware of any changes to these items and does not expect any other items to be brought forward at the meeting. If there are changes or new items, you or your proxyholder can vote your shares on these items as you, he or she sees fit. The persons named on the form of proxy will have discretionary authority with respect to any changes or new items which may properly come before the meeting and will vote on them in accordance with their best judgment.

1. Receiving the Consolidated Financial Statements

The Corporation’s consolidated financial statements for the fiscal year ended December 31, 2023 and related management’s discussion and analysis are included in our Annual Report on Form 20-F. Our Annual Report on Form 20-F is available on our website https://bip.brookfield.com/bipc, under “Notice and Access 2024” and on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar, and is being mailed to registered and non-registered shareholders of the Corporation who have contacted the Corporation to request a paper copy of the Annual Report on Form 20-F. Shareholders who have signed up for electronic delivery of the Annual Report on Form 20-F will receive it by email.

2. Election of Directors

The board of directors of the Corporation (the “Board”) is comprised of eight members, all of whom are to be elected at the meeting. The Board mirrors the board of directors of the general partner of BIP, except that John Mullen is the non-overlapping director member of the Board who assists the Corporation with, among other things, resolving any conflicts of interest that may arise from its relationship with the partnership. If you own exchangeable shares or class B shares, you can vote on the election of all eight directors. The following persons are proposed as nominees for election:

● Jeffrey Blidner | ● William Cox | ● Roslyn Kelly | ● John Mullen | |||

● Suzanne Nimocks | ● Daniel Muñiz Quintanilla | ● Anne Schaumburg | ● Rajeev Vasudeva | |||

The appointment of the directors must be approved by a majority of the votes cast by holders of exchangeable shares and class B shares, voting together as a single class.

2024 MANAGEMENT INFORMATION CIRCULAR / 10

Voting by Proxy

The Management Representatives designated on the proxy to be completed by shareholders intend to cast the votes represented by such proxy FOR each of the proposed nominees for election by the shareholders as set forth under “Election of Directors” in Part Two of this Circular, unless the shareholder who has given such proxy has directed that such shares be otherwise voted or withheld from voting in the election of directors.

Director Nominees

The Board recommends that the eight director nominees be elected at the meeting to serve as directors of the Corporation until the next annual meeting of shareholders or until their successors are elected or appointed.

The Board believes that the collective qualifications, skills and experiences of the director nominees allow for the Corporation to continue to maintain a well-functioning Board with a diversity of perspectives. The Board’s view is that, individually and as a whole, the director nominees have the necessary qualifications to be effective at overseeing the business and strategy of the Corporation.

Jeffrey Blidner and Anne Schaumburg were appointed to the Board on March 12, 2020 and William Cox, Roslyn Kelly, Daniel Muñiz Quintanilla and Rajeev Vasudeva were appointed to the Board on March 16, 2020. John Mullen was appointed to the Board on May 5, 2021. Suzanne Nimocks was appointed to the Board on August 2, 2022.

We expect that each of the director nominees will be able to serve as a director. If a director nominee tells us before the meeting that he or she will not be able to serve as a director, the Management Representatives designated on the form of proxy, unless directed to withhold from voting in the election of directors, reserve the right to vote for other director nominees at their discretion.

Each director’s biography contains information about the director, including his or her background and experience, holdings of exchangeable shares and other public company board positions held, as at April 23, 2024. See “Director Share Ownership Requirements” in Part Three of this Circular for further information on director share ownership requirements.

2024 MANAGEMENT INFORMATION CIRCULAR / 11

The following eight individuals are nominated for election as directors of the Corporation:

Jeffrey Blidner(a)

Age: 76

Director since: March 12, 2020

Director of the general partner of BIP since: 2008

(Affiliated)(d)

