DESCRIPTION OF SHARE CAPITAL

For purposes of this section, references to “our company”, “the company”, “we”, “us” and “our” refer only to the issuer.

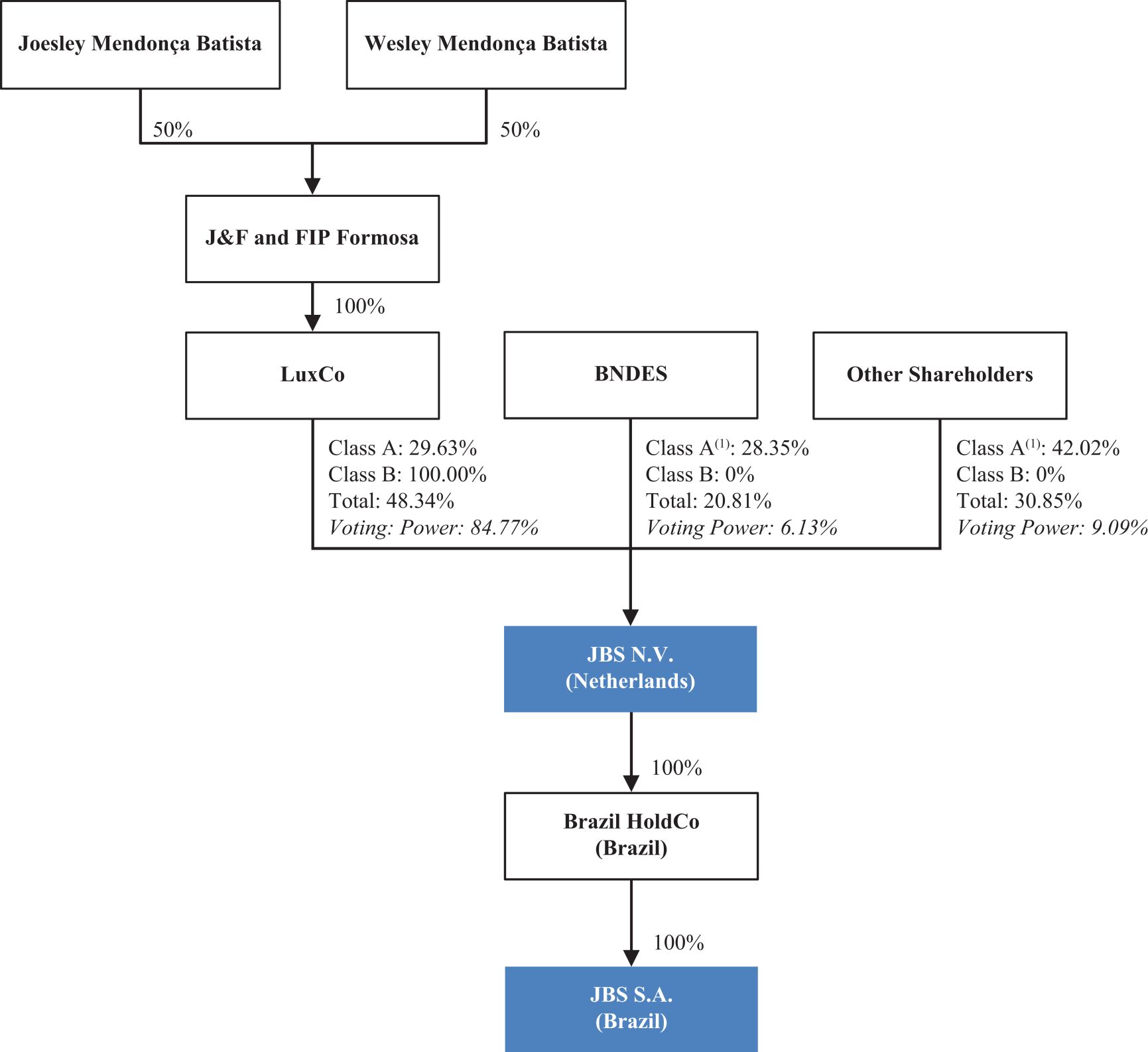

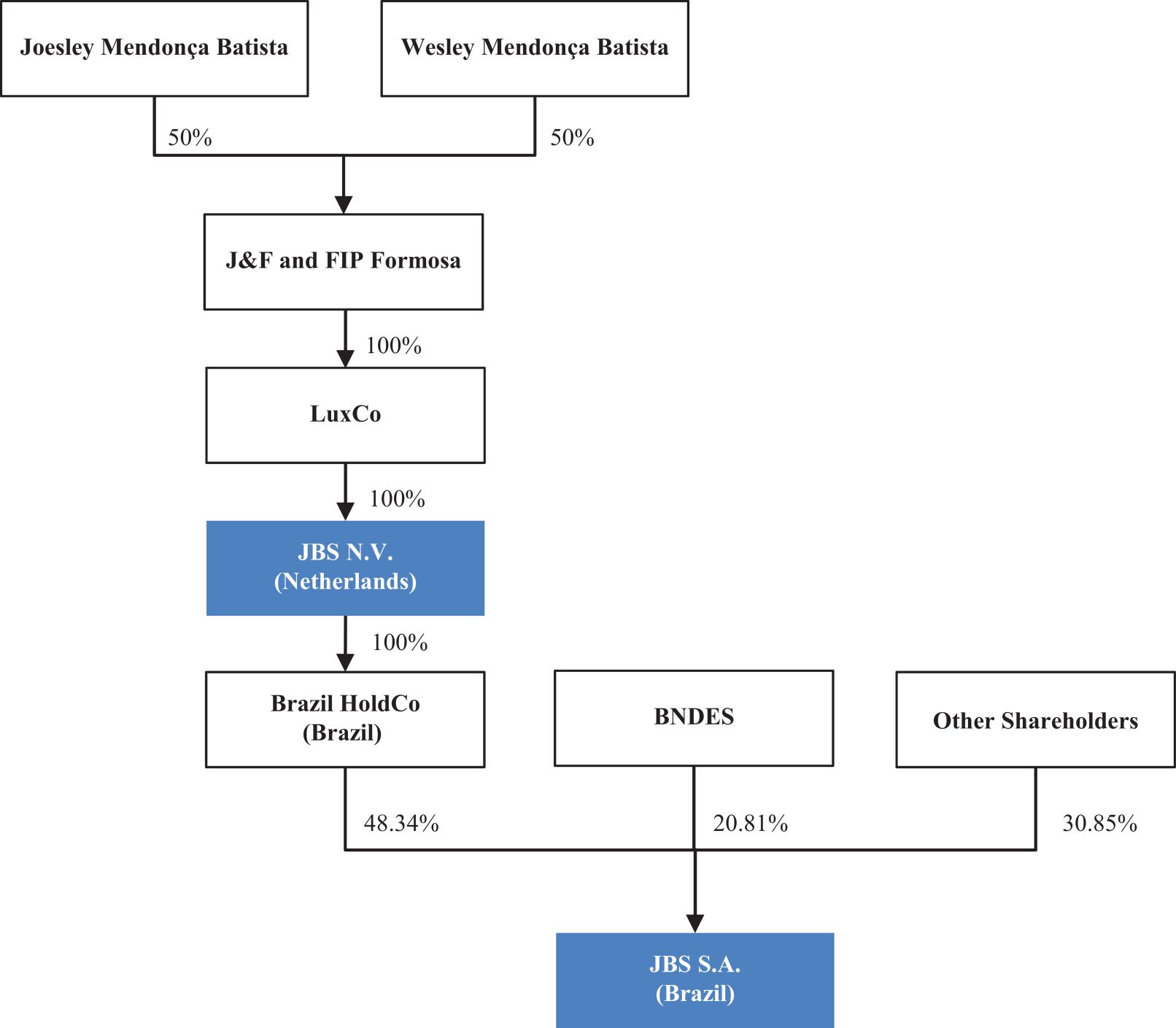

The issuer was incorporated on October 9, 2019 as a private limited liability company (besloten vennootschap met beperkte aansprakelijkheid) under Dutch law, with its corporate seat (statutaire zetel) in Amsterdam, the Netherlands, with the name “Violet Holdings B.V.” On February 3, 2020, its name was changed to “Swift Foods B.V.” and, on November 17, 2022, its name was changed to “JBS B.V.” Prior to the Closing Date, the issuer will be converted into a public limited liability company (naamloze vennootschap) under Dutch law with the name “JBS N.V.” Its registered office is located at Stroombaan 16, 5th Floor, 1181 VX, Amstelveen, Netherlands. Its telephone number is +31 20 656 47 00.

The following description of our share capital is a summary of the material terms of our articles of association that will be effective on the Closing Date. Because the following is only a summary, it does not contain all of the information that may be important to you. You should carefully read the complete text of our articles of association, the form of which will be filed as an exhibit to the registration statement of which this prospectus forms a part.

Share Capital

Upon the completion of the Proposed Transaction, JBS N.V.’s share capital will consist of the: (1) Class A common shares, with a par value of €0.01 per share (“Class A Common Shares”): (2) Class B common shares, with a par value of €0.10 per share (“Class B Common Shares” and, together with the Class A Common Shares, the “Common Shares”); and (3) conversion shares, with a par value of €0.09 per share (“Conversion Shares”, and, together with the Common Shares, the “Shares”).

