- XPER Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

-

Shorts

-

DRS Filing

Xperi (XPER) DRSDraft registration statement

Filed: 12 Oct 21, 12:00am

Exhibit 99.1

Dear Xperi Stockholder:

We are pleased to deliver to you this information statement to inform you that on , the board of directors of Xperi Holding Corporation (“Xperi”) approved the distribution of all the then issued and outstanding shares of common stock of [Xperi Product] (“[Xperi Product]”), a wholly owned subsidiary of Xperi, to Xperi stockholders. At the time of the distribution, [Xperi Product] will hold Xperi’s product business.

As previously announced, Xperi intends to separate into two independent, publicly traded companies—one for each of its product and IP licensing businesses. It is expected that after the distribution of [Xperi Product], Xperi will be renamed “Adeia Inc.” (“Adeia”). Once renamed, Adeia is expected to change its symbol to “ ”. Until such time, Xperi will continue to trade on the Nasdaq Global Select Market under the symbol “XPER.“The distribution of [Xperi Product] common stock will occur on , 2022 by way of a pro rata dividend to Xperi stockholders. Each Xperi stockholder will be entitled to receive shares of [Xperi Product] common stock for every share of Xperi common stock held by such stockholder at the close of business on , 2022, the record date of the distribution.

Immediately following the distribution, Xperi stockholders as of the record date for the applicable distribution will own 100% of the [Xperi Product] common stock and [Xperi Product] will become an independent, publicly traded company. Assuming the distribution is completed, immediately following the distribution, Adeia will continue to hold Xperi’s IP licensing business. The Xperi board of directors believes that creating two focused companies is the best way to drive value for all of Xperi’s stakeholders. They also believe that the separation of Xperi’s product and IP licensing businesses will better position both companies to capitalize on significant growth opportunities and focus their resources on their respective businesses and strategic priorities.

We expect the distribution of [Xperi Product] common stock to be tax-free for U.S. federal income tax purposes, except for any cash received in lieu of fractional shares. You should consult your own tax advisor as to the particular tax consequences of the distribution of [Xperi Product] common stock to you, including potential tax consequences under state, local and non-U.S. tax laws.

Stockholder approval of the distribution is not required. You are not required to take any action to receive your [Xperi Product] common stock and you do not need to pay any consideration or surrender or exchange your Xperi shares to receive your [Xperi Product] common stock.

Immediately following the distribution, you will own shares in both Adeia and [Xperi Product]. We intend to apply to have [Xperi Product]’s common stock listed on the [●] under the symbol “XPER”. In connection with the distribution of [Xperi Product], Adeia is expected to change its stock symbol to “ ”.

The enclosed information statement is being mailed to all Xperi stockholders who held shares of Xperi common stock as of the record date for the distribution of [Xperi Product] common stock. This statement describes the distribution in detail and contains important information about Xperi, [Xperi Product] and the distribution. We urge you to read the information statement carefully.

We want to thank you for your continued support of Xperi, and we look forward to your support of [Xperi Product] in the future.

| Sincerely, |

| Jon Kirchner |

| Chief Executive Officer and President |

| Xperi Holding Corporation |

| [[Xperi Product] LOGO] | ||

Dear [Xperi Product] Stockholder:

[Letter to come]

| Sincerely, | ||

[●] | ||

[Chief Executive Officer] | ||

[Xperi Product] | ||

Information included herein is subject to completion or amendment. A Registration Statement on Form 10 relating to these securities has been filed with the Securities and Exchange Commission under the Securities Act of 1934, as amended.

Preliminary and Subject to Completion, dated , 2022

[[Xperi Product] LOGO]

INFORMATION STATEMENT

[Xperi Product]

Common Stock, Par Value $0.001 Per Share

This information statement is being furnished to the holders of common stock of Xperi Holding Corporation (“Xperi”) in connection with the distribution of shares of common stock of [Xperi Product] (“[Xperi Product]”). [Xperi Product] is a wholly owned subsidiary of Xperi that, at the time of the distribution, will hold Xperi’s product business. Xperi will distribute all the outstanding shares of [Xperi Product] common stock on a pro rata basis to its common stockholders.

[Xperi Product] is organized as a corporation under the laws of the State of Delaware.

For every share of Xperi common stock held of record by you as of the close of business on , 2022, the record date for the distribution, you will receive shares of [Xperi Product] common stock. No fractional shares of [Xperi Product] common stock will be issued. Instead, you will receive cash in lieu of any fractional shares. As discussed under “The Separation and Distribution—Trading Between the Record Date and Distribution Date,” if you sell your Xperi common stock in the “regular-way” market after the record date and before the separation and distribution, you will also be selling your right to receive shares of [Xperi Product] common stock in connection with the separation and distribution. We expect the shares of [Xperi Product] common stock to be distributed by Xperi to you on , 2022. We refer to the date of distribution of [Xperi Product] common stock as the “distribution date.” After the distribution, we will be an independent, publicly traded company.

No vote of Xperi stockholders is required or being sought to effect the distribution. Therefore, you are not being asked for a proxy to vote on the separation or the distribution, and you are requested not to send us a proxy. You do not need to pay any consideration, exchange or surrender your existing shares of Xperi common stock or take any other action to receive your shares of [Xperi Product] common stock.

The distribution is intended to be tax-free to Xperi stockholders for United States federal income tax purposes, except for cash received in lieu of fractional shares. The distribution is subject to the satisfaction or waiver by Xperi of certain conditions, including the receipt of an opinion of Skadden, Arps, Slate, Meagher & Flom LLP (“Skadden”) confirming that the distribution and certain transactions entered into in connection with the distribution generally will be tax-free to Xperi and its shareholders for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. Cash received in lieu of any fractional shares of Xperi common stock will generally be taxable to you.

Xperi currently owns all the outstanding shares of [Xperi Product]. Accordingly, there is no current trading market for [Xperi Product] common stock, although we expect that a limited market, commonly known as a “when-issued” trading market, will develop as early as the trading day prior to the record date for the distribution, and we expect “regular-way” trading of [Xperi Product] common stock to begin on the distribution date. [Xperi Product] intends to apply to have its common stock authorized for listing on the [●] under the symbol “XPER.”

Following the separation and distribution, [Xperi Product] will qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, and, as such, is allowed to provide in this information statement more limited disclosures than an issuer that would not so qualify. In addition, for so long as [Xperi Product] remains an emerging growth company, it may take advantage, for a period of time, of certain exceptions from the Sarbanes-Oxley Act of 2002 and the Dodd-Frank Act of 2010.

In reviewing this information statement, you should carefully consider the matters described under the caption “Risk Factors” beginning on page 19.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this information statement is , 2022 and is first being mailed to Xperi stockholders on or about , 2022.

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 7 | ||||

| 11 | ||||

| 19 | ||||

| 49 | ||||

| 51 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

NOTES TO THE UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION | 62 | |||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 63 | |||

| 86 | ||||

| 102 | ||||

| 103 | ||||

| 110 | ||||

| 111 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 113 | |||

| 114 | ||||

| 118 | ||||

| 119 | ||||

| 123 |

Except as otherwise indicated or unless the context otherwise requires, the information included in this information statement about [Xperi Product] assumes the completion of all of the transactions referred to in this information statement in connection with the separation and distribution. Unless the context otherwise requires, references in this information statement to “[Xperi Product],” “we,” “us,” “our,” “our company” and “the company” refer to [Xperi Product], a Delaware corporation, and its consolidated subsidiaries after giving effect to the separation and distribution. Unless the context otherwise requires, references in this information statement to “Xperi” refer to Xperi Holding Corporation, a Delaware corporation, and its consolidated subsidiaries other than, for all periods following the separation and distribution, [Xperi Product]. References in this information statement to [Xperi Product]’s historical assets, liabilities, products, business or activities are generally intended to refer to the historical assets, liabilities, products, business or activities of the [Xperi Product] business as it was conducted as part of Xperi and its subsidiaries prior to the spin-off. Unless the context otherwise requires, references in this information statement to the “separation” or the “spin-off” refer to the separation of [Xperi Product] from Xperi’s other businesses and the creation, as a result of the distribution, of an independent, publicly traded company, [Xperi Product].

