UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-39160

SOC TELEMED, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 84-3131208 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

2411 Dulles Corner Park, Suite 475

Herndon, Virginia | | 20171 |

| (Address of principal executive offices) | | (ZIP Code) |

Registrant’s telephone number, including area code: (866) 483-9690

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value of $0.0001 per share | | TLMD | | The Nasdaq Stock Market LLC |

| | | | | |

Warrants, each exercisable for one share of

Class A Common Stock for $11.50 per share | | TLMDW | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the last reported sales price of the registrant’s Class A common stock on The Nasdaq Stock Market on June 30, 2021, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $342.4 million.

The number of shares of the registrant’s Class A common stock outstanding as of March 24, 2022, was 101,336,178.

DOCUMENTS INCORPORATED BY REFERENCE

None.

SOC Telemed, inc.

annual report on form 10-K

For the fiscal year ended decembEr 31, 2021

Table of Contents

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this “report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are forward-looking and as such are not historical facts. These forward-looking statements include, without limitation, statements regarding future financial performance, business strategies, expansion plans, future results of operations, estimated revenues, losses, projected costs, prospects, plans and objectives of management. These forward-looking statements are based on our management’s current expectations, estimates, projections and beliefs, as well as a number of assumptions concerning future events, and are not guarantees of performance. Such statements can be identified by the fact that they do not relate strictly to historical or current facts. When used in this report, words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” and variations thereof and similar words and expressions are intended to identify such forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this report may include, for example, statements about:

| ● | our ability to consummate the proposed transaction with Patient Square Capital (the “Transaction”) on the anticipated terms and timeframe, including obtaining stockholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, litigation, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the Company’s business and other conditions to the completion of the Transaction; |

| ● | our ability to recognize the anticipated benefits of the Acquisition, which may be affected by, among other things, competition and our ability to manage our growth following the Acquisition; |

| ● | our financial performance and capital requirements; |

| ● | our expectations relating to bookings and revenues; |

| ● | our market opportunity and our ability to estimate the size of our target market; |

| ● | our ability to retain our existing customers and to increase our number of customers; |

| ● | potential acquisitions and integration of complementary businesses and technologies; |

| ● | our ability to maintain and expand our network of established, board-certified physicians and other provider specialists; |

| ● | our ability to attract, integrate, and retain key personnel and highly qualified personnel; |

| ● | our ability to comply with new or modified laws and regulations that currently apply or become applicable to our business; |

| ● | the implementation and effects of our restructuring plan; |

| ● | the effects of the COVID-19 pandemic on our business and operations; |

| ● | the outcome of any known and unknown litigation and regulatory proceedings; |

| ● | the possibility that our business may be harmed by other economic, business, and/or competitive factors; and |

| ● | other factors described in this report, including those described in the section entitled “Risk Factors” under Part I, Item 1A of this report. |

The forward-looking statements contained in this report are based on our current expectations and beliefs concerning future developments and their potential effects on our business. There can be no assurance that future developments affecting our business will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” under Part I, Item 1A of this report. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all such risk factors, nor can we assess the effect of all such risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

The forward-looking statements made by us in this report speak only as of the date of this report. Except to the extent required under the federal securities laws and rules and regulations of the SEC, we disclaim any obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, there is no assurance that the events or results suggested by the forward-looking statements will in fact occur, and you should not place undue reliance on these forward-looking statements.

Unless the context otherwise indicates, references in this report to the terms “SOC Telemed,” the “Company,” “we,” “our” and “us” refer to SOC Telemed, Inc., a Delaware corporation, and its consolidated subsidiaries.

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those described in the section entitled “Risk Factors” under Part I, Item 1A of this report, that represent challenges that we face in connection with the successful implementation of our strategy and growth of our business. The occurrence of one or more of the events or circumstances described in the section entitled “Risk Factors,” alone or in combination with other events or circumstances, may adversely affect our ability realize the anticipated benefits of the Transaction and may harm our business. Such risks include, but are not limited to:

| ● | The Transaction, the pendency of the Transaction or our failure to complete the Transaction could harm our business, results of operations, financial condition and stock price. |

| ● | We operate in a competitive industry, and if we are not able to compete effectively, our business, financial condition, and results of operations will be harmed. |

| ● | The level of demand for and market utilization of our solutions are subject to a high degree of uncertainty. |

| ● | We have a history of losses and anticipate that we will continue to incur losses in the future. We may never achieve or sustain profitability. |

| ● | Our business, results of operations, and financial condition may fluctuate on a quarterly and annual basis, which may result in a decline in our stock price if such fluctuations result in a failure to meet any projections that we may provide or the expectations of securities analysts or investors. |

| ● | Our business, financial condition and results of operations have been and may continue to be adversely impacted by the COVID-19 pandemic or similar epidemics in the future or other adverse public health developments, including government responses to such events. |

| ● | Our sales cycle can be long and unpredictable and requires considerable time and expense. As a result, our sales, revenues, and cash flows are difficult to predict and may vary substantially from period to period, which may cause our results of operations to fluctuate significantly. |

| ● | Developments affecting spending by the healthcare industry could adversely affect our revenues. |

| ● | If our existing customers do not continue or renew their contracts with us, renew at lower fee levels or decline to purchase additional services from us, our business may be harmed. |

| ● | Our telemedicine business and growth strategy depend on our ability to maintain and expand our network of established, board-certified physicians and other provider specialists. If we are unable to do so, our future growth would be limited and our business would be harmed. |

| ● | Our telemedicine business is dependent on our relationships with affiliated professional entities, which we do not own, to provide physician services, and our business would be harmed if those relationships were disrupted. |

| ● | We may acquire other companies or technologies, which could divert our management’s attention, result in dilution to our stockholders, and otherwise disrupt our operations, and we may have difficulty integrating any such acquisitions successfully or realizing the anticipated benefits therefrom, any of which could harm our business. |

| ● | We may require additional capital from equity or debt financings to support business growth, and this capital might not be available on acceptable terms, if at all. |

| ● | Our substantial indebtedness following the Acquisition could harm our business and growth prospects. |

| ● | If we fail to comply with extensive healthcare laws and government regulations, we could suffer penalties or be required to make significant changes to our operations. |

| ● | Our use and disclosure of personally identifiable information, including health information, is subject to federal and state privacy and security regulations, and our failure to comply with those regulations or to adequately secure the information we hold could result in significant liability or reputational harm to us, which could, in turn, harm our customer base and our business. |

| ● | Warburg Pincus has significant influence over us, and their interests may conflict with ours and those of our other stockholders in the future. |

| ● | Future sales of shares by existing stockholders and future exercise of registration rights may adversely affect the market price of our Class A common stock. |

Part I

Item 1. Business.

