As filed with the Securities and Exchange Commission on December 2, 2020

Registration No. 333-251053

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1 TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Burning Rock Biotech Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| | | | |

| Cayman Islands | | 8071 | | Not Applicable |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

601, 6/F, Building 3, Standard Industrial Unit 2

No. 7, Luoxuan 4th Road

International Bio Island, Guangzhou, 510005

People’s Republic of China

+86 020-3403 7871

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, N.Y. 10168

+1 (800) 221-0102

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Shuang Zhao, Esq.

Cleary, Gottlieb, Steen & Hamilton LLP

c/o 37th Floor, Hysan Place

500 Hennessy Road

Causeway Bay, Hong Kong

+852 2521-4122 | | Kyungwon Lee, Esq. Shearman & Sterling LLP c/o 21st Floor, Gloucester Tower, the Landmark 15 Queen’s Road Central Central, Hong Kong +852 2978 8000 |

Approximate date of commencement of proposed sale to the public:

as soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

|

Title of each class of securities

to be registered | | Amount to be

registered(2)(3) | | Proposed maximum

offering price per

share(3) | | Proposed maximum

aggregate offering price (2)(3) | | Amount of registration fee |

Class A ordinary shares, par value US$0.0002 per share(1) | | 2,113,700 | | US$28.70 | | US$60,663,190.00 | | US$6,618.35(4) |

|

|

| (1) | American depositary shares issuable upon deposit of Class A ordinary shares registered hereby have been registered under a separate registration statement on Form F-6 (Registration No. 333-238921). Each American depositary share represents one Class A ordinary share. |

| (2) | Includes Class A ordinary shares that are issuable upon the exercise of the underwriters’ option to purchase additional securities. Also includes Class A ordinary shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the shares are first bona fide offered to the public. These Class A ordinary shares are not being registered for the purpose of sales outside the United States. |

| (3) | Estimated solely for the purpose of determining the amount of registration fee in accordance with Rule 457(c) under the Securities Act of 1933, based on the average of the high and low trading prices on November 27, 2020 of the Registrant’s American depositary shares listed on the Nasdaq Global Market, with each American depositary share representing one Class A ordinary share of the Registrant. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

”, “BURNING ROCK DX”, “

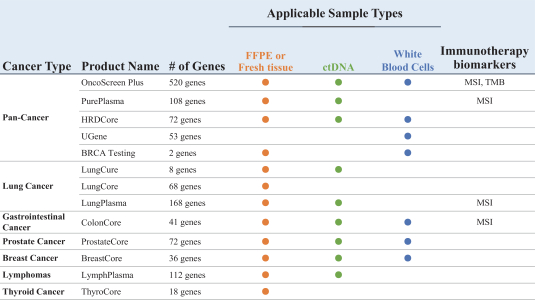

”, “BURNING ROCK DX”, “ ” and product and service names, and 66 trademark applications pending in China. We also own four registered domain names, including our official website.

” and product and service names, and 66 trademark applications pending in China. We also own four registered domain names, including our official website.