Unless otherwise indicated or the context otherwise requires, this information statement describes [Xperi Product] as if the Internal Reorganization and Business Realignment (each as defined in the section entitled “The Separation and Distribution”) have been completed and as if [Xperi Product] held the product business of Xperi during all periods described. As a result, references in this information statement to [Xperi Product]’s historical assets, liabilities, products, business or activities are generally references to the applicable assets, liabilities, products, business or activities of Historical Xperi on a pro forma basis as if the Internal Reorganization and Business Realignment had already occurred and [Xperi Product] was a standalone company holding Xperi’s product business. See the section entitled “The Separation and Distribution” for further information.

You should carefully read this entire information statement, which forms a part of the registration statement on Form 10 (the “Form 10”), as well as (i) the audited combined financial statements of [Xperi Product] and notes thereto, (ii) the audited combined financial statements of TiVo Product for the years ended December 31, 2019 and 2018, and (iii) the unaudited combined financial statements of TiVo Product for the three months ended March 31, 2020 and 2019, which are incorporated by reference herein and filed as Exhibits 99.2, 99.3 and 99.4, respectively, to the Form 10 of which this information statement forms a part. The combined financial statements included for TiVo Product are presented to provide readers an understanding of the product business of Pre-Merger TiVo. Some of the statements in this information statement constitute forward-looking statements. See the section entitled “Cautionary Statement Concerning Forward-Looking Statements.”

You should not assume that the information contained in this information statement is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this information statement may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations.

1

Unless otherwise indicated or the context otherwise requires, references in this information statement to:

| • | “Adeia” refers to Xperi and its consolidated subsidiaries, following the distribution of [Xperi Product], at which time Adeia will hold the IP licensing business of Xperi and is expected to be renamed “Adeia Inc.”; |

| • | “Business Realignment” has the meaning set forth in the section titled “The Separation and Distribution”; |

| • | “distribution” refers to the transaction in which Xperi will distribute to its stockholders all of the then issued and outstanding shares of [Xperi Product] common stock; |

| • | “distribution date” refers to the date of the distribution, which is expected to be on , 2022; |

| • | “Internal Reorganization” refers to the meaning set forth in the section titled “The Separation and Distribution”; |

| • | “Mergers” refers to the merger of Pre-Merger Xperi and Pre-Merger TiVo pursuant to an all-stock merger of equals transaction consummated on June 1, 2020; |

| • | “Pre-Merger TiVo” refers to TiVo Corporation and its consolidated subsidiaries prior to the Mergers; |

| • | “Pre-Merger Xperi” refers to Xperi Corporation and its consolidated subsidiaries prior to the Mergers; |

| • | “record date” refers to , 2022, the date set by the Xperi board of directors to determine the Xperi stockholders eligible to receive the distribution of [Xperi Product] common stock; |

| • | “separation” refers to the transaction in which [Xperi Product] will be separated from Xperi; |

| • | “TiVo Acquisition” refers to the acquisition of TiVo Inc. (renamed TiVo Solutions Inc.) by Rovi Corporation in a cash and stock transaction consummated on April 28, 2016; |

| • | “TiVo Product” refers to the product business of Pre-Merger TiVo; |

| • | “[Xperi Product],” “we,” “us,” “our” and “the Company” refer to [TiVo Product HoldCo LLC], the newly formed holding company for Xperi’s product business and its consolidated subsidiaries after giving effect to the Internal Reorganization and Business Realignment, resulting in [Xperi Product] holding the product business of Xperi; |

| • | “[Xperi Product] common stock” refers to the shares of common stock, par value $0.001 per share, of [Xperi Product]; |

| • | “Xperi” or “Historical Xperi” refers to Xperi Holding Corporation, a Delaware corporation, and its consolidated subsidiaries, prior to the distribution of [Xperi Product]; and |

| • | “Xperi stockholders” refers to holders of record of the common stock of Xperi in their capacity as such. |

2

The following is a summary of material information discussed in this information statement. This summary may not contain all the details concerning the separation and distribution or other information that may be important to you. To better understand the separation, distribution and our business and financial position, you should carefully review this entire information statement.

Our Company

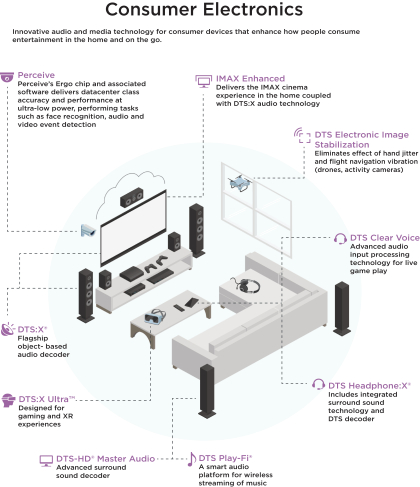

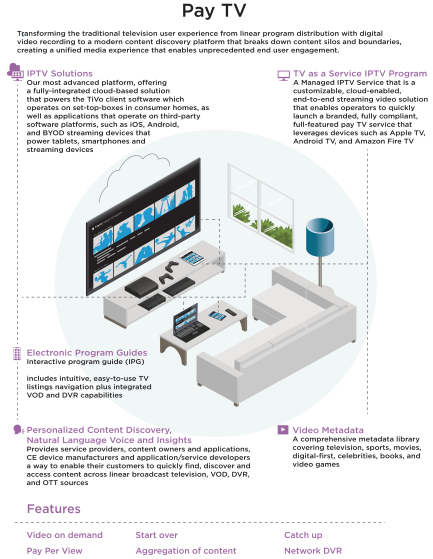

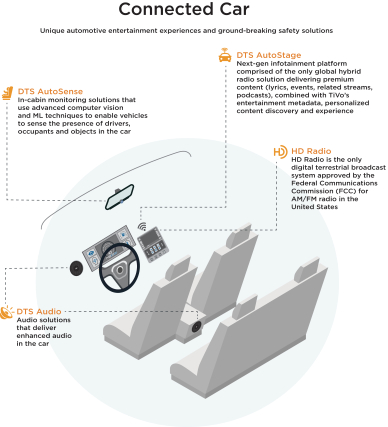

Our company, [Xperi Product], comprises a portfolio of software and services that address one of the biggest consumer trends in entertainment today – the massive proliferation of content and the rapidly changing habits for how consumers are finding, watching and enjoying entertainment. We offer consumers a unique and seamless end-to-end entertainment experience, from choice to consumption, in the home, in the car and on-the-go. Additionally, through our technology solutions, we can offer our customers and partners additional ways to monetize that consumption. We group our business into four categories based on the products delivered and customers served: Consumer Electronics, Pay-TV, Connected Car and Platform Solutions.

