CONFIDENTIAL TREATMENT REQUESTED

PURSUANT TO 17 C.F.R. Section 200.83

The price of cattle, pork and feed ingredients in the domestic markets has significantly fluctuated in the past, and we believe that it will continue to fluctuate over the next few years. Any increase in the price of cattle, pork and feed ingredients and, consequently, production costs may adversely impact our gross margins and our results of operations if we are not able to pass these price increases to our clients. Conversely, any decrease in the price of cattle, pork and feed ingredients and, consequently, our production costs, may positively impact our gross margins and our results of operations.

Effect of level of indebtedness and interest rates

As of December 31, 2021, our total outstanding indebtedness was R$92,518.2 million, consisting of R$11,914.3 million of current loans and financings and R$80,603.9 million of non-current loans and financings, representing 58.1% of our total liabilities, which totaled R$159,312.4 million as of December 31, 2021.

As of December 31, 2020, our total outstanding indebtedness was R$65,906.7 million, consisting of R$4,562.1 million of current loans and financings and R$61,344.6 million of non-current loans and financings, representing 54.8% of our total liabilities, which totaled R$120,257.6 million as of December 31, 2020.

The interest rates that we pay on our indebtedness depend on a variety of factors, including local and international interest rates and risk assessments of our company, our industry and the global economies.

Fluctuations in domestic market prices of fresh and processed products can significantly affect our operating revenues

Domestic market prices for fresh and processed products are generally determined in accordance with market conditions. These prices are also affected by the additional markup that retailers charge end consumers. We have negotiated these margins with each network of retailers and depending on the network, with each store individually.

Effects of fluctuations in export prices of fresh and processed products on operating revenues

Fluctuations in export prices of our raw and processed products can significantly affect our net operating income. The prices of fresh and processed products that we charge in domestic and export markets have fluctuated significantly in recent years, and we believe that these prices will continue to fluctuate in the future.

Effects of fluctuations in exchange rates between the Brazilian real and foreign currencies

Our results of operations and financial condition have been, and will continue to be, affected by the rate of the depreciation or appreciation of the Brazilian real against foreign currencies.

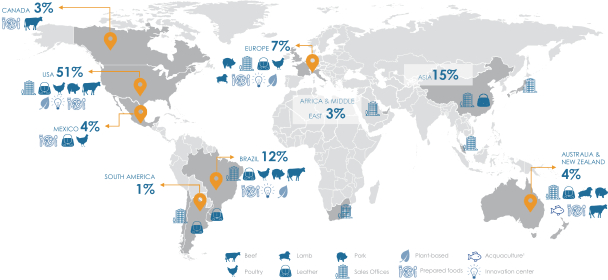

A substantial portion of our net revenue is linked to foreign currencies because the majority of our business is conducted by entities outside of Brazil and a large part of our exports are denominated in foreign currencies, principally U.S. dollars. Any depreciation or appreciation of the Brazilian real against foreign currencies may impact our revenues, causing a monetary increase or decrease, provided that the other variables remain unchanged.

In addition, a substantial portion of our loans and financings is denominated in foreign currencies. For this reason, any depreciation of the Brazilian real against foreign currencies may significantly increase our finance expense and our current and non-current loans and financings denominated in reais. Conversely, any appreciation of the Brazilian real against foreign currencies may significantly decrease our finance expense and current and non-current loans and financings denominated in reais.

Our risk management department enters into derivative instruments previously approved by our board of directors to protect financial assets and liabilities and future cash flow from commercial activities and net

105