Corporate History and Background

We were incorporated in Delaware in September 2019 and formed as a special purpose acquisition company known as Healthcare Merger Corp. (“HCMC”) for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. Our legacy business (“Legacy SOC Telemed”) was founded in 2004. On October 30, 2020, we completed the acquisition of Legacy SOC Telemed pursuant to an Agreement and Plan of Merger, dated as of July 29, 2020 (the “Merger Agreement”), by and among us, Sabre Merger Sub I, Inc., a Delaware corporation and a wholly owned subsidiary of HCMC, Sabre Merger Sub II, LLC, a Delaware limited liability company and a wholly owned subsidiary of HCMC, and Specialists On Call, Inc., a Delaware corporation. We collectively refer to the transactions contemplated by the Merger Agreement as the “Merger” or the “Merger Transaction.” As part of the Merger Transaction, we changed our name from Healthcare Merger Corp. to SOC Telemed, Inc.

On March 26, 2021, we completed the acquisition (the “Acquisition”) of Access Physicians Management Services Organization, LLC (“Access Physicians”), a multi-specialty acute care telemedicine provider. The Acquisition expanded our clinical solutions to include teleCardiology, teleInfectious Disease, teleMaternal-Fetal Medicine, teleNephrology, teleEndocrinology and other specialties to offer a comprehensive acute care telemedicine portfolio to meet the demands of the market and grow our provider breadth and depth.

Acquisition by Patient Square Capital

On February 2, 2022, we entered into an Agreement and Plan of Merger (the “Transaction Agreement”) with Spark Parent, Inc., a Delaware corporation (“Spark Parent”), and Spark Merger Sub, Inc., a Delaware corporation and a direct, wholly owned subsidiary of Parent (“Spark Merger Sub”), pursuant to which Spark Merger Sub will merge with and into the Company (the “Transaction”), with the Company surviving the Transaction as a direct, wholly owned subsidiary of Spark Parent (the “Surviving Corporation”). Spark Parent and Spark Merger Sub are each subsidiaries of investment funds advised by Patient Square Capital, L.P. (“Patient Square Capital”), a leading dedicated health care investment firm. At the effective time of the Transaction (the “Effective Time”), the Surviving Corporation, will be indirectly owned by Patient Square Capital and certain of its affiliates.

The Company’s Board of Directors (the “Board”) has unanimously approved the Transaction Agreement and the transactions contemplated thereby, including the Transaction, and, subject to certain exceptions set forth in the Transaction Agreement, resolved to recommend that our stockholders adopt and approve the Transaction Agreement.

Under the terms of the Transaction Agreement, at the Effective Time, each share of our Class A common stock outstanding immediately prior to the Effective Time (subject to certain exceptions, including shares of Class A common stock owned by stockholders of the Company who have not voted in favor of the adoption and approval of the Transaction Agreement and properly exercised appraisal rights in accordance with Section 262 of the General Corporation Law of the State of Delaware) will be canceled and automatically converted into the right to receive $3.00 in cash (the “Transaction Consideration”), without any interest thereon and subject to any applicable withholding taxes. The Transaction Agreement provides that the Company’s equity awards that are outstanding immediately prior to the Effective Time will be subject to the following treatment as of the Effective Time:

| ● | Each option to purchase shares of Class A common stock that is vested in accordance with its terms and outstanding as of immediately prior to the Effective Time will, provided that such option has a per share exercise price less than the Transaction Consideration, automatically and without any required action on the part of the holder thereof, be canceled and converted into the right to receive an amount in cash, without interest, equal to (i) the total number of shares of Class A common stock underlying such option multiplied by (ii) the excess of (A) the Transaction Consideration over (B) the per share exercise price for such option, subject to applicable withholding taxes; |

| ● | Each option that is not vested and is outstanding as of immediately prior to the Effective Time will, provided that such option has a per share exercise price less than the Transaction Consideration, automatically and without any required action on the part of the holder thereof, be canceled and replaced with a new award to be issued by Spark Parent or one of its affiliates following the Effective Time; |

| ● | Any option, whether or not vested, that has a per share exercise price that is equal to or greater than the Transaction Consideration will be canceled for no consideration; |

| ● | Each RSU held by a non-employee director of the Company that is outstanding as of immediately prior to the Effective Time will, automatically and without any required action on the part of the holder thereof, be canceled and converted into the right to receive an amount in cash, without interest, equal to (i) the total number of shares of Class A common stock underlying such RSU multiplied by (ii) the Transaction Consideration, subject to applicable withholding taxes; |

| ● | Each RSU (other than those held by a non-employee director of the Company) that is not vested and is outstanding as of immediately prior to the Effective Time will, automatically and without any required action on the part of the holder thereof, be canceled and replaced with a new award to be issued by Spark Parent or one of its affiliates following the Effective Time; |

| ● | Each PSU that is outstanding as of immediately prior to the Effective Time and for which the applicable performance condition has been satisfied as of immediately prior to the Effective Time will, automatically and without any required action on the part of the holder thereof, be canceled and converted into the right to receive an amount in cash, without interest, equal to (i) the total number of shares of Class A common stock underlying such PSU multiplied by (ii) the Transaction Consideration, subject to applicable withholding taxes; and |

| ● | Each PSU that is outstanding as of immediately prior to the Effective Time and for which the applicable performance condition has not been satisfied as of immediately prior to the Effective Time will be canceled for no consideration. |

The Transaction Agreement also provides that, following the date of the Transaction Agreement, except for the offering under the Company’s 2020 Employee Stock Purchase Plan (the “ESPP”) in effect as of the date of the Transaction Agreement, no offering under the ESPP will be authorized or commenced, no new participants will commence participation in the ESPP, no participant in the ESPP will be permitted to increase his or her payroll contribution rate in effect as of the date of the Transaction Agreement or make separate non-payroll contributions, the accumulated contributions of each participant will be used to purchase shares of Class A common stock prior to the Effective Time in accordance with the ESPP, after which all purchase rights under the ESPP will be terminated, and the ESPP will terminate effective as of (and subject to the occurrence of) the Effective Time. The Transaction Agreement further provides that, at the Effective Time, each warrant that is outstanding as of immediately prior to the Effective Time will, in accordance with its terms, automatically and without any required action on the part of the holder thereof, cease to represent a warrant in respect of our Class A common stock and will become a warrant exercisable for Transaction Consideration.

During the period beginning on the date of the Transaction Agreement and continuing until 11:59 p.m., New York time on March 4, 2022, we had the right to, among other things, (1) solicit alternative acquisition proposals, (2) provide information (including non-public information) to third parties in connection therewith pursuant to an acceptable confidentiality agreement, and (3) initiate or continue discussions with third parties in connection therewith. During such period, the Company’s financial advisor, at the direction of the Board, communicated with additional parties to gauge their interest in making an alternative acquisition proposal. No party made an alternative acquisition proposal during such period. From and after 11:59 p.m., New York time on March 4, 2022, the Company must comply with customary non-solicitation restrictions.