Strategy and Solutions

Xperi invents, develops and delivers technologies that enable extraordinary experiences. In the home, in the car and on the go, we manage content and connections in a way that is smart, immersive and personal. We do this by developing ground-breaking innovations that enhance how consumers interact with products and services on a daily basis. Our inventions are focused on driving increased value for partners, customers and consumers across multiple end-markets.

Key elements of our strategy by end-market include:

| • | Consumer Electronics: Provide innovative audio and media technology for consumer devices that enhances how people consume their entertainment content in the home, in the car and on the go. Also, we are utilizing our machine-learning capabilities through an internally incubated AI chip company that delivers datacenter-class accuracy and performance to edge-based devices at ultra-low power. |

| • | Pay-TV: Transform the traditional television user experience from linear multi-channel video program distribution (“MVPD”) with cloud based digital video recording (“DVR”) to a modern content discovery platform that breaks down content silos and boundaries, creating a unified media experience that enables unprecedented end user engagement. |

| • | Connected Car: Deliver unique automotive entertainment experiences as well as ground-breaking safety solutions. |

| • | Platform Solutions: Leverage our video streaming and personalized content discovery platforms that combine vMVPD (virtual MVPD), subscription video on demand (“SVOD”), ad-based video on demand (“AVOD”) and free ad supported television (“FAST”) in a unified end user experience with embedded technology to monetize consumer engagement with connected TV advertising. |

Emerging Growth Company

As a company with less than $1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will continue to be an emerging growth company until the earliest to occur of:

| • | the last day of the fiscal year following the fifth anniversary of the distribution; |

| • | the last day of the fiscal year with at least $1.07 billion in annual revenues; |

| • | the last day of the fiscal year in which we are deemed to be a large accelerated filer, which means that we have been public for at least twelve months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last day of our then-most recently completed second fiscal quarter; or |

3

| • | the date on which we have issued more than $1.0 billion of non-convertible debt during the prior three-year period |

Until we cease to be an emerging growth company, we may take advantage of reduced reporting requirements generally unavailable to other public companies. Those provisions allow us to:

| • | provide reduced disclosure regarding our executive compensation arrangements pursuant to the rules applicable to smaller reporting companies, which means we do not have to include a compensation discussion and analysis and certain other disclosure regarding our executive compensation; |

| • | not provide an auditor attestation of our internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act of 2002, as amended; and |

| • | not hold a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We have elected to adopt the reduced disclosure requirements described above for purposes of the information statement. In addition, for so long as we qualify as an emerging growth company, we expect to take advantage of certain of the reduced reporting and other requirements of the JOBS Act with respect to the periodic reports we will file with the SEC and proxy statements that we use to solicit proxies from our stockholders. As a result of these elections, the information that we provide in this information statement may be different than the information you may receive from other public companies in which you hold equity interests. In addition, it is possible that some investors will find our common stock less attractive as a result of these elections, which may result in a less active trading market for our common stock and higher volatility in our stock price.

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We may take advantage of the longer phase-in periods for the adoption of new or revised financial accounting standards under the JOBS Act until we are no longer an emerging growth company. Our election to use the phase-in periods permitted by this election may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the longer phase-in periods permitted under the JOBS Act and who will comply with new or revised financial accounting standards. If we were to subsequently elect instead to comply with public company effective dates, such election would be irrevocable pursuant to the JOBS Act.

See “Risk Factors—Risks Related to Ownership of Our Common Stock—For as long as we are an emerging growth company, we will not be required to comply with certain requirements that apply to other public companies” for certain risks related to our status as an emerging growth company.

Summary Risk Factors

An investment in our common stock is subject to several risks associated with our business, the spin-off, and ownership of [Xperi Product] common stock. The following list of risk factors is not exhaustive. Please read carefully the risks relating to these and other matters described under the section entitled “Risk Factors” beginning on page [●].

An investment in [Xperi Product] common stock is subject to several areas of risk which may affect our operations or stock price, including the following:

Risks Related to our Business

| • | Our business and results of operations have been, and are expected to continue to be, impacted by the global COVID-19 pandemic. |

| • | The long-term success of our business is dependent on a royalty-based business model, which is inherently risky. |

4

| • | Our licensees may delay, refuse to or be unable to make payments to us due to financial difficulties or otherwise, or shift their licensed products to other companies to lower their royalties to us. |

| • | It is difficult for us to verify royalty amounts owed to us under our licensing agreements, and this may cause us to lose revenue. |

| • | If we fail to develop and timely deliver innovative technologies and services in response to changes in our markets and industries, our business could decline. |

| • | Our products and services face intense competition from various sources, and we may not be able to compete effectively. |

| • | We face competitive risks in the provision of entertainment offerings involving the distribution of digital content provided by third-party application providers through broadband. |

| • | Our pursuit of acquisitions and divestitures may adversely affect our business operations or stock price if we cannot successfully execute our strategies. |

| • | If we fail to protect and enforce our intellectual property rights, contract rights, and our confidential information, our business will suffer. |

| • | If we are unable to further penetrate the streaming and downloadable content delivery markets and adapt our technologies for those markets, our royalties and ability to grow our audio business could be adversely impacted. |

| • | Our failure to adequately manage our increasingly complex distribution agreements, including licensing, development and engineering services, may cause unexpected delays and loss of revenue in the deployment of advanced television solutions. |

| • | We depend on a limited number of third parties to design, manufacture, distribute and supply hardware devices upon which our TiVo software and service operate. |

| • | We maintain inventories of TiVo-branded products based on our demand forecast, which may be incorrect and lead to excess or insufficient inventory. |

| • | Further deterioration of trade relations between the United States and China, other trade conflicts and barriers, economic sanctions, and national security protection policies could limit or prevent existing or potential customers from doing business with us. |

| • | Our systems, networks and online business activities are subject to cybersecurity and stability risks, information technology system failures, and security breaches. |

| • | The nature of our business requires the application of complex accounting principles. Significant changes in U.S. generally accepted accounting principles (“GAAP”) could materially affect our financial position and results of operations. |

| • | New governmental regulations or new interpretations of existing laws, including legislative initiatives, could cause legal uncertainties and result in harm to our business. |

Risks Related to the Separation

| • | We may be unable to achieve some or all of the benefits that we expect to achieve from our separation. |

| • | If the distribution, together with certain related transactions, were to fail to qualify for non-recognition treatment for U.S. federal income tax purposes, then we could be subject to significant tax and indemnification liability and stockholders receiving [Xperi Product] common stock in the distribution could be subject to significant tax liability. |

| • | The IRS may assert that the Mergers cause the distribution and other related transactions to be taxable to Xperi, in which case we could be subject to significant indemnification liability. |

| • | We will be subject to continuing contingent tax-related liabilities of Xperi following the distribution. |

5

| • | We will agree to numerous restrictions to preserve the tax-free treatment of the distribution and certain related transactions in the United States, which may reduce our strategic and operating flexibility. |

| • | Neither [Xperi Product’s] financial information nor our pro forma combined financial information are necessarily representative of the results we would have achieved as an independent, publicly traded company and may not be a reliable indicator of our future results. |

| • | Following the separation and distribution, we may not enjoy the same benefits of diversity, leverage and market reputation that we enjoyed as a part of Xperi. |

| • | Our customers, prospective customers, suppliers, or other companies with whom we conduct business may need assurances that our financial stability on a standalone basis is sufficient to satisfy their requirements for doing or continuing to do business with them. |

| • | In connection with our separation we will assume, and indemnify Adeia for, certain liabilities. If we are required to make payments pursuant to these indemnities, we may need to divert cash to meet those obligations and our financial results could be negatively impacted. In addition, Adeia will assume, and indemnify us for certain liabilities. These indemnities may not be sufficient to insure us against the full amount of liabilities for which we will be allocated responsibility, and Adeia may not be able to satisfy their indemnification obligations in the future. |

| • | Until the distribution occurs, Xperi has the sole discretion to change the terms of the distribution. |

| • | The business separation and related transactions may expose us to potential liabilities arising out of state and federal fraudulent conveyance laws and legal distribution requirements. |

| • | If we fail to maintain effective internal control over financial reporting, our ability to produce accurate financial statements could be impaired, which could increase our operating costs and affect our ability to operate our business. |

| • | We have identified material weaknesses in our internal control over financial reporting which could adversely affect our ability to report our financial and operating results accurately or on a timely basis, and impact overall investor confidence and the value of our common stock. |

The above list of risk factors is not exhaustive. Please read the information in the section entitled “Risk Factors” for a more thorough description of these and other risks.