Areas of Expertise: Growth Initiatives, Governance, Legal Expertise, International Experience, Strategic Planning Acumen, Infrastructure, Power, Private Equity, Property | Jeffrey has served as a director of the Corporation since the special distribution of exchangeable shares to the holders of BIP Units in March 2020 (the “special distribution”) and as a director of the general partner of the partnership since 2008. Jeffrey is a Vice Chair of Brookfield Corporation and former Chief Executive Officer of Brookfield’s Private Funds. He is Chair of the general partner of Brookfield Renewable Partners L.P., Chair of Brookfield Renewable Corporation, Director of the general partner of Brookfield Business Partners L.P. and Director of Brookfield Business Corporation. He also serves as a director of Brookfield Corporation and the general partner of Brookfield Property Partners L.P. Prior to joining Brookfield in 2000, Jeffrey was a senior partner at a Canadian law firm. Jeffrey’s practice focused on merchant banking transactions, public offerings, mergers and acquisitions, management buy-outs and private equity transactions. Jeffrey received his LLB from Osgoode Hall Law School and was called to the Bar in Ontario as a Gold Medalist. Jeffrey is not considered an independent director because of his role at Brookfield.

| |||||||||

Board/Committee Membership

|

|

Public Board Membership During Last Five Years | ||||||||

Board |

|

Brookfield Infrastructure Corporation Brookfield Business Corporation Brookfield Renewable Corporation Brookfield Property REIT Inc. Brookfield Business Partners L.P. Brookfield Corporation Brookfield Property Partners L.P. Brookfield Renewable Partners L.P. Brookfield Infrastructure Partners L.P. |

2020 – Present 2022 – Present 2020 – Present 2018 – Present 2016 – Present 2013 – Present 2013 – Present 2011 – Present 2008 – Present | |||||||

Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

1,060 |

|

9,549 |

|

10,609 | ||||||

William Cox(a)

Age: 61

Director since: | William has served as a director of the Corporation since the special distribution in March 2020 and as a director of the general partner of the partnership since November 3, 2016. William is also a director of Brookfield Reinsurance. He is the President and Chairman of Waterloo Properties in Bermuda; a fifth generation family owned business which operates real estate and retail investment companies in Bermuda. He has developed large scale, commercial projects in Bermuda and operates a successful group of retail operations. Will graduated from Saltus Grammar School, where he served as Chairman of the Board of Trustees and completed his education at Lynchburg College in Virginia.

| |||||||||

Board/Committee Membership |

|

Public Board Membership During Last Five Years | ||||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 12

March 16, 2020

Director of the general partner of BIP since: 2016

(Independent)(b)

Areas of Expertise: Business Development, Human Resource Management, Risk Management, Business Ethics, Social and Environmental Responsibility, Asset Management, Infrastructure, Private Equity, Real Estate

|

Board

Nominating and Governance Committee (Chair) |

|

Brookfield Infrastructure Corporation Brookfield Reinsurance Ltd. Brookfield Infrastructure Partners L.P. |

2020 – Present 2021 – Present 2016 – Present | ||||||

| Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

470

|

|

11,185

|

|

11,655

| ||||||

Roslyn Kelly(a)

Age: 51

Director since: March 16, 2020

Director of the general partner of BIP since: 2020

(Independent)(b)

Areas of Expertise: Corporate Strategy and Business Development, Mergers and Acquisitions, Finance and Capital Allocation, Risk Management, Asset Management, Government and Public Policy, Economic Policy, International Affairs, Energy and Power, Financial Services, Healthcare, Infrastructure, Insurance, Manufacturing, |

Roslyn has served as a director of the Corporation since the special distribution in March 2020 and as a director of the general partner of the partnership since February 7, 2020. She manages the family office of Lance Uggla, the current CEO of HIS Markit. She has fulfilled various investment banking and portfolio management roles throughout her career within several large global financial institutions, and most recently was a senior managing director in Mediobanca’s Alternative Asset Management Group, based in London. Roslyn holds a BBS in Finance from Trinity College, Dublin and an MBA from Georgetown University, McDonaugh School of Business.

| |||||||||

Board/Committee Membership |

|

Public Board Membership During Last Five Years

| ||||||||

Board

Audit Committee(c) |

|

Brookfield Infrastructure Corporation Brookfield Infrastructure Partners L.P. |

2020 – Present 2020 – Present | |||||||

Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

—

|

|

20,008

|

|

20,008

| ||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 13

Natural Resources, Private Equity, Real Estate, Accounting, Human Resource Management, Marketing | ||||||||||

John Mullen(a)

Age: 68

Director since: May 5, 2021

(Independent)(b)

