INVESTOR PRESENTATION NASDAQ: FWRG August 22, 2024 A BREAKOUT GROWTH STORY MORE THAN 40 YEARS IN THE MAKING Exhibit 99.2

2 FORWARD LOOKING STATEMENTS In addition to historical information, this presentation may contain a number of “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, which are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different from the statements made herein. All statements other than statements of historical fact are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to any historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “future,” “intend,” “outlook,” “potential,” “project,” “projection,” “plan,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other similar expressions. You should evaluate all forward-looking statements made in this presentation in the context of the risks and uncertainties disclosed in our filings with the Securities and Exchange Commission (the “SEC”), accessible on the SEC’s website at www.sec.gov and the Investors Relations section of the Company’s website at https://investors.firstwatch.com/financial-information/sec-filings. Important factors that could cause actual results to differ materially from those in the forward-looking statements include the following: uncertainty regarding the Russia-Ukraine war, the Israel-Hamas war and the related impact on macroeconomic conditions, including inflation, as a result of such conflicts or other related events; our vulnerability to changes in economic conditions and consumer preferences; our inability to successfully open new restaurants or establish new markets; our inability to effectively manage our growth; potential negative impacts on sales at our and our franchisees’ restaurants as a result of our opening new restaurants; a decline in visitors to any of the retail centers, lifestyle centers, or entertainment centers where our restaurants are located; lower than expected same-restaurant sales growth; unsuccessful marketing programs and limited time new offerings; changes in the cost of food; unprofitability or closure of new restaurants or lower than previously experienced performance in existing restaurants; our inability to compete effectively for customers; unsuccessful financial performance of our franchisees; our limited control over our franchisees’ operations; our inability to maintain good relationships with our franchisees; conflicts of interest with our franchisees; the geographic concentration of our system-wide restaurant base in the southeast portion of the United States; damage to our reputation and negative publicity; our inability or failure to recognize, respond to and effectively manage the accelerated impact of social media; our limited number of suppliers and distributors for several of our frequently used ingredients and shortages or disruptions in the supply or delivery of such ingredients; information technology system failures or breaches of our network security; our failure to comply with federal and state laws and regulations relating to privacy, data protection, advertising and consumer protection, or the expansion of current or the enactment of new laws or regulations relating to privacy, data protection, advertising and consumer protection; our potential liability with our gift cards under the property laws of some states; our failure to enforce and maintain our trademarks and protect our other intellectual property; litigation with respect to intellectual property assets; our dependence on our executive officers and certain other key employees; our inability to identify, hire, train and retain qualified individuals for our workforce; our failure to obtain or to properly verify the employment eligibility of our employees; our failure to maintain our corporate culture as we grow; unionization activities among our employees; employment and labor law proceedings; labor shortages or increased labor costs or health care costs; risks associated with leasing property subject to long-term and non-cancelable leases; risks related to our sale of alcoholic beverages; costly and complex compliance with federal, state and local laws; changes in accounting principles applicable to us; our vulnerability to natural disasters, unusual weather conditions, pandemic outbreaks, political events, war and terrorism; our inability to secure additional capital to support business growth; our level of indebtedness; failure to comply with covenants under our credit facility; and the interests of our largest stockholder may differ from those of public stockholders. The forward-looking statements included in this presentation are made only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. NON-GAAP FINANCIAL MEASURES (UNAUDITED) To supplement the consolidated financial statements, which are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), we use the following non-GAAP measures, which present operating results on an adjusted basis: (i) Adjusted EBITDA, (ii) Adjusted EBITDA margin, (iii) Restaurant level operating profit and (iv) Restaurant level operating profit margin. Our presentation of these non-GAAP measures includes isolating the effects of some items that are either nonrecurring in nature or vary from period to period without any correlation to our ongoing core operating performance. These supplemental measures of performance are not required by or presented in accordance with GAAP. Management believes these non- GAAP measures provide investors with additional visibility into our operations, facilitate analysis and comparisons of our ongoing business operations because they exclude items that may not be indicative of our ongoing operating performance, help to identify operational trends and allow for greater transparency with respect to key metrics used by management in our financial and operational decision making. Our non-GAAP measures may not be comparable to similarly titled measures used by other companies and have important limitations as analytical tools. These non-GAAP measures should not be considered in isolation or as substitutes for analysis of our results as reported under GAAP as they may not provide a complete understanding of our performance. These non- GAAP measures should be reviewed in conjunction with our consolidated financial statements prepared in accordance with GAAP. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities. CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES

• The disruptive leader defining the fast-growing Daytime Dining category • An overnight success more than 40 years in the making • $2.3M AUV* achieved in one 7½ hour daytime shift (7:00 AM - 2:30 PM) • 538 system-wide restaurants across 29 states at end of Q2 2024, and growing • Modest per person average of $17**, making us an affordable luxury for most • Broad consumer appeal to diverse demographics and socio-economic groups • Elevated, “instagrammable” on-trend menu that features fresh, in-season produce • Proven portability with restaurants in our top decile spanning 10 states and 20 DMAs *AUV metric representative of FY 2023. All other figures as of Q2 2024. **PPA for comparable restaurant base as of Q2 2024. See definition of AUV under Definitions in Appendix for definition of comparable restaurant base. 3 IF YOU HAVEN’T BEEN TO A FIRST WATCH, CONSIDER THIS YOUR WAKE-UP CALL

® • First Watch holds majority of visit share of Daytime Dining segment (1) • Daypart is still in its early stages with upside potential vs. established lunch and dinner • Tremendous opportunity since more than 70% of breakfast occasions occur at home (2) • High consumer interest in “breakfast all day” • Daytime Dining daypart supports attractive and portable new unit economics SERVED BREAKFAST IS (1) Placer.ai data, referenced 8/4/2024, comparing First Watch and Daytime Dining competitive set 2019-2024 YTD (2) Datassential, Latest Breakfast Keynote Report (April 2023) 5

Health & Freshness1 2 3 • Operating exclusively during daytime • Inspired, chef-driven menu • Legacy players have not evolved with consumer preferences and tastes • Younger generations are more discerning and health focused, demanding more from brands • “One of Gen Z’s favorite restaurant brands” (Technomic, January 2024) • Highly fragmented competitive set 6 Exploration & Creativity Engaging Environments THE ALL DAY CAFE IS CHANGING THE GAME & BRINGING EXCITEMENT TO AN EVOLVING DAYPART

