The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and itis not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED April 29, 2022

PROSPECTUS

Burning Rock Biotech Limited

Class A Ordinary Shares

Debt Securities

Warrants

We may offer and sell Class A ordinary shares, par value US$0.0002 per share, including American depositary shares, or ADSs, each representing one Class A ordinary share, debt securities or warrants in any combination from time to time in one or more offerings, at prices and on terms described in one or more supplements to this prospectus. In addition, this prospectus may be used to offer securities for the account of persons other than us.

Each time we or any selling security holder sell securities, we will provide a supplement to this prospectus that contains specific information about the offering and the terms of the securities. The supplement may also add, update or change information contained in this prospectus. We may also authorize one or more free writing prospectuses to be provided in connection with a specific offering. You should read this prospectus, any prospectus supplement and any free writing prospectus carefully before you invest in any of our securities.

We or any selling security holder may sell the securities independently or together with any other securities registered hereunder to or through one or more underwriters, dealers and agents, or directly to purchasers, or through a combination of these methods, on a continuous or delayed basis. See “Plan of Distribution.” If any underwriters, dealers or agents are involved in the sale of any of the securities, their names, and any applicable purchase price, fee, commission or discount arrangements between or among them, will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

The principal executive offices of Burning Rock Biotech Limited is located at No.5, Xingdao Ring Road North, International Bio Island, Guangzhou, People’s Republic of China, and its telephone number at that address is +86 020-3403 7871. The registered address of Burning Rock Biotech Limited in the Cayman Islands is located at the offices of Maples Corporate Services Limited at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

Our ADSs are currently listed on the NASDAQ Global Market under the symbol “BNR.” On April 22, 2022, the closing price of our ADSs on the Nasdaq Global Market was US$6.28 per ADS. Each ADS represents one Class A ordinary share.

Investing in our securities involves risks. You should read the “Risk Factors” section in the applicable prospectus supplement, any related free writing prospectus and the documents we incorporate by reference in this prospectus before investing in our securities.

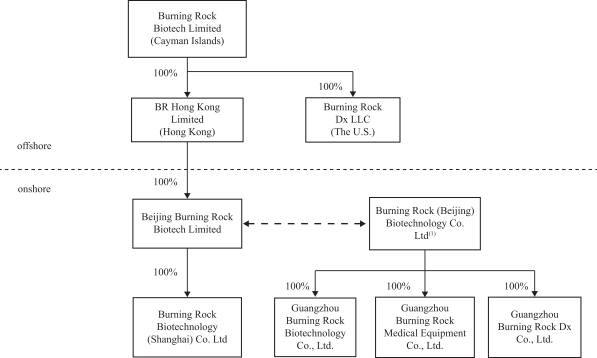

We are not a Chinese operating company but a holding company incorporated in the Cayman Islands. As a holding company with no material operations of our own, we conduct operations primarily through our subsidiaries and through contractual arrangements with the variable interest entity, or VIE, and its subsidiaries. These contractual arrangements enable us to exercise effective control over the VIE, receive the economic benefits that could potentially be significant to the VIE in consideration for the services provided by our subsidiaries, and hold an exclusive option to purchase all or part of the equity interests in and assets of the VIE when and to the extent permitted by PRC law. Because of these contractual arrangements, we are the primary beneficiary of the VIE and hence consolidate its financial results with ours under U.S. GAAP. Investors in our ADSs thus are not purchasing equity interest in our operating entities in China but instead are purchasing equity interest in a Cayman Islands holding company. The securities offered in this prospectus are securities of our Cayman Islands holding company, not of our operating subsidiaries or the VIEs. As used in this prospectus, “we,” “us,” “our company,” “our,” or “the Company” refers to Burning Rock Biotech Limited and its subsidiaries, “the VIE” refers to our PRC variable interest entity, Burning Rock (Beijing) Biotechnology Co. Ltd. and “the VIEs” refers to the VIE and its subsidiaries.