Areas of Expertise: Corporate Strategy and Business Development, Mergers and Acquisitions, Finance and Capital Allocation, Legal and Regulatory, Asset Management, Government and Public Policy, Transport, Infrastructure, Telecommunications | John has served as a director of the Corporation since May 5, 2021. John is a professional director and has extensive international transportation and logistics experience with more than two decades in senior positions with multinationals including most recently as Managing Director and Chief Executive Officer of Asciano Ltd from 2011 to 2016. His experience includes 10 years with the TNT Group – two years of those as its Chief Operating Officer. From 1991 to 1994, he held the position of Chief Executive Officer of TNT Express Worldwide. John joined Deutsche Post DHL Group in 1994, becoming Chief Executive Officer of DHL Express Asia Pacific in 2002 and joint Chief Executive Officer, DHL Express in 2005. He was then Global Chief Executive Officer, DHL Express, from 2006 to 2009. John is Chairman of Brambles, Treasury Wine Estates and Scyne Advisory. Until recently, John was a non-executive Director and Chairman of Telstra, an Australian telecommunications and media company, and was the Chairman of Toll Group, a transport and logistics company owned by Japan Post. John holds a Bachelor of Science degree from the University of Surrey in the U.K., is also a member of the Australian Graduate School of Management and a Councillor of the Australian National Maritime Museum.

| |||||||||

Board/Committee Membership

|

|

Public Board Membership During Last Five Years | ||||||||

Board

Nominating and Governance Committee |

|

Brookfield Infrastructure Corporation Brookfield Infrastructure Partners L.P. Treasury Wine Estates Limited Brambles Limited Brookfield Infrastructure Partners L.P. Telstra Corporation Limited

|

2021 – Present 2021 – 2022(f) 2023 – Present 2019 – Present 2017 – 2020(f) 2008 – 2023

| |||||||

Number of Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

— |

|

6,740 |

|

6,740 | ||||||

Daniel Muñiz Quintanilla(a) |

Daniel has served as a director of the Corporation since the special distribution in March 2020 and as a director of the general partner of the partnership since August 1, 2019. He is a seasoned business executive who has held senior positions with multinational mining and infrastructure companies for over a decade. Most recently, he was Managing Director and Executive Vice President of Americas Mining Corporation, the holding company of the Mining Division of Grupo Mexico, S.A.B. de C.V. He served as a member of the Board of Directors and was the Executive Vice President of Southern Copper Corporation, a subsidiary of Americas Mining Corporation, where he led several successful mergers and acquisitions, joint ventures and other similar transactions. He has also held the roles of Executive President and Chief Executive Officer of Industrial Minera Mexico S.A. de C.V., the Underground | |||||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 14

Age: 50

Director since: March 16, 2020

Director of the general partner of BIP since: 2019

(Independent)(b)

Areas of Expertise: Corporate Strategy and Business Development, Mergers and Acquisitions, Finance and Capital Allocation, Legal and Regulatory, Asset Management, Government and Public Policy, Economic Policy, Natural Resources, Manufacturing, Transport, Infrastructure, Insurance, Private Equity |

Mining Division of Grupo Mexico, and Chief Financial Officer of Grupo Mexico. Daniel holds a LLM from Georgetown University and a MBA from Instituto de Empresa, Madrid, Spain.

| |||||||||

Board/Committee Membership

|

|

Public Board Membership During Last Five Years | ||||||||

Board

Audit Committee (Chair)(c) |

|

Brookfield Infrastructure Corporation Gatos Silver, Inc. Brookfield Infrastructure Partners L.P. Hudbay Minerals Inc. Southern Copper Corporation |

2020 – Present 2021 – Present(g) 2019 – Present 2019 – Present 2008 – 2018 | |||||||

Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

— |

|

5,400 |

|

5,400 | ||||||

Suzanne Nimocks(a)

Age: 65

Director since: August 2, 2022

(Independent)(b)

Areas of Expertise: Corporate Strategy and Business Development, Mergers and Acquisitions, Finance and Capital Allocation, Asset Management, Risk Management, Electric Power, Natural Gas, Renewables, Economic Policy, Financial Services, Infrastructure, Private Equity | Suzanne Nimocks has served as a director of the Corporation and as a director of the general partner of the partnership since August 2, 2022. Suzanne serves as a member of the board of directors of Ovintiv Inc., a leading North American energy producer, and is Lead Independent Director for Owens Corning, a global building and construction materials leader. She is a former director for Arcelor Mittal and Valaris plc. and was formerly a Senior Partner of McKinsey & Company where she was a leader in the firm’s global organization, risk management and electric power, natural gas and renewables practices. Suzanne holds a BA from Tufts University, Medford, USA and a MBA from Harvard University.