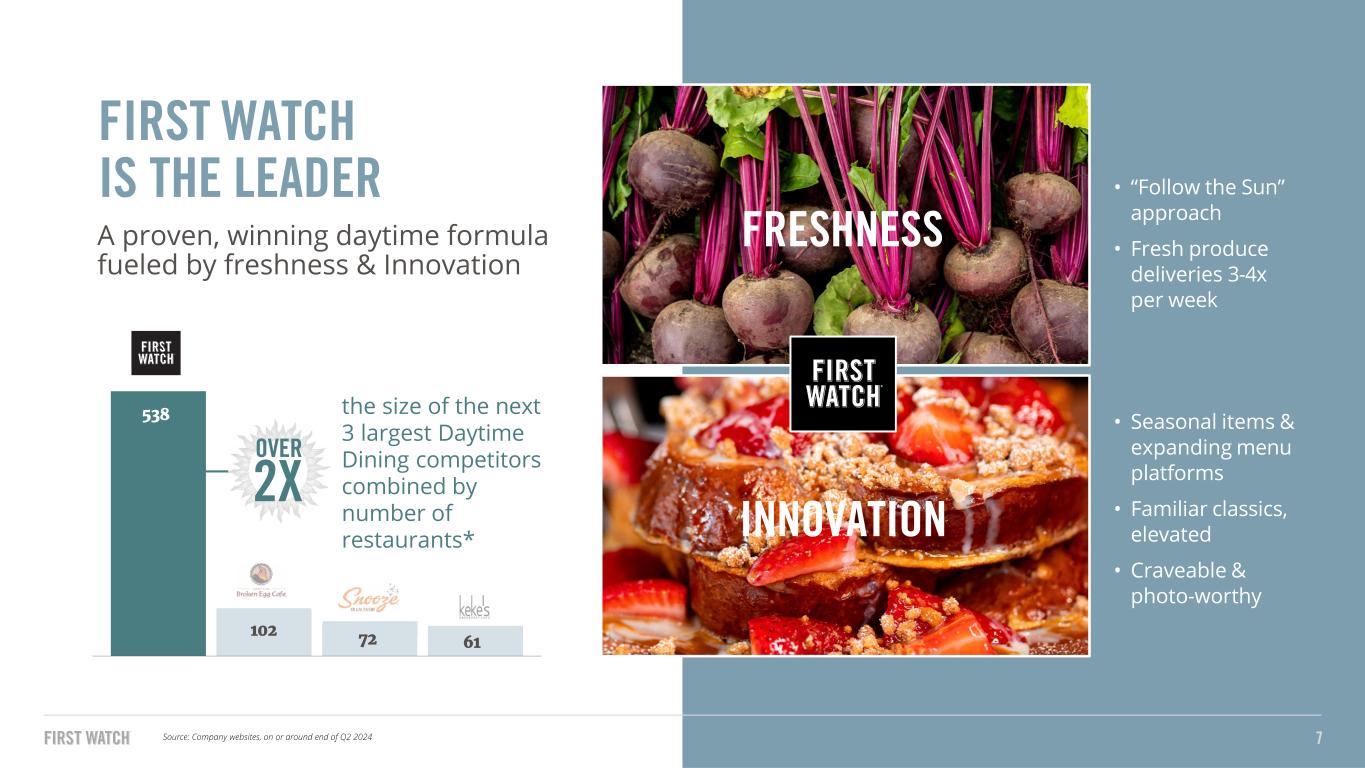

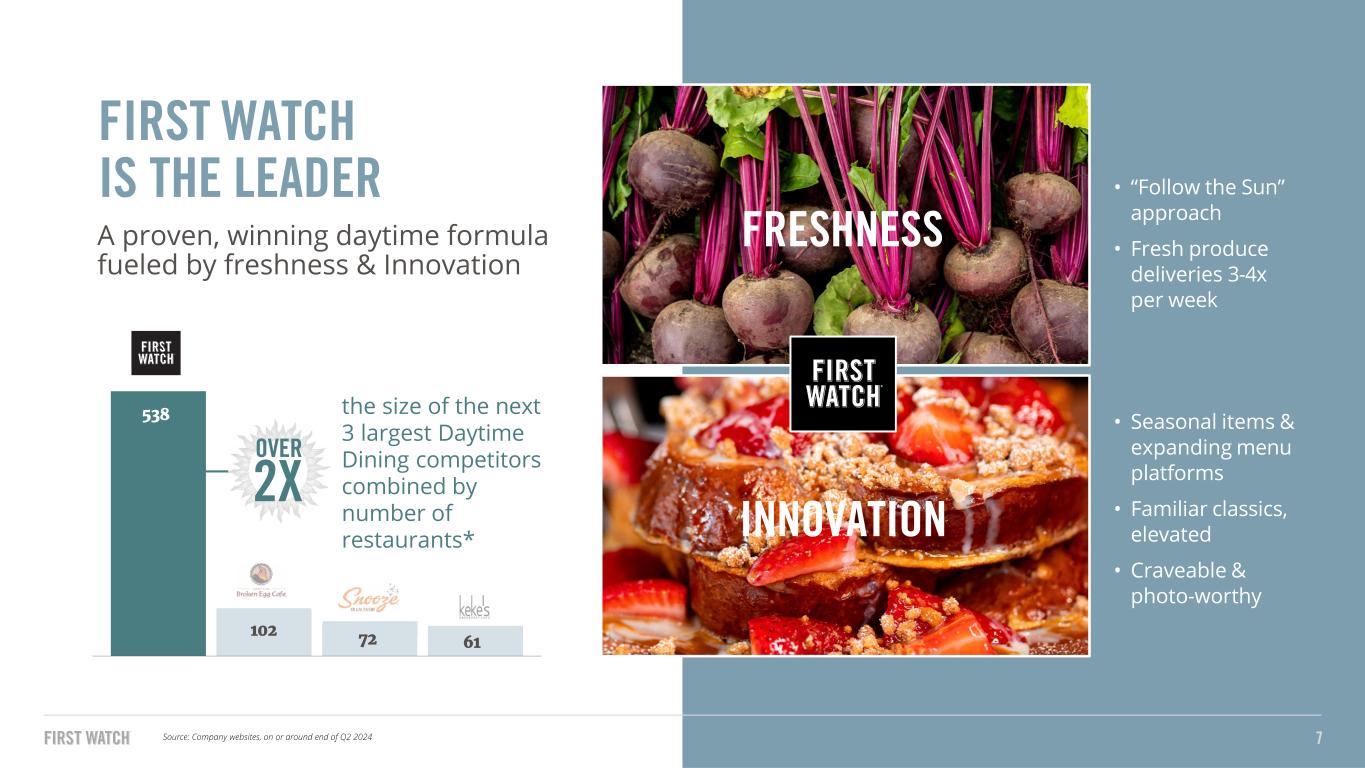

the size of the next 3 largest Daytime Dining competitors combined by number of restaurants* FIRST WATCH IS THE LEADER A proven, winning daytime formula fueled by freshness & Innovation FRESHNESS INNOVATION 2X OVER • “Follow the Sun” approach • Fresh produce deliveries 3-4x per week • Seasonal items & expanding menu platforms • Familiar classics, elevated • Craveable & photo-worthy Source: Company websites, on or around end of Q2 2024 7 102 61 538 72

