worthless. As a result, investors are deprived of the benefits of PCAOB inspections. On August 26, 2022, the PCAOB signed a statement of Protocol with the China Securities Regulatory Commission and the Ministry of Finance of the People’s Republic of China, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong. For a detailed description of risks related to HFCA Act, see “Item 3.D. Key Information—Risks Associated with the Holding Foreign Companies Accountable Act” in our 2021 Form 20-F and see “Risk Factors—Risks Relating to Doing Business in the PRC— If the U.S. Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect our auditors as required under the Holding Foreign Companies Accountable Act, the SEC will prohibit the trading of our ADSs. A trading prohibition for our ADSs, or the threat of a trading prohibition, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections of our auditors deprives our investors of the benefits of such inspections” in this prospectus.

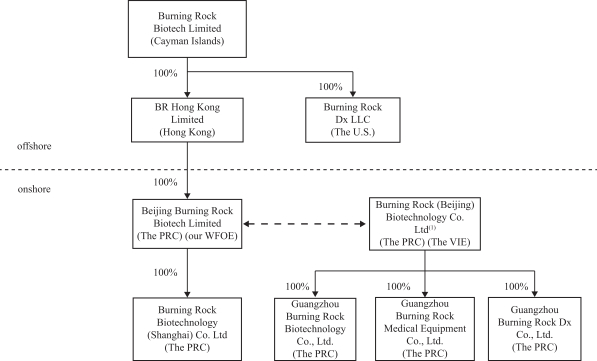

The typical structure of cash flows through our organization is as follows: (i) we transfer funds to our WFOE, Beijing Burning Rock Biotech Limited, through either capital contributions or loans from our Hong Kong subsidiary, BR Hong Kong Limited.; (ii) our WFOE makes loans to the VIE, Burning Rock (Beijing) Biotechnology Co. Ltd.; (iii) the VIE and its subsidiaries receive funds generated from sales of products and/or services to third-party customers; and (iv) when the VIE intends to settle any amounts owed to us under the VIE Agreements, the VIE will pay service fees to our WFOE pursuant to the exclusive business cooperation agreement, and our WFOE will transfer funds to BR Hong Kong Limited, which in turn will transfer funds to us, all through distributions, dividends or repayment of shareholder loans.

As of the date of this prospectus, none of our PRC subsidiaries nor the VIE has declared or paid any dividends or made any distributions to their respective holding companies, including Burning Rock Biotech Limited, nor does any of them have intention to do so. As of the date of this prospectus, the VIE has not settled any amounts owed to us under the VIE Agreements and does not have the intention to do so. As of the date of this prospectus, Burning Rock Biotech Limited has not declared any dividend and does not have a plan to declare a dividend to its shareholders. Nevertheless, cash transfers have been made to date between Burning Rock Biotech Limited, our subsidiaries and the VIEs and such cash transfers have been made in one direction only and in the direction to the VIE as of the date of this prospectus. We currently do not have cash management policies that dictate when or how funds are transferred between us, our subsidiaries and the VIEs. For details regarding the payments between us, our subsidiaries and the VIEs, see “Our Company—Holding Company Structure and Contractual Arrangements with the VIE” in this prospectus.

There are limitations on our ability to transfer cash between us, our subsidiaries and the VIEs, and there is no assurance that PRC government will not intervene or impose restrictions on the ability of us, our subsidiaries and the VIEs to transfer cash.

For more information related to the condensed consolidating schedule and the consolidated financial statements, see “Our Company—Holding Company Structure and Contractual Arrangements with the VIE” in this prospectus.

The majority of our income is received in Renminbi, and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions can be made in foreign currencies without prior approval from the State Administration of the Foreign Exchange in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders. The PRC government has implemented a series of capital control measures, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder loan repayments. It may continue to strengthen its capital controls and our PRC subsidiary’s dividends and other distributions may be subjected to tighter scrutiny and may limit the ability of Burning Rock Biotech Limited, our Cayman holding entity, to use capital from our PRC subsidiary. For details regarding the restrictions on our ability to transfer cash between us, our subsidiaries and the VIEs, restrictions on currency exchanges in China and capital controls the Chinese government may impose, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in the PRC—We may rely on dividends and other distributions from our subsidiaries in China to fund our cash and financing requirements, and any limitation on the ability of our subsidiaries to make payments to us could adversely affect our ability to conduct our business”, and “—The PRC government’s control of foreign currency conversion may limit our foreign exchange transactions, including dividend payments on our ordinary shares”, and”—PRC regulation of loans to and direct investments in PRC entities by offshore holding companies may delay or prevent us from making loans or additional capital contributions to our subsidiaries, which could adversely affect our liquidity and our ability to fund and expand our business” in the 2021 Annual Report.

For 2019, 2020 and 2021, Burning Rock Biotech Limited and its subsidiaries provided loans of RMB34 million, nil and RMB315 million, respectively, to the VIE and VIE’s subsidiaries.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.