| |||||||||

Board/Committee Membership

|

|

Public Board Membership During Last Five Years | ||||||||

Board

Nominating and Governance Committee |

|

Brookfield Infrastructure Corporation Brookfield Infrastructure Partners L.P. Owens Corning Arcelor Mittal S.A. Ovintiv Inc. Valaris plc |

2022 – Present 2022 – Present 2012 – Present 2011 – 2022 2010 – Present 2010 – 2021(h) | |||||||

Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

4,000 |

|

— |

|

4,000 | ||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 15

Anne Schaumburg(a) Age: 74

Director since: March 12, 2020

Director of the general partner of BIP since: 2008

(Independent)(b)

Areas of Expertise: Corporate Strategy and Business Development, Mergers and Acquisitions, Finance and Capital Allocation, Energy and Power, Financial Services, Infrastructure, Natural Resources, Accounting, Human Resource Management, Marketing |

Anne has served as a director of the Corporation since the special distribution in March 2020 and as a director of the general partner of the partnership since November 3, 2008, including serving as Chair since February 2020. Anne is also a director of Brookfield Reinsurance. She has been a member of the board of directors of NRG Energy, Inc., a power generation company listed on NYSE, since 2005. From 1984 until her retirement in 2002, Anne was a Managing Director and senior banker in the Global Energy Group of Credit Suisse First Boston. Anne has worked in the investment banking industry for 28 years specializing in the power sector. Anne ran Credit Suisse’s Power Group from 1994 to 1999, prior to its consolidation with Natural Resources and Project Finance, where she was responsible for assisting clients on advisory and finance assignments. Her transaction expertise, across the spectrum of utility and unregulated power, includes mergers and acquisitions, debt and equity capital market financings, project finance and leasing, utility disaggregation and privatizations. Anne is a graduate of the City University of New York.

| |||||||||

Board/Committee Membership

|

|

Public Board Membership During Last Five Years | ||||||||

Board (Chair)

Audit Committee(c) |

|

Brookfield Infrastructure Corporation Brookfield Reinsurance Ltd. Brookfield Infrastructure Partners L.P. |

2020 – Present 2021 – Present 2008 – Present 2005 – Present | |||||||

Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||||

Exchangeable Shares |

|

BIP Units(e) |

|

Total Number of Exchangeable Shares and BIP Units | ||||||

2,920 |

|

28,120 |

|

31,040 | ||||||

Rajeev Vasudeva(a)

Age: 64

Director since: March 16, 2020

Director of the general partner of BIP since: 2019

(Independent)(b)

Areas of Expertise: |

Rajeev has served as a director of the Corporation since the special distribution in March 2020 and as a director of the general partner of the partnership since August 1, 2019. He has advised global organizations on appointing, assessing and developing leaders over the last two decades. He had a 25-year career with Egon Zehnder, the global leadership advisory firm, as a Partner in the India and UK, culminating in his appointment as the Chief Executive Officer of the firm for five years from 2014-2019. Prior to being appointed CEO, he was the Partner-in-charge for global operations, technology and financial performance. His consulting engagements were primarily focused on serving clients in the Telecom and Technology sector. During his initial career, he worked as a management consultant with Price Waterhouse and Touche Ross in India and the U.S. Rajeev currently serves on the board of Sofina, an investment holding company listed on the Brussels stock exchange, and on the board of Pidilite Industries Ltd., a specialty chemicals company, listed on the Bombay Stock Exchange and is a member of the Nomination and Remuneration Committee. Rajeev is a qualified Chartered Accountant and lawyer and holds an MBA from the University of Michigan, Ann Arbor, USA.

| |||||||||

Board/Committee Membership |

|

Public Board Membership During Last Five Years | ||||||||

| Corporate Strategy and | Board |

| Brookfield Infrastructure Corporation | 2020 – Present | ||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 16