GROWTH & PERFORMANCE

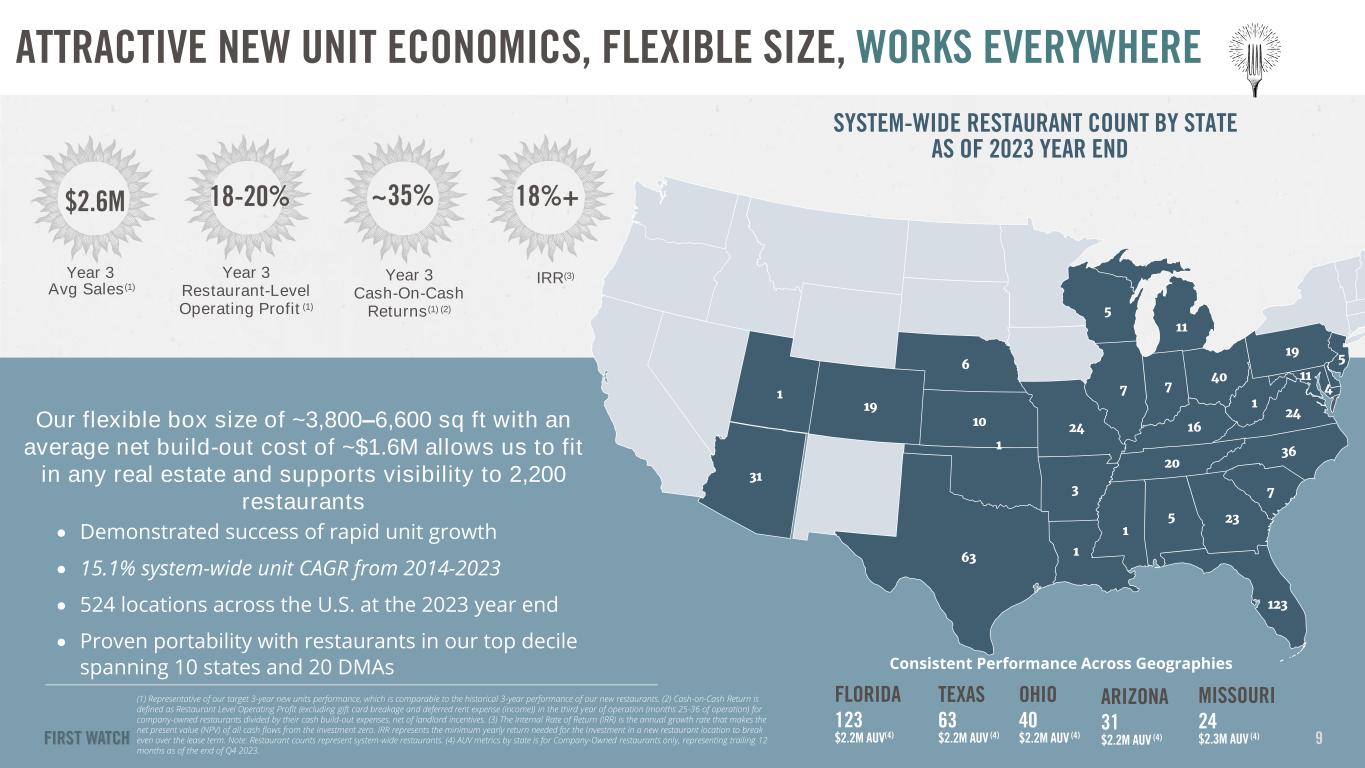

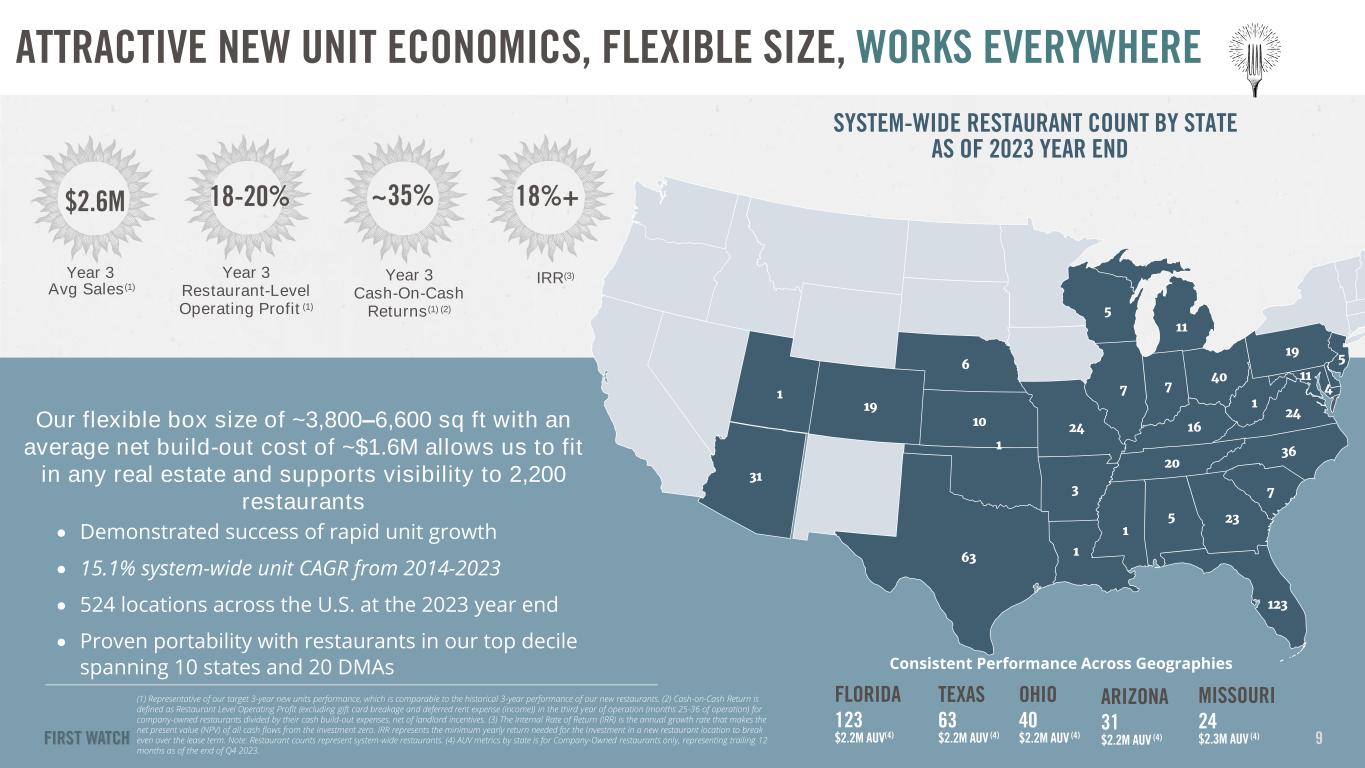

SYSTEM-WIDE RESTAURANT COUNT BY STATE AS OF 2023 YEAR END ® Our flexible box size of ~3,800–6,600 sq ft with an average net build-out cost of ~$1.6M allows us to fit in any real estate and supports visibility to 2,200 restaurants (1) Representative of our target 3-year new units performance, which is comparable to the historical 3-year performance of our new restaurants. (2) Cash-on-Cash Return is defined as Restaurant Level Operating Profit (excluding gift card breakage and deferred rent expense (income)) in the third year of operation (months 25-36 of operation) for company-owned restaurants divided by their cash build-out expenses, net of landlord incentives. (3) The Internal Rate of Return (IRR) is the annual growth rate that makes the net present value (NPV) of all cash flows from the investment zero. IRR represents the minimum yearly return needed for the investment in a new restaurant location to break even over the lease term. Note: Restaurant counts represent system-wide restaurants. (4) AUV metrics by state is for Company-Owned restaurants only, representing trailing 12 months as of the end of Q4 2023. 9 1 19 10 6 24 3 63 1 1 5 23 123 7 36 20 16 7 5 11 40 1 24 19 5 11 47 31 1 • Demonstrated success of rapid unit growth • 15.1% system-wide unit CAGR from 2014-2023 • 524 locations across the U.S. at the 2023 year end • Proven portability with restaurants in our top decile spanning 10 states and 20 DMAs $2.6M 18-20% ~35% 18%+ Year 3 Avg Sales(1) Year 3 Restaurant-Level Operating Profit (1) Year 3 Cash-On-Cash Returns(1) (2) IRR(3) ATTRACTIVE NEW UNIT ECONOMICS, FLEXIBLE SIZE, WORKS EVERYWHERE FLORIDA 123 $2.2M AUV(4) OHIO 40 $2.2M AUV (4) ARIZONA 31 $2.2M AUV (4) MISSOURI 24 $2.3M AUV (4) TEXAS 63 $2.2M AUV (4) Consistent Performance Across Geographies

WE ARE REITERATING THE LONG-TERM PERFORMANCE TARGETS WE IDENTIFIED AT THE IPO Note: These are not projections; they are goals/targets and are forward-looking, subject to significant business, economic, regulatory and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based upon assumptions with respect to future decisions, which are subject to change. Actual results will vary and those variations may be material. For a discussion of the important factors that could cause these variations, please consult the “Risk Factors” section in our Annual Report on Form 10-K as of and for the year ended December 31, 2023 and our other filings with the Securities and Exchange Commission. Nothing in this presentation should be regarded as a representation by any person that these goals/targets will be achieved and the Company undertakes no duty to update its goals/targets. (1) System-wide restaurants refers to First Watch company-owned and franchise-owned restaurants. UNIT GROWTH LOW DOUBLE DIGITS SYSTEM-WIDE SALES GROWTH (1) MID-TEENS ADJ. EBITDA GROWTH MID-TEENS SAME-RESTAURANT SALES GROWTH APPROX. 3.5% OCTOBER 1, 2021 10

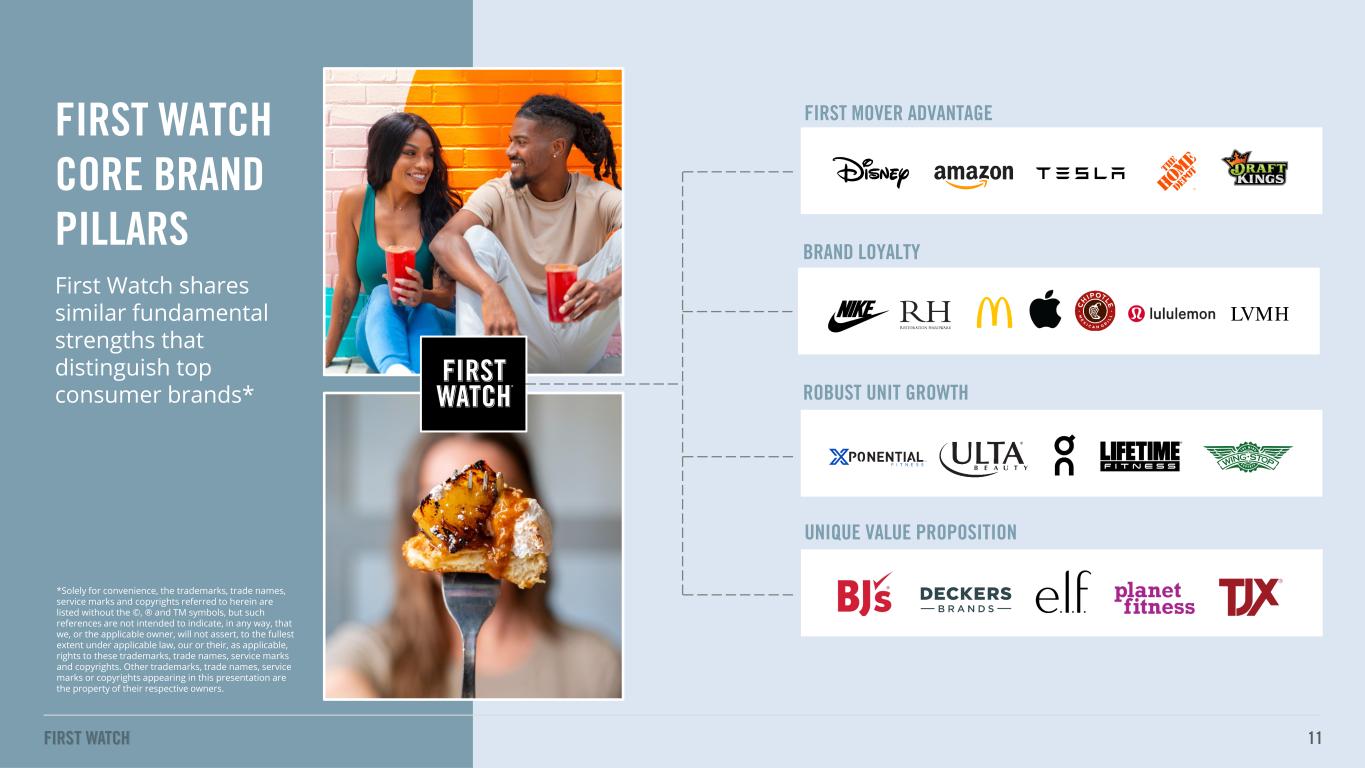

FIRST WATCH CORE BRAND PILLARS First Watch shares similar fundamental strengths that distinguish top consumer brands* *Solely for convenience, the trademarks, trade names, service marks and copyrights referred to herein are listed without the ©, ® and TM symbols, but such references are not intended to indicate, in any way, that we, or the applicable owner, will not assert, to the fullest extent under applicable law, our or their, as applicable, rights to these trademarks, trade names, service marks and copyrights. Other trademarks, trade names, service marks or copyrights appearing in this presentation are the property of their respective owners. 11 FIRST MOVER ADVANTAGE ROBUST UNIT GROWTH BRAND LOYALTY UNIQUE VALUE PROPOSITION

THE SECRET INGREDIENTS TO OUR SUCCESS

OUR MISSION IS SIMPLE. WE PUT • Single shift from 7 AM to 2:30 PM • No night shifts, ever • Investment in employees’ personal and professional growth WE PUT EMPLOYEES FIRST WHO IN TURN PUT GUESTS FIRST • Employees are empowered to make guests happy • Culture of service • Superior restaurant execution 13 ® 13

