DESCRIPTION OF SHARE CAPITAL

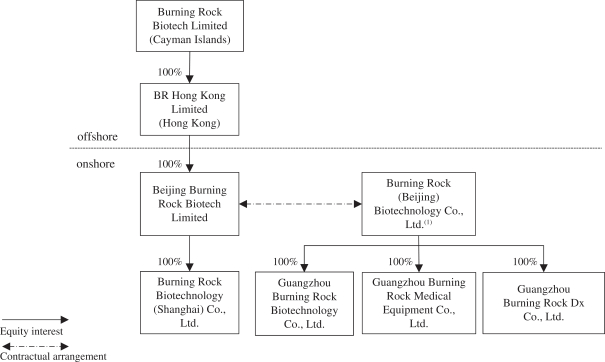

We are a Cayman Islands company and our affairs are governed by our memorandum and articles of association, as amended from time to time, and the Companies Law of the Cayman Islands, which we refer to as the Companies Law below.

As of the date of this prospectus, our authorized share capital is US$50,000 divided into 250,000,000 shares, par value of US$0.0002 each, comprising (a) 188,207,510 ordinary shares, and (b) 61,792,490 preferred shares comprising (i) 22,714,874 Series A preferred shares, (ii) 10,589,670 Series A+ preferred shares, (iii) 12,768,717 Series B preferred shares, (iv) 13,589,757 Series C preferred shares and (v) 2,129,472 Series C+ preferred shares.

As of the date of this prospectus, there were 25,031,575 ordinary shares, 22,714,874 Series A preferred shares, 10,585,231 Series A+ preferred shares, 12,768,717 Series B preferred shares, 13,534,514 Series C preferred shares and 2,129,472 Series C+ preferred shares that are issued and outstanding. All of our issued and outstanding ordinary shares are fully paid, and all of our issued and outstanding preferred shares will be redesignated or converted into ordinary shares on aone-for-one basis.

We will issue 13,500,000 Class A ordinary shares represented by our ADSs in this offering and issue 1,724,138 Class A ordinary shares in the concurrent private placement, based on an assumed initial offering price of US$14.50 per ADS, the mid-point of the estimated range of initial public offering price. Therefore, upon completion of this offering and the concurrent private placement, we will have 84,663,673 Class A ordinary shares and 17,324,848 Class B ordinary shares issued and outstanding. All of our ordinary shares issued and outstanding prior to the completion of the offering are and will be fully paid, and all of our Class A ordinary shares to be issued in the offering will be issued as fully paid. Our authorized share capital post-offering will be US$50,000 divided into 230,000,000 Class A ordinary shares with a par value of US$0.0002 each and 20,000,000 Class B ordinary shares with a par value of US$0.0002 each.

OurPost-Offering Memorandum and Articles

We will adopt the tenth amended and restated memorandum and articles of association, which will become effective and replace our current eighth amended and restated memorandum and articles of association in its entirety upon completion of this offering. The following are summaries of material provisions of thepost-offering memorandum and articles of association and of the Companies Law, insofar as they relate to the material terms of our ordinary shares.

Ordinary Shares

General. Holders of Class A ordinary shares and Class B ordinary shares will have the same rights except for voting and conversion rights. All of our outstanding ordinary shares are fully paid andnon-assessable. Certificates representing the ordinary shares are issued in registered form. Our shareholders who arenon-residents of the Cayman Islands may freely hold and transfer their ordinary shares.

Conversion. Each Class B ordinary share is convertible into one (1) Class A ordinary share at any time by the holder thereof. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Upon any sale, transfer, assignment or disposition of any Class B ordinary share by a holder thereof to any person who is not an affiliate of such holder, or upon a change of control of any Class B ordinary share to any person who is not an affiliate of the registered shareholder of such Class B ordinary share, such Class B ordinary share shall be automatically and immediately converted into one Class A ordinary share. Furthermore, each Class B ordinary share will be automatically converted into one Class A ordinary share, if (i) at any time the holder thereof and the affiliates of such holder collectively hold less than 5% of the total number of our issued and outstanding shares, or (ii) at any time the holder thereof and the affiliates of such holder collectively hold less than 8.5% of the total number of our issued and outstanding shares and the holder thereof is no longer providing services to us in a position equivalent to or above vice president.

Dividends. The holders of our ordinary shares are entitled to such dividends as may be declared by our board of directors. Our tenth amended and restated articles of association provide that dividends may be declared

165

”, “BURNING ROCK DX”, “

”, “BURNING ROCK DX”, “ ” and product and service names, and 160 trademark applications pending in China. We also own four registered domain names, including our official website.

” and product and service names, and 160 trademark applications pending in China. We also own four registered domain names, including our official website.