Our corporate structure is subject to risks associated with our contractual arrangements with the VIEs. The Company and its investors may never directly hold equity interests in the businesses that are conducted by the VIEs. Uncertainties in the PRC legal system could limit our ability to enforce these contractual arrangements, and these contractual arrangements have not been tested in a court of law. Because we do not hold equity interests in the VIEs, we are subject to risks due to the uncertainty of the interpretation and application of the PRC laws and regulations regarding the VIEs and the VIE structure, including regulatory review of overseas listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual arrangements with the VIEs. We are also subject to the risk that the PRC government could disallow the VIE structure. If these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we and the VIE could be subject to severe penalties or be forced to relinquish our interests in those operations. This would result in the VIE being deconsolidated. The majority of our assets, including the necessary licenses to conduct business in China, are held by the VIE. A significant part of our revenues is generated by the VIE. An event that results in the deconsolidation of the VIE would have a material effect on our operations and result in the value of the securities diminish substantially or even become worthless. Our holding company, our PRC subsidiary and the VIE, and our investors face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIE and, consequently, significantly affect the financial performance of the VIE and our Company as a whole. As a result, the value of our securities may depreciate significantly or become worthless. For a detailed description of the risks associated with our corporate structure, “Item 3.D. Key Information—Risks Associated with Our Corporate Structure” in our annual report on Form 20-F for 2021 filed with the SEC on April 29, 2022 (the “2021 Form 20-F”) and “Risk Factors—Risks Related to Our Corporate Structure” in this prospectus.

Additionally, we are subject to certain legal and operational risks associated with the operations of our subsidiaries and the VIEs in the PRC. PRC laws and regulations governing our current business operations are sometimes vague and uncertain, and therefore, these risks may result in a material negative change in our subsidiaries’ and the VIE’s operations, significant depreciation of the value of our ADSs, or a complete hindrance of our ability to offer or continue to offer our securities to investors, which could cause the value of your securities to become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in the PRC with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over PRC-based companies listed overseas using the VIE structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. Since these statements and regulatory actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond and what existing or new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact of such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list on a U.S. or other foreign exchange. For a detailed description of risks related to doing business in China, see “Item 3.D. Key Information—Risks Associated with Being Based in or Having the Majority of the Operations in China” in our 2021 Form 20-F and “Risk Factors—Risks Relating to Doing Business in the PRC— Recent regulatory developments in China may subject us to additional regulatory review and disclosure requirements, expose us to government interference, or otherwise restrict or completely hinder our ability to offer securities and raise capitals outside China, all of which could materially and adversely affect our business, and cause the value of our securities to significantly decline or become worthless.” in this prospectus

In addition, as early as 2024, our securities could be prohibited from trading on a national exchange or over-the-counter under the Holding Foreign Companies Accountable Act, or the HFCA Act, if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect or fully investigate our independent registered public accounting firm located in China for three consecutive years beginning in 2021. The trading prohibition could be accelerated to 2023 if the Accelerating Holding Foreign Companies Accountable Act is enacted. Our independent registered public accounting firm that issued the audit report included in our annual report filed with the SEC, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB is required by the laws of the United States to undergo regular inspections by the PCAOB to assess its compliance with the laws of the United States and professional standards. Because we have substantial operations within the PRC and the PCAOB is currently unable to conduct full inspections of the work of our independent registered public accounting firm as it relates to those operations without the approval of the Chinese authorities, our independent registered public accounting firm is not currently inspected by the PCAOB. This lack of PCAOB inspections in the PRC prevents the PCAOB from regularly evaluating our independent registered public accounting firm’s audits and its quality control procedures, and our independent registered public accounting firm is therefore subject to the determinations announced by the PCAOB on December 16, 2021. As a result, investors are deprived of the benefits of PCAOB inspections. For a detailed description of risks related to HFCA Act, see “Item 3.D. Key Information—Risks Associated with the Holding Foreign Companies Accountable Act” in our 2021 Form 20-F and see “Risk Factors—Risks Relating to Doing Business in the PRC— If the U.S. Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect our auditors as required under the Holding Foreign Companies Accountable Act, the SEC will prohibit the trading of our ADSs. A trading prohibition for our ADSs, or the threat of a trading prohibition, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections of our auditors deprives our investors of the benefits of such inspections.” in this prospectus.

We are dependent upon cash dividends, distributions and other transfers from our subsidiaries to make dividend payments. As of the date of this prospectus, there have not been any such dividends or other distributions from our subsidiaries. In addition, none of our subsidiaries have ever issued any dividends or distributions to us or to U.S. investors as of the date of this prospectus. The majority of our income is received in Renminbi, and shortages in foreign currencies may restrict our ability to pay dividends or other payments, or otherwise satisfy our foreign currency denominated obligations, if any. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from trade-related transactions can be made in foreign currencies without prior approval from the State Administration of the Foreign Exchange in the PRC as long as certain procedural requirements are met. Approval from appropriate government authorities is required if Renminbi is converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may, at its discretion, impose restrictions on access to foreign currencies for current account transactions and if this occurs in the future, we may not be able to pay dividends in foreign currencies to our shareholders.

For 2019, 2020 and 2021, Burning Rock Biotech Limited and its subsidiaries provided loans of RMB34 million, nil and RMB315 million, respectively, to the VIE and VIE’s subsidiaries.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2022.