® • One menu all day • One scheduling shift allows GM to oversee the entire business • No shoulder periods - highly efficient One Shift, One Menu, One Focus Driving Operational Excellence Our unique single-shift operating model allows us to attract, hire and retain our most important asset: great people 14

MINT MOCHA ICED COFFEE BARBACOA CHILAQUILES BREAKFAST BOWL BROOKLYN BREAKFAST SANDWICH ® STRAWBERRY TRES LECHES FRENCH TOAST COMFORTING & FAMILIAR MENU MEETS INTRIGUE & INNOVATION • Familar forms with seasonal flavors • Early trend identification • Five seasonal menu changes per year CITRUS HIBISCUS PUNCH 15 SUNNY SEOUL HASH

® • Track record of establishing partnerships with the best makers, bakers and growers • Menu rotates every 10 weeks to reflect the season and ensure ongoing relevancy • Focus is on quality and freshness WE FOLLOW THE SUN AND CARE WHERE OUR FOOD COMES FROM 16

...AND WE KEEP RAISING THE BAR ® MILLION DOLLAR BREAKFAST SANDWICH PURPLE HAZE 17

SHAREABLES CREATE ADD-ON OPPORTUNITIES 18 ® 18 GINGERBREAD SPICE DONUTS RAINBOW TOAST BACON CHEDDAR CORNBREAD CARAMEL CRUNCH CINNAMON ROLL CINNAMON SPICE CHURROS MILLION DOLLAR BACON • Capitalizes on the social nature of breakfast / brunch meals • Generates incremental sales and opportunity to test pricing with incremental menu mix • 6.1% of customers purchased shareables in Q2 2024 vs. 1.9% in 2017 • Shareables instead of appetizers or desserts (maintains table turns)

• ~91% of system rolled out • Highly incremental and margin accretive to all other beverages including fresh juice • Accounts for ~5.1%* of dine-in customers at serving restaurants • Presents continued innovation opportunity • No physical bar needed * Q2 2024 Enhances the brunch occasion, creating additional opportunity to attract younger demographics ® 19 CRAFTED COCKTAILS (REALLY GOOD MORNINGS)

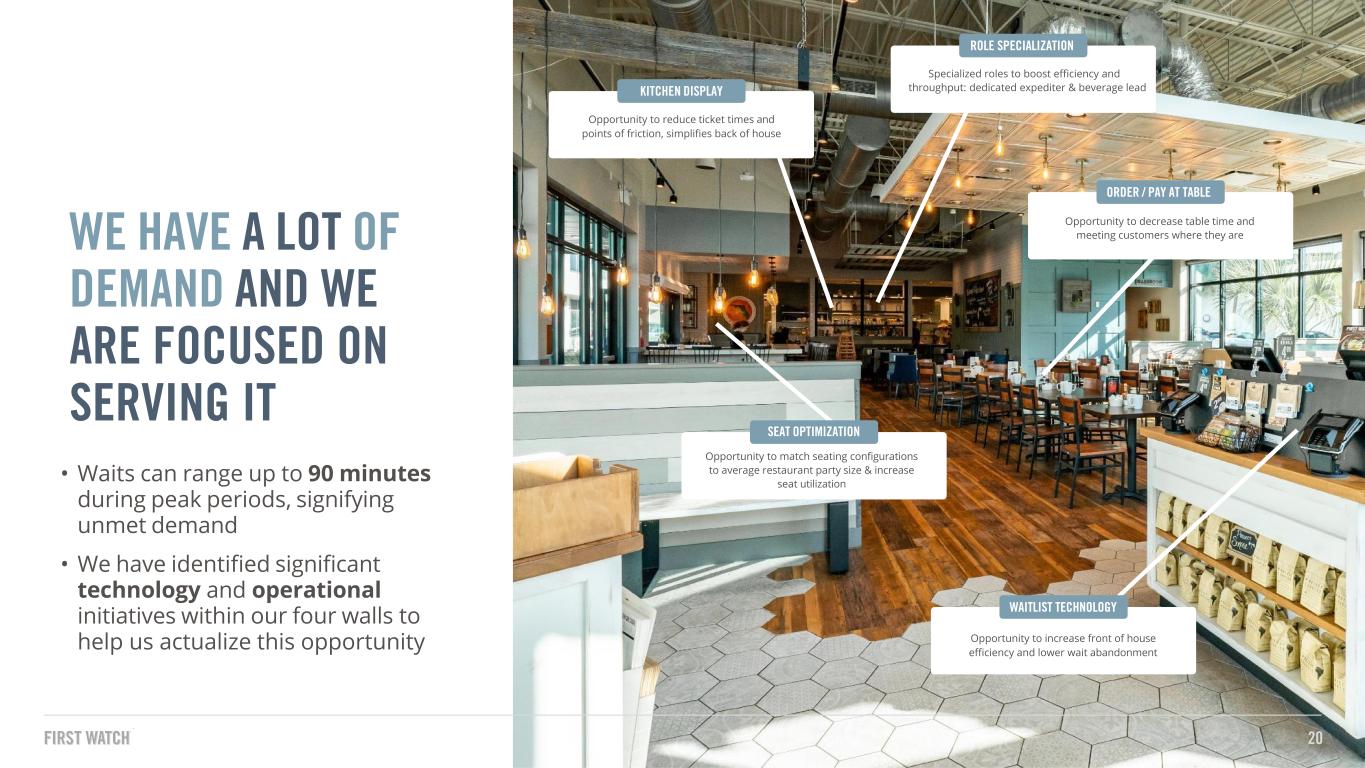

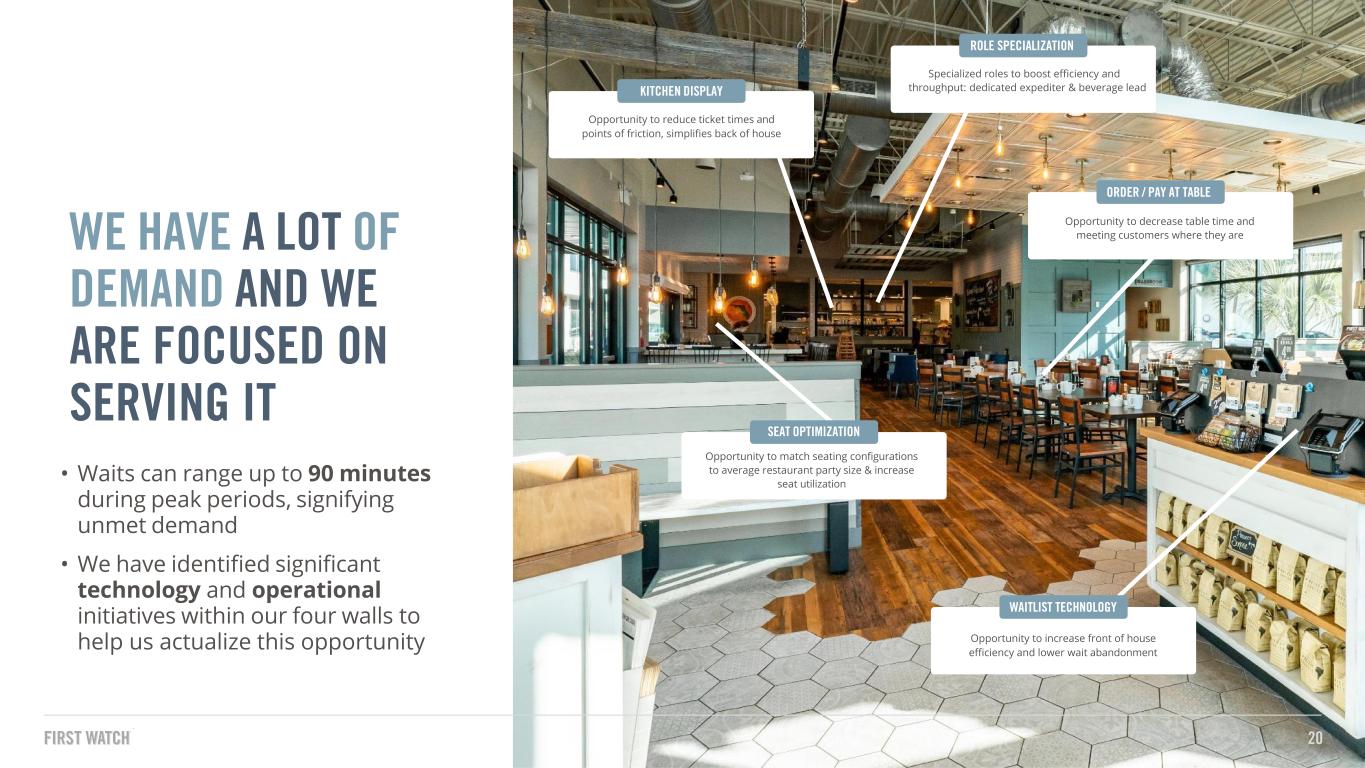

Opportunity to increase front of house efficiency and lower wait abandonment WAITLIST TECHNOLOGY ORDER / PAY AT TABLE Opportunity to decrease table time and meeting customers where they are KITCHEN DISPLAY Opportunity to reduce ticket times and points of friction, simplifies back of house SEAT OPTIMIZATION Opportunity to match seating configurations to average restaurant party size & increase seat utilization WE HAVE A LOT OF DEMAND AND WE ARE FOCUSED ON SERVING IT • Waits can range up to 90 minutes during peak periods, signifying unmet demand • We have identified significant technology and operational initiatives within our four walls to help us actualize this opportunity ROLE SPECIALIZATION Specialized roles to boost efficiency and throughput: dedicated expediter & beverage lead ® 20