Either we or Spark Parent may terminate the Transaction Agreement in certain circumstances, including if (1) the Transaction is not completed by August 2, 2022, subject to certain limitations, (2) a court of competent jurisdiction has issued a final, non-appealable injunction prohibiting the consummation of the Transaction, (3) the Company’s stockholders fail to adopt and approve the Transaction Agreement, and (4) the other party breaches its representations, warranties or covenants in the Transaction Agreement such that certain conditions would not be satisfied, subject in certain cases, to the right of the breaching party to cure the breach. The parties may also terminate the Transaction Agreement by mutual written consent. If the Transaction Agreement is terminated in certain other circumstances, including by us in order to enter into a superior proposal or by Spark Parent because the Board withdraws its recommendation in favor of the Transaction, we would be required to pay Spark Parent a termination fee of approximately $11.5 million; provided that a lower fee of approximately $7.7 million will apply with respect to a termination to enter into a superior proposal during the “go-shop” period described in the preceding paragraph. In addition, if the Transaction Agreement is validly terminated (1) by Spark Parent for our breach of our representations, warranties or covenants in the Transaction Agreement such that certain conditions would not be satisfied, subject in certain cases, to our right to cure the breach, (2) by either party if the Company’s stockholders fail to adopt and approve the Transaction Agreement or (3) because the Transaction is not completed by August 2, 2022 (subject to certain limitations), we will be required to pay the termination fee if, within 12 months after termination of the Transaction Agreement, we enter into an alternative acquisition proposal that was made prior to the termination of the Transaction Agreement.

We made customary representations, warranties and covenants in the Transaction Agreement, including, among others, covenants to conduct our business in all material respects in the ordinary course during the period between the date of the Transaction Agreement and the completion of the Transaction. The parties have agreed to use reasonable best efforts to take all actions necessary to consummate the Transaction, including cooperating to obtain the regulatory approvals necessary to complete the Transaction.

Completion of the Transaction is subject to the satisfaction or waiver of customary closing conditions, including (1) the adoption and approval of the Transaction Agreement by the Company’s stockholders; (2) the expiration or termination of the applicable waiting period under the Hart-Scott Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”); (3) the absence of any order, injunction or law prohibiting the Transaction; (4) the accuracy of the other party’s representations and warranties, subject to certain materiality standards set forth in the Transaction Agreement; (5) compliance in all material respects with the other party’s obligations under the Transaction Agreement; and (6) each party having received from the other party a certificate confirming that the relevant conditions have been satisfied with respect to that party. The parties made the filings required under the HSR Act on February 14, 2022, and the applicable waiting period under the HSR Act expired at 11:59 p.m., Eastern Time, on March 16, 2022. A special meeting of the Company’s stockholders to consider and vote on a proposal to adopt and approve the Transaction Agreement is scheduled to be held on April 4, 2022. The parties expect the Transaction to close in the second quarter of 2022. If the Transaction is consummated, the Company’s Class A common stock and warrants to purchase shares of Class A common stock will be delisted from the Nasdaq Global Select Market (“Nasdaq”) and deregistered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

On February 2, 2022, concurrently with the execution of the Transaction Agreement, each of Christopher M. Gallagher, the Company’s Chief Executive Officer and a member of the Board, the Gallagher 2020 Children’s Trust, for which Dr. Gallagher serves as a trustee, Steven J. Shulman, the Chairman of the Board, and SOC Holdings LLC, an affiliate of Warburg Pincus LLC (“Warburg Pincus”), entered into a voting and support agreement with the Company and Spark Parent pursuant to which each such stockholder has agreed, among other things, to vote their shares of Class A common stock in favor of adoption and approval of the Transaction Agreement, and against any competing transaction, so long as, among other things, the Transaction Agreement remains in effect. As of February 25, 2022, the record date for the special meeting, those stockholders beneficially owned and are entitled to vote in the aggregate approximately 38.7% of the issued and outstanding shares of Class A common stock entitled to vote at the special meeting.

For additional information related to the Transaction Agreement and related voting and support agreements, please refer to our filings previously made with the SEC in connection with the Transaction, including the Company’s definitive proxy statement filed on March 7, 2022, and the full text of the Transaction Agreement and the form of voting and support agreement, copies of which were filed on February 4, 2022, as Exhibits 2.1 and 99.1 to the Company’s Current Report on Form 8-K.

Because the Transaction is not yet complete, and except as otherwise specifically stated, the descriptions and disclosures presented elsewhere in this report, including those that present forward-looking information as that term is defined elsewhere herein, assume the continuation of SOC Telemed as a public company. If the Transaction is consummated, our actions and results may be different than those anticipated by such forward-looking statements contained in this report, and such differences may be material.

Our Mission

Our mission is to partner with healthcare organizations to bring clinicians and patients together using innovative technologies to improve clinical care and patient outcomes in a measurable way.

Overview

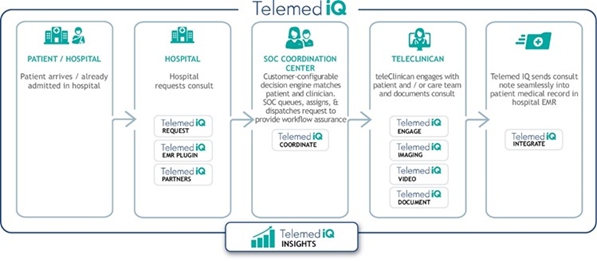

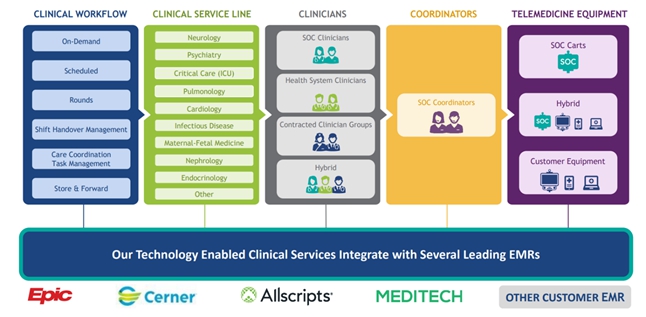

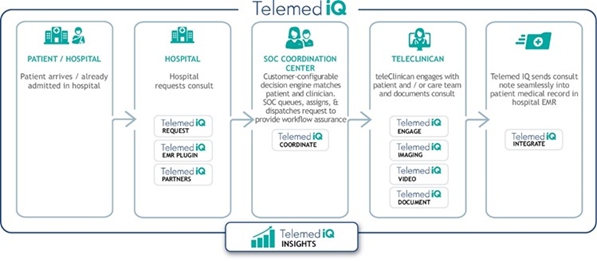

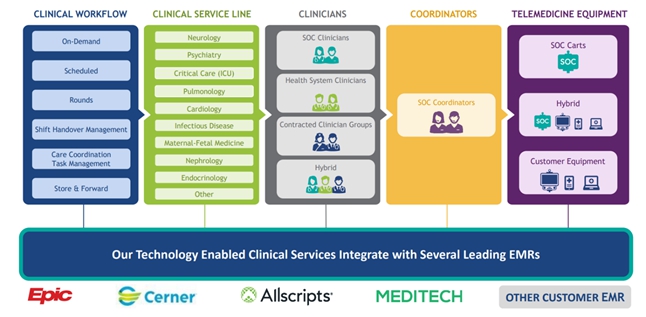

We are the leading provider of acute care telemedicine services and technology to U.S. hospitals and healthcare systems, based on number of customers. We provide technology-enabled clinical solutions, which include acute teleNeurology, telePsychiatry, teleCritical Care (ICU), telePulmonology, teleCardiology and other specialties. We support time-sensitive specialty care when patients are vulnerable and may not otherwise have access. Our solution was developed to support complex workflows in the acute care setting by integrating our cloud-based software platform, Telemed IQ, with a panel of consult coordination experts and a network of clinical specialists to create a seamless, acute care telemedicine solution.