Corporate Information

[Xperi Product] was incorporated in the State of Delaware on June 30, 2021. The current address of [Xperi Product]’s principal executive offices is 2160 Gold Street, San Jose, California 95002. [Xperi Product] can be contacted by calling (408) 519-9100. Our website address is [●]. The reference to our website is a textual reference only. Information on our website, any website directly or indirectly linked to our website, or any other website mentioned in this information statement does not constitute in any way part of this information statement and is not incorporated by reference into this information statement, and you should not rely on any such information in making an investment decision.

Trademarks indicated by use of the symbols ® or ™ are trademarks of Xperi or [Xperi Product] or their respective affiliated companies or respective owners.

6

SUMMARY OF THE SEPARATION AND DISTRIBUTION

The following is a summary of the material terms of the separation, distribution and other related transactions. For a more detailed description of the matters described below, see the section entitled “The Separation and Distribution” beginning on page [●].

| Distributing company | Xperi Holding Corporation | |

| Distributed company | [Xperi Product], a Delaware corporation and a wholly owned subsidiary of Xperi that will be the holding company for Xperi’s product business. Following the distribution, [Xperi Product] will be an independent, publicly traded company. | |

| Distribution ratio | Each Xperi stockholder will receive shares of [Xperi Product] common stock for every share of Xperi common stock held on , 2022, the record date for the distribution. Xperi stockholders may also receive cash in lieu of any fractional shares, as described below. | |

| Distributed securities | In the distribution, Xperi will distribute to Xperi stockholders all of the then issued and outstanding shares of [Xperi Product] common stock. Following the separation and distribution, [Xperi Product] will be a separate company, and Adeia will not retain any ownership in [Xperi Product].

The actual number of shares of [Xperi Product] common stock that will be distributed will depend on the number of shares of Xperi common stock outstanding on the record date.

Immediately following the distribution, Xperi stockholders will own shares in both [Xperi Product] and Adeia. In connection with the distribution of [Xperi Product], Adeia is expected to change its stock symbol to “ ”. | |

| Fractional shares | Xperi will not distribute any fractional shares of [Xperi Product] common stock. Instead, if you are a registered holder, , the distribution agent will aggregate all fractional shares that would have otherwise been issued in the distribution into whole shares and sell the whole shares in the open market at prevailing market prices on behalf of all Xperi stockholders entitled to receive a fractional share. The distribution agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to those stockholders (net of any required withholding for taxes applicable to each stockholder) who otherwise would have been entitled to receive a fractional share in the distribution. Xperi stockholders who receive cash in lieu of fractional shares will not be entitled to any interest on amounts paid in lieu of fractional shares. Any cash received in lieu of fractional shares generally will be taxable to Xperi stockholders as described in the section entitled “U.S. Federal Income Tax Consequences of the Distribution.” | |

| Record date | The record date for the distribution is the close of business on , 2022. | |

| Distribution date | The distribution date is expected to be on , 2022. | |

| Distribution | On the distribution date, Xperi will issue shares of [Xperi Product] common stock to all Xperi stockholders as of the record date based on the distribution ratio. The shares of [Xperi Product] common stock will be issued electronically in direct registration or book-entry form and no certificates will be issued. | |

7

Commencing on or shortly following the distribution date, the distribution agent will mail to stockholders who hold their shares directly with Xperi (registered holders) a direct registration account statement that reflects the shares of [Xperi Product] common stock that have been registered in their name.

For shares of Xperi common stock that are held through a bank, the bank will credit the stockholder’s account with the [Xperi Product] common stock they are entitled to receive in the distribution.

Xperi stockholders will not be required to make any payment, to surrender or exchange their shares of Xperi common stock or to take any other action to receive their shares of [Xperi Product] common stock in the distribution.

If you are an Xperi stockholder on the record date and decide to sell your shares on or before the distribution date, you may choose to sell your Xperi common stock with or without your entitlement to receive [Xperi Product] common stock in the distribution. Beginning on or shortly before the record date and continuing through the last trading day prior to the distribution, it is expected that there will be two markets in Xperi common stock: a “regular-way” market and an “ex-distribution” market. Shares of Xperi common stock that are traded in the “regular-way” market will trade with the entitlement to receive the [Xperi Product] common stock that is distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without the entitlement to receive the shares of [Xperi Product] common stock distributed pursuant to the distribution. Consequently, if you sell your shares of Xperi common stock in the “regular-way” market on or prior to the last trading day prior to the distribution date, you will also be selling your right to receive [Xperi Product] common stock in the distribution. | ||

| Conditions to the distribution | The distribution is subject to the satisfaction of the following conditions, among other conditions described in this information statement:

• The SEC having declared effective the Form 10 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), no stop order relating to the Form 10 being in effect, no proceedings seeking such a stop order being pending before or threatened by the SEC and this information statement having been distributed to Xperi stockholders;

• the listing of [Xperi Product] common stock on [●] having been approved, subject to official notice of issuance;

• [the Xperi board of directors having received an opinion from a nationally recognized independent appraisal firm to the effect that, following the distribution, [Xperi Product] and Xperi will each be solvent and adequately capitalized, and that Xperi has adequate surplus under Delaware law to declare the dividend of [Xperi Product] common stock;]

• the Internal Reorganization and Business Realignment having been effectuated prior to the distribution date;

• the Xperi board of directors having declared the dividend of [Xperi Product] common stock to effect the distribution and having approved the distribution and all related transactions, which approval may be | |

8

given or withheld in the board’s absolute and sole discretion (and such declaration or approval not having been withdrawn);

• Xperi having elected the individuals to be members of our board of directors following the distribution, and certain directors as set forth in the separation agreement having resigned from the Xperi board of directors;

• each of us and Xperi and each of our or its applicable subsidiaries having entered into all ancillary agreements to which it and/or any such subsidiary is contemplated to be a party;

• no events or developments having occurred or exist that make it inadvisable to effect the distribution or that would result in the distribution and related transactions not being in the best interest of Xperi or its stockholders;

• no order, injunction or decree by any governmental entity of competent jurisdiction or other legal restraint or prohibition preventing consummation of the distribution or any of the related transactions, including the transfers of assets and liabilities contemplated by the separation agreement, shall be pending, threatened, issued or in effect; and

• the receipt by Xperi of an opinion of Skadden, in form and substance satisfactory to Xperi (in its sole discretion) (the “Tax Opinion”), substantially to the effect that, among other things, the distribution, together with certain related transactions, will qualify as a tax-free transaction for U.S. federal income tax purposes under Section 355 and Section 368(a)(1)(D) of the Internal Revenue Code of 1986, as amended (the “Code”).