AIDED AWARENESS VS. GUEST SATISFACTION THE GROWTH OPPORTUNITY IS CLEAR: THOSE THAT KNOW US, LOVE US. Source: Datassential, as of February 2024. Awareness based on consumers living in metro areas where brand has locations. Last visit in the top 2% of ‘Excellent’ and ‘Very Good’ ratings. 40% 99% 97% 80% 96% 77% 65% 62% 66% 67% 21

AWARDS AND RECOGNITION 2022 Culture at Work Award 22 2023 & 2024 Customer Experience All-Star2022 & 2023 Top 100 Most Loved Workplace 2023 Most Loved Brands, #1 Restaurant, #4 Overall 2019 & 2020 Best People Practices Finalist 2018 Best Places to work 2020 America’s Favorite Restaurant Brand

APPENDIX

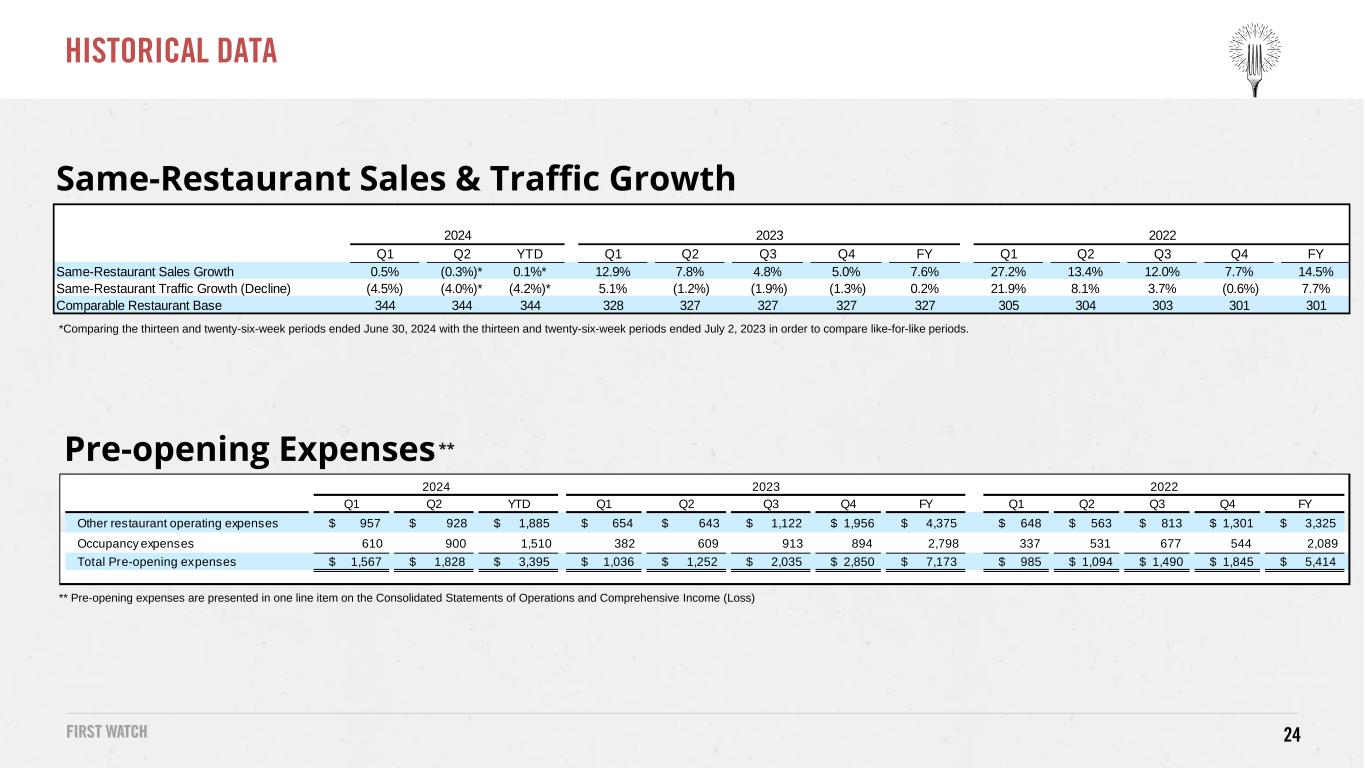

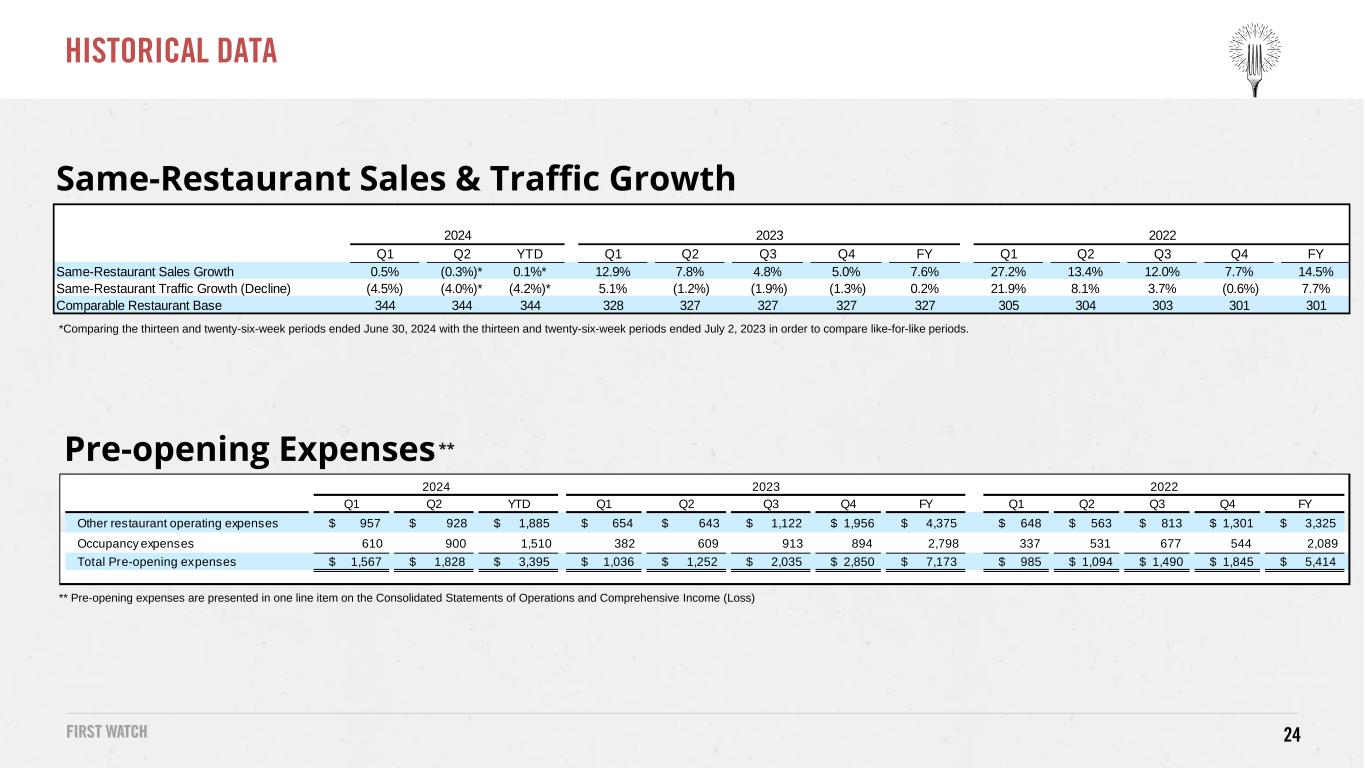

24 ** Pre-opening expenses are presented in one line item on the Consolidated Statements of Operations and Comprehensive Income (Loss) Same-Restaurant Sales & Traffic Growth Pre-opening Expenses ** HISTORICAL DATA *Comparing the thirteen and twenty-six-week periods ended June 30, 2024 with the thirteen and twenty-six-week periods ended July 2, 2023 in order to compare like-for-like periods. Q1 Q2 YTD Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Same-Restaurant Sales Growth 0.5% (0.3%)* 0.1%* 12.9% 7.8% 4.8% 5.0% 7.6% 27.2% 13.4% 12.0% 7.7% 14.5% Same-Restaurant Traffic Growth (Decline) (4.5%) (4.0%)* (4.2%)* 5.1% (1.2%) (1.9%) (1.3%) 0.2% 21.9% 8.1% 3.7% (0.6%) 7.7% Comparable Restaurant Base 344 344 344 328 327 327 327 327 305 304 303 301 301 2023 20222024 Q1 Q2 YTD Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Other restaurant operating expenses $ 957 $ 928 $ 1,885 $ 654 $ 643 $ 1,122 $ 1,956 $ 4,375 $ 648 $ 563 $ 813 $ 1,301 $ 3,325 Occupancy expenses 610 900 1,510 382 609 913 894 2,798 337 531 677 544 2,089 Total Pre-opening expenses $ 1,567 $ 1,828 $ 3,395 $ 1,036 $ 1,252 $ 2,035 $ 2,850 $ 7,173 $ 985 $ 1,094 $ 1,490 $ 1,845 $ 5,414 2023 20222024