Hospitals and health systems today face many challenges. Over the next decade, the U.S. is expected to continue to face a shortage of primary care and specialist physicians in both urban and rural communities, which will adversely impact access to care and clinical outcomes. In addition, hospitals and health systems have difficulty efficiently staffing with unknown and unpredictable patient demand, leading to increased costs or delays in patient care. These challenges, combined with increased financial pressure, are driving hospitals and healthcare systems to seek solutions that can deliver cost-effective access to qualified clinicians and high-quality care.

We focus on the acute care telemedicine industry. Access to timely care is essential to improved health outcomes, but the complexity in the operating environment for acute care telemedicine creates significant barriers to entry. Technology, workflows and clinical network elasticity are critical to connect remote specialists to patients and on-site providers within minutes. Additionally, predictive modeling, actionable analytics, a flexible decision engine and workflow assurance facilitate clinician deployment in a protocol driven framework. An effective telemedicine platform also must be integrated across hospitals and health systems yet work within the local system hardware and software infrastructure in order to optimize workflow and enhance clinical outcomes.

Our cloud-based Telemed IQ platform optimizes workflows and supports various provider-to-provider and provider-to-patient interactions (on-demand, scheduled, rounding, etc.) via any web-enabled device, at any care location, across the care continuum. Our platform is a fully integrated and configurable technology solution that seamlessly combines voice, video, imaging, electronic medical record (“EMR”) integration, clinical workflow optimization, clinical resource management, analytics, predictive modeling and other reporting tools. As an enterprise offering, Telemed IQ enables hospitals, health systems and other healthcare organizations to provide telemedicine programs and drive revenue growth and/or optimize clinical coverage costs, either with their own clinical team or in conjunction with our affiliated network of established, board-certified physicians and other provider specialists. Our affiliated national provider network is comprised of more than 380 board-certified neurologists, psychiatrists, intensivists, pulmonologists, cardiologists, infectiologists, perinatologists, nephrologists, endocrinologists and other physicians, representing a critical mass of scarce clinical resources ready for deployment and collaboration at nationwide sites of care. Our platform can be extended to other specialties and service lines, based on our customer’s needs and their own clinical teams, and has been utilized across more than 20 specialties.

We have experienced significant growth since the founding of our business in 2004. We derive our revenues primarily from hospitals and health systems, physician groups, post-acute providers, and government customers. As a result of the Acquisition, we have expanded our focus from primarily the emergency department to include other inpatient-based specialties, thus diversifying both the number of clinical services and where they are provided in the acute care setting. We also now offer hybrid services with on-site physicians in addition to our primary telemedicine service offering.

Our customers generally enter into multi-year agreements where they pay us a fixed monthly fee for the availability to perform a pre-determined number of consults and/or to provide on-demand consultations. In 2021, approximately 70% of our revenues were from fixed monthly fees. In addition, if our customers exceed their fixed monthly allotment of consults, we charge a per consult rate (i.e., a variable fee) for any subsequent consultations during that period. Customers may also choose to license the Telemed IQ platform for virtualizing their own clinician networks. In these instances, we receive a subscription license fee for each clinician that uses our platform. Although revenues from Telemed IQ subscription license fees have been immaterial to date, they have been increasing in recent periods and we plan to continue to invest in the go-to-market resources to address our market opportunity. We also provide RCM capabilities to customers where physician services are eligible for reimbursement. In these cases, we bill patients and third-party payers for physician services rendered.

COVID-19 Impact on Telemedicine

The COVID-19 pandemic has had a significant impact on the telemedicine market by increasing utilization, awareness and acceptance among patients and providers. In the current environment, telemedicine has been promoted at the highest levels of government as a key tool for on-going healthcare delivery while access to healthcare facilities remains limited due to state-mandated stay-at-home orders and general patient fear of traditional in-person visits. Moreover, with clinicians quarantined or otherwise relegated to their homes due to safety issues, telemedicine has provided a solution for remote providers to continue to care for patients and for hospitals to access additional specialists to augment remaining staff. During the COVID-19 pandemic, the U.S. Congress and the Centers for Medicare and Medicaid Services (“CMS”) significantly reduced regulatory and reimbursement barriers for telemedicine. As a result, telemedicine spending increased starting in 2020, and we expect this trend to continue after the public health emergency. In addition to Medicare and Medicaid, many states have issued executive orders or permanent legislation removing or reducing the regulatory and reimbursement barriers for telemedicine.

Our Stakeholders

We provide value to all of our stakeholders — the hospital, the physician and the patient.

| ● | Hospitals: We provide hospitals with efficient, collaborative high-quality care at a lower cost. In particular, we enable hospitals to retain high-value capabilities benefiting their communities, such as stroke care, avoid costly backlogs for psychiatric evaluations in emergency departments and inpatient sites of care, and improve patient quality of care through timely access to specialized resources. |

| ● | Physician Groups: We enable physician groups to more effectively deploy clinical capital. By doing so, physician groups can better optimize scarce and expensive clinical resources to better match clinician supply to patient demand and improve their productivity and profitability. |

| ● | Patients: We provide patients with access to quality care when and where it is needed. We ensure patients have access to scarce clinical specialists and rapid intervention to address acute procedures for better outcomes. |

Our Telemed IQ Platform

Adapting the acute care workflow to telemedicine involves a complex orchestration between patient, remote physician, bedside health provider and consult coordination experts. All of these participants are mediated by a low-code, highly configurable software platform, which features a configurable decision engine, matching patients and physicians and coordinating the various stages of the procedure and follow-up.

Illustrative example:

| ● | Patient presents in the emergency room with stroke symptoms. |

| ● | Onsite clinician initiates a consult request to a teleNeurologist using our Telemed IQ platform. |

| ● | Our configurable decision engine prioritizes the consult given clinically based acuity and required response time data points. |

| ● | Simultaneously, the platform scores and ranks the physicians who are eligible to handle this consult. |

| ● | After the most appropriate and available teleNeurologist is selected, contacted and engaged on our Telemed IQ platform, the physician evaluates the patient over an automated video connection. Through our platform, the physician views the same images that are available in the hospital and collaborates with the onsite clinicians for the patient’s care. Upon completion of the consultation, evaluation notes are seamlessly transferred via the Telemed IQ into the patient’s EMR. |

Our Solution

Acute care is a complex and heterogeneous environment within a single hospital, and every hospital within a larger integrated delivery network can have its own unique workflows. To operate in this environment, we need to be flexible, adapting to these workflows and the technology infrastructure. We built our platform technology and solutions around this premise and have successfully addressed this complexity. As a result, we can enable varying provider-to-patient and provider-to-provider interactions across different specialties, provider groups, locations and technology infrastructure.