The fulfillment of these conditions does not create any obligation on Xperi’s part to effect the distribution, and the Xperi board of directors has the ability, in its sole discretion, to amend, modify or abandon the distribution and related transactions at any time prior to the distribution date. | ||

| Stock exchange listing | We intend to file an application to list the shares of [Xperi Product] common stock on [●] under the symbol “XPER.”

We anticipate that as early as the trading prior to the record date, trading in shares of [Xperi Product] common stock will begin on a “when-issued” basis and that this “when-issued” trading market will continue through the last trading day prior to the distribution date. See the section entitled “The Separation and Distribution—Trading Between the Record Date and Distribution Date.” | |

| Transfer agent | [●] | |

| [Xperi Product]’s indebtedness | We do not anticipate that [Xperi Product] will have any material indebtedness. | |

| Risks relating to [Xperi Product], ownership of [Xperi Product] common stock and the distribution | Our business is subject to both general and specific risks, including risks relating to our business, to our relationship with Adeia following the separation and distribution and to us being a separate, publicly traded company. You should read carefully the section entitled “Risk Factors.” | |

| Tax considerations | It is a condition to the distribution that Xperi receive the Tax Opinion, substantially to the effect that, among other things, the distribution, together with certain related transactions, will qualify as a tax-free transaction for U.S. federal income tax | |

9

purposes under Section 368(a)(1)(D) and Section 355 of the Code. Additionally, Xperi has received a private letter ruling from the Internal Revenue Service (the “IRS”), substantially to the effect that, among other things, the distribution, together with certain related transactions, will qualify as a tax-free transaction for U.S. federal income tax purposes under Section 368(a)(1)(D) and Section 355 of the Code (the “IRS Ruling”).

Assuming the distribution so qualifies, no gain or loss will be recognized by Xperi stockholders, and no amount will be included in the income of an Xperi stockholder, upon the receipt of shares of [Xperi Product] common stock pursuant to the distribution. However, any cash payments made in lieu of fractional shares will generally be taxable to the stockholder. For a more detailed discussion, see the section entitled “U.S. Federal Income Tax Consequences of the Distribution.” | ||

| Certain agreements with Xperi | We will enter into the separation agreement with Xperi (which will, after the separation of [Xperi Product], become Adeia) to effect the separation and distribution and provide a framework for our relationship with Adeia after the separation and distribution. We also intend to enter into various other agreements with Xperi, including [a tax matters agreement, an employee matters agreement, intellectual property cross-license agreements, trademark license agreements, transition service agreement and certain other intellectual property, services, supply and real estate agreements]. These agreements will provide, among other things, for the allocation between us and Adeia of the assets, liabilities and obligations of Xperi (including its investments, property and employee benefits and tax-related assets and liabilities) attributable to periods prior to, at and after our separation from Xperi and will govern certain relationships between us and Adeia. For a discussion of these arrangements, see the section entitled “Certain Relationships and Related Party Transactions.” | |

10

QUESTIONS AND ANSWERS ABOUT THE SEPARATION AND DISTRIBUTION

| What is [Xperi Product] and why is Xperi separating its product business and distributing [Xperi Product] common stock? | Prior to the completion of the Mergers on June 1, 2020, each of Pre-Merger Xperi and Pre-Merger TiVo was a standalone, publicly traded company. Pre-Merger Xperi operated a global business that included a product licensing segment and a semiconductor and IP licensing segment. Pre-Merger TiVo operated a global business that included a product segment and an IP licensing segment.

As a result of the Mergers, each of Pre-Merger Xperi and Pre-Merger TiVo became a subsidiary of Xperi. In connection with their entry into the merger agreement, Pre-Merger Xperi and Pre-Merger TiVo contemplated that, at some point following the Mergers, Xperi may pursue, subject to the approval of the Xperi board of directors and any required regulatory approvals, the separation of the combined company, Xperi, into two independent, publicly traded companies—one for each of the combined company’s product and IP licensing businesses. Following the closing of the Mergers, Xperi announced its intention to pursue, subject to the approval of the Xperi board of directors and any required regulatory approvals, such separation.

In connection with the separation of Xperi’s product and IP licensing businesses, Xperi will undertake the Internal Reorganization and Business Realignment, such that, at the time of distribution, [Xperi Product] will hold, directly or indirectly, Xperi’s product business. [Xperi Product] is a newly formed holding company for Xperi’s product business and the separation will be effected by way of a pro rata dividend of [Xperi Product] common stock to Xperi stockholders. Following the separation and distribution, [Xperi Product] will be a separate company, and the remaining company will not retain any ownership interest in [Xperi Product].

The separation of us from Xperi and the distribution of [Xperi Product] common stock are each intended to provide Xperi stockholders with equity investments in separate companies that will be able to focus on their respective businesses, with [Xperi Product] offering consumers a unique and seamless end-to-end entertainment experience through Consumer Electronics, Connected Car, Pay-TV and Platform Solutions. The separation is expected to enhance the long-term performance of each business for the reasons discussed in the sections entitled “The Separation and Distribution—Background of the Distribution” and “The Separation and Distribution—Reasons for the Separation and Distribution.” | |

| Why am I receiving this document? | We are delivering this document to you because you are an Xperi stockholder as of the close of business on , 2022, the record date for the distribution. As an Xperi stockholder as of the record date, you are entitled to receive shares of [Xperi Product] common stock for every share of Xperi common stock that you hold at the close of business on such date. This document will help you understand how the separation and distribution will affect your investment in Xperi and your investment in [Xperi Product] after the separation. | |

| What are the reasons for the separation? | The Xperi board of directors believes that the separation of Xperi into two independent, publicly traded companies through the separation of Xperi’s product and IP licensing businesses is in the best interests of Xperi and its stockholders and is the best available opportunity to unlock the value of Xperi’s business. | |

11

The Xperi board of directors (as described in the section entitled “The Separation and Distribution—Background of the Distribution”), considered a wide variety of factors in evaluating the planned separation and distribution and in deciding to proceed with the distribution, including the risk that the distribution is abandoned and not completed. Among other things, the Xperi board of directors considered the following potential benefits of the separation and distribution:

• Increased Management Focus on Core Business and Distinct Opportunities. The separation will enable the respective management teams to adopt strategies and pursue objectives specific to their respective businesses, and better focus on strengthening their respective core businesses and operations;

• Improved Operational and Strategic Flexibility. The separation will permit each business to pursue its own business interests, operating priorities and strategies more effectively, and will enhance operational flexibility for both businesses, particularly in dealing with suppliers and customers; | ||

• Focused Capital Allocation. The separation will eliminate competing priorities for capital allocation between Xperi’s product and IP licensing businesses;

• Distinct Investment Profile. The separation will simplify how investors evaluate each business, streamline the investment profiles of both businesses and may enhance their marketability; and

• Better Talent Recruitment and Retention. The separation will improve access to talent by allowing each company to capitalize on their distinct cultures and recruitment strategies.

The Xperi board of directors also considered a number of potentially negative factors, including Xperi Product’s ability to be profitable on a standalone basis, Adeia continuing to develop new patentable innovations with fewer engineers and no associated product business, and the loss of synergies from ceasing to operate as part of a larger, more diversified company, risks relating to the creation of a new public company, such as increased costs from operating as a separate public company, potential disruptions to the businesses and loss or dilution of brand identities, possible increased administrative costs and one-time separation costs, restrictions on each company’s ability to pursue certain opportunities that may have otherwise been available in order to preserve the tax-free nature of the distribution and certain related transactions for U.S. federal income tax purposes, and the potential inability to realize the anticipated benefits of the separation and distribution.