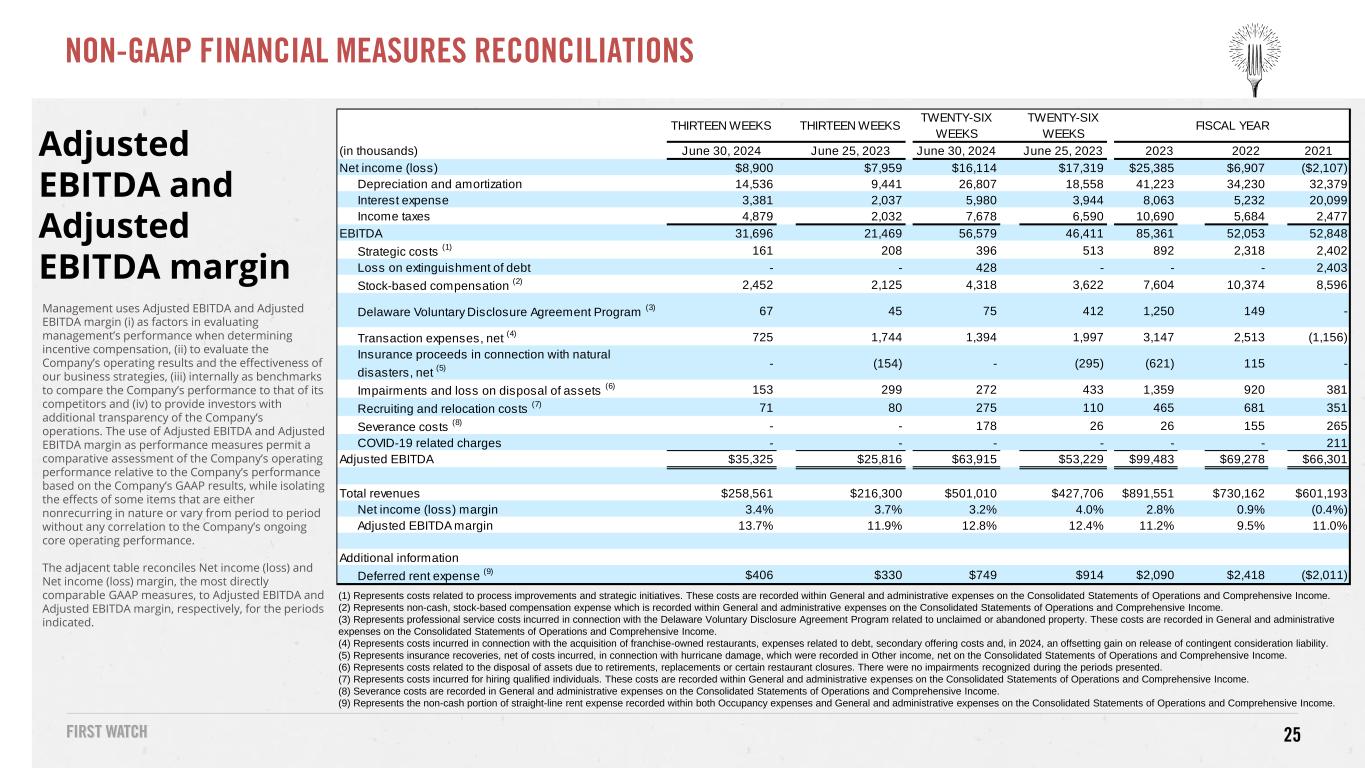

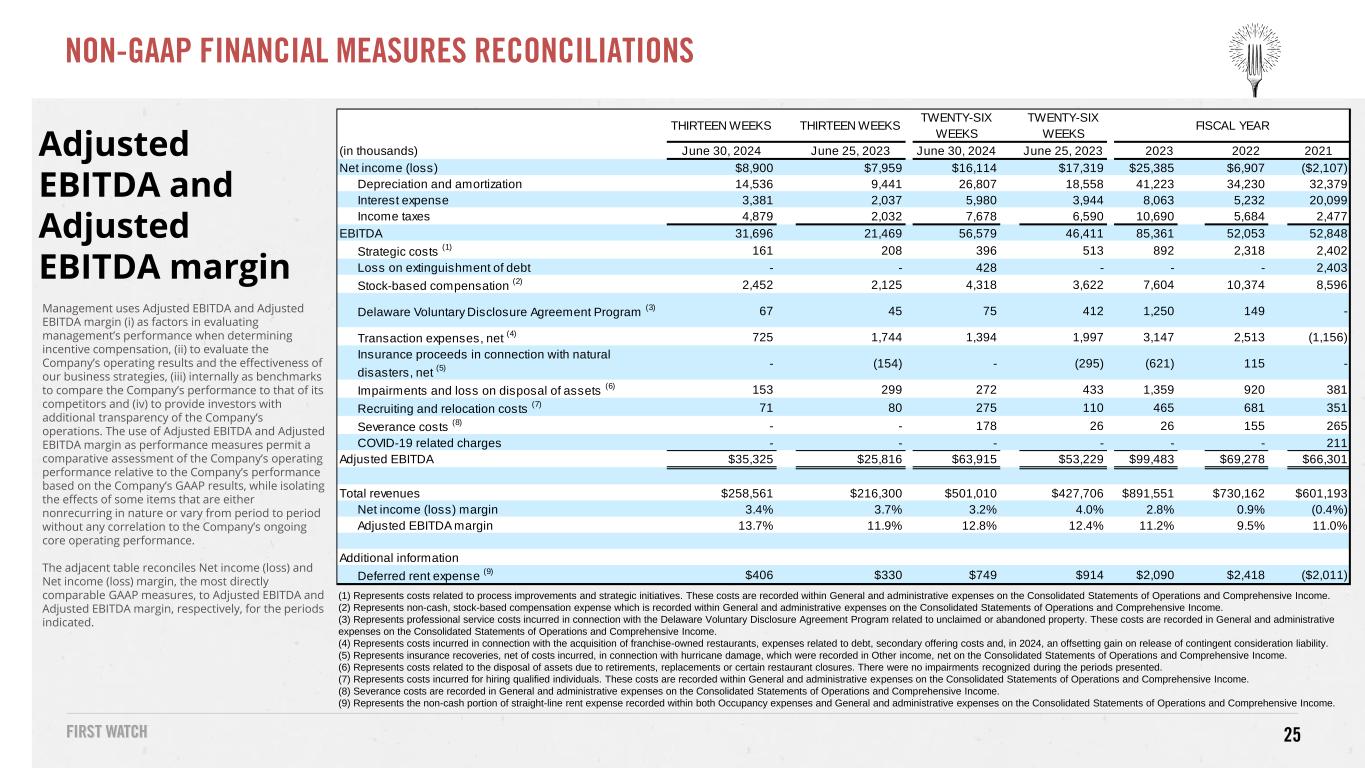

25 Management uses Adjusted EBITDA and Adjusted EBITDA margin (i) as factors in evaluating management’s performance when determining incentive compensation, (ii) to evaluate the Company’s operating results and the effectiveness of our business strategies, (iii) internally as benchmarks to compare the Company’s performance to that of its competitors and (iv) to provide investors with additional transparency of the Company’s operations. The use of Adjusted EBITDA and Adjusted EBITDA margin as performance measures permit a comparative assessment of the Company’s operating performance relative to the Company’s performance based on the Company’s GAAP results, while isolating the effects of some items that are either nonrecurring in nature or vary from period to period without any correlation to the Company’s ongoing core operating performance. The adjacent table reconciles Net income (loss) and Net income (loss) margin, the most directly comparable GAAP measures, to Adjusted EBITDA and Adjusted EBITDA margin, respectively, for the periods indicated. NON-GAAP FINANCIAL MEASURES RECONCILIATIONS Adjusted EBITDA and Adjusted EBITDA margin (1) Represents costs related to process improvements and strategic initiatives. These costs are recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income. (2) Represents non-cash, stock-based compensation expense which is recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income. (3) Represents professional service costs incurred in connection with the Delaware Voluntary Disclosure Agreement Program related to unclaimed or abandoned property. These costs are recorded in General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income. (4) Represents costs incurred in connection with the acquisition of franchise-owned restaurants, expenses related to debt, secondary offering costs and, in 2024, an offsetting gain on release of contingent consideration liability. (5) Represents insurance recoveries, net of costs incurred, in connection with hurricane damage, which were recorded in Other income, net on the Consolidated Statements of Operations and Comprehensive Income. (6) Represents costs related to the disposal of assets due to retirements, replacements or certain restaurant closures. There were no impairments recognized during the periods presented. (7) Represents costs incurred for hiring qualified individuals. These costs are recorded within General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income. (8) Severance costs are recorded in General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income. (9) Represents the non-cash portion of straight-line rent expense recorded within both Occupancy expenses and General and administrative expenses on the Consolidated Statements of Operations and Comprehensive Income. THIRTEEN WEEKS THIRTEEN WEEKS TWENTY-SIX WEEKS TWENTY-SIX WEEKS (in thousands) June 30, 2024 June 25, 2023 June 30, 2024 June 25, 2023 2021 Net income (loss) $8,900 $7,959 $16,114 $17,319 $25,385 $6,907 ($2,107) Depreciation and amortization 14,536 9,441 26,807 18,558 41,223 34,230 32,379 Interest expense 3,381 2,037 5,980 3,944 8,063 5,232 20,099 Income taxes 4,879 2,032 7,678 6,590 10,690 5,684 2,477 EBITDA 31,696 21,469 56,579 46,411 85,361 52,053 52,848 Strategic costs (1) 161 208 396 513 892 2,318 2,402 Loss on extinguishment of debt - - 428 - - - 2,403 Stock-based compensation (2) 2,452 2,125 4,318 3,622 7,604 10,374 8,596 Delaware Voluntary Disclosure Agreement Program (3) 67 45 75 412 1,250 149 - Transaction expenses, net (4) 725 1,744 1,394 1,997 3,147 2,513 (1,156) Insurance proceeds in connection with natural disasters, net (5) - (154) - (295) (621) 115 - Impairments and loss on disposal of assets (6) 153 299 272 433 1,359 920 381 Recruiting and relocation costs (7) 71 80 275 110 465 681 351 Severance costs (8) - - 178 26 26 155 265 COVID-19 related charges - - - - - - 211 Adjusted EBITDA $35,325 $25,816 $63,915 $53,229 $99,483 $69,278 $66,301 Total revenues $258,561 $216,300 $501,010 $427,706 $891,551 $730,162 $601,193 Net income (loss) margin 3.4% 3.7% 3.2% 4.0% 2.8% 0.9% (0.4%) Adjusted EBITDA margin 13.7% 11.9% 12.8% 12.4% 11.2% 9.5% 11.0% Additional information Deferred rent expense (9) $406 $330 $749 $914 $2,090 $2,418 ($2,011) FISCAL YEAR 2023 2022