Our cloud-based Telemed IQ technology platform supports various clinical workflows and can support any specialty, be deployed across our network of board-certified physicians and other provider specialists, third-party clinicians or both, and run on any telemedicine endpoint at any location. We leverage our platform across two different configurations that we sell to the market:

| ● | Core Services: We integrate our Telemed IQ platform and acute physician network to provide a turnkey acute care telemedicine solution that addresses the clinical provisioning and financial needs of our customers. The benefits of our core services are to rapidly provide access to scarce physicians and other provider specialists to help our hospital partners increase access to specialist care, improve outcomes for their patients, retain high-value capabilities, reduce costs and enable customers to care for more clinically complex cases. Following the Acquisition, we also offer a hybrid model, which provides physicians on-site using our Telemed IQ platform. |

| ● | Telemed IQ Platform: We provide our Telemed IQ platform on a standalone basis as a solution to health systems and other provider groups that want to virtualize their own clinician resources using a technology platform that was purpose-built to support the complex and unique needs of an acute patient care setting. Our platform has been utilized across more than 20 specialties. |

Our Offerings

Core Services. We integrate our Telemed IQ platform and acute physician network to provide a turnkey acute care telemedicine solution that addresses the clinical provisioning and financial needs of our customers. The benefits of our core services are to rapidly provide access to scarce physicians and other provider specialists to help our hospital partners increase access to specialist care, improve outcomes for their patients, retain high-value capabilities, reduce costs and enable customers to care for more clinically complex cases.

Telemed IQ Platform. We provide our Telemed IQ platform on a standalone basis as a solution to health systems and other provider groups that want to virtualize their own clinician resources using a technology platform that was purpose-built to support the complex and unique needs of an acute patient care setting. Our platform has been utilized across more than 20 specialties.

RCM Capabilities. We provide RCM capabilities to customers where physician services are eligible for reimbursement. In these cases, we bill patients and third-party payers for physician services rendered.

Technology

Our Telemed IQ platform was purpose-built to run our acute care services business. We developed a scaled, configurable platform with sophisticated functionality to meet our clinical, financial and operational needs. Our customers benefit from our experience, data analysis, continuous enhancements and best practices. Our Telemed IQ platform helps our customers achieve their clinical, financial and operational goals by facilitating the efficient deployment of clinical resources to where it is needed most. Our platform can be extended to other specialties and service lines, based on the customer’s needs, and has been utilized across more than 20 specialties. Customers can deploy the platform with their own network of clinicians, our network of board-certified physicians and other provider specialists, third-party clinicians, or any combination thereof.

Our low-code development platform provides us with a significant competitive advantage. We can conceptualize, configure, and deploy new workflows and clinical service lines rapidly, adding value to our customers and facilitating growth. Our browser-based platform permits clinicians to conduct telemedicine evaluations using a laptop, tablet or phone application on iOS and Android platforms. We offer two-way integration with EMR systems and have received formal certification from both Epic and Cerner.

To optimize the assignment of clinicians to the telemedicine consult, our platform uses multiple automated decision support engines that sort incoming consults according to customer-guided custom priority rules. The decision support engines determine the most appropriate clinician who can and should take the consult based on each customer’s predetermined rules. Our platform also manages the structured communication between the clinician initiating the consult and the clinician accepting the consult assigned action.

Our Telemed IQ platform captures a significant volume of clinical and operational data that is utilized on a de-identified basis to provide our customers with actionable data analytics and benchmarking. We believe our data analytic tools and transparency fosters trust among our customers and helps optimize their workflow while improving quality of care, throughput, response time, and productivity.

Scalability and Security

We host our applications and serve our customers from several cloud-based data centers, including those operated by Amazon Web Services, which are designed to support high levels of availability and have redundant subsystems and compartmentalized security zones. Our data center facilities employ advanced measures to ensure physical integrity, including redundant power and cooling systems and advanced fire and flood prevention. We have implemented telehealth industry-standard processes, policies and tools across our software development and network administration, including regularly scheduled vulnerability scanning and third-party penetration testing in order to reduce the risk of vulnerabilities in our system. We also have achieved HITRUST CSF security certification, a recommended framework trusted by many health systems and hospitals to manage risk, and realized over 99.99% uptime of our platform during the twelve months ended December 31, 2021. Our systems transmit encrypted backup files and logs over secure connections to multiple storage devices. We monitor our systems for any signs of trouble and take precautions as necessary.

Operations

Our implementation, training, clinical provisioning, credentialing, customer service and technical teams work collaboratively to onboard new customers and efficiently execute acute care telemedicine consultation requests.

Implementation and Training

In the ordinary course, a typical installation of our solution requires approximately 90 to 120 days, depending on customer processes and resources. However, we can rapidly deploy our solution in as little as 72 hours as we demonstrated during the COVID-19 pandemic. We provide training for our customers to ensure a seamless transition to our telemedicine services. Prior to any implementation, we analyze our customers’ workflow and develop an implementation plan that meets their objectives and incorporates industry best practices.

Clinical Provisioning

Our clinical provisioning team matches clinical supply to demand by focusing on both our customer’s long-term and short-term clinical coverage needs. We analyze historical data and use our proprietary and predictive analytics and tools to evaluate each clinical service line to project consult demand in order to assess the number of specialists needed for each hour of the day and each day of the week. We continuously monitor and analyze utilization data from across the country to identify patterns, surges and spikes and adjust coverage as necessary. We also use a variety of data sources and analytics to drive our long-term staffing strategy and scale our practice in advance of demand.

Credentialing, Licensing, and Privileging

Acute care telemedicine is different from consumer telehealth offerings because physicians must be both licensed in the state where the patient is located and be privileged at the healthcare facility where the patient is being treated. These requirements create a highly complex compliance environment, because there is significant variability in the licensing and credentialing requirements and procedures mandated by individual state licensing boards and related lead times. At the facility level, the administrative burden associated with credentialing and privileging is a resource-intensive process. We ensure that our network of board-certified physicians and other provider specialists acquire and maintain the qualifications required for their specialty and receive the licenses and privileges necessary to practice across multiple states and facilities in a timely manner. We have established rigorous processes and policies that allow us to meet the expectations of our customers and comply with applicable federal, state and accreditation standards. Every physician who applies for privileges is reviewed by a group of peers in accordance with applicable regulatory and accreditation requirements. As of December 31, 2021, we manage approximately 3,600 licenses and 15,600 privileges on behalf of our network physicians.

Consult Coordination Center

The critical nature of our work often requires physicians to make life-saving decisions shortly after interacting with a health facility or patient. Every inbound request and consultation is monitored by a team of consult coordination experts. These experts are responsible for monitoring and managing the efficient execution of our services from the initial consult request through preparation, physician assignment, and post-evaluation documentation on a 24-hour, 7-days-a-week, and 365-days-a-year basis. Our technology solution empowers the team managing this capability with tools to manage consult flow, prioritize by consult severity and ensure that the technology, physician, bedside provider and patient are ready for clinical interaction. All of our communications take place in real-time, providing physicians and other provider specialists with immediate updates around patient status. Appropriate metrics are captured for each telemedicine consult for quality assurance purposes and evaluation in quality care and customer satisfaction.