Business Development, Finance and Capital Allocation, Accounting, Economic Policy, International Affairs | Sofina Marico Limited Pidilite Industries Ltd. Brookfield Infrastructure Partners L.P. Centum Learning Ltd. | 2023 – Present 2021 – Present 2020 – Present 2019 – Present 2019 – 2022 | ||||||

Number of Exchangeable Shares and BIP Units Beneficially Owned, Controlled or Directed | ||||||||

Exchangeable Shares |

BIP Units(e) |

Total Number of Exchangeable Shares and BIP Units | ||||||

4,750 |

— |

4,750 | ||||||

Notes:

| (a) | Jeffrey Blidner principally lives in Ontario, Canada. William Cox principally lives in Bermuda. Roslyn Kelly and Rajeev Vasudeva principally live in London, United Kingdom. John Mullen principally lives in New South Wales, Australia. Daniel Muñiz Quintanilla principally lives in Madrid, Spain. Anne Schaumberg principally lives in New Jersey, United States of America and Suzanne Nimocks principally lives in Texas, United States of America. |

| (b) | “Independent” refers to the Board’s determination of whether a director nominee is “independent” under Section 1.2 of National Instrument 58-101 — Disclosure of Corporate Governance Practices. John Mullen is the non-overlapping board member of BIPC who assists BIPC with, among other things, resolving any conflicts of interest that may arise from its relationship with BIP. John Mullen served on the board of directors of the general partner of BIP from 2017 to 2020 and most recently from May 5, 2021 until he resigned from such board of directors on August 2, 2022. |

| (c) | Daniel Muñiz Quintanilla is the chair of the audit committee of the Board and is our audit committee financial expert. The audit committee of the Board consists solely of independent directors, each of whom are persons determined by the Corporation to be financially literate within the meaning of National Instrument 52-110 – Audit Committees. Each of the members of the audit committee of the Board has the ability to read and understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. |

| (d) | “Affiliated” refers to a director nominee who (i) owns greater than a de minimis interest in the Corporation (exclusive of any securities compensation earned as a director) or (ii) within the last two years has directly or indirectly (a) been an officer of or employed by the Corporation or any of its affiliates, (b) performed more than a de minimis amount of services for the Corporation or any of its affiliates, or (c) had any material business or professional relationship with the Corporation other than as a director of the Corporation. “De minimis” for the purpose of this test includes factors such as the relevance of a director’s interest in the Corporation to themselves and to the Corporation. |

| (e) | The Corporation requires its directors who are not affiliated with Brookfield to hold sufficient exchangeable shares and/or BIP Units such that the acquisition cost of the exchangeable shares and/or BIP Units held by such directors is equal to at least two times their annual retainer for serving as directors of the Corporation and the general partner of BIP, as applicable, as determined by the Board from time to time (the “Director Share Ownership Requirement”). Independent directors of the Corporation are required to meet the Director Share Ownership Requirement within five years of joining the Board. The value of two times the annual retainer for each such director is $300,000. For more information, see “Director Share Ownership Requirements” in Part Three of this Circular. Each of the directors individually and collectively beneficially own less than 1% of the exchangeable shares. |

| (f) | John Mullen previously served as a director of the general partner of BIP from 2017 to 2020 and from May 2021 to August 2022. |

| (g) | Daniel Muñiz Quintanilla is a director of Gatos Silver, Inc. (“Gatos”). On April 1, 2022, the Ontario Securities Commission issued a management cease trade order against the chief executive officer and chief financial officer of Gatos ordering each such executive officer to cease trading in the securities of Gatos until Gatos completed its annual continuous disclosure filings for the year ended December 31, 2021 as required by Ontario securities laws. Additional management cease trade orders were issued by the Ontario Securities Commission on April 12, 2022 and July 7, 2022 in connection with certain other delays in Gatos’ financial reporting. Such management cease trade orders lapsed on June 29, 2023. |

| (h) | Suzanne Nimocks was a director of Valaris plc (formerly Ensco-Rowan) from 2010 until April 2021. Valaris plc filed for bankruptcy in August 2020 and emerged on May 1, 2021. Suzanne resigned from the board of directors of Valaris plc on April 30, 2021. |

2024 MANAGEMENT INFORMATION CIRCULAR / 17

Summary of 2024 Nominees for Director

The following summarizes the qualifications of the 2024 director nominees that led the Board to conclude that each director nominee is qualified to serve on the Board.