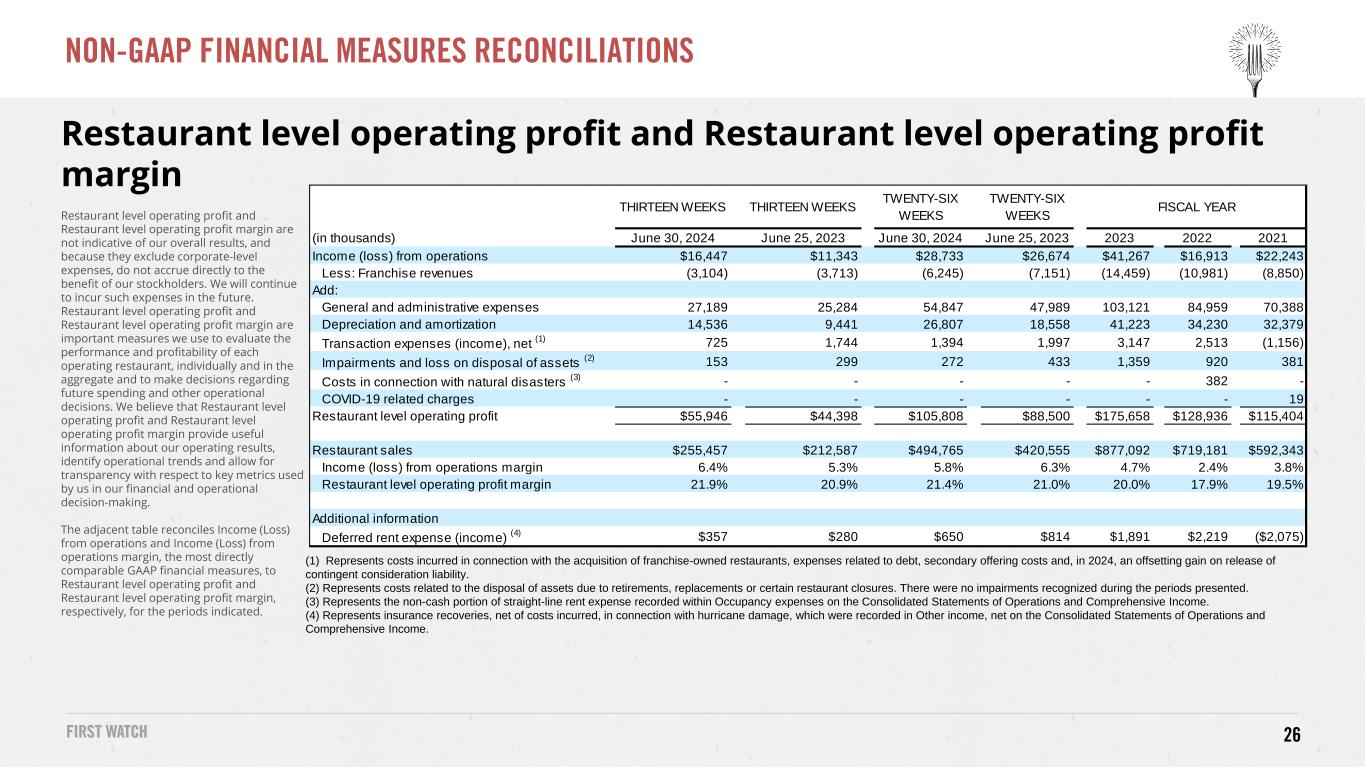

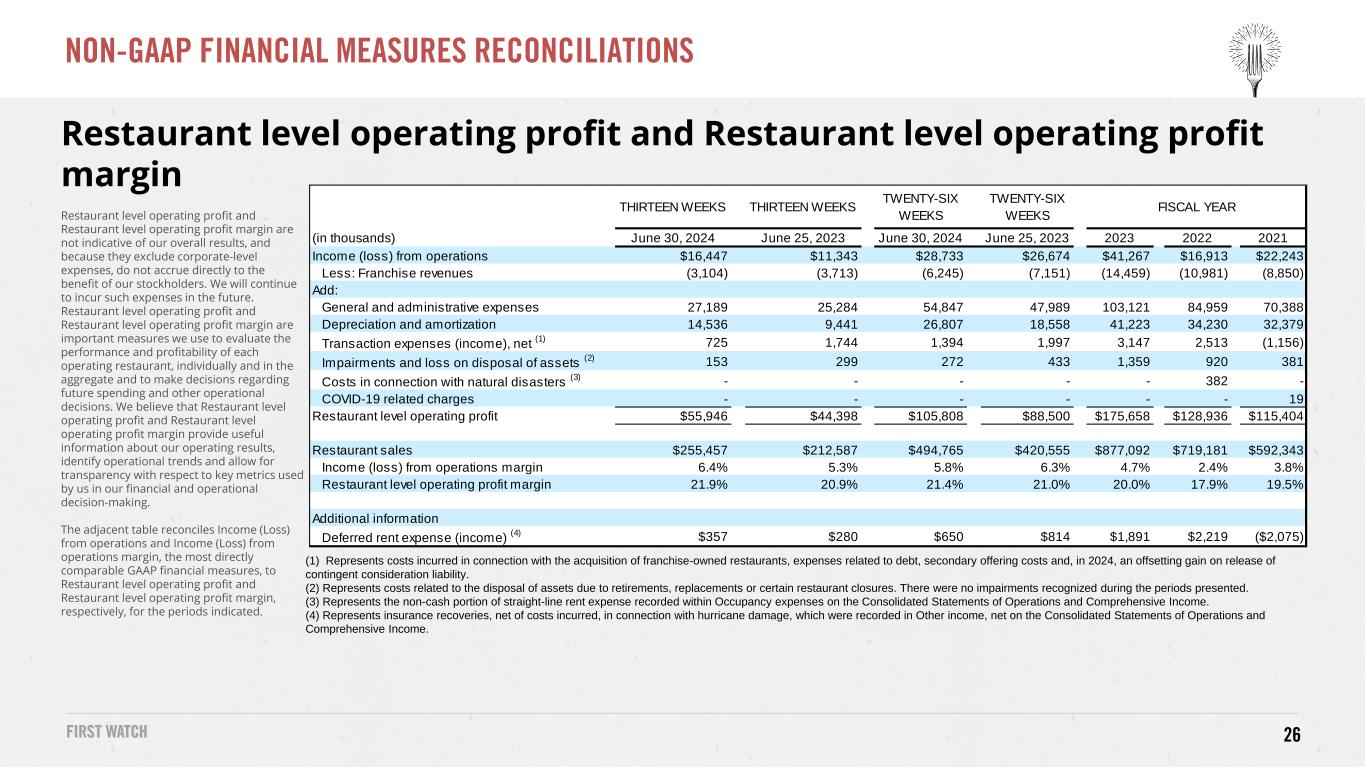

26 Restaurant level operating profit and Restaurant level operating profit margin are not indicative of our overall results, and because they exclude corporate-level expenses, do not accrue directly to the benefit of our stockholders. We will continue to incur such expenses in the future. Restaurant level operating profit and Restaurant level operating profit margin are important measures we use to evaluate the performance and profitability of each operating restaurant, individually and in the aggregate and to make decisions regarding future spending and other operational decisions. We believe that Restaurant level operating profit and Restaurant level operating profit margin provide useful information about our operating results, identify operational trends and allow for transparency with respect to key metrics used by us in our financial and operational decision-making. The adjacent table reconciles Income (Loss) from operations and Income (Loss) from operations margin, the most directly comparable GAAP financial measures, to Restaurant level operating profit and Restaurant level operating profit margin, respectively, for the periods indicated. Restaurant level operating profit and Restaurant level operating profit margin NON-GAAP FINANCIAL MEASURES RECONCILIATIONS (1) Represents costs incurred in connection with the acquisition of franchise-owned restaurants, expenses related to debt, secondary offering costs and, in 2024, an offsetting gain on release of contingent consideration liability. (2) Represents costs related to the disposal of assets due to retirements, replacements or certain restaurant closures. There were no impairments recognized during the periods presented. (3) Represents the non-cash portion of straight-line rent expense recorded within Occupancy expenses on the Consolidated Statements of Operations and Comprehensive Income. (4) Represents insurance recoveries, net of costs incurred, in connection with hurricane damage, which were recorded in Other income, net on the Consolidated Statements of Operations and Comprehensive Income. THIRTEEN WEEKS THIRTEEN WEEKS TWENTY-SIX WEEKS TWENTY-SIX WEEKS (in thousands) June 30, 2024 June 25, 2023 June 30, 2024 June 25, 2023 2023 2022 2021 Income (loss) from operations $16,447 $11,343 $28,733 $26,674 $41,267 $16,913 $22,243 Less: Franchise revenues (3,104) (3,713) (6,245) (7,151) (14,459) (10,981) (8,850) Add: General and administrative expenses 27,189 25,284 54,847 47,989 103,121 84,959 70,388 Depreciation and amortization 14,536 9,441 26,807 18,558 41,223 34,230 32,379 Transaction expenses (income), net (1) 725 1,744 1,394 1,997 3,147 2,513 (1,156) Impairments and loss on disposal of assets (2) 153 299 272 433 1,359 920 381 Costs in connection with natural disasters (3) - - - - - 382 - COVID-19 related charges - - - - - - 19 Restaurant level operating profit $55,946 $44,398 $105,808 $88,500 $175,658 $128,936 $115,404 Restaurant sales $255,457 $212,587 $494,765 $420,555 $877,092 $719,181 $592,343 Income (loss) from operations margin 6.4% 5.3% 5.8% 6.3% 4.7% 2.4% 3.8% Restaurant level operating profit margin 21.9% 20.9% 21.4% 21.0% 20.0% 17.9% 19.5% Additional information Deferred rent expense (income) (4) $357 $280 $650 $814 $1,891 $2,219 ($2,075) FISCAL YEAR

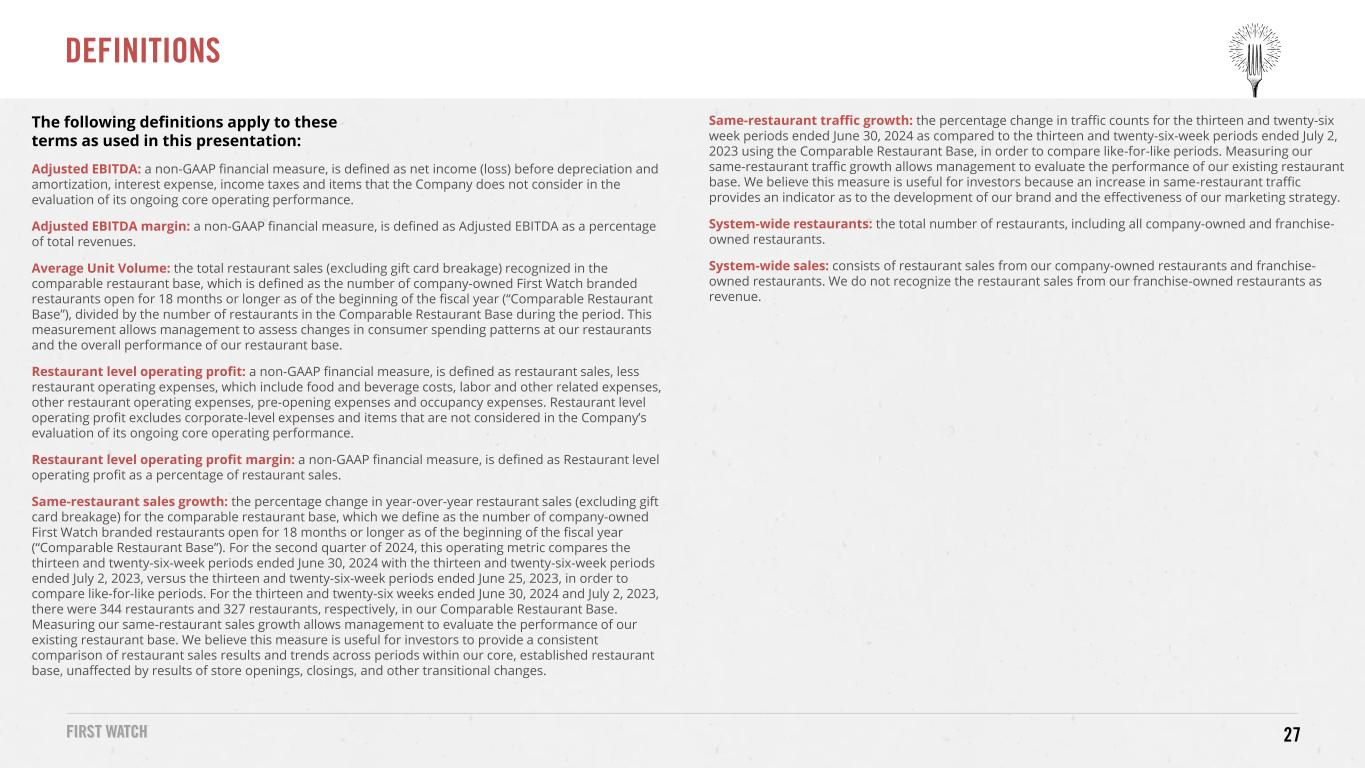