Quality

We are focused on providing the highest level of clinical and operational quality. We have developed a comprehensive quality management program that supports evidence-based practices, tracks customer satisfaction levels and encourages continuous improvement of telemedicine services. Our clinical leaders regularly review industry accepted standards and, when appropriate, make changes to our protocols. As new practice standards are introduced, our network of board-certified physicians and other provider specialists review these standards and adapt them for national telemedicine practice. Our network physicians and other specialists are continuously trained and evaluated to appropriately integrate and utilize these updated practice standards.

In 2006, we were the first telemedicine organization to earn The Joint Commission’s Gold Seal of Approval for Ambulatory Health Care Accreditation, a status we have retained since that time. Similar to our hospital customers, we are evaluated for compliance with ambulatory care standards, including coordination of care, physician credentialing, monitoring of clinical quality, operational infrastructure, security and emergency procedures. Since 2018, we have been accredited for telemedicine by URAC (formerly known as the ClearHealth Quality Institute). Our processes undergo regular review by The Joint Commission and URAC as part of their ongoing accreditation processes.

Sales and Marketing

We have a team of experienced sales executives who are primarily responsible for selling our solutions and services directly to hospitals and health systems. Our team is organized into geographic territories and supported by clinical experts, technical experts, business development and lead-generation managers. In addition, we have developed channel customers who incorporate our platform as part of a model that combines on-site staffing solutions with telemedicine.

Our marketing program supports our growth and lead generation though content development, brand awareness, search engine optimization, field marketing events, integrated campaigns, industry relations and public media.

Research and Development

Our ability to continue to differentiate and enhance our platform depends on our capacity to continue to introduce new services, technologies and functionality. Our product development team is responsible for the design, development, testing and certification of our solution. We are a customer-led organization that has invested heavily in our strategic product management team, low-code development platform, network of industry relationships and innovative infrastructure. We focus our research and development spend on delivering new products and further enhancing the functionality, performance and flexibility of our solution.

Competition

The telemedicine market is rapidly evolving and highly competitive. We expect competition to intensify in the future as existing competitors and new entrants introduce new telemedicine services and software platforms or other technology to U.S. healthcare providers, particularly hospitals and healthcare systems. We currently face competition from a range of companies, including other incumbent providers of acute care telemedicine consultation services and specialized software providers that are continuing to grow and enhance their service offerings and develop more sophisticated and effective transaction and service platforms. In addition, large, well-financed healthcare providers have in some cases developed their own telemedicine services and technologies utilizing their own and third-party platforms and may provide these solutions to their patients.

While there are several competitors in our industry, many began from a hardware-centric focus, with the goal of extending and integrating their devices into hospitals. We approached the development of our Telemed IQ platform differently by focusing on optimizing a large network of board-certified physicians and other provider specialists across numerous complex workflows. As a result, configurability, modularity and optimization became imperative and we subsequently made these capabilities available on a low-code development platform to address the configurability needs of our customers.

We believe we compete favorably based on the following key competitive factors for our industry:

| ● | access to a broad network of established, board-certified physicians and other provider specialists; |

| ● | purpose-built acute care platform with highly configurable workflows and easy integration; |

| ● | demonstrated scalability; |

| ● | clinical and service quality; |

| ● | reporting, analytics and benchmarking; |

Tele-Physicians Practices

We support and coordinate the services of our affiliated clinician network through administrative support services agreements, management services agreements or similar arrangements (collectively, “Administrative Agreements”) with nine independent professional entities: Tele-Physicians, P.C. (d/b/a California Tele-Physicians), Tele-Physicians, P.C. (d/b/a Georgia Tele-Physicians), Tele-Physicians, P.C. (d/b/a New Jersey Tele-Physicians), Tele-Physicians, P.A. (d/b/a Texas Tele-Physicians), JSA Health California PC, JSA Health Texas PLLC, Access Physicians, PLLC, AP US 9, P.C. and AP US 14, P.A. (collectively, the “Tele-Physicians Practices”). The Tele-Physician Practices are 100% physician-owned and employ or contract with physicians for the clinical and professional services provided to customers of ours and the Tele-Physicians Practices. Under the Administrative Agreements, we have agreed to serve as the sole and exclusive administrator of all non-clinical, day-to-day operations and business functions required for the administrative operation of each Tele-Physicians Practice, including business support services, contracting support, accounting, billing and payables support and technology support, so that each Tele-Physicians Practice may provide to its customers professional medical diagnosis, evaluation and therapeutic intervention services in certain specialty areas through telemedicine and other in-person consultations. The Administrative Agreements typically require the Tele-Physicians Practices to maintain the state licensure and other credentialing requirements of its physicians and professional liability insurance covering each of its physicians. We separately carry a medical professional liability insurance policy. Under each of the Administrative Agreements, the applicable Tele-Physicians Practice pays us either (a) a monthly administrative fee of a fixed dollar amount multiplied by the average number of customer facilities then under contract with the Tele-Physicians Practice, plus certain direct costs incurred by us on behalf of the Tele-Physicians Practice, or (b) a monthly management fee consisting of (i) a fixed monthly amount, (ii) certain overhead costs we incur and attribute to the applicable Tele-Physicians Practice and (iii) a set percentage of such incurred overhead costs. Typically, the Administrative Agreements have an initial five-year term and automatic annual extensions thereafter, while the Administrative Agreements assumed with the Access Physicians acquisition have an initial fifteen-year term. Unless earlier terminated upon mutual agreement of the parties or unilaterally by a party following the commencement of bankruptcy or liquidation proceedings by the non-terminating party, a material breach of the applicable Administrative Agreement by the non-terminating party or otherwise pursuant to the terms thereof, each of the Administrative Agreements automatically renews for a one-year term. The Tele-Physicians Practices are considered variable interest entities and their financial results are included in our consolidated financial statements. See Note 5, Variable Interest Entities, of our consolidated financial statements included elsewhere in this report.

Intellectual Property

We believe that our intellectual property rights are valuable and important to our business. We primarily rely on a combination of trademarks, copyrights, trade secrets, intellectual property assignment agreements, confidentiality procedures, nondisclosure agreements and employee nondisclosure and invention assignment agreements, and other similar measures to establish and protect our intellectual property and internally developed technology, including our Telemed IQ software platform. Our trademarks include SOC Telemed, marks for our acquired businesses, and various marketing slogans. Although we do not currently hold a patent for Telemed IQ, we continually assess the most appropriate methods of protecting our intellectual property and may decide to pursue available protections in the future. However, these intellectual property rights and procedures may not prevent others from competing with us. Despite our efforts to protect our intellectual property rights, unauthorized parties may attempt to copy aspects of our solution or to obtain and use information that we regard as proprietary, and may also attempt to develop similar technology independently. We may be unable to obtain, maintain and enforce the intellectual property rights on which our business depends, and assertions by third parties that we violate their intellectual property rights could harm our business.

Regulatory Environment

Our operations are subject to comprehensive United States federal, state and local regulation in the jurisdictions in which we do business. The laws and rules governing our business and interpretations of those laws and rules continue to expand and become more restrictive each year and are subject to frequent change, especially health regulatory requirements. Our ability to operate profitably will depend in part upon our ability, and that of our affiliated provider network, to operate in compliance with applicable laws and rules. Those laws and rules continue to evolve, and we therefore devote significant resources to monitoring developments in healthcare regulation. As the applicable laws and rules change, we are likely to make conforming modifications in our business processes from time to time. No assurance can be made that a review of our business by courts or regulatory authorities will not result in determinations that could adversely affect our operations or that the healthcare regulatory environment will not change in a way that restricts our operations.