All Director Nominees Exhibit: ● High personal and professional integrity and ethics ● A proven record of success ● Experience relevant to the Corporation’s global activities | ● A commitment to sustainability and social issues ● An inquisitive and objective perspective ● An appreciation of the value of good corporate governance | |

The Board is comprised of eight directors, which the Corporation considers an appropriate number given the diversity of its operations and the need for a variety of experiences and backgrounds to effectively oversee the governance of the Corporation and provide strategic advice to management. The Corporation reviews the expertise of incumbent and proposed directors in numerous areas, including those listed in the following chart.

Director Nominees | Business Development | Corporate Strategy / M&A | Leadership of a Large / Complex Organization | Risk Management | Legal & Regulatory | Sustainability | Industry Experience | |||||||

Jeffrey Blidner | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Infrastructure, power, private equity, property | |||||||

| William Cox | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Asset management, real estate, infrastructure, private equity | |||||||

Suzanne Nimocks | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Asset management, energy and power, economic policy, financial services, infrastructure, private equity | |||||||

| Roslyn Kelly | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Asset management, government and public policy, economic policy, international affairs, energy and power, financial services, healthcare, infrastructure, insurance, manufacturing, natural resources, private equity, real estate, accounting, human resource management, marketing | |||||||

| John Mullen | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Asset management, government and public policy, transport, infrastructure, telecommunications | |||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 18

Director Nominees | Business Development | Corporate Strategy / M&A | Leadership of a Large / Complex Organization | Risk Management | Legal & Regulatory | Sustainability | Industry Experience | |||||||

| Daniel Muñiz Quintanilla | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Asset management, government and public policy, economic policy, natural resources, manufacturing, energy and power, financial services, infrastructure, insurance, private equity | |||||||

| Anne Schaumburg | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Energy and power, financial services, infrastructure, natural resources, accounting, human resource management, marketing | |||||||

| Rajeev Vasudeva | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | Accounting, economic policy, international affairs | |||||||

2023 Director Attendance

We believe the Board cannot be effective unless it governs actively. We expect our directors to attend all Board meetings and all of their respective committee meetings. Directors may participate by video or teleconference if they are unable to attend in person. The table below shows the number of Board and committee meetings each director nominee attended in 2023. All director nominees standing for re-election attended at least 90% of the Board meetings in 2023, with seven of those director nominees attending every Board meeting. The Board and its committees meet in camera without management present at all meetings, including those held by teleconference.

| Directors | Independent | All | Board | Audit Committee | Nominating and Governance Committee | |||||||

Jeffrey Blidner

| no | 5 of 5 | 100% | 5 of 5 | — | — | ||||||

William Cox

| yes | 9 of 9 | 100% | 5 of 5 | — | 4 of 4 | ||||||

Roslyn Kelly

| yes | 9 of 9 | 100% | 5 of 5 | 4 of 4 | — | ||||||

John Mullen

| yes | 8 of 9 | 90% | 4 of 5 | — | 3 of 4 | ||||||

Daniel Muñiz Quintanilla | yes | 9 of 9 | 100% | 5 of 5 | 4 of 4 | — | ||||||

Suzanne Nimocks

| yes | 5 of 5 | 100% | 5 of 5 | — | — | ||||||

Anne Schaumburg | yes | 13 of 13 | 100% | 5 of 5 | 4 of 4 | 4 of 4 | ||||||

Rajeev Vasudeva

| yes | 5 of 5 | 100% | 5 of 5 | — | — | ||||||

2024 MANAGEMENT INFORMATION CIRCULAR / 19

3. Appointment of External Auditor

On recommendation of the audit committee of the Board (the “Audit Committee”), the Board proposes the reappointment of Deloitte LLP as the external auditor of the Corporation. Deloitte LLP, including the member firms of Deloitte Touche Tohmatsu Limited and their respective affiliates (collectively, “Deloitte”), is the principal external auditor of the Corporation. Deloitte has served as the external auditor of the Corporation since 2019. The appointment of the external auditor must be approved by a majority of the votes cast by holders of exchangeable shares and class B shares, voting together as a single class.