27 The following definitions apply to these terms as used in this presentation: Adjusted EBITDA: a non-GAAP financial measure, is defined as net income (loss) before depreciation and amortization, interest expense, income taxes and items that the Company does not consider in the evaluation of its ongoing core operating performance. Adjusted EBITDA margin: a non-GAAP financial measure, is defined as Adjusted EBITDA as a percentage of total revenues. Average Unit Volume: the total restaurant sales (excluding gift card breakage) recognized in the comparable restaurant base, which is defined as the number of company-owned First Watch branded restaurants open for 18 months or longer as of the beginning of the fiscal year (“Comparable Restaurant Base”), divided by the number of restaurants in the Comparable Restaurant Base during the period. This measurement allows management to assess changes in consumer spending patterns at our restaurants and the overall performance of our restaurant base. Restaurant level operating profit: a non-GAAP financial measure, is defined as restaurant sales, less restaurant operating expenses, which include food and beverage costs, labor and other related expenses, other restaurant operating expenses, pre-opening expenses and occupancy expenses. Restaurant level operating profit excludes corporate-level expenses and items that are not considered in the Company’s evaluation of its ongoing core operating performance. Restaurant level operating profit margin: a non-GAAP financial measure, is defined as Restaurant level operating profit as a percentage of restaurant sales. Same-restaurant sales growth: the percentage change in year-over-year restaurant sales (excluding gift card breakage) for the comparable restaurant base, which we define as the number of company-owned First Watch branded restaurants open for 18 months or longer as of the beginning of the fiscal year (“Comparable Restaurant Base”). For the second quarter of 2024, this operating metric compares the thirteen and twenty-six-week periods ended June 30, 2024 with the thirteen and twenty-six-week periods ended July 2, 2023, versus the thirteen and twenty-six-week periods ended June 25, 2023, in order to compare like-for-like periods. For the thirteen and twenty-six weeks ended June 30, 2024 and July 2, 2023, there were 344 restaurants and 327 restaurants, respectively, in our Comparable Restaurant Base. Measuring our same-restaurant sales growth allows management to evaluate the performance of our existing restaurant base. We believe this measure is useful for investors to provide a consistent comparison of restaurant sales results and trends across periods within our core, established restaurant base, unaffected by results of store openings, closings, and other transitional changes. Same-restaurant traffic growth: the percentage change in traffic counts for the thirteen and twenty-six week periods ended June 30, 2024 as compared to the thirteen and twenty-six-week periods ended July 2, 2023 using the Comparable Restaurant Base, in order to compare like-for-like periods. Measuring our same-restaurant traffic growth allows management to evaluate the performance of our existing restaurant base. We believe this measure is useful for investors because an increase in same-restaurant traffic provides an indicator as to the development of our brand and the effectiveness of our marketing strategy. System-wide restaurants: the total number of restaurants, including all company-owned and franchise- owned restaurants. System-wide sales: consists of restaurant sales from our company-owned restaurants and franchise- owned restaurants. We do not recognize the restaurant sales from our franchise-owned restaurants as revenue. DEFINITIONS

® STEVEN L. MAROTTA Vice President, Investor Relations 941-500-1918 investors@firstwatch.com