Provider Licensing, Medical Practice, Telemedicine Standards and Related Laws and Guidelines

The practice of medicine is subject to various federal, state and local laws, regulations and approvals, relating to, among other things, health provider licensure, adequacy and continuity of medical care, medical practice standards (including specific requirements when providing healthcare utilizing telemedicine technologies and consulting services among providers), medical records maintenance, personnel supervision, and prerequisites for the prescription of medication. The application of some of these laws to telemedicine is unclear and subject to differing interpretation. Further, laws and regulations specific to delivering medical services utilizing telemedicine technologies continues to evolve, with some states incorporating modality and consent requirements for certain telemedicine encounters.

U.S. Corporate Practice of Medicine; Fee-Splitting

We contract with physician-owned professional associations and professional corporations to make available coordinated telemedicine services on our platform. In connection with these arrangements, we administer all non-clinical aspects of the telemedicine services to support the independent professional associations, professional corporations, and their health providers, including billing, scheduling and a wide range of other administrative and support services, and they pay us a pre-determined amount for those services. These contractual relationships are subject to various state laws that prohibit fee-splitting (sharing of professional services income with non-professionals) or the practice of medicine by lay entities or unlicensed persons.

The corporate practice of medicine and fee-splitting laws vary from state to state and are not always consistent among states. In addition, these requirements are subject to broad powers of interpretation, enforcement discretion by state regulators, and, in some cases, dated, yet still valid case law. Some of these requirements may apply to us or our affiliated provider network even if we do not have a physical presence in the state, based solely on the engagement of a provider licensed in the state or the provision of telemedicine to a resident of the state. However, regulatory authorities or other parties, including providers in our affiliated provider network, may assert that, despite these arrangements, we are engaged in the corporate practice of medicine or that our contractual arrangements with affiliated physician groups constitute unlawful fee-splitting. In this event, failure to comply could lead to adverse judicial or administrative action against us and/or our providers, civil or criminal penalties, receipt of cease-and-desist orders from state regulators, loss of provider licenses, or the need to make changes to the arrangements with our affiliated provider network; each of which could interfere with our business or prompt other adverse consequences.

U.S. Federal and State Fraud and Abuse Laws

Federal Stark Law

Our affiliated provider network may be subject to the federal self-referral prohibitions, commonly known as the Stark Law. Where applicable, this law prohibits a physician from referring beneficiaries of certain government programs to an entity providing “designated health services” if the physician or a member of such physician’s immediate family has a “financial relationship” with the entity, unless an exception applies. The penalties for violating the Stark Law include the denial of payment for services ordered in violation of the statute, mandatory refunds of any sums paid for such services, civil penalties for each violation, and possible exclusion from future participation in the federally funded healthcare programs. A person who engages in a scheme to circumvent the Stark Law’s prohibitions may be fined for each applicable arrangement or scheme. The Stark Law is a strict liability statute, which means proof of specific intent to violate the law is not required. In addition, the government and some courts have taken the position that claims presented in violation of the various statutes, including the Stark Law can be considered a violation of the federal False Claims Act (described below) based on the contention that a provider impliedly certifies compliance with all applicable laws, regulations and other rules when submitting claims for reimbursement. A determination of liability under the Stark Law could harm our business.

Federal Anti-Kickback Statute

We are also subject to the federal Anti-Kickback Statute. The Anti-Kickback Statute is broadly worded and prohibits the knowing and willful offer, payment, solicitation or receipt of any form of remuneration in return for, or to induce, (i) the referral of a person covered by Medicare, Medicaid or other governmental programs, (ii) the furnishing or arranging for the furnishing of items or services reimbursable under Medicare, Medicaid or other governmental programs or (iii) the purchasing, leasing or ordering or arranging or recommending purchasing, leasing or ordering of any item or service reimbursable under Medicare, Medicaid or other governmental programs. Certain federal courts have held that the Anti-Kickback Statute can be violated if “one purpose” of a payment is to induce referrals. In addition, a person or entity does not need to have actual knowledge of this statute or specific intent to violate it to have committed a violation, making it easier for the government to prove that a defendant had the requisite state of mind or “scienter” required for a violation. Moreover, the government may assert that a claim including items or services resulting from a violation of the Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act, as discussed below. Violations of the Anti-Kickback Statute can result in exclusion from Medicare, Medicaid or other governmental programs as well as civil and criminal penalties, including fines per violation and damages of up to three times the amount of the unlawful remuneration, and imprisonment of up to ten years. Imposition of any of these remedies could harm our business. In addition to a few statutory exceptions, the U.S. Department of Health and Human Services Office of Inspector General, or OIG, has published safe harbor regulations that outline categories of activities deemed protected from prosecution under the Anti-Kickback Statute provided all applicable criteria are met. The failure of a financial relationship to meet all of the applicable safe harbor criteria does not necessarily mean that the particular arrangement violates the Anti-Kickback Statute. However, conduct and business arrangements that do not fully satisfy each applicable safe harbor may result in increased scrutiny by government enforcement authorities, such as the OIG.

False Claims Act

Both federal and state government agencies have continued civil and criminal enforcement efforts as part of numerous ongoing investigations of healthcare companies and their executives and managers. Although there are a number of civil and criminal statutes that can be applied to healthcare providers, a significant number of these investigations involve the federal False Claims Act. These investigations can be initiated not only by the government but also by a private party asserting direct knowledge of fraud. These “qui tam” whistleblower lawsuits may be initiated against any person or entity alleging such person or entity has knowingly or recklessly presented, or caused to be presented, a false or fraudulent request for payment from the federal government, or has made a false statement or used a false record to get a claim approved. In addition, the improper retention of an overpayment for 60 days or more is also a basis for a False Claim Act action. Penalties for False Claims Act violations include fines for each false claim, plus up to three times the amount of damages sustained by the federal government. A False Claims Act violation may provide the basis for exclusion from the federally funded healthcare programs. In addition, some states have adopted similar fraud, whistleblower and false claims provisions.

State Fraud and Abuse Laws

Most states in which we operate have also adopted similar fraud and abuse laws as described above. The scope of these laws and the interpretations of them vary from state to state and are enforced by state courts and regulatory authorities, each with broad discretion. Some state fraud and abuse laws apply to items or services reimbursed by any payor, including patients and commercial insurers, not just those reimbursed by a federally funded healthcare program. A determination of liability under such state fraud and abuse laws could result in fines and penalties and restrictions on our ability to operate in these jurisdictions.