Upon incorporation on October 9, 2019 (as Violet Holdings B.V.), we issued one share with a par value of €1.00 to JBS S.A. On February 3, 2020, the issuer issued an additional 44,999 ordinary shares with a par value of €1.00 each to JBS S.A. to meet the minimum capital requirements for the conversion of the issuer into a public limited liability company (naamloze vennootschap) under Dutch law. These 45,000 ordinary shares were converted and split into 450,000 Class B Common Shares on November 17, 2022, pursuant to an amendment to our articles of association. On February 20, 2023, the issuer issued 624,500,000 Class A Common Shares to JBS S.A., which Class A Common Shares were immediately thereafter repurchased by and transferred to the issuer.

On September 4, 2023, JBS S.A. sold and transferred all 450,000 Class B Common Shares held by it to LuxCo. On September 15, 2023, the company issued 243,704,227 Class A Common Shares to LuxCo, the issue price for which shares was at the time left unpaid. On December 27, 2023, the company issued 297,860,722 Class B Common Shares to LuxCo against the contribution of shares in Brazilian HoldCo, by which contribution the Class A Common Shares issued on September 15, 2023, were also paid up.

As of the date of this prospectus, our issued share capital is €38,513,114.47, consisting of 868,204,227 Class A Common Shares, all of which have been fully paid in and of which 624,5000,000 are held by JBS B.V. and 243,704,227 are held by LuxCo, and 298,310,722 Class B Common Shares, all of which have been fully paid in and are held by LuxCo.

Immediately following the completion of the Proposed Transaction, our issued share capital will consist of 814,216,001 Class A Common Shares, of which 241,234,515 will be held by LuxCo and 572,981,486 will be held by JBS S.A.’s non-controlling shareholders, and 294,842,184 Class B Common Shares, all of which will be held by LuxCo., excluding the potential issuance or transfer of JBS N.V. Class A Common Shares to certain members of senior management as a performance bonus for the successful completion of the Proposed Transaction, as further described under “Management—Compensation of Executive Officers and Directors.”

241