DESCRIPTION OF SHARE CAPITAL

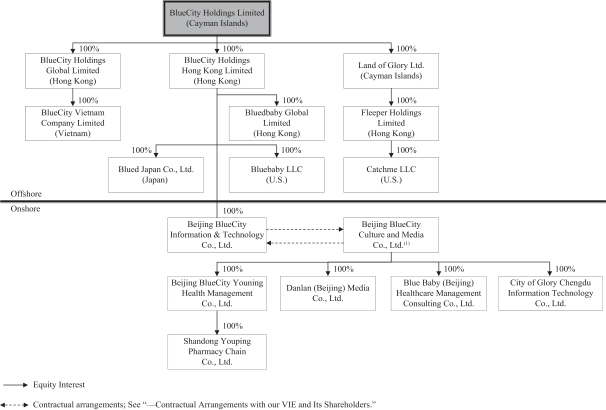

We are a Cayman Islands exempted company with limited liability and our affairs are governed by our memorandum and articles of association, as amended and restated from time to time, the Companies Law of the Cayman Islands, which is referred to as the Companies Law below, and the common law of the Cayman.

As of the date of this prospectus, our authorized share capital is US$50,000 divided into 489,944,215 ordinary shares with a par value of US$0.0001 each and 10,055,785 preferred shares with a par value of US$0.0001 each, of which 1,439,102 preferred shares are designated as Series A preferred shares with a par value of US$0.0001 each, 1,891,291 preferred shares are designated as SeriesA-1 preferred shares with a par value of US$0.0001 each, 1,862,069 preferred shares are designated as Series B preferred shares with a par value of US$0.0001 each, 1,246,621 preferred shares are designated as Series C preferred shares with a par value of US$0.0001 each, 977,961 preferred shares are designated as SeriesC-1 preferred shares with a par value of US$0.0001 each, 116,640 preferred shares are designated as SeriesC-2 preferred shares with a par value of US$0.0001 each, and 2,522,101 preferred shares are designated as Series D preferred shares with a par value of US$0.0001 each. As of the date of this prospectus, 5,614,840 ordinary shares, 1,439,102 Series A preferred shares, 1,891,291 SeriesA-1 preferred shares, 1,862,069 Series B preferred shares, 1,246,621 Series C preferred shares, 977,961 SeriesC-1 preferred shares, and 2,143,786 Series D preferred shares are issued and outstanding. All of our issued and outstanding shares are fully paid.

Immediately prior to the completion of this offering, our authorized share capital will be changed into US$500,000 divided into 5,000,000,000 shares of a nominal or par value of US$0.0001 each, comprising of (i) 4,600,000,000 Class A Ordinary Shares of a par value of US$0.0001 each, (ii) 200,000,000 Class B Ordinary Shares of a par value of US$0.0001 each and (iii) 200,000,000 shares of a par value of US$0.0001 each of such class or classes (however designated) as the board of directors may determine in accordance with our post-offering articles of association. Immediately prior to the completion of this offering, all of our issued and outstanding ordinary shares and preferred shares will be converted into, and/or re-designated and re-classified as, Class A ordinary shares on a one-for-one basis, except that the 5,614,840 ordinary shares held by BlueCity Media Limited will be re-designated as Class B ordinary shares.

Our Post-Offering Memorandum and Articles of Association

We have conditionally adopted an amended and restated memorandum and articles of association, which will become effective and replace our current amended and restated memorandum and articles of association in its entirety immediately prior to the completion of this offering. The following are summaries of material provisions of the post-offering memorandum and articles of association and of the Companies Law, insofar as they relate to the material terms of our ordinary shares.

Objects of Our Company. Under our post-offering memorandum and articles of association, the objects of our company are unrestricted and we have the full power and authority to carry out any object not prohibited by the laws of the Cayman Islands.

Ordinary Shares. Our ordinary shares are divided into Class A ordinary shares and Class B ordinary shares. Holders of our Class A ordinary shares and Class B ordinary shares will have the same rights except for voting and conversion rights. Our ordinary shares are issued in registered form and are issued when registered in our register of members. We may not issue shares to bearer. Our shareholders who are nonresidents of the Cayman Islands may freely hold and vote their shares.

Each Class B ordinary share is convertible into an equal number of Class A ordinary shares upon the occurrence of certain matters as set forth in our post-offering memorandum and articles of association, including upon any direct or indirect sale, transfer, assignment or disposition of Class B ordinary shares by a holder thereof to any person other than holders of Class B ordinary shares or their affiliates. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

168