Other Healthcare Laws

The federal Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, or HITECH, and their implementing regulations, which we collectively refer to as HIPAA, established several separate criminal penalties for making false or fraudulent claims to insurance companies and other non-governmental payors of healthcare services. Under HIPAA, these two additional federal crimes are: “Healthcare Fraud” and “False Statements Relating to Healthcare Matters.” The Healthcare Fraud statute prohibits knowingly and recklessly executing a scheme or artifice to defraud any healthcare benefit program, including private payors. A violation of this statute is a felony and may result in fines, imprisonment or exclusion from government sponsored programs. The False Statements Relating to Healthcare Matters statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact by any trick, scheme or device or making any materially false, fictitious or fraudulent statement in connection with the delivery of or payment for healthcare benefits, items or services. A violation of this statute is a felony and may result in fines or imprisonment. These criminal statutes punish certain conduct resulting in the submission of claims to private payors that may also implicate the federal False Claims Act if resulting in claims to governmental health programs.

In addition, the Civil Monetary Penalties Law imposes civil administrative sanctions for, among other violations, inappropriate billing of services to federally funded healthcare programs and employing or contracting with individuals or entities who are excluded from participation in federally funded healthcare programs. Moreover, a person who offers or transfers to a Medicare or Medicaid beneficiary any remuneration, including waivers of co-payments and deductible amounts, that the person knows or should know is likely to influence the beneficiary’s selection of a particular provider, practitioner or supplier of Medicare or Medicaid payable items or services may be liable for civil monetary penalties for each wrongful act. Moreover, in certain cases, providers who routinely waive copayments and deductibles for Medicare and Medicaid beneficiaries without appropriate justification can also be held liable under the federal Anti-Kickback Statute and False Claims Act, which can impose additional penalties. One of the statutory exceptions to the prohibition is non-routine, unadvertised waivers of copayments or deductible amounts based on individualized determinations of financial need or exhaustion of reasonable collection efforts. The OIG emphasizes, however, that this exception should only be used occasionally to address special financial needs of a particular patient. Although this prohibition applies only to federal healthcare program beneficiaries, the routine waivers of copayments and deductibles offered to patients covered by commercial payers may implicate applicable state laws related to, among other things, unlawful schemes to defraud, excessive fees for services, tortious interference with patient contracts and statutory or common law fraud.

U.S. Federal and State Health Information Privacy and Security Laws

There are numerous U.S. federal and state laws and regulations related to the privacy and security of personally identifiable information, or PII, including health information. In particular, HIPAA establishes privacy and security standards that limit the use and disclosure of protected health information, or PHI, and require the implementation of administrative, physical, and technical safeguards to ensure the confidentiality, integrity and availability of individually identifiable health information in electronic form. Our affiliated network providers and our hospital, health system and other provider customers are all regulated as covered entities under HIPAA. Since the effective date of the HIPAA Omnibus Final Rule on September 23, 2013, HIPAA’s requirements are also directly applicable to the independent contractors, agents and other “business associates” of covered entities that create, receive, maintain or transmit PHI in connection with providing services to covered entities. SOC Telemed is a business associate under HIPAA when we are working on behalf of our affiliated medical groups and hospital, health system, and other provider customers.

Violations of HIPAA may result in civil and criminal penalties. We must also comply with HIPAA’s breach notification rule. Under the breach notification rule, covered entities must notify affected individuals without unreasonable delay in the case of a breach of unsecured PHI, which may compromise the privacy, security or integrity of the PHI. In addition, notification must be provided to the HHS and the local media in cases where a breach affects more than 500 individuals. Breaches affecting fewer than 500 individuals must be reported to HHS on an annual basis. The regulations also require business associates of covered entities to notify the covered entity of breaches by the business associate.

State attorneys general also have the right to prosecute HIPAA violations committed against residents of their states. While HIPAA does not create a private right of action that would allow individuals to sue in civil court for a HIPAA violation, its standards have been used as the basis for the duty of care in state civil suits, such as those for negligence or recklessness in misusing personal information. In addition, HIPAA mandates that HHS conduct periodic compliance audits of HIPAA covered entities and their business associates for compliance. It also tasks HHS with establishing a methodology whereby harmed individuals who were the victims of breaches of unsecured PHI may receive a percentage of the Civil Monetary Penalty fine paid by the violator. In light of the HIPAA Omnibus Final Rule, recent enforcement activity, and statements from HHS, we expect increased federal and state HIPAA privacy and security enforcement efforts.

HIPAA also required HHS to adopt national standards establishing electronic transaction standards that all healthcare providers must use when submitting or receiving certain healthcare transactions electronically.

Many states in which we operate and in which patients of our customers reside also have laws that protect the privacy and security of sensitive and personal information, including health information. These laws may be similar to or even more protective than HIPAA and other federal privacy laws. For example, the laws of the State of California, in which we operate, are more restrictive than HIPAA. Where state laws are more protective than HIPAA, we must comply with the state laws we are subject to, in addition to HIPAA. In certain cases, it may be necessary to modify our planned operations and procedures to comply with these more stringent state laws. Not only may some of these state laws impose fines and penalties upon violators, but also some, unlike HIPAA, may afford private rights of action to individuals who believe their personal information has been misused. In addition, state laws are changing rapidly, and there is discussion of a new federal privacy law or federal breach notification law, to which we may be subject.

In addition to HIPAA, state health information privacy and state health information privacy laws, we may be subject to other state and federal privacy laws, including laws that prohibit unfair privacy and security practices and deceptive statements about privacy and security and laws that place specific requirements on certain types of activities, such as data security and texting.

In recent years, there have been a number of well-publicized data breaches involving the improper use and disclosure of PII and PHI. Many states have responded to these incidents by enacting laws requiring holders of personal information to maintain safeguards and to take certain actions in response to a data breach, such as providing prompt notification of the breach to affected individuals and state officials. In addition, under HIPAA and pursuant to the related contracts that we enter into with our business associates, we must report breaches of unsecured PHI to our contractual partners following discovery of the breach. Notification must also be made in certain circumstances to affected individuals, federal authorities and others.

Reimbursement

Medicare

The Medicare program offers beneficiaries different ways to obtain medical benefits: (i) Medicare Part A, which covers, among other things, in-patient hospital, SNFs, home healthcare, and certain other types of healthcare services; (ii) Medicare Part B, which covers physicians’ services, outpatient services, durable medical equipment, and certain other types of items and healthcare services; (iii) Medicare Part C, also known as Medicare Advantage, which is a managed care option for beneficiaries who are entitled to Medicare Part A and enrolled in Medicare Part B; and (iv) Medicare Part D, which provides coverage for prescription drugs that are not otherwise covered under Medicare Part A or Part B for those beneficiaries that enroll.

Our affiliated provider network is reimbursed by the Part B and Part C programs for certain of the telemedicine services it provides to Medicare beneficiaries. Medicare coverage for telemedicine services is treated distinctly from other types of professional medical services and is limited by federal statute and subject to specific conditions of participation and payment pursuant to Medicare regulations, policies and guidelines, including the location of the patient, the type of service, and the modality for delivering the telemedicine service, among others.

Medicaid

Medicaid programs are funded jointly by the federal government and the states and are administered by states (or the state’s designated managed care or other similar organizations) under approved plans. Our affiliated provider network is reimbursed by certain state Medicaid programs for certain of the telemedicine services it provides to Medicaid beneficiaries. Medicaid coverage for telemedicine services varies by state and is subject to specific conditions of participation and payment.

Participation in Medicare/Medicaid Programs