The Xperi board of directors concluded that the potential benefits of pursuing the separation and distribution outweighed the potentially negative factors in connection therewith. For more information, see the sections entitled “The Separation and Distribution—Reasons for the Separation and Distribution” and “Risk Factors.” |

12

The Xperi board of directors also considered these potential benefits and potentially negative factors in light of the risk that the distribution is abandoned or otherwise not completed, resulting in Xperi not separating into the intended separate publicly traded companies. The Xperi board of directors believes that the potential benefits to Xperi stockholders discussed above apply to the separation of the intended two businesses and that the creation of each independent company, with its distinctive business and capital structure and ability to focus on its specific growth plan, will provide Xperi stockholders with greater long-term value than retaining one investment in the combined company. | ||

| Why is the separation of [Xperi Product] structured as a distribution? | Xperi currently believes the separation by way of distribution is the most efficient way to separate its product business from Xperi for various reasons, including that a separation by way of distribution will (i) offer a high degree of certainty of completion in a timely manner, lessening disruption to current business operations; (ii) provide a high degree of assurance that decisions regarding [Xperi Product]’s capital structure will align with its business objectives and provide the continued financial flexibility and financial stability to support its long-term growth and generate stockholder returns; and (iii) generally be tax-free to Xperi stockholders for U.S. federal income tax purposes (except for any cash received in lieu of fractional shares). Xperi believes that a tax-free separation will enhance the value of both Xperi and [Xperi Product]. See the section entitled “The Separation and Distribution—Reasons for the Separation and Distribution.” | |

| What do I have to do to participate in the distribution? | You are not required to take any action to receive your [Xperi Product] common stock, although you are urged to read this entire document carefully. No approval of the distribution by Xperi stockholders is required and Xperi is not seeking your approval. Therefore, [Xperi Product] is not asking you for a proxy to vote on the separation or the distribution, and [Xperi Product] requests that you do not send [Xperi Product] a proxy. You will not be required to pay anything for the shares of [Xperi Product] common stock you will receive in the distribution nor will you be required to surrender or exchange any shares of Xperi common stock to participate in the distribution. | |

| What is the record date for the distribution? | Xperi will determine record ownership as of the close of business on , 2022, which we refer to as the “record date.” | |

| What will I receive in the distribution? | If you hold Xperi common stock as of the record date, on the distribution date you will receive shares of [Xperi Product] common stock for every share of Xperi common stock you held on the record date, as well as a cash payment in lieu of any fractional shares (as discussed below). You will receive only whole shares of [Xperi Product] common stock in the distribution. For a more detailed description, see the section entitled “The Separation and Distribution.” | |

| How will fractional shares be treated in the distribution? | No fractional shares of [Xperi Product] common stock will be distributed. Consequently, you will not receive any fractional shares of [Xperi Product] common stock and instead will receive a cash payment in lieu of any fractional shares you would otherwise have been entitled to receive in the distribution.

Xperi has engaged as its distribution agent. The distribution agent will aggregate all fractional shares that would have otherwise been issued in the distribution into whole shares and will sell the whole shares in the open market | |

13

| at prevailing market prices on behalf of all Xperi stockholders entitled to receive a fractional share. The distribution agent will then distribute the aggregate cash proceeds of the sales, net of brokerage fees and other costs, pro rata to those stockholders (net of any required withholding for taxes applicable to such stockholder). You will not be entitled to any interest on the amount of payment made to you in lieu of fractional shares. | ||

| Will the number of Xperi shares I own change as a result of the distribution? | No, the number of shares you own will not change as a result of the distribution. Immediately following the distribution, you will hold the same number of shares of Xperi (which will, after the separation of [Xperi Product], become Adeia) that you held immediately prior to the distribution. Your proportionate interest will also not change, so you will own the same proportionate amount of Adeia immediately following the separation and distribution that you owned of Xperi immediately prior to the separation and distribution. In connection with the distribution of [Xperi Product], Adeia is expected to change its stock symbol to “ ”. | |

| How many shares of [Xperi Product] common stock will be distributed? | The actual number of shares of [Xperi Product] common stock that will be distributed will depend on the number of shares of Xperi common stock outstanding on the record date. The shares of [Xperi Product] common stock that are distributed will constitute all the then issued and outstanding shares of [Xperi Product] common stock immediately prior to the distribution and Xperi (which will, after the separation of [Xperi Product], become Adeia) will not retain any ownership interest in [Xperi Product] following the distribution. For a more detailed description, see the section entitled “Description of Our Capital Stock.” | |

| When will the distribution occur? | It is expected that the distribution will be effected prior to the opening of trading on the distribution date, subject to the satisfaction or waiver of certain conditions. On or shortly after the distribution date, the whole shares of [Xperi Product] common stock will be credited in book-entry accounts for each stockholder entitled to receive the shares of [Xperi Product] common stock in the distribution. We expect Xperi’s distribution agent to take approximately two weeks after the distribution date to fully distribute to stockholders any cash they are entitled to receive in lieu of fractional shares. See “—How will I receive my shares of [Xperi Product] common stock?” for more information. | |

| If I sell my shares of Xperi common stock on or before the distribution date, will I still be entitled to receive shares of [Xperi Product] common stock in the distribution? | If you are an Xperi stockholder on the record date and decide to sell your shares before the distribution date, you may choose to sell your Xperi common stock with or without your entitlement to receive [Xperi Product] common stock in the distribution. Beginning on or shortly before the record date and continuing through the distribution, it is expected that there will be two markets in Xperi common stock: a “regular-way” market and an “ex-distribution” market. Shares of Xperi common stock that are traded in the “regular-way” market will trade with the entitlement to receive the [Xperi Product] common stock that is distributed pursuant to the distribution. Shares that trade in the “ex-distribution” market will trade without the entitlement to receive the shares of [Xperi Product] common stock distributed pursuant to the distribution. Consequently, if you sell your shares of Xperi common stock in the “regular-way” market on or prior to the last trading day prior to the distribution date, you are also selling your right to receive [Xperi Product] common stock in the distribution. | |

14

| You should discuss these alternatives with your bank, broker or other nominee. See the section entitled “The Separation and Distribution—Trading Between the Record Date and Distribution Date.” | ||

| How will I receive my shares of [Xperi Product] common stock? | Registered stockholders: If you are a registered stockholder (meaning you own your shares of Xperi common stock directly through an account with Xperi’s transfer agent, Computershare Trust Company, N.A., (“Computershare”)), the distribution agent will credit the whole shares of [Xperi Product] common stock you receive in the distribution to your book-entry account with our transfer agent on or shortly after the distribution date. Approximately two weeks after the distribution date, the distribution agent will mail you a book-entry account statement that reflects the number of whole shares of [Xperi Product] common stock you own, along with a check for any cash in lieu of fractional shares you are entitled to receive.

Beneficial stockholders: If you own your shares of Xperi common stock beneficially through a bank, broker or other nominee, your bank, broker or other nominee will credit your account with the whole shares of [Xperi Product] common stock you receive in the distribution on or shortly after the distribution date. Your bank, broker or other nominee will also be responsible for transmitting to you any cash payment you are entitled to receive in lieu of fractional shares. Please contact your bank, broker or other nominee for further information about your account and the payment of any cash you are entitled to receive in lieu of fractional shares.