On any ballot that may be called for in the appointment of the external auditor, the Management Representatives designated on the form of proxy intend to vote such shares FOR reappointing Deloitte LLP, an Independent Registered Public Accounting Firm, as the external auditor, and authorizing the directors to set the remuneration to be paid to the external auditor, unless the shareholder has specified on the form of proxy that the shares represented by such proxy are to be withheld from voting in relation to the appointment of the external auditor.

Principal Accounting Firm Fees

Aggregate fees billed to the Corporation for the fiscal year ended December 31, 2023 by Deloitte amounted to approximately $3.847 million, the entire amount representing audit and audit-related fees. Fees reported for a particular year include differences between actual and planned amounts from the prior year, if applicable.

From time to time, Deloitte provides other non-audit services to the Corporation pursuant to an Audit and Non-Audit Services Pre-Approval Policy (the “Audit Policy”). The Audit Policy governs the provision of audit and non-audit services by the external auditor and is annually reviewed by the Audit Committee. The Audit Policy provides for the Audit Committee’s pre-approval of permitted audit, audit-related, tax and other non-audit services. It also specifies a number of services the provision of which is not permitted by the external auditor, including the use of the external auditor for the preparation of financial information, system design and implementation assignments.

The following table sets forth further information on the fees billed by Deloitte to the Corporation for the fiscal years ended December 31, 2023 and December 31, 2022.

| $ thousands | 2023 | 2022 | ||

Audit fees | 3,722 | 1,721 | ||

Audit-related fees | 125 | 88 | ||

Tax fees | — | — | ||

All other fees | — | — | ||

Total fees | 3,847 | 1,809 | ||

Audit fees include fees for the audit of our annual consolidated financial statements, internal control over financing reporting and interim reviews of the consolidated financial statements included in our quarterly interim reports. This fee also includes fees for the audit or review of financial statements for certain of our subsidiaries, including audits of individual assets to comply with lender, joint venture partner or regulatory requirements.

Audit-related fees relate primarily to services pertaining to capital market transactions and other securities related matters. Audit-related fees also include fees for translation.

2024 MANAGEMENT INFORMATION CIRCULAR / 20

Tax fees related to fees incurred for tax compliance, tax advice and tax planning.

Deloitte is independent with respect to the Corporation within the meaning of the Rules of Professional Conduct of the Chartered Professional Accountants of Ontario and within the meaning of the U.S. Securities Act of 1933, as amended and the applicable rules and regulations thereunder adopted by the U.S. Securities and Exchange Commission and the Public Company Accounting Oversight Board (United States).

2024 MANAGEMENT INFORMATION CIRCULAR / 21

Part Three – Statement of Corporate Governance

Practices

Overview

The Corporation’s corporate governance policies and practices are comprehensive and consistent with the guidelines for corporate governance adopted by the Canadian Securities Administrators. The Corporation’s corporate governance practices and policies are also consistent with the requirements of the U.S. Securities and Exchange Commission, the listing standards of the NYSE and the applicable provisions under the U.S. Sarbanes-Oxley Act of 2002, as amended.

The structure, practices and committees of the Board, including matters relating to the size, independence and composition of the Board, the election and removal of directors, requirements relating to board action and the powers delegated to the Board committees, mirror the practices of the partnership and are governed by the Corporation’s articles and policies adopted by the Board. The Board is responsible for exercising the management, control, power and authority of the Corporation except as required by applicable law or the Corporation’s articles. The following is a summary of certain provisions of the Corporation’s articles and policies that affect the Corporation’s governance.

Board of Directors

The Board is currently comprised of eight directors. The Board may consist of between three and eleven directors or such other number of directors as may be determined from time-to-time by a resolution of the shareholders of the Corporation and subject to the Corporation’s articles. At least three directors and at least a majority of the directors holding office must be independent of the Corporation and Brookfield, as determined by the Board using the standards for independence established under applicable securities laws. The Board mirrors the board of directors of the general partner of the partnership, except that there is one additional non-overlapping member of the Board who assists the Corporation with, among other things, resolving any conflicts of interest that may arise from its relationship with Brookfield Infrastructure. John Mullen currently serves as the non-overlapping director.

Election and Removal of Directors