The shares of [Xperi Product] common stock will not be certificated. As a result, no physical stock certificates will be issued to any stockholders. See the section entitled “The Separation and Distribution—When and How You Will Receive the Distribution” for a more detailed explanation. | |

| What are the conditions to the distribution? | The distribution is subject to several conditions, including, among others:

• the SEC having declared effective the Form 10 under the Exchange Act, no stop order relating to the Form 10 being in effect, no proceedings seeking such stop order is pending before or threatened by the SEC and this information statement having been distributed to Xperi stockholders;

• the listing of [Xperi Product] common stock on [●] having been approved, subject to official notice of issuance;

• [the Xperi board of directors having received an opinion from a nationally recognized independent appraisal firm to the effect that, following the distribution, we and Xperi will each be solvent and adequately capitalized, and that Xperi has adequate surplus under Delaware law to declare the dividend of [Xperi Product] common stock;]

• the Internal Reorganization and Business Realignment as they relate to us having been effectuated prior to the distribution date;

• the Xperi board of directors having declared the dividend of [Xperi Product] common stock to effect the distribution and having approved the distribution and all related transactions, which approval may be given or withheld in the board’s absolute and sole discretion (and such declaration or approval not having been withdrawn); | |

15

• Xperi having elected the individuals to be the members of our board of directors following the distribution[, and certain directors as set forth in the separation agreement having resigned from the Xperi board of directors];

• each of us and Xperi and each of our and its applicable subsidiaries having entered into all ancillary agreements to which it and/or such subsidiary is contemplated to be a party;

• no events or developments having occurred or existing that make it inadvisable to effect the distribution or that would result in the distribution and related transactions not being in the best interest of Xperi or its stockholders;

• no order, injunction or decree by any governmental entity of competent jurisdiction or other legal restraint or prohibition preventing consummation of the distribution or any of the related transactions, including the transfers of assets and liabilities contemplated by the separation agreement, shall be pending, threatened, issued or in effect; and

• the receipt by Xperi of the Tax Opinion.

The fulfillment of these conditions does not create any obligation on Xperi’s part to effect the distribution, and the Xperi board of directors has the ability, in its sole discretion, to amend, modify or abandon the distribution and related transactions at any time prior to the distribution date. | ||

| Can Xperi decide to cancel the distribution even if all the conditions have been met? | Yes. The distribution is subject to the satisfaction of certain conditions. See the section entitled “The Separation and Distribution—Conditions to the Distribution.” Even if all such conditions are met, Xperi has the ability, in its sole discretion, not to complete the distribution if, at any time prior to the distribution, the Xperi board of directors determines, in its sole discretion, that the distribution is not in the best interests of Xperi or its stockholders, that a sale or other alternative is in the best interests of Xperi or its stockholders, or that market conditions or other circumstances are such that it is not advisable at that time to separate the product business from Xperi. | |

| What are the U.S. federal income tax consequences of the distribution to me? | The distribution is conditioned on the receipt of the Tax Opinion, in form and substance acceptable to Xperi, substantially to the effect that, among other things, the distribution, together with certain related transactions, will qualify as a tax-free transaction under Section 355 and Section 368(a)(1)(D) of the Code. Additionally, Xperi has received the IRS Ruling, substantially to the effect that, among other things, the distribution will qualify as a tax-free transaction under Section 355 and Section 368(a)(1)(D) of the Code. Assuming the distribution so qualifies, for U.S. federal income tax purposes, no gain or loss will be recognized by you, and no amount will be included in your income, upon the receipt of shares of [Xperi Product] common stock pursuant to the distribution. However, any cash payments made instead of fractional shares will generally be taxable to you. For a more detailed discussion, see the section entitled “U.S. Federal Income Tax Consequences of the Distribution.” | |

| How will the distribution affect my tax basis in my shares of Xperi common stock? | Assuming that the distribution is tax-free to Xperi stockholders (except for taxes related to any cash received in lieu of fractional shares), your tax basis in the Xperi common stock held by you immediately prior to the distribution will be | |

16

| allocated between your shares of Xperi common stock and the [Xperi Product] common stock that you receive in the distribution in proportion to the relative fair market values of each immediately following the distribution. For a more detailed discussion, see the section entitled “U.S. Federal Income Tax Consequences of the Distribution.” | ||

| Will my shares of Xperi common stock continue to trade following the distribution? | Your Xperi common stock, which will now represent ownership of Adeia, will continue to trade on Nasdaq. In connection with the distribution of [Xperi Product], Adeia is expected to change its stock symbol to “ ”. | |

| How will the distributions affect the operations of Xperi? | It is expected that after the distribution of [Xperi Product], Xperi will be renamed “Adeia Inc.” The remaining company will continue to operate the IP licensing business of Xperi. | |

| How will [Xperi Product] common stock trade? | [Xperi Product] common stock will trade on the [●] under the symbol “XPER.” We anticipate that trading in [Xperi Product] common stock will begin on a “when-issued” basis as early as the trading day prior to the record date for the distribution and will continue through the last trading day prior to the distribution date. When-issued trading in the context of a separation refers to a sale or purchase made conditionally on or before the distribution date because the securities of the separated entity have not yet been distributed. When-issued trades generally settle within two weeks after the distribution date. On the distribution date any when-issued trading of [Xperi Product] common stock will end and “regular-way” trading will begin. Regular-way trading refers to trading after the security has been distributed and typically involves a trade that settles on the second full trading day following the date of the trade. See the section entitled “The Separation and Distribution—Trading Between the Record Date and Distribution Date.” We cannot predict the trading prices for [Xperi Product] common stock before, on or after the distribution date. | |

| What indebtedness will [Xperi Product] have following the separation? | At the time of the separation, we expect to have no indebtedness, except for certain trade payables and accrued liabilities associated with the product business. | |

| Will the separations affect the trading price of my Xperi common stock? | We expect the trading price of shares of Adeia common stock immediately following the distribution to be lower than the trading price of Xperi common stock immediately prior to the distribution because the trading price will no longer reflect the value of the product business. Furthermore, until the market has fully analyzed the value of Adeia without [Xperi Product] and the value of [Xperi Product] as a standalone company, the trading price of shares of both companies may fluctuate. There can be no assurance that, following the distribution, the combined trading prices of the common stock of us and Adeia will equal or exceed what the trading price of Xperi common stock would have been in the absence of Xperi’s pursuit of the separation, and it is possible the aggregate equity value of the two independent companies will be less than Xperi’s equity value prior to the distribution of us. | |

| Are there risks associated with owning shares of [Xperi Product] common stock? | Yes. Our business is subject to both general and specific risks, including risks relating to our business, our relationship with Adeia following the separation and distribution and of us being a separate, publicly traded company. Accordingly, you should read carefully the information set forth in the section entitled “Risk Factors” in this information statement. | |

17

| Does [Xperi Product] intend to pay cash dividends? | [Xperi Product] intends to either pay no cash dividend or a nominal cash dividend depending on [Xperi Product]’s capital allocation needs and discussions with the [Xperi Product] Board of Directors. | |

| What will [Xperi Product]’s relationship be with Adeia following the separation and distribution? | We will enter into the separation agreement with Xperi to effect the separation (including the Internal Reorganization and Business Realignment) and distribution of [Xperi Product]. We will also enter into certain other agreements with Xperi, including [a tax matters agreement, an employee matters agreement, intellectual property cross-license agreements, trademark license agreements and certain other intellectual property, services, supply and real estate-related agreements]. These agreements will collectively provide for the terms of the allocation between us and Adeia of the assets, liabilities and obligations of Xperi and its subsidiaries (including its investments, property and employee benefits and tax-related assets and liabilities) and will govern the relationship between us and Adeia subsequent to the completion of the separation and distribution. For additional information regarding the separation agreement and other transaction agreements, see the sections entitled “Risk Factors—Risks Related to the Separation” and “Certain Relationships and Related Party Transactions.” | |

| Do I have appraisal rights in connection with the separation and distribution? | Xperi stockholders are not entitled to appraisal rights in connection with the separation and distribution. | |

| Who is the transfer agent and registrar for [Xperi Product] common stock? | Following the separation and distribution, will serve as transfer agent and registrar for [Xperi Product] common stock.

Computershare currently serves as Xperi’s transfer agent and registrar. In addition, will serve as the distribution agent in the distribution and will assist Xperi in the distribution of [Xperi Product] common stock to Xperi stockholders. | |

| Where can I get more information? | If you have any questions relating to the mechanics of the distribution, you should contact the distribution agent at:

Before the separation and distribution, if you have any questions relating to Xperi, you should contact Xperi at:

[●]

After the separation and distribution, if you have any questions relating to Adeia, you should contact Adeia at:

[●] | |

18

You should carefully consider the following risks and other information in this information statement in evaluating us and [Xperi Product] common stock. The risk factors generally have been separated into three groups: risks related to our business, risks related to the separation and risks related to ownership of our common stock.

Any of the following risks, as well as additional risks and uncertainties not currently known to us or that we currently deem immaterial, could materially and adversely affect our business, results of operations or financial condition. Our operations could be affected by various risks, many of which are beyond our control. Based on current information, we believe that the following identifies the most significant risks that could affect our business, results of operations or financial condition. Past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. See the section entitled “Cautionary Statement Concerning Forward-Looking Statements” for more details.

Risks Related to Our Business Operations

Our business and results of operations have been, and are expected to continue to be, impacted by the global COVID-19 pandemic.

Our business and results of operations have been adversely affected by the global COVID-19 pandemic and related events and we expect its impact to continue. Given the ongoing and dynamic nature of the circumstances, it is difficult to predict the full impact of the COVID-19 pandemic on our business, and there is no guarantee that we will be able to address its adverse impacts fully or effectively. The impact to date has included periods of significant volatility in various markets and industries. The volatility has had, and we anticipate it will continue to have, an adverse effect on our customers and on our business, financial condition and results of operations, and may result in an impairment of our long-lived assets, including goodwill, increased credit losses and impairments of investments in other companies. In particular, the automotive market, as well as the broad consumer electronics industries, have been and we anticipate will continue to be impacted by the pandemic and/or other events beyond our control, and further volatility could have an additional negative impact on these industries, customers, and our business. For example, we experienced an approximately 15% decline in our royalty revenue in 2020 from our products sold to the automotive market, such as HD Radio, as compared to the prior year and currently expect automotive royalties will remain below pre-pandemic levels at least in the near-term. In addition, the COVID-19 pandemic and to a lesser extent, U.S. restrictions on trade with certain customers based in China, may continue to impact the financial conditions of our customers, who may not be able to satisfy their obligations under our agreements timely or at all. For example, we recorded an incremental provision for credit losses of approximately $2.0 million and $4.3 million in the first and fourth quarters of 2020, respectively, due to the heightened risk of nonpayment on existing accounts receivable as a result of the impaired financial condition and liquidity positions of certain of our customers. If more of global customer base experiences impaired financial conditions or liquidity positions, it may adversely affect our business, results and financial condition.

In addition, actions by United States federal, state and foreign governments to address the COVID-19 pandemic, including travel bans, stay-at-home orders and school, business and entertainment venue closures, also had a significant adverse effect on the markets in which we conduct our businesses. The COVID-19 pandemic poses the risk that our workforce, suppliers, and other partners may be prevented from conducting normal business activities for an indefinite period of time, including due to shutdowns or stay-at-home orders that may be requested or mandated by governmental authorities. We also implemented policies to allow our employees to work remotely as a result of the pandemic as we reviewed processes related to workplace safety, including social distancing and sanitation practices recommended by the Centers for Disease Control and Prevention. The impacts of the COVID-19 pandemic could also cause delays in obtaining new customers and executing renewals and could also impact our business as consumer behavior changes in response to the slowed economic conditions.

19

The extent of impacts resulting from the COVID-19 pandemic and other events beyond our control will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of the pandemic and actions taken to contain the coronavirus or its impact, the emergence of transmissible or severe strains of coronavirus, the speed at which recently authorized vaccines are administered and the effectiveness of these vaccines in slowing the pandemic, and divergent government orders and actions taken in response to the pandemic, among others. Even after the pandemic has subsided and economic activities gradually reopen and increase, we may continue to experience material and adverse impacts to our business, operating results, and financial condition as a result of the pandemic’s lasting global economic impact, including any recession that has occurred or may occur in the future. The ultimate impact of the COVID-19 pandemic or a similar health epidemic is highly uncertain and subject to change. We do not yet know the full extent of potential delays or impacts on our applicable business, operations or the global economy.

The long-term success of our business is dependent on a royalty-based business model, which is inherently risky.

The long-term success of our business is dependent on future royalties paid to us by customers. Royalty payments under our licenses may be based upon, among other things, the number of subscribers for pay TV, a percent of net sales, a per unit sold basis or a fixed quarterly or annual amount. We are dependent upon our ability to structure, negotiate and enforce agreements for the determination and payment of royalties, as well as upon our customers’ compliance with their agreements. We face risks inherent in a royalty-based business model, many of which are outside of our control, such as the following:

| • | the number of subscribers our pay TV customers have or the number of set-top-boxes our pay TV customers provide to their end-user subscribers; |

| • | the rate of adoption and incorporation of our technology by semiconductor manufacturers, assemblers, foundry, manufacturers of consumer and communication electronics, and the automotive and surveillance industry; |

| • | the willingness and ability of materials and equipment suppliers to produce materials and equipment that support our licensed technology, in a quantity sufficient to enable volume manufacturing; |

| • | the ability of our customers to purchase such materials and equipment on a cost-effective and timely basis; |

| • | the length of the design cycle and the ability of us and our customers to successfully integrate certain of our imaging technologies into their integrated circuits; |

| • | the demand for products that incorporate our licensed technology; |

| • | the cyclicality of supply and demand for products using our licensed technology; |

| • | the impact of economic downturns; and |

| • | the impact of poor financial performance of our customers. |

For example, the ability to enjoy digital entertainment content downloaded or streamed over the internet has caused some consumers to elect to cancel their pay TV subscriptions. If our pay TV customers are unable to maintain their subscriber bases, the royalties they owe us may decline.

Our licensees may delay, refuse to or be unable to make payments to us due to financial difficulties or otherwise, or shift their licensed products to other companies to lower their royalties to us.

A number of our customers may face severe financial difficulties from time to time. Customers may face financial difficulties which may result in their inability to make payments to us in a timely manner, or at all. These risks may be heightened by operating and cash flow disruptions these companies face as a result of the

20

COVID-19 pandemic. In addition, we have had a history of, and we may in the future experience, customers that delay or refuse to make payments owed to us under license or settlement agreements. Our customers may also merge with or may shift the manufacture of licensed products to companies that are not currently licensees of technology. This could make the collection process complex and difficult, which could adversely impact our business, financial condition, results of operations and cash flows.

It is difficult for us to verify royalty amounts owed to us under our licensing agreements, and this may cause us to lose revenue.